SCOTT HALL

Senior Managing Director

scott.hall@berkadia.com

CA Lic. 01917029

ANDREW HOLT

Senior Managing Director andrew.holt@berkadia.com

CA Lic. 01469822

JARED KELSO

Senior Managing Director

jared.kelso@berkadia.com

NY Lic. 40KE1177408

STEVE MICHELS

Senior Managing Director steve.michels@berkadia.com

NY Lic. 10401288926

AARON LAPPING

Senior Director

aaron.lapping@berkadia.com

CA Lic. 02027729

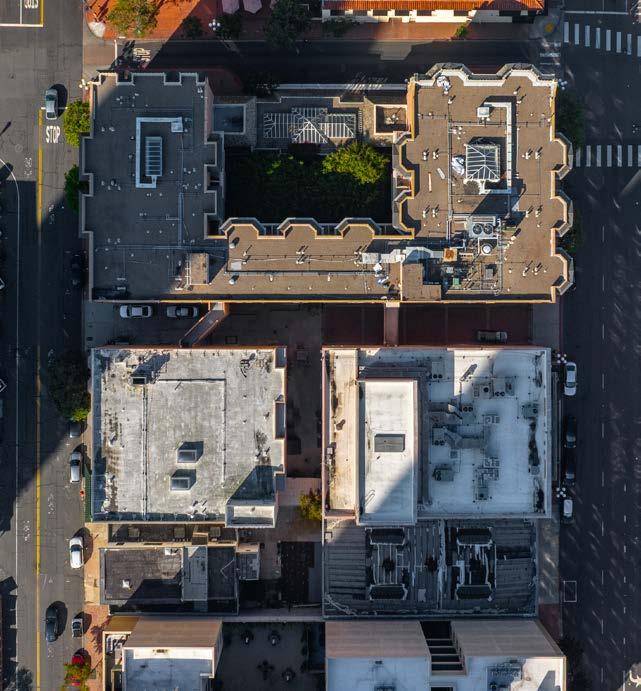

Berkadia Real Estate Advisors Inc. is pleased to offer, on an exclusive basis, the opportunity to acquire the fee-simple interest in the 132-key Horton Grand Hotel (the “Hotel,” or “Property”), strategically located in the heart of Downtown San Diego’s Gaslamp Quarter. Originally built in the mid-1880s, this iconic Victorian boutique property has been held by the same family for over 30 years. Completely unencumbered of brand and management, the offering presents a rare “blank canvas” opportunity for a comprehensive mixed-use reimagination, allowing a new investor to transform the Hotel into a premier hospitality and entertainment destination with significant near-term value add and future development potential. This unique offering includes the 24,000-square-foot Horton Grand Theatre, a 5,000-square-foot adjacent warehouse, and a nearby parking lot offering a new owner diversified revenue streams. The Hotel’s unparalleled Gaslamp location provides immediate access to a robust mix of leisure, corporate, and convention demand within a perennial top-tier U.S. lodging market.

ADDRESS

GUESTROOMS

311 Island Ave, San Diego, CA 92101

132 guestrooms including 24 suites

YEAR BUILT 1880’s and reconstructed in 1986

TOTAL BUILDING SF / TOTAL ACRES

- HOTEL

- THEATER

- WAREHOUSE

- 530 ISLAND AVE PARKING LOT

±114,000 SF / 1.43 Acres

» 85,000 SF / 0.99 Acres

» 24,000 SF / 0.22 Acres

» 5,000 SF / 0.12 Acres

» 0 SF / 0.10 Acres

BRAND / MANAGEMENT Independent / Unencumbered

TENURE Fee simple

LABOR Non-Union

BUILDINGS

MEETING & EVENT SPACE

Hotel (2 Buildings - 4 Floors Each, 1 Basement), Theater (2 Floors), Warehouse

6 venues; 11,714 SF of indoor and outdoor meeting and event space

» Regal Ballroom – 3,440 SF

» Regency Room – 1,792 SF

» Courtyard 2,720 SF

» Copley Alley – 1,800 SF

» Salt & Whiskey Private Dining Room - 1,452 SF

» Foyer – 510 SF

The above total meeting and event space does not capture the 3,500-square-foot Horton Grand Theatre space.

FOOD AND BEVERAGE Salt & Whiskey

$59 per night (valet-only)

PARKING

AMENITIES

DESTINATION AMENITY FEE

» 25 valet-only leased spaces (off-site)

» 16 space lot at 530 Island Ave (managed by Ace)

» Open-air courtyard

» Fireplaces in every room

» Fitness Center

» Balconies in majority of rooms

» Complimentary WiFi

$24 per night; Includes complimentary WiFi, bottled water, access to business center and fitness center, as well as two beverage coupons at Salt & Whiskey

Prime Gaslamp real estate located at the intersection of Fourth Avenue and Island Avenue, the Property sits adjacent to over 16 million square feet of office space and is within walking distance of many of America’s Finest City’s premier amenities, including Seaport Village, Petco Park, the San Diego Convention Center, the USS Midway Museum, and Little Italy.

The Property is also proximate to several recently delivered Class A office projects—including West (289,000 SF), 2100 Kettner (195,000 SF), Twenty by Six (90,000 SF), and RaDD (1.5M SF)—and lies only a few blocks from the one-million-square-foot Campus at Horton mixed-use redevelopment.

Moreover, the Horton Grand Hotel is Downtown San Diego’s oldest hotel, having hosted millions of guests since opening, including multiple heads of state and notable celebrities such as President Benjamin Harrison, King Kalākaua, Babe Ruth, and Joe Louis.

This entirely unencumbered, one-of-a-kind opportunity offers a new investor the ability to reposition the Property through a range of capital initiatives, including near-term value-add enhancements and long-term development potential.

The Horton is offered completely unencumbered of brand and management. A unique opportunity exists to reimagine the Property as a mixed-use entertainment/hospitality destination that includes an elevated boutique hotel, experiential food and beverage offerings, creative event spaces, entertainment venues, multiple revenue streams and future development potential all in the heart of San Diego’s famed Gaslamp Quarter.

The Horton Grand Hotel is a meticulous 1986 reconstruction and combination of two distinct, original Victorian-era hotels from the mid1880s: the elegant Grand Horton Hotel and the more informal BrooklynKahle Saddlery Hotel. Originally facing demolition in the 1970’s to make way for the Horton Plaza mall, the city saved the structures by having both buildings dismantled, piece by piece, cataloged, and then rebuilt at the Hotel’s current location. This painstaking effort preserved a landmark that, in its original form, hosted notable guests like President Benjamin Harrison, King Kalākaua, Babe Ruth, Joe Louis, and famous lawman Wyatt Earp.

The Property’s strategic location in the heart of the Gaslamp Quarter benefits from its adjacency to Seaport Village, Petco Park, and the many dining and entertainment venues located in Downtown. The Hotel is a short walk to the Convention Center, RaDD, Campus at Horton, Little Italy and San Diego’s famed bayfront attractions.

90 RESTAURANTS

36 BARS

12 NIGHTCLUBS

97 WALK SCORE

$3.8 BILLION MULTI-PHASED EXPANSION INCLUDES TERMINAL 1 REPLACEMENT, TERMINAL 2 IMPROVEMENTS AND NEW PARKING STRUCTURE | 2028 COMPLETION

PLANNED

UNDER CONSTRUCTION

RECENTLY COMPLETED

45-STORY-1,100 UNIT CLASS-A MULTIFAMILY UNITS | PLANNED

$510 MILLION INCLUDES 280,000 SF OFFICE SPACE, 10,000 SF RETAIL & 431 LUXURY APARTMENTS | 2024 COMPLETION

CAMPUS AT HORTON

$330 MILLION INCLUDES 700,000 SF OFFICE SPACE UNDER CONSTRUCTION | PHASE I | 2026+ DELIVERY

$1.6 BILLION INCLUDES 1.7 M SF OFFICE & RETAIL SPACE UNDER CONSTRUCTION | 2024 COMPLETION

$440 MILLION INCLUDES 450 APARTMENTS AND WHOLE FOODS MARKET | 2026 COMPLETION

500,000 SF OFFICE SPACE PLANNED

Several transformational projects are currently underway in Downtown San Diego as investors are eager to contribute to the modern evolution of one of the more resilient urban city centers in the country. Notable projects include the $3.8 billion Seaport Village redevelopment, IQHQ’s 1.7 million-square-foot Research & Development District, and the Campus at Horton redevelopment. Recent Class-A deliveries within Downtown San Diego include Holland Partner Group and Lowe ‘s West (289,000 SF and 431 apartments), Kilroy’s 2100 Kettner (195,000 SF), and LeBeau Realty’s Twenty by Six (90,000 SF).

530 ISLAND AVE PARKING LOT

PARK & MARKET

66,000 SF OFFICE & CLASSROOM SPACE | 2022 COMPLETION

SEAPORT SAN DIEGO

$3.8 BILLION REDEVELOPMENT INCLUDES 500-FOOT OBSERVATION TOWER, MARINE RESEARCH CAMPUS, “BLUE TECH” OFFICE SPACE, AQUARIUM AND EVENT CENTER, 275,000 SF OF RETAIL AND 16-ACRES OF RECREATIONAL SPACE | 2028+ DELIVERY

San Diego reported strong hotel performance metrics in 2024, continuing impressive gains following the depths of the COVID-19 pandemic. The market experienced significant recovery from both transient and group business resulting in a 27.8% ADR increase over 2019 (5th largest increase in the country). While occupancy still has not recovered to the pre-pandemic peak of 78.5%, San Diego ranked 4th among top 25 markets this past year at 74.3% occupancy. With an exceptionally diverse demand base, San Diego has historically been more resilient than other major West Coast hospitality markets. Layering on significant growth throughout the MSA through biotech, high-tech and education expansion (with preexisting strong demand in these areas) on top of the region’s always-strong tourism, defense, manufacturing, international trade and year-round conventions, San Diego is undergoing a meaningful renaissance. Significant outpaced RevPAR growth compared to other top hotel markets is expected for years to come. San Diego is wellestablished as a national economic powerhouse and will continue to distinguish itself as one of the premier lodging markets in the country.

diego airport (san) is the busiest single-runway commercial service airport in the world

3.3M POPULATION $14.6B VISITOR SPENDING IN FY 2024

"no. 2 best big city in America"

- Conde Nast Traveler 2024 Readers Choice

32.5M

one of the most popular tourist destinations in the world

"#3 largest concentration of life sciences in the U.S."

50 miles of sun-soaked coastline and world famous attractions $22B

The Property presents investors with an incredible opportunity to embrace any number of significant value-add initiatives that will dramatically increase the near-term bottom line and drive value well into the future. Re-imaging the Horton Grand and its associated holdings as a mixed-use entertainment/ hospitality destination that includes an elevated boutique hotel, experiential F&B, creative event spaces, entertainment venues, multiple revenue streams and future development potential all in the heart of San Diego’s famed Gaslamp District is a generational opportunity.

ISLAND AVENUE

Salt & Whiskey

Ground

The Regal Ballroom

3,440 SF Meeting Space

HOTEL BUILDING #2

Originally Built 1886 / Moved and Reassembled in 1986 Courtyard

COPLEY ALLEY

HOTEL BUILDING #1

HORTON GRAND THEATRE

Built 1980 (Currently Closed)

Built in 1986 / Renovated in 2023 / Contains 24 Suites

WAREHOUSE

Built 1971

The blank-slate nature of the opportunity presents significant value-add potential including branding and management optionality, a complete guestroom transformation, a reimagining of the food and beverage programming and further activation of underutilized spaces at the Hotel, among other opportunities. These initiatives are expected to lead to substantial top- and bottom-line improvements.

• Independent nature presents optimal flexibility to assess distribution strategies, revenue management optimization and brand alternatives to further position the Hotel MANAGEMENT

• Hotel has been self-managed by various family members or Trustee for decades

• Institutional-quality management will generate immediate upside day one

• Foyer and lobby upgrades to appeal to higher-rated guests

GUESTROOM RENOVATION

• Transformative guestroom repositioning with discerning lifestyle finishes

FOOD & BEVERAGE

• Reconcept F&B outlet to drive additional in-house and public activity and appeal

• Convert unutilized 1,700-square-foot basement into an additional outlet, club, speakeasy or flex event space

• Consider leasing to/partnering with local or regional F&B operators

MEETING SPACE

• Enhance Regal Ballroom and Regency Room to embrace more dynamic group appeal

UNDERUTILIZED SPACES

• Activate 2,700-square-foot courtyard with attractive programming to further distinguish the space for social and corporate group events, meetings and functions

• Relocate small gym (formerly a boardroom and a guestroom) from lobby to basement, which could also allow for gym expansion

• Consolidate and relocate back-of-house needs to basement, thus creating additional revenue generation opportunities in prime main-level spaces

Transform this currently dormant space into a mixed-use entertainment destination

• Premium Dine-In Cinema (e.g. “The Lot”)

• Private Membership Club (e.g. “SoHo House” or “The Reading Club”)

• Supper Club (e.g. “Delilah”)

• Comedy Club (e.g. “Comedy Cellar”)

• Music Venue (e.g. “MTV Unplugged”)

• Night Club (e.g. “Studio 54”)

• Performing Arts Venue (e.g. “La Jolla Playhouse”)

• Flexible Specialty Event Space

Develop or operate these concepts in-house, via partnership or third-party lease

Creatively re-purpose space into experiential destination for general public and hotel guests

• Curated Food Hall Collective (e.g. “Sky Deck” or “Liberty Station Public Market”)

• Brewery Collective (e.g. “Brewers Deck”)

• Specialty Retail Collective (e.g. “The Space”)

• Food Truck Collective

• Flexible Specialty Event Space

• Public Serving Parking Lot

Develop or operate these concepts in-house, via partnership or third-party lease

Further activation with open connectivity to Hotel, Theatre or Warehouse

Create unique indoor/outdoor spaces

• Speakeasy Bar Entrance

• Flexible Hotel Function Space

• Al Fresco Dining

• Art Gallery Series

• Car Shows

• Convention Center Pop-Ups

• Food Truck Park

Entitle the combined Theater and Warehouse parcels for future development

• Class A Apartments

• High-End Condominiums

• Branded Residential

• Creative Mixed-Use Project

• Structured Parking Lot

Upon entitlement, realize material gains through selling the development opportunities or building projects (in JV partnership or on own account)

Currently operated by ACE as a 16-space parking lot, 2 blocks east of Hotel

Sale-leaseback to maximize near-term value-creation

Entitle Parking Lot for future development

• Affordable Housing

• Market Rate Apartments

• Condominiums

• Focused-Service Hotel

Upon entitlement, realize material gains through selling the development opportunity or building project (in JV partnership or on own account)

The material contained in this document is confidential, furnished solely for the purpose of considering investment in the property described therein and is not to be copied and/or used for any purpose or made available to any other person without the express written consent of Berkadia Real Estate Advisors LLC and Berkadia Real Estate Advisors Inc. In accepting this, the recipient agrees to keep all material contained herein confidential.

This information package has been prepared to provide summary information to prospective purchasers and to establish a preliminary level of interest in the property described herein. It does not, however, purport to present all material information regarding the subject property, and it is not a substitute for a thorough due diligence investigation. In particular, Berkadia Real Estate Advisors LLC, Berkadia Real Estate Advisors Inc. and Seller have not made any investigation of the actual property, the tenants, the operating history, financial reports, leases, square footage, age or any other aspect of the property, including but not limited to any potential environmental problems that may exist and make no warranty or representation whatsoever concerning these issues. The information contained in this information package has been obtained from sources we believe to be reliable; however, Berkadia Real Estate Advisors LLC, Berkadia Real Estate Advisors Inc. and Seller have not conducted any investigation regarding these matters and make no warranty or representation whatsoever regarding the accuracy or completeness of the information provided. Any pro formas, projections, opinions, assumptions or estimates used are for example only and do not necessarily represent the current or future performance of the property.

Berkadia Real Estate Advisors LLC and Berkadia Real Estate Advisors Inc. and Seller strongly recommend that prospective purchasers conduct an in-depth investigation of every physical and financial aspect of the property to determine if the property meets their needs and expectations. We also recommend that prospective purchasers consult with their tax, financial and legal advisors on any matter that may affect their decision to purchase the property and the subsequent consequences of ownership.

All parties are advised that in any property the presence of certain kinds of molds, funguses, or other organisms may adversely affect the property and the health of some individuals. Berkadia Real Estate Advisors LLC and Berkadia Real Estate Advisors Inc. recommend, if prospective buyers have questions or concerns regarding this issue, that prospective buyers conduct further inspections by a qualified professional.

The Seller retains the right to withdraw, modify or cancel this offer to sell at any time and without any notice or obligation. Any sale is subject to the sole and unrestricted approval of Seller, and Seller shall be under no obligation to any party until such time as Seller and any other necessary parties have executed a contract of sale containing terms and conditions acceptable to Seller and such obligations of Seller shall only be those in such contract of sale.

For more information on these and other Berkadia® exclusive listings, please visit our website at www.berkadia.com

Berkadia®, a joint venture of Berkshire Hathaway and Jefferies Financial Group, is an industry leading commercial real estate company providing comprehensive capital solutions and investment sales advisory and research services for multifamily and commercial properties. Berkadia® is amongst the largest, highest rated and most respected primary, master and special servicers in the industry.

© 2026 Berkadia Proprietary Holding LLC

Berkadia® is a trademark of Berkadia Proprietary Holding LLC

Investment sales and real estate brokerage businesses are conducted exclusively by Berkadia Real Estate Advisors LLC and Berkadia Real Estate Advisors Inc. Commercial mortgage loan origination and servicing businesses are conducted exclusively by Berkadia Commercial Mortgage LLC and Berkadia Commercial Mortgage Inc. Tax credit syndication business is conducted exclusively by Berkadia Affordable Tax Credit Solutions. In California, Berkadia Real Estate Advisors Inc. conducts business under CA Real Estate Broker License #01931050; Adrienne Barr, CA DRE Lic. # 01308753. Berkadia Commercial Mortgage Inc. conducts business under CA Real Estate Broker Lic. #01874116. This proposal is not intended to solicit commercial mortgage company business in Nevada. For state licensing details for the above entities, visit www.berkadia.com/licensing.

SCOTT HALL

Senior Managing Director

scott.hall@berkadia.com

CA Lic. 01917029

ANDREW HOLT

Senior Managing Director andrew.holt@berkadia.com CA Lic. 01469822

STEVE MICHELS Senior Managing Director steve.michels@berkadia.com NY Lic. 10401288926

JARED KELSO Senior Managing Director jared.kelso@berkadia.com NY Lic. 40KE1177408

AARON LAPPING Senior Director aaron.lapping@berkadia.com CA Lic. 02027729