DEMO BEYOND THE

WHAT

CODERS NEED TO ASK BEFORE AI ARRIVES

MEDICALLY ASSISTED SUICIDE IN THE U.S. AND GLOBAL PERSPECTIVES FOR PRACTICE MANAGERS

ICD-10 VITAMIN D DEFICIENCY (E55.9): A COMPLETE GUIDE

HEALTHCARE AWARENESS SPOTLIGHT: NOVEMBER IS LUNG CANCER AWARENESS MONTH

THE IMPORTANCE OF DATA AND NETWORK SEGMENTATION

AIHC is a licensing/certification partner with CMS offering in-person training and online certification courses We

The American Institute of Healthcare Compliance is a national organization for Healthcare Professionals with over 30,000 members & subscribers. We are recognized as a healthcare education organization with the Internal Revenue Service (IRS) operating as a Section 501(c)(3) nonprofit corporation. Revenue generated by AIHC is reinvested in the organization to pursue its educational purpose and benefit its members.

they are the ones leading the changes instead of following them. As the writers emphasize, this opens an opportunity for professionals to actively shape their coding careers and ensure their knowledge and expertise remain central to both their personal and organization’s

coo Nichole Anderson, CPC nichole@billing-coding.com

We have other articles on 2026 ICD10-CM changes and updates, vitamin D deficiency, the impact of the 2026 MPFS proposed rule on radiology practices, taxonomy codes, data and network segmentation, medically assisted suicide, auditing like a consultant, coders vs. auditors, the role of coding in advancing health equity, chiropractic billing errors, medical debt on credit reports, and our healthcare spotlight on lung cancer awareness. Did you know that studies have shown that laughter can be a complemental therapy for those with lung cancer as it improves mood and quality of life? Of course, prevention is the best cure! Fill your lungs with laughter—at least a laugh a day!

So as you pass around the gravy boats (my favorite) this Thanksgiving, be sure to share what and who you’re thankful for. As you meet for Christmas party games or Christmas Eve cookies and cocoa or Christmas Day gift exchanges— whatever your traditions—remember to be mindful and take in each and every moment. On New Year’s Eve, I encourage you to reflect on the previous year; ask yourself when you felt the most joyful, the most connected—and then do more of that. Have (truly) Happy Holidays!

Amber Joffrion – BC Advantage Editor

subscriptions manager Ashley Knight ashley@billing-coding.com

advertising sales@billing-coding.com

Renewals: Keep your rate locked in for life! www.billing-coding.com/renewals

Change of address: Email subscriptions@billing-coding.com or call 864 228 7310

The Importance of Data and Network Segmentation

2026 ICD-10-CM Changes

ICD-10 Vitamin D Deficiency (E55.9): A Complete Guide

What Is the Real Impact of the 2026 MPFS Proposed Rule on Radiology Practices? 2026 ICD -10-CM Updates

Medically Assisted Suicide in the U.S. and Global Perspectives for Practice Managers

Audit Like a Consultant, Even if You’re Not One Coders Vs. Auditors: A Lighthearted Look at Life on Both Sides Bringing SDOH Into Focus: The Role of Coding in Advancing Health Equity Stop Losing Money: Fix These Chiropractic Billing Errors

EXPERT CONTRIBUTORS THIS ISSUE

Dawson Ballard Jr, RHIA, CCS-P, CPC, CPMA, AAPC Fellow, has an unquenchable passion for medical coding, so much so that many affectionately call him a true “coding nerd.” With more than 20 years of experience in CPT, ICD10-CM, and HCPCS coding, he has built his career as a respected consultant, auditor, and educator.

Regina Mixon Bates is a nationally recognized healthcare consultant, speaker, and author with over two decades of experience in medical practice management, revenue cycle operations, and compliance. She is the founder and CEO of The Physicians Practice S.O.S. Group®, where she helps providers nationwide streamline operations and strengthen patient-centered care strategies. www. ppsosgroup.com

Karen Blanchette, MBA, is the Executive Director of PAHCOM. The PAHCOM collaborative network enables solo providers and small group physician practices to access focused information vital to managing their healthcare businesses effectively.

Sandy Coffta is Vice President of Client Services at Healthcare Administrative Partners. Coffta has over 17 years of experience in client relationship management, including reimbursement analysis, workflow optimization, and compliance education. www.hapusa.com

Shannon DeConda, CPC, CPC-I, CEMC, CMSCS, CPMA, CMPM, CPMN, is the Director of Coding and a partner at DoctorsManagement, as well as the founder and president of NAMAS. Shannon brings more than 16 years of multi-specialty auditing and coding experiences to DoctorsManagement clients, helping practices optimize business processes and maximize reimbursements. www.doctors-management.com – namas.co

Matt Kolinski, MD, is an Associate Management Consultant at DoctorsManagement. Dr. Matt has

extensive experience spanning 20+ years as a practicing physician and entrepreneur. Dr. Matt has a passion for reengineering the business of healthcare. With his handson experience in medicine, he combines his expertise and passion to perform practice assessments, feasibility studies, and help practice start ups.

Janine Mothershed is the founder and CEO of Coding Clarified, an innovative online medical coding school committed to transforming lives through flexible, highquality career training. https://codingclarified.com/

Sonal Patel, BA, CPMA, CPC, CMC, ICDCM, is CEO and Principal Strategist of SP Collaborative, LLC. Sonal has over 13 years of experience understanding the art of business medicine as a nationally recognized thoughtleader, speaker, author, creator, and consultant to elevate coding compliance education for the business of medicine. www.spcollaborative.net

Rachel V. Rose, JD, MBA, advises clients on compliance, transactions, government administrative actions, and litigation involving healthcare, cybersecurity, corporate, and securities law, as well as False Claims Act and DoddFrank whistleblower cases. She also teaches bioethics at Baylor College of Medicine in Houston. Rachel can be reached through her website: www.rvrose.com

Taylor Webster, CPC, CCS, is Head of Coding Quality, and Tricia Lewis, CPC, CPMA, is Coding Quality Advisor at Fathom, a health technology company that uses deep learning artificial intelligence to automate medical coding for a wide range of specialties and practices. As certified coders, Webster and Lewis manage strategic analysis, client analytics, programmatic auditing, and reporting on behalf of Fathom’s health system, physician group, and health plan clients. www.fathomhealth.com

Colorado First in Nation to Collect Healthcare Pricing Data From Insurers

Colorado is the first state in the nation to make healthcare and drug prices more transparent in an effort to increase competition and bring down costs.

Federal rules passed during the first Trump administration requiring health insurance companies to post negotiated prices took effect in 2022.

Kristin Paulson, president and CEO of the Center for Improving Value in Healthcare, said there were major glitches, and the posted data was nearly impossible to decipher. In response, Colorado lawmakers passed a bill last year mandating exactly how insurers had to make data accessible.

"This is an effort to make sure those prices are more accessible to consumers," Paulson explained. "To make sure that consumers can actually get to those prices and use them, hopefully to be making more informed healthcare decisions."

Senate Bill 80 requires insurers to post pricing data specific to Colorado and requires them to disclose prices for the most frequently prescribed medicines. The law also calls for the removal of so-called “ghost codes,” billing codes for care likely never delivered, for example, a code indicating a foot specialist delivered a baby.

Americans spend more than twice as much for healthcare than residents in other wealthy nations. The higher medical bills are due to higher prices, not because people are accessing more services, according to an analysis by the healthcare research organization KFF.

Paulson believes pricing data collected by Colorado’s Division of Insurance and her group’s Shop for Care tool can help bring down those costs.

"It really gives employers the ability to look at prices," Paulson outlined. "To look at what one plan costs versus another plan, and be able to use some of their market power when

they are setting up their benefit plan to drive down some of those costs in the negotiating process."

As Colorado has collected the first round of transparency data, the Division of Insurance said it plans to make data available on its Transparency in Coverage webpage by early next year. The Division also wants to share its findings with researchers interested in helping Coloradans better understand their pricing options.

Source: kiowacountypress.net

Fathom Named #1 Solution for Reducing Cost of Care in KLAS 2025 Emerging Solutions Top 20 Report

Fathom, the leader in autonomous medical coding, recently announced that it was recognized as the #1 solution for Reducing the Cost of Care in the 2025 KLAS Emerging Solutions Top 20 Report.

The top 20 emerging solutions were selected by healthcare leaders across the country from KLAS's emerging solutions research. The aim was to find the solutions that had the greatest potential to disrupt the healthcare market. Solutions were rated by how well they could impact the Quadruple Aims of Healthcare: to improve outcomes, reduce the cost of care, improve patient experiences, and improve clinician experiences.

"KLAS's Emerging Solutions Top 20 winners are helping to redefine what meaningful innovation looks like in healthcare. These companies pair bold ideas that tackle healthcare's real problems, elevate patient care, and strengthen operational performance," said Adam Gale, CEO of KLAS. "In what is an uncertain and fast-moving landscape, they aren't reacting to change; they're setting the pace. We're proud to recognize their leadership and the impact they're delivering today and in the years ahead."

In selecting Fathom for the top position in cost reduction, healthcare thought leaders highlighted the technology's

tangible ROI. This impact stems from 90%+ automation rates across medical specialties at the same or better accuracy relative to customers' previous coding solutions, as unanimously validated by customers in an earlier KLAS Emerging Company Spotlight report on Fathom (September 2024). Across Fathom's client base today, automation rates include 99% in radiology, 95% in primary care and urgent care, 92% in emergency medicine, and similar across other outpatient departments.

"Existing clients have reported high levels of throughput and accuracy, which not only enhances operational efficiency but also contributes to significant cost savings," said one VP who served as a Top 20 reviewer for KLAS. "Additionally, the improved precision in coding reduces the likelihood of claim denials, thereby minimizing future revenue leakage and administrative burden."

Source: fathomhealth.com

ASE Leading Push to Revise CPT Code for Interventional Echocardiography

The American Society of Echocardiography (ASE) is working on a proposal to create a new CPT coding structure for interventional echocardiography during structural heart procedures.

CPT code 93355 is used to report transesophageal echo (TEE) services during transcatheter intracardiac therapies. It is used for diagnostic TEE and ongoing manipulation of the TEE transducer to guide sizing and/or placement of implants, determination of adequacy of the intervention, and assessment for potential complications. But ASE said the code is used more like a catch-all that covers a variety of TEE uses and procedures.

There has been a rapid growth in the use of this code in recent years, which corresponds to a rise in the usage of interventional echo, used to guide transcatheter aortic valve replacement (TAVR) and left atrial appendage occlusion (LAAO) procedures. TAVR cases alone went from zero percent of aortic valve replacements prior to its approval in 2012

to more than 84% by 2023. TAVR usage has also seen rapid increases in recent years with low-surgical risk patient trials showing outcomes as good as surgery, which has opened the door to younger patients now seeking the less invasive procedure.

CMS may have concerns about the rapid growth in this one code, but there are larger issues in echocardiography on the need for more specific coding.

“There is a single CPT code for the interventional echos, and it is applied across multiple interventional procedure codes. So, we have one code for everything, where as our interventional colleagues have a code for TAVR, a code for mitral TEER, a code for tricuspid TEER. CMS looks at this and says, ‘Oh my god, there has been an explosion of imaging,’ because it is all under one code,” ASE President David H. Wiener, MD, director of clinical operations at the Jefferson Heart Institute and a clinical professor of medicine at Thomas Jefferson University, told Cardiovascular Business.

The American Medical Association (AMA), which creates and monitors usage of CPT codes, periodically reviews its CPT codes through its Specialty Society Relative Value Scale (RVS) Update Committee (RUC), to which ASE has an advisor. ASE is now working on a proposal for new interventional echo coding structures to better reflect the work done in the field.

CPT code 93355 was created in 2015 for medically necessary situations. It was being used for TAVR and LAAO procedures by 2017. Prior to this, hospitals performing these procedures had to eat the cost of the interventional echocardiographer, because there was no reimbursement. While the CPT code helped offset these costs, ASE said it does not cover all of the costs in terms of time and having an echocardiographer tied up in one procedure that can take several hours. There has been interest in working on a new code for some time to help correct this, especially as echocardiographers are now increasingly needed to guide even more mitral and tricuspid transcatheter procedures.

Source: cardiovascularbusiness.com

2026 ICD-10-CM Changes

Effective October 1, 2025, the 2026 ICD-10-CM update is live, with 480+ new codes, 38 revisions, and 28 deletions. The focus this year: sharper clinical detail, clearer guidance around genetics and social determinants of health (SDOH), and better data specificity for patient care and reimbursement.

Why

this

update matters:

Greater clinical specificity and laterality

Expanded recognition of genetic/hereditary conditions

Better capture of SDOH

Coding pathways for emerging diseases/treatments

Guideline Updates You’ll Use Every Day

“Multiple sites” clarified:

• If documentation specifies each involved site, code each site separately.

• Use a “multiple sites” code only when the provider does not specify individual locations.

HIV coding (B20, Z21, R75) refined:

• B20: Use for HIV disease/AIDS or any HIV-related condition; once assigned, use B20 permanently.

• Z21: Asymptomatic HIV positive.

• R75: Inconclusive serology.

• Pregnancy: Sequence pregnancy codes first, then HIV status.

• New: Z29.81 for PrEP (pre-exposure prophylaxis) encounters.

New: Type 2 diabetes in remission:

• E11.A distinguishes true remission from “resolved/ controlled.”

• Requires explicit provider wording: “in remission.”

Hypertension + heart disease linkage:

• If documentation links HTN with heart conditions (e.g., heart failure, myocarditis), assign I11- codes.

• If clearly unrelated, code separately. Rely on provider documentation—avoid assumptions.

Notable Code Set Changes (By Area)

Infectious diseases:

• Expanded HIV-related conditions.

• New detail for Demodex mite infestation.

Neoplasms:

• New codes for inflammatory breast cancers.

• Includes laterality and research-aligned categories.

Blood and endocrine:

• Abnormal autoantibody findings (e.g., rheumatoid factor, anti-CCP) without clinical RA.

• Hyperoxaluria now broken out (primary, secondary, dietary-related).

• Familial hypercholesterolemia split into homozygous vs heterozygous.

• Lipodystrophy subtypes, including HIV-associated.

Neurology and genetics:

• Multiple sclerosis: relapsing vs progressive, active/ inactive status.

• Primary apraxia of speech: new code supports neuro/ speech data capture.

• Limb-girdle muscular dystrophy: genetic-specific expansion.

Eyes/ears and congenital:

• Thyroid eye disease and secondary angle-closure glaucoma now laterality-specific.

• Usher syndrome type-specific codes.

• New codes for syndromes such as Kabuki, CTNNB1, Howell Foundation, and others.

• Neurodevelopmental disorders reflect specific gene variants (e.g., FOXG1, DLG4, SLC6A1).

Skin and ulcers:

• Chronic non-pressure ulcers (abdomen, face, arms, groin) now severity-specific.

• New codes for abscesses, contusions, puncture wounds of flank/groin/abdominal wall.

Pain and lab findings:

• Expanded abdominal and flank pain with laterality.

• R11.16: Cannabis hyperemesis syndrome.

• Costovertebral angle tenderness added.

• Codable abnormal immunologic labs even without a definitive diagnosis.

External causes and SDOH:

• New external-cause detail (e.g., fishing-hook piercings, sharp objects via orifices).

• Additions for Gulf War illness/war-related exposures.

• Clearer capture of prophylactic surgeries (even without family history).

• New Z codes for financial insecurity and utility access.

Action Checklist for Coding Leaders

To comply with the recent changes, be sure to:

• Update charge masters, problem lists, EHR pick-lists, and templates.

• Educate providers to use phrases like “in remission,” site-specific detail, and explicit HTN-heart links.

• Tune CDI queries for HIV status, diabetes remission, “multiple sites,” and ulcer severity.

• Audit hot spots early (HIV status sequencing, E11.A use, I11- linkage, SDOH Z-codes).

• Refresh training: Share quick guides and example notes that meet new specificity.

Quick reminders:

• Once B20, always B20.

• E11.A requires documented remission—not just “controlled.”

• Don’t default to “multiple sites” when documentation lists distinct locations.

• Use SDOH Z-codes when clearly documented and relevant to care.

2026 continues the push toward precision. Pair clear provider documentation with the new options (remission, genetic variants, SDOH, laterality/severity) to protect reimbursement and improve data quality.

ICD-10 VITAMIN D DEFICIENCY (E55.9): A COMPLETE GUIDE

Did you know that almost one billion people around the world are affected by vitamin D deficiency? It has become one of the most common issues seen in primary care today. Routine blood tests and chronic fatigue diseases need vitamin level testing, and using the right ICD-10 vitamin D deficiency code is necessary. In this article, we’re going to learn about ICD-10 code E55.9, how to avoid billing errors, and related CPT codes and screening rules.

What Is Vitamin D Deficiency?

Vitamin D deficiency means that your body does not have enough vitamin D—an important nutrient for the body to work properly. This usually occurs when you are not in the sunlight long enough or you are not consuming foods that contain vitamin D. It is more common than you may think, and it can happen to anyone regardless of his or her age.

Symptoms of vitamin D deficiency include:

• Chronic fatigue or tiredness

• Bone or joint pain

• Muscle cramps

• Frequent infections

• Mood changes

• Hair loss (in some cases)

Some common causes of vitamin D deficiency include:

• Not spending enough time in the sun

• Having a poor diet

• Obesity

• Chronic kidney disease

• Liver diseases

• Malabsorption disorders, such as celiac disease or Crohn’s disease

• Certain medications, like anticonvulsants or glucocorticoids

Diagnosis Criteria

A vitamin D blood test (25-hydroxyvitamin D) measures the levels of vitamin D. Table 1 will help you understand it.

Table 1

Vitamin D Levels and Diagnoses

25(OH)D Level Interpretation

< 20 ng/mL Deficiency

20–30 ng/mL Insufficiency

30–50 ng/mL Optimal

> 100 ng/mL Possible Toxicity

What is E55.9?

E55.9 is the ICD-10 code for vitamin D deficiency. It is used when a patient has low vitamin D levels, but the actual cause of the deficiency is not mentioned in any documents. This is a billable code that is widely used in primary healthcare, endocrinology, and general practice.

This means that different terms like “hypovitaminosis D” (ICD-10), “vitamin D insufficiency,” or “low vitamin D” are billed under the same code, as the reason is still unknown.

When and When Not to Use E55.9

It is important to know when to use the ICD-10 code (E55.9) for proper diagnosis, and when not to use it to avoid any claim denials. It should not be used as a proxy when screening or supplementing patients. Only use E55.9 when there is clinical evidence of the deficiency.

ICD-10-CM code E55.9 should only be used in certain conditions, such as when the patient has fatigue, bone pain, muscle weakness, and similar symptoms, and the patient has a 25-hydroxyvitamin D level < 20 ng/mL (lab tests show deficiency in vitamin D levels).

You should not use E55.9 in the following scenarios:

Preventive Screening: If a patient has a routine checkup or general screening, use Z13.21 – Screening code for detecting vitamin or nutrient deficiencies.

Supplementation Without Testing: Do not use E55.9 if:

• The patient is taking over-the-counter vitamin D as a general supplement.

• No lab test has confirmed a deficiency.

• No symptoms or signs are documented related to the deficiency.

To avoid coding errors and denials:

• The medical documents should always contain a 25-hydroxyvitamin D lab test report.

• Ensure clinical notes explain the symptoms or medical necessity.

• Don’t use E55.9 as a “default” for all vitamin D discussions, only for confirmed deficiencies.

Screening for Vitamin D Deficiency – Z13.21

In case you are ordering lab work to test vitamin D levels without having any symptoms, the appropriate code to

be utilized is Z13.21 – Encounter of screening nutritional deficiency. This ICD-10 code is applied specifically when the reason for the visit is preventive and is not related to a diagnosed condition.

That is, when the patient is healthy and you are only checking to see that the levels are low, use Z13.21 as the appropriate ICD-10 code for vitamin D screening.

Medicare’s Stance on Preventive Vitamin D Testing

Vitamin D testing is not covered by Medicare during routine screening unless there is a medically necessary purpose.

This means:

• If you are using E55.9 to justify routine lab work, there’s a high chance that your claim could be denied.

• Z13.21 should only be used when screening is done without any symptoms, and even then, you must verify whether the payor covers it.

To have an insurance plan (including Medicare) reimburse the cost of vitamin D testing, most policies (including Medicare) require a documented symptom or risk factor, such as fatigue, bone loss, or some chronic diseases.

Improper Use of E55.9 = Denied Claims

Using E55.9 when a deficiency hasn’t been diagnosed can flag your claim as inaccurate or not medically necessary.

For example:

• If you list E55.9 during a preventive visit with no symptoms or lab confirmation, it may be considered fraudulent coding.

• If Medicare or a private payor reviews the chart and sees no lab evidence or clinical signs, the claim will likely be denied or flagged.

To stay compliant:

• Use Z13.21 for screening.

• Use E55.9 only when there’s a confirmed deficiency. Always match the ICD-10 screening for vitamin D deficiency with proper CPT codes (like 82306) and supporting documentation.

CPT Codes for Vitamin D Testing

When a doctor checks your vitamin D levels, they usually request a test called 25-hydroxyvitamin D. To make sure insurance covers it without delay, the right CPT code needs to be used. There are other codes too, depending on the kind of test done.

A complete list of CPT codes related to Vitamin D testing is shown in Table 2.

Common CPT Codes for Vitamin D

CPT Code Test Name

82306

82652

83516

004335 (Labcorp)

005199 (Labcorp)

006049 (Quest)

006118 (Quest)

Vitamin D; 25-hydroxy

Vitamin D; 1,25-dihydroxy

Immunoassay

Vitamin D, 25-Hydroxy, Total, Immunoassay

Description

The most widely applied test is a test that is used to determine the status of vitamin D (D2 + D3). It is both screening and diagnostic.

A special test is employed in case of suspected hypercalcemia, kidney problems, or any other metabolic mess.

Sometimes used in labs that utilize this method for vitamin D-related hormone levels. Not specific to vitamin D alone, but occasionally bundled.

A lab-specific panel test for vitamin D – CPTs vary based on the lab and methodology.

Vitamin D, 1,25-Dihydroxy Lab-specific variation for the 1,25 test (linked to CPT 82652).

Vitamin D, 25-Hydroxy, LC/MS/MS The advanced testing method is often coded as 82306, but can vary with payor/lab.

Vitamin D, 1,25-Dihydroxy Often aligned with CPT 82652, specific to Quest Labs.

Note: There are internal codes or test panels used in some labs (Labcorp, Quest, etc.). When you use third-party lab services, always check what CPT is being billed.

Related ICD-10 Codes for Vitamin D

In most instances, doctors end up applying E55.9 when diagnosing a lack of vitamin D. Other codes would, however, be applied based on what the patient is experiencing, including some symptoms, treatment history, or laboratory findings. It is not all about paperwork, but it assists in ensuring that the information is clear when it comes to billing and insurance purposes.

There are also a few other ICD-10 codes that relate to vitamin D or similar metabolic issues as shown in Table 3.

Table 3

Common ICD-10 Codes for Vitamin D and Related Conditions

ICD-10 Code Description

E55.0 Rickets due to vitamin D deficiency. (It is used when there is a deficiency, which results in skeletal deformities, especially in children.)

E55.9 Unspecified vitamin D deficiency. (It is the most commonly used code if the cause isn’t known.)

Z13.21 Screening for nutritional deficiency. (It is used to order tests without a confirmed diagnosis.)

E83.51 Disorders of calcium metabolism. (Sometimes paired with vitamin D deficiency, especially in endocrine disorders.)

Z91.120 Patient noncompliance with dietary therapy. (Useful if a deficiency persists due to the patient’s behavior.)

M83.0 Adult osteomalacia due to vitamin D deficiency. (It is rarely used, but applicable in advanced or chronic cases.)

D89.2 Disorders involving the immune mechanism, not elsewhere classified. (May relate if the deficiency affects immune function.)

Table 2

Conclusion

Only on the basis of the following, E55.9 (Unspecified Vitamin D Deficiency) can be assigned correctly to the medical record:

• A lab report of 25-hydroxyvitamin D that indicates low vitamin D status in the body (usually less than 20 ng/mL).

• The related symptoms of this are mentioned in the medical records (e.g., fatigue, pain, bone ache, weak muscles).

• Provider interpretation of lab results or diagnosis, not just the lab report itself.

Remember that the physician’s note should mention “Vitamin D deficiency” explicitly, even if lab results are attached.

Attending Medicare, CMS limits coverage of vitamin D testing to medical necessity; this implies that a diagnosis such as E55.9 should be accompanied by all symptoms, laboratory findings, and justified need to test or treat to be covered.

Always include the test date, lab value, reference range, and the provider’s interpretation in your documentation to maintain compliance, avoid denials, and increase reimbursement.

What Is the Real Impact of the 2026 MPFS Proposed Rule on Radiology Practices?

While the initial impression of the Medicare Physician Fee Schedule (MPFS) Proposed Rule for 2026 was an increase of 3.83% or 3.32% depending upon a physician’s APM status, the real story is told by doing further analysis. We performed a volume-weighted analysis for a composite sample practice using volumes from our database.

Overall, the professional component reimbursement for diagnostic radiology in our sample practice is estimated to increase by only 1.10% while global reimbursement for diagnostic radiology is estimated to increase only 2.00% from 2025 levels, based on the same volume of services. Interventional radiology was not included in our analysis because some CPT codes have been removed without information as to their replacement. The estimates included in the Proposed Rule were a decrease of 3% for the professional component and an increase of 1% for global reimbursement.

This is the breakdown of our analysis by modality:

* PET scan reimbursement is set at the local carrier level for global billing. That data is not available currently and so global PET was eliminated from the analysis.

The mix of modalities performed by a particular practice will affect its overall result.

Why the Result Is Less Than the Conversion Factor Increase

The Proposed Rule contains adjustments to the valuation of certain services, as discussed more fully in our article, “There Might Be Some Good News in the Medicare Physician Fee Schedule Proposed Rule for 2026”. Some arbitrary shifting of value away from the hospital setting and a blanket “Efficiency Adjustment” have changed many of the RVU values, offsetting the overall fee schedule increases that are proposed. The proposed rule also contains a site-ofservice shift from facility-based (hospital) services to office-based services; however, this adjustment will not apply to diagnostic radiology, according to the Radiology Business Management Association (RBMA) Federal Affairs Committee. The RBMA recently released its letter to CMS pointing out the flaws it perceives in the application of these two valuation adjustments.

Conclusion

Understanding the annual changes in Medicare’s fee schedules is useful when analyzing areas where the practice’s revenue might be increasing or decreasing. Many commercial payors base their fees on the Medicare table, though not all of them make the same changes, or at the same time, as Medicare does. We will continue to keep you abreast of the Medicare payment system.

Coffta is Vice President of Client Services at Healthcare Administrative Partners. Coffta has over 17 years of experience in client relationship management, including reimbursement analysis, workflow optimization, and compliance education. www.hapusa.com

The process used to perform a volume-weighted analysis involves gathering data from the previous year that shows the number of times each procedure code was billed for Medicare patients. The procedure volumes are multiplied by the 2025 Medicare fee schedule rates in one column, and again by the Proposed 2026 Medicare fee schedule rates in another column. Totaling each column will reveal the total practice revenue for the previous year and the reimbursement that the practice could expect in the current year assuming the volume of each procedure is unchanged. The percentage increase or decrease can then be calculated.

Sandy

2026 ICD-10-CM upDates

here’s a C oMprehensIve breakDown of how the fY 2026

InpatIent prospeC tIve paYMent sYsteM (Ipps) fInal rule—

publIsheD bY CMs on august 4, 2025—Is set to reshape MeDICal C oDIng, DoCuMentatIon, anD reIMburseMent startIng oC tober 1, 2025.

Payment Rate Updates and Reimbursement Impacts

There is an overall increase of approximately 2.6% in inpatient operating payment rates for hospitals that are meaningful users of EHRs and participate in quality reporting programs. This stems from a 3.3% market basket increase minus a 0.7% productivity adjustment.

Additionally, there is an estimated $5 billion increase in total Medicare payments in FY 2026, including an approximate

$2 billion increase in uncompensated care payments to disproportionate share hospitals (DSHs) and an approximate $192 million increase via New Technology Add-on Payments (NTAPs).

Long-Term Care Hospitals (LTCHs) will see a 2.7% base payment increase (reflecting a 3.4% basket minus 0.7%).

Coding Implication

NTAPs are significant. Coding professionals must ensure accurate capture of related ICD-10-CM/PCS codes for approved technologies to secure additional payment. The finalized rule includes new NTAP designations with associated coding guidance.

New MS-DRG assignments, including those for percutaneous coronary atherectomy, complex aortic arch procedures, and more, require updated coding workflows.

MS-DRG Coding Changes and Documentation Requirements

Several new MS-DRGs have been finalized, such as for complex aortic arch procedures, endovascular abdominal aorta and iliac branch procedures, and percutaneous coronary atherectomy with/without intraluminal device.

Changes include reassigned and deleted DRG codes, including removal of MS-DRGs 077–079 (hypertensive encephalopathy).

New diagnosis code titles and coding order for CC/MCC lists may shift how severity is captured in MS-DRG assignment.

Coders must familiarize themselves with new MS-DRGs, confirm mapping accuracy, update EHR templates, and ensure documentation precisely reflects new classifications to avoid revenue loss.

Quality Reporting and Value-Based Adjustments

Several quality measures have been removed, including COVID-19 vaccination coverage measure, Hospital Commitment to Health Equity, and Social Drivers of Health screening measures.

Medicare Advantage patient data is now included in supplementary quality programs like the Readmissions Reduction Program and VBP adjustments.

Notably, the Health Equity Adjustment is removed, potentially reducing payment modifications for equityrelated factors.

Coding and Documentation Impact

Coders must ensure that coding reflects changed denominator/numerator definitions and that Medicare Advantage remains well integrated.

Removing some equity-related measures underscores the importance of coding accuracy in remaining quality metrics to support reimbursement.

Transforming Episode Accountability Model (TEAM)

The TEAM is effective January 1, 2026—a bundled payment model covering five surgical episodes, including CABG, total hip/knee arthroplasty, spinal fusion, major bowel procedures, and acute myocardial infarction.

The model includes updates to target pricing, risk adjustment, and quality measures. Notably, “voluntary opt-in” is allowed for hospitals already in BPCI Advanced or CJR models.

CMS estimates savings of $368 million over five years, with no significant change from FY 2025 projections.

Implication for Coders

Hospitals participating in TEAM need episode-level coding alignment, including consistency across inpatient and postacute settings.

Accurate coding ensures integrity of bundled payment calculations and quality tracking over extended episodes.

Wage Index and Policy Safeguards

The low-wage index hospital policy is permanently discontinued as of FY 2026; however, a transitional safeguard applies for hospitals whose wage index would drop more than 9.75% versus FY 2024—they’ll be capped at 90.25% of their prior wage index.

CMS continues applying standard rural, frontier, and state floor policies.

Payment adjustments for low-volume hospitals revert to original criteria starting October 1, 2025 (e.g., <200 discharges and >25 road miles from nearest subsection hospital).

Billing Considerations

Accurate location and volume reporting remain critical. Coders and billing staff must track discharges and site geography to determine eligibility for special payment adjustments.

Summary Table: Key Impacts for Medical Coding and Billing

Area Key Change

Payment Rates & NTAPs +2.6% update; ~$192M NTAP increase

MS-DRG Updates

Quality Measures

TEAM Model

Wage Index Policy

Low-Volume Policy

New and deleted DRGs; CC/MCC changes

Removal of equity and COVID-19 measures; MA data integration

Bundled payment for surgical episodes

Low-wage index phase-out; transitional cap

Reversion to standard criteria effective Oct 1, 2025

Final Thoughts and Next Steps

1 Update coding resources, including codebooks, EHR templates, and DRG mapping logic, to reflect new MS-DRGs and NTAPs.

2 Train coding staff on new documentation requirements, especially for TEAM and MAS coding changes.

3 Coordinate with finance and compliance teams to track wage index adjustments, low-volume qualification, and NTAP supplemental payments.

4 Monitor published guidance, including Fact Sheets and supplemental files from CMS (e.g., Table 6P for new ICD-10 code guidance).

5 Watch webinars, such as the AHA’s coding-focused webinar held August 28, 2025, which covers MSDRG changes, NTAPs, and coding implications.

Implication for Coding/Documentation

Ensure NTAP codes are captured accurately to seize payment opportunities

Update DRG assignment logic, EHR templates, and train coders

Adjust performance reporting workflows; ensure MA coding

Align episode-based coding; maintain consistency post-acute

Verify wage index applicability through documentation

Ensure correct documentation for eligibility

The FY 2026 IPPS Final Rule—with its payment increases, NTAP and DRG updates, TEAM model, and policy shifts—necessitates immediate updates to coding practices and documentation workflows. Aligning coding strategy now will safeguard compliance and position your facility to capture appropriate reimbursement.

Janine Mothershed

Janine Mothershed is the founder and CEO of Coding

Clarified, an innovative online medical coding school committed to transforming lives through flexible, high-quality career training. A Certified Professional Coder (CPC) and licensed AAPC instructor, Janine brings over a decade of experience in healthcare administration, medical coding, and workforce development. https://codingclarified.com/

HOW PROPER USE OF TAXONOMY CODES PREVENTS DENIALS AND ENSURES COMPLIANCE

In the complex world of healthcare administration, accuracy and compliance are paramount. One of the most overlooked yet essential elements in this process is the use of taxonomy codes. These unique, standardized identifiers play a pivotal role in ensuring that both medical practices and individual providers are properly recognized, reimbursed, and protected when interacting with payors.

What Are Taxonomy Codes?

Taxonomy codes are 10-character alphanumeric identifiers assigned to healthcare providers to classify their specialty or subspecialty. Standardized by the National Uniform Claim Committee (NUCC), these codes clarify the roles and functions of medical providers within the healthcare system. Whether you’re a general practitioner, a specialized surgeon, or a multi-specialty group, taxonomy codes ensure your expertise is accurately represented in every claim you submit.

Why Are Taxonomy Codes Important for Practices?

• Streamlining Billing Processes: Taxonomy codes help practices submit claims that clearly identify the nature of the services rendered. This specificity reduces billing disputes and delays, ensuring smoother interactions with payors and faster reimbursement.

• Enhancing Compliance: Federal and state regulations, including HIPAA, require the use of standardized codes for electronic transactions. Taxonomy codes help practices meet these requirements, minimizing errors and enhancing transparency. Proper use of taxonomy codes also reduces the risk of audits and penalties associated with improper billing practices.

• Supporting Credentialing and Provider Enrollment: When enrolling providers with payors or credentialing new staff, taxonomy codes are used to verify qualifications and specialties. This ensures that only appropriately trained and licensed professionals are authorized to provide specific services, protecting both the practice and its patients.

Why Are Taxonomy Codes Important for Providers?

• Accurate Representation of Specialty: For individual providers, taxonomy codes are essential for ensuring that claims reflect their true area of expertise. This is especially important for specialists, as payors use these codes to match claims with provider qualifications and patient needs.

• Preventing Claim Denials: Incorrect or missing taxonomy codes can lead to claim denials, resulting in lost revenue and administrative headaches. By using the correct taxonomy code, providers ensure that their claims are processed efficiently and accurately.

• Facilitating Regulatory Compliance: Taxonomy codes help providers align their billing practices with federal guidelines, reducing the risk of audits and investigations. This alignment is crucial for maintaining a good standing with payors and regulatory bodies.

How to Check and Update Your Taxonomy Codes

• Check Your Taxonomy Code via the NPI Registry: Visit the official NPI Registry at https:// npiregistry.cms.hhs.gov/. Enter your NPI number or name to view your taxonomy code(s), specialty, and practice address.

• Verify and Update Your Taxonomy Code in NPPES: Log in to the National Plan & Provider Enumeration System (NPPES) at https://nppes. cms.hhs.gov/ to manage your NPI record. Navigate to the taxonomy section and select the code(s) that best match your specialty. Designate one as your primary taxonomy code.

• Use Taxonomy Code Lookup Tools: Browse the official NUCC taxonomy code set at https://www. cms.gov/medicare/enrollment-renewal/providerssuppliers/health-care-taxonomy. You can also use third-party tools like https://npiprofile.com/ taxonomy-lookup, https://npidb.org/taxonomy/, and https://healthprovidersdata.com/hipaa/ codes/TaxonomyCodes_LookUp.aspx.

• When to Update Your Taxonomy Code:

• Credentialing or Enrollment

• Practice Changes

• Regular Review (NUCC updates taxonomy codes twice a year)

Pro Tip:

Always designate your primary taxonomy code in NPPES, as payors often use this for claim adjudication and credentialing. Keeping your taxonomy codes current helps avoid billing delays and ensures you’re properly recognized for your specialty.

Conclusion

Taxonomy codes are far more than a technical requirement; they are a cornerstone of efficiency, accuracy, and compliance in the healthcare system. By enhancing billing accuracy, supporting credentialing, and facilitating regulatory compliance, taxonomy codes protect both practices and providers from costly errors and compliance risks. As healthcare continues to evolve, the importance of taxonomy codes will only grow, making them an indispensable tool for every medical practice and provider.

Matt Kolinski, MD, is an Associate Management Consultant at DoctorsManagement. Dr. Matt has extensive experience spanning 20+ years as a practicing physician and entrepreneur. Dr. Matt has a passion for re-engineering the business of healthcare. With his hands-on experience in medicine, he combines his expertise and passion to perform practice assessments, feasibility studies, and help practice start ups.

Prior to joining DoctorsManagement, Dr. Matt attended the Chicago College of Osteopathic Medicine at Midwestern University, and went on to a prestigious pulmonary fellowship with a pediatric lung doctor. Since obtaining his DO, Dr. Matt has been a practicing physician, entrepreneur, and thought leader. www.DoctorsManagement.

healthCare awareness spotlIght

noveMber Is lung CanCer awareness Month

Although World Lung Cancer Day is honored on August 1st of each year, Lung Cancer Awareness Month is observed in November in the United States. Organizations like the American Lung Association and the Lung Cancer Foundation of America aim to raise awareness about lung cancer, risk factors, its symptoms, and early detection methods. They also encourage people to quit smoking, get screened, and support continued lung cancer research.

Lung Cancer Statistics

The American Cancer Society has asserted that lung cancer accounts for approximately 1 in 5 cancer deaths in the U.S., claiming more lives annually than breast, prostate, and colorectal cancers combined. And at a global level, according to the World Health Organization, an estimated 2.2 million people are diagnosed with lung cancer each year, and 1.8 million people die from the disease.

For women, there are a number of alarming statistics:

• 1 in 5 women diagnosed with lung cancer today have never smoked.

• Since 1987, lung cancer is the leading killer among women (surpassing breast cancer).

• Every 9 minutes, a woman dies from lung cancer.

There continues to be significant disparities in research and treatment for both women and Black Americans:

• Lung cancer death rates have gone up 102% in women, while the death rate has decreased 29% in men; this trend emphasizes the need for more effective prevention and treatment strategies for women.

• Black Americans who have lung cancer were 19% less likely to receive surgical treatment compared to White Americans, and Black lung cancer patients are less

likely to have their cancer tissue tested for biomarkers, which can help determine an individualized course of treatment that is potentially lifesaving.

Lung Cancer Facts

There are two main types of lung cancer:

• Non-Small Cell Lung Cancer (NSCLC) is the most common form. It accounts for roughly 85% of all lung cancer cases and includes adenocarcinoma and squamous cell carcinoma. It tends to grow more slowly than the second main type and may be detected earlier, particularly through low-dose computed tomography (CT) screening. Advances in genetic testing have enabled targeted therapies and immunotherapies, significantly improving survival for many patients with advanced NSCLC.

• Small Cell Lung Cancer (SCLC) is a fast-growing and aggressive form of lung cancer; it makes up approximately 10–15% of cases. It is strongly linked to smoking and is often diagnosed at an advanced stage due to its rapid spread, especially to the brain, liver, and bones. While SCLC typically responds well to initial chemotherapy and radiation, recurrence is common. Research into immunotherapy and novel combinations continues to offer hope for improved outcomes.

Are You at Risk for Developing Lung Cancer?

Healthy adults take approximately 20,000 breaths per day. With each breath taken, the lungs are exposed to a host of environmental factors.

Here are 9 known risk factors:

• Smoking (cigarette, cigar, and pipe smoking). Smoking tobacco is thought to be responsible for 80% of all lung cancer diagnoses.

• Second-hand smoke. Even if you do not smoke, your lung cancer risk increases if you are routinely around others who smoke tobacco.

• Radon gas exposure. Found in soil, radon gas levels detected between 2.0 and 4.0 picocuries per liter (pCi/L) are considered high.

• Other known carcinogens exposure. These include radioactive ores (such as uranium); inhaled arsenic; inhaled beryllium; inhaled cadmium; inhaled silica; inhaled vinyl chloride; inhaled nickel compounds; inhaled chromium compounds; inhaled coal products; inhaled mustard gas; and inhaled chloromethyl methyl ethers.

• Arsenic in drinking water. Although the Environmental Protection Agency regulates arsenic levels in public drinking water in the United States, there are still some instances of high arsenic levels in communities using private wells. Albuquerque, New Mexico, is the only urban area in the U.S. with substantial natural arsenic levels in drinking water.

• Air quality. The American Lung Association’s “State of the Air” report looks at two of the most widespread and dangerous air pollutants, fine particles, and ozone. The 2025 report includes many key findings. It “finds that even after decades of successful efforts to reduce sources of air pollution, 46% of Americans—156.1 million people—are living in places that get failing grades for unhealthy levels of ozone or particle pollution.”

Other researchers estimate that about 5% of lung cancer deaths worldwide are due to outdoor air pollution. People who live in cities, especially near high-traffic roads, have a slightly increased risk of lung cancer if they are primarily walking or cycling as their mode of transportation.

• Previous radiation to lungs. People who have had chest radiation therapy to treat other cancer, such as breast cancer, are at a higher risk for lung cancer. Your age at the time of the previous treatment affects your risk for lung cancer.

• Family history or personal history. If you have previously had lung cancer, you have a higher risk of developing another lung cancer. Siblings and children of those who have had lung cancer also run a slightly higher risk of developing lung cancer themselves.

• Asbestos exposure. Mostly found in mines, mills, and shipyards, exposure to large amounts of asbestos puts you at a greater risk of developing mesothelioma, a type of cancer that starts in the lining surrounding the lungs.

FREE WEBINARS & CEUS!

Compliance With Locums

Presenter: Rachel Rose, JD, MBA

Time: 44:43 minutes

It’s important to understand locum tenens and its role in healthcare. Rachel Rose, Attorney at Law, discusses locums contracts, billing implications, and modifiers to help you understand what is permissible and compliant under federal and state regulations.

CEUs are available for all of the following associations at no additional cost: AAPC, AHIMA, ARHCP, PMI, PAHCS, PHIA, POMAA, MAB, MED-C, HBMA, NEBA, PAHCOM, AHCAE, PMBA www.billing-coding.com/ceus

Lung Cancer Screening Guidelines

In 2025, the American Cancer Society and U.S. Preventive Services Task Force (USPSTF) recommend annual lung cancer screenings through only low-dose CT for people who do not have any signs or symptoms.

In 2025, the American Cancer Society and U.S. Preventive Services Task Force (USPSTF) recommend annual lung cancer screenings through only low-dose CT for people who do not have any signs or symptoms.

Eligibility criteria also include:

Lung Cancer Signs and Symptoms You Should Know

Here are 7 signs and symptoms from the Lung Cancer Foundation of America:

Lung Cancer Awareness and Education

Let’s take action this November and promote lung cancer awareness by celebrating current treatments. We can advocate for continued research and development to improve outcomes for those people with a lung cancer diagnosis. Through education, we can collectively help to remove ongoing biases and disparities in both research and treatment. Awareness of breath matters this Lung Cancer Awareness Month—breathe in hope, exhale out action.

Sonal Patel, BA, CPMA, CPC, CMC, ICDCM, is CEO and Principal Strategist of SP Collaborative, LLC. Sonal has over 13 years of experience understanding the art of business medicine as a nationally recognized thought-leader, speaker, author, creator, and consultant to elevate coding compliance education for the business of medicine. www.spcollaborative.net

BEYOND THE DEMO

WHAT CODERS NEED TO ASK BEFORE AI ARRIVES

Technology procurement in healthcare is notoriously complex. Evaluation and implementation timelines stretch from months to years, involving multiple stakeholders across clinical, technical, and financial departments. Yet when it comes to autonomous coding technology, one crucial voice often gets overlooked: the coding professionals who are closest to the function at hand.

This oversight is costly. While executives typically drive technology purchases, coders possess critical insights that can prevent implementation challenges and performance issues down the line. Their daily experience with their organization’s coding nuances, payor-specific requirements, and workflow realities provides irreplaceable perspective during vendor evaluation—ultimately impacting ROI.

At AAPC HEALTHCON in Orlando earlier this year, we spoke with hundreds of coders who expressed interest in contributing their expertise to technology decisions, especially around the fast-growing autonomous coding category. Many recognized that their specialized knowledge could help prevent the kinds of problems that tend to plague healthcare technology adoption.

As providers increasingly adopt autonomous coding, certified coders have a unique opportunity to shape and enhance these decisions by asking the right questions during vendor evaluations. This article provides an actionable framework for doing exactly that.

Why Coder Expertise Drives Better Technology Decisions

Consider how autonomous coding handles an encounter. Once documentation is complete—say, for an ER visit—the technology analyzes elements including patient history, physical exam, and medical decision-making. A seasoned coder immediately recognizes the ways in which their organization’s documentation patterns support (or hinder) reliable automation for different scenarios and what edge cases to test.

This technical understanding proves invaluable during vendor evaluation. Coders can assess whether a system’s capabilities align with their organization’s reality. They spot potential integration challenges that might not surface until implementation begins.

The cost of excluding coder input from technology decisions is significant. Systems that fail to integrate with existing workflows create frustration and resistance. Implementation delays occur when unforeseen compatibility issues emerge. And change management becomes an uphill battle when staff feel their concerns weren’t heard.

Involving coders in technology decisions dramatically increases the odds of success. When coders participate meaningfully in vendor evaluation, they help ensure the selected technology will work well in their environment. Most importantly, coders who understand the technology’s capabilities are better positioned to shape their evolving roles. Rather than viewing automation as a threat, they can strategically guide how it complements their expertise and benefits their organization.

Essential Questions for Vendor Evaluations

Armed with their specialized knowledge, coders should focus their vendor evaluation on three critical areas: accuracy measurement, guideline adaptation, and exception handling.

Accuracy Measurement:

Start with the fundamentals: How is accuracy measured? This question exposes what approach underlies quality calculations and whether vendors use rigorous auditing standards. The strongest vendors measure accuracy against certified human coding and across representative samples for all relevant coding elements.

Follow up by asking how vendors verify that their systems maintain accuracy over time. As technology performance can drift without proper monitoring, understanding the vendor’s approach to ongoing validation helps predict long-term reliability. Indeed, the health system’s coders will often play a direct and critical role in supervising the accuracy of the technology’s coding.

Dig deeper into the auditing process. How frequently are accuracy assessments conducted? Who performs them? What sample sizes are used? These details reveal whether accuracy claims are backed by solid methodology.

Finally, ask about continuous improvement processes. How do coders request changes to resolve identified issues? The best systems incorporate feedback loops from coders to steadily raise performance (and hence ROI) over time.

Guideline Adaptation:

As all coders know, guidelines change frequently, and so systems must adapt quickly. Ask what happens when guidelines change mid-year. Some vendors may require weeks or months to incorporate updates, creating compliance risks during transition periods.

Understand how annual updates are incorporated and tested. The strongest systems can anticipate and implement changes almost immediately while maintaining accuracy standards. Weaker systems struggle with the complexity of

guideline changes, dragging down performance after launch. Don’t forget about site-specific or payor-specific coding rules. Many organizations have unique requirements that some autonomous systems may not address fully. Understanding how vendors handle customization helps

predict implementation complexity.

Exception Handling:

In the real world, coding involves constant exception handling. Ask how systems manage incomplete or ambiguous documentation. This question reveals whether the technology can handle the messiness of actual documentation.

Understand how exceptions are flagged for human The best systems provide clear, actionable information why cases require human intervention, enabling coders to focus their time effectively on remedying the affected encounters.

Ask about the volume and types of exceptions the system typically generates. High exception rates can overwhelm coding teams and undermine automation benefits. example, if you’re looking at autonomous coding for your radiology department, can the technology handle interventional cases? Understanding these patterns set proper performance and ROI expectations.

Shaping the Future of Coding Through Effective Evaluation

When coders participate meaningfully in technology evaluation, they’re not just setting up their organizations success—they’re actively shaping their professional For instance, well-implemented autonomous coding enables coders to focus on complex cases that truly require their expertise. It eliminates backlogs and reduces demanding productivity standards. Most importantly, creates opportunities for professional growth. As the Outpatient Coding Manager at one early-adopting system put it, “Since implementation, we’ve trained coders on different coding areas… and a lot of those coders also learned LCD edits.”

Coders become stewards of the technology, running programmatic audits for quality assurance. They identify patterns in cases requiring human intervention, helping improve the AI system’s performance over time. They more proactive approaches to preventing denials through policy development and provider education.

These strategic contributions emerge naturally when technology complements rather than conflicts with

TheisStruggle real

One Subscription. Endless CEUs. Zero Fluff.

FREE 4 Week Trial with 4 FREE CEUs

Subscriptions starting as low as $15 per month for 24 annual CEUs

Hey Readers!

Don’t forget: You can now listen to your favorite articles online!

While at your desk, in the car, or at home, you can listen to the articles on Billing-Coding.com.

You don’t need “reading time” as long as you have time to listen. We see you, multitaskers!

This option is also great for auditory learners and those who like to listen along as they read!

Each listen provides you with knowledge of all things billing, coding, auditing, compliance, and physician practice management.

Remember: BC Advantage is THE resource for medical practices and the people behind them!

We’ve been bringing you articles to read— and now listen to—for over 20 years!

Visit Billing-Coding.com, select an article, and push play!

expertise. Coders who understand their tools can guide their organizations toward better outcomes.

The Competitive Advantage of Coder Involvement

Organizations that meaningfully incorporate coder insights during technology evaluation gain significant competitive advantages. They make more accurate projections of automation potential, improving ROI capture and departmental planning. Time-to-value accelerates as systems are configured more correctly from the start.

Perhaps most importantly, coders who engage in technology evaluation become champions of change rather than potential sources of resistance. They understand how the technology works and how it fits into their evolving roles and teams.

The healthcare industry is at a turning point. Autonomous coding technology is rapidly expanding, and early adopters are gaining significant operational advantages. Organizations that leverage coder expertise during vendor evaluation position themselves for success.

For coding professionals, this represents an opportunity to actively shape their careers rather than simply react to technological change. By bringing their specialized knowledge to technology decisions, they ensure their expertise remains central to their organizations’ success.

The question isn’t whether autonomous coding will transform the industry—it’s whether coders will help guide that transformation. Those who engage meaningfully in technology evaluation will find themselves leading the change rather than following it.

Taylor Webster, CPC, CCS, is Head of Coding Quality, and Tricia Lewis, CPC, CPMA, is Coding Quality Advisor at Fathom, a health technology company that uses deep learning artificial intelligence to automate medical coding for a wide range of specialties and practices. As certified coders, Webster and Lewis manage strategic analysis, client analytics, programmatic auditing, and reporting on behalf of Fathom’s health system, physician group, and health plan clients. www.fathomhealth.com

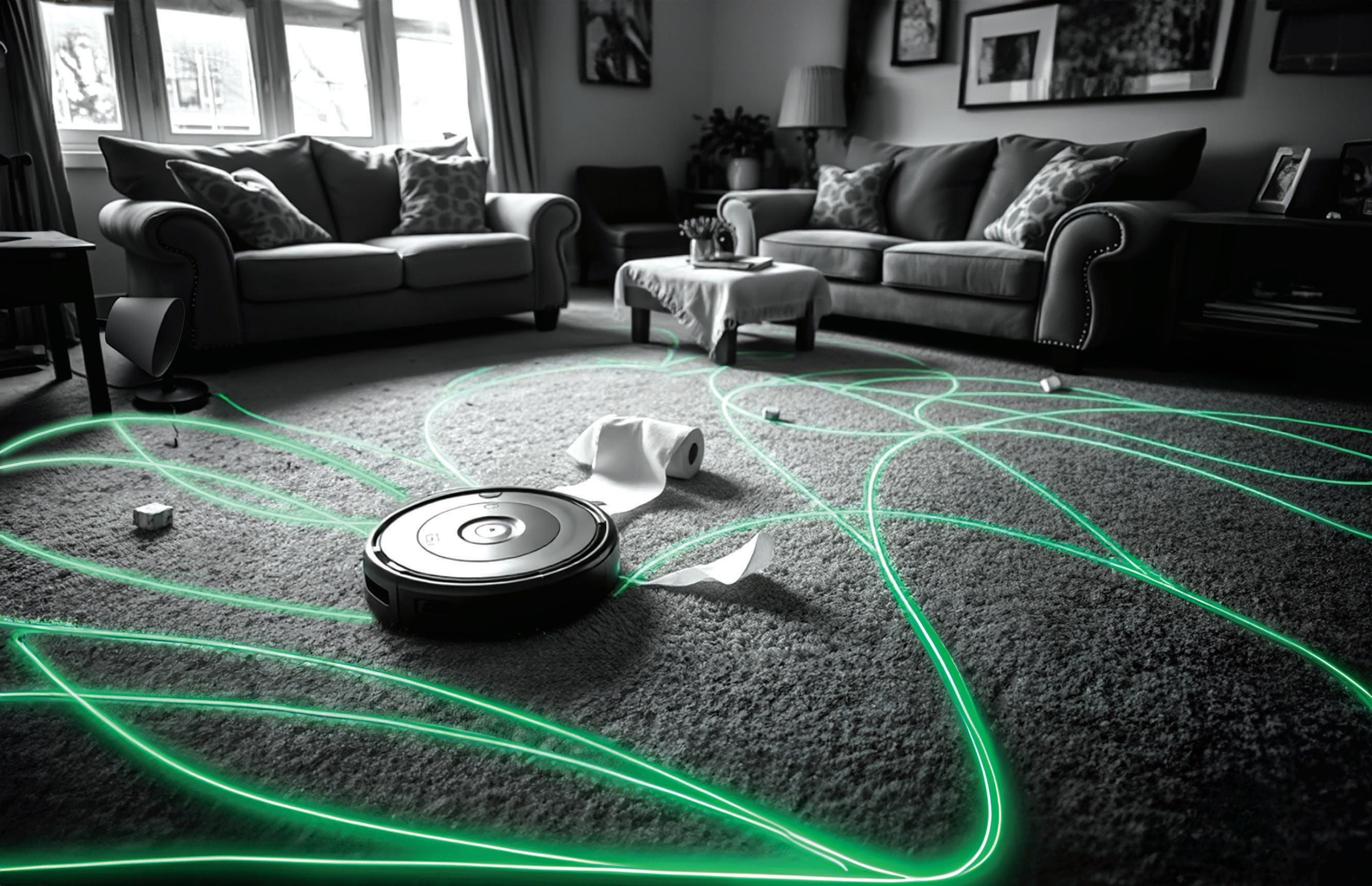

THE IMPORTANCE OF DATA AND NETWORK SEGMENTATION

On January 6, 2025, the U.S. Department of Health and Human Services Office for Civil Rights (HHS OCR) published a notice of proposed rulemaking, “HIPAA Security Rule to Strengthen the Cybersecurity of Electronic Protected Health Information,” with public comments due March 7, 2025. As of September 13, 2025, the Final Rule has not been released.

Let’s step back for a moment to January 5, 2021, when H.R. 7898 was signed into law to address the recognition security practices, amend the HITECH Act, and expressly provide for the Secretary to mitigate audits and fines for covered entities and business associates who have recognized security practices in place for “not less than the previous 12 months.”

Recognized security practices means the standards, guidelines, best practices, methodologies, procedures, and processes developed under section 2(c)(15) of the National Institute of Standards and Technology Act, the approaches promulgated under section 405(d) of the Cybersecurity Act of 2015, and other statutory authorities. Such practices shall be determined by the covered entity or business associate, consistent with the HIPAA Security Rule (part 160 of title 45 Code of Federal Regulations and subparts A and C of part 164 of such title).

Given that the National Institute of Standards and Technology (NIST) was mentioned, it is important to note that there is a HIPAA Security Rule-specific NIST special publication. NIST SP 800-66 (rev. 2) compliments the requirements set forth in the HIPAA Security Rule. While this publication is not meant to usurp the HIPAA Security Rule (legally it cannot because it is not a regulation), it is helpful in three ways: (1) meeting federal government grant and contract requirements; (2) having a cross-walk between the HIPAA Security Rule and NIST standards; and (3) falling under the umbrella of “recognized security practices” that can mitigate liability under H.R. 7898.

There is one item—network segmentation—that cannot be overlooked. The remainder of this article is dedicated to explaining what network segmentation is and why it is essential to mitigating the risk of a material cybersecurity incident, as well as complying with HIPAA and Federal Acquisition Regulations (FAR), as well as related government contract and grant provisions.

Analysis

For those who are unfamiliar or perhaps did not notice three words in the HIPAA Security Rule—standard,

required, and addressable—now is the time to notice. In a nutshell, “standard” and “required” are compulsory items. “Addressable” does not mean optional; however, instead of the specific item (think encryption being “addressable”), a covered entity or a business associate needs to document why that particular safeguard is not implemented and what is in place that meets the same objective. Safeguards are categorized in three buckets: technical, administrative, and physical. If the anticipated proposal in the January 6, 2025 notice of proposed rulemaking (NPRM) to update the HIPAA Security Rule makes it in, then the distinction between “required” and “addressable” would disappear.

Network segmentation essentially works in conjunction with layered security, which has many layers to penetrate before an attacker could reach the sensitive health data. Think of medieval times when castles were often surrounded by a forest, then an open field, then a moat requiring a drawbridge to enter the initial area behind the wall, and then other safety mechanisms as slots to shoot arrows from, pointed tips so that the wall could not be scaled, and other defense mechanisms. This is how layered security works, just with different safeguards—firewalls, encryption, secure Wi-Fi, network segmentation, etc.

Then, like cutting a tray of brownies into individual pieces, a network is divided into smaller, siloed segments. This enables better control of data flow and enhanced security. Under any revisions to the HIPAA Security Rule, network segmentation will simply be mandatory and 45 CFR 164.312(1)(2)(vi) would require covered entities and business associates to “implement technical controls to segment their electronic information systems in a reasonable and appropriate manner.” In reality, it has already been an existing requirement in NIST, 42 CFR Part 2 and generally in 45 CFR § 164.312(a) to protect electronic protected health information (ePHI), which is included in the broader definition following the 21st Century Cures Act of electronic health information (EHI).

NIST SP 800-66 (rev. 2), on page 65, Table 21, identifies key activities as technical safeguards that fall under the umbrella of Access Control, which is §164.312(a) of the HIPAA Security Rule. See Table 1.

MEDICALLY ASSISTED SUICIDE IN THE U.S. AND GLOBAL PERSPECTIVES FOR PRACTICE MANAGERS

As medical practice managers, you navigate complex ethical, legal, and operational challenges daily. One topic gaining attention is Medically Assisted Suicide, or Medical Aid in Dying (MAID), which is legal in a growing number of U.S. states and select countries worldwide. Understanding its legal status, implications for practice management, and global benchmarks can help you prepare your team for patient inquiries and ensure compliance with evolving regulations.

MAID in the United States: Legal Landscape and Implications

In the U.S., MAID—where a physician provides a terminally ill patient with a prescription for self-administered lethal medication—is legal in 11 jurisdictions: Washington, D.C., and the states of California, Colorado, Hawaii, Maine, Montana, New Jersey, New Mexico, Oregon, Vermont, and Washington. Oregon led the way in 1994 with its Death with Dignity Act, followed by Washington in 2008 and others more recently, with New Mexico legalizing MAID in 2021. These laws typically require patients to be 18 or older, residents of the state, and diagnosed with a terminal illness with six months or less to live. Euthanasia, where a physician directly administers lethal drugs, remains illegal nationwide.

Data from Oregon, a pioneer in MAID, shows steady but limited use: In 2022, 278 patients used lethal prescriptions, representing 0.6% of total deaths. Across all U.S. jurisdictions allowing MAID, approximately 8,700 deaths have occurred since 1997, averaging about 300 annually. Cancer patients account for roughly 66% of MAID cases, followed by those with amyotrophic lateral sclerosis (ALS) at

8%. Practice managers in these states must ensure staff are trained on legal requirements, including patient eligibility, documentation, and reporting to state health authorities. For example, Oregon mandates detailed reporting to its Health Authority, a process that requires meticulous recordkeeping to avoid penalties.

For practices in states where MAID is illegal (39 states as of 2025), managers should be prepared for patient inquiries, especially as 17 states, including New York and Florida, are considering MAID legislation. Staff training on compassionate communication is critical to address these sensitive discussions while adhering to state laws. Visit the PAHCOM Education Calendar and CEUs On-Demand for free training on patient communication and compliance, which can help your team navigate these conversations effectively.

Global Benchmarks: Insights From Other Countries

Globally, MAID and euthanasia are legal in countries like Canada, Belgium, the Netherlands, and Switzerland, offering useful comparisons. In 2021, Canada reported 10,064 MAID deaths, accounting for 3.3% of all deaths, a sharp rise since legalization in 2016. The Netherlands, where both MAID and euthanasia are legal, saw 5.1% of deaths attributed to these practices in 2022. Belgium follows closely, with 2.6% of deaths in 2022 involving MAID or euthanasia. Switzerland, which permits only self-administered MAID, reported 1,196 assisted deaths in 2019, primarily among cancer patients.

These countries highlight stricter oversight and broader eligibility criteria than the U.S. For instance, Canada allows MAID for non-terminal but “grievous and irremediable” conditions, sparking debate among disability advocates. In contrast, U.S. laws are narrower, focusing on terminal illnesses. Globally, cancer remains the leading condition for MAID, accounting for up to 80% of cases, similar to U.S. trends. These benchmarks underscore the importance of clear policies and staff training, as patient demand may grow if U.S. laws expand.

Practical Steps for Practice Managers

For practices in MAID-legal states, compliance is paramount. Ensure your electronic health record (EHR) systems are configured to track MAID-related documentation securely. Train staff on state-specific protocols, such as obtaining two physician confirmations of eligibility. In states where MAID is illegal, focus on patient education and referral pathways to palliative care.

Cybersecurity is also critical, as sensitive MAID-related patient data requires robust protection. An HITCM-PP certification will prove a valuable asset when navigating privacy regulations, including HIPAA compliance, and can guide your team in safeguarding patient information. As public debate grows—49% of Americans support MAID legalization per Pew Research—practice managers must stay informed. Use The PAHCOM Forum to communicate directly with fellow members from within or outside of your state. Whether through PAHCOM or your specialty forums, networking within the professional community will help you stay ahead of regulatory changes.

Conclusion

Medically Assisted Suicide is a complex issue with evolving legal and ethical dimensions. By understanding U.S. laws and global trends, practice managers can prepare their teams to handle patient inquiries with compassion and compliance. Leverage professional association and specialty resources to strengthen your practice’s operational and ethical framework, ensuring you’re ready for this sensitive topic.

Karen Blanchette, MBA, is the Executive Director of PAHCOM. The PAHCOM collaborative network enables solo providers and small group physician practices to access focused information vital to managing their healthcare businesses effectively. Contact Karen at https://my.pahcom.com/contact-karen

Trained and professionally certified managers make a difference. Learn more about the CMM and HITCM-PP at https://my.pahcom.com/certifications.

AUDIT LIKE A CONSULTANT, EVEN IF YOU’RE NOT ONE

You’re sitting in your office, internal auditor hat on, reviewing a chart from a provider you’ve worked with for years. You know his documentation style, you know how he practices, and, yes, sometimes you can tell what he had for lunch based on the typos in the EMR.

So, when you see an encounter that feels a little off, your brain naturally fills in the blanks: “Oh, he always does that because…” Or, let’s be honest, “Yeah, he’s billing a 99215 again; I wonder if it really was high risk.” Sound familiar?

That’s internal auditing. It’s not wrong, it’s just relational. You’re auditing within a system or a practice that you understand, and it’s likely to maintain compliance, correct patterns, and support a shared goal of documentation improvement. You bring experience and context.

But when you step into a consulting role, it’s a whole different ballgame. Even if you don’t plan to move into consulting full-time, learning to audit with a consultant’s mindset adds serious value—to your audits, your providers, and your organization.

The Shift: From Defender to Validator

As a consultant, I don’t have the luxury, or the burden, of knowing your story, your physician’s story, or the political dynamics of your organization. I actually walk into an audit with zero built-in opinions or pre-conceived context of what the outcomes will be. I don’t know how this provider typically documents, what the practice culture is, or how many times this chart has been touched. I come in clean.

And that’s the point.

Consulting allows an unbiased lens. A just-the-facts, showme-the-proof approach that doesn’t lean into assumptions— good or bad.

We must identify:

• The Problem: As an internal auditor, you can’t exactly walk around with blinders and noise-canceling headphones just to stay unbiased. Like it or not, you will be influenced by what you know. Relationships, reputations, and past patterns inevitably creep in.

• The Fix: Treat every audit like a blind audit. Approach the encounter as if you know nothing about the provider, because, in a consulting role, you usually don’t. No backstory, no history, no preconceived notions. Just you, the documentation, and the standards. This mindset helps remove the unconscious bias that comes with familiarity. You’re not auditing the person; you’re auditing the encounter. And when you focus solely on what’s documented and whether it justifies the service, you elevate the integrity of the audit itself.

Here’s the biggest shift I had to make:

• Internal Auditor: “It’s documented, therefore done.”

• Consultant Auditor: “It’s documented, but is it supported?”

See the difference?

Consulting audits demand validation, not just verification. I’m not just checking if something was documented. I’m checking why it was documented. Does it support the medical necessity of the service? Do the elements align with the level billed? Does this chart hold up if no one knows the provider, their habits, or their history?

Not Negative, Just Neutral

I want to be really clear here: This isn’t about being overly critical; it’s about being complete. Consulting isn’t about finding faults; it’s about seeking alignment. It’s asking: Does every piece of this service have its foundation in the documentation? That requires a certain level of neutral detachment.

We’re not here to accuse or excuse, we’re here to assess. And that makes a big difference in how we communicate our findings, especially in environments where providers feel attacked or misunderstood.

What Trips People Up—Yep, the Clinical Cliff

Now let’s talk about the elephant in the exam room: clinical interpretation.

Here’s where I see a lot of auditors, especially those transitioning from internal roles, get tripped up. In trying to validate documentation, they slide a little too far and start trying to make clinical interpretations or start trying to infer what the provider should or should not have said or done clinically. No way! Not our job. Until we have MD, DO, ARNP, or PA behind our name, along with our coding/auditing credentials, we should never try to even get close to the clinical cliff.

We do not say things like, “Well, the patient had this condition, so the provider probably…” or “This seems like it would be medically necessary because…” Nope. We don’t go there.

We are not physicians. And our role is not to explain why something might have happened. Our role is to ensure the documentation clearly demonstrates what happened and that it meets the requirements for what was billed. It’s tempting, especially when you want to defend the provider. But if we stray into clinical reasoning, we risk overstepping our scope and weakening our findings.

You’re Not the Ref; You’re the Replay Booth

Internal auditors are like coaches watching the game in real time. You are part of the team, helping correct the plays and get everyone across the compliance finish line.

But as a consultant? You are the replay booth. You watch the footage. You slow it down. You call what you see—no more, no less.

And that, my friends, is where the real value lies.

Shannon DeConda, CPC, CPC-I, CEMC, CMSCS, CPMA, CMPM, CPMN, is the Director of Coding and a partner at DoctorsManagement, as well as the founder and president of NAMAS. Shannon brings more than 16 years of multi-specialty auditing and coding experiences to DoctorsManagement clients, helping practices optimize business processes and maximize reimbursements. www.doctorsmanagement.com – namas.co

CoDers vs. auDItors

a lIghthearteD look at lIfe on both sIDes

As someone who’s been on both sides of the fence—as a coder and now an auditor— I’ve come to appreciate the unique role each plays in the world of reimbursement. Both have their perks (and their pitfalls), so here’s a lighthearted take on the everentertaining tug-of-war between coding and auditing.