And these are my grandkids!

Home is more than just a physical space. It's where you've created countless memories, shared moments with loved ones, and where you feel most comfortable.

When it comes time to buy a new home and begin a new chapter, the process can oftentimes feel overwhelming. Buying a home can be an emotional journey, and it's understandable to feel apprehensive. Rest assured that together, we can help you navigate the process with ease We'll outline the process and create a plan together, so you don't have to do any of the heavy lifting.

From setting a budget, to finding the right neighborhood, negotiating the best terms for you & creating a smooth close, this booklet will be your guide.

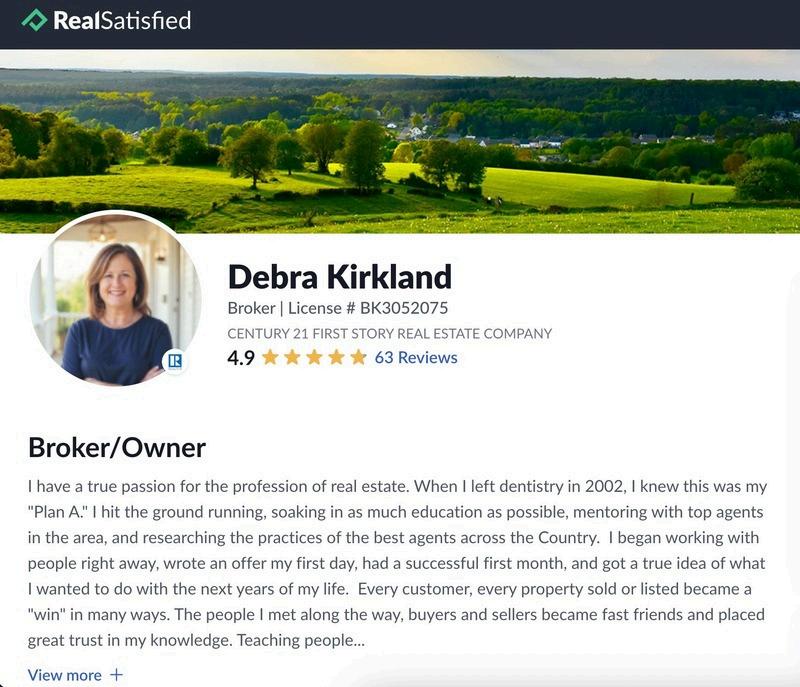

Real estate agent, online educator and influencer for good. I support people who have a true desire and hard work ethic to build a life and business they love...through real estate.

137K 203K FOLLOWERS ACCTS ENGAGED 88% BUYERS AND SELLERS

LAST 90 DAYS

8.9 K

Reach

26,445

Profile Visits

21.2K Impressions

Debbiewalkedus througheverystep, answeredallour questions,andmade surewefeltconfident inourdecisions “

Shenotonlyhelpedus sellourhomequickly butgotusaboveasking price!Herdedication andattentiontodetail trulysetherapart.We highlyrecommendher toanyonelookingto buyorsell.

Iknowthatbuyinganewhomecanbestressful...

Butitdoesn'thavetobe.Insteaditcanbethe gloriousstarttoanewchapter.Theanticipation ofcreatingnewmemoriesinahomethatbetter servesyourneeds.We'reheretohelpyou determineyourbudget,findtheperfect neighborhood&hear"offeraccepted!”

Movingtoanewhomeisexcitingandwecan't waittohelpyoueverystepoftheway.

I know… the dreaded B word. But having a clear budget will make this process SO MUCH EASIER. Start by meeting with a lender to finalize numbers, but first, consider what monthly payment feels comfortable for your family. A good rule of thumb: keep your mortgage under 1/3 of your take-home pay. However, there are exceptions depending on your life stage:

Early in your career? You might stretch your budget slightly. For example, young professionals, like new attorneys, could overextend a bit, knowing their income is likely to grow. Near retirement or on a fixed income? Stick to a more conservative budget to ensure financial stability.

Are you renting? Do you need to sell your current home? Closings typically take 30 days, so line up your dates to be sure they work for you.

If you need to sell your current home in order to buy your new home, it’s important to have it cleaned, staged and photographed PRIOR to looking at homes. This allows for me to best negotiate a Buyer Contingency, meaning that your new home purchase is contingent on your current home selling. As an agent, I need to be able to show the sellers we’re ready to go to market ‘overnight’ so we don’t delay the closing process.

If you’re renting, know that your first mortgage payment isn’t usually due for 45-60 days AFTER close of escrow, which helps you not double up on rent and mortgage payments.

Determinewhatyouwant yourmonthlypaymenttobe Determinehowmuchyou wanttoputdown

Interviewlenders Crunchthenumbersto determinehowmuchhome youcanafford

Determinewhatyour'must have'itemsare Definethelocationyou wanttolivein Setupyourhomesearch

Walkanyhomesthatmeet allofthequalifications you'vesetuntilyoufindthe rightone&submitanoffer

OFFER ACCEPTED!

Depositearnestmoney 10-dayinspectionperiod Appraisal

Signalllenderdocuments Signalltitledocuments Senttorecord+fund

Scheduleyourmovers Turnonallutilitiesinyour name WelcomeHome!

Buying a new home is so much fun, and this is the part where you daydream about all the possibilities. I like to remove all constraints of budget and location and write down ALL the things I’d love to have inside my home. Not gonna lie, my list is fairly epic, but it makes me happy to think about all the possibilities

After I’ve filled my mind with all the possibilities, I start sorting them and ranking them in order of importance, narrowing it down to 3-5 must-haves It’s important to do this BEFORE you start looking at houses so you don’t get distracted by something that might seem like what you want, but really isn’t.

We’ll refer to this list when we’re out looking at homes If a pool is on your MUST-HAVE list, then we’re only going to walk homes that have pools OR are priced in a way that allows you to immediately put one in This ends up saving everyone so much time AND ensures you get what you really want.

Unrepresented consumers account for 70% of all real estate lawsuits.

Are you required to have a real estate agent to purchase a home? No.

But you’re also not required to have a professional cut your hair, so why do you pay someone to do that? Because you don’t want to walk around with your hair a mess, right?

Buying a home is often one of the biggest financial investments you’ll make in your lifetime. A lot can go wrong and unfortunately, it can go REALLY wrong if you don’t know what you’re doing. We have stories!

Inside real estate transactions there are typically two agents involved. One agent represents the seller, the other agent represents the buyer. Each agent works to create circumstances that are agreeable to their clients.

Typically, seller’s offer 3% of the purchase price to their agent and 3% to the buyer’s agent. New NAR regulations prohibit us from offering a buyer co-broke inside the MLS, but it is still recommended that seller’s offer a co-broke to a buyer’s agent, here’s why:

Now that you have a clear idea on what you want and the numbers you’d like to hit, it’s time to talk to a lender. Every buyer must have a pre-approval before seeing any homes. Depending on your price point (usually luxury listings), Listing Agents will require proof of funds prior to showings. This ensures sellers aren’t prepping their home for showings for buyers that aren’t in a position to buy.

Your pre-approval will be submitted with any offer so the sellers know you can secure a loan for their property. Once you have your pre-approval, revisit your ‘must have’ list to be sure those items can realistically be secured at your price point.

We had been searching for months with no luck until we partnered with Debbie’s lending representatives. Their ability to pinpoint exactly what we wanted and present great options was incredible. The home we ended up purchasing checked every box on our list thank you, Debbie!

I USE A VARIETY OF STRATEGIES AND TOOLS TO HELP YOU FIND YOUR PERFECT HOME, MAKING SURE YOU HAVE ACCESS TO THE BEST OPTIONS ON THE MARKET.

Now it's time to start shopping for your new home! We'll automate this by setting up a custom home search for you with all of the criteria you listed above. This means anytime a new home hits the market that meets your criteria, you'll get an email notification. If you like what you see, reach out and I'll set an appointment to walk the home.

A few ground rules to make this process as enjoyable as possible:

Do not walk homes that are not in your budget. I can promise you this never ends well and oftentimes makes you disappointed in what you CAN afford.

Remember when walking homes, someone else is often living there. This means we want to be respectful of their space, especially if little kids are in tow.

And finally, there are almost always cameras, so save any talk of pricing for after the showing.

Once we have an accepted contract, we send it to the Title Company who will facilitate the closing documents. The Title Company works with all parties involved (buyer, seller, both agents and lender) to compile all the documents necessary to close

EARNEST DEPOSIT

01 02 03

EARNEST DEPOSIT: Your earnest deposit is typically 1% of the purchase price.

Once all contingencies are met, your earnest money will be non-refundable and will be applied towards your down payment.

INSPECTION PERIOD: This is your time to do all of your due diligence on the property. It is HIGHLY recommended that you hire a professional inspector to do a full inspection of the home.

APPRAISAL: Once the inspection is complete the next contingency to remove is the appraisal contingency Most loans require an appraisal prior to funding

This is your time to do all of your due diligence on the property. It is HIGHLY recommended that you hire a professional inspector to do a full inspection of the home. You can google some options or I’m happy to share a few companies I’ve worked with in the past, but who you use as your inspector is your decision. The inspector will climb into the attic, check the a/c, run all the faucets, check all the electrical and look for anything that is out of order. They’ll then provide you with a full report that is often dozens of pages long you want them to be thorough! They’ll point out everything that is in working order and everything that is not. Once the inspection is done, you’ll have an opportunity to ask the seller to repair or replace anything that isn’t working properly. Let it be noted, you cannot ask for things that are working properly to be repaired or replaced. If buyer and seller cannot come to an agreement during this due-diligence period, buyer has the opportunity to cancel the contract and receive a full refund of their earnest money.

Once the inspection is complete the next contingency to remove is the appraisal contingency. Most loans require an appraisal and if the home doesn’t appraise for the purchase price buyers and sellers have a few options. The buyer can exercise their right to cancel the contract and receive an full refund of their earnest money, or buyer and seller can renegotiate on the price or buyer can bring the difference between the appraisal amount and loan amount in cash to the closing table to bridge the gap.

Once the appraisal contingency has been met, the buyer’s earnest money is typically what we call, ‘hard.’ This means that should you decide to cancel the contract, you will not receive a refund of your earnest money deposit.

We’ve bought and sold several homes over the years, but D stands out as the most dedicated and knowledgeable realtor we’ve ever worked with. She listened to our needs, kept us informed, and made the entire experience enjoyable. We can’t wait to work with her again.

If you’re selling your current home in order to buy your new home, you’ll have this contingency as well that needs to be fulfilled before your earnest money goes hard. We’ll go over all of these dates so you know exactly what is expected of you and the sell of your home.

During this time, it’s imperative that you stay in close contact with your lender. They’ll need specific paperwork and information only you can provide them. It is also of the upmost importance that you refrain from any other major purchases that could impact your financing. This would be buying a new car or boat or swiping your credit card for furniture for the new house. These purchases can negatively impact your debt to income ratio and implode your deal before it’s done. Hang tight until we close on your dream home and then you have full reign to get that home furnished or buy that new car.

This occurs 2-4 days prior to close and is your chance to walk the home one last time to ensure that all of the repair requests have been completed and that the house is in the same condition as when you bought it. It’s normal to see boxes stacked in the garage because sellers are moving too! If everything looks good, you’ll sign paperwork accepting the home’s condition and we’ll be on our way to a smooth close.

From day one, Debbie’s communication and professionalism impressed us. Her personality and attention to what was important to us really made us comfortable. Her understanding of the local market and keen negotiation skills ensured we got the best deal possible. We’re so grateful for all her hard work!

Closing day is usually a collection of a few days. The Title Company will receive loan documents 3-5 days prior to close and you’ll have two options: you can make an appointment to sign at the Title Company OR they’ll send the documents to you with a notary to sign in the comfort of your own home. Either way is just fine, but you’ll need to be sure if you’re signing at home that there is time for documents to get back to the Title Company in a timely manner (this only comes into play if you’re signing out-of-state). Both buyers and sellers usually sign all the documents a few days prior to close, so that on closing day, all that is left to do is send the title to record at the County Clerk's Office.

Your property is officially closed once the title has been recorded, then funding will follow. Depending on which day of the week and the time of day, sometimes funding doesn’t happen until the next day. Banks often work on Eastern Time so if you’ve recorded late in the day on a Friday, you can expect it to fund on Monday.

Good news? Once it’s funded we can release the keys to your new home to you!

I know this is about more than selling high and buying low and I can promise you that while there will be some bumps in the process, I'll be doing my best to help you avoid any delays or roadblocks. You can expect weekly phone calls with my trademark tell it like it is honesty & creative problem solving to get you where you want to go.

Debbie Kirkland

Real Estate Broker