The shift toward low-emission transport is no longer something on the horizon – it is here today. Every operator, large or small, is now looking for practical solutions that reduce their environmental impact while maintaining the performance, capability, and dependability their business relies on.

At Hino, we are proud to have led this conversation in Australia for more than 18 years. As the only manufacturer offering a Hybrid Electric light-duty truck, we have proven that innovation and practicality can go hand in hand. Our Hybrid Electric range delivers up to 22%* in fuel savings and emissions reductions without the need for recharging or compromise on range – a solution that works in the real world, not just on paper.

What makes our Hybrid Electric offering unique is the strength of Toyota Group technology, combined with Hino’s deep understanding of how Australian businesses operate. This is engineering that is versatile, with an extensive model line-up designed to suit a wide variety of industries. It is technology that is proven, and equipped with our Hino SmartSafe package as standard – because safety is just as important as sustainability.

This booklet reflects not just what we say about our Hybrid Electric trucks, but what others are saying too – from customers who have seen the results in their day-to-day operations, to industry experts who have driven the trucks and evaluated everything from performance to sustainability. Their stories underline why Hybrid Electric is the right solution for today, and a smart step towards the future.

The future of transport is rapidly changing. Around the world, urbanisation, resource scarcity and growing environmental pressures are reshaping how people and goods move. Australia is no exception. The Federal Government has committed to ambitious targets, including net zero emissions by 2030, and businesses across the nation are seeking practical solutions that balance efficiency, cost and sustainability.

Hino is playing a leading role in addressing these challenges and our commitment extends across the entire lifecycle of the vehicle, from production to operation, with a target to reduce CO2 emissions by 90%. This means not only producing more efficient engines, but also advancing next-generation technologies including Hybrid Electric, Plug-in Hybrid, Battery Electric and Fuel Cell Electric vehicles.

Importantly, Hino Australia has a solution that has been leading the way in low-emissions for over 18 years. The Hino 300 Series Hybrid Electric is a proven performer. Customers benefit from up to 22% in fuel savings, reduced maintenance, and reductions in CO2 emissions, with no compromise on range or performance.

Hino’s pedigree in hybrid technology is unmatched. From the world’s first hybrid commercial vehicle in 1991, to the long-running success of the Toyota Prius, to Australia’s only Hybrid Electric light-duty truck meeting Euro 6 standards, Hino continues to set the benchmark for innovation and reliability.

The Hino 300 Series Hybrid Electric range is more than just a step forward in technology, it’s a smarter way to do business. By delivering lower operating costs, reducing environmental impact and supporting Australia’s sustainability goals, the Hino Hybrid Electric gives operators a genuine competitive advantage.

Richard Emery President & CEO

Hino Motor Sales Australia

The true measure of success is not just in engineering or emissions data – it’s in how Hino Hybrid Electric performs in the real world. From diverse industries and day-to-day operations, the feedback has been clear: The Hino Hybrid Electric is helping businesses lower costs, improve efficiency, and advance their sustainability goals. Here’s what our operators are experiencing firsthand.

While it is early days, we are already seeing 20-25 per cent improvement in fuel consumption, which correlates to a reduction in CO2 emissions. The addition of Hino Hybrid Electrics is the small but significant stepping stone in the evolution of our fleet.”

Evert Verhage, Fleet Manager, Charles Sturt Council

For me, morally, it’s more about reduced emissions. We burn a lot of diesel and create a lot of emissions through the work that we do in our industry and we are very conscious of that.”

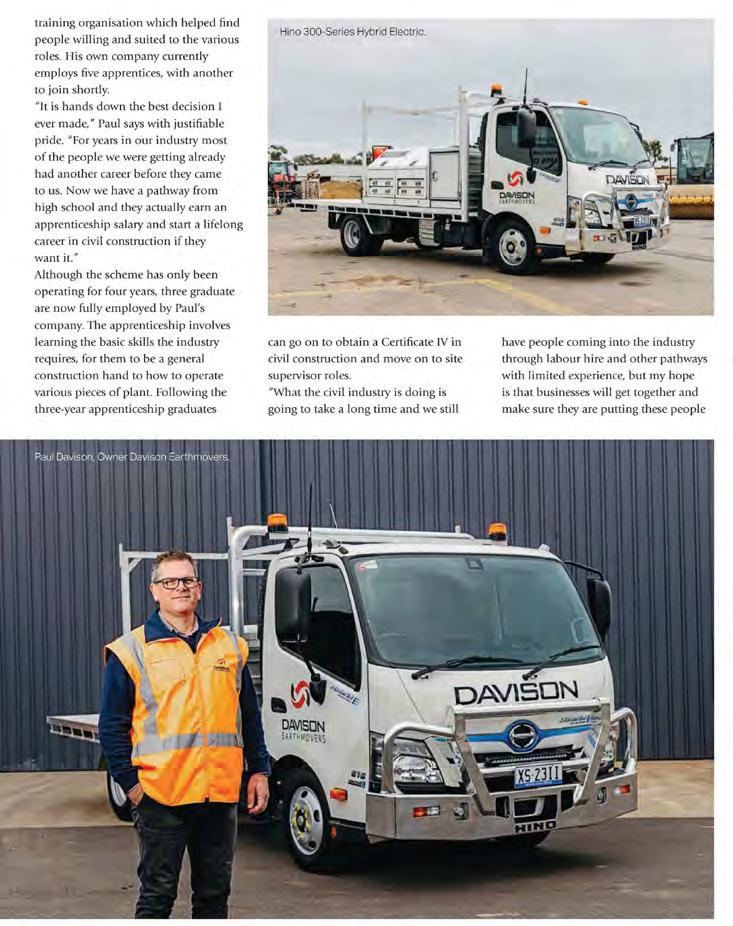

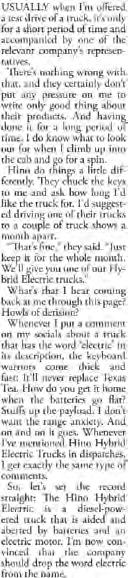

Paul Davison, Managing Director, Davisons Earthmovers

Over the last 24 months, we have tracked fuel on our Hybrid Electric and Diesel equivalent 300 Series trucks and have noted a 10 to 15% difference in fuel consumption – this is an immediate cost saving for the business, and also means a reduction in our CO2 emissions.”

Brendan Cannon, Group Fleet & Utilisation Manager, Altus Traffic

Looking at the numbers, hybrids are much more manageable and the Total Cost of Ownership gap is almost nothing. It’s not as simple as saying we’ll take ten EVs because we must consider what’s required to support them, and their range capability.”

Daniel McEvedy, National Fleet and Logistics Manager, Alsco Uniforms

The price of hybrids has come down a lot , with hybrids versus the normal (diesel) truck price, so pretty much from our point of view we can start getting savings straight away with these.”

Melinda Uhlmann, Asset Manager, CNW

The introduction of Hybrid Electric trucks to our fleet brings a positive impact on the environment and ensures cost savings for SIXT customers, especially during times of high-interest rates and cost-of-living pressures.”

Murari Rijal, Franchise Owner, SIXT

To prove the real-world efficiency of the Hino Hybrid Electric, we put it to the test at Mount Panorama in Bathurst. Over a 295km course designed to replicate the conditions of a local delivery operation, two Hybrid Electric trucks were evaluated in parallel with their diesel equivalents. With all trucks loaded to 4.5 tonnes and driven by nine drivers of varying experience levels, Hino-Connect telematics captured the performance data and evaluated accordingly. The results speak for themselves.

Most would think of a hybrid as being only suited to the stop/start conditions of urban traffic but this is not the case. The system works equally as well in hilly terrain, where the slopes will feed power back into the battery.”

“During the four or so hours of our trip the diesel Hino consumed 15.7 litres of fuel while the Hybrid only used 11.5 litres. That’s 4.2 litres/28.95 per cent less.”

More precise measurement from the onboard electronics brings the result to 6.329km/L for the diesel versus 8.265km/L for the hybrid. This is a reduction in fuel burn of 30.58 per cent.”

“By day’s end the Hino hybrid’s fuel figures made for impressive reading. The diesel had consumed 21.2 litres… while the 616 hybrid was down to 16.9 litres.”

““Across 142km of driving… the diesel model used 13.6L/100km. This equates to a 21.2 per cent fuel efficiency improvement across the day, exceeding Hino’s official claim of 20 per cent.”

“In a truck, torque is your best friend and the benefits of the hybrid system were obvious when climbing an incline. The diesel engine was able to purr at low RPM while the hybrid system did the heavy lifting.”

Australia’s leading trucking journalists have independently put the Hino Hybrid Electric to the test. From fuel savings and lower emissions to comfort, performance and drivability, their feedback highlights the real-world advantages of Hybrid Electric technology across a range of conditions.

HYBRID technology might seem like a fleeting option as the world hurtles toward a battery electric future, but for truckmaker Hino it is a long-term solution it has been refining since 2007, offering a compelling car-licence alternative to dual-cab utes for tradies and fleet operators.

Using proven Toyota Group technology for its parallel hybrid system, the Hino 300 Series Hybrid is claimed to deliver fuel consumption and emissions reductions of up to 20 per cent –which GoAuto recently put to the test in Sydney – as well as reduced maintenance costs.

Unlike many hybrid passenger cars that downsize engine capacity, Hino kept the full-size diesel engine for its working truck models to help ensure a long working life and understressed powertrain.

An electric motor is sandwiched between the clutch and gearbox, working in parallel with the diesel engine to offer assistance that leads to improved efficiency and reduced carbon dioxide emissions.

The N04C four-cylinder turbo-diesel engine, combined with the electric motor, produces 111kW and 470Nm with maximum torque developed from as low as 1200rpm.

All hybrid Hino models are coupled to a six-speed automated manual transmission (AMT) that is slower swapping cogs than a traditional automatic, but familiar to truck drivers. If added operator control is required, the AMT can be manually overridden.

How does this translate into reduced running costs? After our back-to-back test drive of diesel and hybrid Hino 300 trucks, the team at Hino HQ was forthcoming in sharing the drive data from the on-board telematics and our expectations

were exceeded. In an age of inflated fuel-use claims and exaggerated range numbers, Hino has clearly erred on the side of caution.

Across 142km of driving (loaded), during which the diesel 300 trailed the Hybrid 300, we returned a fuel use figure of 11.1 litres per 100km. By comparison, the diesel model used 13.6L/100km.

This equates to a 21.2 per cent fuel efficiency improvement across the day, exceeding Hino’s official claim of 20 per cent. A typical driver would travel twice as far as we did in a day, so the savings would be significant across, say, a year.

Hino Australia product strategy manager, Daniel Petrovski told GoAuto that 300 hybrid customers can “reduce yearly maintenance costs by up to 16 per cent” compared with the diesel equivalent.

Using the electric motor as a starter motor and alternator allin-one contributes to these savings because these ancillaries do eventually fail on traditional trucks, and the regenerative braking goes a long way to preserving brake pads.

Based on our efficiency saving across the day, when factoring in an average of 45,000km driven each year and an average diesel cost of $2 per litre, the hybrid offers a $2147 fuel bill saving, while also emitting 2877kg less CO2 than its dieselonly sibling.

The monthly fuel cost saving alone is $179, which coupled with Hino’s claimed lower maintenance costs and the reduced CO2 emissions, the hybrid 300 could be a compelling option for those considering a greener truck.

However, at a list price of $74,209 for the hybrid 300 we drove and $57,574 for the equivalent diesel model (both before on-road costs), the electrified option comes at a premium of $16,635.

This does not appear to be dissuading customers, though. Around 700 Hino hybrids are on Australian roads at present but Mr Petrovski told GoAuto that the company already has 300 orders so far this year compared to an average of 50 in

previous years.

“By the end of the year, there will be over 1000 on the road and that will get to 1500 pretty quickly,” he said.

As fuel prices continue to climb, the light truck end of town s becoming more aware of the dollars they throw at diesel.

While battery electric vehicles (BEV) are likely to be the future of light- and medium-duty commercial vehicles, Hino says the hybrid 300 is the best bridging solution for “right now” without any of the driving range limitations present with BEVs.

The latest generation 300 also scores Hino’s full suite of SmartSafe safety technology with pre-collision system, pedestrian detection, lane departure warning, and more.

Earlier this year, Hino bolstered the 300 Series range with ‘Built to Go’ models, essentially offering a pre-built range of genuine body types including various factory-backed tipper and tray body options.

The Hybrid 300 TradeAce wide-cab model we drove was fitted with a genuine Hino aluminium tray, ladder racks and a bullbar, optioned with a 4495kg GVM allowing it to be driven with a car licence. The sticker price on one of these is $74,209 before on-road costs, or similar to a high-end dual-cab 4x4 ute.

Depending on application, the Hybrid 300 Series range can be optioned with up to an 8500kg GVM, but the 4495kg GVM model we tested still offers a healthy 1945kg payload –eclipsing that of popular 4x4 dual-cab utes.

“The introduction of the new alloy tray and TradeAce Built to Go models to our Hybrid Electric range offers customers a high quality, cost effective and versatile drive-away solution that can reduce business operating costs from day one,” said Mr Petrovski.

So how does the hybrid drive compared to its diesel 300 Series stablemate?

Driving impressions

We spent quite a lot of time in the outgoing Hybrid 300 Series in 2019, which impressed us with its frugal fuel use and simple operation.

In 2020, Hino introduced the new model with a range of functional upgrades like a six-speed AMT, revised hybrid system operation and more safety tech. Let’s see how it compares.

Leaving Hino’s head office in Caringbah with exactly one tonne of sand in the tray, we navigated heavy traffic before reaching the motorway and bound for the Eastern Suburbs to test the Hybrid on a drive route indicative of typical trade use.

The six-speed transmission offers a lower first gear and taller sixth compared with the old model’s five-speed unit, which

improves performance from a standstill as well as at highway speeds.

During stop-start driving the truck will also now accelerate, under light throttle, off the mark using electric power only. Once required, the clutch couples the diesel motor to the driveline and it awakens from idle.

We experimented with how far we could get on electric-only power, reaching 20-30km/h before the diesel came into play. The transition was pretty seamless but noticeable in how quiet it is off the line.

This is a new feature, which in urban stop-start driving offers an efficient take-off that contributes to the improved fuel economy. The stop-start engine shutoff helps too, and the electric motor both doubles as a starter motor and replaces the alternator.

What remains the same across model generations we’ve tested, is that during normal driving the engine really lugs; operating at such low revolutions it feels like it’s about to stall. That’s normal, though, because the electric motor is busy helping the diesel engine propel the Hybrid 300.

Another fuel-saving feature that feels a little unusual at first, is the coast function that disengages the clutch when coasting – effectively dropping into ‘angel gear’ – instantly reengaging when power is required.

The little 300 feels better on the highway than it ever has, probably due to the taller sixth gear and coast function, with a quiet and comfortable cabin.

It really shines in urban environments though, where it lugs around sipping less diesel but without a noticeable compromise – in fact the torque spread is even better than a diesel-only 300 Series.

Once you’ve got your head around the differences in driving behaviour, with things like the coast function, low operating RPM, and electric-only take-off, it’s an enjoyable truck to be in.

We didn’t manually shift the AMT at any point across the day, even when climbing the hills out around Vaucluse or accelerating onto the motorway uphill. It’s a well sorted driveline that does what it says on the box.

A real world comparison between diesel-hybrid and current diesel technologies produces some impressive results.

The concept is simple: take two Hino 300 Series 616 TradeAce trucks, fit them up with realistic simulated loads on their Ready to Go alloy trays, and operate them on the same route for the best part of a day and compare the numbers recorded by a Hybrid and a current spec diesel.

The 616 TradeAce is powered by a 4.0-litre 150hp (110kW) diesel engine driving through a 6-speed Allison automatic transmission.

Of course, it’s impossible to drive two trucks at once so we take the lead in the Hybrid while a Hino staffer pilots the diesel version and stays close behind us.

The planned route takes us on what could, definitely, be a realistic delivery run around Sydney with simulated dropoffs at such iconic locations as the Canterbury Racecourse, Sydney Fish Markets, Barangaroo, and Woolloomooloo as well as the loading docks at well-known hardware chains and shopping centres.

The HinoConnect telematics program is utilised to accurately measure the fuel consumption of both vehicles. Remember, same load and same route at the same time of day (we were actually nose-to-tail for much of it) so same traffic conditions.

It could be argued that the only potential variable could be different driving styles, but this is mostly negated by travelling

so close together and the results for both vehicles show no harsh braking or acceleration incidents.

The Hino Hybrid uses a parallel electric diesel design and a Toyota Group nickel metal hydride battery, which has been used in over 15 million hybrid vehicles worldwide.

The Hybrid’s 4.0 litre four-cylinder diesel engine is supplemented by an upgraded electric motor coupled to the front of the six-speed automated manual transmission, which in itself is an upgrade over the previous model’s five-speed AMT.

Along the way Hino experimented with a fully automatic transmission but found that fuel efficiency suffered so went back to automated manuals for production hybrid trucks.

The box has a very low first gear and double overdrive ratios meaning hill starts are easy and cruising at 100 km/hr is done at around 2,000 engine rpm. On take-off, the electric motor initiates the drive momentum and once moving the clutch engages smoothly to tap into the power from the diesel.

A bonus for maintenance costs is this set-up results in a substantial reduction in clutch component wear as the clutch only has to match speed between the motor and the engine rather than take the strain of the initial take off.

Once moving, as the transmission upshifts the electric motor delivers some of its power immediately before the clutch reengages to further smooth out torque delivery.

The electric motor also functions as the starter motor for the diesel engine, saving weight and maintenance and it also operates as the vehicle’s alternator for both powering electricals such as lights and the multi-media system, in addition to recharging the main battery and the conventional 12-volt battery.

would operate the engine brake on a diesel-only Hino 300.

Even around town the regenerative braking is very effective and will extend the life of brake components such as pads and rotors. The stop-start system minimises inefficient idling time and we soon become quite adept at anticipating traffic light changes and taking our foot off the brake pedal just as our light is about to change to green.

This restarts the diesel with the brakes automatically remaining held by the Hill Hold function, keeping the truck stationary until the accelerator pedal is depressed.

The 300 Series Hybrid was its fastest growing model for the year, helped along with the introduction of the new Alloy Tray and TradeAce Built to Go models to the Hybrid Electric range and can be ordered fitted with a Hino Genuine aluminium tray, ladder racks and a Hino Genuine alloy bullbar on Wide Cab models or an alloy nudge bar on Standard Cab units. As with other Hino Hybrid Electric trucks, the new Built to Go models include the comprehensive Hino SmartSafe safety package with advanced driver-assist technology including Pre-Collision System (PCS) with Autonomous Emergency Braking (AEB), Pedestrian Detection (PD) and Lane Departure Warning System (LDWS).

This is in addition to Vehicle Stability Control (VSC), reverse camera, dual SRS airbags, and four-wheel disc brakes.

Hino announced in 2022 it would be pursuing a renewed focus on the Hybrid and has revised the way it presents the Hybrid equation to customers.

“It used to be how long to pay back the premium,” says Hino Australia’s Department Manager – Product Strategy Daniel Petrovski.

“But customers are not buying like that anymore and the payback needs to be on a cash flow basis and at the end of, say, a five-year finance arrangement they also need to have more cash in their pockets with a Hybrid than if they’d bought a diesel.”

Currently the Hino Hybrid has a premium over the diesel of just over $16,000 based on the list price of each truck. Hino has developed a Return on Investment calculator which allows the input of a number of variables including annual kilometres travelled and the current and predicted cost of diesel fuel.

Hino is being realistic in presenting hybrid-diesel trucks as a solution to emissions issues.

There will be Battery Electric Vehicles, there will be Fuel Cell Electric Vehicles and there will be Hybrids. Larger vehicles and long distances do not suit current BEV technology and Australia will require extended ranges for many applications.

from day one.

It’s widely acknowledged that the cost of diesel is unlikely to go down, and although this exercise used the then current retail diesel price of $2.00 per litre, as the price at the bowser goes up the Hino Hybrid presents an even better business case.

During the four or so hours of our trip the diesel Hino consumed 15.7 litres of fuel while the Hybrid only used 11.5 litres. That’s 4.2 litres/28.95 per cent less.

Examined on the typical km/litre metric, this converts to 6.13 km/litre from the Hybrid and 8.63 km/litre for the diesel model. Extrapolated over a theoretical 12 months travel of 48,500 kilometres, the savings are a remarkable $2,973 based on $2.00 per litre.

Take it out to 5 years/240,000 kilometres and the Hybrid’s savings amount to $14,868 without taking into account the reduction in maintenance costs associated with operating a Hybrid. And the planet receives a bonus as well.

Using the same input numbers the Hybrid emits 511 kgs less CO² per month than the equivalent diesel, or 6,137 kgs less per year.

OK, so here’s the disclaimer: environmental benefits and operational savings will vary according to each application, but we are left in no doubt that the Hybrid’s performance capabilities closely match those of its sister diesel equivalent on what we consider a realistic and balanced test exercise.

Regenerative braking and battery charging can be maximised by using the wand located on the steering column which

But in the meantime, smaller vehicles performing metropolitan tasks, similar to this typical stop-start multi-drop exercise, can be contributing to the operator’s bottom line

determines whether we replace a truck or not.

“We run a bit of a traffic light system, so if it’s running a low average service cost then it stays but once it gets up into the orange – that’s when we look at replacing it.

“The plan is to replace them with Hino Hybrids as they reach end of life,” she said.

While it’s too early for CNW to report on real-world fuel savings or emissions reductions for its Hino 300 Hybrid trucks, the company is focused on the future benefits of hybridising its fleet.

“The fuel saving and the CO2 savings are where we see the benefits for the company and we do certainly see future benefits for the company based on our analysis,” CNW Chief Executive, Simon Baynes said.

next five years, Ms Uhlmann says it is likely to consist mostly of hybrid vehicles – but she didn’t rule out the addition of BEVs.

“I definitely see the hybrid being our main truck purchase, because even when we need the larger truck they’ve now got that larger truck, because we get around that 8.5-tonne GVM as well,” she said.

“So from our point of view we can pretty much keep rolling Hybrids out right now as a business.”

The company hopes to add more true hybrid utes to its light vehicle fleet, too, with just one 48v mild hybrid Toyota HiLux added so far.

“Hopefully one day we get something in the ute space, so that we can get more hybrids into the fleet because we are heavily light vehicle based as well,” Ms Uhlmann said.

“We purchased one hybrid HiLux but it only really runs the accessories, so it’s just 48 volt.”

The sky’s the limit for CNW, as the company continues to grow in line with the rapid electrification of the modern world while also focusing on its approach to sustainability through fleet hybridisation.

“We’re always looking for growth and the industry is in pretty good shape, particularly the electrical industry with the electrification of the world and the massive opportunities there,” Mr Baynes said.

Family owned and operated electrical wholesaler CNW opened its doors in 1952 and, while the world has changed a lot across the last 72 years, the company has ridden the technology wave the entire way. Now, it turns its sights to emissions reduction across its fleet of around 200 vehicles.

CNW invited Fleet HV News to its Murarrie warehouse in Brisbane, as the team welcomed three new Hino 300 Hybrid trucks to its growing fleet of trucks – with plans to replace outgoing runners with hybrid models.

“The price of hybrids has come down a lot, with hybrids versus the normal (diesel) truck price, so pretty much from our point of view we can start getting savings straight away with these,” CNW Asset Manager, Melinda Uhlmann explained.

Across the existing fleet of trucks and utes, with Toyota and Hino making up the bulk of the units, a few standout models have proven perfect for the delivery work CNW undertakes in both metro and regional areas.

“They’re pretty much all Hino 300 Series trucks now and mostly the 616 model, but we do go to a 921 for the rural

regions where we have to go to mine sites,” Ms Uhlmann said.

“Over the years we’ve found Hino has had the best longevity for us, they’ve met our needs and we’ve got the relationships with the dealerships here.

“They go above and beyond when we need one about sourcing it and then they know our specs really well – it just makes purchasing easy for us.

“We get good resale too, especially in the market at the moment!”

The fleet approach at CNW is to run vehicles until maintenance costs start to creep, taking a calculated approach to replacement, with outgoing vehicles likely to be replaced by hybrid models into the future.

“We run a lean fleet and our owner’s motto is that if we can run the vehicle and keep it in good working order then we get the longevity benefits,” Ms Uhlmann said.

“So we run a ‘cost analysis versus kilometres’ structure that

Despite being an electrical wholesaler, which happens to also sell electric vehicle chargers, CNW is set on hybrid vehicles at this stage based on the amount of rural kilometres they clock.

“I think the infrastructure needs to catch up a bit with the electric, because we do have a lot of remote locations and we would need to stop and charge, whereas with the hybrid you’ve got flexibility and then you can do long kilometres in them,” Ms Uhlmann said.

Ms Uhlmann’s advice for fleets considering a hybrid truck, perhaps due to range and residual value concerns associated with a dedicated battery electric vehicle (BEV), is to give it a go.

“I think it’s worth having a go with hybrids, even if you only get one or two for a couple of years to see what difference they make,” she said.

“From our point of view, when the cost became similar and we could also see benefits in fuel savings and co2 reductions, it made sense for us to go that way.”

When asked where she sees the fleet heading across the

“At CNW Electrical Wholesale, sustainability serves as a foundational principle guiding our every decision and our unwavering commitment to the community drives us to pave the way towards a clearer, more sustainable world.”

Hino Australia pushes hybrid trucks as stepping stone on decarbonisation journey

HINO Australia continues its 300 Series diesel-electric hybrid push amid a widespread electrification focus sweeping the transport industry, including hopes to expand its range with the Japan-only 700 Series Hybrid.

While Hino does offer its light-duty Dutro Z-EV electric truck in Japan, which has been in production for more than a year, the Australian arm is focused on its hybrid offerings.

Hino Australia president and CEO Richard Emery sat down with GoAuto to discuss the truck-maker’s hybrid focus as it aims to offer a bridging solution to decarbonisation of the road transport industry.

“We had clients who had said to us last year, ‘nope, we’re looking at buying some battery-electric trucks, we don’t think hybrid-electric’,” Mr Emery said.

“They’re now coming back and discussing it with us again.”

Mr Emery says the truck-maker saw strong interest in electric trucks at a dealer level last year, but the interest is beginning to shift back to hybrids as a mid-term solution.

“Everyone was buying an electric truck, but all they were doing was buying one or two to trial or test,” he said.

“A year later, they’re saying, ‘right, we’ve got that in place now, but for us as a truck business making wholesale changes to our fleet across to electric is probably five years away’.

“So they can keep buying diesels, slow down the rotation of trucks, or re-look at hybrid-electrics.”

The truck market shift, Mr Emery says, mimics the cooling seen across the passenger battery electric vehicle (BEV) market as later-to-adopt consumers question practicality, purchase price and, of course, residual value.

In fact, hybrid car sales were up 195 per cent year-on-year in April, while BEVs sales experienced a five per cent yearon-year slide in the same month to represent the first yearon-year monthly dip in more than three years.

“I think you’ve seen that in the general electric car area globally because there’s been a bit of a softening, not in demand but in focus of interest,” said Mr Emery.

“And of course, the truck industry was always a little bit

sceptical about application and range and weight.

“They knew they’d need to look at it and trial some trucks to see how it works, but obviously with the costs of electric trucks and all of the compromises, it kind of felt to us like last year it was rampant.”

Mr Emery highlighted that while the car market has achieved a penetration rate of 10 per cent for electric vehicles, the road transport industry operates on weight and compromises are not quite as easy to make.

“We think there is a glass ceiling on the transition to battery electric between now and 2030, because I just can’t see how the industry is going to pick up more than 10 per cent,” he said.

“If you think about how many trucks that is, that’s a lot of trucks to go into the industry that need to be charged and are compromised on range and weight and things like that.

“The industry is not ready to make that shift, not just in terms of what they purchase but how they run their businesses.”

Hino Australia believes the solution, at least in the interim,

is hybrid solutions like its 300 Series Hybrid and the Japanonly 700 Series Hybrid that the firm is pushing to bring Down Under and which Mr Emery revealed is “certainly now on the table”.

“We’ve said to our dealers, talk to your clients about how they’re going to transition their fleet across the next ten years because that’s how long it’s going to take – maybe longer,” Mr Emery said.

“So, we think hybrid electric has a five-year window, where guys might say, ‘10 per cent of our trucks are going to move across to battery electric, but we can’t justify the expense and the compromises to go beyond that, so let’s put another 10 or 20 per cent of our fleet to hybrid electric’

The rhetoric at Hino Australia is that the hybrid models offer a stepping stone in the electrification journey, complementing battery electric options, which Mr Emery sums up with an analogy.

“I told one of our dealers that if we’re trying to cross a river, to transition the fleet as we need to do, at the moment stakeholders and shareholders and boards are asking fleet managers to go the whole way in one jump – and some are going to fall into the river,” he said.

“If we can be the stepping stone in the middle of the river to allow them to have a crack, to start to make the jump to battery electric easier if it’s still two years from now or three years from now.

“The people jumping the whole way across are also doing it with immense amounts of government money and it’s not sustainable”

PETER WHITE

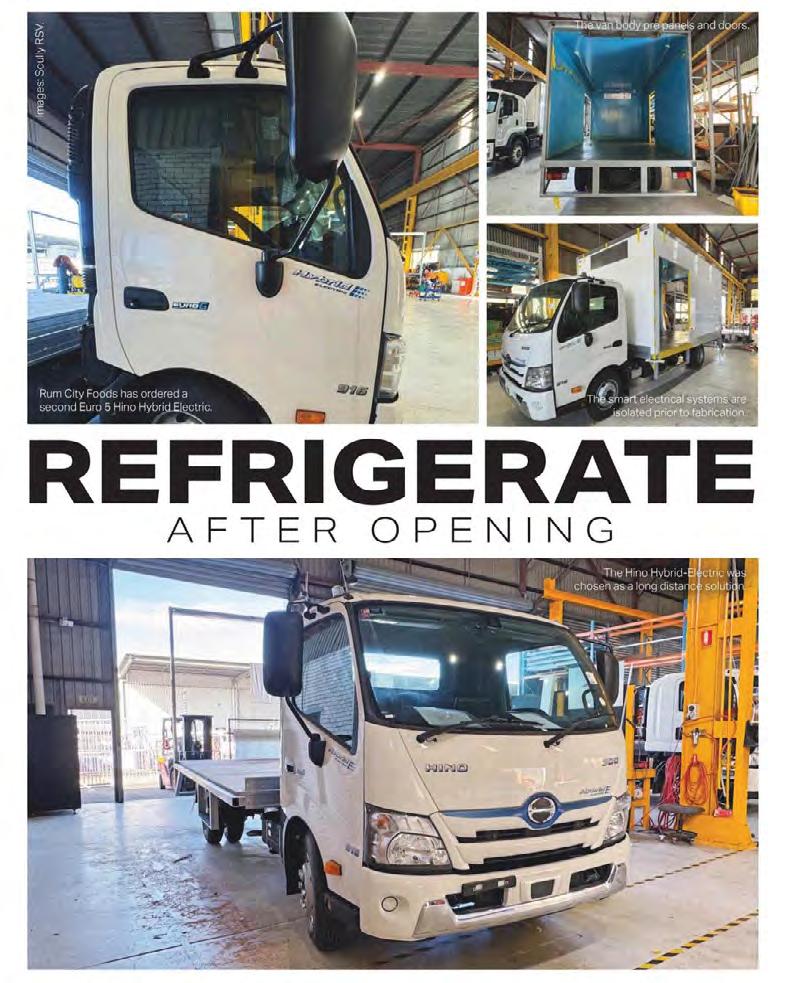

Paving the way to green solutions, Scully RSV is introducing its first hybrid-electric refrigerated solution – via Hino – to the local market.

Known for its innovative craftmanship, Scully RSV is providing customers a solution to help them transition to lower emission heavy vehicles without having to compromise on performance.

The journey to refrigerated hybrid truck-builds began when long-standing customer Rum City Foods asked for a greener transport solution.

However, according to Andrew McKenzie, CEO of Scully RSV, fabrication of a hybrid truck isn’t as easily replicated the same as it is on a standard diesel-driven truck.

“They’ve got batteries, they’ve got smart electrical systems, so you must be able to isolate those systems before you can start to weld and apply electric current to those vehicles,” he says.

“So, it’s important that we’re aware of those circumstances and those situations. Our experience and our investment in our engineering resource allows us to capitalise.”

As well as having 30 years manufacturing experience, several factors contribute to the businesses success in building such models.

Live feedback from trucks already in their fleet, according to Andrew, plays a vital role in the developmental process.

“We’ve got that in depth experience of having 400 trucks in our

rental fleet,” he says.

“Every single day, we’re getting live feedback on how they operate, how they work, what potential failure modes exist within the products. We develop the product off the back of that. That’s how we do it.”

The benefits for Rum City Foods are twofold as Andrew describes the impact this will have not only for Scott McIntyre, Rum City Foods Sales Manager, but also for the business.

The smart electrical systems are isolated prior to fabrication. “He gets to start to learn, develop and understand a little bit more about what operating electric trucks looks like in his fleet but still has the ability and assurance that, at the end of the day, he’s got the diesel engine that he can get home if there is a particular issue,” Andrew says.

“He runs long distances in North Queensland, and so full electric doesn’t yet work for him, so the hybrid solution is perfect.”

In fact, Rum City Foods was so impressed with the initial build it ordered a second Hino Hybrid-Electric refrigerated body manufactured by Scully before the first one was delivered.

Focused on bringing the project to fruition, Andrew emphasises how it is a collaborative effort between Scully RSV and Hino trucks.

With the fabricating process in full swing, they expect to deliver the complete truck body within two weeks.

“We’re quite literally working through with the engineering team at Hino down in Sydney in terms of the fabrication process associated with it at the moment,” he says.

“All the panel kits, doors, sliders, and steps are all sorted out. The parts are ordered, so we’re in the manufacturing phase now. Within the next two weeks, that will be popping out the

other side of the factory.”

Beyond manufacturing, Andrew also highlights the process that goes into producing and crafting such vehicles and how a dual thinking approach is essential to good product development.

“From a product available perspective, there’s really two schools,” he says. “There’s real world and then there’s theory. And so, you really need to take both approaches.”

Working with Queensland University of Technology and their customers, Andrew explains how the company adopts best practices.

“We still collaborate with Queensland University of Technology (QUT) and utilise best practice, what’s new technology, what’s new thinking — trying to really get and tap into fresh minds and fresh ideas around best practices not just from a product perspective but from a manufacturing and systems perspective,” he says.

For Scully RSV, growth is now on the agenda, moving into a new 12,000m² facility in Brisbane late last year, Andrew reveals the company’s ambition towards building to record volumes.

“Today, we’re building at near record volumes and that will continue to grow in the coming weeks and months as we push towards building 60 a month,” he says.

“That’s ultimately the goal, and that’s the scale and the capacity of this factory here in Brisbane. Then we’ve got some options that are at play in some other regions.”

Since moving in six months ago, Scully RSV has gone through a number of iterations in terms of factory layout to optimise their processes.

“We’ve now reached a point where we’re comfortable and happy with our factory layout and its ability to consistently and reliably allow us to produce to time-bound production slots.” says Andrew.

“It’s unlocked the efficiency in our build and manufacture of the product.”

With no intention to slow down, the company remains focused on their customers and how the introduction of the Hino Hybrid-Electric trucks will ultimately help them on their journey to sustainable solutions.

“They will be available to our customers who want to start to dip their toe into the water in terms of what it means to genuinely take that step into the next phase of clean emissions vehicles,” he says.

“It’s exciting. We don’t want to hype it up and then under deliver, we’re more about actions and outcomes as an organisation. So, those vehicles will make their way into our fleet, and they will form a part of what we do as a good corporate citizen.”

As part of its partnership with the Repco Supercars Championship, Hino Australia will debut this hybrid tilt tray this month. Image: Hino Australia

Hino Australia will debut a new 300 Series hybrid electric tilt tray recovery vehicle at the Sydney SuperNight event, being held from 19-21 July.

The truck will be fitted with a unique Kyokuto single car carrier body with a tilt tray slide that allows loading work to be performed at almost any angle down to zero degrees.

“The Kyokuto body is unique and relatively new to Australia – it has been selected as it meets the exacting operational requirements of Supercar races and will ensure the safe and prompt removal of crashed Supercars and other race cars,” said Richard Emery, president and CEO of Hino Australia.

“One of the major benefits of the tilt slide is that, once the tray is on the ground, loading can be done at a near zero degree angle and from the ground eliminating the risk of falling from heights.”

The quick removal of crashed cars is possible thanks to a one-handed, single button remote operation.

“As part of our long-term partnership with Supercars, we have provided a 500 Series standard cab recovery vehicle for the last five years. The 300 Series hybrid electric is a natural progression that ties in with Supercars sustainability strategy,” added Emery.

Supercars chief operating officer Tim Watsford says the truck is a welcome addition to the Supercars recovery fleet.

“This marks a significant step forward in our commitment to sustainability and efficiency,” he said.

“This addition to our fleet confirms a significant milestone for Supercars and we look forward to utilising their advanced features to ensure seamless recovery operations at our events.”

The hybrid electric and 500 series standard cab recovery vehicles will be in action at the Sydney, Bathurst, Gold Coast and Adelaide rounds of the 2024 Supercars Championship.

FLEET HV NEWS TEAM 14 October 2024

Hino Australia has highlighted its dedication to advancing hybrid and electric trucks, setting priorities for 2024 and beyond. According to Hino Australia President & CEO Richard Emery, the focus will remain on the Euro 6-compliant 700 Series and 300 Series Hybrid Electric trucks.

“We will finish 2024 with a similar volume to last year, and our Euro 6 products… will remain our focus for the coming years,” Emery stated, underscoring the importance of these vehicles in Hino’s portfolio.

At a recent business briefing, Hino showcased its Hybrid Electric trucks in varied applications, demonstrating their adaptability. Among the featured vehicles was a Tilt Tray Recovery Vehicle, which is used at Supercars events. Another highlight was a council-specified tipper with an electric Power Take-Off (PTO), allowing it to function without the diesel engine.

This reflects Hino’s efforts to engage a broader market by showcasing hybrid capabilities in diverse environments, from council work to vehicle recovery.

Emery also emphasised the role of Hino’s Parts Distribution Centre in bolstering aftersales results and mentioned that the dealership network has expanded its service work bay

capacity by 17% in the past two years, including new Hino Hub satellite workshops.

Looking forward, Hino Australia is actively testing various lowemission technologies. Emery pointed out that the 300 Series Hybrid Electric trucks have been pivotal in reducing fuel consumption and emissions in Australia for over 15 years.

“They are the most appropriate solution for the current business and customer environment,” he said, noting Hino’s approach aligns with local needs.

To further prepare for Australia’s transition to electric vehicles, Hino plans to trial the 700 Series Hybrid Electric and the battery-electric Dutro Z-EV in 2025, evaluating their practicality and cost-effectiveness.

These trials will help ensure Hino’s electric options meet customer requirements when full-scale adoption becomes viable.

GRAHAM HARSANT

22 October, 2024

Richard Emery, president and CEO of Hino Australia, recently gave an update on the state of play for the business currently and moving forward, as the company transitions towards Euro 6.

Refreshingly honest, Richard spoke of the companies supply problems, particularly with their ‘Ready To Go’ range – as well as a stronger emphasis going forward on the Hino Hybrid Electric product, currently available in the 300 Series, and possible testing of the 700 Series Hybrid Electric (available in Japan) in Australia in 2025.

The Hybrid Electric demonstration fleet on display showed various applications that the company is honing in on in terms of where they think this propulsion form is at its best – the fleet to be used for drives and training with dealerships and customers going forward.

Using the famous Bathurst 1000 race weekend as a platform, Richard spoke about the company’s involvement in motorsport. For the same reason that journalists were keen to attend the weekend, the company uses their involvement as an attraction for customers and dealers who continue to be engaged in Supercars.

The company has been involved in the sport for a long time on a number of different levels. They are a major sponsor of the Supercar Championship itself including the iconic Hino Hub (technology) and the Recovery Team (safety), sponsoring the Toyota 86 Series and a partnership with Team 18 (performance).

The company believes that all these elements provide a great connection to the Hino brand. “These are all brand attributes fundamental to our business,” said Richard. “And we can execute and activate them with our relationship with supercars.”

In talking of the company’s market outlook and performance, Emery was candid in his comments.

“We have seen a softening of the market in the last six months after being on quite a strong run. That is probably manifesting itself mostly in the light segment while the corporate levels are still consistent and robust. Post-Covid government incentives pushed sales dramatically, causing supply chain issues. 2024 is settling back down due to some structural issues, supply and the market is coming back a bit.”

Hino sees problems in getting bodies built, and believes that key to any opportunities going forward is the OEM’s working to control and increase capacity of the finished product.

As an example, the time to build up a finished truck (trays, tippers,etc) has stretched out to an average of over 120 days currently whereas only a few years ago it was 90 days.

“We have many examples of customers having to wait six months or more for a body build slot and get a body put on a truck. So the local bodybuilding industry h as not been able to keep up and adjust to the surge that has occurred since Covid. Whilst settling down a bit it is still going to be a problem going forward and has put the company on the back foot.”

Hino believe they need to take greater control of the finished product, especially as – unlike many other manufacturers –they warrant the bodies on their trucks. Whilst the company does not receive a great number of warranty claims, the far larger proportion of these is related to these bodies, hence the company’s desire to be able to exercise greater control and influence in this area. “All the customer sees is a Hino. They don’t see the truck and the body as two separate

entities so it is obviously in our interest to ensure that the body supplied to our trucks are simply the best.

“Our bodybuilding industry in Australia is majority mum and dad, a shed and some welders. Hino build their tippers out of Kyoto in Japan and it is a production line like building a truck, with robots et cetera. We don’t have that scale in Australia and when we spoke to a lot of our bodybuilders with whom we have very good relationships they were reticent to commit to a bigger share because of staffing problems et cetera. So the capacity hasn’t grown to keep up with the demand.”

The company has invested heavily in their parts distribution business recently and has seen the impact the investment has had on the business over the past three or four years. This was a significant investment in the middle of Covid which doubled the capacity of their parts capability. Off the back of that, the company has seen the parts business increase by 40 per cent.

When supply of new vehicles was under severe pressure through 2021, 2022 and 2023, clients were keeping their old trucks longer to meet customer demands and Hino was able to supply the necessary parts and equipment to enable them to do so.

This led to pressure on work bay capacity and qualified staff – problems common to the trucking industry as a whole. Hino has worked with dealers to get more young people into the industry but it remains an issue, albeit slightly easing. These problems exist across bodybuilding and auxiliary industries that feed the company’s business.

Dealers have also invested some $50 million on their facilities since Covid, showing their faith in the company’s product.

Richard Emery went on to discuss the company’s sales projections for the future, predicting a drop from the current high 5000s to around the 4000 mark for 2025 due to the tooling up and introduction of Euro 6 vehicles

“Late next year Australia will move to Euro 6. In that transition will see a production gap between our Euro 5 offering and the incoming Euro 6 supply. This in itself is not unusual as you retool.

“We have been working through this with our dealers and customers and whilst not ideal we have managed to balance this approach and the challenge in terms of our conversations with dealers and customers.

“Beyond that, 300 series will also have a gap in availability although not as severe as the 500 series. Whilst the dealers are somewhat frustrated and disappointed they remain committed to our joint business despite this hiccup in 2026. A normal trading environment is expected to return in 2027.”

Hino is not ignoring full electric or BEV, having one on display at Bathurst for trucking journalists to get a first-hand look at. Image: Graham Harsant The company has two products which are already Euro 6,

these being the heavy duty 700 Series and the 300 Series Hybrid Electric. The company is concentrating on these two products over the next couple of years.

“We think there is significant growth opportunity in Hybrid Electric, and the 700 has never really hit its straps. Our supply line for the 700 series has been restrained over the last couple of years and that is now opening up. We will be working hard to increase sales well beyond the 500 or so per annum that we are currently moving.”

Hino believes that sales of 1000 plus for both the 700 Series and 300 Series Hybrid Electric are eminently achievable. Hybrid Electric is a no-brainer in that whilst requiring a greater outlay of capital (approximately $16,000), the benefits in terms of fuel saving and greater power far outweigh cost and relatively minor weight penalties

Customers that would not look at Hybrid Electric a year ago are now coming to Hino with renewed interest. Given the consistently high price of diesel, the only surprise is that they didn’t investigate earlier. Adding to their confidence should be parent company, Toyota’s solid reputation in the field of hybrid electric.

In further news Hino have announced that with the Euro six change the company will move totally to two-pedal operation, deleting manual transmissions as an option. They will also be rationalising the range, reducing product variants from 164 to 99. The 700 Series will go against the trend, increasing that range from 18 to 29 models.

A new (for Australia) in-house 12 speed AMT gear box will also be offered for the first time on various products.

Hino is not ignoring full electric or BEV, having one on display at Bathurst. However the company sees huge market advantage in being able to provide Hybrid Electric vehicles with their attendant benefits as a method of transitioning.

As the only player in this field at this time, Hino would have to be in the box seat to capitalise on a unique but proven product.

Hitching the Hino wagon to Hybrid - Toyota’s truck brand explains its reticence to embrace battery electric.

Hino has declared that it will continue to hitch its wagon to hybrid drivelines as the industry battles to reduce carbon emissions.

Speaking with Australian truck journalists at a recent media briefing, Hino Australia boss Richard Emery said the company would ramp up its commitment to Hybrid technology both with the 300 series light duty models, which are already available here and with its flagship 700 Series heavy duty models, that are yet to be released with hybrid drivelines here.

Emery said customer trials of 700 Series hybrids should start in the New Year, with the heavy duty hybrid already on sale and working in its native Japan.

Emery believes that sales of the 300 Series Hybrid could be significantly increased from its current rate of around 300 units per annum and has challenged his team to increase the number of 300 Series hybrids to around 1000 a year.

“You’ve already seen us ramp up on our commitment towards hybrid electric, so we want to really concentrate on

these two products over the next two years.”

“We still think there’s significant growth opportunity in hybrid electric anyway, and 700 Series has never really hit its tracks.”

Emery has signalled the desire to bring the heavy duty hybrids down under, with the Japanese based, Toyota controlled truck maker still a way off having a major footprint in the battery electric ecosphere or in having a viable full battery electric truck solution.

The Hino would not be drawn on the well documented Toyota claims that solid state batteries will be the real game changer in zero emission vehicle power, when they are predicted to come to market around 2028. It is fair to say that both Toyota and Hino’s apparent tardiness in introducing or embracing pure electric models may well be linked to solid state battery innovation may have a lot to do with the arrival of the new tech.

Toyota has predicted that solid state batteries should double range and halve charging times, making battery electric

vehicles far more viable than they are at the moment.

Before that however, Emery says that hybrids are the most practical and realistic solution for everyday truck operators, particularly for fleets seeking to reduce emissions, but not ready to spend the added investment required for full battery electric and the challenges that come with that including charging and range limitations.

For the past year or so Hino has tried a subtle rebrand for its hybrid technology, calling them Hybrid Electric Trucks, however nothing can be taken away from the fact that the prime source of power for these trucks is the diesel internal combustion engine they run.

Emery emphasised that 70 per cent of electrified vehicles or alternative fuel vehicles in the Australian market are hybrids.

“When we look at our sales history we were kicking along the bottom there about 25 sales a year, and in 2022 that went up to 72 on a 75 vehicle target. Last year, we sold 220 on a target of 250, this year we’re up over 350 in terms of order intake, so in terms of what our plan was for hybrid, we’re on that pathway for that 1000 hybrids a year.”

Emery said the company is being very realistic about the approach to the transition that’s going to happen over the next couple of years, adding that the overall situation has multiple layers and solutions.

“I know we we have copped some criticism, along with Toyota, as part of that family of companies, that we have had our heads in the sand on the matter of battery electric vehicles,” Emery admitted.

“However, just like Toyota, we can take exception to that, because we’ve had hybrid trucks reducing consumption emissions in Australia for 15 years or so, and we are ramping up our marketing and volume as we see them as a unique offering with real world benefits now within the markets coming our way,” Emery said.

The Hino boss said the company continues to invest in all of the zero emission technologies whether it is hybrid, battery electric or hydrogen fuel cells.

“No doubt the move to ZEV and the move to hydrogen fuel cell will accelerate and our business continues to invest in all those things and we’ll have fits and starts, and there’ll be surges where, whether it be because of incentives or whatever else primes the market, make no mistake, when that tipping point comes, we expect that we’ll Hino will be at the forefront of that because we’re part of our biggest automotive group in the World,” said Emery.

“For now however, our job is to offer the best all round solutions for the current business and customer environment, and at the moment that is ICE and hybrid electric,”

“Hino with Toyota continues to trial our solutions for improved technology, not just on ICE engines, but with hybrid electric,

battery electric and fuel cell drivetrains investments that together run into billions, and we have trial programs in Japan on all of these technologies,” Emery added.

Hino proved that it is not excluding current tech battery electric trucks. On hand for the media to inspect at the briefing in the city of Orange in central Western NSW was a Hino Dutro Z-EV van. The light duty Japanese spec battery electric truck based on a Dutro or 300 Series platform was fitted with a ‘van style’ with low flat floors wide opening side and back doors and a walk through capability. Although we didn’t have the opportunity to drive the Dutro, it presented a potential new niche for Hino, not only in body design but in zero emission potential.

Emery did confirm however that the Dutro Z-EV is being tested and trialled in Australia in an effort to better understand the technology and how it can be improved for our conditions. He didn’t give any indication of when such a truck might find it’s way on to Hino showroom floors.

Emery also indicated that the relationship the company has had with battery electric conversion and engineering operation, SEA Electric was still in existence but although he didn’t annunciate it, the tenor of the comments indicated that it was possibly not in great health.

SEA Electric was sold to a Canadian venture capital company earlier this year and while there have been discussions about Hino continuing to sell the ‘knock down roller kits’ to SEA for fitment of electric drivelines, it is clear the relationship is not in a strong position.

“We have had discussions with the new owners but I am not sure about the long term future of the SEA operation in Australia,” Emery told T&B News.

“The SEA Electric trucks are sold under their compliance plate, not a Hino plate, Hino sells the CKD kits to SEA and they have a relationship with Hino dealers to sell their electric trucks,” he said.

“SEA has an ongoing relationship with Hino in North America which helps them meet strict requirements in states like California but I am not sure about the long term future of that operation, time will tell,” he said.

To demonstrate Emery’s point about the usability and versatility of the Hino Hybrid truck chassis the company showcased a hybrid tilt tray Hino at the Bathurst 1000 across the same weekend it was briefing the truck media in Orange.

Similarly the company showed off a truck that it said ideally met the needs of local councils, with a Hybrid tipper fitted with an electric PTO (power take-off), which allows the operator to power the tipper without the diesel engine running, reducing emissions when the vehicle is stationary but working.

In the annual business briefing late last year, Richard Emery, President and CEO of Hino Australia, and Daniel Petrovski, Department Manager for Product Strategy at Hino Australia, laid out a transformative vision for the future of fleet management. They emphasised the critical role hybrid electric trucks will play in reducing emissions, cutting fuel costs, and serving as a stepping stone toward battery electric trucks (BEVs). Here’s why fleet operators should look to hybrid technology as a key component of their 2025 strategy.

Hybrid electric trucks offer fleet operators an immediate and practical solution for lowering operational costs and reducing environmental impact. As Petrovski explained, “You’re getting up to 20% fuel savings and CO2 reductions, and those trucks are cheaper to operate for the customers.” This efficiency positions hybrids as a compelling alternative to traditional diesel vehicles, especially as regulatory pressures and costs associated with diesel engines increase.

Hino’s hybrid trucks are already making a significant impact in markets like Japan, where the 300 Series Hybrid has been well-received. Petrovski highlighted, “We’ve got thousands of Dutro ZEVs and hybrid trucks operating in Japan across diverse applications, from food co-ops to short-distance delivery fleets.”

Cost is a pivotal consideration for fleet managers. Petrovski shared detailed insights into the cost analysis of diesel, hybrid, and battery electric trucks over five years and 240,000 kilometres of operation. “For a diesel truck, you’re looking at around $175,000 in total costs, including fuel, maintenance, and repayments. A hybrid reduces that to about $150,000,” he stated. This $25,000 saving is significant, especially when diesel prices are expected to rise due to Euro 6 emissions standards.

Hino’s approach to pricing further enhances the appeal of hybrid technology. Emery confirmed, “When we introduce Euro 6, there will be additional componentry and costs associated with diesel trucks. However, we’re putting a price freeze on hybrid electric trucks, making them increasingly attractive.”

Battery electric trucks, while promising in the long term,

remain cost-prohibitive for many operators today. Petrovski explained, “The purchase price of a battery electric truck is higher than the total costs of a diesel or hybrid electric truck over five years. Plus, you often need two electric trucks to do the job of one diesel or hybrid.”

For many fleets, hybrid electric technology serves as a critical bridge toward full electrification. “Battery electric vehicles are great for lightweight, short-distance applications,” Petrovski noted. “But for anything requiring range beyond 100 kilometres or payloads over a tonne, hybrids are the solution.”

Hino’s hybrid trucks offer versatility across various applications. “We’re building fleets of hybrids tailored for different needs: council tippers, tilt trays, steel trays, plumbers’ trucks, and refrigerated vans,” Emery said. He also highlighted that hybrid trucks perform well not just in urban environments but also on country roads. “Our hybrids can intermittently operate at speeds of 80 to 90 kilometres per hour on electric power alone, delivering efficiency no matter the application.”

Petrovski and Emery were candid about misconceptions surrounding hybrid technology. One prevailing myth is that hybrids are limited to urban delivery vans. “If there’s an application in the light-duty market, a hybrid can almost certainly fit the role,” Petrovski asserted.

Another misconception is the weight penalty of hybrid electric systems. Petrovski clarified, “A 300 series hybrid electric is actually about 75 kilograms lighter than its fivelitre diesel counterpart, offering efficiency without payload compromise.”

While hybrid electric trucks have been well-received in markets like Japan, adoption in Australia has been slower. This is partly due to a lack of incentives. “In Japan, hybrids make up a significant portion of sales,” Emery noted. “But in Australia, we’re doing it without any government incentives.”

Petrovski highlighted the importance of education and market readiness. “We’re investing in educating our sales teams and dealers about the applications where hybrid

technology excels,” he said. Hino is also showcasing the capabilities of its hybrid fleet through customer trials and real-world demonstrations.

As everyone returns to work in 2025, fleet operators face mounting pressures to reduce emissions and adapt to changing regulations. Hino’s hybrid electric trucks offer an immediate, cost-effective solution that bridges the gap to full electrification. With rising diesel prices and increasing environmental scrutiny, hybrid technology is poised to become an indispensable part of the fleet landscape.

In Emery’s words, “There will come a point where the gap between diesel and hybrid narrows, just as we’ve seen with Toyota’s passenger vehicles. At that crossover point, hybrids become the clear choice.”

For fleet managers seeking to future-proof their operations, the message from Hino is clear: the time to invest in hybrid electric trucks is now.

Australia’s largest provider of traffic services, Altus Traffic, continues to reduce its fuel bill and CO2 emissions courtesy of the adoption of Hino 300 Series Hybrid Electrics into its fleet.

“Our fleet comprises of over 600 trucks, which are a combination of Truck Mounted Attenuators (TMAs) and Drop Deck bodies,” said Brendan Cannon, Group Fleet & Utilisation Manager for Altus Traffic.

“By continuing to add Hino Hybrid Electric vehicles to our fleet, Altus benefits from a cost-effective, lower-emission, and driverfriendly truck that seamlessly integrates into our operations while reducing fuel expenses and environmental impact,” said Mr Cannon.

“Over the last 24 months, we have tracked fuel on our Hybrid Electric and Diesel equivalent 300 Series trucks and have noted a 10 to 15% difference in fuel consumption – this is an immediate cost saving for the business, and also means a reduction in our CO2 emissions,” said Mr Cannon.

“We have been purchasing Hybrid Electrics since 2008 and currently have over 14 on our fleet,” he continued.

“One of the benefits is that the hybrid drive system operates automatically to assist the diesel engine and reduces fuel consumption – this means we benefit from lower fuel costs without requiring anything additional from our drivers.

“Our drivers don’t really notice any difference driving the Hybrid Electric and enjoy its smooth handling, making it a seamless and user-friendly solution.”

Australia’s largest provider of traffic services, Altus Traffic, continues to reduce its fuel bill and CO2 emissions courtesy of the adoption of Hino 300 Series Hybrid Electrics into its fleet. Image courtesy of Hino.

The Hino Hybrid Electrics use a standard diesel pump meaning there are no refuelling issues, range restrictions or charging requirements.

“Another advantage is the regenerative braking which converts kinetic energy into stored battery power when the truck decelerates, and also acts as an auxiliary brake – this improves efficiency and increases the life of the brakes, reducing our maintenance costs.

“From a fleet management perspective, the high levels of safety features allow us to meet our OH&S requirements,” he said.

Like all Hino 300 Series 4×2 models, the Hybrid Electric models feature Hino SmartSafe, a comprehensive safety package with advanced driver-assist technology that takes an active focus in protecting the life of drivers, passengers and other road users.

Hino SmartSafe includes a Pre-Collision System with Autonomous Emergency Braking, Pedestrian Detection and Lane Departure Warning System, plus Vehicle Stability Control, reverse camera, dual SRS airbags, four-wheel disc brakes, UN ECE R-29 cab strength certified and easy start.

Altus Group is Australia and New Zealand’s largest provider of traffic management services operating across more than 60 locations and providing traffic control, traffic engineering, event management and training services.

South Australia’s City of Charles Sturt continues to reduce its fuel bill and CO2 emissions courtesy of Hino 300 Series Hybrid Electric trucks in its fleet.

“There are over 50 trucks in our fleet and we recently added five Hybrid Electrics, which will assist us to reduce our carbon footprint and our impact on the environment,” said Evert Verhage, Fleet Manager for City of Charles Sturt.

“While it is early days, we are already seeing a significant fue saving which correlates to a reduction in CO2 emissions.

“The addition of Hino Hybrid Electrics is the small but significant stepping stone in the evolution of our fleet.

“The light-duty trucks are used by our teams to maintain more than 450 reserves and almost 500 hectares of open space across the City of Charles Sturt.

“The tray body is fitted with enclosed tool boxes and a Redarc charging system that allows for the easy recharging of battery power tools, as opposed to the previous two-stroke power tools.

The Hino Hybrid Electrics use a standard diesel pump meaning there are no refuelling issues, range restrictions or charging requirements.

Like all Hino 300 Series 4×2 models, the Hybrid Electric models feature Hino SmartSafe, a comprehensive safety package with advanced driver-assist technology that takes an active focus in protecting the life of drivers, passengers and other road users.

Hino SmartSafe includes a Pre-Collision System (PCS) with Autonomous Emergency Braking (AEB), Pedestrian Detection (PD) and Lane Departure Warning System (LDWS), plus Vehicle Stability Control (VSC), reverse camera, dual SRS airbags, four-wheel disc brakes, UN ECE R-29 cab strength certified and easy start.

The City of Charles Sturt is home to approximately 130,000 people from over 105 cultures and backgrounds, and is located to the west of the Central Business Distribute of Adelaide located between the city and the sea.

The Hino 300 Series Hybrid Electric range is available from Hino dealerships Australia-wide and includes the 616 Standard and Wide Cab 4.5 tonne GVM car-licensed models through to the 716 Wide Cab with a 6.5 tonne GVM and the 916 Wide Cab, which has a maximum GVM of 8 tonne.

Built to suit any industry, the versatile Hino Hybrid Electric offers a range of Built to Go models including Alloy Tray and TradeAce variants, or can be customised to any application, to meet the unique needs of any business.

“These features all contribute to our commitment to reduce emissions and look after our City for future generations.

“Our drivers are happy with the comfort, safety and features of the Hino Hybrid Electrics,” he concluded.

Hino trucks are renowned for their quality, durability and reliability so choosing Hino was an easy decision for City of Charles Sturt.

The Hino 300 Series Hybrid Electric range is available from Hino dealerships Australia-wide and includes the 616 Standard and Wide Cab 4.5 tonne GVM car-licensed models through to the 716 Wide Cab with a 6.5 tonne GVM and the 916 Wide Cab, which has a maximum GVM of 8 tonne.

Built to suit any industry, the versatile Hino Hybrid Electric offers a range of Built to Go models including Alloy Tray and TradeAce variants, or can be customised any application to meet the unique needs of any business.

As a part of their recent briefing, Hino presented some of the figures surrounding their sales across 2024, looking back on how the market has developed over the past four years since the advent of the pandemic.

Looking at figures from October 2024, Hino had sold 4,193 trucks in Australia in the year to date, which was tracking extremely similarly to the 2023 figures.

While there was a boom in sales immediately following the pandemic, this is now starting to level out.

“We’ve certainly seen some softening of the market in the past six months after being on a strong run,” Hino Australia president and CEO Richard Emery says.

“That’s manifesting itself in the light segment, and at the discretionary level. Tradies, retail, mum and dad businesses that may have a ute and a handful of trucks.

“At the corporate level, they’re still consistent and robust. The market’s been running pretty strong post-COVID. It’s getting potentially back to a ‘normal’ level of units sold.

“There was an acceleration in 2017-18, settled back down in COVID, but then past 2020 there was a bit of catch-up on

the latent demand.”

Richard believes that many truck OEMs have almost hit a limit on how quickly they can get trucks out to customers with the supply challenges that the pandemic provided.

This is especially in consideration with the change in what Hino can now produce with Euro 6 emissions in mind. There’s an expectation for a drop off for sales from late 2025 until production on the 500 Series can continue.

“Most of us found it hard to keep up from a supply perspective,” Richard says.

“The industry has held the number back across 2022-23 because of those supply issues. Some of it is structural issues, some is supply, and some is the market cutting back a little bit.

“We think the market is banging up against a glass ceiling due a number of things including lack of supply, getting bodies built, shipping out of Japan and other markets as well. We are bullish about the market out to 2030.

“We believe OEMs are working to control and increase capacity to finish products, and that will break through that

ceiling. We’re basing our supply on getting a truck out in 90 days, but that’s blown down to 120 days. Some customers are waiting for bodies to be built for six to nine months.”

Richard sees an advantage for Hino in its parts and distribution centre.

When they aren’t able to produce as many new trucks for customers across 2025 and 2026, this will continue to offer a servicing option for customers with older fleets.

“Although we’ve talked about our investment in our parts and distribution centre in numerous occasions, we can’t stress how much it has impacted our businesses,” Richard says.

“It has doubled our capacity for our parts business. When supply of new vehicles was under pressure, clients were keeping their old trucks longer. We did see a surge in maintenance across COVID.”

One of the challenges that Hino has faced in recent years which has drawn out production times is delays in the supply of bodies.

While some are built out of Hino’s home country of Japan in factories with full production lines, much of the Australian body building industry is kept relatively local and smallscale.

Like many other OEMs, Hino is beholden to the capacity these body builders are able to supply.

“Our body building industry in Australia is majority mum and dad businesses,” Richard says.

“We build our tippers out of Kyoto in Japan. It is a production line. We don’t have that scale here. When we spoke to our bodybuilders, they said they didn’t want to commit to a bigger shed and they didn’t have staff.

“30 per cent of our supply line in Australia is already over an

120 day wait. It is certainly a structural issue that we have to work on. It’s in our interest, our dealer’s interest and our customer’s interest to get right.”

What is then done locally comes with significant logistical challenges.

“We have a heap of distribution challenges,” Hino Australia Manager of Product Strategy Daniel Petrovski says.

“We do plenty of alloy trays, but they’re all coming out of Sydney. We can’t do a deal with three different bodybuilders in three different states.

“There’s a balance of 120 days vs 60 days, what’s the cost against the freight task and the quality and warranty? Standard warranty has gone from three to five years, and we have the body included.”

With the greater production of the Hybrid Electric, Hino is also eyeing off the challenges that brings in the workshop.

Like other areas of the industry, workshop mechanics, and specifically those with expertise in working on electric vehicles, are in high demand.

“There’s a lot of pressure on workshop guys,” Richard says.

“It is on two fronts: work rate capacity, and qualified staff. We can’t get enough welders and skilled workers in the industry off the back of COVID.

“We’re working with dealers to get more apprenticeships. It’s a struggle to take on the truck industry as an apprenticeship. We’re also working with our dealers on bringing in technicians from the Philippines, South Africa and the UK.

“We want to build a really strong foundation at the back of our business. Building that robust ecosystem for Hino in Australia is what we’re focusing on at the moment.”

While recent global emissions issues has caused Euro 6 model production to be delayed, Hino is focusing on its leading hybrid technology

Image: Hino Australia

Hino Australia has reiterated it will continue to focus on developing its hybrid electric truck models as it prepares for a delay in producing certain heavy vehicles for the local market.

With global emissions issues leading to a delay in the brand’s research and development process, there will be delays for the unveiling of Hino’s 300 and 500 Series Euro 6 compliant vehicles.

At a Darwin business briefing yesterday, Hino Australia president and CEO Richard Emery said the brand expects to deliver more than 5,000 units to local customers this year, matching its 2024 efforts.

After recently passing 150,000 unit sales in Australia, Emery expects Hino to experience a dip in sales in the next year as emissions issues globally has delayed Hino’s ability to deliver Euro 6 compliant vehicle models to the Australian market.

“In 2022, emissions issues put out engineering teams on the back foot and halted work on new projects as we had to re-test our previous models,” Emery says.

“We worked with our parent company Hino Motors globally

and Australian regulators to certify every model we have on sale, even ones that we no longer sell in the market. “That work finished late last year and was done without us having to halt the sales of our models.”

Emery says it’s important to note that all Hino products met certification requirements without needing a re-work. However, it delayed the brand’s ability to have vehicle updates ready for the arrival of ADR 80 in November this year that requires Euro 6 emissions standards to be implemented.

“In simple terms, we won’t meet the Euro 6 introduction timeline for some of our models,” he says.

“We ceased production of the 500 Series last year, and existing stock production is supported until the end of this year. Production won’t re-start until October next year on the Euro 6 model.”

There will also be a gap in production on the 300 Series model. In the meantime, Hino is turning its focus to technology that pre-dates any emissions issues in its hybrid electric space.

Hino’s hybrid electric technology was first launched in 2007, with the brand leading the way in this space in Australia for many years. With the technology also already meeting Euro 6 emissions compliance regulation and avoiding any supply issues, Hino is preparing to expand its hybrid capabilities.

“The continue focus is on our hybrid market – I make no apologies for continuing to concentrate on hybrid,” Emery says.

“Hybrid provides a perfect interim option – diesel powertrains will remain the pre-eminent solution in the Australian trucking industry beyond 2030, battery electric is and will be a key part of fleets and will emerge, while hydrogen will also play a role, but we believe hybrid electric will remain the only high volume, lower-emission truck in Australia over the next decade. Hino is currently the only manufacturer to offer one.”

Emery says Hino is the only brand in Australia that is currently working on all of these drivetrain solutions through Hino Motors, having started trials for a heavy-duty Profia (700 Series) hydrogen truck more than two years ago.

“As our competitors begin to offer diesel options that meet Euro 6 emissions compliance (like our Hybrid Electric does), the gap in monthly lease payments between hybrid and diesel will continue to decrease,” he says.

“Furthermore, interest is increasing in 2025 – at the end of May, we were at 71 per cent of the total Hybrid Electric deliveries in 2024.

“Our recent fuel efficiency test around the iconic Mt