SUMMARY AND HIGHLIGHTS:

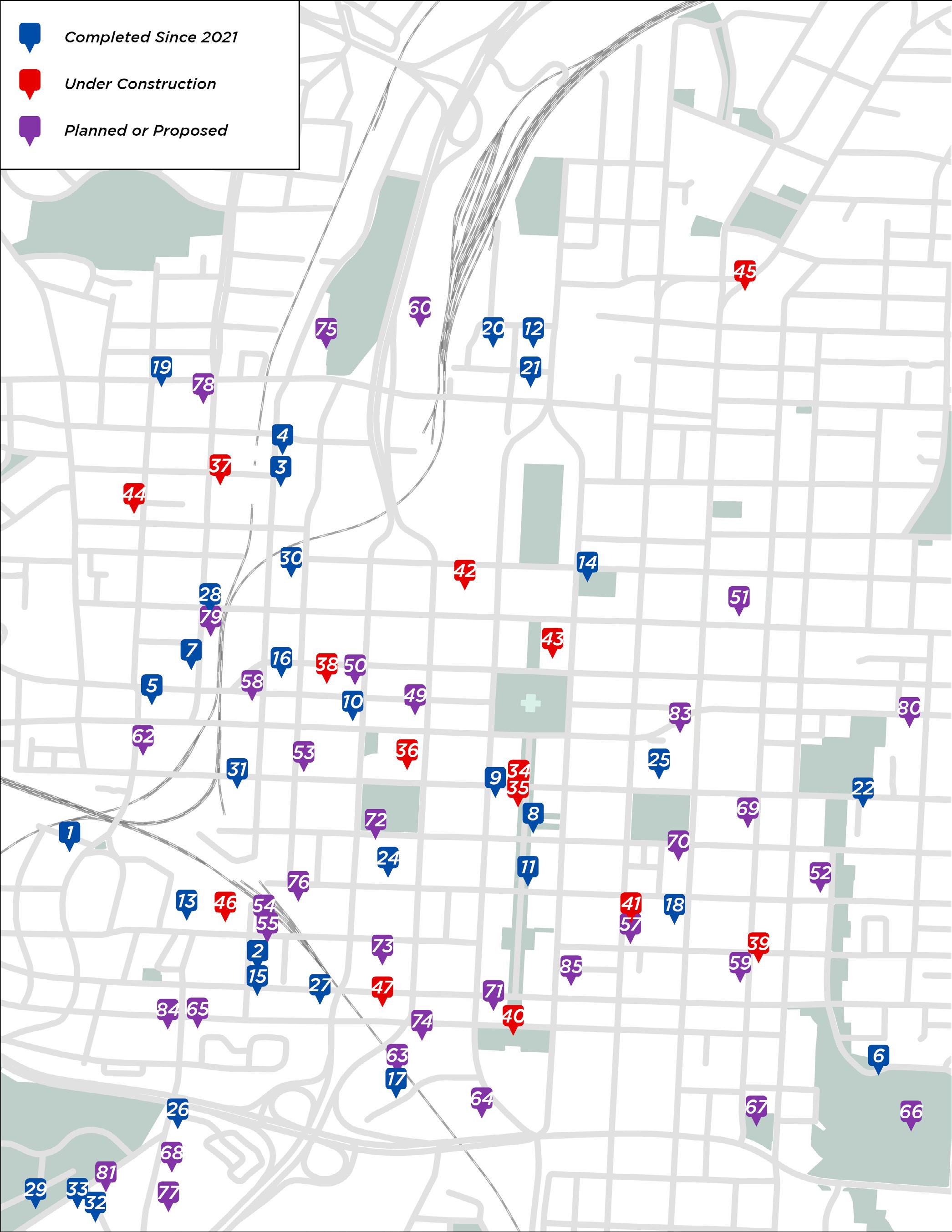

There are 14 developments under construction that will collectively deliver 611 residential units, 342 hotel rooms, and 56,500 square feet of storefront space upon completion.1 An additional 38 projects are currently in planning or have been proposed and, if completed, would deliver 6,342 residential units, 368,392 square feet of office space, 1,454 hotel rooms, and 256,124 square feet of retail.1

In 2025, Downtown Raleigh delivered 1,493 residential units across five projects, the highest total of any year on record 1 This includes the recent completion of The Ray at The Weld, which added 392 apartment units.1 Downtown Raleigh’s stabilized apartment occupancy rate is 90.3%, excluding recently completed developments.2

Downtown Raleigh recorded +149,815 square feet of net office absorption in 2025, including +17,156 square feet in Q4.3 Class A direct occupancy ended the year at 86.6%.3 Smith Anderson, the Triangle’s largest law firm, expanded its footprint at 150 Fayetteville to more than 112,000 square feet.2

14 Q4 2025 PROJECTS UNDER CONSTRUCTION1

1,493 RESIDENTIAL UNITS DELIVERED1 2025

+149,815 SF CLASS A OFFICE NET ABSORPTION3 2025

1DRA 2CoStar 3JLL

*Stabilized occupancy does not include recently completed projects

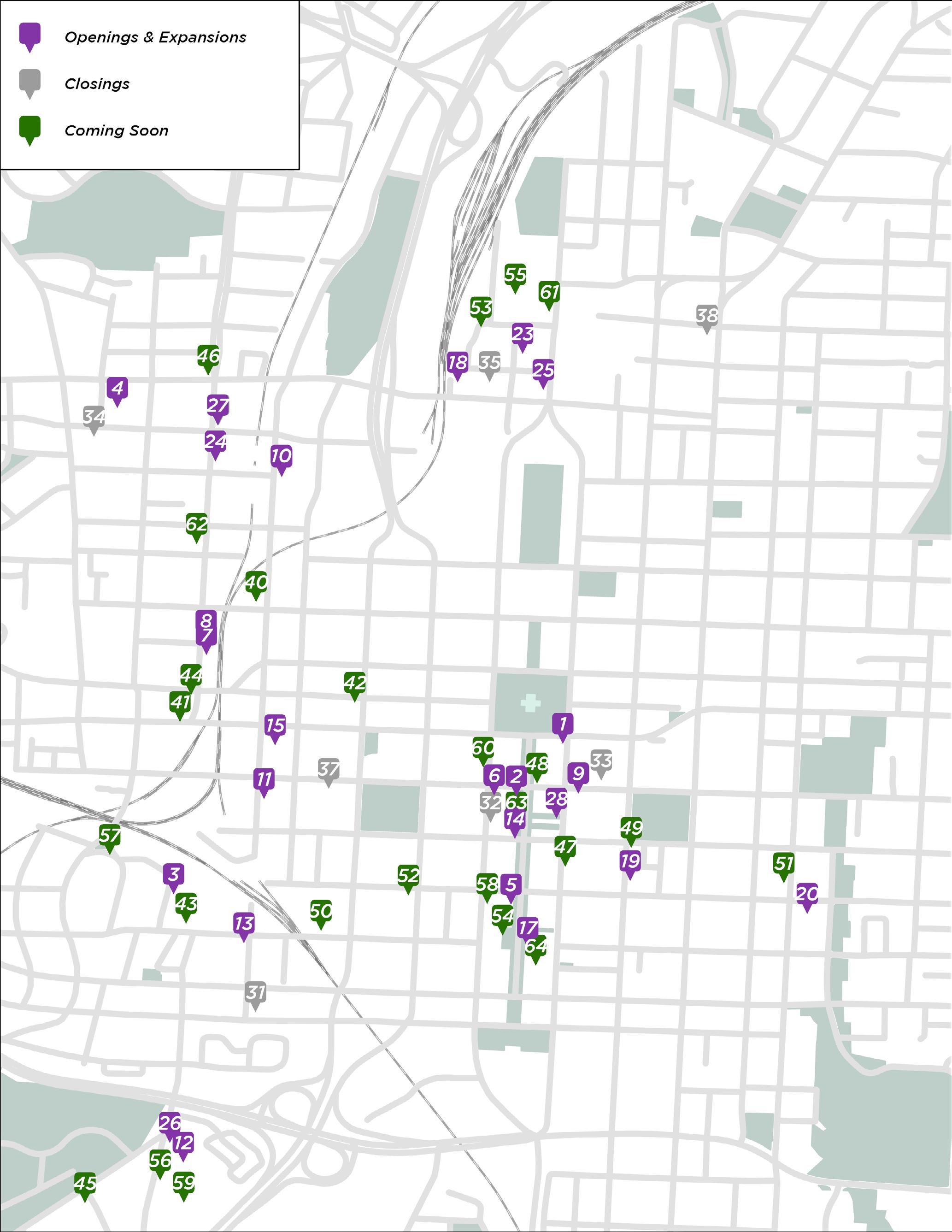

There were 25 storefront business openings and nine closures in Q4, resulting in a net gain of +16 storefront businesses 1 In 2025, Downtown Raleigh recorded 88 storefront business openings and 47 closures, resulting in a net gain of +41 businesses 1 An additional 25 storefront businesses are currently announced as coming soon in Downtown Raleigh.1

Estimated food and beverage revenue in Downtown Raleigh increased +0.2% year to date through November compared with the same period last year.2 Downtown Raleigh visitor visits increased +5.2% year over year in 2025, with Glenwood South recording the highest increase at +9.0%.3

Estimated average monthly hotel room revenue between October and November increased +6.2% year over year, while Downtown Raleigh welcomed more than 2.1 million unique visitors in Q4. 2,3

Construction continues on the former Holiday Inn’s conversion into a 204-room Hotel Indigo, and plans have been filed for a 13-story, 180-room hotel with a 2,500 square foot restaurant on the adjacent site.

Bloc[83], a 492,000 square foot two-building mixed-use development in downtown sold for $210.5 million 4 Delivered between 2019 and 2021, the property is 97% leased and includes approximately 27,000 square feet of ground floor retail and amenity space. Four properties at the corner of Wilmington Street and East Hargett Street were sold for $2.7 million.4

+17,156 SF

Class A Office Total Net Absorption Q4 20255

Total Visits To Downtown Raleigh 2025 Year Over Year3 INCREASE

+0.2%

Increase in Food and Beverage Sales Through November 2025 Year Over Year2 +41 Storefront Businesses 20251 NET GAIN +6.2% INCREASE

Average Monthly Hotel Room Sales Revenue From Q4 20252

1DRA

2Wake County

3Placer.ai

4CoStar

5JLL +5.2%

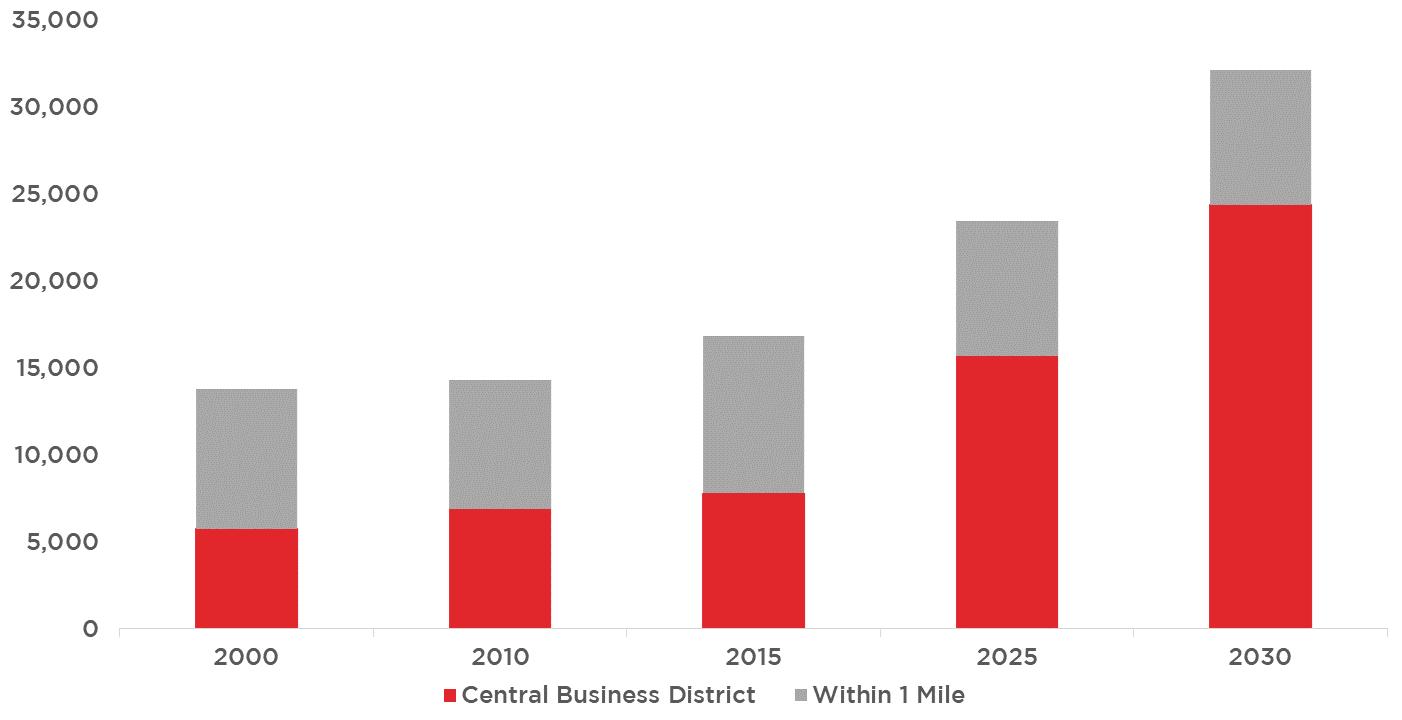

Overall, there is $8.3 billion of investment in the current Downtown Raleigh development pipeline.1 This includes an estimated $3.5 billion in projects completed since 2015, $1.2 billion in projects under construction, and $3.6 billion in proposed or planned developments.1

$3.5 Completed (since 2015) BILLION $1.2 Under Construction as of Q4 BILLION $3.6 Proposed/Planned Developments BILLION $8.3 Completed since 2015, Under Construction, and Planned Developments BILLION

Ray, the second of two towers in phase one of the Weld, has delivered 392 apartment units in Downtown Raleigh. The residential tower is located directly adjacent to the 308-acre Dorothea Dix Park and features a rooftop amenity space with a pool, grills, cabanas, and outdoor lounge.

Lichtin Plaza, located in front of the Martin Marietta Center for the Performing Arts, is undergoing a transformation. Planned improvements include a dedicated drop off lane, new wheelchair accessible ramps, expanded greenspace, and flexible public space designed to support events, circulation, and everyday use.

Recently filed plans indicate a second hotel is proposed on the site adjacent to the former Holiday Inn. The proposed 13-story hotel at 300 Hillsborough Street would include 180 rooms and a 2,500 square foot restaurant, while construction continues on the conversion of the former Holiday Inn into a 204-room Hotel Indigo.

An interactive development map with updated listings of project information and images is viewable at downtownraleigh.org/ do-business/ developments

2

3

1

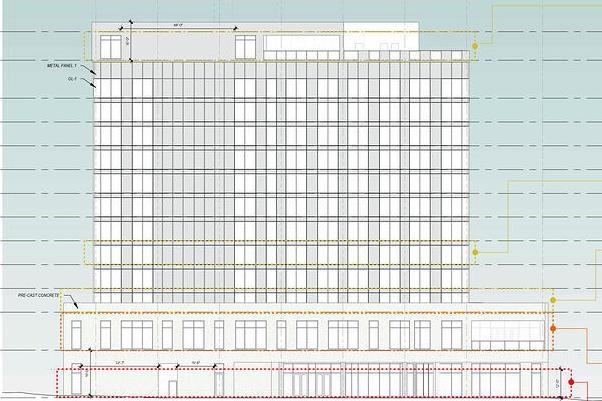

Downtown Raleigh recorded +149,815 square feet of net office absorption in 2025, including +17,156 square feet in Q4.1 Class A direct occupancy ended the year at 86.6%.1 Downtown Raleigh saw several large notable leases in 2025 including BuildOps leasing 24,292 square feet at The Creamery and RapidScale leasing 27,000 square feet at Tower Two in Bloc[83].4 Smith Anderson, the Triangle’s largest law firm by headcount, expanded its footprint at 150 Fayetteville to more than 112,000 square feet.4 Bloc[83], a 492,000 square foot mixed use two-tower development, sold for $210.5 million.5

PERFORMANCE INDICATOR:

OFFICE MARKET

Class A Office Average Rent PSF1

Class A Office Net Absorption1 $40.69

+17,156 SF

6,424,512 SF Total Office Inventory2 86.6% Class A Office Occupancy Rate1

Class A Delivered Since 20203 Q4 2025

898,412 SF

1JLL 2CBRE 3DRA

4Triangle Business Journal 5CoStar

+149,815 SF

CLASS A OFFICE NET ABSORPTION IN 2025¹

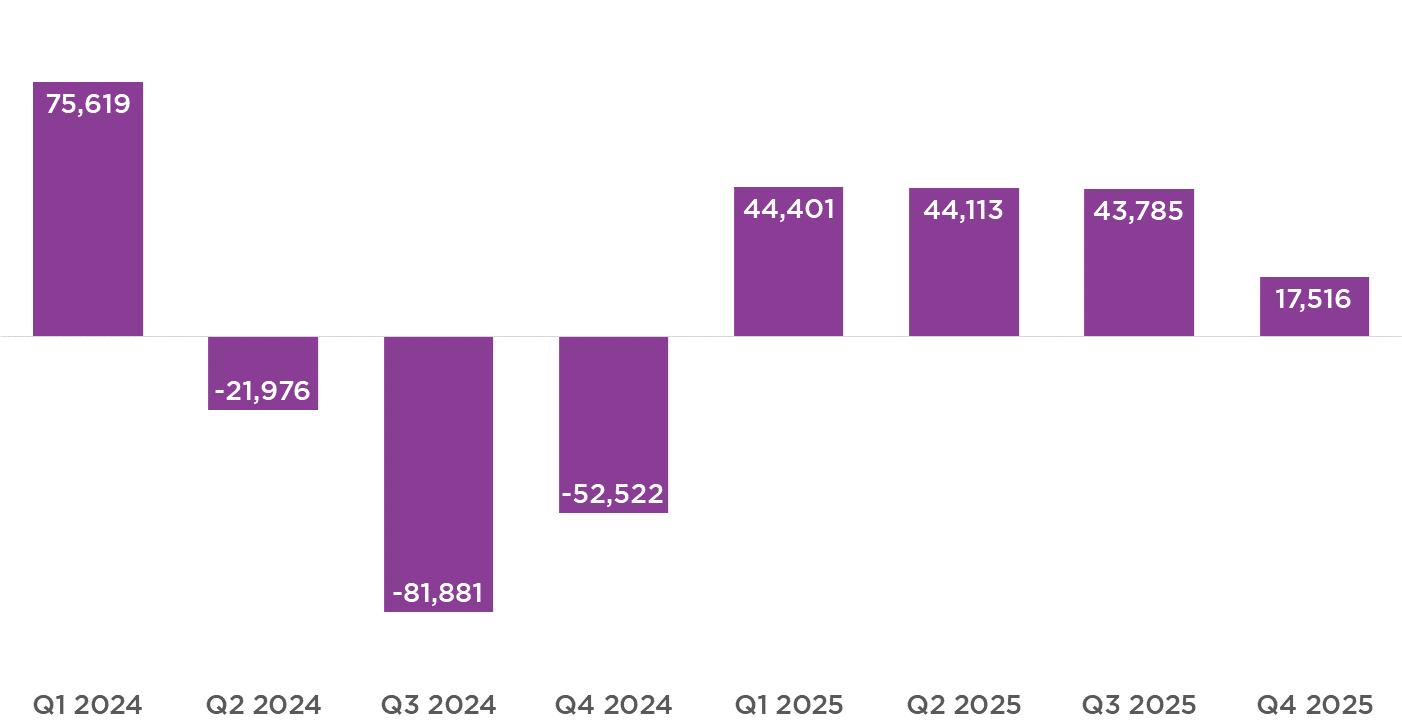

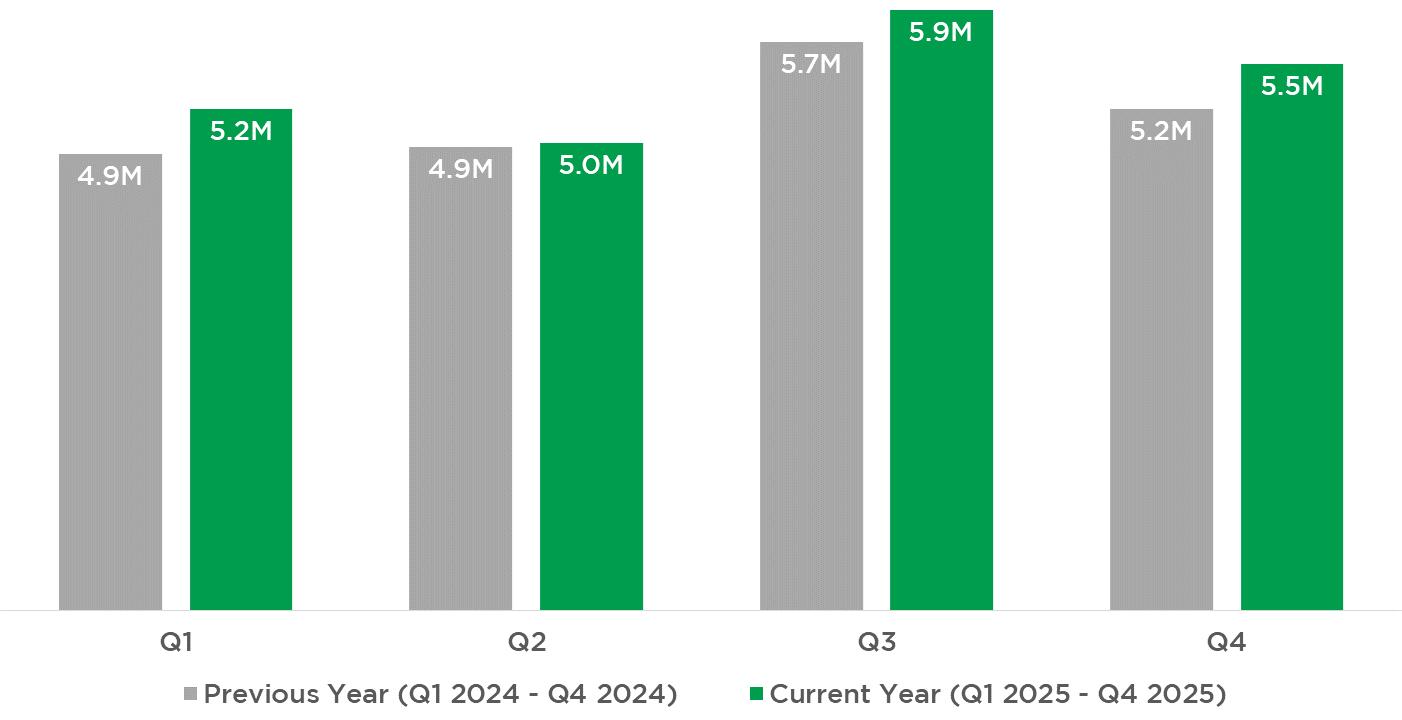

A total of 1,493 residential units were delivered across five projects in Downtown Raleigh in 2025, the most of any year, including 392 units from Ray at The Weld in Q4.2 There are 611 residential units under construction across five developments, with an additional 6,342 units proposed or in planning across 24 developments.2

Downtown Raleigh’s stabilized apartment occupancy rate is 90.3%, while net absorption totaled +142 units in Q4, bringing year end net absorption to +958 units.1 Average monthly asking rent per unit is $1,952, or $2.33 per square foot.1

PERFORMANCE INDICATOR: APARTMENT UNITS NET ABSORPTION2

RESIDENTIAL MARKET Q4 2025

$1,952 Average Asking Rent per Unit1

Residential Units Delivered in 20252

1,493

Residential Units Under Construction2

611

Residential Inventory2

11,101 units

1CoStar 2DRA

*Does not include recently completed projects 90.3% Stabilized Occupancy1*

+958 units NET ABSORPTION 20251

TO LIVE FOR QUALITY OF LIFE 2024-2025

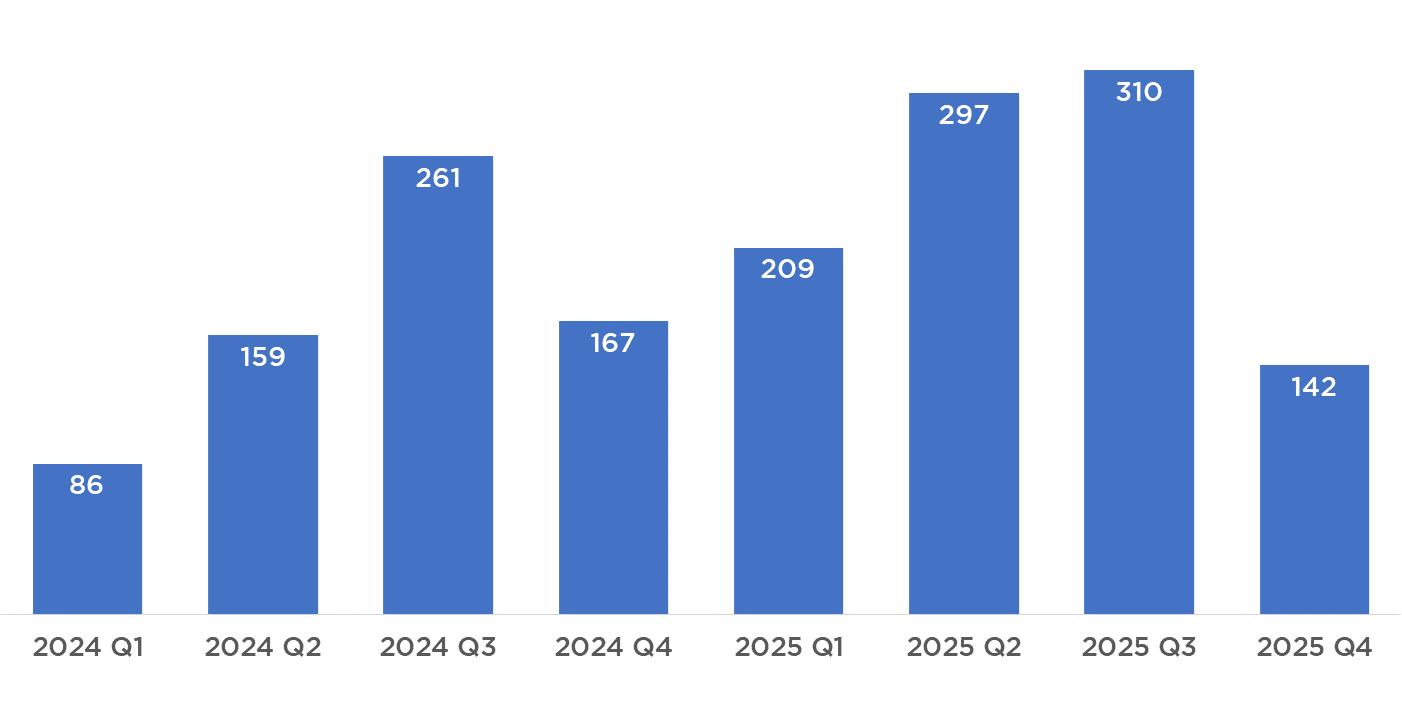

There were 25 storefront business openings and nine closures in Q4, resulting in a net gain of +16 storefront businesses. Additionally, Carroll’s Kitchen closed its former location and relocated to a new space next door at 230 S Wilmington Street. In 2025, Downtown Raleigh recorded 88 storefront business openings and 47 closures, resulting in a net gain of +41 businesses. Another 25 storefront businesses are currently announced as coming soon in Downtown Raleigh.

Downtown Raleigh visitor visits increased +5.2% year over year in 2025, with Glenwood South recording the highest increase at +9.0%.

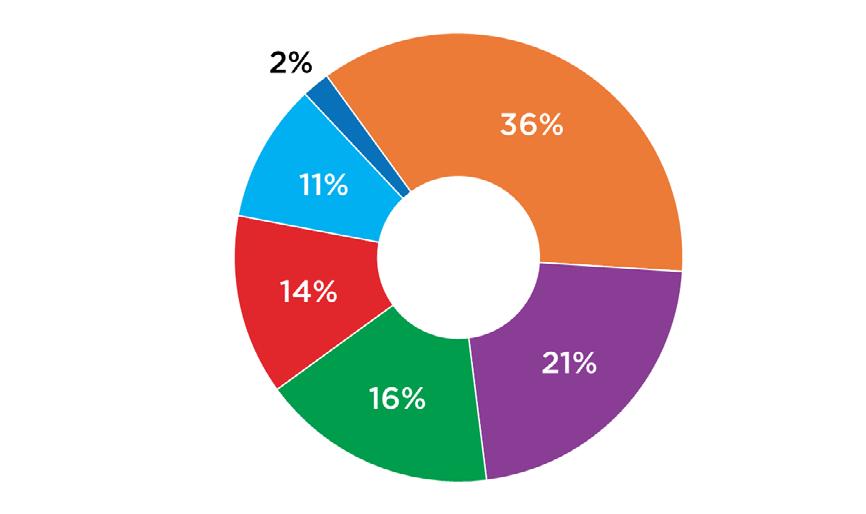

PERFORMANCE INDICATOR:

TOTAL VISITOR VISITS TO DOWNTOWN RALEIGH2

RETAIL MARKET

Q4 2025

25 New Storefront Business Openings & Expansions (Q4)1

25 Storefront Businesses Coming Soon1

Retail SF Delivered in 20251

56,327

Retail SF Planned or Proposed1

256,124

1DRA 2Placer.ai 3News & Observer

+5.2% increase

TOTAL 2025 VISITOR VISITS COMPARED TO 20241

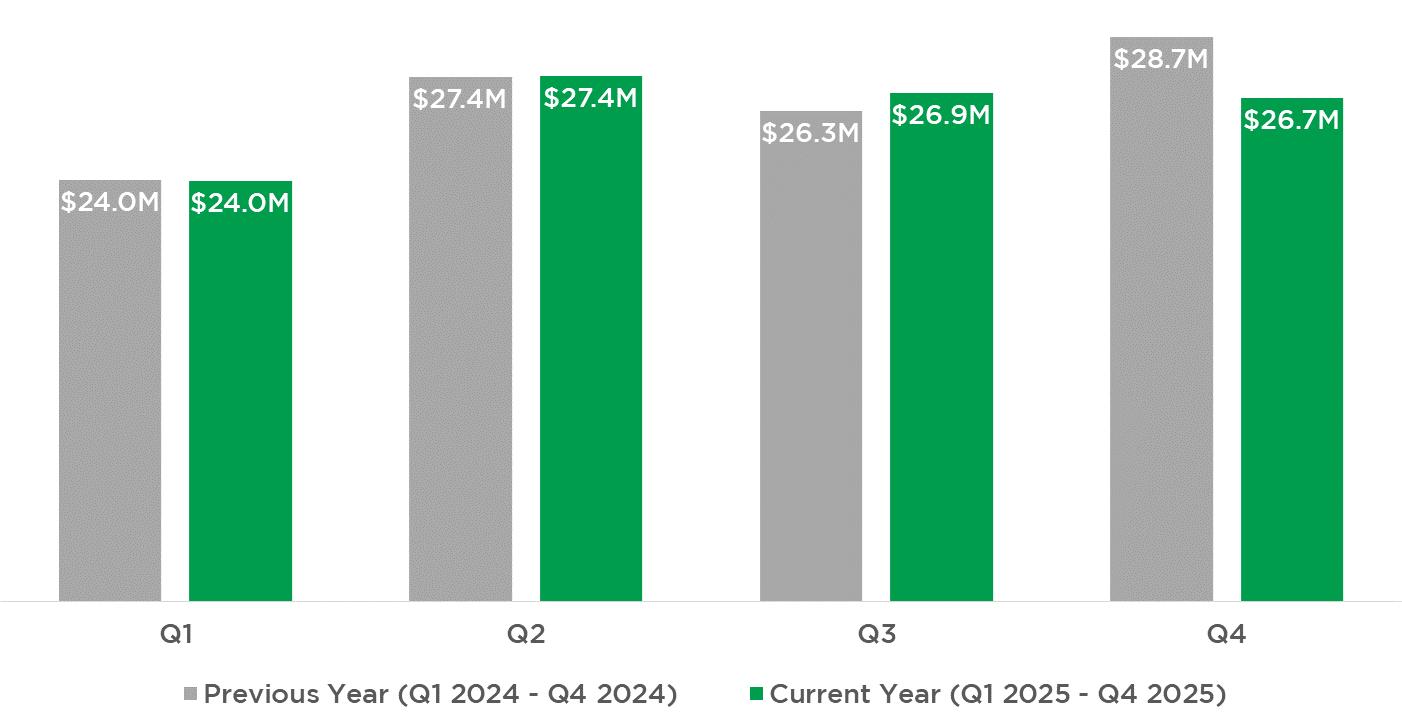

Food and beverage sales in Downtown Raleigh increased +0.2% year to date through November compared with the same period last year. The Glenwood South District recorded a +6.4% year to date increase, the largest gain among downtown districts this year overall.

PERFORMANCE INDICATOR:

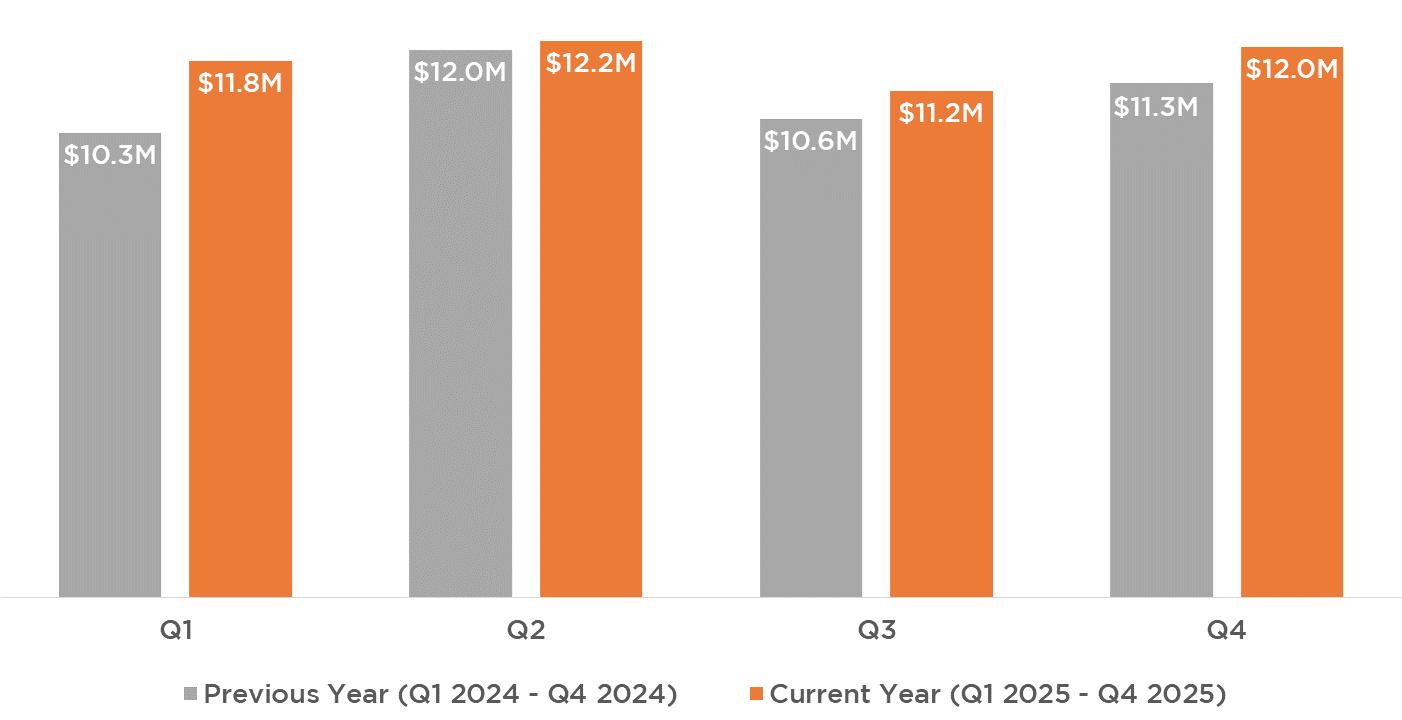

AVERAGE MONTHLY FOOD AND BEVERAGE SALES BY QUARTER*1

FOOD AND BEVERAGE SALES BY DISTRICT IN Q41

Monthly Food & Beverage Sales in Q41* $28.7 Million in Q4 2024

Construction continues on the conversion of the former Holiday Inn into a 204-room Hotel Indigo, while recently filed plans indicate a second hotel is proposed on the adjacent site. The proposed 13-story hotel at 300 Hillsborough Street would include 180 rooms and a 2,500 square foot restaurant. Site preparation is ongoing at 415 S. Blount Street for the future 138-room TownePlace Suites by Marriott.3 Estimated average monthly hotel room revenue between October and November increased +6.2% year over year. 1 During the Illuminate Art Walk, which ran from 5th of December through January 6th, Fayetteville Street saw 129,304 visitor visits between 4pm and midnight.2

PERFORMANCE INDICATOR:

DOWNTOWN AVERAGE MONTHLY HOTEL ROOM REVENUE1

Q4 2025

1,454

Hotel Rooms Planned or Proposed

342

Hotel Rooms Under Construction or Renovation3

2.1M Unique Downtown Visitors in Q42

$12M Average Monthly Hotel Room Revenue Q4*

1Wake County Tax Administration, DRA 2Placer.ai 3DRA

*Only October & November Data Available

+6.2% INCREASE Q4 2025 AVERAGE MONTHLY HOTEL ROOM REVENUE YEAR OVER YEAR1*

The MICHELIN Guide’s first-ever “American South” edition spotlighted Downtown Raleigh’s dining scene. Sam Jones BBQ earned a Bib Gourmand distinction, recognizing restaurants that serve great food at a great value. Several downtown restaurants were also named to the Recommended list, including Brewery Bhavana, Crawford & Son, Jolie, Poole’s Diner, St. Roch Fine Oysters + Bar, The Pit, and Stanbury.

Construction has begun on a new 6,000+ seat amphitheater located one block south of the existing venue. The current amphitheater will remain operational through the 2026 outdoor concert season, while the new venue is under construction and scheduled to open for the 2027 season.

Plans have been announced for a 600room, 27-story full service Omni Hotel at the southern end of Fayetteville Street. The hotel is anticipated to be the largest in the Triangle by room count and is timed to support the Convention Center expansion, with construction expected to begin in 2026 and completion targeted for late 2028.

The Raleigh Convention Center will undergo a 300,000 square foot expansion adding flexible event and meeting space and is planned to be complete and operational by late 2029.

15,600+

43,300+

21.7M Visitor Visits Per Year2

33.6

145K

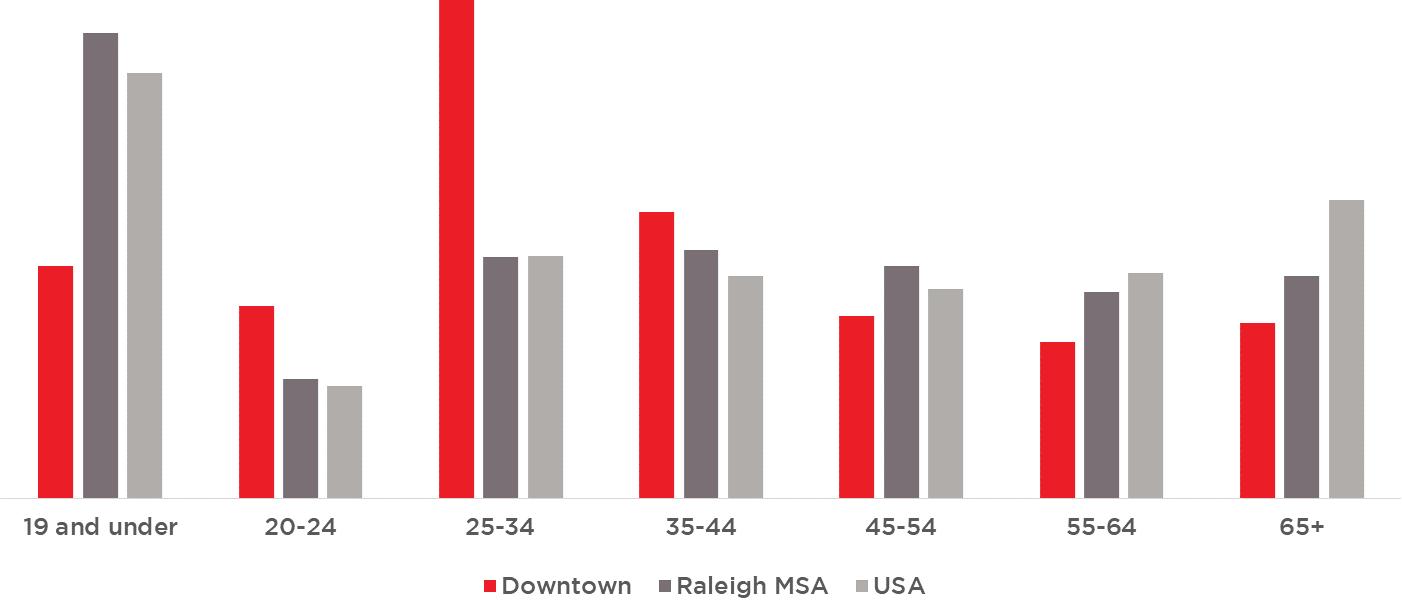

Median Age1 Average Household Income1

68.2% Resident Population1 Employees Within 1 Mile of the State Capitol1

Bachelor’s Degree or Higher1

40.5% Of population between ages 20-341

DRA has a mission of advancing the vitality of Downtown Raleigh for everyone. DRA facilitates this mission through five goals:

Improve downtown economy through recruitment, pop-ups, financial support, research, marketing & promotions;

Advocate to make downtown a place for everyone that reflects evolving needs and interests of the community and lessons learned from the recent past;

Make downtown an engaging place to live, work, and visit through safe activations that appeal to a wide variety of stakeholders;

Improve and maintain a sense of safety and security in downtown through our Ambassador program, Social Services and work with RPD; and,

Elevate and improve DRA’s internal organization and processes through improved database, project management, communication, financial stewardship, and planning.

For additional information and resources visit: downtownraleigh.org/do-business

DOWNTOWN BOUNDARY AND DISTRICT MAP 1 2 3 4 5

CONTACT FOR QUESTIONS:

Gabriel Schumacher Research Director

Downtown Raleigh Alliance 919.821.6981 // gabrielschumacher@downtownraleigh.org