Convenience Store News is expanding its dedication to the industry’s smaller players

SINCE OUR FOUNDING IN 1969, Convenience Store News’ mission has been to deliver the insights, analysis, market research and business intelligence that helps c-store retailers stay ahead of what’s next — critical information to grow sales and profits. It’s a mission we take seriously, which is why every year, we identify ways to better serve our audience.

As 2026 gets underway, one of our major initiatives for the new year is to expand our dedication to the industry’s small operator community. Oftentimes, the biggest c-store chains dominate the headlines, while thousands of small operators across the country — many of them, family-owned businesses — quietly toil away serving the unique needs of their community.

In fact, 63% of the roughly 152,000 convenience stores currently serving customers in the United States are owned by single-store owners or those with less than 10 stores in total. The industry’s largest operators (those with more than 500 stores) account for just 22.4%.

Our 2026 Forecast Study, found in this issue, reveals that the industry’s small operators are most concerned about the U.S. economy, labor challenges and rising operational costs. As a result, their outlook on 2026 is divided between neutral expectations and slight improvement. On a scale of one to five — where 1 represents “Terrible, wake me up when it’s over” and 5 represents “It’s going to be our best year ever!” — the largest percentage of small operators (47%) rate their expectations for this year at a 3. The top rating last year was also a 3.

EDITORIAL EXCELLENCE AWARDS (2016-2026)

2021 Jesse H. Neal National Business Journalism Award

Finalist, Best Infographics, June 2021

2018 Jesse H. Neal National Business Journalism Award

Finalist, Best Editorial Use of Data, June 2017

2023 American Society of Business Press Editors, National Azbee Awards

Silver, Data Journalism, January/April/June 2022

2023 American Society of Business Press Editors, Upper Midwest Regional Azbee Awards Gold, Data Journalism, January/April/June 2022

Bronze, Diversity, Equity and Inclusion, March 2022

2016 American Society of Business Press Editors, National Azbee Awards Gold, Best How-To Article, March 2015

Bronze, Best Original Research, June 2015

2016 American Society of Business Press Editors, Midwest Regional Azbee Awards

Gold, Best How-To Article, March 2015

Silver, Best Original Research, June 2015

2020 Trade Association Business Publications

Intl. Tabbie Awards

Honorable Mention, Best Single Issue, September 2019

2016 Trade Association Business Publications

Intl. Tabbie Awards

Silver, Front Cover Illustration, June 2015

This year, our goal is to help small operators shift from neutral to drive — revving up their businesses, navigating obstacles and keeping pace in today’s rapidly evolving industry.

Convenience Store News has long been doing its part to support the small operator community with our annual State of the Small Operator Study, Small Operator content in every issue of the magazine, an entire Small Operator section of our website, and a weekly Small Operator newsletter delivered to inboxes every Monday. Last year, we introduced two more elements: the Outstanding Independents Awards program, which honors single-store owners and small operators that are making a big impact in the industry; and the Outstanding Independents Summit, a free, one-day virtual event that provides valuable insights and actionable knowledge.

We’re thrilled to be taking our commitment to the next level this year with the launch of Small Operator Academy. Free to c-store retailers with 20 stores or less, our members-only hub will deliver exclusive, curated resources that equip small operators with the tools, insights and support they need. New content, including video seminars and expert columns, will be added biweekly. Check out CSNews.com for information on how to register.

Helping all convenience retailers thrive is our objective, so if you have suggestions on how Convenience Store News can better meet your needs, don’t hesitate to drop me a line.

For comments, please contact Linda Lisanti, Editor-in-Chief, at llisanti@ensembleiq.com.

2025 Eddie Award Honorable Mention, Folio:

Business to Business, Retail, Full Issue, September 2024

Business to Business, Magazine Section

2024 Eddie Award, Folio:

Winner, Business to Business, Retail, Single Article, May 2024

Honorable Mention, Business to Business, Magazine Section 2023 Eddie Award Honorable Mention, Folio:

Business to Business, Retail, Full Issue, September 2022

Business to Business, Retail, Single Article, March 2023

2022 Eddie Award, Folio:

Winner, Business to Business, Retail, Single Article, March 2022

Winner, Business to Business, Food & Beverage, Series of Articles, October 2021

Honorable Mention, Business to Business, Retail, Single Article, September 2021

2020 Eddie Award, Folio:

Business to Business, Retail, Series of Articles, September 2019

2018 Eddie Award Honorable Mention, Folio:

Business to Business, Retail, Website

Business to Business, Retail, Full Issue, October 2017

Business to Business, Editorial Use of Data, June 2017

2017 Eddie Award, Folio: Winner, Business to Business, Retail, Single/Series of Articles, May 2017

Honorable Mention, Business to Business, Retail, Single/Series of Articles, June 2016

EDITORIAL ADVISORY BOARD

Laura Aufleger OnCue Express

Richard Cashion Curby’s Express Market

Billy Colemire Majors Management

Robert Falciani

ExtraMile Convenience Stores

Jim Hachtel Core-Mark

Chris Hartman Rutter’s

It was another year of disruption, innovation and unexpected pivots

AS I DO EVERY YEAR, it’s once again time for me to look back at the predictions I made a year ago and assess how they played out — and then look ahead to the trends that will shape the coming year for the convenience retail industry.

Let’s start where much of last year’s conversation began: electric vehicles (EVs). My forecast that EV momentum would slow without federal incentives proved accurate. We saw several major car companies scale back their EV sales projections, and a number of retailers scaled back planned installations of chargers as EV sales plateaued. Yet, interestingly, some operators still found success by focusing on experience-driven charging — comfortable seating, enhanced foodservice and digital ordering that encourage longer times in the store. For 2026, I predict stable, not explosive, growth and thoughtful, ROI-driven deployments tied closely to foodservice and loyalty strategies.

2026 may demand more creativity and strategic focus than any year before it.

My call that cybersecurity would become the industry’s top technology priority was, unfortunately, validated. The significant uptick in attempted breaches forced organizations to tighten protocols and invest in new tools. In 2026, I expect to see more artificial intelligence (AI) powered monitoring systems and stricter compliance requirements across the board. At the same time, AI’s role in operational automation has expanded dramatically, particularly in forecasting, dynamic pricing and labor optimization. This is something I expect will accelerate.

Once again, foodservice remained the engine of growth in 2025. I predicted an expansion of premium, global and health-forward offerings. Retailers delivered, introducing everything from comfort food to regional and ethnic specialties that rival fast-casual concepts. In 2026, I expect retailers to push even further into customization, speed-scratch cooking, and digitally enabled “micro-restaurants” within the store. With shrinking margins, shifting consumer habits and increasing competition from quick-service restaurants, convenience retailers are being challenged to rethink what “foodservice” means in a world where “convenience” alone no longer guarantees success.

One of my biggest concerns last year — retail theft — regrettably escalated. Shrink levels in some markets reached new highs, and retailers continued to grapple with safety concerns and alarming operating costs. In 2026, I expect to see a wave of investments in smart shelving, AI-driven surveillance and restricted-access product areas. Some operators will rethink store formats entirely.

A bright spot I predicted for 2025 — retail media networks (RMNs) — continued to surge, evolving into a meaningful profit center. This year, I anticipate retailers will integrate RMNs more deeply with their loyalty programs, personalizing in-store screens, pump media and targeted mobile offers in real time.

As for merger-and-acquisition activity, consolidation remained strong in 2025 with several regional chains changing hands. Rising compliance costs, labor challenges and technology investments accelerated the pace. I believe 2026 will continue this trend as multiunit operators grow larger and smaller chains look for exit opportunities.

Unfortunately, something I hoped to be wrong about — the lack of progress on swipe fee reform — played out just as expected this past year. Fees climbed again in 2025, placing even more pressure on margins. I would love to predict meaningful relief in 2026, but realism suggests we’re in for another year of frustration.

As we enter 2026, the themes remain familiar: innovation, operational discipline and customer experience. What’s changed is the speed, and necessity, of adaptation. The convenience store industry has always been resilient, but 2026 may demand more creativity and strategic focus than any year before it.

For comments, please contact

Don Longo, Editorial Director Emeritus

, at dlongo@ensembleiq.com.

18 Tempered Expectations

Restrained consumer spending and rising operating costs lead to a more reserved outlook.

20 Mixed Opinions

Some c-store retailers feel confident about the year ahead, while others are apprehensive.

24 Varied Perspectives

The industry’s small operators have divided opinions on their 2026 prospects.

28 Optimism Fades Amid Challenges

Retailers lower their expectations as they prepare for a potentially rocky 2026.

40 Glass Half Full C-store suppliers and distributors take a slightly more positive view on 2026.

In 2015 Game Leaf was introduced as part of the Garcia y Vega portfolio of cigars, revolutionizing the Rolled Leaf cigar category. Now, as part of our 10th anniversary celebration, we’re reintroducing Game Leaf with colorful, eye-catching, consumer-tested 3-cigar packaging designed to bring Rolled Leaf customers more of what they want.

AVAILABLE AT 3 FOR $2.19 TRIAL PRICING AND SAVE ON 3

3 REASONS FOR 3-PACK SALES

While all other Rolled Leaf formats showed velocity declines in 2024, the velocity for 3-packs rose by 15%.

In 2024, the 3-pack was the only Rolled Leaf format to show volume growth, along with a 5.7% increase in share of the market.

Rolled Leaf 3-packs were added to shelves in over 9,700 c-stores in 2024, an 11% increase in store count over 2023.

3 REASONS TO GO WITH GAME LEAF

Game Leaf is able to build on the tremendous brand equity of Game, the #1 selling Natural Leaf cigar in the US.

Game Leaf’s commitment to quality and stringent quality standards—from broadleaf crop selection through manufacturing—ensure the best quality Rolled Leaf cigar available.

Consumers equate the Game Leaf brand with the Garcia y Vega tradition of quality and craftsmanship, as Garcia y Vega has been making Natural Leaf cigars since 1882.

8550 W. Bryn Mawr Ave., Ste. 225, Chicago, IL 60631 (773) 992-4450 Fax (773) 992-4455 WWW.CSNEWS.COM

BRAND MANAGEMENT

SENIOR VICE PRESIDENT/GROUP PUBLISHER, CONVENIENCE NORTH AMERICA Sandra Parente sparente@ensembleiq.com

EDITORIAL

EDITOR-IN-CHIEF Linda Lisanti llisanti@ensembleiq.com

EXECUTIVE EDITOR Melissa Kress mkress@ensembleiq.com

MANAGING EDITOR Danielle Romano dromano@ensembleiq.com

SENIOR EDITOR Angela Hanson ahanson@ensembleiq.com

EDITORIAL DIRECTOR EMERITUS Don Longo dlongo@ensembleiq.com

CONTRIBUTING EDITORS Renée M. Covino, Tammy Mastroberte

ADVERTISING SALES & BUSINESS

ASSOCIATE BRAND DIRECTOR Rachel McGaffigan - (774) 212-6455 rmcgaffigan@ensembleiq.com

ASSOCIATE BRAND DIRECTOR Ron Lowy - (330) 840-9557 - rlowy@ensembleiq.com

ACCOUNT EXECUTIVE & CLASSIFIED ADVERTISING Terry Kanganis - (917) 634-7471 - tkanganis@ensembleiq.com

DESIGN/PRODUCTION/MARKETING

ART DIRECTOR Cristian Bejarano Rojas crojas@ensembleiq.com

PRODUCTION DIRECTOR Pat Wisser pwisser@ensembleiq.com

MARKETING MANAGER Jakob Wodnicki jwodnicki@ensembleiq.com

SUBSCRIPTION SERVICES LIST RENTAL mbriganti@anteriad.com

SUBSCRIPTION QUESTIONS contact@csnews.com

CHIEF EXECUTIVE OFFICER

CHIEF FINANCIAL OFFICER

CHIEF PEOPLE OFFICER

CHIEF OPERATING OFFICER

The civil penalty settles a lawsuit filed by the Federal Trade Commission (FTC) alleging that 7-Eleven violated a 2018 consent order when it acquired a fuel outlet in St. Petersburg, Fla., without prior notification. This marks the largest negotiated settlement in the FTC Bureau of Competition’s history.

2

Fans can follow @SheetzGaming on social media platforms to learn more about future collaborations, loot and more. Gamers have the opportunity to connect while sharing their best hits, favorite “schnackz” and Sheetz hauls.

The retailer is staying the course on its goal to build 500 new stores by 2028. According to President and CEO Alex Miller, the company has opened 29 new stores since May and has another 73 stores currently under construction.

The operator of Revel convenience stores acquired nine locations in California’s Tri-Valley region and three stores in the Lake Tahoe area. Former owner C&J Cox Corp. will continue to operate two c-stores in California.

Its financing agreement with The Briad Group focuses on the development and acquisition of new sites. The investment will support two to four Circle K convenience store and mini travel center projects annually over the next several years.

Three out of four professionals will experience burnout at some point in their careers. It’s a silent threat that erodes confidence, damages relationships and diminishes health. In a 30-minute webinar, now available for on-demand viewing at CSNews.com, career and leadership coach, HR consultant and bestselling author Courtney Murphy discusses how to identify early warning signs of burnout, assess causes, build a toolkit of practical strategies to manage stress, and more.

For more webinars, visit the CSNews Webinars section of CSNews.com.

When a restroom falls short of expectations — whether due to cleanliness, privacy or accessibility — patrons don’t just notice, they act, writes Dotti Haynes of Essity, a multibillion-dollar global professional hygiene company. For operators, this means the restroom is no longer an afterthought. It’s a frontline differentiator that can drive repeat visits, positive reviews and even social media buzz. She offers three practical principles to guide restroom strategy: prioritize cleanliness and safety; design for comfort and privacy; and show that you care.

Kellanova is bringing four new Pringles flavors to the away-from-home channel. Coming to convenience stores are Pringles Smoky Bacon, which features notes of hickory smoke and pork flavors; and Pringles Smoky Cheddar, blending a mild sweet, applewood smokiness with bold and creamy cheddar cheese flavor. The Pringles Hot Ones line is also introducing a 2.5-ounce grab-and-go size for maximum portability. In partnership with the Emmy-nominated show, “Hot Ones,” two varieties are joining the line: Pringles Hot Ones The Classic Hot Sauce, with complex notes of the Chile de Arbol pepper; and Pringles Hot Ones Los Calientes Barbacoa, which features notes of chipotle, smoky jalapeño, and earthy herbs and spices.

Kellanova Chicago pringles.com

A year after marking 90 years in the channel, the retailer continues to grow its brand

RACETRAC INC. wrapped up 2025 on a high note, celebrating two notable milestones.

The Atlanta-based convenience store retailer introduced its brand to a new market on Dec. 2 when it cut the ribbon on its first North Carolina store. Located in Monroe, the store is strategically positioned along the busy U.S. Route 74 corridor connecting to Charlotte, and represents a significant milestone in RaceTrac’s growth strategy, according to the company.

The opening of this store brings RaceTrac’s signature “Whatever Gets You Going” convenience experience to North Carolina residents for the first time and adds approximately 30 new jobs. This move follows recent new market entries into Indiana, Ohio and South Carolina.

The Monroe store offers a wide variety of made-in-store food and beverage options, including grab-and-go pizza, chicken tenders, sandwiches, salads, fresh fruit cups and a Swirl World frozen yogurt bar with a wide array of toppings. Six blends of RaceTrac’s “Crazy Good Coffee” with all the fixings are available for coffee lovers.

Outside, the forecourt offers a variety of competitively priced fuel options. Professional drivers and construction vehicles can take advantage of the spacious rear canopy

with lanes for high-flow diesel and diesel exhaust fluid, the retailer noted.

RaceTrac’s North Carolina debut closely followed the opening of its 600th convenience store in Garden City, Ga., on Nov. 20. A ribbon-cutting ceremony featured gift card giveaways, samples from popular brands, and a donation to Savannah Feed the Hungry.

“RaceTrac’s 600th store marks a pivotal milestone in our growth and expansion strategy, and we’re especially proud to celebrate this opening in our home state of Georgia,” said

RaceTrac CEO Natalie Morhous.

“Garden City’s proximity to the Port of Savannah, thriving logistics industry and vibrant local neighborhoods make it the ideal spot for RaceTrac to serve professional drivers, commuters and residents alike — providing whatever gets them going.”

RaceTrac celebrated its 90th year in the convenience channel in 2024.

The music icon unites with the travel stop operator for a rebrand initiative

TENNESSEAN TRAVEL STOP entered into a strategic partnership with global superstar Dolly Parton to rebrand and revitalize the travel stop operator’s Cornersville, Tenn., location.

In 2026, the site will debut under a new name, Dolly’s Tennessean Travel Stop, uniting the trusted Tennessean Travel Stop brand with the cultural reach and unmistakable Tennessee spirit of Dolly Parton, the entities said in an announcement.

The first rebranded location will serve as both a proof of concept and flagship for future sites planned under the new Dolly’s Tennessean Travel Stop banner. Additional locations across Tennessee and beyond are set to be announced in 2026.

“I have spent the bulk of my life on the road, and more specifically on a bus. All the years spent visiting greasy spoon cafes, truck stops and roadside pit stops have given me an understanding of what travelers desire on the road,” Parton said. “Whether you are driving a truck, a bus or a car, you want a place that feels like home and recharges you for the rest of your journey. I believe we will

fill a void out there on the highways, all while bringing the heart and soul of Tennessee.”

The flagship location, which is remaining open while under renovation, will introduce an evolved travel experience that integrates modern amenities, curated dining and authentic regional retail with approachable comfort. While specific design details are remaining under wraps until the official unveiling, the venture is already moving through the necessary permitting and partnership phases.

“The Tennessean has long been a ‘home away from home’ for truck drivers, travelers and locals alike. Our roots in this community run deep — we’ve created jobs, built connection and welcomed generations of people through our doors,” said Gregory H. Sachs, chairman/CEO of Tennessean Travel Stop and Sachs Capital Group. “This new partnership allows us to carry that legacy forward in a way that celebrates everything special about Tennessee.

“Together with Dolly and her team, we’re reimagining what a travel stop can be — transforming it into a warm, inviting destination where everyone feels welcome to slow down, kick up their feet and stay awhile,” he continued.

Further announcements regarding opening timelines, design partners and expansion markets are expected in the coming months as plans progress.

Wawa Inc. opened its 1,000th fuel store, located in Pennsylvania’s Delaware County, on Dec. 11. The chain plans to expand its network into central Pennsylvania, starting with 10 locations in Centre County and others surrounding it over the next five years.

Love’s Travel Stops expanded its network in November with the opening of three travel stops. They are in Trinidad, Colo.; Stroud, Okla.; and Sterling, N.D. These locations add 283 truck parking spaces to the company’s footprint.

Freedom Oil Co. sold its 27-store chain to Mizpah Ventures LLC, a Chicago-based company. With this deal, the Owens family, which owned the stores in central Illinois and Florida for three generations, says goodbye to the convenience channel.

Alimentation Couche-Tard Inc. opened a new distribution center in the Midwest. The 266,000-square-foot facility, located in Otsego, Minn., will support nearly 500 Holiday Stationstores and Circle K locations throughout the Twin Cities and Upper Midwest.

Royal Farms entered into a partnership with Bitstop, bringing Bitstop ATMs to all 310 of the convenience store chain’s locations. The partnership makes Bitstop the exclusive digital currency ATM provider at Royal Farms locations.

TravelCenters of America (TA), part of the bp portfolio, recently opened three new TA Express locations. The sites are in Decatur, Texas; Dale, Ind.; and Fillmore, Utah. With the addition of these sites, TA’s network grew by 216 truck parking spaces.

Brew LLC acquired 13 convenience stores and one licensed vape products and tobacco retailer in Iowa from Danlee Corp. The c-stores carry the Jiffy and Phillips 66 banners and will now be rebranded as Brew stores, offering fuel from bp Amoco.

Little General Stores expanded in its home state of West Virginia with the acquisition of five U-SAVE convenience store locations. The stores are in Mt. Nebo, Summersville, Craigsville, Canvas and Richwood.

7-Eleven Inc. is bringing an international fan-favorite menu item to its U.S. stores. The Japanese-Style Egg Salad Sandwich, made with soft, fluffy milk bread, is now available at participating 7-Eleven, Speedway and Stripes locations.

Majors Management LLC is rolling out the new MAPCO Car Wash App, developed in partnership with Convenience & Energy Advisors and powered by Liquid Barcodes. The app includes a store locator and games, among other features.

Stewart’s Shops implemented a policy for handling change in response to the national penny shortage. Under its “common cents” solution, if a customer is owed one penny, the retailer will give that customer a nickel instead.

Mars Inc. completed its $35.9-billion acquisition of Kellanova on Dec. 11. The addition of Kellanova expands the portfolio of Accelerator, a division of Mars Snacking, with complementary brands such as RXBAR, and Nutri-Grain and Special K bars.

The Hershey Co. wrapped up its purchase of LesserEvil, expanding its better-for-you portfolio. LesserEvil’s leadership team remains with the company to continue driving its innovative commercial model, speed-to-market capabilities and manufacturing operations.

Dr Pepper teamed up with Casey’s General Stores Inc. for the Fansville $100,000 Tuition Giveaway. The pair awarded five $20,000 tuition prizes at the end of 2025.

Tote.ai, an AI-native POS system for convenience store and fuel retailers, received $22.6 million in funding to accelerate hiring, market expansion and product features. The round was led by Cota Capital, with Storm Ventures and Cervin Ventures joining.

Lula Commerce raised another $8 million to meet the growing digital demands of convenience retailers. The recent Series A round of funding was led by SEMCAP AI, with participation from Rich Products Ventures, GO PA Fund, NZVC, UP.Partners, Green Circle Foodtech Ventures, and Outlander VC.

Molson Coors has undertaken a corporate restructuring plan, which called for the elimination of roughly 400 salaried positions across its Americas business by the end of 2025. The plan is designed to create a leaner, more agile organization.

Black Buffalo unveiled enhancements to its Herd Rewards loyalty program, now allowing members to redeem points for coupons that are valid not only online and on subscription orders, but also in-store at participating retail locations.

Dial up your product mix with the latest launches and must-watch trends in candy and snacks. This is where standout items get discovered — and sales strategies get sharper.

Mr. Pibb

Mr. Pibb, the beloved spicy cherry soda that amassed a devoted fan following for nearly three decades, is making a comeback with a new look and added caffeine kick. The brand first launched in 1972 and was renamed Pibb Xtra in 2001. Now, due to popular demand, a reformulated Mr. Pibb is returning with a national rollout planned for 2026. With 30% more caffeine than Pibb Xtra and a bold, delicious taste profile featuring intensely sweet cherry with hints of caramel and a spicy bite, the new Mr. Pibb is crafted for consumers looking for flavor with a kick. Mr. Pibb and Mr. Pibb Zero Sugar will be available in 12-packs of 12-ounce cans, as well as 20-ounce and 2-liter bottles (Mr. Pibb only).

THE COCA-COLA CO. • ATLANTA • COCA-COLACOMPANY.COM

Zig-Zag introduces a two-pack cigarillo line, combining premium quality with a competitive 99-cent price point (in most markets). With 63% of U.S. cannabis smokers purchasing cigarillos weekly, this new format addresses consumer demand for two-packs without sacrificing the premium experience the brand is known for, according to its maker. The collection — which is now available nationwide — includes fan-favorite flavors such as Sweet, Diamond, Grape, Blueberry and Gold. The Zig-Zag Two-Pack Cigarillo Line is designed to provide retailers with an opportunity to drive repeat sales.

TURNING POINT BRANDS INC. • LOS ANGELES • ZIGZAG.COM

Nerds Juicy Gummy Clusters take the original Nerds Gummy Clusters to the next level. The new product features a unique multisensory experience of tangy, crunchy Nerds candies on the outside, a chewy gummy center on the inside, plus a drop of juice — all in one mega bite. Launching in a bold Strawberry Punch flavor, the candy is now available at select retailers and will roll out nationwide in 2.65-ounce, 4.5-ounce and 7.15-ounce packs, with a suggested retail price between $2.49 and $6.49. According to the maker, this launch marks the brand’s most anticipated innovation since the debut of Nerds Gummy Clusters in 2020.

FERRARA • CHICAGO • NERDSCANDY.COM

New from Rich Products Corp., On Top Chocolate Soft Whip is a pourable, ready-to-use cold foam with a light texture that enables layering in both hot and cold beverages. Operators need only to thaw and pour it to enhance nearly any beverage, from specialty coffees to shakes, dirty sodas, smoothies and cocktails, the company noted. On Top Chocolate Soft Whip comes frozen in a 19-ounce carton, 12 per case, with a shelf life of 365 days frozen and 21 days refrigerated. The product joins Rich’s On Top Soft Whip portfolio, which includes cold foam with a sweet cream flavor and the plant-based On Top Oat Milk Soft Whip pourable topping. RICH PRODUCTS CORP. • BUFFALO, N.Y. • RICHSUSA.COM/BEVERAGES

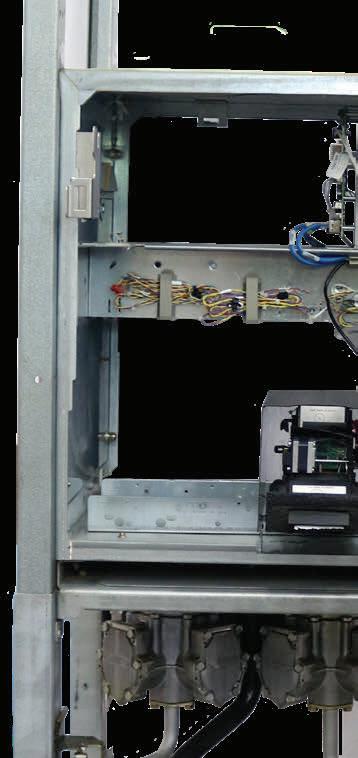

Dover Fueling Solutions, a part of Dover Corp., is making its Bulloch POS system available to fuel and convenience operators in the United States. Bulloch unifies point of sale, electronic payment systems and forecourt controllers into a single software solution that simplifies operations, maximizes uptime and provides consistent quality support. Designed for performance and with operators’ pain points in mind, Bulloch features dualterminal redundancy and configuration backups, remote software control and assisted installs, and proactive software monitoring to minimize downtime, reduce truck rolls and quickly resolve issues, according to the company. DOVER FUELING SOLUTIONS • AUSTIN, TEXAS • DOVERFUELINGSOLUTIONS.COM

Non-flavored rough cuts are driving profits and Swisher Sweets Leaf Dark Aromatic is set to keep that demand going. Tap into this high-growth segment now!

Non-flavored rough cuts are driving and Swisher Sweets Leaf Dark Aromatic is set to that demand Tap into this segment now!

Restrained consumer spending and rising operating costs lead to a more reserved outlook A Convenience Store News Staff Report

HEADING INTO 2025, the convenience store industry’s retailers, distributors and suppliers had a more positive outlook on both the U.S. economy and their own business prospects than the year before. They hoped that better economic conditions would lower inflation and its impact, boosting consumers’ disposable income, which would increase c-store foot traffic.

Now, a year later, a complete economic turnaround has not materialized. As a result, convenience channel retailers, distributors and suppliers are more reserved in their outlook on the year ahead, according to the findings of the 2026 Convenience Store News Forecast Study

Most have a neutral or slightly positive outlook on their business prospects. On a scale of one to five — where 1 represents “Terrible, wake me up when it’s over” and 5 represents “It’s going to be our best year ever!” — the largest percentage of c-store retailers (46%) rate their expectations for 2026 at a 3, while 37% put their rating at a 4 and 12% selected a 5. The industry’s distributors and suppliers are a bit more optimistic, with only 36% choosing the neutral rating of 3, while 32% selected 4 and 19% selected 5.

Predictions on the state of the U.S. economy this year are divided on all sides of the convenience retail proposition. While the sentiment is more positive among suppliers and distributors than among retailers, optimism has declined among both groups vs. a year ago.

Read on to learn more about what the industry’s key players predict for 2026.

SPONSORED BY

Some c-store retailers feel confident about the year ahead, while others are apprehensive

By Danielle Romano

AT THIS TIME LAST YEAR, many U.S. convenience store retailers were more confident about the future of the economy and its impact on their business. This year, the operators surveyed by Convenience Store News are more divided in their projections for the year ahead.

When asked about their outlook on the economy for 2026, the number of c-store retailers that have a neutral outlook increased 11 points year over year to 37%, while the number that have a positive outlook dropped 9 points to 28%. On the bright side, slightly fewer operators this year (35%) have an outright negative economic outlook compared to last year’s study.

Respondents point to a turbulent political climate, consumers’ conservative spending, and the continued impact of tariffs and inflation as reasons for their apprehension.

“ICE deportations will dramatically change the labor force,” said one Forecast Study retailer participant. Another pointed out, “Benefit cuts at the federal level threaten to reduce the total amount of money available for spending in our community.”

Still, on a scale of one to five — where 1 represents “Terrible, wake me up when it’s over” and 5 represents “It’s going to be our best year ever!” — nearly half of the retailers surveyed (49%) rate their expectations for the year ahead at a 4 or 5. Only 5% of retailers selected a rating of 1 or 2, while the remaining 46% put their expectations at 3.

In terms of sales growth, roughly six in 10 operators foresee positive total sales growth in 2026, though optimism is falling. The percentage of retailers that expect their sales to increase declined 7 points year over year, while the percentage expecting a decrease (13%) jumped 10 points. A little more than a quarter of operators are projecting stability year over year.

Retailers are less optimistic about profit growth. This year’s study shows greater percentages are either expecting their 2026 profits to stay the same (44%, up 5 points vs. a year ago) or to decline (16%, up 4 points). Accordingly, the percentage of operators that expect their profits to increase dropped 9 points compared to a year ago, landing at 40%.

As in past years, the annual Forecast Study asked convenience retailers to weigh in on the factors that will have the biggest impact on their sales and profitability in the year ahead. For the second consecutive year, inflation and economic issues are

Bevvy-Glide™ makes every bottle and can glide forward on angled shelves, ensuring products stay neatly organized, perfectly front-faced, and easy to shop. Its sleek design boosts brand visibility while delivering a durable, cost-effective solution for cold vaults and beyond.

Built strong and eco-friendly, Bevvy-Glide™ adapts to virtually any cooler or shelf with breakaway depth sections and interconnecting lanes. Installation is quick and tool-free. Just drop it in and let Bevvy-Glide™ do the work. Reliable, sustainable, cost-effective, and built to last, it’s the smart way to merchandise beverages.

There’s a Bevvy-Glide to fit any cooler and any beverage size.

Inflation & national economic issues

Increasing operational costs

Tobacco & e-cigarette regulations

Motor fuel prices

Labor turnover & hiring

Changes in foot traffic patterns

Brick-and-mortar competition

Investments in foodservice

Increasing regulation (excluding tobacco regulations)

consumer expectations of "convenience"

top of mind — 20% cite this as their top concern, while 50% put it in their top three.

Retailer comments on inflation and the economy include:

• “The buying power of money is declining.”

• “I will really worry about more tariffs and the effects they will have on the economy as well as inflation issues.”

• “Increased costs are leading to decreased margins.”

Also for the second straight year, increasing operational costs came in at No. 2 on the list of concerns (cited by 15% as their top worry and by 45% in their top three). Rounding out the top five are tobacco and e-cigarette regulations, motor fuel prices, and labor turnover and hiring.

Changes in foot traffic are also a chief concern among c-store retailers. While most still expect either traffic growth or stability in 2026, these projections are tempered compared to last year. Growth expectations are down 13 points, while status quo expectations are up 11 points.

In the good news column, more convenience store retailers this year are anticipating cross-channel competition levels to stay the same (up 13 points from last year’s study) and fewer operators are bracing for an increase in competition (down 13 points).

Due to increasing economic pressures on consumers’ wallets, c-store operators perceive dollar stores as their biggest competitive threat this year. Food delivery sites/apps and Amazon/Amazon Fresh are on their radar, too, signaling the importance of digital ordering and delivery.

Despite the challenges facing the convenience channel, retailers are bullish about seizing opportunities that will make their businesses stand out and provide guests with a seamless experience.

One area primed for investment is technology. The top tech-enabled enhanced convenience services that operators plan to add are mobile app ordering, at-pump ordering and third-party delivery. These investments illustrate operators’ focus on mobile capabilities that enable digital shopping pathways to fit consumers’ evolving definition of convenience.

Foodservice expansion is also on many retailers’ to-do lists now that the convenience channel has established itself as a trusted destination for fresh food and beverages.

“We’re making lots of upgrades. More food, more mobile,” one retailer commented. Another said, “We plan to continue our made-to-order food program so it’s available in more stores with more ways to order.” CSN

The industry’s small operators have divided opinions on their 2026 prospects

By Linda Lisanti

SAME AS A YEAR AGO, the convenience store industry’s small operators (those operating 20 stores or less) are concerned about the U.S. economy, rising operational costs and labor uncertainty. As a result, their outlook on 2026 is divided between neutral expectations and slight improvement.

On a scale of one to five — where 1 represents “Terrible, wake me up when it’s over” and 5 represents “It’s going to be our best year ever!” — the largest percentage of small operators (47%) rate their expectations for this year at a 3. The top rating last year was also a 3.

In the good news column, more small operators opted for a positive rating this year. The percentage selecting a rating of 4 or 5 went from 42% last year to 47% this year. Still, this figure is slightly lower than the industry’s large operators, 51% of whom chose a 4 or 5.

Interestingly, and perhaps correspondingly, the industry’s large operators are also more bullish on the economy than small operators. While an equal percentage of each group (28%) hold a very/slightly positive outlook on the economy, a significantly larger percentage of small operators (42%) hold a very/slightly negative view vs. just 28% of large operators.

Not surprisingly then, when asked to identify the issues that will have the biggest impact on their sales and profitability in the year ahead, small operators put inflation and national economic issues at the top of their list. This issue jumped from No. 2 last year to No. 1 this year.

Last year’s No. 1 issue, increasing operational costs, remains a top challenge but dropped into the No. 3 spot this year behind labor turnover and hiring, which jumped one spot. Operators say the tight labor market is making it difficult to find qualified workers.

Despite the challenges, small operators plan to continue investing in their businesses throughout 2026, albeit at a measured pace. Marketing, technology and foodservice are priorities.

“We need to find ways to bring people into the store and not just outside at the pumps,” said one operator. Others mentioned store remodels to increase foodservice offerings, adding more promotional items, and expanding the incentives offered to customers.

Making the customer experience as convenient as possible is a priority as well. While the majority of small operators surveyed indicate that they already offer mobile pay both in-store and at the pump, ordering via mobile app, third-party delivery and self-checkout kiosks are the leading enhanced convenience services that small operators plan to add in the year ahead.

Large operators also plan to focus on mobile app ordering and third-party

delivery. However, unlike small operators, enabling at-pump ordering for in-store items is a priority for this group. Just 5% of the large operators surveyed said they currently have this ability.

Both small and large operators are hoping their efforts will lead to increases in foot traffic, sales and profits. When asked about total store growth in 2026, 63% of small operators said they expect an increase in dollar sales, but just 40% expect increased profits. The industry’s large operators are aligned in their profit expectations. However, only about half anticipate higher dollar sales.

When it comes to in-store foot traffic expectations, small operators are also more optimistic than large operators that they’ll see a change for the better this year: 42% of small operators anticipate stronger foot traffic this year vs. 36% of large operators. Notably, the percentage of large operators predicting stronger foot traffic dropped by 23 points year over year. CSN

By Angela Hanson

THE GOOD NEWS is that by and large, convenience store retailers aren’t pessimistic about their sales expectations for 2026, with both large and small operators predicting status quo from many product categories rather than outright declines.

The bad news is that absolute optimism is in short supply, as rising costs are likely to be a challenge for consumers and retailers’ margins alike.

Foodservice and other tobacco products (OTP) are notable bright spots for the channel despite some declining confidence in both categories’ growth potential for the year ahead.

Here are the individual category forecasts for 2026:

Expectations for the future of motor fuels have shifted significantly compared to a year ago. Half of study participants expect their average fuel dollars per store to stay the same in 2026, up 16 points from last year’s study, while 40% expect an increase, a 14-point drop year over year.

Gallon sales are projected to stagnate further, with nearly six in 10 retailers reporting that they anticipate their average gallons per store will stay the same this year — up 21 points from one year ago — compared to just 30% that expect their gallons to increase.

Large operators are significantly more optimistic about this category than small operators. More than half of large operators (53%) expect their average fuel dollars per store to increase vs. 28% of small operators. However, large operators are split on their expectations for average gallons per store, with equal percentages (41%) predicting either an increase or no change. Meanwhile, a full three-quarters of small operators expect their per-store gallons to stay the same.

Retailers also expect the fuels category to face more challenges than opportunities this year, citing factors such as rising costs, declining travel and global economic factors. One study participant pointed to the price of oil and its effect on street margins. “Consistently low oil prices

will ultimately squeeze street margins,” this retailer noted.

Others predict reduced sales at premium fuel sites. “Consumers trade down to lower-tier fuel grades during points of higher cost per gallon,” another operator observed.

A year after expectations plateaued, projections for cigarette sales in 2026 are once again in the red. The percentage of retailers that expect their average dollar sales per store in this category to decline jumped 12 points to 44%, with the remainder split between those that think their dollar sales will stay the same (28%) or increase (27%, down 10 points year over year).

Projections for average cigarette unit volume per store are even more dire, with 61% of study participants saying they anticipate a volume decline this year— an 18-point jump from last year’s study. Just 14% expect a volume increase, down 12 points from a year ago.

Both large and small operators are aligned in their expectations. However, large operators are more negative with 51% reporting that they expect their cigarette dollar sales to decline compared to 38% of small operators. When it comes to unit volume, a higher percentage of both groups (69% of large operators and 52% of small operators) forecast a decline.

Convenience retailers do see opportunities in offering strong category discounts and partnering with tobacco companies on loyalty. At the same time, though, they cite rising prices, competition from alternative products and health concerns as challenges — which may prove insurmountable, according to some. “Cigarettes will continue to die and sales will transfer to other tobacco sales,” one retailer predicted.

Despite this, a slight majority of retailers expect to hold steady on the number of cigarette SKUs they offer, while 59% plan to maintain the current square footage devoted to cigarettes.

For yet another year, the OTP category carries on its long-running trend of more positive expectations compared to the cigarettes category, although retailer confidence has declined somewhat compared to a year ago.

Just over half of retailers expect their

average OTP dollar sales per store to increase in 2026 (down 12 points), while 35% say sales will stay the same (up 10 points.) Retailers have similar expectations for their average OTP unit volume per store, with 48% predicting an increase (down 14 points) and 38% predicting no change (up 11 points).

Large operators are more optimistic with 58% forecasting a dollar sales increase and 55% forecasting a volume increase, compared to 45% and 41% of small operators, respectively.

According to study participants, vapes, nicotine pouches and other emerging alternative products are on the rise, particular among the younger generations. “As cigarettes diminish, OTP products will increase to take their place,” one operator predicted.

While some are concerned about rising prices and the evolving regulatory space, 38% plan to increase the square footage they devote to OTP, while just under half

say they will maintain what they currently have. Meanwhile, retailers are evenly split on whether they plan to increase or maintain their SKU count for OTP.

As one retailer emphatically stated, “Food is the driving force for the industry.”

C-store retailers continue to express optimism regarding the future of foodservice, albeit not quite as strongly as a year ago. Sixty-four percent of study participants say their average prepared food dollar sales per store will increase in 2026, down from 73% in last year’s study, while 28% expect their dollar sales in this category to hold steady. The sentiment is similar for unit volume as 61% forecast their volume per store will increase and 31% expect no change.

While the majority of both small and large operators expect the prepared food category to make gains this year, small operators are particularly optimistic with 69% predicting that their dollar sales will increase compared to 58% of large operators, and an equal percentage predicting the same for unit volume compared to 53% of large operators.

Anticipated challenges include keeping costs in check, labor issues, as well as competition from other brick-and-mortar foodservice businesses and at-home meal providers.

Operators expect to find foodservice opportunities in limited-time offers, faster options that don’t compromise quality, and reasonable pricing compared to fast food. Half of retailers plan to add more prepared food SKUs in 2026 and just under half plan to add more square footage.

There’s good news in that very few operators expect 2026 sales to decline in the dispensed beverages category, which includes hot, cold and frozen drinks.

Rather, more than half of study participants (57%) expect their average dollar sales per store in this category to stay the same, up 10 points from last year, while 36% predict an increase. Six in 10 think their average unit volume per store will see no change, while 33% expect an increase.

The industry’s small operators foresee a brighter future for dispensed beverages than large operators, as 44% say their dollar sales will rise compared to 29% of

large operators, and 36% say their unit volume will increase compared to 29% of large operators.

At least 70% of all study participants plan to keep their dispensed beverage SKU count and square footage the same this year. While high costs are expected to be a notable challenge, respondents point to specialty and premium drinks, cold brew and espresso, and healthier options as opportunities to grow the business in the year ahead.

Expectations for the packaged beverages category in 2026 are not as strong as in previous years.

“Many buyers of this category are day laborers, so if there are ICE raids in our city, we see a drop in sales,” one retailer told Convenience Store News

While just 12% of study participants predict a decrease in their average dollar sales per store of packaged beverages, this represents a 9-point jump from a year ago. Just over half expect their dollar sales to stay the same. In regard to unit volume, 11% forecast a decrease, while 57% predict no change year over year. Large operators express more optimism: 44% expect their dollar sales to increase and 39% expect their volume to increase, compared to 31% and 26% of small operators, respectively.

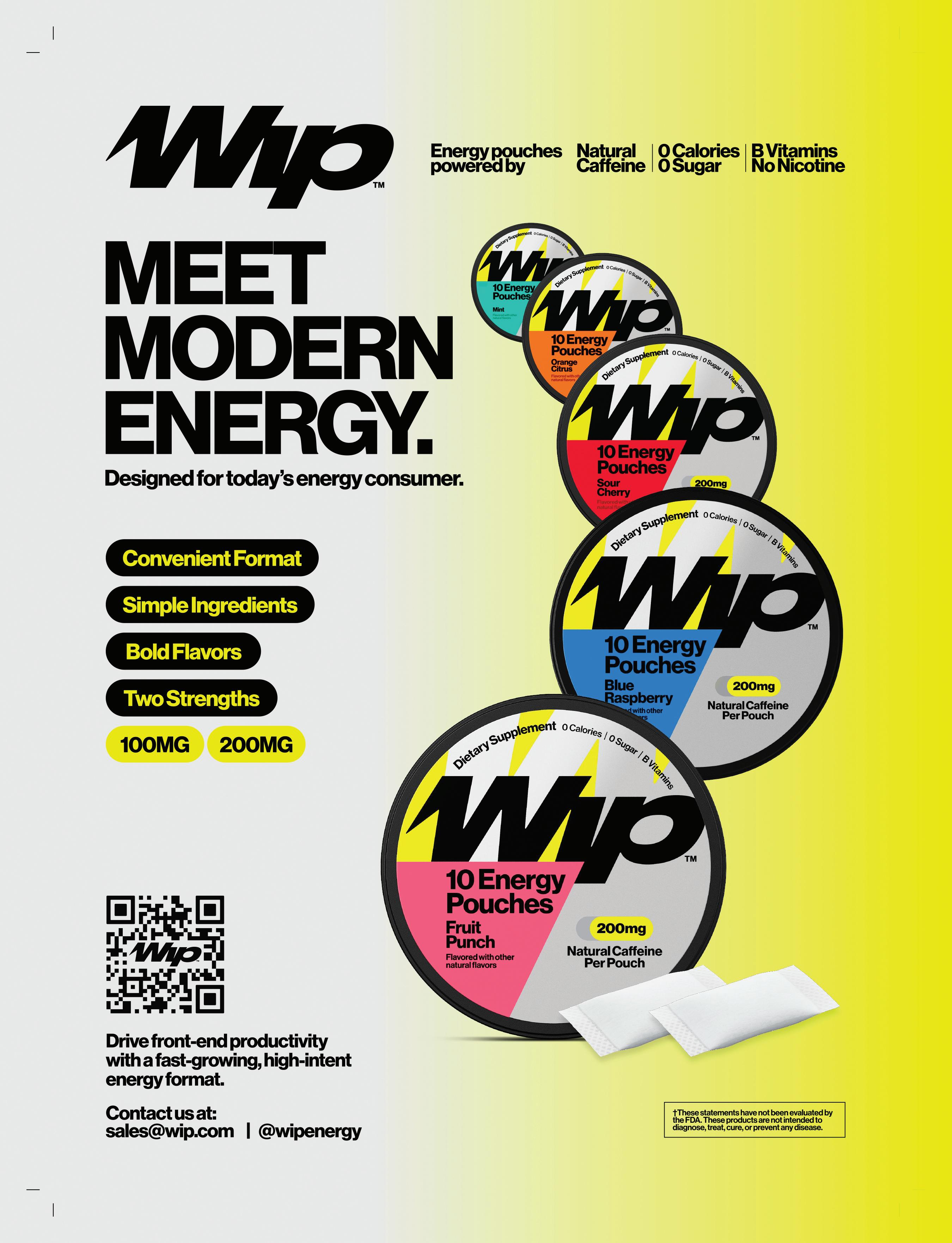

According to operators, energy drinks and better-for-you options are likely to be the biggest packaged beverage opportunities in 2026. “The energy category is ON FIRE,” one retailer enthused, adding that “having a healthy offering is crucial to hit every customer’s favorite option. Also, having clean and protein-packed options will be necessary.”

Around a third of c-store retailers plan to add more packaged beverage SKUs in 2026, yet just 15% intend to increase their square footage to accommodate new offerings.

On the other side of the cold vault, the beer and malt beverages category is expected to be stable in 2026, with just over half of the retailers surveyed anticipating no change in the category’s average dollar sales per store, while 37% anticipate an increase.

Operators are even more likely to predict

static performance in unit volume, as 60% expect their average per-store volume to stay the same — the same percentage that made such a prediction a year ago, and more than double the percentage that foresee a volume increase (27%).

Large and small operators have similar expectations for dollar sales. However, large operators are more likely to expect units to increase compared to small operators, 31% vs. 23%.

Anticipated challenges for the category include rising prices and young adult consumers choosing to drink less. “It will be a hard year,” one operator predicted.

Retailers are encouraged by the product innovation that’s happening now in the beer and malt beverages category. “Innovative products will interest customers,” another operator stated. “Customers on tight budgets will treat themselves with adult beverages.”

Both SKU count and square footage in this category are expected to hold steady in 2026.

Similar to a year ago, the majority of the retailers surveyed expect more of the same from the candy category in 2026, with 54% predicting no change in their average dollar sales per store and 56% predicting no change in their average unit volume per store.

However, as a potential warning sign, predictions of decline are on the rise in this year’s study: 18% say their candy dollar sales will decrease, up 10 points from last year’s study; and 29% say their candy unit volume will decrease, up 11 points.

Both small and large operators are more likely this year to be bracing for declines in dollars and units and less likely to expect increases compared to last year’s study. As such, few operators expect to make changes to either SKU count or square footage.

Retailers see opportunity in the candy category via larger/sharing sizes, seasonal/limited-time items and better-for-you/lower sugar options. But prices are expected to be a challenge. “Massive price increases will drive sales, but not necessarily units or profits,” one retailer noted.

Similar to candy, retailers expect a flat performance from salty snacks this year. Approximately two-thirds

"Manufacturer ‘tariff’ backed cost increases are impacting retails and the customer is feeling it in their wallets."

—Study respondent

Category Forecast: Alternative Snacks

of operators (66%) expect their average dollar sales per store to stay the same, up 10 points from a year ago, while 68% expect no change in their average unit volume per store. Retailers are also less likely to say that dollars or units will increase compared to last year.

Large and small operators are closely aligned in their expectations, with around two-thirds or more of each predicting no change in dollars or units. Accordingly, 77% of retailers plan to keep their SKU count the same and 81% foresee no change in square footage.

Similar to the candy category, pricing is a major challenge for salty snacks. “Same story as candy — manufacturer ‘tariff’ backed cost increases are impacting retails and the customer is feeling it in their wallets. Many are trading down or moving to store/private brands,” one operator explained.

Those who do expect to boost sales say they’ll do so by promoting products and segments within the category that are perceived by consumers as being healthier. “People are choosing a lot more healthy nuts and mixes,” observed one operator.

For the second straight year, retailers predict status quo from the alternative snacks category. Seven in 10 say their average dollar sales per store will stay the same in 2026, while just 23% expect sales to increase — down 8 points from a year ago. The same percentage predict an increase in their average unit volume per store, compared to approximately two-thirds of operators anticipating no change in volume.

Large and small operators are aligned, with two-thirds or more predicting that both dollar sales and unit volume will see no change this year. Unsurprisingly, nearly three-quarters of participants say they will not make changes to the category’s SKU count or square footage.

Despite these predictions, some retailers express strong optimism for alternative snacks, particularly those perceived as healthier. “Alternative snacks will have another explosive year. The use of GLP-1 and focus on protein on diets has created a major drive in this category,” one retailer stated. “Between meat snacks and protein bars, this category can’t lose right now.”

Category

However, other operators point out that rising prices overall may prompt consumers to cut back on discretionary purchases, which could impact this category in particular.

Convenience retailers expect to struggle against more value-oriented operators such as dollar stores in 2026, but maintain that the edible grocery category still has value to the channel.

“These are a convenient, ‘I forgot it at the store’ grab,” said one retailer. “Weather will be the biggest factor if we get the heavy snow this winter.”

Sixty-two percent of study participants expect their average dollar sales per store of edible grocery to stay the same year over year, while 21% expect a decrease. Predictions for average unit volume per store are similar with 65% expecting no change and 21% bracing for a decline. Accordingly, around two-thirds of retailers say they will keep their edible grocery SKU count steady and 73% report no planned change to square footage either.

Large and small operators have similar expectations for the category, with a majority of both predicting more of the same. Small operators are slightly more likely to expect a decrease in dollar sales (23% vs. 19% of large operators) and unit volume (25% vs. 16%).

Nonedible grocery is expected to join its edible counterpart in having a flat 2026.

Pricing and competition are major challenges in this category. “These products are too costly in convenience stores for me to expect growth in sales,” one retailer said. Another noted that “this is a complimentary/store-specific type offer and not a primary traffic driver.”

Nearly seven in 10 study participants expect their average dollar sales per store of nonedible grocery to stay the same this year, while 19% foresee sales declining. Meanwhile, 71% say their average unit volume per store will hold steady, and 19% expect a volume decline.

As with edible grocery, small and large operators have similar expectations that this category will see limited growth this year. Small operators, though, are more likely to expect a decrease in dollar sales

(26% vs. 12% of large operators) and unit volume (26% vs. 12%).

Retailer confidence in the growth of general merchandise is on the decline this year.

Sixty-three percent of operators expect their average dollar sales per store in this category to stay the same in 2026 (up 16 points from last year’s study), while only 24% expect a sales increase (down 10 points). Expectations for average unit volume per store are similar with 67% predicting no change (up 13 points) and just 19% predicting an increase.

Large and small operators line up in their expectations for dollar sales as the majority of both predict no change. However, in regard to unit volume, 21% of small operators expect their general merchandise volume to decline compared to 8% of large operators.

Some retailers see opportunity in offering unique, innovative general merchandise items, while others expect a tough economy to limit purchases regardless. SKU count and square footage in this category are both expected to remain level this year.

According to c-store retailers, the health and beauty care (HBC) category will either stay the same or decline in 2026. Nearly seven in 10 operators expect their average HBC dollar sales per store to stay the same (up 18 points from a year ago), while 25% expect decreased dollar sales. An even larger percentage (73%) expect their average HBC unit volume per store to stay the same (up 16 points), while 24% think their volume will decrease.

The majority of both small and large operators expect dollars and units to hold steady in the category. However, more small operators are bracing for a decline in both metrics.

Some retailers plan to use travel-size offerings and clean/natural HBC products to boost sales, but others expect the category to stay slow as it may have reached a price ceiling. “People will no longer just stop in to grab something quick with us, they will go to a grocery store for cheaper prices,” one retailer remarked.

Unsurprisingly, virtually no operators plan to add HBC SKUs or square footage this year. CSN

Category Forecast: Health & Beauty Care

suppliers and distributors take a slightly more positive view on 2026

By Melissa Kress

THE CONVENIENCE CHANNEL’S suppliers and distributors are slightly more optimistic about their 2026 business outlook vs. last year — and they’re slightly more optimistic than their retailer counterparts when it comes to the year ahead.

On a scale of one to five — where 1 represents “Terrible, wake me up when it’s over” and 5 represents “It’s going to be our best year ever!” — 51% of suppliers and distributors have a positive view, while 36% are neutral and only 13% indicate a negative outlook.

That said, economic concerns have been a constant theme for the retail community over the past few years. From fluctuating fuel prices to on-again, off-again tariffs to questions around the Federal Reserve and interest rates, the drivers behind these concerns continue to plague the supplier and distributor communities, as well as retailers and consumers.

Opinions on the future of the U.S. economy are divided on both sides of the convenience retail proposition. While optimism has declined among both groups vs. a year ago, the sentiment is more positive among suppliers and distributors than among retailers.

Specifically, 46% of respondents from the supplier and distributor communities report having a very or slightly positive view on the U.S. economy in 2026 (down 6 points from the previous year), compared to just 28% of retailers (down 9 points year over year).

Nonetheless, 32% of suppliers and distributors do hold a very or slightly negative view on the economy, which is up double digits. The remaining 22% have a neutral view.

Feelings around their specific product categories also have dipped from 12 months ago, with more suppliers and distributors reporting a neutral or negative outlook on their product category for 2026. While 56% of respondents still hold a very or slightly positive outlook, this represents a 14-point decrease vs. last year’s study. Meanwhile, 27% hold a very or slightly

C-store suppliers and distributors predict tariffs and trade policies will have the most impact on their sales and profitability this year.

negative outlook (up 6 points) and 17% hold a neutral outlook (up 8 points).

On the good news front for the convenience store industry, competition from other retail channels may be waning somewhat, as fewer c-store suppliers and distributors (58%, a 6-point decrease) say they expect cross-channel competition to ramp up this year; 42% expect it to remain at the same level (a 13-point increase).

Where do suppliers and distributors see the strongest competition coming from?

Ranking at the top are Amazon/Amazon Fresh (44%); grocery retailer sites/apps such as Walmart.com, Target.com and Kroger.com (42%); grocery delivery sites/apps such as Instacart and Shipt (41%); and food delivery sites/apps such as DoorDash, Uber Eats and Grubhub (36%). On the flip side, fast-casual restaurants (10%) and drugstores (9%) rank as the lowest threats.

Additionally, among those who work with multiple retail channels, just shy of two-thirds of suppliers and distributors (64%) view business conditions in the convenience channel as positive. That compares to 56% for grocery, 55% for mass merchandise, and 46% for the restaurant channel. Only 20% of suppliers and distributors say c-store business conditions are negative.

Despite their glass half full outlook, the c-store industry’s suppliers and distributors do cite several concerns as they move into 2026 — and not surprisingly, many are the same issues causing concern for convenience retailers and consumers.

The issue that supplier and distributor respondents predict will have the most impact on their sales and profitability this year is tariffs and trade policies, with 20% ranking this as their top concern and 34% ranking it in their top three.

Rounding out their top five highest-ranked concerns are:

• Decline in consumer spending — 15% top issue, 42% top three

• Inflation and national economic issues — 10% top issue, 37% top three

• New product development in their category — 10% top issue, 25% top three

Consumer

Inflation & national economic issues

New product development in your category

Increasing operational costs

Increasing regulation

Raw materials costs

Retailer unit expansion

Supply chain issues

Consumer spending growth

Investments in foodservice

E-commerce

Labor turnover & hiring

Retailer consolidation

Emerging technologies

• Increasing operational costs — 10% top issue, 34% top three

At the bottom of their list, suppliers and distributors do not foresee e-commerce having a significant impact on their sales and profitability. Also notably, no respondents selected labor turnover, retailer consolidation or emerging tech as their foremost concern. CSN

Acquisitions involving small and midsize companies have dominated the M&A space lately

By Renée M. Covino

IS THE WHOLE TRULY GREATER than the sum of its parts?

That’s the thinking behind mergers and acquisitions, emphasizing the idea that the combination of companies can lead to business outcomes that surpass what each could achieve independently.

Globally, across all industries, merger-and-acquisition (M&A) activity grew 10% in the first nine months of 2025 compared to the same period a year ago, according to the “Global M&A Report” released in October by the Boston Consulting Group.

Drilling down to the convenience store industry, there were some big-name M&A deals that made headlines recently: Sunoco’s acquisition of Parkland Corp. for $9.1 billion, Alimentation Couche-Tard Inc.’s (ACT) acquisition of GetGo Cafe + Market for $1.6 billion, and ACT’s proposed acquisition of Seven & i Holdings that fell through.

However, despite notable M&A activity among large c-store chains in 2025, the majority of activity the past two years has involved smaller chains with 50 or fewer stores.

“Due to two-thirds of the 150,000 c-stores across America being single-store operations, and both labor and technology costs rising, this is largely expected,” Vasudha Cidambi, a business analyst at Evanston, Ill.-based Cadent Consulting Group, told Convenience Store News. “These rising costs incent small c-stores to sell their businesses,

but also incent larger c-stores to buy smaller c-stores and spread their costs thinner while increasing profitability.”

Dennis Ruben, executive managing director for Chicago-based NRC Realty & Capital Advisors LLC, agrees that although there were a few large transactions in the past year, most of the ones reported were what he calls “medium-sized deals” in the 10- to 50-store range — and he believes this is what will constitute most of the activity going forward.

“These are the chains that will continue to have challenges competing effectively with the larger operators,” he said. “In addition, with purchase price multiples remaining strong, the bonus depreciation incentives in the recently enacted Tax Bill for convenience store acquisitions and an improved interest rate environment, the M&A landscape should remain robust next year.”

Terry Monroe, president and founder of American Business Brokers & Advisors, likewise believes consolidation of convenience stores will continue. However, he pointed to ownership demographics — the

declining rate of baby boomers and the fact that a large majority of c-stores are owned by baby boomers who don’t have business successors.

“There is a trend that most businesses that are being sold in this industry — excluding those being sold because of death, divorce or bankruptcy — are being sold by owners who are baby boomers that don’t have anyone to succeed them in the ownership of the business,” he explained.

Looking to 2026, Monroe says “you may see one or two more mega deals, but the majority of acquisitions are going to be regional because there are not many large operators left to consolidate, but there are lots of regional players.”

Until a couple of years ago, most c-store operators looking to expand wanted to stay within their basic geographic footprint. That has changed recently.

“Now, operators are willing to look everywhere for quality assets and companies,” Ruben noted. “When we have conversations with operators about the types of acquisitions they are looking for, we consistently hear the same thing — that if there is enough ‘critical mass,’ they will go anywhere in the continental United States. This change in attitude will open up the door to more potential purchasers of companies — something that is much needed in light of the industry consolidation that has taken place over the past few years.”

Richard Bode, managing partner of Cadent Consulting Group, expects geographic diversification to play a significant role in c-store M&A in 2026. “As the industry continues to consolidate, c-store operators are increasingly looking beyond their traditional footprints to tap into new customer bases and diversify their exposure to regional fuel demand patterns,” he said.

Bode highlighted MAPCO’s recent

expansion into three new states following the divestiture of stores from ACT’s acquisition of GetGo, which he said illustrates how regulatory requirements can create opportunities for smaller and midsized chains to grow through regional acquisitions.

He believes this trend is being driven by multiple factors. First, fuel demand continues to vary significantly by region due to differences in electric vehicle adoption, urbanization and commuting patterns. “Expanding into new geographies allows c-store chains to hedge against these regional fluctuations and maintain more stable revenue streams,” he said.

Second, as larger chains grow through acquisitions, the U.S. Securities and Exchange Commission and the Federal Trade Commission are increasingly requiring divestitures to prevent monopolistic market conditions. “These divestitures open the door for smaller players to enter new markets and scale their operations,” Bode stated.

Cadent Consulting Group’s Cidambi pointed out, however, that this also means individually owned c-stores may continue to decline in number. “While they will still represent the majority of the market, their share is likely to shrink as they face pressure from larger, better-capitalized competitors,” she reasoned. “Additionally, with c-store trips trending downward, geographic expansion becomes a strategic imperative for chains seeking to maintain foot traffic and relevance in a shifting retail landscape.”

She also made note of the recent trend of what she calls “super-regional” convenience store chains: midsize regional players such as Buc-ee’s, Wawa, Sheetz and QuikTrip that have developed loyal fanbases due to competitive features like being well-lit, offering fresh food and having consistently clean bathrooms.

“Many of these super regionals are expanding into new regions, driving intrigue and getting customers excited about novel, improved c-store experiences,” Cidambi told CSNews. “As these chains grow in size, they become competition for large c-store chains who are established but, due to their size, may suffer from inconsistent in-store experiences.”

Another notable M&A trend as of late finds foodservice integration gaining momentum. For instance, RaceTrac acquiring Potbelly and/or a foodservice angle playing a more important role in c-store acquisitions.

Ruben is one who expects this trend to continue. He believes RaceTrac’s acquisition of Potbelly was “quite interesting” for a number of reasons.

“First, RaceTrac has not historically been actively involved in acquiring existing c-store operations,” he explained. “In addition, the scarcity of larger companies to acquire has made the remaining industry players look to other alternatives to expand their businesses. RaceTrac saw Potbelly as an opportunity to acquire a quality foodservice chain and integrate it into its portfolio of c-stores. This is a very interesting model for other industry participants, and I would not be surprised to see similar types of acquisitions by other c-store operations in the near future.”

Monroe called the RaceTrac/Potbelly acquisition “a brilliant idea,” and he also believes foodservice integration will continue to be a focus. “A successful food program is going to be necessary going forward in the convenience store business and acquiring a food brand that already has expertise will propel the chain into the food business quickly and expertly instead of trying to reinvent the wheel,” he said.

The way Bode sees it, foodservice integration will continue in 2026, but on a highly selective basis. “At the moment, the perception of fresh food offerings in the c-store space is low, leaving a gap for c-stores to fill. Many are also suffering from low fuel margins. … The c-store space holds an opportunity for QSR [quick-service restaurant] chains to gain foot traffic and sales, especially as consumers may currently see more value in a c-store purchase than a traditional QSR purchase,” he said.

“Despite consumers’ wallets being strapped as they face economic and social uncertainty, they are looking for value and premium experiences to stretch their dollar,” he continued.

Tied into the foodservice integration trend are socioeconomic considerations that experts believe will and should affect M&A activity in 2026 — sometimes in a cautionary way.

One of the most important emerging dynamics for next year is the evolving role of convenience stores as food access points, according to Cidambi. Although it came to an end in November, the longest government shutdown in U.S. history combined with the temporary shutdown of SNAP benefits contributed to a notable decline in consumer sentiment and a heightened focus on value to prepare for high levels of economic uncertainty. As a result, consumers are increasingly willing to switch retail channels in search of affordable, convenient food options.

“This environment presents a growing opportunity for c-stores with strong QSR offerings,” she emphasized. “As traditional foodservice providers struggle with declining traffic and rising costs, c-stores that can offer quality, value-driven food options stand to gain market share. We anticipate that M&A activity in 2026 will reflect this trend, with more deals centered around acquiring or integrating QSR capabilities to meet evolving consumer expectations.”

There is also a risk that continued c-store consolidation could negatively impact rural communities. In many rural areas, convenience stores serve as the primary, if not only, source of food and essential goods, Cidambi pointed out, citing that rural areas have the highest rates of food insecurity with less than 40% of individuals residing in rural areas having access to major food delivery services.

“Thus, convenience stores are crucial in helping rural areas cope with these disparities,” she said. “If smaller, independently owned stores are acquired and subsequently shut down due to underperformance or strategic realignment, it could exacerbate food insecurity in regions already facing limited access. This underscores the importance of thoughtful, community-conscious M&A strategies that consider not just profitability, but also the broader social impact of consolidation.” CSN

By Tammy Mastroberte

CATERING TO THE DIGITAL CONSUMER, delivering personalized offers via loyalty programs, and making sure their backend technology can handle it all are things convenience store operators have been working on in recent years, and this is set to continue in 2026 — along with a focus on cloud computing and an emphasis on data and analytics.

“In 2025, there was a lot of focus on cloud computing and how point-of-sale (POS) and other data is flowing freely to the cloud, so they can access data in real time,” reported Gray Taylor, executive director of Conexxus, an Alexandria, Va.-based nonprofit organization focused on advancing technology in the c-store industry. “Amazon pioneered this with CI/CD (Continuous Integration and Continuous Delivery) pipelines in 2000, where you can push out new code overnight and it would eliminate having to do time-consuming updates in the store.”

In the past, all the technology and data remained at the store level because cloud computing did not exist, according to Jon Kelly, chief revenue officer at Mako Networks, a network management company based in Elgin, Ill. Retailers then started sending data and transactions to the cloud but in today’s digital world, networking requirements are changing.

“Now, people are sending video and media files that are high bandwidth, so it’s changing the network requirements at the store,” Kelly explained. “With AI applications, they want to process at the edge, so instead of streaming to the cloud that takes up bandwidth, many are looking to process locally, and this needs additional capabilities at the store. And [with] the processing of

bandwidth being higher, firewalls and security need to be bigger as well.”

Convenience retailers also want the ability to see what is going on in a store and be able to work remotely, whether it’s sending updates, receiving data on equipment alarms, or more.

“We have seen a major push toward remote operations,” said Steve Akers, chief product and technology officer at Titan Cloud, a software company headquartered in Franklin, Tenn. “Operators want to understand what is happening at every site without sending someone onsite. Remote alarm triage, remote diagnostics and better visibility into forecourt assets have become essential, especially for multi-site operators running leaner teams.”

In 2026, many retailers will be building upon projects started in 2025, and in some cases even earlier, with the goal of “getting smarter with the technology they already rely on,” Akers added.

Along with cloud computing and remote operations, the digital consumer is a top priority for 2026 — same as it was in 2025. This encompasses a focus on online ordering, delivery, brand websites and

loyalty programs. Over the last couple of years, improving loyalty programs through personalization has been top of mind — and budget — for c-store operators.

“Retailers are packing more interaction with the consumer into their loyalty programs, including gamification where they play a game and win something, as well as more personalization,” Taylor told Convenience Store News.

At Atlanta-based convenience store chain RaceTrac Inc., which operates nearly 800 locations, 2025 was the start of the company’s “digital transformation” where it executed a new tech stack, shared Ryan Blumenthal, director of marketing technology and digital guest experience. For example, the chain implemented Braze, a customer engagement platform launched in the last quarter of 2025 that sits on top of its loyalty program to offer more personalization.

“We are in the early stages, but have seen growth in our loyalty engagement,” Blumenthal said. “Bigger things are in motion now. We are halfway done with our digital experience platform with Optimizely where our websites for RaceTrac Inc. will sit, allowing us to customize and personalize the website.”

RaceTrac is leaning into all aspects of the digital consumer and will be implementing a new online ordering platform in 2026 that’s proprietary to the company, with an identity platform to house customer data and profiles across its brands. The retailer’s backend loyalty platform will be migrated to a new provider in 2026 as well.

“Obviously, the digital guest is very valuable to RaceTrac and we believe in our hot food offering, specifically pizza, so we want guests to be able to order and pick up in-store,” Blumenthal said, noting that the chain currently uses third parties but wants to bring this in-house to provide customers more options and better pricing.

The company is moving to Capillary Technologies as a loyalty provider with the intention of scaling as it goes, including offering new technology such as a VIP fueling program and ensuring the backend technology for stability, infrastructure and data management.

RaceTrac has more than 3 million members in its RaceTrac Rewards loyalty program. As Blumenthal explained, personalization is key to the chain’s future loyalty plans with the goal of “speaking to the right consumer