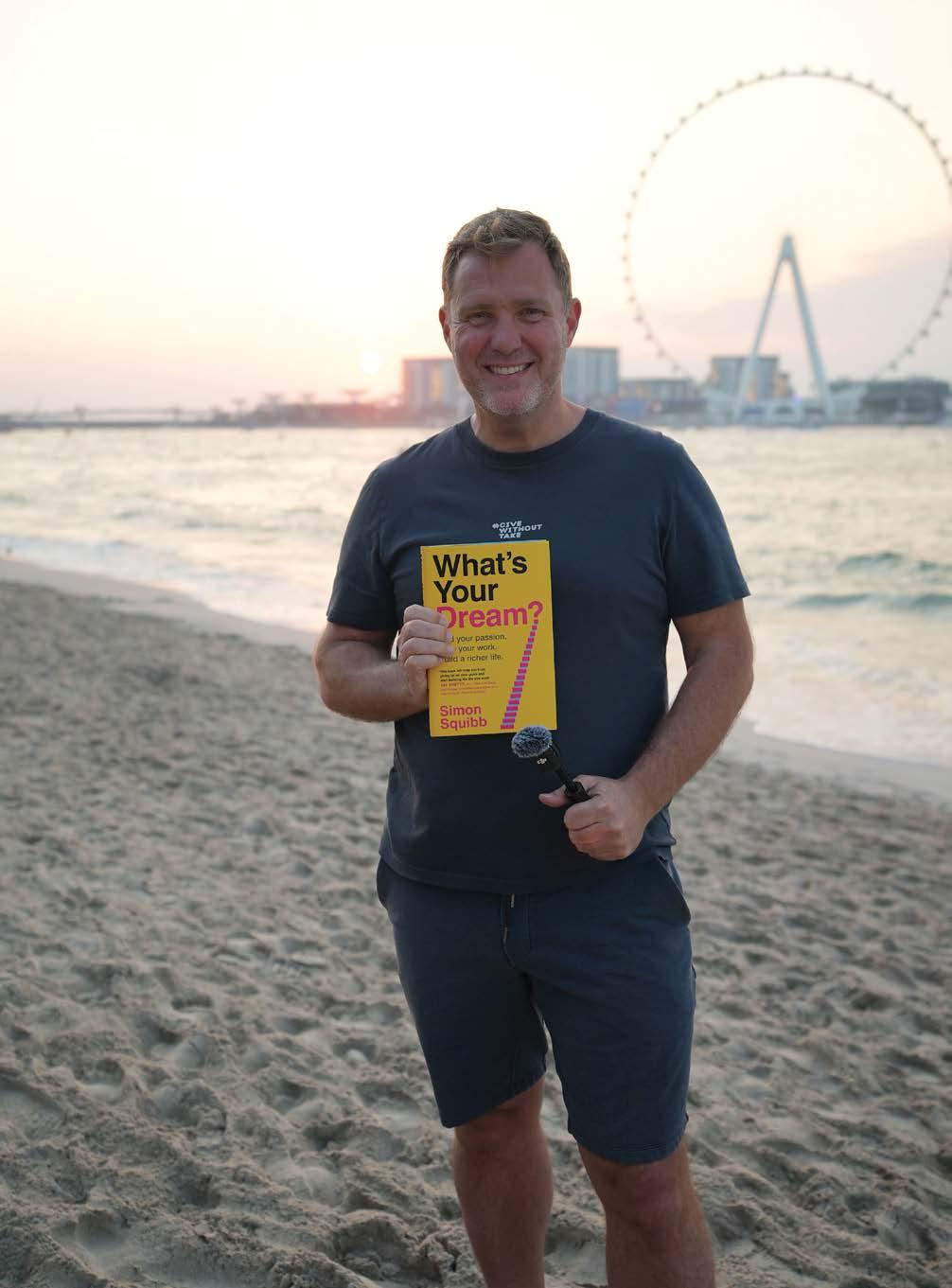

Simon Squibb wants to transform job centres into ‘dream centres,’ boost financial literacy, and revamp the UK start-up scene

20 After the Win Before the Wave

InSilicoTrials wins at The AI Summit London 24 Sharp Instincts in the Age of AI Entrepreneur James Caan reveals all

FEATURES EDITOR Patricia Cullen patricia.cullen@bncb2b.com

CEO Wissam Younane wissam@bncpublishing.net

MANAGING DIRECTOR Rabih Najm rabih@bncpublishing.net

ART DIRECTOR Simona El Khoury

EDITORIAL TEAM Tamara Pupic, Aalia Mehreen Ahmed

MEDIA SALES MANAGER Olha Kovalova olha.kovalova@bncb2b.com

GENERAL MANAGER Daniel Malins daniel@bncb2b.com

REGIONAL DIRECTOR Andy B. andy@bncb2b.com

CONTRIBUTING WRITERS Omar Hamdi, Kamales Lardi, Callum Scott, Elliot Kay

SUBSCRIBE Contact subscriptions@bncb2b.com to receive Entrepreneur United Kingdom every issue.

COMMERCIAL ENQUIRIES sales@bncb2b.com

Access fresh content daily on our website

Entrepreneurship is often portrayed as a straight line - start here, scale there, and success follows. But for many, the journey is more like a labyrinth: winding, unpredictable, and full of unexpected turns. In this Entrepreneur UK July issue we catch up with Karim Fatehi MBE, Chief Executive of the London Chamber of Commerce, where he champions London’s business community with cautious optimism. The capital has long been the heartbeat of UK entrepreneurship, drawing founders with its vibrant ecosystem and vast opportunities. For many, London remains the centre of gravity. Yet, as our feature Life After London reveals, stepping outside the city also offers something incredibly worthwhile.

Across the country, a growing number of entrepreneurs are choosing to build their businesses beyond the capital. These founders aren’t turning their backs on The Big Smoke; rather, they’re seeking environments that offer a different kind of opportunity - closer ties to community, a clearer sense of purpose, and the freedom to innovate without the constraints of urban congestion and cost. Their stories remind us that entrepreneurial spirit thrives in many places here in the UK, not just in a London postcode. In another feature, James Caan CBE, entrepreneur and

investor, offers sharp insight into a vital element for today’s founders: judgment. In an era dominated by artificial intelligence (AI) and data, Caan argues that instinct and experience remain irreplaceable. For all the hype around technology, it’s the human ability to read a room, assess risk, and make bold decisions that still gives leaders their edge. Meanwhile, Tom Wood, Head of Business Banking at HSBC, shares how his team supports the next generation of UK entrepreneurs - not just by providing finance, but also guidance. It’s a reminder that behind every ambitious business is a network of support, often working quietly in the background. This month’s cover feature spotlights Simon Squibb, the founder and CEO of HelpBnk - a platform designed to help people start and grow businesses while being rewarded for supporting others. HelpBnk has grown into a vital community for over 250,000 members, and Squibb’s social media channels attract half a billion views each month. He didn’t want to be an entrepreneur - he had to be one. From his early days as a teenage gardener to becoming a leader in community-driven start-up support, his journey reflects how necessity can evolve into purpose. Inside, we explore Squibb’s perspectives on disrupting education, fostering growth, and making entrepreneurship accessible to all. At the heart of his approach is a simple but powerful question he asks: ‘What’s your dream, and how can I help you turn that into a reality?’ Now, that’s what I call dreamy.

In this July issue of Entrepreneur UK, we explore why so many businesses struggle to secure funding - and share practical ways to fix it. We also delve into the often unspoken reality of loneliness in business and how community can be a lifeline. Other features include start-ups tackling food waste, and a deep dive into the art of building trust before traction - a vital but often overlooked step in early business growth. Finally, for those with global ambition, we turn to an expert for clear-eyed advice on expanding to the UAE.

Entrepreneurship isn’t about ticking boxes or following a script. It’s about chasing your dream, finding your people, and embracing every twist along the way. That kind of journey changes everything.

Hope you enjoy the read!

Patricia Cullen

Features Editor, Entrepreneur United Kingdom

PATRICIA CULLEN

London is known as the epicentre of UK innovation - a glittering magnet for entrepreneurs, investors and talent alike. The city’s sprawling start-up ecosystem pulses with opportunity: networking events, venture capital firms, accelerators, and a dense community

of like-minded disruptors. But beneath the surface, a quiet revolution is unfolding across the North, in cities like Manchester, where founders are challenging the assumption that success means being based in the capital.

The story of these northern start-ups is not one of scarcity or compromise, but of strategic choice and unexpected advantages. For founders like Harvey Lowe, co-founder of Arcube, a travel sector start-up, and Jana Stella, founder of NeuWave Technologies - both residents of Sister, Manchester’s £1.7bn innovation district - the decision to build outside London has been liberating. Sister is fast becoming one of the UK’s leading innovation districts, providing a fertile ecosystem for ambitious start-ups to thrive beyond the capital.

Lowe explains: “For a lot of companies, they are located in London to be closer to other start-ups, suppliers, clients, etc. However, operating in London comes with significantly higher costs, which can be challenging for start-ups - especially when a London base isn’t essential. For us – operating in the travel sector - being located in the capital isn’t critical for reaching customers or prospects as we often travel to international events to meet airline companies.” Manchester offers Arcube benefits that might be overlooked by a capital-centric mindset.

“We’re linked very closely with the university, and are able to tap into great graduate and higher education talent pools, which would be harder to connect to given the expanse of the ecosystem in London,” Lowe says. That local connection extends to suppliers too. “We also see that a surprising number of our suppliers are actually based in Manchester, Leeds and the general North. It’s great to meet these people in-person which wouldn’t happen if we were down South.”

Stella echoes these advantages from a highly specialised sector. “Our sector requires a niche skillset (in wave modelling and oceanography)

→ Harvey Lowe, co-founder of Arcube

“People assume being outside London means you have less access to opportunity, capital, and talent. The reality for us is that we’re less distracted by the noise, and we can work with a leaner team without compromising on quality”

where the speciality really lies outside of London. Being in Manchester means we can tap into our technical network easily. We’ve also really benefitted from local initiatives for office space and funding.” Cost efficiency is another critical factor: “It’s definitely helped from a cost perspective. Building a start-up already requires close monitoring of expenditure, so the

funding outside of London stretches much further.”

Both founders challenge the myth that location limits access to capital and opportunity. “People assume being outside London means you have less access to opportunity, capital, and talent. The reality for us is that we’re less distracted by the noise, and we can work with a leaner team without compromising on quality,” Lowe says.

→ Jana Stella, founder of NeuWave Technologies

BUILDING OUTSIDE THE CAPITAL GIVES US MORE FREEDOM. WE’RE ABLE TO MAKE DECISIONS WITHOUT BEING CAUGHT UP IN THE NOISE OR TRENDS THAT MAKE UP THE LONDON SCENE. THERE’S LESS PRESSURE TO FOLLOW WHAT EVERYONE ELSE IS DOING”

Stella adds, “It’s industry dependent, but for us it hasn’t been the case. Sure, a lot of our investment is London based, but it’s only a

train ride away. Our customers are all over the British coastlines.”

For Lowe, the quality of life is tangible: “I only have a 25

minute ‘commute’ (walk) to the office in the morning given that the city is so walkable!” Despite occasional questions about

location - “People outside the UK sometimes ask if we’re based in London” - it’s never really a concern. “We are two hours away from London if we have to be there for a meeting or event.”

Freedom from the London bubble is the real prize.

“Building outside the capital gives us more freedom. We’re able to make decisions without being caught up in the noise or trends that make up the London scene. There’s less pressure to follow what everyone else is doing,” Lowe says. Minor inconveniences like “slightly longer travel times” don’t slow progress. “We’ve got all the access to capital, talent, and opportunity we need. The trade-off is worth it and we aren’t looking back.”

Alongside the technical and operational advantages championed by Lowe and Stella, Rachel Morgan-Trimmer, founder of Firebird - a Manchester-based neurodivergent consultancy - highlights a more intangible but equally crucial benefit: community. “People always say the North is friendlier but it really makes an impact when it comes to networking, helping other people out, etc.” For Morgan-Trimmer, this warmth isn’t just anecdotal; it’s an essential pillar for building a business rooted in inclusivity and connection. As a neurodivergent entrepreneur, she also appreciates practical lifestyle differences. “Travelling about is a bit easier, partly because it’s less crowded and city centres are more concentrated.”

Morgan-Trimmer challenges

another pervasive myth about location and opportunity. “They think you ‘have’ to be in London to get anywhere or do anything. I actually do a lot of work in London and it doesn’t make a difference to them (or my other clients) where I’m based. I can do Manchester to London and back in a day. I don’t think there are fewer opportunities in the North than there are in London.” On the question of feeling underestimated because of her location, Morgan-Trimmer is unequivocal. “No. In this day and age, I find that people don’t really care where you’re based. In fact, many of my clients don’t even know until I mention it!” The freedom this founder finds outside London is both professional and personal. “I love London, don’t get me wrong, but having grown up down south, I definitely prefer living and working in Manchester. I find the culture here to be friendly, supportive and a bit more direct – which obviously is perfect for a neurodivergent entrepreneur!”

The new geography of opportunity

What unites these founders is a shared rejection of London as a prerequisite for innovation. Instead, they embrace the strategic advantages of their location, supported by strong local ecosystems, universities, funding initiatives, and a cultural vibrancy that’s often missing from capital life.

Manchester’s Sister innovation district, backed

by a £1.7bn investment, exemplifies the regional drive to build world-class environments that nurture start-ups without the London price tag. It’s a place where businesses can tap into highly skilled talent, access cutting-edge research, and connect with suppliers and partners - all while enjoying a quality of life that fosters focus and creativity.

This shift is also supported by the reality of modern connectivity. The ability to travel to London in a matter of hours, combined with digital tools that facilitate remote working and global outreach, means start-ups no longer need to choose between presence and opportunity.

“They think you ‘have’ to be in London to get anywhere or do anything. I actually do a lot of work in London and it doesn’t make a difference to them (or my other clients) where I’m based

London remains a powerhouse - a city of ideas, capital and unmatched density - but it’s no longer the only game in

→ Rachel Morgan-Trimmer, founder of Firebird ”

town. For founders like Lowe, Stella and MorganTrimmer, Manchester offers something different: space to think, room to grow, and a community that prizes collaboration over competition. The shift isn’t about turning away from the capital, but expanding the idea of where innovation can thrive. As start-ups flourish beyond the old postcode boundaries, one thing is becoming clear: the future of UK entrepreneurship is not about choosing between London and elsewhereit’s about making both work, on your own terms.

While some London insiders may still view the capital as the only place for innovation, the stories of Lowe, Stella, and Morgan-Trimmer highlight a broader truth: success is no longer about geography alone, but about mindset, community, and strategic choice.

“Our results speak louder than our location,” Lowe adds.

How Greyparrot built a global AI powerhouse in under five years by

ENTREPRENEUR UK STAFF

In the tech world, ‘waste’ rarely makes the shortlist of blue-chip market opportunities. But for Mikela Druckman, co-founder and CEO of Greyparrot, a clean-tech company using artificial intelligence (AI) to revolutionise waste sorting and recycling, the status quo was a glaring omission. “Depth over breadth has been hugely important for us. From day one, we made a deliberate decision to focus on the waste industry - an under-digitised sector with massive environmental and economic impact.” The bet on waste paid off - and fast. By focusing tightly on what she calls “deep domain expertise in waste analytics,” Greyparrot turned ignorance into insight and insight into impact.

Rather than spreading thin, Greyparrot doubled down on a single sector and on one type of technology. “A big early bet was our approach to hardware. While we do deploy hardware to gather data, we made a conscious decision not to build robotic arms or complex recycling plant machinery ourselves.” Their team built software that works with existing hardware in recycling plants - from Bollegraaf to Van Dyk - enabling rapid scale without reinventing industrial infrastructure. “That choice set us apart. It allowed us to scale faster, stay agile, and focus on what we do best: building industry-leading AI models, data infrastructure, and integrations that work across any plant setup. We recognised early on that access to large-scale, high-quality data would be one of the most valuable assets we could build - and that’s become a core strength.”

Greyparrot’s growth model rests on collaboration. By partnering with established players the company expanded from day one - globally. “Greyparrot is an AI and data software specialist, and we partner with the best in the business when it comes to plant builders, robotics, and system integration.” These alliances were strategic turbochargers. Together with Bollegraaf and Van Dyk, Greyparrot deployed its systems across 20 countries, analysing tens of billions of waste objects annually. “Today, we’re proud to be a global clean tech leader.”

The world’s fastest-growing consumer goods sector was generating almost no intelligence, and Druckman turned that ignorance into opportunity with hard metrics: “In one

instance, a single contamination alert from our system saved a European facility £47,000 in reprocessing costs and fines. In another, our AI identified an aluminium sorting issue in minutessaving £48,000 on a single batch of material.” Those case studies became proof. And with packaging under regulatory pressure, Greyparrot’s ability to trace material flow upstream - into manufacturing - unlocked a new narrative: “We’re helping brands understand the downstream consequences of their packaging design decisions… Insights don’t just enhance recyclingthey directly inform packaging design, support regulatory compliance, and accelerate progress toward circularity goals.”

Greyparrot’s Deepnest platform takes consumer goods companies into live-feedback mode. Instead of theoretical recyclability, they can now see what happens to packaging postconsumption - data that could prompt rapid design shifts.

When AI meets real-world complexity, blind spots reveal themselves.

Greyparrot found wasted money hiding in unexpected places: “I was surprised by the scale of invisible inefficiencies… Over the last year alone, our systems detected and categorised over 40bn waste objects into 111

categories, revealing massive shifts in quality and contamination over the course of a single day.” Packing shrink sleeves and resistant materials like Tetra Pakdesigned without recycling in mindbecame tangible examples of downstream effects.

“Take Lucozade bottles - their full plastic shrink sleeve meant that they weren’t being recognised by recycling machinery, so they spent £6m to redesign more sustainable products.” With real-time data, companies can emerge with 10–20% recovery gains in a single shift.

Opportunities in the $3tn waste sector

Waste’s disruptability is debated, but Druckman points to three major shifts driving this opportunity:

1/ Smarter hardware integration, with AI embedded into the sorting process.

2/ AI retrofits for legacy plants, offering high ROI without new infrastructure.

3/ Emerging data-driven compliance, led through platforms like Deepnestconnecting material flow to brand decisions.

“Analysing 15 tonnes of waste typically takes a trained staff member around 375 hours. With

AI, it takes six.” For entrepreneurs, this suggests embedding your tech, retrofitting old systems, or influencing upstream incentiveswhile leaving physical assets in place.

The reality check Greyparrot’s success isn’t a fairy tale. The company has survived pandemics, downturns, and hypercautious fundraising environments. “One of the biggest lessons that’s shaped how we’ve built Greyparrot is the importance of resilience - not just in the technology, but in the business itself.” Steady growth and autonomy in her team proved that momentum didn’t rely on a singular figure. “During my second maternity leave, the team not only kept things running - they delivered growth in both headcount and revenue.” That’s not just good leadership; it’s a replicable organisational structure

fit for start-ups scaling globally.

A circular future fueled by AI

Looking ahead, Druckman sees AI as the operating system for recycling plants, but the bigger play lies elsewhere: “AI is laying the foundation for circular decision-making. Data from waste is now flowing upstream to inform how products are designed, tested, and improved - closing the loop between packaging innovation and recyclability.” Plants are just the beginning. The next layer is connecting recycling feedback to packaging, design, and supply chains.

“Entrepreneurs will play a huge role in scaling this transformation, and that’s what we’re doing with Deepnest.” By rethinking rubbish, Greyparrot shows how innovation can recycle old problems into new possibilities - a truly circular success story.

The London Chamber of Commerce Chief on business resilience, start-ups and surviving the storm by

PATRICIA CULLEN

In the UK capital, somewhere off the corridors of power, Karim Fatehi OBE, CEO of the London Chamber of Commerce and Industry, is doing what he does best: advocating for business while carefully navigating the crosswinds of policy, politics and persistent economic unease.

Caution may underpin the Chamber’s latest message, but it is matched by a quiet sense of determination. Representing a network of approximately 10,000 businesses — from fledgling start-ups to heavyweight corporates - the organisation occupies a unique position in the economic landscape. For Fatehi, the challenges ahead are undeniable. But so too, he insists, are the grounds for hope.

“We’ve seen through the COVID-19 pandemic and Brexit, and we are currently navigating the recent economic shocks,” he says. “London has always been, and continues to be, a major global city when it comes to showcasing resilience.” Yet resilience, he suggests, is under siege. “Businesses are feeling the strain — caught between global economic headwinds and the ripple effects of domestic policy, including hikes in national insurance and tighter employment regulations. The hospitality sector, for example, is having to make some tough decisions on pay, potential redundancies and the viability of operating in the long term”

This is not just an impressionistic concern. “We’ve done a survey with our members,” he says. “85% of the businesses are not expecting economic growth during the current parliament.” It’s a damning figure. There is,

Fatehi insists, no single silver bulletbut there are some obvious fixes. What’s missing, he argues, is sustained support for growth. “We also need to ease the tax burden on businessesfrom national insurance to business rates and beyond.” Despite the frustrations, the CEO insists the Chamber remains hopeful - and that its network plays a critical role in keeping the ecosystem alive. “Naturally, the Chamber informs and advocates for SMEs… we’ve got to be optimistic.”

The organisation takes a broad yet practical approach, balancing strategic vision with on-the-ground support. “Our extensive network allows us to act in our members’ best interests and engage directly with decision-makers.” he says. The Chamber’s events - including a recent breakfast roundtable featuring Lord Johnson, Deputy Chair of the

BUSINESSES ARE FEELING THE STRAIN - CAUGHT BETWEEN GLOBAL ECONOMIC HEADWINDS AND THE RIPPLE EFFECTS OF DOMESTIC POLICY, INCLUDING HIKES IN NATIONAL INSURANCE AND TIGHTER EMPLOYMENT REGULATIONS.

Conservative Party and Andrew Bailey, Governor of the Bank of England, amongst others - are one way they help businesses speak directly to policymakers. The focus? “How can the business effectively manage these additional costs without hindering the growth?”

Pressed on what businesses are looking for, Fatehi is clear: “What businesses want is prosperity,” he said. “They’re looking for an environment that allows them to engage with their European counterparts with minimal friction - free from

“ ”

What businesses want is prosperity. They’re looking for an environment that allows them to engage with their European counterparts with minimal friction - free from unnecessary barriers, so they can grow and thrive.

unnecessary barriers, so they can grow and thrive.” His advice to founders navigating trade volatility and rising costs is clear-eyed and pragmatic. “We’ve seen the tariffs, which is 10% for all UK exporters…but it wasn’t 25% like other tariffs.” That thread of optimism runs through, even as global trade rules grow ever more uncertain. What drives the Chamber’s forward-looking outlook, he explains, is London’s enduring role in the global order.

“We are in a very unique position… London remains the global hub for international trade and a magnet for businesses worldwide. We need to retain our position.”

Just this week, Fatehi points out, momentum was building: “We had the opportunity to see the FTA between India and the United Kingdom has come to reality. Also, the U.S. and there are other FTAs on the horizon.” As he sees it, the task is clear: to help businesses capitalise on those opportunities.

“It’s crucial for London’s business communities to seize the opportunity, explore new markets, and unlock their potential,” he said. “We must identify the best path forward.”

There’s a realism to his tone, but it is balanced by a quiet pride in what London’s business community has achieved. “We must be resilient, we must remain optimistic, and we must be ready for the challenges ahead,” he said. “The UK remains steadfast in its commitment to business, demonstrating unwavering resilience and adaptability.”

“We must be resilient, we must remain optimistic, and we must be ready for the challenges ahead. The UK remains steadfast in its commitment to business, demonstrating unwavering resilience and adaptability

by OMAR HAMDI /

Nvidia had $29m of revenue at IPO, and Amazon had revenues of $16m at the time they went public. London has all the potential to provide companies with this growth opportunity” says Neil Shah, Head of Tech Primary Markets at the London Stock Exchange.

Despite comprising only 1.4% of the 503 companies in the S&P 500 index of the largest USlisted businesses, the ‘Magnificent 7’ (Apple, Microsoft, Amazon, Nvidia, Alphabet, Meta, and Tesla) were responsible for over 50% of the index’s total gains - and over 75% of its earnings growth - in 2024.

It’s sometimes hard to believe how small some of those companies were when they first went public, especially when high profile US IPOs are now reserved for companies with revenues in the billions, not millions. “When I started out in investment banking at Thomas Weisel Partners in 2009,” continues Shah, “there were software companies going public in the US with about $40 million in revenue. It is a very different picture today, that would just be impossible. It would probably still be impossible at $400m in revenue. $400m of revenue a quarter, maybe, but not annually.”

But it is still possible in London. This may come as a surprise to the average Brit who may only come across the London Stock Exchange in the evening news summary of the FTSE 100 with its big banks, big pharma and miners. The London Stock Exchange team gets as excited about early stage growth companies as they do about unicorns. Most stock exchanges have left the messy business of young, growing scale ups to VCs or Private Equity. Not so in London. “AIM turns 30 this year. It is the world’s most successful growth market and is run by the London Stock Exchange. Nominated advisers closely support companies not only through the IPO process, but thereafter. And some of the work required by a company to go public could potentially be done at a tenth of the cost of a US listing.”

“When companies choose to list in London, they can benefit from a full-time fundraising team in the form of the house broker retained by the company, meaning there is less of a burden on a company founder. And as public companies, they can also attract and incentivise talent in a liquid, transparent way that private companies cannot.” Shah also believes that (along with

AIM TURNS 30 THIS YEAR. IT IS THE WORLD’S MOST SUCCESSFUL GROWTH MARKET AND IS RUN BY THE LONDON STOCK EXCHANGE…AND SOME OF THE WORK REQUIRED BY A COMPANY TO GO PUBLIC COULD POTENTIALLY BE DONE AT A TENTH OF THE COST OF A US LISTING” “

a range of high-quality small cap funds and investors) Venture Capital Trusts, or VCTs - a unique British invention that combines the best of a Silicon Valley VC and a traditional small cap fundoffer an attractive alternative to more fashionable venture funding sources.

The traditional venture capital model has fueled household name successes like Uber, Facebook and Zoom. But it has also given the world high profile failures like WeWork, Theranos and 23andMe. London’s approach, where sensible valuations, supportive institutional investors and quality growth companies mingle, could be having its moment.

AIM has supported some fantastic founder-led companies such as Craneware which went public with $15m of revenue in 2007 ($200m today) and Cerillion, which went public in 2016 with £14m of revenue and a £22m market cap. Today, it’s worth over £450m.

Nvidia founder Jensen Huang took to the stage at London Tech Week in mid June, saying “The UK has one of the richest AI communities anywhere on the planet... and the third largest AI capital investment of anywhere in the world.”If Huang or Bezos were taking Nvidia or Amazon public today, they may be looking to the City, not Wall Street, for support. “British investors are really well-travelled. More than a third of our [London-listed] companies are international,” says Shah. “It doesn’t matter where you’re from, you can be successful here.”

Omar Hamdi is the founder of Pathos Communications

Fresh off their The AI Summit London win, InSilicoTrials is turning regulatory-grade AI into the backbone of nextgen drug development. by ENTREPRENEUR

UK STAFF

When Luca Emili stepped off the stage at The AI Summit London, clutching the event’s top innovation prize, it wasn’t just a moment of recognition - it was a quiet inflection point. For InSilicoTrials Technologies, the win marked more than validation; it signalled a shift in how the future of drug development might be written - not in wet labs or waiting rooms, but in algorithms, simulations, and code. “Winning The AI Summit London Package was a meaningful milestone for us. It confirmed the strength of the technology we have developed and validated the mission we are committed to.”

That mission? To embed safe, scalable, and regulatory-ready AI into the heart of clinical trials. Not as an optional extra, not in a decade’s time - but now. “Our goal is to bring safe, scalable, and regulatory-ready AI into the core of drug development. The exposure we gained through this recognition is already opening new doors.” InSilicoTrials has been developing regulatory-grade simulation platforms - once considered bleeding-edge science fiction - into practical tools now used by pharma leaders and regulators. But Emili is quick to point out: this isn’t about chasing trends. It’s about being ahead of them.

“This recognition also arrived at a very timely moment. The FDA recently launched Elsa, their first agency-wide AI platform. It is a strong signal that computational methods and artificial intelligence are now central to regulatory science.” Where others are racing to adapt to Elsa, Emili’s clients have already been using similar tools. “While many in the industry are just starting to react to this development, our clients have been preparing for it for years. They have used our platform to build submissions that are already aligned with what regulators like the FDA are starting to expect.”

In other words, InSilicoTrials didn’t pivot to AI and regulation - they built for it from day one. “They are generating transparent, validated, and machine-readable outputs that speak the same computational language as these new AI-enabled review systems.” The message is clear: the future isn’t catching up to InSilicoTrials. InSilicoTrials is helping shape it. “For us, winning this package was more than an award. It was a signal that the work we have been doing is now fully aligned with where the future of drug development is headed. We are not adjusting to this shift. We have helped lead it.”

And the momentum is building. “Now, with greater visibility and momentum, we are ready to accelerate our impact even further.”

The AI Summit London wasn’t just a trophy moment. It was a rare, public-facing moment of proof - an opportunity to demystify a deeply technical domain in front of investors, innovators, and the broader AI community. “Presenting our technology at The AI Summit London gave us an exceptional opportunity to engage with a wide range of stakeholders. These included investors who understand the long-term vision required in deep tech and AI innovators looking for practical impact. It also gave us a chance to demonstrate that regulatory-grade simulation is no longer a concept for the future. It is already operational, and it is actively influencing how clinical trials are being designed and optimised today.”

But behind the technical elegance of Emili’s platform is a hard-earned lesson about building in one of the world’s most regulated - and riskaverse- sectors.“One of the most difficult aspects has been managing the balance between rapid innovation and the cautious pace of regulatory acceptance. In healthcare, especially when working with something as novel as AI-driven simulation, speed alone is not enough.” Instead, Emili has focused on building trust through credibility and transparency - both in the product and the ecosystem surrounding it. “This is precisely why I chose to

launch and then co-edit Toward Good Simulation Practice, an open-access book published by Springer Nature that since March 2024 has been distributed in more than 44,000 copies. This project was the result of a global collaboration that included experts from the FDA, the Avicenna Alliance, and the VPH Institute. It establishes clear best practices for how modeling and simulation should be used in regulatory decisionmaking.” This dual mission - building the tools and the standards that validate them - sets InSilicoTrials apart. Emili’s vision is not just to innovate within the system, but to help mature it. “Our goal was not only to innovate but also to actively contribute to the creation of the standards that will help this innovation mature and

gain widespread acceptance.”

And how did they find product-market fit in such a complex space? Not by guessing, but by building alongside the people who would use the tools. “We reached product-market fit by staying very close to the needs of those who would eventually use our platform. Rather than developing in isolation, we collaborated from the beginning with researchers, clinicians, and regulatory teams. We focused on building technology that integrates easily into existing workflows and enhances decision-making without disrupting what is already in place.”

For other founders entering the tricky terrain of health tech and AI, Emili offers a sober but inspiring roadmap. “The most important advice I can give is to focus on

building trust. In health tech, having a powerful algorithm or a sophisticated platform is only part of the equation. You need to make your work explainable and verifiable. It is also critical to build a team that understands both the science and the healthcare system. This is a multidisciplinary industry that demands depth in many areas.”

And perhaps most importantly, grit. “Be ready to commit for the long term. The path is complex, but the potential to create meaningful change in patient outcomes and healthcare efficiency makes the effort more than worthwhile.” In a world chasing AI hype cycles, Emili and InSilicoTrials stand as something different: a company that’s not just riding the wave, but laying the tracks beneath it.

From Welsh football to American wrestling, Rob Edwards is building community-first sports ventures that defy conventionand geography. by ENTREPRENEUR UK STAFF

When Rob Edwards took over a struggling Welsh football club during COVID-19, many would have questioned the timing - let alone the location. Six hours away, with no prior experience in football management, Edwards was flying blind. Yet five years on, Haverfordwest County AFC has not only qualified for European competition twice but also built one of the strongest youth programmes in the country.

Now, the founder of Morley Sports Management is turning his attention across the Atlantic to breathe new life into Ohio Valley Wrestling, a cult US promotion once home to the likes of John Cena, a 17-time WWE world champion wrestler and Brock Lesnar, an American professional wrestler. His mission? To rewrite the rules of modern sports ownership through community values, clear vision, and relentless momentum. His biggest challenge?

“Taking over a football club during a global pandemic. I live six hours away. I couldn’t get there, and I’d never had any experience of running a football club…. but I knew instinctively it had potential,” Edwards recalls. “I knew I was never going to relocate, so from day one I had to invest in people. If people don’t buy into the values, they don’t stick around very long. But if they do, you can build something with a clear vision.”

Building that team has been central to Edwards’ approach. “We’ve built the best off-field team I could have hoped for – people who are passionate and dedicated and who’ve completely bought into our dream. It’s the same now with OVW in Kentucky. It’s a long way away again, a lot of passionate people, but it lacked clear direction. The job is to empower people, put them in

“

You need to stay calm and logical. Not everything goes your way – and when it doesn’t, the worst thing you can do is get flustered. I tend not to get too up or too down. I’ve always kept that middle ground”

the right places, and give them credit for what they achieve.”

Edwards’ entrepreneurial journey is marked by pragmatism and steadiness in the face of challenges. When setbacks come, he keeps a steady head. “You need to stay calm and logical. Not everything goes your way – and when it doesn’t, the worst thing you can do is get flustered. I tend not to get too up or too down. I’ve always kept that middle ground. If you walked past me after a major success or a big loss, you probably wouldn’t notice a difference. That’s always been my demeanour.”

Financial backing came largely from Edwards’ prior career in finance. “There’s been minimal outside investment. Most came off the back of my previous business and my career in finance. The barrier to entry for Welsh football isn’t huge, it’s very accessible – financially and structurally. It gave us

the opportunity to step in and try to build something different from the ground up.”

The same entrepreneurial mindset is driving Edwards’ latest venture with OVW. “Because of our experience with Haverfordwest County AFC in Wales, we saw a similar opportunity with OVW in Kentucky. It’s an under-appreciated asset in the industry in modern times, but there’s massive potential.”

His advice to aspiring founders? “Have self-confidence and be openminded. When I took over the football club, I had no background in it, but I trusted my instincts. I used experience, common sense, and values that mattered to me. That’s been the foundation. We’re trying to build businesses founded on community and social impact. With those fundamentals in place, commercial success will come. You’ve got to believe in what you stand for. If you stay true to your values inside and outside of business, you can build something meaningful.”

For Edwards, motivation comes from the thrill of constant innovation. “I need stimulation. I’ve never been able to sit still. I wake up when the sun comes up and my brain kicks in – I’m raring to go. I’m impulsive. If I get an idea in my head, I’m all in. What keeps

me going is being disruptive, pushing things forward, coming up with new ideas and concepts. With both the football club and OVW, we’re constantly evolving – and on top of that we’ve got consultancy work and partnerships with sporting brands. That forward momentum is what wakes me up in the morning. There’s always a new problem to solve.”

Ultimately, Edwards believes success hinges on leadership and trust. “Be confident in your ability – if you’re leading a business and people don’t buy into you, it won’t work. People buy in to people. Investment in people is 100% at the heart of our model. We’re not always on the ground, so we need to trust the teams to run with the vision. But we also lead from the front – if you want people to dive into the trenches, you need to be the one starting the charge. I’m quite demanding, but only because I hold myself to that same standard.”

Edwards is a rare breed of entrepreneur – one who builds across continents and cultures, grounded in community values and driven by relentless momentum. Whether in Wales or Kentucky, his unconventional playbook is quietly reshaping what modern sports ownership can look like.

Entrepreneur James Caan on judgement, leadership — and why UK start-ups need more than hype to survive.

by PATRICIA CULLEN

AI is no longer the future. It’s the baseline. But while tech entrepreneurs pivot, scale and scramble for relevance, James Caan CBE remains focused on something more enduring: judgement. “The edge that can’t be replicated is judgementspecifically, commercial instinct based on lived experience,” he says. “AI can process a million data points, but it still can’t weigh reputational risk, read a room in a board pitch, or decide whether a client is bluffing in a negotiation.” It’s the kind of thing you expect from someone who’s spent decades navigating the peaks and pitfalls of business - not from a spreadsheet, but from the seat at the table. And while generative AI and predictive intelligence dominate headlines, Caan is more interested in how technology rewires the foundations of business strategy - not just its surface.

AI isn’t a tool. It’s a test. “The blind spot is failing to integrate AI at the strategic level, not just operationally,” Caan, British entrepreneur and former investor on the BBC show Dragon’s Den, warns. “Too many founders treat AI as a bolt-onautomating emails or improving customer service - instead of rethinking how AI could fundamentally reshape their business model.” The shift is already happening. “If you’re not embedding AI into your product development, commercial strategy, or market positioning, you’re behind the curve.” And the answer? Not just hiring a head of data science - but raising the bar on fluency at the top. “Build AI fluency in your leadership team. Not everyone needs to code, but everyone needs to understand

where AI creates value. Create a roadmap for where automation or predictive intelligence can streamline costs or open new markets. Waiting for a ‘perfect use case’ is a delay you can’t afford.”

Conviction beats perfection

So what separates the entrepreneurs who adapt from those who lead? It’s not charm. Or vision. Or even ingenuity, he argues. It’s belief. “It’s not charisma or creativity - it’s strategic conviction,” Caan says. “The ability to make bold decisions early, without waiting for perfect evidence.” And in a world where certainty is a myth, those who hesitate fall behind.

“In 2025, with markets moving fast and signals constantly shifting, leaders who wait to be

100% sure are already too late.” He cites Deloitte’s Human Capital Trends: “Leaders who demonstrate high decisiveness outperform their peers in innovation-led growth by 34%. That’s a meaningful margin - and it’s not about being reckless, but about being resolute.”

Still, no one does it alone Caan isn’t pretending vision alone builds companies. His obsession - one he returns to frequently - is team building. “Your business is like a ship embarking on a journey. Your team

members are your crew. If they work well together, know their roles, and communicate effectively, they can navigate through rough seas and reach your destination.” And the opposite? “If they’re not aligned, the ship can easily veer off course or, worse, sink.”

That means clarity from day one. “Ensuring everyone is pulling in the same direction is crucial.

In a start-up, you need everyone aligned with the company’s vision and goals. This alignment means that every decision, every action taken by the team, contributes to the larger objective.” The best founders, he says, invest in people as much as products. “It’s not just about finding people with the right skills – they need to fit in with your com-

pany’s culture too. When everyone gets along and shares the same values, teamwork happens naturally.”

And, crucially, they make growth part of the job. “Always encourage your team to keep learning and growing. This shows you care about their future and helps them improve their skills. When people feel valued and see that you’re investing in them, they’re more motivated and loyal.”

For all the talk of grit and instinct, Caan’s focus eventually returns to what many UK founders quietly admit: funding here is harder. And for scale-ups? Brutal. “If I could push one policy lever, it would be this: double down on early-stage capital

incentives, especially through scale-ups,” he says. “The UK has great seed-stage support, but we lose too many high-potential businesses between Series A and Series C.”

It’s a familiar point - but Caan wants sharper action: “We should look at enhancing the EIS cap from £1m to £3m per investor, extend reliefs to professional investors, and allow UK pension funds to direct a larger portion into early-stage innovation - similar to recent reforms in Australia and Canada.”

The stakes are high. “Start-ups are already contributing significantly: in 2025, UK start-ups are responsible for 17% of net new private-sector jobs, but many are constrained by capital drag. Smart policy now would compound long-term returns

MILLION DATA POINTS, BUT IT STILL CAN’T WEIGH REPUTATIONAL RISK, READ A ROOM IN A BOARD PITCH, OR DECIDE WHETHER A CLIENT IS BLUFFING IN A NEGOTIATION”

for the economy - not just founders.”

Big ideas, small circles He namechecks Revolut and BrewDog as examples of start-ups who understood that culture and autonomy weren’t extras - they were engines. “Revolut placed a strong emphasis on building a team that was agile and innovative,” he says. “They created cross-functional teams that could work independently on different projects, promoting a culture of autonomy and accountability.”

Of BrewDog: “BrewDog’s founders built a team that shared their passion for beer and innovation. They introduced the ‘Equity for Punks’ programme, which turned their customers and employees into shareholders, creating a deep sense of ownership and loyalty.” Caan’s recipe for success is disarmingly simple: hire for culture, invest in growth, make space for ideas - then get out of the way. “True innovators don’t hedge every move. They make the call, commit resources, and create alignment. In uncertain times, the decisive get momentum — and momentum beats perfection every time.”

For all the talk of AI

and capital strategy, what Caan returns to - again and again - is something curiously human: clarity. In a world where everyone’s shouting, it’s hard to hear what matters - and clarity of thought, values, and action becomes not just useful, but rare. And rare things, in business as in life, hold value. AI will keep accelerating, changing how companies are built and scaled. But Caan sees it less as a silver bullet, more as a mirror. It reveals what’s already strong, and exposes what’s weak. In companies where purpose is vague or leadership brittle, automation won’t save them. In those with vision, cohesion and courage, it becomes a force multiplier. Yet what lingers from a conversation with Caan isn’t just strategy or systems. It’s a kind of seasoned calm. He’s not seduced by the flash of innovation for its own sake. He’s seen too many cycles, watched too many “next big things” become footnotes. What lasts, in his world, is consistency: founders who know what they stand for, teams who trust each other, companies built with longevity in mind. That’s why his call for a smarter funding

policy isn’t just about unlocking cash - it’s about protecting momentum. The UK has no shortage of ideas or talent. What it sometimes lacks is the long-range thinking to let those ideas breathe. Scaling, after all, isn’t just a phase - it’s a leap. One that needs more than seed capital and slogans.

Still, for all his credentials, Caan is not nostalgic. He speaks the language of today’s founders fluently: digital-native, growth-minded, globally alert. But his advice resists trendchasing. Instead, it lands somewhere quieter - and arguably more radical. Build deliberately. Invest in people. Don’t wait for the perfect moment. Use technology, yesbut don’t forget why you’re building in the first place. Because in the end, Caan isn’t betting on AI. He’s betting on judgment - not the loudest voice in the room, but the steadiest. In an era defined by velocity, he offers something rarer: a framework for staying clear-headed when everyone else is pivoting. And maybe that’s the new edge - not just knowing where the world is going, but having the nerve to build something solid while it’s still moving.

How HSBC is supporting the next generation of UK entrepreneurs. by

PATRICIA CULLEN

The pace of change has never been as fast as it is right now –and yet it will never be as slow as it is today.” Tom Wood, Head of Business Banking at HSBC UK, leans forward slightly as he delivers this line – part observation, part call to arms. In an economy still finding its feet after the seismic shocks of Brexit, Covid-19, and inflation, it’s a quote that feels particularly apt. For UK entrepreneurs, uncertainty has become a constant. But so too has the need for evolution - in business models, funding strategies, and the role of their banking partners.

As the Head of Business Banking for one of the world’s largest financial institutions, Wood is clear-eyed about the weight of this

well as the broader economic environment.”

This is not merely marketing speak. In recent years, HSBC has sought to reposition its role in the entrepreneurial ecosystem - not just as a lender, but as a partner. “This is where

pandemic, UK SMEs have endured unprecedented levels of change; from navigating the post-pandemic recovery to rising energy costs, inflation and most recently tariffs,” Wood says. “At the same time, in many industries, innova-

MY TEAM INTERACTS WITH OVER 75,000 SMALL BUSINESS

EVERY SINGLE YEAR. WE REALLY DO UNDERSTAND HOW CRUCIAL ACCESS TO INSIGHT, GUIDANCE, AND SUPPORT IS - ESPECIALLY FOR FOUNDERS AND ENTREPRENEURS AT THE START OF THEIR JOURNEYS”

→Tom Wood, Head of Business Banking at HSBC

moment. “The UK’s entrepreneurs have been looking to their banking partners for guidance navigating the fast changing and uncertain geopolitical environment,” he says. “To do this, banks need to have strong relationships with their clients built on foundations of trust and understanding; both in terms of the entrepreneur’s business as

HSBC really excels,” Wood says, “bringing global insight to local business is where we come into our own.”

Few have emerged from the pandemic unscathed, and for small and medium-sized businesses (SMEs), the aftershocks continue to reverberate. “Since the

tion and technology (such as AI) has made it easier for new entrants to enter and disrupt markets, forcing entrepreneurs to evolve their business models to defend against competitive threats and meet the ever-increasing expectations of their customers.” It’s a daunting list, but Wood is quick to praise the businesses HSBC works with. “Despite the above,

the UK SMEs that we work with have shown incredible resilience through this period. Support and guidance through periods of uncertainty is one of the key ways that we look to support SMEs at HSBC.”

Resilience alone, however, isn’t a business strategy. Recognising the challenges SMEs face, HSBC recently launched a new initiative to provide more structured support. “That’s why we’ve recently launched the HSBC Small Business Growth Programme – designed to help small business owners not just survive but thrive,” says Wood. “Built in partnership with Microsoft, WIRED Consulting and UpSkill Universe, the programme will provide business owners with practical and engaging tools and resources on topics that matter.”

The initiative stems from what Wood describes as “countless interactions” with entrepreneurs across the country. “My team interacts with over 75,000 small business owners every single year,” he says. “We really do understand how crucial access to insight, guidance, and support is - especially for founders and entrepreneurs at the start of their journeys. That’s exactly why we created our Small Business Growth Programme; to help early-stage businesses grow with confidence, backed by the right expertise.”

HSBC HAS BEEN AROUND FOR 160 YEARS – THE WORLD HAS CHANGED A LOT IN THAT TIME AND SO HAVE WE. ONE OF THE KEYS TO OUR SUCCESS AND LONGEVITY HAS BEEN THE ABILITY TO ANTICIPATE, EVOLVE AND DELIVER, FIRST AND FOREMOST, CLIENT-CENTRIC SOLUTIONS”

THE FUNDING CHALLENGE - AND WHY IT’S NOT WHAT YOU THINK

Access to finance remains one of the most frequently cited challenges among early-stage businesses — but according to Wood, the issue is more nuanced than a simple lack of available funding. “Access to information, business networks and role models are the main themes I hear when speaking regularly to small business,” he explains. “Access to finance is of course another barrier, but the issue here is

more about knowing what is available and appropriate for a business at their stage of growth rather than lack of availability.”

Education, Wood argues, is crucial. “It’s about matching the right funding solution with the stage that the business is at and the founders’ ambitions. Speaking to a bank or other advisors can help entrepreneurs work out what is right for them.” That’s why HSBC is putting boots on the ground, investing in local expertise. “We have

dedicated Business Specialists on hand in local communities to help business owners to better understand their options and make more confident decisions.”

REINVENTING THE BANK-ENTREPRENEUR RELATIONSHIP

For a bank with a 160-year history, innovation can’t just be a slogan - it must be a structural reality. And HSBC is keen to demonstrate how it’s evolving its own approach. “We are

relaunching our Business Banking Proposition for UK SMEs in a big way with the HSBC Small Business Growth Programme,” Wood says. “Alongside this, we are actively reviewing our product and proposition offering, with input from customers, to ensure the solutions that we offer meet the needs of SMEs.” This includes a diverse range of funding models tailored to different stages of business growth.

“For small businesses with simple needs, our focus is to make it easier and quicker to access our finance solutions,” says Wood. “For the more complex growing business, it’s about how we adapt some of the solutions that we already make available to our corporate or international clients, expanding the product availability and tailoring the product features to make them more suitable for the SME market.”

As inflation and rising costs continue to squeeze margins, HSBC is also focused on offering hands-on help. One example? Business reviews. “A key part of our strategy at HSBC is to provide entrepreneurs more access to dedicated specialists on the ground, in local communities,” says Wood. “SMEs can book in for a Business Review, virtually or in person, with one of over 100 business specialists in all regions across the UK.” These reviews aim to give founders not just financial

For the more complex growing business, it’s about how we adapt some of the solutions that we already make available to our corporate or international clients, expanding the product availability and tailoring the product features to make them more suitable for the SME market.” “

insight, but a clear-headed understanding of their options in a volatile environment. “HSBC’s Small Business Growth Programme is packed with practical tools and resources to help SMEs to become more resilient and succeed,” he adds.

As start-ups increasingly build with sustainability and digital transformation in mind, the banks that support them must also evolve. Wood believes HSBC is prepared for what’s coming. “HSBC has been around for 160 years – the world has changed a lot in that time and so have we,” he says. “One of the keys to our success and longevity has been the ability to anticipate, evolve and deliver, first and foremost, client-centric solutions.” Listening, he says, is more important than ever. “Listening to what our clients are telling us, understanding where the market is going and sharing that insight is key,” Wood

says. “This approach has served us well in the past and will no doubt serve us well in the future, supporting the next generation of UK entrepreneurs.”

In an age of relentless change, UK entrepreneurs aren’t short on challenges - rising costs, technological disruption, supply chain uncertainty. What many are short on is time: time to think, to plan, to breathe. For all the talk of agility and innovation, what often matters most is something more grounded - access to good information, a reliable sounding board, and people who actually understand the pressures of running a business right now. That’s the shift Wood wants to see in the banking world: less focus on selling products, more on showing up. If HSBC’s new direction is to mean anything, it will be in how well its teams embed themselves in real business communities - not just with webinars and toolkits, but with a lived understanding of what it means to grow a company when the margins are tight and the path is unclear.

There’s no shortage of

ambition in the UK’s small business sector. But ambition doesn’t flourish in a vacuum. It needs networks, access, encouragement - and sometimes just a conversation that doesn’t start with a sales pitch. Of course, banks alone won’t fix the systemic issues UK entrepreneurs face. But they can make the road a little less lonely - especially if they remember that relationships aren’t built through apps, but through attention. It’s about listening before advising. And in a sector where too much support arrives too late, that might be a quiet kind of progress worth paying attention to.

In an era where speed is the only constant, Wood’s parting message is one of cautious optimism - and an invitation. “Banks must keep up,” he says. “Trying to be as simple and agile as possible and focusing on our customers is one of the ways that we are doing this in my team within SME Business Banking at HSBC.” In an unpredictable world, that may be just what the UK’s entrepreneurs need to hear.

→ Entrepreneur and educator Simon Squibb in conversation

When Simon Squibb knocked on a stranger’s front door at age 15 and asked if he could tidy their garden, he wasn’t chasing a dream. He wasn’t pitching a side hustle or escaping a corporate grind. He was homeless, grieving, and desperate. That unplanned knock would become the start of a long entrepreneurial career — not driven by strategy, but survival.

How a teenage gardener found purpose in business and keeps growing it his way.

by PATRICIA CULLEN

“I started a gardening company with no website, no brochure, no sales experience, having never started a business before in my life,” he recalls. “And the reason that I started that business isn’t because I wanted to be an entrepreneur, or I even knew what it was… I just had no choice.”

Squibb, the founder and CEO of HelpBnk - a community-powered startup support platform with over 250,000 members - is now widely recognised as an entrepreneur, investor, author, and energetic advocate for founders who don’t fit the typical mould. His TikTok-style videos giving away mentorship, equipment and cash to aspiring business owners rack up millions of views monthly.

But the roots of Squibb’s mission lie far from the glow of internet virality. They’re grounded in loss, instability, and a deep sense that the UK system isn’t built to help the people who need it most.

When Squibb was a teenager, life unravelled quickly. “My father died suddenly when I was 15 years old. And not long after that, my mum and I had an argument. And my mum kicked me out of home, which meant I suddenly had to fend for myself and figure out how to make it in the world.” Despite spending 12 years in school, Squibb felt wildly unprepared. “It had never been mentioned to me what an entrepreneur was, or how I could become one… I didn’t know how money worked. I didn’t know how anything worked. The only thing the school system really taught me was that one day I was expected to get a job.”

But that wasn’t even an option. With no national insurance number and no fixed address, job applications were impossible. “I tried. And I just couldn’t get a job. So then I went to social services. And they told me just to go back home, which I couldn’t do either. So I was stuck, really.” That’s when something shifted. “I call this moment the moment the entrepreneur muscle woke up in my brain. For the first time, I had to use it. We all have it. But I had to use it for the first time.”

He spotted a large house with an unkempt garden. “Maybe the people with the nice big house will pay you to tidy up their garden,” he thought. “And so I, through needing it, not just wanting it, found the courage to walk up the path.” The owner said yes. And a business - albeit short-lived - was born. “It went on to fail. But I had an amazing experience the next eight months trying to make a gardening company work. And that was my first experience as an entrepreneur.”

That early necessity-led venture eventually evolved into a more deliberate path. Squibb would go on to launch and sell multiple companies, including Fluid, a creative agency in Hong Kong that saw

significant success. But it wasn’t until later that he found what he now sees as the real engine of long-term motivation: purpose.

“When I was younger, I didn’t really have one belief. I just needed to survive… I think as I’ve

People only regret what they don’t do, not what they do do… If you don’t try something, you’ll have a regret. And if you do try and it fails, you’ll have a good story”

gotten older, I’ve come to realise that the businesses that drive me the most are ones that have purpose, ones that matter more than me.” It was at Fluid, a company based in Hong Kong, that this lesson crystallised. “It was going really well, but people were leaving and I wondered why. And then I realised that it was because the company was just there to make money.” So he made a change. “I wanted to make it about the thinkers and the creatives and not just about making money… giving them the time to be creative and making sure they’re paid well.” For Squibb, the best businesses now aren’t necessarily the biggest - they’re the most meaningful. “I think the purpose of life is a life of purpose.”

Of course, preaching purpose in a world obsessed with monetisation doesn’t come easy. “Even now with what I’m doing, a lot of people judge me. It’s like, ‘Oh, you’re just doing it for views, you’re just doing it for likes.’ And I’m permanently defending myself saying I’m doing it to help people enjoy their work and give people more options than just getting a job.”

That’s one of Squibb’s loudest critiques of the UK system: it pushes everyone toward a narrow version of success. School. University. Job. Stability. But there are so many more possibilities. His book, What’s Your Dream?, is a manifesto for this mindset - an invitation

I’D LOVE TO MAKE JOB CENTRES INTO DREAM CENTRES.I’D LOVE TO REDESIGN THEM AND MAKE THEM PLACES WHERE PEOPLE CAN GO AND LEARN HOW TO DO WHAT THEY LOVE… GIVE THEM THE TOOLS, THE FUNDING AND NETWORK TO MAKE THAT HAPPEN”

to dream first, strategise later. He says, “People only regret what they don’t do, not what they do do… If you don’t try something, you’ll have a regret. And if you do try and it fails, you’ll have a good story.”

Squibb’s advice to UK entrepreneurs varies depending on life stage, but the message is clear: if you’re young, take the leap now. “If you’re single, and you’ve got a job, the likelihood is if you quit that job, you could get another job… you don’t realise how much time you’ve got, how much freedom you’ve got. So when you’re young, I think you should really just take every bit of risk you can.”

Cost is the killer, so he recommends keeping living expenses low. “Live at home if you can while you get your dream off the ground. Give yourself a solid runway - six to twelve months - with low living costs and some savings to support the journey.”

For those with more responsibilities? It’s harder but this is no excuse. “Kids don’t do what you say, they do what you do,” he says. “If you want them to dream, you have to dream.” }}

MY BIG DREAM

TO FIX THE

SO THAT

AS YOUNG AS 4 OR 5 YEARS OLD. I WANT TO POWER THAT UP, INVESTING FURTHER IN HELPBNK.COM, INVESTING IN EDUCATION-RELATED PLATFORMS AND BUSINESSES”

Asked what he would do if he had £500 and no contacts in the UK today, his answer is unequivocal: social media. “It’s the new TV. My channel gets half a billion views a month. We haven’t ever paid for a post, sponsored a post. Everything’s organic.” He advises putting that £500 into making one great piece of content - something that informs, entertains or sells. “I’d sell something in that video to generate the money back… with AI, it’s getting cheaper.”

While London remains the gravity centre of UK entrepreneurship, Squibb thinks smaller towns like Tunbridge Wells are quietly generating the next wave. “It’s one of the few towns where the old high street is doing better than the new high street.”

He recently helped restore a historic water fountain in the area - not just as a civic act, but as a bet on localism. “I believe we’re returning to a time when we value genuine connections with people and communities. I have quite a few friends now in Tunbridge Wells who are building businesses.” But the real start-up hub? “These days the best hub is online. I have a

→The entrepreneur Simon Squibb, thinking beyond the usual

platform called HelpBnk.com with 252,000 entrepreneurs on it… you have to go where the community is.”

Ask Squibb what he’d redesign in the UK’s start-up ecosystem and his answer is blunt: “I’d love to make job centres into dream centres.” He believes these spaces have become lifeless and bureaucratic - not built to inspire, but to contain. “I’d love to redesign them and make them places where people can go and learn how to do what they love… give them the tools, the funding and network to make that happen.” This vision - of accessible, empowering spaces for anyone with an idea - sits at the heart of his platform HelpBnk. It’s designed for the people the ecosystem usually ignores: the non-technical, non-venture-backed majority.

“There’s 60–70% of the population that would love to start their own business but don’t have any funding. They can’t afford a course. And they don’t have a business that necessarily people want equity in.”

Whether it’s a dog-walking venture, a bakery, or a flower business, he believes these “bottom of the pyramid” start-ups deserve support. “No one’s really servicing that part of the ecosystem because there’s no money in that ecosystem… so I’m helping that sector for free.” Everyone wants to see unicorns and more successful businesses in the UK, but that means we have to encourage more people, particularly the younger generation, give them the tools, the capital and the support to start something. “This could create a huge difference in the UK long term, creating an additional sloth of businesses that are investable for the VC market. The unicorns of the future.”

Winning $1m at the One Billion Summit supercharged Squibb’s ambitions - especially around education. The entrepreneur challenges the idea that entrepreneurship is only for the privileged, has built multi million pound businesses and asked thousands of people to name their dream. His own? “My big dream is to fix the education system, so that schools include business education and financial literacy for students as young as 4 or 5 years old. I want to power that up, investing further in HelpBnk.com, investing in education-related platforms and businesses.” If he gets his way, future generations won’t need to stumble into entrepreneurship by accident - they’ll be taught to dream, build, and believe from the start. And if you’re young right now? You’re luckier than you know. Because if Squibb realises even half of his vision, the world you’ll be starting up in will be fairer, freer, and finally built with you in mind. Now that’s what I call dreamy.

by CALLUM SCOTT

After a year of high interest rates, stricter lending rules and a shaky economy, 2025 has made it a lot harder for small businesses to get the funding they need. According to the British Business Bank, just 43% of smaller businesses successfully secured external finance in Q2 2024, down from 50% the year before. And even when businesses are referred to alternative lenders through the UK’s bank referral scheme, only 1 in 20 actually get funding. So it’s no surprise that applying for finance has become not only more complicated, but much more competitive.

The drop in approval rates is mostly due to how uncertain the economy still feels, and because lenders are being more careful about who they say yes to. Even though the UK economy grew by 0.9% in 2024, it’s still only 3.2% above where it was before the pandemic, which is one of the slowest recoveries in the G7 countries. That kind of slow progress makes lenders nervous, so they’re

looking more closely at each application and only backing businesses that can show they’re stable and low risk. Adding to the challenge is a big shift in where Small and medium enterprise (SME) lending is actually coming from. In 2024, 60% of business lending came from outside the major high street banks, the highest level on record. Challenger banks and specialist lenders are stepping in to fill the gap, but they’re also being picky. Even though total

Relying too much on an overdraft, paying suppliers late, or filing your accounts with Companies House after the deadline can all make lenders nervous” “

In today’s cautious and competitive lending environment, ambition alone isn’t enough to secure funding. Lenders want to see that your business is financially sharp, well organised and has potential to grow, without being risky”

lending to SMEs hit £62 billion last year, most lenders are now backing businesses that can show they’ve got their finances in good shape, with solid planning, stability and a clear ability to repay what they borrow.

Even businesses that are bringing in decent revenue are getting turned down for finance, and it’s often because of small things that raise red flags. Relying too much on an overdraft, paying suppliers late, or filing your accounts with Companies House after the deadline can all make lenders nervous. These things signal that the business might not be managing its money well, which makes it harder for

lenders to trust that a loan will be repaid on time.

Cash flow is still one of the biggest challenges for SMEs, and late payments are a major reason why. A 2023 study found that 27% of small businesses in the UK were owed between £5000 and 20,000 in unpaid invoices, and more than half said the problem had got worse over the year. When you’re waiting on that much money, it puts a lot of pressure on your cash flow. And when lenders see those kinds of issues, it can make them question how sustainable or stable your business really is.

A lot of SME owners think that as long as their revenue is growing, they’ll have no trouble getting funding. But in reality, lenders are looking at the bigger picture. Things like steady cash flow, consistent profits and whether you can realistically keep up with repayments all matter more than just how much money you’re bringing in.

In 2024, loan approvals rose by 23% to nearly 45,000, and overdraft approvals jumped by 47% to just under 59,000. But that doesn’t mean it’s suddenly easier to get finance, it just shows that more businesses are applying. Lenders are still being selective. What they really want to see is a business that’s clear about its numbers, has a solid plan, and can show how it’ll repay the money. A steady cash flow forecast, an up-to-date balance sheet, and a clear repayment plan will go further than fast

growth that hasn’t been backed up by structure or strategy. The problem is often timing. By the time most SMEs apply, it’s already too late to fix the numbers. Getting lender-ready starts six to twelve months earlier. You need to show that you’re not just making money, but managing it well.

One of the biggest barriers is that SMEs aren’t applying for funding at all. In 2023, only 3.5% applied for new or renewed finance, and just 26% looked for external advice about their financial position. Fear of rejection or uncertainty about where to start plays a big role, but without guidance, businesses often don’t realise they’re underprepared until they’re already in front of a lender. By that point, it’s usually too late to fix the gaps.

Even when businesses do apply, simple mistakes can hold them back. Outdated financials, projections that are too vague to be useful, or skipping over weaknesses in the hope they’ll go unnoticed can all hurt your chances. With lenders being so selective, these things can quickly lead to rejection. Underinvestment is another common issue. 58% of SMEs who felt they hadn’t invested enough blamed the high cost of credit, while 55% said they couldn’t borrow at a fair rate. But often, it’s poor planning and messy finances that are really getting in the way.

IF YOU WANT TO IMPROVE YOUR CHANCES OF GETTING FUNDING, THE WORK NEEDS TO START EARLY, IDEALLY SIX TO TWELVE MONTHS BEFORE YOU APPLY. THAT MEANS CUTTING BACK ON OVERDRAFTS, PAYING SUPPLIERS ON TIME, KEEPING YOUR BOOKS AND FILINGS UP TO DATE, AND BUILDING OUT REALISTIC FORECASTS”

If you want to improve your chances of getting funding, the work needs to start early, ideally six to twelve months before you apply. That means cutting back on overdrafts, paying suppliers on time, keeping your books and filings up to date, and building out realistic forecasts. It also helps to look at your business through a lender’s eyes. If you wouldn’t lend to yourself, it’s probably time to tidy things up or bring in expert help. Most importantly, these habits shouldn’t only kick in when you’re actively applying. The businesses

that get a yes in 2025 will be the ones that already look strong on paper, not the ones scrambling to look organised at the last minute. Being lenderready isn’t something you tick off once; it’s a way of running your business. In today’s cautious and competitive lending environment, ambition alone isn’t enough to secure funding. Lenders want to see that your business is financially sharp, well organised and has potential to grow, without being risky. If you understand what they’re looking for, deal with any red flags early, and build solid financial habits ahead of time, you’ll be in

a much stronger position to stand out and get the yes you’re aiming for.

Callum Scott is the founder and Managing Director of Winchester Corporate Finance. With over a decade of experience in the financial sector, he specialises in supply chain finance and is known for his hands-on leadership style. Under his guidance, Winchester Corporate Finance has sourced over £70m in funding for small businesses, offering tailored solutions such as business loans, asset finance and invoice finance.

by ENTREPRENEUR UK STAFF

Public relations is a US$107bn industry that rarely questions its own orthodoxy. Agencies operate on retainer, charge fees upfront, and justify outcomes later. Results are often measured in the nebulous currency of “impressions” or “strategic visibility.” Clients—particularly large corporates—are expected to trust the process. Omar Hamdi does not. The founder of Pathos Communications, a London-based tech-enabled public relations (PR) firm, has spent the past six years challenging the standard model, one invoice at a time. His firm bills clients only after securing coverage in a publication the client values. It is a commercial inversion of PR’s prevailing logic. And it is working.

Since launching in 2019, Pathos has grown to a staff of 60, representing 20 nationalities, and now serves more than 5,000 clients across 53 countries. According to the Financial Times’ FT1000 rankings, it is currently the fastestgrowing advertising and marketing company in the United Kingdom, and the 33rd fastestgrowing European company in any sector. Unlike many of its peers, Pathos has remained consistently profitable and cash-generative. Its clientele is drawn almost entirely from the global majority: small and medium-sized enterprises (SMEs). These account for roughly 90% of all

businesses globally and more than half of employment, according to the World Bank. Yet their presence in mainstream media is disproportionately marginal. “Go to any major news site’s business section,” says Hamdi. “You’ll find political coverage or stories about billion-dollar companies. But where are the SMEs?”

Pathos’s wager is simple: most SMEs will not commit thousands to speculative media exposure, but will gladly pay for tangible outcomes. The company’s “pay-onresults” model depends on selecting stories that are almost certain to succeed. To that end, Pathos has developed a trove of first-party data on over 250,000 prospects and built an internal AI tool—PathosMind—to triage, score, and shape narratives before a human pitch is made.

“We almost always filter failures out at the qualification stage,” Hamdi explains. “By the time a client receives a proposal, we already know it’s publishable.” At the heart of the firm’s approach is a proprietary editorial framework. In 2022, Hamdi developed an internal ontology—a classification system—of publishable story types. “Editors are more predictable than you think,” he quips. “There are only 13 kinds of story. If you want to know what

THERE’S NO DICHOTOMY BETWEEN SUBSTANCE AND STYLE. A PIECE ON FOOD SECURITY IN THE SAHEL IS COMPETING FOR ATTENTION WITH A PHOTO OF KIM KARDASHIAN. IF YOUR STORY ISN’T PRESENTED WELL, NO ONE WILL READ IT— HOWEVER IMPORTANT IT IS”

they are, apply for a job and sign an NDA.” While glib, the underlying proposition is serious: media success is neither mystical nor purely relational—it is patterndriven, and thus increasingly susceptible to algorithmic foresight. PathosMind operationalises that idea.

Some might question whether this model encourages soft or commercially biased content. Hamdi rejects that framing. “There’s no dichotomy between substance and style. A piece on food security in the Sahel is competing for attention with a photo of Kim Kardashian. If your story isn’t presented well, no one will read it— however important it is.”

Pathos’s remit is deliberately narrow. It does not traffic in political campaigns, reputation laundering or contentious lobbying. “What we do is globally uncontroversial,” Hamdi says. “We’re giving a voice to entrepreneurs and growing businesses. No government—except perhaps North Korea— could object to that.”

The company has also avoided the industry’s