The Berbice Bridge will be closed to vehicular traffic on: Wednesday, January 28 –11:45h–13:15h and Thursday, January 29 – 13:00h–14:30h.

Parika and Supenaam departure times – 05:00h, 10:00h-12:00h, 16:00h, 18:30h daily.

Thundery showers are expected to ease to light evening showers, followed by cloudy skies. Temperatures are expected to range between 22 degrees Celsius and 29 degrees Celsius.

Winds: East North-Easterly to Easterly between 1.78 metres and 4.02 metres.

High Tide: 12:18h reaching a maximum height of 2.32 metres.

Low Tide: 18:36h reaching a minimum height of 0.88 metre.

$150B in cash transfers

a

under 1 million people – Pres Ali …more money, more support, better quality of life for Guyanese

Budget 2026 caters for some $150 billion in cash transfers for a nation of under one million people, President Dr Irfaan Ali has pointed out as he highlighted rising disposable income among Guyanese driven by lifestyle changes.

Speaking during a pre-recorded discussion with women in the Private Sector on Monday, the Head of State said there were multiple indicators showing an increase in disposable income among citizens.

While noting that cash transfers alone are not the solution to national growth and development, he noted that they play an important role in supporting households and improving quality of life.

Through the Government’s various cash transfer initiatives included in Budget 2026 – many of which are rollover programmes that saw increased funding – President Ali asserted that many families and households are now growing their savings, which can be used to meet other needs.

Once Budget 2026 is passed, the “Because We Care” cash grant will increase to $60,000 per child, benefitting some 206,000 children.

President Ali highlighted that this translates to in excess of $12 billion in direct transfer to the population.

Coupled with the $100,000 per adult citizen cash grant initiative, he noted that this represents an accumulative $72.4 billion being disbursed directly into the hands of citizens.

There is now the annual transportation grant for students, pegged at $20,000 per child.

“That’s another $4.1 billion…You’re already at $77 billion with those three measures alone,” the President noted, reminding too that every newborn to a Guyanese mother in the country is entitled to $100,000.

He further outlined that old age pensioners will now get $46,000 per month, an annual cost of $52 billion, as well as a $20,000 transportation grant, and the public assistance programme, which will see $25,000 per person being distributed.

“So, you’re talking cumulatively about close to maybe $150 billion of cash transfer in a country with less than a million persons going out there,” President Ali remarked.

Tax relief

Disposable income is also increased through the various tax relief measures introduced in Budget 2026, the Head of State explained.

“Tax relief is more money in your pocket, taking home

more money,” he posited, highlighting that the increase of the income tax threshold from $130,000 to $140,000 will remove some 5000 persons from the tax register.

“That is putting billions of dollars, additional dollars, into the economy, into people’s pockets directly. So, you’re going home with more money. So, if you’re working $140,000, you have no taxes. You take that home, straight home,” the President emphasised.

The President pointed out that the removal of personal property tax is another way in which individuals can retain more of their earned monies.

Additionally, he said the adjustments of taxes on the importation of various categories of vehicles ultimately benefit the consumers.

Budget 2026 caters for the removal of VAT on new vehicles below 1500cc (vehicles less than four years old) to reduce the cost of importation.

It also makes provisions for VAT to be removed on hybrid motor vehicles below 2000cc.

The Government will also introduce a flat tax of $2 million on double-cab pick-ups less than 2000cc, irrespective of age, and $3 million on double-cab pick-ups between 2000cc and 2500cc, irrespective of age.

Additionally, the Government will remove all import duties and taxes on all-terrain vehicles (ATVs) for all categories. Similarly, all taxes and duties for outboard engines up to 150 horsepower will be eliminated to further reduce the cost of transportation within hinterland and riverine communities.

Other interventions

The President explained that there are many other programmes being rolled out by the Government, all aimed at ensuring citizens keep more money in their pockets and that their lives improve.

In the area of education,

for example, he explained that beyond cash grants, parents and guardians benefit significantly from other initiatives.

“You have the Government paying for eight subjects for CXC. You have the national school feeding programme, free education at the University of Guyana, the GOAL scholarship programme, and the hinterland scholarship programme. This is tens of thousands of children and hundreds of billions of dollars that you would have otherwise paid for these services that you’re now saving,” the President emphasised. He also spoke about the Government’s housing programmes, which are making homeownership more accessible for citizens. This year, the low-income mortgage ceiling will move from $20 million to $30 million, which will make housing loans at commercial banks more affordable to borrowers.

Editor: Tusika Martin

News Hotline: 231-8063 Editorial: 231-0544, 223-7230, 223-7231, 225-7761 Marketing: 231-8064 Accounts: 225-6707

Mailing address: Queens Atlantic Industrial Estate Industrial Site, Ruimveldt, Georgetown Email: news@guyanatimesgy.com, marketing@guyanatimesgy.com

The decision to remove the 14-day residency requirement for couples seeking to be legally married in Guyana is a strategic policy reform with the potential to unlock a new dimension of tourism-led growth. Welcomed by the Tourism and Hospitality Association of Guyana (THAG), the measure signals an intention to modernise tourism offerings, enhance competitiveness, and harness the economic value of the creative and cultural services sector within the broader Orange Economy.

Globally, destination weddings have emerged as one of the fastest-growing niche tourism markets, with the industry valued at more than US$300 billion in 2023. Couples increasingly seek unique, culturally rich, and visually striking locations to mark life’s most significant milestones. In the Caribbean, several destinations have capitalised on this trend by offering streamlined marriage requirements that allow weddings within days of arrival. These jurisdictions have benefited from increased visitor arrivals, longer stays, higher per capita spending, and stronger linkages between tourism and creative industries. Guyana’s former 14-day residency requirement stood in sharp contrast to regional practices and was misaligned with visitor behaviour. With most tourists staying between four and ten days, the requirement effectively excluded the country from competing in the destination wedding market. Reducing the residency period removes this structural barrier and places Guyana on a more level footing with regional peers, opening the door to a segment of travellers whose spending extends far beyond accommodation and airfare.

Destination weddings are not confined to hotel rooms and ceremonial spaces, but rather they are complex, multi-layered events that depend heavily on local creative and cultural services. Fashion designers produce bespoke attire; photographers and videographers capture moments that are shared globally; decorators and event stylists transform spaces using local aesthetics; musicians and entertainers bring cultural authenticity; and beauty professionals, florists, caterers, and planners ensure seamless execution. Each wedding becomes a micro-economy, circulating income across multiple sectors and supporting a wide range of skills.

For Guyana, this reform offers a particularly strong opportunity to integrate tourism growth with the development of creative industries. Local designers can showcase garments inspired by indigenous motifs, rainforest textures, and coastal influences. Musicians and performers can introduce visitors to traditional and contemporary Guyanese sounds. Décor and event styling can draw on local craftsmanship, natural materials, and cultural symbolism. Photography and visual media generated by these events become powerful, organic marketing tools, projecting Guyana’s landscapes and cultural richness to international audiences without additional public expenditure.

Beyond the immediate economic gains, destination weddings can help smooth seasonality in the tourism sector. Unlike leisure travel that peaks during specific months, weddings occur year-round, creating more consistent demand for hotels, venues, transport providers, and creative professionals. This steady flow of activity supports small and micro-enterprises, improves income stability, and encourages investment in skills development and service quality.

The policy shift also aligns with the objectives outlined in Budget 2026, themed “Putting People First”. By positioning Guyana as a niche tourism destination, the measure reinforces a development approach that values inclusivity, local participation, and value-added services. Expanding tourism is no longer viewed solely through the lens of visitor numbers but through the depth of economic linkages and the extent to which local talent and entrepreneurship are engaged.

Importantly, destination weddings offer an avenue to diversify Guyana’s tourism narrative. While ecotourism and nature-based experiences remain central, weddings introduce an emotional and aspirational dimension that appeals to a different demographic. Couples, families, and guests often combine ceremonies with tours, cultural experiences, and extended stays, further amplifying economic impact. Repeat visits, referrals, and long-term brand recognition often follow.

Effective implementation will require coordination across Government agencies, the hospitality sector, and creative industry stakeholders to ensure that processes are efficient, standards are upheld, and local providers are integrated into wedding packages. Clear guidelines, professional certification, and marketing support can further strengthen the ecosystem and maximise benefits.

The removal of the residency requirement is a move to unlock new markets, give creative professionals opportunities, and embed tourism growth within a cultural and economic framework.

Destination weddings can become a meaningful contributor to employment, enterprise development, and the international promotion of Guyana’s unique identity.

Dear Editor,

The PNC had two options on Monday: abstain or vote for Azruddin Mohamed to become Opposition Leader. What happened instead was an eel-like attempt at the in-between.

On Friday, Terrence Campbell and the PNC publicly stated that they were against abstaining from the Opposition Leader vote, effectively embracing Mohamed. Their justification? Collaboration. Fast forward to Sunday night, when senior APNU MP Ganesh Mahipaul had to school the

WIN leader on basic Parliamentary procedure relating to Parliamentary committee makeup, prompting the indicted MP to accuse Ganesh of being in the PPP’s pocket.

Now to Monday itself. The PNC’s Twelve Disciples, as they ironically call themselves, showed up to the House, walked out without nominating a single person from their slate... and then walked right back in!

Campbell now claims that literally refusing to vote for the man, leaving the chamber, and returning moments later

was an act of extending an “olive branch”. If anything, it was tekkin’ shaft.

I said before that Azruddin’s election would have consequences for the PNC. What unfolded on Monday was nothing short of a humiliation ritual for the party of Forbes Burnham. There is no room for meaningful collaboration here. If anything, this is political cuckoldry parading as strategy.

Yours faithfully, Nikhil Sankar

Budget 2026 is a game-changer for Region 3’s growth, health, education

Dear Editor,

The Head of the Region Three Private Sector Inc (R3PSInc), Halim Khan, has welcomed the Government’s 2026 National Budget as a decisive step toward broad-based, inclusive growth, positioning Region Three to emerge as one of Guyana’s most dynamic investment and manufacturing corridors.

Speaking after Finance Minister Dr Ashni Singh presented Budget 2026 to the National Assembly, Khan highlighted that the budget’s focus on small and medium-sized enterprises (SMEs), housing, infrastructure, value-added production, and human capital development reflects years of advocacy by the Private Sector in Region Three.

“This budget sends a clear signal that national development is no longer confined to Georgetown or a few coastal pockets,” Khan said. “For Region Three, it opens real opportunities for manufacturing, agro-processing, logistics, and small business growth.”

Budget 2026 introduces measures aimed at lowering business costs and widening access to financing, including the establishment of a capitalised Guyana Development Bank offering zero-interest microcredit to small entrepreneurs, expanded co-investment financing through commercial banks, and the removal of VAT on locally made furniture and jewellery. Export incentives for value-added forestry products were also enhanced.

Khan noted that these initiatives directly benefit clusters of small manufacturers, contractors, and agro-processors operating along the West Demerara and Essequibo coast.

“For years, businesses in this region have struggled with access to affordable capital and high input costs. This represents a deliberate shift to empower local producers, not just importers.”

The budget also raises the low-income mortgage ceiling from $20 million to $30 million and extends the facility to insurance companies, a move expected to stimulate construction and related industries in Region Three, where new housing areas are being developed. Expanded infrastructure, including roads, utilities, and community services, is set to integrate the region more fully into the national economic grid.

“Every new house built creates jobs for carpenters, masons, electricians, hardware suppliers, and transport operators,” Khan said. “This is how a local economic ecosystem is nurtured.”

Khan emphasised that the budget prioritises long-term human development through substantial investments in health and education. With the expansion of regional hospitals, rollout of electronic health records, and training of over 5400 nurses and allied health professionals, “access to quality healthcare is no longer limited to urban centres; residents in West Demerara and surrounding areas will enjoy improved services,

shorter wait times, and better preventative care,” he said.

On education, the budget provides for scholarships, free university education, technical and vocational training, and digital schooling programmes.

“Education is the ultimate security measure,” Khan remarked. “A well-educated population strengthens our communities, reduces social vulnerabilities, and provides the human capital needed for sustainable economic and social development.”

Khan stressed that Region Three is strategically positioned to become a hub for manufacturing, logistics, and value-added production, bridging the capital and the Essequibo coast. He also highlighted the importance of modern aviation infrastructure and reliable utilities, noting: “Without dependable electricity, water, and air transport, no economy – whether manufacturing, agriculture, or services – can function or grow.” These are foundational to sustainable development.”

“Budget 2026 demonstrates that national growth and regional development can go hand in hand,” Khan concluded. “The Private Sector is ready to do its part. If these measures are implemented effectively, Region Three will not just benefit from national growth – it will help drive it.”

Yours

WEDNESDAY, JANUARY 28, 2026

Parliamentary

Minister Gail Teixeira has described Guyana’s $1.558 trillion Budget 2026 as a people-centred plan aimed at expanding social support, strengthening public services and ensuring that economic growth translates into improved living conditions nationwide. In a statement issued following the presentation of the budget, Teixeira noted that it is the largest national budget in Guyana’s history and is fully financed without the introduction of new taxes. She said the budget builds on the People’s Progressive Party/ Civic (PPP/C) Government’s focus on inclusive development and shared prosperity.

According to the Minister,

Budget 2026 increases direct support to households through measures such as

a higher income tax threshold, expanded “Because We Care” cash grant, new trans-

portation assistance for pensioners and schoolchildren, a $100,000 grant for every newborn and increased public assistance and oldage pension payments. She said these initiatives will place billions of dollars in disposable income into the hands of citizens. Teixeira also pointed to major allocations for key social sectors, including $183.6 billion for education and $161.1 billion for health care, aimed at expanding access and modernising systems across the country. Housing has been allocated $159.1 billion, while significant investments were also earmarked for water, energy diversification, roads and bridges and drainage and irrigation. The budget includes target-

Two women, who were arrested last weekend after Police uncovered more than 300 pounds (lbs) of cannabis along the West Coast of Berbice (WCB), have now been remanded to prison. The two women, 33-year-old Shamay Bryan and Sarafina Cheddy, both of Smithfield, New Amsterdam, were on Tuesday arraigned before Magistrate Michelle Matthias at the Blairmont Magistrate’s Court. Both women were charged with possession of narcotics for the purpose of trafficking, following the discovery of 345.8 lbs of cannabis during a Police stop-and-search operation along the Number 10 Public Road, WCB, on Saturday morning.

Police told the court that the quantity is a significant narcotics find for the division

and is part of ongoing intelligence-led operations targeting drug trafficking routes between Berbice and other parts of the country. Police said that the women were occupants of a motor car that was intercepted around

07:20h, during which ranks discovered several brown salt bags and black garbage bags in the vehicle’s trunk, containing bulky parcels wrapped in transparent plastic. In court, both Bryan and Cheddy pleaded not guilty to

the charge and were remanded to prison. They are scheduled to return to court on March 26. During the hearing, Bryan told the court that she operates a grocery business at Smithfield, while Cheddy stated that she is a housewife. Police Prosecutor Sergeant Garfield Edwards informed the court that Cheddy is a former member of the Guyana Prison Service (GPS) and is already before the court on a similar narcotics charge. Edwards said Cheddy is currently on $100,000 bail in that matter, which dates back to December 2022, while then using the name Sarafina Pitt. She was arrested at the New Amsterdam Prison with a suspected 500 grams of cannabis. That case is still pending before the court.

2026 shows that Govt is looking out for health, dignity, inclusion of all Guyanese

Dear Editor, I want to thank the Minister of Finance, Dr Ashni Singh, for presenting Budget 2026 to the National Assembly yesterday. I also want to thank the Government of Guyana for a budget that meets the needs of our most vulnerable citizens, such as young children, people with disabilities, and the elderly.

What struck me most about this budget is that it’s not just about numbers and predictions; it’s also about people. President Dr Mohamed Irfaan Ali rightly stated that “Budget 2026 is positioned with the people at the centre”. The steps are meant to have the biggest effect on people and improve their quality of life. Those words mean a lot to

me because they show that development needs to be felt at the level of the home and the community.

I was especially happy to hear the President say that Budget 2026 really includes all parts of the Guyanese population, even the elderly. Older people often feel like they’ve been forgotten, but this budget shows that our health, dignity, and well-being are still important as the country moves forward.

The plans for people with disabilities and kids with special needs are also good. The President said that the main problem for these people is access, and he made it clear that the Government is dealing with this directly, whether it’s getting to school, getting to

buildings, getting to medical care, or getting to social services.

As outlined by the Minister, Budget 2026 delivers tangible support for vulnerable groups through a range of targeted measures, including an increase in the old-age pension to $46,000 per month, at an annual cost of $52 billion, providing pensioners with a steadier income to cope with rising living costs; the introduction of annual transportation grants for pensioners and schoolchildren, easing the burden of travel to essential services and schools; an increase in the Because We Care cash grant to $60,000 per child, benefiting more than 206,000 children nationwide and the expansion of public

assistance to $25,000 per person, extending vital support to the most financially vulnerable households.

I’m glad that this budget shows that a society that cares is one that looks out for its most vulnerable members. Budget 2026 makes us sure that the Government is not only in charge of the economy, but also looking out for the health, dignity, and inclusion of all Guyanese.

This budget that puts people first is great. Thank you to the Government and the Minister of Finance. I can’t wait to see these promises come true in communities all over our country.

Yours respectfully, Brian Azore

ed funding for vulnerable groups, with $316.5 million allocated for persons living with disabilities, $78.3 billion for children, women and the elderly and $7.5 billion for Amerindian and hinterland communities. Teixeira said these allocations reflect the Government’s commitment to ensuring that development benefits all communities. She further noted that investments in agriculture, mining, manufacturing and energy are expected to support job creation and expand economic opportunities, while the continuation of the zero-per cent excise tax on fuel and energy diversification initiatives will provide relief to households and businesses. Teixeira said Budget 2026 also supports governance reforms,

$150B

This year also, the Government will continue direct assistance to homeowners with $7.5 billion allocated to support upgrades to homes.

President Ali further highlighted that citizens are saving as a result of the Government’s decision to keep freight charges at pre-pandemic levels for the calculation of import taxes. This was done in 2021 and has been extended every year since. Again, Budget 2026 caters for another 12-month extension.

He noted that citizens are also saving as a result of the Government’s measure which will be continued this year, to maintain a zero per cent excise tax on petroleum products, forgoing an estimated $100 billion in annual revenue.

Lifestyle changes

President Ali emphasised that the lives of many

transparency and the use of technology to improve public service delivery and citizen participation. Funding has been allocated to strengthen national reporting mechanisms and constitutional bodies, in keeping with Guyana’s international obligations. She urged citizens to assess the budget based on its practical impact, stating that investments in infrastructure, education, healthcare and housing are directly linked to improved access to services and economic participation.

According to Teixeira, Budget 2026 reflects the Government’s commitment to placing people at the centre of national development and ensuring that growth is felt across all regions of Guyana.

citizens continue to improve under the People’s Progressive Party/Civic Administration, as reflected in the simple, everyday advancements in their daily activities.

“Someone will complain and say to you, ‘It’s really expensive to fuel up the car this month.’ But that same person, a year ago, did not have a car,” he pointed out.

“So, it’s changes in living condition and style also. So, with increasing improvement in that disposable income, you will see structural changes. You know this; those who are in the restaurant, fast food, or fine dining business, you will see more people going out to eat. That is not accidental. That’s a function of disposable income, giving you the opportunity to experience something that you would have never experienced before,” he added.

WEDNESDAY, JANUARY 28, 2026

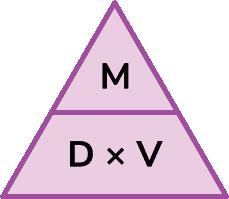

Density is a compound measure which tells us about the mass of an object in relation to its volume.

The formula for density is:

Density = mass/volume

For example, if an object has a mass of 500 kg and a volume of 2.5 cubic metres, then the density would be

Density = mass/volume = 500/2.5 = 200 kg/m3

The density formula can be rearranged to calculate mass or calculate volume given the other two measures. An easy way to remember the formula and the different rearrangements is to use this density-mass-volume triangle.

Example 1

A platinum bar has a volume of 40cm³ and a mass of 840g. Calculate the density of the platinum bar.

Step 1: Write down the compound measure formula with the correct subject.

To calculate the density, we need to divide the mass of the object by its volume.

D = M/V

Step 2: Substitute known values into the formula and carry

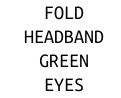

(measuring

13

x 16 cm). Cut this out to create two snout pieces.

2. Draw around one of the felt snouts onto card and cut this out a little smaller than the felt arch. Glue onto one of the felt pieces.

3. To make the teeth, cut two 1 in. wide strips from the width of a piece of white felt. Cut triangles into the strips. Glue around the edge of the second felt snout so that only the triangles are visible from the other side.

out the calculation.

As M = 840 and V = 40, we have:

D = M/V = 840/40 = 21.

Step 3: Write down the solution, including the units. The density of the platinum bar is 21g/cm³.

Example 2

A steel block has a mass of 1.17 kg. The density of steel is 7.8g/cm3. Calculate the volume of the steel block.

Step 1: To calculate the volume, we divide the mass of the object by the density of the substance.

V=D/M

Step 2: Here we have been given the mass in kilograms, but the density is in g/cm³, and so we need to convert the mass to grams first.

1.17 kg = 1170g

Now that we have the mass in grams, we can calculate the volume of the steel block.

As D = 1170 and M = 7.8 , we have:

V = D/M = 1170/7.8 =150.

Step 3: The volume of the steel block is 150cm³.

4. Glue the two snout pieces together, with the teeth and cardboard on the inside. Fold the teeth down so they aren’t lying flat – you can add a dab of glue to each one if they don’t stay. Leave to dry, then bend the snout so that it matches the curve of the headband.

5. Cover the headband in green felt - cut the felt into segments that are wide enough to wrap around the band with a little overlap. Glue in place and trim any excess.

6. Glue the snout to the top of the headband.

7. Cut two circles from black felt for the eyes, about 2cm wide. Then cut two 1cm-wide black circles for the nostrils. Glue the larger felt circles onto the cotton balls and the small ones onto two green pom-poms.

BY JAMES JOYCE

O bella bionda, Sei come l’onda! Of cool sweet dew and radiance mild

The moon a web of silence weaves In the still garden where a child Gathers the simple salad leaves.

A moon-dew stars her hanging hair, And moonlight kisses her young brow; And, gathering, she sings an air: “Fair as the wave is, fair, art thou!”

Be mine, I pray, a waxen ear To shield me from her childish croon, And mine a shielded heart for her Who gathers simples of the moon.

[Source: Poetry (May 1917)]

8. Cut two strips of green felt measuring about 5 x 15 cm. Add glue to half the cotton ball, on the opposite side to the pupil. Wrap the felt around the ball. Press the felt onto the glue; don’t worry about the folds for now. Hold in place with an elastic band whilst the glue dries if necessary. Once dry, trim the excess folds of felt.

9. Glue the eyes on top of the headband and the nostril pom-poms onto the end of the snout. (adapted from hobbycraft.co.uk)

Write a story where a scent or taste evokes a memory or realisation for your character.

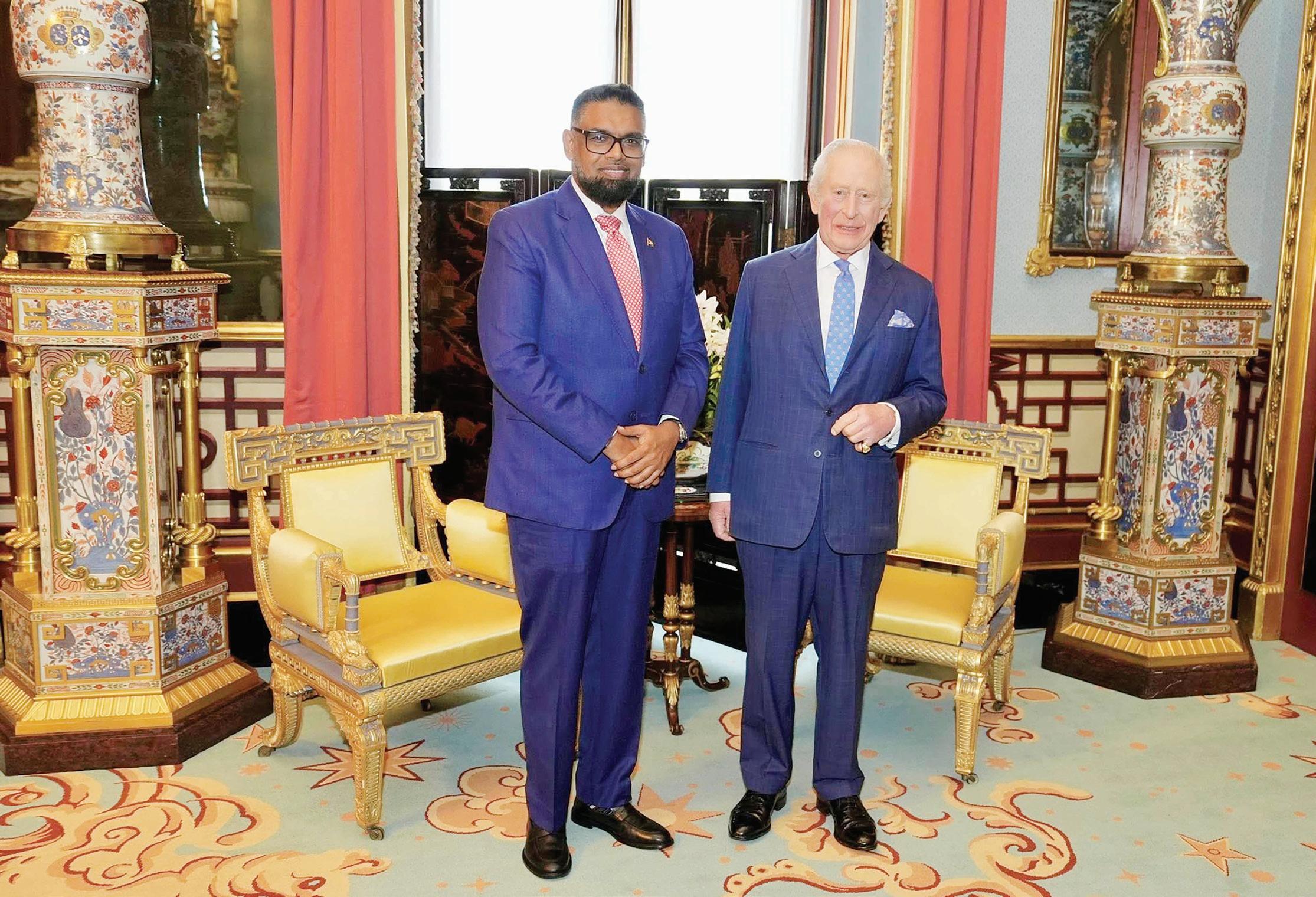

… “we have 5 years to fulfil our commitments” – Pres Ali

Emphasising that Budget 2026 remains true to its theme of “Put People First”, President Dr Irfaan Ali reminded critics that his administration has a five-year mandate to deliver on all the commitments outlined in its manifesto. Aimed at building a modern and prosperous Guyana with opportunities for all, the People’s Progressive Party/Civic (PPP/C) has presented a $1.558 trillion Budget 2026, featuring tax incentives across multiple sectors, higher thresholds, housing subsidies and measures to ease the cost of living. This marks the first budget of the Dr Irfaan Ali-led administration following its re-elec-

tion in September 2025.

While many welcomed the measures in the Government’s fiscal plan, some critics have claimed there is a mismatch between certain budget provisions and the party’s campaign commitments. For instance, some have pointed out that President Ali promised to increase the ‘Because We Care’ cash grant for students to $200,000, inclusive of a new transportation grant. In Budget 2026, each student will now benefit from $85,000, following the increase of the grant to $60,000, the introduction of a $20,000 transportation grant, and the $5000 uniform voucher. In a live broadcast on

President Dr Irfaan Ali

Tuesday, President Ali reminded that his adminis-

tration was elected to serve for another five years, and

during that term, it will deliver on all its commitments made to the people. “We have five years. The naysayers believe that we have six months or one year. You elected us for five years to fulfil or surpass our commitment. And I assure you that we will do just that. Together, we are going to do great things,” the Head of State noted. This point was also highlighted by Minister of Public Works Juan Edghill in a live broadcast on Monday evening. “This is just the first instalment of the commitment that PPP/C would have made,” he contended, highlighting the gradual increase of the “Because We Care” cash grant during the last

five years, in keeping with the party’s commitment during the 2020 elections. “We moved from $10,000 to $15,000 in the first instalment, but we closed at 2025 with it being $50,000,” Edghill outlined.

Referring to the increases catered for in Budget 2026, he explained that “this first instalment, we are adding an additional $10,000, which will take it to $60,000; the $5000 uniform grant and the $20,000 transportation grant will take it up now to $85,000… So we got 2026, 2027, 2028, 2029, 2030 to fulfil a series of commitments at a particular ceiling that was proposed in our manifesto that we promised the people.”

The Private Sector Commission (PSC) and the Guyana Manufacturing and Services Association (GMSA) have welcomed Budget 2026, describing it as a package of measures that supports economic growth, strengthens competitiveness, and advances Private Sector development while addressing social priorities.

In a statement following the presentation of the $1.588 trillion Budget 2026, themed “Putting People First” the PSC said the allocation reflects a commitment to creating an environment in which businesses can expand, investment can increase, and citizens can benefit from national development.

From a business perspective, the PSC noted that several measures will improve operating conditions for enterprises. These include targeted incentives through Special Development Zones, the removal of corporate tax on agriculture and agro-processing, revisions to the export allowance framework, and the removal of Value Added Tax (VAT) on locally produced furniture and jewellery. According to the Commission, these initiatives are expected to support local production, value-added activities, and export competitiveness.

The PSC also highlighted

the proposed establishment of a dedicated Small and Medium-Sized Enterprise (SME) Development Bank as a key intervention. The institution, supported by capital injections, micro-credit facilities and co-investment financing, is expected to improve access to financing, strengthen entrepreneurship, and support job creation across priority sectors. Measures aimed at reducing business and household costs were also welcomed. The PSC pointed to the removal of VAT and duties on security equipment, vehicles, hybrids, all-terrain vehicles and outboard engines, as well as the continuation of zero excise tax on fuel and adjustments to import tax calcula-

tions. These measures, the Commission said, will help to lower operational expenses for businesses while easing cost-of-living pressures for consumers.

Beyond the business environment, the PSC noted that Budget 2026 includes several initiatives targeted at families, workers and vulnerable groups. Increased grants for children, transportation, uniforms, education, pensions and public assistance, along with the removal of corporate tax on child-care and elderly-care facilities, are expected to contribute to workforce stability. The Commission said that higher income tax thresholds, the removal of net property tax, cash grants and increased sti-

pends are projected to inject about $100 billion into disposable income, supporting consumer demand and business activity.

Diversification, inclusive growth

Similarly, the GMSA welcomed Budget 2026, acknowledging the Government’s focus on economic resilience, diversification and inclusive growth. The Association pointed to Guyana’s economic expansion of 19.3 per cent in 2025, with the non-oil economy growing by 14.3 per cent.

The GMSA highlighted the performance of the manufacturing sector, which grew by 20 per cent, and the services sector, which expanded by eight per cent, noting that both contributed significantly to non-oil economic growth. Against the backdrop of global economic uncertainty influenced by geopolitical developments and market volatility, the Association said the measures outlined in Budget 2026 are intended to strengthen resilience and support long-term diversification.

The Association also welcomed the inclusion of several policy recommendations it had submitted to the Ministry of Finance. These include the removal of VAT on locally manu-

factured furniture, including doors, mouldings and beds; revisions to the export allowance to include value-added timber products; the removal of VAT on locally manufactured jewellery; the establishment of Special Development and Economic Zones to support export-orientated manufacturing; and the proposed creation of a Junior Stock Exchange.

The GMSA further welcomed plans to establish a development bank capitalised at US$100 million, with provisions for collateral-free financing of up to $3 million for small and medium-sized enterprises. The removal of corporate tax on agriculture and agro-processing was also cited as a measure that will support productive sectors.

In its statement,

the GMSA thanked the Government for the presentation of the $1.558 trillion Budget 2026 and expressed anticipation for continued collaboration with policymakers. The Association said the allocations for housing, agriculture, agro-processing and technology are expected to positively impact businesses, providing greater certainty for expansion investments over the medium to long term. Both organisations said Budget 2026 reflects an approach that seeks to align Private Sector development with social support measures, with the potential to stimulate investment, expand opportunities for enterprises, and deliver broadbased benefits as Guyana continues its economic development trajectory.

ell, it’s clear that the race to present the Budget goes not to the swift…but to the marathon speaker who can go the distance. Finance Minister Ashni Singh had to keep going for SEVEN AND A HALF HOURS to just read Budget 2026!! To be fair, he had to break regularly from his presentation to berate several obstreperous members of the Chicken Man-led APNU remnants. But then again, his tone and volume had to be even more stentorian and hectoring during those interludes – so it wasn’t like he was taking VOCAL breaks!! Most folks finish the Boston Marathon in three hours – and the rule is you gotta finish within six hours!! Your Eyewitness is reliably informed that for his marathon presentation, Ashni had to be in training with several voice coaches who work with opera stars!!

Over on the Opposition benches – led now by Sanction Man all decked out in the faux “designer” outfits that are fobbed off on him to give him gravitas?!! When you don’t know, you don’t know!! If you have real money, you don’t wear other people’s labels and become walking advertising mannequins for them!! You fly into Saville Row in London and get outfitted with “bespoke” suits that are made just for you!! Shoes from Gazizno and Girly on the block can set you back US$6000 – but they come with a lifetime guarantee, and you can fly in and have your soles replaced when they get worn!! So, imagine the suits!! Anyhow, folk wisdom talks about “Neva see; come fuh see!!” And talking about clothes… your Eyewitness wonders whether Chicken Man’s bright red garb wasn’t a not-so-subliminal come-on to the PPP!!

Sanction Man – now officially designated as the LOO – tried to work on his image as a policy lightweight by furrowing his brow and pretending he was soaking up the 7 hours of tightly spun verbiage!! He and his band of Scrapes also didn’t join in on the raucous picong slung by the APNU (diminished) band at Ashni!! Sadly, it was too much for some – such as their usually vociferous Gen Secretary –who literally nodded off so frequently, bets were wagered by some in the visitors’ benches as to when her head would actually hit the desk in front of her!! Afterwards Sanction Man actually criticised the APNU contingent for their behaviour, which he contrasted negatively to his and his Scrapes’ studious silence!! Poor fellow doesn’t know that “throwing talk” is part of the parliamentary tradition – once it’s witty and not scatological!!

Anyhow, following tradition, Parliament will have a oneweek recess, and next Monday the LOO is supposed to lead off the debate on the Budget!! And THIS your Eyewitness will be looking forward to – since Sanction Man will have to go beyond soundbites prepared by his Sissy!!

Follow your Eyewitness and get your popcorn and channa ready!!

…the old guard

Your Eyewitness never thought this would happen to him – he’s actually missing the PNC!! And it’s not that they allowed themselves to be thrashed by an upstart neophyte who possibly can’t even SPELL “politics”!! It’s more to do with the PERSONS Leader Aubrey picked to send to Parliament!! Chicken Man and Black Pudding Man?? Please!!! Hammie must be having conniptions!!

Just look at their tactics – your Eyewitness is being EXTREMELY KIND in his use of the word!! – during the confirming of the LOO. First, they ostentatiously announced they wouldn’t field anyone against Sanction Man!! Leaving everyone to conclude they wanted to bury the hatchet! A Black Pudding Man’s candidacy would’ve put at least ONE WIN MP on the spot – and FGM!!

But they then walked out when the votes were cast!! Couldn’t they have simply abstained??

Confusion in the ranks!!

…reality

A few years back, the Russian Bauxite co. – RUSAL –owned by oligarch Deripaksha walked out on their bauxite concessions because the workers played hardball. They’re back!!

So, what’re the new conditions gonna be?? Who will blink??

…“we can compete with any country now” – King’s

The Guyana Jewellery Association (GJA) has welcomed the Government’s decision to remove Value Added Tax (VAT) on locally produced jewellery, describing the measure as a progressive policy shift

that will strengthen domestic manufacturing and value addition within the mineral sector.

The announcement was made by Finance Minister, Dr Ashni Singh during the presentation of Budget 2026 to the National Assembly on Monday. According to the Finance Minister, the removal of VAT on locally made

Government for its responsiveness to industry feedback.

The Board also welcomed the move as a signal of confidence in local artisans, manufacturers, diamond setters, and designers, whose contributions it said play an important role in national development and the strengthening of domestic value chains.

In addition, the Association reaffirmed its commitment to representing all stakeholders within the jewellery industry, including those not yet formally en-

jewellery is intended to encourage local value addition and expand opportunities for small and medium-sized enterprises operating in the jewellery-making sub-sector.

In a statement issued on Tuesday, the Board of Directors of the GJA said the measure represents a meaningful investment in Guyana’s local jewellery industry, noting that it reduces both production and consumer costs while improving the competitiveness of Guyanesemade jewellery in the domestic market.

The Association said the policy creates a more enabling environment for local entrepreneurs to expand operations, invest in innovation, and grow their businesses. It also noted that the removal of VAT corrects longstanding structural challenges that previously placed locally manufactured jewellery at a disadvantage when compared wssith imported alternatives.

According to the GJA, the decision reflects the Government’s recognition of the craftsmanship, skill, and creative talent that exists within Guyana’s jewellery sector. The Association highlighted that local jewellers continue to transform the country’s mineral resources into finished products that meet international standards, supported by a high level of technical expertise and artistic excellence

The GJA further noted that its members have consistently raised concerns regarding the application of VAT on locally manufactured jewellery during engagements with policymakers. The Association said it was encouraged to see those concerns reflected in national policy and commended the

gaged, and signalled its intention to pursue inclusive programmes aimed at supporting both emerging and established professionals.

The GJA said it stands ready to work closely with the Natural Resources Ministry and other relevant agencies to advance complementary initiatives focused on skills development, formalisation, expanded market access, and the long-term, sustainable growth of Guyana’s jewellery sector.

Budget 2026 is themed “Putting People First” and includes a range of measures aimed at supporting local production, entrepreneurship, and economic diversification.

Meanwhile, Harinand Persaud of King’s Jewellery World, speaking on the measure, said local jewellers are very excited about the initiative.

“Well, first of all, I must thank the Government. I think we’re very excited at the removal of the VAT on jewellery. For a number of years, Guyana has been known for its jewellery all over the world. And the removal of this VAT, obviously 40 per cent off now, will make us more competitive.”

He added, “We are going to definitely be able to compete with any other country because now this saving will now go directly to the customers. So we think it’s really forward-thinking action by the Government that invests in the people of Guyana, the creativity, the craftsmanship, the jewellers, and the goldsmiths. It’s been a number of years that we’ve been known for the jewellery. And now, obviously, being competitive, it’s definitely going to put us back on the market.”

The Tourism and Hospitality Association of Guyana (THAG) has welcomed the Government’s decision to reduce the 14-day residency requirement for couples seeking to be legally married in the country, describing the move as a significant step toward expanding tourism offerings and strengthening the Orange Economy.

In a statement on Tuesday, THAG said the reform follows recommendations submitted to the Finance Ministry and positions Guyana to enter the global destination wedding market, one of the fast-

est-growing niche tourism segments. According to Allied Market Research, the destination wedding industry was valued at more than US$300 billion in 2023.

THAG noted that several Caribbean destinations that permit weddings within 24 to 72 hours of arrival have successfully captured this market, generating increased tourism revenue. Guyana’s previous requirement of a 14-day stay was seen as a major limitation, given that most visitors typically remain in the country for between four and ten days. The association said reducing the residency pe-

riod aligns Guyana with regional practices and improves its competitiveness.

The association further highlighted that destination weddings rely heavily on creative and cultural services, including fashion design, photography, décor, music, beauty services, entertainment, and event styling. As a result, the reform is expected to create new income opportunities for local artists, designers, performers, and small creative enterprises.

THAG added that beyond direct tourism earnings, the change is likely to generate year-round demand for local suppliers and creative professionals, contributing to the growth of small businesses while promoting Guyana’s cultural and natural assets to international audiences.

The announcement comes amid a series of fis-

cal measures outlined in Budget 2026 aimed at supporting local industries

Presenting Budget 2026, themed “Putting People First”, to the National Assembly on Monday, Finance Minister Dr Ashni

Singh said that the measure aims to position Guyana as a niche tourism market and is expected to expand economic activity in the hospitality sector.

“The Government will remove the 14-day residency

requirement for destination weddings,” Dr Singh told the National Assembly. “This initiative is expected to increase tourism-related revenue and support the growth of our hospitality industry.”

The Guyana Gold and Diamond Miners Association (GGDMA) has welcomed the 2026 National Budget presented by Senior Minister in the Office of the President with responsibility for Finance, Dr Ashni Singh, citing measures aimed at reducing operating costs, supporting production and advancing the modernisation of the mining sector. In a statement, the Association noted the strong performance of the sector in 2025, with gold production increasing by an

estimated 11.6 per cent and total declarations reaching 484,321 ounces. While largescale operators accounted for much of the growth with a 15.5 per cent increase, declarations to the Guyana Gold Board (GGB) also rose by 45.6 per cent. The GGDMA attributed improved declarations in part to strengthened compliance and enforcement, which it said has helped sustain the sector’s contribution to national development. The Association highlighted several measures in Budget 2026 that

it said will directly benefit miners across the country. Among them is the removal of all import duties and taxes on All-Terrain Vehicles (ATVs), which is expected to ease transportation challenges and reduce costs for operations in difficult terrain. Tax relief on outboard engines up to 150 horsepower was also welcomed, as river transport remains critical for many mining activities. In addition, the GGDMA praised the introduction of a simplified flat tax regime for double-cab pickups. Under the new system, pickups with engine capacity below 2000cc will attract a flat tax of $2 million, while those between 2000cc and 2500cc will be subject to a flat tax of $3 million, regardless of vehicle age. The Association said the measure brings clarity and predictability to vehicle importation costs and supports miners who rely on these vehicles for transporting personnel, tools, and supplies. The GGDMA also

underscored the importance of the Government’s decision to maintain a zero per cent excise tax on petroleum products, noting that fuel remains one of the largest operating expenses in the sector. Investments in hinterland infrastructure were another key area of support. The Association welcomed the allocation of $10 billion to begin works on hinterland roads in areas including Achiwib, Kaburi, and Karisparu, describing improved road access as essential for safer and more efficient movement of equipment and personnel.

Continued investment in hinterland airstrips was also praised. The GGDMA pointed to works at airstrips in Aishalton, Kaieteur, Karisparu, Kwakwani and Paramakatoi, as well as ongoing projects at Ekereku Bottom, Jawalla, Kaikan and Matthew’s Ridge. It also noted that an additional $4 billion has been identified for 2026 to complete existing projects and begin upgrades at other locations, including Mahdia and Linden. The Association reiterated its support for Government efforts to formalise the gold sector and improve trace-

ability. It said measures such as mandatory local bank accounts, updated personal records for miners and the recently launched mineral mapping initiative are important steps toward a more transparent and efficient industry. With gold declarations projected to reach 510,450 ounces in 2026 and the gold mining subsector expected to expand by 5.4 per cent, the GGDMA encouraged miners to take advantage of the incentives outlined in the budget. The Association said continued cooperation, improved compliance and efforts to reduce leakages will be key to achieving these targets. The GGDMA affirmed its commitment to working closely with the Ministry of Natural Resources and the Guyana Geology and Mines Commission (GGMC) to ensure that the measures in Budget 2026 deliver lasting benefits for the mining sector and the wider economy.

Budget 2026 – Guyana shows that natural resources are a blessing, not a

Ehe question of whether natural resource wealth is a blessing or a curse has always been a topic that stirs robust debate. In particular, the question of whether oil represent a blessing or a curse has been the subject of fierce debate around the world. Even though extensive scientific research has been conducted, there is no conclusive answer. Since Guyana has become an oil producer, this question has also occupied political discourse in our stratosphere. The evidence so far is that oil has been a blessing for Guyana. The fact that my generation’s big dream was to own a bicycle and that this generation’s big dream is to own their own home and a car is testimony to the transformation in Guyana. Bear this in mind – the National Health Budget for 2026 is almost 10 times the largest health budget I had when I was Minister of Health.

On Monday, January 26th, Minister Ashni Singh presented Budget 2026. At $1.558 trillion, it was Guyana’s largest budget ever, by far. We can expect that this will continue to be repeated for each budget during this second term of President Irfaan Ali’s presidency. At this rate, Guyana’s budgetary allocation will surpass the $2 trillion mark by 2029, and this could even happen in Budget 2028. Imagine how far we have come. In 1990, Guyana’s budget was less than $10 billion. In 2020 it was approximately $300 billion. In just five years, the PPP Government under President Irfaan Ali has increased the annual budget by more than 500 per cent.

It was also the longest-ever budget presentation for Guyana’s Parliament. It lasted five hours, 42 minutes. It might very well be the world’s longest-ever parliamentary budget presentation in history. I believe that Ashni Singh holds the world record for at least three of the top five longest budget speeches in history.

Usually, when historians speak of the longest and shortest budget presentations, references are made to presentations in England and India. In England, where Budget Day and its presentation are similar to Guyana’s, the longest-ever budget presentation was given by William Ewart Gladstone on April 18th, 1853, and it lasted four hours and 45 minutes. The shortest-ever in England was delivered by Benjamin Disraeli in 1867, and it lasted 45 minutes. In India, Finance Minister Nirmala Sitharaman holds the record for the longest budget speech which was in 2020, lasting two hours and 42 minutes. But the last 10 minutes of her speech had to be read out by the Speaker because she became too sick to finish it. The shortest-ever budget speech for India was delivered by Hirubhai Patel, whose 1977 budget presentation lasted less than 10 minutes.

Outside of the length and size of Budget 2026 is a budget that reflects Guyana’s sustainable growth. Budget 2026 reports that Guyana’s GDP grew 19.3 per cent, with a non-oil GDP growth of 14.3 per cent. Whether we take the whole economic growth or just the non-oil GDP growth, Guyana is way ahead of every other country in the world. It has owned this record for five consecutive years. This is a remarkable record in a world where growth has been uneven. The World Bank, UNCTAD and other global organisations have projected that Guyana’s GDP growth will continue to be the highest GDP growth for any country until, at least, 2030. While oil is a driving force, the Irfaan Ali-led PPP Government has been able to craft economic policies, strategies and plans that have propelled Guyana forward.

Globally, the highest average annual global GDP growth was in 1964 when the average growth was 6.4 per cent, and the lowest was negative 2.8 per cent in 2020, at the height of COVID-19. The world’s economy has averaged about three per cent over the last several years, according to the World Bank and UNCTAD. The estimate for average global growth between now and 2030 also hovers around three per cent. The emerging markets of South Asia, Sub-Saharan Africa, and Southeast Asia are expected to grow between 4.5 per cent and 5.8 per cent. For developed countries, growth are expected to remain around 1.5 per cent to two per cent.Guyana’s expected GDP growth for 2026 is projected to be 16 per cent, way above the 2026 projections for the other high-flying countries. Given these statistics, Guyana has shown remarkable resilience, and credit must be given to President Irfaan Ali, VP Bharrat Jagdeo and Minister Ashni Singh.

The economic landscape at the end of 2025 around the world shows a mix of recovery and growth, particularly in regions like Africa and Asia. Established economies like India and Vietnam continue to demonstrate robust growth driven by domestic demand and investment. India is expected to grow at a rate of 6.9 per cent in 2026, maintaining its record as the fastest-growing economy among large economies. Vietnam is expected to grow at a rate of 6.3 per cent in 2026. Guyana’s growth, therefore, places it at the top of the world.

The naysayers will argue that the growth has nothing to do with the PPP/C Government. They will attribute the growth solely to oil. But the non-oil economy also grew at an impressive rate, surpassing all other economies in the world. Agriculture, forestry and fishing grew by 11.5 per cent. This was driven by sugar, which expanded by 26.5 per cent; rice, by 15.7 per cent; other crops, by 11.1 per cent; livestock, by 12.5 per cent; and forestry, by 2.7 per cent. Outside of oil, the other extractive industries played a role in the growth of the non-oil economy. For example, gold grew by 11.6 per cent and bauxite by 53.4 per cent. Manufacturing grew by 20 per cent. Construction surged by 31 per cent.

National budgets now represent a statement of transformation and are a testimony to the blessings oil has brought to Guyana. The growth in other extractive industries, like gold and bauxite, in agriculture, manufacturing, construction and services, and the growth in the purple and orange economies show that Guyana has utilised oil resources to transform our country. This is a blessing.

ncroachments along sections of B Field Sophia and the Dennis Street, Georgetown corridor are set to be removed as the Government of Guyana moves ahead with major infrastructure upgrades, including a full rehabilitation of B Field and the expansion of Dennis Street into a four-lane roadway, Public Works Minister Juan Edghill announced on site on Tuesday.

The Minister stated that the Government has engaged a contractor for the full upgrade of B Field Sophia, similar to the work being done in E Field Sophia. The Dennis Street corridor has also been earmarked for an upgrade.

One of the current challenges in the area involves traffic flow on Dennis Street, where two lanes are on one side of the trench and two on the other. The Government has been discussing this issue for several months and has sought to remove all

encumbrances from the reserve and carriageway.

Encroachments

The Public Works Minister explained that in both B Field and E Field, wherever encroachments existed, the Government had made provisions to construct tarmacs to transition vendors off the roadway, allowing them to continue operating their businesses without disruption. He emphasised that these measures ensure no one is being displaced or put out of business, whether they sell food, groceries, or other goods.

Amidst this, he underlined the situation with two unoccupied stalls that had been abandoned for a long period. “We have a situation, however, where these two stalls have been unoccupied for a long period, and we’ve been trying to make contact with the owners or the persons concerned, but we have not been able to do so. Right now, we have a need, a great

need, and this has to be addressed swiftly,” he said, highlighting the urgency of the matter due to the arrival of a long-haul trailer to carry sheet piles for the B Field project.

“These tarmacs are being made, but tonight [Tuesday] we must have these encroachments removed so that we’ll be able to get the piles in. The reason I’m do-

ing this live is so anybody concerned can come and talk to us and let us know, because with immediate effect we want to be able to dismantle this,” he added.

Speaking directly to the owners, the Minister said, “If you’re the owner, come and collect your materials. Once we dismantle them, we will have to discard them, because we cannot allow this. But we must be able to get the trucks to turn in. This is the danger when people put up structures on the roadway.”

He further explained that the removal was necessary because structures on the shoulder of the road pose a risk when long vehicles attempt to turn. “If you put a structure on the shoulder of a road and a long vehicle has to make a turn, the piles will hit everything here and be demolished,” the Minister said, urging affected persons to contact the Ministry.

Alate-night altercation at Issano Landing, Middle Mazaruni, Region Seven (Cuyuni-Mazaruni) has left a 38-year-old gold miner dead, with Police now confirming the arrest of the suspect in the case. Dead is Emanuel Williams, also known as “Chiney”, a miner of Bartica. The incident occurred around 23:30h on Friday, January 23, 2026, at 14 Mile Issano Landing, Region Seven.

Police reports indicate that Williams was at a bar in the area when he became involved in an argument with another male. During the confrontation, he was stabbed in the chest. The suspect fled the scene shortly after. Williams was sub-

sequently escorted to the Bartica Regional Hospital, where his body was lodged pending a post-mortem examination. On Monday, a post-mortem was conducted by Government Pathologist Dr Nehaul Singh at the Memorial Gardens Funeral Home, which revealed that Williams died from perforation of the lung and heart due to a stab wound to the chest. His body was later handed over to relatives for burial.

Prior murder link

Police have since arrested Travis Brewster, also known as “Turpin,” a miner of Victory Valley, Wismar, Linden, in connection with the killing. Brewster was apprehended on Monday,

at about 15:35h at 14 Mile, Issano Landing, Region Seven (Cuyuni-Mazaruni), where the incident occurred. Brewster had been the subject of a wanted bulletin in relation to the murder of Ron Clarke, which was committed in Linden on July 17, 2025. He is also a suspect in the murder of Williams and is currently in Police custody as investigations continue. Clarke’s bullet-riddled body was discovered in a drain at Victory Valley, Linden, Region 10 (Upper Demerara-Berbice).

Police arrested one person and were searching for Brewster, who was at large. Clarke, who resided at William Street, Kitty, Georgetown, and Wisroc Housing Scheme, was found dead by a 19-yearold construction worker, who alerted Police. Clarke’s body was transported to the Linden Hospital Complex by a passing vehicle, where he was pronounced dead on arrival.

was also found in his underwear.

“Violent and senseless”

A post-mortem revealed Clarke sustained 14 gunshot wounds: five to the right arm, two to the groin, one to the hip, and six to the right thigh. A warhead

In the wake of Williams’ death, the Small Miners Association of Guyana Inc (SMAGI) has expressed deep concern and strongly condemned the violent killing. In a statement shared on its Facebook page, SMAGI described the incident as a “violent and

senseless” act and noted that while violence has long cast a shadow over the mining industry, the loss of life under such circumstances remains profoundly tragic. The association emphasised that law-abiding miners have the right to work in peace and safety while earning a fair livelihood for their families. It described mining as an honourable profession that demands resilience, sacrifice and hard work under extremely challenging conditions. According to SMAGI, Williams’ death has been deeply felt throughout the mining community, impacting both struggling and successful miners alike and serving as a stark reminder of ongoing security concerns within the sector. While expressing support for recent Government efforts to regularise the mining industry, the association called for comprehensive security measures to be implemented and enforced with equal urgency, stressing that the protection of all stakeholders must be treated as a national priority.

Gunmen opened fire on a Police patrol at Wairawa Backdam, Cuyuni River, Region Seven (Cuyuni-Mazaruni) on Sunday afternoon, leaving one officer injured.

The incident occurred around 14:00h while four Police ranks were conducting roving patrol operations in the area. During the operation, the ranks parked their All-Terrain Vehicles (ATVs) at a location and continued checks on foot in the surrounding terrain.

Reports revealed that after completing their patrols, two of the ranks returned to retrieve the ATVs, while the other members remained in the area conducting further checks. On their way

back, the two ranks encountered three men dressed in camouflage and tactical clothing, each armed with high-powered rifles.

The suspects reportedly opened fire on the ranks. One officer returned fire while both officers took cover, after which the gunmen retreated into the dense forest.

The remaining members of the patrol later responded to the scene to assist their colleagues. During the exchange, one Police officer sustained minor injuries to his knee and rib area after falling while taking cover. No other injuries were reported.

Police have confirmed that investigations into the attack are ongoing.

The driver of a motor car involved in a fatal collision on the Diamond New Interlink Road, East Bank Demerara (EBD), that claimed the life of 33-yearold Jason Bhojedat of Annandale, East Coast Demerara (ECD), on Sunday, is in Police custody as investigations continue.

The accident, which occurred around 23:30h, involved minibus BAK 8702 and motor car PKK 6633. According to Police, Bhojedat was the driver of the minibus. A passenger from the minibus, a 31-year-old male of Diamond New Housing Scheme, EBD, also sustained injuries.

Police investigations revealed that the motor car was travelling south along the eastern lane, reportedly at a fast rate behind the minibus. An attempt to overtake resulted in a collision with the

Dead: Jason Bhojedat

right rear of the minibus. The impact caused the minibus to collide with a light pole, overturn multiple times, and land on the western parapet. Bhojedat, Distillery Plant Manager at Demerara Distillers Limited (DDL), was flung from the

vehicle and found unconscious on the roadway. He was pronounced dead at the scene by an on-duty doctor.

Both the minibus passenger and the driver of the motor car, a 28-year-old labourer from Diamond New Housing Scheme, sustained injuries and were treated at the Diamond Regional Hospital. They were later discharged.

Police confirmed that a breathalyser test was not conducted on the car driver due to injuries to his mouth, for which he received stitches. He remains in custody, assisting with the investigation.

The body of Bhojedat was removed and taken to the Memorial Gardens Funeral Home, where it is awaiting a post-mortem examination. Investigations into the circumstances surrounding the accident are ongoing.

Fyear. Making the disclosure during his presentation of Budget 2026 on Monday, Dr

Singh said the Government’s support of the quarrying industries is guided by the goal of ensuring a reliable

and sustainable supply of aggregates that can keep pace with the country’s current construction boom.

“In recent years, expanded capacity in sand and stone quarrying has been supported by the issuance of new licences and other investment in the industries,”

he noted. At the end of 2025, he said there were 18 operational quarries, with expanded operations expected this year.

The finance minister revealed that the mining and quarrying sector is estimated to have expanded by 21 per cent in 2025 and is pro-

jected to grow by 17.6 per cent this year.

Natural Resources Minister Vickram Bharrat had previously revealed that national quarrying production has increased from approximately 650,000 tonnes in 2020 to nearly 5.5 million tonnes in 2025.

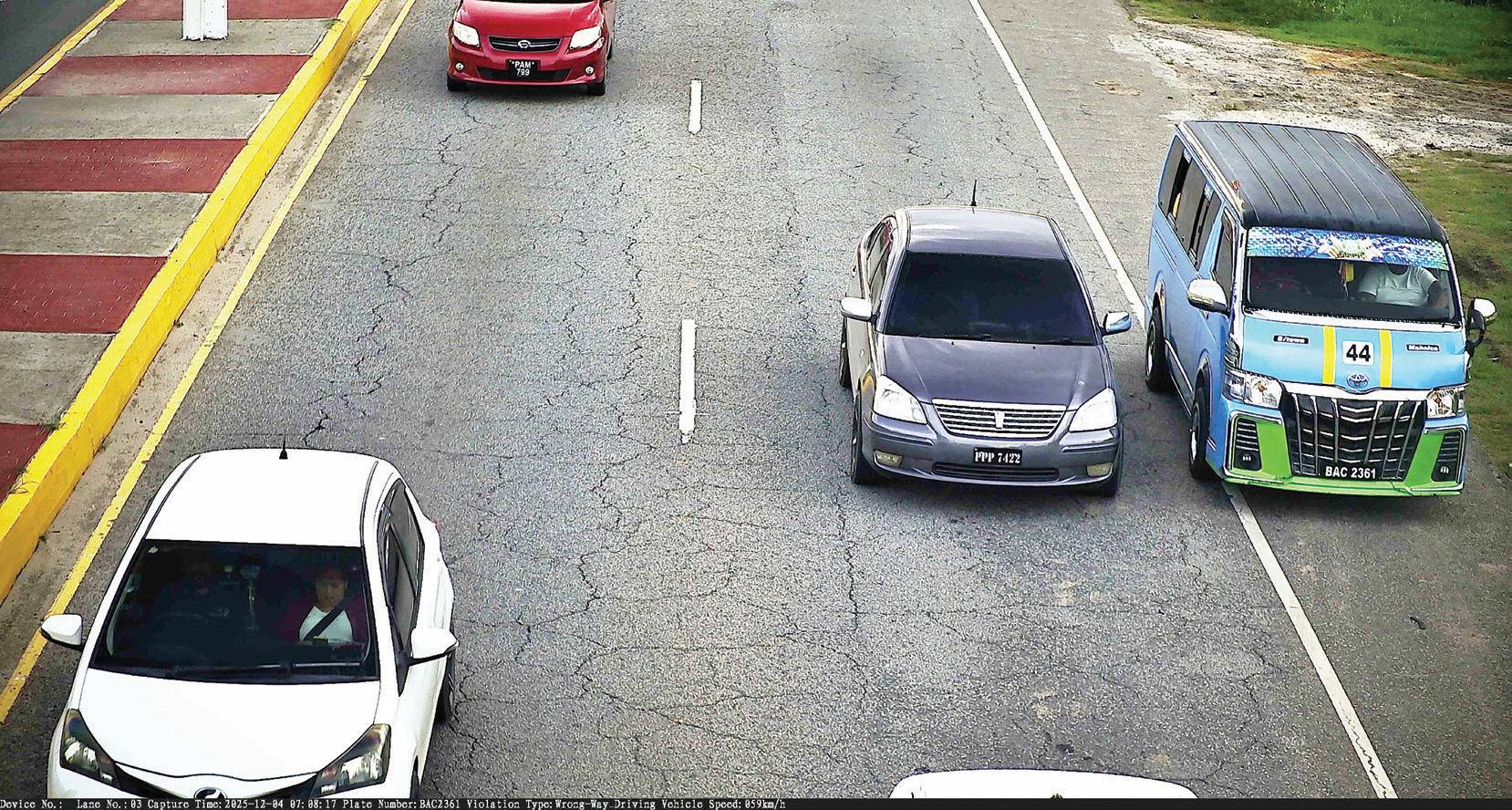

The Guyana Police Force (GPF) has recorded more than 6500 illegal third-lane violations using footage from the Safe Road Intelligent System (SRIS), with hundreds of matters already heard and determined by the courts. Police said on Tuesday that 585 cases have so far been processed, resulting in fines and, in some instances, the suspension of drivers’ licences. The remaining matters are currently at various stages of review, charge preparation and prosecution. Illegal third-lane driving occurs when motorists unlawfully use the outer edge or shoulder of a roadway as an additional traffic lane, rather than for its intended purpose. The GPF said the practice poses serious safety risks, undermines traffic order and significantly increases the likelihood of collisions, particularly along high-volume roadways.

According to Police, third-lane violations are not

classified as ticketable offences under existing traffic regulations and must therefore be prosecuted before a Magistrate. Each incident captured by SRIS cameras is individually reviewed by trained Police personnel, with footage carefully analysed, compiled and prepared as evidence for presentation in court. Once drivers are identified, Police officers use electronic tablets to show motorists the recorded footage of the infraction as part of the verification and charge preparation process prior to court proceedings.

The GPF said it is strengthening its prosecutorial and administrative capacity to reduce delays and ensure a faster turnaround in advancing SRIS-related cases through the court system, as the scope of camera-based enforcement continues to expand nationwide.

Police have again urged motorists to comply with traffic laws and desist from the unlawful use of roadway shoulders and outer lanes,

warning that sustained enforcement will continue. In December, the Government announced plans to introduce significant reforms to road traffic laws, including increased fines for speeding and an expanded list of ticketable offences under the Safe Road Intelligent System. Authorities indicated that legislative amendments are being finalised to allow for wider use of e-ticketing, tougher penalties for dangerous and negligent driving, and the introduction of additional enforcement mechanisms such as a demerit point system.

At present, the e-ticketing component of SRIS is used primarily for speeding and seatbelt offences, with thousands of cases already recorded and substantial sums collected in fines. The proposed reforms are aimed at strengthening accountability among road users, reducing reckless driving and addressing the persistent rise in traffic accidents and fatalities across Guyana.

Edghill emphasised that the areas in question were clearly abandoned and that no one would reasonably claim they were occupied. He noted that Government officials had inspected the carriageway multiple times and had already removed seven substructures overgrown with grass and litter. He urged concerned persons to contact the Ministry, explaining that only three stalls would be removed to allow trucks to safely turn in for the project. He add-

ed that the announcement was also intended to address misinformation on social media, where some believed they could pressure the Government.

“So please, if this concerns you, contact the Ministry, because the operation will remove just these three stalls to allow the truck to make the turn coming in with the sheet pack. We wanted to make this known. One of the reasons we are here is that people are doing things and believe if they go to social

media, they can put pressure on the Government,” he said. Meanwhile, the Minister noted that a new bridge is being constructed at the head of the corridor to address the morning traffic bottleneck. He called for community cooperation, emphasising that collaboration with the Government is key to achieving meaningful transformation in local areas. The Minister added that Budget 2036 prioritises the people, with all projects designed to ensure that residents benefit.

Oil prices settled three per cent higher on Tuesday as producers reeled from a winter storm that hobbled crude production and drove US Gulf Coast crude exports to zero over the weekend.

Brent crude futures settled up US$1.98, or 3.02 per cent, at US$67.57 a barrel. US West Texas Intermediate crude settled up US$1.76, or 2.9 per cent, at US$62.39 a barrel.

US oil producers lost up to two million barrels per day, or roughly 15 per cent of national production, over the weekend, analysts and traders estimated, as a severe winter storm swept across the country, straining energy infrastructure and power grids.

Severe weather has boosted crude futures, with shortterm risks tilted to the upside on fears of supply disruptions, said Fawad Razaqzada, market analyst at City Index.

”The cold weather in the US will likely cause quite significant drawdowns in oil stocks over the next few weeks, particularly if this weather persists,” said Tamas Varga, an oil analyst at broking PVM.

Exports of crude oil and liquefied natural gas from US Gulf Coast ports tumbled to zero on Sunday amid frigid weather, ship tracking service Vortexa said.

Exports rebounded on Monday with flows coming in above seasonal norms as ports reopened, said Samantha Santa Maria-Hartke, head of market analysis at Vortexa. (Excerpt from Reuters)

of

The families of two Trinidadian men who were killed in a US missile strike on a boat in the Caribbean in October sued the Trump Administration in federal court, arguing the ”premeditated and intentional killings lack any plausible legal justification.”

Chad Joseph and Rishi Samaroo were among the six passengers who were killed when the boat they were travelling in was destroyed by a US missile on October 14, 2025, according to a 23page complaint filed in the US District Court for the District of Massachusetts on Tuesday. Joseph’s mother and Samaroo’s sister filed the suit on behalf of their families, naming the US as a defendant.

The October strike was part of the Trump Administration’s campaign against alleged drug-trafficking boats in the Caribbean and eastern Pacific, mostly targeting boats coming from Venezuela. The Administration has carried out at least 35 strikes since September, most recently last week. The attacks have

killed more than 100 persons.

President Trump posted footage of the October 14 strike on Truth Social at the time, writing that intelligence showed the boat ”was trafficking narcotics, was associated with illicit narcoterrorist networks, and was transiting along a known [designated terrorist organisation] route.” He said six male narco-terrorists were killed.

The lawsuit said Joseph and Samaroo lived in Trinidad and Tobago and had travelled to Venezuela to fish and work on farms. They were returning to their homes in Trinidad and Tobago on the boat that was struck, according to the complaint.

In December, the relatives of 42-year-old Alejandro Carranza Medina filed a complaint against the US with the Inter-American Commission on Human Rights, saying Medina was not involved in drug trafficking and had been fishing when his boat was destroyed. (Excerpt from CBS News)

Three young brothers died Monday after falling through ice on a private pond north of Bonham, Texas, according to multiple local and state agencies.

Two of the boys, ages eight and nine, were pulled from the water by a neighbour and first responders. Medical care was immediately administered before the children were taken to a local hospital by ambulance.

The six-year-old did not resurface but was later recovered after an extensive search of the pond.

All three children were pronounced dead.

The victims have been identified as brothers Howard, six; Kaleb, eight; and EJ, nine, according to relatives who spoke with KDFW.

The Bonham Fire Department confirmed the deaths were the result of the boys falling into the icy pond

during the winter storm.

The boys’ mother, Cheyenne Hangaman, told KDFW about her desperate attempt to save her sons. She said Howard, the youngest brother, went underwater first, and his older brothers jumped in to help him.

“I started running toward the pond, and I jumped in. I tried to save them while also trying to keep myself alive,” Hangaman said. “As soon as I jumped in, I locked up. I couldn’t do anything.”

Hangaman said a coach also tried to help the boys out of the freezing water. The mother eventually had to be pulled out by a neighbour.

“It was one of me and three of them, and they all needed me at one time. I just couldn’t... I couldn’t save them,” she said.

A GoFundMe page, “Helping My Sister Through This Heartbreak”, has been set up to help the family. (Excerpt from FOX10 News)

Trump says he will “de-escalate”

Speaking to press and supporters in Iowa, United States President Donald Trump was asked whether he agrees with others in his Administration that Alex Pretti was a ”domestic terrorist”.

”I haven’t heard that,” President Trump said, adding, ”I don’t like that he had a gun.”

But, he said, despite the gun, Pretti’s killing in Minneapolis on Saturday was a ”very unfortunate incident”.

Videos examined by BBC Verify show Pretti was holding a phone as he filmed agents, and he was visibly not holding a gun in his hands.

Asked about the situation in Minneapolis, Trump said crime numbers are

”good” because the ongoing immigration operations there took ”hardened criminals” off the streets.

He also notes that White House ”border tsar” Tom Homan is there now meeting with local officials.

Prime Minister Kamla Persad-Bissessar has endorsed the use of body cameras by Police Officers in the field, calling it a move that will strengthen public confidence in the Trinidad and Tobago (T&T) Police Service (TTPS).

Asked yesterday about last week’s fatal Policeinvolved shooting in St Augustine and whether it highlighted the need for Officers to wear body cameras, Persad-Bissessar said, “I agree that the use of body cameras will be a positive measure to increase confidence in the TTPS.”

Pressed further, she said, “I prefer to wait until the investigation is completed before making a comment on that specific incident.”

Persad-Bissessar’s comments came as the family of Joshua Samaroo launched their own investigation into the incident, seeking to piece together the final moments that led to his death. And in a series of voice

T&T PM: Police Officers should wear

notes late yesterday, in which he confirmed certain facts for the first time since the shooting, Commissioner of Police (CoP) Allister Guevarro said none of the Officers involved had been suspended or sent on leave up to late yesterday.

Samaroo, a 31-year-old father of two who lived at Bamboo Number 1, Valsayn, with his common-law wife, Kaia Sealy, was killed by Police at the corner of Bassie Street Extension and Dookiesingh Street, St Augustine, on January 20.

Sealy, 28, was shot multiple times and remains paralysed in hospital.

Deputy Commissioner of Police, Operations, Suzette Martin visited the Eric Williams Medical Sciences Complex, Mt Hope, yesterday, to conduct a welfare check on Sealy.

Well-placed sources told Guardian Media, “The family is on the hunt for the truth.” (Excerpt from Trinidad Guardian)

”We’re going to de-escalate a little bit,” he said, continuing to say that recent killings in Minneapolis by federal agents – of Renee Good and Alex Pretti – were ”terrible”.

He praised Good’s Trump-supporting parents, adding that Good may have been ”radicalised”.