ON THE GROW Super Regionals focus on expansion

BEYOND CIGARETTES

Tobacco category can play key role at grocery

ENGAGING WITH YOUTH

Retail media could make the difference

ON THE GROW Super Regionals focus on expansion

BEYOND CIGARETTES

Tobacco category can play key role at grocery

ENGAGING WITH YOUTH

Retail media could make the difference

EnsembleIQ is the premier resource of actionable insights and connections powering business growth throughout the path to purchase. We help retail, technology, consumer goods, healthcare and hospitality professionals make informed decisions and gain a competitive advantage.

EnsembleIQ delivers the most trusted business intelligence from leading industry experts, creative marketing solutions and impactful event experiences that connect best-in-class suppliers and service providers with our vibrant business-building communities.

Volume 104 Issue 9

52 FEATURE Good to Grow

The five retailers chosen as Super Regionals are making the most of their opportunities for expansion.

61 RESEARCH

Retail Intelligence Report

PG and Placer.ai present a data-driven deep dive into consumer trends and operational imperatives.

66 FEATURE

How Retail Media Can Help Grocers Connect With Gen Z, Millennials

Research shows that the in-store environment might be an ideal touchpoint to engage with younger generations.

68 NONFOODS More Than Smoke

Tobacco products can still play a key role at grocery retail.

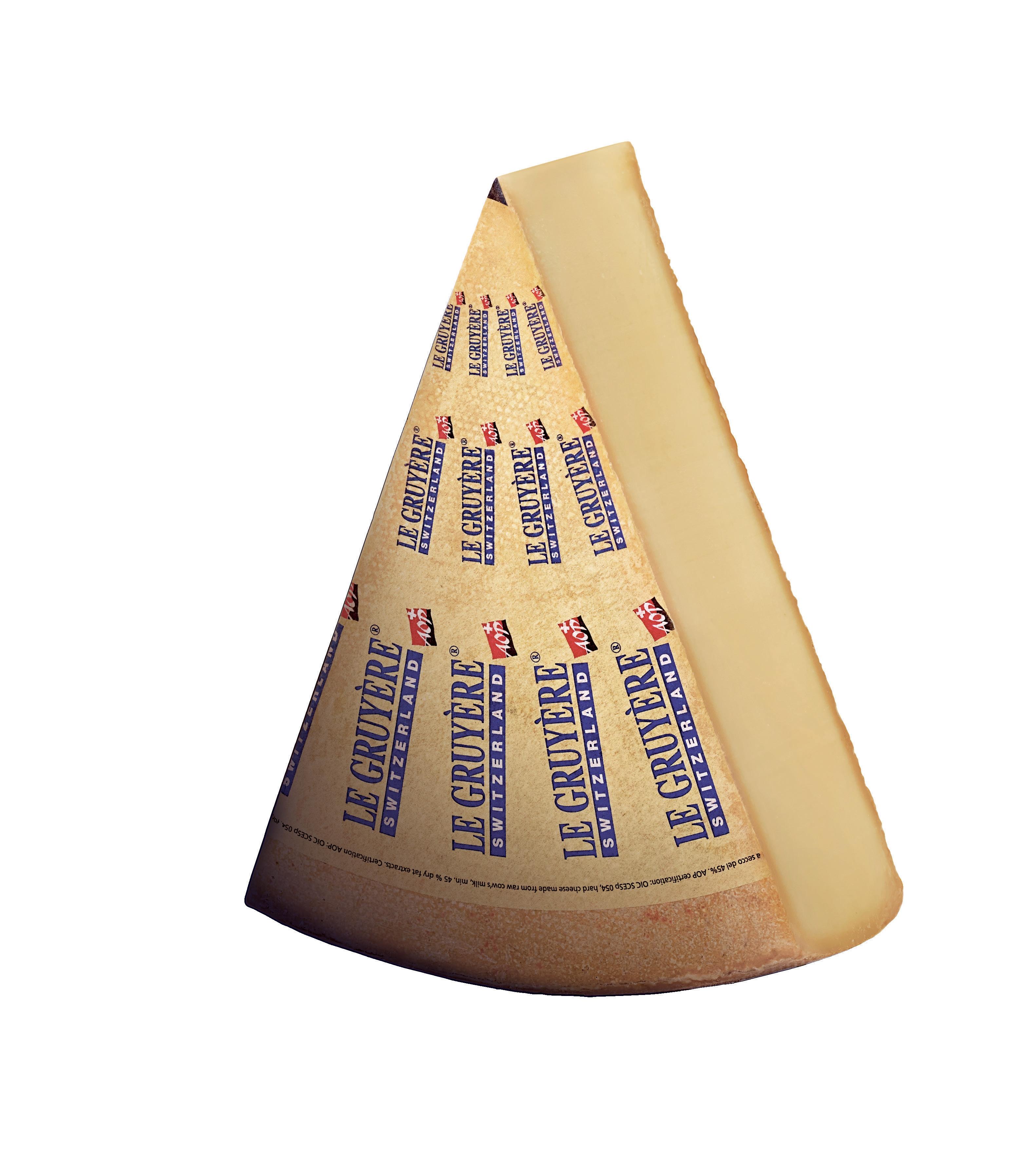

72 FRESH FOOD

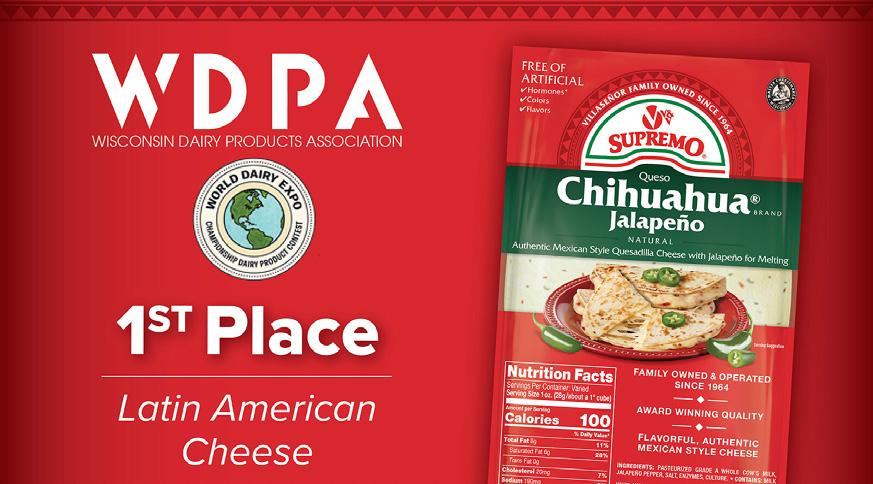

Cheese Aims to Please

Multicultural offerings, seasonal selections and plant-based innovation are category highlights.

8550 W. Bryn Mawr Ave. Ste. 225, Chicago, IL 60631 Phone: 773-992-4450 Fax: 773-992-4455 www.ensembleiq.com

BRAND MANAGEMENT

SENIOR VICE PRESIDENT, GROUP BRAND DIRECTOR Eric Savitch esavitch@ensembleiq.com

EDITORIAL

EDITORIAL DIRECTOR & ASSOCIATE PUBLISHER Gina Acosta gacosta@ensembleiq.com

MANAGING EDITOR Bridget Goldschmidt bgoldschmidt@ensembleiq.com

DIGITAL EDITOR Marian Zboraj mzboraj@ensembleiq.com

MULTIMEDIA EDITOR Emily Crowe ecrowe@ensembleiq.com

CONTRIBUTING EDITORS Karen Appold, Mike Duff, Debby Garbato and Barbara Sax

ADVERTISING SALES & BUSINESS

ASSOCIATE PUBLISHER, REGIONAL SALES MANAGER Tammy Rokowski (INTERNATIONAL, SOUTHWEST, MI) 248-514-9500 trokowski@ensembleiq.com

REGIONAL SALES MANAGER Theresa Kossack (MIDWEST, GA, FL) 214-226-6468 tkossack@ensembleiq.com

SENIOR ACCOUNT EXECUTIVE Johanna Lupardus (CT, DE, MA, ME, RI, SC, TN, NH, VT, MD, VA, KY) 330-990-4635 jlupardus@ensembleiq.com

PROJECT MANAGEMENT/PRODUCTION/ART

PRINT DESIGNER Catalina Carrasco cgonzalezcarrasco@ensembleiq.com

ADVERTISING/PRODUCTION MANAGER Maria del Mar Rubio mrubio@ensembleiq.com

SENIOR DIRECTOR OF MARKETING Nicola Tidbury ntidbury@ensembleiq.com

SUBSCRIPTION SERVICES

LIST RENTAL mbriganti@anteriad.com

SUBSCRIPTION QUESTIONS contact@progressivegrocer.com

CORPORATE OFFICERS

CHIEF EXECUTIVE OFFICER Jennifer Litterick

CHIEF FINANCIAL OFFICER Jane Volland

CHIEF OPERATING OFFICER Derek Estey

CHIEF PEOPLE OFFICER Ann Jadown

PROGRESSIVE GROCER (ISSN 0033-0787, USPS 920-600) is published monthly, except for July/August and November/December, which are double issues, by EnsembleIQ, 8550 W. Bryn Mawr Ave. Ste. 225, Chicago, IL 60631. Single copy price $18.20, except selected special issues. Foreign single copy price $21.80, except selected special issues. Subscription: $134 a year; $246 for a two year supscription; Canada/Mexico $182 for a one year supscription; $249.90 for a two year supscription (Canada Post Publications Mail Agreement No. 40031729. Foreign $182 a one year supscription; $249.90 for a two year supscription (call for air mail rates). Digital Subscription: $78 one year supscription; $144 two year supscription. Periodicals postage paid at Chicago, IL 60631 and additional mailing of ces. Printed in USA. POSTMASTER: Send all address changes to brand, 8550 W. Bryn Mawr Ave. Ste. 225, Chicago, IL 60631. Copyright ©2024 EnsembleIQ All rights reserved, including the rights to reproduce in whole or in part. All letters to the editors of this magazine will be treated as having been submitted for publication. The magazine reserves the right to edit and abridge them. The publication is available in microform from University Micro lms International, 300 North Zeeb Road, Ann Arbor, MI 48106. The contents of this publication may not be reproduced in whole or in part without the consent of the publisher. The publisher is not responsible for product claims and representations.

By Gina Acosta

THE COMPANY’S CEO GIVES SAGE ADVICE ON LISTENING, LONGEVITY AND LEADERSHIP.

Every once in a while, you sit across the table from a CEO and realize you’re not really talking about grocery. You’re talking about something bigger: values, stewardship and what it means to lead people, not just a business.

That’s how I felt during my conversation last month with Kevin Murphy, CEO of Publix Super Markets. I was in Lakeland, Fla., to interview Murphy and several other Publix leaders for this month’s cover story marking the retailer’s 95th anniversary. But our convo felt more like a masterclass in empathy and humanity than an interview.

Murphy is the kind of leader who de ects credit, keeps his voice low and still talks about bagging groceries at his rst Publix store as a teenager. He measures his legacy not in pro ts, but in how many people he has helped grow.

Here are the top ve takeaways from our conversation:

Murphy never once used the words “innovation” or “transformation.” Instead, he talked about people. “We’re in the people business; we just happen to sell groceries,” he told me. That simple line should reframe every conversation about technology, AI and automation in this industry. The lesson: You can modernize without losing your humanity.

Publix’s employee ownership model has been copied on paper, but never in spirit. Every associate has the opportunity to own shares of the company — and, more important, shares in its purpose. Murphy calls it “a winning recipe.”

He added: “When you own something, you care about it differently. People will go above and beyond for something they own.”

Imagine if every retailer built that kind of

Gina Acosta Editorial Director and Associate Publiser gacosta@ensembleiq.com

emotional equity — not just nancial equity — into their culture.

Murphy described his job as “chasing grand opening every day.” This is the opposite of complacency — a reminder that perfection is temporary, but discipline is permanent.

Anyone can look great on opening day. The hard part is looking great on day 3,456. That philosophy explains why Publix stores feel as meticulously cared for as they did 20 years ago. Consistency, Murphy said, is the hardest thing to achieve in retail and the easiest thing for a shopper to notice when it slips.

I left Lakeland thinking about how deliberately Publix protects its culture. The company literally manufactures it — in its bakeries, dairies and fresh kitchens — by controlling quality and process down to the inch.

But culture is also protected through people. “You can’t buy culture,” Murphy told me. “You have to build it.”

5. Leadership Is About the Next Generation, Not Your Own

Murphy carries Publix’s history with a quiet weight. He talks about “protecting this company for the next generation” the way some people talk about protecting a family heirloom.

“Every generation of Publix leaders has protected this company for the next one,” he said. “That’s my job now: to make sure the next generation inherits a company stronger than the one I did.”

That’s not a sound bite; that’s a philosophy of service. And it’s a reminder that true leadership has very little to do with titles and everything to do with stewardship.

As I wrapped up my visit, I found myself thinking less about grocery and more about grace. About the quiet excellence of people who still believe consistency, kindness and ownership are the real differentiators.

In an industry that often celebrates the loudest disruptors, Publix believes that steadiness can be bold.

7

National Pearl Harbor Remembrance Day. Think of those who perished when WWII rst arrived on our shores.

1

Eat a Red Apple Day. Direct those who celebrate to your enticing produce display.

2

3

Bingo’s Birthday Month

National Drunk and Drugged Driving Prevention Month

National Egg Nog Month

National Fruitcake Month

4

5

National Giving Day

National Tie Month

National Write a Business Plan Month

Operation Santa Paws

6

14

The Jewish festival of Hanukkah begins at sundown, running through sundown on Dec. 22.

21 Winter Solstice. Time to embrace the dark side.

28

National Call a Friend Day. Why not send a gift basket or owers from your store(s) as well?

Safety Razor Day. Encourage cleanshaven shoppers – or those who wish to be – to mark the occasion by visiting your personal care aisle.

Candle Day. Poll your customers to nd out their fave scents.

8

National Blue Collar Day. Pay tribute to all of your hard-working associates and colleagues who engage in manual labor.

9

Lost and Found Day. Make sure you have a procedure to safeguard any items accidently left behind by shoppers or employees.

15

National Lemon Cupcake Day. Let shoppers know they’re on sale in the bakery department.

22

On Forefathers’ Day, let’s not forget our foremothers and their remarkable contributions to this country.

16

Las Posadas. Sponsor a local procession reenacting the biblical story of Mary and Joseph’s journey to Bethlehem, a seasonal tradition in Latin America.

23

National Roots Day. Ask associates to share family recipes as a way to celebrate their various heritages.

29

International Cello Day. Crank up some Yo-Yo Ma to ood the aisles with beautiful music.

30

Sodium Bicarbonate Day. Whether for baking, cleaning, deodorizing or relieving stomach upset, this is quite a versatile compound.

10

Birthday of Emily Dickinson (1830). The celebrated New England poet was also an accomplished baker.

17

Festival of Winter Walks. Publish some suggested routes for families to enjoy together.

24

Christmas Eve. Be ready to assist those infamous last-minute shoppers.

31

New Year’s Eve. Resolve to do even more to strengthen your connection with shoppers and associates.

Extraordinary Work Team Recognition Day. Go, team!

11

National App Day. This is a good time to go over yours for any bugs, or to start the process of rolling one out.

18

Flake Appreciation Day. Hold a contest inviting young artists to draw their best snow scenes to decorate the windows of your store(s).

National Blue Jeans Day. This ubiquitous wardrobe choice among shoppers and associates alike has been around since the 1870s.

St. Nicholas Day. In some cultures, children leave out their shoes the night before so the saint can leave small gifts in them.

12

Gingerbread Decorating Day. Offer products and tips to get families started on a tasty holiday project.

19

National Emo Day. Hey, if that’s your jam.

13

National Cream Cheese Frosting Day. Yum!

25

Christmas Day. Act as a not-so-secret Santa to reward your dedicated employees with small gifts.

26

Kwanzaa. Light a kinara (candelabra) to mark this modern pan-African holiday that runs through Jan. 1.

20 Games Day. Suggest snacks and easy meals to accompany marathon sessions of Monopoly or Scrabble.

27

International Day of Epidemic Preparedness. It’s always wise to be ready for the next health emergency.

It’s the holiday season... and once again, consumers will be redeeming Holiday Gift Checks at grocery stores and supermarkets across the country! The Holiday Gift Check Program brings customers into your stores and helps you sell turkeys or hams! When businesses in your area give Holiday Gift Checks to their employees or clients, you win with an increase in turkey and ham sales and a positive impact on your bottom line

Deposit the Holiday Gift Checks, along with any other business or payroll checks. Check security features include microprint, watermarks and a security screen.

or hams.

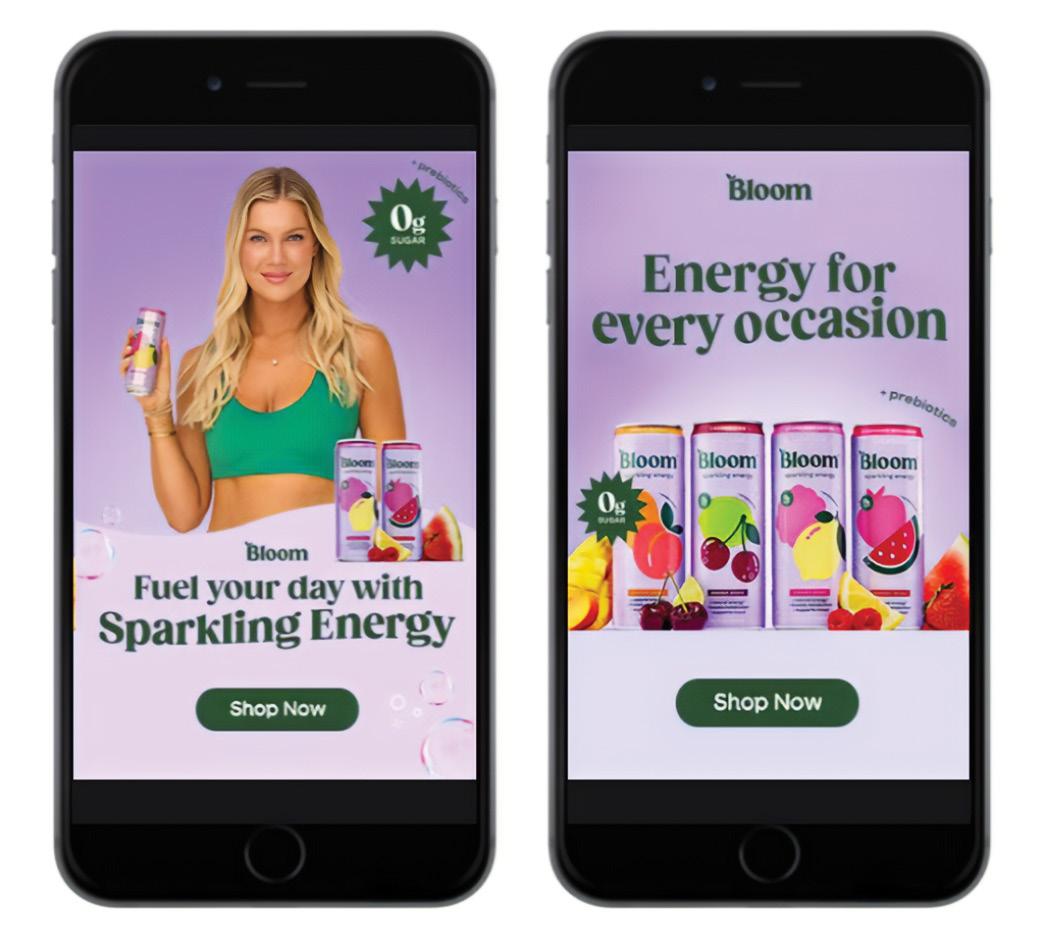

KEY COLLABORATORS HAVE HELPED THE BRAND STRATEGICALLY POSITION ITSELF IN A CROWDED MARKET.

By Emily Crowe

The functional nutrition and energy space might be a crowded one, but newcomer Bloom is helping consumers take ownership of their health with its high-quality supplements ranging from greens and superfoods drink mixes and gummies to ready-to-drink sparkling energy beverages. The growing company recently partnered with Winston-Salem, N.C.-based data-driven technology company Inmar Intelligence and key retailers on a marketing activation aimed at reaching both past purchasers and new buyers during receptive times tied to health, inspiration and recharging.

For the activation, Bloom’s creative team emphasized its clean, sparkling energy positioning and established the brand as a better-for-you challenger in the category. By working with key retail partners and using Inmar’s targeting and measurement, Bloom was able to drive meaningful retail traf c, deliver measurable results and better align itself with everyday wellness routines.

Nicolette Passini, shopper marketing manager at Austin, Texasbased Nutrabolt, spoke with Progressive Grocer about how the company made it happen.

Progressive Grocer: It’s exciting to launch a new brand, especially a rst-of-its-kind wellness-based sparkling energy drink. What has that experience been like for you and the team? How did that unique perspective shape the way you approached this campaign?

Nicolette Passini: It’s been incredibly exciting to launch Bloom’s rst sparkling energy drink. For our team, the process has been about more than just entering the energy category – it’s been about reshaping it. We know today’s consumers want more than a quick boost of energy; they want clean energy that ts their wellness lifestyle. That perspective shaped the campaign. We designed activations and messaging to highlight Bloom as a lifestyle- rst energy brand, one that energizes without compromising health values.

PG: Bloom’s recent campaign emphasized Health Inspiration, Power Up and Purchase-Based Moments. How does this approach re ect broader shifts in how consumers are rede ning their energy needs?

NP: Consumers today are looking for energy that’s more intentional and more aligned with their overall lifestyle goals. They’re not reaching for a boost when they’re tired – they want products that help them feel balanced, focused and motivated throughout their day. By building our campaign around Health Inspiration, Power Up and Purchase-Based Moments, we were able to connect directly with those needs. It re ects a larger shift away from traditional, high-intensity energy use cases and more toward functional energy that supports wellness, productivity and sustainable routines.

PG: Bloom’s most recent campaign, in partnership with Inmar Intelligence, showed success in driving brand awareness as well as in-store traf c and engagement. How do results like these help Bloom demonstrate its unique value to both consumers and retail partners?

NP: The Inmar campaign results – increasing awareness, driving store traf c and sparking engagement – prove that Bloom can stand out while adding value at retail. Bloom can bring incremental traf c and new shoppers into the category. For consumers, it validates that our wellness- rst position resonates, which strengthens our story with partners who want products that not only sell, but also build long-term loyalty. Those results reinforce Bloom’s role as a differentiated energy brand that adds value across the entire ecosystem, including consumers, retailers and the category overall.

PG: Campaign insights showed that Bloom resonated the most during weekday afternoons and evenings, when shoppers were focused on routines and wellness goals. How does this align with Bloom’s positioning as a wellness lifestyle- rst energy brand, compared to more traditional energy drink competitors?

NP: What’s powerful about that is that it gives our retail partners a clear roadmap on how to position the brand in-store. Those are peak shopping windows when consumers are thinking about their wellness routines, and Bloom’s wellness- rst positioning allows retailers to capture that demand in a way traditional energy drinks don’t. It’s not just about selling cans – it’s about helping retailers build a differentiated energy set that speaks to evolving consumer needs, ultimately driving incremental trips and higher basket value.

campaign. How do these different shopping patterns connect to Bloom’s strategy for building both trial and loyalty?

NP: It shows that Bloom is hitting two critical stages of the shopper journey: Single cans are often the entry point to try something new, while multipacks signal that they’ve not only tried the product, but made Bloom part of their lifestyle. Our strategy is built on making it easy for shoppers to discover us in quick trips, then rewarding them with formats that support repeat purchase and long-term loyalty.

PG: Functional beverages are increasingly blurring the lines between energy, wellness and lifestyle. How does Bloom’s success in this campaign underscore its ability to carve out a distinctive space among both emerging brands and established players?

NP: Emerging brands may offer wellness or niche energy products, and established brands often focus on traditional, high-caffeine options. Bloom sits at the intersection of energy, wellness and lifestyle, delivering clean, functional energy that supports everyday routines. The campaign results show that this unique positioning not only attracts attention, but also drives trial and engagement, making Bloom a differentiated choice in a crowded market.

“These campaigns are essential for turning interest into trial and trial into loyalty. By pairing Moments-powered media with in-store o ers, we are meeting consumers at the exact point where intent turns into action.”

—Nicolette Passini, Shopper Marketing Manager, Nutrabolt

PG: Bloom also works with Inmar to amplify in-store offers coupled with Moments-powered media. What role do these campaigns play in supporting trial, loyalty and overall retail performance?

NP: These campaigns are essential for turning interest into trial and trial into loyalty. By pairing Moments-powered media with in-store offers, we are meeting consumers at the exact point where intent turns into action. That not only drives trial by lowering the barrier to rst purchase, but it also builds loyalty by reinforcing Bloom as a brand that consistently shows up in their routines. For retailers, it means stronger conversion, repeat traf c and a healthier performance story across the category.

PG: Data indicated that both quick trips for single cans and longer store visits for multipacks were in uenced by the

PG: One of the learnings from Inmar’s post-campaign reporting was that brand lift and ad unit engagement was high in the tness-focused creative unit. How does that in uence the way you optimize and reach consumers moving forward?

NP: The high engagement with tness-focused creative reinforces that Bloom resonates most when we connect directly to consumers’ wellness and active lifestyles. Moving forward, it guides us to prioritize content and placements that speak to those Moments, whether it’s pre- or post-workout, midday routines, or tness-related inspiration. This approach ensures our campaigns drive meaningful connections with the right consumers at the right time.

Scan the QR code to get in touch with Inmar Intelligence about driving trial and loyalty in the beverage category.

Jel Sert has been a leading manufacturer of drink and dessert mixes and freezable novelties for decades. But those products are only the beginning of what the company offers. Armed with expertise in manufacturing food products for the world’s largest CPG companies, Jel Sert is ready to develop high-quality products for grocery retailers, too.

Here, Matt Ingemi, Chief Strat egy Officer and Vice President of Business Development, explains the benefits of partnering with Jel Sert’s team of development and project management experts to elevate grocers’ private label portfolios.

Progressive Grocer: Let’s talk about private label in general. What are some trends, and what is the growth trajectory of store-brand products?

MI: We’re seeing store brands evolve with greater variety and stronger consumer perception. Shoppers increasingly treat them as intentional choices, not just lower-cost alternatives. While matching National Brand Equivalents (NBEs) remains important for core offerings, much of the category’s growth now comes from tapping into emerging consumer trends and preferences. Private brands will almost always offer dollar value, but today, consumers are no longer expecting a lower-value product or product experience.

PG: Why should retailers consider partnering with Jel Sert? How is the company equipped to help elevate private label offerings?

MI: As a branded CPG company, we invest heavily to stay at the forefront of innovation in every category we serve. That means we can share category and consumer insights, and help build a robust presence in social commerce, mining information from a first-party relationship with our loyal consumers.

We bring that same level of insight to our retail partners — helping them identify opportunities early and innovate within their private brand portfolios.

PG: Do you have any examples of how JelSert’s branded innovation has influenced or strengthened a retailer’s private label line?

MI: A strong example is the rise of the #WaterTok trend on TikTok, where consumers began experimenting with flavored powder and liquid mixes to transform the way they hydrated. Jel Sert leaned in early, fueling the movement with speed and variety in our branded drink mixes. We’ve since applied that same playbook — rapid product development tied to cultural moments — with select retail partners, enabling them to launch trend-driven drink mixes under their private labels. The result: private brand assortments that feel culturally relevant, not just category fillers.

PG: How does a partnership with Jel Sert go beyond basic transactions for your retail clients?

MI: We see ourselves as an extension of our partners’ teams, not just a supplier. That means sharing insights on consumer behavior, category shifts, and product innovation, even if it means retailers may use that information in competitive bids. We’re confident in our vertically integrated sourcing and manufacturing, but our true differentiator is the turnkey service we deliver: innovation strategy, R&D, packaging development, design, and world-class operations. For our retail partners, the value goes well beyond manufacturing; it’s about having a strategic innovation partner who can help grow the reach and impact of their private brand portfolios.

FOR MORE INFORMATION ABOUT HOW JEL SERT CAN HELP BUILD YOUR BRAND, VISIT JELSERT.COM.

Red meat is on the menu for the long haul, despite a myriad of challenges, ranging from in ation to health to sustainability. While these challenges present obstacles, most consumers don’t trade out of the category entirely. However, 20% note a decline in their intake, which is a trend that warrants close observation over time.

In a crowded and relatively stagnant market, convenience can be a powerful differentiator. The good news is that it can be achieved in various ways, from pre-cooked/pre-cut options to ideas for easy preparation methods. Pair these with an emphasis on health bene ts to create the foundation for a winning strategy.

Red meat sales are projected to rise to $76.9 billion in 2025, despite challenges. While costs deter some consumers, cooking at home to save money remains strong, boosting demand for red meat. Sustained interest in natural protein supports its stability, although health and sustainability concerns may slow growth.

Younger consumers have less established habits regarding red meat, making this an ideal time to help them build lasting routines. With less experience cooking red meat, these consumers may need guidance on choosing cuts and preparing them. Pre-cooked/seasoned options can also ease their hesitation and make red meat more approachable.

Red meat consumption remains stable across income levels, but buying habits tell a different story. When money is tight, people eat less red meat, meaning that it may not be a priority. Positioning red meat as a complement to affordable proteins, rather than as the main focus of a meal, could help shift the perception that it’s unattainable.

Health bene ts like high protein and affordability drive higher red meat consumption, but they’re also key reasons for cutting back, unveiling a major fracture in perceptions. Focus on factors like health and value to strengthen motivations for those eating more red meat, while addressing the concerns of those reducing their intake.

Rising prices, health concerns and a reluctance to cook may push red meat from being the centerpiece of meals to playing a more supporting role. More than a quarter of consumers are eating smaller portions, underscoring meat’s challenge to shine as a center-ofplate item. This shift is particularly evident in the move toward less traditional meal options like snacking, international cuisines or plant-forward dishes, where pork and beef risk losing prominence. However, these meats can regain relevance when positioned as flavor enhancers, a role they often play in popular international cuisines like Japanese and Latin American cooking.

Use on-pack messaging to clearly convey easy preparation steps, cooking time and meal-pairing suggestions, highlighting value and hand-holding consumers through the process.

More than 30% of consumers find red meat more challenging to cook than other types of meat. The majority of shoppers possess basic or intermediate cooking skills, with nearly half cooking out of necessity rather than passion. Providing pre-cooked meats removes the hassle of seasoning and preparation, helping reduce cooking fatigue and make mealtime easier. Along with convenience, pre-cooked meals can o er versatility, savings and food waste reduction.

Register now: let’s celebrate together FEB 22ND — 26TH, 2026 I HALL 12, BOOTH C35 I DÜSSELDORF,

Register now for an appointment

We look forward to welcoming you to EuroShop 2026, the world’s biggest retail trade fair in Düsseldorf, Germany.

Discover our new products and technical innovations, enjoy culinary specialties from our chefs from Northern Italy, and let’s celebrate together ...

Register now for a personal appointment. We look forward to meeting you there.

Incollabor ationwith :

FROM AMERICA’S

As the only beekeeper-owned cooperative in the United States, Sioux Honey Association Co-op has been a leader in the honey industry since its founding in 1921. Today, in partnership with American Farmland Trust (AFT), the co-op is launching U.S. Farmed™ Certified Honey, making Sue Bee® and Aunt Sue’s® the first honey brands to carry this seal. Progressive Grocer spoke with Dustin Livermore, Vice President of Quality & Supply Chain (and hobbyist beekeeper), and David Coy, a commercial beekeeper member and Vice Chairperson of the Board, about what this certification means for grocers and shoppers.

PG: Tell us about American Farmland Trust and the U.S. FarmedTM Certified Seal.

DUSTIN LIVERMORE: AFT is a national nonprofit dedicated to protecting farmland, promoting sustainable agriculture, and keeping farmers on the land. The U.S. FarmedTM Certified Seal is the only thirdparty audited certification verifying that products are made with U.S.-grown ingredients. We’re proud that Sue Bee® and Aunt Sue’s® are the first honey brands to carry this certification.

PG: Why should grocery retailers care?

DAVID COY: As a beekeeper, I know the care it takes to produce honest, high-quality honey. The seal is more than a label — it proves every jar comes from American soil, farms, and bees.

DL: There are five key reasons this is important for grocery retailers.

1. Consumer trust is shifting toward transparency. Shoppers are skeptical about food sourcing, especially honey, which has faced mislabeling and adulteration. This seal reassures customers that their honey is truly American and traceable from hive to bottle.

2. Support for American agriculture resonates. Today’s shoppers want to back local farmers and sustainable practices. Carrying this honey directly supports U.S. beekeepers, agriculture, and ecosystems.

3. Di erentiation in a crowded category. The honey aisle is competitive. No other honey has this verified U.S. source certification, giving grocers a unique selling point.

4. Environmental and pollination benefits. Supporting U.S. honey supports pollination of American crops and beekeepers. Healthy bees mean healthier farms and a stronger food system.

5. Honesty sells. The seal aligns with rising consumer demand for authenticity and ethical sourcing. Stocking it demonstrates integrity in food.

PG: Which products carry the U.S. Farmed™ Certified seal?

DL: Sioux Honey Association Co-op offers several certified products including Sue Bee® Pure Premium, Local, Spun®, Hot and Sea Salt Honey, plus Aunt Sue’s® Raw & Unfiltered Clover and Wildflower Honey.

PG: Any final thoughts for grocers?

DC: I encourage grocers to carry U.S. Farmed™ Certified honey. It’s pure, traceable, and made here at home. Adding it shows support for local farmers while giving customers confidence in what they buy.

FOR MORE INFORMATION, CONTACT YOUR SIOUX HONEY SALES DIRECTOR.

By Molly Hembree, MS, RD, LD

THE FACTS, RETAILERS CAN HELP SHOPPERS MAKE INFORMED DECISIONS ABOUT THESE PRODUCTS AT THE GROCERY

lthough plant-based alternatives burst onto the scene in full force just a few years ago, the enthusiasm for this category persists, albeit at a more predictable pace. Consumers following a plant-based eating pattern for the long term, such as adherence to a vegetarian or vegan diet, or those looking to nd plant-centered alternatives that suit their health needs or preferences, continue to seek innovative products from these sections of the grocery store. A key area of plant-based options still making headlines is that of plant proteins. It’s prudent to be aware of what makes plant-based proteins similar to or different from their animal-based versions; that way, shoppers can make informed decisions on them at the grocery store.

Protein tends to be synonymous with meat; however, protein is abundant in the plant kingdom as well. In fact, lentils, beans, tofu, peanut butter and other natural sources of plant protein are more cost-effective than most meats. It’s recommended to consume a wide variety of plant proteins to achieve a strong balance of amino acids, the building blocks of protein. Although products vary considerably, one serving of a plant-based “mock meat” likely has between 10-20 grams of protein, while one serving of 73% lean ground beef or one serving of raw chicken wings contains about 17 grams of protein.

status isn’t seen as detrimental to public health. Nonetheless, dietary cholesterol isn’t advantageous to the diet, and the body produces enough cholesterol of its own for all physiological needs. Most adults may see a bene t in keeping dietary cholesterol intake below 300 milligrams daily.

Plant-based proteins continue to pique the interest of consumers, and providing clarity about the nutritional pros and cons of this category can boost shopper confidence.

More processing often equates to added ingredients like sugar or salt to accomplish tastier alternative dishes. Plant-based proteins may undergo heightened levels of processing to imitate their animal-based counterparts. Table salt, or sodium chloride, adds an incredible amount of avor and is the rst ingredient that most food manufacturers will use to elevate a product’s palatability. However, some private and national brands that are experienced in crafting tasty plant-based proteins have found clever ways to add rich avor without sodium, instead opting for ingredients like mushrooms, tomatoes, seaweed, nutritional yeast, or premium herbs and spices.

Fiber, which goes hand in hand with plants, isn’t naturally found in animal foods. Daily adequate ber intake is connected to reduced risk of developing cardiovascular disease, type 2 diabetes and some cancers, and has been associated with lower body weight. Although wholesome plant ingredients like beans, lentils, nuts, seeds, whole grains, fruits and vegetables often boast impressive ber content, the nutrient can also be easily incorporated into plant proteins. Added ber, which is called out in ingredient statements, may include psyllium husk, cellulose or inulin, as well as vegetable powders and bean ours.

Dietary cholesterol makes its way into our diet only via animal-based ingredients like eggs, dairy, meat, poultry, seafood or their derivatives. However, the American Heart Association and the Academy of Nutrition and Dietetics’ stance on cholesterol has morphed over the years, and now dietary cholesterol intake

Added fats often found in plant proteins can include palm oil, palm kernel oil, cocoa butter or coconut oil. These fats contain a meaningful amount of saturated fat, of which intake is associated with increased “bad” LDL cholesterol and risk of heart disease. Daily saturated fat intake should be kept to less than 10% of calories, or about 22 grams of saturated fat, for someone following a 2,000-calorie diet.

Plant-based proteins continue to pique the interest of consumers, and providing clarity about the nutritional pros and cons of this category can boost shopper condence. Work with your dietitian to clear up any confusion about plant-based proteins through opportunities like expert infographics or blogs, store tours, shelf talkers, original recipes, or food demos.

Chris Chatterton President

By Gina Acosta

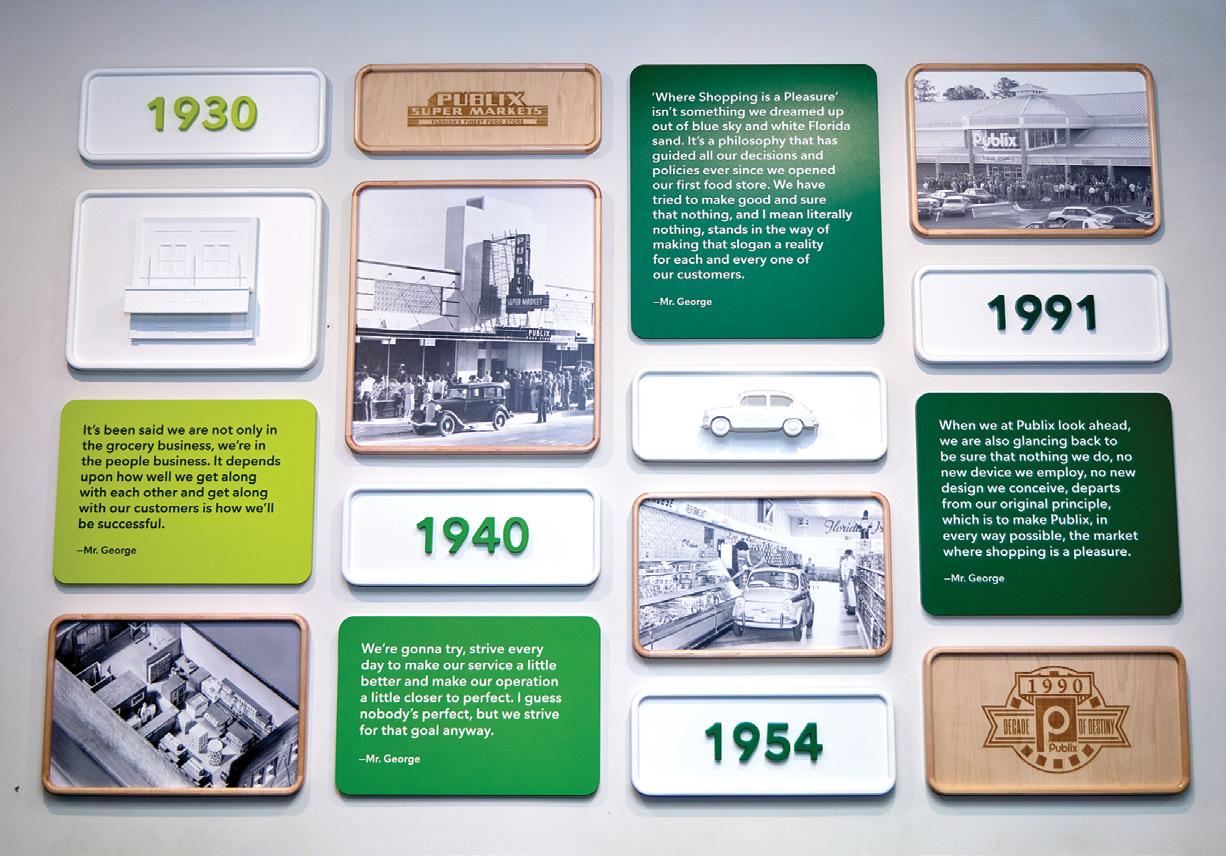

When shoppers walk into a Publix store, they don’t see robots prowling the aisles or giant screens urging them to buy more. There are no smart carts calculating totals, nor are there shelves that light up to demand attention.

Instead, shoppers fi nd something radical in its simplicity: calm, serenity, warmth. The lighting is gentle, the shelves are immaculate, and the associates greet you as if they’ve been expecting you all day long.

That sense of ease in a Publix store is the byproduct of a 95-year philosophy, one that places dignity, courtesy and ownership above digital gadgetry. In the world of grocery, where automation often masquerades as progress, Publix’s restraint feels almost revolutionary. You might even say that these are stores where shopping is, quite literally, a pleasure.

When 22-year-old George Jenkins opened his fi rst Publix in Winter Haven, Fla., in 1930, he wanted to build a grocery store unlike any other. His dream was to deliver the fi nest service in the fi nest stores with the fi nest employees.

In 1954, when advertising director Bill Schroter proposed a new slogan inspired by what customers were saying about Publix stores, “Where Shopping Is a Pleasure,”

values and standards. That loyalty and dedication that’s been earned over many years continues to resonate.”

Murphy’s own story mirrors that of thousands of Publix associates who turned part-time jobs into lifelong careers. “I started at 14 bagging groceries, and it’s worked out pretty well,” he jokes in an interview at the company’s Lakeland, Fla., headquarters.

He says that what Publix gave him, and what he now tries to give back, is opportunity. “It’s rare these days to grow and mature personally while growing and maturing in your career,” Murphy notes. “Publix o ers that at every level. Our people can come in at 16 or 60 and still fi nd a path to their personal best.”

“It’s rare these days to grow and mature personally while growing and maturing in your career. Publix o ers that at every level. Our people can come in at 16 or 60 and still find a path to their personal best.”

—Kevin Murphy, CEO, Publix Super Markets

Mr. George (as everyone in the grocery industry called him) instantly saw that it captured the company’s soul. “This isn’t something we dreamed up out of blue sky and white Florida sand,” he later said. “It’s a philosophy that has guided all our decisions and policies ever since.”

Nearly a century later, that philosophy not only defi nes the brand, but also underpins a business model that continues to achieve colossal growth in delighting shoppers. With more than 1,420 stores across eight states and annual sales exceeding $59.7 billion, Publix celebrates its 95th anniversary this year not as a nostalgia play but as proof that doing business the right way still works.

“Publix is a strong brand that has lasted and resonated for 95 years,” CEO Kevin Murphy says. “It’s a credit to our foundation, our

Longtime colleagues remember how Murphy was always hanging around after his shift, looking for ways to do things better: “He had to be told to go home.” That relentless curiosity made him one of the company’s best operators.

“For me, being an operator is about atmosphere,” Murphy explains. “What does it feel like when you walk in? What weather are your associates creating? Customers who feel welcome shop longer, and they buy more.”

He often walks stores and notices small things: a crooked label, a warm greeting, the scent of fresh bread.

“Those details tell you everything,” he says. “We’re not just selling groceries. We’re selling a feeling: that you’re wanted, that you’re valued.”

Publix’s structure allowed Murphy to rise through the ranks. “At Publix, you can start as a cashier or deli clerk and end up in accounting, marketing or pharmacy operations,” he observes. “It’s about preparing for opportunity. Publix o ers that.”

He adds: “We talk a lot about ownership and promotion from within, but the real magic is how we help people see things in themselves that they may not have seen otherwise. Somebody believed in me early on, more than I believed in myself. That’s something I think about every day as a leader.”

“Without a doubt, the key has been Publix people,” Murphy asserts. “The pride of ownership is a winning recipe. People will often go above and beyond for something they own.”

Each year, Publix shares profits with associates through stock ownership. “We reinvest in our people,” Murphy adds. “They care more because they own more. That creates a competitive advantage in every market we enter.”

That ownership structure is one reason that Publix has maintained a culture of stability and humility. “You can’t buy culture; you have to build it,” Murphy says. “Ours was built by people who understood that when you share success, you multiply it.”

a day, seven days a week, and maintain standards, conditions, freshness, everything. Our goal is to deliver the same great shopping experience at 8 a.m. on a Tuesday as we do on grand-opening day.”

That operational rigor is also paired with humanity. “Our customers don’t just expect clean floors and full shelves,” he says. “They expect eye contact. They expect kindness. That’s what we deliver.”

“Our customers don’t just expect clean floors and full shelves. They expect eye contact. They expect kindness. That’s what we deliver.”

—Kevin Murphy, CEO, Publix Super Markets

He often reminds associates that consistency is Publix’s greatest strength, as well as its greatest challenge. “We chase grand opening every day in every store,” he says. “Few retailers are willing to do what it takes to repeat that experience every single day, but we do.”

Murphy calls repetition the art of discipline: “We operate 15 hours

From its Florida base, Publix now stretches through Georgia, Alabama, Tennessee, South Carolina, North Carolina, Virginia, and Kentucky, opening roughly 30 new locations each year. Expansion could easily dilute the culture, but Murphy insists otherwise.

“We operate the same Publix in eight states,” he says. “We don’t change our prototypes or standards. Publix is Publix. Over 95 years, we’ve identifi ed the best way to operate a supermarket, and that’s what customers expect.”

Still, the business environment is tougher than ever. Regulatory pressures climb, costs soar and competitors multiply. Yet Murphy’s optimism remains intact. “We just want to sell groceries and take care of our customers,” he says. “With the loyalty of our associates and communities, our outlook is very positive. … The responsibility of protecting this company, our people and their futures never leaves my mind. It’s a weight, but it’s a privilege.”

Purina’s Purple Leash Project aims to help transform the domestic violence landscape to save lives at both ends of the leash.

By Joe Toscano, Vice President, Trade & Industry Development at Purina

Every year, millions of Americans experience domestic violence. For many survivors, a pet is more than just a companion—it is a source of comfort, resilience, and unconditional love. Yet, for nearly half of survivors, the presence of a beloved pet becomes a heartbreaking barrier to safety. Research shows that 48% of domestic abuse survivors delay leaving a dangerous situation because they cannot take their pet with them, and fewer than one in five domestic violence shelters nationwide currently accept pets.

This stark reality is what inspired Purina to launch the Purple Leash Project in partnership with nonprofit RedRover. The goal is simple but urgent: To create a future where no one must choose between escaping abuse and protecting their pet. Since its inception in 2019, the Purple Leash Project has provided more than 55 grants to shelters across the country, funding everything from outdoor play yards to indoor housing that accommodates both survivors and their pets. Thanks in part to these efforts, the number of pet-friendly domestic violence shelters has more than doubled in just five years, rising from 8% to nearly 20% today.

Awareness is a vital part of creating meaningful change in the domestic violence landscape. To shine a light on and help reduce the stigma around being a domestic violence survivor, we partnered with Variety® to honor actor, advocate and survivor Sarah Hyland with the first-ever Variety Courage Award presented by Purina at the annual Variety Power of Women event in Los Angeles last October. This recognition underscored both her personal journey and her commitment to raising visibility for survivors who face the painful choice of leaving a pet behind.

Most recently, we were privileged to partner with Sarah again to create the Courageous Together Collection, which launched this September, with the intention of inspiring courage, sparking conversations and reducing the stigma that too often surrounds domestic abuse. Available

exclusively at shop.PurpleLeashProject. com, the collection features items for pets and people, including necklaces, and bag charms designed in partnership with causefocused jewelry brand Coastal Caviar. One hundred percent of every purchase from the collection benefits and is a donation to RedRover in support of the Purple Leash Project, directly funding shelter improvements so survivors and pets can escape—and heal—together.

We are proud of the progress we’ve made but know there is much more work to be done. Retailers also have an important role to play in advancing this mission. Grocery stores, in particular, are uniquely positioned at the heart of their communities, serving as daily touchpoints for millions of families. By engaging with the Purple Leash Project, retailers can help spread awareness, raise funds and provide meaningful support to local shelters. Opportunities include featuring specially marked Purina products, hosting in-store donation and round-up programs, or working with your Purina reps to secure Purple Leash Project merchandising displays.

We’ve seen retailers and customers make meaningful change in their own local communities by engaging with shelters in their own backyards—from organizing supply drives, offering retail gift cards to support shelters and survivors and more.

The impact of this work extends far beyond corporate philanthropy. By supporting survivors and their pets, retailers can foster trust, demonstrate leadership in social responsibility and make a direct difference in the lives of vulnerable families within their own communities.

Domestic violence may often remain hidden, but together we can bring visibility, compassion, and change. Purina invites retail partners to stand with us in this mission. To learn more about the Purple Leash Project, access resources, or make a donation, reach out to your Purina rep or visit Purina.com/ Courage.

Because no survivor should ever have to choose between their own safety and the safety of their pet.

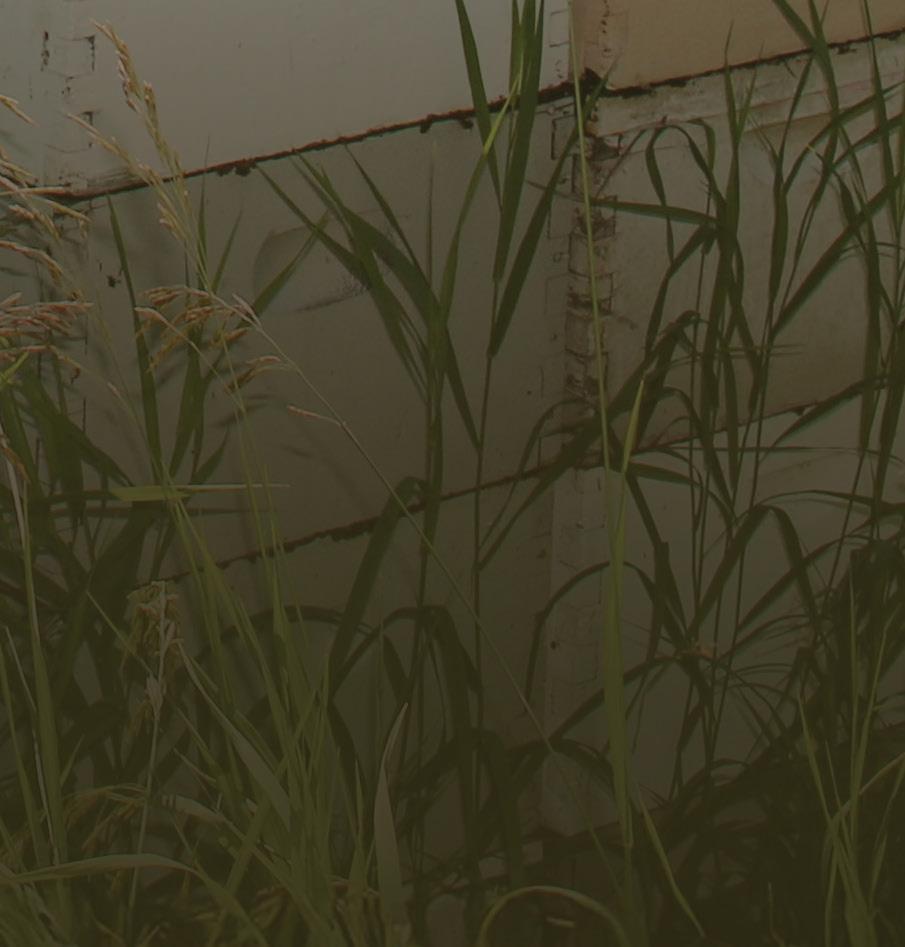

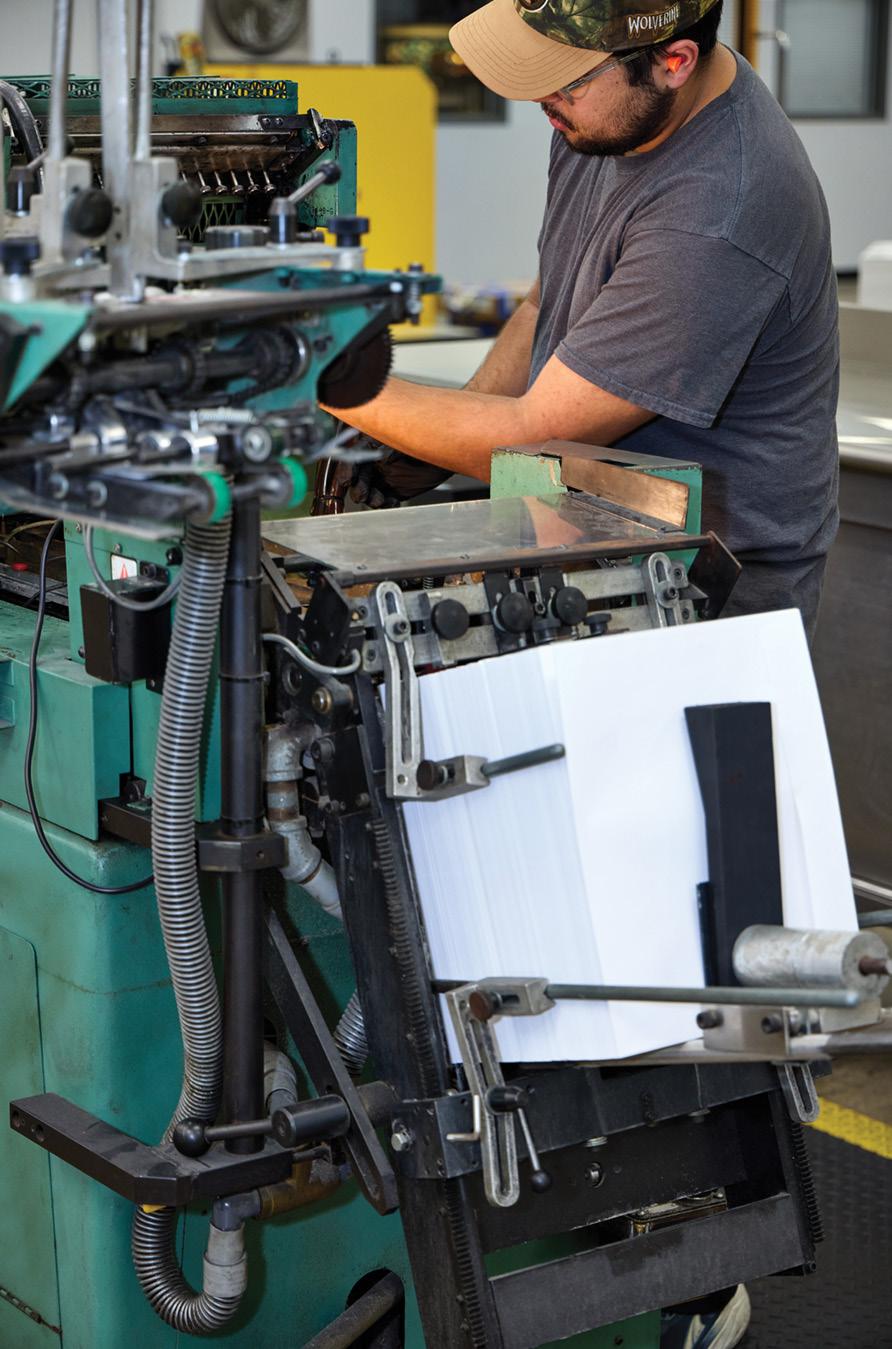

Publix is more vertically integrated than most of its competitors, operating 10 food plants and its own printing facility.

“It doesn’t make sense for us to make green beans,” says Doug Harris, VP of manufacturing, who led Progressive Grocer on a tour of one of his plants, “but it does make sense to process our own milk, make our own ice cream and bake our own bread. It boils down to quality, service and competitive advantage.”

He calls the company’s 1980s-era decision to open its own dairy plant “one of the smartest moves Publix ever made.” That plant, which now produces milk, tea and water for all Publix stores, remains a model of innovation and e ciency.

“The most important innovation for us isn’t always technological,” Harris adds. “It’s our safety culture. The greatest way to show associates we care is to provide a safe workplace. Every new hire gets safety training on day one, and that focus never stops.”

At Publix’s Fresh Kitchen facilities in Florida and Georgia, Harris points to precision and speed. “An order comes in at 3:30 p.m., and by 4 p.m. the next day, it’s produced, loaded and delivered,” he says. “We do that 362 days a year for all 1,420plus stores.”

“We try to hire good people and then make them even better. Publix has made me a better person. And when you retire from here, you want to leave it better than you found it, because the next generation is counting on you.”

The company’s 3-D printing capabilities, housed within its printing plant, are also breaking new ground. “We’ve used 3-D printing to produce equipment parts and even a replica of a 1940s Publix car for a company exhibit,” Harris says. “There’s really nothing our team can’t make.”

—Doug Harris, VP of Manufacturing, Publix Super Markets

Behind the machinery, however, is a human legacy. “We try to hire good people and then make them even better,” Harris says. “Publix has made me a better person. And when you retire from here, you want to leave it better than you found it, because the next generation is counting on you.”

For Malinda Renfroe, VP of marketing, protecting Publix’s emotional connection with shoppers is her department’s mission. She started two decades ago as a tra c clerk and now leads a team of 470.

“With a brand that’s 95 years old, you have to balance nostalgia and innovation,” she says. “Customers remember getting a cookie from the bakery as a child, and that sense of memory is powerful. But we also have to evolve.”

She points to Publix’s internal culture as one reason that the message stays authentic. “We overinvest in people who are willing to invest in themselves,” Renfroe says. “That’s what keeps our culture strong, and it’s why our storytelling feels real.”

Club Publix, the retailer’s loyalty platform, embodies that blend of tradition and technology. “It enables one-to-one communication and personalized o ers,” she explains, “but unlike other retailers, you don’t need to be a member to get our deals. That comes straight from Mr. George’s belief that everyone should be treated like kings and queens.”

“We overinvest in people who are willing to invest in themselves. That’s what keeps our culture strong, and it’s why our storytelling feels real.”

—Malinda Renfroe, VP of Marketing, Publix Super Markets

Her marketing philosophy extends to emotion. “The fi rst thing customers say to me is, ‘I love your Christmas spots,’” Renfroe says. “Our campaigns resonate because they show we understand our customers want to create special moments for their loved ones, and we help them do that.”

Those “special moments” are a deliberate part of the company’s creative strategy. “Our brand work is slightly aspirational but always grounded in real life,” she adds. “It’s about showing the food, the family and the feeling of belonging. You can’t fake that.”

Renfroe’s department has even documented a “Publix way” of storytelling so future leaders never lose the brand’s voice. “It starts with strategy,” she notes. “Before every campaign, we ask: Does this stay true to who we are? Does it make our customers feel something real?”

While many grocery retailers are getting out of the pharmacy business, Publix is proving that grocery pharmacy can not only survive, but also thrive.

“When Publix Pharmacy started, it was about putting pills in a bottle,” recalls Dain Rusk, VP of pharmacy. “Today, it’s about clinical services and customer experience.”

That evolution positioned Publix perfectly for the pandemic. “We were so well prepared,” Rusk recounts. “Competitors weren’t set up that way.”

Rusk says that early on, Publix leaned into technology, workflow and immunization training. “It allowed pharmacists to focus on people, not just production,” he explains. “That’s made us one of the few profitable pharmacy chains in the country.”

According to Rusk, Publix’s ownership mentality also gives its pharmacy operations a competitive advantage. “Our people behave di erently because they’re owners,” he says. “It’s like the di erence between renting an apartment and owning a home – you take more pride when it’s yours.”

Even as it honors the past, Publix is building toward its centennial. “We have a team actively working on the 100th anniversary,” Murphy confi rms. “It’s about owning the legacy and paying homage to where we’ve been, while staying relevant for where we’re headed.”

He views that task as both a privilege and a duty. “Every generation of Publix leaders has protected this company for the next one,” Murphy says. “That’s my job now, to make sure the next generation inherits a company that’s even stronger than the one I did.”

Murphy smiles when asked about the secret to Publix’s longevity. “We’re in the people business; we just happen to sell groceries,” he asserts. “As long as we keep that at the center, Publix will be strong for the next 95 years. If you treat people right, they’ll treat your customers right. That’s been true for 95 years, and it’ll still be true at 100.”

In the end, Publix’s legacy is about the disciplined grace of doing simple things extraordinarily well. Clean stores. Fresh food. Loyal associates. Customers who feel at home.

“Few retailers are willing to do what it takes to repeat that experience every single day,” Murphy notes. “That’s what makes us hard to compete with.”

For 95 years, that pursuit – humble, relentless and profoundly human – has made shopping at Publix not just convenient, but also genuinely pleasurable. In an era obsessed with disruption, that may be the boldest idea of all.

EXPERTS REVEAL WHICH PRODUCE TRENDS AND ITEMS WILL STEAL THE SHOW THIS SEASON.

By Karen Appold

In recent years, notable trends have emerged regarding shoppers’ preferences for fruits and vegetables — think organic, locally sourced, exotic, pre-cut and functional superfoods. As the weather cools and 2025 winds down, experts expect these trends to continue, highlighting which produce items will likely be superstars.

Regarding organic produce, Carl DelPrete, CEO of Uncle Giuseppe’s Marketplace, a Melville, N.Y.-based supermarket chain of 11 stores, expects consumers to seek out dense, nutrient-rich staples such as sweet potatoes and winter squash that work for both weeknight meals and holiday entertaining.

“Beyond classic orange sweet potatoes, we’re seeing strong curiosity for Japanese sweet potatoes and white sweet potatoes, which roast up with a caramelized exterior and creamy interior,” DelPrete says.

“Parents and younger households are opting for organic basics when price gaps are manageable; they appreciate clear labeling and consistent availability.”

—Carl DelPrete,

Squash follows a similar path. “Butternut and acorn remain anchors, while delicata is gaining share because it cooks quickly, has an edible skin, and it suits both small households and

with consumers.

simple to prepare at home,” he says. “Goldenberries add a bright, sweettart pop to cheese boards, yogurt and salads, while the papery husk signals freshness and helps protect the fruit’s quality.”

According to Fink, consumers are embracing tropical and culturally diverse fruits like dragon fruit, passion fruit, ube and peppers. “Dragon fruit is visually appealing and aids digestive health, while passion fruit’s sweet-tart avor dishes up global air to the consumer plate,” she says.

Goldenberries add a bright sweet-tart pop to cheese boards, yogurt and salads.

items such as chopped butternut squash, peeled cored apples, sliced root vegetables, and bagged mixes of winter greens or slaws are more common, Swamy observes. Retailers and processors are investing in technologies – such as modi ed-atmosphere packaging – that preserve quality while giving speed and ease to consumers.

Ube represents the food color of choice this season as purple yams are used in desserts and lattes, Fink continues. Equally appealing, biquinho peppers are tear-shaped Peruvian peppers with mild heat and a sweet avor.

Thanks to the food-as-medicine movement, consumers are seeking value-added produce that offers cognitive bene ts as well as gut health and immune support, Fink says.

Soursop, a tropical fruit, is being researched and studied for its potential anti-in ammatory and antimicrobial properties, Fink says. Also known as graviola, it offers a tangy sensory combination of citrus, pineapple and strawberry and is known for its spiky green skin, soft white pulp and sweet-tart avor.

Leafy greens and cruciferous vegetables that are positioned as daily wellness staples for ber, folate and detoxi cation include arugula, kale, spinach, Brussels sprouts and cauli ower.

Antioxidant-rich berries continue to be standouts as superfoods this year, including cranberries, blueberries and raspberries, Fink says. Linked to brain health, heart health and anti-in ammatory bene ts, berries are often featured in snack packs and smoothie kits.

Although apples, pears and cherries have long been associated with good health, simply identifying as healthy is no longer enough. In a produce section with abundant choices, calling out the speci c nutritional traits or functions of items can help consumers clarify their selections, says Jon DeVaney, president of the Yakima, Wash.-based Washington State Tree Fruit Association. “Fiber and gut health, as well as hydration, have been traits of interest for apple and pear consumers, while cherries’ anti-in ammatory bene ts have gained attention,” he notes.

Today’s consumers show a strong willingness to trade cost and freshness for convenience. In fall and winter, ready-to-use

Uncle Giuseppe’s regularly develops new cut combinations to satisfy time-pressed shoppers. “Cauli ower rice and zucchini noodles are reliable performers because they t nicely into low-prep, low-waste cooking and take sauces and seasonings well,” DelPrete says. “The key is daily cutting and tight quality control, so texture and avor hold up.”

Fink notes that top pre-cut winners include apple slices, carrot sticks, mini cucumbers, jicama sticks and celery boat snacks that can replace ultra-processed food options in lunchboxes, fridges, and grab-and-go coolers.

Consumers are using pre-cut convenience produce not only to simplify their meal planning, but also to reduce food waste, she adds. Major retailers and c-stores are offering multi-compartment kits with pre-cut veggies, dips, and grains or cheese — ideal for time-starved and health-conscious consumers.

Retailers are increasingly using storytelling, e.g., grower videos, farm pro les and sustainability narratives, to build emotional connections, Swamy says. QR codes and digital traceability allow consumers to scan and learn more about origin, soil conditions or carbon metrics — turning packaging itself into a marketing channel.

Social media and in uencer tie-ins, like shareable “produce of the week” or recipe posts, help to drive discovery, she continues. Subscription-based boxes, meal kit partnerships with suppliers of seasonal produce, and “bundle” promotions, e.g., displays that educate consumers on how to cook a product, or suggestions on what pairs well with it, all help to lift basket size.

In-store sampling with recipe pairing, cross-merchandising with complementary items and dynamic pricing, such as discounts on items nearing the end of their shelf life, are also used. “These methods are effective because they reduce consumer friction, build knowledge and trust, and make produce stand out in a crowded store environment,” Swamy observes.

This fall and winter, consumers will seek out food that sustains them across multiple meals, with minimal waste. Clear cooking guidance at the point of sale, dependable freshness, and a breadth of sizes and varieties help households plan for both weeknights and holidays, DelPrete advises. When the basics are excellent, shoppers feel con dent branching out to newer varieties and exotic items.

ECRM Sessions give brands face time with multiple, relevant buyers. Each session also provides buyers with access to the popular and emergent brands their shoppers want. All in one place.

Scan the QR code or visit ecrm.marketgate.com now to learn more and find a session that works for you.

ECRM connects retail and foodservice brands and buyers with curated pitch sessions, white glove service, and expansive support resources.

ecrm.marketgate.com

This year’s 2025 GenNext honorees show that youth is no barrier to achieving great things in the grocery industry.

By PG Staff

Ranging in age from a tender 25 to a seasoned 39, this year’s GenNext Awards honorees work in a range of disciplines at a wide variety of retailers, CPG companies and solution providers, but the people appearing on the following pages all have one important thing in common: their dedication to furthering the food industry through their extraordinary efforts.

Youth has proved no barrier for our 107 honorees, all under the age of 40, who have stepped up to take charge in the face of operational challenges, economic pressures, staf ng issues and more to deliver the goods for their businesses and, by extension, the millions of consumers who depend on them. These young leaders have already learned that “growth often comes with obstacles,” in the words of one nominator, and most have applied that lesson by taking a proactive approach to future problems.

This approach includes bringing new ideas to the fore and having the know-how and tenacity to implement

them. “By combining strategic thinking with hands-on leadership, she is shaping a future where both associates and customers bene t from her forward-focused approach,” a second nominator said of a candidate who was ultimately chosen to receive a GenNext Award.

What’s more, as well as excelling at their respective jobs, many of the 2025 cohort of GenNexters are paying it forward to those just starting out on their own career paths, helping develop colleagues’ skills to feed the pipeline of talent that keeps this industry so vibrant. As a third nominator noted admiringly of an honoree, “Many of the colleagues she has mentored are rsttime professionals who have excelled in the wake of her tutelage.”

Read on to nd out more about our 2025 GenNext Awards recipients.

Senior Director of Sales, Acosta Group Age: 29

Clients’ sales under Kaes’ team’s management grew 5.4% in dollars over the past year. She also successfully managed the business of several key clients at Albertsons corporate, the Albertsons Intermountain division and WinCo. Her responsibilities included trade planning, managing client funds and overseeing new-item reviews and business updates. These efforts resulted in signi cant achievements, such as a 23% increase in Freshpet sales and a 474% increase in Poppi sales in the Intermountain division. As a strategic and results-oriented leader who is also supportive, Kaes has been instrumental in training and motivating her team of nine business managers.

Chief of Staff, 99 Ranch Market Age: 28

At 99 Ranch Market, Zhou is a driving force in fostering strong leadership and a collaborative team culture. She has implemented strategic initiatives that enhance executive alignment, empower leaders and improve cross-functional collaboration. Her ability to streamline decision-making and create structured communication channels has strengthened teamwork and operational ef ciency across the organization. Further, Zhou mentors emerging talent and has built an inclusive culture where diverse perspectives thrive. She has cultivated an environment fostering innovation, engagement and long-term success.

Manager, Reporting and Analysis, ADUSA Distribution Age: 28

Feaser’s role ensures the seamless ow of information between leaders and operations associates. She built the reporting and analysis team from scratch, successfully recruiting, training and developing a team of seven professionals who hit the ground running. The team’s crowning achievement was creating the rst-ever Distribution & Transportation services and vendor inbound compliance applications, involving more than 30 new reports across critical operational areas. These applications revolutionized how data is accessed and used company-wide, enhancing visibility and enabling data-driven decision-making at every level.

VP Business Intelligence and Insights, Acosta Group Age: 38

Andreoli’s strategic initiatives have elevated Acosta’s Canadian market presence. She developed a more independent, insight-rich reporting function that leveraged newly available data assets. This involved creating customized reporting solutions to reduce client costs and drive revenue growth and positioning. Acosta can now standardize outputs, make data accessible across business units and empower teams that may not have had access to complex or cost-prohibitive insights. Andreoli also runs public-speaking and presentation workshops for her team.

Manager, Distribution Inventory/Receiving, ADUSA Distribution Age: 34

One of Hearle’s signi cant accomplishments was the creation of a labor utilization tool that tracks cleaning frequencies against available labor hours, ensuring that critical sanitation work is completed on time and ef ciently. This has reduced labor hours, improved compliance and reduced sanitation gaps. He also led an initiative to modernize equipment and optimize procedures, aligning the department with current industry best practices. Simultaneously, Hearle promoted key team contributors and built a structure emphasizing accountability and ongoing improvement. These moves increased code adherence and audit compliance.

VP, Retail Operations, Acosta Group Age: 35

Garza collaborated with internal cross-functional partners to design and implement real-time dashboards for eld managers. These tools have allowed leaders in the eld to instantly access performance metrics, enabling faster, more informed decisions at store level. Additionally, Garza’s team developed automated, customized reporting that is delivered directly to eld managers each morning and is tailored to their speci c needs. This “daily snapshot” allows them to start each day with clarity as to where to allocate their time and resources, improving team productivity and execution.

Industrial Engineer, ADUSA Distribution Age: 28

Miller has contributed to multiple large-scale projects that have improved ef ciency and optimized warehouse performance. One key initiative involved leading re-slotting and re-rack efforts to maximize space, improve product ow and reduce handling time. Changes directly support cost savings and improve throughput during peak periods. Miller was also instrumental in onboarding and training new engineers, sharing institutional knowledge and helping them quickly acclimate to the distribution network’s pace and complexity. Additionally, he played a leadership role in transforming ADUSA’s internship program into a talent development pipeline.

KELSEY RIOUX

Manager, Network Inventory Control, ADUSA Distribution Age: 38

As a recognized expert in inventory control and planning, Rioux provides leadership that fosters growth, motivates employees and promotes continuous improvement. For example, ADUSA’s Vendor Inbound Compliance program experienced major growth, putting intense pressure on its infrastructure. Rioux took charge of the program, navigating its complexities and initiating a complete overhaul that yielded a more ef cient, streamlined operation. She also created a receiving governance function, under which she establishes new processes and best practices for that operational area, generating greater ef ciency and consistency.

ESG Finance Analyst, Ahold Delhaize USA Services LLC

Age: 25

Shen conducts pre-submission reviews and validation processes and participates in climate risk assessment data collection as well as European taxonomy reporting. She has an outstanding ability to identify errors, collaborate with teams to implement corrections and enhance reporting quality, ensuring compliance with industry standards and sustainability goals. Shen also wrote a consultation paper on emissions reporting, providing a clear framework for properly allocating emissions within the correct scopes.

Director, Automation, ADUSA Distribution Age: 34

Bringing to his role a diverse background traversing multiple supply chain disciplines, Ward has led cross-functional groups in the implementation of several strategic projects. These included rebuilding two sortation systems and replacing 200-plus linear feet of conveyance with no operational downtime. His team also launched the iWarehouse program, leading to a 60% safety improvement and a reduction in lift repair/replacement costs. The implementation of equipment upgrades generated annual savings and productivity improvements of 8% to 15%. Ward received ADUSA’s Strike Common Ground award for his leadership of teams.

Manager, Store Communications, The Giant Co. Age: 34

Banks has led initiatives to improve store user experience with communications platforms. By changing the work ows for the store communications department, she reduced overall volume of communications in the company task management system. Banks also refreshed 20 department-speci c sites on the company intranet, improving navigation and organizing content to be impactful, and she rolled out a new single-signon mobile interface that introduced core work applications on 3,200 mobile devices at 198 locations.

Director of Fresh Sourcing, Ahold Delhaize USA Services LLC

Age: 37

Buletza, whom colleagues describe as a decisive, team-focused communicator, played a key role in transitioning the operations of two fresh meat facilities from Ahold Delhaize USA to a vendor. This resulted in vendor colleagues moving into the company and onto Buletza’s team. He quickly integrated them while taking on his new responsibilities. Under his auspices, this new group is able to work collaboratively, ef ciently and effectively. Buletza and his team also partner with the company’s local retail brands to drive meaningful savings and value that’s then reinvested into Ahold Delhaize USA and its brands.

Store Manager, The Giant Co. Age: 39

Heron’s most signi cant accomplishment to date was being appointed store manager of one of the newest Giant stores, located on South Broad Street in Philadelphia. Leading up to and following the December 2024 grand opening, he took the lead in establishing solid partnerships with local organizations. The store has created more than 200 jobs and continues to provide freshness and value to the community. Additionally, in his work with the Empower business resource group, Heron is passionate about mentoring and supporting others within the organization.

ANKITA SHARMA

Senior

Software Engineer,

Ahold Delhaize USA Services LLC

Age: 32

Sharma played a major role in driving an order hub initiative forward, collaborating with external technical contractors, stakeholders and architecture teams while balancing her existing workload. Her efforts yielded a tool that gives operations teams real-time visibility into customer orders, letting them proactively monitor and address issues. This helps mitigate revenue impact while signi cantly reducing incident resolution time. Sharma’s ability to maintain momentum on this project and align multiple teams without disrupting ongoing priorities accelerated progress on the digital team and inspired those around her.

Manager of Community Relations and Strategic Partnerships, The Giant Co. Age: 38

Hopcraft has improved internal education as regards community relations programs, ensuring that store teams fully understand key initiatives and deadlines. She helped develop a volunteer calendar incorporating all community relations, regional partnerships, and DE&I events, and she oversaw work to enhance the guidelines of Giant’s Take Care Fund for associates. Hopcraft also co-chairs Giant’s LINC business resource group, which focuses on women through a lens of career growth, business acumen and community support.

www.adusa.

https://www.linkedin. any/ ahold-delhaize-usa/

Business Intelligence Analyst, The Giant Co. Age: 29

Taylor has become a leading voice for truth, insight and collaboration at The Giant Co. For instance, he recently led the development of several business intelligence tools and reports that provide immediate and actionable insights in the areas of sales, labor, customer experience, replenishment and merchandising. Taylor’s mastery of business intelligence solutions provides daily insights that have improved visibility to information and eliminated the need for manually generated legacy reports, as well as enabling Giant’s leaders to identify risk and future opportunities with minimal effort.

Creative Manager, Giant Food Age: 37

Bell’s campaigns push the boundaries of traditional marketing. He led the Home to Home storytelling series and the This is Home campaign, the latter an award-winning culturally signi cant series that highlighted community members’ and associates’ heritages and food traditions. Both efforts show Bell’s ability to create authentic, inclusive narratives that resonate with diverse audiences while conveying the brand’s value and community connection. He also helped restructure the creative team by streamlining processes and optimizing work ows, thereby achieving a six- gure cost savings.

Category Manager, Giant Food Age: 34

Bousson’s deep understanding of market trends, ability to anticipate consumer preferences, and strong relationships with key suppliers contributed to the growth and pro tability of the condiment and sauce categories. Careful analysis and market research insights led her team to introduce a variety of innovative products that meet emerging consumer preferences and keep the brand competitive and well positioned. Further, Bousson’s expertise in data analysis and forecasting has allowed her to consistently optimize inventory levels, reduce stockouts and improve supply chain ef ciency.

Manager Price Strategy, Giant Food Age: 35

Davidson’s visionary leadership and process innovations helped drive Giant Food’s pricing strategy. Her focus on both technical and human solutions demonstrates her ability to lead through complexity and deliver meaningful outcomes. She transformed Giant Food’s commercial forecast process by identifying inefciencies, partnering with a vendor to implement advanced solutions and coaching the team to adopt new practices. This initiative elevated forecasting accuracy and enabled more effective long-term decision-making. Davidson also developed critical internal pricing tools.

Manager Distribution Systems, Giant Food Age: 37

Vatan accomplished a wide range of key initiatives that contributed to operational ef ciency and technological advancement at the Jessup, Md., distribution center. He upgraded Vocollect servers, introducing a French-language package to support a diverse workforce. Vatan also successfully transitioned handheld devices to a new operating system and integrated Intune endpoint management for improved security. He played a pivotal role in maintaining operations during a cyberattack, ensuring data recovery and business continuity. Additionally, he expanded WiFi coverage to improve connectivity.

Store Manager, Stop & Shop

Age: 39

Simmons implemented a recognition program that celebrates both individual and team achievements. By regularly acknowledging small wins, he fosters a culture of appreciation that motivates employees and boosts team morale. This innovation not only improved employee engagement, but also directly contributed to enhanced operational performance. Simmons’ leadership was also evident during a challenging period when supply chain issues led to increased out-of-stocks. He held brainstorming sessions with his team to identify creative solutions, resulting in proactive measures that signi cantly reduced out-of-stocks and improved inventory management.

Category Manager, Stop & Shop Age: 33

A notable project spearheaded by Gonsalves was transitioning cosmetics from vendor-provided xtures to a smaller, pegged format, with the aims of optimizing space, improving merchandising ef ciency and providing a better overall shopping experience. She also works with vendor partners to get ahead of challenges and come up with mutually bene cial solutions. Gonsalves’ leadership is further shown by her organization of learning sessions and ability to foster knowledge sharing and professional growth, as well as by her willingness to assume authoritative roles outside of her core duties.

Front End Operations Manager, Albertsons Cos.

Age: 31

Among her numerous accomplishments at Safeway, Calimbas created a digital front end manager and bookkeeper teams channel hub, where all front end resources are accessible in one area, an innovative move that has improved communication and processes, and she grew NorCal Proud Facebook page membership by 65% from the previous year, creating a welcoming, inclusive environment for associates to share what they’re proud of in their stores. Dedicated to team development through mentorship and training, Calimbas is upbeat and happy to help others, adding fun and joy to work.

Store Manager, Stop & Shop Age: 36

In her role as manager of a Stop & Shop store in Levittown, N.Y., Quarles consistently upholds store standards and provides exceptional customer service. When her location received many associates transferring from a nearby closing store, she smoothed the transition as much as possible by giving the new associates a welcome letter providing store information, including relevant contacts. Quarles is also the district lead for Stop & Shop’s Store Culture Committee, to which store managers submit small wins that occur at their locations, and she mentors associate store managers in her district.

Store Director, Albertsons Cos.

Age: 39

Cipres is a training champion for San Diego’s South Area, where she was specially selected to coach and mentor future store directors and assistant store directors. She also serves as a district labor coach, supporting her fellow associates with best practices and guidance in labor and scheduling. In her role as a store director, Cipres collaborated closely with Starbucks’ district manager to thoroughly understand the business and how her team could provide the best experience. Additionally, she somehow found the time to complete both the Retail Certi cate Management and the McKinsey Academy programs.

Distribution Operations Supervisor, Stop & Shop

Age: 31

Recognizing the vast cultural backgrounds and potential language barriers that his team faces, Rivas has created a nurturing environment that fosters growth and retention. Already uent in Spanish, he learned key phrases in Haitian Creole and Portuguese to communicate better with his team. He also developed a strategy incorporating visual aids to enable new hires speaking various languages to better engage in a 90day training program. This initiative not only improved the associates’ comprehension, it also fostered a sense of community among them.

Service Deli Operations Specialist, Albertsons Cos. Age: 35

One of Frost’s priorities is to develop a team of dedicated and passionate leaders and mentors who share her devotion to providing an exceptional product/service experience for shoppers. She prepared and hosted a meeting with the district’s food safety leadership that emphasized the importance of food safety and sanitation practices and communicated that importance to deli department teams. Frost also developed the Hero Hour follow-through program, which encourages and requires that each location guarantee preparedness for evening sales and business growth opportunities.

Store Director, Albertsons Cos.

Age: 35