https://ebookmass.com/product/distrust-big-data-data-

Instant digital products (PDF, ePub, MOBI) ready for you

Download now and discover formats that fit your needs...

The 9 Pitfalls of Data Science Gary Smith

https://ebookmass.com/product/the-9-pitfalls-of-data-science-garysmith/

ebookmass.com

The Big R-Book: From Data Science to Learning Machines and Big Data Philippe J. S. De Brouwer

https://ebookmass.com/product/the-big-r-book-from-data-science-tolearning-machines-and-big-data-philippe-j-s-de-brouwer/

ebookmass.com

Google Cloud Platform for Data Science: A Crash Course on Big Data, Machine Learning, and Data Analytics Services Dr. Shitalkumar R. Sukhdeve

https://ebookmass.com/product/google-cloud-platform-for-data-sciencea-crash-course-on-big-data-machine-learning-and-data-analyticsservices-dr-shitalkumar-r-sukhdeve/ ebookmass.com

Serial Revolutions 1848 Clare Pettitt

https://ebookmass.com/product/serial-revolutions-1848-clare-pettitt/ ebookmass.com

Ethnopolitics in the New Europe John T. Ishiyama

https://ebookmass.com/product/ethnopolitics-in-the-new-europe-john-tishiyama/

ebookmass.com

Communication Works, 11th edition 11th Edition, (Ebook PDF)

https://ebookmass.com/product/communication-works-11th-edition-11thedition-ebook-pdf/

ebookmass.com

Dalton (Heaven Hill Shorts Book 9) Laramie Briscoe [Briscoe

https://ebookmass.com/product/dalton-heaven-hill-shortsbook-9-laramie-briscoe-briscoe/

ebookmass.com

Intense Group Behavior and Brand Negativity: Comparing Rivalry in Politics, Religion, and Sport Cody T. Havard

https://ebookmass.com/product/intense-group-behavior-and-brandnegativity-comparing-rivalry-in-politics-religion-and-sport-cody-thavard/ ebookmass.com

The Edge David Baldacci

https://ebookmass.com/product/the-edge-david-baldacci/

ebookmass.com

Tarak's Torment: Shifters of Valo Prime Book 1 Crystal Rose

https://ebookmass.com/product/taraks-torment-shifters-of-valo-primebook-1-crystal-rose/

ebookmass.com

GarySmithhasdoneitagain. Distrust isawildridethatderailstheBigData hypetrainwithforce,style,andaboveallsardonichumour.Smithisamasterof illustratingbyexample—examplesthatarefresh,unexpected,attimesshocking,andattimeshilarious.ComealongonSmith’stourofstatisticalsnake-oil andyou’llneverlookatAIordatasciencethesamewayagain.

—CarlT.Bergstrom ProfessorofBiology,UniversityofWashington

Authorof CallingBullshit:TheArtofSkepticisminaDigitalWorld

AnyfanofCarlSagan’s TheDemonHauntedWorld willlovethisbook.Like Sagan,Smithdiscussesthechallengestohumanprogressthatresultfroma lackofcriticalthinkingskills,andhedoessowithaSagan-esquekeeneye andeloquentvoice.Smithalsomakesclearhowthethreatstosoundjudgment andeffectivedecisionsaremoreformidablethanthoseofSagan’sday,asfaulty thinkingisnowaidedandabettedbyanInternet-fuelleddistrustofscience, viralmisinformation,andvenomousconspiracytheories.Thewisdominthis bookisdesperatelyneeded.

—TomGilovich IreneBleckerRosenfeldProfessorofPsychology CornellUniversity Authorof TheWisestOneintheRoom

Itturnsoutthat,unlikethemythicalhero,AIhastwoAchilles’heels.Notonly arethetechnologiesnotintelligent,moreperniciously,neitheraretoomuchof thestatisticsanddatauseonwhichAIandbigdatarely.GarySmithprovides abrilliantlyexecutedcounteragainstpseudo-scienceandtheaccumulating garbagewemisleadinglycallinformation,includingtimelyandimportant warningsandwaysforwardforpolicy-makers,practitioners,academics,and citizensalike.

—LeslieWillcocks ProfessorEmeritus,LondonSchoolofEconomicsandPoliticalScience

Animmenselyreadablelookatwhyweneedsciencemorethanever,butalso whyandhowscienceneedstocleanupitsact.Recommendedforanyonewho occasionallywonderswhetherthat“outspoken”familymemberonFacebook mightjusthaveapoint.

—NickBrown,PhD,scientificintegrityresearcher

Smithmarvellouslyillustratestheevolutionofdisinformation.Herichly demonstrateshowblindfaithintechnologyenablesmoremisrepresentationsof thetruth.Distrust articulatesahumblingviewofhowweshouldthinkcritically aboutnewfindingsfromhypedtechnologytrends.

—KarlMeyer,ManagingDirector,DigitalAlphaAdvisorsLLC FormerPartneratKleinerPerkins

Distrust

GARYSMITH

GreatClarendonStreet,Oxford,OX26DP, UnitedKingdom

OxfordUniversityPressisadepartmentoftheUniversityofOxford. ItfurtherstheUniversity’sobjectiveofexcellenceinresearch,scholarship, andeducationbypublishingworldwide.Oxfordisaregisteredtrademarkof OxfordUniversityPressintheUKandincertainothercountries ©GarySmith2023

Themoralrightsoftheauthorhavebeenasserted Allrightsreserved.Nopartofthispublicationmaybereproduced,storedin aretrievalsystem,ortransmitted,inanyformorbyanymeans,withoutthe priorpermissioninwritingofOxfordUniversityPress,orasexpresslypermitted bylaw,bylicenceorundertermsagreedwiththeappropriatereprographics rightsorganization.Enquiriesconcerningreproductionoutsidethescopeofthe aboveshouldbesenttotheRightsDepartment,OxfordUniversityPress,atthe addressabove

Youmustnotcirculatethisworkinanyotherform andyoumustimposethissameconditiononanyacquirer

PublishedintheUnitedStatesofAmericabyOxfordUniversityPress 198MadisonAvenue,NewYork,NY10016,UnitedStatesofAmerica

BritishLibraryCataloguinginPublicationData Dataavailable

LibraryofCongressControlNumber:2022940620

ISBN978–0–19–286845–9

DOI:10.1093/oso/9780192868459.001.0001

Printedandboundby CPIGroup(UK)Ltd,Croydon,CR04YY

LinkstothirdpartywebsitesareprovidedbyOxfordingoodfaithand forinformationonly.Oxforddisclaimsanyresponsibilityforthematerials containedinanythirdpartywebsitereferencedinthiswork.

INTRODUCTION

Disinformation,DataTorturing,andDataMining

Whatwerethegreatestinventionsofalltime—notcountingfire,the wheel,andslicedbread?Theprintingpresshastobenearthetop ofanyone’slistbecauseitallowedideasandinventionstobespread widely,debated,andimproved.Electricity,internalcombustionengines,telephones,vaccinations,andanesthesiasarealsoworthycandidates.Thesearejust thevery,verytopofavery,verylonglist.Lookaroundyou,atyourcomputer, eyeglasses,refrigerator,plumbing,andalloftheothereverydaythingswetake forgranted.

Wherewouldwebewithoutscience—livingshortbrutishlivesincaves?Iexaggerate,butnotmuch,andonlytomakethepointthatscienceandscientists haveenrichedourlivesbeyondmeasure.Iincludeeconomists,psychologists, andother“softer”scientistsinthisgroup.DuringtheGreatDepressioninthe 1930s,governmentseverywherehadsolittleunderstandingoftheeconomy thattheirpolicieswereutterlycounterproductive.WhenFranklinRoosevelt campaignedforU.S.Presidentin1932,hepromisedtoreducegovernment spendingby25percent.Oneofthemostrespectedfinancialleaders,Bernard Baruch,advisedRooseveltto“Cutgovernmentspending—cutitasrationsare cutinasiege.Tax—taxeverybodyforeverything.”TheFederalReserveletthe moneysupplyfallbyathirdandCongressstartedatradewarthatcaused exportsandimportstofallbymorethan50percent.

Today,thankstotheoreticalandempiricaleconomicmodels,we(well,most ofus)knowthatspendingcuts,taxhikes,monetarycontractions,andtrade warsareexactlythewrongpoliciesforfightingeconomicrecessions.Thisis why,duringtheglobaleconomiccrisisthatbeganintheUnitedStatesin2007,

governmentsdidnotrepeattheerrorsofthe1930s.Withtheworldeconomy onthebrinkofasecondGreatDepression,governmentsdidtherightthing bypumpingtrillionsofdollarsintotheirdeflatingeconomies.Dittowiththe COVID-19economiccollapsein2020.Plus,scientistsdevelopedthevaccines thattamedtheCOVIDpandemic.

Unfortunately,scienceiscurrentlyunderattackandscientistsarelosing credibility.Therearethreeprongstothisassaultonscience:

Disinformation

Datatorturing

Datamining

Ironically,science’shard-wonreputationisbeingunderminedbytoolsinvented byscientists.DisinformationisspreadbytheInternetthatscientistscreated. Datatorturingisdrivenbyscientists’insistenceonempiricalevidence.Data miningisfueledbythebigdataandpowerfulcomputersthatscientistscreated.

InthisIntroduction,Iwilluseexamplesrelatedtobitcointoillustratethis tragedy.

Money

Moneyisasecretsauceforeconomicprogressbecauseitallowspeopletospecializeinjobstheyaregoodatandusethemoneytheyarepaidtobuythings frompeoplewhoaregoodatotherjobs.Prettymuchanythingcanserveas moneyaslongaspeoplebelievethatitcanbeusedtobuythings.Ifthatsounds circular,itis.

Inpractice,overthepast4000years,thepredominantmoneyshavebeen preciousmetals—mostlysilver,toalesserextentgold,andevenlessfrequently copper.However,anenormousvarietyofothermoneyshavealsobeenused. Wampum(beadsmadefromshells)waslegaltenderinseveralAmerican colonies.TobaccowasusedasmoneyinVirginiafornearly200years,inMarylandfor150years,andinneighboringstatesforshorterperiods.Infact,a1641 lawmadetobaccolegaltenderinVirginiaandprohibitedcontractspayablein goldorsilver.Rice,cattle,andwhiskeyhavebeenlegaltenderand,although

theylackedlegalsanction,musketballs,hemp,furs,andwoodpeckerscalps havealsobeenusedasmoney.

TheislandofYapinMicronesiaisrenownedforusingstonemoneyformore than2000years.AsshowninFigure I.1,these raistones areroundlikeawheel withaholeinthecenterandoftentallerthanaperson.Thestoneswereobtained bycanoeexpeditionstoPalauor,forfinerandrarerstones,toGuamsome 400milesaway.Theseaswereoftenstormyandthedestinationshostile.Many canoesneverreturned.

Inthe1870s,DavidDeanO’Keefe,anAmericanwithasturdyboat,brought enormousstonesintoYapinexchangeforcoconuts,fish,andwhateverelsehe wanted.Thelargeststone,saidtobe20feettall,isatthebottomoftheYap harbor,whereitfellwhilebeingunloadedfromhisschoonerontoaraft.Even thoughthestonedisappearedfromview,itisstillconsideredtobemoneyby generationaftergenerationofowners.

Today,theislandersusestonebeads,seashells,beer,andU.S.dollarsfor smalltransactions.Thelargestonesareusedtopayforland,permissionto

FigureI.1 Araistone.

marry,politicaldeals,andsubstantialdebts.Whenalargestonechangesownership,atreecanbeputthroughitsholesothatitcanberolledfromitsold ownertoitsnewone.Becauseabrokenstoneisworthless,stonesareoftenleft inonespot,withtheownershipcommonknowledge.Thelargeststonesareso wellknownthattheyhavenames.Thepeoplepasson,butthestonesremain.

ThestonesacquiredbeforethearrivalofO’Keefearethemostvaluable;those broughtinbyO’Keefeareworthhalfasmuch;andmorerecentstonesareessentiallyworthless.In1984 TheWallStreetJournal reportedthatanislander boughtabuildinglotwitha30-inchstone,explainingthat“Wedon’tknowthe valueoftheU.S.dollar.”

Usingstonesforcurrencyseemsodd,butisitanyodderthanusingpaper money?TheYapislandersacceptraistonesaspaymentbecausetheyareconfidentthattheycanusethestonestobuythingstheywant.Theiracceptanceas moneyrestsonthisconfidence,nothingmore.Thesameistrueofourmoney. Itisworthlessexceptforthefactthatitcanbeusedtobuythings.

Moneydoesn’tneedtobesomethingwecanholdinourhands,andmost ofuschoosetoliveinanessentiallycashlesssocietyusingelectronicrecords oftransactions.Ourincomecangodirectlyintoourbankaccountsandour billscanbepaidwithacheck,debitcard,creditcard,ordirectlyfromourbank accounts.Cashisonlyneededforpayingpeoplewhowon’ttakechecksorcredit cards—perhapsforbuyingfoodatalocalfarmer’smarket,payingourchildren tomowthelawn,ormakingpurchaseswedon’twantthegovernmenttoknow about.

Evenso,theamountofcashincirculationcontinuestogrow.Thereisnow morethan$2trillioninU.S.currencyincirculation,including18billion$100 bills—anaverageof54BenjaminsforeveryAmericanman,woman,andchild. Therearemore$100billsthan$1bills.

Wherearethese18billionBenjamins?Ithasbeenestimatedthatmorethan halfofallU.S.cashisheldoutsidetheUnitedStates.Someisheldasreserves bycentralbanks;someisusedbycitizensandbusinessesasasecondcurrencyorasahedgeagainsteconomicinstability.Muchofthecash,domestically andabroad,isusedforillegaloruntaxedactivitiesthatleavenoelectronic record.

Whichbringsustobitcoin,theoriginalandmostwell-knowncryptocurrency.Thebitcoinconceptwasunveiledina2008paperwrittenbysomeone usingthepseudonymSatoshiNakamotoandwasimplementedthefollowing year.

Whennewsstoriesarewrittenaboutbitcoin,thereisoften,asinFigure I.2, anaccompanyingimageofagold(orsometimessilver)coinwithalargeBand verticalhashmarks,likeadollarsign.

Thereis,ofcourse,nobitcoincoin.Bitcoinsandothercryptocurrenciesare digitalrecords—likebankaccountsandcreditcards.Thedifferenceisthatbank accountandcreditcardrecordsaremaintainedbyfinancialinstitutionsandtied tosocialsecuritynumbers,whilecryptocurrencytransactionsarerecordedin adecentralizedblockchainthat,intheory,preservestheanonymityofusers.

Nobodywithacreditcardoracheckingaccountneedstouse$100billsor bitcoins,butpeoplewhowanttobuyorsellthingsinsecretlikethem.Itshould notbesurprisingthatgovernmentshavebeenabletoforcebitcoindealersto turnoverfinancialrecords,leadingtoarrestsandbitcoinconfiscations.Unlike bagsof$100bills,blockchaintechnologycanactuallycreateanelectronictrail thathelpslawenforcementofficialsfollowthemoneyanddocumentcriminal transactions.

Blockchaintransactionsaresoslowthatthevalueofabitcoincanchange substantiallybetweenthebeginningandendofatransaction.Transactionsare alsoexpensive,andenvironmentallyunfriendly.In2021,CambridgeUniversity researchersestimatedthatbitcoinblockchainsconsumeasmuchelectricityas theentirecountryofArgentina,withonly29countriesusingmoreelectricity thanbitcoin.Bitcoinisessentiallystrip-miningtheclimate.

InJune2022,agroupof1500prominentcomputerscientistssignedalettertoU.S.Congressionalleadersstatingthatblockchaintechnologyis“poorly suitedforjustabouteverypurposecurrentlytoutedasapresentorpotential sourceofpublicbenefit.”

FigureI.2 Amythicalbitcoin.

Thefactthatbitcoinhasnoinherentvaluemakesitagreatexampleofthe threethemesrunningthoughthisbook:disinformation,datatorturing,and datamining.

Disinformation

Alargepartoftheinitialallureofbitcoinwasthattheunderlyingblockchain technologywasnotcreatedbytheeconomicandfinancialelitebutbyamysteriousoutsiderwhoseidentityisstillunknown.ADavidsteppeduptobattle Goliath.Bitcoinisnotcontrolled,regulated,ormonitoredbygovernmentsor thebankingsystem. TheDeclarationofBitcoin’sIndependence,endorsedby numerouscelebrities,statesthat

Weholdthesetruthstobeself-evident.Wehavebeencyclicallybetrayed,liedto,stolen from,extortedfrom,taxed,monopolized,spiedon,inspected,assessed,authorized, registered,deceived,andreformed.Wehavebeeneconomicallydisarmed,disabled,held hostage,impoverished,enervated,exhausted,andenslaved.Andthentherewasbitcoin.

PaulKrugman,aneconomicsNobelLaureateand NewYorkTimes columnist, haswrittenthatbitcoinis

somethingofacult,whoseinitiatesaregiventoparanoidfantasiesaboutevilgovernmentsstealingalltheirmoney ... JournalistswhowriteskepticallyaboutBitcointellme thatnoothersubjectgeneratesasmuchhatemail.

Ilearnedfirsthandaboutthecult’sparanoiawhenIwrotesome MarketWatch columnsaboutbitcoin.Hereareafewresponses(withspellingmistakes corrected)frominfuriatedreaders:

RichpeoplefearBitcoinasitmeanstheirwealthcouldbeshiftedoverto“peasants” andarescaredofbecomingirrelevant.

Bitcoinmakescrossborderpaymentspossibleandprovidesaneasywayforpeople toescapefailedgovernmentmonetarypolicy.

NobodybelievethisorchestratedFUDwhichisallpaidforbyAmericanExpressand otherbankinginstitutions.

FUDisapopularacronymfor“fear,uncertainty,anddoubt.”AnotherisHODL. AnenthusiastoncemisspelledHOLDasHODL(therearelotsofmisspellingon bitcoinforums)anditwasmisinterpretedasanacronymfor“holdonfordear life.”BitcoinfanaticsignoretheFUDandjustHODL.

Theironyhereisthatscientistscreatedourhighlyefficientfinancialsystem. TheyalsocreatedtheInternetthatbroadcaststhebitcoingospelthatdenounces ourfinancialsystem.Conspiracytheoriesandparanoiaareasoldasthehuman race,buttheInternethasmadetheircirculationfastandfrenzied.

TorturedData

Cryptocurrenciesarealousywaytobuyandsellthings.Ontheotherhand, manygulliblespeculatorsthinkthatwildlyfluctuatingbitcoinpriceswillmake themrich.Startingfromapriceof$0.0008in2009,bitcoin’spricetopped $67,000inNovember2021.Figure I.3 showsthewildupsanddownsinprices since2014.

2014201520162017201820192020202120222023 Price, dollars

FigureI.3 Herewegoagainandagain.

Itisnosurpriseandthatprofessionalsandamateurshavesearchedforways topredictwhichdirectionbitcoinpriceswillgonext.Theunsolvableproblem isthatthereisnorationalexplanationformovementsinbitcoinprices.How cananyonepredicttheirrational?

The intrinsicvalue ofaninvestmentishowmuchyouwouldbewillingto paytoholditforever.Theintrinsicvalueofastockisthepriceyouwouldpay togetthedividends.Theintrinsicvalueofabondisthepriceyouwouldpay togettheinterest.Theintrinsicvalueofanapartmentbuildingisthepriceyou wouldpaytogettherents.Theintrinsicvalueofbitcoiniszerobecauseyouget nocashfromholdingit.

Investorswouldbuystocks,bonds,andapartmentbuildingsevenifthere werealawthatprohibitedthemfromeverselling.Theywouldnotbuybitcoins underthatconditionbecausetheonlywaytomakeaprofitistosellthemto someoneelse.ThisiscalledtheGreaterFoolTheory—buyatafoolishprice, hopingtoselltoanevenbiggerfool.

DuringtheDutchtulipbulbbubble,bulbsthatmighthavefetched$20(in today’sdollars)inthesummerof1636wereboughtbyfoolsinJanuaryfor$160 andboughtbybiggerfoolsafewweekslaterfor$2000.Thepricesofexotic bulbstopped$75,000.DuringtheSouthSeaBubbleinthe1700s,foolsbought worthlessstockinhopesofsellingtobiggerfools.Onecompanywasformed “forcarryingonanundertakingofgreatadvantage,butnobodyistoknowwhat itis.”Theshamelesspromotersoldallthestockinlessthanfivehoursandleft England,nevertoreturn.Anotherstockofferwasforthe“nitvender”orselling ofnothing.Yet,nitwitsboughtnitvenders.

Bitcoinsareamodern-daynitvender.Now,asthen,pricesaredrivenby fear,greed,andotherhumanemotions—whatthegreatBritisheconomistJohn MaynardKeynescalled“animalspirits.”Peoplebuybitcoinbecausetheyhope thatbiggerfoolswillpayhigherprices.

In2017,asthebitcoinbubblepickedupspeed,thestockpriceofLong IslandIcedTeaCorp.increasedby500percentafteritchangeditsnameto LongBlockchainCorp.Atthepeakofthebitcoinbubble,acompanyintroducedacryptocurrencythatdidn’tevenpretendtobeaviablecurrency.Itwas truthfullymarketedasadigitaltokenthathad“nopurpose.”Yet,peoplespent hundredsofmillionsofdollarsbuyingthisnitvender.

TheWildWestofBanking,Again

OnJuly13,2022,theCoinMarketCapwebsitereportedthepricesof9909 cryptocurrencieswithatotalmarketvalueof$900billion.Seeingthis,Iwas remindedoftheWildWestperiodofAmericanbanking.Intheearly1800s, therewerethousandsofbank-issuedcurrencies.Onehistorianwrotethat corporationsandtradesmenissued“currency.”Evenbarbersandbartenderscompeted withbanksinthisrespect ... nearlyeverycitizenregardeditashisconstitutionalright toissuemoney.

OnesuccessfulMidwesternbankerrecalledhisstartinthebusiness:

Well,Ididn’thavemuchtodoandsoIrentedanemptystoreandpainted“bank”on thewindow.Thefirstdayamancameinanddeposited$100,andacoupleofdayslater, anothermandepositedanother$250andsoalongaboutthefourthdayIgotconfidence enoughinthebanktoputin$1.00myself.

BythetimeoftheCivilWar,therewere7000differentbankcurrenciesin circulation,ofwhich5000werecounterfeit.Bankswerestate-regulatedandregulationsregardingprecious-metalreserveswerelax.AMassachusettsbankthat hadissued$500,000inbanknoteshad$86.48inreserves.InMichigan,acommoncollectionofreserves(includinghiddenlead,glass,andten-pennynails) passedfrombanktobank,aheadofthestateexaminers.Openingabankand issuingbanknotesseemedlikeaneasywaytoliterallymakemoney.Itwasan occupationthatattractedthemostreputableandpublic-spiritedpeopleandthe lowestandmostdown-and-outscoundrels.Manyhelpedthecountryprosper; otherssimplyredistributeditswealth.

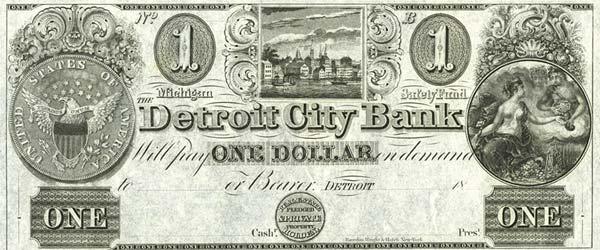

Figure I.4 showsthelavishlyembellished$1billissuedbytheDetroitCity Bank,whichwassaidtobebackedby“PledgedProperty”of“RealEstate& PrivateHoldings.”Thebankopenedin1837andclosedin1839.

FigureI.4 A$1billissuedbytheDetroitCityBank. Credit:PaperMoneyGuarantee.

Therewasnoneedforthousandsofbankcurrenciesinthenineteenthcenturyandthereisnoneedforthousandsofcryptocurrenciestoday.Perhapsthe mostludicrous(itisadmittedlyatoughcall)isDogecoin,whichwascreated asajokebytwosoftwareengineers.Itadvertisesitselfasthe“funandfriendly internetcurrency”andusesthefaceofaShibaInudogfromthe“Doge”meme asitslogo(Figure I.5).Inthefirst30daysafteritsofficiallaunchonDecember6,2013,morethanamillionpeoplevisiteddogecoin.com.InJanuary2014, Dogecoin’stradingvolumewaslargerthanthatofallothercryptocurrencies

combined.Soon,everyDogecointweetfromElonMusksentshockwavesto Dogecoinprices.OnMay7,2021,Dodgecoin’stotalmarketvaluehit$82billion,makingitthethirdmostvaluablecryptocurrency(behindbitcoinand Ethereum).Twomonthslater,itsvaluehadplummeted90percentandMusk wassuedformarketmanipulation.

Somestruggledtomakesenseofthisnonsense.AneconomistattheUniversityofNewSouthWalesBusinessSchooldescribedDogecoinas“notso muchanalternativedeflationarynumismaticinstrumentasitisaninflationary leisuredexplorationofcommunity-buildingaroundacryptoasset.”Thatkind ofgobbledegookhardlyenhancesthereputationofscientists.

Meanwhile,thetwoDogecoinco-foundersbailed,evidentlyexasperated andembarrassedthattheirjokehadgottenoutofcontrol.Onewrotethat, “Cryptocurrencyisasolutioninsearchofaproblem ... .Ifanything,itexistsasaneducationaltool.It’sareminderthatwecan’ttakethisstuffseriously.” Theotherexplainedhisdeparture:“Iwaslike,‘Okay,thisisdumb.Idon’twant tobetheleaderofacult.’”

FigureI.5 Acutepuppycoin.

JustWhenYouThoughtitCouldn’tGet AnyCrazier

Asifcryptocurrenciesweren’tsufficientlyfoolish,wenowhaveCryptoKittiesandothercrypto-collectibles.Bitcoinsare fungible inthatallbitcoinsare identicalandinterchangeable.Acrypto-collectible,incontrast,isaunique, non-fungibledigitaltoken(NFT)thatcannotbecopied,substituted,orsubdivided.

Almostallcrypto-collectiblesaretradedandvalidatedonEthereum’s blockchainnetwork.CryptoKittieswereunveiledin2017andpricessoared, withtheDragoncryptoKittysellingfor$172,000in2018.Cryptopunkswere unleashedin2017,andasofDecember9,2022,thecreatorsofcryptopunksreportedthattherehadbeen15,496salesforatotalof$2.47billion.InJune2021, theAlienCryptopunkwithaMaskshowninFigure I.6 soldfor$11.8million toShalomMeckenzie,thelargestshareholderofDraftKings,afantasysports bettingorganization.

Ifitseemsfittingthatafantasysportsmogulwouldbuyfantasyart,itiseven moreironicthatin2018,agroupclaimingtobeboredMITstudentscreated EtherTulips—NFTsthatlookliketulips.Thefounderswerebrutallyhonest:

[L]otsofpeoplehavebeencallingcryptothebiggestbubblesinceTulipmania.Well, we’reagroupofboredcollegestudentsanddecidedtopushthecrazetothenextlevel byputtingvirtualtulipsontheEthereumblockchain!

TheEthertulipswebsiteisequallycandid:

Tulipmaniawasabubbleinthe17thcenturyduringwhichpricesfortulipsroseto ridiculouslevels.Onebulbcostmorethanahouse!Thetulipmarketcrashedin1637, soyouwereborntoolatetoparticipate—butnoworries!We’rebringingtulipmaniato the21stcentury.

Iwasconvincedthatthesewereindeedboredcollegestudentswhenthey includedthepunchline:“Whatcouldgowrong?”

TheAlienCryptopunkwithamask. Credit:CourtesyofSotheby’sandLarvaLabs.

MarketManipulation

Thereisanotherimportantfactordrivingcryptocurrencyprices.Inapumpand-dumpscheme,agroupofscammerscirculateuntruthfulrumorsaboutan investment,whiletradingitbackandforthamongthemselvesateverhigher prices,luringinthecredulous.Afterpriceshavebeenpumpedup,theconspiratorsdumptheirholdingsbysellingtothesuckers(aka“bagholders”).In 2019, TheNewYorkTimes reportedthatDonaldTrumphadbeeninvolvedina handfulofpump-and-dumpschemesinthelate1980s:

Aslossesfromhiscoreenterprisesmounted,Mr.Trumptookonanewpublicrole, tradingonhisbusiness-titanbrandtopresenthimselfasacorporateraider.Hewould acquiresharesinacompanywithborrowedmoney,suggestpubliclythathewascontemplatingbuyingenoughtobecomeamajorityowner,thenquietlysellontheresulting riseinthestockprice.

FigureI.6

The tacticworkedforabriefperiod—earningMr.Trumpmillionsofdollarsingains— untilinvestorsrealizedthathewouldnotfollowthrough.

Bitcoin’spricesurgesoftenseemlikepump-and-dumpscams.Krugmanhas writtenthat

Bitcoin’suntetherednaturealsomakesithighlysusceptibletomarketmanipulation.Back in2013fraudulentactivitiesbyasingletraderappeartohavecausedasevenfoldincrease inBitcoin’sprice.Who’sdrivingthepricenow?Nobodyknows.Someobserversthink NorthKoreamaybeinvolved.

In2019the WallStreetJournal reportedthatnearly95percentofthereported bitcointradesarefaketradesintendedtomanipulateprices.A2020studypublishedinthe JournalofFinance concludedthatnearlyalloftheriseinbitcoin pricesin2017wasduetotradingbyonelarge,unidentifiedtraderusinganother digitalcurrency,calledTether,tobuybitcoin.

Ina2021report,ResearchAffiliates,awidelyrespectedinvestmentmanagementcompany,concludedthat perhaps[bitcoin]isjustabubbledrivenbyafrenzyofretail,andsomeinstitutional, moneyeagertogetapieceoftheaction.Alternatively,andfarlikelierinmyopinion,is thatthis“bubble”ismorefraudthanfrenzy.

OnAugust3,2021,theheadoftheSecuritiesandExchangeCommission(SEC) saidthatcryptocurrencymarketswere“rifewithfraud,scamsandabuse.” InJune2022theU.S.DepartmentofJusticechargedsixindividualswith cryptocurrencyfraud.AsIwritethis,alotofpeoplearewaitingformoreshoes todrop.

Figure I.3 showstherun-upinbitcoin’spricein2017,culminatingina peakpriceof$19,497onDecember16,followedbysharpdecline.Therewas noreasonforthisupanddownotherthaninvestorspeculationand/ormarketmanipulation.IthappenedagainonMonday,April1,2019,asthevolume ofbitcointradingmorethandoubledandthepricejumped17percent.The rallywasconcentratedinaone-hourintervalwhenthepriceleapt21percent between5:30a.m.and6:22a.m.Londontime.Wholetthefoolsout?OneplausibleexplanationwasanarticlewrittenasanAprilFool’sjokereportingthatthe SEChadheldanemergencymeetingovertheweekendandvotedtoapprove

twobitcoin-basedexchangetradedfunds(ETFs).Fortruefools,ithardlymatteredwhatsparkedtherally.Aslongaspricesaregoingup,foolswillbuyin hopesofsellingtobiggerfools.

Afteralull,bitcoinpriceandvolumetookoffagaininlateOctober2020. Whenitwillend,nooneknows.Butitwillend—badly.Atsomepoint,the supplyofgreaterfoolswilldryup,themanipulatorswilldumptheirbitcoin, andthebitcoinbubblewillendthewayallbubblesend.Today,welaughatthe Dutchwhopaidthepriceofahouseforatulipbulb.Futuregenerationswill laughatusforpayingthepriceofafancycarforliterallynothing.

TorturingDatatoPredictBitcoinPrices

Thefactthatchangesinbitcoinpricesaredrivenbyfear,greed,andmanipulationhasnotstoppedpeoplefromtryingtocrackthesecretofbitcoinprices. Empiricalmodelsofbitcoinpricesareawonderfulexampleofdatatorturing becausebitcoinshavenointrinsicvalueand,so,cannotbeexplainedcredibly byeconomicdata.

Undauntedbythisreality,aNationalBureauofEconomicResearch(NBER) paperreportedthemind-bogglingeffortsmadebyYaleUniversityeconomics professorAlehTsyvinskiandagraduatestudent,YukunLiu,tofindempirical patternsinbitcoinprices.

TsyvinskicurrentlyholdsanendowedchairnamedafterArthurM.Okun, whohadbeenaprofessoratYalefrom1961to1969,thoughhespentsixofthose eightyearsonleavesothathecouldworkinWashingtonontheCouncilofEconomicAdvisorsasastaffeconomist,councilmember,andthenchair,advising presidentsJohnF.KennedyandLyndonJohnsonontheireconomicpolicies. HeismostwellknownforOkun’slaw,whichstatesthata1percentage-point reductioninunemploymentwillincreaseU.S.outputbyroughly2percent,an argumentthathelpedpersuadePresidentKennedythatusingtaxcutstoreduce unemploymentfrom7to4percentwouldhaveanenormouseconomicpayoff.

AfterOkun’sdeath,ananonymousdonorendowedalectureseriesatYale namedafterOkun,explainingthat

ArthurOkuncombinedhisspecialgiftsasananalyticalandtheoreticaleconomistwith hisgreatconcernforthewell-beingofhisfellowcitizensintoathoughtful,pragmatic, andsustainingcontributiontohisnation’spublicpolicy.

ThecontrastbetweenOkun’sfocusonmeaningfuleconomicpoliciesand Tsyvinski’sfar-fetchedbitcoincalculationsisstriking.

LiuandTsyvinskireportcorrelationsbetweenthenumberofweeklyGoogle searchesforthewordbitcoin(comparedtotheaverageoverthepastfourweeks) andthepercentagechangesinbitcoinpricesonetosevenweekslater.Theyalso lookedatthecorrelationbetweentheweeklyratioof bitcoinhack searchesto bitcoinsearchesandthepercentagechangesinbitcoinpricesonetosevenweeks later.Thefactthattheyreported bitcoin searchresultslookingbackfourweeks andforwardsevenweeksshouldalertustothepossibilitythattheytriedother backward-and-forwardcombinationsthatdidnotworkaswell.Dittowiththe factthattheydidnotlookbackfourweekswith bitcoinhack searches.They evidentlytorturedthedataintheirquestforcorrelations.

Evenso,onlysevenoftheirfourteencorrelationsseemedpromisingforpredictingbitcoinprices.OwenRosebeckandIlookedatthepredictionsmadeby thesecorrelationsduringtheyearfollowingtheirstudyandfoundthatthey wereuseless.Theymightaswellhaveflippedcoinstopredictbitcoinprices.

LiuandTsyvinskialsocalculatedthecorrelationsbetweenthenumberof weeklyTwitterbitcoinpostsandbitcoinreturnsonetosevenweekslater.Unlike theGoogletrendsdata,theydidnotreportresultsfor bitcoinhack posts.Three ofthesevencorrelationsseemeduseful,thoughtwowerepositiveandonewas negative.Withfreshdata,nonewereuseful.

Theonlythingthattheirdataabuseyieldedwascoincidentalstatisticalcorrelations.EventhoughtheresearchwasdonebyaneminentYaleprofessorand publishedbytheprestigiousNBER,theideathatbitcoinpricescanbepredicted reliablyfromGooglesearchesandTwitterpostswasafantasyfueledbydata torturing.

Theironyhereisthatscientistscreatedstatisticaltoolsthatwereintended toensurethecredibilityofscientificresearchbuthavehadtheperverseeffectofencouragingresearcherstotorturedata—whichmakestheirresearch untrustworthyandunderminesthecredibilityofallscientificresearch.

DataMining

Traditionally,empiricalresearchbeginsbyspecifyingatheoryandthencollectingappropriatedatafortestingthetheory.Manynowtaketheshortcutof lookingforpatternsindataunencumberedbytheory.Thisiscalled datamining inthatresearchersrummagethroughdata,notknowingwhattheywillfind.

Waybackin2009,MarcPrensky,awriterandspeakerwithdegreesfromYale andHarvardBusinessSchool,claimedthat

Inmanycases,scientistsnolongerhavetomakeeducatedguesses,constructhypotheses andmodels,andtestthemwithdata-basedexperimentsandexamples.Instead,they canminethecompletesetofdataforpatternsthatrevealeffects,producingscientific conclusionswithoutfurtherexperimentation.

Wearehard-wiredtoseekpatternsbutthedatadelugemakesthevastmajority ofpatternswaitingtobediscoveredillusoryanduseless.Bitcoinisagainagood example.Sincethereisnologicaltheory(otherthangreedandmarketmanipulation)thatexplainsfluctuationsinbitcoinprices,itistemptingtolookfor correlationsbetweenbitcoinpricesandothervariableswithoutthinkingtoo hardaboutwhetherthecorrelationsmakesense.Inadditiontotorturingdata, LiuandTsyvinskiminedtheirdata.

Theycalculatedcorrelationsbetweenbitcoinpricesand810othervariables, includingsuchwhimsicalitemsastheCanadiandollar–U.S.dollarexchange rate,thepriceofcrudeoil,andstockreturnsintheautomobile,book,andbeer industries.YoumightthinkIammakingthisup.Sadly,Iamnot.

Theyreportedfindingthatbitcoinreturnswerepositivelycorrelatedwith stockreturnsintheconsumergoodsandhealthcareindustriesandnegativelycorrelatedwithstockreturnsinthefabricatedproductsandmetalmining industries.Thesecorrelationsdon’tmakeanysenseandLiuandTsyvinskiadmittedthattheyhadnoideawhythesedatawerecorrelated:“Wedon’tgive explanations .Wejustdocumentthisbehavior.”Askepticmightask:What isthepointofdocumentingcoincidentalcorrelations?

Andthatisalltheyfound.TheAchillesheelofdataminingisthatlargedata setsinevitablycontainanenormousnumberofcoincidentalcorrelationsthat arejustfool’sgoldinthattheyarenomoreusefulthancorrelationsamong randomnumbers.Mostfortuitouscorrelationsdonotholdupwithfresh data,thoughsome,coincidentally,willforawhile.Onestatisticalrelationship thatcontinuedtoholdduringtheperiodtheystudiedandtheyearafterward wasanegativecorrelationbetweenbitcoinreturnsandstockreturnsinthe paperboard-containers-and-boxesindustry.Thisissurelyserendipitous—and pointless.

Scientistshaveassembledenormousdatabasesandcreatedpowerfulcomputersandalgorithmsforanalyzingdata.Theironyisthattheseresourcesmake

itveryeasytousedataminingtodiscoverchancepatternsthatarefleeting.Resultsarereportedandthendiscredited,andwebecomeincreasinglyskeptical ofscientists.

LookingForward

Thethreecentralreasonsforthecredibilitycrisisinsciencearedisinformation,datatorturing,anddatamining.Ichoseexamplesrelatedtobitcoinfor thisIntroductioninordertoillustratethecrisis.Bitcoinishardlyanisolated case.Ichoseitbecauseitissoclearthatbitcoinbelieversdon’ttrustauthorities andbecauseitsotemptingtotortureandminebitcoindata.Thechaptersto comewillexpandontheseargumentsandgiveexamplesfromawidevarietyof fields.

Disinformation

Theideathatscientistsareatoolusedbytherulingclasstocontrolushasreal consequences.Vaccinesforpolio,measles,mumps,chickenpox,andotherdiseaseshavebeenlifesaversformillions,yetsomepeoplebelievethatvaccines maybepartofanefariousgovernmentplottoharmusorspyonus.BritonAndrewWakefieldisthesourceofthenowdebunkedclaimthattheMMRvaccine causesautism.Journalshaveretractedhisresearchandhehasbeenbarredhim frompracticingmedicineintheUnitedKingdom,yetcelebritiescontinueto spreadhiswildlyirresponsiblefabricationsthroughouttheInternet.

So,too,withdangerousfalsehoodsaboutCOVID-19vaccines.Itissad enoughthatpeoplewhobelievetheseuntruthsrisktheirlives,buttheyalso endangerothers.HerearesomeInternetresponsestoaMarch2021CNBC newsstoryaboutCOVID-19vaccinations:

Flushotsareproventomakeyou38%morelikelytocatchanotherrespiratoryvirus likecovid.

SCAMDEMIC

IwilldowhatIwant.Iwillalwaysbefree.Dearcommunist,I’mnotsorry Easywaytotargettheelderly.Don’tbefooledpeople.

Iwontvaxiwontmaskiwontfollowmandatesorguidelinesandimarmed.

RichardHorton,editorofthemedicaljournal TheLancet,hasnotedtheparadoxbetweenU.S.scientificachievementsandthepublicdistrustofscientists: