Thiscasestudydemonstratesthatbyreplacingrisky bondsinaportfoliowithlong-termincomeattrue wholesalepricing,investorshaveamuchbetterchance ofbeatinginflation,recession,anduncertainoutcomes generatedbycommonlyused"cookie-cutter"asset allocationmodels.

Withtheeliminationofthevolatilityriskandmarket riskinherentwithbondinvestments,theoverall portfoliogrowthoftheWholesaleIncome Advantage™strategyexceededthetypical60% stocks,40%bondsassetallocationmodelinevery timeframeshowninthecasestudy.

AcomprehensiveMonteCarloanalysisover15years,20years,and25years eachproducedadramaticallyhigherendresultwiththelowerriskassetwhen comparedtothetypicalWallStreetassetallocationmodel.

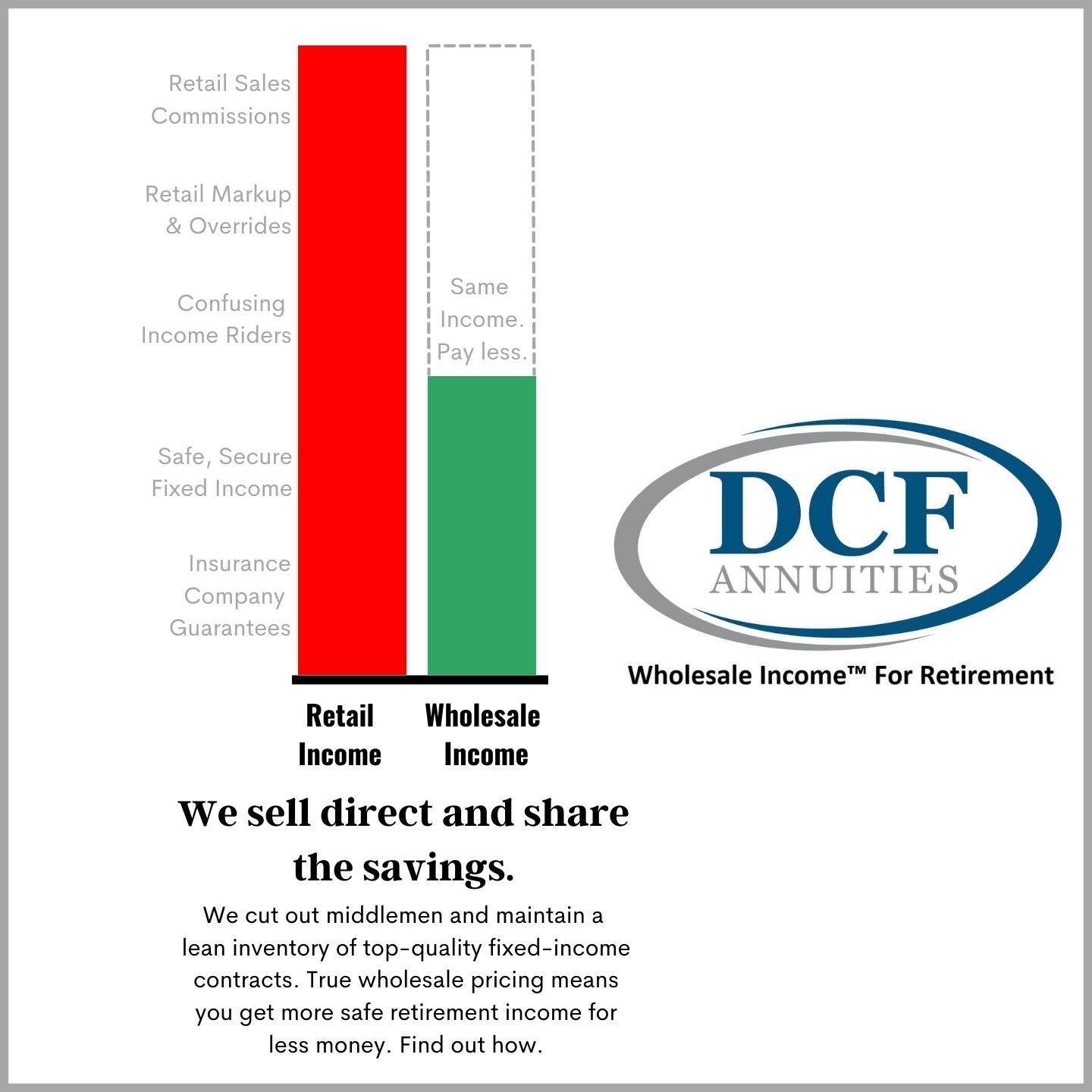

Thecasestudyhighlightstheoutcomefromanidenticalgrowthassetpaired witheithertypicalbondsforsafetyortheresultsusingretirementincomeattrue wholesalepricingforthesafepartoftheportfolio.