check out the “Maximize the Tax Credit Opportunity” on for a quick review of the four credits available.

start with the article on PAGE 9.

to use the TAX CREDIT WORKSHEET as you are reviewing the list of organizations throughout the publication.

Check out the list of categories on PAGE 20 to help you find an organization that connects.

We recommend taking this publication and your worksheet when you meet with your tax adviser!

LOOKING FOR AN ONLINE VERSION OF THIS GUIDE?

Check out AZTaxCreditGuide.com and click on the digital version of this publication. All tax forms and tax credit listings include the organizations’ websites so that giving is just a click away.

At Frontdoors Media, we believe community is built not by chance, but by choice. It’s woven from thousands of acts of intention and generosity, and this guide is your invitation to become part of that tapestry.

Welcome to the 2025-2026 Arizona Tax Credit Giving Guide.

Our state’s visionary tax credit program puts you in the driver’s seat, allowing you to transform a tax liability into a community asset. It’s not a deduction; it’s a dollar-for-dollar credit that redirects your funds to accredited nonprofits and schools that are shaping the future of our communities. No deductions. No extra cost. Just pure impact.

And here’s the brilliant part: This isn’t a single choice, but a series of opportunities. Because the credits are separate, you can contribute across multiple categories and stack your impact. This means you can support a child in foster care, fund a classroom project and strengthen a local charity, all in the same tax year. For instance, a couple filing jointly can redirect up to $987 to a Qualified Charitable Organization — and that’s just one of several powerful credits you can claim.

Within these pages, you’ll find a curated directory of organizations, all vetted and approved by the Arizona Department of Revenue. Use this guide as your blueprint: Discover a cause that speaks to you, fill out the worksheet on the back cover, and partner with your tax adviser to put your state taxes to work — right here at home.

This isn’t just about feeling good. It’s about doing good, strategically.

Together, let’s build a more vibrant Arizona. The power is in your hands.

Karen

Karen Werner, Editor in Chief

Tax Credit Contributions Boost Arizona Nonprofits in Times of Need

Executive Council Charities (18)

The Scottsdale Charros (18)

A New Leaf (24), (34)

Ability360 (42)

ACCEL (48)

Advance Community (26)

ALS Arizona (28)

American Service Animal Society (52)

Area Agency on Aging, Region One (39)

Arizona Burn Foundation (29)

Arizona Cancer Foundation for Children (22)

Arizona Legal Women and Youth Services (ALWAYS) (38)

Aspiring Youth Academy (54)

Aster Aging (39)

Autism Society of Greater Phoenix (48)

Benevilla (40)

Big Brothers Big Sisters of Central Arizona (54)

Boys & Girls Clubs of Greater Scottsdale (55)

Boys & Girls Clubs of the Valley (55)

Central Arizona Shelter Services (CASS) (35)

Children’s Cancer Network (22)

Chrysalis (24)

Circle the City (29)

Cortney’s Place (49)

Delta Dental of Arizona Foundation (30)

Valley of the Sun United Way (19)

Diana Gregory Outreach Services (40)

Dress for Success Arizona (43)

Duet: Partners In Health & Aging (41)

Families Raising Hope (23)

Fishers of Men for Veterans (53)

Fresh Start Women’s Foundation (43)

Gesher Disability Resources (49)

Habitat for Humanity Central Arizona (35)

Helping Hands for Single Moms (26), (36)

HonorHealth Foundation (30)

Hope Ignites Phoenix (56)

House of Refuge (36)

Hushabye Nursery (31)

ICAN: Positive Programs for Youth (56)

Jewish Family & Children’s Service (31), (44)

Keys to Change (37)

Lions Camp Tatiyee (50)

Maggie’s Place (37), (44)

Make Way for Books (57)

MASD dba Arizona Disabled Sports (50)

Midwest Food Bank (27)

Military Assistance Mission (53)

National Kidney Foundation of Arizona (32)

National Kidney Foundation of Arizona –

Camp Kidney (57)

Neighbors Who Care (41)

New Life Center (25)

New Pathways for Youth (58)

NourishPHX (45)

one•n•ten (58)

One Step Beyond, Inc. (51)

Pawsitive Friendships (51)

Paz de Cristo Community Center (45)

Phoenix Children’s Foundation (32)

Phoenix Indian Center (46)

Power Paws Assistance Dogs (52)

Pregnancy Care Center of Chandler (27)

Ronald McDonald House Central and Northern Arizona (46)

Ryan House (33)

Save the Family Foundation of Arizona (38)

Society of St. Vincent de Paul (28), (47)

Sojourner Center (25)

Southwest Human Development (59)

The Neighborhood Christian Clinic (33)

The Singletons (23)

Valley of the Sun YMCA –Valley YMCA Cares (42), (59)

Valleywise Health Foundation (34)

WHEAT (47)

Aid to Adoption of Special Kids (AASK) (62)

Arizona Sunshine Angels (62)

Catholic Charities Community Services (63)

Center for the Rights of Abused Children (63)

Child Crisis Arizona (64)

BASIS Charter Schools (69)

Hope & A Future (64)

Onward Hope, Inc. (65)

RISE AZ Family Services (65)

The Foster Alliance (66)

Voices for CASA Children (66)

Phoenix Modern (69)

Academic Opportunity of Arizona (72)

Acton Academy Phoenix (72)

All Saints’ Episcopal Day School (73)

Brophy Community Foundation (73)

Catholic Education Arizona (74)

Jewish Tuition Organization (74)

New Way Academy (75)

By Tom Evans

Tax credit contributions continue to be a great way for Arizona residents to make a difference in their communities — and a critical part of funding the mission for many Arizona nonprofits during a challenging fundraising environment.

Arizona law allows taxpayers to give a donation to a qualified charity or tuition organization and get a dollar-for-dollar reduction on state income taxes. Over time, these contributions have become increasingly popular for residents and beneficial for nonprofits.

The State of Arizona allows these tax credits when donors give to qualified organizations in these categories:

• Arizona Qualifying Charitable Organizations, which provide basic needs to qualifying low-income families and individuals, the chronically ill and disabled. Limits are $495 for individuals and $987 for married couples for tax year 2025 and $506 for individuals and $1,009 for married couples for the 2026 tax year.

• Qualifying Foster Care Organizations, with limits of $618 for individuals and $1,234 for married couples for tax year 2025 and $632 for individuals and $1,262 for married couples for the 2026 tax year.

• Public School Tax Credit Organizations, with limits of $200 and $400.

• Private School Tuition Organizations, with limits of $769 for individuals and $1,535 for married couples for the 2025 tax year and $787 for individuals and $1,570 for married couples for the 2026 tax year.

• Certified School Tuition Organizations (also known as the “Switcher” Individual Tax Credit); these organizations may only receive your contribution if you’ve already maxed out the Private School Tuition Organization credit first — for which limits increased to $766 individually and $1,527 for married couples for 2025 and $784 for individuals and $1,561 for married couples for 2026.

• Private School Tuition Organizations for Corporations: C corporations, S corporations, LLCs and insurance companies can qualify for two types of credits. The first one is called the Corporate Contributions to School Tuition Organizations, which supports low-income students in private schools. The full name of the second credit is Corporate Contributions to School Tuition Organizations for Displaced Students or Students with Disabilities.

Contributions made between Jan. 1, 2026 and April 15, 2026 may be applied to either the previous tax year or the current one — a strategic opportunity for donors. (Just remember: you must choose one year or the other.)

Brenda Blunt, partner with Eide Bailly LLP, said that changes in federal law may also create new opportunities for those looking to maximize their charitable giving.

“The One Big, Beautiful Bill, signed into law on July 4, 2025, also created some tax planning opportunities by making some changes to the federal law limiting charitable contributions for higher-income taxpayers and expanding them for non-itemizers for the 2026 tax year,” Blunt said. “Before making an election to claim contributions made in 2026 on your 2025 Arizona return, you may want to factor in how this new law will impact you in 2026 to determine which year will yield the highest benefit.”

Ellen Lord, vice president of philanthropy for Maggie’s Place, said tax credit contributions are also a great way to ensure that donations stay local and support our community.

“It’s wonderful that Arizona residents have the opportunity to support nonprofits near and dear to

their heart, while benefiting from a credit against their state taxes,” she said. “Maggie’s Place is fortunate to be on the list of qualified tax credit organizations. Our mission is unique as we are one of a few nonprofits across the country who serve homeless, pregnant women. Donations from individuals help us provide essential resources for women and their babies, including safe shelter, emotional support and vital programs and services.”

For a complete list of qualifying charitable organizations and qualifying foster care organizations visit azdor.gov/tax-credits/ contributions-qcos-and-qfcos. Organizations are also added on an ongoing basis, so it may be worth your time to check back before year-end and again before April 15, 2026 — the last day 2025 tax credit contributions can be made.

Food access is a key issue holding children back from a successful future. At Valley of the Sun United Way, we will never stop supporting our community until this issue—and other key issues in education, housing & homelessness, health, and workforce development—are solved. See how you can help at vsuw.org.

Some charities under the Arizona Qualified Charity Tax Credit have a slightly different designation as “umbrella organizations.” They are eligible for contributions of $495 per person and $987 per couple as well, but are listed differently on the State of Arizona’s web site. For example, Executive Council Charities, Valley of the Sun United Way and other United Way organizations across the state are considered “umbrella organizations” because they may receive tax credit contributions and distribute them to other nonprofit partners in the community.

Use the Tax Credit Worksheet on the back cover to take notes and record the QCO code for the charities you choose. You can choose more than one!

Our mission is to support charity organizations focused on helping youth in our community overcome adversity and reach their full potential as productive, caring and responsible citizens.

Support Arizona Youth (SAY) is the annual campaign for Executive Council Charities (ECC), an umbrella organization for the Arizona charitable tax credit. Through SAY, donors can take advantage of the tax credit for both qualified and foster care charities, or indicate a preference for any specific qualified charity. Not only are 100 percent of the funds forwarded to benefit vital programs at these charities, but ECC also covers all credit card processing fees.

ec70phx.com

Tax Code 20726

The Charro Arizona Tax Credit program gives you the opportunity to contribute tax dollars to qualified nonprofits actively working to address the issues you care about — foster care support, youth sports, public education and more.

Since 1961, the Scottsdale Charros have been deeply embedded in the Scottsdale community, supporting youth, schools and charitable organizations. By donating to the Charro AZ Tax Credit Program, you’re contributing to a trusted group with deep connections in the community. We work closely with city leaders, schools, businesses and law enforcement to ensure your donation addresses the most urgent needs.

charros.com/give

Tax Code 20726

Valley of the Sun United Way is creating a better future for everyone in our community. A community where every child, family and individual is healthy, has a safe place to live and has every opportunity to succeed in school, in work and in life.

Your gift supports our community-wide efforts to create Mighty Change in Maricopa County through our MC2026 plan that tackles some of the Valley’s most urgent issues. This communitydeveloped and community-driven plan is supported by our donors and implemented alongside our more than 300 local MC2026 Coalition partners, including businesses, schools, nonprofits and other community organizations. Together, we will meet Bold Goals focused on closing education gaps, preventing homelessness and increasing access to healthcare and betterpaying jobs to create a more equitable and thriving community for everyone. Join us today!

vsuw.org

Tax Code 20726

Since 1993, Your Part-Time Controller, LLC (YPTC) has focused exclusively on helping nonprofits with their accounting, financial reporting, and financial management needs.

We help nonprofit organizations by providing ongoing and interim accounting and Controller/CFO solutions, as well as a variety of specialized services such as financial reporting and forecasting, bookkeeping, budgeting, data visualization, and more.

“YPTC is amazing. We’ve come miles away from where we were. We know we’re learning from the best experts out there for knowledge and support. They’re helping us to be fiscal stewards of our dollars. They’ve done so much to help us get our house in order. You don’t have to hire someone in-house when you have an amazing organization like this.”

-Melissa Steimer, Chief Executive Officer, Gabriel’s Angels

Per the Arizona Department of Revenue, a QCO provides immediate basic needs to residents of Arizona who receive temporary assistance for needy families (TANF) benefits, are low-income residents of Arizona, or are individuals who have a chronic illness or physical disability.

A QCO must meet ALL of the following provisions:

• Is exempt from federal income taxes under Section 501(c)(3), or is a designated community action agency that receives community services block grant program monies pursuant to 42 United States Code Section 9901.

• Provides services that meet immediate basic needs.

• Serves Arizona residents who receive temporary assistance for needy families (TANF) benefits, are low-income residents whose household income is less than 150 percent of the federal poverty level, or are chronically ill or physically disabled individuals.

• Spends at least 50 percent of its budget on qualified services to qualified Arizona residents.

• Affirms that it will continue spending at least 50 percent of its budget on qualified services to qualified Arizona residents.

The QCO organizations listed in the Arizona Tax Credit Giving Guide have chosen the following categories to best describe the programs they offer the community:

- CANCER SUPPORT [ PG. 22 ]

- DOMESTIC VIOLENCE [ PG. 24 ]

- FAMILY ASSISTANCE [ PG. 26 ]

- FOOD BANK [ PG. 27 ]

- HEALTHCARE [ PG. 29 ]

- HOUSING SUPPORT [ PG. 35 ]

- LEGAL SERVICES [ PG. 39 ]

- SENIOR SERVICES [ PG. 39 ]

- SOCIAL SERVICES [ PG. 42 ]

- SPECIAL NEEDS [ PG. 48 ]

- VETERAN SERVICES [ PG. 52 ]

- YOUTH DEVELOPMENT [ PG. 54 ]

Use the Tax Credit Worksheet on the back cover to take notes and record the QCO code for the charities you choose. You can choose more than one!

Where kids with cancer can be kids.

Arizona Cancer Foundation for Children provides social, emotional and financial support to families managing the health and well-being of a child diagnosed with childhood cancer. Our 12,000-square-foot Scottsdale facility offers a home away from home — with an art studio, play areas, teen lounge, Baxter’s Kitchen, stocked pantry and clothing market — spaces designed to comfort, nourish and inspire. Through counseling, K9 therapy, community events and financial assistance, families find hope, healing and connection. Your support ensures no child or family faces childhood cancer alone.

azcancerfoundation.org

Tax Code 20873

Children’s Cancer Network supports children and families affected by childhood cancer by providing financial assistance, emotional support and educational resources to improve quality of life during and after treatment.

Arizona Tax Credit contributions directly support Children’s Cancer Network programs that empower over 1,000 childhood cancer warriors and their families each year. These vital funds provide financial assistance through gas and food cards, access to our Food Pantry, counseling and emotional support programs. Contributions also support seasonal initiatives like Adopt-a-Family for the holidays and Back-to-School events. Every donation helps promote education, encourage healthy lifestyles and raise awareness of the childhood cancer journey. Your tax credit gift ensures families receive meaningful support at every stage, offering hope and resources when they need it most. Thank you for making a lasting impact.

childrenscancernetwork.org

Tax Code 20176

A volunteer-run nonprofit, Families Raising Hope provides critical financial relief to individuals in Arizona undergoing cancer treatment, helping them afford everyday necessities during their fight.

Each year, Families Raising Hope uses Arizona Tax Credit contributions to fuel our Cancer Patient Financial Assistance Program. These funds are distributed as one-time grants that help individuals and families in Arizona who are undergoing cancer treatment. The grants cover critical, everyday living costs — such as rent or mortgage, utilities, groceries and transportation to treatments. Thanks to these contributions, patients can focus on healing instead of financial stress, reducing the risk of treatment disruption. By supporting this program, donors directly empower hope, helping families maintain stability and dignity during their cancer journey.

familiesraisinghope.org

Tax Code 22575

The Singletons exists to provide consistent support and hope to single-parent families battling cancer.

Arizona Tax Credit contributions directly support The Singletons’ programs for single-parent families battling cancer. Because cancer affects the entire family, these funds fuel The Singletons Kitchen meal kits, Bare Necessities household supplies, Birthday Bash celebrations for children, and Wellness Beyond Cancer workshops. The Singletons have been serving the Valley for almost 20 years and counting, and with our recent expansion in Tucson, we are reaching even more families. Together, these services provide nourishment, stability and moments of joy, allowing families to focus on healing and togetherness.

TheSingletonsAZ.org

Tax Code 21020

A New Leaf provides lifesaving shelter and support to families experiencing homelessness, domestic violence and other crisis situations. Our mission is “helping families, changing lives.”

Right now, there is a survivor of abuse desperately seeking freedom and safety. Your generous tax credit donation will directly provide safe shelter, legal support and trauma counseling to survivors of domestic violence in your local community. All contributions will be used to serve survivors at A New Leaf’s lifesaving domestic violence shelters across the Valley. By making a tax credit donation, you will be providing lifesaving support to families fleeing abuse.

Thank you for your kindness!

TurnaNewLeaf.org

Tax Code 20075

At Chrysalis, our fundamental belief is simple: No abuse is OK. We help individuals and families break free from violent, fearful relationships and discover new confidence, resilience and lasting hope.

Choose Safety. Choose Healing. Choose Chrysalis. Right now, a survivor is making the hardest decision of their life — to leave. Your Arizona tax credit ensures they won’t face it alone. For 40 years, Chrysalis has provided comprehensive care that transforms lives: emergency shelter, trauma therapy, legal advocacy and transitional housing. We’re a fierce organization of advocates offering a complete 360-degree approach — serving survivors, children and offenders to break cycles of abuse at the root.

Your $495 tax credit costs you nothing but means everything to a family escaping violence today. Give now. Save a life.

noabuse.org

Tax Code 20076

New Life Center is a statewide leader in shelter support — rooted in our mission to build safe, stable communities by preventing and responding to domestic violence, sexual violence and trafficking.

New Life Center proudly serves as one of Arizona’s largest emergency shelters for survivors of violence and human trafficking. With your support, New Life Center can welcome women, men and families that were quite literally forced to run for their lives, often arriving with nothing more than the clothes they were wearing when they escaped. Your generosity allows us to offer immediate safety, critical resources and care to approximately 350 adult and child survivors escaping from various forms of violence each year. Together, we are creating stable communities where all have a safe place to call home.

newlifectr.org

Tax Code 20559

Overcoming the impact of domestic violence, sexual violence and human trafficking, one life at a time.

When you support Sojourner Center, you’re standing beside survivors every step of the way. Your tax credit contributions help power our essential programs like Emergency Shelter, Transitional Housing and Community Outreach. Your support also makes possible trauma-informed childcare, pet companion services and lay legal assistance, providing access to the everyday needs that empower survivors to find safety, healing and a fresh start. Best of all, your contribution supports our mission while reducing your Arizona state tax burden. That’s a win-win for you and our community! Join us in building a future free from violence, one life at a time.

sojournercenter.org

Tax Code 20544

Advance Community empowers under-resourced communities by removing barriers and providing nutritious food, education and medical care to improve health, foster equity, strengthen resilience and create lasting impact.

Arizona Tax Credit contributions support Advance Community’s domestic health and wellness programs, which provide vital resources to under-resourced communities throughout Phoenix. These contributions help fund initiatives like Stove to Table, which provides nutritious meals to low-income seniors, and nutrition boxes, which give families access to healthy foods. They also support education and outreach programs for children, teens, adults and seniors, such as oral health workshops, chronic disease prevention classes and resource navigation, connecting individuals to local services and support networks. By funding these efforts, Arizona Tax Credit contributions help Advance remove barriers, promote health equity and build stronger, healthier communities.

advancecommunity.org

Tax Code 22188

Helping Hands for Single Moms helps low-income single-mom families achieve financial independence through higher education.

In 2026, 36 more single moms in our Scholarship-Plus Program will graduate and attain livable wage jobs, while 88 others move closer to that goal. We’ll provide over $1 million in financial assistance and supportive services, combined, to our hard-working single moms who make great sacrifices for their children.

More than a transaction, your support is a transformation to a brighter future, empowering single-mother families to overcome generational poverty through education and a helping hand.

If you are (or know) a single-mom college student who could benefit from our scholarship program, please share: helpinghandsforsinglemoms.org/apply helpinghandsforsinglemoms.org

Tax Code 20193

Pregnancy Care Center supports women and men facing unplanned pregnancies with free services like pregnancy tests, ultrasounds, prenatal and parenting classes, and more — empowering them to choose life and hope.

Since 2007, Pregnancy Care Center of Chandler has supported women and men facing unplanned pregnancies with love, compassion and tangible resources. Your generous support funds 100% free, life-affirming services, including pregnancy tests, ultrasounds, parenting and prenatal education, fatherhood mentorship, post-abortion healing and essential baby items like diapers and clothing. These critical programs empower clients to choose life and confidently prepare for parenthood. Now, with the addition of our new ICU Mobile Unit, we can bring these vital services directly to underserved and far-reaching communities — ensuring that no woman has to face an unplanned pregnancy alone.

pccChandler.com

Tax Code 20562

It is the mission of Midwest Food Bank to share the love of Christ by alleviating hunger and malnutrition and providing disaster relief.

The Arizona Division of Midwest Food Bank distributes over $60 million in food and supplies annually. Midwest Food Bank provides weekend backpack meals to students, snack packs for homeless individuals and protein-rich meals for disaster relief. Every dollar contribution yields $30 worth of food and supplies for those facing food insecurity. And over 99 cents of every dollar you donate will go directly toward providing food to people in need.

arizona.midwestfoodbank.org

Tax Code 20927

St. Vincent de Paul harnesses the power of our community to feed, clothe, house and heal all who are in need — whether in body or in spirit.

We believe in the intrinsic value of every person — to serve and be served. Our dining rooms and food boxes are more than just meals. Families gain access to supportive programs and referrals to community resources. When people are at their lowest point and have lost their housing, St. Vincent de Paul is there to offer not only a bed, but a path to find home again. With your support, St. Vincent de Paul is helping seniors, families and children in need in our community with food, housing, affordable healthcare and much more.

stvincentdepaul.net

Tax Code 20540

We work to unite the ALS community in our collaborative approach to foster bold research initiatives, advance national and state advocacy efforts, and provide comprehensive care and support to individuals and families affected by ALS.

ALS Arizona symbolizes the hopes of people everywhere that Amyotrophic Lateral Sclerosis will one day be a disease of the past, conquered by the dedication of thousands who have worked ceaselessly to understand and eradicate it. Until that day comes, ALS Arizona relentlessly pursues its mission to help people living with ALS and to leave no stone unturned in the search for a cure for this progressive neurodegenerative disease. ALS is relentless, but so are WE!

alsaz.org

Tax Code 20693

Founded in 1967, the Arizona Burn Foundation improves the quality of life for burn survivors and their families in Arizona while promoting burn prevention through advocacy and education.

ABF guides burn survivors and their families from crisis through lifelong healing. ABF’s continuum of care includes support during hospitalization, recovery after discharge, and thrive programs like tailored camps, retreats, school re-entry programs and scholarship opportunities. ABF also offers direct emotional and peer support, and financial assistance, including lodging, transportation, meal vouchers, medical garments, equipment and therapy to burn survivors and their families. In partnership with local organizations, ABF also delivers burn prevention education to children through Milo & Moxie™ programs and installs free smoke alarms in vulnerable communities, including those with deaf and hard-ofhearing residents.

azburn.org

Tax Code 20667

We started with a simple but urgent idea: to deliver healthcare solutions that compassionately address the needs of all individuals facing homelessness in Maricopa County.

Circle the City is a 501c3 nonprofit and the only Federally Qualified Healthcare Center in Arizona exclusively serving individuals facing homelessness. We operate two medical respite centers, two outpatient healthcare clinics, five mobile medical units and five street medicine teams.

Our Medical Respite Centers allow patients a safe place to heal and recover from an illness. Seventy-seven percent who complete their plan of care are discharged to somewhere other than the street or a shelter.

circlethecity.org

Tax Code 20693

Delta Dental of Arizona Foundation creates a path to better health and wellness for Arizonans by helping to improve the oral health and food security of underserved Arizonans.

Delta Dental of Arizona Foundation funds nonprofits and programs in Arizona that improve access to preventive and restorative dental care, oral health education, nutritional education and food for underserved populations throughout the state. Grants are awarded to community dental clinics that provide free or sliding scale fees to underserved populations, including St. Vincent de Paul, Valleywise Health, NOAH, and El Rio Health. Educational nutrition or dental programs funded include Advance Community, Children’s Museum of Phoenix, Greater Arizona Puppet Theater, plus Foothills, Desert Mission and St. Mary’s food banks. One hundred percent of tax credit donations are used to fund these programs.

deltadentalaz.com/foundation

Tax Code 20261

Tax Code 20516 HEALTHCARE

For more than 95 years, HonorHealth Desert Mission has made Arizona stronger through a heartfelt tapestry of care — nourishing bodies, nurturing minds and knitting together families for a healthier Phoenix community.

With the support of a generous community, Desert Mission provides three essential programs to serve our most vulnerable neighbors: Desert Mission Food Bank — Families receive free or low-cost nutritious food based on their needs, along with nutrition education and access to resource and referral services. Lincoln Learning Center — This accredited early childhood education center lays a strong foundation for kindergarten and lifelong learning. Adult Day Healthcare — Older adults, many living with dementia, benefit from a safe, supervised environment that offers enriching activities and compassionate care.

HonorHealthFoundation.org

We embrace substance-exposed babies and their caregivers with compassionate, evidence-based care that changes the course of their entire lives.

Arizona Tax Credit contributions to Hushabye Nursery directly support the care of infants born withdrawing from opioids. These vulnerable babies receive compassionate, 24/7 medical care in a calm, nurturing environment designed specifically for healing. Alongside this, parents and caregivers are surrounded with peer mentorship, therapeutic support and personalized case management — including treatment coordination, legal advocacy, basic needs assistance and reunification planning. This holistic model not only helps babies recover more quickly but also empowers families to stay together and thrive. Every contribution makes a lasting impact on Arizona families, creating brighter futures filled with hope and stability.

hushabyenursery.org

Tax Code 22019

As one of Maricopa County’s largest integrated healthcare providers, Jewish Family & Children’s Service delivers whole-person care that addresses both mental and physical health needs.

Three of our healthcare centers offer comprehensive behavioral health and primary care services for individuals of all ages, faiths and backgrounds. Behavioral healthcare services, available at all our centers, include psychiatric care, medication management, substance abuse counseling and individual and group therapy. Our primary care services include treatment for colds and flu, acute pain and injuries, high blood pressure management and annual wellness exams.

jfcsaz.org

Tax Code 20255

Our mission is to provide awareness, assistance and hope to Arizonans at-risk and impacted by kidney disease.

Since 1963, NKF AZ has been the agency of last resort for thousands of friends, neighbors and families. The heart of the foundation is its direct emergency aid services. These include rides to dialysis, help with critical medication, dental work and more. Path to Wellness, the foundation’s free community health screening, helps identify kidney disease early. The Erma Bombeck Donor Awareness Project educates people on the importance of kidney donation, and Camp Kidney provides a free weekend of medically supervised magic for kids with kidney disease. NKF AZ proudly celebrated 60 years of serving the Arizona Kidney Community in 2023.

Tax Code 20663

Phoenix Children’s Foundation supports Phoenix Children’s mission to advance, hope, healing and world-class healthcare for children and their families in Arizona and beyond.

Every day, Phoenix Children’s opens its doors to children facing life’s toughest moments — serving nearly 200,000 patients a year, regardless of their family’s ability to pay. As Arizona’s only Level 1 Pediatric Trauma Center, we provide hope and healing when they’re needed most. It costs $2.7 million a day to operate, and more than half of our families have little or no private insurance, yet no child is turned away. One in four Arizona children has received our care. Your gift helps save lives, restore health and ensure every child has the chance to grow up healthy, strong and full of hope.

Tax Code 20551

Ryan House enriches the quality of life and creates cherished memories for children and their families, providing a muchneeded break from 24/7 caregiving as they navigate lifelimiting or end-of-life journeys.

The Support-A-Stay Program at Ryan House provides 24-hour respite stays for children with life-limiting and terminal conditions. Respite is a gift of time; short-term overnight stays that help a family take breaks from the stress of 24/7 home care. Through the Support-A-Stay Program, we provide professional nursing care, expert Child-Life care, life-enhancing therapeutic/expressive activities and experiences, food and nourishment along with anticipatory grief, legacy work and bereavement support in our 12,500-square-foot, home-like medical facility. ryanhouse.org

Tax Code 20088

Providing medical, dental and behavioral healthcare to uninsured and underserved patients in Phoenix — improving health, offering compassion and treating every patient with dignity and respect.

Your Arizona Tax Credit gift helps uninsured and underserved patients in Phoenix receive low-cost medical, dental and behavioral healthcare at The Neighborhood Christian Clinic. Because of you, more than 10,000 patient visits each year provide whole-person care — meeting physical, emotional and spiritual needs in a welcoming, respectful environment. Your generosity also equips the next generation of healthcare professionals to serve vulnerable populations with skill, compassion and integrity. Every dollar you give directly improves health, restores dignity and offers hope for today and encouragement for the future — while qualifying for the Arizona Charitable Tax Credit.

thechristianclinic.org

Tax Code 20278

Valleywise Health Foundation is the Arizona-based nonprofit dedicated to providing financial support for critical patient and program needs at Arizona’s only public teaching health system, Valleywise Health.

At Valleywise Health, over 65 percent of our patients are financially vulnerable. By making a tax credit donation to Valleywise Health Foundation, you’re playing a vital role in transforming the health and well-being of our community. Your generous support enables Valleywise Health to fulfill its mission to provide exceptional care, without exception, every patient, every time — regardless of ability to pay. Your contribution directly funds essential programs, innovative research, educational resources and critical patient services like burn survivorship care, evidence-based behavioral health programs and the training of tomorrow’s healthcare professionals. Join us in creating healthier communities across the Valley.

valleywisehealthfoundation.org

Tax Code 20047

A New Leaf provides lifesaving shelter and support to families experiencing homelessness, domestic violence and other crisis situations. Our mission is “helping families, changing lives.”

You have the power to give hope and dignity back to a family in crisis. Make a generous tax credit donation today, and you will provide food, immediate shelter and long-term support to a family experiencing homelessness in your local community. All contributions will be used to serve families in need at A New Leaf’s lifesaving homeless shelters located across the Valley. By making a tax credit donation, you will be helping a family overcome homelessness and find stability. Thank you for your kindness!

TurnaNewLeaf.org

Tax Code 20075

Envisioning a community where everyone has a home. Every night, hundreds of Arizonans facing homelessness need just one thing: a roof over their heads. Since 1984, CASS has been Arizona’s largest provider of low-barrier emergency shelter for single adults. Your tax credit gifts make a difference by supporting our neighbors at one of our three emergency shelters: CASS shelter for adults on the Key Campus; The Haven senior shelter for adults 55 and older; and Vista Colina, our apartment-style family shelter. Together, our shelters house more than 850 people each night, 365 days a year. Give today to support nightly shelter, case management and housing support for Arizona’s most vulnerable neighbors.

cassaz.org

Tax Code 20328

Habitat brings people together to build homes, communities and hope. Together, we empower Arizona families to build brighter futures and stronger communities.

Unlock a brighter future for Arizona families with Habitat for Humanity Central Arizona. By leveraging your tax credit contributions, we’re able to build and improve safe, decent and affordable homes throughout Maricopa County. Since 1985, with the help of generous donors and volunteers, we’ve been transforming communities and changing lives. Your contribution directly supports our mission to unite people in building homes, communities and hope. Plus, benefit from a tax credit while making a meaningful difference. Support Habitat, and together we can build lasting change for families in need of affordable housing.

habitatcaz.org

Tax Code 20434

HOUSING SUPPORT

HOUSING SUPPORT

We assist low-income single mom families while the mother attains a postsecondary degree, financial independence and a positive family legacy. Your gift empowers single moms to overcome generational poverty.

Helping Hands for Single Moms empowers low-income singlemom families to achieve financial self-sufficiency through postsecondary education. In 2026, 36 single moms will graduate and attain a livable wage job, while 88 others move one step closer to that goal. Next year, we will provide over $1 million in financial assistance and supportive services to families. Donations help hardworking single moms who are making great sacrifices for their children. Your support makes a lasting difference! If you are (or know of) a single-mom college student who could benefit from our scholarship, please share this application link: helpinghandsforsinglemoms.org/apply

helpinghandsforsinglemoms.org

Tax Code 20193

House of Refuge provides transitional housing and comprehensive wraparound support to Arizona families experiencing homelessness, empowering them to rebuild their lives and achieve lasting self-sufficiency.

Arizona Tax Credit contributions directly support House of Refuge’s comprehensive program for families experiencing homelessness — providing safe, stable housing, personalized case management and pathways to employment and education. These funds cover essential needs that promote long-term stability, including home goods, food, clothing, youth and teen programming, and life skills training such as financial literacy. Every dollar helps families transition from crisis to independence within a supportive community, equipping them with the tools and confidence to build a brighter, self-sufficient future.

houseofrefuge.org/az-tax-credits

Tax Code 20170

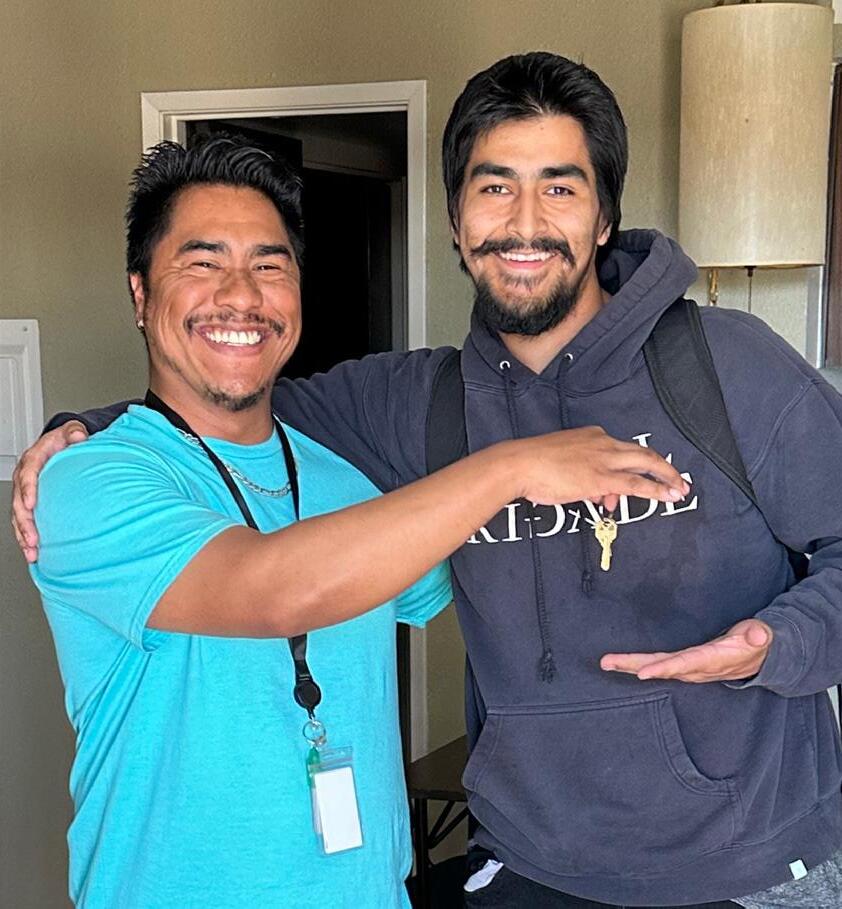

Keys to Change is using the power of collaboration to create solutions to end homelessness throughout Maricopa County. Together, we’re unlocking the way home.

Your support for Keys to Change connects your unhoused neighbors with the care and navigation they need to rebuild their lives. Your tax credit gifts benefit Key Campus — a 13-acre homeless solutions hub in downtown Phoenix — home to a dozen partner agencies. The Keys to Change Mail Room provides a physical address for anyone without one — necessary for employment applications and more. Key Campus services include 700 shelter beds, street outreach, medical respite, daily meal service, ID replacements, Social Security navigation and mental health care. With your support and collaboration, we’re on a mission to end homelessness.

keystochangeaz.org

Tax Code 20970

Since we opened our doors in 2000, Maggie’s Place has provided over 1,200 homeless, pregnant and parenting women and 700 babies with a safe and nurturing environment.

Today, we manage and operate five residential homes throughout Maricopa County that serve over 100 women each year. Your tax-deductible contribution directly supports our shelter operations, which provide a safe and nurturing environment, access to resources, supplies and ongoing support, helping women break the cycle of generational trauma so they can build a meaningful, independent life for themselves and their families.

maggiesplace.org

Tax Code 20492

Equipping families to address poverty, overcome homelessness and achieve self-sufficiency.

Arizona Tax Credit contributions help Save the Family Foundation of Arizona take a compassionate, holistic approach to ending family homelessness. We don’t just provide safe housing — we walk alongside families, addressing their financial independence, mental health and children’s well-being. Through personalized case management and wraparound services, we empower families with the tools and support they need to break free from the cycle of poverty. These contributions make it possible for families to rebuild their lives, find stability and create a brighter, more secure future together.

savethefamily.org

Tax Code 20320

Arizona Legal Women and Youth Services is a nonprofit legal and social services provider that represents and supports sex and labor trafficking survivors of all ages, as well as young people under 25 impacted by crime, homelessness or foster care.

Through legal representation and other strategies, the organization’s team of lawyers, social workers and other advocates ensure clients have what they need to achieve safety and stability, despite what has happened to them. ALWAYS focuses on family law, immigration applications and criminal history repair, making it possible for clients to receive the holistic services they need to move forward with their lives — for themselves and their loved ones.

alwaysaz.org

Tax Code 20888

Partnering with our community and enriching the quality of life for older adults, caregivers and underserved populations, Area Agency on Aging has been a leader in aging services for 51 years.

The Area Agency on Aging is a private nonprofit organization that plans, develops, funds, administers and coordinates programs and services in Maricopa County for adults, 60 years and older, family caregivers of older adults, adults ages 1859 with physical disabilities and long-term care needs, and people 18 and older who are living with HIV. Serving over 110,000 individuals annually, the Agency has developed over 58 innovative programs in response to unmet community needs. These programs have expanded the populations served to include elder refugees, persons with behavioral health conditions, and victims of late-life domestic violence, elder abuse and sexual assault.

aaaphx.org

Tax Code 20044

Aster Aging, serving the East Valley since 1979, is a nonprofit providing services that help older adults navigate the journey of aging with dignity, independence and community connection.

Arizona Tax Credit contributions directly support Aster’s core programs, which help thousands of seniors in the East Valley live independently, maintain their health and stay socially connected. These funds make possible our Meals on Wheels program, providing nutritious daily meals to homebound older adults; vibrant Senior Centers that offer activities, classes and community meals; Social Services that connect seniors with vital resources; and In-Home Support that assists with daily living tasks for vulnerable individuals. Your donation ensures these essential services remain accessible, improving quality of life and fostering dignity for older adults in our community.

asteraz.org

Tax Code 20426

Benevilla enriches lives by serving older adults, adults with disabilities, children and the families that care for them by promoting health and independence.

Benevilla provides supportive services to community neighbors while recognizing that caring for the needs of older adults reaches beyond the individual to the entire family. Our services include Life Enrichment Adult Day centers with specialized programming for those unable to care for themselves (memory loss, Parkinson’s, stroke survivors) while providing much needed respite for family caregivers, free home services allowing homebound older adults to remain independent in their own homes (assisted transportation, grocery shopping, friendly visitors and more), caregiver support groups and resources, preschool and childcare, and Benefitness Adaptive Gym. With your support, we serve more than 4,000 individuals annually.

benevilla.org

Tax Code 20493

Diana Gregory Outreach Services enriches lives through healthy eating and focuses on increasing access to fresh produce, nutrition education and caring social interactions among seniors and veterans.

Diana Gregory Outreach Services has been serving the disadvantaged, high-poverty community in Maricopa County since 2009. Our organization focuses on alleviating food insecurity and strengthening health and racial equity by providing access to nutritious food and education with a delivery model to reach the target population. The following programs benefit from tax credit donations: Senior Delivery program, Grandparents Raising Grandchildren, Senior Health & Nutrition Workshops, Senior Fitness Education, Veggies for Veterans and Sustainability Matters (GFM Farm).

dianagregory.com

Tax Code 21050

Since 1981, Duet has been promoting health and wellbeing through vitally needed free-of-charge services to homebound adults, family caregivers and grandparents raising grandchildren.

Your Arizona Tax Credit gift to Duet brings compassion, dignity and hope to older adults who might otherwise feel forgotten. You help homebound neighbors stay independent, access healthy food and medical care, and feel less alone through dedicated volunteers. You nurture family caregiver well-being with personalized support and meaningful connection throughout their journey. You uplift grandparents raising grandchildren through enriching outings, bilingual guidance and vital respite. Your generosity does more than help someone get by; it helps them feel seen, valued and deeply cared for. Give purpose. Give connection. Give hope with Duet.

duetaz.org

Tax Code 20552

Neighbors Who Care’s committed volunteers enable seniors to live fulfilling lives in their homes for as long as possible, ensuring that they remain active and independent members of the community.

Arizona’s tax credit helps Neighbors Who Care recruit for and manage compassionate volunteer services to help seniors maintain their independence through the dedicated support of our volunteers.

We provide care and support for:

+ Seniors who are homebound, whether permanently or for a short term

+ Seniors who are physically limited, frail or lonely

+ Seniors recovering from surgery or hospitalization

+ Caregivers in need of relief

Our goal is to help homebound seniors in our community remain in their own homes. We provide the support they need to maintain their independence and quality of life for as long as possible.

neighborswhocare.com

Tax Code 22246

The YMCA strengthens communities by empowering seniors of all backgrounds through programs and services that promote healthy and independent living.

Your support funds vital senior services, including outreach programs, wellness initiatives, diabetes care and chronic illness management, transportation to medical appointments and grocery stores, fall prevention classes and social activities. These funds help seniors maintain their health, independence and connection to the community, ensuring they receive the care and resources needed to thrive. Thanks to your generosity, we can make a meaningful difference in the quality of life of older adults facing physical, social and economic challenges.

valleyymcacares.org

Tax Code 20708

Ability360 offers and promotes programs designed to empower people with disabilities so that they may achieve or continue independent lifestyles within the community.

Over 40 years ago, Ability360 began offering services to people with disabilities and has become the largest Center for Independent Living in Arizona. With a focus on empowering individuals with disabilities to achieve independent lifestyles, we offer five core services: information and referral, independent living skills training, peer support, advocacy, assistance with transitioning to community living and support for youth. In addition, we offer home care services, home modifications, employment services, sports and fitness programs and much more. Your tax credit donation ensures we can continue to support the disability community throughout Arizona, regardless of their financial abilities.

Ability360.org

Tax Code 20090

Dress for Success Arizona empowers women to achieve economic independence through support, professional attire and career development tools to help them thrive at work and in life.

Arizona Tax Credit contributions support a wide range of Dress for Success Arizona programs that empower women to achieve economic independence. These include the Career Center, Mobile Career Center, Fast Track to Success, Styling Services, and the Professional Women’s Group. Contributions also help fund programs like EducateHER, The Reset, Tailor Made for Success, Bank On Arizona, and HOPE for Success. Each initiative provides critical services such as job readiness training, professional attire, financial education and post-release support. Tax credit donations directly impact women and families across Arizona by helping them secure employment, build confidence and create lasting stability.

dfsphoenix.org

Tax Code 20168

A pillar in the Valley for over 30 years, Fresh Start transforms lives by providing access and resources that help women achieve self-sufficiency and use their strength to thrive.

Fresh Start’s vision is to create unlimited opportunities for all women. To empower women to achieve self-sufficiency, our organization’s strategic approach encompasses five key areas of service: Family Stability, Health and Well-Being, Financial Management, Education and Training, and Careers. These pillars of support are the foundation for the Impact Program, a comprehensive pathway to economic independence and personal empowerment. Through access to our workforce training resources, family law support, in-person and virtual workshops, and other services, thousands of Arizona women aged 18 and older have transformed their lives, their children’s lives, and our community for generations to come.

freshstartwomen.org

Tax Code 20525

Jewish Family & Children’s Service is dedicated to strengthening the community by providing behavioral health, healthcare and social services to all ages, faiths and backgrounds.

JFCS empowers individuals and families across Maricopa County through a comprehensive range of social services designed to meet diverse needs. From child welfare and support for youth aging out of foster care to domestic violence intervention, job training, GED preparation and access to food and basic necessities, JFCS walks alongside people during life’s most difficult transitions. We also provide specialized services for older adults, helping them remain safe, independent and connected. Rooted in compassion, our programs uplift people of all faiths, ages and backgrounds with dignity and respect.

jfcsaz.org

Tax Code 20255

Since we opened our doors in 2000, Maggie’s Place has provided over 1,200 homeless, pregnant and parenting women and 700 babies with a safe and nurturing environment.

Today, we manage and operate five residential homes throughout Maricopa County that serve over 100 women each year. Your taxdeductible contribution directly supports our shelter operations, which provide a safe and nurturing environment, access to resources, supplies and ongoing support, helping women break the cycle of generational trauma so they can build a meaningful, independent life for themselves and their families.

maggiesplace.org

Tax Code 20492

NourishPHX is the trusted community hub serving vulnerable individuals and families by offering resources to satisfy immediate needs and provide pathways to self-sufficiency.

Your tax credit to NourishPHX will help more than 8,500 families with food assistance & basic needs, help with SNAP (food stamps) and AHCCCS (healthcare) applications, as well as job assistance to provide a pathway out of poverty. In addition, we partner with more than 40 other nonprofits to provide services at our facility, including free classes/workshops from financial education to jewelry-making. Volunteers are welcome.

nourishphx.org

Tax Code 20385

Paz de Cristo Community Center is more than a meal; we feed, clothe and empower our neighbors in need.

For over 35 years, Paz de Cristo Community Center in Mesa has provided vital services to individuals and families facing homelessness, hunger and poverty. Your Arizona Tax Credit donation directly funds nightly meals, food boxes, showers, clothing and essential ID and birth certificate assistance. Every contribution brings hope and immediate relief to those who need it most. Your support makes a lasting impact and supports our community’s more vulnerable members.

pazdecristo.org

Tax Code 20275

As the oldest American Indian Center, we serve as the hub for the advancement of our urban American Indian relatives with culturally relevant essential services, programs and initiatives.

Since 1947, the Phoenix Indian Center has been a center of community engagement. Continuing with this tradition, we provide opportunities to connect with and support the children, youth and families who live and work in our busy metropolitan area. In 2025, our Center provided direct assistance to over 9,500 individuals, with our outreach efforts touching the lives of more than 35,000 urban American Indian people. Your financial support demonstrates your commitment to making a tangible difference in the lives of those we serve. We envision a healthy and thriving urban American Indian community.

phxindcenter.org

Tax Code 20394

She weighed just over a pound when she was born. Her parents called her their little fighter.

At Cambridge House, they stayed close — pumping milk, folding tiny clothes, whispering through the NICU glass. Every day, they crossed the street to Phoenix Children’s — exhausted, scared, but together.

One morning, they returned to find a note on their door: We’re rooting for your miracle. Your donation made that moment possible.

You gave them more than shelter. You gave them courage. Because when your baby is fighting to live, the most powerful medicine isn’t found in a hospital — it’s love, wrapped in comfort, just steps from her side.

Your generosity keeps families close — and hope within reach.

ronaldmcdonaldhousecnaz.org

Tax Code 20400

St. Vincent de Paul harnesses the power of our community to feed, clothe, house and heal all who are in need — whether in body or in spirit.

We believe in the intrinsic value of every person — to serve and be served. Our dining rooms and food boxes are more than just meals. Families gain access to supportive programs and referrals to community resources. When people are at their lowest point and have lost their housing, St. Vincent de Paul is there to offer not only a bed, but a path to find home again. With your support, St. Vincent de Paul is helping seniors, families and children in need in our community with food, housing, affordable healthcare and much more.

stvincentdepaul.net

Tax Code 20540

Since 1979, the WHEAT organization has been working to end hunger and poverty at the root. The mission of WHEAT is to educate, advocate, engage and empower individuals in the fight against hunger and poverty.

Our major programs include the Clothes Silo, a clothing boutique that empowers economically disadvantaged women through the provision of free workwear and on-the-job training, and the Fair Trade Store, a retail shop partnering with artisans and smallscale farmers around the globe to help break the cycle of poverty through fair and ethical trade.

hungerhurts.org

Tax Code 20391

We serve all people who have disabilities to learn, work and live successfully with dignity and independence.

When you support ACCEL, you empower people who have disabilities to develop their unique gifts. With your Arizona Tax Credit contribution, ACCEL provides essential educational, behavioral, therapeutic and vocational programs that give children and adults who have developmental disabilities, behavior disorders and intellectual disabilities the tools they need to thrive. Your support cultivates independence and empowers individuals with disabilities to achieve their goals. Join us in transforming lives and building a brighter future for our disability community. accel.org

Tax 20317

Our mission is to create connections, empowering everyone in the Autism community with the resources needed to live fully. We serve communities across Arizona.

When you support the Autism Society of Greater Phoenix, you are helping individuals with Autism and their families across Arizona. We are families helping families. Established in 1973, our vision is to create a world where everyone in the Autism community is connected to the support they need, when they need it. We offer programs for all ages and support in English and Spanish. We provide support groups, social events, education, advocacy and more! Our events provide valuable information and give our community a chance to connect and share resources. We invite you to join our mission and empower your community.

Tax Code 20728

Cortney’s Place is a family-founded nonprofit providing an inclusive, stimulating and meaningful communitybased day program for adults with intellectual and developmental disabilities.

Cortney’s Place aims to encourage, support and engage adults with developmental disabilities. Our focus is providing participants with fulfilling opportunities that enable them to live an active, enriched life through a monthly curriculum combining therapies, purposeful classes and community outings. Our year-round programming includes hydrotherapy, healthy cooking, art, science, life skills, adaptive fitness, music therapy and technology learning groups. Our programming gives a foundation for individuals to improve self-esteem, acquire social skills and gain independence. Cortney’s Place provides a safe, inclusive, positive and supportive environment. Your tax credit contribution helps support the amazing work we do at Cortney’s Place.

cortneysplace.org

Tax Code 20130

SPECIAL NEEDS

Founded in 1985, Gesher Disability Resources serves children and adults affected by a disability through inclusion assistance in the classroom, resource referral, residential support and social groups.

Gesher programs offer tools that break down barriers caused by stigma and isolation within the Intellectual & Developmental Disability (IDD) community, making participation in social activities like bowling, swimming, zoo visits and other events integral to their well-being. Every month, Gesher offers activities focused on inclusivity. Expansion of Gesher’s residential program is a priority since members of the IDD community have difficulty accessing safe, secure, affordable housing. Gesher also offers educational support for students with learning challenges attending schools that lack the bandwidth to provide individualized learning. Over 4,000 Arizonans are impacted by Gesher programming each year.

gesherdr.org

Tax Code 20748

SPECIAL NEEDS

Lions Camp Tatiyee provides entirely free, life-changing summer camp experiences to special needs youth from across Arizona, helping to promote their emotional health, independence, self-esteem and confidence.

Your generous contribution will provide a life-changing summer camp experience for a child with special needs — at absolutely no cost to their family. Lions Camp Tatiyee serves children across Arizona with learning, developmental, physical, hearing and vision-related disabilities, as well as those with autism. Each summer consists of eight one-week sessions, tailored to the ages and disabilities of the youth we serve. Youth attend adventure programming, educational curriculum and empowerment activities. Please join Lions Camp Tatiyee in creating a supportive space to empower special needs youth to become more independent, confident and happy.

CampTatiyee.org

Tax Code 20677

Arizona Disabled Sports focuses on providing sports and recreational opportunities for individuals with physical and developmental disabilities and visual impairments.

Our vision is a community that creates opportunities that empower individuals of all abilities through sports and recreation. Recognizing the importance of recreation and competitive opportunities that contribute to quality of life, the primary mission of AzDS is to provide a variety of programs and activities to individuals with disabilities. AzDS offers two different types of programs that include adaptive opportunities for individuals with developmental disabilities through the Team Mesa programs, as well as adaptive opportunities for individuals with physical disabilities through the Arizona Heat physically challenged programs. Our goal is to let no one sit on the sidelines!

arizonadisabledsports.com

Tax Code 20139

One Step Beyond empowers adults with intellectual disabilities to explore their potential and reach beyond expectations through innovative education, employment and enrichment programs.

Your support helps foster a more inclusive Arizona, where individuals of all abilities thrive and contribute to the community. One hundred percent of Arizona Tax Credit contributions support One Step Beyond, Inc.’s day training and employment programs for adults with intellectual disabilities. These funds provide hands-on training in culinary arts, performing and visual arts, fitness, job readiness and life skills. Contributions also fund inclusive community outings, vocational experiences and creative workshops, empowering participants to build independence, confidence and meaningful connections.

OSBI.org

Tax Code 20638

We support individuals with special needs by using the special bond of pets to help them reach their full potential.

Redefining special needs therapy through innovation, compassion and exceptional care within the special needs community. Our curriculum-based programs help individuals enhance their motor skills, emotional regulation, executive functioning, sensory processing and more by engaging in adaptive activities supported by pets of various species. Pawsitive Friendships was founded in 2014 by a passionate mother of a son with autism, who discovered she increased her son’s progress by incorporating her French bulldog, Zoe, into his therapy. We are a 96% volunteer-run organization serving over 2,300 individuals annually throughout Maricopa and Pima Counties, making Pawsitive Friendships and developing essential skills a success.

pawsitivefriendships.org

Tax Code 20861

Since 2001, Power Paws has provided trained service dogs for disabled children and adults.

One hundred percent of your tax credit donation will go toward training assistance dogs for disabled children or adults. There is no cure for the children and adults Power Paws serves.

azpowerpaws.org

Tax Code 20712

We work with disabled veterans and help them train their own dog to be their service animal — all at no cost to the veteran.

The American Service Animal Society is a nonprofit organization founded in 2006, dedicated to enabling disabled veterans to live more productive lives through the use of service dogs. Using a weekly small-class format, we work with the veteran and their own dog, teaching them to work as a bonded team to meet the veteran’s specific needs, whether physical, emotional or a combination of both. We offer them LIFETIME support through various social events and additional training as needed. All of this is provided at no cost to the veteran.

dogs4vets.org

Tax Code 20587

We work to help homeless and distressed veterans lead a better quality of life.

Our mission is to support veterans with dignity and care. We provide food boxes, emergency boxes, blankets, sleeping bags, tents, clothing and household goods, as well as assistance in finding housing, and guidance with civilian transitions. We also serve as a valuable partner, helping veterans navigate their military benefits and available programs.

We are able to provide our veterans with these vital items through many fundraising programs and the generous donations from kind people like you.

fishersofmenforveterans.com

Tax Code 21042

Military Assistance Mission provides financial assistance and morale aid to Arizona military, their families and our wounded heroes.

Military Assistance Mission is a nonprofit that offers a financial assistance program that covers food, rent, mortgage, auto payments, utilities and auto insurance. MAM’s education assistance programs help service members and spouses with school expenses like textbooks, invoices, dorm/school living and parking fees. Additionally, MAM organizes morale-boosting family events, such as baby showers, holiday programs and tickets to sporting events.

azmam.org

Tax Code 20118

Aspiring Youth Academy ignites the entrepreneurial spirit in today’s young minds and elevates the lives of Title I teens across our community.

Arizona Tax Credit contributions directly support youth from Title I schools and low-income backgrounds through impactful, year-round programming. These funds power the AYA Innovation Hub (a 12-lesson, standards-aligned curriculum developed in partnership with ASU’s Edson E+I Institute), the Future Innovators Teen Mentor Program (matching students with real-world mentors), our Spring Break Innovation Camp (85+ teens, five days, one big pitch) and the AYA Innovator’s Circle — monthly meetups where teens explore entrepreneurship through handson events with local founders. Each program delivers meaningful experiences in financial literacy, leadership and innovation, helping students build confidence and skills for success.

aspiringyouth.org

Tax Code 20810

Our mission is to create and support one-to-one mentoring relationships that ignite the power and promise of youth. For 70 years, we have been empowering Arizona’s youth through mentorship.

Each time a gift is made to Big Brothers Big Sisters of Central Arizona, potential is ignited within our community. BBBSAZ makes meaningful, professionally supported matches between adult volunteers (“Bigs”) and youth (“Littles”) ages 6 through 18. Your support helps create mentoring relationships that inspire confidence, build character and shape brighter futures for youth across Maricopa and Pinal Counties.

Each donation lights a spark. Each volunteer becomes a role model. Together, we ignite a generation. Be the reason a child believes in their future. Give. Mentor. Advocate.

bbbsaz.org

Tax Code 20332

Our mission is to enable all young people, especially those who need us most, to reach their full potential as productive, caring, responsible citizens.

When you support Boys & Girls Clubs of Greater Scottsdale with your tax credit donation, you ensure local kids have the tools to succeed — no matter their circumstances. Your gift supports innovative after-school and summer programs, pairing academic help, STEM, arts and leadership training with the encouragement of trusted mentors. Last year, we provided $1.6 million in program assistance so youth could access these life-changing opportunities without financial barriers. This is your chance to direct your Arizona tax dollars to a proven program shaping tomorrow’s leaders — and create a ripple effect for years to come.

bgcs.org

Tax Code 20091

BGCAZ is the premier out-of-schooltime provider and leading voice for youth development in Arizona, ensuring youth and teens have the skills and resilience to successfully navigate childhood and prepare for adulthood.

Boys & Girls Clubs of the Valley offers affordable after-school and summer programs for 17,000+ youth in grades K-12. In 30+ Clubs, BGCAZ provides award-winning programs designed to change lives. For over 75 years, BGCAZ has created equity and opportunity through academic, social and workforce opportunities. We help young people make healthy decisions and focus on social and emotional development to build resilient young adults. Most importantly, we work to develop strong character and leadership skills by creating positive connections to caring adults. According to a recent ASU study, every $1 invested in BGCAZ returns $14.79 to the Arizona economy.

bgcaz.org

Tax Code 20331

Hope Ignites Phoenix (formerly Boys Hope Girls Hope of Arizona) nurtures and guides motivated young people in need to become well-educated, career-ready men and women for others.

Since 1989, Hope Ignites Phoenix has empowered low-income, first-generation youth in Greater Phoenix with long-term, yearround support from 6th grade through college and into career launch. Through academic tutoring, individualized support, leadership development, college and career readiness, and family engagement, we help students succeed against the odds. The results speak for themselves: 100 percent graduate high school, 74 percent earn a college degree, and most graduate college with little or no student debt. We believe that education, opportunity and caring relationships transform lives and communities, igniting hope for generations to come.

hopeignitesphoenix.org

Tax Code 20356

Our mission is to provide access to out-of-school-time opportunities that empower all youth and their families to pursue what is most meaningful to them.

ICAN provides FREE, high-quality out-of-school-time programs for youth in underserved Arizona communities. Our awardwinning, year-round program offers a safe, engaging space where kids build academic skills, explore future careers and develop confidence — academic support, positive youth development, enrichment and future exploration, and community and family support — ICAN helps over 700 youth each year thrive. Your Arizona Charitable Tax Credit contribution makes this possible, transforming lives and building stronger, more resilient communities across Chandler, Mesa and beyond.

icanaz.org

Tax Code 20031

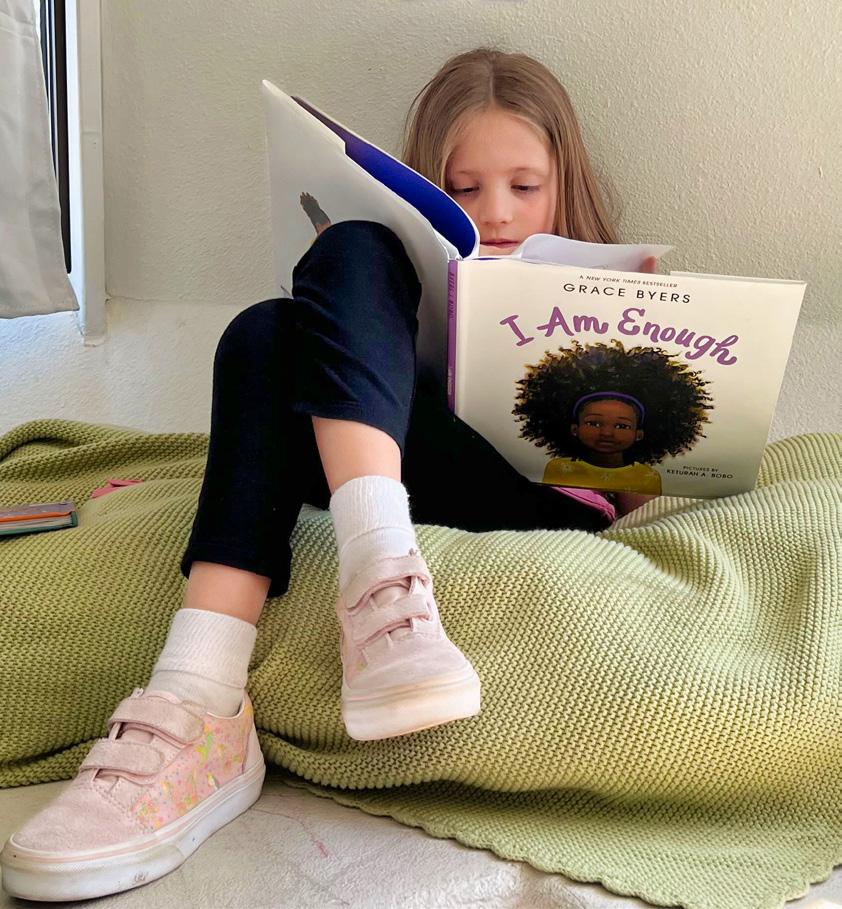

Donate today and help create a future where every child can read, learn and thrive.

Make Way for Books is a nonprofit working across Arizona to give every child a strong start from birth to age 5. We empower parents, caregivers and early educators — a child’s first and most important teachers — with books, research-based strategies and tools that turn daily moments into powerful learning.

Our signature programs work together: Story Project equips educators in childcare and preschool settings with coaching and resources, while Story School empowers families to support their child’s learning through bilingual, evidence-based learning experiences in community spaces. The free Make Way for Books app turns smartphones into libraries — anytime, anywhere. makewayforbooks.org

Tax Code 20166

Camp Kidney, a program of the National Kidney Foundation of Arizona, is a free three-day overnight camp for Arizona kids 8–18 with chronic kidney disease, on dialysis or awaiting/ post-transplant.

For most kids, going to camp is an annual tradition, a time filled with adventure, independence and friendships. But for children living with kidney disease, who face daily medical needs and physical limitations, camp is typically out of reach. Camp Kidney changes that, giving kids a place where they can just be kids. Held each October at Camp Pinerock in Prescott, it is one of five camps nationwide created to serve this medically fragile population. Established in 2017, Camp Kidney provides a medically safe and emotionally supportive environment where these special youth can experience the joys of camp.

azkidney.org

Tax Code 20663

New Pathways for Youth transforms lives by guiding young people through mentorship, skill-building and support, empowering them to overcome adversity and create a future filled with joy, purpose and possibility.

Arizona Tax Credit contributions directly support New Pathways for Youth’s Level Up Program, Level Up Academy, Young Adult Program, and Caregivers Circle — each providing 1:1 mentorship, guidance and resources to help youth and their families break through barriers and thrive. These funds also power our Back to School Drive, Holiday Celebration, Scholarships, and Skills Labs for career readiness, ensuring youth, young adults and their families have year-round support. Every dollar provides stability, opportunity and hope, helping those we serve to live their lives filled with joy and purpose.

Tax Code 20267

one·n·ten supports LGBTQ+ youth and young adults ages 11-24. We enhance their lives by providing empowering social and service programs that promote self-expression, selfacceptance, leadership development and healthy life choices.

With your support, LGBTQ+ youth and young adults acquire skills for self-sufficiency, well-being and resilience. Signature programs include our Downtown Phoenix Youth Center, Statewide Satellite Groups, Identity-Affirming, Workforce Development, Housing Solutions, Camp OUTdoors and Health & Wellness. We facilitate over 100 unique programs per month across our sites, and all programs are no-cost for youth to attend. We cultivate an atmosphere of acceptance and self-expression, which is especially important to youth still discovering their identities and those who cannot safely express themselves at work, home, school or in their communities. one·n·ten creates safe, affirming spaces where LGBTQIA+ youth can thrive.

onenten.org

Tax Code 20190

Southwest Human Development strengthens the foundation Arizona’s children need for a great start in life.

For over 40 years, Southwest Human Development — one of Arizona’s largest nonprofits — has helped children from birth to age 5 and their families grow and succeed. As an Easterseals affiliate, we provide support through 40+ programs focused on disabilities, early learning, mental health, Head Start, family support, early literacy and professional training. Our work strengthens families, promotes school readiness and supports healthy development during the most critical years of life. Donations qualify for the Arizona Charitable Tax Credit — making it easy to give locally and create lasting impact.

swhd.org

Tax Code 20390

The YMCA strengthens communities by empowering youth and families of all backgrounds through programs that promote healthy living, youth development and social responsibility. By supporting programs that empower individuals and families, you help those still struggling to make ends meet. We provide workforce development through education and job training, rental assistance for residents at the Lincoln Family Downtown YMCA and specialized programs for youth and adults with special needs. Affordable childcare and early learning give low-income families a strong start, while outreach and wellness programs support seniors and those managing chronic illnesses like diabetes. Every dollar goes directly to programs that create stability, opportunity and healthier lives for some of our community’s most vulnerable members.

valleyymcacares.org

Tax Code 20708

Per the Arizona Department of Revenue, a QFCO provides immediate basic needs to residents of Arizona who receive temporary assistance for needy families (TANF) benefits, are low-income residents of Arizona, or are individuals who have a chronic illness or physical disability, and provide immediate basic needs to at least 200 qualifying individuals in the foster care system.

A QFCO must meet ALL of the following provisions:

• Is exempt from federal income taxes under Section 501(c)(3) or is a designated community action agency that receives community services block grant program monies pursuant to 42 United States Code Section 9901.

• Provides services that meet immediate basic needs.