Staying ahead in credit management

ALSO IN THIS EDITION:

l Data-driven decisions: discover the future of credit management depends on the quality of your data

l Late payments unpacked: Why do some customers always pay late? We reveal patterns and strategies

l Preparing for hearings: what clients must know: ensure you’re informed and ready with expert guidance

Our 2025 supporters

National partners

Divisional partners

Divisional supporting sponsors

Monika

Monika Lacey

Marcus Bruhn

Nicholas Taylor

Jacob Searle

Daniel Taylor

Alison Covington

EDITOR/ADVERTISING

Claire Kasses, General Manager

Tel Direct: 02 9174 5727 or Mob: 0499 975 303

ISSN 2207-6549

DIRECTORS

Julie McNamara FICM CCE – Australian President

Mary Petreski FICM CCE – Victoria/Tasmania

Troy Mulder FICM CCE – Western Australia/Northern Territory

Rob Jackson MICM CCE – South Australia

Theresa Brown MICM CCE – New South Wales

Steven Staatz MICM CCE – Queensland

Daniel Taylor MICM – Co-opted Director

CHIEF EXECUTIVE OFFICER

Nick Pilavidis FICM CCE

Level 3, Suite 303, 1-9 Chandos Street, St Leonards NSW 2065

PO Box 64, St Leonards NSW 1590

Tel: (02) 8317 5085, Fax: (02) 9906 5686

Email: nick@aicm.com.au

PUBLISHER

Nick Pilavidis FICM CCE | Email: nick@aicm.com.au

CONTRIBUTING

EDITORS

NSW – Gary Poslinsky MICM

Qld – Emma Purcival MICM CCE

SA – Maria Scacchitti MICM

WA/NT – Jeremy Coote MICM CCE

Vic/Tas – Alex Hawtin MICM

Email: claire@aicm.com.au

EDITING and PRODUCTION

Anthea Vandertouw | Ferncliff Productions Tel: 0408 290 440 | Email: ferncliff1@bigpond.com

THE EDITOR reserves the right to alter or omit any article or advertisement submitted and requires idemnity from the advertisers and contributors against damages or liabilities that may arise from material published. CREDIT MANAGEMENT IN AUSTRALIA is published by the Australian Institute of Credit Management, Level 3, Suite 303, 1-9 Chandos Street, St Leonards NSW 2065. The views expressed in CREDIT MANAGEMENT IN AUSTRALIA are not necessarily those of Australian Institute of Credit Management, which does not expect or invite any person to act or rely on any statement, opinion or advice contained herein (whether in the form of an advertisement or editorial) and neither the Institute or any of its employees, agents or contributors shall be liable for any opinion contained herein. © The Australian Institute of Credit Management, 2025.

SA: Trivia Night: Lisa Anderson FICM CCE from Coopers with Paul Zenkteler from Oracle collecting his prize.

Vic/Tas: Inspirational presentation by keynote speaker Holly Bailey from Play like a Girl Australia.

Qld: Accounting 101: Lynne Walton MICM – Access Intell, Vicky Reeves MICM – Cement Australia, Stacey Woodward MICM CCE and Michelle Carruthers MICM – NCS.

NSW: NSW 2025 CP winner Ben Strajn MICM with NSW 2025 YCP winner Arian Bahmiyari MICM.

WA/NT: Melissa Sharpe MICM MC at the WA Awards Night.

Julie McNamara FICM CCE National President

Welcome to the August edition of Credit Management in Australia.

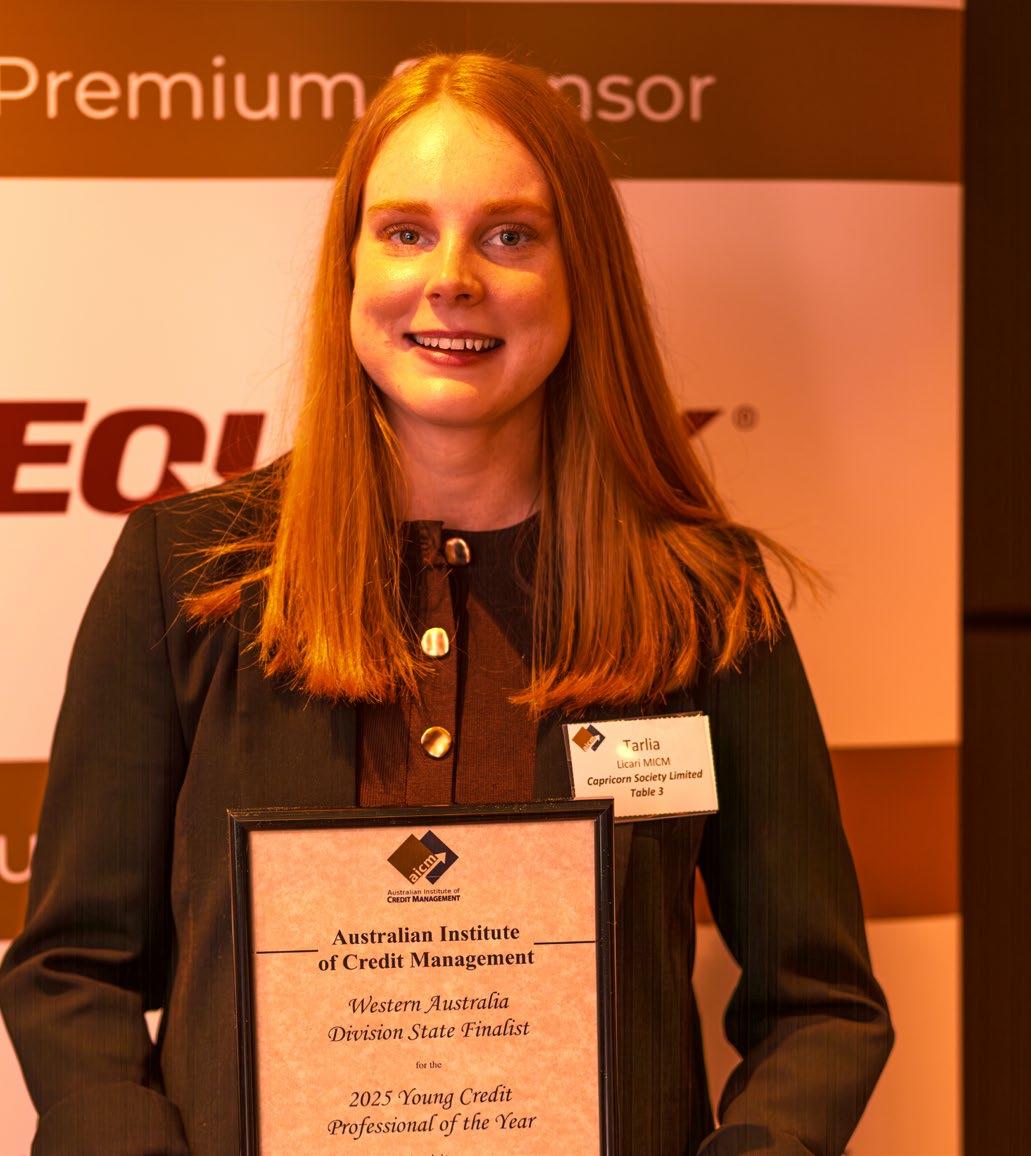

Across Melbourne, Brisbane, Sydney and Perth, we’ve come together at our spectacular awards nights to honour the finalists and winners of the Young Credit Professional (YCP) and Credit Professional (CP) of the Year awards. These events are more than just recognition; they’re a powerful reminder of the professionalism, impact, and leadership credit professionals bring to business every day. The celebrations continue in Adelaide in the coming weeks, and I look forward to sharing in the energy and pride that these events inspire. Congratulations to all the finalists and division winners, it takes courage to step out of our comfort zones to “have a go” but it is so worth the effort!

This is such an exciting time in our calendar with planning for the AICM National Conference is in full swing. Beyond the learning and networking opportunities, the conference will be a momentous occasion to announce our national award winners and celebrate the 2025 YCP, CP, and Credit Team of the Year at the President’s Dinner. If you haven’t registered yet, I encourage you to do so, early bird rates are closing soon.

I look forward to seeing you all there and catching up with my AICM family.

I’m also pleased to see growing engagement with the Credit Knowledge Hub (CKH). This

platform is proving to be a valuable resource for both personal and team development. If you haven’t yet explored its potential, I invite you to join the CKH Information Session on 21 August to discover how it can support your growth. The team at our AICM head office have done an amazing job with the development and delivery of the CKH, just another initiative to make all our roles that much more professional and reliable.

A heartfelt thank you to all members who have renewed their membership, your continued trust in AICM strengthens our shared mission. We look forward to connecting with many of you at the upcoming Divisional AGMs over the next few weeks.

Finally, our WINC luncheons are wrapping up in spectacular fashion, with record attendance in Brisbane, nearly 300 participants, making it the largest WINC event to date. Thank you to everyone who joined us and contributed so generously to fundraising efforts across the country. The WINC journey continues with our recent and upcoming WINC webinars, and I hope to see many of you there.

Let’s keep celebrating the excellence and energy that make our credit community so exceptional.

Warm regards,

Julie McNamara FICM CCE National President

“Beyond the learning and networking opportunities, the conference will be a momentous occasion to announce our national award winners and celebrate the 2025 YCP, CP, and Credit Team of the Year at the President’s Dinner.”

AICM recent graduates

AICM would like to congratulate its recent graduates:

FNS51522 Diploma of Credit Management

Ethan Fleming QLD Dynamic supplies

FNS40122 Certificate IV in credit management

Liza Muir QLD Neumann

Jade Stafford QLD Brisbane city Council

FNS30420 Certificate III in Mercantile Agents

Georgette Little Vic/Tas CCSG

Classroom training calendar

Accurate credit decisions require quality data

By Marcus Bruhn*

Data quality is a crucial element of effective risk management. Yet, credit decisions are routinely made with data that is inaccurate, duplicated, poorly compiled, incomplete or dated. While it’s tempting to place unwavering trust in data, in a world characterised by an unprecedented volume of information, low-quality data can silently undermine even the most robust decisionmaking processes.

Consider the direct impact: a credit decision based on flawed information can alienate customers, result in lost revenue, and incur compensatory overspending. Simply put, bad data yields wrong answers, directly impacting your portfolio’s health and profitability.

Elevating your data quality for smarter decisions

The challenge lies in extracting genuine value from this vast data landscape.This involves a multifaceted approach to ensuring the data you rely on is robust and reliable.

Data source and breadth

The depth and variety of your data sources are crucial. Limited sources or datasets lacking relevant detail often mean critical parts of the data story are missing, leading to inaccurate conclusions.

Diverse and broad data paints a clearer picture. For instance, a comprehensive commercial credit report should draw on enough data points to detail the inquirer, date, dollar value, credit

“The depth and variety of your data sources are crucial. Limited sources or datasets lacking relevant detail often mean critical parts of the data story are missing, leading to inaccurate conclusions.”

Marcus Bruhn

type, and originating industry. When any of these fields are missing, it’s a clue that the report is probably based predominantly on ASIC search data and may lack the necessary context to interpret warning signs of credit risk.

Ensure your data provider draws on a breadth of reliable, authoritative sources spanning consumer, commercial, fraud and identity. In particular, understanding the consumer data of company directors can offer powerful insights into their overall risk profile. Additionally, understanding emerging risks such as climate risk, Environmental, Social, and Governance (ESG) requirements will necessitate incorporating new data sets into your risk assessments.

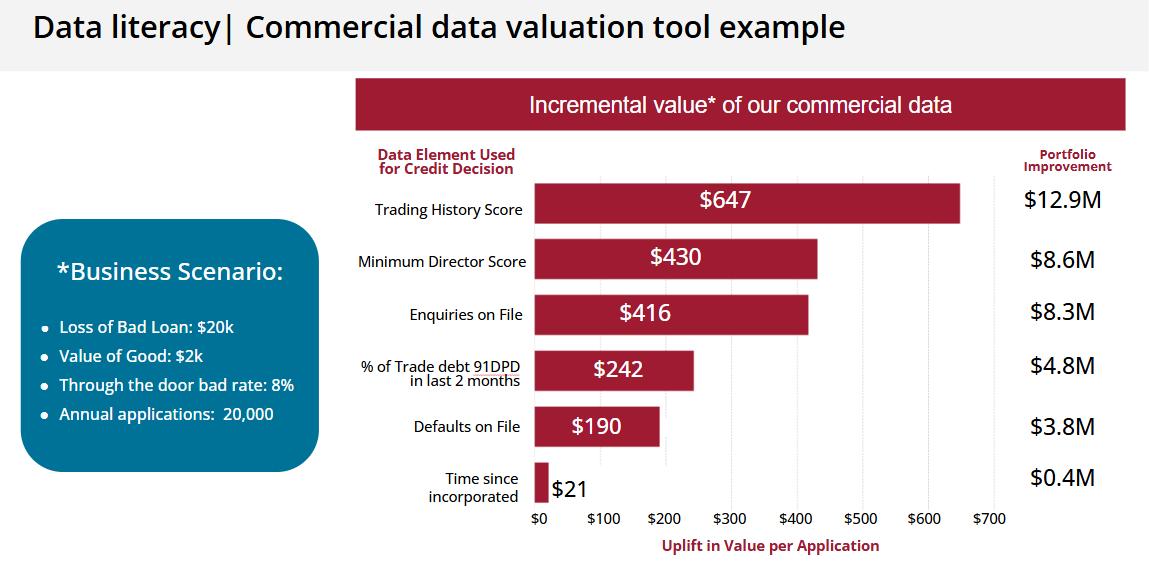

Below, an Equifax analysis of portfolio profitability

demonstrates the value of quality data sources for making credit decisions.

In this hypothetical scenario, the bank processes 20,000 loan applications with an average of 8% bad rate. Bad loans cost the bank $20,000 while a good loan yields $2,000. The analysis quantifies how different data elements contribute to portfolio profitability. While individual data points like ‘Time since Incorporated’ offer some uplift, the real power lies in the synergy of comprehensive data, using a range of elements like Trading History Score (which brings in the predictive elements of the directors and enquiries on file), Minimum Director Score and Enquiries on File.

For instance, Enquiries on File can offer an uplift of $416 per application, potentially

contributing $8.3M to portfolio improvement. Trading History Score (which combines all the underlying data) can potentially provide an even higher uplift of $647 per application, possibly leading to a substantial $12.9M in portfolio improvement.

This clearly demonstrates how a greater depth and breadth of data, particularly through more predictive attributes –like Trading History scores, which utilise enquiries on file, director and trade payment data – translates into enhanced profitability and more effective credit decisions for a given portfolio. Bringing all these distinct elements together through sophisticated credit risk scores provides the most effective mechanism for a predictive assessment, helping to maximise overall portfolio profitability and minimise risk.

“Data can quickly become obsolete. The fresher your data, the more accurate your insights.”

Data freshness and real-time insights

Data can quickly become obsolete. The fresher your data, the more accurate your insights. Enquire about your data provider’s refresh cadence. Real-time or near real-time data collection is crucial for identifying rapidly escalating risks. For example, unless the ASIC data your provider uses is timely and up to date, it may miss important recent credit events, thereby overlooking vital information for your risk assessment.

Equifax provides over 100M ASIC reports to customers every year. This large volume of generated reports allows us to more frequently link, match and correlate this data with our on-file data sets, constantly adding value and enriching all our credit reports.

Data matching and linkage

The ability to accurately match and link disparate data records is fundamental. A data provider’s sophisticated data preparation and advanced

machine learning algorithms are key to connecting various pieces of information. This enables a more complete view of financial health and customer behaviour.

For comprehensive insight into a business’s viability, it’s crucial to connect commercial data with the consumer profiles of company directors. This holistic view can reveal critical financial instability that might otherwise go unnoticed.

As a consumer and commercial credit bureau,

Equifax has the data to pull together a detailed and comprehensive profile of a director. In addition to ASIC director and shareholder information, we also link information from an individual’s consumer profile where consent is given.

Data Quality and AI-driven decisions

The rapid adoption of Artificial Intelligence (AI) capabilities further underscores the critical importance of data quality. AI models are only as effective as the data they are trained on. If the underlying data is corrupted, biased, or lacks integrity, any AI solution built upon it will produce similarly flawed outcomes.

While AI can aid in detecting and addressing some data issues, the foundational principle remains: high-quality, unbiased, and comprehensive data is essential for robust

credit risk scores and effective AI-driven solutions.

Data cleansing and governance

Given the vast amounts of data businesses manage, ensuring its accuracy, reliability, and timeliness is paramount. Data cleansing, the process of fixing inaccuracies, incomplete, duplicate, or wrongly formatted records, offers significant benefits. It can prevent issues like charging deceased customer accounts, thereby reducing liability, processing costs, and improving customer service.

For credit professionals, regular data quality audits are prudent. When refreshing credit risk models, this provides an ideal opportunity for a deep dive into data integrity, leading to improved data quality and more effective risk models.

Equally important, setting up processes for the ongoing

monitoring of data feeds to detect anomalies and ensure consistency. This data governance framework should include processes for refreshing data as frequently as possible, as well as maintaining the security and compliance of your data – more critical than ever as the risk of data breaches increase.

Prioritising data quality in your dealings with data providers and implementing strong internal data governance can help build a value-driven foundation to fuel the accuracy of your credit decisions.

Contact Equifax on 13 8332 or equifax.com.au/contact to learn more about the reliability and predictiveness of Equifax data.

*Marcus Bruhn General Manager Data Commercialisation and Governance Equifax www.equifax.com.au

Why some customers always pay late and how to manage them

By Nicholas Taylor*

Late payments are a persistent pain point for Australian businesses, with CreditorWatch data consistently showing that payment delays are a leading indicator of credit risk and business failure. While one-off late payments can be caused by temporary cash flow issues, some customers are repeat offenders – they always seem to pay late, no matter how clear your terms or how often you follow up.

So why do these customers continually miss deadlines? And more importantly, how can you deal with them effectively,

without damaging the relationship or your own cash flow?

The psychology and patterns behind chronic late payers

Some customers don’t just accidentally pay late – they’ve made it part of how they operate. Here are the most common types of chronic late payers:

1. The Cash Flow Juggler

This customer pays late because they’re constantly short on cash. They’re not deliberately trying to harm you – they’re just robbing Peter to pay Paul.

Nicholas Taylor “While one-off late payments can be caused by temporary cash flow issues, some customers are repeat offenders –they always seem to pay late, no matter how clear your terms or how often you follow up.”

“Their payments are late because their internal systems are poor – they forget, lose invoices, or don’t have streamlined approval processes.”

2. The Deliberate Delayer

This group knows exactly what they’re doing. They strategically delay payments to preserve their own working capital and prioritise bigger suppliers who can apply more pressure.

3. The Disorganised Operator

Their payments are late because their internal systems are poor – they forget, lose invoices, or don’t have streamlined approval processes.

4. The Conflict Avoider

Sometimes customers delay

payment because there’s an unspoken dispute over quality, delivery, or expectations – but they haven’t raised it directly.

5. The ‘Too Big to Chase’ Offender

Large businesses often take advantage of their size and bargaining power. They know smaller suppliers are reluctant to risk the relationship and may let late payments slide.

Red flags to watch out for CreditorWatch’s data shows that consistent late payment

behaviour often precedes default or insolvency. Warning signs include:

l A history of payment defaults

l Multiple address or directorship changes

l Refusal or delays in providing trade references

l Sudden changes in communication or responsiveness

How to handle customers that always pay late

Dealing with chronic late payers requires a blend of process, persistence, and pragmatism.

Here’s how to do it effectively:

1. Segment your customers by risk

Use credit reporting tools to group your customers into low, medium, and high credit risk. Allocate your attention and resources accordingly. For late payers in the high-risk group, tighten terms or switch to cashon-delivery.

2. Get your onboarding process right

Ensure new customers undergo proper credit checks, sign your terms and conditions, and agree to a clear payment schedule. This gives you a legal and operational advantage later on.

3. Make it easy to pay

Sometimes customers pay late because invoicing isn’t clear or payment methods are limited. Use automated invoicing tools and offer multiple payment options to remove excuses.

4. Send polite but firm reminders

Don’t wait until an invoice is overdue to remind customers. Automated email reminders a few days before the due date, and again on the day, help push your invoice to the top of their list.

5. Charge late payment fees or offer discounts

Incentivise prompt payment with early-payment discounts or

“Automated email reminders a few days before the due date, and again on the day, help push your invoice to the top of their list.”

discourage delays with late fees – but only if these are included in your terms and legally enforceable.

6. Escalate strategically

If payment still doesn’t come through, use tools from credit reporting agencies to escalate:

l Send a payment demand letter

l Register a payment default

7. Reassess the relationship

If a customer is consistently late and unresponsive, they may not be worth keeping. Consider moving them to upfront payment terms or discontinuing the relationship to protect your cash flow.

When to be flexible

– and when to be firm

Not every late payment warrants a hardline response. Consider the customer’s history: if they’ve generally been reliable, a one-off issue may be worth accommodating. But if they’re habitual late payers who don’t communicate, it’s time to protect your business first.

Late payments are more than a nuisance – they can cripple small business cash flow and increase insolvency risk. Understanding the why behind chronic late payers gives you the tools to respond smarter.

*Nicholas Taylor Corporate Manager, CreditorWatch www.creditorwatch.com.au

Three powerful workshops.

One transformative experience. Join credit professionals from across the industry for a unique opportunity to learn, refresh, and connect. This bundle covers the essentials of Personal Insolvency, Corporate Insolvency, and Personal Property Securities (PPS) designed to elevate your understanding and sharpen your skills.

Workshop 1: Understanding Personal Bankruptcy

Friday 12th September | 12:30 – 4:30 PM AEST

Gain clarity on the fundamentals of personal insolvency. Learn the language of bankruptcy, how to read documentation, complete proofs of debt, and engage with trustees effectively.

Workshop 2: Understanding Corporate Insolvency

Friday 19th September | 12:30 – 4:30 PM AEST

Recognise the signs of corporate distress and learn best practices for interacting with insolvency practitioners. Understand notifications, internal processes, and key indicators.

Workshop 3: Personal Property Securities (PPS)

Friday 26th September | 12:30 – 4:30 PM AEST

Master the PPSA and PPSR. Learn how to register, perfect, and release securities, and understand the legal implications for leases, hires, and credit agreements.

Who Should Attend?

Credit team members ready to level up

Experienced professionals seeking a refresher

Anyone involved in credit, leasing, or lending

Certificate of Completion awarded after all three workshops. Earn 12 CPD Points.

Cost:

Member: $855 inc GST

Non-Member: $1,005 inc GST

Australia wastes $4.5 Billion in unsold goods annually – but there’s a smarter way forward

As the cost-of-living crisis continues and millions of Australians face daily challenges affording essentials, a new report has revealed a confronting paradox: while the need grows, billions of dollars’ worth of unsold retail goods are going to waste each year.

According to a new report by Deloitte Access Economics, commissioned by national charity Good360 Australia, $4.5 billion worth of new, unused consumer goods are discarded annually. This includes $2.9 billion in unsold retail stock

and over $1.5 billion in returned online purchases, much of it still in perfect condition.

A growing waste problem in essential goods

The report reveals a 17% increase in waste since 2021, with the largest rise in everyday essentials such as toiletries, cleaning supplies, and infant care items. These are the very products most needed by families struggling to make ends meet.

For businesses, this trend represents a commercial and logistical burden -managing

“We have two growing problems – rising levels of unmet need and rising levels of waste. At Good360, we connect those dots.”

excess stock, navigating returns, and absorbing warehousing costs. For communities, it’s a missed opportunity to provide support and dignity to people experiencing hardship.

Good360: Connecting surplus with need

Marking its 10th anniversary, Good360 Australia has shown there’s a smarter, more impactful alternative. The charity has already redistributed over $500 million in new, surplus goods – supporting 4.8 million Australians and diverting over 7,600 tonnes of product from landfill.

“We have two growing problems – rising levels of unmet need and rising levels of waste.

At Good360, we connect those dots,” says Alison Covington AM, Founder and Managing Director.

“Our model is proven, scalable, and delivers real impact for business, the environment, and society.”

A national movement for good

Working with over 4,800 charities and disadvantaged schools, Good360 has given more than 43 million items a second life – from clothing and hygiene products to school supplies and furniture. Each donation supports education, reduces stress, and restores dignity to people doing it tough.

With its current success as a springboard, Good360 has now set an ambitious new goal: to deliver $500 million worth of goods annually by 2030, matching in one year what it achieved across its first decade.

Strategic

value for businesses

James Atkins, Good360’s new Chair and a seasoned strategy advisor, highlights the cost businesses bear for unsold inventory: “It’s not just the physical costs – there are reputational, sustainability, and opportunity costs too.”

He explains that by donating through Good360, businesses can strengthen ESG outcomes, improve supply chain efficiency, and demonstrate leadership in social responsibility. “It turns a sunk cost into a community investment,” says Atkins.

Alison Covington AM, Good360 Australia Founder & MD.

A smarter policy approach

The Deloitte report also calls for greater government support to help scale Good360’s model nationwide – echoing the success of coordinated responses to food waste. “This is smart, noninflationary policy that delivers fiscal and social dividends,” says Atkins.

In a challenging economic climate, this approach offers a rare trifecta: lower costs for businesses, reduced environmental impact, and practical support for vulnerable Australians.

A call to action for businesses

Good360 is now encouraging more businesses –especially people with excess, ageing, or seasonal inventory – to take part in the solution.

“To the credit managers, logistics teams, and retail leaders dealing with surplus stock daily –there is a better way,” Covington urges. “What was once a liability can become a lifeline.”

For AICM members, who play a pivotal role in the lifecycle of inventory and credit decisions, this presents a unique opportunity to align financial strategy with positive social and environmental outcomes.

Be Part of the Circle of Good

Alison Covington AM, has proudly attended the WINC luncheons as part of Good360’s partnership with AICM, and shared her inspiring journey of building the organisation from the ground up. Her message – a blend of innovation, action, and optimism – resonates strongly with AICM’s mission to empower and uplift.

You can help expand Good360’s impact in two simple ways:

1. Donate: Every $1 enables Good360 to deliver $20 worth of goods to Australians in need.

Donate here

2. Spread the Word: Know a client or business with surplus goods? Encourage them to donate and join the Circle of Good. Learn more

Together, we can help fill homes with dignity, not just goods – and create a more sustainable, compassionate economy in the process.

Update from across the ditch: Navigating the plateau –credit trends stabilise amid economic uncertainty

By Monika Lacey MICM*

As we move through the third quarter of 2025, the economic climate in New Zealand remains defined by cautious optimism and persistent headwinds.

Over the past three months, Centrix data has revealed a nuanced picture of household and business credit behaviour, one that reflects both resilience and restraint.

In May, the National Government delivered its second Budget, focused on financial prudence and targeted investment to stimulate productivity and infrastructure.

The Reserve Bank responded by cutting the Official Cash Rate

(OCR) to 3.25%, its lowest level since October 2022.

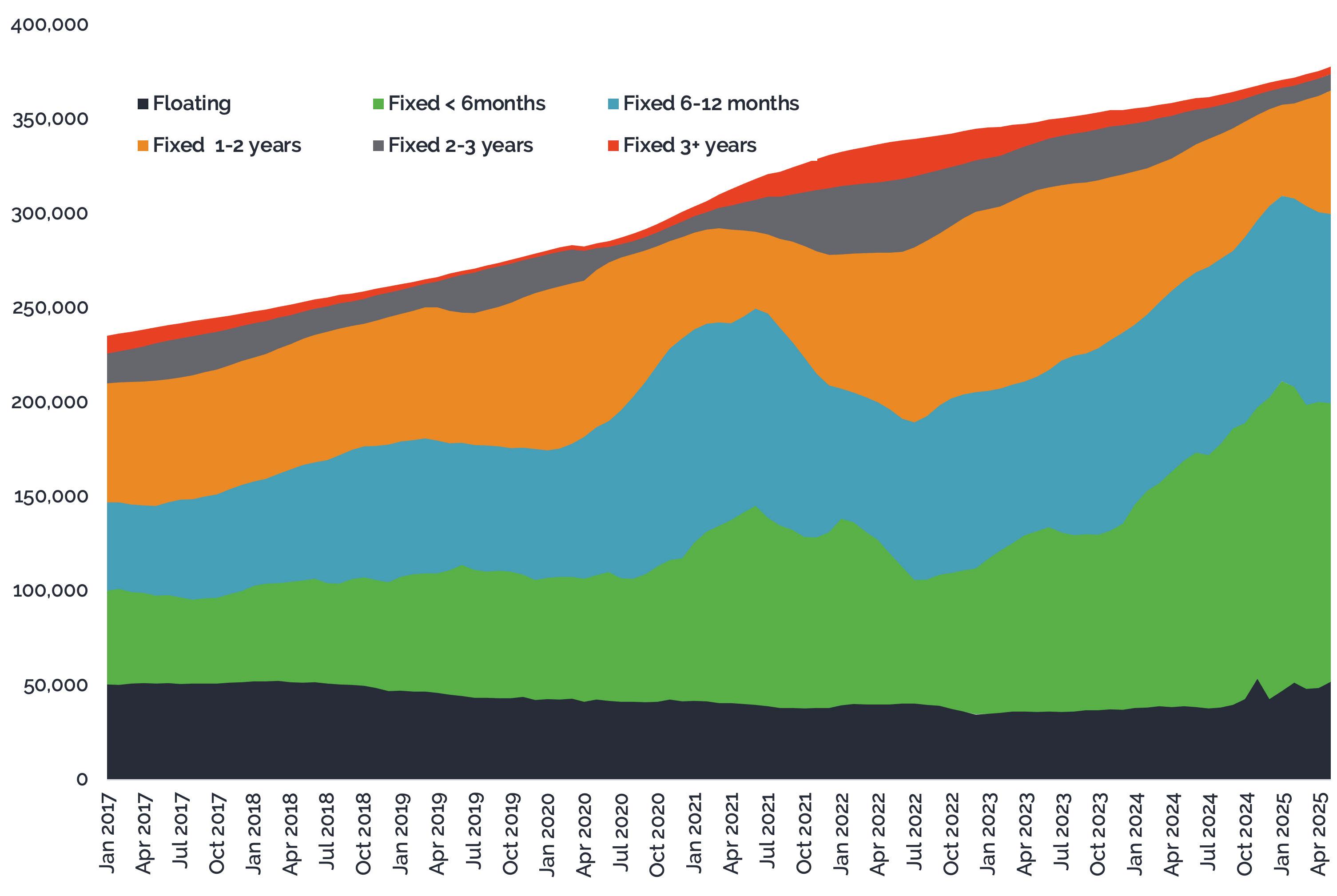

This move sparked a rise in credit demand, particularly in mortgage refinancing, as borrowers sought relief from high fixed rates (unlike Australians, majority of New Zealanders fix their mortgages – the most popular terms being 1-24 months).

June brought signs of stabilisation – GDP grew by 0.8% in the March quarter, slightly above expectations, and consumer arrears began to level out.

Mortgage arrears declined, and credit card and personal

“Over the past three months, Centrix data has revealed a nuanced picture of household and business credit behaviour, one that reflects both resilience and restraint.”

Monika Lacey MICM

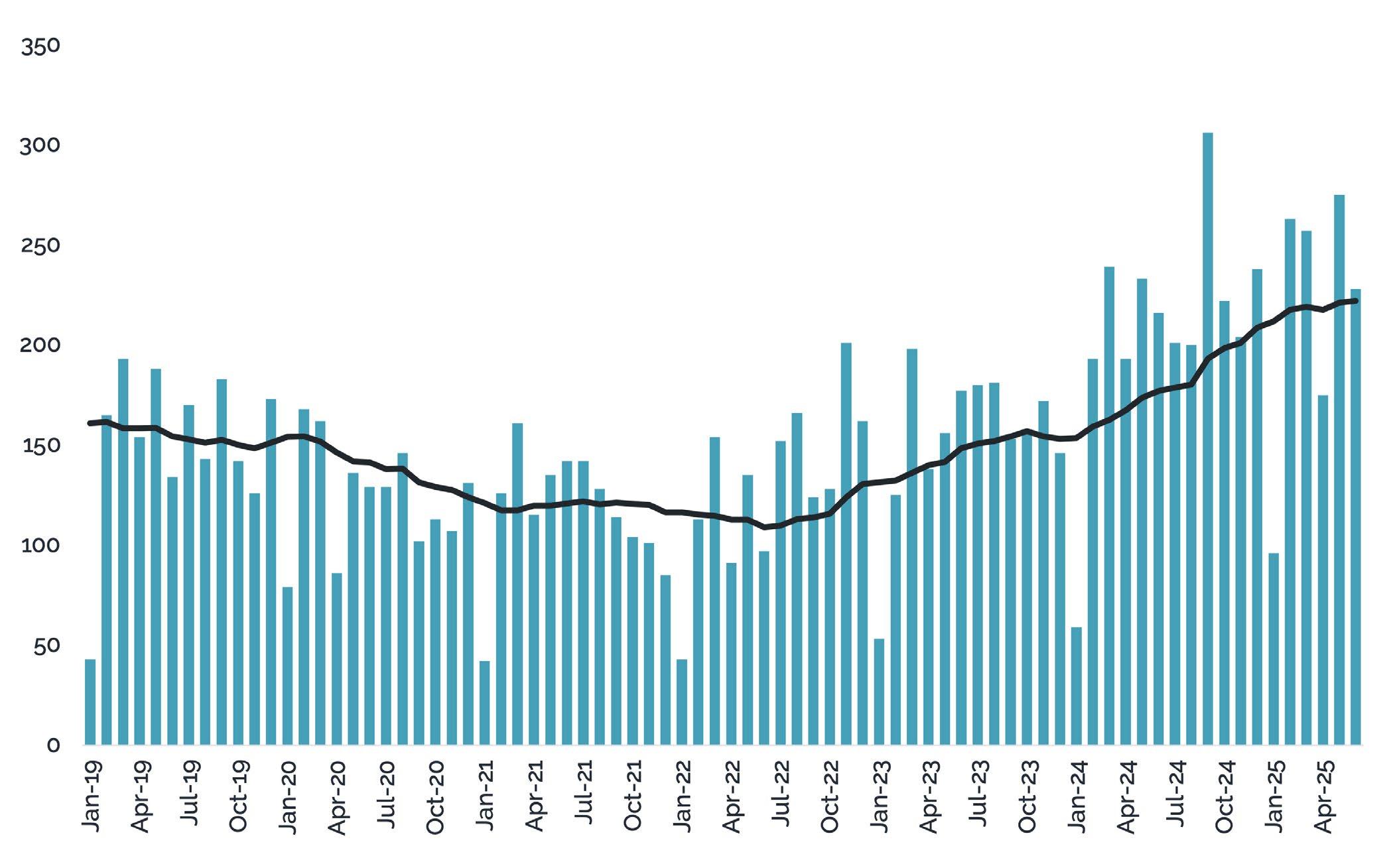

Consumer Arrears Trends

loan arrears showed modest improvement. However, financial hardship cases continued to climb, and company liquidations remained elevated.

By July, the Reserve Bank paused its rate-cutting cycle, holding the OCR steady at 3.25%.

This decision reflects a “wait-and-see” approach amid persistent inflation, global trade uncertainty, and a plateaued recovery.

Credit trends followed suit: while arrears improved slightly, the pace of recovery slowed, and business defaults remained high.

Across these three months, the data tells a story of a nation adapting to uncertainty.

Households are cautiously managing debt, while businesses are navigating volatile conditions.

Home Loan Arrears

Consumer arrears stabilise, lending rises

The first half of 2025 showed a continuous year on year improvement in consumer arrears, although this gap is now closing.

Consumer arrears hovered

around 12.4% of the credit-active population across May, June, and July. In June, arrears dipped to 12.36%, with 478,000 individuals behind on payments.

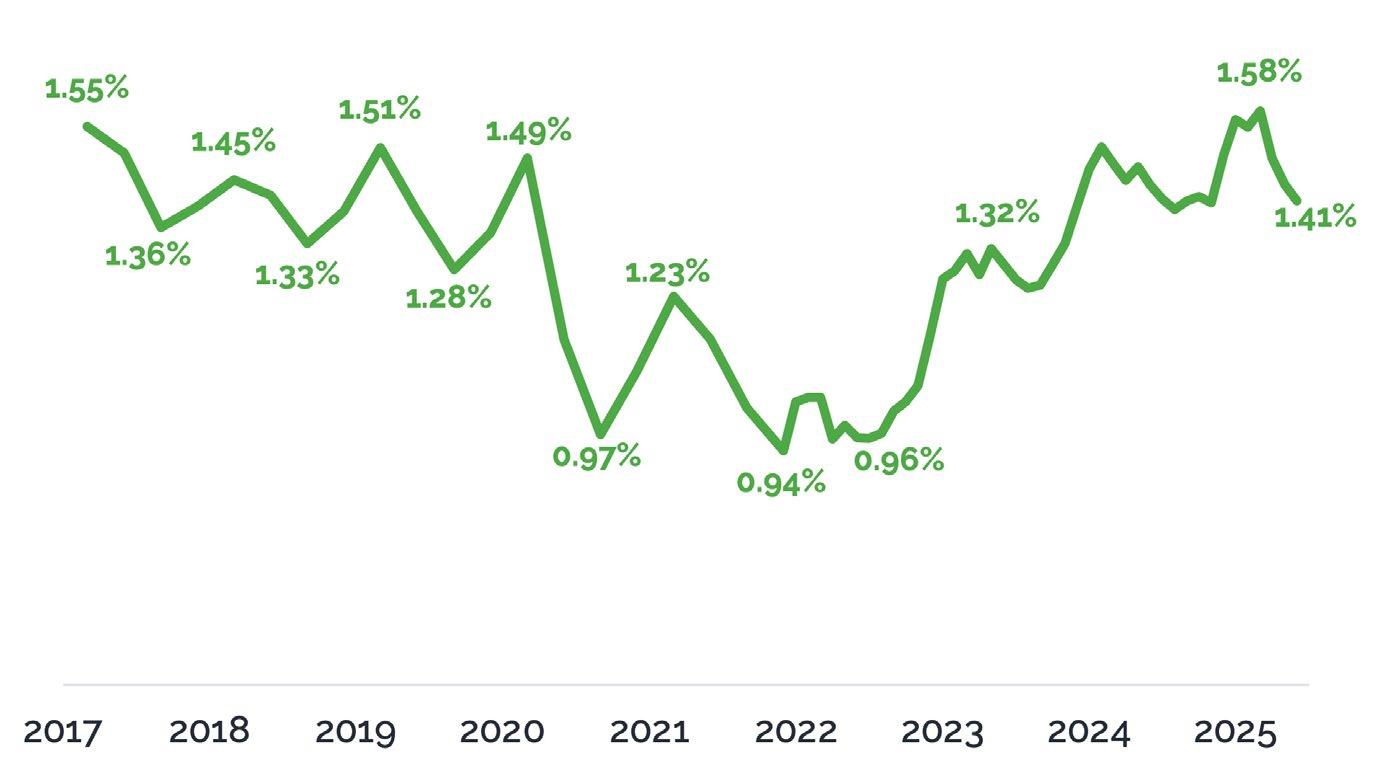

Mortgage arrears improved month-on-month, falling from 1.49% in April to 1.41% in June.

Credit Card & Auto Loan Arrears

Personal Loan & BNPL Arrears

Telco & Utility Arrears

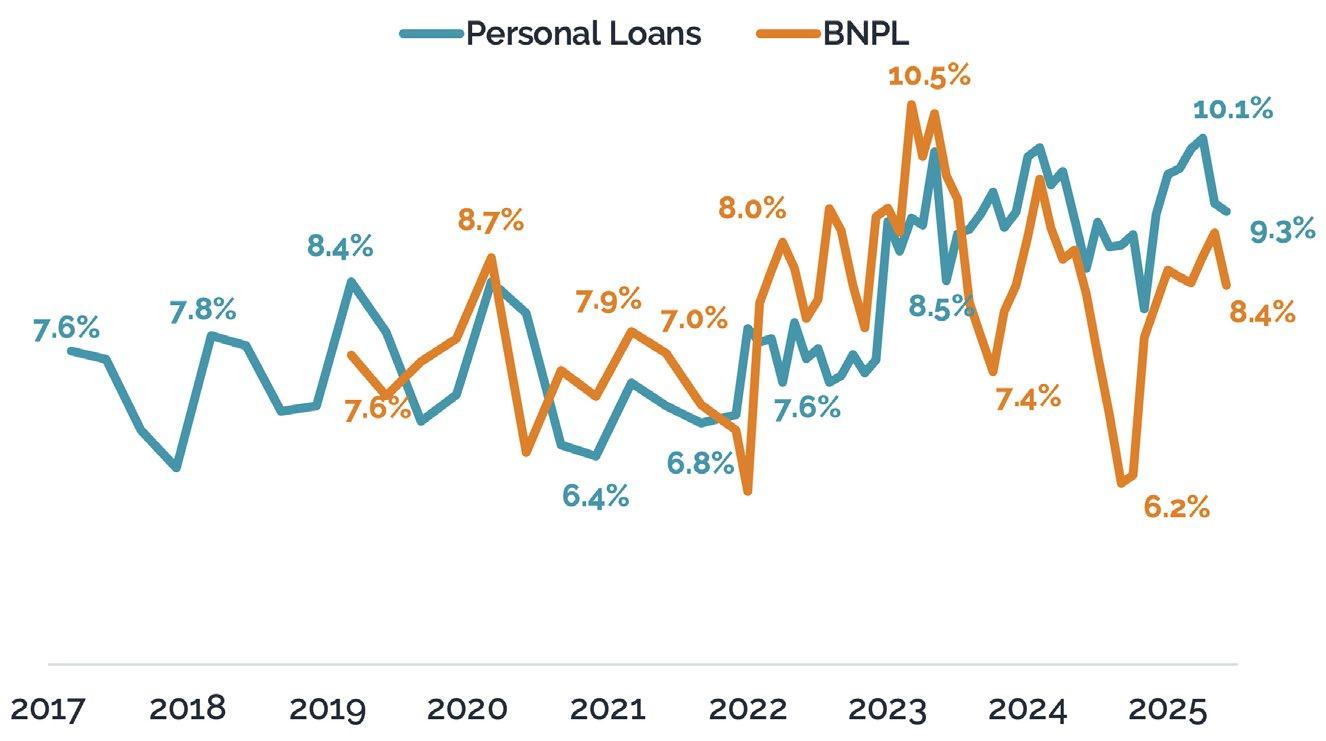

In June, credit card arrears dropped below 4% for the first time since September 2022, and personal loan arrears eased to 9.3%.

Buy Now, Pay Later (BNPL) arrears continued their downward trend, reaching 8.4% in both March and June. Retail energy and telco arrears also showed modest improvements, though telco arrears remain elevated compared to last year.

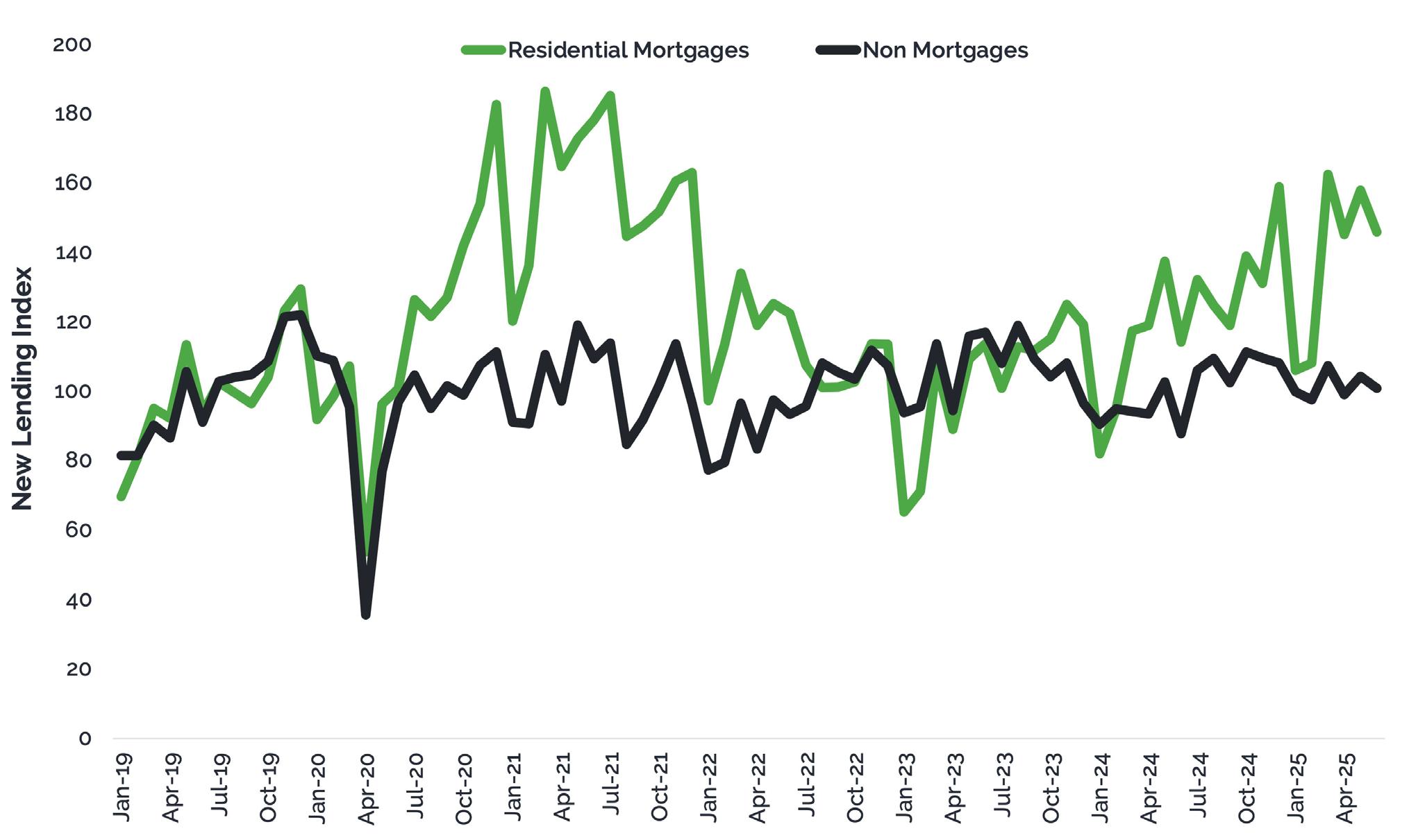

Mortgage momentum builds

New household lending surged across all three months. Mortgage lending rose 21.2% year-on-year in June, driven by refinancing activity as 79% of mortgages are set to be repriced over the next 12 months.

Non-mortgage lending, including credit cards, personal loans, vehicle finance, and BNPL, also rose steadily, up 5.5% in June.

The average mortgage size now sits at $518,000, with Auckland leading at $688,000.

First-home buyers are borrowing more, with average loan sizes up 4.6% year-on-year.

Financial hardship showing signs of easing

Financial hardship cases rose to 14,700 in May and declined slightly to 14,450 in June.

While still up 7.1% year-onyear, the rate of increase has slowed.

New Consumer Lending (Indexed to 2019)

Residential Mortgages: Repricing Maturity

Financial Hardship Growth

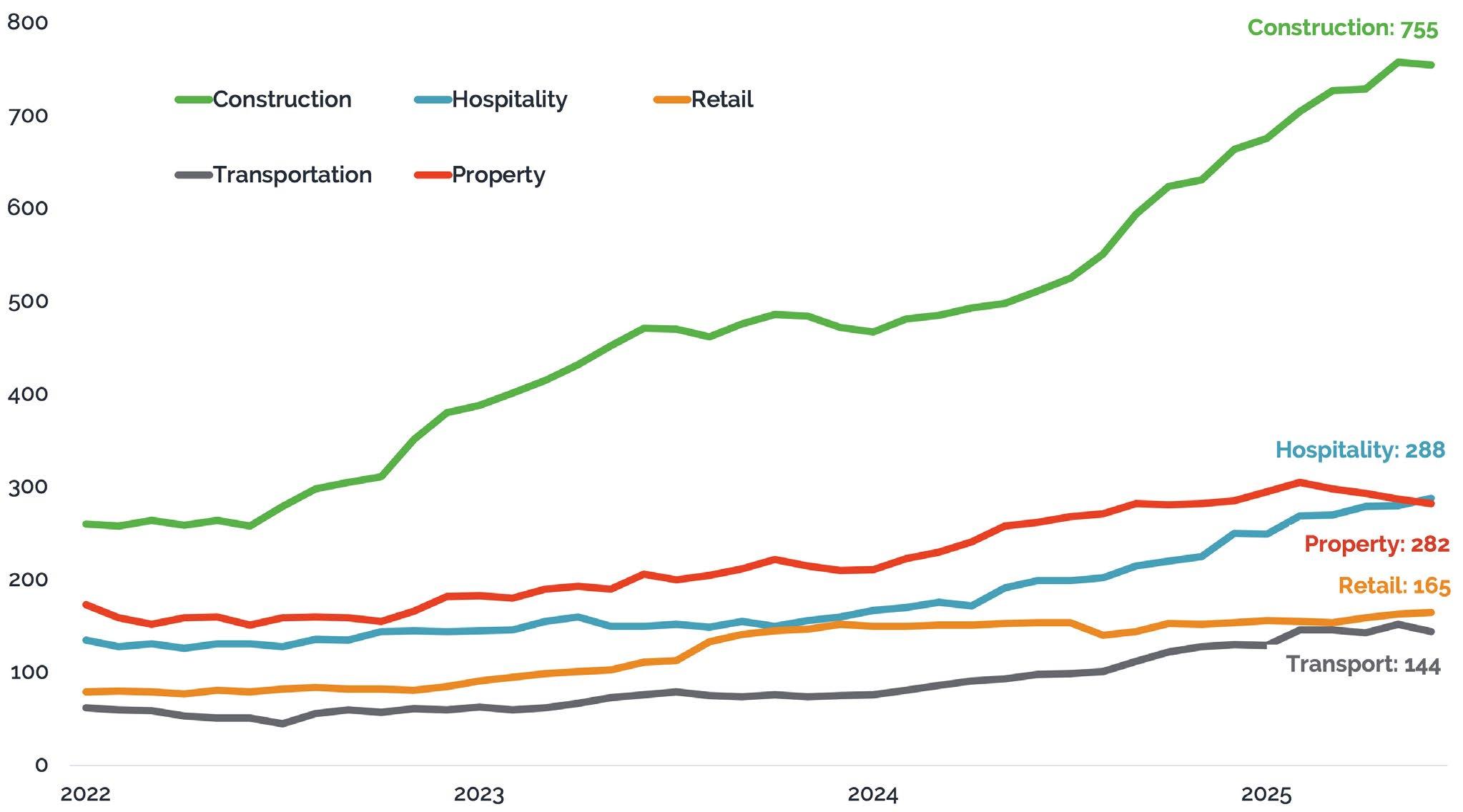

Business Credit Demand: 2020 – 2025

Company Liquidations Up 25% YoY

“Hospitality has now overtaken property as the secondmost affected sector, with 288 hospitality firms placed into liquidation in the past year, up from 199 the year prior.”

Mortgage payment difficulties remain the leading cause (45%), followed by credit card debt (29%) and personal loans (18%). The most affected age group continues to be 35–49-year-olds.

Business credit demand up, defaults persist

Business credit demand rose consistently across all three months, up between 8 and 9% year-on-year.

Retail, hospitality, financial services, and arts/recreation sectors led the growth.

However, defaults climbed across all sectors, up 13–18% yearon-year, with manufacturing and property/rental sectors most affected.

Company liquidations reveal mounting pressure across key sectors

Company liquidations remain a key indicator of economic stress.

Over the past year, liquidations have surged: up 30% in May, 27% in June, and 26% in July year-on-year. While the pace of increase is beginning to ease, the volume remains high.

The number of liquidations are partly due to increased enforcement activity by the IRD (NZ’s equivalent of the ATO).

The construction sector continues to bear the brunt, with over 750 building firms liquidated in the past 12 months.

Hospitality has now overtaken property as the second-most affected sector, with 288 hospitality firms placed into liquidation in the past year, up from 199 the year prior.

Retail, transport, and manufacturing also show elevated failure rates.

Economic Update

Small businesses, particularly sole proprietors managing multiple ventures, are facing elevated debt stress, with many relying on home equity to sustain operations – increasing their financial vulnerability.

These pressures are compounded by rising operating costs and shifting consumer spending patterns.

A delicate balance ahead

The past three months have shown that while the worst may be behind us, the path

to recovery is far from certain. Credit trends are stabilising, but not yet improving at pace.

Households are cautiously optimistic, with refinancing activity and improved arrears suggesting some financial breathing room.

However, persistent hardship, elevated business defaults, and sector-specific vulnerabilities – particularly in construction and hospitality – underscore the fragility of the current environment.

As we look ahead to the

second half of 2025, the focus must remain on resilience.

For households, that means staying on top of repayments and seeking support early. For businesses, especially SMEs, it means managing cash flow carefully and adapting to shifting consumer behaviour, as the economy continues to find its footing.

*Monika Lacey MICM Chief Operating Officer

Centrix Credit Bureau of New Zealand www.centrix.co.nz

Annual Company Liquidation Volumes

“Small businesses, particularly sole proprietors managing multiple ventures, are facing elevated debt stress, with many relying on home equity to sustain operations – increasing their financial vulnerability. ”

UPCOMING SPECIAL INTEREST GROUPS:

Corporate Insolvency: 9 September 2025 – Share scenarios, discuss legislative proposals, and drivers of insolvency trends. Register Now

eInvoicing: 16 September 2025 – Dive into the latest in electronic invoicing through the Peppol Framework. Register Now

Personal Insolvency: 11 November 2025 – Explore trends, scenarios, and legislative changes. Register Now

Why join a Special Interest Group?

l Share and Learn: Exchange insights on what strategies work and what don’t, gaining valuable knowledge from peers.

l Answer Known and Unknown Questions: Find answers to your questions and discover new ones through engaging discussions.

l Deep Dive into Practical Aspects: Explore the practical, day-to-day aspects of our work in greater detail.

l Explore Complex Issues: Understand how others approach areas where there are no clear black-and-white answers so you can implement the best solution for your scenario.

l Tap Community Knowledge: Access the collective wisdom of the community and understand the credit profession’s day-to-day realities.

l Understand Best Practices: Learn and implement industry best practices shared by fellow professionals.

l Professional Growth: Gain new ideas for improvement and stay ahead of trends.

l Contribute to Advocacy: Play a role in AICM advocacy efforts and shape the future of our profession.

l Membership Benefits: Enhance your membership experience and build valuable professional relationships.

We are excited to announce the launch of our new member only Special Interest Groups (SIGs), designed to enhance your professional development and foster stronger connections within our community. These groups will offer a unique platform to dive deep into niche topics, share best practices, and discuss the day-to-day challenges and triumphs of our profession.

Commercial Credit KPI’s: 18 November 2025 – Discuss trends, causes, and initiatives to improve KPI’s. Register Now

Complaints and Disputes: 9 December 2025 – Share best practice insights, legislative updates, and industry trends. Register Now

How to participate:

l Quarterly Zoom Meetings: Join interactive sessions with audio and video.

l Pre-Meeting Surveys: Share your initial views, questions and comments before the meeting to help shape the discussion.

l Facilitated Discussions: Engage in open forums led by experienced chairs.

l Ongoing Engagement: Continue the conversation post-meeting via the AICM LinkedIn Group.

Schedule and Registration

l There will be at least two SIGs each month, with each session lasting one hour.

l Topics will initially be held quarterly which may increase or decrease based on developments in the area.

l Registration is open now for the upcoming sessions.

l SIGs are a member only benefit.

We look forward to your active participation in these groups. Together, let’s shape the future of our profession and strengthen our community.

Global trends, local impacts: Insights from ACA International’s Annual Convention

By Daniel Taylor MICM*

In July, I had the privilege of attending the ACA International Annual Convention in Louisville, Kentucky, one of the most significant global events for credit and collections professionals. As someone deeply embedded in both the credit and debt recovery sectors, the opportunity to engage with international thought leaders and technology providers reinforced just how interconnected our challenges and opportunities are.

Regulation, reform, and reputational risk

A recurring theme throughout the conference was the complexity of regulatory change. In the U.S., the withdrawal of the CFPB’s advisory opinion on

medical debt was a case study in how policy, if poorly designed can create industry uncertainty and unintended consequences. The advisory opinion was ultimately deemed a “major rule” requiring proper legislative process something the industry successfully challenged. This outcome was a reminder of the importance of industry advocacy, especially when regulation intersects with compliance costs, consumer rights, and operational clarity. Here in Australia, we too are navigating an evolving regulatory landscape, particularly around data privacy, financial hardship, and responsible collections. For credit managers, this reinforces the need to remain informed, engaged, and agile in responding to change.

“Here in Australia, we too are navigating an evolving regulatory landscape, particularly around data privacy, financial hardship, and responsible collections.”

Daniel Taylor MICM

“Technology dominated the conversation at ACA, with a sharp focus on how artificial intelligence, automation, and analytics are reshaping customer engagement, compliance oversight and portfolio performance.”

AI, automation, and smarter engagement

Technology dominated the conversation at ACA, with a sharp focus on how artificial intelligence, automation, and analytics are reshaping customer engagement, compliance oversight and portfolio performance.

In particular, U.S. firms are investing heavily in decision engines, predictive analytics, and real-time compliance tools delivering not only operational efficiency but a more tailored customer journey. These tools are enabling better segmentation, smarter timing of engagement and more consistent outcomes.

For Australian credit teams, the key takeaway is not just to “digitise,” but to digitise with intent aligning innovation with business objectives, risk appetite, and customer expectations. Many of the tools showcased are now accessible to Australian firms and the time to assess integration pathways is now.

The voice AI revolution – are we ready?

Perhaps the most provocative trend was the emergence of Voice AI fully automated voicebots capable of holding complete debt resolution conversations without human intervention. These systems are

no longer theoretical; they are operational in parts of the U.S. and demonstrating measurable uplift in contact rates and compliance.

But with this innovation comes complexity. In an Australian context, there are key questions we must ask:

l Will consumers accept AI-led conversations?

l How do we ensure compliance with the Privacy Act, ACCC guidelines, and State-based consumer protection laws?

l What ethical frameworks are needed to support automation in sensitive financial conversations?

Agencies and credit teams looking to explore this technology must start by evaluating their data infrastructure, omni-channel readiness, and consumer sentiment frameworks. Hybrid models where Voice AI supports human agents may present a more acceptable path forward in the short term.

This is not just about replacing people with machines. It’s about enhancing the customer experience and freeing up skilled agents to handle higher-value or more complex conversations. Done right, Voice AI can improve consistency, reduce complaints, and elevate operational outcomes but only if deployed with transparency and control.

Tech trends shaping the future of credit

Beyond Voice AI, the convention showcased several other important trends that are reshaping the credit and collections ecosystem:

l Real-Time Agent Assist Tools: AI is being deployed not only to interact with customers but to support agents in realtime during conversations. These tools provide prompts, next-best-action suggestions,

and compliance monitoring allowing agents to remain compliant and effective without slowing down the call. This represents a significant step forward in blending human empathy with digital efficiency.

l Conversational Analytics and Sentiment Tracking: New technologies are enabling the detailed analysis of voice, email, SMS, and chat interactions to assess customer sentiment, compliance risk, and engagement effectiveness. These tools can identify frustration, confusion, or satisfaction giving credit teams the ability to adapt strategies based on customer emotion and response in near real time.

l AI-Powered Hardship Identification: Several platforms now include machine learning models trained to identify indicators of financial hardship through behavioural patterns, language cues, and historical interactions. This offers the potential to engage customers earlier with tailored support and more empathetic recovery strategies supporting

“Done right, Voice AI can improve consistency, reduce complaints, and elevate operational outcomes but only if deployed with transparency and control.”

both compliance and longterm repayment outcomes.

l Next-Generation Dashboards: Many firms showcased user-centric, highly visual dashboards that combine operational data, compliance metrics, and predictive analytics. These dashboards provide collection managers and credit executives with immediate insights and red flags no longer relying on manual reporting or lagging indicators. The message was clear: data is not just for data teams, everyone in the credit chain needs access to actionable intelligence.

l Digital Identity and Consent Management: With increasing scrutiny on data handling and digital engagement, technologies that support secure identity verification and dynamic consent management were on display. These are critical for omni-channel strategies that must align with modern privacy obligations, especially as digital communications expand.

It wasn’t long ago that customer self-service payment apps were hailed as the next big thing in collections offering improved accessibility, convenience, and digital-first engagement. Today, they are no longer a novelty or innovation; they’re simply an expected part of the credit lifecycle. This rapid shift from

breakthrough to baseline serves as a powerful reminder of just how quickly technology matures in our sector.

What was once considered cutting-edge can become standard in a matter of months. For credit leaders, this highlights the importance of building integration-ready, flexible tech environments. Rather than relying on monolithic systems, organisations must embrace architectures that allow for modular, tech-agnostic integrations so they can adapt to new tools, channels, and consumer preferences without having to rewire the entire operation. The future belongs to those who build with change in mind.

People, culture, and sector image

Another major topic one with clear parallels to the Australian market was the challenge of attracting and retaining talent. Whether in collections, credit management or customer support, our industry needs to do more to position itself as a meaningful, professional and values-driven career path.

In the U.S., organisations are investing in culture, training, and flexibility to respond to generational shifts and expectations. The message is clear: if we want to compete for talent, we need to reframe the narrative of what it means to work in credit and collections and create environments where

“...if we want to compete for talent, we need to reframe the narrative of what it means to work in credit and collections and create environments where people feel supported and valued.”

people feel supported and valued.

Why international exposure matters

One of the most valuable aspects of attending international conferences particularly in the U.S. is the ability to see what’s coming next. The scale and maturity of the American market often means that emerging technologies and operating models arrive there first.

By engaging with these trends at their point of inception, we in Australia can better prepare, adapt, and lead.

Exposure to the global credit ecosystem allows us to:

l Benchmark ourselves against world leaders

l Identify technologies that are ready (or nearly ready) for Australian implementation

l Understand the risks and rewards of early adoption

l Build relationships with innovators and vendors who may soon shape our local supply chain

In many ways, this global engagement is no longer optional it’s essential. Credit sits at the heart of economic stability and those working within it must be informed, future-focused, and globally connected. I firmly believe that by participating in these global conversations, we strengthen not only our organisations, but our profession as a whole.

*Daniel Taylor MICM CEO CCSG Group of Companies

Board Member – Australian Institute of Credit Management www.ccsgroup.com.au

What should I, the client, know when preparing for a hearing?

By Jacob Searle MICM*

Jacob

Engaging in the legal process can be a daunting experience, particularly for those unfamiliar with courtroom procedures and legal jargon. Whether the hearing is a simple case management review, a directions hearing to effectively progress the matter, an interlocutory application on a specific point or a final hearing as the matter reaches trial, preparation is essential to ensure the best possible outcome.

Understand the nature and purpose of the hearing

The first step in preparation is a genuine understanding

of what the hearing is about. Each hearing has different objectives and requirements as well as challenges. It is vital to work closely with your legal representation to understand why they are before the Court. Ask questions, be curious and engage with representation to be best placed in any situation before the Court.

Know the legal framework and issues in dispute

In our experience, you will always benefit from an understanding of the key issues in dispute. relating to their case. A proper understanding of strategy and

“Whether the hearing is a simple case management review, a directions hearing to effectively progress the matter ... or a final hearing as the matter reaches trial, preparation is essential to ensure the best possible outcome.”

Searle MICM

legal principles will ensure comprehension as to the relevance of the evidence and give insight into the arguments being presented by legal representatives.

Gather and organise evidence

Evidence is everything. When preparing for application hearings and trials, you will likely be required to produce evidence, swear or affirm an affidavit and possibly give evidence verbally to the Court. At the earliest juncture compiling all relevant documents such as agreements, correspondence, photographs, financial

“Make security visible: speak to your teams regularly, present at staff forums, send security awareness newsletters and be collaborative around risks.”

statements, invoices, searches, or other material relevant to the case will assist in creating efficiency and minimise costs when the litigation starts. These documents should be organised and maintained allowing a clear handover to your representation. This avoids confusion and allows for early identification and rectification of issues that may present themselves.

It is not to be understated the importance of maintaining records even prior to engaging legal representation. It is recommended that you have procedures in place to ensure consistency of record keep and document management. It is as simple as accurately recording notes when making phone calls by including dates, details and your name to easily identify the best witness.

Giving evidence in Court

– Review the material prepared by your representation and be familiar with your affidavit You should read the material prepared by your legal representation, especially an affidavit you intend to sign. We recommend sitting down with your representation, asking questions and clarifying any points or legal jargon you do not understand.

A true understanding of what has been stated under oath is critical, particularly when giving evidence in Court.

Real life example

In a recent matter handled by our office, we were required to make an urgent application to the Supreme Court of New South Wales to protect our client’s interest in a property previously caveated. The property in question was encumbered by various mortgages and caveats. Supposedly each party was served with a lapsing notice requiring urgent action to maintain each caveat. As no caveator responded to the lapsing notice, each caveat on

the property lapsed the day prior to when settlement was to occur. It became clear very quickly that something wasn’t quite right.

Within a day we were required to prepare and file a notice of motion together with extensive supporting affidavits from a variety of sources to prove to the Court that the client’s caveat should remain on title. We were successful in the client’s application and the interest in the property were preserved, however this was only possible by working

“A true understanding of what has been stated under oath is critical, particularly when giving evidence in Court.”

closely and collaboratively with the client whilst utilising the client’s well-maintained records and information. This is an example of how the client’s understanding of the key legal issues and importance involved in their case translates into genuine results.

What to take away

Preparing for a hearing involves more than just showing up. It requires a clear understanding of the case, well-organised evidence, familiarity with the process and trust in the process.

“Make security visible: speak to your teams regularly, present at staff forums, send security awareness newsletters and be collaborative around risks.”

If you are well prepared and actively involved in the preparation process with your legal representatives, you are in the best position to assist and to achieve a favourable outcome.

If you wish to understand how best to prepare for your future Court related

experiences, or if you need legal representation by our specialist commercial litigators, please contact our team at Results Legal on 1300 757 534.

*Jacob Searle MICM E: jsearle@resultslegal.com.au T: 1300 757 534 www.resultslegal.com.au

Pandemic-era leniency is being “shown the door”

By Fiona Reynolds MICM*

There will be increasing pressure on businesses over the next 12 months as the Australian Government, the Australian Taxation Office and the Australian Securities and Investments Commission ‘tighten the screws’ to make it more difficult for businesses to avoid, delay or restructure out of tax and superannuation obligations and liability for insolvent trading.

The key strategies:

1. The Australian Taxation Office is ramping up collection activity, using AI technology to sharpen its analytics and tightening its policies for assessing small business restructuring proposals.

2. The Australian Securities and Investments Commission has

issued an updated regulatory guide concerning director’s duty to prevent insolvent trading.

3. The Australian Government has introduced a reform to make it harder for businesses to claim a tax deduction for the interest that they pay on late payments and underpayments to the Australian Taxation Office. It is also pressing ahead with its goal to reduce the timeframe for employers to pay their employees’ superannuation.

The Strategies in more detail

Australian Taxation Office

l The ATO’s increase in collection activity is real.

“The Australian Government has introduced a reform to make it harder for businesses to claim a tax deduction for the interest that they pay on late payments and underpayments to the Australian Taxation Office.”

Fiona Reynolds MICM

“The ATO is using real-time data and AI-driven analytics to identify tax payers who are not lodging returns.”

{ Its appetite for waiving interest and agreeing to long payment plans has diminished.

{ It is issuing increasing numbers of Directorpenalty notices and garnishee notices.

{ It is reporting defaults to credit agencies.

{ It is filing more applications to wind up companies.

l The ATO is using real-time data and AI-driven analytics to identify tax payers who are not lodging returns. This includes: single touch payroll reporting, cross-matching

data with financial institutions and employee tip-offs regarding unpaid super

l The ATO is adopting a higher level of scrutiny of small business restructuring proposals. It will:

{ More closely scrutinise compliance with tax and super obligations.

{ Require director and related party creditor debts to be included in the restructuring plan. It will not support plans that propose to subordinate any director and related party debts.

{ Not support plans where

it considers that the SBR process is being used to circumvent a winding up proceeding or to gain an unfair advantage over other businesses.

Talking to CPA Australia, Shaun Matt CPA and Partner at Cor Cordis shared his insight into the ATO’s more targeted approach to assessing Small Business Restructuring proposals:

“They’re really looking at the future viability and compliance history of the businesses and making sure that any proposals are in the best interests of all stakeholders”.

Australian Securities and Investments Commission

l ASIC’s updated regulatory Guide 217 Duty to Prevent Insolvent Trading: Guide for Directors (RG 217) issued in December 2024 provides directors with updated guidance on their duty to prevent insolvent trading, the liability of holding companies for debts incurred when a subsidiary is insolvent, and the use of safe harbor to obtain protection from liability for insolvent trading.

l The Guide was last updated in 2020 and is the product of ASIC’s consultation with registered liquidators, professional bodies and other interested parties.

l It signals that ASIC is working to support the Australian Government to ensure that directors clearly understand their obligations and are more accountable for their actions.

Australian Government Taxation and Superannuation Reforms

l Tax payers can no longer claim an income deduction for ATO interest charges incurred on or after 1 July 2025. This applies to General Interest Charges and Shortfall Interest Charges

“A 2024 report by the council calculates that 2.8 million people are failing to receive their full super entitlements each financial year...”

for late payments and underpayments.

l This is expected to have a significant impact on businesses that are already experiencing cash flow problems.

l From 1 July 2026, there are plans to introduce the ‘Payday Superannuation’ policy. This will impose an obligation on employers to pay their employees’ super at the same time as their salary and wages. This is not yet law. The legislation is in draft form. Consultation on the draft legislation concluded on 11 April 2025.

l If this policy is implemented, it will have a huge impact on businesses. Currently, employers must pay their staff super at least every three months. Imposing an obligation to pay staff super every pay day will put a lot of extra financial pressure on employers.

In a recent article published by ABC News, it reported on Super Member’s Council statistics on unpaid super:

“Tax payers can no longer claim an income deduction for ATO interest charges incurred on or after 1 July 2025.”

“A 2024 report by the council calculates that 2.8 million people are failing to receive their full super entitlements each financial year, with the average underpayment per affected worker being $1,810.”

These statistics give some insight into the significance of the impact this policy will have on businesses.

Is there a silver lining?

Perhaps it’s not all doom and gloom? The real target of these measures are the businesses that try to use the system to avoid or delay paying their creditors, often at the cost of those that do. The silver lining is that if they work, then only the businesses that conduct themselves like good corporate citizens will survive. That has to be a good thing. In the meantime, there is likely to be more pain to come for struggling businesses as they adjust to these tougher measures. The message to businesses is now clear; the time of pandemic-era leniency is gone.

*Fiona Reynolds MICM

Partner

T: 07 3212 6731

E: Fiona.Reynolds@turkslegal.com.au

President’s Report

We are well into the second half of the year now, and the momentum in our QLD credit community is still going strong!

Our Accounting 101 for Credit Professionals breakfast session was a success – thank you to everyone who joined us. A huge shoutout to Vincents for generously hosting and for providing the incredibly knowledgeable and engaging Shannon Walker, whose practical insights and delivery were appreciated by all in the room.

We also recently celebrated one of the biggest highlights of our calendar, the AICM Awards Night! Congratulations to our Young Credit Professional (YCP) winner, Makayla Golding, and Credit Professional (CP) of the Year, Ruthven Underhill (with Caitlin Shillingford accepting the award on his behalf). It was a brilliant evening recognising the outstanding talent in our industry. A special mention to Jordan McNee, who did an exceptional job MCing the night and keeping the energy high throughout the celebrations.

Thank you to the judges for both awards who generously gave up their time and thank you to our sponsors, we truly appreciate your continued partnership for awards like these, shining a spotlight on those within our industry. Looking

forward to cheering on our Queenslanders at the upcoming National Conference on the Gold Coast. If you haven’t registered already, get in now, it’s going to be an amazing 3 day event.

Looking ahead, we’re so excited for the upcoming WINC 10-Year Celebration in Brisbane. This event is always a standout, but this year holds extra significance as we reflect on a decade of connection, empowerment, and progress. It’s set to be a truly special day, and we can’t wait to see you all there– sparkles, smiles, and all!

As always, thank you to our members, sponsors, and council. Your continued support is what makes all this possible. I look forward to seeing many of you at these upcoming events!

– Stacey Woodward MICM CCE QLD President

Accounting 101: Thank you to Vincents for hosting this event.

Accounting 101: Lynne Walton MICM – Access Intell, Vicky Reeves MICM –Cement Australia, Stacey Woodward MICM CCE and Michelle Carruthers MICM – NCS.

queensland

Accounting 101

– A Morning of Insights and Engagement

Held on the morning of May 21st at the stunning Vincents offices, our latest Personal Development session, Accounting 101, proved to be both informative and enjoyable. Guests were treated to a delicious breakfast and breathtaking views from the Vincents deck, overlooking the river and distant mountains – a perfect setting to kickstart the day.

Shannon Walker led the session and truly was the ideal presenter. His engaging style made what can often be a dry topic accessible and interesting. He kept the audience involved from start to finish– helped, perhaps, by Stacey’s bag of chocolates that encouraged plenty of questions! Shannon handled every question with ease, offering clear, relatable explanations that everyone could understand, regardless of their accounting experience.

The session began with a grounding in the fundamentals:

What is Accounting?

While some attendees work with financial reports and statements daily, others were less familiar with these documents. Regardless of experience level, everyone left with new knowledge and practical takeaways they could apply in their roles.

Key Takeaways from the Session:

1. Financial reports are only as good as the data entered.

“The art of recording, classifying, and summarising in a significant manner and in terms of money, transactions, and events of financial character–and interpreting the results thereof.”

2. Always consider who prepared the financial reports.

3. Understand the purpose behind the reports.

4. Be mindful of non-core or non-cash items that can distort performance.

2025 Qld YCP of the Year Makayla Golding from Cleanaway. Stacey Woodward MICM CCE – NCS, Josh Mann & Sophie Chiesa – CreditorWatch.

Vanessa Hendey MICM, Emily Wong MICM and Shannon Walsh MICM – Shell Energy.

5. Ratios are powerful tools that can provide guidance and benchmarks. Following the session, attendees took advantage of the remaining time to network, connect, and enjoy the morning ambiance on the deck. The combination of learning, community, and stunning surroundings made for a truly memorable event.

Stay tuned for more upcoming Personal Development sessions in Queensland – we look forward to seeing you there!

For more photos of the event CLICK HERE

Queensland Awards Night 2025: A Night to Remember

In true Queensland fashion, the weather kept us on our toes. As guests began arriving for the prestigious 2025 Queensland Awards Night, an unexpected storm swept through Brisbane. Despite the sudden downpour and gusty winds, our dedicated finalists and guests were undeterred. Nothing was going to dampen the excitement of such a special evening.

Held at the iconic Customs House on the Brisbane River, the venue provided a stunning backdrop to the celebration. While the doors had to

be closed to keep out the wind and rain – resulting in a few soggy jackets and even a broken shoe –the mood inside remained warm, enthusiastic, and celebratory.

The evening commenced with canapés and networking, allowing guests to reconnect and enjoy the beautiful surroundings. Soon after, attendees were ushered to their tables for the commencement of formal proceedings and dinner service.

Young Credit Professional Finalists – Dalton Gismondi MICM – Transurban, Emily Wong MICM – Shell Energy, Makayla Golding – Cleanaway, Jessica Bester MICM – NCS, Lachlan McKinnon MICM CCE – Vincents.

Mark Moorhouse MICM, Makayla Golding and Angela Hughes MICM – Cleanaway.

queensland

Our host for the evening, Jordan McNee, welcomed everyone with energy and professionalism, setting the tone for the night ahead.

This year’s awards showcased some truly exceptional talent in the two categories: Young Credit Professional (YCP) of the Year and Credit Professional (CP) of the Year.

As a member of the judging panel for the YCP award, I can confidently say this year presented the most competitive and inspiring group of candidates we’ve ever seen. Each finalist brought a unique perspective, depth of knowledge, and passion to the interviews. A personal favourite question of mine is always, “How did you get into credit?” It’s remarkable how few people plan to enter the credit profession from the outset, yet all bring such dedication once they do.

Congratulations to all our outstanding YCP finalists: Dalton Gismondi, Emily Wong, Jessica Bester, Lachlan McKinnon, and Makayla Golding. While all were deserving, the judges’ unanimous choice for the 2025 YCP Award was Makayla Golding, whose insight and enthusiasm stood out during the interview process. The award was presented by Luke Matthews from CreditorWatch,

who took a moment to highlight the strengths of each finalist.

The spotlight then turned to the Credit Professional of the Year award. This category featured an incredibly strong field of candidates with extensive experience and leadership in the credit industry: Ben Blake, Dean Phillips, Erica Barron, and Ruthven Underhill. Each of these professionals contributed thoughtful perspectives during the interview process and demonstrated a strong commitment to the field.

The 2025 CP Award was deservedly presented to Ruthven Underhill, recognised for his outstanding contributions and leadership in credit. The award was sponsored by Experian and presented by Dennis Balen with the assistance of Kirsty Gray, past CP finalist and current Queensland Council member. The evening concluded with the presentation of service awards and a delightful dessert, providing a fitting end to a night of recognition, celebration, and community.

Congratulations once again to all finalists and winners. We look forward to seeing you at future AICM events as we continue to celebrate excellence in the credit profession.

For more photos of the event CLICK HERE

Credit Professional Finalists – Erica Barron MICM CCE – National Masonry, Caitlin Shillingford – accepting award for Ruthven Underhill MICM CCE – Tradelink, Dean Phillips MICM CCE – FeeSynergy, Ben Blake MICM CCE – Cleanaway.

Vale – Marion Hintz

It is fitting we pause to recognise the passing of a great Woman in Credit and a true pioneer of our profession.

Marion first joined the Australian Institute of Credit Management (AICM) in 1978 and remained a devoted member for an extraordinary 47.5 years. Her commitment and influence spanned generations, shaping the very foundations of credit education and professional development in Australia.

In the 1980s, Marion served as State President for a three-year term, where her leadership was marked by innovation, inclusivity, and a deep passion for education. She was a gifted trainer who shared her knowledge with humour, clarity and enthusiasm, qualities that endeared her to colleagues and students alike.

Marion was instrumental in developing the TAFE segment of the credit course that became part of the Diploma of Credit Management during the 1980s and early 1990s. Many of today’s senior credit professionals began their journey through this very program, a testament to her lasting impact on the profession.

Her contributions to Queensland training were equally profound. Marion played a key role in formulating the official documentation for Certificate III and IV, which later became part of the nationally registered training organisation operated by AICM. Her work laid the groundwork for the structured, high-quality education that

continues to support credit professionals across the country.

In 2005, Marion was awarded Life Membership, an honour befitting her decades of service, leadership, and dedication to the Institute.

Beyond formal education, Marion co-authored the ‘Easy Guide to Credit Control for Small Business’, helping small businesses navigate invoicing and collections with confidence. She also organised the AICM Speakers Club, a division of Rostrum, which empowered many members to develop their public speaking and presentation skills – skills that proved invaluable in boardrooms and leadership roles.

Her wit, energy and generosity left a lasting impression on all who knew her. Marion’s legacy continues to shine through the many credit professionals she mentored and encouraged. She was not only a leader but a beloved icon of the AICM, whose influence will be felt for years to come.

Marion sadly passed away after a long illness at 77 years of age. She leaves behind a legacy of excellence, compassion, and unwavering commitment to the credit profession.

Some of Marion’s friends will be getting together on 26th September to raise a glass to her. If anybody is interested in joining in please contact Faye Whiffin on 0414 617 904.

queensland

Member Spotlight

Dean Phillips MICM CCE

I had the pleasure of catching up with Dean Phillips recently for our Member in the Spotlight interview. Dean has had a busy year – he was a finalist for Credit Professional of the Year (Qld) and has recently completed his CCE Exam.

What is your current position and who do you work for?

I’m the Head of Credit Management at FeeSynergy, a Melbourne-based company. I’ve been here for three years, leading a team of five.

How long have you been a member of the AICM? Just over five years.

How did you get into credit?

Like many people, I wasn’t sure what I wanted to do after high school. I started working in a warehouse, but quickly realised it wasn’t where I wanted to stay. I completed a university degree but didn’t pursue a career in that field. In 2003, I applied for a credit role – and that’s what started it all. That role opened doors and gave me the opportunity to work all over the world. I left the industry briefly for six months but ultimately came back because credit is my passion. I’ve always known I wanted to help people, and credit gives me that opportunity.

What is your biggest professional accomplishment to date?

Making mental health a priority in the workplace is something I’m very proud of. I’m a qualified Mental Health First Aider, and I’ve made it a point to support younger staff members who are juggling study and work.

We brought in guest speaker Donna Thistlethwaite to share her experience, helping to open important conversations about mental wellbeing. I believe it’s vital to know how your team

is feeling, especially after tough phone calls or challenging days.

In a previous role, I helped set up a staff-led mental health committee – with no managers involved – to create a safe and supportive space for honest dialogue.

What advice would you give to emerging credit professionals?

Credit management isn’t just about numbers – it’s about people. I’ve learned a lot from both great and not-so-great managers, and the biggest lesson has been the importance of emotional intelligence.

Treat people with respect. Everyone has a story. If someone is angry, they’re reacting to a situation –not to you personally. Always keep the conversation respectful and focus on building relationships. Culture is a massive factor. It’s a bit of a buzzword, but when you get it right, everything changes – even the tough days become easier to manage.

What has been your biggest professional challenge so far?

Leading a team through major organisational change – transitioning from a small business to an ASX-listed company – was incredibly challenging.

The process meant navigating uncertainty and reassuring the team about their roles and the future. I had to manage different personalities and focus on building strong internal relationships. Leading through economic shifts while still delivering the best outcomes was a big learning curve.

What has being an AICM member done for you? It’s opened my eyes to how many incredible people are in this industry. It’s great to connect with like-minded professionals, bounce ideas around, and access valuable education and networking opportunities. Being part of a community like this makes a real difference.

You recently completed your CCE – how was that experience? Honestly? Stressful – but very rewarding. I was

“Credit management isn’t just about numbers – it’s about people. I’ve learned a lot from both great and not-so-great managers, and the biggest lesson has been the importance of emotional intelligence.”

nervous leading up to the classroom exam, but once I arrived, the environment was great. It was a good group of people, and the process really pushed me outside my comfort zone.

When I found out I had passed, it was a huge relief. It was definitely worth it.

Would you recommend the CCE to others? Absolutely – 100%.

Why did you apply for Credit Professional of the Year?

I felt like I was finally ready. In previous years, I’d focused more on the success of my team. But this year, things have been going really well, so I thought – why not give it a shot?

I’ve got a great team behind me, and I wanted to challenge myself.

What did you enjoy about the process?

I reached out to a previous CP winner, which gave me the chance to connect with people who were really supportive. I was nervous heading into the interview, but the judges made it feel relaxed and encouraging. It was a great process.

Would you recommend applying to others?

Definitely. It gives you a chance to reflect on your personal achievements – something we don’t always do, especially when we’re focused on our teams. I’ve felt very supported throughout the entire journey.

I hope my experience inspires others to go for it. If I can do it, anyone can.

What are the benefits of a group membership for you and your team?

We use the Credit Knowledge Hub as part of our onboarding, and the team regularly joins webinars.

We recently attended a Special Interest Group (SIG) event, which was a great experience.

The AICM has been incredibly valuable for both me and the company – and I’m lucky to be with an organisation that truly supports our professional development.

The Australian Institute of Credit Management welcomes our Partners for 2025 Our National, Divisional and Professional Partners support and work with the AICM to promote the Institute’s activities, represent the Credit Industry and develop the careers of all

south australia

President’s Report

SA Council Takeover – A Trophy on Tour

A big thank you to Elizabeth Dobbie for leading a fun and engaging initiative during the SA Council LinkedIn takeover. Elizabeth took on the role of sharing photos from Council Members’ workplaces and the various locations they visited, allowing the President’s Trophy to travel with them.

This creative approach added a new layer of excitement with the introduction of “Find the President’s Trophy”, which turned out to be a great success and brought members together in a lighthearted and memorable way.

Celebrating 10 Years of Women in Credit

On 20th June, SA WINC Luncheon was held at Kooyonga Golf Club to celebrate a remarkable milestone – the 10-year anniversary of Women in Credit. The event was a resounding success, honouring a decade of achievements, leadership, and progress for women in the credit industry.

In the spirit of celebration, some attendees embraced the theme by wearing outfits that glittered and sparkled, adding a festive touch to the occasion.

We were honoured to welcome Alison Covington AM from our 2025 AICM charity partner Good360 Australia, alongside our distinguished

guest speaker, The Hon. Michelle Lensink MLC, Shadow Minister for Planning and Housing, Human Services, Women and the Prevention of Domestic, Family, and Sexual Violence. Their insights and presence added depth and meaning to the event.

Also joining us were Debbie Leo MICM, GM Corporate Sales, Equifax; Anna Taylor MICM, Principal at Results Legal; and Kathleen Lenton MICM from NCI, whose contributions helped make the day memorable.

Our raffles and fundraising efforts raised over $3,000, a fantastic achievement for South

SA Trivia Night: Quizmaster asking the tough questions.

SA Trivia Night at Mylk Bar in Adelaide.

Lisa Anderson FICM CCE from Coopers with Paul Zenkteler from Oracle collecting his prize.

Australia and a testament to the generosity of our community.

A special thank you goes to Alice Carter FICM CCE from Lynch Meyer Lawyers, for organising the event and to Lisa Anderson FICM CCE from Coopers Brewery, for co-ordinating the prizes and menu.

Your efforts were instrumental in making the celebration a success. Here’s to the next decade of empowering women in credit!

SA Trivia Night – A Night of Fun, Facts, and Fantastic Prizes

The SA Trivia Night held at Milky Bar was a huge success, drawing a great crowd and plenty of competitive spirit. Our Quiz Master, John Rolfe, delivered a diverse range of questions that had everyone reaching for their thinking caps.

A big thank you to Lisa Anderson from Coopers Brewery for once again organising a seamless and enjoyable evening. The atmosphere was lively, the food was fantastic, and the prizes were plentiful, especially for Paul Zenkteler from Oracle, who walked away with more than his fair share of wins!

Major Prize Winners:

l 1st Prize: 6 month Junior & Adult Season Pass to Seacliff Golf Course – Elizabeth Dobbie (NCI)

l 2nd Prize: Ultimate Golf Pass to Seacliff Golf Course – Nicola Strever (Lynch Meyer)

l 3rd Prize: 23L Coopers DIY Beer Kit – Paul Zenkteler (Oracle IS)

Additional Prize Winners:

l Nick Brown (Lynch Meyer) – Farmhouse Bakery voucher

l Steve Barnett (Oracle IS) – NCI Blanket/Throw

Rug & Prohibition Gin

l Paul Zenkteler (Oracle IS) – Regency Park

SHANZ Mini Golf Family Pass, 1 Case Coopers

Aussie Lager & 1 Case Coopers Vintage 2004

With great food, a fantastic venue and some very lucky winners, the night was a brilliant example of the SA credit community coming together for fun and connection.

For more photos of the event CLICK HERE

Women in Credit Luncheon – 10 Year Anniversary

This year WINC was held at the Kooyonga Golf Club on the 20th June. The event brought together

The Hon. Michelle Lensink MLC.

Alison Covington AM from Good360.

south australia

credit professionals for an afternoon of inspiration and connection. It is a platform to recognise the contributions of women in credit, share stories, and raise funds for meaningful causes.

The keynote address was delivered by The Hon. Michelle Lensink MLC, a long-time advocate for equality, leadership, and inclusive opportunity. She shared her insights from public service, underscoring the value of women’s supporting women in every sector including finance and credit management.

This year’s luncheon was partnered with Good360 an Australian organisation focused on redistributing essential household goods to Australians in need. There were raffles and auctions on the day.

The success of the 2025 Adelaide Luncheon is a testament to the growing influence of the WINC initiative across Australia. For those in credit and collections WINC provides an invaluable opportunity to connect, reflect and grow. For more photos of the event CLICK HERE

Spotlight on Excellence: YCP & CP Awards Night

Mark your calendars for 28th August as the SA credit community gathers at The Arkaba Hotel for the highly anticipated Young Credit Professional (YCP) and Credit Professional (CP) Awards Night.