Content Revisions Enhance Learning

Instructors and students guided this edition’s revisions. Revisions include

∙ New Cheat Sheets at each chapter-end visually reinforce key chapter concepts.

∙ More concise text covering the same content. New 24th edition has 115 fewer pages than 23rd edition.

∙ Over 210 new assignments—all available in Connect with algorithmic options.

∙ Gross method is used for merchandising transactions, reflecting practice—adjusting entries for new revenue recognition rules are set in an appendix.

∙ Many new Need-to-Know (NTK) demos and accompanying videos to reinforce learning.

Chapter 1

Updated opener—Apple and entrepreneurial assignment.

Updated salary info for accountants.

Revised business entity section along with adding LLC.

Updated section on FASB objectives and accounting constraints.

New layout for introducing the expanded accounting equation.

New layout for introducing financial statements.

Updated Apple numbers for NTK 1-5.

New Cheat Sheet reinforces chapter content.

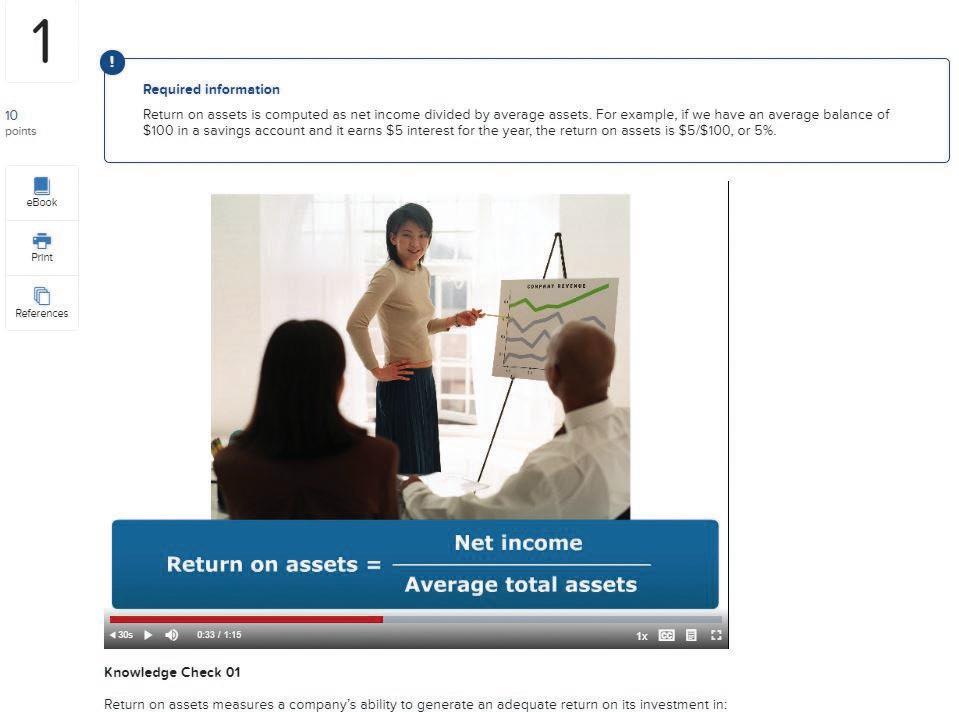

Updated return on assets analysis using Nike and Under Armour

Added a new Exercise assignment and Quick Study assignment.

Added new analysis assignments: Company Analysis, Comparative Analysis, and Global Analysis.

Chapter 2

NEW opener— Fitbit and entrepreneurial assignment.

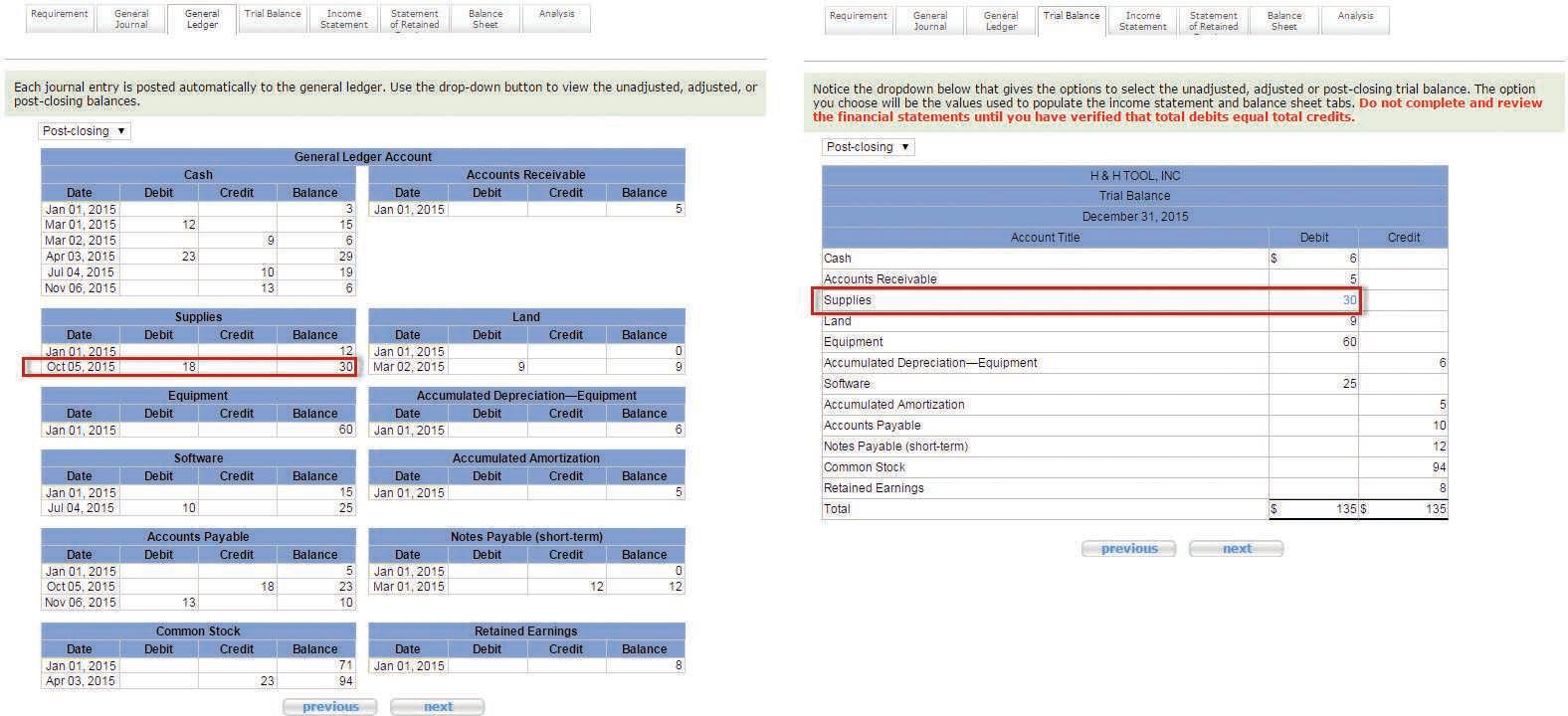

New visual for process to get from transactions to financial statements.

New layout on four types of accounts that determine equity.

Improved presentation of “Double-Entry System” section.

Updated Apple data for NTK 2-4.

Updated debt ratio analysis using Costco and Walmart

New Cheat Sheet reinforces chapter content.

Added four new Quick Studies.

Added three new Exercises.

Added new analysis assignments: Company Analysis, Comparative Analysis, and Global Analysis.

Chapter 3

NEW opener— Urban One and entrepreneurial assignment.

Revised learning objectives and chapter preview—each type of adjusting entry is assigned its own learning objective.

Updated “Recognizing Revenues and Expenses” section.

New streamlined “Framework for Adjustments” section.

Continued emphasis of 3-step adjusting process.

Enhanced Exhibit 3.12 on summary of adjustments.

Updated profit margin analysis using Visa and Mastercard

Improved layouts for Exhibits 3A.1 through 3A.5.

New Cheat Sheet reinforces chapter content.

Added three new Quick Studies.

Added two new Exercises.

Added new analysis assignments: Company Analysis, Comparative Analysis, and Global Analysis.

Chapter 4

NEW opener— Snapchat and entrepreneurial assignment.

New Decision Insight on women in accounting.

Shortened discussion of closing entries.

Exhibit 4.5 color-coded all adjustments.

Enhanced Exhibit 4.7 on steps of accounting cycle with images.

Streamlined section on classified balance sheet.

Updated current ratio analysis using Costco and Walmart

New Cheat Sheet reinforces chapter content.

Added two new Quick Studies.

Added new analysis assignments: Company Analysis, Comparative Analysis, and Global Analysis.

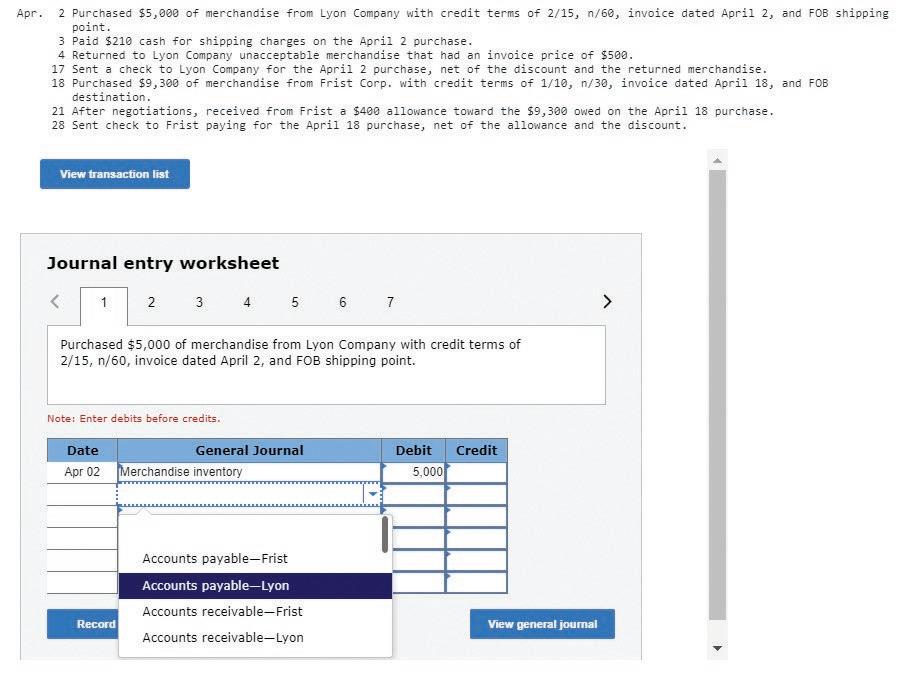

Chapter 5

NEW opener— Build-A-Bear and entrepreneurial assignment.

Updated introduction for servicers vs. merchandisers using Liberty Tax and Nordstrom

Revised NTK 5-1 covers basics of merchandising. Reorganized “Purchases” section to aid learning.

New Decision Insight on growing number of returns for businesses.

Enhanced entries on payment of purchases within discount period vs. after discount period.

Improved discussion of entries for sales with discounts vs. sales without discounts.

Color-coded Exhibit 5.12 highlights different merchandising transactions.

Updated acid-test ratio and gross margin analysis using Nike and Under Armour

Appendix 5B explains adjusting entries for future sales discounts, returns, and allowances.

Appendix 5C covers the net method.

Appendix 5D moved to online only.

New Cheat Sheet reinforces chapter content.

Added three new Quick Studies.

Added four new Exercises.

Added new analysis assignments: Company Analysis, Comparative Analysis, and Global Analysis.

Chapter 6

NEW opener— Shake Shack and entrepreneurial assignment.

New Ethical Risk on the alleged fraud of Homex.

Simplified introduction to inventory costing.

Shortened explanation for specific identification.

Enhanced layout to explain effects of inventory errors across years.

Updated inventory turnover and days’ sales in inventory analysis using Costco and Walmart

Added colored arrow lines to Exhibits 6A.3 and 6A.4 to show cost flows from purchases to sales.

New Cheat Sheet reinforces chapter content.

Added one new Quick Study.

Added two new Exercises.

Added new analysis assignments: Company Analysis, Comparative Analysis, and Global Analysis.

∙ Revised the Investments chapter for the new standard.

∙ New assignments that focus on financial statement preparation.

∙ Many new and revised General Ledger and Excel assignments.

∙ New Accounting Analysis assignments—all available in Connect— using real-world data from Apple, Google, and Samsung

∙ Updated videos for each learning objective in new Concept Overview Video format.

Chapter 7

Updated opener— Box and entrepreneurial assignment.

Revised learning objectives and chapter preview—each type of journal is assigned its own learning objective.

New Decision Insight on financial impact of Pok émon Go for Nintendo

Streamlined presentation of system principles and system components.

Enhanced “Basics of Special Journals” and “Subsidiary Ledgers” sections to improve learning.

New simplified designs for Exhibits 7.5, 7.7, 7.9, and 7.11 to improve student comprehension.

Removed discussion of sales tax and postponed it to the current liabilities chapter.

New section on Data Analytics and Data Visualization.

New days’ payable outstanding analysis using Costco and Walmart

New Cheat Sheet reinforces chapter content.

Added five new Quick Studies.

Added three new Exercises.

Added new analysis assignments: Company Analysis, Comparative Analysis, and Global Analysis.

Chapter 8

NEW opener— Care.com and entrepreneurial assignment.

New COSO framework to guide internal control, including COSO cube.

New discussion of internal control failure at Amazon that cost customers $150 million. Simplified bank statement for learning.

Revised “Bank Reconciliation” section to separate bank balance adjustments and book balance adjustments.

New summary image on adjustments for bank balance and for book balance.

Removed collection expenses and NSF fees—most are immaterial and covered in advanced courses.

Updated days’ sales uncollected analysis using Starbucks and Jack in the Box New Cheat Sheet reinforces chapter content. Added three new Quick Studies. Added eight new Exercises.

Added new analysis assignments: Company Analysis, Comparative Analysis, and Global Analysis.

Chapter 9

NEW opener— Facebook and entrepreneurial assignment.

Updated company data in Exhibit 9.1.

Streamlined direct write-off method.

Enhanced Exhibit 9.6 showing allowances set aside for future bad debts along with journal entries.

New calendar graphic added as learning aid with Exhibit 9.12.

New Excel demo to compute maturity dates. Updated accounts receivable analysis using Visa and Mastercard New Cheat Sheet reinforces chapter content.

Added five new Quick Studies.

Added one new Exercise.

Added new analysis assignments: Company Analysis, Comparative Analysis, and Global Analysis.

Chapter

10

NEW opener— New Glarus Brewery and entrepreneurial assignment.

Updated company data in Exhibit 10.1.

Added entry with Exhibit 10.3 and Exhibit 10.4.

Simplified “Partial-Year Depreciation” section.

Added margin table to Exhibit 10.14 as a learning aid.

New Decision Insight box on extraordinary repairs to SpaceX’s reusable orbital rocket.

New simple introduction to finance leases and operating leases for the new standard.

Updated asset turnover analysis using Starbucks and Jack in the Box

Simplified Appendix 10A by postponing exchanges without commercial substance to advanced courses.

New Cheat Sheet reinforces chapter content.

Added two new Quick Studies.

Added one new Exercise.

Added two new Problems.

Added new analysis assignments: Company Analysis, Comparative Analysis, and Global Analysis.

Chapter 11

NEW opener— Pandora and entrepreneurial assignment.

Updated data in Exhibit 11.2.

Streamlined “Short-Term Notes Payable” section.

Simplified explanation of FICA taxes.

Updated payroll tax rates and explanations.

Revised NTK 11-4.

New W-4 form added to Appendix 11A.

New Cheat Sheet reinforces chapter content.

Added two new Quick Studies.

Added four new Exercises.

Added new analysis assignments: Company Analysis, Comparative Analysis, and Global Analysis.

Chapter 12

Updated opener— Scholly and entrepreneurial assignment.

Streamlined partnership characteristics and types of organizations.

Simplified graphic on business entity characteristics.

Enhanced partnership formation example to emphasize partner investments are recorded at market value.

Revised NTK 12-1.

Shortened “Partner Withdrawal” section.

New Cheat Sheet reinforces chapter content.

Added one new Quick Study.

Added four new Exercises.

Added new analysis assignments: Company Analysis, Comparative Analysis, and Global Analysis.

Chapter 13

NEW opener—Yelp and entrepreneurial assignment.

New Decision Insight on bots investing in stocks based on erroneous news.

New AT&T stock quote explanation.

New graphic visually depicting cash dividend dates.

New table summarizing differences between small stock dividends, large stock dividends, and stock splits.

Updated Apple statement of equity in Exhibit 13.10.

Updated PE ratio and dividend yield using Amazon, Altria, Visa, and Mastercard

Simplified book value per share explanation and computations.

New Cheat Sheet reinforces chapter content.

Added six new Quick Studies.

Added four new Exercises.

Added new analysis assignments: Company Analysis, Comparative Analysis, and Global Analysis.

Chapter 14

NEW opener— e.l.f. Cosmetics and entrepreneurial assignment.

Updated IBM bond quote data.

Simplified numbers in Exhibit 14.7.

Simplified Exhibit 14.10 on premium bonds.

Simplified numbers in Exhibit 14.11.

Bond pricing moved to Appendix 14A.

Simplified Exhibit 14.12 for teaching the note amortization schedule.

Updated debt-to-equity analysis using Nike and Under Armour

New Excel computations for bond pricing in Appendix 14A.

Simplified numbers in Exhibits 14B.1 and 14B.2.

Revised Appendix 14C for new standard on finance leases and operating leases.

New Cheat Sheet reinforces chapter content.

Added five new Quick Studies.

Added four new Exercises.

Added four new Problems.

Added new analysis assignments: Company Analysis, Comparative Analysis, and Global Analysis.

Chapter 15

Updated opener— Echoing Green and entrepreneurial assignment.

New learning objective P4 for new category of stock investments.

Revised and simplified Exhibit 15.2 for new standard on investments.

Reorganized text to first explain debt securities and then stock securities.

Revised trading and available-for-sale securities to cover only debt securities given the new standard.

New section on stock investments with insignificant influence.

New Exhibit 15.6 to describe accounting for equity securities by ownership level.

Updated component-returns analysis using Costco and Walmart Investments in international operations set online as Appendix 15A.

New Cheat Sheet reinforces chapter content.

Added three new Quick Studies. Added four new Exercises. Added two new Problems.

Added new analysis assignments: Company Analysis, Comparative Analysis, and Global Analysis.

Chapter 16

NEW opener—Vera Bradley and entrepreneurial assignment.

New box on Tesla’s cash outflows and growing market value.

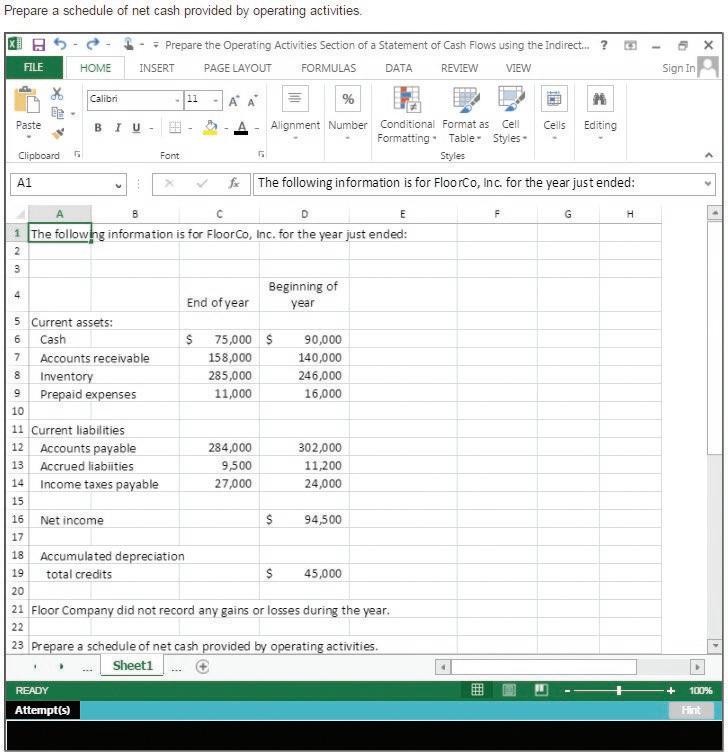

Slightly revised infographics on cash flows from operating, investing, and financing.

Streamlined sections on analyzing the cash account and noncash accounts.

New presentation to aid learning of indirect adjustments to income.

Simplified T-accounts to reconstruct cash flows.

Simplified reconstruction entries to help compute cash flows.

Updated cash flow on total assets analysis using Nike and Under Armour

New Cheat Sheet reinforces chapter content.

Added ten new Quick Studies.

Added four new Exercises.

Added new analysis assignments: Company Analysis, Comparative Analysis, and Global Analysis.

Chapter 17

Updated opener— Morgan Stanley and entrepreneurial assignment.

Updated data for all analyses of Apple using horizontal, vertical, and ratio analysis.

Updated comparative analysis using Google and Samsung

Streamlined section on ratio analysis.

Streamlined the “Analysis Reporting” section.

Shortened Appendix 17A.

New Cheat Sheet reinforces chapter content.

Added eight new Quick Studies.

Added two new Exercises.

Added new analysis assignments: Company Analysis, Comparative Analysis, and Global Analysis.

Chapter 18

NEW opener— MoringaConnect and entrepreneurial assignment.

Added discussion on role of managerial accounting for nonaccounting and nonbusiness majors.

Added equation boxes for total manufacturing costs and cost of goods manufactured.

New margin exhibit showing product and period cost flows.

Added lists of common selling and administrative expenses.

Updated and edited several exhibits for clarity.

New Cheat Sheet reinforces chapter content. Added new analysis assignments: Company Analysis, Comparative Analysis, and Global Analysis.

Chapter 19

NEW opener— HoopSwagg and entrepreneurial assignment.

Revised discussions of manufacturing costs and link between job cost sheets and general ledger.

Added graphic linking job cost sheets and general ledger accounts.

Enhanced exhibit of 4-step overhead process. Added formula for computing applied overhead.

New short discussion of cost-plus pricing. Added margin T-accounts and calculations for clarity.

New Cheat Sheet reinforces chapter content.

Added one new Quick Study.

Added new analysis assignments: Company Analysis, Comparative Analysis, and Global Analysis.

Chapter 20

NEW opener—Azucar Ice Cream and entrepreneurial assignment.

Revised discussion comparing process and job order costing systems.

Added cost flow graphic.

New margin graphic illustrating EUP.

Revised discussion of weighted-average versus FIFO method of process costing.

Revised discussion of using the process cost summary.

New graphic on FIFO goods flow.

Added margin T-accounts and calculations for clarity.

New Cheat Sheet reinforces chapter content.

Added one new Exercise.

Added new analysis assignments: Company Analysis, Comparative Analysis, and Global Analysis.

Chapter 21

NEW opener— Ellis Island Tropical Tea and entrepreneurial assignment.

Added margin graphs of fixed, variable, and mixed costs.

New Excel steps to create a line chart.

Moved details of creating scatter plot to Appendix 21A, with Excel steps.

Revised discussion of scatter plots.

Moved details of creating a CVP chart to Appendix 21C, with Excel steps.

New Cheat Sheet reinforces chapter content.

Added one new Exercise.

Added new analysis assignments: Company Analysis, Comparative Analysis, and Global Analysis.

Chapter 22

NEW opener— Misfit Juicery and entrepreneurial assignment.

Added T-accounts and steps to exhibit margins.

Added numbered steps to several exhibits.

Expanded discussion of cost of goods sold budgeting.

New exhibit for calculation of cash paid for interest.

Expanded discussion with bulleted list on use of a master budget.

New Cheat Sheet reinforces chapter content.

Added one new Quick Study.

Added one new Exercise.

New assignment on CMA exam budgeting coverage.

Added new analysis assignments: Company Analysis, Comparative Analysis, and Global Analysis.

Chapter 23

NEW opener—Away and entrepreneurial assignment.

Added graph to flexible budget exhibit.

Revised discussion of flexible budget.

New exhibit and discussion of computing total cost variance.

Edited discussion of direct materials cost variance.

Edited discussion of evaluating labor variances.

Edited discussion of overhead variance reports.

New exhibit for summary of variances.

New Cheat Sheet reinforces chapter content.

Added two new Exercises.

Added new analysis assignments: Company Analysis, Comparative Analysis, and Global Analysis.

Chapter 24

NEW opener—Jibu and entrepreneurial assignment.

Updated Walt Disney ROI example.

New Decision Analysis on cash conversion cycle.

New Cheat Sheet reinforces chapter content.

Added two new Quick Studies.

Added two new Exercises.

Added new analysis assignments: Company Analysis, Comparative Analysis, and Global Analysis.

Chapter 25

NEW opener— Solugen and entrepreneurial assignment.

Organized decision scenarios into three types: production, capacity, and pricing.

Expanded discussion of product pricing. Added other pricing methods: value-based, auction-based, and dynamic.

New Decision Analysis on time and materials pricing of services.

New Decision Insight on blockchain technology.

New Cheat Sheet reinforces chapter content.

Added four new Quick Studies.

Added one new Exercise.

Added new analysis assignments: Company Analysis, Comparative Analysis, and Global Analysis.

Chapter 26

NEW opener— Fellow Robots and entrepreneurial assignment.

New discussion of postaudit of investment decisions.

Added example of investment in robotics.

New Cheat Sheet reinforces chapter content.

Added two new Exercises.

Added new analysis assignments: Company Analysis, Comparative Analysis, and Global Analysis.

Appendix A

New financial statements for Apple, Google, and Samsung

Appendix B

New Decision Maker on postponed retail pricing.

Continued Excel demos for PV and FV of lump sums.

Continued Excel demos for PV and FV of annuities.

Appendix C

New Cheat Sheet reinforces appendix content.

Appendix D

NEW appendix on lean principles and accounting.

Describes lean business principles. Measures production efficiency. Illustrates how to account for product costs using lean accounting.

New: 13 Discussion Questions, 14 Quick Studies, 14 Exercises, and 3 Problems.

Acknowledgments

John J. Wild, Ken W. Shaw, and McGraw-Hill Education recognize the following instructors for their valuable feedback and involvement in the development of Fundamental Accounting Principles. We are thankful for their suggestions, counsel, and encouragement.

Darlene Adkins, University of Tennessee–Martin

Peter Aghimien, Indiana University South Bend

Janice Akao, Butler Community College

Nathan Akins, Chattahoochee Technical College

John Alpers, Tennessee Wesleyan University

Sekhar Anantharaman, Indiana University of Pennsylvania

Karen Andrews, Lewis-Clark State College

Chandra D. Arthur, Cuyahoga Community College

Steven Ault, Montana State University

Victoria Badura, Metropolitan Community College

Felicia Baldwin, City College of Chicago

Reb Beatty, Anne Arundel Community College

Robert Beebe, Morrisville State College

George Henry Bernard, Seminole State College of Florida

Cynthia Bird, Tidewater Community College, Virginia Beach

Pascal Bizarro, Bowling Green State University

Amy Bohrer, Tidewater Community College, Virginia Beach

John Bosco, North Shore Community College

Nicholas Bosco, Suffolk County Community College

Jerold K. Braun, Daytona State College

Doug Brown, Forsyth Technical Community College

Tracy L. Bundy, University of Louisiana at Lafayette

Marci Butterfield, University of Utah

Ann Capion, Scott Community College

Amy Cardillo, Metropolitan State University of Denver

Anne Cardozo, Broward College

Crystal Carlson-Myer, Indian River State College

Julie Chasse, Des Moines Area Community College

Patricia Chow, Grossmont College

Maria Coclin, Community College of Rhode Island

Michael Cohen, Lewis-Clark State College

Jerilyn Collins, Herzing University

Scott Collins, Penn State University, University Park

William Conner, Tidewater Community College

Erin Cornelsen, University of South Dakota

Mariah Dar, John Tyler Community College

Nichole Dauenhauer, Lakeland Community College

Donna DeMilia, Grand Canyon University

Tiffany DeRoy, University of South Alabama

Susan Dickey, Motlow State Community College

Erin Dischler, Milwaukee Area Technical College–West Allis

Holly Dixon, State College of Florida

Vicky Dominguez, College of Southern Nevada

David Doyon, Southern New Hampshire University

Chester Drake, Central Texas College

Christopher Eller, Appalachian State University

Cynthia Elliott, Southwest Tennessee Community College–Macon

Kim Everett, East Carolina University

Corinne Frad, Eastern Iowa Community College

Krystal Gabel, Southeast Community College

Harry Gallatin, Indiana State University

Rena Galloway, State Fair Community College

Rick Gaumer, University of Wisconsin–Green Bay

Tammy Gerszewski, University of North Dakota

Pradeep Ghimire, Rappahannock Community College

Marc Giullian, Montana State University, Bozeman

Nelson Gomez, Miami Dade College–Kendall

Robert Goodwin, University of Tampa

Steve G. Green, U.S. Air Force Academy

Darryl Greene, Muskegon Community College

Lisa Hadley, Southwest Tennessee Community College–Macon

Penny Hahn, KCTCS Henderson Community College

Yoon Han, Bemidji State University

Becky Hancock, El Paso Community College

Amie Haun, University of Tennessee–Chattanooga

Michelle Hays, Kalamazoo Valley Community College

Rhonda Henderson, Olive Harvey College

Lora Hines, John A. Logan College

Rob Hochschild, Ivy Tech Community College of Indiana–South Bend

John Hoover, Volunteer State Community College

Roberta Humphrey, Southeast Missouri State University

Carley Hunzeker, Metro Community College, Elkhorn

Kay Jackson, Tarrant County College South

Elizabeth Jennison, Saddleback College

Mary Jepperson, Saint John’s University

Vicki Jobst, Benedictine University

Odessa Jordan, Calhoun Community College

Susan Juckett, Victoria College

Amanda Kaari, Central Georgia Technical College

Ramadevi Kannan, Owens Community College

Jan Klaus, University of North Texas

Aaron P. Knape, The University of New Orleans

Cedric Knott, Henry Ford Community College

Robin Knowles, Texas A&M International University

Kimberly Kochanny, Central Piedmont Community College

Sergey Komissarov, University of Wisconsin–La Crosse

Stephanie Lareau Kroeger, Ocean County College

Joseph Krupka, Lander University

Tara Laken, Joliet Junior College

Suzanne Lay, Colorado Mesa University

Brian Lazarus, Baltimore City Community College

Kevin Leifer, Long Island University, CW Post Campus

Harold Levine, Los Angeles Valley College

Yuebing Liu, University of Tampa

Philip Lee Little, Coastal Carolina University

Delores Loedel, Miracosta College

Rebecca Lohmann, Southeast Missouri State University

Ming Lu, Santa Monica Community College

Annette C. Maddox, Georgia Highlands College

Natasha Maddox, KCTCS Maysville Community and Technical College

Rich Mandau, Piedmont Technical College

Robert Maxwell, College of the Canyons

Karen McCarron, Georgia Gwinnett College

Michael McDonald, College of Southern Neveda

Gwendolyn McFadden-Wade, North Carolina A&T University

Allison McLeod, University of North Texas

Kate McNeil, Johnson County Community College

Jane Medling, Saddleback College

Heidi H. Meier, Cleveland State University

Tammy Metzke, Milwaukee Area Technical College

Jeanine Metzler, Northampton Community College

Michelle Meyer, Joliet Junior College

Pam Meyer, University of Louisiana at Lafayette

Deanne Michaelson, Pellissippi State Community College

Susan Miller, County College of Morris

Carmen Morgan, Oregon Tech

Karen Satterfield Mozingo, Pitt Community College

Haris Mujahid, South Seattle College

Andrea Murowski, Brookdale Community College

Jaclynn Myers, Sinclair Community College

Micki Nickla, Ivy Tech Community College of Indiana–Gary

Dan O’Brien, Madison College–Truax

Jamie O’Brien, South Dakota State University

Grace Odediran, Union County College

Ashley Parker, Grand Canyon University

Pamela Parker, NOVA Community College Alexandria

Margaret Parrish, John Tyler Community College

Reed Peoples, Austin Community College

Rachel Pernia, Essex County College

Brandis Phillips, North Carolina A&T University

Debbie Porter, Tidewater Community College–Virginia Beach

M. Jeff Quinlan, Madison Area Technical College

James E. Racic, Lakeland Community College

Ronald de Ramon, Rockland Community College

Robert J. Rankin, Texas A&M University–Commerce

Robert Rebman, Benedictine University

Jenny Resnick, Santa Monica Community College

DeAnn Ricketts, York Technical College

Renee Rigoni, Monroe Community College

Kevin Rosenberg, Southeastern Community College

David Rosser, University of Texas at Arlington

Michael J. Rusek, Eastern Gateway Community College

Alfredo Salas, El Paso Community College

Carolyn Satz, Tidewater Community College–Chesapeake

Kathy Saxton, Bryant & Stratton College

Wilson Seda, Lehman College–CUNY

Perry Sellers, Lonestar College–North Harris

James Shimko, Ferris State University

Philip Slater, Forsyth Technical Community College

Clayton Smith, Columbia College Chicago

Patricia Smith, DePaul University

Jane Stam, Onondaga Community College

Natalie Strouse, Notre Dame College

Erica Teague-Friend, Gwinnett Technical College

Louis Terrero, Lehman College

Geoff Tickell, Indiana University of Pennsylvania

Judith A. Toland, Bucks County Community College

Debra Touhey, Ocean County College

Jim Ulmer, Angelina College

Bob Urell, Irvine Valley College

Kevin Veneskey, Ivy Tech Community College

Teresa Walker, North Carolina A&T University

Terri Walsh, Seminole State College of Florida

Eric Weinstein, Suffolk County Community College, Brentwood

Andy Welchel, Greenville Technical College

Joe Welker, College of Western Idaho

Jean Wells, Howard University

Denise White, Austin Community College

Jonathan M. Wild, Oklahoma State University

Kenneth Wise, Wilkes Community College

Shondra Woessner, Holyoke Community College

Mindy Wolfe, Arizona State University

Jan Workman, East Carolina University

Lori Zaher, Bucks County Community College

Jessie Zetnick, Texas Woman’s University

Laurence Zuckerman, Fulton-Montgomery Community College

Many talented educators and professionals have worked hard to create the materials for this product, and for their efforts, we’re grateful. We extend a special thank you to our contributing and technology supplement authors, who have worked so diligently to support this product.

Contributing Author, Connect Content, General Ledger Problems, and Exercise PowerPoints: Kathleen O’Donnell, Onondaga Community College

Text and Supplements Accuracy Checkers: Dave Krug, Johnson County Community College; Mark McCarthy, East Carolina University; Kate McNeil, Johnson County Community College; Wanda Wong, Chabot College; and Beth Kobylarz

Test Bank Authors and Accuracy Checkers: Melodi Bunting, Madison College; Brian Schmoldt, Madison College; M. Jeff Quinlan, Madison College; and Teri Zuccaro, Clarke University

LearnSmart Author, Concept Overview Videos, PowerPoint Presentations, and Instructor Resource Manual: April Mohr, Jefferson Community and Technical College, SW

Special recognition extends to the entire team at McGraw-Hill Education: Tim Vertovec, Steve Schuetz, Natalie King, Michelle Williams, Julie Wolfe, Michele Janicek, Christina Sanders, Michael McCormick, Lori Koetters, Xin Lin, Kevin Moran, Debra Kubiak, Brian Nacik, and Daryl Horrocks. We could not have published this new edition without your efforts.

John J. Wild Ken W. Shaw

1

Accounting in Business 2

Importance of Accounting 3

Users of Accounting Information 4

Opportunities in Accounting 4

Fundamentals of Accounting 6

Ethics—A Key Concept 6

Generally Accepted Accounting Principles 7

Conceptual Framework 7

Business Transactions and Accounting 9

Accounting Equation 10

Transaction Analysis 11

Summary of Transactions 14

Communicating with Users 15

Income Statement 15

Statement of Owner’s Equity 17

Balance Sheet 17

Statement of Cash Flows 17

Decision Analysis—Return on Assets 18

Appendix 1A Return and Risk 21

Appendix 1B Business Activities 22

2 Analyzing and Recording Transactions 44

Basis of Financial Statements 45

Source Documents 45

The “Account” Underlying Financial Statements 45

Ledger and Chart of Accounts 48

Double-Entry Accounting 49

Debits and Credits 49

Double-Entry System 49

Analyzing and Processing Transactions 51

Journalizing and Posting Transactions 51

Processing Transactions—An Example 52

Summarizing Transactions in a Ledger 57

Trial Balance 58

Preparing a Trial Balance 58

Financial Statements Prepared from Trial Balance 59

Decision Analysis—Debt Ratio 62

3 Adjusting Accounts for Financial Statements 84

Timing and Reporting 85

The Accounting Period 85

Accrual Basis versus Cash Basis 86

Recognizing Revenues and Expenses 86

Framework for Adjustments 87

Deferral of Expense 87

Prepaid Insurance 87 Supplies 88

Other Prepaid Expenses 89 Depreciation 89

Deferral of Revenue 91

Unearned Consulting Revenue 92

Accrued Expense 93

Accrued Salaries Expense 93

Accrued Interest Expense 94

Future Cash Payment of Accrued Expenses 94

Accrued Revenue 95

Accrued Services Revenue 96

Accrued Interest Revenue 96

Future Cash Receipt of Accrued Revenues 96 Links to Financial Statements 97

Trial Balance and Financial Statements 98

Adjusted Trial Balance 98 Preparing Financial Statements 99

Decision Analysis—Profit Margin 101

Appendix 3A Alternative Accounting for Prepayments 104

4 Completing the Accounting Cycle 128

Work Sheet as a Tool 129

Benefits of a Work Sheet (Spreadsheet) 129 Use of a Work Sheet 129

Work Sheet Applications and Analysis 130

Closing Process 133

Temporary and Permanent Accounts 134

Recording Closing Entries 134

Post-Closing Trial Balance 137

Accounting Cycle 137

Classified Balance Sheet 138

Classification Structure 138

Classification Categories 139

Decision Analysis—Current Ratio 141

Appendix 4A Reversing Entries 143

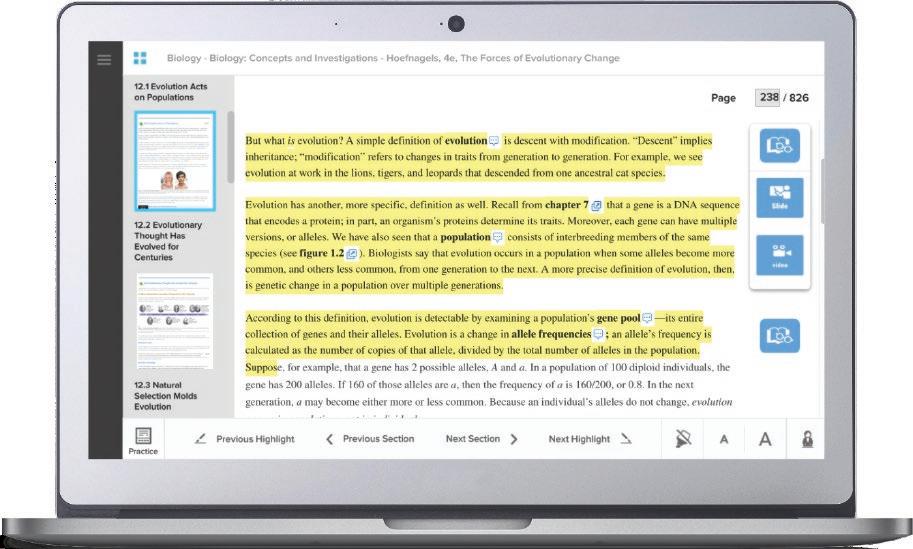

5 Accounting for Merchandising Operations 166

Merchandising Activities 167

Reporting Income for a Merchandiser 167

Reporting Inventory for a Merchandiser 168

Operating Cycle for a Merchandiser 168

Inventory Systems 168

Accounting for Merchandise Purchases 169

Purchases without Cash Discounts 169

Purchases with Cash Discounts 169

Purchases with Returns and Allowances 171

Purchases and Transportation Costs 172

Accounting for Merchandise Sales 174

Sales without Cash Discounts 174

Sales with Cash Discounts 175

Sales with Returns and Allowances 175

Adjusting and Closing for Merchandisers 177

Adjusting Entries for Merchandisers 177

Preparing Financial Statements 178

Closing Entries for Merchandisers 178

Summary of Merchandising Entries 179

More on Financial Statement Formats 177

Multiple-Step Income Statement 180

Single-Step Income Statement 181

Classified Balance Sheet 182

Decision Analysis—Acid-Test and Gross Margin Ratios 183

Appendix 5A Periodic Inventory System 187

Appendix 5B Adjusting Entries under New Revenue

Recognition Rules 191

Appendix 5C Net Method for Inventory 192

6 Inventories and Cost of Sales 214

Inventory Basics 215

Determining Inventory Items 215

Determining Inventory Costs 216

Internal Controls and Taking a Physical Count 216

Inventory Costing under a Perpetual System 217

Inventory Cost Flow Assumptions 217

Inventory Costing Illustration 218

Specific Identification 218

First-In, First-Out 219

Last-In, First-Out 219

Weighted Average 220

Financial Statement Effects of Costing Methods 221

Tax Effects of Costing Methods 222

Valuing Inventory at LCM and the Effects of Inventory Errors 224

Lower of Cost or Market 224

Financial Statement Effects of Inventory Errors 225

Decision Analysis—Inventory Turnover and Days’ Sales in Inventory 227

Appendix 6A Inventory Costing under a Periodic System 233

Appendix 6B Inventory Estimation Methods 238

7 Accounting Information Systems 258

System Principles 259

System Components 260

Special Journals and Subsidiary Ledgers 261

Basics of Special Journals 261

Subsidiary Ledgers 261

Sales Journal 263

Cash Receipts Journal 265

Purchases Journal 267

Cash Payments (Disbursements) Journal 268

General Journal Transactions 269

Technology-Based Accounting Systems 270

Technology in Accounting 270

Data Processing in Accounting 270

Computer Networks in Accounting 270

Enterprise Resource Planning Software 271

Data Analytics and Data Visualization 271

Cloud Computing 271

Decision Analysis—Days’ Payable Outstanding 271

8 Cash, Fraud, and Internal Control 290

Fraud and Internal Control 291

Purpose of Internal Control 291

Principles of Internal Control 292

Technology, Fraud, and Internal Control 293

Limitations of Internal Control 293

Control of Cash 294

Cash, Cash Equivalents, and Liquidity 294

Cash Management 295

Control of Cash Receipts 295

Control of Cash Payments 297

Banking Activities as Controls 301

Basic Bank Services 301

Bank Statement 302

Bank Reconciliation 303

Decision Analysis—Days’ Sales Uncollected 306

Appendix 8A Documentation and Verification 308

9 Accounting for Receivables 326

Valuing Accounts Receivable 327

Direct Write-Off Method 330

Allowance Method 331

Estimating Bad Debts 334

Percent of Sales Method 334

Percent of Receivables Method 334

Aging of Receivables Method 335

Notes Receivable 337

Computing Maturity and Interest 338

Recording Notes Receivable 339

Valuing and Settling Notes 339

Disposal of Receivables 341

Decision Analysis—Accounts Receivable Turnover 341

10 Plant Assets, Natural Resources, and Intangibles 358

SECTION 1—PLANT ASSETS 359

Cost Determination 360

Machinery and Equipment 360

Buildings 360

Land Improvements 360

Land 360

Lump-Sum Purchase 361

Depreciation 361

Factors in Computing Depreciation 361

Depreciation Methods 362

Partial-Year Depreciation 365

Change in Estimates 366

Reporting Depreciation 366

Additional Expenditures 367

Ordinary Repairs 368

Betterments and Extraordinary Repairs 368

Disposals of Plant Assets 368

Discarding Plant Assets 369

Selling Plant Assets 369

SECTION 2—NATURAL RESOURCES 371

Cost Determination and Depletion 371

Plant Assets Tied into Extracting 372

SECTION 3—INTANGIBLE ASSETS 373

Cost Determination and Amortization 373

Types of Intangibles 373

Decision Analysis—Total Asset Turnover 376

Appendix 10A Exchanging Plant Assets 379

11 Current Liabilities and Payroll

Accounting 396

Known Liabilities 397

Characteristics of Liabilities 397

Examples of Known Liabilities 398

Accounts Payable 399

Sales Taxes Payable 399

Unearned Revenues 399

Short-Term Notes Payable 399

Payroll Liabilities 402

Employee Payroll and Deductions 402

Employer Payroll Taxes 403

Internal Control of Payroll 404

Multi-Period Known Liabilities 404

Estimated Liabilities 405

Health and Pension Benefits 405

Vacation Benefits 406

Bonus Plans 406

Warranty Liabilities 406

Multi-Period Estimated Liabilities 407

Contingent Liabilities 408

Accounting for Contingent Liabilities 408

Applying Rules of Contingent Liabilities 409

Uncertainties That Are Not Contingencies 409

Decision Analysis—Times Interest Earned Ratio 409

Appendix 11A Payroll Reports, Records, and Procedures 412

Appendix 11B Corporate Income Taxes 417

12 Accounting for Partnerships 436

Partnership Formation 437

Characteristics of Partnerships 437

Organizations with Partnership Characteristics 438

Choosing a Business Form 438

Accounting for Partnership Formation 438

Dividing Partnership Income or Loss 439

Partnership Financial Statements 441

Partner Admission 442

Purchase of Partnership Interest 442

Investing Assets in a Partnership 443

Partner Withdrawal 444

No Bonus 444

Bonus to Remaining Partners 445

Bonus to Withdrawing Partner 445

Death of a Partner 445

Liquidation of a Partnership 446

No Capital Deficiency 446

Capital Deficiency 448

Decision Analysis—Partner Return on Equity 449

13 Accounting for Corporations 464

Corporate Form of Organization 465

Corporate Advantages 465

Corporate Disadvantages 465

Corporate Organization and Management 466

Corporate Stockholders 466

Corporate Stock 467

Common Stock 468

Issuing Par Value Stock 468

Issuing No-Par Value Stock 469

Issuing Stated Value Stock 469

Issuing Stock for Noncash Assets 469

Dividends 471

Cash Dividends 470

Stock Dividends 471

Stock Splits 473

Financial Statement Effects of Dividends and Splits 473

Preferred Stock 474

Issuance of Preferred Stock 474

Dividend Preference of Preferred Stock 475

Reasons for Issuing Preferred Stock 475

Treasury Stock 477

Purchasing Treasury Stock 477

Reissuing Treasury Stock 477

Reporting of Equity 479

Statement of Retained Earnings 479

Statement of Stockholders’ Equity 480

Decision Analysis—Earnings per Share, Price-Earnings Ratio, Dividend Yield, and Book Value per Share 480

14 Long-Term Liabilities 500

Basics of Bonds 501

Bond Financing 501

Bond Issuing 502

Bond Trading 502

Par Bonds 502

Discount Bonds 503

Bond Discount or Premium 503

Issuing Bonds at a Discount 504

Premium Bonds 506

Issuing Bonds at a Premium 506

Bond Retirement 508

Long-Term Notes Payable 510

Installment Notes 510

Mortgage Notes and Bonds 511

Decision Analysis—Debt Features and the Debt-to-Equity Ratio 512

Appendix 14A Bond Pricing 515

Appendix 14B Effective Interest Amortization 517

Appendix 14C Leases and Pensions 518

15 Investments 536

Basics of Investments 537

Purposes and Types of Investments 537

Classification and Reporting 538

Debt Investments 538

Debt Investments—Basics 538

Debt Investments—Trading 539

Debt Investments—Held-to-Maturity 540

Debt Investments—Available-for-Sale 541

Equity Investments 543

Equity Investments—Insignificant Influence, Under 20% 543

Equity Investments—Significant Influence, 20% to 50% 545

Equity Investments—Controlling Influence, More Than 50% 547

Accounting Summary for Debt and Equity Investments 548

Decision Analysis—Components of Return on Total Assets 549

16 Reporting the Statement of Cash Flows 568

Basics of Cash Flow Reporting 569

Purpose of the Statement of Cash Flows 569

Importance of Cash Flows 569

Measurement of Cash Flows 569

Classification of Cash Flows 570

Noncash Investing and Financing 571

Format of the Statement of Cash Flows 571

Preparing the Statement of Cash Flows 572

Cash Flows from Operating 573

Indirect and Direct Methods of Reporting 573

Applying the Indirect Method 573

Summary of Adjustments for Indirect Method 576

Cash Flows from Investing 577

Three-Step Analysis 577

Analyzing Noncurrent Assets 577

Cash Flows from Financing 579

Three-Step Analysis 579

Analyzing Noncurrent Liabilities 579

Analyzing Equity 580

Proving Cash Balances 580

Summary Using T-Accounts 582

Decision Analysis—Cash Flow Analysis 583

Appendix 16A Spreadsheet Preparation of the Statement of Cash Flows 586

Appendix 16B Direct Method of Reporting

Operating Cash Flows 588

17 Analysis of Financial Statements 612

Basics of Analysis 613

Purpose of Analysis 613

Building Blocks of Analysis 613

Information for Analysis 614

Standards for Comparisons 614

Tools of Analysis 614

Horizontal Analysis 614

Comparative Statements 614

Trend Analysis 617

Vertical Analysis 618

Common-Size Statements 618

Common-Size Graphics 620

Ratio Analysis 622

Liquidity and Efficiency 622

Solvency 624

Profitability 625

Market Prospects 626

Summary of Ratios 627

Decision Analysis—Analysis Reporting 628

Appendix 17A Sustainable Income 631

18 Managerial Accounting Concepts and Principles 650

Managerial Accounting Basics 651

Purpose of Managerial Accounting 651

Nature of Managerial Accounting 652

Fraud and Ethics in Managerial Accounting 653

Career Paths 654

Managerial Cost Concepts 655

Types of Cost Classifications 655

Identification of Cost Classifications 657

Cost Concepts for Service Companies 657

Managerial Reporting 658

Manufacturing Costs 658

Nonmanufacturing Costs 658

Prime and Conversion Costs 659

Costs and the Balance Sheet 659

Costs and the Income Statement 659

Cost Flows and Cost of Goods

Manufactured 662

Flow of Manufacturing Activities 662

Schedule of Cost of Goods Manufactured 663

Trends in Managerial Accounting 666

Decision Analysis—Raw Materials Inventory

Turnover and Days’ Sales in Raw Materials

Inventory 668

19 Job Order Costing 686

Job Order Costing 687

Cost Accounting System 687

Job Order Production 687

Job Order vs. Process Operations 688

Production Activities in Job Order Costing 688

Cost Flows 689

Job Cost Sheet 689

Materials and Labor Cost 690

Materials Cost Flows and Documents 690

Labor Cost Flows and Documents 693

Overhead Cost 694

Set Predetermined Overhead Rate 695

Apply Estimated Overhead 695

Record Actual Overhead 697

Summary of Cost Flows 698

Using Job Cost Sheets for Managerial Decisions 699

Schedule of Cost of Goods Manufactured 700

Adjusting Overhead 701

Factory Overhead Account 701

Adjust Underapplied or Overapplied Overhead 701

Job Order Costing of Services 702

Decision Analysis—Pricing for Services 703

20 Process Costing

726

Process Operations 727

Organization of Process Operations 727

Comparing Process and Job Order Costing Systems 728

Equivalent Units of Production 729

Process Costing Illustration 730

Overview of GenX Company’s Process Operation 730

Pre-Step: Collect Production and Cost Data 731

Step 1: Determine Physical Flow of Units 732

Step 2: Compute Equivalent Units of Production 732

Step 3: Compute Cost per Equivalent Unit 733

Step 4: Assign and Reconcile Costs 733

Process Cost Summary 735

Accounting for Process Costing 736

Accounting for Materials Costs 737

Accounting for Labor Costs 738

Accounting for Factory Overhead 739

Accounting for Transfers 740

Trends in Process Operations 742

Decision Analysis—Hybrid Costing System 743

Appendix 20A FIFO Method of Process Costing 747

21 Cost-Volume-Profit Analysis 772

Identifying Cost Behavior 773

Fixed Costs 774

Variable Costs 774

Graphing Fixed and Variable Costs against Volume 774

Mixed Costs 774

Step-wise Costs 775

Curvilinear Costs 776

Measuring Cost Behavior 777

Scatter Diagram 777

High-Low Method 778

Regression 778

Comparing Cost Estimation Methods 778

Contribution Margin and Break-Even Analysis 779

Contribution Margin and Its Measures 779

Break-Even Point 780

Cost-Volume-Profit Chart 782

Changes in Estimates 782

Applying Cost-Volume-Profit Analysis 783

Margin of Safety 783

Computing Income from Sales and Costs 784

Computing Sales for a Target Income 785

Evaluating Strategies 786

Sales Mix and Break-Even 787

Assumptions in Cost-Volume-Profit Analysis 789

Decision Analysis—Degree of Operating Leverage 790

Appendix 21A Using Excel for Cost Estimation 792

Appendix 21B Variable Costing and Performance

Reporting 793

Appendix 21C Preparing a CVP Chart 796

22 Master Budgets and Planning 814

Budget Process and Administration 815

Budgeting Process 815

Benefits of Budgeting 816

Budgeting and Human Behavior 816

Budget Reporting and Timing 817

Master Budget Components 817

Operating Budgets 818

Sales Budget 818

Production Budget 818

Direct Materials Budget 820

Direct Labor Budget 821

Factory Overhead Budget 822

Selling Expense Budget 823

General and Administrative Expense Budget 824

Investing and Financing Budgets 825

Capital Expenditures Budget 825

Cash Budget 825

Budgeted Financial Statements 829

Budgeted Income Statement 829

Budgeted Balance Sheet 830

Using the Master Budget 830

Budgeting for Service Companies 830

Decision Analysis—Activity-Based

Budgeting 831

Appendix 22A Merchandise Purchases Budget 839

23 Flexible Budgets and Standard Costs 864

Fixed and Flexible Budgets 865

Fixed Budget Reports 866

Budget Reports for Evaluation 867

Flexible Budget Reports 867

Standard Costing 871

Standard Costs 871

Setting Standard Costs 871

Cost Variance Analysis 872

Materials and Labor Variances 874

Materials Variances 874

Labor Variances 876

Overhead Standards and Variances 877

Flexible Overhead Budgets 877

Standard Overhead Rate 877

Computing Overhead Cost Variances 879

Standard Costing—Management Considerations 882

Decision Analysis—Sales Variances 883

Appendix 23A Expanded Overhead Variances and

Standard Cost Accounting System 888

24 Performance Measurement and Responsibility Accounting 912

Responsibility Accounting 913

Performance Evaluation 913

Controllable versus Uncontrollable Costs 914

Responsibility Accounting for Cost Centers 914

Profit Centers 916

Direct and Indirect Expenses 916

Expense Allocations 917

Departmental Income Statements 918

Departmental Contribution to Overhead 921

Investment Centers 922

Return-on-Investment and Residual Income 922

Investment Center Profit Margin and Investment Turnover 924

Nonfinancial Performance Evaluation Measures 925

Balanced Scorecard 925

Transfer Pricing 927

Decision Analysis—Cash Conversion Cycle 928

Appendix 24A Cost Allocations 931

Appendix 24B Transfer Pricing 933

Appendix 24C Joint Costs and Their Allocation 934

25 Relevant Costing for Managerial Decisions 956

Decisions and Information 957

Decision Making 957

Relevant Costs and Benefits 958

Production Decisions 958

Make or Buy 959

Sell or Process Further 960

Sales Mix Selection When Resources Are Constrained 961

Capacity Decisions 963

Segment Elimination 963

Keep or Replace Equipment 964

Pricing Decisions 965

Normal Pricing 965

Special Offers 967

Decision Analysis—Time and Materials Pricing 969

26 Capital Budgeting and Investment Analysis 990

Capital Budgeting 991

Capital Budgeting Process 991

Capital Investment Cash Flows 992

Methods Not Using Time Value of Money 992

Payback Period 992

Accounting Rate of Return 995

Methods Using Time Value of Money 996

Net Present Value 996

Internal Rate of Return 1000

Comparison of Capital Budgeting Methods 1002

Postaudit 1002

Decision Analysis—Break-Even Time 1004

Appendix 26A Using Excel to Compute Net Present Value and Internal Rate of Return 1006

Appendix A

Financial Statement Information A-1

Apple A-2

Google A-10

Samsung A-14

Appendix B Time Value of Money B

Appendix C Activity-Based Costing C

Appendix D Lean Principles and Accounting D-1

Index IND-1

Chart of Accounts CA

Brief Review Managerial Analyses and Reports BR-1

Financial Reports and Tables BR-2

Selected Transactions and Relations BR-3

Fundamentals and Analyses BR-4