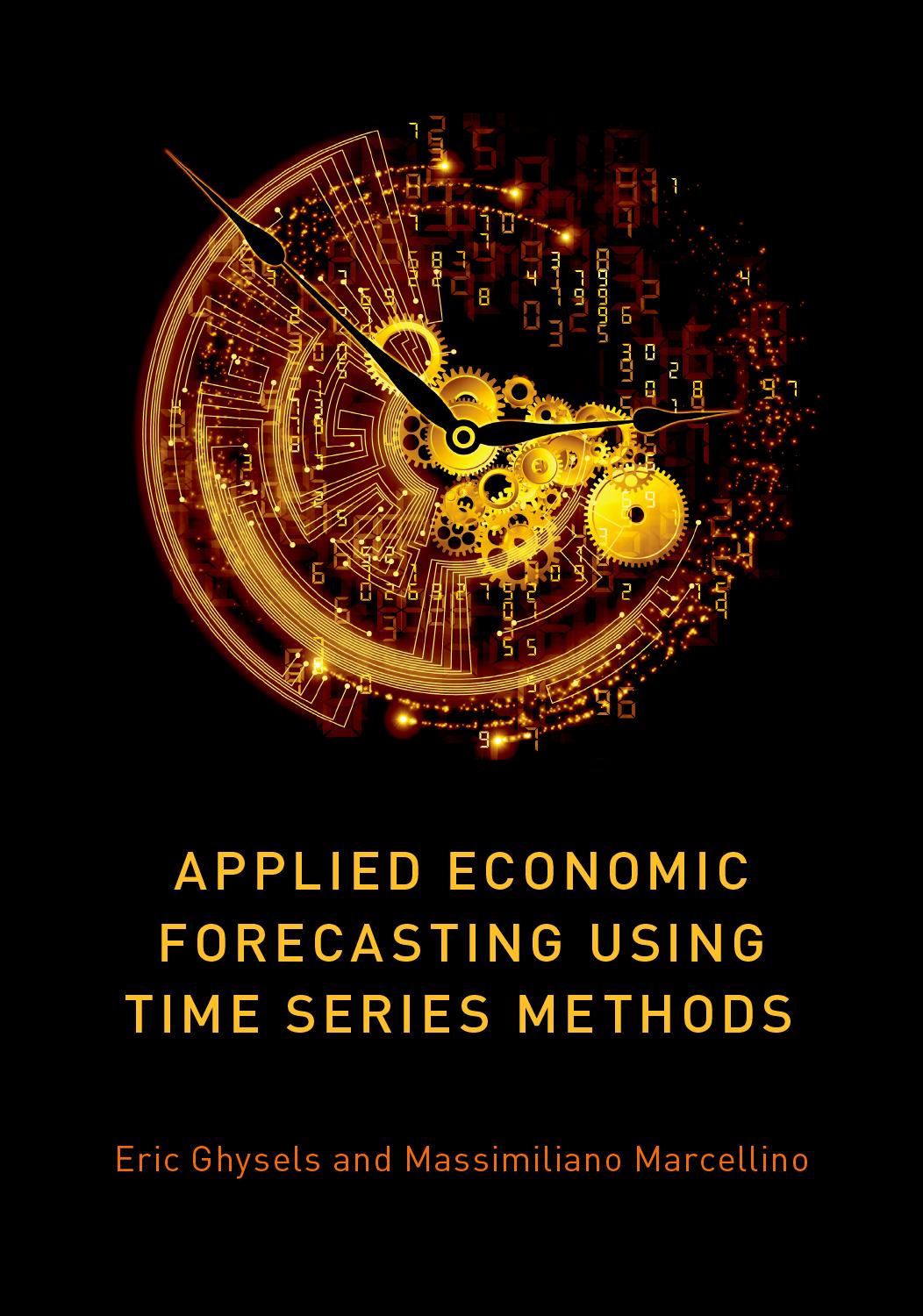

AppliedEconomicForecasting usingTimeSeriesMethods

AppliedEconomicForecastingusing TimeSeriesMethods

EricGhysels UniversityofNorthCarolina,ChapelHill,UnitedStates

MassimilianoMarcellino BocconiUniversity,Milan,Italy

OxfordUniversityPressisadepartmentoftheUniversityofOxford.Itfurthers theUniversity’sobjectiveofexcellenceinresearch,scholarship,andeducation bypublishingworldwide.OxfordisaregisteredtrademarkofOxfordUniversity PressintheUKandincertainothercountries.

PublishedintheUnitedStatesofAmericabyOxfordUniversityPress 198MadisonAvenue,NewYork,NY10016,UnitedStatesofAmerica.

c OxfordUniversityPress2018

Allrightsreserved.Nopartofthispublicationmaybereproduced,storedin aretrievalsystem,ortransmitted,inanyformorbyanymeans,withoutthe priorpermissioninwritingofOxfordUniversityPress,orasexpresslypermitted bylaw,bylicense,orundertermsagreedwiththeappropriatereproduction rightsorganization.Inquiriesconcerningreproductionoutsidethescopeofthe aboveshouldbesenttotheRightsDepartment,OxfordUniversityPress,atthe addressabove.

Youmustnotcirculatethisworkinanyotherform andyoumustimposethissameconditiononanyacquirer.

LibraryofCongressCataloging-in-PublicationData

Names:Ghysels,Eric,1956-author. | Marcellino,Massimiliano,author.

Title:Appliedeconomicforecastingusingtimeseriesmethods/EricGhysels andMassimilianoMarcellino.

Description:NewYork,NY:OxfordUniversityPress,[2018]

Identifiers:LCCN2017046487 | ISBN9780190622015(hardcover:alk.paper) | ISBN9780190622039(epub)

Subjects:LCSH:Economicforecasting–Mathematicalmodels. | Economic forecasting–Statisticalmethods.

Classification:LCCHB3730.G4592018 | DDC330.01/51955–dc23LCrecord availableathttps://lccn.loc.gov/2017046487

987654321

PrintedbySheridanBooks,Inc.,UnitedStatesofAmerica

2.4Sometestsforhomoskedasticityandnocorrelation......

5.3.1AC/PACbasedspecification...............

5.3.4Specificationwithinformationcriteria.........

5.6Diagnosticchecking.......................

5.7Forecasting,knownparameters.................

5.7.1Generalformula......................

5.7.2Someexamples......................

5.7.3Someadditionalcomments................

5.8Forecasting,estimatedparameters...............

5.9Multi-steps(ordirect)estimation................

5.10.1TheBeveridgeNelsondecomposition..........

5.12.1Deterministicseasonality.................

5.12.2Stochasticseasonality...................

5.13Exampleswithsimulateddata.................

5.13.1StationaryARMAprocesses...............

5.13.4Forecasting........................

5.14Empiricalexamples.......................

5.14.1ModelingandforecastingtheUSfederalfundsrate..

5.14.2ModelingandforecastingUSinventories........

5.15Concludingremarks.......................

6.8StructuralVARswithlong-runrestrictions........

6.9VARmodelswithsimulateddata................

6.10Empiricalexamples.......................

7.3Cointegrationanderrorcorrectionmodels...........

7.4EngleandGrangercointegrationtest..............

7.5Johansencointegrationtest...................

7.6MArepresentationsofcointegrated

7.7Forecastinginthepresenceof cointegration...........................

7.10.1TermstructureofUKinterestrates...........

7.10.2Compositecoincidentandleadingindexes.......

7.10.3Predictingcoincidentandleadingindicesintheperiod beforethecrisis......................

7.10.4Predictingcoincidentandleadingindices duringthefinancialcrisis.................

8.2.1Parametersasrandomvariables.............

8.2.2Frompriortoposteriordistribution...........

8.2.3Anexample:Theposteriorofthemeanwhenthe varianceisknown.....................

8.2.4TheBayesianlinearregressionmodel..........

8.3.1BaselineBVARspecification...............

8.4.1Thepropermethod....................

8.4.2Thepseudo-iteratedapproach..............

8.4.3Thedirectforecastingapproach.............

8.5Examplewithsimulateddata..................

8.6.1GDPgrowthintheEuroarea..............

9.8.4Two-stepsaheadforecasting...............

9.9Example:Forecastingindustrial

11.3.1ThekeyequationsoftheKalmanfilter.........

12.3.3Slopeornoslope?.....................

12.3.4U-MIDASandMIDASwithstepfunctions......

12.3.5ExtensionsoftheMIDASregressionmodel.......

12.4Mixed-frequencyVAR......................

12.4.1Parameter-drivenapproach................

12.4.2Observation-drivenapproach...............

12.5Example:Nowcastingwithsimulateddata...........

12.5.1Thebridgeequationapproach..............

12.5.2TheMIDASregressionapproach............

12.6Example:NowcastingUSGDPgrowth.............

12.6.1Predictingtheworsttroughofthecrisis........

12.6.2Predictingmildpositiveandnegativegrowthrates..

12.6.3PredictingGDPgrowthrates,2007-2012........

12.7Concludingremarks.......................

13ModelsforLargeDatasets

13.4.1Mixed-frequencyfactormodels..............

13.4.2Mixed-frequencythreepassregressionfilter.......

13.4.3Missingobservationsandraggededges.........

13.5Examplewithsimulateddata..................

13.6Empiricalexample:ForecastingGDPgrowth.........

13.7Concludingremarks.......................

14ForecastingVolatility

14.3MIDASregressionsandvolatilityforecasting.........

14.3.1Realizedvolatility.....................

14.3.2RealizedvolatilityandMIDASregressions.......

14.3.3HARmodels........................

14.3.4Directversusiteratedvolatilityforecasting.......

14.3.5VariationsonthethemeofMIDASregressions.....

Preface

Economicforecastingisakeyingredientofdecisionmakingbothinthepublicandintheprivatesector.Governmentsandcentralbanks,consumersand firms,banksandfinancialinstitutionsbasemanyoftheirdecisionsonfuture expectedeconomicconditionsoronthepredictionsofspecificindicatorsof interestsuchasincomegrowth,inflation,unemployment,interestrates,exchangerates,earnings,wages,oilprices,andsoon.Unfortunately,economic outcomesaretherealizationofavast,complex,dynamicandstochastic system,whichmakesforecastingverydifficultandforecasterrorsunavoidable.However,forecastprecisionandreliabilitycanbeenhancedbytheuse ofpropereconometricmodelsandmethods,likethosewepresentinthis book.

Wewishtosatisfyanaudienceincludingbothundergraduateandgraduatestudentswillingtolearnbasicandadvancedforecastingtechniques,and researchersinpublicandprivateinstitutionsinterestedinappliedeconomic forecasting.Forthisreason,thebookisdividedintofourparts.InPartI,the firstchapterprovidesabriefreviewofbasicregressionanalysis,followedby twochaptersdealingwithspecificregressiontopicsrelevantforforecasting, suchasmodelmis-specification,includingstructuralbreaks,anddynamic modelsandtheirpredictiveproperties.Thefourthchapter,onthetopic offorecastevaluationandcombination,isthefirstexclusivelydedicatedto forecasting.ThematerialinPartIcouldbeusedinthesenioryearofan undergraduateprogramforstudentswhohaveastronginterestinapplied econometrics,orasanintroductiontoeconomicforecastingforgraduatestudentsandresearchersfromotherdisciplines.

PartIIofthebookisdevotedtotimeseriesmodels,inparticularunivariateautoregressiveintegratedmovingaverage(ARIMA)modelsandvector autoregressive(VAR)models.Specifically,Chapter5dealswithARIMA models,Chapter6withVARmodels,Chapter7withcointegrationander-

rorcorrection(ECM)models,andChapter8withBayesianmethodsfor VARanalysis.Thematerialprogressivelybecomesbettersuitedformaster leveland/orPhDlevelclasses,inparticularthechaptersoncointegration andBayesianVARs.ModelsconsideredinPartIIarealsocommontoolsfor practicalforecastinginpublicandprivateinstitutions.

PartsIIIandIVofthebookcontainacollectionofspecialtopicschapters. Eachchapterisself-contained,andthereforeaninstructororresearchercan pickandchoosethetopicssheorhewantstocover.PartIIIdealsmainly withmodelingparametertime-variation.Specifically,Chapter9presents ThresholdandSmoothTransitionAutoregressive(TARandSTAR)models, Chapter10Markovswitchingregimemodels,andChapter11statespace modelsandtheKalmanfilter,introducing,forexample,modelswithrandom coefficientsanddynamicfactormodels.

PartIVdealswithmixedfrequencydatamodelsandtheirusefornowcastinginChapter12,forecastingusinglargedatasetsinChapter13and, finally,volatilitymodelsinChapter14.

Eachchapterstartswithareviewofthemaintheoreticalresultstopreparethereaderforthevariousapplications.Examplesinvolvingsimulated datafollow,tomakethereaderfamiliarwithapplicationusingatfirststylizedsettingswhereoneknowsthetruedatageneratingprocessandone learnshowtoapplythetechniquesintroducedineachchapter.Fromour ownteachingexperiencewefindthistobeextremelyusefulasitcreates familiaritywitheachofthetopicsinacontrolledenvironment.Thesimulatedexamplesarefollowedbyrealdataapplications-focusingonmacroeconomicandfinancialtopics.Someoftheexamplesrunacrossdifferent chapters,particularlyintheearlypartofthebook.Alldataarepublic domainandcoverEuroarea,UK,andUSexamples,includingforecasting USGDPgrowth,defaultrisk,inventories,effectivefederalfundsrates,compositeindexofleadingindicators,industrialproduction,EuroareaGDP growth,UKtermstructureofinterestrates,tomentionthemostprominent examples.

Thebookismostlysoftwareneutral.However,foralmostallthesimulatedandempiricalexamplesweprovidecompanion EViews R and R code. Theformerismostly-butnotexclusively-amenudrivenlicensedsoftware packagewhereasthelatterisanopensourceprogramminglanguageandsoftwareenvironmentforstatisticalcomputingandgraphicssupportedbythe

R FoundationforStatisticalComputing.1.Weprovidecodeanddataforall thesimulatedandempiricalexamplesinthebookontheweb.2 Moreover,all thetablesandfiguresappearinginthebookwereproducedusing EViews R

Asthetitlesuggests,thisbookisan applied timeseriesforecastingbook. Hence,wedonothavethepretensetoprovidethefulltheoreticalfoundationsfortheforecastingmethodswepresent.Indeed,therearealreadya numberofbookswiththoroughcoverageoftheory.ThemostrecentexampleistheexcellentbookbyElliottandTimmermann(2016)whichprovides anin-depthanalysisofthestatisticaltheoryunderlyingpredictivemodels, coveringavarietyofalternativeforecastingmethodsinbothclassicaland Bayesiancontexts,aswellastechniquesforforecastevaluation,comparison, andcombination.Equallyusefulandcomplimentaryarethemanystandard econometricstextbookssuchasHendry(1995),Judge,Hill,Griffiths,L¨utkepohl,andLee(1988),StockandWatson(2009),Wooldridge(2012),and themanygraduatetimeseriestextbookssuchasBoxandJenkins(1976), ClementsandHendry(1998),Diebold(2008),Hamilton(1994),orL¨utkepohl (2007),amongothers.

Weshouldalsohighlightthatthisbookisanapplied timeseries forecastingbook.Assuch,wewillnotdiscussforecastingusingeconomictheorybasedstructuralmodels,suchasDynamicStochasticGeneralEquilibrium (DSGE)models,see,e.g.,DelNegroandSchorfheide(2013)foranexhaustiveoverviewandreferences.Typically,thesestructuralmodelsarebetter suitedformedium-andlong-horizonforecasting,andforpolicysimulations, whiletimeseriesmethodsworkbetterfornowcastingandshort-termforecasting(say,uptoone-yearahead).

Thisbookwouldnothavebeencompletedwithouttheinvaluableand skillfulhelpofanumberofourcurrentandformerTAsandRAs.Special thanksgotoCristinaAngelico,FrancescoCorsello,FrancescoGiovanardi, NovellaMaugeri,andNazire ¨ Ozkanwhohelpedwithallthesimulationand empiricalexamplesthroughouttheentirebook,aswellasHanweiLiuwho wrotethe R codes.Theircontributionstothebookwereinvaluable.We wouldalsoliketothankmanycohortsofundergraduate,master,andPhD

1Pleasevisitthewebpagehttp://www.eviews.comforfurtherinformationon EViews R and R programminglanguageWikipediawebpagehttps://en.wikipedia.org/wiki/R (programming language).

2Pleasevisitourrespectivewebpageswww.unc.edu/∼eghyselsorwww.igier.unibocconi. it/marcellinotodownloadthecodeanddata.

studentswhotookcoursesbasedonthematerialscoveredinthebookat BocconiUniversityandattheUniversityofNorthCarolina,ChapelHilland theKenan-FlaglerBusinessSchool.

Wearealsogratefultoanumberofcoauthorsofpapersonthetopics coveredinthebook.Inparticular,EricGhyselswouldliketothankLucia Alessi,ElenaAndreou,JennieBai,FabioCanova,XilongChen,Riccardo Colacito,RobertEngle,ClaudiaForoni,LarsForsberg,PatrickGagliardini, Ren´eGarcia,CliveGranger,AndrewHarvey,JonathanHill,CasidheHoran, LyndaKhalaf,AndrosKourtellos,VirmantasKvedaras,EmanuelMoench, KaijiMotegi,DeniseOsborn,AlbertoPlazzi,EricRenault,MircoRubin, AntonioRubia,PedroSanta-Clara,PierreSiklos,ArthurSinko,Bumjean Sohn,RossValkanov,Cosm´eVodounou,FangfangWang,JonathanWright, andVaidotasZemlys(andMassimilianoofcourse!).MassimilianoMarcellino wouldliketothankKnut-AreAastveit,AngelaAbbate,ElenaAngelini,Mike Artis,AnindyaBanerjee,GuenterBeck,SteliosBekiros,RalfBurggemann, AndreaCarriero,RobertoCasarin,ToddClark,FrancescoCorielli,Sandra Eickmeier,CarloFavero,LaurentFerrara,ClaudiaForoni,GiampieroGallo, AnaGalv˜ao,PierreGu´erin,JeromeHenry,ChristianHepenstrick,Kristin Hubrich,OscarJorda,GeorgeKapetanios,MalteKn¨uppel,Hans-Martin Krolzig,DaniloLeiva-Leon,WolfgangLemke,HelmutL¨utkepohl,IgorMasten,GianLuigiMazzi,GrayhamMizon,MatteoMogliani,AlbertoMusso, ChiaraOsbat,FotisPapailias,MarioPorqueddu,EstebanPrieto,Tommaso Proietti,FrancescoRavazzolo,ChristianSchumacher,DaliborStevanovic, JimStock,FabrizioVenditti,andMarkWatson(andEricofcourse!).

Severalcolleaguesprovidedusefulcommentsonthebook,inparticular FrankDiebold,HelmutL¨utkepohl,SerenaNg,SimonPrice,FrankSchorfheide, andAllanTimmermann.Ofcourse,weremainresponsibleforanyremaining mistakesoromissions.

Finally,wewouldliketothankourfamiliesfortheircontinuoussupport andunderstanding.Weforecastaquieterandmorerelaxed“Lifeafterthe Book,”butasallforecasters,wecouldbeprovenwrong.

EricGhysels,ChapelHill,UnitedStates MassimilianoMarcellino,Milan,Italy

PartI

ForecastingwiththeLinear RegressionModel

Chapter1 TheBaselineLinearRegression Model

1.1Introduction

Themostcommonmodelinappliedeconometricsisthelinearregression model.Italsoprovidesthebasisformoresophisticatedspecifications,such asthosethatwewillconsiderinthefollowingchapters.Henceitisuseful tostartwithashortoverviewaboutthespecification,estimation,diagnosticcheckingandforecastinginthecontextofthelinearregressionmodel. Moredetailedpresentationscanbefound,forexample,inHendry(1995), Judge,Hill,Griffiths,L¨utkepohl,andLee(1988),Marcellino(2016),Stock andWatson(2009),Wooldridge(2012),amongothers.

Thechapterisstructuredasfollows.InSection1.2weintroducethe basicspecificationandassumptions.InSection1.3wediscussparameter estimation.InSection1.4weconsidermeasuresofmodelfit.InSections 1.5and1.6wederive,respectively,optimalpointanddensityforecasts.In Section1.7wedealwithparametertestingandinSections1.8and1.9with variableselection.InSection1.10weevaluatetheeffectsofmulticollinearity. InSections1.11and1.12wepresentexamplesbasedon,respectively,simulatedandactualdata.Section1.13exploressomefeaturesoftimelagsin thecontextofforecastingwiththebaselinelinearregressionmodel.Section 1.14concludesthechapter.

1.2Thebasicspecification

Weareinterestedinassessingtheexplanatorypowerofasetof k variables, groupedinto X, forthevariable y. Forexample,wemaywanttostudywhat explainsthebehavioroftheshortterminterestrateorofinflationforagiven country.Fortheformervariable,candidateregressorstobeincludedin X aremeasuresoftheoutputgapandofinflationarypressures,sincethese arethetypicaldriversofthedecisionsofcentralbanks,whosepolicyrate isinturnakeydeterminantoftheshortterminterestrate.Forinflation, wemaywanttoconsidercostpushfactors,suchasunitlaborcostsand thepricesofintermediateinputsandenergy,thoughinflationexpectations canalsomatteriftheyaffectthewagebargainingprocessandtheprice determinationmechanism.

Fromastatisticalpointofview,boththeelementsof X and y arestochasticprocesses,namely,collectionsofrandomvariables,forwhichwehavea setofrealizations, Xt and yt,t =1,...,T. Continuingthepreviousexample, wecancollectdataoninflationandtheshortterminterestrateoveragiven temporalperiod,forexample1970to2012,atagivenfrequency t, e.g.,each monthoreachquarter,oreveneachday,orevenperhapseachminutefor theinterestrate.Inthefollowingwewillnotexplicitlydistinguishbetween arandomvariableanditsrealization,unlessnecessaryforclarity.Notealso thatsomeofthevariablesin X canbedeterministic,forexample X can includeaninterceptoralineartrend.

Ifweassumethattheexplanatoryvariables X havealinearimpacton thedependentvariable y, wecanwritethemodelasfollows:

t =1,...,T. Moreover, βi isaparameterrelatedtotheexplanatorypower of Xit,i =1,...,k. Moreprecisely,asthemodelin(8.2.4)implies E[yt|X1t, X2t,...,Xkt]= X1tβ1 + X2tβ2 + ...Xktβk,βi measuresthechangein theexpectedvalueof yt whenthereisamarginalchangein Xit, andthe other Xsarekeptconstant.Finally, εt isanerrortermcapturingthepart of yt thatisnotexplainedbythevariablesin Xt. Formally,itis εt = ytE[yt|X1t,X2t,...,Xkt].

Ifwegroup yt and εt,t =1,...,T, intothe T × 1vectors y and ε respectively, β1,...,βk intothe k × 1vector β, and X1t,...,Xkt,t =1,...,

T, intothe T × k matrix X, wecanrewritethelinearregressionmodelas

Wemakeafewadditionalassumptionsonthemodelin(1.2.2),mostof whichwillberelaxedlateron:

Assumption1.2.1 (LinearRegressionAssumptions). Thelinearregression modeldefinedinequation(1.2.2)satisfiesthefollowingassumptions:

LR1 E(ε)=0,

LR2 E(εε )= σ2IT ,

LR3 X isdistributedindependentlyof ε,

LR4 X X isnonsingular,

LR5 X isweaklystationary.

TheassumptionsLR1throughLR5aretypicallyknownas“weakassumptions.”Thefirstassumptionsaysthattheexpectedvalueoftheerror termshouldbeequaltozero,namely,onaveragethemodelshouldprovidea correctexplanationfor y, whichisabasicingredientofareasonablemodel. Assumption1.2.1-LR2statesthatthematrixofsecondmomentsoftheerrors(whichisalsoequaltotheirvariancecovariancematrixgivenAssumption 1.2.1-LR1)isdiagonal.Thisimpliesthatthevarianceoftheerrortermis stableovertime(homoskedasticity),andthattheerrorsareuncorrelatedover time(nocorrelation).Therequirementthat X isdistributedindependently of ε, inAssumption1.2.1-LR3,isneededtoguaranteegoodpropertiesfor thesimplestparameterestimator,aswewillseeinthenextsection.Assumption1.2.1-LR4istypicallyreferredtoaslackofperfectmulticollinearity, anditisconcernedwithregressorredundancyandtheidentifiabilityofall the β parameters.Actually,considerthecasewhere k =2and X1 = X2 Thematrix X X inthiscasehasdimensions2 × 2, butitsrankisequalto one,anditcanbeeasilyshownthatwecanonlyidentify(namely,recover fromtheavailableinformation) β1 + β2 butnotboth β1 and β2 separately. Assumption1.2.1-LR5isinsteadconcernedwiththeamountoftemporal persistenceintheexplanatoryvariables,andbasicallyrequiresthatifeach elementof X isaffectedbyashock,theresultingeffectsonthatelement

(andon y)arenotpermanent.Amoreprecisedefinitionofweakstationarity willbegiveninChapter5,andatreatmentofthelinearmodelwithoutthis assumptioninChapter7.

Toconclude,itisworthhighlightingthreeadditionalimplicitassumptions onthemodelin(1.2.2).First,alltherelevantexplanatoryvariablesare includedinthemodel(therearenoomittedvariablesandnoredundant variables).Second,linearity,whichmeansthatthemodelislinearinthe parameters β. Hence,amodelwith x2 1t asanexplanatoryvariableremains linear,whileamodelwhere y dependson xβ it isnolongerlinear.Finally, stabilityofthe β parametersovertime,namelytherelationshipbetween y and X doesnotchangeoverthesampleunderanalysis.Thisisanimportant assumptionwhichwillbediscussedatlengthlater.

1.3Parameterestimation

Themodelin(1.2.2)canstillnotbeusedforforecastingsincewedonotknow thevaluesoftheparametersin β (and σ2).Toaddressthisissue,weneed todefineanestimatorfortheparameters,namely,afunctionoftherandom variables X and y thatisinformativeaboutthetrue β (and σ2).Substituting therandomvariables X and y intheexpressionfortheestimatorswiththeir realizations,wewillthenobtainanestimatefor β (and σ2). Severalestimatorsfortheparametersofthelinearregressionmodelare feasiblebut,ifweassumeforthemomentthat X isdeterministic,fromthe GaussMarkovtheorem,weknowthatthebestlinearunbiasedestimator (BLUE)for β is

Thisistheso-calledordinaryleastsquares(OLS)estimator,whichcanbe derivedastheminimizerwithrespectto β of

Xtβ)2 , where Xt isa1 × kvectorcontaining

TheOLSestimatorisunbiasedbecause

whichmeansthatifwecoulddrawaverylargenumberofsamplesfrom y, eachofdimension T, andforeachsample j wecomputed ˆ βj usingthe formulain(1.3.1),theaverageacrossthemanysamplesof ˆ βj wouldbeequal to β. TheOLSestimator ˆ β isthebestlinearunbiasedestimatorsinceitis

themostpreciseintheclassofthelinearunbiasedestimatorsfor β. Inother words, ˆ β hasminimalvarianceintheclassofestimatorsthatareobtained asalinearcombinationofthe y1,...,yT Minimumvariance,moreformally, meansthatthedifferencebetweenthevariancecovariancematrixof ˆ βj and thatofanotherlinearunbiasedestimatorisnegativedefinite.Thisisa convenientpropertysinceitimpliesthatweareusingoptimallytheavailable information,inthesenseofobtainingthemostpreciseestimatorforthe parameters β. Specifically,itis

( ˆ β)= σ 2(X X) 1 ,

wherethe k elementsonthemaindiagonalofthis k × k matrixcontain var( ˆ βj ),j =1,...,k, andtheoff-diagonalelementsreportthecovariances amongtheelementsof ˆ β. Notethatwecanrewrite var( ˆ β)as

Whileestimatorsarerandomvariables,estimatesarejustnumbers,andsince ingeneral X X/T convergestoamatrixwhen T divergeswhile σ2/T goesto zero,itis lim T →∞ Var( ˆ β)=0

Thisfinding,combinedwiththeunbiasednessof ˆ β, impliedthattheOLS estimatorisconsistentfor β, meaningthatwhenthesizeofthesamplesize T getsverylarge ˆ β getsveryclosetothetruevalue β (moreformally, ˆ β convergesinprobabilityto β).

Letusnowuse ˆ β toconstructtheresiduals

andcollectˆ εt,t =1,...,T, intothe T × 1vectorˆε. Theresidualsarerelated totheerrorsbutdifferent.Specifically,theyare:

ˆ ε =(I X(X X) 1X )ε.

Wecanusetheresidualstoconstructanestimatorforthevarianceofthe errors σ2 as