$10,000,000

$9,000,000

$8,000,000

$7,000,000

$6,000,000

$5,000,000

$4,000,000

$3,000,000

$2,000,000

$1,000,000

$0

Average sale price for single-family homes from 10/2024 to 12/2024, compared to the period from 10/2025 to 12/2025.

$2,500

$1,000 $1,500 $2,000

Price per square foot ratio for single-family homes from 10/2024 to 12/2024, compared to the period from 10/2025 to 12/2025.

Average Sale Price

10/2024 - 12/2024 10/2025 - 12/2025

Price/Square Foot Ratio

10/2024 - 12/2024 10/2025 - 12/2025

Source: MLSListings, Inc., as of January 15, 2026

Criteria: Single Family Residential

By Francis Lopez, Director of Listings

The housing inventory on the peninsula has continued its momentous decline over the past several years. This can be attributed to interest rates in two intertwined ways: (1) with interest rates above 6%, homeowners have been hesitant to move, instead opting to stay in their current home; and (2) many homeowners are enjoying the historically low interest rates from their purchase or refinance in 2020-2022, some as low as 2%.

While inventory has seen an uptick over the past year as home sellers have become more comfortable with interest rates, and no indications that we will ever see rates as low as during the pandemic, there is an upcoming concern that we may see the number of homes on the market rise dramatically. This, too, can be credited to a common type of mortgage home buyers acquired during the pandemic: adjustable-rate mortgages.

Adjustable-rate mortgages (ARMs) are mortgages in which the borrower has an interest rate locked in for set amount of time before the rate readjusts to the current market rates. These ARMs are commonly set for 5-, 7-, or 10-year terms. Not quite as common as the traditional 30-year mortgage, these ARMs typically include lower initial interest rates and can offer homebuyers an opportunity to purchase a home they otherwise would not be able to. After the 5-, 7-, or 10year term, the interest rate adjusts depending on the difference between their initial rate and the current rates. But with the incredibly low rates secured by homebuyers during the pandemic, each of these ARMs will soon see increased rates across the board as their initial rates expire.

According to the Urban Institute, data for ARMs originating between 2020-2022 show 19.5% of ARMs are set to adjust in 5 years, 47.8% in 7 years, and 32.7% in 10 years.1 The first set of ARM rates have begun to reset, but the vast majority will adjust in the next 2-3 years. All of this points to one fact: an alarming number of homeowners will soon see their interest rates increase, with many seeing their monthly payments almost double. The reality is that many homeowners

will soon be forced to move and sell their home. And with 67% of the pandemic-era ARMs likely coming to the end of their terms over the next few years, this will cause a rush of homes onto the market. These home sellers may also face increased desperation to sell their home to avoid the increased cost, and with increased competition, may result in lower home sale prices across the board.

The current housing market has remained steady with lower inventory and buyers accustomed to the current interest rates. But the ticking time-bomb of adjustablerate mortgages will change the market dramatically in 2027 and beyond, with a large supply of homes slated to enter the market. If you are considering selling your home in the next year, reach out to DeLeon Realty today to see how we can provide you with the best home selling experiences before the ARMs race starts.

1Citation from the Urban Institute: 1. https://www.urban.org/urban-wire/ should-borrowers-be-afraid-adjustable-rate-mortgages

on what captures their attention online. DeLeon Realty consistently invests in best-in-class photography, narrated cinematic videos, custom floor plans, and refined digital marketing that immediately elevates our listings above the competition. Every listing is designed to stop the scroll, create urgency, and drive a larger pool of highly qualified buyers to our open houses.

Equally important, our website and marketing content are produced entirely in-house which gives us the ability to adapt to the style and format best suited to the local buyer pool. From town- and neighborhood-specific market insights to legal guidance and design expertise, our content establishes credibility and trust with sophisticated buyers who expect depth, precision, and proven expertise.

DeLeon Realty also has a dedicated marketing arm focused exclusively on the Chinese community, one of the most influential buyer groups in Silicon Valley. We employ a fulltime marketing specialist with an MBA in Marketing whose sole responsibility is outreach, branding, and exposure within this highly targeted market.

As our Palo Alto listing agent, I pride myself on being fluent in both Mandarin and Cantonese, allowing me to communicate directly with buyers, respond to questions in real time, and represent each home with authenticity and cultural fluency. We also employ a full-time interior designer who speaks Mandarin and Cantonese to help with the home preparation process, as well as provide design guidance to the buyer.

Like many others, tech professionals and Chinese buyers often prefer move-in-ready homes. DeLeon Realty’s inhouse design and preparation team works closely with sellers to achieve maximum impact with minimal cost. Through strategic updates, thoughtful design choices, and professional staging, our homes present beautifully, photograph exceptionally well, and create a strong emotional connection with buyers. This, in turn, drives increased interest, more offers, and stronger results.

For sellers seeking true market exposure and a competitive edge, DeLeon Realty delivers where it matters most.

By Colette R. Thomason, Esq.

We have recently seen several noteworthy updates in the legal real estate arena. The first new law discussed below has been implemented, the second will be in the summer, and the third is still evolving.

1) Effective January 1, Business & Professions Code § 10140.8 (AB 723) requires agents to disclose when a property photo has been digitally altered by including a label such as “digitally altered,” and to provide the original, unaltered image alongside the altered version. The law applies to still images modified through photo editing software or artificial intelligence to add, remove, or change property elements, including fixtures, furnishings, finishes, floor plans, landscaping, façades, and visible exterior features or views. Routine edits for lighting, color correction, sharpening, cropping, straightening, angle, white balance, or exposure are excluded.

Examples of edits that require disclosure are digital staging, adding appliances that aren’t actually there,

changing carpet to hardwood floor, changing the color of interior or exterior walls, hiding scratches in floors/ walls, removing power lines, or changing the view out a window.

The local MLS now requires both the photoshopped and the unaltered images be uploaded for full transparency.

In my eight years at DeLeon Realty, I do not recall us ever photoshopping a photo to the extent a disclosure would be required under this new law. However, many agents do make these edits and with advances in AI and photoshop, it can be impossible to tell when a photo has been altered.

To illustrate, compare the photos below. Both are digitally altered, but only one is within the limits of the law. The photo on the right has had the powerlines, a utility pipe, crosswalk sign, and a patch in the road removed, plus greenery added to the front yard. The photo on the right is misleading, thus the need for this new law.

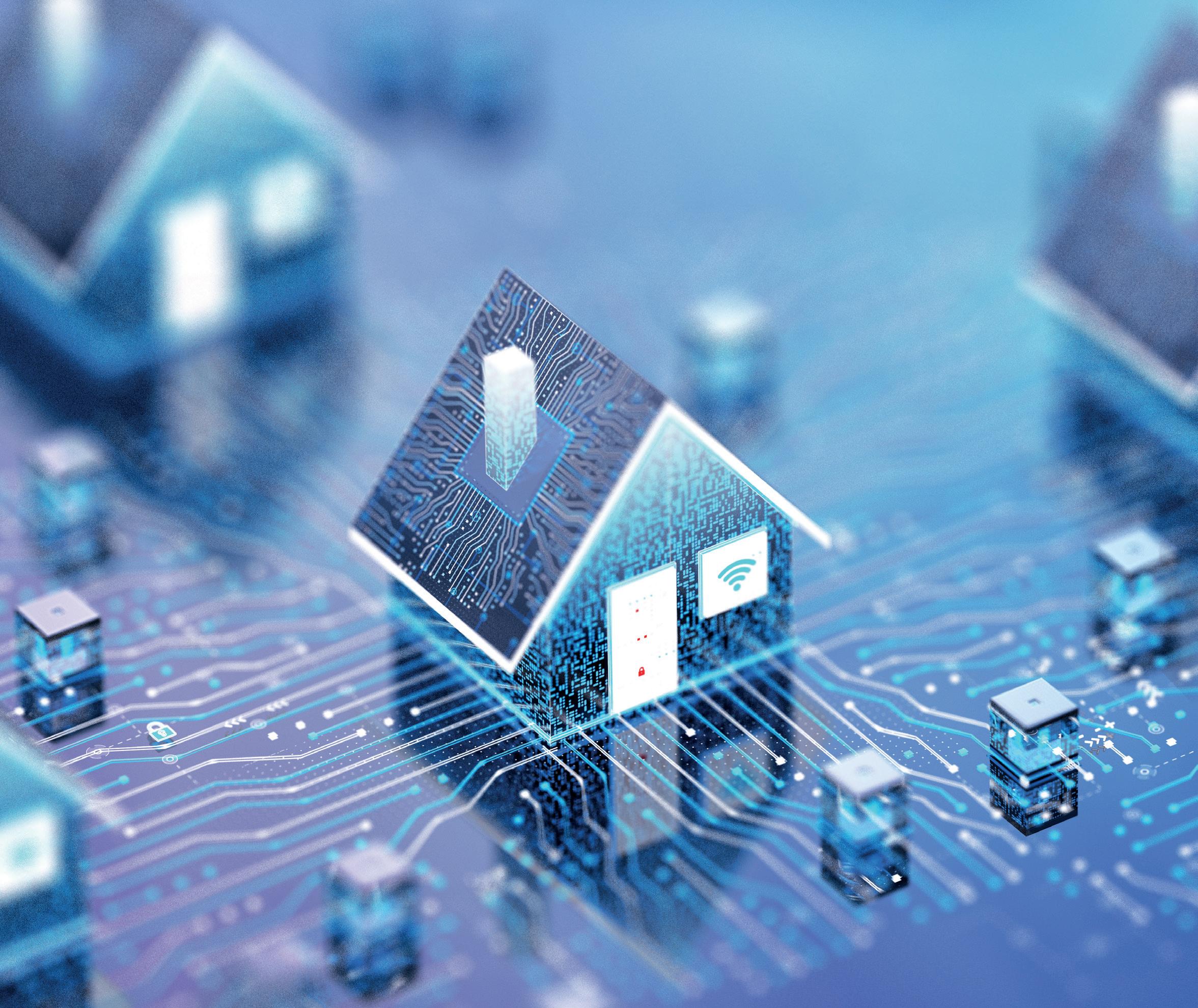

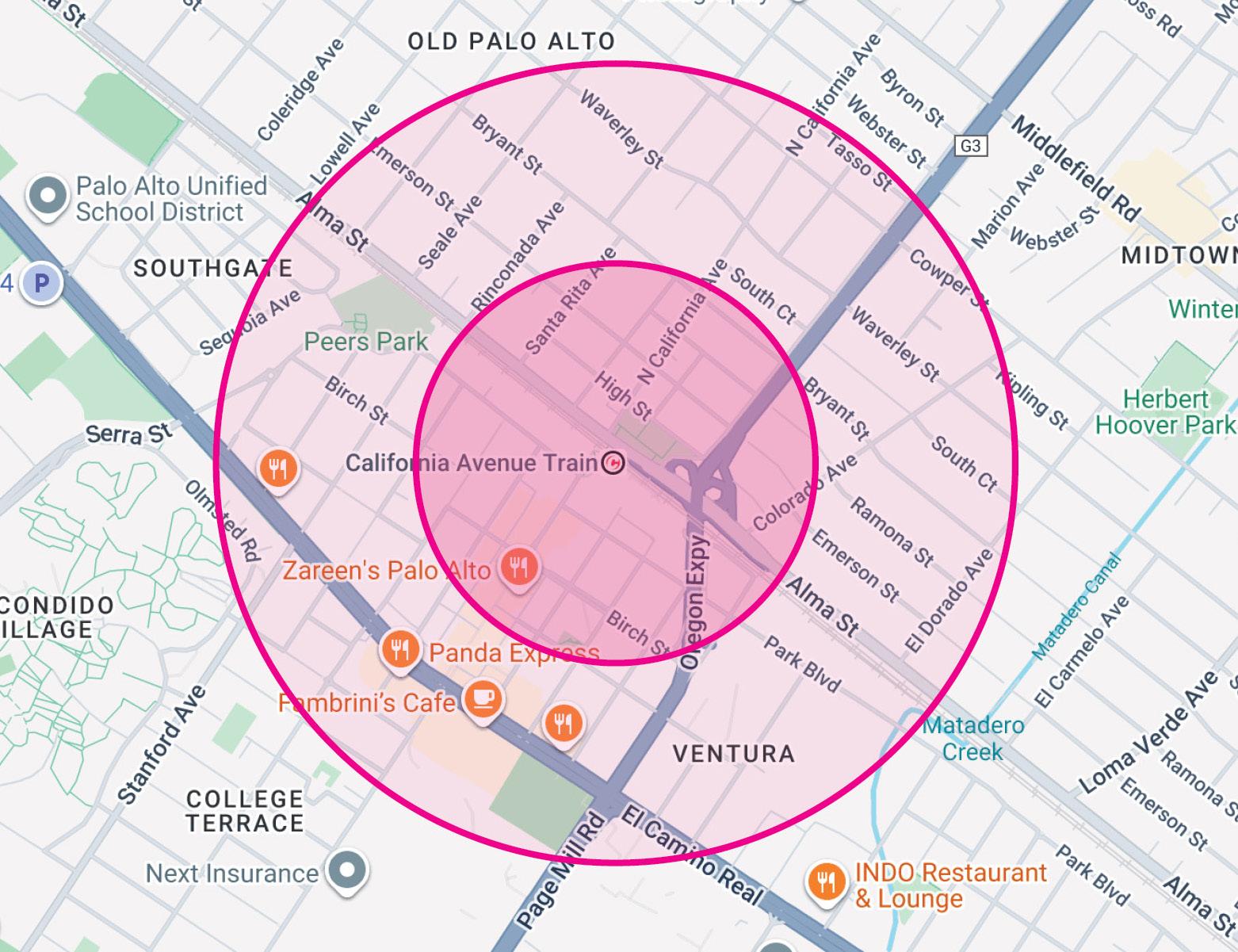

2) In recent years, California has enacted rezoning measures to promote housing affordability. The latest, Government Code §§ 65912.155–65912.162.1 (SB 79), requires cities in certain counties, including San Mateo and Santa Clara, to allow high-density housing within one-half mile of qualifying public transit stops, such as Caltrain stations. The law establishes height and density standards based on proximity to transit and service frequency. Because Caltrain is classified as Tier 1, with 72 or more daily trains, projects may reach 75 feet in height within one-quarter mile of a station and 65 feet within one-half mile, provided the city has a population of at least 35,000.

This could mean developers would be permitted to build up to seven-story apartment buildings within one-quarter mile of the Menlo Park and Palo Alto Caltrain stations, and up to six stories within one-half mile of those stations. As shown on the maps below, this encompasses a broad area, extending into Old Palo Alto and even a portion of Atherton, whose Caltrain station closed approximately five years ago.

Opponents of the bill express concern about the impact of high-density projects with mandatory affordability requirements in otherwise affluent residential neighborhoods, particularly as cities are already managing other state housing mandates and must now comply with this measure beginning July 1, 2026. Proponents argue that increasing housing near transit is essential to meeting affordable housing demand while reducing reliance on freeway traffic through greater use of public transportation.

The maps on this page show the estimated quarter-mile and half-mile distances from the Menlo Park and the Palo Alto California Avenue Caltrain stations.

3) Perhaps unexpectedly, President Trump and Governor Newsom share a policy position blaming large institutional investors for contributing to housing unaffordability. On January 7, President Trump announced via Truth Social a proposal to limit the number of singlefamily homes a large investment company may own. He urged Congress to codify the restriction into law and stated that he was taking immediate steps to bar such investors from acquiring additional single-family homes.

Following suit in his address on January 8, Governor Newsom spoke about big investors, such as private equity and hedge funds, snatching up single-family homes from regular individual homebuyers, thus making housing unaffordable and driving up rents in California. Governor Newsom pleaded with lawmakers to pass a ban on large private equity landlords in California.

Neither the President nor the Governor provided details regarding their respective proposals, including which landlords would be affected or how any ban or limitation would be implemented. In recent years, California legislators have introduced, but rejected, bills that would have capped company ownership of single-family rental homes at 1,000 properties. As of this writing, it remained unclear whether a similar limit would be adopted at the state or national level. President Trump is expected to address housing affordability proposals at the World Economic Forum in Davos on January 19–23. For now, there appears to be bipartisan alignment at both the state and national levels around improving housing affordability.

Disclaimer: Please note the laws discussed herein are very nuanced and detailed. The above is a brief summary and not a complete explanation of all aspects of each law.

By Lisa Lombardi, Certified Appraiser

Recent changes to Multiple Listing Service (MLS) rules, driven by industry-wide commission reforms, have not-so-quietly changed how transaction details are reported. Most notably, broker compensation and seller concessions are no longer displayed in the MLS. While sale prices are still public, the terms behind those prices often are not. In Silicon Valley’s luxury market, this missing context can make a meaningful difference.

In communities such as Atherton, Palo Alto, Menlo Park, Los Altos, and Los Altos Hills, what might seem like a modest concession can represent a six-figure adjustment. When those concessions are no longer visible in the MLS, comparable sales may appear stronger, or weaker, than they truly were, depending on how the transaction was structured behind the scenes.

As appraisers, we rely on accurate and complete data to determine market value. With commission and concession details no longer readily available:

• We must verify transaction terms manually, often by reaching out directly to listing and buyer agents.

• Appraisal timelines can be extended, especially when agents are difficult to reach or when lenders request more detailed explanations.

• When key details cannot be confirmed, appraisers may take a more cautious or conservative approach, especially with custom or luxury properties.

This additional scrutiny is most noticeable in markets with low inventory and limited recent sales, where each comparable carries significant weight.

For real estate agents, CMAs have become more nuanced and less formula-driven:

• Two homes may show similar sale prices, yet one may have included substantial credits or buyerpaid compensation that is no longer visible.

• Accurate pricing now relies more heavily on local knowledge, direct experience, and insight into how comparable homes actually sold.

In today’s environment, context matters just as much as the numbers.

The new MLS rules have not changed how market value is determined, but they have changed how value is analyzed, supported, and explained. In Silicon Valley’s luxury markets, thoughtful pricing, clear documentation, and experienced professionals on all sides of the transaction are more important than ever to ensure reliable CMAs, smoother appraisals, and successful closings.

Silicon Valley’s Importance and Wealth Will Continue to Grow

Having experienced the 1990s dot-com boom firsthand as a young Wilson Sonsini attorney, I have witnessed several cycles of boom and bust in Silicon Valley. However, the speed and pervasiveness with which AI is already transforming the global economy lead me to believe that this wave of wealth creation will dwarf those of the past. Several data points underscore Silicon Valley’s current strength and its continued upside:

• The world’s three most valuable companies are headquartered here. Nvidia and Google are each valued at over $4 trillion, with Apple just below that mark.

• Collectively, Nvidia and Google added more than $3 trillion in market capitalization in 2025 alone! Google buyers power much of the local luxury market, and Nvidia buyers are increasingly confident stepping into their dream homes.

• Five of the world’s ten most valuable companies are based here, including Broadcom (#7) and Meta

(#9). Three other top-ten companies – Microsoft, Amazon, and Tesla – each employ thousands of workers in Silicon Valley.

The Luxury Market Will Continue to Build Momentum

Last year marked only the second time my brokerage experienced its strongest sales volume in the fourth quarter, the other being 2020, when pent-up demand surged after the onset of Covid. Personally closing over $130 million in homes priced above $10 million in just the past few months signals continued strength ahead. As private AI firms such as OpenAI expand secondary stock offerings or move closer to eventual IPOs, increased liquidity should further fuel luxury demand. Atherton, Los Altos Hills, Palo Alto, and Woodside are particularly poised for record-setting years, with demand likely to outpace available supply.

AI Buyers Will Change What Luxury Homes Provide

AI has not only increased demand, it has reshaped buyer priorities. The AI founders I work with tend to be younger than prior generations of founders and are far more focused on health, longevity, and lifestyle. Many of my clients are increasingly prioritizing spas, cold

plunges, and wellness centers over traditional tasting rooms and expansive wine cellars. Outdoor living spaces that evoke a Four Seasons resort are growing in popularity, along with heightened emphasis on privacy and family security.

Buyers who rely on financing should see further relief as mortgage rates trend downward. Most economists project the 30-year fixed rate will dip below 6% by year’s end. I often recommend 7-year ARMs in a declining rate environment, and with the right lender and optimized relationship pricing, some clients are already securing rates in the low 5% range.

After years of constrained supply, 2026 may finally bring an increase in available inventory. Many homeowners locked in historically low mortgage rates during the pandemic, often through 7-year ARM loans that begin expiring in 2027. For years, owners hesitated to sell, unwilling to trade sub-3% rates for mortgages that peaked near 7.5%. Morningstar recently reported that,

for the first time in several years, more homeowners now carry mortgage rates above 6% than below 3%.1 As these pandemic-era loans expire, more owners are likely to trade up or down, freeing up additional housing supply.

The Silicon Valley housing market once again navigated a turbulent year marked by geopolitical uncertainty and economic volatility. Yet Silicon Valley continues not only to endure, but to reach new heights as the epicenter of AI innovation and venture capital investment. The bottom line remains unchanged: this is a supply-constrained market where wealth creation, particularly from AI, can overpower high mortgage rates and global uncertainty. Buckle up for what promises to be another dynamic and compelling year for Silicon Valley real estate.

1.https://www.morningstar.com/news/marketwatch/20260108177/forthe-first-time-in-years-more-homeowners-have-a-6-mortgage-rate-thana-3-one-thats-great-news-for-frustrated-buyers

Silicon Valley luxury real estate rewards experience, and Ken DeLeon offers unmatched insight, strategy, and results at the highest level. His leadership and hands-on approach consistently deliver exceptional outcomes. For buying or selling a luxury home above $10 million, expertise matters. Call Ken DeLeon today to get started!

for how they expect to live five to ten years from now, not just how they live today.

Location remains paramount. Walkability, school districts, commute efficiency, and neighborhood character continue to drive long-term desirability, often outweighing cosmetic finishes.

Buyers in 2026 are not chasing trends. They are making decisions with longevity and value in mind.

Winning Through Preparation

Even in a more balanced market, the best homes still attract strong interest. The difference is that prepared buyers do not scramble. They arrive ready.

Here are four offer factors that matter beyond price.

1. Financing that removes doubt

Fully underwritten approvals with trusted local lenders still separate serious buyers from everyone else. Sellers do not just want a strong buyer. They want a buyer who is certain. When a reputable lender can confidently speak to the file, it reduces friction and increases trust.

2. Disclosures mastered before offer day

Many buyers lose homes not because their offer is weaker, but because they are still processing disclosures later than they should. Winning buyers review early, ask targeted questions, and understand the property's risk profile. That allows them to write with clarity and avoid last minute uncertainty.

3. Terms that fit the seller’s life

The best offer is the one that aligns with the seller’s preferred timeline and logistics. Closing date, possession, rent back, deposit strength, and contingency structure should be tailored to the specific listing, not copied from a template. When terms reduce stress for the seller, they create leverage for the buyer.

4. Presentation that signals professionalism

Sellers notice clean paperwork, decisive communication, and a tight narrative. A well-

structured offer package that highlights certainty, timelines, and readiness can outperform a slightly higher offer that feels sloppy or unpredictable.

In practice, two offers at the same price are rarely equal. Sellers consistently favor buyers who demonstrate certainty, clean execution, and a clear understanding of the transaction.

Silicon Valley real estate has always been complex. In 2026, true expertise is essential.

Understanding off-market opportunities, pricing psychology, and seller motivation can mean the difference between almost securing a home and owning it. The buyers who succeed consistently are represented by teams that understand how listings are positioned, how decisions are made behind the scenes, and where leverage truly exists.

At DeLeon Realty, our approach is deliberately different. We never double-end commissions. That choice is not a slogan. It is a philosophy. This ensures our focus, strategy, and advocacy remain entirely devoted to our clients. Every recommendation, every negotiation, and every decision is guided by one priority: achieving the best outcome for the client.

The most successful Silicon Valley buyers in 2026 are not simply motivated. They are strategically aligned.

They partner with a team that prepares them well before the right home hits the market, one that understands the nuances of the local market, negotiates with precision and transparency, and acts with complete loyalty.

Buying a home in Silicon Valley is not about luck. It is about preparation, insight, and expert representation. When those elements align, buyers do not just participate in the market. They win.

At DeLeon Realty, this is exactly how we help buyers succeed.

By the DeLeon Design Team

In California, a garage is a highly valued feature, yet for many homeowners, it hasn’t felt the warmth of a car tire in years.

Many Californians take great pride in the appearance of their vehicles and appreciate knowing their “baby” is safely tucked away behind a secure garage door. Others, however, have transformed this space into oversized storage rooms, makeshift gyms, laundry zones, or kid-approved play areas where messes are encouraged. While functional for everyday living, these spaces are often overlooked when it comes time to prepare a home for sale.

When sellers get ready to list, attention typically centers on kitchens, bathrooms, and curb appeal, which are all very important elements. The garage, however, is frequently neglected. Over time, garages tend to accumulate clutter, cobwebs, grimy windows, and stained or worn floors. These details subtly but meaningfully impact a buyer’s perception of the entire property. This oversight can result in leaving real value on the table.

The good news is that transforming a garage doesn’t require a major renovation. Most of these issues can be resolved in just a few hours with the right tools and expertise, such as shop vacs, cobweb wands, blowers, and professional floor scrubbers. Not coincidentally, this is exactly the type of equipment you’ll often find in a DeLeon contractor van.

For sellers looking to take things a step further, our field coordinators can etch and apply a durable epoxy floor coating that is stain-resistant, easy to clean, and visually striking. This simple upgrade dramatically elevates the space, making the garage feel intentional, polished, and move-in ready.

Once the garage has been properly prepared, our design team steps in to stage it in a way that highlights its versatility. Sometimes that means showcasing a light home gym, other times a play area or o\rganized

storage solution. The goal is always the same: to help buyers envision the possibilities.

Best of all, much of this work can often be handled by our in-house field coordinators and designers, frequently at no cost to our sellers.

When thoughtfully updated, the garage becomes more than just a utility space. It becomes an extension of the home and a powerful contributor to overall value.

$15,000,000

$10,000,000

$5,000,000

$1,000,000

$0

$5,000,000

$4,000,000

$3,000,000

$2,000,000

Menlo Park Inventory # of New Listings

Mountain View Inventory # of New Listings

$8,000,000

$6,000,000

$4,000,000

$2,000,000

February - April 2026

EVENT DATE TIME LOCATION

Arts Los Altos Downtown Walking Tour Feb 6, March 6, April 3 5-6pm Mandahlia Sculpture, 169 State Street Free

First Fridays Feb 6, March 6, April 3 6-9pm Downtown Los Altos Free

Valentine’s Choco -“Super” Stroll Experience March 6, 2-5pm Veterans Community Plaza $37

Black & White: Bay Area Art + Poetry Benefit Feb 21 5-8pm Los Altos Community Center Free

Downtown Los Altos Saint Paddy’s Beer Stroll March 13 6-9pm Veterans Community Plaza

LAH County Fire District Brush and Yard Trimmings Collection Feb 21, March 21, April 18 9am – 2pm Foothill College, Parking Lot 1 Free

Drive-Thru Shred Event March 21 8-11am Town Hall Parking Lot Free

23rd Annual Hoppin’ Hounds Biscuit Hunt April 4 9-10:30am Westwind Community Barn $10 per entry

EVENT DATE TIME LOCATION COST

Black Liberation Month Celebration Feb 7 1-4pm Bell Haven Community Campus Free

Friends of the Library Book Sale March 20-21 Fri: 2-5pm Downtown Los Altos Free

Spring Festival and Egg Hunt April 4 Egg Hunt 10am-1pm Egg Hunt @ Burgess Park Free for Menlo Park Residents; $5 for nonresidents

Community Fun Run April 25 9am – 1pm Bell Haven Community Campus TBA

EVENT DATE TIME LOCATION

Hearts & Hocus Pocus: An evening of Magic, Mystery & Compassion Feb 12 5-7pm Sheraton Palo Alto Hotel Free

2nd Annual Hearts & Harmony Valentine’s Day Dance Feb 13 5-7pm Mitchell Park Community Center Free Spring 2026 Family Day March 22 2-4:30pm Palo Alto Art Center Free

2nd Annual Around the World in a Day Festival March 28 10am – 1pm Lucie Stern Community Center Free Earth Day Festival 2026 April 19 1-4pm Palo Alto Art Center Free