Welcome to this special edition of Pickle dedicated to IndiaJoy 2025, a landmark event that continues to redefine India’s Media & Entertainment (M&E) landscape. As we step into 2025, the industry stands at a decisive crossroads, poised for transformative growth fueled by innovation, investment, and global ambition.

This year is particularly pivotal for the Indian M&E sector. With rapid technological advancements and shifts in audience preferences, 2025 is set to be a defining year, signaling new directions for content, creativity, and commerce. At the center of this dynamic evolution is Hyderabad—a city that has firmly established itself as one of India’s foremost hubs for media, entertainment, and digital creativity.

Hyderabad’s contribution to the M&E sector is both rich and multifaceted. It is home to the iconic Ramoji Film City, the world’s largest film studio complex, and the soon-to-be-launched Image Towers, a state-of-the-art facility designed to house both global and domestic AVGC (Animation, Visual Effects, Gaming, and Comics) and XR (Extended Reality) companies.

The city boasts the enterprising Telugu film industry, which has propelled Indian soft power onto the global stage with cinematic blockbusters like Baahubali, Pushpa, RRR, and the much-anticipated Kalki. Landmark

institutions such as ANR Studios, with its advanced post-production facilities including the ANR-QUBE virtual production setup and cutting-edge LED wall technology, highlight Hyderabad’s edge in technical innovation.

Moreover, Hyderabad is not just about big studios and blockbuster films. It is a crucible for startups and innovation, epitomized by hubs like T-Hub and premier educational institutions such as ISB, driving the fusion of technology and creativity. The city’s animation prowess gave the world Little Bheem, a testament to its global storytelling potential.

Hyderabad’s spirit of enterprise is best exemplified by visionary filmmakers like SS Rajamouli, whose meticulous execution of international film shoots and Oscar-winning achievements have placed Indian cinema on the world map.

Next month, as Mumbai hosts the CII M&E Global Investor Meet on December 1 and 2, it presents another unprecedented opportunity for investors and creators to collaborate and shape the future of Indian entertainment. IndiaJoy 2025 is not just an event—it is a celebration of the city’s unique energy, ambition, and leadership in the M&E

For any queries, please contact us. Stay tuned for the latest from India’s dynamic M&E industry.

n vidyasagar pickle media nat@pickle.co.in, www.pickle.co.in

Pickle Volume XVIII 6th Edition

Published by Pickle Media Private Limited

Email: natvid@gmail.com l Mumbai l Chennai No.2, Habib Complex Dr Durgabhai Deshmukh Road RA Puram CHENNAI 600 028

For advertising: natvid@gmail.com / pickle@pickle.co.in

Senior Editor : Vivek Ratnakar

Editorial Coordinators : Maitreyi Vidyasagar, Shruti Sundaranand

Design: Jose J Reegan, James, D Sharma, S Lakshmanan

Photo Editor : K K Laskar

Admin & Operations : B Rajalakshmi

Email: natvid@gmail.com

Pickle Business Guide 2025 Copyright 2025 by Pickle Media Pvt Ltd. All Rights Reserved. Pickle is an ad supported business guide tracking the filmed entertainment business in India.

SOUTH ASIA’S

SOUTH ASIA’S

SOUTH ASIA’S

SOUTH ASIA’S

TOP FILM MARKET FOR

TOP FILM MARKET FOR

TOP FILM MARKET FOR

TOP FILM MARKET FOR

TOP FILM MARKET FOR SOUTH ASIA’S

GLOBAL COLLABORATIONS & CO-PRODUCTION

GLOBAL COLLABORATIONS & CO-PRODUCTION

GLOBAL COLLABORATIONS & CO-PRODUCTION

GLOBAL COLLABORATIONS & CO-PRODUCTION

GLOBAL COLLABORATIONS & CO-PRODUCTION

20-24 November, 2025 | At Marriott, Panjim, Goa

20-24 November, 2025 | At Marriott, Panjim, Goa

20-24 November, 2025 | At Marriott, Panjim, Goa

20-24 November, 2025 | At Marriott, Panjim, Goa

20-24 November, 2025 | At Marriott, Panjim, Goa

Main verticals

Main verticals

Main verticals

Main verticals

Main verticals

CO PRODUCTION MARKET

CO PRODUCTION MARKET SCREENWRITERS’ LAB

CO PRODUCTION MARKET SCREENWRITERS’ LAB WORK IN PROGRESS LAB

SCREENWRITERS’ LAB WORK IN PROGRESS LAB

CO PRODUCTION MARKET SCREENWRITERS’ LAB WORK IN PROGRESS LAB

WORK IN PROGRESS LAB

CO PRODUCTION MARKET SCREENWRITERS’ LAB WORK IN PROGRESS LAB

VIEWING ROOM

VIEWING ROOM

VIEWING ROOM

It is a converging point for South Asian & international film makers & film producers, sales agents & festival programmers for potential creative & financial collaboration

November 20-28,2025 | Goa, India

LOS ANGELES I NOVEMBER 11-16, 2025

The

2025 is not just a milestone for Indian media and entertainment—it’s the year India stepped confidently onto the world stage, ready to shape the future of global storytelling

The year 2025 will be remembered as a watershed moment for India’s media and entertainment (M&E) industry—a year when promise transformed into performance, and India cemented its status as a global creative powerhouse. Box office records were shattered, digital platforms surged, animation broke new ground, and landmark policy initiatives laid the foundation for sustainable, innovation-driven growth. More than just numbers, 2025 told a story of India’s cultural richness, technical prowess, and unique “Advantage India” in the global M&E landscape.

India’s “Advantage” in global M&E now rests on several pillars:

Cultural and Linguistic Diversity: With over 20 major languages and hundreds of dialects, India offers a creative ecosystem unmatched anywhere in the world. This diversity not only fuels regional storytelling but also provides international studios with access to a vast, multifaceted audience.

Skilled Talent and Competitive Costs: India’s creative and technical talent pool

is among the world’s largest, bolstered by specialized institutions like IICT and government incentives. Cost-effective production and access to cutting-edge technology make India the destination of choice for global projects.

Policy and Infrastructure Support: The India Cine Hub streamlines permissions and incentivizes foreign productions. Progressive AVGC policies at both national and state levels, along with significant investments in infrastructure, have created regional hubs and attracted international investment.

Startup and Creator Economy Boom: India’s thriving startup ecosystem in M&E— spanning gaming, animation, digital content, and tech innovation—demonstrates the country’s entrepreneurial spirit. Global streaming platforms are forging coproductions and localizing content, further integrating India into the international creative supply chain.

Prime Minister Modi’s vision of “Create in India for the World” is now a reality. International productions increasingly view India as a preferred partner, not just for cost reasons, but for the creative synergy and coproduction opportunities the country offers.

In 2025, technology became the great enabler. AI-powered tools helped M&E companies boost revenues and cut costs, while post-production houses used AI to slash rendering times and enhance global competitiveness. Content recommendation, dubbing, dynamic ad insertion, and predictive analytics were all revolutionized by AI, amplifying—not replacing—human creativity.

India’s digital creators, now numbering over 2 million, influenced $350 billion in consumer spending annually, a figure projected to reach $1 trillion by 2030. Yet, only 8-10% monetize effectively—highlighting both the sector’s vast potential and the need for more equitable revenue-sharing frameworks. The youth-driven creator economy, with 83% of Gen Z identifying as potential creators, is poised to become the industry’s growth engine.

After years of pandemic-induced uncertainty, 2025 marked a spectacular comeback for Indian cinema. Box office collections soared

NON-HINDI

FOR OVER 60% OF BOX OFFICE REVENUES AND OTT VIEWERSHIP, PROVING THAT LOCAL STORIES HAVE NATIONAL—AND GLOBAL— APPEAL

by 27% in the first half of the year, reaching ₹4,812 crore, with cumulative collections by July climbing to ₹7,175 crore—well on track to eclipse the 2023 record. This resurgence was not merely about higher footfalls; it was the triumph of strategic content curation, diversity, and a renewed theatrical experience.

Blockbusters like Kantara: Chapter 1 and Chhaava redefined the very idea of panIndian cinema. Rishab Shetty’s Kantara: Chapter 1—an epic rooted in Karnataka’s folk traditions—crossed ₹800 crore globally, captivating audiences across languages with its cultural authenticity and world-class VFX. Meanwhile, Vicky Kaushal’s Chhaava,

Rishab Shetty’s Kantara: Chapter 1—an epic rooted in Karnataka’s folk traditions—crossed ₹850 crore globally, captivating audiences across languages with its cultural authenticity and world-class VFX

a mid-budget historical drama, delivered a staggering 500%+ return on investment and became a national sensation. These films proved that Indian cinema’s future lies in leveraging local narratives for global impact, blending tradition with innovation.

Perhaps the most telling trend of 2025 was the dominance of regional cinema. NonHindi language films contributed 63% of all-India box office collections in early 2025, underscoring how Telugu, Tamil, Kannada, and Malayalam films have expanded far beyond their linguistic heartlands. Regional filmmakers, empowered by authentic storytelling and technological sophistication, not only conquered new markets but also redefined what “mainstream” Indian cinema means.

This surge was mirrored on digital platforms, where 86% of OTT viewership was

focused on local stories. The appetite for regional content signaled India’s evolving cultural confidence—a narrative that speaks authentically to its own people, while increasingly resonating with global audiences.

In 2025, Indian animation had its own breakout moment. Mahavatar Narsimha, produced by Hombale Films, grossed ₹300325 crore to become the country’s highestgrossing animated film. Its success validated the commercial viability of mythological animation and laid the groundwork for an ambitious Mahavatar Cinematic Universe. For an industry long overshadowed by its Western and East Asian counterparts, this was a milestone—showcasing India’s ability to blend devotion, storytelling, and technical excellence in a format once considered niche.

The launch of the Indian Institute of Creative Technology (IICT) as a National Centre of Excellence for AVGC-XR (Animation, Visual Effects, Gaming, Comics, and Extended Reality) marked a strategic leap for the industry. With partnerships involving JioStar, Adobe, Google, Meta, Microsoft, and NVIDIA, IICT aims to train world-class creative talent and bridge the persistent skills gap.

Meanwhile, the inaugural World Audio Visual & Entertainment Summit (WAVES) in Mumbai attracted delegates from over 100 countries and generated $1.1 billion in media deals— infrastructure commitments that position

India as an emerging global M&E hub. The government’s $1 billion Creator Economy support underscores a new era of active state engagement, with policies encouraging 100% FDI in broadcasting and streamlined licensing to foster investment and innovation.

2025 was the year digital officially overtook television as India’s largest M&E segment, accounting for 32% of total industry revenues. Digital advertising grew 17%, and the number of internet users soared to 900 million, driven by 5G adoption and a proliferation of affordable smartphones.

OTT platforms reached 601 million users, with paid subscriptions and Connected

TV usage both experiencing double-digit growth. The preference for ad-supported (AVOD) platforms remained strong, but streaming consolidation, such as the Disney+Hotstar merger into JioHotstar, signaled a shift toward aggregation and co-subscription models. Netflix, notably, remained the only profitable OTT platform in this fiercely competitive market, while others pivoted toward family-friendly content for India’s vast Tier 2 and 3 cities.

The Promotion and Regulation of Online Gaming Act 2025 brought long-awaited regulatory clarity, banning all forms of realmoney gaming. While this disrupted shortterm ad revenues, it redirected the industry toward esports and skill-based gaming— segments now recognized as legitimate, sustainable, and globally competitive. Esports revenues rose to $139.3 million, and social gaming filled the gap left by RMG, projected to reach $8.36 billion by 2030.

While national OTT players battled profitability challenges, regional platforms like Hoichoi, Aha, Stage, and ManoramaMAX quietly built sustainable models through single-language focus, diaspora monetization, and costefficient operations. These platforms, with deep local moats, are now prime acquisition targets for national players seeking diversity.

The adoption of virtual production technologies also advanced sustainability goals. Real-time game engines and digital workflows cut carbon emissions by up to 50% and reduced production costs, making eco-friendly filmmaking an industry imperative.

Yet, 2025 was not without its challenges. Piracy continued to drain ₹224 billion annually from the industry, with more than half of media consumers accessing illegal content. Regulatory uncertainty—especially regarding content oversight—created creative and investment risks. Talent shortages, particularly in VFX, animation, and AI-driven content, threatened scalability. And despite strong box office numbers, India’s screen density remained critically low, limiting access in non-urban areas.

These challenges underscore the need for systemic solutions: robust anti-piracy enforcement, regulatory clarity that balances accountability with creative freedom, accelerated talent development, and expanded theatrical infrastructure.

2025 was more than a year of big numbers; it was a pivotal inflection point for India’s M&E industry. The convergence of box office resurgence, digital dominance, animation breakthroughs, policy innovation, and technological adoption demonstrated that India has the creative talent, consumption scale, and institutional frameworks to rival any global entertainment powerhouse.

As India scripts its narrative as the world’s new content hub, 2025 stands as both celebration and clarion call—a landmark year that must catalyze sustained transformation. The journey ahead will demand urgent action on piracy, regulatory reform, talent development, infrastructure expansion, and fair creator monetization. If India rises to the occasion, its creative brilliance will translate into economic empowerment for the millions driving its ongoing cultural renaissance.

IndiaJoy 2025 is both a reflection of and a driver of growth in the AVGC-XR sector in India. It is where talent meets opportunity, where local stories get global exposure, and where the creative economy is not only talked about but also fuelled.

Organized by the Telangana VFX, Animation and Gaming Association (TVAGA), with the robust backing of the Government of Telangana, IndiaJoy brings together the brightest minds and most ground-breaking technologies in film, animation, VFX, gaming, comics, OTT, and digital arts

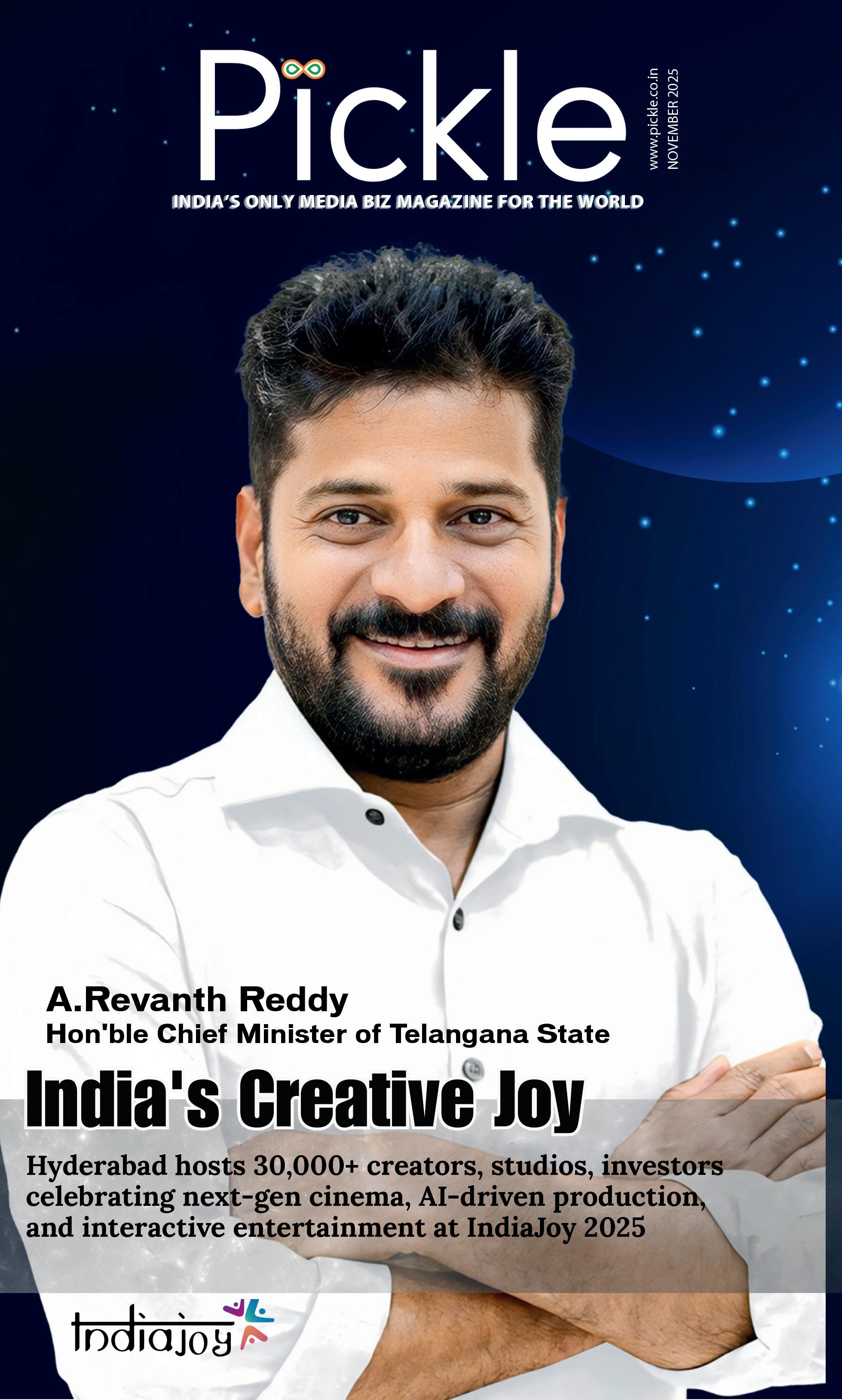

Industry leaders meet Telangana CM to present IndiaJoy 2025: (L to R) Dil Raju (Producer & TFDC Chairperson), A. Revanth Reddy (Hon’ble Chief Minister of Telangana), Mike Madhava Reddy (General Secretary TVAGA, Founder & CEO, Rotomaker), Rakesh Panakanti (CRO, TVAGA), Shaik Khaja Vali (COO, TVAGA)

The halls of HICC-Hitex begin to fill with activity early in the morning. LED walls light up, and motion-capture rigs are powered on. Indie filmmakers rehearse their pitches, while VFX artists make last-minute adjustments to their projects. Cosplayers prepare their costumes under bright lights. Creators, gamers, animators, and producers gather, all set to take part in a festival that celebrates the evolving world of entertainment.

Hyderabad’s HICC Hitex will be a busy crossroads for more than 30,000 creators, studios, brands, and visionaries on November 1 and 2. IndiaJoy 2025 is India’s biggest digital entertainment festival, and it will fill the air with excitement.

This year’s theme is “Powering the Creative Economy,” with all new initiatives aimed at fostering industry growth, innovation, and global connectivity.

Organized by the Telangana VFX, Animation and Gaming Association (TVAGA), with the robust backing of the Government of Telangana, IndiaJoy brings together the brightest minds and most groundbreaking technologies in film, animation, VFX, gaming, comics, OTT, and digital arts.

“Our creative industries are the pride of Telangana. By fostering innovation and inclusion, IndiaJoy is catalyzing economic growth and building Hyderabad’s global reputation,” says Chief Minister A Revanth Reddy.

IndiaJoy 2025 is more than just an event; it’s a platform for partnerships, an incubator for ideas, and a marketplace for content creators and buyers. The event is spread across eight different conference rooms, each hosting a specific vertical. With over 150 speakers, 200+ exhibitors, and 10 flagship conferences, the event’s scale is unprecedented.

India’s AVGC-XR sector is growing faster than most other global markets, at more than 25% a year. India is now the go-to production partner for Hollywood, streaming services, and global studios because it has almost 2 million professionals working on animation, gaming, and VFX pipelines around the world.

Telangana is at the top of this rise. It has almost 30% of India’s VFX workers, world-class studios, and a state policy that encourages the growth of IP creation, gaming, and startups.

IndiaJoy is not just riding this wave; it is also shaping it. This is the sixth edition. Madhava Reddy Yatham, general secretary of the TVAGA and CEO of Rotomaker, says that

“IndiaJoy is about opening doors.” It’s a chance for every creator, storyteller, and business owner to show off their skills and connect with the world.

The Indian Film Market (IFM) is a joint project between TVAGA and Producer Bazaar that is a big deal for the industry this year. The IFM is the first closed-room marketplace

• Dates: November 1–2, 2025

• Venue: HICC Hitex, Hyderabad

• Expected Footfall: 30,000+ creators, producers, and media professionals

• Exhibitors: 200+

• Speakers: 150+

• Key Verticals: Film, Animation, VFX, Gaming, Comics, OTT, Digital Media

• Flagship Conferences: Cinematica, VFX Summit, OTT Pulse, Desi Toons, Creator Street, DreamHack, Comic Con India, ASIFA India Conference, IndiaJoy B2B Pavilion, AMD GameOn

• New Initiative: Indian Film Market (IFM)

and networking hub for India’s film and AVGC (Animation, VFX, Gaming, Comics) industries.

“The Indian Film Market is a big deal for India’s creative industries. We are building a global-facing, structured, and open marketplace for Indian content,” says G.K. Tirunavukarasu, CEO and Founder of Producer Bazaar.

At IFM, curated lists of films, web series, shorts, adaptations, and regional titles are matched with pre-approved buyers from India and around the world, including OTT platforms, broadcasters, distributors, and satellite channels.

The Pitch-to-Deal Forum gives up-and-coming storytellers direct access to top producers and decisionmakers. The Rights Exchange makes deal-making clearer and faster.

There is a special Awarding Ceremony for confirmed deals that honours real business impact and sets a new standard for content marketplaces in India.

The IndiaJoy Innovation Conclave stands out as a pivotal event aimed at harnessing artificial intelligence (AI) within the filmmaking sector. This initiative is a collaboration between India’s Ministry of Electronics and Information Technology and the

Software Technology Parks of India. A highlight of the conclave is the AI Filmmaking Challenge, which offers participants the chance to secure funding for transforming their AIgenerated short films into full-length features intended for submission to international film festivals.

As AI technologies evolve and increasingly influence various aspects of content production— including scriptwriting and postproduction—India’s creative industries face an urgent need to adapt. Historically, these industries have relied on cost-effective labor; however, the rise of AI presents both a challenge and an opportunity that could significantly impact their competitiveness in the global market.

Madhava Reddy Yatham, noted that IndiaJoy’s focus on AI, and filmmaking techniques, sets it apart from other industry events in India. A collaboration with Waves Animation Bazaar will allow winners of the Creative India Challenge to pitch intellectual properties to animation buyers attending IndiaJoy.

IndiaJoy 2025 is a collection of major events, each one a celebration of the successes and goals of its industry.

Cinematica is a top place for cinematography and film technology. It connects filmmakers with the best directors and technicians. The Expo makes the film industry more efficient, from networking to masterclasses, and keeps India at the top of the world in filmmaking.

The VFX Summit is a place where new ideas can flow, bringing together leaders from around the world and Indian pioneers. Expect in-depth looks at new VFX technologies, industry roundtables, and B2B matchmaking—all of which are meant to help India’s VFX and animation industries grow faster.

This one-day meeting brings together everyone involved in the animation value chain. Desi Toons is both a celebration and a call to action for India’s animators and producers. It focusses on indigenous IPs and their potential around the world.

IndiaJoy B2B Pavilion brings together three powerful formats — Indian Film Market (IFM) for global content deals, Pitch to Deal

INDIAJOY 2025 IS MORE THAN A FESTIVAL—IT’S A STRATEGIC MARKETPLACE, POLICY FORUM, AND CREATIVE LABORATORY, ALL CONVERGING IN HYDERABAD, THE EPICENTER OF INDIA’S AVGC REVOLUTION

for creators to showcase ideas to decision-makers, and Frames & Codes where technology, gaming, and storytelling converge to shape the future of digital entertainment.

OTT Pulse brings together the people in charge of India’s streaming revolution. Sessions focus on new trends, business models, and how powerful local stories can be on global platforms.

Creator Street is a creative playground for the AVGC-XR sector. It has panel discussions, artist alleys, competitions, and masterclasses. It is the heart of India’s next generation of visual storytellers.

DreamHack and Comic Con India are back for their sixth years, turning IndiaJoy into a pop culture festival. Comic Con India has a lot of cool things for fans to do, like cosplay contests, celebrity panels, and a lively exhibitor area. DreamHack is the biggest gaming and esports event in the country.

ASIFA is one of India’s oldest animation groups. It gives artists and animators the latest tools and stories to help shape the future of computer graphics in India.

The WAVES Animation Bazaar is a dedicated platform created in partnership with WAVES OTT, designed to bridge the gap between animation creators and potential buyers, such as broadcasters, streaming platforms, and production houses. The event aims to provide animation studios, individual creators, and IP (Intellectual Property) owners with a structured opportunity to present their original concepts, pilot episodes, or completed content to decision-makers from the media and entertainment industry.

The B2B Pavilion at IndiaJoy is where content and opportunity come together. This year, the

event will focus even more on AI, digital storytelling, and immersive experiences.

The Pitch-to-Deal forum, the BuyerSeller Market, and the Frames & Codes segment are all ways for creators to learn, meet other creators, and make money from their work. Panel discussions on funding strategies, IP management, and new trends help Indian stories do well around the world.

Powered by AMD, GameOn 2025 unites gamers, creators, and tech enthusiasts. “AMD GameOn 2025 is where technology, play, and community converge. We’re empowering the next generation of gamers and creators with AI and innovation,” said Pradeep Ramamurthy, Country Head, AMD India. The event includes:

6 AMD Universe Showcase: Hands-on with Ryzen AIpowered laptops, Radeon AI PRO R9700 GPUs, and real-world content creation setups.

6 Buildmasters Zone: PCbuilding contests and live demos.

• Deal-Making: Meet OTT execs, buyers, producers, and close real content deals.

• Up-skilling: Workshops and masterclasses from global industry leaders.

• Showcases: The best in animation, gaming, VFX, and tech.

• Networking: Connect with 30,000+ professionals and visionaries.

• Awards & Recognition: Celebrate the best of Indian creativity.

• Innovation: Experience the latest in AI, AR, VR, and digital storytelling.

6 E-sports: Counter-Strike 2 tournament with a ₹5 lakh prize pool, organized by FragNation.

6 Free Play Zone: Play the latest AAA and India-made games on cutting-edge AMD hardware.

6 Tech Talks: Learn how AI is reshaping gaming and creation.

As Hyderabad continues to welcome the world’s entertainment industry, IndiaJoy stands as a testament to the transformative power of creativity, technology, and collaboration. The event’s impact is clear: partnerships are forged, projects greenlit, and global buyers recognize the value of Indian talent. Hyderabad’s emergence as a hub for innovation is no longer an aspiration—it is a reality, driven by a skilled workforce,

supportive policies, and a thriving studio ecosystem.

IndiaJoy highlights the growing maturity of India’s creative sector and the rising importance of the creative economy to the nation’s growth.

Mike Madhava Reddy, General Secretary of TVAGA and CEO Rotomaker, speaks to Pickle about what’s new at IndiaJoy 2025, how the event is shaping the future of Indian entertainment, and why Hyderabad is emerging as a global creative powerhouse

As IndiaJoy 2025 gears up to welcome thousands of creators, technologists, and industry leaders to Hyderabad, the event’s vision has never been clearer: empower the creative economy and connect talent with opportunity. In this conversation with Pickle, Mike Madhava Reddy, General

Secretary of TVAGA and CEO, Rotomaker, discusses what makes this year’s IndiaJoy truly special, the new initiatives on offer, and how Hyderabad is shaping up as a global hub for media and entertainment.

What sets this year’s IndiaJoy apart from previous editions?

IndiaJoy 2025 is not just bigger in scale—it’s more focused and strategic. This year, we’re bringing together nine major industry events under one umbrella over two days. Each vertical—film, VFX, animation, OTT, comics, esports, and emerging tech—has its own dedicated forum and leadership. We’re launching new flagship initiatives, like the India Film Market, and doubling down on fostering innovation through creator challenges that focus on AI and emerging technologies.

Can you elaborate on the nine verticals and the new initiatives at IndiaJoy 2025?

Absolutely. We have events like Cinematica for film, VFX Summit, Desi Toons, OTT Pulse, Creator Street (for comics), and AMD

Mike Madhava Reddy, General Secretary of TVAGA and CEO Rotomaker

On the innovation front, our AI Filmmaking Challenge, powered by IFA, will support selected filmmakers in creating full-length AI-driven films

Gameon for esports. For emerging tech, there’s the IndiaJoy Innovation Conclave—a new initiative. The India Film Market is another big addition, launched in partnership with Producers Bazaar. This market has two sub-verticals: “Pitch to Deal,” where creators can pitch concepts to OTTs and producers, and a buyerseller market for completed films looking for distribution. There’s also an IP exchange for content rights. On the innovation front, our AI Filmmaking Challenge, powered by IFA, will support selected filmmakers in creating full-length AI-driven films. We’re also hosting Unreal Cinematics and VFX simulation challenges, encouraging the next wave of tech-driven storytelling.

What is the expected turnout this year, and who are the key participants?

We anticipate 30,000 to 40,000 attendees, including creators, animators, VFX artists, producers, and tech innovators from across India and beyond. This year, the main theme is “powering the creative economy,” and our initiatives reflect that focus. Notably, we’re expecting participation from major OTT platforms like Amazon Prime, Sun NXT, Jio, Shorts TV, and others, who are eager to discover new content and talent.

How is IndiaJoy connecting creativity with mainstream industry opportunities?

Our core mission is to bridge the gap between creators and buyers—be it production houses, distributors, or OTT platforms. Events like the IndiaJoy Film Market and Waves Animation Bazaar enable talent to pitch directly to industry leaders. We’re also facilitating governmentindustry roundtables to foster policy support, and signing MOUs with organizations like IICT and T-Hub to promote innovation and entrepreneurship.

WE’RE CREATING A SPACE FOR TALENT TO SHINE, FOR IDEAS TO TURN INTO BUSINESS OPPORTUNITIES, AND FOR HYDERABAD TO CONTINUE ITS RISE AS A CREATIVE CAPITAL

What is the government’s role and objective in supporting IndiaJoy?

The Telangana government, led by the IT and Tourism departments, is integral to the organisation of IndiaJoy. Their goal is to promote Hyderabad as a global creative hub, encourage investment, support the IMAGE Tower project, and create more jobs in the creative sector. They are backing both local and international companies, helping to build an ecosystem where talent and innovation can thrive.

What are the three key takeaways or objectives you hope attendees will achieve at IndiaJoy 2025?

First, we want creators to capitalize on their content—whether it’s selling their films, finding producers, or connecting with

OTT platforms. Second, we aim to educate the industry on emerging technologies—especially the impact of AI, VFX, and animation—through panels and workshops led by top experts. Third, IndiaJoy is about building networks and partnerships, helping storytellers meet the right people to take their ideas forward.

Any final thoughts on the impact of IndiaJoy?

IndiaJoy is more than a festival; it’s a marketplace and a launchpad for the future of Indian entertainment. We’re creating a space for talent to shine, for ideas to turn into business opportunities, and for Hyderabad to continue its rise as a creative capital. For anyone in the media and entertainment ecosystem, IndiaJoy 2025 is the place to be. Technology changes rapidly, That’s why we need event like IndiaJoy to educate people, help them build connections, and focus on what truly matter

Access a curated deal pipeline across films, streaming, theme parks, gaming, virtual production, and AI driven ventures

Access a curated deal pipeline across films, streaming, theme parks, gaming, virtual production, and AI driven ventures

Access a curated deal pipeline across films, streaming, theme parks, gaming, virtual production, and AI driven ventures

Access a curated deal pipeline across films, streaming, theme parks, gaming, virtual production, and AI driven ventures

See sector-specific opportunities from top media houses, fast growing tech innovators, and state-backed infrastructure projects.

See sector-specific opportunities from top media houses, fast growing tech innovators, and state-backed infrastructure projects.

Hold one-on-one meetings short listed

meetings

Hold one-on-one meetings short listed from over 100+ companies seeking funding.

funding.

Talk directly to promoters who are already generating revenue and now ready to scale.

Talk directly to promoters who are already generating revenue and now ready to scale.

Talk directly to promoters who are already generating revenue and now ready to scale.

Talk directly to promoters who are already generating revenue and now ready to scale.

See sector-specific opportunities from top media houses, fast growing tech innovators, and state-backed infrastructure projects.

Explore co-investment structures under India’s 17 co-production treaties.

Explore co-investment structures under India’s 17 co-production treaties.

Explore co-investment structures under India’s 17 co-production treaties.

Explore co-investment structures under India’s 17 co-production treaties.

Spot ventures that are exitready, with commercialization strategies in place.

See sector-specific opportunities from top media houses, fast growing tech innovators, and state-backed infrastructure projects. Spot ventures that are exitready, with commercialization strategies in place. Hold

Spot ventures that are exitready, with commercialization strategies in place.

Spot ventures that are exitready, with commercialization strategies in place.

Hear from industry leaders who have already built successful positions in the sector.

Hear from industry leaders who have already built successful positions in the sector.

Hear from industry leaders who have already built successful positions in the sector.

Visit

Equity Funds Strategic Investors Venture Capital Funds

Private Equity Funds

Private Equity Funds

Strategic Investors

Venture Capital Funds

Strategic Investors Venture Capital Funds

HNIs (High-Net-Worth Individuals)

HNIs (High-Net-Worth Individuals)

HNIs (High-Net-Worth Individuals)

Accelerators

Accelerators

Hear from industry leaders who have already built successful positions in the sector.

Hear from industry leaders who have already built successful positions in the sector.

Visit

Visit

Visit new studio hubs coming up in Mumbai, New Delhi, Bengaluru, and Chennai.

Visit new studio hubs coming up in Mumbai, New Delhi, Bengaluru, and

Be part of India’s expanding $30B+ M&E industry with CIIfiltered access to emerging opportunities.

Be part of India’s expanding $30B+ M&E industry with CIIfiltered access to emerging opportunities.

Be part of India’s expanding $30B+ M&E industry with CIIfiltered access to emerging opportunities.

Be part of India’s expanding $30B+ M&E industry with CIIfiltered access to emerging opportunities.

Be part of India’s expanding $30B+ M&E industry with CIIfiltered access to emerging opportunities.

Investee Participants

Investee Participants

Digital Platforms and service providers – OTT, Vertical Videos, FAST TV and AI services.

Digital Platforms and service providers – OTT, Vertical Videos, FAST TV and AI services.

Digital Platforms and service providers – OTT, Vertical Videos, FAST TV and AI services.

Digital Platforms and service providers – OTT, Vertical Videos, FAST TV and AI services.

Broadcasters, Broadband media providers and aggregators

Broadcasters, Broadband media providers and aggregators

Broadcasters, Broadband media providers and aggregators

Broadcasters, Broadband media providers and aggregators

Traditional Print brands/Integrated Trans media houses

Traditional Print brands/Integrated Trans media houses

Traditional Print brands/Integrated Trans media houses

Online gaming studios

Traditional Print brands/Integrated Trans media houses

Online gaming studios

Online gaming studios

Online gaming studios

Filmed entertainment studios, production companies and independent specialists

Filmed entertainment studios, production companies and independent specialists

Filmed entertainment studios, production companies and independent specialists

Filmed entertainment studios, production companies and independent specialists

Animation & VFX studios

Animation & VFX studios

Animation & VFX studios

Animation & VFX studios

Theme Parks, Exhibition and Venue services

Theme Parks, Exhibition and Venue services

Theme Parks, Exhibition and Venue services

Theme Parks, Exhibition and Venue services

Live Events & Music

Live Events & Music

Live Events & Music

Live Events & Music

OOH

OOH

OOH

OOH

Infrastructure companies

Infrastructure companies

Infrastructure companies

Infrastructure companies

Government Agencies

Government Agencies

Government Agencies

Government Agencies

Growth

Growth

to global networks and co-production opportunities. Growth capital for expansion, technology upgrades, and new market entry.

Growth capital for expansion, technology upgrades, and new market entry.

to

networks and co-production opportunities.

Experienced

Curated Deal Flow

Ventures

Curated Deal Flow

Ventures aren’t just listed — they’re handpicked. Each has been screened for funding readiness

Meet

Meet

Direct Access

Direct Access

Efficient Matchmaking

Efficient Matchmaking

Expect introductions and pitch sessions with 80–100 vetted partners, designed to make every meeting count

Expect introductions and pitch sessions with 80–100 vetted partners, designed to make every meeting count

One

One Opportunity

One on One Opportunity

Focused Deal Environment

Networking

Focused Deal Environment

Networking

5TH - 7 TH NOV 2025

MIPCOM 2025 marked an irreversible shift: the future winners in entertainment will be those who blend creator-driven models with traditional studio strengths, layered monetization, and multiplatform strategies. ‘Hybrid’ is now essential; ‘pure-play’ alone leads to obsolescence

Lucy Smith, Director of MIPCOM, declared 2025 to be a generational turning point. MIPCOM’s transformation—YouTube’s keynote, direct creator pitches, advertiser-funded content summits, and BBC Studios’ embrace of creators in executive roles—revealed that

integration of creators, fandoms, and platformagnostic strategies is now the industry’s new foundation. Media businesses are urged to act immediately to avoid irrelevance; adaptation is now imperative.

YouTube, boasting $9.8 billion in quarterly ad revenue (Q2 2025), showcased its power as an audience amplifier, not a platform competitor.

Pedro Pina’s keynote emphasized that studiocreator partnerships enlarge total revenue— BBC Earth’s 14 million YouTube fans, for instance, are further monetized through paid OTT, merchandise, live events, and crossplatform consumption.

Key implications:

6 Sole focus on direct-to-consumer streaming is insufficient; simultaneous licensing to YouTube, TikTok, and regionals is a must.

6 Audience relationships, spread across fragmented platforms, multiply revenue— fragmented fandoms reliably outperform captive subscriber strategies.

6 Platform flexibility outperforms gatekeeping—licensing widely generates much higher ROI.

Action point:

Shift quarterly strategy meetings to audience partnership dialogues with YouTube, TikTok, and regional heads. Optimize each franchise for marginal viewership on every major platform, capturing incremental revenue from diverse audiences.

Creator Upfronts at MIPCOM 2025 saw influencers pitching series ideas directly to studios. Tubi revealed creator partnerships drive 40% of new users; Dhar Mann demonstrated creator-led broadcast-scale hits. Executives must realize that creators are not mere talent replacements—they are gateways to deep, monetizable audience relationships.

Traditional TV stars generate passive popularity; creators cultivate active, loyal communities with higher engagement, frequency, and lifetime value.

BBC Studios now appoints creators as executives, signaling that audience expertise is now as vital as broadcast expertise.

Key implications:

6 Integrate creators into executive decisionmaking, not just talent rosters.

6 Evaluate creator-originated IP (characters, fan bases) alongside traditional pitches.

6 Structure partnerships for genuine upside— not just one-off licensing; creators should share in merchandising, spinoffs, and platform revenue.

Action point:

Conduct a formal audit: Identify 50-100 creators whose demographics fit your targets. Request analytics from their platforms. Offer the top 10 formal partnership deals with creative, distribution, and revenue-sharing incentives.

Maria Rua Aguete revealed microdramas (2-3 minute scripted episodes) would account for $11B in global revenue by 2025, nearly double FAST channel revenues. Sixty percent of microdrama revenue is paid (subscription/ transaction)—users pay for emotionally hooking content, reversing old theories about content length and ad inventory.

Microdramas achieve an ARPU of $20/week or up to $80/month—far outpacing Netflix’s $12/ month average. Their ultra-fast, cost-effective production (40-60% cheaper) and rapid velocity create outsized returns.

China dominates with 83% of the share, but Japan, Korea, Thailand—and, notably, India—now stand ready due to rich storytelling traditions and multilingual reach.

Key implications:

6 Studios likely already possess 50-100 IPs suitable for microdrama derivatives.

6 Even a 10% success rate in microdramas generates profits, given the low cost and high ARPU.

6 Microdramas become the ideal testbed for new creators and concepts—success can be quickly scaled up.

Action point:

Identify 5-10 franchises for microdrama treatment; launch 20-30 episodes per IP across YouTube Shorts, TikTok, and Instagram Reels. Track engagement closely—double down on top performers, and cut underperformers by episode 5.

Vertical integration and ownership (DTC streaming) proved financially unsustainable. Despite massive spending ($15-30B annually for major streamers), only Netflix remains consistently profitable—largely due to cost discipline, not content economics.

Why licensing/distribution wins:

6 Eliminates costly tech overhead.

6 Leverages local expertise.

6 Diversifies revenue across platforms/ regions.

6 Enables multi-year windowing and rapid pivoting.

Action point:

Audit major franchises—compare revenue across distribution vs. exclusive ownership. Distribution wins 7-8 out of 10 times.

Short-form (YouTube Shorts, TikTok, Reels) fuels discovery; long-form (series, deep dives) drives monetization. Success means orchestrating both simultaneously—a content architecture, not two silos.

Repurposing one long-form asset into 1525 derivative clips delivers 6-12% payback of production cost and extends audience reach across platforms.

Action point:

Pick one franchise, produce 50 derivative pieces, and distribute everywhere. Monitor performance for a month; calculate the conversion rate to long form and multiply the impact across more franchises.

BBC Studios now prioritizes “fandom-first” strategies—maximizing intense audience relationships, not mere reach. Repeat engagement, emotional investment, and loyalty have a multiplicative impact on ARPU and lifespan.

Implementation tiers:

6 Casual audience (40%): free, adsupported, low ARPU.

6 Regulars (40%): subscription-based, active participation, higher ARPU.

6 Superfans (20%): premium access, co-creation, events/merchandise— driving the highest ARPU.

Action point:

Map each franchise’s audience by intensity. Invest in Tier 3 content, aiming for a 5% conversion increase in superfans to drive ARPU 20-30% higher.

New-generation studios produce microdramas at a fraction of the traditional cost.

6 Microdramas: $5K–15K per episode; 2-3 minutes each; 100+ episodes monthly.

6 Traditional scripted: $500K–2M per episode; 42 minutes each.

6 Revenue comes from advertising, paid tiers, and direct subscriptions, with ARPU averaging $5-20 per user— often multiples of traditional formats.

India’s WAVES Bazaar uses homegrown IP, regional talents, and diaspora appeal to compete globally. Multilingual abilities are key advantages.

Action point:

Commission 100 microdrama episodes for 5 franchises ($200K-$300K budget). Launch widely; pursue scale (if engagement rates cross 500K views/50% completion). Else, pivot quickly.

Winning creators don’t rely just on subscriptions— they maximize revenue per engaged user via layered monetization:

6 Casuals (60%): advertising, low revenue.

6 Regulars (20%): subscriptions, mid revenue.

6 Superfans (1%): merchandise, events, licensing—half the revenue.

Layered strategy:

6 Advertising (YouTube, TikTok)—base layer.

6 Subscriptions (Patreon, channel memberships).

1. Distribution Wins

6 Multi-channel licensing outperforms exclusive DTC ownership.

6 Most franchises earn more when widely distributed.

2. Creators = Audience

6 Creator-fan relationships drive higher monetization and loyalty.

6 Compensation should align with ARPU, not just episode counts.

3. Microdramas: Low Cost, High ARPU

6 Microdramas cost up to 60% less and generate 3-5x higher ARPU.

6 Studios must allocate 15-20% of budgets to microdrama trials.

4. Fandom Metrics Overreach Metrics

6 Engagement, repeat viewership, and ARPU outperform pure volume.

6 Revamp dashboards; focus on loyalty and intensity.

5. Multi-Format Is Essential

6 Every content piece should be repurposed across short and long formats.

6 Dedicated teams for social derivative strategies are now a must.

6. Data Transparency = Competitive Moat

6 Platforms and studios that share analytics attract top creators.

6 Contracts must mandate deep data sharing and third-party verification.

6 Transactions (episode sales, early access).

6 Live events (livestreams, meetups).

6 Merchandise (branded, limited edition).

6 Brand partnerships and IP licensing (major revenue verticals).

Action point:

Audit your current revenue layers. Identify and survey superfans for willingness-to-pay across premium tiers. Aim for Layer 3-7 revenue to outpace Layer 1-2 within a year.

THE FUSION OF CREATORS, PLATFORMS, AND STUDIOS IS UNSTOPPABLE.

Lucy Smith’s 2025 verdict: the era of streaming wars is over. Now, leadership is decided by creator integration, audience quality, and layered monetization. The chaos of the previous decade (2015-2024) has ended. Those pivoting to hybrid models—melding creators, studio strengths, and innovative distribution—will win. Pure-play approaches are outdated; adaptation is mandatory.

This transition is evolutionary, not catastrophic. The convergence of creators and mainstream media has already arrived. The central question for organizations is not if but how rapidly they can integrate these strategies.

MIPCOM 2025 demonstrated that survival and success in entertainment no longer depend on old rules or wishful thinking about “pure” business models. Winning companies are now defined by their ability to:

6 Blend creator-driven and studio-driven content.

6 Distribute everywhere, not just via owned apps.

6 Monetize fandoms through layers—not just subscriptions.

6 Embrace microdramas, multi-format assets, and data transparency as core pillars.

AGUETE REVEALED MICRODRAMAS (2-3 MINUTE SCRIPTED EPISODES) WOULD ACCOUNT FOR $11B IN GLOBAL REVENUE BY 2025, NEARLY DOUBLE FAST CHANNEL REVENUES

The only sustainable advantage is adaptability. The fusion of creators, platforms, and studios is unstoppable. For executives, the mandate is clear: pivot aggressively, embrace partnership, and invest in audience relationships, not just content.

The convergence is not in the future; it’s already here. Success rests on how quickly organizations evolve from legacy models to embrace the hybrid, layered, and creatorcentered ecosystem revealed at MIPCOM 2025.

We’ve brought the Creator Economy into the heart of the market, welcomed YouTube for their first major presence at the market, and staged our first brand funded content summit in BrandStorytelling which alongside a new phase of convergence between content creation, digital influence, and innovatio

Pickle

Email : pickle@pickle.co.in

Web: www.pickle.co.in