Hatim Abounassf on Saudi Broadcasting Authority's role at FOMEX as the Kingdom's media landscape evolves

Managing Director Vijaya Cherian vijaya.cherian@cpipromedia.com

+971 (0) 55 105 3787

Editorial Director Vijaya Cherian vijaya.cherian@cpipromedia.com

+971 (0) 55 105 3787

Editorial Contributors

Kalyani Gopinath

Nusrat Ali

Urooj Fatima

Sub Editor Aelred Doyle

Group Sales Director Sandip Virk sandip.virk@cpipromedia.com

+971 (0) 50 929 1845 / +44 (0) 7516 993 862

Finance Executive Yonwin D’souza finance@cpipromedia.com

Art Director David Fraser design@cpipromedia.com

EVENTS & MARKETING events@cpipromedia.com

Web Developer Hafiz Muhammad Waqas IT@cpipromedia.com

Dominic De Sousa (1959-2015)

PARTNER

Maria De Sousa

Published by

Ramadan is almost here, and with it comes the industry’s most unforgiving stress test. This is the moment when months of commissioning decisions, production spend and scheduling strategy are exposed to real audiences, real ratings and real commercial pressure. Across the region, teams are either putting the final touches on their Ramadan productions or quietly recalibrating their marketing plans, not knowing which titles will secure eyeballs this year and what new trends the season will spark.

This year, several big events are unfolding at the same time – FOMEX in Saudi Arabia, Web Summit Qatar, ISE in Barcelona –while Dubai has just wrapped the 1 Billion Followers Summit. This clearly shows that the Middle East is no longer waiting its turn in the global media conversation. It is actually setting the pace.

Saudi Arabia sits at the centre of that momentum. Billions of dollars have been committed to content, broadcast infrastructure, live events and sports rights under Vision 2030. For vendors and systems integrators, this market is huge. That is why FOMEX matters: it shows where Saudi broadcast and media priorities are heading next, and which technologies are being shaped specifically for local workflows and end users rather than imported wholesale. It also serves as the premise for how we put together the BroadcastPro Summit KSA each year. This year, it will take place on Feb 5 at the Radisson Blu, Riyadh Minhal. Our panels focus on where the pressure is greatest today: financing content year-round, monetising in a fragmented streaming market, moving AI from experimentation to deployment, harnessing sports to drive audiences and budgets, and making technology choices that will shape operations for the next five years.

Saudi Arabia is no longer an emerging media market. It is setting the tone for the rest of the region, and we want to be part of the conversations in the Kingdom. See you in KSA.

VIJAYA CHERIAN, EDITORIAL DIRECTOR

5

SRMG launches new sports app; 1 Billion Followers

Summit unveils new initiatives; Egypt’s National Media Authority returns to scripted TV with Ramadan thriller; Abu Dhabi gets new media investment fund; and more

STUDIO LAUNCH – DUBAI

COVER STORY SETTING THE COURSE FOR FOMEX

Hatim Abounassf talks about SBA’s new projects, its role at FOMEX and how the event reflects Saudi Arabia’s shifting media landscape and ambitions, including what visitors can expect this year

EXCLUSIVE – REPORT DECODING VIEWERSHIP

16

Audimatic uses AFCON 2025 and the FIFA Arab Cup 2025 as litmus tests to analyse TV audience behaviour across four markets 26

AI-POWERED, HUMAN-LED

A new AI studio launches in Dubai with a team of experienced industry professionals to help companies explore new AI production models 32

OPENING NEW DOORS WITH BAAB

Emirati filmmaker Nayla Al Khaja reflects on the making of BAAB, her psychological thriller exploring loss and grief, which premiered in Dubai last month and was created with music maestro AR Rahman

WHY CABSAT MAKING THE CASE FOR INNOVATION

From AI-led workflows to immersive production, the Middle East’s oldest broadcast show enters a new chapter

42

22

PANEL DISCUSSION BUILDING STREAMING PLATFORMS THAT LAST

Regional OTT executives explore how MENA streaming platforms are recalibrating scale, partnerships and technology to stay relevant in a fast-moving digital market

36

GUEST COLUMN THE AI ADVANTAGE

James Varndell explains how AI and large language models are helping video teams monitor performance at scale and resolve issues before viewers are affected 44

A new sports app from Saudi Research and Media Group (SRMG), GOAT, short for Greatest of All Time, has launched to cater to a mobile first audience. The app combines live updates, breaking news, video highlights and match insights into an always-on experience structured around fan

habits and matchday flow.

In its initial rollout, GOAT focuses on football, with particular emphasis on the Saudi Pro League alongside major international competitions. Aggregating content from SRMG’s established brands, including Arriyadiah, Asharq Al Awsat, Asharq Sports and Sport 24, the

app positions itself as a primary source for up-tothe-minute Saudi football news underpinned by SRMG’s editorial standards. The platform is also designed to open new monetisation avenues, such as intelligent sponsorships, data-led brand partnerships and premium experiences centred on major moments.

As a scalable product, it is intended to help brands, leagues and partners connect with highly engaged sports audiences through formats that enhance the fan experience. SRMG plans to continue developing GOAT with interactive features. The app is available to download on iOS and Android platforms.

Neom has revealed the five Saudi game studios chosen to receive funding under the latest cycle of Level Up, the programme’s largest cohort to date. The announcement follows an initial mentorship phase that supported a further 18 studios, making this the most expansive edition since its launch.

Run by Neom Gaming, Level Up is the Kingdom’s longestrunning gaming accelerator and a key pillar of Saudi Arabia’s National Gaming &

Esports Strategy under Vision 2030. It is designed to help local studios overcome the challenges of scaling a sustainable game business through tailored funding, mentorship and global industry access.

In the first phase

of the latest cycle, at least 23 studios received mentorship across a wide range of business, creative and technical disciplines. From this group, five studios (Aiqona Productions, Fourcast Studio, Makera, OFF BOX Studios and Phys)

were selected for the next stage, where they will receive funding to accelerate product launches, along with an additional seven months of intensive support. Participants will also gain access to Neom’s expanding Publisher Partner Network, which includes prominent international and regional players. The programme has resulted in the creation of over 170 jobs with 100% portfolio survivability and substantial growth of investee entities.

The fourth edition of the 1 Billion Followers Summit, organised by the UAE Government Media Office, unveiled a series of initiatives spanning entrepreneurship, funding, technology, social impact and creative innovation. More than 30,000 attendees, including over 15,000 content creators and more than 500 speakers from around the world, were present.

The Summit launched the Creators Market, a dedicated platform for content creation companies to showcase ideas, share insights, seek partnerships and explore opportunities to establish or expand their presence in the UAE. Powered by the Dubai Chamber of Digital Economy, it hosted over 70 SMEs, including startups founded by content creators who have successfully transitioned into business leadership roles. It also served as a gateway for investment discussions, knowledge exchange and high-value business deals.

The impact of targeted mentorship and industry support was evident during the final presentations of the Creators Ventures Accelerator programme, an initiative by Creators HQ, the region’s first

dedicated creators’ hub, and global venture capital firm 500 Global. It falls under the Creators Ventures programme, an initiative focused on supporting creator-led startups with a combined valuation exceeding $130m. Following the final stage, two startups qualified for funding consideration from Creators HQ.

In a move aimed at expanding commercial pathways for creators, Creators HQ partnered with Amazon Ads to launch Amazon Creators Foundry, a programme designed to help creators unlock new revenue streams, scale their businesses and bring locally developed products to Amazon.ae. The initiative offers end-to-end support, education and mentorship across product development, marketing

and brand building, alongside opportunities to expand internationally through Amazon’s global selling programme and boost visibility via dedicated storefronts and Amazon Ads credits.

As part of its focus on purposeful storytelling, the Summit witnessed the launch of the $1.36m Social Content Fund by Creators HQ in collaboration with creator monetisation platform Alfan. The Fund is designed to support creators producing family- and societyfocused content, with an emphasis on projects that promote family cohesion, positive social values and constructive dialogue.

In addition to financial backing, beneficiaries will receive training on content creation and monetisation, access to monetisation

tools and use of stateof-the-art production facilities. Further, they will gain access to alfan.io, a monetisation platform that allows creators to launch digital shops, collaborate with brands and generate sustainable income streams.

The Summit also celebrated creative excellence with the awarding of the $1m AI Film Award to Tunisian filmmaker Zoubeir Jlassi for his film Lily. Presented by Her Highness Sheikha Latifa bint Mohammed bin Rashid Al Maktoum, Chairperson of the Dubai Culture and Arts Authority, the award was organised by the Summit in partnership with Google Gemini.

The AI Film Award attracted 3,500 film submissions, while more than 30,000 participants from 116 countries registered interest, underlining the initiative’s global reach. It aims to encourage the production of impactful films that make extensive use of AI tools while delivering culturally resonant and socially meaningful messages.

The announcements and awards at the 1 Billion Followers Summit underscore the UAE’s positioning as a global hub for the creator economy.

Egypt’s National Media Authority (ENMA) has announced its return to scripted television production after a decade-long hiatus. The move signals a major change in state-backed programming strategy ahead of the Ramadan 2026 drama season.

The Authority’s production arm, Maspero, will mark its comeback with Justice Within, a 15-episode psychological thriller co-produced with Xylophone Film Production. The project was selected

from 53 submissions by a 12-member committee, positioning the series as both a test case for reviving Maspero’s production activities and a key element of wider reform efforts within Egypt’s national broadcasting system.

The timing reflects the continued importance of Ramadan as the most commercially significant period for Arabic television drama. During Ramadan 2025, average daily viewership across satellite and digital

platforms reached around 9.1m viewers, with an estimated 13.3m unique viewers. Audiences spent an average of four hours and 35 minutes per day watching content. Satellite television accounted for approximately 56% of viewing time with streaming platforms making up the remaining 44%. Regional advertising expenditure during Ramadan is widely estimated to have surpassed $1bn, reinforcing the season’s status as a critical marketplace for premium scripted content.

Los Angeles investment firm Guggenheim Brothers Media (GB Media) has partnered with Abu Dhabi’s Ethmar International Holding (EIH) to establish a multimillion-dollar investment fund targeting the media, entertainment and digital creative economy sectors. Headquartered in Abu Dhabi, the fund is being positioned as a significant step in strengthening the emirate’s role as a leading creative industries hub in the Gulf. It will invest in content creation, creator tools and infrastructure,

digital intellectual property, entertainment technologies, fan engagement platforms and next-generation storytelling.

GB Media was founded in 2024 by industry veterans Dillon LawsonJohnston, a descendant of the Guggenheim family, and Criswell Fiordalis. The firm focuses on early-stage and growthstage companies shaping the future of media and entertainment. Lawson-Johnston brings experience from companies such as

UTA, Sugar23, Untitled Entertainment and Anonymous Content, while Fiordalis has previously held senior roles at Lionsgate, MRC, Hello Sunshine and WEBTOON.

EIH is an Abu Dhabi investment company led by Sheikh Hamdan bin Mohammed bin Zayed Al Nahyan, son of UAE President Sheikh Mohamed bin Zayed Al Nahyan.

Lawson-Johnston and Fiordalis said: “We are thrilled to partner with Eithmar International

Holding to advance our shared mission of supporting the earlystage creative companies shaping the future of culture from Abu Dhabi to the world. EIH brings the scale, ambition and long-term strategic vision this sector needs, and together we aim to build the destination platform for the world’s emerging creative businesses. GB Media will be a place where founders can access the resources, community and strategic support required to thrive globally.”

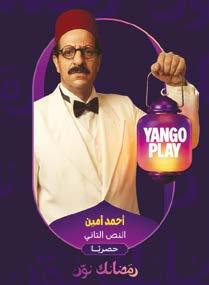

Yango Play has revealed its drama slate for Ramadan 2026, unveiling exclusive productions led by prominent names in Arab drama. The upcoming season also marks Yango Play’s entry into Gulf

drama with its first Kuwaiti production. Building on the strong momentum of last Ramadan, the platform brings together social drama, suspense and comedy across a varied selection of series fronted by an elite group of actors. Among the highlights is Manna’a, a suspense thriller featuring a large ensemble cast including Hend Sabry, Ahmed Khaled Saleh, Mohamed Anwar and Khaled Selim. The comedy series El-Nos El-Tani returns for a second season with Ahmed Amin reprising his role as Abdel Aziz El-Noss, joined

by a familiar cast and a special guest appearance by Hamza El-Eily. The line-up also includes Kan Ya Makan, a comedy-drama starring Maged El-Kedwany, and Ein Sehreya, a mystery-driven drama led by Essam Omar. Expanding into Gulf content, Yango Play will debut its first Kuwaiti series, Little Steps, a social family drama. The series features a well-known Kuwaiti cast and focuses on the emotional struggles and resilience of its characters. Additional projects are set to be announced in the coming months.

Qvest has named Thorsten Sauer as its new CEO. Sauer will guide the group’s strategic development while consolidating its recent international expansion into a more integrated organisation and maintaining emphasis on profitable growth. He will also be appointed CEO of RSBG Information & Communication Technologies GmbH, the majority shareholder of Qvest Group GmbH within the RSBG Group.

Sauer brings more than 20 years of senior leadership experience across the information, communications and media technology

sectors. He has held multiple CEO roles and is recognised for his expertise in driving growth strategies, managing transformation programmes, overseeing mergers and acquisitions, and leading post-merger integration processes. Most recently, he served in a dual capacity as CEO of Pixel Power and VP of Media Technology at its parent group, Rohde & Schwarz.

JAKOB MEJLHEDE ANDERSEN

Rotana Media Group has appointed Jakob Mejlhede Andersen, former Chief Content Officer at Viaplay Group and Shahid, as a Strategy Consultant. Andersen, who founded UAE production company The Yard Films in 2022 after leaving Shahid in November 2021, brings extensive international and regional experience to the role. Prior to Shahid, he held senior roles at Viaplay Group, then known as NENT Group, including a period as CEO of NENT Studios UK. His career spans multiple leadership positions across the European and Middle Eastern media and content sectors.

Rotana operates a diversified portfolio that includes film production, free-to-air TV channels, radio, a record label and other media-related businesses. The Group has offices in Jeddah, Kuwait, Dubai, Beirut and Cairo.

Music platform Anghami Inc reported strong revenue and subscriber growth for the six months ending June 30, 2025, driven by the integration of OSN+ and its expanded strategic partnership with Warner Bros. Discovery (WBD). Revenue rose 97% yearon-year to $48.4m, with subscription income reaching $43m. Anghami’s paid subscriber base

doubled to 3.54m by the end of June, while total registered users surpassed 120m across the region, reflecting strong conversion from free to paid offerings. It also expanded its distribution reach through new OSN+ partnerships with PlayStation and Noon, opening additional customer acquisition channels. A key milestone was a

$57m strategic investment by WBD into OSN Streaming Ltd, Anghami’s majority owner. This further strengthened the partnership between the companies and reinforced OSN+ as the exclusive home for HBO content, Max Originals and a broad range of international entertainment. Furthermore, the integration of music

and video services into a single unified platform drove higher engagement, encouraging users to upgrade to full entertainment subscriptions. However, the company reported a net loss of $37.1m for the period, reflecting increased investment in subscriber acquisition, OSN+ integration costs and broader platform expansion.

The Middle East media and entertainment industry is entering a phase of accelerated growth, with the market estimated to reach $48.43bn in 2026 and projected to climb to nearly $76.79bn by 2031, according to a report by Mordor Intelligence. The outlook implies a compound annual growth rate (CAGR) of 9.66% over the forecast period, underpinned by rapid digital adoption, favourable demographics and sustained investment.

Online and digital platforms emerged as the dominant segment, accounting for almost

60% of total market revenue in 2025.

Video-on-demand services led content categories in 2025, capturing close to 30% of revenues. Advertising is expected to be the fastest-growing segment through 2031. Subscription services remain central to revenues, though freemium and in-app purchase models are gaining traction, especially within gaming.

Advertising generated $13.22bn in 2025, 29.93% of the market, with revenues forecast to expand at an 11.05% CAGR as programmatic capabilities mature.

Strong demand for premium scripted content, live sports and genre diversification continues to support subscription retention, while improved audience measurement is strengthening advertiser confidence. Advertising-supported formats are expected to outperform transactional video models. Industry consolidation is creating new crossselling opportunities, while gaming revenues continue to rise.

Digital platforms accounted for 59.62% of total revenue in 2025, reinforcing the shift to direct-to-

consumer distribution. Hybrid models that blend linear TV with on-demand libraries are growing at a 10.65% CAGR. Subscriptions were 45.92% of the market, with freemium and in-app purchases forecast to exceed $15.62bn by 2031. Smartphones remained the primary device for media consumption, accounting for 44.88% of value. Saudi Arabia led the market with a 39.22% share in 2025, followed by the UAE as the fastest-growing market, benefiting from a supportive regulatory environment and strong international investment.

NMK Electronics, a Midwich Group company, has opened NMK Beyond, a 21,500sqft technology experience hub in Al Quoz, Dubai. Conceived for industry professionals, creators and future innovators, the facility features a range of interactive zones, including immersive audio-visual environments, a Dolby Atmos-enabled recording and listening studio, AI-powered meeting and training rooms, and dedicated content creation areas designed around modern production workflows. The aim is to demonstrate how

these solutions function in practical, everyday scenarios. Beyond showcasing technology, NMK Beyond also serves as a regional centre for skills development and professional training. In 2025 alone, the hub welcomed more than 6,000

The Red Sea Fund, an initiative of the Red Sea Film Foundation, has completed its submissions phase for post-production projects in the first funding cycle of 2026. Applications were accepted from January 6 to January 27. The funding cycle is dedicated exclusively to projects that have completed principal photography and are seeking support during post-production. To qualify, projects have to be feature-length films with a minimum running time of 60 minutes. Directors must be of African or Asian nationality, or of Arab nationality or origin. Selected projects must be completed within six months of signing the agreement. Launched in 2021, the fund has backed over 330 projects to date, many of which have achieved international recognition.

visitors, with over 4,000 industry professionals taking part in hands-on training sessions, certifications and interactive demonstrations.

The hub has already hosted leading global industry figures, including Metallica’s live sound engineer Greg Price,

and features technologies used by internationally renowned performers such as Coldplay. NMK says this highlights how tools deployed on global stages are shaping workplaces, classrooms and creative industries.

At the launch, NMK also revealed that it has become the exclusive GCC distributor for Neat, a collaboration solutions brand, and confirmed the opening of a new Control Room within NMK Beyond, extending the facility’s capabilities into criticaloperations environments.

Gravity Media recently provided end-to-end technical facilities for a New Year’s Eve concert in Riyadh, delivering a world-class live production viewed across the world. Produced by Premium Projects (Germany) for Ad Dimension, a subsidiary of Jeddah-based event company Benchmark, the concert featured a 60-piece orchestra with Egyptian artist Angham Mohamed Ali Suleiman. Broadcast live in UHD format, the event aired on MBC and across over 10 digital channels in the region.

Gravity Media deployed its fully equipped NOVA 101 OB truck and delivered a complex multi-camera setup comprising 23 cameras, including Sony HDC-3500 as the main camera system. The production included a wide range of specialist and robotic cameras to capture dynamic angles, including Agito and Furio robotics, Sony FR7 auto pods and track-mounted units, LUNA wire cam, Jimmy Jib, Steadicam, RF cameras, Sony FX3 and P50 cameras, Marshall minicams, and drone coverage.

Filmmakers came together for three days of hands-on learning and female-led workshops, with conversations centred on filmmaking and emerging sustainable approaches, at the latest CINECommunity edition hosted by Advanced Media

Advanced Media hosted another successful edition of its biannual digital cinema event, CINECommunity, last month. Held from January 15-17, the event was organised in partnership with the Courtyard Art and Community Centre and AnalogTheRoom. This year, Advanced Media’s showroom was

reimagined to replicate the Courtyard, a cherished Dubai landmark and one of the oldest cultural spaces in the emirate. The fourth CINECommunity brought together the local filmmaking community, fostering collaboration and creative and technical exchange.

“Cinema is different from other

forms of art. A filmmaker cannot work on his own, he needs a team. Even the idea of cinema comes from the community – it is from the world around us that we create stories,” said Kaveh Farnam, Managing Director of Advanced Media. “Each year that spark we started in the

form of this community is gaining ground. This idea of having a place where people can get together, share experiences, know and learn about the cinema workflow – all that has been facilitated through this community.”

Women leading was a crowning feature of the event, symbolising their growing presence in filmmaking and the creative world. For the first time, half of the CINECommunity workshops were spearheaded by female instructors. Los Angeles-based cinematographer Sarah Winters directed three workshops covering shooting with RED cameras, and techniques and tips for cinematic and commercial lighting. In the ‘Cinematic Speed Storytelling with Sony FX6’ workshop, Cairo-based cinematographer Zeina Khalil addressed the challenges cinematographers face as they attempt to move between cinematic image-making and high-speed, adaptive music video production.

One of the UAE’s first advisors on sustainable practices in film production, Nena Ostrogovic (along with Wiehan Kruger), led the ‘Greening the UAE Screen One Frame at a Time with Clean Energy’ workshop. “All of us need a space where sustainability, creativity and community meet,” said Ostrogovic. “It reminds me why I do this work and that it is an

opportunity for all of us to make a difference. The workshop is an enabler. Sustainable filmmaking isn’t about limiting creativity; it’s about expanding our impact. Every choice on set becomes a chance to shape a cleaner, more efficient industry.”

Other hands-on workshops were led by industry practitioners including Fouad Aoun, Michael Krecek, Mohammed Kamal, Jiri Novak, Nikita Petsa and Wiehan Kruger. Designer and architect Dariush Zandi – the mind behind the Courtyard’s architecture – delivered a seminar on the importance of community in the creative process. Mohammed Kamal, founder of AnalogTheRoom, delivered a workshop tracing the evolution of cameras from early pinhole devices to classic film bodies and modern digital technology. Participants explored a range of camera formats, including 35mm, medium and large, with the opportunity to handle and shoot with each one. Among the new contributors at CINECommunity 2026 was Praguebased VFX and post-production studio Magiclab. The session explored real-world workflows across colour grading, VFX integration and finishing, highlighting the importance of planning for post early in the filmmaking process.

One workshop that caught our eye was ‘No Budget Cinematography’, especially relevant as emerging filmmakers explore shooting films on smartphones and within slim budgets. In such scenarios, creativity and lighting are key, said Dubaibased cinematographer and DoP Fouad Aoun.

Aoun highlighted how modern digital cinema cameras make it possible to work with far less illumination than before. The real challenge lies in understanding the space being filmed.

“You have one camera and limited light, how do you make it happen? You play with light. So, when you enter a room, instead of concentrating on what light to add, think where the sun is coming from and try to use it as your key light. Follow the sun and trust your camera.”

The fourth edition of FOMEX will be held at the Hilton Riyadh Hotel & Convention Center from February 2-4, 2026, alongside the Saudi Media Forum. In an exclusive interview with Hatim Abounassf, Executive VP For Engineering Affairs and General Supervisor of the Strategy and Planning Sector at Saudi Broadcasting Authority, BroadcastPro ME explores SBA’s role at the event, its significance for the Arab media landscape and what visitors can expect from this year’s edition

With the Kingdom hosting unprecedented global events and major projects, what is SBA’s strategic roadmap to manage these massive requirements while staying ahead of the rapid shifts in viewer behaviour and digital consumption locally, regionally and internationally?

SBA is executing an ambitious strategy designed for agility, scale and global resonance. To meet the demands of the Kingdom’s giga-projects and events, we are transitioning gradually to an AI-driven, cloud-native host broadcaster model. This shift allows us to scale production infrastructure instantly for global audiences while maintaining the highest technical standards. We are executing a digital switch for worldwide distribution to complement our traditional DTH foundations. By

integrating a platform-agnostic ecosystem leveraging global CDNs and advanced OTT streaming, we are ensuring that SBA content is no longer geographically limited but accessible on every device, everywhere.

This hybrid approach allows us to stay ahead of viewing behaviours through data-driven personalisation and social-first storytelling. Our roadmap ensures that as the Kingdom transforms, SBA provides the high-tech, borderless lens through which the local, regional and international audience experience the Saudi journey in real time.

Can you elaborate on SBA’s role in FOMEX?

The Saudi Broadcasting Authority plays a central and strategic role in FOMEX 2026. SBA is not only a key partner but also a driving force

behind the development of the Kingdom’s broadcast ecosystem. Their involvement ensures that the event aligns with national priorities, supports industry modernisation and reflects the highest professional standards. SBA also contributes through technical expertise, industry leadership and by facilitating collaboration between local and international companies. Their presence helps position FOMEX as a platform that truly represents the future of broadcasting in Saudi Arabia.

Now that it is in its fourth year, can you tell us how FOMEX has evolved? The exhibition reflects the rapid transformation taking place across Saudi Arabia’s media and broadcast sector. We’ve aligned closely with national trends such as digital

transformation, cloud-based production, AI-driven workflows and the modernisation of broadcast infrastructure, key pillars supporting Vision 2030. This upcoming edition is especially distinguished by the honour of receiving royal patronage from the Custodian of the Two Holy Mosques, King Salman bin Abdulaziz Al Saud. This recognition reflects the Kingdom’s commitment to strengthening its media ecosystem and elevating platforms that drive innovation and industry development.

Feedback from past participants helped shape FOMEX 2026. Exhibitors appreciated the quality of visitors and the strong business environment, for instance, but asked for more space, more specialised zones and deeper technical sessions. Visitors wanted more hands-on experiences and clearer access to emerging technologies.

As a result, this year we have expanded the exhibition layout, introduced new innovation and demo zones, enhanced the conference programme and created more opportunities for

direct interaction between global brands and local talent. In short, the event has grown in direct response to what our partners and attendees told us they needed.

FOMEX now serves as a strategic platform showcasing both technological innovation and national media priorities within the Saudi Media Forum. It operates as the dedicated exhibition component of the broader Saudi Media Forum, bringing together technology,

infrastructure and innovation conversations in one integrated space.

Unlike other shows, we have seen FOMEX become familyfriendly in the evening?

The decision to make FOMEX familyfriendly in the evenings is intentional. The event runs from 11am to 7pm daily, with evenings aligning with Riyadh Season, offering visitors access to cultural and entertainment activities across the city. Families can enjoy a more inclusive experience while engaging with the creative and technological side of the media industry. It also inspires younger generations, giving them early exposure to broadcasting, content creation and innovation.

Who are some of your key exhibitors at FOMEX?

We already have a strong line-up of key exhibitors confirmed for FOMEX 2026. Major global brands such as Sony, Ross Video, Lawo, Grass Valley, Blackmagic Design and Sennheiser will be showcasing their latest broadcast and production technologies. We will also host a dedicated roundtable sponsored by the Ministry of Media

and the Ministry of Communications. FOMEX will also feature regional and Saudi companies that are contributing to the Kingdom’s fast-growing media ecosystem. Their presence will highlight local innovation, system integration capabilities and new solutions tailored to the Saudi market.

HUMAIN, one of Saudi Arabia’s leading AI companies, is an exhibitor. Its CEO will be speaking at the Saudi Media Forum. SBA will also sign a strategic agreement with HUMAIN during FOMEX. Other major national entities such as STC, Diriyah Company and the Royal Commission for Riyadh City will also have significant presence, reflecting strong local industry engagement. There will be prominent speakers from SBA, along with international executives who will share insights on the future of broadcasting, digital transformation

We expect several companies to introduce new products and solutions specifically for the Saudi market at FOMEX 2026

and content innovation.

Visitors can expect to see nextgeneration studio systems, IPbased workflows, cloud production tools, virtual production setups and advanced audio solutions. Overall, the exhibition floor will offer a comprehensive view of where the industry is heading, both

globally and within the Kingdom. We expect to have more than 300 exhibitors, of which approximately 50% are international.

Are companies planning to unveil new products?

Yes, there will be a dedicated central announcement zone with hourly product unveilings throughout the exhibition. We expect several companies to introduce new products and solutions specifically for the Saudi market at FOMEX 2026. Many of our international exhibitors see Saudi Arabia as one of the fastest growing media markets in the region, so they are choosing this event as the platform to debut new technologies.

Could you share some numbers on the rate of growth of the media industry in Saudi Arabia and how FOMEX aligns with Saudi Arabia’s

Vision 2030 goals for the media and entertainment sector?

Saudi Arabia’s media and entertainment sector has been growing at one of the fastest rates in the region. Industry reports indicate annual growth of around 8-10%, driven by major investments in digital infrastructure, content creation and new production technologies. The Kingdom is also expanding its media hubs, training programmes and regulatory frameworks to support a more competitive and innovative industry.

FOMEX aligns closely with Vision 2030 by supporting these national priorities. The event brings together global technology leaders, local innovators and key government stakeholders to accelerate digital transformation, modernise broadcast operations and develop local talent. By showcasing the latest technologies and creating a platform for knowledge exchange, FOMEX contributes directly to the Kingdom’s goal of building a world class media ecosystem.

Are there initiatives to showcase local talent?

Yes, FOMEX 2026 strongly emphasises Saudi talent and innovation. We have dedicated areas within the exhibition for Saudi startups, content

creators and emerging technology companies to present their work. These initiatives are designed to highlight the creativity and technical capabilities developing within the Kingdom’s media landscape.

We’re also working closely with national organisations to provide training opportunities and connect local talent with global

industry leaders. Certified twoday training programmes with international companies will provide accreditation and skills development for university students and young professionals. The goal is to ensure that Saudi innovators have a prominent platform and that their contributions are visible alongside major international brands.

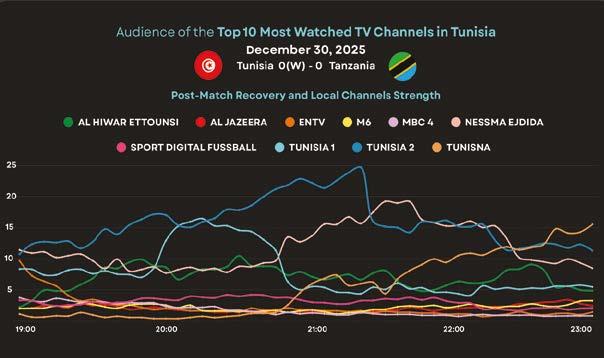

Audience measurement platform Audimatic shows how real-time data opens a window into national viewing cultures across two continental competitions. The data, captured from December 1, 2025, to January 20, 2026, focuses on audience behaviour in four countries that broadcast the FIFA Arab Cup 2025 and AFCON 2025, and have been specially curated for BroadcastPro ME by Audimatic

Major football tournaments have long served as stress tests for television ecosystems. They concentrate attention, intensify emotions and expose audience behaviours with a clarity that routine programming rarely achieves. The combination of AFCON 2025 and the FIFA Arab Cup 2025 offered a particularly rich field of observation. Across Africa and the Arab world, millions of viewers reorganised their daily schedules around key fixtures, turning television into a shared national arena. Beyond sporting narratives, these competitions generated something of equal importance for the broadcast industry: clear, real-time signals on how audiences react to live sports, distribution strategies and channel positioning.

Why AFCON 2025 and the Arab Cup 2025 mattered for audience analysis

AFCON remains Africa’s most powerful sporting and media event. The Arab Cup, meanwhile, brings together overlapping audiences, shared cultural references and major regional broadcasters, with Morocco emerging as the 2025 champion.

Real-time audience measurement platform Audimatic has shared some charts on viewership. These reports focus on Algeria, Egypt, Morocco and Tunisia, as these four markets were present in both competitions, enabling consistent cross-tournament and cross-country comparisons.

Together, AFCON and the Arab Cup activate:

• National identity and public broadcasters

• Free-to-air versus international sports networks

[In Morocco], exclusive rights drive immediate match-time dominance, while ... international sports channels can assert broader leadership across multiple fixtures within a tournament

Audimatic launched a public daily TV audience dashboard on December 1, 2025, providing open access to audience data in the four countries before and throughout AFCON 2025, while contextualising patterns already observed during the Arab Cup.

For Morocco, two distinct audience curves illustrated different dimensions of viewing behaviour.

• Mass simultaneous viewing

• Intense emotional engagement

They also allow observation of:

• Audience concentration under peak demand

• Channel leadership during high-pressure moments

• Post-match audience redistribution

• The strategic role of analysis and studio programming

To support this analysis,

The first graph (Figure 1) focuses on the Arab Cup final on December 18, 2025, between Morocco and Jordan. The trend analysis of the top 10 mostwatched channels during the match shows clear dominance by beIN Sports, which held the broadcast rights. Throughout the final, beIN Sports held the majority of live viewing, confirming the decisive impact of exclusive rights during high-stakes fixtures.

The second curve (Figure 2) analyses the AFCON 2025 semifinal between Morocco and Nigeria, a match also won by Morocco. Here, a different pattern emerged. One channel,

Figure

SPORTDIGITAL Fussball, distinguished itself by leading audience levels during the match. This was not limited to the Morocco fixture; the same channel also dominated during the other semi-final, Senegal-Egypt.

Taken together, these two cases illustrate Morocco’s dual viewing logic: exclusive rights drive immediate match-time dominance, while certain international sports channels can assert broader leadership across multiple fixtures within a tournament.

Egypt: International sports channels driving live peaks

For Egypt, the analysis centres on the Egypt-Benin match on January 5, 2026, using a detailed audience curve during the live broadcast. The graph (Figure 3) highlights a clear concentration of viewing around two channels, SK1 HR and Max Sport 3, both carrying the match. They exhibited sharp audience peaks aligned precisely with kickoff and key match moments.

This confirms a recurring pattern in the Egyptian market: audience attention remains diversified during

In the Egyptian market, audience attention remains diversified during the day, but international sports broadcasters act as powerful accelerators during live football

the day, but international sports broadcasters act as powerful accelerators during live football, temporarily overtaking generalist and entertainment channels.

Tunisia: Post-match recovery and local channel strength In Tunisia, the selected graph (Figure 4) covers the full day of the Tunisia-Tanzania match, which ended in a 1–1 draw. Rather than focusing on the match broadcaster, the analysis highlights what happened after the final whistle. The data shows a clear recovery – and redistribution – of audiences toward local channels, particularly Tunisia 2 and Nessma Jadida. This post-match rebound illustrates the ability of national broadcasters to recapture attention through studio programmes, debates and analysis. It also underscores the strategic value of post-match content in a competitive and pluralistic market. In Tunisia, football does not end with the match – it extends into editorial and analysis spaces where local channels retain strong influence.

Algeria: A 24-hour view of audience concentration

For Algeria, the bar graph (Figure 5) represents the 10 most-watched channels over the full 24 hours of January 6, 2026. The picture is unequivocal. ENTV led the day, reflecting its position as the national broadcaster holding domestic rights for the competition. Its dominance extended beyond match time, anchoring the entire viewing day. Close behind, El Heddaf TV emerged as a strong secondary force, particularly through its post-match analysis shows, where it frequently took the lead once live play ended.

This illustrates a clear division of roles within the Algerian market: ENTV as the primary live-event destination, and El Heddaf as the reference for post-match interpretation and debate.

Cross-market insights from two major competitions

• Broadcast rights shape matchtime leadership: Channels holding live rights dominate peaks, but leadership structures differ beyond the match.

• Post-match programming

In Tunisia, football does not end with the match – it extends into editorial and analysis spaces where local channels retain strong influence

is a strategic battlefield: Analysis, debate and studio content play a decisive role in retaining audiences.

• National viewing cultures remain highly distinct: Each market reflects deeply rooted habits shaped by trust, history and broadcaster positioning.

• Live football still defines appointment television: Despite platform fragmentation, major tournaments continue to generate mass simultaneous viewing.

Football as a mirror of TV ecosystems

AFCON 2025 and the FIFA Arab Cup 2025 confirmed that football is more than premium content – it is a revealing lens on television ecosystems. As African and MENA television markets continue to evolve, initiatives like this signal a shift toward an industry where audience data is not only measured but interpreted, contextualised and shared.

MORE DETAILED REPORTS

Audience of all TV channels watched in Algeria January 6, 2026 Over 24 hours

16

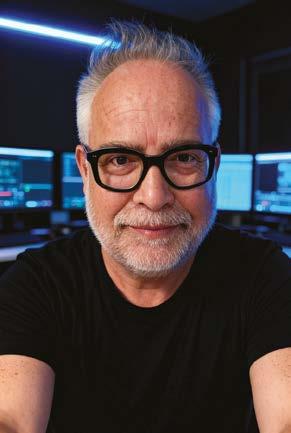

A new studio in Dubai has taken AI as its production route, combining automation with human creative direction to address the region’s growing demand for highvolume, culturally accurate content. Gilles Vidal, who helms the studio, speaks to

BroadcastPro ME about why TAAMAI was built, how it operates and where AI meaningfully fits into

the production process

In recent times, demand for video has exploded across government, corporate, brand and platform clients both regionally and globally, but the mechanics of production have largely remained unchanged. Shoots take time, budgets remain high, and when producers reach for stock libraries to fill the gaps, the region often disappears into something generic, flattened or culturally off-key.

It is this structural gap that TAAMAI Studio, a newly launched AI-driven production facility established by Dubai digital agency Granite MENA, has set out to address.

“TAAMAI is the AI production arm of Granite MENA; it is not an add-on to

an existing workflow. It was designed from the ground up as a stand-alone studio with its own creative governance, production logic and team structure,” says Granite MENA CEO Paul Wallis. The company, founded 18 years ago in Ireland, established its Middle East presence in late 2024 with an office in Dubai. The office now has a team of 15, with plans to expand to Saudi Arabia.

“From the outset we saw agentic AI not as a shortcut, but as a structural shift in how digital production could be organised,” says Lionel Laulhé, VP Growth. “We built Granite MENA’s AI practice early because scale, localisation and speed were becoming central requirements for digital production.

TAAMAI is a natural extension of that thinking; it is an AI-native production studio designed to support high-volume storytelling while maintaining creative control and cultural relevance.”

Rather than relying on a single physical facility in the traditional sense, TAAMAI operates as a hybrid production model, combining AInative workflows with Granite MENA’s in-house creative teams and a curated collective of regional and international partners and talent. Gilles Vidal, who has spent more than 25 years producing films and content and 14 years working across the Middle East, says the decision to operate TAAMAI as a separate arm was deliberate.

“The starting point was very practical. I repeatedly ran into the same limitation: global stock libraries that misrepresent local culture, people and environments, and a persistent shortage of authentic GCC images, videos and voice-over.”

As content demands have accelerated, that limitation has become

harder to ignore. Brands, government entities and large organisations now require high volumes of video that needs to be continuously refreshed, visually premium and culturally precise. Traditional production can deliver quality, but not always at the speed, scale or cost that such briefs demand.

AI offers a fundamentally different production model that can address that.

Vidal cautions that “retrofitting AI into traditional workflows would

I see AI as an extension of the creative team, not a replacement. Its value lies in accelerating production and expanding creative possibility

GILLES VIDAL, HEAD OF TAAMAI STUDIO

only replicate their limitations … what was needed was a dedicated studio with its own creative standards and accountability. That is why we created TAAMAI Studio.”

The tipping point came when AI outputs evolved from impressive demonstrations into something that could be actively directed and controlled as a production medium, he explains. “The moment I could apply real creative direction, controlling tone, realism, cultural detail and narrative consistency, I knew this was no longer experimental. It had matured into a medium that required proper structure and responsibility.”

In practical terms, the studio’s AI-driven identity does not imply the absence of human creatives.

TAAMAI operates on a hybrid model, with human teams retaining creative authorship while specific stages of production lean heavily on machine generation, particularly during concept exploration, visual variation and selected motion sequences.

“I see AI as an extension of the creative team, not a replacement. Its value lies in accelerating production and expanding creative possibility. Storytelling, emotional direction, pacing, cultural judgement and final decisions remain entirely human-led,” Vidal elaborates. That philosophy extends to the studio’s technology stack. TAAMAI uses a mix of third-party models and internally developed systems, with its differentiation rooted less in proprietary technology and more in how those tools are coordinated.

“We rely on best-in-class third-party models, but our real advantage is orchestration – how we combine them through proprietary workflows, prompt architectures, cultural conditioning and internal qualitycontrol processes,” Vidal explains.

Under the hood, the studio works with diffusion-based image and video models, language models

for narrative structuring, and custom orchestration layers that give creative directors control over style, realism and continuity, he says. “Automation handles scale and speed. Refinement, selection and approval are entirely human-led. Every asset is reviewed, curated and signed off by experienced directors and producers before delivery.”

Crucially, AI creation is approached with content localisation in mind from the outset, ensuring that language, visual cues, casting logic and narrative framing can be adapted efficiently across markets without losing cultural relevance. TAAMAI can generate projects end to end, from scripts and storyboards through visuals, motion, voice-over, music and final edits.

The studio is also explicit about where it draws the line: “We intentionally stop when live performance, physical interaction or real-world authenticity are essential to the story.”

Structurally, the platform is modular rather than monolithic, allowing flexibility without forcing creatives into a single technical system. “Authorship is human. AI does not own ideas or intent. The director and the client retain full creative ownership, exactly as they would in a conventional production.”

For a studio operating in the Middle East, cultural specificity is not treated as a dataset problem. The AI studio positions its regional setup as a function of lived experience and creative judgement. “Visual references, symbolism, language, casting logic and narrative framing are defined by creatives with real experience in

the region. AI executes within those boundaries; it does not invent them.”

Safeguards are built into the process to avoid the hollow aesthetic that has become synonymous with AI-generated work. “Strong art direction, rejection protocols and cultural review are all built into the workflow. We deliberately discard outputs that feel visually impressive but culturally empty.”

In addition, as AI has moved from novelty to production tool, new creative roles have emerged within the studio. “We now have roles such as AI Creative Directors, Prompt Architects, AI DoPs and AI Quality Controllers – positions that sit between creative intent and technical execution.”

Rejection, Vidal notes, is frequent. Outputs are routinely discarded for lacking emotional depth or narrative coherence, reinforcing the idea that AI generates possibilities rather than finished work. “It is part of the process. AI generates options; emotion is shaped by humans.”

Clear limitations remain.

Long-form continuity, complex physical interaction and subtle human performance continue to be

challenges for AI-based production. Live acting and spontaneous emotion remain areas where traditional filmmaking excels. Quality control relies on layered human review, locked visual styles, version control and final creative sign-off. Ethical considerations were addressed early, including transparency, authorship, intellectual property and cultural respect.

Client conversations tend to

revolve around familiar concerns: safety, originality, brand integrity and cultural respect. These discussions are typically led by senior producers and creative directors rather than technologists, with clients guided through pilots, education and transparent workflows to build confidence.

The studio has begun engaging with clients across government and enterprise sectors, where content volume and localisation are critical.

“These are sectors where speed, scale and accuracy directly affect effectiveness,” Vidal says. “AI-driven projects are typically faster and can offer more flexibility than traditional production, particularly for contentheavy or multi-market briefs.”

He cautions, however, that not every brief benefits from AI. It fits best, he points out, in concept films, explainers, internal communications and scalable visual storytelling. Performance-driven narratives remain better served by traditional methods. “We start with the story and objectives, not the technology itself.”

Looking beyond novelty, Vidal’s view of AI’s broader impact is pragmatic. Rather than eroding craft or talent, he argues that AI should amplify ideas and regional voices when used responsibly. “Being trusted as a serious creative studio and producing work that feels authentic, emotional and unmistakably rooted in the region is what matters.”

For an industry under pressure to produce more, faster, without losing its sense of place, the arrival of an AI studio in the market represents a practical response. Whether it becomes a blueprint for future studios in the region will depend not on its algorithms, but on its ability to consistently deliver work that still feels human.

Emirati filmmaker Nayla Al Khaja’s second feature BAAB, a psychological drama that explores grief, memory and loss, premiered in the UAE last month. In an interview with Vijaya Cherian, she reflects on the creative and emotional forces that shaped the film

BAAB centres on a woman grappling with the death of her twin sister while living with tinnitus, a condition that becomes both a physical affliction and an emotional conduit within the plot. The film, co-written with Emirati writer Masoud Amralla Al Ali, is partly inspired by Nayla Al Khaja’s own experiences with loss and grief. BAAB is also the first Arabic-language film to feature award-winning composer AR Rahman, who brings an exceptional musical dimension to the narrative. The production brought together a regional and international crew of around 140 people, including DoP Rogier Stoffers, film editor Sebastian Funke and sound designer Krishnan Subramanian. Shot in Ras Al Khaimah in under 19 days instead of the originally planned 32, BAAB was produced by

Al Khaja along with Sultan Saeed Al Darmaki and Jude S. Walko under the Dark Dunes Productions umbrella.

The film’s intensity, and its confluence of music, silence and visual storytelling, set the stage for this conversation with the filmmaker about the creative choices that brought it to life.

This film feels so intensely personal, yet the set was large. How did you protect intimacy and emotional focus?

Scale can be deceptive. Even with a large crew, intimacy is protected by intention. I kept the emotional core very close, limited access during sensitive scenes and made sure the cast felt emotionally safe. We created quiet pockets on set where performance mattered more

than logistics. When the heart of the film is protected, the scale dissolves.

Portraying female grief in a society where emotion is often private can be challenging. How did you approach this at the script stage with Masoud? Writing with Masoud was an act of trust. We spoke openly about grief, silence and what is often left unsaid. Rather than explaining pain, we allowed it to exist. The script was built around restraint. What is not written is just as important as what is written. That approach honoured the privacy of emotion while giving it space to breathe. Interestingly, I had tinnitus just like the character –and then Masoud developed it as well in the middle of writing the script! He was in so much pain; he said my script must have had such dark energy.

Sound and silence feel like part of the same symphony. Was there ever a temptation to explain more? Absolutely. There is always that moment in the edit where you wonder if the audience needs more guidance. But I chose to trust the viewer. Silence is not absence, it is invitation. We worked carefully so that quiet never felt empty. It remained emotionally charged. I believe audiences are far more intuitive than we give them credit. Sound design was particularly challenging in this film, so I travelled to Chennai to work with Krishnan Subramanian for 45 days straight to bring it to a place where it felt right.

Did working with senior artists ever create creative tension, particularly with AR Rahman? There were strong opinions, but never conflict. What I valued was that everyone respected the emotional language of the film. AR Rahman approached BAAB with sensitivity. When differences arose, they were always resolved keeping in mind what served the story best. That kind of

collaboration elevates the work; he also has a very relaxed demeanour and is very passionate and comes up with innovative ideas. It was also his first foray into this genre, which presented a challenge that excited him.

Between Three and BAAB, how have you evolved as a filmmaker? I learned to listen more and explain less. With BAAB, I trusted instinct over reassurance. I avoided over-structuring and rushing emotional beats, and allowed ambiguity to exist. I also learned the importance of preparation, especially when dealing with psychologically demanding material. The two films are very different, but with BAAB I feel I discovered my cinematic voice more fully.

What were the biggest challenges during shooting?

The shooting schedule was extremely tight, leaving very little room for error or flexibility. We simply didn’t have the luxury to over-extend or experiment endlessly with shots. On top of that, the emotional weight of the material was

heavy and maintaining that intensity consistently was challenging. Working within the budget added another layer of pressure, as did assembling the right cast and crew to support such a demanding film. Every decision had to be precise and intentional. I remember some days when I only had one or two shots per scene, which was brutal.

Did you worry the film might be too local to travel internationally?

I never worried about it being too local. The more specific you are, the more universal the emotion becomes. Cultural detail grounds the film, but grief, love and loss are shared human experiences. That balance came naturally once we committed to emotional honesty. After the premiere, most of the feedback came from European viewers, so I believe the film travelled well and language was not a barrier.

What do you hope international audiences take away that

reviews may not yet capture?

I hope they feel something linger. BAAB is not meant to be consumed quickly. It is meant to stay with you, to surface later in quiet moments. That internal echo is more important to me than immediate interpretation.

Can you share some technical details about the film?

We shot digitally with a strong emphasis on dynamic range and texture. After every shot and take, we applied LUTs on set to bring the image closer to the intended post-production colour, which helped everyone stay aligned with the film’s final visual language. A substantial portion of the film was shot on built sets, including the dream sequences. The location where we built the sets was an old, decommissioned school that we transformed to serve the psychological atmosphere of the story. Every technical decision was driven by mood and emotional tone rather than spectacle. The film was shot on the ARRI

BAAB is not meant to be consumed quickly. It is meant to stay with you, to surface later in quiet moments

NAYLA AL KHAJA, FILMMAKER

Alexa, framed in a 2.39:1 scope aspect ratio to support its psychological tone.

Is this the dream time to be a filmmaker in the Arab world? Is funding still a challenge? It is an exciting time, but not an easy one. There are more platforms and opportunities, yes, but funding continuity remains a challenge. Festivals like Red Sea and Cairo are opening doors, but sustaining careers still requires resilience and long-term support structures. In the UAE in particular, we might see a surge in films being treated as serious creative and financial assets.

Can you share the budget of the film? It was $1.6m.

Are you exploring different windowing rights and streamer interest?

Yes, we are actively navigating different windowing strategies. There has been interest from regional platforms, but we are being very considered about timing and positioning. At this stage, we are exploring all options and platforms carefully to ensure the film’s journey is handled thoughtfully and strategically. This is being managed by our sales agent.

Anything new or exclusive you can share?

What I can say is that BAAB continues to reveal itself in unexpected ways through audience response. Each screening feels like a new conversation.

What’s next for you?

I am developing new scripts that continue to explore psychological, horror and genre-driven storytelling. I would like to explore a thriller comedy that is highly commercial.

As monetisation models evolve and audience behaviour shifts, MENA streaming leaders at the ASBU BroadcastPro Summit discussed how they are rethinking scale, partnerships and technology to build platforms that can endure in an increasingly competitive digital market

Omdia’s 2025 forecast for the MENA region shows SVOD subscriptions topping 27m, with the streaming market expected to earn $1.5bn by the end of this year. With a large addressable base, how many untapped customers are there and how many are needed to be a digital powerhouse? In this hypercompetitive scenario, OTT leaders and strategists redefine monetisation models to build resilient platforms in one of the world’s fastest-growing digital markets.

The panel on building the Middle East’s next digital powerhouses at the ASBU BroadcastPro ME Summit in November was moderated by industry leader and media veteran Tracey Grant. It comprised Ahmed Qandil, Director of D2C Business – Shahid, MBC Group; James Walmsley, Director of Technology and Analytics, TOD; Jim Hall, Senior Sales Engineer, Fastly; Nisrine Ghazal, Vice President Digital, Rotana Media Services; and Samer Majzoub, General Manager, Viu MENA.

Despite recent research highlighting global subscription fatigue, consumer resistance to price rises and slowing growth in some markets, industry reports see huge growth potential in the MENA. While powerhouses are not created ad hoc, they are organisations that can work across different generations while maintaining momentum, disrupting markets and changing how people perceive media. This requires operators to be agile and transformative in this era of streaming 2.0, “as well as leveraging the latest and greatest intelligently, because it helps them achieve cost goals even at peak utilisation periods”, said Jim Hall, Senior Sales Engineer, Fastly.

Scale is inherently harder with platforms. Being able to maintain it in a challenging region in terms of application and production quality, and pushing forward through new product experiences and meaningful engagement with customers, adds value.

“If we can communicate with customers better and provide better quality of service, if we can live up to that, we can call ourselves a powerhouse,” said James Walmsley, Director Technology, Analytics and Product, TOD.

To scale, operators employ different propositions. Grant began the conversation by asking what was working for the panel of architects and specialists from two sides of the ecosystem – SVOD, AVOD, hybrid and bundled collaborations, or integrating with each other to offer a one-stop streaming service.

Built to support a hybrid

As a predominantly premium sports provider, it’s difficult to see an immediate shift to freemium

JAMES WALMSLEY, DIRECTOR OF TECHNOLOGY & ANALYTICS, TOD

monetisation or dual-stream model, Viu brought its working prototype to this part of the world when the company moved to the Middle East in 2018, gaining access to a lot of users through the freemium model. Acquiring on the free layer and then converting has worked for Viu, and AVOD is part of that funnel on the B2C side, from acquisition through to retention.

“We built our content proposition on three main pillars,” said Samer Majzoub, GM, Viu MENA. “Thanks to our strong relations with the Korean studios in Southeast Asia, we brought and localised Korean content, which is our stronghold here. We are also a leading destination for Turkish content in the region, complemented by Arabic originals and co-productions.”

Building on what is supportive to the journey, working models reflect longterm monetisation mix strategies that are core to an organisation’s strategy. The history of the region shows it has never been a pay-TV market, with mass audiences always on free-to-air.

“But as we witnessed willingness to pay, we had to break certain notions, like willingness to pay for Arabic content,” said Ahmed Qandil,

Director of D2C Business – Shahid, MBC Group. “Since we come at the back of a big broadcaster, we started as an AVOD service. When we elevated ourselves to see how people liked to consume their content, we were able to launch a successful SVOD service.”

In a nascent region, relationships with audiences play a key part. While the two models remain largely untapped, the difficulty lies in trying to operate across two tiers.

“Some play with ad-supported tiers or launch AVOD services with library content,” Qandil continued. “If you wish to be successful in both, you must take both seriously. In terms of investment

As we witnessed willingness to pay we had to break certain notions, like willingness to pay for Arabic content

DIRECTOR OF

– SHAHID, MBC GROUP

and proposition, you need to know how to differentiate the offering to audiences. Otherwise, one will cannibalise the other, which typically happens, but you need to manage that to be more successful.”

Working a smart balance between AVOD and SVOD in the Middle East based on viewer behaviour, freemium accelerates growth and is a gateway into emerging markets. Free content has always shown high demand, but “the Premier League and World Cup are not going to be free any time soon”, Walmsley pointed out.

He continued: “But we are looking at ways to adjust our library, and if not for free, how about the Premier League a couple of days after the event or maybe highlights the next day? A lot of very active conversation and careful experimentation goes on within TOD, and we get to adopt a hybrid approach. If we want to achieve scale, then we’re going to have to adjust our offering to accommodate that. But as a predominantly premium sports provider, it’s difficult to see an immediate shift to freemium.”

For a lot of broadcasters, moving investments to the digital side after spending a long time in analogue

can be daunting, especially when they lack the resources. Two years ago, when Rotana Media launched its premium video marketplace, the objective was to assist broadcasters lacking the resources, know-how or scale to compete in the digital world.

“We take that uncertainty away by helping monetise their inventory and providing ad solutions. Or if they have content, premium or archive, we create FAST channels and help them distribute those onto platforms and monetise on

their behalf,” explained Nisrine Ghazal, Vice President Digital, Rotana Media. Managing a premium video marketplace involves looking at trends in the market as well as digital ad spend, she went on. “According to IAB MENA, digital ad spend in 2024 was $6.95bn. Around 90% of that money goes to the big tech companies – social and search. We are left with $700m, and so we are working to support local broadcasters in capturing a part of that.”

This fragmentation sits under one

marketplace that advertisers can tap into without having to reach out to every single broadcaster. Scale and monetisation on the European side is a confluence of the two, noted Hall, with freemium moving into subscription and premium moving into AVOD.

“It is different for each company and is based on diverse strategies and what each is essentially trying to achieve. Using every method available to achieve growth is entirely dependent on the nature of the enterprise. But I’m curious to see what happens with FAST here, because that has died in Europe. A lot of the issues faced in European countries have been the lack of interest and the cost for content providers to create FAST channels. I’m hopeful that it works here and am looking forward to seeing positive results.”

A recent Omdia report states that FAST in the region will grow from $12m in 2024 to $33m in 2029. If it’s accessible through another application, including OEMs, there are opportunities, but the global perception is that FAST is archived content that nobody wants to see.

“Rotana has the largest Arabic library in the world,” said Ghazal. “We have that window to create FAST

I’m curious to see what happens with FAST here, because that has died in Europe

NISRINE GHAZAL, VICE PRESIDENT DIGITAL, ROTANA MEDIA SERVICES

channels and, by working together with solutions providers and by converting live broadcast feeds, audiences can now turn on their TV and automatically see the channels they want. What we are doing is not only creating FAST channels out of archived inventory, but also enabling immediate access to live brand channels. If viewers want to watch Rotana Khalejia, they can turn on a TCL TV and have that instantly. And that’s a way to monetise that content.” Streaming is a difficult business, especially with consolidation around the world and giants taking over. The industry is moving towards collaborations with established broadcasters or consolidated partnerships between studios and

technology partners. This signifies a move away from stand-alone OTT platforms. Bundling, closer collaboration and even deeper integration are possibly the future.

“Multiple approaches to partnerships exist,” said Qandil. “For instance, we host all SBA content on Shahid. We partner with many other broadcasters and content creator studios to host their content on Shahid under a revenue-sharing model. It is a successful model and it’s growing year over year. More consolidation means fewer players acting as hosts or aggregators. That’s where I see it going.”

Bundling makes sense as ARPU rises and the cost of subscriptions increases. It becomes more compelling for users to buy packs that provide access to multiple services, but they must deliver on retention and longer CLVs for platforms.

“We have stopped short of hard integrating with our partners,” said Walmsley. “We have a Paramount partnership, as many do, even with smaller or local providers where content is delivered as assets that we can distribute. We will end up with bundled services, and we will work with smaller producers in

Data is our backbone, and we make decisions based on that

SAMER

an aggregated fashion to build an adaptable product while continuing to fight for our share of that value.”

Harnessing AI for operational efficiency, smarter discovery and personalisation is imperative in today’s rapidly moving industry. Whether it’s metadata enrichment, compliance monitoring or editorial decision-making, it promises faster, more efficient delivery and can break down user bases and aid hyper-personalisation. Using a single feature more frequently might prompt a different trigger for another user cohort. Doing that segmentation in real time and at greater speed plays into how companies work with customers.

“We can pull in vast sets of CDN logs and see what the knock-on impact of those actions and reactions are. It enables us to segment a base quicker,”

said Walmsley. “But we believe it is better to have tangible, realistic goals to move towards, rather than constantly trying to keep up with developments in models and capabilities.”

Companies wishing to scale are implementing AI efficiencies that help them make informed, data-driven decisions. “We invested in data a long time ago and have reached a point where we process 7TB of data a day, powering everything we do. Our recommendation engines are driven by data that we collect daily, down to precise interest profiles and behavioural signals,” said Qandil.

With Shahid in a unique position as an Arab service available worldwide, the company is using AI for dubbing and subtitling to service a growing global audience. “AI subtitles our content into 32 languages, and we are testing advances in dubbing. We hope to roll out AI-dubbed content in different languages next year.”

As OTT players use AI to scale new audiences and reach additional regions, data continues to play a central role in retention and cost optimisation.

“Data is our backbone, and we make decisions based on that,” said Majzoub. “We have segmented our users across multiple segments and data classes. By introducing an AI layer we will accelerate toward real-time operations, embedding it into content discovery to better predict churn behaviour and actively manage retention. ”

In the world’s fastest-growing digital markets, the future is shaped by meaningful possibilities that enhance scale, reach and monetisation. While working to deliver higher-quality content, operators must also creatively expand monetisation to reclaim value currently flowing to social platforms. As economic models evolve, platforms must prioritise proactive disruption in pursuit of subscriber growth, while expanding their footprint to reach new audiences.

From AI-led workflows to immersive production and new funding models, the Middle East’s broadcast and media ecosystem is being reconfigured in real time. CABSAT’s next chapter will reflect how technology, talent and ambition are converging across the region

The broadcast and media industry is at a point of structural change. Artificial intelligence is moving from experimentation into everyday workflows, immersive production is becoming more accessible and the boundaries between broadcasters, creators, platforms and investors are increasingly blurred.

Across the Middle East, these changes are unfolding rapidly.

Investment in infrastructure, talent and production capability continues to accelerate, and regional broadcasters and studios are playing a more active role in global content conversations. Industry events like CABSAT reflect this evolution, adapting in step with the market they serve.

From experimentation to execution

AI remains one of the clearest indicators of how rapidly broadcast workflows are evolving. The conversation has moved decisively beyond whether AI should be adopted to how it can

be implemented responsibly and at scale. Automated editing, real-time captioning, multilingual localisation and metadata management are now part of everyday production environments.

In the Middle East, which is defined by linguistic diversity and multi-platform consumption, these tools offer more than efficiency gains. They enable faster turnaround, wider reach and more precise audience engagement, and are also influencing commissioning strategies, helping broadcasters respond more quickly to audience behaviour and performance data.

Infrastructure, integration and scale

Alongside software-driven innovation, there is renewed focus on core broadcast infrastructure. Live production, IPbased workflows and system resilience remain central concerns, particularly as audiences expect higher quality and greater reliability across platforms. The continued presence of established global brands such as Ross Video,

Grass Valley, Evertz and Imagine Communications reflects the industry’s reliance on proven, scalable systems that underpin critical broadcast operations. Equally important is the role played by regional mega distributors, including Advanced Media Trading and Grand Stores, which act as the connective tissue between global manufacturers and local markets. Their scale, integration expertise and long-term partnerships remain essential to how broadcast technology is specified, deployed and supported across the Middle East. Together, these layers highlight a market that continues to value reliability and integration, even as workflows become more flexible and software-driven.

Immersive production comes of age Immersive technologies are no longer confined to premium drama or major

international sporting events. Virtual production, extended reality and realtime graphics are increasingly finding their way into news, entertainment and branded content as costs fall and expertise becomes more widely available.

Software-driven studios are evolving into hybrid environments where physical and digital production coexist. While this creates new creative possibilities, it also places greater emphasis on skills development, workflow integration and close collaboration between technical and editorial teams.

One of the most significant shifts facing the industry is the growing overlap between traditional broadcast and the creator economy. Digital-first creators are no longer operating at the margins. They are commissioning professional

production, attracting brand investment and building audiences at scale. For broadcasters, this presents both challenge and opportunity. Established production values and editorial rigour increasingly influence creator-led formats, while creators bring speed, authenticity and new distribution models into the mainstream.

This convergence is reshaping how content is funded and distributed. Co-productions, partnerships and hybrid formats are becoming more common, particularly in markets where local stories are gaining international attention.

Alongside established players, there is growing attention on a new wave of technology providers entering the regional market. Norrdlys, AWPRO,

Accsoon and MINAR represent a shift towards more agile, compact, mobile-first production solutions. These newer entrants often address specific production challenges, from lightweight live contribution and connectivity to streamlined onlocation and creator-led workflows.

The Middle East’s growing influence in the global media landscape is underpinned by sustained investment. Governments, media groups and private capital are committing resources to studios, training initiatives and content funds. Saudi Arabia’s expanding media ecosystem, alongside the UAE’s established role as a regional hub, reflects a broader ambition to play a larger role across the content value chain. This includes not only production but also distribution, technology development and intellectual property creation.