In partnership with

In partnership with

As a member of the Taskforce on Nature-related Financial Disclosures (‘TNFD’) and the Canadian TNFD Consultation Group, Fengate recognizes the importance of the protection of our natural ecosystems and preserving our natural capital. Not only is nature loss closely linked to climate change, the World Economic Forum’s research also shows that $44 trillion of economic value generation – over half of the world’s total GDP – is moderately or highly dependent on nature and the ecosystem services that it provides. While climate has been at the top of the global agenda, nature is less understood, more complex to evaluate, and harder to standardize across industries and geographies.

In real estate, this gap is critical: properties depend on healthy ecosystems for resilience, tenant wellbeing, and long-term value creation.

Fengate recognizes the value of collaborative dialogue and transparent information sharing to advance TNFD alignment and elevate industry-wide awareness of nature-related risks and opportunities. This paper outlines key steps Fengate is taking, in collaboration with Alvéole, a Montreal-based company specializing in urban beekeeping and nature-based solutions for commercial buildings to assess nature-related risks with the aim of encouraging peers across the sector to adopt similar approaches.

Fengate, like many other organizations, has dependencies and impacts on nature, which gives rise to nature-related risks and opportunities that could have a material impact on business. TNFD developed an integrated approach for the identification and assessment of nature-related issues, called the LEAP approach, or ‘LEAP’ for short (Locate, Evaluate, Assess and Prepare). This approach aims to help organizations conduct the due diligence necessary to inform disclosure statements aligned with the TNFD recommendations, but at an early stage, it is also a useful approach for real estate organizations looking to identify and assess their nature-related issues.

In 2025, Fengate partnered with Alvéole to carry out an initial LEAP assessment of our real estate portfolio. The result was a clearer picture of where our assets interact with sensitive ecosystems, the risks and opportunities, and what steps we can take today to mitigate those risks and enhance biodiversity.

Natural Capital: The TNFD defines natural capital as the stock of renewable and non-renewable natural resources such as plants, animals, air, water, soil and minerals that combine to yield a flow of benefits to people.

Ecosystem Services: The contributions of ecosystems to the benefits that are used in economic and other human activity. This includes provisioning services, regulating and maintenance services, and cultural services.

The first step in the LEAP approach is to identify how Fengate’s real estate portfolio interacts with nature. This involves mapping the geographic locations, industry sectors, and ecological contexts of the assets.

the scope

At the sector level, and in line with ISSB guidance, the TNFD advises organizations to use the Sustainability Accounting Standards Board (“SASB”) sector classification (SICS) to determine which aspects of their business model and value chain are included in the assessment’s scope. For Fengate, this assessment specifically targets the direct operations of our real estate portfolio, focusing on the Real Estate Activities sector within SICS.

Screen for sectorial dependencies and impact on nature

Once the sector has been defined, Fengate worked with Alvéole to conduct dependency and impact screening. TNFD defines dependency as the way in which businesses rely on nature for the operations, and impact as the effects that business has on nature, which can be either positive or negative.

Examples of dependency and impact areas for Real Estate Activities include:

▪ Soil and sediment retention services –which help prevent erosion and support landscaping stability

▪ Visual amenity services – reflecting the high value of greenery and landscaped areas for occupant satisfaction and property value

▪ Disturbances such as noise and light

▪ Emissions of toxic pollutants into water and soil

▪ Volume of water use

▪ Area of land use

▪ GHG emissions

ENCORE ‒ Tools available at this phase include ENCORE, which can be used for dependency and impact screening under the Real Estate Activities sector classification.

Identify geospatial interactions with nature

Once sector dependencies and impacts are identified, the next step is to pinpoint the geographic locations of real estate assets and examine how these sites interact with nearby ecosystems and biomes.

Based on IUCN Global Ecosystem Typology, there are 25 Biomes. The following biomes are commonly found in Canada:

Temperate broadleaf and mixed forests

Temperate grasslands, savannas, shrublands

At a more localized level, urban real estate typically interacts with a variety of urban and peri-urban (transitional zones) ecosystems including:

1. Green infrastructure systems such as pollinatorfriendly landscapes, rain gardens, and urban tree canopies

2. Modified grasslands and ornamental planting areas used for amenity and landscape aesthetics

3. Riparian corridors and small wetlands near sites may be sensitive to runoff and chemical inputs

These systems offer various ecosystem services including soil and sediment retention services, visual amenity services, pollinator and habitat provision, local air quality regulation, and storm and flood mitigation. Companies such as Alvéole can support property owners and operators in mapping specific asset locations to specific biomes and ecosystems where real estate interacts with nature, and where real estate depends on the services that those ecosystems provide.

Government of Canada Open Maps ‒ this tool provides public access to geospatial data for mapping, analysis, planning, and informed decision-making

Temperate conifer forest

Boreal transition and mixed wood plains

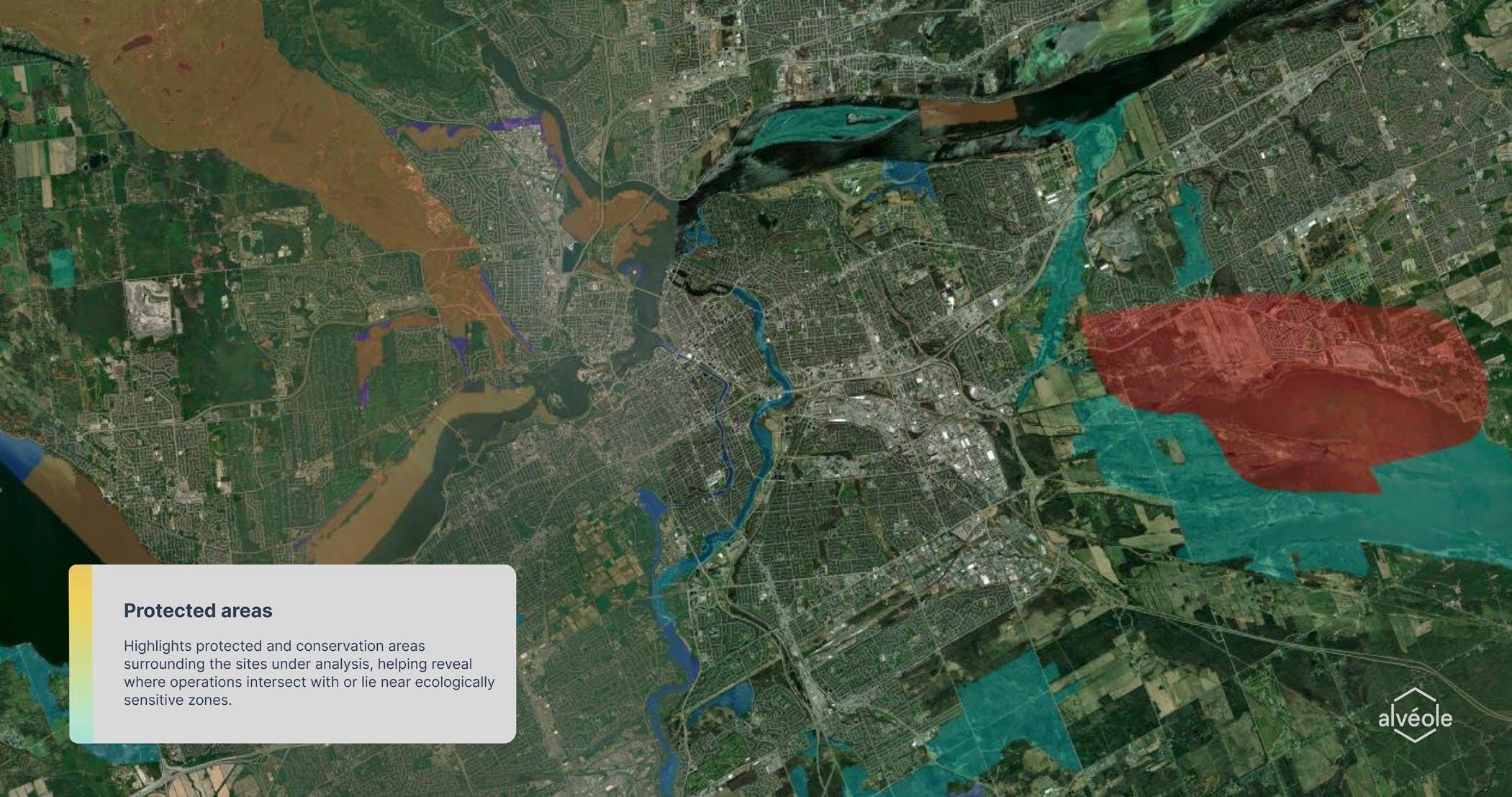

Identify interface with sensitive locations

By leveraging the same geospatial information, organizations like Fengate can use that information to further identify whether those specific sites and operations are in sensitive locations. According to TNFD, a sensitive location is any site that meets one or more of the following conditions:

▪ Important for biodiversity (e.g. rare or endemic species, Key Biodiversity Areas, proximity to protected areas, local MSA scores)

▪ High ecosystem integrity or areas with rapidly declining ecological health

▪ High water risk

▪ Important for ecosystem services (e.g. pollination, cultural value, community reliance)

Alvéole can assist organizations in identifying assets that are located within or near sensitive areas. These sites are subject to greater attention from regulators and investors, presenting opportunities for property owners and managers to protect or improve local biodiversity.

This process highlighted priority properties which scored low on Mean Species Abundance (MSA) or were located near sensitive areas. These became immediate priorities for targeted interventions.

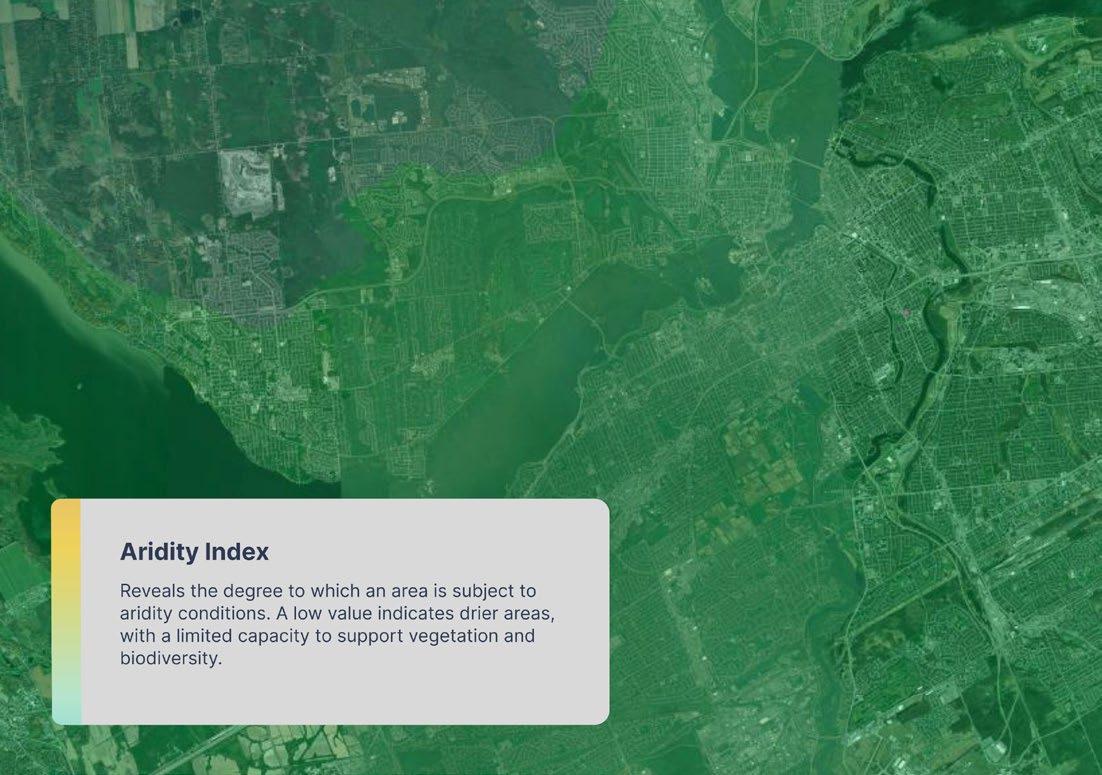

Once key sites near sensitive areas have been identified, the next step in the LEAP process is to develop an understanding of the organization’s potentially material dependencies and impact on nature, which is determined through an understanding of the relevant environmental assets and ecosystem services that the surrounding environment provides, and what the primary impact drivers are at each site. By crossreferencing these insights with sites operating in or near sensitive areas, property owners and operators can better prioritize their resources and develop effective response strategies.

Identification of environmental assets, ecosystem services and impact drivers DEPENDENCE ON NATURE

Environmental assets such as urban green spaces, soil and sediment subtrades provides valuable ecosystem services including soil and sediment retention services and storm and flood mitigation services. External factors such as climate change may impact the availability of those ecosystem services, resulting in potential risks for the organization.

Conversely, organizational activities can introduce impact drivers that alter the state of local ecosystems, leading to reputation or regulatory risks.

- Environmental impacts

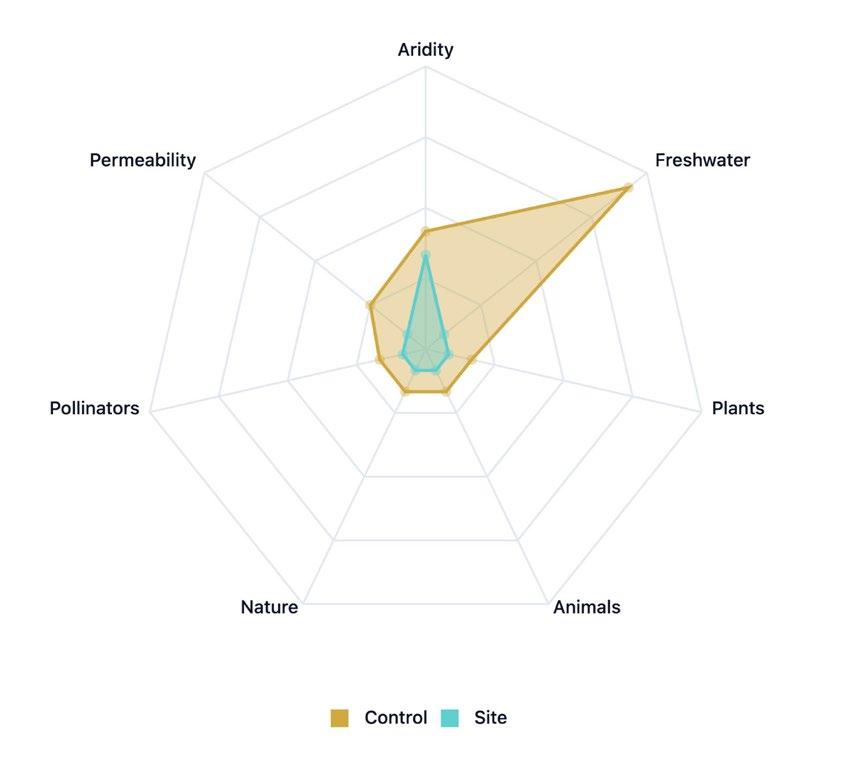

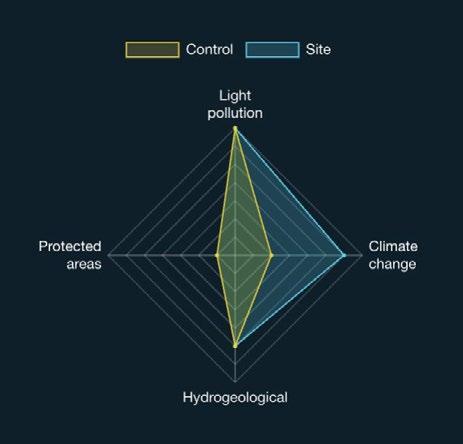

Compares environmental and biodiversity conditions between the assessed site and a surrounding control area. Broader coverage across axes like freshwater and permeability indicates higher impacts from huma activity on those dimensions. Together, these metrics offer a multidimensional view of the site’s ecological status and its interaction with local natural systems.

Where possible, organizations can also attempt to quantify the scale and scope, defined as severity (low, mid, high) of the dependencies and impacts. Alvéole supported Fengate in the measurement of dependencies and impacts, and quantifying the change in the stage of nature at each site. Where these dependencies and impacts are materially present for assets in sensitive locations, property managers and owners should prioritize these areas for responding, monitoring, and reporting.

Sensitive locations

Locations with material dependency/ impact

Priority sites were flagged for interventions tailored to their risk profiles. From pollinator-friendly landscaping and permeable surfaces, to droughttolerant native planting and rainwater harvesting, ensuring nature-based solutions directly addressed the ecological stressors identified.

Once organizations have evaluated priority sites where there may be material dependencies or impacts on nature, and where those assets are located within sensitive areas, property owners and managers can proceed to identify and prioritize the risks and opportunities that are associated with those dependencies and impacts.

Fengate and Alvéole identified nature-related risks across the portfolio, from water scarcity and soil degradation to urban heat stress, and paired each with a practical opportunity for resilience. By framing risks directly alongside actionable solutions such as drought-tolerant planting, pollinator-friendly landscaping, and green infrastructure, Fengate was able to transform complex nature risks into tangible interventions that strengthen both biodiversity and asset resilience.

Examples of risks and associated opportunities include:

Increased stranded asset risk due to soil degradation or flood risk

Introduce drought-resistant and native plant species to enhance site resilience

Potential regulatory and reputational risks

Increased water scarcity risk

Minimize construction and operational waste through sustainable practices; utilize environmentally friendly cleaning supplies to prevent contamination runoff

Reduce reliance on potable water for irrigation

Heat island effect from reduced vegetation cover

Increase irrigation needs due to non-native or drought-prone species

Establish natural shading to mitigate heat island effects and lower operational costs

Introduce drought-resistant and native plant species; reduce reliance on potable water for irrigation

As organizations collect essential information about priority sites, material risks, and related opportunities and mitigations, they can make informed decisions on how to respond. This includes allocating resources, setting nature-related goals and targets, and establishing robust governance and risk management processes.

With clear priorities identified, Fengate began to embed nature into investment and operational decisionmaking. This included portfolio-wide governance steps, as well as flagship on-the-ground projects

Fengate conducts nature risk assessments during the diligence stage across all new opportunities. This involves identifying potential impacts such as increased water scarcity, extreme heat and drought risks, and proximity to sensitive areas, then formulating strategies to mitigate these risks through site-specific interventions.

Fengate is proud of the two resident-run community gardens at our urban rental communities. This helps transform shared terraces and outdoor spaces into vibrant hubs for growing food and building connections. In partnership with The Backyard Urban Farm Co., we recently launched a new community garden at 20 Monte Kwinter Court in Toronto and hosted workshops that brought residents together to start a seasonal herb and vegetable garden. At 1140 Wellington in Ottawa, residents grow produce from spring to fall, donating much of it to the nearby Parkdale Food Centre. These initiatives foster sustainability, community engagement, and a deeper connection to nature.

We have partnered with Alvéole to help enhance biodiversity across our portfolio and bring tenants together through beekeeping events and initiatives. With 14 active hives including 4 at our Friday Harbour Resort and 10 across our commercial properties, we seek to support pollinator health while creating meaningful learning opportunities for the tenants. Each beehive houses more than 80,000 honeybees and in 2024 alone, our commercial properties harvested over 450 pounds of honey, hosted 10 educational workshops, and more than 200 tenants engaged in Alvéole-led events.

As part of Fengate’s sustainable design strategy, our new development projects thoughtfully integrate nature and biodiversity to enhance both green space and community well-being. This includes features such as native and drought-tolerant plant species, green roofs, and tree planting to support urban canopy coverage. Two of our current development projects exemplify this approach.

▪ 500 Upper Wellington in Hamilton, Ontario, will feature a 6,000 square foot vegetated green roof planted with native and drought-tolerant species, contributing to local biodiversity and stormwater management.

▪ At 355 Adelaide Street West in Toronto, Ontario, the project team is proposing a Privately Owned PubliclyAccessible Space (POPS) designed to be enjoyed by both building tenants and the broader community. This welcoming space will offer approximately 3,000 square feet that includes trees, shrubs, and grass to enhance connectivity between the urban environment and nature.

Both 500 Upper Wellington and 355 Adelaide Street West are LiUNA Pension Fund of Central and Eastern Canada (LPFCEC) projects built in partnership with Fengate and the Hi-Rise Group

Within our commercial portfolio, Fengate has established green cleaning policies that mandate the use of environmentally friendly cleaning supplies that prevent harmful contamination runoff and support the health of both tenants and the surrounding ecosystem. These products are biodegradable and minimize the introduction of toxins into soil and water systems.

Bird collisions with windows have become a leading conservation biology concern worldwide. Across our portfolio, we are exploring bird deterrence initiatives to reduce collisions at the buildings we manage. As part of our new development projects, bird-friendly design is an important component of our strategy, and our teams adhere to municipal requirements such as the Toronto Green Standard, and the guidelines set out by LEED for projects pursuing certification.

Fengate has achieved zero operational waste across our office locations through dedicated zero-waste programs. These initiatives include recycling, composting, and partnership with U-PAK Emerald Waste to convert landfill waste to energy, resulting in 100% of all waste diversion rate from landfills.

Alvéole delivers nature insights and reporting that drive portfolio resilience and asset value.

TNFD is reshaping how companies assess and disclose nature-related risk – and large LPs are beginning to push for it. For CRE, the challenge is unique: biodiversity insights are hyper-local, changing from one property to the next, while available data is fragmented, and hard to scale

Meeting these expectations requires tools built for real estate – solutions that transform site-level biodiversity data into clear, scalable portfolio-level insights.

Alvéole’s Nature for Real Estate is an AI-powered biodiversity and nature-risk assistant designed for commercial real estate owners and managers. Built on Alvéole’s experience working across more than 2,000 assets and partnering with 800+ leading real estate brands globally, it transforms biodiversity data into actionable ESG insights.

➔ Framework Alignment: Translates biodiversity data into disclosure-ready reports aligned with global frameworks like TNFD, GRESB, BREEAM and others.

➔ Benchmarking & Portfolio Insights: Benchmarks against a database of thousands of buildings worldwide and highlights competitive positioning.

➔ Impact Mapping: Identifies location-specific dependencies and impacts using the TNFD LEAP approach.

➔ Accessibility: Provides clear, practical recommendations designed for asset managers and ESG teams.

How it Works

Site-Specific Remote Sensing

Ground-Truth Monitoring

Framework-Aligned Reports. Made easy.

Together, these projects demonstrate how TNFD-aligned nature risk assessment translates into visible, replicable outcomes across a real estate portfolio. Our experience with Alvéole shows that assessing and acting on nature risk is achievable, practical, and creates value. We encourage peers across the real estate sector to take the LEAP, to locate, evaluate, assess, and prepare, and to work with expert partners to embed nature into asset management. The results are healthier assets, more resilient portfolios, and stronger connections between people and the ecosystems we all rely on.

*Fengate refers to the Fengate group of companies which is comprised of Fengate Capital Management Ltd., its affiliated entities and the funds or other investment vehicles that they manage. Fengate has produced this Report for informational purposes only. The information contained in the Report is believed to be accurate at the time of publication of the brochure; however, Fengate does not guarantee or warrant or make any representations concerning the quality, suitability, accuracy completeness or timeliness of the information contained in the Report.

*Important Disclosures For illustrative purposes only. The views and statistics included are for informational purposes only and are not intended to serve as a forecast, a guarantee of future results, or investment recommendations.

This report is provided solely for informational purposes, does not promote any business or business interest of Fengate Asset Management, and does not constitute an offer or a solicitation to buy or sell any security, product or service in any jurisdiction.

© 2025 Serafini Holdings Corporation. All rights reserved.