DECEMBER 2025

Austin closed out 2025 with 709 single-family home sales, a 61% increase from last December While sales volume ticked up, pricing showed the continued effects of the year ’ s buyer-friendly environment

The median sales price settled at $584,900 (-41% YoY), while the average sales price held relatively flat at $822,315 (-0 4% YoY)

Price per square foot averaged $339, down slightly from previous months

Inventory tightened significantly As of January 8th, there are 1,972 active listings, bringing months of supply down to 2 79 (318 in December) This is a sharp seasonal contraction from the 5+ months we saw in late summer, driven largely by sellers pulling homes off the market for the holidays rather than a massive surge in buyer demand

Buyers: The " on-paper " stats show tightening inventory, but don't let that fool you into panic The high frequency of price drops (54%) and a list-to-close ratio of 91 38% prove you still have significant negotiating power on homes that are lingering

Sellers: The crowd has thinned With fewer active listings competing for attention, serious buyers are looking at your home However, with prices softening year-over-year, pricing and preparation remains your leverage

A Year of Stabilization & Opportunity

If 2024 was the year of correction, 2025 was the year of stabilization. We spent much of the year discussing the " power shift" where inventory surged, and buyers regained the driver's seat. Looking back at the full 12 months, the data confirms a market finding its footing.

Total Sales: The city finished with 8,312 single-family sales, a 2.2% increase year-over-year. Demand didn't disappear; it just became more selective.

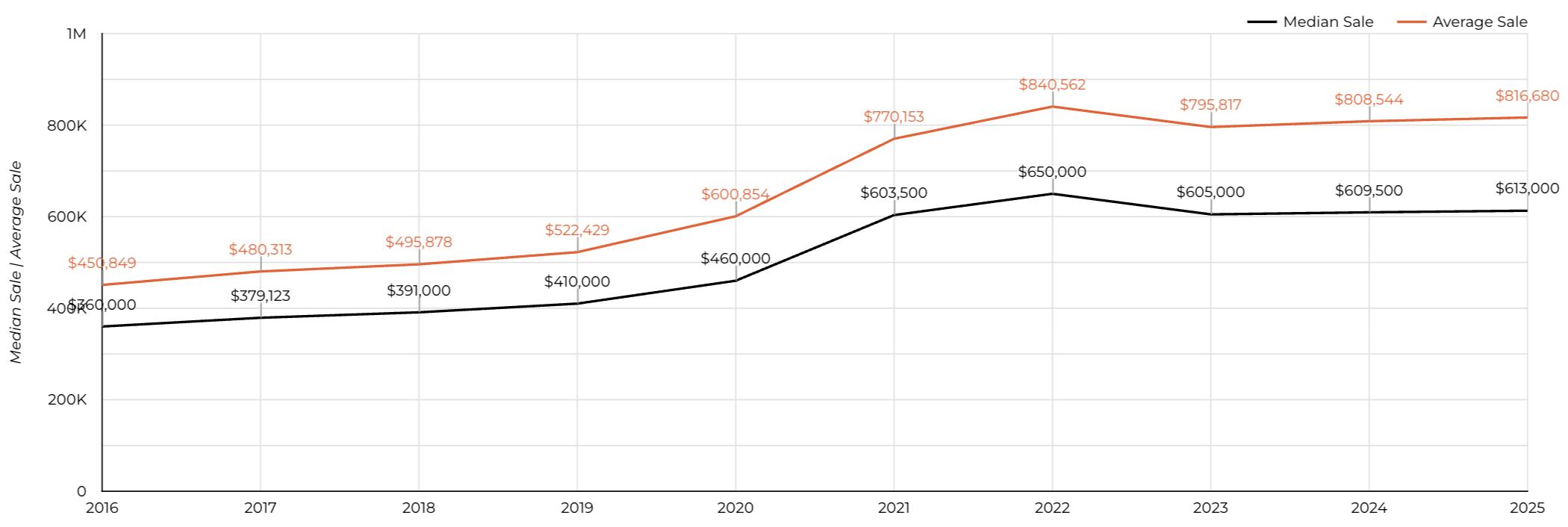

Pricing: The median sales price for the year landed at $613,000, a marginal 0.7% increase from 2024. This flatness signaled the end of the rapid appreciation era and the arrival of a more predictable, balanced market.

Total Volume: The City of Austin saw $6.79 billion in single-family home sales volume, up 3.2%, proving that despite high rates and national headlines, money is still moving in Austin real estate.

The Takeaway: The "crash" never came, but neither did the "boom." Austin settled into a new normal where success was defined by precision pricing right, prepping well, and negotiating hard.

3.18 Months: A Seasonal Squeeze Months of supply dropped to 3.18 in December, a stark contrast to the 5.1 months we saw in July.

Context is Key: This drop is largely seasonal. New listings plummeted by 10.1% at 383, as sellers waited for the new year, while pending sales ticked up 3.5% at 497. This created a temporary math problem that makes the market look tighter than it feels on the ground.

What it Means: We are technically in "Seller's Market" territory (< 6 months) purely by the numbers, but the buyer leverage remains due to the stale nature of older inventory.

The New Standard Price reductions remained a dominant theme through the end of the year 54% of active listings carried a price drop in December

Median time to first price drop: 21 days

Average price drop: 9%

Price Drop Outcomes: Listings that dropped their price went under contract after a median of 35 days

Insight: The gap between seller expectation and buyer reality is about 9% Sellers who bridge that gap upfront sell in weeks; those who don't can sit for months

Negotiation Has Re-Entered the Chat Homes closed at 91 38% of the list price in December

This is a strong signal that list prices are still lagging behind market value

Buyers: You are effectively negotiating an average of -8 6% off the asking price across the board Use this data to justify offers below the list price, especially on homes with high DOM Sellers: If you are pricing with "wiggle room, " you are likely pricing yourself out of consideration The data suggests buyers aren't just wiggling; they are demanding significant concessions

New Listings: 383 (-101% YoY) Sellers pulled back significantly for the holidays

New Under Contracts: 497 (+3 5% YoY) Demand outpaced supply in December, eating into the inventory backlog

Median Days on Market: 54 days (+2 days YoY).

Average Days on Market: 75 days.

The "New Spring" Market

As we roll into January 2026, the market is waking up.

Month-to-Date (Jan 1-8): We've already seen 139 New Listings hit the market, signaling the holiday freeze is thawing.

Pending Activity: 96 homes have gone under contract in the first week of the year alone.

Outlook: We expect inventory to climb rapidly in late January and February. The "window of opportunity" where buyers had low competition is closing as the spring market ramps up early.

The Spring Thaw

If rates remain stable, we anticipate a busy Q1 The seasonal tightening of inventory we saw in December will reverse as new sellers enter the market for the "Spring" rush, which in Austin often starts in February

Buyers: Be prepared for more competition on the best homes. The "stale" inventory will still be there for bargaining, but fresh, well-priced listings will move fast.

Sellers: The backlog of inventory is your biggest threat You must launch as the "shiny penny " perfect condition and sharp price to stand out against the noise of 2025's leftover listings

Austin has transitioned from a post-pandemic "reset" to a distinct phase of stability The crash never materialized; instead, the market cooled and found its footing

2023: The Reset After the 2022 peak ($650k), the market corrected sharply The median price dropped to $605,000, shedding previous overheating as buyer urgency cooled 2024: Finding the Floor Volatility faded Prices leveled out at $609,730 as the market absorbed higher interest rates and rising inventory

2025: Stabilization Confirmed The " new normal" is here Pricing remained flat at $613,000 (+0 5%), while sales volume ticked up 2 2% (8,312 sales) Demand is stable but highly price-sensitive

Compass RE is a licensed real estate broker All material is intended for informational purposes only and is compiled from sources deemed reliable but is subject to errors omissions changes in price condition sale or withdrawal without notice No statement is made as to the accuracy of any description or measurements (including square footage) This is not intended to solicit property already listed No financial or legal advice provided Equal Housing Opportunity Photos may be virtually staged or digitally enhanced and may not reflect actual property conditions

The Average DOM shows the number of days a property was on the market before it sold. An upward trend in DOM indicates a move toward a Buyer’s market.

The Sold Price vs. Original List Price reveals the percentage of the Original List Price properties sold for.

Real estate economists tell us a six-month supply of For Sale Inventory represents a balanced market between sellers and buyers

Over six months of For Sale inventory indicates a Buyer’s market. Less than six months of inventory indicates a Seller’s market.