FROM THE #1 DERMATOLOGIST- & PHARMACISTRECOMMENDED SKINCARE BRAND†‡

FROM THE #1 DERMATOLOGIST- & PHARMACISTRECOMMENDED SKINCARE BRAND†‡

CeraVe Anti-Dandruff Hydrating Shampoo and Conditioner can help eliminate dandruff flakes without disrupting the scalp barrier to leave hair feeling healthy and soft.

• Pyrithione zinc helps eliminate flakes, itch, and irritation

• Ceramides 1, 3, & 6-II help restore and maintain the skin barrier

• Niacinamide helps calm the scalp

• Hyaluronic acid helps maintain hydration

• Free of methylisothiazolinone (MIT) to help avoid skin irritation

• Suitable for sensitive scalps

• Suitable for all hair types and curl patterns

• Suitable for chemically-treated and color-treated hair

SIGNIFICANTLY REDUCED DANDRUFF1

†IQVIA, ProVoice Survey: Latest 12 months rolling, ending Sept 2025. ‡IQVIA, ProVoice Survey: June 2–5, 2025.

Reference: 1. Data on file. L’Oreal. Protocol: A 4-week clinical study was conducted on 31 subjects ages 18 to 59 with mild to severe dandruff. CeraVe Anti-Dandruff Hydrating Shampoo and Conditioner were used 3x per week, followed by a 2-week regression.

Explore the benefits of CeraVe Anti-Dandruff Hydrating Shampoo and Conditioner

Facebook.com/DrugStoreNews linkedin.com/company/drug-store-news/ instagram.com/dsn_media

34 RETAIL STRATEGIES

Catering to customers on GLP-1 medications could increase sales for retailers

40 INSIDE BEAUTY

Consumers are driving a new wave of innovation that’s boosting sales across mass-market beauty

46 PHARMACY TECH & AUTOMATION

Retail pharmacies are reaping both financial and clinical returns on their technology investments

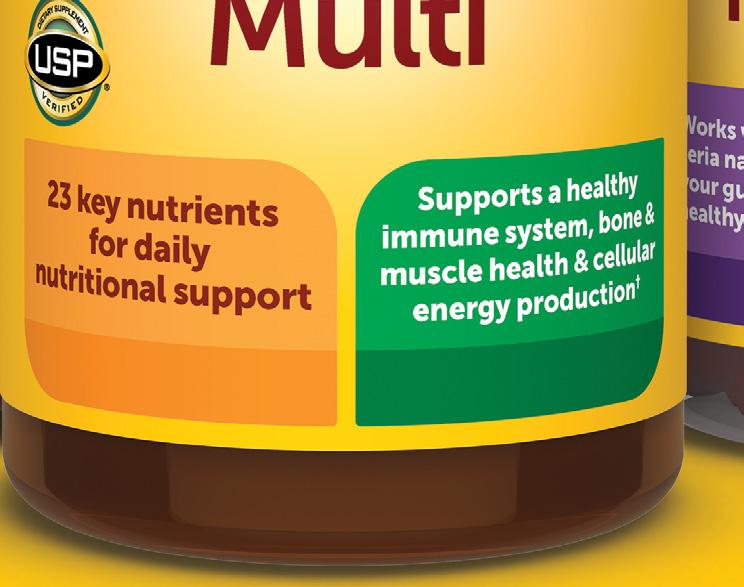

52 REX AWARDS: VMS

DSN’s Retail Excellence Awards recognizes leaders in vitamins, minerals and supplements

56 HEALTH

In the cough/cold category, online vs. in-store performance depends on urgency level

60 GREETING CARDS

Pharmacies could take of steps to boost engagement among core consumers and underrepresented shoppers in the greeting card aisle

Community pharmacy is hoping 2026 is the year things change

PHARMACY IS STILL RELEVANT, ESPECIALLY AS MORE STATES RECOGNIZE THAT THE INDUSTRY CAN BE AN IMPORTANT PART OF AN OVERBURNED HEALTHCARE SYSTEM.

Now that we’re in a New Year, it’s a good time to step back and take stock of the current state of community pharmacy. The past year can be summed in one word–mixed.

Let’s first look at the persistent challenges.

Staffing (for pharmacists as well as technicians) remains a concern, reimbursement is a nuisance, drug shortages and price increases are still prevalent, competition from other outlets on the front end and competitors from new pharmacy models are growing and national legislative efforts on PBM reform appear stalled.

Those aren’t the only issues. Store closures are still happening and consolidation continues. In 2025, Walgreens bought 70-year-old West Virginia chain, Fruth Pharmacy. Company head Lynne Fruth said the continued closures of pharmacies are largely due to lower reimbursement rates and PBMs. Perhaps the biggest, though not totally surprising, news of the last year is the shuttering of the Rite Aid chain.

But it’s not all bad news. Pharmacy is still relevant, especially as more states recognize that pharmacists can be an important part of an overburdened healthcare system (Insiders say the country still needs a more unified expanded scope of practice, like Canada).

Another bright spot is that more pharmacists are seeing the benefits of integrating technology and artificial intelligence. AI-powered solutions are helping retail pharmacies run more profitably and deliver better patient outcomes. On top of that, with recent executive orders and deals with pharma companies, American consumers may see lower drug prices in 2026.

So what will we see this year? Will PBM reform finally pass Congress and arrive on the president’s desk? How will the MAHA movement affect vaccine participation and community pharmacy’s place in the healthcare system? Will more states expand scope of practice for pharmacists? Will we see more store closures and how will they affect rural areas and underserved populations?

No matter what transpires this year, executives remain bullish that the industry is positioning itself to be better and stronger in the end. But buckle up; it could be a bumpy ride.

8550 W. Bryn Mawr Ave., Ste. 200 Chicago, IL 60631 773.992.4450 Fax 773.992.4455 www.drugstorenews.com

BRAND MANAGEMENT

Senior Vice President & Publisher John Kenlon 516.650.2064 jkenlon@ensembleiq.com

EDITORIAL Editor-in-Chief, Editorial Director Nigel F. Maynard nmaynard@ensembleiq.com

Managing Editor Julianne Mobilian jmobilian@ensembleiq.com

Senior Editor Sandra Levy slevy@ensembleiq.com

Beauty Editor Gisselle Gaitan ggaitan@ensembleiq.com

ADVERTISING

atomas@ensembleiq.com

Regional Manager Steven Werner 312.961.7162 swerner@ensembleiq.com

DESIGN/PRODUCTION/MARKETING

Art Director Catalina Gutierrez cgutierrez@ensembleiq.com

Production Manager Maria del Mar Rubio mrubio@ensembleiq.com

Marketing Manager Kathryn Abrahamsen kabrahamsen@ensembleiq.com

SUBSCRIPTION SERVICES List Rental mbriganti@anteriad.com

Subscription Questions contact@drugstorenews.com

HRG’s five notable products from December

In December, suppliers introduced 229 new products, 89 more than the 140 new products they introduced in November. Waukesha, Wis.-based HRG reviewed 12 products in the health category, 125 items in the wellness sector and 92 products in the beauty aisle to see which ones stood out as Products to Watch:

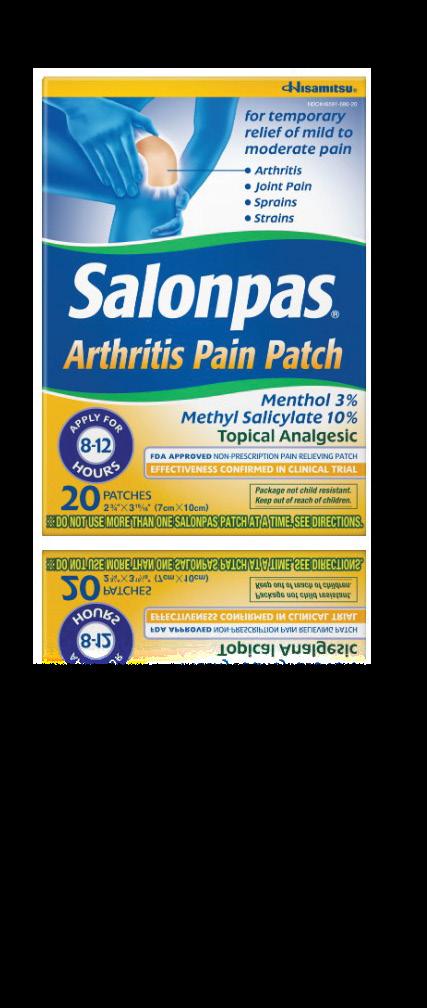

Hisamitsu’s Salonpas Arthritis Pain Patch is formulated for the temporary relief of mild to moderate pain associated with arthritis, joint pain, sprains and strains. It says the patch contains 3% menthol and 10% methyl salicylate (a nonsteroidal anti-inflammatory drug) and can be used for eight to 12 hours. One pack contains 20 patches.

Vapor-Max Ointment by Mentholatum is a cough suppressant that delivers natural camphor, eucalyptus oil and menthol in a topical formula. The brand said the ointment delivers up to eight hours of medicated vapors to help relieve chest and nasal congestion, soothe coughs and ease minor aches and pains. The site indicates it is safe for adults and children ages 2 and up. It comes in a 1-oz. jar.

Advantice Health said its AmLactin Calm & Renew Lotion soothes and hydrates dry, sensitive skin. The lotion contains ginger root to calm, while

2% lactic acid AHA is meant to exfoliate to promote natural skin cell turnover for soft, smooth and healthy-looking skin. The company said the lotion is clinically proven to reduce redness and enhance radiance. It’s designed to be gentle enough to use every day on the face or body and is formulated without fragrance, dyes, parabens or phthalates. It comes in a 14.1-oz. bottle.

Haleon said its Sensodyne Cavity + Sensitivity Toothpaste defends against cavities and provides sensitivity relief. It’s formulated with an optimized sodium fluoride solution to help strengthen the teeth’s protective layer, while potassium nitrate travels down tubules to soothe nerves and block pain. Company materials indicate that the product is proven to provide 24/7 protection against sensitive teeth with twice daily brushing. It comes in a 2.7-oz. tube.

Natural Eyes Floaters Relief tablets by The Relief Products are formulated to address the common symptoms of floaters. The company said the homeopathic tablets are designed to be fast-dissolving and temporarily relieve squiggly lines, dark spots and dust particles in vision. It’s made with eight 100% naturally sourced active ingredients that work gently and safely, the brand said. A bottle contains 70 tablets.

Target has opened an immersive, experiential format in New York City focused on style, design and fashion.

The discounter has transformed its 26,000-sq.-ft., two-level store in Manhattan’s SoHo neighborhood as a “one-of-a-kind concept store where everyday shopping meets play, discovery and style.” The outpost will feature curated fashion and beauty items chosen by influencers and celebrities, seasonal drops and an evolving assortment to keep pace with the latest styles and trends.

The opening comes as Target COO Michael Fiddelke is preparing to take the reins from longtime CEO Brian Cornell in February.

“Guided by incoming CEO Michael Fiddelke’s vision to put style and design at the company’s forefront, Target SoHo reflects Target’s ability to move at the speed of culture, transforming retail into a destination for inspiration and connection,” the company said. “From concept to completion in just four months, the store showcases Target’s agility and ambition to redefine what shopping can feel like.”

Target SoHo highlights

The store features a seasonal edit, “Curated By,” led by the Target team in partnership with NYC “tastemakers.”

The assortment will connect customers to influential voices in fashion and lifestyle, offering a personal glimpse into their favorite Target finds across fashion, beauty and home. Actress and comedian Megan Stalter will kick off the first edit.

A dedicated section on the first floor, “The Drop,” will offer a rotating showcase of merchandise.

Additional store features include:

• Broadway Beauty Bar: Described as a beauty playground designed for experimentation, this area will offer a curation of Target’s best beauty picks, hand-selected by top talent in the beauty space. Customers can explore trending products, try samples and capture content in the “Viral Vanity” studio. At launch, celebrity makeup artist Katie Jane Hughes has curated her “must-have” Target beauty picks.

• Gifting Gondola: This photo-ready installation is designed for playful discovery and gifting inspiration. Complete with a convex mirror

for capturing festive reflections, the Gifting Gondola will showcase an assortment of exclusive Target-branded merchandise.

The store also offers plenty of opportunities for selfies and Instagram photos.

“Style and design are part of Target’s DNA, and there’s no better place for us to showcase what’s next for our brand than in one of the style capitals of the world,” said Cara Sylvester, executive VP and chief guest experience officer, Target. “With Target SoHo, we’re bringing together the best of Target and the best of New York—elevasted products, immersive storytelling and an experience that invites guests to explore, express and get inspired. This store is a bold reflection of our commitment to style, and it’s just one part of our larger investment in Target’s design-driven future that grows our roots even deeper in New York City.”

Target said the store will adapt and evolve through 2026 and beyond as it explores how different concepts and products resonate with consumers. Customers can expect new experiential zones, seasonal activations, a café and event programming.

This story originally appeared on sister publication Chain Store Age

Why 2026 Is the ‘Year of the Cat’ and What It Means for Pet

By Joe Toscano, Vice President, Trade & Industry Development at Purina

Cat o w n ership i n the U.S. c on ti n ues t o clim b at a n u n precede n ted pace, with 49 milli on h o useh o lds no w shari n g their h o mes with cats , which is a 23 % i n crease si n ce 2023, acc o rdi n g t o the America n Pet Pr o ducts Ass o ciati on . This gr o wth is reshapi n g the pet aisle a n d setti n g the stage fo r 2026 t o b e the Year of the Cat. With m o re c on sumers l oo ki n g t o elevate the way the y f eed , treat a n d care fo r their cats , o pp o rtu n ities acr o ss the categ o r y have n ever b ee n str on ger.

Products Designed Around Cat Parents’ Priorities

Acr o ss o ur cat p o rtf o li o, Puri n a c on ti n ues t o meet the m o me n t with pr o ducts that reflect the ev o lvi n g n eeds a n d e x pectati on s of t o day ’s cat pare n ts. Fr o m elevated te x tures a n d culi n ar y -i n spired recipes t o s o luti on s that simpli fy care, o ur appr o ach ce n ters on maki n g the bon d b etwee n cats a n d their f amilies easier, m o re j oyf ul a n d m o re attai n a b le. Palata b ilit y a n d te x ture-led e x perie n ces are bo th i n flue n ci n g c on sumer b u y i n g decisi on s.

Fa n c y Feast ® Gems® b ri n g re fin ed culi n ar y artistr y t o the bo wl with te n der paté ce n ters wrapped i n elega n t , sav o r y lay ers that fo rm a p y ramid shape pre f erred by eve n the m o st fin ick y f eli n e – per f ect fo r pet pare n ts seeki n g a premium di n i n g e x perie n ce fo r their cats. Mea nwhile, the rise of yo u n ger cat o w n ers has f ueled gr o wth i n i n teractive f eedi n g a n d treati n g. Friskies® Lil’ Licka b les™, a ha n dson treat , a n d Puri n a ONE® Immu n e Supp o rt Purées – licka b le cat treats f eaturi n g Vitami n E a n d Omega- 3 f att y acids – bo th tap directl y i n t o that tre n d by o fferi n g a f u n, e n gagi n g way fo r pe o ple t o bon d with their cats.

With s o ma ny n ew cats e n teri n g h o useh o lds , the litter aisle remai n s on e of the m o st relia b le a n d resilie n t segme n ts i n the pet categ o r y. Premiumiz ati on is shapi n g this space, with c on sumers seeki n g b etter o d o r c on tr o l , simpli fi ed mai n te n a n ce a n d m o re sustai n a b le o pti on s.

Od o r c on tr o l remai n s the t o p pri o rit y fo r litter sh o ppers , a n d Puri n a is addressi n g this n eed with n ew Tid y Cats® Per fo rma n ce o pti on s lau n chi n g i n Ja n uar y, deliveri n g p o wer f ul o d o r c on tr o l desig n ed t o keep h o mes with cats smelli n g clea n . C onve n ie n ce c on ti n ues t o b e

a ke y driver as well , see n i n o pti on s like Tid y Cats® LightWeight o r the Tid y Cats® Bree ze® Litter Sy stem , which simpli fi es upkeep with disp o sa b le pads that l o ck i n m o isture a n d o d o r fo r seve n day s (fo r on e cat , whe n used as directed) a n d pellets that last a m on th.

I nno vati on als o e x te n ds t o the gr o wi n g aut o mated litter segme n t. Puri n a part n ered with Litter-R obo t ® t o devel o p a litter speci fi call y o ptimized fo r the Tid y Cats® The Per f ect C y cle™ setti n g i n the Whisker app, helpi n g c on sumers get the m o st o ut of their aut o mated clea n up s y stems.

Outside the litter box, we c on ti n ue t o sh o wcase o ur scie n ti fi c e x pertise with Puri n a ONE® LiveClear ® – a n i nno vati on b acked by m o re tha n 10 y ears of research – which has b ee n sh o w n t o simpl y a n d sa f el y reduce the maj o r allerge n i n cat hair a n d da n der by a n average of 47 perce n t , starti n g with the third week of dail y f eedi n g. N o w widel y availa b le, Puri n a ONE LiveClear helps cat l o vers with allerge n se n sitivities spe n d qualit y time with their cats.

Helping Retailers Win

Puri n a’s leadership g o es b e yon d pr o duct i nno vati on . We’re c on ti n ui n g t o supp o rt retailers thr o ugh the my Puri n a app, a l oy alt y a n d e n gageme n t platf o rm that rewards

sh o ppers fo r i n teracti n g with the Puri n a p o rtf o li o. The app als o i n tr o duces pet o w n ers t o n utriti on tips , trai n i n g advice a n d c o mpleme n tar y pr o ducts , helpi n g drive b r o ader b asket e x pl o rati on a n d l on g-term e n gageme n t.

A n d , with o ur dedicated categ o r y team , we w o rk hard t o c o lla bo rate directl y with retailers on data- b acked strategies , mercha n disi n g rec o mme n dati on s a n d s o luti on s such as shel f o ptimiz ati on s that d o u b le capacit y fo r larger litter pails , impr o vi n g bo th sales a n d i n -st o ck per fo rma n ce.

As the i n dustr y steps i n t o the Year of the Cat , Puri n a remai n s c o mmitted t o a n ticipati n g c on sumer n eeds a n d helpi n g retailers capture the m o me n tum acr o ss foo d , treats a n d litter. With a r ob ust pipeli n e of i nno vati on an d a h o listic appr o ach t o supp o rti n g cat o w n ers – all b acked by a b e n ch of n earl y 500 Puri n a scie n tists , veteri n aria n s a n d pet care e x perts – we are pr o ud t o help retailers u n l o ck the f ull p o te n tial of this de fin i n g m o me n t fo r the f eli n e categ o r y

Costco Wholesale has sued the Trump administration, requesting the Court of International Trade to consider all tariffs collected under the International Emergency Economic Powers Act unlawful, per an NBC News Report.

In a filing on Nov. 28, Costco said it is seeking a “full refund” of all duties under the act paid as a result of President Donald Trump’s executive order that imposed what he called “reciprocal” tariffs.

“Because IEEPA does not clearly authorize the President to set tariffs ... the Challenged Tariff Orders cannot stand and the defendants are not authorized to implement and collect them,” Costco’s lawyer wrote in the lawsuit, per the report.

The report noted that the Supreme Court is reviewing the legality of Trump’s expansive tariff agenda. In oral arguments in early November, justices appeared skeptical about the government’s case to let them continue, the report said.

Both conservative and liberal justices asked hard questions of Solicitor General D. John Sauer, though some of the conservatives seemed more sympathetic to his arguments, the report said, noting that Trump became the first president ever to use the IEEPA law to impose import duties. Lower courts earlier ruled against the administration’s use of the law but kept the tariffs in place while the case was argued.

Costco does not reveal in the filing how much the duties have cost the company. Importers who have paid nearly $90 billion under the IEEPA law, according to U.S. Customs and Border Protection data through late September, per the report.

In May, on Costco’s earnings call, chief financial officer Gary Millerchip informed investors that about a third of Costco’s

sales in the United States are imported products. Millerchip said items imported from China represented about 8% of total U.S. sales, per the report.

Millerchip said that while Costco was seeking a direct impact from tariffs on imports of some fresh food items from Central and South America, it decided not to increase prices “because they are key staple items” for its customers. Some of those fresh food items included pineapples and bananas. “We essentially held the price on those to make sure that we’re protecting the member,” he said, per the report.

In September, Millerchip told analysts: “We continue to work closely with our suppliers to find ways to mitigate the impact of tariffs, including moving the country of production where it makes sense and consolidating our buying efforts globally to lower the cost of goods across all our markets.”

Through the end of October, the government had collected $205 billion in tariffs.

The report also noted that Costco joins other companies that are seeking tariff refunds through the courts. Revlon, eyeglass maker EssilorLuxottica, motorcycle manufacturer Kawasaki, canned foods seller Bumble Bee, Japanese auto supplier Yokohama Tire and many smaller firms have also filed similar suits, the report said.

Revlon has appointed a new vice president of marketing innovation, global professional hair. Ariadne Oliveira, who took over the role on Nov. 24, is based in Barcelona and will work on the women’s hair care and styling divisions across the Revlon portfolio.

Oliverira has more than 25 years of experience across the beauty, food and health care divisions, and has worked throughout Europe, the Americas and Asia.

“We are thrilled to welcome Ariadne to Revlon,” said Charles Waters, president of International at Revlon. “Her proven track record of driving transformation, coupled with her passion for innovation and multicultural perspective, make her the ideal leader to take Revlon Professional to the next level.”

“I am truly honored to join Revlon Professional at such a pivotal time for the company and the industry,” Oliveira said. “The professional hair category has immense potential, and I am excited to unlock new opportunities for growth and creativity. Together with this talented team, I look forward to building on the strength of our iconic brands, deepening our connection with consumers and customers, and driving innovation that inspires and empowers the global hair community.”

Dollar General announced three leadership updates. Matthew Simonsen has transitioned to an expanded role as senior vice president, business intelligence and development from his prior role as senior vice president, real estate and store development. Simonsen will now lead Dollar General’s decision science and analytics team as well as the process improvement team. He will also continue to oversee the company’s real estate strategy, execution and management for Dollar General and Mi Súper Dollar General stores.

Simonsen has extensive leadership experience across DG business functions, previously serving as vice president, analytics and business intelligence; vice president, merchandising and supply chain services and senior director, store operations. Prior to Dollar General, he held roles of increasing responsibility at 7-Eleven and Blockbuster.

April Crofford was promoted to vice president, store facilities management where she will continue to evolve and lead Dollar General’s field maintenance technician program. In partnership with DG’s real estate team, Crofford will also support the execution of DG’s Renovate and Elevate remodel projects.

Initially joining the company in 2016 as a district manager, store operations, Crofford has held progressive leadership roles in DG’s field facilities maintenance department including her most recent role as senior director, store facilities management. Prior to Dollar General, she accumulated more than eight years in retail experience, primarily in merchandising roles. In April 2025, Crofford was named to Chain Store Age’s Top Women in Retail list in the Store Development and Facilities category.

Tito Rydinsky was promoted as division vice president, store operations and will lead operations for more than 2,200 stores across the mid-west and south-central regions. He joined the company in 2018 as district manager, operations and most recently served as senior director, store operations.

Rydinsky has more than 20 years of leadership experience in corporate and field retail store operations from various national retail organizations.

The United States and the United Kingdom have reached an agreement that secures a 0% tariff rate for all U.K. medicines exported to the United States for at least three years in return for the country spending more on new medicines, per an ABCnews report and an AP report.

The agreement, announced by U.K. and U.S. officials, calls for the United States to exempt U.K.-origin pharmaceuticals, pharmaceutical ingredients and medical technology from import taxes, the report said.

The report also noted that in return, U.K. pharma companies committed to invest more in the United States and create more jobs, according to the Trump administration.

As part of the deal, the U.K. government said it will invest around 25% more in new and effective treatments—the first major hike in such spending in over 20 years, the report added.

“This vital deal will ensure U.K. patients get the cutting-edge medicines they need sooner, and our world-leading UK firms keep developing the treatments that can change lives,” Science and Technology Secretary Liz Kendall said, per the report.

The report also noted that U.S. Health Secretary Robert F. Kennedy Jr. said the agreement “strengthens the global environment for innovative medicines and brings long-overdue balance to U.S.–U.K. pharmaceutical trade.”

Albertsons said its new AI shopping assistant is a web browser experience designed to make grocery shopping faster and more personalized. The shopping assistant moves beyond search to execute complex end-to-end grocery tasks, helping customers complete shopping, from recipe to cart, in minutes.

Building on the success of the company’s Ask AI tool introduced earlier this year, the agentic shopping assistant is a customer-friendly conversational experience powered by many collaborative agents, now available on all Albertsons’ banner websites, including Albertsons AI, Safeway AI and Vons AI.

Powered by Open AI models, the Albertsons AI shopping assistant aims to reduce grocery shopping time from an average of 46 minutes to as little as four minutes by helping customers plan meals, restock essentials, discover new products and shop smarter. The assistant can be accessed on banner web browsers in the Meals Hub and exemplifies agentic commerce, meaning it doesn’t just answer questions, it actively completes shopping tasks for customers, such as:

• Rapid Restock: Quickly reorder weekly essentials and frequent purchases.

• Plan Meals: Generate a practical weekly meal plan and shopping list with deduplicated ingredients added to cart.

• Shop Lists: Type or upload an image of a written grocery list, and the assistant will find personalized products for everything on the list.

• Fridge Cleaner: Discover recipes using what’s already in the fridge and pantry, saving money and reducing food waste.

This vital deal will ensure U.K. patients get the cutting-edge medicines they need sooner, and our world-leading U.K. firms keep developing the treatments that can change lives.”

— Liz Kendall Science and Technology Secretary

• Shop Recipe: Instantly import an online recipe or image and add ingredients to cart.

• Event-Ready: Choose a theme, or let the assistant use the next upcoming holiday, and see curated product ideas with offers.

Expanding into the Albertsons Cos. banner mobile apps in early 2026, the Albertsons AI shopping assistant will launch additional agentic commerce capabilities including budget optimization, in-store aisle location to find a specific product and voice integration. Additionally, the assistant’s multi-agent architecture sets the stage for compatibility with off-platform agents, opening doors for future integrations with experiences like apps in the chat feature, the company said.

For almost a century, Boiron has provided families with the purest medicines made from the earth’s best resources. From our renowned Arnicare® line, to trusted Oscillococcinum® and Camilia® brands, our expanding range meets the diverse needs of your customers.

*CLAIMS BASED ON TRADITIONAL HOMEOPATHIC PRACTICE, NOT ACCEPTED MEDICAL EVIDENCE. NOT FDA EVALUATED.

L’Oréal is making several changes across its Professional Products Division, announcing several leadership appointments across its Redken, Color Wow and L’Oréal Professionnel brands.

The company has made three general manager shifts:

Mounia Tahiri has been named general manager of Redken US. Tahiri previously worked on the L’Oréal Professionnel brand, where she focused on growing Biolage, architecting Ulta’s prestige hair care omni-model and guiding L’Oréal Professionnel past the $100M in sales milestone. She previously led Matrix US Haircare.

Guillaume Duez has been named general manager of Color Wow. Following the closure of Color Wow’s acquisition by L’Oréal, Duez will help lead the brand alongside its founder and CEO Gail Federici. He joined the company in 2010 and has held global and U.S. roles including head of Redken Color, vice president of marketing for Kérastase and Shu Uemura, and also served as general manager of both brands.

Julie Fortier will take over as general manager of L’Oréal Professionnel. Prior to joining the U.S. division, she spent 18 years at L’Oréal Canada, including serving as the general manager for Kérastase and Shu Uemura. In her prior experience with the company, she also helped establish alignment with SalonCentric and brand partners.

Walmart is expanding its drone delivery program.

The retailer announced in a LinkedIn post that it’s bringing customers in the Atlanta metro its fastest delivery option yet—Walmart drone delivery powered by Wing.

“Just in time for the holidays, five stores are now offering items delivered in as fast as 30 minutes, expanding access to everyday essentials and redefining convenience. This launch is just the beginning with Charlotte, Houston, Orlando and Tampa up next!” the retailer said.

ABC News reported that Walmart provided Good Morning America with an exclusive look at what it calls a drone nest, where its delivery program launched on Wednesday. The report noted that Walmart became the first retailer to scale drone delivery across five states.

The report went on to explain how the drones work: “They will hover about 150 yards above the ground, then slowly lower the package on a tether and safely release the package once it’s touched the ground. The drones can carry packages up to two and a half pounds, fly within a six-mile radius of a Walmart store avoiding traffic, stop signs and pedestrians. They also follow FAA guidelines and have sensors to avoid obstacles during the delivery.”

Walgreens’ retail media arm is expanding its retail media ecosystem through a new partnership with Rokt.

Rokt leverages e-commerce technology, including machine learning and AI, to make transactions more relevant to each shopper.

“At Walgreens Advertising Group, we are committed to connecting brands with one of the most loyal and engaged consumer bases in the country,” said Abishake Subramanian, group vice president, consumer marketing, Loyalty and Walgreens Advertising Group. “By expanding our retail media ecosystem with AI-powered capabilities, we’re giving advertisers new ways to engage customers in meaningful moments while creating incremental value for Walgreens.”

The agreement enables non-endemic brands to reach consumers on Walgreens.com’s order confirmation page.

“We are very excited to work with a respected household name like Walgreens to deliver real-time relevance for Walgreens Advertising Group’s audience of consumers nationwide,” said Craig Galvin, chief revenue officer at Rokt. “Together, we’re planning to unlock a new monetization channel that enhances the customer experience and delivers measurable performance at scale, while also putting Walgreens’ in-house initiatives at the forefront to maximize the company’s customer experience.”

By introducing non-endemic messaging coupled with relevant first-party offers into the transaction moment, Walgreens Advertising Group can diversify its advertiser mix, unlock new monetization opportunities and deliver more engaging shopper experiences, the companies noted.

It’s not about being the lowest — it’s about being the clearest and most consistent

By Jason Reiser

RJason Reiser is chief executive officer of Market Performance Group

emember how Mondays used to start? Walmart’s weekly Beats Report would hit your inbox, and you held your breath. If your item price had been beaten somewhere else, you knew what came next: price-protection conversations, maybe an unplanned Rollback and an awkward huddle with finance. As a Walmart buyer, I watched that same ritual play out with every vendor. Back then, the week had a tempo. Today, the clock never stops.

Sophisticated AI price monitoring and Amazon’s algorithm have turned a weekly pulse into a livewire. There’s no hiding, no pause button. A single low price anywhere can echo everywhere Amazon isn’t just comparing UPCs. It matches by price per unit across families, sizes and formats. If it’s published, assume it’s visible. That’s how a weekend deal becomes the market price by Tuesday—and why frequent price promotions can punch holes in price integrity that take weeks to close.

Feeling pressed? You’re not alone. Across categories, manufacturers say their No. 1pain point is maintaining price integrity across channels. Transparency, algorithmic matching and relentless promotions are pulling prices lower and keeping them there.

The ripple effects are real: Margin erosion, brand dilution and strained retailer relationships. Add third-party sellers and it’s no surprise that even strong brands struggle to hold the line.

Our first instinct? Fight price with price. But that sprint ends painfully. Undisciplined promotions, club packs without guardrails and siloed, account-by-account decisions only fuel the fire.

Decisions made for one account trigger price cuts in others. Swapping counts without changing consumer value doesn’t fool unit-level matching. And single-use promo codes? They get scraped and spread, with leaks everywhere. Those old “configuration tricks”? They rarely work now.

So how do you win? Not by chasing price drops. Instead, rebuild discipline in an always-on marketplace.

Leaders now treat price integrity as a capability, not a reaction. It’s part of their operating system—governed, data-driven and strategically aligned.

They’re asking new questions:

• Who owns the price in a transparent marketplace?

• How do we align sales, marketing and finance when one decision ripples everywhere?

• How should our assortment, price pack architecture and promotional design evolve to defend value?

These are complex questions, with no one-size-fits-all answer. We’re helping many brands modernize MAP enforcement, rebuild governance and protect brand equity in an AI-driven marketplace.

Quick example: A mid-size health and wellness brand recently faced significant marketplace price erosion, hurting margin and retailer trust. By uncovering root causes of compression and defining targeted actions, they’ve begun regaining control of their narrative and profitability.

They’re not done, but that clarity around the drivers, and a roadmap to address them, has already put them on stronger footing.

Price integrity isn’t about being the lowest. It’s about being the clearest and most consistent. Shoppers reward that. Retailers appreciate it. Your P&L depends on it.

And if you miss those Monday Beats, think of it this way: They once told you where you stood after a weekend; today the feed updates every hour. The principle is the same. You may not beat the algorithm, but you can protect your brand. Those who listen and act with discipline will stay in rhythm with the market. As for the rest? The beat moves on without them.

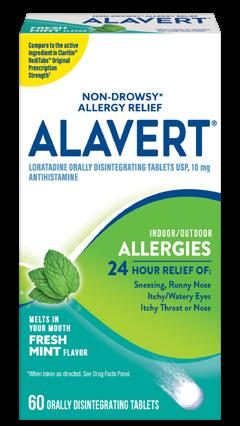

For some people, pharmacy is in their blood. DSN sat down with some to find out what inspired them to keep their family legacy alive

By Sandra Levy

There’s something about a pharmacy career that is, well, highly contagious. DSN sat down with several pharmacists who were inspired to follow in their relatives’ footsteps and to keep pharmacy in the family.

Whether they are independent pharmacy store owners, work for retail chains or practice at industry associations, these pharmacists have one thing in common: a passion for pharmacy that was ignited by a relative who cared for patients in their communities throughout the years. We even spoke with twins who are both well on their way to becoming pharmacists. Here are their inspirational stories:

“We both chose community pharmacy and share the belief that independent pharmacies are vital to local health care. The heart of our work has always been the same: serving patients with compassion, building relationships and ensuring they receive the best possible care”

—Thomas

McDowell, owner of McDowell’s Pharmacy

The co-branded pharmacy franchise models from Medicine Shoppe International, Inc. can help you grow your business, without sacrificing your independence. Access the advantages of scale, maximize operational efficiencies, drive revenue opportunities and expand patient care in your community.

Consider pairing your trusted pharmacy name with The Medicine Shoppe® Pharmacy or Medicap Pharmacy® to:

• Leverage the strength of a national pharmacy brand while maintaining your local brand presence

• Collaborate with a dedicated Franchise Business Consultant to plan, forecast and monitor all aspects of performance to reach your goals

• Take advantage of our flexible signage model when updating an existing store or expanding into a new community location

• Access a high-performing network providing contract management, best practice sharing, clinical programs and marketing support to drive patient engagement

Scan QR code to contact us today and learn how franchising can help achieve your business goals

The information provided is not intended as an offer to sell or the solicitation of an offer to buy a franchise. The offer of a franchise can only be made through the delivery of our franchise disclosure document. Medicine Shoppe International, Inc. (MN Franchise Reg. #F-145) Medicap Pharmacies Incorporated (MN Franchise Reg. #F-884) 7000 Cardinal Place, Dublin, OH 43017. New York: This advertisement is not an offering. An offering can only be made by a prospectus filed first with the Department of Law of the State of New York. Such filing does not constitute approval by the Department of Law. © 2025 The Medicine Shoppe International, Inc. All Rights Reserved. THE MEDICINE SHOPPE, MEDICAP, The Medicine Shoppe LOGO, the Pill Capsule design and the Mortar & Pestle design are trademarks of Cardinal Health and may be registered in the US and/or in other countries. All other trademarks are the property of their respective owners. Lit. No. 1PD25-3992608 (12/2025)

Kristen Riddle, newly elected president of the National Community Pharmacists Association, and owner of American Home Pharmacy in Clinton, Ark., is a sec ond-generation pharmacist.

Her dad, Eddie Glover, was a pharma cist who graduated from the University of Oklahoma. When Riddle was in high school, her father bought the pharmacy with his business partner. Sixteen years ago, Riddle and her husband, who is a physical therapist, became partners with her parents.

“I wanted to follow in my dad’s footsteps and work with him in the pharmacy, so I went to pharmacy school,” Riddle said. She is a graduate of the University of Arkansas for Medical Sciences College of Pharmacy.

Riddle recalled that when she was young, she would often go to her dad’s pharmacy with her brother to stock shelves and wrap gift items. “We didn’t have computers and the laser printers that we have now. You would type the prescription labels on a typewriter and there were stickers that would go on the bottle,” she said. “Sometimes the labels would fall on the floor. After school I’d clean the floor and help around the store.”

Riddle is nostalgic when she shares how her dad closed the pharmacy on Christmas

“

We have been a family of advocacy for many years. My dad is still involved in the pharmacy world. He handed that torch off to us”

—Kristen Riddle,

NCPA president

Eve and her family would go home and open presents knowing that they had tire-

Witnessing the respect that her dad had in the community and in the pharmacy ignited her desire to become a pharmacist. “I could see how he helped people and invested in those patients. I wanted to do that as well. I wanted to have that impact on those individual patients and families in our community. ”

Riddle praises the camaraderie and mentoring that she received from her father. “He invested in me. His leadership in the community and the pharmacy is how I went about counseling a patient,” she said. For instance, early in her career, Riddle gave patients an overload of information. “I told them everything from how their cholesterol medication worked to all of the possible side effects. I pulled everything out all at one time and it was overwhelming. My dad pulled me aside and said, ‘That patient really doesn’t want to know exactly how the statin works, they want to know how to take it. They will trust you with the rest.’ It was valuable to have that mentorship.”

Riddle also learned to be open to ideas from staffers even if she doubted the ideas could work. “Dad said, ‘You have to listen to all ideas. This one might not work, but

next time it could be the best idea. If you shut them down they won’t come to you with ideas.’”

Riddle’s dad also imparted the importance of advocacy and leadership skills to her. Eddie Glover was very involved in the NCPA and although he is retired, he is still involved with the Arkansas Pharmacy Association.

As a young pharmacist, Riddle traveled with Glover to meetings with NCPA leaders, and to the state capitol where her dad spoke to senators and congressmen about pharmacy and compounding. “My dad was involved with different leaders, and now my husband is running for state representative for our district,” said Riddle, now at the helm of her national post.. She previously led the Arkansas Pharmacists Association and served as a delegate to the United States Pharmacopeia.

“We have been a family of advocacy for many years. My dad is still involved in the pharmacy world. He handed that torch off to us,” she said.

In following in her dad’s footsteps, Riddle is mindful of the importance of her staff: “I call our staff members my pharmacy family. It’s a very family oriented business so when there is true family, there is a connection,” she said.

When he was growing up, Thomas McDowell—a fourth-generation pharmacist and current owner of McDowell’s Pharmacy in Scotland Neck, N.C., a member of Good Neighbor Pharmacy— saw firsthand how his dad made an impact on patients’ lives, not only by filling prescriptions but by being a trusted voice in the community.

“Watching those interactions showed me that pharmacy was more than a career. It was a calling rooted in service, compassion and relationships. That inspired me to follow in his footsteps and continue that legacy,” Thomas said.

Thomas said that he and his father, Joe, received excellent educations in pharmacotherapy and medication management.

“Those foundations are timeless. My father’s training prepared him to ensure the safe and effective use of medications, and that remains the core of what we do as pharmacists. The main difference lies in the scope of practice and the opportunities available to us at this time.”

Emphasizing that his education at the University of North Carolina placed far greater emphasis on clinical service delivery than his father’s, Thomas said, “These expanded opportunities reflect how the profession has evolved, giving pharmacists the ability to engage patients more directly in their health and play a larger role in preventative and chronic care. In many ways, my education was built on the same strong base as my father’s education, but it positioned me to step into an expanded clinical role that was not as accessible in practice when he began his career.”

When it comes to the career paths that he and his father choose, Thomas said there are

similarities and differences. “We both chose community pharmacy and share the belief that independent pharmacies are vital to local health care. The heart of our work has always been the same: serving patients with compassion, building relationships and ensuring they receive the best possible care.”

Thomas said the biggest divergence in their paths lies in the opportunities available within the profession. His father built his career at a time when the pharmacist’s role was centered on dispensing, counseling and being a trusted healthcare presence in the community.

“My path builds on that foundation by incorporating expanded clinical services, such as immunizations, point of care testing and disease state management,” he said. “These services allow me to take a more proactive role in preventing illness and helping patients manage chronic conditions, while still holding onto the same values and patient-first mindset that guided my father. In many ways, it feels less like a different path and more like an evolution of the one he started, adapting to new opportunities while staying true to the mission of community pharmacy.”

For Thomas, the best part of sharing the profession with a family member is the shared understanding and respect for the work. “Having someone who knows the challenges, the long hours and the responsibility that comes with being a pharmacist is invaluable. It also creates a bond across generations. Our conversations often go beyond family life and touch on how to adapt, improve and innovate in our profession. Having someone like my dad, who I can go to for guidance and wisdom, has been extremely helpful as I continue my journey as a pharmacist and business owner.”

His dad’s side of the story: Thomas’ dad, Joe McDowell, UNC SOP 1981, a third-generation pharmacist and former owner of McDowell’s Pharmacy, said that as the youngest of three children, he was always aware that he was the last chance to continue his father’s and grandfather’s legacy as pharmacy owners in their rural town.

“My dad never put pressure on me, but I did feel like pharmacy was something I

should at least explore,” Joe said. “I saw how respected my dad was in our community, how people trusted him and his passion to help the healthcare needs of his community. He was always accessible, empathetic and so knowledgeable. More than anything, I think I wanted to emulate his example of service to others and try to earn the respect as he did.”

When it comes to comparing their educations Joe said, “I think pharmaceutical innovation has developed many more therapeutic classes and novel medications, so there are a lot more medications to be knowledgeable about. In my schooling, I feel that I may have had a stronger and more diverse background in subjects such as pharmacognosy, pharmaceutical math, as well as some economics and pharmacy management. It would be hard to have had a more thorough preparation for clinical pharmacy than I had, but I’m sure Thomas was in good hands at Carolina.”

When queried about the best part of having a son for a pharmacist, Joe said, “I am so proud of him for accepting the challenge to be the fourth generation to serve in our family pharmacy—which still operates from the original 1901 building—and that he gets to know and help many of the same generations of families which have depended on us for improvements of their health care. His courage, determination and innovations have allowed our pharmacy to stay successful in what has been the most difficult environment I have seen in my lifetime.”

The TRUE METRIX® Brand provides you and your patients expanded access to national managed care plans and state coverage, and is sold under the brand names of the nation’s premier retail drug stores, distributors, and independent pharmacies. tr

CVS Caremark: Commercial

Express Scripts®: Commercial

Aetna®: Medicare Plans/ Medicaid

Centene: Medicare Advantage (Wellcare)/ Health Exchange (Ambetter)

Elevance Health (Anthem): Medicaid

Humana: Medicare Advantage/ Medicaid

Cigna Healthcare®: Commercial

Molina Healthcare: Medicare Advantage/ Medicaid/ Health Exchange

Proctor

Kurt Proctor, senior vice president of strategic initiatives at the NCPA, fondly remembers “growing up” in his father Tom’s drug store, Old Wood Drug, in Cass City, Mich.

Although he didn’t follow his parents in the family business, the lessons he learned from his dad, a pharmacist, and his mom, the drug store’s bookkeeper, inspired his career with NCPA, as well as with the National Association of Chain Drug Stores, where he held numerous titles.

Procter recalled that shortly after he was born, his dad moved from a mid-sized town to one of only 2,000 people and bought the corner drug store. Proctor said, “I grew up working in the store. From middle school age I was officially putting in hours at the store. It was a small town with two pharmacies next door to each other. They were very competitive with each other. My mother was an accountant and she did all the books for the store and my father was the pharmacist and ran the store.”

Although the role was not as defined as it is today, Proctor recalled working at the store in a pharmacy tech role. “I was in the back helping fill prescriptions. The gentleman my father bought the store from was a second-generation owner and he worked for my dad for a number of years. When we got our first computer he said, ‘I’m done,’” he said with a chuckle.

Proctor also helped his father with the pharmacy’s front end, which sold beer, wine, milk, soda, record albums, cassette tapes, car stereo equipment, jewelry, film, magazines, books and candy.

“That was my responsibility. You name it, we had it. I spent a lot of time in the general merchandise business in the front end and crushing boxes and putting them in bins in the back of the store, putting price tags on everything and organizing things, before I got back to the pharmacy side.”

Proctor also helped his mother with the pharmacy’s bookkeeping. “All business was done with checks and every month we’d get a stack of checks. Even before I started working in the store, it was my job to sort the checks in numerical order so my

mom would identify which checks didn’t clear yet and make sure they cleared. I’ve always said I was mostly interested in the business of pharmacy from the get-go,” he said, noting that he always thought that he’d go to pharmacy school.

Indeed, he graduated from Ferris State College, the same pharmacy school where his dad received his PharmD degree. From there, he went straight to graduate school, where he earned a master’s degree and a doctorate from the University of Texas in Austin.

Procter said that his dad was active in the local Rotary Club, served at the district level and eventually became world chairman for the Rotary’s Youth Exchange Program. Proctor said his dad’s leadership contributed to his desire and passion to serve in leadership positions.

After graduate school, Proctor joined NACDS in 1989, and held many positions throughout the years, starting as director of research and information, where he supported policy development work, eventually rising to senior vice president of pharmacy. At NACDS, he was instrumental in starting a PBM, Surescripts and the NACDS Foundation, for which he served as president.

When he arrived at NCPA he was also involved in start-ups, namely Community CareRx and Mirixa with Member Health, the NCPA Innovation Center and Community Pharmacy Enhanced Services Network. “There have been a number of times where I’ve been very involved with startups, which has been interesting and not something I specifically sought out,” he said.

The best thing about having a dad who was a pharmacist, said Proctor, was getting exposure to the business, even in hospital pharmacy. “You are an important figure and part of your community,” he said. He recalled accompanying his father —and the town’s other pharmacist— to the hospital in the middle of the night to fill urgent pharmacy needs when the hospital pharmacy was closed.

“In his own store, when it was closed, he’d go in at night and fill prescriptions. My dad was a role model for serving his community. I understood and appreciated the value of these independent pharmacies and owners of how important they were to their community and how respected they were,” Proctor said.

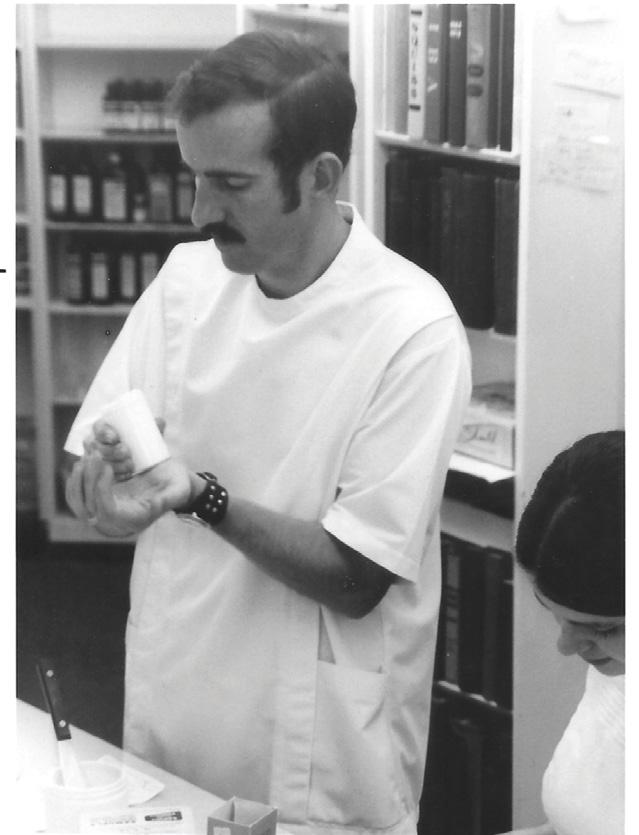

Breathe Right®

Drug-free nasal congestion relief and clearing you can feel right away with our nasal strips and sparkling saline nasal rinse spray.

Children’s Dimetapp®

Parents’ stress-free sick day solution for children’s cough, cold, and allergy symptoms.

NEW fast-dissolving, 24-hour relief of classic indoor and outdoor allergy symptoms.

Campho Phenique®

A powerful cold sore formula that relieves pain and itch, dries the cold sore and moisturizes.

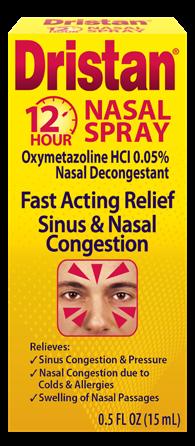

A powerful decongestant nasal spray that quickly relieves sinus and nasal congestion for up to 12 hours. Dristan®

Walgreens’ pharmacy interns Sean Bly and Stephen Bly are identical twins. They are both recipients of Walgreens’ Pharmacy Educational Assistance Program scholarships, and they are attending Ferris State University’s pharmacy program in Big Rapids, Mich. During school breaks, Sean interns at Walgreens inside Harper Hospital, while Stephen works at a specialty pharmacy site in Detroit.

“We’re known as the pharmacy twins,” Sean said. “But to us, it’s just going to school and work, like any other student. We’re learning how to navigate it all by struggling and succeeding at the same time.”

Stephen, who was always interested in medical school, took a pharmacy class in high school. “I was able to get my feet wet early with that class, and it made me realize this is really what I want to do for the rest of my life,” he said.

Having a wife and mother who work at a Kroger pharmacy is very special to Rani Saadallah, who has been a pharmacist for eight years. He has held various roles since joining Kroger in 2007 and works in White Lake, Mich.

His wife, Christina Hindo, graduated in 2019 from Massachusetts College of Pharmacy and Health Sciences, and has been with Kroger since 2019. She became a pharmacy leader in 2022 and works in Farmington Hills, Mich.

Saadallah credits his mom, Khulood Yousif—a nationally certified lead technician who also works at Kroger in Southfield, Mich.—for inspiring him to pursue a career in pharmacy.

“Ever since she started working as a pharmacy technician, my mom always took the time to carefully explain the importance of medication in healing and how pharmacists play a vital role in patient care, making it a truly rewarding job,” Saadallah said.

“I’m incredibly proud to have a son and daughter-in-law who are both pharmacy leaders at Kroger. It’s a remarkable achievement,” Yousif said.

Saadallah said the best thing about sharing the pharmacy profession with family members is the opportunity to discuss medication updates,healthcare tips and patient care stories.

Yousif added, “It’s also enjoyable because we can exchange relatable stories on the phone or over dinner and support each other with ideas.”

Hindo echoed her family’s sentiments: “We understand the demands of our work, share stories, exchange ideas and challenge each other, but above all, we support one another because we truly comprehend the profession and its demands.”

Sean, who was interested in medical research, worked at a local Walgreens after finishing his undergrad at Michigan State University and was inspired by staff pharmacists. “They really kind of pushed me to go into pharmacy. They all wanted me to do my best. I took that and ran with it,” he said.

The twins credit their grandma, who was a nurse and who demonstrated her diabetes care routines, for teaching them about the importance of patient empathy and for inspiring them to choose pharmacy as a career.

Before she passed, their grandmother learned of their decision to attend pharmacy school. Sean said it was “the best news she could receive. She was so happy.”

With support from each other and from their family, the siblings’ goal to become full-time Walgreens pharmacists is within reach.

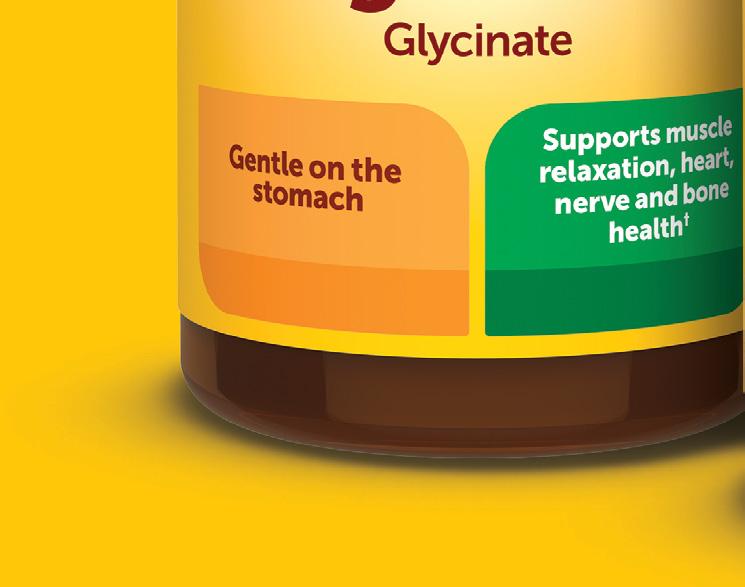

Catering to customers on GLP-1 medications could increase sales and credibility for retailers

By Amanda Baltazar

Sometimes referred to as “miracle drugs,” GLP-1 medications are bringing lasting change to many users’ lives.

This category of drugs, glucagon-like peptide-1 agonists, is used primarily to treat patients with diabetes and for weight loss.

Known by names like Ozempic and Mounjaro, the medications reduce users’ thoughts of food, disposing them toward wanting to eat less and to eat healthier.

The numbers are large. According to Circana, a Chicago-based market research firm, 23% of households use GLP-1 medications, said Sally Lyons Watts, global executive vice president and chief advisor, consumer goods and foodservice

insights, in a November 2025 webinar, “GLP-1 Unlocked: Retail Impacts in a New Era of Accessibility.” And the prevalence of consumers taking these medications is increasing. Lyons Watt reported that 2.9 million more consumers are filling prescriptions for them than was the case a year ago—an increase of 16%.

Circana data shows that the bulk of people–61%—taking GLP-1 meds are doing so for weight loss. But it seems every day there’s talk of other conditions these medications can help, including dementia, cardiovascular health and sleep apnea.

Add to that, the drugs will soon be cheaper and also be available in pill form which will “really blow it up,” said Leigh O’Donnell, head of shopper and category insights at Kantar.

These numbers are only expected to get bigger. According to advisory company KMPG, the global GLP-1 market is forecast to grow at a 29.6% compound annual growth rate through 2030. Morgan Stanley estimates that the global market will be worth $150 billion in the next 10 years.

The problem for retailers is that by eating less, these consumers are buying less. In fact, according to KPMG, 31% of these consumers spend less on groceries every month.

Retailers need to step it up a little. Most major retailers don’t yet have an in-store or shelf strategy that addresses GLP-1 users. It’s time to get educated”

—Leigh O’Donnell, head of shopper and category insights, Kantar

These are big numbers and they represent an opportunity for drug stores. A study last spring by Acosta Group showed retailers need to adapt to these consumers.

Acosta’s study revealed that GLP-1 users want more beverages, yogurt, nutrition bars, fresh produce, lean proteins and highprotein snacks. And they want fewer sweet or salty snacks, soda pop, carbs, fried foods and alcohol.

While drug stores don’t typically carry fresh produce or proteins, she said, they can focus on the packaged products. Water of all kinds, she explained, is an opportunity, since some users of GLP-1s find the drugs cause dehydration. And drinks fortified with vitamins, electrolytes, probiotics and even protein can be particularly appealing.

KPMG’s research shows consumers want more healthy snacking options, especially with protein; healthier carbonated beverages with fewer ingredients or healthier ingredients, and overall more healthy products and fewer processed foods. Even alcohol is taking a hit. These customers are also spending more in

the health and beauty aids section of stores, according to NielsenIQ. Earlier on this tends to be products for gastrointestinal health, vitamins and supplements, as consumers grapple with initial GLP-1 side effects (which often go away), but this becomes other products as consumers seek to enhance their looks as they feel better about themselves. “So they’re pretty valuable consumers,” said Sherry Frey, vice president of total wellness at NielsenIQ.

In addition, 75% of people in a recent study by Kantar picked up their initial prescription at a drug store, and drug stores tend to remain top of mind for prescriptions so there’s a huge opportunity, O’Donnell pointed out. “Drug’s got a lot of tailwind with GLP-1s.”

And these customers are changing where they shop, based on who’s adapting to their new needs. According to data from Kantar, 46% of GLP-1 users say they have a new go-to retailer, often because they’re seeking stores that better support their evolving dietary needs.

Who is doing a good job? Not many stores. Walmart.com has a protein, fitness

and weight management page; and GNC stores have a section dedicated to GLP-1 users, featuring products like anti-nausea medication, supplements and satiety products.

Grocery chain Hy-Vee stands out. It has an end-cap close to the pharmacy featuring items like protein shakes, probiotics, digestive and bone health supplements and fiber supplements. Stores also promote their personalized dietitian counseling to develop nutrition plans on these end-caps.

“By making these products and resources more visible within our stores, we’ve been able to help more individuals manage their medication side effects, and in turn, support their medication adherence,” said Elisa Sloss, assistant vice president, HealthMarkets & Dietitians. “These displays are designed to inform and educate consumers about the resources available to them.”

“Retailers need to step it up a little,” said O’Donnell. “Most major retailers don’t yet have an in-store or shelf strategy that addresses GLP-1 users. It’s time to get educated.”

Drug stores that want to meet these customers’ needs could create a specific section to make products related to GLP1 medications easier to find and browse, said Kathy Risch, senior vice president of shopper insights and thought leadership at Acosta Group.

“For drug stores it’s a great way to reinvent themselves,” she said. “They need to create occasions so they’re a resource for healthier items.”

Stores can simply add these items or create an entire category for GLP-1 users, Risch said. This could include healthier foods and beverages, supplements for nutritional needs including vitamins and fiber; cough drops and mints because GLP1 users report having a dry throat and bad breath and even products to help with the side effects, which are most commonly nausea, fatigue and bloating. Acosta’s study revealed that 85% of consumers suffering side effects purchase additional products.

Andrew Lindsay, principal, consumer and retail strategy lead, KPMG, also thinks

this leaves plenty of opportunity for drug stores, especially at the front of store point of sale, where a lot of impulse sales happen.

But they should also think about product placement and focus on how the consumer navigates the stores, he says. Since shoppers visiting drug stores for GLP-1 medications head for the pharmacy, it could be a good idea to place food options back there. “Maybe even creating a wellness zone of snacks could be helpful,” he said. “Or focusing around supplements and thinking about the nutrition those consumers are seeking.”

“For drug, this is an opportunity to embrace the ripple effect,” said Lyons Watt. “Embrace the medication, the food and beverages they want to consume, the trackers, the makeup and grooming products. Embrace this GLP consumer in a way that embraces their lifestyle journey.”

On top of this, she pointed out, since the cost of GLP-1 mediations is currently so high, the shoppers taking these medications tend to be higher income consumers. “So it’s a very attractive consumer, but it’s going to

broaden and it’s going to broaden fast (as prices come down), and it’s important to attract consumers no matter what income. This is the time to really get behind it.”

This category would work well at the back of a drug store, Risch said, “so the shopper would be able to see and conveniently shop it when they’re getting their drug refill but the pharmacist can also help them with it.”

Lyons Watt liked the idea of a GLP-1 section toward the pharmacy, which is a trusted area. It could even merchandise products to consumers waiting in line to pick up prescriptions.

While drug stores can boost sales of GLP-1 focused products, they can also become a trusted resource for Americans taking these medications. “There’s huge opportunity for drug stores to educate,” Risch pointed out. She said that consumers trust their preferred retailer and that drug stores, whose business is health, “are already a more credible source.” But, she adds, “retailers are not leveraging that fully.”

The drug channel, said Frey, “can be the point of truth for the consumer.”

Drug stores, she said, can offer printed material in stores or verbally through the pharmacy. They can also optimize digital channels like their website or app, “to educate, help consumers choose the right products, and be a helpful friend in guiding them to the right products. It’s very important for retailers and manufacturers to have a strong voice with helpful facts.”

And pharmacists rank high when it comes to trust, said Lyons Watt. “There is so much confusion, [but] the pharmacist is a trusted resource.” This gives drug stores an advantage, she pointed out. Pharmacists could answer questions about drugs but also diet, or they could include a nutritionist or dietitian on staff. “I’ve got to believe there would be an incremental boost in getting that type of one-on-one engagement.”

Consumers of all ages are taking GLP1 medications and of them, according to Acosta, 91% of millennials, 90% of Gen Z and 64% of Gen X are interested in packaged foods that support their weight loss goals. They also want clear messaging on packages. This means fortified foods, especially with a focus on protein but also products in smaller sizes.

The Trade-Off Consumer Survey by data analytics firm Big Chalk in the spring showed that around 33% of GLP-1 users are buying smaller pack sizes. They just don’t eat that much. They’re happy with half the portion they used to have,” said Rick Miller, partner.

The survey shows that the caloric reduction for patients on a GLP-1 diet ranges from 16% to 39%. And while they want to eat less unhealthy food, he said, their desire to eat in general has gone down even more.

One food manufacturer that’s bringing changes is Conagra.

A year ago, the company added “GLP-1 Friendly” badges on 26 Healthy Choice items and is looking for opportunities to add more products to this collection, said Alexa Longarini, Healthy Choice brand manager.

The products are doing well and “have been turning two times faster than competitive single-serve items with on-pack GLP1 positioning,” she said.

These products are designed to meet customers’ specific needs as they take GLP-1 medications.

“Because these medications suppress appetite, nutrient intake is critical. Showcasing our meals as accessible and healthy options with the right ingredients that help meet their needs gives them a reason to try Healthy Choice,” Longarini claimed.

But it’s also important to make sure the GLP-1 badge is distinct. “Grabbing a con-

sumer’s attention in the grocery aisle is difficult, so the messaging must be simple and distinctive,” she said. And since the two collections, Café Steamers and Simply Steamers, are grouped together on the shelf, “there’s collective visibility around the products.”

Conagra’s not alone. Last year Nestle launched Vital Pursuit high-protein, vitamin- and mineral-enriched ready meals as “dietary support” for consumers taking GLP-1 medications. Smaller brands are getting into the game, too. Earlier this year, Two Spoons Creamery in Los Angeles launched a high-protein ice cream with “GLP-1-friendly ingredients” and Sweet Freedom, which offers drinks, syrups and sauces, tells consumers it is “perfect for GLP-1 users.”

Because consumers are often looking for smaller portions or single portions of products, this can be an opportunity for drug stores, said Lyons Watt. Offering them, even if they’re not the most healthy, can go a long way toward satisfying a GLP-1 appetite.

Consumers are driving a new wave of innovation that’s boosting sales and reshaping strategies across mass-market beauty

uilding on the strong sales momentum generated in 2025, mass-market retailers aim to keep beauty sales on an upward trajectory.

Mass marketers posted greater growth than prestige from January through September 2025, reversing a three-year trend in which premium sales outpaced the market, according to data from Circana (a Chicago-based market research firm).

Fragrances, lip products, hair care and face serums were among the best sellers in 2025 and are expected to remain strong this year. Rising prices and an uncertain economy could drive more shoppers to affordable mass brands in 2026. Retailers are ready. Walmart is going all in on adding brands and offering beauty bars during seasonal events. Target is amplifying its position in mass fragrances and adding more lip brands.

CVS is putting muscle behind skin care and wellness. The chain named dermatologist Dr. Camille Howard as its firstever beauty dermatologist advisor and fortified its effort behind in-store beauty consultants, according to Michelle LeBlanc, vice president of merchandising for beauty, personal care and Hispanic strategy team at CVS Health.

Rachael Vegas, chief commercial officer at Walgreens, vows to supercharge the retailer’s front end. “We have 8,000 doors and we have customers walking in all day long. I think there is a foundation for success there,” she said of opportunities to augment pharmacy transactions.

Here, industry experts reveal their forecasts for beauty in the new year.

Jeremy Lowenstein Chief Marketing Officer, Milani

Cosmetics:

We continue to be energized by Milani’s momentum and the strong outlook for the brand. Milani is strategically positioned to appeal to a broader spectrum of consumers, which has led to strong growth across all our retail partners with outpaced category growth across the Primer, Tinted Moisturizer and Face Powder segments.

Milani is building on its leadership and heritage in complexion, as demonstrated by our 2025 launch of the Conceal + Perfect Blur Out Skin Tint Sticks, which we expect to continue to be a strong performer. Our success in mascara continues as well, supported by the addition of a new brown shade to our Lash Extensions Tubing Mascara lineup.

We’re also seeing encouraging growth across lips and multibenefit products. Milani’s new Keep it Full Plumping Lip Liners are driving renewed excitement in the lip category, while lip balms, supported by our new Keep it Full Glossy Plump Balm, are experiencing significant growth reminiscent of the surge we saw with lip oils. What sets our lip balms apart is their unique duality—they function as both a balm and a plumper, powered by peptides, aligning with consumers’ demand for products that offer multiple benefits and deliver meaningful results.

You asked, We listened!

Leading with innovation, superior quality, and first-hand consumer insights, the NEW KISS delivers an enhanced shopping experience and results retailers can count on in the fashion nail category.

Emilio Smeke CEO, Esponjabon:

The wellness boom shows no signs of slowing, and neither does Esponjabon. Building on the cult success of the viral Mother of Pearl soap sponge, the brand is unveiling a bold new look designed to captivate today’s beauty consumers—without compromising what made it iconic. As the category evolves, Esponjabon remains rooted in its original ethos: making skincare simple, satisfying, and accessible. With new formulas like Neutral and Hyaluronic Acid joining the lineup, the upgraded design positions the brand for growth while honoring the heritage formula beloved by millions. A modern, shelf-ready aesthetic makes it more relevant than ever for the fast-moving drugstore and mass beauty channel. For Esponjabon, this isn’t just a relaunch— it’s the next chapter in beauty innovation, one where multifunctional formats meet elevated rituals.

Katherine Morón CEO, Tu Azul:

The trends taking shape in 2026 feel distinctly consumer driven, rooted in wellness, authenticity and a deeper understanding of hair health. One of the biggest shifts is the rise of scalp care as a central part of the beauty routine. People are beginning to treat the scalp with the same intention they give their skin, creating space for lightweight botanical treatments designed for everyday use. At Lola From Rio, we’ve seen this evolution

firsthand with our Rapunzel Tonic, which has become a staple for customers seeking healthier-looking roots without heaviness or residue.

Another major shift is the continued momentum in textured hair innovation. Consumers with curls, waves and coils want products that honor and enhance their natural pattern, and the industry is finally catching up. Our Meu Cacho Minha Vida Combing Cream and Jelly Gel have seen significant growth because they offer definition without buildup and allow texture to shine. As this category expands, so are we, with new curl-focused launches on the way for textured-hair consumers looking for performance, hydration and ease. Wellness culture is also reshaping how people choose their hair care. Customers now want products that support their lifestyle. It reflects a broader shift toward products that support the rhythm of an active life rather than just a styling moment.

Deborah Dixon

Owner/Founder, OUT OF MOUNTAINS; Precious Mineralz LLC: OUT OF MOUNTAINS skin care for men and women is built on innovation and results. We know of no other company incorporating halloysite, a nanotubular clay that delivers key ingredients—such as peptides and hyaluronic acid—deep into the skin with time-release precision. Consumers focused on skin health can trust that our products are vegan, crueltyfree, clean and packaged in recyclable containers.

In 2026, men’s skin care will continue to grow. We launched our men’s line in mid2025 with five core products for skin care and grooming, and we’ll be expanding that offering with additional items next year. We are also developing hair care products and a daily moisturizer with SPF. Our philosophy centers on prevention, not just treatment and repair, and new formulations will incorporate many of the ingredients already proven effective in our current collection.

Juan Morillo Office Manager, OKAY Pure Naturals: In 2026, beauty is moving toward skinbarrier wellness, natural ingredients and simple nourishment. Consumers are gravitating toward products that feel gentle and supportive rather than harsh or overly clinical—a space where OKAY Pure Naturals already excels.

Our 100% Pure Oils, African Shea Butter, African Black Soap and our new Batana Collection all reflect this shift. Batana is especially exciting because it repairs damaged hair, supports scalp health and provides deep moisture for both hair and skin. It taps into the growing demand for powerful botanical ingredients. The broader trend toward sustainability and minimal routines also plays to our strengths, giving our multi-use oils and butters a natural advantage and laying the groundwork for potential future innovations such as packaging updates or refill systems.

Another defining trend for 2026 is the blending of hair, body and wellness into a unified experience. Consumers want routines that feel like self-care, with attention to texture, scalp health and simple daily rituals. OKAY’s Black Jamaican Castor Oil, Coconut Curls line, body butters, turmeric soaps and the Batana Collection all support this movement. Batana, in particular, has become a hero ingredient for repairing and defining textured hair.

Shalimar Dalal Maakar

CEO, Obliphica Professional:

I’m inspired by the shift toward ritual over routine—consumers looking for products and experiences that transform self-care into a sensory, restorative moment. That ethos aligns with our mission: to elevate everyday hair care into a luxurious wellness ritual that delivers transformative results for both hair and scalp.

Longevity in beauty is increasingly defined by prevention, protection and cellular resilience. Just as skin care has moved toward maintaining healthy function rather than simply reversing visible signs of aging, hair care is following suit. We’re formulating with powerful natural actives like seaberry (sea buckthorn) to help restore balance and protect the scalp’s biome, preserving hair integrity at every stage of life.

Will Henderson

Founder, Skincare Generics:

AI-driven skin care tools are reshaping the drug store aisle in a major way. More consumers are using apps that scan their skin, analyze ingredient lists or build personalized routines. That means brands need to be exceptionally clear about what’s in their products and how they fit within a regimen. We view this as a positive shift. At Skincare Generics, we list every ingredient and keep our formulas straightforward, making it easier for both people and technology to evaluate our products based on facts— not hype.

Vera Oh

Co-founder and CEO, VOESH: These are the four major trends we’re seeing. Sensorial performance and pleasure now go hand in hand. Products must feel indulgent and deliver visible results. Think silky textures, moodlifting scents and active ingredients like glycolic acid, squalane and probiotics— all in one formula.

Body care is getting smarter. Skin caregrade ingredients and delivery systems are moving beyond the face. Consumers expect hydration, exfoliation and microbiome care from head to toe. Korean beauty is inspiring more than just facial care. Layered, ritual-driven routines are expanding into bath and body. Textures, fermentation and ingredient stories are leading the way. Clean is the starting point, clean itself is no longer a differentiator. It’s expected. What matters now is how brands combine clean formulas with clinical results, skin compatibility and sustainable choices.

Janell Stephens

Founder and CEO, Camille Rose: In 2026, beauty and hair trends continue to move toward simplicity, speed and texture-centered care. Across our core consumer, 56% to 70% say they want to spend less time on their hair. Search behavior reflects this mindset, with “detangling” ranking as the fourth trending search, only behind Modern, Low Maintenance and Textured. This highlights a growing desire for manageability and wash-and-style moments that give consumers back time across all curl patterns. These data points align with broader category momentum. Mousse is the fastest growing form in hair