ALMOST 50% OF EURO VEHICLES IN NORTH AMERICA COME WITH CASTROL EDGE.

Castrol EDGE Euro Car is formulated to deliver at least 40% improved performance versus the most advanced European manufacturer and ACEA limits.** Creating more power for the same amount of fuel.***

We surveyed counter professionals at parts distributors across Canada for their feedback on topics ranging from how they like their job to industry trends to what would make things better and more. Check out what they had to say

The automotive aftermarket has long been lauded as resilient. That’s a strength. But as the toll of tariffs weighs on the industry, it’s coming at more than just a financial cost

Jobber News is Canada’s longest-established publication serving the distribution segment of the Canadian automotive aftermarket. It is specifically directed to warehouse distributors, wholesalers, machine shops, and national accounts.

Automotive Group Director | Nickisha Rashid (647) 355-7416

nickisha@turnkey.media

Publisher | Peter Bulmer (585) 653-6768 peter@turnkey.media

Managing Editor | Adam Malik (647) 988-3800 adam@turnkey.media

Contributing Writer | Zakari Krieger, Meagan Moody, Kumar Saha,

Creative Director | Samantha Jackson

Video / Audio Engineer | Ashley Mikalauskas, Nicholas Paddison

Sales | Peter Bulmer, (585) 653-6768 peterb@turnkey.media

Delon Rashid, (416) 459-0063 delon@turnkey.media

Nickisha Rashid, (647) 355-7416 nickisha@turnkey.media

Circulation | Delon Rashid, (416) 459-0063 delon@turnkey.media

Production | Tracy Stone tracy@turnkey.media

Jobber News is published by Turnkey Media Solutions Inc. All rights reserved. Printed in Canada. The contents of this publication July not be reproduced or transmitted in any form, either in part or full, including photocopying and recording, without the written consent of the copyright owner. Nor July any part of this publication be stored in a retrieval system of any nature without prior consent.

Canada Post Canadian Publications Mail Sales Product Agreement No. 43734062

“Return Postage Guaranteed” Send change of address notices, undeliverable copies and subscription orders to: Circulation Dept., Jobber News, 48 Lumsden Crescent, Whitby, ON, L1R 1G5

Jobber News Magazine (ISSN#0021-7050) is published six times per year by Turnkey Media Solutions Inc., 48 Lumsden Crescent, Whitby, ON, L1R 1G5

From time to time we make our subscription list available to select companies and organizations whose product or service July interest you. If you do not wish your contact information to be made available, please contact us.

Oftentimes, conversations with automotive parts professionals will inevitably turn to deep dives about the parts they source, the platforms they use and the performance of both.

But the biggest challenge facing the Canadian automotive aftermarket today isn’t technical, it’s human.

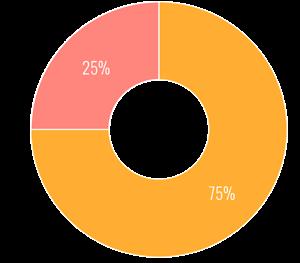

According to this year’s Counter Professionals Survey, nearly four in 10 (37.5 per cent) of respondents working the front desks of parts distributors cited staffing as their biggest challenge. And when asked what challenge impacts their job the most, the top answer was again staffing, with half saying so.

That’s a warning. The people who keep your business running are sending a message: They’re stretched thin, burned out and struggling to keep up. And if their bosses don’t listen, risks persist from lost sales to lost staff.

The squeeze is real. Shops and jobber stores across the country are finding it harder to attract young talent. Trade schools aren’t filling the pipeline, and the perception of counter work isn’t one that inspires outsiders despite the critical and great work done.

But here’s the thing: Hiring is only half the battle. The other half is supporting the people you already have.

This year’s survey saw several respondents highlight training as a critical need. That’s not surprising. Vehicles are evolving rapidly, not just in the ICE, hybrid, EV sense, but the seemingly never-ending number of SKUs that make parts lookup more complex than ever. The biggest issue they have when dealing with customers is wrong info about the vehicle being worked on. So the shop or DIYer may not know enough about the vehicle in need, leaving the counter pro scrambling to fill in the blanks.

Counter staff are expected to be walking encyclopedias, tech troubleshooters and customer service reps all rolled into one. And yet, many say they’re not getting the training they need to keep up.

It’s not just about product knowledge. It’s about confidence. It’s about giving your team the tools to do their job well and the respect to know their role matters. It’s not entry-level. It’s not disposable. It’s a skilled position that requires technical knowledge, emotional intelligence, and real-time problem-solving.

Respondents have noticed the decline in training from suppliers. It “goes a long way” when a rep, who they know is already stretched too thin, shows up and trains staff on their products.

Counter staff also want to be listened to. They want input on stocking decisions. They also want feedback. It dovetails into respect. Recognition, autonomy and a little appreciation go a long way. Yeah, ice cream once in a while is nice, a respondent noted, but what really helps is knowing that the boss sees you, values you and has your back.

The aftermarket is changing. Technology is advancing. Customer expectations are rising. But none of it works without people. If we want to build a stronger, smarter, more resilient industry, we need to start by supporting the ones already holding it together.

President & Managing Partner | Delon Rashid Head of Sales & Managing Partner | Peter Bulmer

Corporate Office

Adam Malik Managing Editor, Jobber News

We

AUTO SERVICE WORLD, FEBRUARY 7, 2025

It’s our job to assist our customers in making educated decisions in these matters. We need to be reminding them that inexpensive tires, in addition to being less effective and safe, wear much quicker and will actually be more expensive in the longer term, while reducing safety. It is important to ask the client their long-term plans for the car. If they’re watching pennies, chances are they want their existing car to last as long as possible – which means extending maintenance intervals and substituting cheaper products is counterproductive. In my experience, assuming that their vehicle is in somewhat decent condition, explaining that proper maintenance and repair is cheaper than vehicle replacement has been successful. This is also where it becomes very beneficial to have built a good and well-educated client base, with a certain amount of trust involved. “The cheapest car to own is the one you already have” is a great line that sums it up pretty accurately.

Geoff Walton, Grant Street Garage

AUTO SERVICE WORLD, FEBRUARY 11, 2025

The technician’s job is to diagnose and repair vehicles. They are not paid to build tickets. Shops that have poor communication have this problem stated in the article. If the techs build the estimate, then why have a service advisor? Service advisors should be properly vetted so they can perform their job. Techs will respect a good service advisor who builds tickets accurately. Train the service advisor to do their job properly.

Bob Ward, The Auto Guys

Exactly Why have a service advisor? I don’t. I have cut out the confusing advisor middle man. No managers, no shop foremen. I just have technicians making money. Sure I may not make as much revenue as the assembly line type business, but I don’t have as much of an expense or a technician shortage issue either.

Rob Nurse, Bob Nurse Motors

I am a journeyman technician, Many years ago, I had a back injury and could not work on the floor of the dealership I was working at. Management gave me a service advisor job, and as a technician, I had the highest sales. The other technicians would line up for me to deal with selling the repairs required and arranging parts. It was a win for the customer, the company and the technicians. Everyone won when having an experienced person at the front line. So I believe the best advisors would be technicians who don’t want to twist wrenches any longer.

Neil Steffler, technician

AUTO SERVICE WORLD, FEBRUARY 13, 2025

We have been using the digital inspection format for several years now. It has been very successful in building great long-term customer relationships. They are all done well within Alan’s time frame. The inspections force the techs to perform a complete inspection so nothing is missed which the service advisor uses to sell work. Professional shops all use Alan’s system with success. Customers have come to expect the report on their vehicle. The important thing we use on them is to promote what is good on their vehicle.

Bob Ward, The Auto Guys

We have had a proper inspection system in place for over 20 years. It was a printed checklist, simple and efficient. Five years ago, we went to a digital process, which our clients love, even the not so tech-savvy ones. With manufacturers extending service intervals, we don’t see our clients as often as we once did. It is just good customer service as we strive to keep our clients' vehicles safe and reliable. Every year millions of dollars are lost because of unrealized maintenance. I suggest the root cause is an inefficient inspection process. This is not up selling or gouging. It is performing required maintenance and repairs. In fact, our clients rely on our expertise and advice as you would your doctor.

Bruce Eccles, Eccles Auto Service

AUTO SERVICE WORLD, FEBRUARY 27, 2025

I agree that training is very important. In these times I have found it necessary to have all employees sign a training agreement stating they need to remain employed with us for one year after completing their training. If they quit, they are responsible for reimbursing me for the training. The last three employees had to pay their training when they left. I pay for any worthwhile training they need, including apprenticeship costs for new employees.

Bob Ward, The Auto Guys

AUTO SERVICE WORLD, MARCH 27, 2025

Am I the only one reading that digital inspections are more of a negative impact to our business than a positive one. By the time your technicians and advisors get their act together to sell a job, Grandma has already left my shop “tail lights down the road”, with a new pinion seal installed. I thought digital inspections were supposed to be the best thing since owners removing themselves from the bays.

Rob Nurse, Bob Nurse Motors

Scan the QR code for the latest and more in-depth news online.

USED VEHICLE PRICES are up while new prices are trending downward as pre-tariff inventory thins out. A new report found that Canada’s auto market is feeling the ripple effects of trade tensions.

The latest AutoTrader Price Index showed that while demand remains strong, the landscape is shifting and buyers are responding quickly.

In the second quarter of 2025, Canadian consumers rushed to purchase vehicles ahead of anticipated price hikes linked to tariffs. This “pull-forward” effect, as AutoTrader put it, has led to a surge in used car demand and a steady rise in prices.

By June, the average used vehicle price had reached $37,664, a 3.6 per cent increase over the previous year. By comparison, new vehicle prices dipped 3.5 per cent year-over-year to $64,445, thanks in part to inventory buffers that helped soften the blow.

Despite a slight dip in demand compared to the first quarter, used car sales rose 1.8 per cent for the quarter and 2 per cent yearto-date. New car sales also remained strong overall, up 5.6 per cent year-to-date, though AutoTrader expects some softening in the months ahead.

Inventory levels are declining and some dealers have underestimated demand when placing 2025 orders. Used inventory remains tight, even with a modest boost from trade-ins and reduced exports to the U.S. The market is still grappling with the long tail of pandemic-era production slowdowns and a drop in lease returns, an estimated 1.5 million fewer vehicles were sold between 2020 and 2023, according to the report.

THE CANADIAN AUTOMOTIVE repair and maintenance sector led the industry in employment growth, posting a 1.7 per cent increase in the first quarter of 2025 compared to the same time last year,

This continues its trend of consistent growth, noted DesRosiers Automotive Consultants. New vehicle dealers also saw a 1.4 per cent rise in jobs, buoyed by strong Q1 sales.

Employment at automotive parts and accessories stores dipped by 0.6 per cent, reflecting a modest pullback in retail staffing, according to DesRosiers.

Employment in Canada’s automotive sector edged down 0.2 per cent overall. The real test for the industry may come in the second quarter, DesRosiers noted, as the effects of the ongoing U.S.Canada trade tensions begin to take hold. April and May brought troubling signs for the broader economy, it observed, with national unemployment hitting 7 per cent and manufacturing job losses mounting.

“The automotive sector will likely see more job losses in the Q2 data,” said Andrew King, managing partner at DesRosiers. “Without a resolution to the trade war soon, at least some of the ground won back post-pandemic will once again be yielded.”

ONTARIO’S SMALL AUTO BUSINESSES are hitting the brakes on growth as the U.S.-Canada trade conflict drags on — and the cost could top $2.9 billion in lost investment over the next year.

That’s the warning from a new report by the Canadian Federation of Independent Business (CFIB), which found that nearly half (49 per cent) of Ontario’s automotive businesses have paused or cancelled planned investments due to trade uncertainty.

The report also found that 65 per cent of businesses in the sector have been directly impacted by U.S. tariffs, with the average business seeing a 13 per cent drop in sales.

“Uncertainty, market volatility, and increased costs are forcing auto business owners to make difficult decisions to keep their doors open,” said Joseph Falzata, CFIB policy analyst for Ontario and co-author of the report. “The desire to grow is there, but with such massive revenue losses, businesses are more focused on keeping their doors open than expanding their operations.”

The report casted doubt on the effectiveness of provincial support programs. Despite a combined $85 million in funding through the Ontario Automotive Modernization Program (O-AMP) and the Ontario Vehicle Innovation Network (OVIN), only 1 to 2 per cent of small auto businesses are expected to benefit. The newly launched $50 million Ontario Together Trade Fund (OTTF) is expected to reach just 1 per cent.

“While these programs were created with good intentions, the reality is that many small business owners have never heard of them and are not eligible,” said Falzata. “The Ontario government needs to focus their efforts not just on the major auto manufacturers, but also on the many small businesses that feed into the province’s auto eco-system.”

CFIB is calling on the province to improve access to these

Scan the QR code to catch up!

HOW AI IS WORKING BEHIND THE AFTERMARKET SCENES, WITH PREDII’S TILAK KASTURI

HOW CRITICAL LEAD ACID BATTERIES ARE, WITH BRYCE GREGORY

A ROADMAP FOR OUR AFTERMARKET FUTURE, WITH DONOVAN RINGO

POSITIONING YOUR SHOP FOR SALE, WITH SUNIL PATEL

programs or redirect some of the funding to reduce Ontario’s Small Business Tax Rate and raise the threshold for eligibility.

At the federal level, the report recommends returning revenue collected through Canadian counter-tariffs to affected small businesses and providing clearer guidance on product origin rules under the Canada-United States-Mexico Agreement (CUSMA).

THE 2025 NEW VEHICLE SALES year was supposed to be the first “normal” year since 2019. But the new global trade environment has changed that outlook.

According to TD Economics’ North American Auto Outlook 2025, the U.S. administration’s sweeping 25 per cent tariffs on imported vehicles and parts are already reshaping the automotive landscape. While partial exemptions have been granted to Canada, Mexico, and the U.K., the broader impact is expected to be significant — especially if the tariffs remain in place through the end of the year.

TD forecasts a 4.0 per cent decline in U.S. vehicle sales and a sharper 7.5 per cent drop in Canada on a fourth-quarter-overfourth-quarter basis. The report warns that rising vehicle prices, slower economic growth, and reduced affordability will weigh heavily on consumer demand.

In the U.S., vehicle prices are expected to rise by thousands of dollars due to tariffs, while broader economic impacts from trade policy could slow GDP growth to 1.5 per cent — half the pace of 2024. In Canada, where the economy is more reliant on U.S. trade, growth is expected to fall below 1 per cent.

TD also observed that early-year sales were likely frontloaded as consumers rushed to buy before tariffs took full effect. A slowdown is expected in the second half of the year as higher prices filter through the market.

The report noted that economic uncertainty has returned to levels not seen since the pandemic, driven by volatile U.S. trade policy.

THE ANNUAL FACTBOOK from the Auto Care Association reported that the Canadian market in 2024 sat at CAD$24.4 billion, up 3 per cent from the year before.

The number of locations of parts and accessories wholesalers increased by almost half a per cent, while the number of retailers increased by 1.2 per cent. The number of repair shops grew by about 40 new establishments, up 0.2 per cent year-over-year.

The most DIY’d task in Canada were oil top-offs at 40.1 per cent while oil changes were DIFM’d the most at 86.7 per cent.

Sales at recreational and used motor vehicle parts and dealers saw a small 0.1 per cent decrease to sit at $45.3 billion.

It further reported through the 2025 Joint Channel Market Size and Forecast that the U.S. automotive aftermarket is on track for another strong year, with new projections showing the industry will reach US$435 billion in 2025 — and continue growing well beyond that.

ONCE THE BACKBONE of the American auto parts world, jobber stores are now fighting to stay relevant as sweeping changes in distribution threaten their survival, according to a recent report.

South of the border, traditional jobber stores — long-time middlemen in the U.S. auto parts supply chain — are facing a steep uphill battle. Lang Marketing’s report paints a stark picture: Jobber stores are disappearing at an alarming rate, with their numbers down more than 47 per cent from their peak in the early 1980s.

Back then, there were over 31,000 jobber outlets across the United States. Today, that number has been nearly cut in half. While the decline slowed in the 2010s, the COVID-19 pandemic reignited the trend, accelerating store closures and exposing deep vulnerabilities in the jobber model.

“The pandemic created unprecedented supply chain issues nationwide,” the report states, noting that the aftermarket — which relies heavily on specific-application parts — was hit especially hard.

Between 2020 and 2023, jobber store closures more than quadrupled compared to the years just before the pandemic. Although the pace of decline eased slightly in 2023, the damage was already done. Lang’s findings suggest the downward trend continued into 2024.

Tire replacement saw the biggest jump, increasing 19 points on a 1,000-point scale, followed by quick oil change (+17 points) and fullservice maintenance and repair (+15 points). These improvements are largely due to faster service completion times and a greater perception of fair charges.

This study measures customer satisfaction with aftermarket service facilities in three key segments: full-service maintenance and repair, quick oil change, and tire replacement. It evaluates seven factors, including ease of scheduling, fairness of charges, service advisor courtesy and performance, facility quality, time to complete service, and quality of work.

Despite the overall rise in satisfaction, franchised dealerships still outpace aftermarket providers in customer trust regarding the use of technology for efficient service and for complex vehicle repairs.

When it comes to communication, text message updates are preferred by more than half of tire replacement and quick oil change customers, yet many still receive phone calls. Customers who receive texts report higher satisfaction scores across the board. Furthermore, photo or video documentation during multi-point inspections significantly increases the likelihood of customers accepting additional work recommendations. For full-service maintenance and repair customers, 41 per cent accepted recommended work when

accompanied by photo/video, compared to just 17 per cent without. Finally, amenities like charging stations and complimentary snacks/beverages have a substantial impact on satisfaction. While highly appreciated, they are infrequently offered. Providing charging stations boosts quick oil change customer satisfaction by 101 points, and snacks/beverages increase tire replacement customer satisfaction by 103 points.

GEN Z IS DRIVING A SIGNIFICANT shift toward AI agentpowered car buying and maintenance, according to recent research. Salesforce reported that three-in-four (74 per cent) of Gen Zers expressed interest in AI agents that can tell them the best time to buy based on price fluctuations, deals, or incentives.

“As the first generation of digital natives become first-time car buyers and lessees, expectations for personalized, digital-first technology — and concerns over prices, existing buying and leasing processes — are poised to disrupt the industry,” the report said.

• Adjustable charging voltage within each battery type as well as adjustable charging amperage to accommodate smaller batteries and to comply with OE vehicle and battery manufacturer specifications.

• Adjustable voltage reflash power mode required by several OEM’s affords extended vehicle reflash procedures and key-on/engine off diagnostics while holding a specific voltage.

• Partial or Full Charge Mode to address charge & retest messages.

• Adjustable 12 Volt 60 Amp Charger

• Adjustable 70 Amp Reflash Power Mode

• 270 Amp Crank Assist

Stephen Squires has been named vice president of the Colonial Group. He takes over from Philip Murphy, who retired from the company after 33 years.

Fix Network has appointed Sonia Bouthillette as vice president of sales and operations in Canada, following the departure of Jeff Labanovich.

Steve Bashir has been promoted by ZF Aftermarket to the newly-created role of head of aftermarket sales for the U.S. and Canada.

Continental’s group sector ContiTech appointed Ryan Gocher as head of distribution for its industrial solutions business in the Americas.

Tom DiPippo has been promoted to director of sales for traditional WDs in Canada and the U.S. with GSP North America. He’s been with the company since 2019.

MEMA, The Vehicle Suppliers Association, has named Jennifer A. Lewis as its new vice president of regulatory affairs. She joins MEMA from the Federal Communications Commission.

Air Lift Company announced the addition of John Aleva as its new president and chief executive officer, responsible for the entire operations of the company.

Younger generations are more open to AI-powered maintenance solutions, such as predictive diagnostics and automated scheduling. Two-thirds (67 per cent) of Gen Zers want agents to automatically schedule service appointments for them, compared to 39 per cent of baby boomers.

This desire to lean on technology first may stem from Gen Zers having a harder time finding a car that suits them and knowing the best time to buy it, the Salesforce report said. Almost 40 per cent of Gen Zers say they’d delay or cancel buying a car due to difficulties choosing the right vehicle, compared to only 21 per cent of baby boomers. Thirty-seven per cent of Gen Zers say they’d delay or cancel buying a car because they’re unsure of the right time to buy amid price fluctuations, compared to 27 per cent of baby boomers. However, Gen Z is more trusting of AI than older generations. Seven in 10 (71 per cent) of Gen Zers believe AI agents will make car maintenance easier, compared to fewer than half (49 per cent) of baby boomers.

Stats that put the North American automotive aftermarket into perspective

Ontario’s small auto businesses are hitting the brakes on growth as the U.S.-Canada trade conflict drags on, costing billions in lost investment over the next year.

Canadian Federation of Independent Business

The average monthly cost of total vehicle ownership — including gas, insurance and maintenance — went up again last year. Including depreciation, that number is $1,850 per month.

RateHub.ca

Electric vehicle owners drive more than their non-EV peers, who drive 18,431 km annually. Hybrid drivers reported 18,700 km on the odometer every year.

Few Canadians think they own the data their vehicle produces, but 74% believe it should be the vehicle owner.

AIA Canada

Many supply chain leaders plan to pass tariff-related costs directly to their customers, while 43 per cent are prioritizing internal supply chain initiatives to manage the impact.

Zero-emission vehicle numbers dropped from 18.9% from Q4 2024 to Q1 2025. It’s also a drop from Q1 2024, which saw ZEVs make up 12.5% of new vehicle registrations

S&P Global Mobility

$ 2.9 BILLION $2.9BILLION $1,370 45% 30% 43% 40 9.7% 20,564 km

Light trucks in 2015 had an average transaction price of $38,477 and now sit at $54,950. Passenger cars jumped 60% from $28,675 to $45,813.

DesRosiers Automotive Consultants

5

Fountain Tire added a new tire retread plant, acquiring Benson Tire’s 20,000 sq-ft facility in London, Ont. It can process up to 30,000 tires per year.

Fountain Tire

Canada added new repair shops last year, up 0.2% year-over-year. Parts and accessories wholesalers increased by almost half a per cent, while the number of retailers increased by 1.2%.

Auto Care Connect

May 12-15, 2025

Phoenix, Arizona

From pushing creativity to embracing innovation to being a strong professional in the automotive aftermarket, Auto Care Connect provided many opportunities for industry leaders to discuss ideas and dream up new ones. The event drew in about 900 auto care professionals from around the world, offering sessions to the Young Auto Care Networking Group (YANG), Paint, Body & Equipment Specialists (PBES), Automotive Content Professionals Network (ACPN) and the overall Auto Care Association membership. Topics discussed ranged from professional development to geopolitical challenges to business and industry technology and beyond.

Distributors and workshops can action some strategies to reduce the impact of levies // By Kumar

Saha

So it happened.

The price hikes that the industry has been dreading for several months are finally here. And there is no stopping them. At least not for the next few months.

Eucon analysis, based on millions of price points that we regularly add to our platform, shows that part prices in Canada increased by over two to three per cent in the first half of 2025. The trend was a complete reversal from 2024, when prices steadily declined quarter after quarter in the aftermarket.

(OEM parts pricing since the pandemic has been a wholly different matter, which requires its own column.)

That drop was a welcome relief from the post-pandemic supersurge, but that is all over now. Blame everything on tariffs. And, as we know by now, they are here to stay — in some form or another. At least in the short term.

Some economists have commented that the impact of tariffs have been overblown. Indeed, data on general consumption from Q2 did not look as dire as some experts had predicted. In fact, inflation cooled down to 1.7 per cent in the month of July. Results were similar south of the border. But the full picture is only emerging. Prices will have trended higher by the time this column is published. Only a wild optimist would think otherwise given the political and economic direction of our planet.

Faced with the inevitable, here are some strategies distributors and workshops can adopt to minimize the impact of tariffs:

Diversify sourcing beyond China while leveraging Canada-US-

Mexico Agreement (CUSMA) advantages. While we do not tariff Chinese parts directly (as of writing), tightening levies on aluminum/ steel from China and other low-cost countries will raise production costs and downstream prices.

CUSMA may be on shaky ground, but most goods still flow tariff-free in North America. Distributors can therefore reduce their exposure by building supply relationships with U.S. and Mexican manufacturers, who benefit from tariff-free access under the CUSMA agreement.

For example, the U.S. now sources more than 40 per cent of its parts from Mexico, showing that regional capacity is growing. Canadian distributors who proactively shift portions of their catalogue to CUSMA-qualified suppliers may face slightly higher unit costs initially but avoid the volatility of sudden tariff surcharges.

Retailers benefit from having consistent supply chains, which makes their pricing more stable and customer trust easier to maintain.

Use inventory strategy to smooth tariff shocks. Tariff measures in Canada, such as the 25 per cent duty on steel and aluminum from certain countries, often have advance notice. Distributors can take advantage of this by pre-buying key SKUs before tariff dates and negotiating extended terms with suppliers to spread out cash flow impact. Retailers should avoid overcommitting to slow-moving parts, instead focusing on predictable high-turn categories like brake components and filters.

Balancing safety stock with cash discipline ensures distributors

do not tie up capital unnecessarily, while still buffering retailers from immediate price hikes when new tariffs take effect.

Adopt flexible pricing policies and transparent communication. Retailers and distributors should revisit their parts pricing structures more frequently, ensuring that markups keep pace with higher landed costs. Tools like pricing matrices, available in shop management systems, help apply consistent margin rules even as base costs rise.

Transparent communication with repair shops and end customers about tariff-driven increases reduces pushback and reinforces professionalism. For example, workshops using a tiered markup system may update rates quarterly instead of annually. This protects gross profit per repair order while giving distributors a structured way to pass through cost changes without eroding customer relationships.

Distributors and shops should also train their sales teams to explain increases as “tariff-driven”, not margin-driven, and offer bundled pricing (e.g. for kits) to soften the perception of price increases.

Leverage tariff remission and government relief programs. In October 2024, Canada introduced a remission framework to temporarily offset the impact of tariffs on EVs, steel and aluminum for qualifying businesses. Similarly, as of writing, the government was also reviewing the requirement to favour the use of Canadian steel and aluminum in local products.

Distributors should explore these opportunities to lower effective

duty costs during transition periods. Retailers can benefit indirectly if their suppliers reduce costs through remission claims and pass some savings down the chain.

Staying current on trade policy consultations, such as Canada’s review of tariffs on batteries and semiconductors, gives distributors a head start on compliance. Proactive participation in industry associations such as the Automotive Industries Association (AIA) also strengthens their ability to lobby for broader or longer remission relief.

Invest in data analytics and demand forecasting. Tariffs create volatility that can ripple unpredictably across parts categories. Distributors who use demand forecasting tools can better identify which SKUs to stock heavily and which to source on demand, avoiding unnecessary exposure to tariff-inflated inventory.

Retailers should coordinate closely with distributors, sharing point-of-sale and repair order trends so that purchasing aligns with real market demand. For example, analyzing seasonal brake and battery replacement patterns allows distributors to stock up before tariff changes hit, reducing cost exposure while maintaining competitive availability for their retail partners.

Setting the standard for quality, durability & performance.

Experience Schaeffler’s reliable OEM repair solutions, engineered for quality and efficiency. Maximize uptime, reduce costs, and ensure easy maintenance with our durable components.

www.vls.schaeffler.us

Counter professionals from parts distributors across Canada point out what they see happening, their concerns, where issues lie and how they can be better supported // By Adam Malik

If you want to know what’s really happening in the automotive aftermarket, ask the people behind the counter at your local jobber.

They’re the ones fielding calls from frustrated techs, deciphering vague part requests and navigating the everexpanding jungle of SKUs. They’re also the ones who know which brands are failing more often, which customers are getting harder to please, and which suppliers are showing up (and which ones are not).

And they’re the ones who, despite the daily grind, still find satisfaction in helping people get back on the road.

Now in its second year, the Annual Counter Professionals Survey lets us take a look at what may have changed over the last year, according to those on the front lines at jobber stores across Canada. It offers a deeper look into the realities of working at Canadian parts distribution outlets and found that, while some themes like the importance of training and the frustrations with poor-quality parts remains constant, others have shifted in subtle but telling ways.

With the rapid emergence of AI, this year’s survey looked to gauge the thoughts of counter staff on the technology. While some counter professionals are cautiously optimistic about its potential to streamline tasks and improve product lookup, others are skeptical, pointing out that no algorithm can match a human’s ability to eyeball a bolt or measure a belt. Still, it’s on the mind of the industry, suggesting that the aftermarket may soon have to reckon with its digital future.

Training continues to be a sore spot. Many respondents lamented the decline in manufacturer-led education and the lack of hands-on support from supplier reps. Yet there’s hope: Some stores are seeing a resurgence in vendor-led training, and counter staff are eager for more.

Customer behavior is also evolving. The “Google mechanic” phenomenon is alive and well, with DIYers increasingly misdiagnosing issues and returning parts that were never needed. Counter staff are calling for better communication and more respect for their expertise, especially as vehicles become more complex and diagnostic tools more essential.

And then there’s the quality issue. If last year’s survey hinted at frustration with “white box” parts, this year’s responses make it loud and clear: Counter professionals are tired of selling junk. They want better inventory, fewer returns and more accountability from suppliers.

One could say that this year’s survey paints a picture of an industry in transition. Counter professionals are adapting to new technologies, shifting customer expectations and a changing supplier landscape. But they’re also asking for help. They want more training, better tools and a seat at the table when decisions are made.

Here’s a deeper dive into the results.

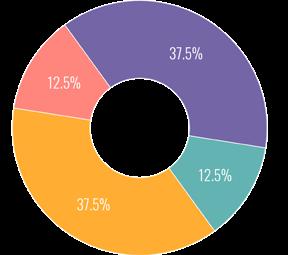

Counter pros continue to be positive about their jobs, though with a slight drop off from the first edition of the survey.

This year, 87.5 per cent said they either love their job or that it’s good. An overwhelming majority, but a drop from last year when 92 per cent responded positively.

Counter staff said that they find fulfillment in helping customers solve problems and keeping vehicles on the road.

“Helping customers find solutions to their everyday challenges,” one noted as to what gives them daily satisfaction.

Respondents emphasized the satisfaction of being part of a constantly evolving industry, especially with the rise of EVs and alternative fuels.

“Helping people get the most life out of their automobiles” is what one respondent said was a core motivator to going through the doors every day.

Also expressed was the pride in being the “go-to” person for tough questions. They enjoy the challenge of solving problems that others can't, and they value the trust placed in them by technicians and customers alike.

Others noted that the variety of tasks, from sourcing rare parts to troubleshooting catalogue errors, keeps the job interesting and rewarding.

On the flip side, parts quality was a sore spot with one in particular pointing out that “I hate selling junk parts to mechanics and customers, as all parts are [terrible] quality.”

Other improvements noted were work conditions to make it more physically comfortable in the store. Air conditioning was one example.

“It’s always money, but even to make the workplace nicer to work in,” another pointed out. “Anti-fatigue mats and good stools go a long way.”

Respondents generally feel supported by their employers, especially when it comes to communication and being heard. Several noted that their input on decisions is valued, and they appreciate it when management provides

encouragement and feedback.

Support from employers also includes flexibility and recognition. Several respondents mentioned that their managers allow them to make decisions on the fly, which helps them feel empowered and trusted.

Some noted that the best part of their day is the interactions they have, be it with the people they work with in the store or the customers who call them up.

“Helping people makes the day worth it,” one said.

However, some that have seen their store go from independent ownership to one now run by a larger corporate entity noted that corporate environments can feel impersonal and that they miss the camaraderie of smaller, independent stores.

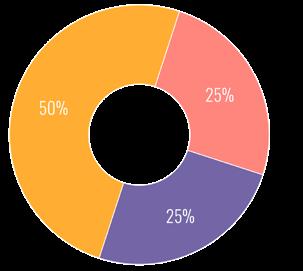

Customer behaviour continues to be a pain point. Last year, lack of knowledge about the part needed (38.5 per cent) was the top pain point for when dealing with pro and DIY customers. This year, it was overtaken by incorrect or incomplete information provided about the vehicle being serviced — half of all respondents identified this as the biggest issue.

One complained about shops ordering parts before completing proper diagnostics. It seems the shop wants to have all possible solutions on hand for when they figure out the issue.

“Google mechanic is often wrong,” said another in a similar vein. “No returns should be allowed to DIY customers. We are not a buy-and-try store.”

The rise of online information has made customers more confident but not always more accurate. Counter professionals reported frequent encounters with customers who insist on specific parts based on internet research, even when those parts are incorrect. This leads to increased returns and wasted time.

And a seeming lack of respect for the work these counter pros do and the skills they have.

“We live in a ‘now’ world. After the pandemic, there are still parts shortages and we are constantly adapting to ‘no lead-times’ and finding options that ‘will fit’ to keep the trucks running with no appreciation for what it took to get a unit out of the shop and back on the road from both customers and technicians,” one respondent explained.

“Customers think most counter persons are just someone behind the computer, whereas a good counter person is as valuable as a good technician,” emphasized another.

The lack of staff and talent shortages continues to be a thorn in the side of counter staff but not as big as before. This year, 37.5 per cent picked it as the top challenge, compared to 62 per cent last year.

Inventory jumped from 15 per cent to 25 per cent this year. Other issues, like product knowledge and difficult customers, made up the rest.

“I am amazed at the lack of inventory and the lack of staff/people willing to work,” wrote one respondent who said they would choose all the options given.

Staffing shortages are affecting morale and performance. Some counter professionals have to multitask, covering phones, walk-ins and deliveries simultaneously. This can lead to burnout and mistakes.

And staffing (50 per cent) and inventory (25 per cent) will continue to be the biggest challenges going forward.

“New staff, product knowledge and learning the technical parts of the job,” one listed as ongoing challenges.

Another just wants more people behind the desk and they’re willing to help them learn.

“I need another counter person. Even a newbie would be fine. I'm always willing to teach the younger staff,” they said.

Know an auto repair shop worthy of recognition?

Nominate them now for the prestigious Shop of the Year Award, sponsored by Milwaukee!

An auto repair shop that has captured the imagination of the community with its unique approach to customer service, dedication to excellence, training, and improving the image of our industry.

Tell us their story:

• What makes this shop special?

• How are they going above and beyond for their customers?

• How are they standing out from their competitors?

• How have they innovated over the last year?

- Milwaukee Tool prize pack valued at $3,500, ranging from PACKOUT ™ equipment to tools

- A visit from a Milwaukee Tool representative and Turnkey Media for an award presentation

-Shop spotlighted in CARS magazine’s December issue

We want to recognize a shop that has demonstrated high performance in the bays, shown innovation and creativity— through training, marketing, customer communication and/or sales. Historical success is always a contributing factor

Deadline: October 12, 2025

www.autoserviceworld.com/awards

SPONSORED BY

“Staffing. There are no young people knocking on the door,” another pointed out. “We are involved at both high school and college levels and [there is still] still very limited interest to our industry.”

They continued, mentioning other challenges like training and that vendors are now starting to offer onsite education on parts for staff.

As for geopolitical issues, if prices are going to go up due to tariff and other charges, having a consistent flowing supply is needed, they added.

“As an independent store, we fight the big chain stores as well as the internet,” said another respondent. “But as people are finding out with warranties and returns, the internet is not the place to buy their parts anymore.”

We asked: If you could give advice to your employer to make your job easier, more enjoyable or improve in any way, what would you tell them?

▶Stay involved in daily operations and offer the staff freedom to make decisions. Good or bad, we learn from all of them.

▶Solicit feedback. Listen to suggestions and act on them. Get rid of roadblocks like unreliable delivery from WDs, shallow depth of inventory, training on how to anticipate job needs. Upsell the extras (which should be in stock), i.e. cleaners, hardware, harnesses, fluids.

▶Ice cream never hurt. But, honestly, having enough staff that your employees are not overworked or stressed because they are so busy with customers.

Inventory issues, ranging from too many SKUs to parts availability, were a common grip among counter pros. The growing variety of parts for ICE, hybrid, and EV platforms has made product lookup more complex.

“Too many choices do not help anyone. Keep brands based on quality, warranty and price. Maximum three choices,” one recommended.

The complexity of vehicle platforms has led to an explosion of SKUs, making inventory management and product lookup more difficult. Counter professionals are calling for better catalog systems and more intuitive software.

One noted that their systems are inferior. They “make us pay a license fee and don't provide us with all the information to properly look up parts. At the same time, RockAuto has a better look-up than the one we pay to use,” the respondent said.

Support from suppliers, manufacturer representatives and vendor reps has become increasingly frustrating for counter staff.

“Would be helpful with more supplier training to keep up to date on the latest,” a respondent noted.

While some reps are praised for their dedication and product knowledge, others are described as “lazy” or absent. The decline in manufacturer-led training is a major concern, with respondents calling for more frequent visits and hands-on education.

“Product training goes a long way,” one counter pro explained, adding that they are starting to see more onsite training for both parts and service staff from vendors. “Unfortunately, they are not ‘involved’ in our business as they are spread out too thinly, i.e., territories are too

large to cover by one person.”

Another echoed that concern. “Training and product support has declined significantly over the past few years as manufacturers have cut sales and training,” the respondent commented.

One pro was more critical, saying it’s hit or miss. “There are some great sales reps who keep us informed and updated on new info, but there are a lot who are lazy,” they said. “I miss the old school sales reps who returned calls/emails. There are only a handful of reps who I know and trust these days.”

There were also complaints about cheap packaging, leading to broken or refused parts.

“Warehouse partners don't control the shipper but should take damage claims seriously as well as unkept promised delivery times,” one respondent said. “The part arriving on time, every time affects the jobber, installer and especially the end user who may be several thousand kilometers from their home and job. The same reps visit repeatedly and many brands remain unrepresented for years, if ever.”

We asked: If you could give advice to your shop customers to help you better support them, what would that be?

▶Give us proper information and better understanding of the process of getting the right part in an efficient manner

▶Product knowledge. Understanding the evolution of our industry would go a long way.

▶Let us know when we don't stock something or pricing is way out on certain products. Give us the feedback to make changes that help you make the decision to buy from us easy and hassle-free.

▶Listen to the counterperson. We see the trends, what parts fail most often, what vehicles break down most.

▶Not always the cheapest is the right part

▶Diagnose more and guess less so we don't have so many returns

While artificial intelligence has been a constant discussion point, it seems to only have a small foothold among jobbers and among counter staff.

Three-quarters of respondents said they don’t use AI at all, with the last 25 per cent saying it’s used a little bit.

That said, most respondents commented that they see how it can help, even if it’s not a major tool they use every day.

“ChatGPT has helped understand new trends in our market area,” one pro observed. “This is constantly evolving and we are looking forward to seeing where it brings us.”

One worried that it would be used to replace training. Another said it’s just a newer version of Google and a way for customers to get the wrong information.

“AI has potential to be both helpful and disruptive. Specifically trained AI platforms will be useful but come at a cost for reliability,” they explained. “General free AI relies on a flawed internet of information to return results. People will quickly tire of dealing with robots and seek out professional, experienced, humans for answers and recommendations. AI can be bought just like Google recommendations.”

Another pointed out that still can’t replace in-person expertise. “It can't look at a bolt and match it up for a customer, or measure a belt for a customer,” they said.

Wakefield 20th Anniversary

June 26, 2025

Toronto, Ontario

Wakefield Canada, a lubricant distribution company that started with the Castrol brand, marked its 20th anniversary with a gathering of employees, retirees and special guests. A barbecue lunch was served in the parking lot of its Lakeshore Road office in Toronto — even as rain poured down from the sky. President Dave Fifield welcomed attendees and highlighted the company’s journey from what started as a 65-employee operation to an organization of over 210 staff. Founder Bob McDonald reflected on the company’s origins of acquiring the Castrol brand in 2005.

The automotive aftermarket sector is proving its resilience in the face of tariffs, but it appears suppliers are not only struggling to stay profitable but also facing additional pressures as the impacts weigh on business and people as uncertainty continues.

The industry has weathered the storm of tariffs better than many expected, noted Paul McCarthy, president of MEMA Aftermarket Suppliers. But not without significant pain. Speaking during a thirdquarter media call, McCarthy highlighted both the strength and the struggles of the sector as it deals with ongoing trade challenges.

“It’s kind of amazing how well the aftermarket has held up despite tariffs,” he observed. “I mean, our sales, if you look at the publicly listed folks who’ve announced, it’s impressive, frankly. And the aftermarket is always resilient.

But McCarthy was quick to point out the heavy burden tariffs have placed on suppliers.

“One thing that can’t be overstated: The enormous cost and time for tariff compliance and analysis — so just the number of people, the time, the cost and the opportunity cost that this has taken suppliers,” he said.

He referenced an internal survey conducted by the association with its member companies. It painted a sobering picture: 42 per cent of suppliers said they don’t expect to make money this year. Some

may break even but many are falling short.

“Certainly a lot of missed plans across the industry, and it’s led to some cost-cutting initiatives,” McCarthy noted.

He further shared direct feedback from members, highlighting the emotional and financial toll, with one noting it’s been a year of body blows.

“Thankfully, they’re not knockout blows. They’re body blows thanks to the aftermarket’s resilience, our nimbleness,” McCarthy said.

Other comments included that suppliers are dealing with volatility every day, that it’s hard to plan, cash flow and margins are being hit even though sales are “fine.” Then there’s the complexity of the tariffs and dealing with changing policy is becoming overwhelming.

“People burned out, people exhausted from dealing with the next tariff hit,” McCarthy explained. “A lot of people focused on nonvalue-added work related to the headlines, rather than to where we all should be.”

Looking ahead, McCarthy said the industry is still trying to determine if the current situation is a short-term disruption or a sign of longer-term change.

“So will this ultimately just be near-term disruption and price adjustment and some new government revenue to offset deficits, or does this mean that there’s more to come, and this will be a longerterm story?” he wondered.

The couple of months have been another whirlwind of economic, geopolitical and political developments that are reshaping the business environment.

For the automotive aftermarket, these forces matter deeply. From the global supply chain to the neighbourhood repair shop, each layer of the sector ultimately reflects shifts in interest rates, consumer confidence, currency values and trade negotiations.

Understanding these linkages is critical for entrepreneurs and distributors operating within Canada’s aftermarket.

At its July 30 meeting, the Bank of Canada once again held its policy rate at 2.75 per cent, marking the fourth consecutive pause. The decision underscored the central bank’s delicate balancing act: On one hand, a slowing domestic economy with signs of labour market cooling; on the other, persistent risks of inflationary pressures driven by tariffs, currency fluctuations, and imported costs.

Tariffs remain the central wildcard. Their downstream impact is clear: Higher input costs filter through distributors and eventually reach Canadian consumers. A weaker Canadian dollar further amplifies these pressures, as it takes more Canadian dollars to buy imported goods, including aftermarket parts. A divergence between U.S. and Canadian bond yields also has consequences for the loonie, which remains vulnerable to monetary policy shifts.

By early August, sentiment had shifted. Evidence of a cooling labour market emerged both in Canada and the United States. The U.S. reported its weakest three-month job growth since the pandemic, with payrolls up only 73,000 in July and prior months revised sharply downward. At the Jackson Hole Economic Forum, U.S. Fed Chair Jerome Powell signalled a more dovish tone, suggesting the time may soon come for rate cuts to re-energize the business environment.

For Canada, an unemployment rate of 6.9 per cent reinforces the narrative of a slowing labour market. Combined with softening consumer sentiment and easing inflation momentum, the stage is being set for the next rate-cutting cycle.

Beyond monetary policy, geopolitical developments are having a direct bearing on Canadian businesses. The Canadian government recently removed retaliatory tariffs on many U.S. goods under the CUSMA agreement, an effort to preserve trade stability with the United States, its most critical trade partner. This pragmatic move contrasts with less favourable trade outcomes other nations have faced when negotiating with the Trump administration, underscoring Canada’s need to maintain a balanced approach.

For the aftermarket, trade stability matters. Distributors rely heavily on predictable cross-border flows of parts, technology, and equipment. Even modest tariff shifts can alter sourcing strategies, squeeze margins, and impact the competitiveness of Canadian jobbers relative to U.S. distributors. In a business where pennies per part often matter, volatility in tariffs and currency values is no small concern.

At the consumer level, sentiment has been trending downward. Canadians are facing higher costs for essentials, rising credit card debt and declining affordability. This has translated into caution around discretionary spending.

However, there is an important counterbalance: Consumers are increasingly reluctant to purchase new vehicles. With higher financing costs, tightening credit conditions and affordability constraints, many Canadians are opting to extend the life of their current vehicles. This has historically been a tailwind for the aftermarket, where repair and maintenance demand benefits from

deferred new vehicle purchases.

At the same time, original equipment manufacturers are grappling with sales softness and margin compression, which can lead to pricing and supply chain adjustments that ripple into the aftermarket. Jobbers who can position themselves as reliable, costeffective, and service-oriented partners will be well-placed to capture share as consumers hold on to vehicles longer.

So, what does this all mean for Canadian jobbers and shops navigating today’s environment?

▶ Neutral but resilient outlook: My sentiment for the aftermarket remains neutral, but importantly, not negative. While consumer caution limits upside, the fundamental trend of vehicle retention supports steady aftermarket demand.

▶ Product strategy matters more than ever: With consumers more discerning, product mix is critical. Stocking the right balance between premium and value-tier parts, ensuring access to fastmoving SKUs and offering solutions that help shops keep repair bills competitive will separate successful distributors from those who struggle.

▶ Currency and tariffs demand vigilance: Distributors should actively manage currency risk and monitor trade developments. Building flexibility into sourcing, whether through diversified suppliers, closer relationships with domestic manufacturers, or hedging strategies, can help insulate against shocks.

▶ Technology and efficiency as differentiators: Amid margin pressure, technology can be an equalizer. From inventory management systems to AI-driven demand forecasting, investing

in efficiency is no longer optional for jobbers seeking to compete. Shops, too, are looking for partners who can help them streamline ordering, calibration, and workflow.

▶ Consolidation and M&A opportunities: Neutral industry growth combined with aging ownership demographics continues to create opportunities for mergers, acquisitions, and private equity activity. Multi-shop operators in collision, glass and mechanical are increasingly looking to expand footprints, and distributors who can provide scale and consistency stand to benefit.

The automotive aftermarket has always been a resilient sector, and today’s environment is no different. While macroeconomic and geopolitical currents create uncertainty, they also create opportunities for those willing to adapt.

Jobbers and shop owners who remain disciplined — carefully managing product strategy, watching costs, and aligning with trusted suppliers — will not only weather the current environment but position themselves to thrive when monetary easing and consumer sentiment eventually improve.

For entrepreneurs in the Canadian aftermarket, resilience is built not on predicting every policy move or trade negotiation, but on building flexible, customer-focused businesses that can adapt to whatever backdrop emerges next.

Canada’s vehicle fleet is aging, and that’s not a short-term anomaly but a structural shift. With the average vehicle in Canada being more than 10 years old, this trend is reshaping how drivers maintain and invest in their vehicles.

For the aftermarket, this isn’t just good news but a defining opportunity.

Jobbers and repair shops can take a measured, strategic approach in responding to aging vehicles with smart inventory planning, thoughtful upselling strategies and support for customers in the shop.

As Canadians keep their vehicles longer, the need for maintenance and repair increases, especially in the mid-life sweet spot. These vehicles require attention in key wear categories. While some consumers delay maintenance, many are willing to invest to extend vehicle life and avoid costly breakdowns.

What shops need are clear service schedules, parts that fit right the first time and supplier support when things go sideways. Older vehicles can bring surprises. Shops need jobbers who offer fast turnaround, accurate availability and guidance when a part number doesn’t match what’s on the car.

What jobbers can do is provide real-time inventory visibility, offer technician training on common mid-life repairs, and work with

"Educate customers on the value of better and best part categories, not just to increase margins, but to support long-term vehicle performance."

shops to build stocking strategies around their most frequent jobs. Educate customers on the value of better and best part categories, not just to increase margins, but to support long-term vehicle performance.

One of the biggest challenges in serving aging vehicles is parts proliferation. Multiple generations of models, mid-year changes, engine variants and fitment differences mean jobbers are under pressure to carry more SKUs than ever and to carry them smartly. Things can go wrong for jobbers when overstocking slow-moving

parts, stocking low-cost versions that get returned and chasing fill rates without a solid understanding of local demand. This all ties up cash flow and reduces flexibility.

Respond by using data to drive decisions, focus inventory on high-demand parts based on trends and VIN-level insights and leverage supplier programs with flexible returns, kits or consolidation to reduce error and improve efficiency.

As demand shifts, communicate early with suppliers about part gaps and explore remanufactured or alternative options to stay ahead.

With the cost of a new vehicle averaging more than $50,000, many consumers are willing to invest in the vehicle they already have. This opens the door to selling higher-quality parts, not just on brand, but on performance, warranty, and peace of mind.

Shops are seeing consumers asking for recommendations on how to “keep their car running another five years” or “get it through winter safely.” These conversations are ideal entry points to upsell better or best products, especially when paired with a simple explanation of long-term value.

Jobbers can support their partners by equipping counter staff and sales teams with product comparison tools. Provide short talking points and visuals that help shops explain the value of premium parts to their customers. When parts reduce comeback risk, protect warranties, and boost customer satisfaction, everyone wins.

To turn this trend into a long-term advantage, jobbers and shops should consider these next steps:

1. Know your local fleet: Use data to track which vehicles and mileage bands dominate in your region. Focus stocking and training around what’s coming through the bays.

2. Educate on mid-life maintenance: Provide content and guidance for shops to use with customers, from preventative maintenance checklists to “good, better, best” product guides.

3. Watch inventory mix: Avoid tying up capital in duplicate SKUs or lowest-cost options that create returns. Prioritize quality and availability.

4. Lean into premium: Help your customers see premium parts not as upsells, but as strategic investments in vehicle longevity.

5. Be proactive, not reactive: Identify what’s aging out of OE warranty or going out of OE production and get ahead of demand before the rush hits.

The aging vehicle fleet isn’t just a talking point but a powerful shift in how drivers think about their vehicles. For aftermarket businesses, it’s an open door to deepen customer relationships, improve profitability, and become an essential partner in a longer ownership journey.

But capitalizing on this trend takes more than just stocking more parts. It requires data-driven planning, smart inventory management, and a commitment to helping shops solve real problems. The road ahead is long and, for those ready to serve it well, full of opportunity.

Steck Manufacturing introduced the new Hold-a-Rotor Tool Kit (STC71000). The kit is designed to secure automotive and light truck disc brake rotors in place during repairs. The plugs are designed to fit the most common 12mm (green) and 14mm (red) wheel mounting studs. These tools help speed up technician repair times during brake pad, wheel bearing and other wheel and brake repairs that require the removal of the rotor. steckmanufacturing.com25_008053_Jobber_News_SEP_CN

Lumileds has added Philips NightGuide platinum halogen upgrade headlights as a direct replacement for standard headlight bulbs. These upgrade halogen headlights are DOT compliant and feature sharp beam cut-off — when properly aimed, they won’t blind oncoming drivers. The upgrades are available in 9003, 9004, 9005, 9005XS, 9006, 9006XS, 9007, 9008, 9012, H1, H7, H11, and H11B applications. www.lumileds.com

NTN Corporation announced new additions to its Low Friction Hub Bearing Series. Two new products with low friction characteristics, “Low Friction Hub Bearing IV” and “Low Friction Hub Bearing V” are now being included. They strive to make their mobility products more efficient. These latest offerings reduce rotational friction by up to 64 per cent when compared to conventional designs, contributing to the increase of fuel and electrical efficiency for a wide range of vehicles including electric vehicles (EVs) and hybrid electric vehicles (HEVs). www.ntnamericas.com

Rislone introduced its new Hy-per Lube High Mileage Treatment Engine Supplement (p/n 34200). It is designed to improve oil performance to eliminate dry starts, reduce friction and wear, prevent oil breakdown and extend engine life. The supplement is a premium additive blend formulated to work with all motor oils, including conventional, highmileage and synthetic, to make older, high-kilometre and highperformance engines run better and last longer than with oil alone. It’s also suitable for use in manual transmissions, differentials and axles. www.rislone.com

Mevotech is launching TTX Brakes, a premium lineup of purpose-designed brake pads for the commercial vehicle segment in 2025. It features five customized formulations, including firstto-market CeraPhite and SuperMet. Each design offers advanced friction technology to deliver a premier level of performance matched to vehicle usage. All TTX Brake pads come with a comprehensive

to facilitate installation. Boxes include caliper mounting hardware. www.mevotech.com

Dayco is expanding its timing chain kit line with 41 part numbers to cover another 49 million vehicles in operation. Three of the new part numbers are already available, and the remaining 38 are scheduled for early 2025. The kits includes: Timing and secondary chains that prevent stretch for the life of the kit; Cam and crank sprockets for noise-free performance; OE-quality, high-grade plastic guides, as well as VVT solenoids and cam phasers when the application calls for it; Packaging that features a QR code that links directly to detailed installation instructions. www.daycoaftermarket.com

Dayco has introduced the next generation of its AutoPartIQ inventory assessment tool with new features for a more productive customer experience. New features of AutoPartIQ include: A more user-friendly interface; Final reports that give customers the opportunity to customize the results with their own market VIO and L12 sales; New product introductions added in real-time; and the incorporation of jobber and WD net pricing. Once a customer’s data is entered, a computed report highlights quick movers and new stock opportunities, in turn, helping identify saleable, in-demand products in given markets which can be quickly added to inventory. www.daycoaftermarket.com

Bosch announced the XpressFIT PRO Wiper Blade, featuring a Uni-link adapter for quick and efficient installation. Designed for installers and commercial accounts, the wiper blade covers 95% of vehicles, eliminating the need for multiple adapters. It incorporates HydroDefense technology with a liquid graphite coating on the rubber's wiping edge, reducing noise and improving wiping quality. The packaging is sustainable, all-paper, plastic-free, easily recyclable, and quickly disassembled. A QR code on the packaging provides video links for installation instructions. www.boschautoparts.com

By attending Canada Night 2025, you can experience the following:

• Valuable networking with Canadian auto care professionals in Las Vegas

• Sponsorship opportunities that will maximize your visibility in front of Canada’s auto care sector

• and more!

Canada Night takes place on November 4, 2025, at HaSalon at The Venetian® Resort Las Vegas during the AAPEX and SEMA trade shows.

Buy a ticket today

NOT ALL BRAKES ARE CREATED EQUAL. TRUST YOUR EUROPEAN VEHICLE TO BRAKE PADS ENGINEERED AND MANUFACTURED IN EUROPE — THESE BRAKE PADS ARE UNIQUELY DESIGNED FOR AMERIBRAKES AND MOMENTUM USA, INC.

FEATURES & BENEFITS

• OE Form, Fit & Function for Optimum Performance

• R90 Certified – E-Marked

• Rigorous Testing – Every Pad Proven

• Full European Coverage – Audi, BMW, VW, Mercedes, Volvo & More

• Best in Class Formulations – Ceramic & Semi-Met materials

• Full caliper and abutment Hardware - (included where applicable)

• Electronic Wear Sensors - (included where applicable)

• Clear labels: Front/Rear Location + Interchange Info

• True European Pedigree – Co-branded with ICER, Manufactured in Spain

– Most other competitive programs are offshored in China, India, Mexico, etc.