Q4 2025 Market Snapshot

Q4 2025 at a Glance

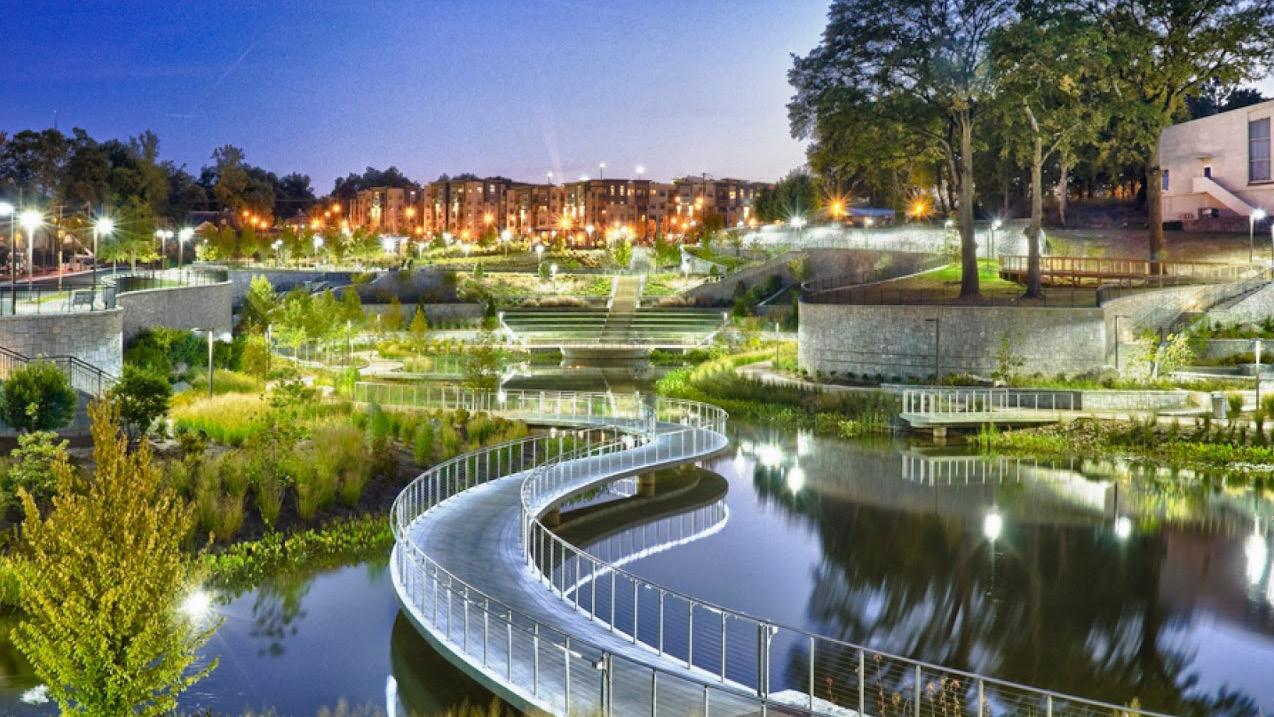

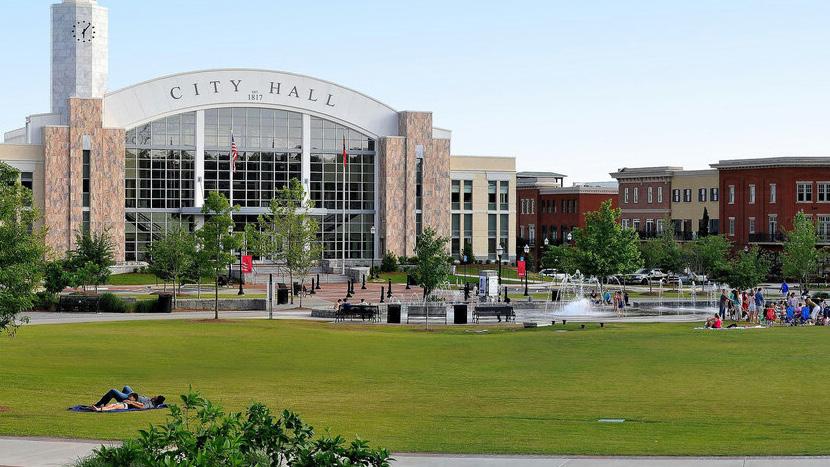

Across The Greater Atlanta Area

Source:

12,242 Homes Sold

$525,087 Average Sale Price

4 Months of Inventory

50 Average Days on Market

Q4 2025 Market Snapshot

Across The Greater Atlanta Area

Source:

12,242 Homes Sold

$525,087 Average Sale Price

4 Months of Inventory

50 Average Days on Market

Q4 2025 compared to Q4 2024 demonstrates stability in Metro-Atlanta real estate, with the market experiencing typical seasonal trends and only minor adjustments. Closed sales declined 3.7% to 12,242 from 12,717, while pending sales decreased 4.3% to 10,740 from 11,221. The median sales price declined 2.1% to $410,000 from $419,000, while the average sales price increased 1.1% to $525,087. Despite the modest declines, this pricing pattern indicates core market stability.

Active listings rose 13.9% from 15,651 to 17,830, providing buyers more selection. Days on market extended from 43 to 50 days, and months of supply increased from 3.5 to 4.0 months. These metrics indicate a more balanced market where homes take longer to sell and buyers have gained negotiating leverage.

Suburban markets outperformed the City of Atlanta in Q4 2025. Single-family homes, concentrated in suburban areas, represented 79.6% of market activity with 9,750 sales and an average price of $541,790. These properties averaged just 48 days on market compared to 69 days for condominiums. Suburban markets also offer the bulk of more affordable housing options under $500,000, which accounted for 64% of total sales.

Year-over-year listing status data reveals important market dynamics. Expired listings increased 20.9% for detached homes and 39.5% for attached homes. Withdrawn listings also rose substantially, with detached homes up 33.0% and attached homes up 10.4%. These increases indicate more homes are failing to sell and being removed from the market. Days on market increased across all listing statuses, with sold attached homes showing the most dramatic increase of 40.9%. Notably, sold detached homes were the only category to experience list price appreciation at 2.7%, while sold attached homes saw list prices decline 11.2%, reflecting the ongoing challenge of selling condominiums.

Market conditions throughout Q4 confirmed the shift toward buyer leverage. The average number of showings required to secure a contract increased to 12.8. More significantly, the average sale price to original list price ratio declined to 94.8% from 95.8%. The disconnect between mortgage rates and buyer activity continued through Q4, suggesting factors beyond financing costs are influencing decisions.

Pricing strategy has become the defining factor separating successful sales from stagnant listings. Homes priced competitively from the outset continue to attract buyers and close within reasonable timeframes. Those testing higher price points face longer market exposure, reduced buyer interest, and eventual price reductions that position sellers unfavorably. Properties aligned with current market conditions achieve results, while those priced on hope or outdated comparables struggle to generate activity.

Buyers are operating under more advantageous market conditions. Increased inventory, extended marketing times, and enhanced negotiating position allow prepared purchasers to be selective and strategic. This environment rewards thorough market knowledge and decisive action when the right opportunity presents itself. That said, market dynamics can vary wildly for select homes in high demand areas so, short selling periods with high interest with multiple offers is still a reality.

Looking ahead to 2026, national forecasts from the National Association of REALTORS and leading housing economists suggest cautious optimism. NAR Chief Economist Lawrence Yun projects a 14% nationwide increase in home sales for 2026 as affordability improves and mortgage rates potentially decline further. Nationally, mortgage rates are currently about 6% but are expected to average 6.2-6.3% in 2026, representing improvement from recent peaks.

For Metro-Atlanta, the outlook points to continued stabilization. Limited inventory, sustained demand for well-located homes, and strong economic fundamentals are expected to support price stability. The market is projected to remain balanced, with modest price growth in the 2-4% range for well-positioned properties in areas that are sought after by consumers.

Metro-Atlanta’s real estate market has transitioned to a more balanced environment where both buyers and sellers can achieve their objectives with realistic expectations and sound strategy. The fundamentals of job growth, population inflows, and economic diversification remain strong and continue supporting long-term stability.

The real estate industry has experienced significant consolidation in recent years, with many companies being absorbed into larger organizations. In this environment, the commitment to the individual consumer has often been diluted as corporate priorities take precedence. Engel & Völkers Atlanta operates differently. We are one brand with a unified commitment; serving our clients first. Our advisors provide authentic expertise, credibility built on proven results, and the stability to guide you confidently through changing market conditions. This singular focus on client success, rather than corporate mandates, distinguishes our approach and ensures that your interests are our priority.

To learn more about homes selling in your neighborhood or dream location, or to understand current market conditions, reach out to your Engel & Völkers Advisor.

Christa Huffstickler Founder and CEO, License Partner

Source: FMLS InfoSparks, Greater Atlanta Area, All Home Types, Q4 2024 - Q4 2025

Source: FMLS InfoSparks, Greater Atlanta Area, All Home Types, October 2025 - December 2025

Q3 2025 $499,999 <

Q3 2025

Source: FMLS InfoSparks, Greater Atlanta Area, All Home Types, January 2025 - December 2025

Inside The Perimeter

Source: FMLS, InfoSparks, Q4 2025 (10/1/25 to 12/31/25)

$1,399,000

Source: FMLS, InfoSparks, Q4 2025 (10/1/25 to 12/31/25)

Source: FMLS, InfoSparks, Q4 2025 (10/1/25 to 12/31/25)

Source: FMLS, InfoSparks, Q4 2025 (10/1/25 to 12/31/25)

Source: FMLS, InfoSparks, Q4 2025 (10/1/25 to 12/31/25)

Source: FMLS, InfoSparks, Q4 2025 (10/1/25 to 12/31/25)

Source: FMLS, InfoSparks, Q4 2025 (10/1/25 to 12/31/25)

Source: FMLS, InfoSparks, Q4 2025 (10/1/25 to 12/31/25)

Source: FMLS, InfoSparks, Q4 2025 (10/1/25 to 12/31/25)

Source: FMLS, InfoSparks, Q4 2025 (10/1/25 to 12/31/25)

Source: FMLS, InfoSparks, Q4 2025 (10/1/25 to 12/31/25)

Source: FMLS, InfoSparks, Q4 2025 (10/1/25 to 12/31/25)

Source: FMLS, InfoSparks, Q4 2025 (10/1/25 to 12/31/25)

Source: FMLS, InfoSparks, Q4 2025 (10/1/25 to 12/31/25)

Outside The Perimeter

$832,500

Source: FMLS, InfoSparks, Q4 2025 (10/1/25 to 12/31/25)

Source: FMLS, InfoSparks, Q4 2025 (10/1/25 to 12/31/25)

Source: FMLS, InfoSparks, Q4 2025 (10/1/25 to 12/31/25)

Source: FMLS, InfoSparks, Q4 2025 (10/1/25 to 12/31/25)

Source: FMLS, InfoSparks, Q4 2025 (10/1/25 to 12/31/25)

Source: FMLS, InfoSparks, Q4 2025 (10/1/25 to 12/31/25)

Source: FMLS, InfoSparks, Q4 2025 (10/1/25 to 12/31/25)

Source: FMLS, InfoSparks, Q4 2025 (10/1/25 to 12/31/25)

Source: FMLS, InfoSparks, Q4 2025 (10/1/25 to 12/31/25)

Source: FMLS, InfoSparks, Q4 2025 (10/1/25 to 12/31/25)

Source: FMLS, InfoSparks, Q4 2025 (10/1/25 to 12/31/25)

Source: FMLS, InfoSparks, Q4 2025 (10/1/25 to 12/31/25)

SINGLE-FAMILY HOMES

$427,500

Source: FMLS, InfoSparks, Q4 2025 (10/1/25 to 12/31/25)

Source: FMLS, InfoSparks, Q4 2025 (10/1/25 to 12/31/25)

Source: FMLS, InfoSparks, Q4 2025 (10/1/25 to 12/31/25)

Source: FMLS, InfoSparks, Q4 2025 (10/1/25 to 12/31/25)

$369,000

Source: FMLS, InfoSparks, Q4 2025 (10/1/25 to 12/31/25)

$354,000

Source: FMLS, InfoSparks, Q4 2025 (10/1/25 to 12/31/25)

$822,500

Source: FMLS, InfoSparks, Q4 2025 (10/1/25 to 12/31/25)

$293,000

Source: FMLS, InfoSparks, Q4 2025 (10/1/25 to 12/31/25)

Source: FMLS, InfoSparks, Q4 2025 (10/1/25 to 12/31/25)

Source: FMLS, InfoSparks, Q4 2025 (10/1/25 to 12/31/25)

Source: FMLS, InfoSparks, Q4 2025 (10/1/25 to 12/31/25)

Source: FMLS, InfoSparks, Q4 2025 (10/1/25 to 12/31/25)

Source: FMLS, InfoSparks, Q4 2025 (10/1/25 to 12/31/25)

TOWNHOMES $507,450

Source: FMLS, InfoSparks, Q4 2025 (10/1/25 to 12/31/25)

Source: FMLS, InfoSparks, Q4 2025 (10/1/25 to 12/31/25)

$450,000

Source: FMLS, InfoSparks, Q4 2025 (10/1/25 to 12/31/25)

Source: FMLS, InfoSparks, Q4 2025 (10/1/25 to 12/31/25)

Source: FMLS, InfoSparks, Q4 2025 (10/1/25 to 12/31/25)

$392,000

Source: FMLS, InfoSparks, Q4 2025 (10/1/25 to 12/31/25)

Source: FMLS, InfoSparks, Q4 2025 (10/1/25 to 12/31/25)

Source: FMLS, InfoSparks, Q4 2025 (10/1/25 to 12/31/25)

Source: FMLS, InfoSparks, Q4 2025 (10/1/25 to 12/31/25)

1

$885,000

Source: FMLS, InfoSparks, Q4 2025 (10/1/25 to 12/31/25)

$414,000

Source: FMLS, InfoSparks, Q4 2025 (10/1/25 to 12/31/25)

Source: FMLS, InfoSparks, Q4 2025 (10/1/25 to 12/31/25)

The following key indicators are used throughout this report to describe market trends:

Properties that are currently listed for sale on FMLS. Additional properties may be for sale at any given time— such as for-sale by owner homes or off-market listings— but are not included in the count of “active listings” in this report if they are not in the FMLS database.

New listings are those that have been added to FMLS in a given month. They do not include active listings that were entered in previous months.

Closed sales represent homes that have sold and transactions have been finalized. This indicator tends to lag market trends slightly because properties typically close one to two months after an offer has been accepted and buyers have locked their interest rates.

Pending sales are properties that have accepted an offer from a buyer and is in the due diligence period. The sales transaction has not happened yet. This is a leading indicator because it give us insight into how buyers and sellers are reacting to the most current market conditions.

The sale price is the final amount paid for a home. It is measured as either an average or a median, with the average price tending to be skewed higher by the highest priced homes. It does not reflect seller concessions, such as closing costs that may have been paid.

Days on market (DOM) measures how long it takes from the time a home is listed until the owner signs a contract for the sale of a property. This tends to vary based on the desirability of a given property, market conditions, and season.

The sale price to list price ratio (SP/LP) indicates if a home sold at (100%), above (>100%), or below (<100%) the listed asking price. The sale price to original list price ratio (SP/OLP) compares the sale price to the original asking price, as the current asking price may have reflected price changes.

Months of inventory indicates how long it would likely take to sell currently listed homes, if no new inventory were added. It is measured as a ratio of active listings to homes sold. 5 to 6 months of inventory is considered a balanced market. Less than 6 months supply tends to favor sellers, and more tends to favor buyers.