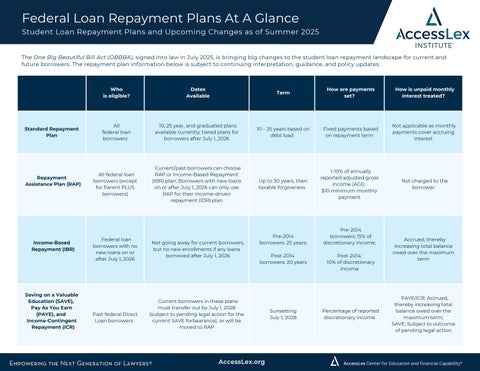

Federal Loan Repayment Plans At A Glance

Student Loan Repayment Plans and Upcoming Changes as of Summer 2025

The One Big Beautiful Bill Act (OBBBA), signed into law in July 2025, is bringing big changes to the student loan repayment landscape for current and future borrowers. The repayment plan information below is subject to continuing interpretation, guidance, and policy updates.

Standard Repayment Plan

Repayment Assistance Plan (RAP)

All federal loan borrowers 10, 25 year, and graduated plans available currently; tiered plans for borrowers after July 1, 2026

All federal loan borrowers (except for Parent PLUS borrowers)

Income-Based Repayment (IBR)

Saving on a Valuable Education (SAVE), Pay As You Earn (PAYE), and Income-Contingent Repayment (ICR)

Federal loan borrowers with no new loans on or after July 1, 2026

Current/past borrowers can choose RAP or Income-Based Repayment (IBR) plan; Borrowers with new loans on or after July 1, 2026 can only use RAP for their income-driven repayment (IDR) plan

10 – 25 years based on debt load Fixed payments based on repayment term

Not applicable as monthly payments cover accruing interest

Not going away for current borrowers, but no new enrollments if any loans borrowed after July 1, 2026

Up to 30 years, then taxable forgiveness

Pre-2014

borrowers: 25 years;

Post-2014

borrowers: 20 years

1-10% of annually reported adjusted gross income (AGI); $10 minimum monthly payment

Pre-2014

borrowers: 15% of discretionary income;

Post-2014: 10% of discretionary income

Not charged to the borrower

Accrued, thereby increasing total balance owed over the maximum term

Past federal Direct Loan borrowers

Current borrowers in these plans must transfer out by July 1, 2028 (subject to pending legal action for the current SAVE forbearance), or will be moved to RAP

Sunsetting July 1, 2028

Percentage of reported discretionary income

PAYE/ICR: Accrued, thereby increasing total balance owed over the maximum term; SAVE: Subject to outcome of pending legal action