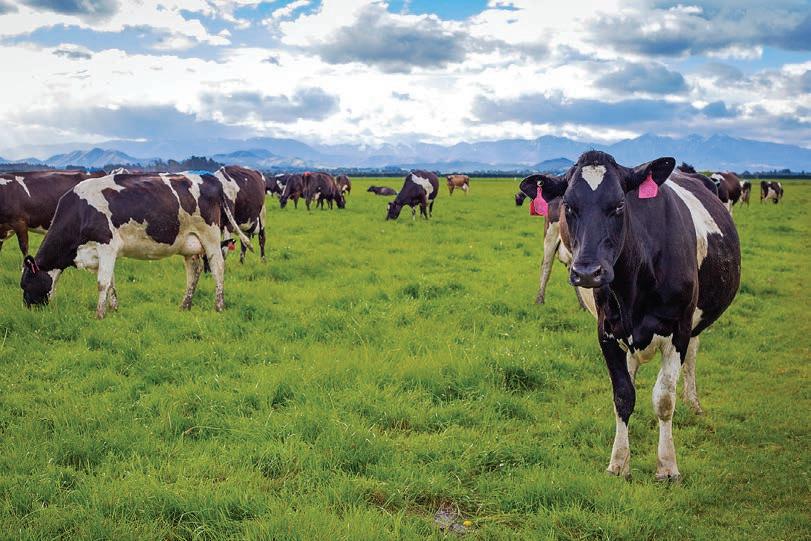

Dairy cows rocket to $3000 a head

ALACK of supply, favourable market conditions and a spate of planned South Island dairy conversions have caused dairy cow prices to skyrocket across the country.

Prices for dairy cows had been largely static over the past few years, sitting at around $1800-$2000 a head, with some occasionally making slightly more.

Now, prices for good adult cows on contract are averaging $3000 with some $3500 and over. In-calf heifer prices have also jumped and are around $2500.

He initially thought the lift in prices was some “early season fever” among buyers, but the higher prices seem to have stayed.

Whale oversees the herd purchase contracts on livestock sales for PGG Wrightson, with cows from these completed sales delivered to the farm on June 1 next year.

When a herd is sold by a contract, around 80% of those cows qualify for the full contract price, he said.

Whale could not comment on the genetic merits of the cows but did say that many of these contracts included a negative test for Johne’s disease.

Whether these prices are the new normal is difficult to say.

Milk price futures have indicated a softening in the dairy market, which could see the milk price drop below $10/kg milk solids next season.

“It will be really interesting to see what cow pricing does with that,” Whale said.

Wool training heads to the Chathams

Wool training will soon reach one of New Zealand’s most remote communities, the Chatham Islands, giving locals a chance to step into the wool harvesting sector. Chatham Islander Tommi Gregory-Hunt, right, will lead an Agricademy training programme, run in partnership with Hokotehi Moriori Trust, Tāmata Hauhā and the Ministry for Primary Industries. Also pictured are Tāmata Hauhā general manager Cherie Tirikatene and Mikayla Mahony.

PGG Wrightson technical manager for livestock Rod Whale said there has been a 50% increase in prices nationwide.

He started noticing a shortage of cows being put up for sale towards the end of last season. That, combined, with the high milk price and planned conversions taking place in the South Island, seems to have fuelled the market.

The high prices increase the challenge facing younger farmers looking to buy cows as they progress up the farm ownership ladder.

“At $3000 for cows and $2500 for heifers, the pot of gold you have to start with is a lot bigger.”

NZ Farmers Livestock general manager Bill Sweeney said it is never just one thing that changes cow prices, but “the stars have

chores

Robots maybe doing some of the mundane work on Thijs Neutel’s Groningen dairy farm in the Netherlands, but he still has plenty to do.

Get in touch

EDITORIAL

Bryan Gibson | 06 323 1519

Managing Editor bryan.gibson@agrihq.co.nz

Craig Page | 03 470 2469 Deputy Editor craig.page@agrihq.co.nz

Claire Robertson

Sub-Editor claire.robertson@agrihq.co.nz

Neal Wallace | 03 474 9240

Journalist neal.wallace@agrihq.co.nz

Gerald Piddock | 027 486 8346

Journalist gerald.piddock@agrihq.co.nz

Annette Scott | 021 908 400 Journalist annette.scott@agrihq.co.nz

Hugh Stringleman | 027 474 4003

Journalist hugh.stringleman@agrihq.co.nz

Richard Rennie | 027 475 4256

Journalist richard.rennie@agrihq.co.nz

Nigel Stirling | 021 136 5570

Journalist nigel.g.stirling@gmail.com

PRODUCTION

Lana Kieselbach | 027 739 4295 production@agrihq.co.nz

ADVERTISING MATERIAL

Supply to: adcopy@agrihq.co.nz

SUBSCRIPTIONS & DELIVERY

0800 85 25 80 subs@agrihq.co.nz

PRINTER

Printed by NZME

Delivered by Reach Media Ltd

Advertise

SALES CONTACTS

Andy Whitson | 027 626 2269

Sales & Marketing Manager andy.whitson@agrihq.co.nz

Janine Aish | 027 300 5990

Auckland/Northland Partnership Manager janine.aish@agrihq.co.nz

Jody Anderson | 027 474 6094

Waikato/Bay of Plenty Partnership Manager jody.anderson@agrihq.co.nz

Palak Arora | 027 474 6095

Lower North Island Partnership Manager palak.arora@agrihq.co.nz

Andy Whitson | 027 626 2269 South Island Partnership Manager andy.whitson@agrihq.co.nz

Julie Hill | 027 705 7181

Marketplace Partnership Manager classifieds@agrihq.co.nz

Andrea Mansfield | 027 602 4925 National Livestock Manager livestock@agrihq.co.nz

Real Estate | 0800 85 25 80 realestate@agrihq.co.nz

Word Only Advertising | 0800 85 25 80 Marketplace wordads@agrihq.co.nz

PUBLISHERS

Dean and Cushla Williamson Phone: 027 323 9407 dean.williamson@agrihq.co.nz cushla.williamson@agrihq.co.nz

Farmers Weekly is Published by AgriHQ PO Box 529, Feilding 4740, New Zealand Phone: 0800 85 25 80 Website: www.farmersweekly.co.nz

ISSN 2463-6002 (Print) ISSN 2463-6010 (Online)

EXCITING: DINZ chief executive Rhys Griffiths says a growth-oriented, value-added space in the European market is exciting for New Zealand venison.

The Global Dairy Trade price index fell on November 5 for the sixth consecutive fortnightly event, losing 2.4% when weighed down by whole milk powder prices falling 2.7%.

Cheddar fell 6.6%, butter by 4.3% and anhydrous milk fat by 1.9%. Mozzarella was up by 1.6% and buttermilk powder was up 1%. The GDT dairy market has fallen by 15.5% since mid-May as milk production increases in New Zealand, Europe, the United States and Argentina.

New Zealand Food Safety has backed down on a proposal to increase the maximum residue levels for glyphosate in certain crops after a public outcry. Glyphosate will also no longer be allowed to be applied directly onto cereal crops grown for human consumption in New Zealand. In March New Zealand Food Safety proposed to increase the maximum residue levels for glyphosate in some grains and peas.

News in brief GDT down Proposal canned Nominations open

Nominations for the Dairy Women’s Network’s 2026 Fonterra Dairy Woman of the Year Award have opened.

The award recognises women who are making a difference on their farms, in their businesses, or in their communities, and are also inspiring others to lead, connect and contribute to a better future for the dairy sector.

New partnership

Massey University and Northland Inc regional development unit have signed a heads of agreement for a partnership covering education, research and innovation.

The agreement is called Waka Hourua and draws on the symbolism of a double-hulled voyaging canoe. It establishes a platform for collaboration between the university, Northland Inc, iwi, local schools and industry.

WARM IN WINTER COOL IN SUMMER

SAPI backed last-ditch bid for Alliance

AMAJOR European rendering company

is understood to have been one of the two mystery backers of a last-ditch attempt by a group of Alliance shareholders to keep the meat cooperative 100% farmer owned.

The group of high-profile shareholders presented an alternative recapitalisation plan to Alliance’s board just 72 hours before the final vote last month on Irish company Dawn Meats’ $270 million offer for 65% of the co-operative.

At the time Alliance chair Mark Wynne dismissed the plan as “largely” a debt swap, saying it offered shareholders “false hope” of retaining control had Dawn’s offer been voted down by shareholders.

While the plan would have largely dealt with a December 19 deadline for the repayment of $188m of term debt, Wynne said, the co-operative would have continued to be severely indebted, most probably breeching interest cover ratios set by its banks for a second year in a row, and possibly

Continued from page 1

aligned this year” because of strong beef prices, the South Island dairy conversions and a shortage of dairy cows in the market.

“Those three things add up to one thing and that’s pretty hot money.” There were some early sales of over $3000 a head, although lately there has been some softening in the market, he said.

But if an exceptional herd is put up for sale now, he expects it would make at least $3000.

“We have sold four herds in the last 10 days, and they have ranged from $2850 to $2925. While

leaving Alliance unable to secure the estimated $250m-$280m in bank working capital required to be competitive in the local livestock market for the coming season.

By comparison, Dawn’s offer cleared the co-operative’s debt, leaving funds to re-invest. The Irish company’s United Kingdom and European market contacts was a further factor in its favour.

Farmers Weekly understands the shareholder group presented two

not elite, they are still very good herds.”

Herds with excellent genetics are also selling well.

The ban in the export of live dairy cattle has also influenced farmers not to rear surplus dairy stock.

The high prices could hold for a couple of seasons because the new conversions will take time, he said.

“On the other side of that is the payout. If the payout comes back – and it will have to come back a reasonable notch – if it comes back to $9.50/kg MS, it might soften a little bit.

“If the payout comes back to $9/ kg MS or under, then you could see a change in those values.”

“indicative offers” to the Alliance board on the Friday before the vote. A third offer was also being worked on.

It is understood one of the confirmed offers was from Italian rendering giant SAPI, which was prepared to pay cash for Alliance’s rendering operations.

The Italian company, which employs 1800 people globally and already has a presence in New Zealand though a joint venture with North Island-based Wallace

This week’s poll question:

Are soaring dairy cow prices sustainable for first-time farmers?

Corporation, would have also provided a loan to Alliance to help refinance its bank debt.

The second offer presented is understood to have come from an offshore financial institution and was for debt funding only.

Both loans would have been paid off over three years from a mix of new shareholder capital, retained earnings and asset sales, as per the letter sent by the shareholder group to Alliance’s 4300 shareholders in mid-September.

One source said the offers were short of the $188m needed to meet the December 19 deadline but were “not far off”.

Furthermore, the cash from the sell-off of Alliance’s rendering plants amounted to a “reasonable proportion” of the debt coming due in December and would have provided at least some of the equity the Alliance board was in search of.

The source understood the indicative offers included loan terms favourable to Alliance.

“There would have been a reduction in interest costs as interest rates are lower this year and [SAPI] had an interest in seeing the co-operative survive because they wanted the rendering product.”

A spokesperson for the shareholder group, Southland farmer Jeff Grant, said the lastminute nature of their campaign had worked against revealing the identity of the backers.

The Italian company would have also provided a loan to Alliance to help refinance its bank debt.

Without access to the detailed financial and operational information provided to interested parties earlier in the fundraising process, further scrutiny of the Alliance business would have been required before the two offshore parties committed to funding.

Revealing their identities would have been detrimental to their reputations should they have walked away from a deal following the completion of their due diligence.

“When you are up against the wall you have to move quickly and be careful about how you do that and that is part of the reason why we can’t disclose [the identity of the backers],” Grant said.

Neither SAPI nor a local representative responded to requests for comment.

Have your say at farmersweekly.co.nz/poll

SHORTAGE: High milk prices, dairy industry expansion and a general shortage of stock have seen a 50% lift in dairy cow prices.

Nigel Stirling NEWS Production

CASH: It is understood Italian rendering giant SAPI was prepared to pay cash for Alliance’s rendering operations.

Meat exports so far unfazed by US tariffs

and the European Union up 35% to $116m.

UNITED States President

Donald Trump’s 15% tariff on New Zealand red meat exports has not yet had a significant economic impact, according to the latest Meat Industry Association data.

New Zealand red meat exports reached $713 million during September on the back of continued strong demand.

This is a 29% increase in exports compared to the same period in 2024.

The value of overall exports for the third quarter of 2025 reached $2.27 billion, 20% higher than the same quarter in 2024.

MIA CEO Sirma Karapeeva said September is the first month when the red meat sector might have seen a material impact of the tariffs on red meat exports to the US.

“While there was a drop in beef exports to the US, that could be partly due to other market factors, as there was also a fall in beef exports to Canada.

“There was also an increase in both sheepmeat and fifth-quarter exports to the US in September.”

The drop in beef exports to North America was offset by increased demand for beef exports to north Asia and the United Kingdom, she said.

Sheepmeat export volumes increased by 14% to 17,890 tonnes compared to September 2024, with the value rising 42% to $252m.

While there was a drop in beef exports to the US, that could be partly due to other market factors.

Sirma Karapeeva Meat Industry Association

exports to the EU, with the volume up 11% to 3327t and the value up 40% to $75m.

Beef exports to the US were down 17% by volume to 6615t and 6% by value to $82m. Canada was down 24% by volume to 2429t and 5% by value to $26m.

New Zealand’s three major markets all increased in value in September, with the US up 25% to $175m, China up 26% to $131m

The volume and value of exports to China, Japan and Korea were all up from last September and there was further growth in exports to the UK, where volume was up 301% to 2074t and value up 457% to $25m. Staff reporter

This was partly due to growth in

Allied approves NZ Farmers Livestock sale

Chair

Hugh Stringleman NEWS Livestock

SHAREHOLDERS of Allied Farmers have approved the sale of subsidiary NZ Farmers Livestock to Rural Livestock.

At a virtual annual shareholders’ meeting they were told that the sale would capture peak agricultural cycle timing and that Rural Livestock is an industry player that can benefit from being a larger, more competitive livestock organisation.

Allied stands to receive $7.5 million from its 67.8% ownership of NZFL and the transaction is planned for December 1.

All existing employees of NZFL and RL will retain their jobs and remunerations.

Allied’s chair, Shelley Ruha, said the strategic benefits of 100% ownership of NZ Rural Land Management Company (NZRLM) enabled Allied to build diversification, income and capability.

“Allied can confidently exit Farmers Livestock and redeploy the sale proceeds into investment opportunities that offer a stronger and more sustainable earnings profile.

“However, if appropriate investment opportunities do not emerge, the board would not rule out the possibility of returning capital to shareholders.

“That said, this would not be our preferred course, as the tax losses mean it is in shareholders’ interests for Allied to invest in opportunities that generate taxable earnings.”

The board unanimously recommended approval of the transaction, being in the best interests of shareholders.

Allied will have $14m cash reserves and a carryover of $175m in tax losses from about a decade back.

Its shares are trading around 80c and have been unchanged for most of the past year.

It is in shareholders’ interests for Allied to invest in opportunities that generate taxable earnings.

Shelley Ruha Allied Farmers

DEMAND: New Zealand red meat exports reached $713 million during September on the back of continued strong demand.

BUILDING:

Shelley Ruha says Allied can confidently exit Farmers Livestock and redeploy the sale proceeds into investment opportunities that offer a stronger and more sustainable earnings profile.

Wild spring weather puts pressure on pilots

RELENTLESSLY challenging weather is putting agricultural safety in the spotlight, with the New Zealand Agricultural Aviation Association calling on pilots and farmers to prioritise the wellbeing of staff and contractors.

Tony Michelle, executive officer for the NZAAA, said ongoing severe weather and narrow weather windows across the country are putting pressure on agriculture aviators to get the job done, and could lead to poor decision-making and safety issues.

Michelle said there were 19 incidents in the first quarter of

this year involving aeroplanes and helicopters doing ag work.

In a couple of incidents helicopters hit wires.

He said in two cases pilots were said to have been distracted, an occurrence often associated with fatigue.

There’s been a significant uptick in aerial fertiliser and ag chemical applications as farmers scramble to promote spring growth.

However, “shocking weather” across the country has put pressure on pilots.

On top of that there’s been a reduction of capacity in the industry, with fewer operators to do essential work.

Those pressures mount up, leading pilots to operate on days, or continue operating in conditions,

Make good, rational decisions, based on the conditions, not on the pressure to get work done.

Tony Michelle New Zealand Agricultural Aviation Association

that are not safe, he said.

Michelle said pressure is often self-induced, when pilots think they have to get a job done, or arise from pressure from clients, who want to get, for example, fertiliser on, for reasons that are understandable.

“We can only get to the jobs when the weather’s suitable, and when we’ve had a spring like

we’ve had, we don’t have enough windows for operators to get out there and service their clients.

“Don’t take those risks. If things are getting to the point where you’re going, ‘Should I be here?’,

it’s actually time to pull the pin.

“Make good, rational decisions, based on the conditions, not on the pressure to get work done.”

Safety is a problem ag aviators face internationally, he said.

New-look national wool sale hailed a success

THE first of the national trials combining nationwide wool sales has met with “solid support”.

While the offering of wool from both the North and South Islands on the same day at the Christchurch Wool Exchange appeared to favour improvement more for the north, the inaugural nationwide sale has been hailed as a success.

“The trial format was well received, and trading activity suggests solid support for future South Island-based sales,” PGG Wrightson Wool North Island appraisal and procurement coordinator Annabel Busby said.

“Overall market sentiment remained firm, and most wool types maintained strong demand, reflecting continued buyer confidence.

“However, hogget wool experienced a slight softening, following a period of exceptional highs in recent weeks.”

The North Island strong wool indicator was up 19 cents with a 90% sale clearance.

Crossbred fleece good style lifted 5% to average $4.28 a kilogram clean with average and poor style lifting 7% at $4.26/kg and $4.23/kg.

RESILIENCE: South Island auction manager Dave Burridge says the crossbred end of the market showed ‘remarkable resilience’, ending the auction in the seller’s favour. Photo: File

Crossbred second shear fleece 75-100mm lifted 2-5% to $4.30/kg for good style and averaged $4.28/ kg while shorter fleece types lifted up to 8%, selling from $3.93/kg to $4.15/kg.

For the South Island the strong wool indicator lifted just 5%, also having a 90% sale clearance.

South Island auction manager

Dave Burridge said the crossbred end of the market showed “remarkable resilience”, ending the auction in sellers’ favour.

“The fine wool market after significant and extremely rapid rises is now experiencing a rollercoaster ride, with buyers now hesitating to show all the signs of the market becoming unstable in this sector,” Burridge said.

Good style crossbred fleece lifted 2% to average $4.67/kg clean with average and inferior style having no change from the previous South Island sale, selling at $4.50/kg and $4.30/kg while crossbred second shear also sold on a par with the previous sale at $4.24/kg for good style and $4.05/ kg for average.

In the fine wool Merino fleece best top-making all sectors took a downward dive with 16-micron down 11% at an average $23.40; 17-micron down 6% at $23.00/kg; 18-micron down 5% at $21.50/kg and 19-micron down 7% at $19.40/ kg.

Mid micron halfbred fleece average prices had 28-micron down 2% at $8.20/kg; halfbred hogget fleece 23-micron down 4% at $14.20/kg and halfbred fleece 25-micron down 12% at $10.70/kg. The next nationwide sale will be held at the Christchurch wool exchange on November 12.

Annette Scott NEWS Food and fibre

Gerhard Uys NEWS Safety

PRESSURE: Tony Michelle, executive officer for the New Zealand Agricultural Aviation Association, says ongoing severe weather across the country is putting pressure on ag aviators.

Beyond the Farm Gate: Diversi cation or Expansion for NZ Farmers?

A generational shift is occurring which could see over $150 billion in rural assets change hands, making the question of how best to invest farm capital more valuable than ever. Succession, risk management, and business resilience are top-of-mind for some of New Zealand’s farming families.

As we know, farming is a cyclical business. At present, we have the bene t of a low exchange rate, reasonable commodity prices, falling interest rates and farm values which are probably trending up, all of which is good. But farming families with foresight are looking through these good times and planning for the long term.

circumstances, and appetite for change. Below, we compare the two approaches, drawing on sector commentary, research, and specialist practical experience.

Diversi cation via O

-Farm Investment

O -farm investment

diversi cation means allocating capital into assets beyond the farm gate. This could include

O -farm investments may also help with succession planning, allowing liquid assets to be more easily split among family members or their income used to support Mum and Dad’s retirement independently from the farm business. Certain investment structures may o er tax e ciencies which are complimentary to taxable farm income.

Investing outside the farm gives access to growth sectors like

Another challenge is exposure to market volatility, including risks from share market downturns and uctuations in property cycles. O -farm investments may also yield lower returns than the potential long-term capital appreciation seen with prime farm property in strong years. There is also a degree of emotional detachment, compared to that of the family farm(s).

management, simpli es decisions, and supports technology adoption. If the farming business grows large enough this can, of itself, provide for family succession.

However, challenges arise when concentrating risk, as income and asset values become dependent upon the risks applying to a single commodity or sector, from market uctuations, climate change, or disease. Liquidity presents another issue, with land periodically being di cult to sell or divide. The complexity of succession is heightened if heirs lack either the interest or the capability to take over the family business. Capital demands may be considerable, requiring substantial initial investment as well as ongoing debt servicing.

With more than half of all farm and orchard owners to reach retirement age in the next decade, according to the Rabobank’s 2025 white paper, Changing of the Guard –Stepping up the Succession Conversation in New Zealand Farming, it makes sense that now is the time to plan and prepare. Traditionally, many farmers have chosen to expand their businesses during good times by buying more land. This approach o ers scale, operational control, and a sense of legacy. However, investment considerations are changing, some farmers are contemplating diversi cation through o -farm investments, allocating capital into assets outside the core farm business, such as equities or land-based investments. So, this raises the question, where to from here?

The right answer will depend on your goals, risk tolerance, family

Is their future outside the farm gate?

Factor O -Farm Investment Diversi cation

Risk

Liquidity

Succession

Management

Returns

Tax

Emotional Value

Resilience

Capital Requirement

kiwifruit, solar, forestry, rural commercial property (the o ers that MyFarm have available), or more broadly, managed funds, or equities. The aim is to create income streams that are less correlated with farm returns, reduce exposure to commodity cycles, and provide cash and assets (and liquidity) for succession and retirement.

If in the right structure, these assets can provide better liquidity than farms, making cash more accessible for emergencies or new opportunities.

Spread (multiple sectors, less correlated)

Higher (managed funds, shares, property syndicates)

Flexible (liquid assets, easier to allocate)

Requires nancial literacy, external advice

Whether you choose to expand your farm business or diversify through o -farm investments, the key is to match your strategy to your family’s needs, risk appetite, and long-term vision. As New Zealand’s farming sector faces its largest-ever intergenerational transfer of

Expanding Farm Business (Buying Another Farm)

Concentrated (commodity, climate, sector)

Lower (land can be illiquid, slow to sell)

Complex (hard to split, may force sale)

Requires operational expertise, time, and focus

Variable, collectively often more stable and predictable Potentially high in strong years, capital appreciation, can uctuate based on point in cycle.

Passive income, potential tax advantages

Lower (less direct involvement)

More resilient to downturns in any one sector

Variable, often lower

kiwifruit, renewables, and commercial property, without the need for direct management.

On the ip side, investing o the farm can present several challenges. One is the loss of control, as there is less direct in uence over how these investments perform compared to managing your own farm. This change requires a trust in external managers or advisers to make sound decisions on your behalf.

Expanding the Farm Business

Active income, need to manage tax

High (connection to land, legacy)

Vulnerable to sector shocks

High (land purchase, debt servicing)

wealth, the question is not just how to grow, but how to secure the future.

The information contained in this article is for general information purposes only. Any reliance you place on such information is strictly at your own risk. It is not intended to constitute legal or nancial advice and does not take your individual circumstances and nancial situation into account. We encourage you to seek assistance from a trusted nancial adviser, legal or other professional advice. Comparative table: O -farm investment vs. buying another farm

This could be through buying another farm, with the extra land either complimenting the core operation ( nishing block, runo ) or expanding it. This approach is familiar, tangible, often emotionally satisfying, and does provide advantages. Larger scale can lower costs, boost bargaining strength, and improve machinery and labour e ciency. Focusing on one enterprise sharpens

Disclaimer:

New Nuffield scholars span ag sectors

FOUR new Nuffield scholars have been announced, representing three regions and industries including dairy, aquaculture and red meat.

The cohort will undertake a Rural Leaders-delivered programme that offers a lifechanging opportunity for travel, study of the latest agriculture innovations and an introduction to decision-makers around the world.

The new scholars are Clare Bradley, a Bay of Plenty aquaculturalist; Jared Clarke, a Canterbury farmer; Kelly Heckler, an Otago farmer; and Tracey Perkins, a Canterbury farmer. They are the 194th, 195th, 196th and 197th New Zealand scholars respectively.

“Clare, Jared, Kelly and Tracey have shown they value giving back to community and industry. They display innovative approaches to their work, and they have demonstrated a track record of meeting challenges head on. Ultimately, they are now tasked with finding those deep insights that will create lasting benefit for New Zealand food and fibre, their industries and their communities,” said Kate Scott, Rural Leaders and Nuffield NZ chair.

NEW PRODUCT

• Clare Bradley, CEO AgriSea, Bay of Plenty Bradley is based in Paeroa with her children and husband, AgriSea chief innovation officer Tane. AgriSea CEO Bradley leads a 30-strong team pioneering seaweed-based bio-stimulants, animal health supplements, and high-value hydrogels for agriculture and biotechnology.

As the founding chair of the Aotearoa New Zealand Seaweed Association, and Rere ki Uta, Rere ki tai, Bradley is driving collaboration between Western science and mātauranga Māori to build a trusted, sustainable sector. Her Nuffield research is likely to explore the economic, environmental, and logistical viability of smaller, decentralised processing hubs and whether they can create local jobs, strengthen value chains, and enhance commercial resilience.

• Jared Clarke, farmer, Canterbury Clarke is a Canterbury dairy farmer with a strong record of performance, innovation and team development. From 2017 to 2022, Clarke and his wife Victoria operated Two Rivers Ltd, a 50/50 sharemilking business milking 2000 cows. In 2022, they formed an equity partnership and purchased Mount Rivers

Ltd, a 1000-cow irrigated dairy farm supplying A2 milk to Synlait. Under their leadership, the business has delivered high returns, sustainability initiatives and strong team retention.

Clarke is interested (and passionate) about the potential for a reduced reliance on imported energy, both on-farm and at a national level, and his Nuffield research is likely to be on the generation and storage of energy.

• Kelly Heckler, farmer, community leader, central Otago Heckler and her family farm Lauder Creek, a high-country sheep and beef property in the Manuherekia catchment of central Otago.

Heckler is a leader and advocate for sustainable food and fibre production, recognised for her commitment to intergenerational resilience in New Zealand’s primary industries.

As chair of Otago Water Resource Users Group, Heckler led the organisation through a major transformation, restructuring it into a formal incorporated society to improve accountability and adaptability. Heckler aims to build a resilient, intergenerational farming business and advance innovative farmplanning solutions that support people and environment. She is

exploring research in freshwater management with specific focus on water allocation in overallocated catchments.

• Tracey Perkins – farmer, sustainable land and water management adviser, founder of AgriThrive Perkins is a Canterbury-based dairy farmer, facilitator, and sustainable land and water management adviser who combines hands-on agricultural experience with a deep commitment to helping rural communities thrive. Living in Darfield on a 1050-

cow dairy farm with her partner Jonny and their three children, Perkins balances family life with leadership in sustainable land use and rural development.

As the founder and lead facilitator of AgriThrive, she is the only agricultural facilitator in New Zealand using a traumainformed, farmer-to-farmer approach. Perkins intends to explore The Third Model, an approach integrating Indigenous stewardship principles with the operational and economic realities of intensive agriculture to create a sustainable foundation for New Zealand’s future.

TwinG uard from Cor teva is the advanced solution for control of damaging pests in forage brassica crops.

TwinG uard protects your brassica crop by combining the proven actives Isoclast® and Jemvelva® to target key pests like nysius aphids and caterpillars.

With fast and effective control, IPM compatibilit y and a low environmental impact, TwinG uard is your go-to solution for reliable brassica crop defence

SCHOLARS: The new Nuffield scholars are, from left, Clare Bradley, Kelly Heckler, Tracey Perkins and Jared Clarke.

Keeping food real in a digital world

Neal Wallace in London MARKETS Trends

THEY are the digital natives, Generation Z, those born between 1997 and 2012 – they do not know a world without the internet, smartphones or social media.

They are also the next cohort to buy our meat, dairy and horticulture products, and they pose a very different marketing proposition to their parents and grandparents.

They are very much aware of the type of world they are inheriting, and can see through any halftruths.

Dr Morgaine Gaye Food futurist

Dr Morgaine Gaye, a Londonbased food futurist, said the perception is they are disconnected, obsessed with the social media and virtual worlds, which means they are divorced from the reality around them and not interested in it.

Believe that at your peril, she warned.

Generation Z is very much aware of what is happening and the type of world they are inheriting, and

can see through any half-truths.

As a food futurist, Gaye advises food companies on marketing and consumer trends, information she gathers from observations or from what could be considered disparate tidbits of information.

She told Farmers Weekly that, while Generation Z are more emotional than older generations and seek food and beverages that address those needs, they also seek the truth.

She described Millennials, those born between 1981 and 1996, as the curling generation because their parents acted like the sweepers clearing a path ahead of a curling stone that has been thrown down the ice as part of the sport.

Their parents do not want them to suffer as they may have.

Millennials are more interested in celebrities than in global issues, but Gaye said Generation Z are more militant, angry about the state of the world they are inheriting and leading protests on streets around the world seeking to drive change.

“They have been raised with the paradigm of get a job, get a better job, get a house, get a bigger house, get a mortgage, get a bigger mortgage, get a car, get a bigger car …

“They are now asking ‘Is that it? I’ve got so much stuff and now I’m not free and I don’t feel so good.’”

Gaye said those preparing to market goods to this emerging

generation must realise they are less trusting and will uncover what is real if they believe they are being fed false information.

“Using a picture of a cow wearing a hat with a daisy in her mouth? Forget it.”

They want to understand, they want reality.

“For them it is ‘Here is the truth, don’t sugarcoat it, make it real,’” said Gaye.

This generation are also focused in their health, which

is reflected in lower intakes of alcohol and caffeine than other generations, although surveys show consumption rates have started to rise.

Gaye said Generation Z are disillusioned by mass-produced food and see real food as coming from smaller producers but also from experiences, such as visiting farms and buying from cottage food producers.

Covid 19 caused them to look at their lifestyles, aspirations and what they were eating, such as the ingredients in alternative protein products.

Gaye said they realised they needed to change and they have gravitated towards nature and reality.

They are eating meat and dairy, but consuming smaller portions of high quality red meat.

She said Generation Z seeks experiences as opposed to surrounding themselves with consumer items such as clothes and shoes.

“Stuff is not what they want and that is what the paradigm of humanity has been telling them for a long time, buy more stuff.”

MORE: See pages 21, 27

There’s life in the WTO yet, experts say

Neal Wallace in London MARKETS Trade

THE current reshaping of world trade is realigning global relationships as countries seek to continue trading while reducing their economic risk.

Michael Gasioreki, Professor of Economics at the University of Sussex, said an example of this is that the United Kingdom and European Union are seeking inclusion in the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) trade deal involving 11 nations from the Pacific Rim and southeast Asia.

This is a conscious effort to work with like-minded nations in a part of the globe that is growing economically – and to also reduce exposure to China and the United States.

“They are reducing their reliance on China and the US economies, but also to move closer to growing emerging regions and to grow their geopolitical significance,” Gasioreki told Farmers Weekly.

The CPTTP deal also includes New Zealand.

There are about 300 regional free trade agreements internationally and Gasioreki said unlike the recent deals agreed to by the

United States after it imposed tariffs on trading partners, these FTAs include legally binding requirements and dispute resolution processes.

“All these deals the US has signed, there is no dispute resolution. It’s a handshake.”

In brokering these agreements, the US has adopted a mostfavoured-nation model that treats countries differently and links trade policy to economic and national security, both counter to World Trading Organisation (WTO) rules.

All these deals the US has signed, there is no dispute resolution. It’s a handshake.

Michael Gasioreki University of Sussex

“That is another reason it does not like the WTO.”

The US also does not like the EU’s deforestation rules, which require exporters of certain products, including – of relevance to US exporters – soy, timber and beef, to prove its production did not cause deforestation.

The US Congress is considering two Bills that would make it illegal for exporters to provide the EU with such information.

“The US debate is less about

trade but a denial of the environmental agenda and a way to stop the so-called Brussels effect, the over-reach of the EU,” he said.

The EU’s implementation of the deforestation rules has been delayed by at least a year.

Gasioreki disagreed that the WTO, and with it the rules-based trading system, is dead or close to death, a claim made widely by political and trade officials.

The US has declared it will not follow WTO rules and China “is close to its edges”, saying it no longer suits its purposes.

But the US accounts for only about 15% of world trade, which leaves 85% still governed by the WTO.

“The WTO still does good stuff and lots of countries still adhere to its policies.”

He said most of the world is willing to conform with WTObrokered trade rules.

“I think what we will see in the next period of time is countries signing a series of bilateral and plurilateral deals on selective issues.”

Carolina Maciel, a researcher in international trade and agrifood law at the university, said the

EU has amended imported food standards to ensure imports meet the same production requirements as domestic producers, a request from European consumers and farmers.

She said while the WTO operates on consensus, it allows for tailored chapters within agreements, such as the recent New Zealand-

UK free trade agreement. That agreement includes chapters providing greater clarity and detail on environmental and animal welfare outcomes than is usual.

She believes that will be the standard in future trade deals, but it will also accommodate differing production systems.

Wallace’s Meeting

Market tour has been made

NEW KIND OF CONSUMER: Food futurist Dr Morgaine Gaye says Generation Z are realistic about the food they eat.

TURBULENCE: The reshaping of world trade is causing a rethink, say University of Sussex academics Carolina Maciel and Michael Gasioreki.

Prof

Marketers eye year-round venison sales

Annette Scott MARKETS Deer

AGROWING appetite for year-round venison is a significant opportunity to get better value for New Zealand venison in the European market, say sector leaders.

Deer Industry NZ (DINZ) chief executive Rhys Griffiths and market activation manager Virginia Connell have returned from Europe “heartened and excited to give the market a more strategic look”.

The pair visited five countries, meeting with several in-market partners, and attended the Anuga trade show, the largest food and beverage show of its kind, held every two years.

Europe has historically been more of a commodity market,

with chilled seasonal bonuses for producers targeting food service during the game season.

After covid and the collapse of the global restaurant trade, DINZ and the NZ exporters started to explore greater value in other markets and channels to diversify demand, such as targeting North America and retail channels.

While there is still a sizeable commodity trade of venison in Europe, Griffiths came away encouraged by the number of companies actively seeking to add value.

“Noticeably, these were companies and people who cared about the provenance of NZ venison, who believed in it as a product and the power of the brand behind it.

“My impression of Europe is a lot more nuanced now.

“It really is a market of two sides,

with one side in that traditional commodity space, yes, but the other in a more growth-oriented, value-added space, and it’s that side of the market that is really exciting.”

Griffiths said from microeconomies like London, where food service is still going strong, to some great work going on in the Nordic states, to a growing appetite to feature venison yearround instead of relying on the traditional game season, “all represent significant opportunity for getting better value for NZ venison in the European market”.

Some of what is driving strong demand in Europe is a macro situation, driven by the global protein shortage, but there were some common themes across the countries and partners, areas that NZ deer farmers as producers and venison as the product are already strong in.

Connell said sustainability is big right now, but in a factsand-figures kind of way, not just beautiful scenery and marketing slogans.

“Verification and traceability are increasingly important, and these need to be backed by strong

EXCITING:

land stewardship and genuine environmental considerations.”

The other theme that came through loud and clear was the increasing focus on nutrition.

“Overall, it was a seriously informative market visit,” Connell said.

New velvet season ‘complicated time’ for market

Annette Scott NEWS Deer

THE new velvet season has got off to a “complicated start” with velvet producers encouraged to closely weigh up their selling options and look to partner with operators with skin in the game.

Speaking on a recent deer industry markets update webinar, Deer Industry New Zealand (DINZ) board director Tony Cochrane said: “Where we sit right now, we don’t have a price, similar to most velvet operators in NZ.”

Cochrane noted that stocks are currently built up in NZ’s overseas markets, particularly China, and that volatility is starting to show.

“This sets up the 20252026 velvet season as another complicated one.”

DINZ chief executive Rhys Griffiths concurred, saying prices are coming later than usual.

“Throw in an early spring weather event for some of our producers, and we feel for farmers

given the additional uncertainty,” Griffiths said.

“As always, our advice remains

the same: stick close to your buyers, weigh up your options closely, look to partner with those operators with skin in the game, and keep an eye out for DINZ updates.”

While this time of year is always something of a game of whispers, with the usual pre-season posturing in the market, there are reports of some margin traders again trying to drive down prices at the wholesale end.

On the demand side, South Korea, in the past driven by a booming health food market, has slowed due to the country’s economic headwinds, leading consumers to seek out less expensive substitutes, such as probiotics and vitamin supplements.

The health food sector is slowing due to a glut of products in the market, meaning more consumer choice and, while health functional foods (HFFs) is a promising

product category, the reality is that it will take a couple of years for volumes to lift.

Which leaves China, where there are currently already stocks of Korean-grade velvet awaiting processing.

End use demand in China is growing, albeit slowly, but brings with it different preferences for velvet, based on a several factors, including traditional opinions on what makes “good” velvet, as well as the ease of processing and associated processing costs.

Cochrane said the control of NZ velvet still rests in the hands of velvet growers to achieve fair value and not be led down a negative pathway by short-sighted buyers.

“Velvet is a niche, high-value product, not a commodity that can be easily replicated.”

November will see visiting delegations from several pharmaceutical companies from both South Korea and China.

DINZ chief executive Rhys Griffiths says a growth-oriented, value-added space in the European market is exciting for New Zealand venison.

OPTIONS: Rhys Griffiths urges velvet producers to weigh up options closely and look to partner with those operators with skin in the game.

Pāmu collars more land with virtual fences

PĀMU’S Eweburn Station in Te Anau is relying on virtual fencing to create efficiencies.

Speaking at a farm open day at the station, Halter president Andrew Fraser said the station was one of the first farms globally to

trial Halter collars on beef cattle, with feedback from the station critical to driving improvements on this front.

Eweburn station is 2879 hectares, with 2305ha effective, predominantly LUC 4. The station wintered 17,880 stock units in 2025, with more than 5000 sheep, 1300 cattle and 2900 deer.

Halter was introduced to the station last year, with a long-term

goal to collar all cattle aged over nine months.

Currently there are collars on 259 R2 beef bulls, 98 R2 trade heifers and 113 mixed-age cows.

Eweburn farm manager Ryan Thomson said virtual fencing is being effectively used to utilise older pasture, with collared animals doing an “excellent job”.

He said 112 cows were collared for calving this season, the first time the station has used collars on cows. It worked well.

Setting up for calving means you need a well thought-out paddock with feed. Cows with calves were separated into different virtual paddocks, he said.

Cows will creep-graze with calves at foot, he said.

He said paddocks that need to be locked up for silage will also be virtually fenced.

The station has had some teething problems with Halter, but has been collaborating with the virtual fencing company to use the challenges to make the collar more efficient.

For instance, collars were redesigned for growing bulls whose necks grow fast, with collars needing to be readjusted every couple of weeks.

Checking collars on seven mobs of bulls every month is a challenge, he said.

However, virtual fencing has enabled the station to run bulls efficiently without the need for “stick and strings”.

Being able to shift bulls daily “while having coffee in the morning” has been a bonus.

However, Thomson said, virtual fencing does not exclude the need for good stockmanship, and boots are needed on pasture to check stock and pasture daily.

Seventeen Halter towers were initially needed to create a mesh tower system to get connectivity across the entire farm, which has a lot of hill terraces.

FIELD-READY VALUE YOU CAN COUNT ON GET GEARED UP WITH CASE IH

But with technology improving fast, the farm now needs only five towers, with the redundant towers soon to be moved to a Pāmu farm on the West Coast.

Ballpark costs for Halter are $96 per collar per year, with a tower costing around $5000, once off. Thomas said with Halter being an ongoing cost, they want to make sure it is cost-neutral.

To this end they calculate how the technology can help them save money through reduced labour, fencing and the need for supplement feeding.

The technology must help them drive revenue, something they do by using 80%-plus of their pasture, well above the industry average.

Case IH is the trusted choice for mixed-farm enterprises to accomplish any task We focus on what matters most: outstanding manoeuvrability, operator-friendly design, compact dimensions, and a high power-to-weight ratio for maximum productivity

For a limited time, get a FREE RedXtend Total Protect warranty upgrade^ available on selected Farmall, Maxxum, Puma and Optum tractors that’s 3 years or 3,000 hours of total peace of mind Plus, lock in low 0.99% P.A finance^ over 3 years across the whole range. Field-ready value you can count on.

For more information visit caseih.co.nz or visit your local Case IH dealer

Gerhard Uys TECHNOLOGY Sheep and beef

WATER: Virtual fencing has been used at Pāmu’s Eweburn Station in Te Anau to maximise pasture use and keep cattle away from waterways.

Photo: Gerhard Uys

NEW GAME: Eweburn farm manager Ryan Thomson says Halter has been a game-changer at the station

Wool training heads to the Chathams

Staff reporter PEOPLE Education

THIS December, wool training will reach one of New Zealand’s most remote communities – Rēkohu, Wharekauri, the Chatham Islands – bringing hands-on skills and industry connection to local learners eager to step into the wool harvesting sector.

Agricademy wool training business Womolife, in partnership with Hokotehi Moriori Trust, Tāmata Hauhā and the Ministry for Primary Industries, will deliver the programme.

Chatham Islander Tommi Gregory-Hunt is managing the programme delivery, working closely with Agricademy, enrolling more than 30 people in online learning, followed by in-shed training courses. The goal is to build practical shearing and wool-handling skills while fostering long-term employment pathways.

“This is more than just training, it’s about creating opportunity in a place where access to industry support is limited,” said Womolife head trainer Carmen Smith.

“The learners here are motivated, resilient, and ready to contribute to the sector.”

Local shed owners have stepped up to support the programme, offering space, equipment and encouragement.

Cherie Tirikatene, general manager at Tāmata Hauhā said: “It’s great for the island, and our rangatahi aspirations and also for the farming and wool industries as a whole.”

The wool training initiative is currently the only programme of its kind in Aotearoa, making the Chatham Islands a national leader in hands-on

Ag sales growth slows as small businesses struggle

Gerald Piddock NEWS Agribusiness

SMALL Business Insights data from Xero for the September quarter shows that sales in the agriculture sector grew 3.3%, well down from 11.1% in the previous quarter to June.

Xero country manager for Aotearoa New Zealand Bridget Snelling said it is a concern to see agriculture sales slow as they have been one of the few bright spots in the New Zealand economy this year.

“The solid sales performance earlier in the year has supported jobs which were up 0.8% year on year, one of only three of the industries [Small Business Insights (XSBI)] tracks to record positive jobs growth in the September quarter,” Snelling said.

The XSBI data shows small businesses continued to struggle.

Sales rose in the quarter, recording the best result in two and half years, but this increase was only 1.9% year on year, making it a decline in inflation-adjusted terms.

wool harvesting education. It sets a precedent for other regions and Māori farming communities seeking to build local capability and employment pathways.

The project is part of a wider collaboration between Agricademy, Hokotehi Moriori Trust, and Tāmata Hauhā, whose work focuses on restoring indigenous ecosystems and unlocking multiple land use opportunities including carbon farming. Together, they are laying the foundation for a transformative programme that blends rural skills development with environmental stewardship.

This is more than just training, it’s about creating opportunity in a place where access to industry support is limited.

Carmen Smith Womolife

The programme will be documented on the WOMO and Tāmata Hauhā social media channels, with learner profiles, trainer interviews, and behindthe-scenes footage capturing the energy and impact of the training.

“We want to show the rest of New Zealand what’s possible when you invest in people, no matter where they live,” said Alister Shennan, Agricademy founder.

For more information, visit www.agricademy.co.nz/ womolife or follow Womolife on Facebook, Instagram and YouTube.

• Disclaimer: Dean Williamson, CEO of AgriHQ, is an Agricademy shareholder.

CooperAitken director Grant Eddy said the agriculture data should be put into context because it is difficult to make assessments of the sector based on quarterly data, particularly for the dairy industry.

For example, the income Fonterra farmers received depended on their advanced and retro payments and the nature of those payments make it hard to assess on a three-month cycle.

Farmer income could also vary due to other factors, such as payments from cull cows, he said.

Overall, it is a positive sign that nominal sales have started to grow again but conditions remain challenging for New Zealand small businesses.

Snelling said the star performers for 2025 have been the manufacturing and professional services industries, having recorded at least three consecutive quarters of positive sales and jobs growth, something that has eluded other industries.

Industries including construction, hospitality and retail continued to be challenged, recording sales growth results of -0.7%, 1% and

2.9% year on year, respectively. Construction was particularly weak, with jobs lower than a year ago for seven consecutive quarters. The September quarter showed jobs down 3.9% year on year. This was matched by a weak jobs result in hospitality and retail.

Stats NZ data shows these three sectors are the biggest employers of young people, and Snelling said that Xero’s results confirm that conditions remain tough in the job market, particularly for young people, with fewer opportunities out there.

However, “while we’re not out of the woods yet, there are some hopeful signs on the horizon, and the Christmas period will be telling. One way we can all bring some community spirit is by making an effort to shop local and support small businesses this festive season.”

Hardy perennial cracks top title

Scott PEOPLE Skills

IT’S a case of third time better for Lars Hardy, crowned Young Auctioneer for 2025 at the annual New Zealand Stock and Station Agents Association’s contest held at Canterbury Park.

Winning the coveted title is a mission accomplished for Hardy, who had been eyeing the winner’s podium for a few years.

Finishing runner-up last year, Hardy, 24, was gunning for more than the bid in his third shot at the prestigious industry title.

Contestants must be under the age of 30, and are required to demonstrate ability, first in an interview to test communication skills and knowledge of the terms

TOP: The top three Young

for

and conditions relating to livestock auctioneering, then in a practical live auction.

“I’d had a couple of goes … I didn’t want to be that guy that went at it for eight years and didn’t win,” Hardy said.

He has been in the industry for four years as a livestock agent with PGG Wrightson, starting in South Canterbury before transferring to the Central-Tararua district in the North Island, where has worked for the past two years.

From growing up on a sheep and beef farm in central Hawke’s Bay to becoming an agent, “I’ve always had a passion for the industry”.

“In my time as an agent I have grown a love for auctioneering and it has become a highlight of my job first doing a little bit down south but really growing into the art

after moving up north. I have been lucky to have ample opportunities selling at Stortford, Dannevirke and Feilding saleyards on a weekly basis under some top auctioneers in the country.

“I love the challenge, bettering myself and doing the best for clients and I’m pretty happy with this win. It was fierce competition this year.”

Hardy now looks forward to heading to Australia, where he hopes to gain more experience.

As well as carrying off the NZSSAA trophy and the Denis Hazlett Medal, as New Zealand champion Hardy gets the opportunity to exhibit his skills at the Sydney Royal Easter Show in 2026.

On his return he’s looking forward to climbing his way further up the ladder.

“I want to keep pushing my way up to the hierarchy in auctioneering, eventually getting to the stud stock.”

Young Auctioneer competition founder and co-ordinator Mick Withers said the eight-strong lineup from across the country was one of huge talent.

Dylan Forde from Carrfields Livestock Canterbury took out second place with Hamish MacDonald from Redshaw Livestock, Hawke’s Bay, coming third.

CLOSE WORK: Chatham Islander Tommi Gregory-Hunt is managing the programme delivery, working closely with Agricademy.

LOSING MOMENTUM: Agriculture, one of the few bright spots in the New Zealand economy, recorded a drop in the rate of sales growth for the September quarter.

Annette

ON

Auctioneers

2025 are, from left, Dylan Forde, who came second; champion Lars Hardy; and thirdplaced Hamish MacDonald. Photo: PGG Wrightson

Take nothing for granted.

When you activate your voluntary subscription to Farmers Weekly you’re preserving an information service no other farmers, anywhere else in the world, get for free.

• Farmers Weekly – the newspaper delivered to 74,000 mailboxes nationally.

• Farmersweekly.co.nz – the website, updated daily and visited by 220,000 people in October.

• Farmers Weekly podcast – new interviews with newsmakers every week.

• Farmers Weekly poll – where your view matters and decision-makers notice.

Thank you to the 1190 members so far, for not taking this service for granted.

To everyone else: Please join the team now. Details below, or call me directly at any time.

Kind regards

Dean Williamson – Publisher dean.williamson@agrihq.co.nz 027 323 9407

BECOME A VOLUNTARY SUBSCRIBER

Start your voluntary annual subscription today. $120 for 12 months. This is a voluntary subscription for you, a rural letterbox-holder already receiving Farmers Weekly every week, free, and for those who read us online.

Choose from the following three options:

Scan the QR code or go to www.farmersweekly.co.nz/donate

Email your name, postal address and phone number to: voluntarysub@farmersweekly.co.nz and we’ll send you an invoice Call us on 0800 85 25 80

Note: A GST receipt will be provided for all voluntary subscriptions.

‘Choose Your Hard’

Taupō farmer, coach and wellbeing facilitator Deanne Parkes shares her thoughts on keeping well on farm with Farmstrong.

Deanne, you wear many hats. What do you enjoy about farming and rural life?

Farming’s in the blood. My family are all farmers and I’m very proud to say that I’m a farmer. I love that sense of connection you have as a farmer with other farmers and the camaraderie with other local farmers when you stop to chat. I grew up on dairy farms, and we were dairy farming but just recently switched to sheep and beef, so I’m not hands-on as much anymore, but I’m still a farmer in so many different ways. I love it.

What are the main pressures you’ve seen in farming?

One of the biggest areas I have noticed that impacts farmers greatly is the lack of sleep they get compared to other industries. I don’t think farmers realise the lack of sleep, leading to fatigue is one of the reasons they feel as if they’re on the back foot all the time.

The other pressure is it can be very hard to switch off. Even when farmers go away on holiday they’re often wondering if there’s a water leak or what’s happening if the weather changes. That sense of constant demand can be draining. It’s a bit like having a tab open on your phone the whole time.

What can people do about this?

Farmers are so good at looking after their animals and crops. I think it’s about applying the same logic to yourself. If you look after yourself too you’ll be in better shape, make better decisions and be able give more back to the farm and your family.

How do you make lifestyle changes like that? Where do you start?

Identify the area to work on first, awareness is key. Everyone is different but what can work well is to treat it as a challenge. Look at the hurdles for something like sleeping better, start with a small change and work through them for a couple of weeks. Take the time to do these things rather than pushing them to one side. Enlist a support person, to help you keep

accountable and walk alongside you for the changes.

How do you make new habits stick?

It’s all about making little changes rather than everything at once. Pick one thing and tweak it. So if it’s sleep, it might mean just going to bed a half an hour earlier. Over a week that’s three and a half hours extra sleep. Those small changes can really add up.

That requires a change in mindset too, doesn’t it?

You’re right, and that can be tough to change, but it is possible. It’s a choice, I love the saying ‘choose your hard’. We know looking after our wellness can be tricky, but not looking after it is hard too. Which approach is going to benefit you and the farm in the long run? If we’re feeling fatigued and don’t make good decisions, it’s the farm and those around us who suffer.

We know looking after our wellness can be tricky, but not looking after it is hard too.

Deanne Parkes Taupō

What about peak periods like calving, lambing, harvest? Any advice?

Preparation is key. If you think of an athlete, they don’t just go straight into Super rugby without any prep, but farmers often just go straight into calving. If you notice that you’re always getting back problems during calving, do some prehab and strengthen that area. There’s so many options these days - you can even meet with a physio online.

You’re part of the Farmstrong champions network. What does being Farmstrong mean to you? It means being proactive, looking after ourselves for the now and future not waiting until we are unwell. Understanding your why helps to drive this. Why are you farming? Farmers are often

farmstrong.co.nz

putting everything and everyone before themselves, but if you talk to them the reason they’re doing it is for their children. So, if it’s all for your children, what example do you want to be setting? Is an exhausted parent with a sore back going to make them fall in love with farming? Think about how you can be role modelling to them.

How do you stay Farmstrong yourself?

I love practicing gratitude. Noticing three good things every day. Life might be difficult but if you can look for the good in your day, it’s a huge help mentally. It may be remembering ‘hey I got the cows milked’ or ‘I reached out to a friend’ or even just ‘my gumboots are dry’. What that does internally is create mood-boosting hormones. It’s also shifts your focus from ‘the pump’s not going ‘or ‘we’ve got a down cow’, to something more helpful.

How important are mental skills in farming?

Mental skills are important for everyone. I don’t think we’ve adopted them enough as an industry because we’re time poor, even though they could really add a lot of value to our ourselves and our businesses. Look at the All Blacks and the Super rugby teams and the time they spend creating a high-performing team culture with the right mindset. It’s massive. But in farming we don’t talk about the mental skills needed for farming, farmers often have the mindset ‘that is how it is’. We often get new teams together and expect everyone to hit the ground running during a highpressured calving with a lack of sleep and poor nutrition. If you want people to thrive in situations that are pressurised, focusing on their personal development including mental skills and setting up the right team culture is really important and can make a positive difference in so many areas.

It can be very hard to get downtime in farming. How important is rest and recovery? Extremely important – you

cannot perform at a top level if you are exhausted and depleted. I remember Dad telling me when I first went farming ‘Don’t do what I did. Don’t miss the kids sports. Have the time off.’ That was his one piece of advice!

So, my husband and I try to have regular time off and give staff time off, but we definitely felt pushback at times in the industry. The mentality was that you’ve got to do these hard yards to get ahead. It was like a badge of honour to say, ‘oh I’ve worked this many days in a row.’ That’s okay if you want to do that, but we need to look at the impact it has to us and our family and know that there are small changes that can be made to make life and farming more enjoyable.

So, what’s your advice?

I come from a sports coaching background and rest and recovery and mental fitness is absolutely vital to sustainable performance. It re-energizes people. When you’re looking at your season plan think about ‘where is my week off just to relax and recover sleep?’, because burnout is far more common than you think, but people don’t talk about it. Change is possible and it

starts with awareness and belief it can be better.

What’s your main message about keeping well on farm? Notice when our energy levels or mood are dropping so we can make changes and address things. Keep habits like Farmstrong’s 5 Ways to Wellbeing front of mind. Use them on a daily basis. Improving mental fitness isn’t hard to do, it’s about doing small things regularly. Take responsibility for how you can help yourself, we can’t wait for other people to come and save us. Changes do not have to be big, start small and those small changes lead to big changes over time. Reach out to someone if you do not know how or where to start.

MORE:

Farmstrong is a nationwide, rural wellbeing programme that helps people manage the ups and downs of farming and growing. Last year, 20,000 farmers attributed an increase in their wellbeing to the programme. For free, farmer-to-farmer tools and resources head to www.farmstrong.co.nz

is the official media partner of Farmstrong

TEAM: Deanne on farm with husband Ben, better known as Rani.

From the Editor

Nourishing the next generations

Neal Wallace Senior reporter

DETERMINING the wants and needs of the next generation of consumers is an imprecise science.

Try rationalising this: Millennials, those born between 1981 and 1996, are driven by feelings, focused on social media and influenced by celebrities. Generation Z, born between 1997 and 2012, are digital natives. The only world they know is one with the internet, smartphones and social media, but that doesn’t define them.

London-based food futurist Dr Morgaine Gaye says they want reality and have very different values and expectations to Millennials.

Generation Z are less trusting than their older cousins, which has helped curb the very real threat that alternative proteins once posed to meat and dairy consumption.

The covid epidemic prompted them to reconsider what they want out of life, and to

LAST WEEK’S POLL RESULT

look anew at the world they would inherit and what they were eating.

Inherently suspicious and questioning, they didn’t like the fact that they couldn’t recognise – let alone trust – many of the ingredients listed on the packaging of alternative protein products.

And therein lies a challenge for those marketing our food products: two emerging generations with two very different outlooks on life.

What was once another looming threat to meat and dairy producers is also stalling. The emerging protein fermentation process is far from being perfected or economically viable, and is plagued by requiring enormous amount of energy.

The general consensus is that demand for dairy and meat should stay buoyant for another year or two due to a combination of declining global production and sustained demand.

Dairy is enjoying what appears to be insatiable global appetite for protein and, while red meat faces some resistance due to price, consumers continue to trust it and recognise its health and dietary attributes.

And that includes Generation Z.

They love dairy protein and while they won’t sit down to a large steak every night, they will regularly eat small portions of quality red meat.

They are a generation who want the truth, and products and experiences that

Fonterra farmers seem poised to take the sensible option when it comes to spending their Lactalis payout.

Voters were asked how they would use their cash windfall: on debt repayment, infrastructure, tech solutions, improved sustainability or other.

Almost 70% (68.3%) of voters said they would be using the money to pay back debt. “Banks will have their hands out, don’t worry,” said one. Another felt the question would have been better if they were asked to rank the options. “A choice of just one option is unlikely to reflect the decision-making reality for most farmers. The answer depends upon existing debt/equity in the property, need for improved or replacement of a structure, tech solutions with high payoff and improved sustainability if the farm can convert this to profitability.”

Of the 4.1% who voted for tech solutions, one believed it was important to “pay it forward. Pay more for talent, improve housing standards, improve cowsheds and other infrastructure efficiencies, provide 50% s/milking jobs, option to lease land, buy parts of farms – to those that are the future.”

Just 2% voted for other, “Whatever each individual farmer wants to do – it’s their money,” said one.

are real. They will quickly see through any whitewashing or attempts to dupe them.

They suffer from high rates of depression and other mental health challenges and live in the virtual world, but that does not mean they are disconnected.

They have a very definite values and expectations, and are genuinely interested in the world around them. They will call it as they see it.

They are emotionally driven, and this creates opportunities as they seek food and beverages to help them deal with stress and anxiety.

They do not accept a life driven by getting a job, a house, a mortgage, and they also don’t accept what they see as global injustice. They are unhappy with aspects of the world they will inherit and are marching in the streets saying so.

Generation Z will also lead the next major consumer trend: improved individual immunity and health.

They will use tools and gadgets to determine their health, and seek food that provides the necessary micronutrients to enhance their individual health and improve immunity.

It wasn’t so long ago that consumer trends posed a major threat to animal protein consumption.

That risk may have eased a little, but the challenge of connecting with the latest consumer cohort remains.

Last week’s question: What should Fonterra farmers prioritise when the Lactalis payout arrives?

Letters of the week On the side of piglets

Dave Stanton Geraldine

AS SHEEP, beef and deer farmers in South Canterbury we free-range-farmed four mated sows a year.

And we concluded pigs are terrible mothers.

My four sows could farrow absolutely anywhere. Each farrowed in different locations – haybarn, side of a dry creek, utility shed etcetera.

The sows had 11-13 piglets each. One runt died and then over a month the mothers lay on, squashed, suffocated and killed all but five of their piglets each.

I would often hear the sound of a screaming piglet. Mum had laid down on it and wouldn’t roll over. I rescued piglets multiple times, but simply could not be there 24 hours a day, seven days a week to help them.

I’m on the side of the piglets’ welfare, survival and livelihood. Certainly over one sow’s temporary, momentary discomfort. We have regulated 600 piglet farmers out of business – the many pig farmers in this country who have simply given up due to the burden of government regulations.

Then, instead of producing our own hormone-free NZ pork, we are choosing to import the pork from countries which have far worse farm practices than we would ever allow in NZ farming.

We are simply exporting the problem.

Keeping fawns in mind

Tony Orman Marlborough

FURTHER to my letter, “A resource to be managed” (November 3), on wild game management, I should have added managing numbers will involve shooting hinds in the months September to mid-November to allow (a) the rising one-year-old youngster to develop through the winter and (b) to avoid leaving newborn fawns to slowly starve in late November-December.

After all, no farmer would take a ewe away from its newborn lamb. It’s important to keep deer numbers well within the carrying capacity of the habitat for both the environment and the wellbeing of animals.

Best letter WINS a quality hiking knife

Send your letter to the Editor at Farmers Weekly P.0. Box 529, Feilding or email us at farmers.weekly@agrihq.co.nz

Selling the farm and our future

Eating the elephant

AOTEAROA New Zealand’s economic foundation is being sold from under our feet.

In the past five years, we’ve seen more and more control slip away from New Zealand farmers and communities. From the dairy factories that process our milk to the brands that carry our reputation around the world, decision-making power and profits are quietly migrating offshore.

Fonterra is exploring the sale of

its consumer business, including Anchor, our most iconic brand, to French dairy giant Lactalis, which is paying a premium for an Asia Pacific-focused brand and valueadd platform.

Tip Top moved into Froneri’s portfolio in 2019. Westland Milk Products was acquired by China’s Yili that same year. Silver Fern Farms sold half its operations to Shanghai Maling. Synlait sold its North Island plant to Abbott, and Alliance has just sold almost two-thirds of the company to the Irish. Goodman Fielder, maker of our everyday staples, became fully owned by Singapore’s Wilmar International in 2019.

Each of these sales might make sense commercially when viewed on its own. But together, they show a clear pattern – New Zealand is becoming a price-taker in its own food system. Farmers and rural communities carry the risk while control and profits shift overseas.

We’re giving the next generation(s) a hospital pass, driven by four key areas: selling assets to meet short-term pressures instead of backing long-term returns; relying too heavily on offshore capital for investment; lacking a clear NZ Inc primary sector vision and strategy; and holding onto outdated ideas that treat national

ownership as a problem rather than a strength.

The cost of losing control is real. When ownership moves offshore, decision-making follows.

Choices about where processing happens, what gets invested in, and whether local facilities stay open move to boardrooms in Shanghai, Waterford or Singapore – not Wairoa, Invercargill or Fanshaw Street.

That means fewer jobs, less resilience, and farmers and communities left taking what they’re offered instead of shaping the future together.

This isn’t about shutting out foreign capital. It’s about being strategic. Many other agricultural nations protect key food assets (like energy and banking) while still welcoming international investment.

We can do the same.

First, we need to define what matters most. That means having

Farm plans top consents for freshwater management

In my view

REGULATED freshwater farm plans were the brainchild of the previous government. While the current government has promised to make them more practical, we remain concerned.

Beef + Lamb New Zealand has long supported integrated farm planning. Done well, it helps farmers manage risk and build value with plans tailored to their needs and completed by farmers themselves.

But integrated farm planning is very different from a regulatory farm plan, which brings with it costly and onerous certification and auditing.

We know many dairy farmers and their representative organisations support farm plans. Memories of anti-dairy farming campaigns remain fresh, and protecting social licence is understandably a priority.

In practice, though, dairy companies often do most of the technical work for their suppliers, removing the burden from farmers. For red meat producers, the

situation is very different. Farmers often supply multiple processors, and companies cannot provide the same level of support.

In some cases, where farms already require a resource consent to operate, replacing that costly consent process with a fit-forpurpose audited farm plan makes sense.

However, regulated farm plans should replace consents, not be added on top of them.

The reality is most farmers are already highly attuned to their environmental responsibilities.

But if a farmer is not undertaking a high risk activity that would require a consent, and the farming practices are permitted, the regulatory farm plan framework has to be significantly different.