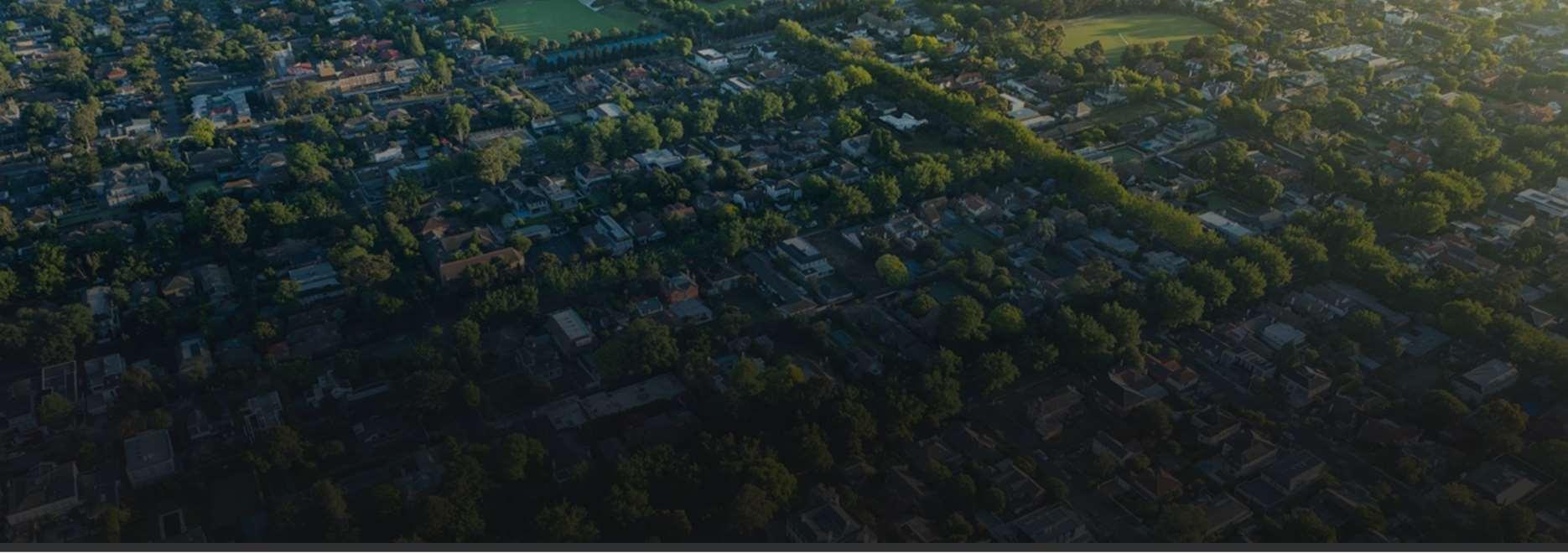

There’snoarguingthepastfewyearshavebeen challengingforhomebuyers,especiallyonthe affordabilityfront.Andifyou’retryingtobuyahome, it’seasytoworryyouwon’tbeabletofindonein yourbudget.Buthere’swhatyouneedtoknow.

Thenumberofhomesforsalehasgrownawhole lotlatelyandthat’strueforbothexisting(previously livedin)andnewlybuilthomes.Here’salookat thosetwobrightspotsforbuyersrightnowandwhy theymaymakeitabiteasiertofindthehome you’vebeenlookingfor.

DatafromRealtor.comsaysthenumberofexistinghomesforsaleimprovedbyanimpressive 22%in2024.Andexpertssayyourpoolofoptionsisexpectedtogetevenbetterthisyear. Forecastsshowinventoryisprojectedtogrowanother11-15%bytheendof2025(see graphbelow):

Thisisgoodnewsforyoursearch.Ifyou haven’tseenahousewithallthefeatures youneed,justknowthat,asthenumberof homesforsalegrows,you’llhavemore optionstochoosefrom.Thatmeansabetter chanceoffindingahomethatchecksall yourboxes.AsRalphMcLaughlin,Senior EconomistatRealtor.com,says:

“Itcouldbeaparticularlygoodtimeto getoutintothemarket...you'regoing tohavemorechoice.Andthat'snot somethingthatbuyershavereallyhadmuch overthepastseveralyears.”

AccordingtodatafromtheCensusandtheNationalAssociationofRealtors(NAR),32.5%,or roughly1in3,homesonthemarketrightnowarenewlybuilthomes.That’smorethanthenorm (seechartsbelow).Butdon'tworry,that'snotbecausebuildersareoverdoingit–it’sjustthat they’retryingtocatchupafteryearsofunderbuilding.

From1983-2019,anaverageofonly13% ofhomesforsalewerenewlybuilt

AsofJanuary2025,over30%ofall homesforsalewerenewlybuilt 32.5% LatestData

Source:NAR

Andthebestpartis,sincebuildershavebeenfocusingonsmallerhomeswithlowerpricepoints, youmayactuallyfindoutnewbuildsarelessexpensivethanyou’dexpect.So,whilealotof peoplewriteoffnewconstructionbecauseit’seasytoassumethecostsarewayhigher,lately, thatpricegapisn’tasbigasyou’dthink.AsCNETsays:

“Ifyouliveinanareawherethere'salotofnewconstructionhappening...youmightbeableto purchaseanewhouseforapricesimilartoorevenlessthanapre-ownedone.”

Ifyouhaven’tbeenabletofindahomethat’sinyourbudget,it’stimetoaskyouragentaboutnew builds.Ifyoudon’t,youmaybecuttingyourpoolofoptionsbyaboutathird.

Morechoicescouldbethekeytounlockingyourhomebuyinggoalsin2025.Reachoutifyou wanttoseewhat’savailableinandaroundourarea.

Wonderingwhat’sinstoreforthehousingmarketthisyear?Andmorespecifically,whatitall meansforyouifyouplantobuyahome?Here’swhattheexpertssayliesahead.

Everyone’skeepinganeyeonmortgageratesandwaitingforthemtocomedown.So,the questionisreally:howfarandhowfast?Thegoodnewsisthey’reprojectedtoeaseabitin 2025.Butnotbymuch.Thatmeansyoushouldn’texpecttoseeareturnof3-4%mortgagerates. Expertsareforecastingratescouldsettleinthemid-6%rangebytheendoftheyear(see chartbelow):

Butyoushouldremember,thiswillcontinuetochangeasnewinformationbecomesavailable. Expertforecastsarebasedonwhattheyknowrightnow.Andsinceeverythingfrominflationto economicdrivershaveanimpactonwhereratesgofromhere,braceforsomeratevolatility. Don’tgetcaughtupintheexactnumbershereandtrytotimethemarket.Instead,focusonthe overalltrendandthatevenasmalldeclinecanhelpbringdownyourfuturemortgagepayment.

Theshortanswer?Notlikely.Whilemortgageratesareexpectedtoeaseabit,homepricesare projectedtokeepclimbinginmostareasjustatamorenormal,sustainablepace.Ifyou averagetheexpertforecaststogether,you’llseepricesareexpectedtogoupabout3%in2025, withmostofthemhittingsomewhereinthe3to4%range(seegraphbelow):

Sodon’texpectasuddendropthat’llscoreyouabigdealifyou’rethinkingofbuyingthisyear. Whilethatmaysounddisappointingifyou’rehopingpriceswillcomedown,refocusonthis.It meansyouwon’thavetodealwiththesteepincreaseswesawinrecentyears,andyou’llalso likelyseeanyhomeyoudobuygoupinvalueafteryougetthekeysinhand.Andthat’sactually agoodthing.

Keepinmind,though,thehousingmarketishyper-local.So,thiswillvarybyarea.Somemarkets willseeevenhigherprices.Andsomemayseepriceslevelofforevendipalittleifinventoryis upinthatlocation.Inmostplacesthough,priceswillcontinuetorise(astheyusuallydo).

Let’sconnectsoyoucangetthescooponwhat’shappeninginourareaandadviceonhowto makeyournextmoveasmartone.

Expertssayrateswillcomedownslightlyintheyearahead–butsomevolatilityisexpected.

Averagemortgagerateswilldeclinemodestlybutremain above6percent,withlikelyboutsofvolatility.

So,youshouldn'ttrytotimethemarket.Instead,it'sbettertofocuson howevenasmallchangeimpactsyourfuturemortgagepayment.

ArecentreportfromBankofAmericahighlights that70%ofprospectivebuyersfearthelongtermconsequencesofrenting,includingnot buildingequityanddealingwithrisingrents.

Ifyou’reonthefenceofwhethertorentorbuy, here’swhatyoushouldknow.Ifyou’reableto makethenumberswork,buyingahomehas powerfullong-termfinancialbenefits.

Buyingahomeallowsyoutoturnyourmonthlyhousingcostsintoalong-terminvestment.That’s because,asshownindatafromtheCensusandtheDepartmentofHousingandUrban Development(HUD),homepricestendtoincreaseovertime(seegraphbelow):

Risinghomepricesdirectlybenefithomeowners.That’sbecausewhenyouownahome,you buildequity—meaningyourownershipstakeinyourhomegrowsasyoupaydownyour mortgageandyourhome'svalueappreciates.Andthat,inturn,makesyournetworthgrow,too.

Rentingmayfeelmoreaffordableintheshortterm,especiallyrightnowwithtoday’shomeprices andmortgagerates.Buttherealityis,overtime,rentalmostalwaysgoesup.Takealookatthe dataandyoucanseethatplayout.AccordingtoCensusdata,rentshavesignificantlyincreased overthedecades(seegraphbelow):

Thismeansifyoudecidetorent,you’lllikelyfacegrowingexpenseseachtimeyoureneworsign anewlease–andthat’llhappenwithoutbuildinganywealthinreturn.Plus,thoserisingcosts maymakeithardertosaveuptobuyahomedowntheroad.

Whenyouownahome,yourpaymentsareaninvestmentinyourfuture.Renting,ontheother hand,meansyourmoneyisgoneforgood—ithelpsyourlandlordbuildequity,notyou.

Rentingisagoodoptionforthosenotready(orable)tobuytoday.Butifyouareabletobuyat today'sratesandprices,ithelpsyoubuildequityandsetsyouupforlong-termfinancialsuccess. So,eventhoughrentingmayseemeasiernow,itcan’tmatchthebenefitsofhomeownership. $0

Ifyoucanaffordit,takecontrolofyourfinancialfuturebymakinghomeownershippartofyour plan.It’saninvestmentyouwon’tregret.

There’sneveraone-size-fits-allanswertowhether nowistherighttimetobuyahome...There’salso nowaytopredictpreciselywhatthemarketwilldoin thenearfuture...Perfectlytimingthemarket shouldn’tbethegoal.Thisdecisionshouldbe determinedbyyourpersonalneeds,financialmeans andthetimeyouhavetofindtherighthome.

Tryingtodecidewhetheritmakesmoresensetobuyahomenoworwait?There’salottoconsider, fromwhat’shappeninginthemarkettoyourchangingneeds.Butgenerallyspeaking,aimingtotime themarketisn’tagoodstrategy—therearetoomanyfactorsatplayforthattoevenbepossible.

That’swhyexpertsusuallysaytimeinthemarketisbetterthantimingthemarket.

Inotherwords,ifyouwanttobuyahomeandyou’reabletomakethenumberswork,doingit soonerratherthanlaterisusuallyworthit.Bankrateexplainswhy:

“Nomatterwhichwaytherealestatemarketisleaning,though,buyingnowmeansyoucanstart buildingequityimmediately.”

Here’ssomedatatobreakthisdownsoyou canreallyseethebenefitofbuyingnow versuslaterifyou’reableto.Each quarter,FannieMaereleasestheHome PriceExpectationsSurvey.Itasksoverone hundredeconomists,realestateexperts, andinvestmentandmarketstrategistswhat theyforecastforhomepricesoverthenext fiveyears.Inthelatestrelease,expertsare projectinghomepriceswillcontinuetorise throughatleast2029justataslower, morenormalpacethantheydidoverthe pastfewyears(seethegraph):

December–December, asForecastinQ42024 EstimatedHome

Butwhatdoesthatreallymeanforyou?Togivethesenumberscontext,thegraphbelowusesa typicalhomevaluetoshowhowitcouldappreciateoverthenextfewyearsusingthoseHPES projections(seegraphbelow).Thisiswhatyoucouldstarttoearninequityifyoubuyahomein early2025.

$83,251

Potentialgrowthinhouseholdwealthoverthenext 5yearsbasedsolelyonincreasedhomeequity ifyoupurchasea$400KhomeinJanuary2025.

$400,000$415,120$430,189$446,149$464,129

$483,251 202520262027202820292030

BasedonpriceappreciationprojectedbytheHomePriceExpectationsSurvey

Inthisexample,let’ssayyoubought$400,000homethisJanuary.Basedontheexpertforecasts fromtheHPES,youcouldgainmorethan$83,000inhouseholdwealthoverthenextfiveyears. That’snotasmallnumber.Ifyoukeeponrenting,you’relosingoutonthisequitygain.

Andwhiletoday’smarkethasitsfairshareofchallenges,thisiswhybuyingisworthitin thelongrun.

Ifyouwanttobuyahome,don’tgiveup.Therearecreativewayswecanmakeyourpurchase possible.Fromlookingatmoreaffordableareas,toconsideringcondosortownhomes,oreven checkingoutdownpaymentassistanceprograms,thereareoptionstohelpyoumakeithappen. Sosure,youcouldwait.Butifyou’rejustwaitingitouttoperfectlytimethemarket,thisiswhat you’remissingouton.Andthatdecisionisuptoyou.

Ifyou’retornbetweenbuyingnoworwaiting,don’tforgetthatit’stimeinthemarket,nottiming themarketthattrulymatters.Let’stalkthroughitifyouhavequestions.

Noonelikesmakingmistakes,especiallywhenthey happeninwhat’slikelythebiggesttransactionofyour life—buyingahome.That’swhypartneringwithatrusted agentissoimportant.Anexpert’sinsightswillhelpyou avoidthetopmistakeshomebuyersaremakingtoday.

Manybuyersaretryingtotimethemarketby waitingforhomepricesormortgageratesto drop.Thiscanbeareallyriskystrategy becausethere’ssomuchatplaythatcanhave animpactonthosethings.AsRickSharga, CEO,CJPatrickCompany,says:

“Don’ttrytotimethemarket—itrarely workswithstocks,andalmostneverworks whenitcomestobuyingahouse.Onlybuy whatyoucanreasonablyaffordgiven whateverthecurrentmarketconditionsare.”

Ifyou’retemptedtostretchyourbudgeta bitfurtherthanyoushould,you’renot alone.Anumberofbuyersaremakingthis mistakerightnow.

Butthetruthis,it’sactuallyreallyimportant toavoidoverextendingyourbudget, especiallywhenotherhousingexpenses likehomeinsuranceandtaxesareonthe rise.Youwanttotalktotheprostomake sureyouunderstandwhat’llreallyworkfor you.Bankrateoffersthisadvice:

“Focusonwhatmonthlypaymentyoucan affordratherthanfixatingonthemaximum loanamountyouqualifyfor.Justbecause youcanqualifyfora$300,000loan doesn’tmeanyoucancomfortably handlethemonthlypaymentsthatcome withitalongwithyourotherfinancial obligations.”

Savingupfortheupfrontcostsofhomeownershiptakessomecarefulplanning.Youhavetothink aboutyourclosingcosts,downpayment,andmore.Andifyoudon’tworkwithateamof experiencedprofessionals,youcouldmissoutonprogramsouttherethatcanmakeabig differenceforyou.Thisishappeningmorethanyourealize.

AccordingtoRealtor.com,almost80%offirst-timebuyersqualifyfordownpayment assistancebutonly13%actuallytakeadvantageofthoseprograms.So,talktoalenderabout youroptions.Whetheryou’rebuyingyourfirsthouseoryourfifth,theremaybeaprogramthat canhelp.

Thislastonemaybethemostimportantofall.Theverybestwaytoavoidmakinga costlymistakeistoleanonapro.Withtherightteamofexperts,youcaneasilydodge anymissteps.

Thegoodnewsisyoudon’thavetodealwithanyoftheseheadaches.Let’sconnectsoyou haveaproonyoursidewhocanhelpyouavoidthesecostlymistakes.

Consistencyisthenameofthegame afterapplyingforamortgage.Besure todiscussanychangesinincome, assets,orcreditwithyourlender,so youdon’tjeopardizeyourapplication.

Don’tchangebankaccounts.

Don’tdepositcash intoyouraccounts beforespeaking withyourbank orlender.

Don’tapplyfornewcreditor closeanycreditaccounts.

Don’tco-signother loansforanyone.

Don’tmakeany largepurchases.

Thebestplanistofullydiscloseanddiscussyourintentions withyourlenderbeforeyoudoanythingfinancialinnature.

Whenitcomestobuyingahome,expertadvicefromatrustedrealestateagentispriceless,now morethanever.Andhere’swhy.Arealestateagentdoesalotmorethanyoumayrealize.

Youragentisthepersonwhowillguideyouthrougheverystepwhenbuyingahomeandlookout foryourbestinterestsalongtheway.Theysmoothoutacomplexprocessandtakeawaythe bulkofthestressofwhat’slikelyyourlargestpurchaseever.Andthat’sexactlywhatyouwant anddeserve.

ThisisatleastpartofthereasonwhyasurveyfromBrightMLSfoundanoverwhelmingmajority ofpeopleagreeanagentisakeypartofthehomebuyingprocess(seevisualbelow):

91%

Ofrespondentsagree"Itwouldbe verystressfultonavigatethe homebuyingprocesswithouta realestateagentorbroker.”

Ofrespondentsbelieve "Arealestateagentorbroker isanessential,trusted advisorforahomebuyer." 87%

1.DeliverIndustryExpertise:Therightagent–theprofessional–willcoachyou througheverythingfromstarttofinish.Withprofessionaltrainingandexpertise,agents knowtheinsandoutsofthebuyingprocess.Andintoday’scomplexmarket,thewayreal estatetransactionsareexecutedisconstantlychanging,sohavingexpertadviceonyour sideisessential.

2.ProvideExpertLocalKnowledge:Inaworldthat’spoweredbydata,agreatagent canclarifywhatitallmeans,separatefactfromfiction,andhelpyouunderstandhow currentmarkettrendsapplytoyouruniquesearch.Fromhowquicklyhomesaresellingto thelatestlistingsyoudon’twanttomiss,theycanexplainwhat’shappeninginyour specificlocalmarketsoyoucanmakeaconfidentdecision.

3.ExplainPricingandMarketValue:Agentshelpyouunderstandthelatestpricing trendsinyourarea.What’sahomevaluedatinyourmarket?Whatshouldyouthinkabout whenyou’remakinganoffer?Isthisahousethatmighthaveissuesyoucan’tseeonthe surface?Noonewantstooverpay,sohavinganexpertwhoreallygetstruemarketvalue forindividualneighborhoodsispriceless.Anofferthat’sbothfairandcompetitiveintoday’s housingmarketisessential,andalocalexpertknowshowtohelpyouhitthemark.

4.ReviewContractsandFinePrint:Inafast-movingandheavilyregulatedprocess, agentshelpyoumakesenseofthenecessarydisclosuresanddocuments,soyouknow whatyou’resigning.Havingaprofessionalthat’strainedtoexplainthedetailscouldmake orbreakyourtransactionandiscertainlysomethingyoudon’twanttotrytofigureouton yourown.

5.BringNegotiationExpertise:Fromoffertocounterofferandinspectiontoclosing, therearealotofstakeholdersinvolvedinarealestatetransaction.Havingsomeoneon yoursidewhoknowsyouandtheprocessmakesaworldofdifference.Anagentwill advocateforyouastheyworkwitheachparty.It’sabigdeal,andyouneedapartnerat everyturntolandthebestpossibleoutcome.

Realestateagentsarespecialists,educators,andnegotiators.Theyadjusttomarketchanges andkeepyouinformed.Andkeepinmind,everytimeyoumakeabigdecisioninyourlife, especiallyafinancialone,youneedanexpertonyourside.Expertadvicefromatrusted professionalispriceless.

Thecomplexitiesofthecurrentconditions meanthat,nowmorethanever,it’ssmartto leanontheguidanceofanexperiencedlocal realestateagent.Ifyouwanttoenterthe housingmarketin2025,whetherasabuyer oraseller,letaproleadthewayforyou.

Doyouhavequestionsabout somethingyoureadhereorabout buyingahomeingeneral?Don’t hesitatetoreachout.

Whetherit’shousingmarket-related, orsomethingaboutyourspecific situation,I’vehelpedotherbuyers findsuccess–andIcanhelpyoutoo.