Fine Wine Investment Guide

An introductory guide to the world of Fine Wine investment & the benefits of investing in this most liquid of alternative assets, managed by professionals

[ kloh ] noun, plural clos. French.

1. a walled vineyard.

2. your personal wine broker, growing and protecting your cellar & investment

Clos Fine Wine specialises in creating and managing portfolios of investment-grade Fine Wines for a global client base looking to diversify their financial holdings.

Utilising a data-led approach and exploiting substantial Fine Wine & investment experience, our personal approach sees us working closely with clients to deliver a return on their investment, whilst also offering parcels of unique wines for special or everyday drinking.

like to be your personal Fine Wine broker, too

Our approach has delivered demonstrable success, outperforming the wider market and ensuring portfolios are resilient to financial market volatility and built for medium and longer term growth.

This guide covers why, when done assiduously, Fine Wine is such an attractive option for investors, and it covers the basic overarching tenets of our investment philosophy.

Should you have any questions or wish to discuss the opportunities available for investing in Fine Wine as an asset, then please do contact us, without obligation; we’d be delighted to speak with you.

01. WHY INVEST IN FINE WINE?

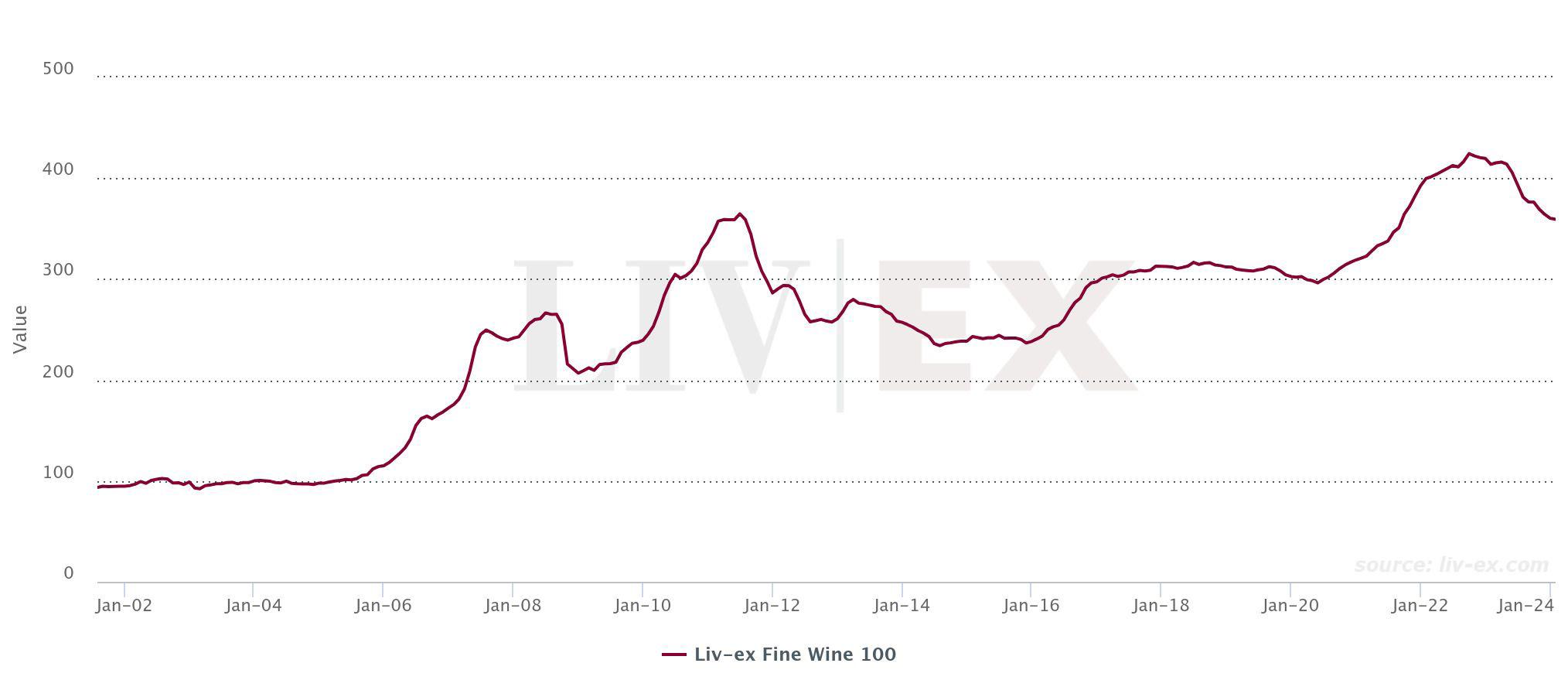

Consistently seen as one of the leading alternative asset classes rather than purely a ‘passion investment’, Fine Wine has been the portfolio diversifier of choice for canny investors for decades. The emergence of a unified global trading platform in Liv-Ex (the London International Vintners Exchange) in concert with evolving global demand and expanding regional focus means that Fine Wine as an asset is more popular than ever, regularly appearing in the top three ‘alternative asset’ types in the Knight Frank Wealth Report.

Recent global events like the coronavirus pandemic, cost of living crisis, war in Ukraine, and inflation have negatively impacted global markets across the past three years, imparting varying degrees of market volatility and driving uncertainty. Throughout that period Fine Wine has steadfastly remained buoyant, placid even during the struggles of 2023, demonstrating its worth as a hedge against inflation and portfolio diversifier.

Uncorking Fine Wine’s value

Inverse supply curve drives appreciation

Fine Wine is driven by the long-term fundamentals of supply and demand, with the most desirable and investable wines in the world made in finite, often minute quantities. Over time as global stocks of the very best wines deplete, their quality improves with age, creating intense demand for a diminishing cache of the best bottles, driving up value particularly after the ten-year mark.

Tax efficient investment & liquidity

Wine is treated as a ‘wasting chattel’ by HMRC, thus financial gains from investing in the asset are Capital Gains Tax exempt, an important bonus for investors. This topic is further investigated on page 23 though it is important that investors take the advice of their financial advisor for any investment. Aside from its favourable tax status, Fine Wine is a highly liquid marketplace, with a clear exit available for the best investment grade wines into a global marketplace via Liv-Ex.

Consistently low correlation to equity markets

One of the key diversification benefits of the asset class to any investor is Fine Wine’s consistently low correlation to key markets like the S&P 500. Examples of Fine Wine’s separation from key equity markets include both the 2008 global financial crisis and the onset of the coronavirus pandemic where, in both cases, Fine Wine was immune to the volatility & turmoil that investors saw more generally.

Physical assets seen as a hedge against risk & inflation

Physical assets tend to perform better than intangible assets during times of economic uncertainty, acting as a store of value. There is demand for, and value in, the great wines of the world, enabling them to maintain value even in periods of economic uncertainty. During inflationary periods like 2023, Fine Wine has been able to act as a buffer for investors, or at least contribute a cooling effect on general asset devaluation.

Currency Hedging

Investors holding stock bought in Sterling often see a boost in trading during times when the currency has dipped, as wine is cheaper in the local currency of international buyers, thus stimulating global demand. Whilst key indexes like the Fine Wine 100 are priced in Sterling, most global buyers are from the US, China and other major markets, meaning that a drop in Sterling does not necessitate a drop in Fine Wine value.

Stability during unpredictable times

Whereas alternative physical assets like designer handbags and whisk(e)y barrels have seen inexorable growth, followed by huge drop offs, Fine Wine has a decades-long track record of financial stability. Across the past five years whilst the FTSE 100 has grown by 7%, the Fine Wine 100, the core index for the Fine Wine market has risen by 25%, in spite of global economic pressures, pandemic and conflicts. (Source: The London Stock Exchange)

Far left: A large format of Château Margaux 2015, a wine which has appreciated by 142% since release. Large formats can demand a premium of 30+% on the market value for regular bottles.

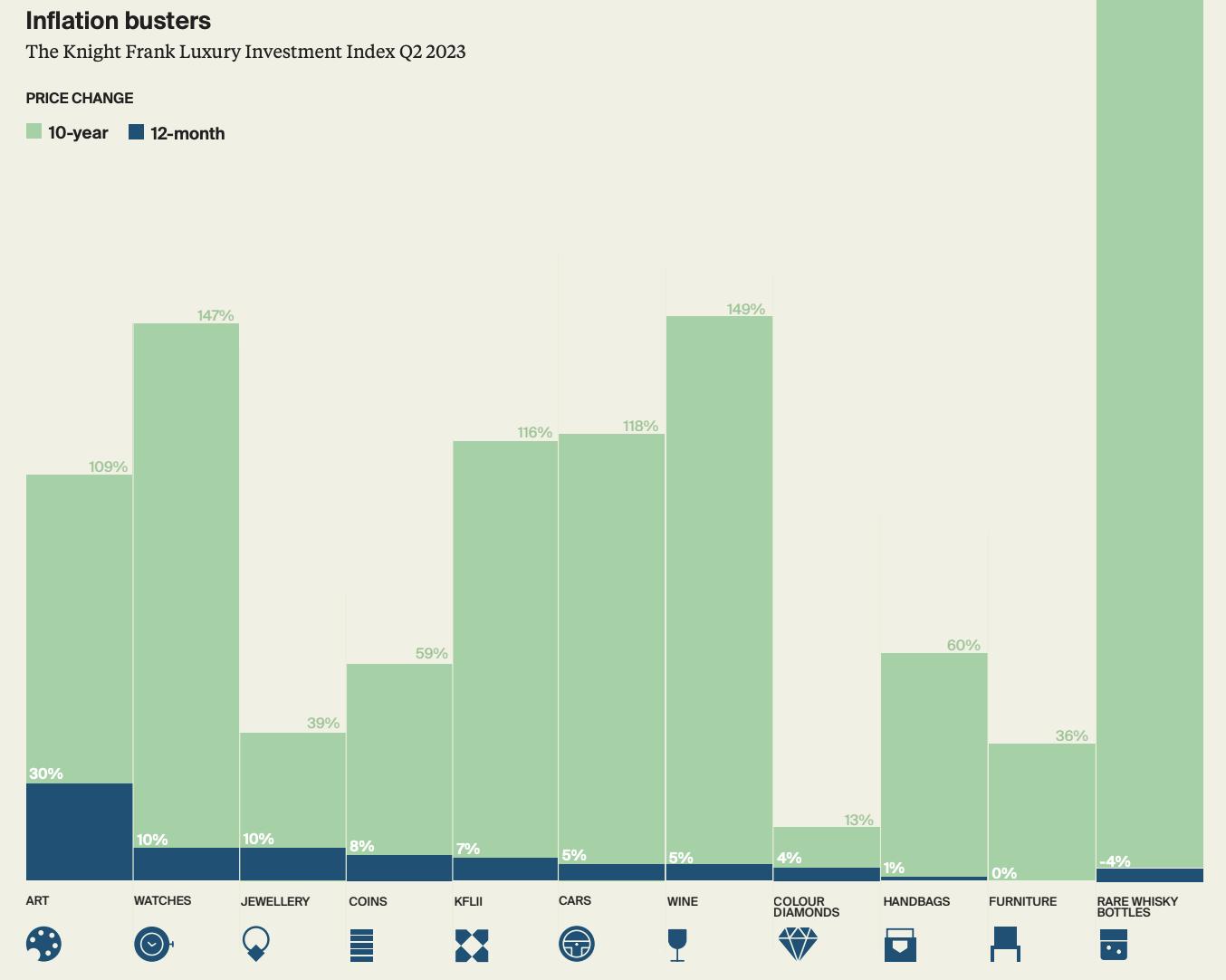

Right: Graphic from the 2023 Knight Frank Wealth Report showing the growth of alternative asset classes across 10 years & the most recent 12 months. Wine has appreciated by 149% in 10 years, second only to the much more recent, and volatile, whisk(e)y market.

Wine outperforming all other alternative assets

The alternative investment sphere is a large one, with asset types like designer handbags, watches, vintage cars and Fine Art all offering investors the opportunity for diversification, though only Fine Wine has the potential to be exempt from Capital Gains Tax. According to the 2023 Knight Frank Wealth Report, Fine Wine has delivered peer-beating returns of 149% across ten years, bettered only by the much more recent, and extremely volatile whisk(e)y market.

THE FINE WINE MARKET

The Fine Wine market has long been regarded as a unique and lucrative investment opportunity, offering investors the potential for high returns and portfolio diversification. However, like any other asset class, the value of Fine Wine is subject to various external forces, including major global events such as economic downturns, geopolitical tensions, environmental disasters, and global health events.

In further understanding Fine Wine’s general lack of market volatility compared to other financial indices, it is important to first delve into the impact of key global events on the Fine Wine market, analysing historical data and market trends to uncover patterns and insights that can inform investment strategies.

Fine Wine is a truly global marketplace with an ever-increasing number of countries who both produce and trade wine. Countries like Brazil and India (where wine consumption jumped by 29% in 2022) have joined the example of China in seeing Fine Wine as the luxury good of choice, either for consumption or investment.

Liv-Ex, the London International Vintners Exchange, is the Gold Standard global digital platform allowing wine to be valued, condition checked and traded securely, bringing buyers and sellers from around the world closer together than ever.

Economic events

Major economic events such as the global financial crisis of 2008 have historically exerted pressure on the Fine Wine market, as with other alternative asset types. During periods of economic uncertainty as seen in 2023/24 with global inflation and high energy prices, consumers tend to reduce discretionary spending, leading to a decrease in demand for luxury goods. However, it is important to note that the Fine Wine index has demonstrated exceptional resilience in the face of major market events, with prices rebounding in the aftermath as market confidence returns.

Geopolitical tensions

Geopolitical tensions and conflicts can have an impact on the Fine Wine market, particularly in regions where wine production is concentrated. Disruptions to supply chains, trade tariffs, and political instability can all affect the availability and pricing of Fine Wines. For example, tensions between the United States and European Union over trade policies

have led to retaliatory tariffs on wine imports, causing minute price fluctuations which the best investment managers can foresee and preempt. Additionally, geopolitical events such as Brexit have affected currency values, with the 2016 Brexit vote leading to a boom in trade of UK, Sterling-priced Fine Wine stocks, driving up the value of the market.

Environmental disasters & global health events

Environmental disasters, including wildfires and extreme weather events like frosts have an impact on the Fine Wine market. Vineyards are highly susceptible to climate variations, with adverse weather conditions affecting grape yields and wine quality. Frost-hit vintages like 2021 in France led to supply shortages and pricing volatility, slowing the overall growth of the Fine Wine 100 index. Conversely, the coronavirus pandemic in 2020-21 saw keenly-priced en primeur releases sell well and, combined with general appetite for Fine Wine during ‘lockdowns’ at home, contributed to a sustained period of market growth.

Key global events shape the market

Our success at Clos Fine Wine has been in acting ahead of the market and forseeing which global events might affect Fine Wine trade, and how. A personal approach, treating each investment portoflio as our own, has created resilient client holdings, largely free from any general market volatility, and leaving them well positioned to weather any global storms or surf any market upturns. The graph below depicts how key global events have impacted the course of the Fine Wine 100 index, the benchmark for the Fine Wine investment world, over 22 years.

September 2008

The start of the finanical crisis as Lehman Brothers files for bankruptcy following nationalisation of Northern Rock in February by the UK Government. Global economic turmoil driven by mortgage-backed securities & linked derivatives causes a devaluation of the Fine Wine 100 index.

November

2008

China announces an economic stimulus package, driving Chinese interest in Fine Wine brands, a popular gift among party officials.

May 2011

The 2010 Bordeaux vintage, hailed as one of the greatest ever, is offered at record-high prices en primeur, riding the crest of the Chinese-led buying wave.

July 2012

China announces a crackdown on gift-giving amongst officials, as part of anti-corruption initiatives. The result is the closing off of a huge wine buying market, almost overnight.

July

2014

The Fine Wine market hits its lowest point since before the China-led boom at the end of 2008, not helped by a poor 2013 vintage in Bordeaux and general buyer apathy.

June 2016

The UK votes for Brexit, making the decision to leave the European Union and single market. Sterling weakens overnight, boosting the Fine Wine market as UK held, Fine Wine stock can be secured at a discount for buyers in other currencies.

October 2019

US ‘Trump tariffs’ on European goods, including Fine Wine under 14% ABV, linked to the Airbus/Boeing dispute impacts demand and the direction of global Fine Wine prices.

March 2020

The global coronavirus pandemic sees the impressive Bordeaux 2019 vintage released at attractive prices, driving a general demand for Fine Wine through various ‘lockdowns’.

February 2023

The cost of living crisis and global inflation, contributed to by the war in Ukraine, slows the Fine Wine market, which had until then enjoyed uninterrupted appreciation.

Below: Sassicaia 2000, a Tuscan wine that has appreciated by 65% across the past five years. The 2013 vintage which features in the example five year portfolio on pp. 14-15 has risen in value by 100% across the same period, demonstrating the benefits of a diverse & robust Fine Wine holding.

INVESTMENT PHILOSOPHY 03.

Our proprietary algorithm is a key tool in determining the best prospects for new and existing portfolios of investment grade wines. Whilst it is complex, absorbing a range of data streams and information, it has at its core six key criteria in deciding the make-up of Fine Wine investment portfolios.

Too often wines are sold as ‘must-buy’ investments by brokers based on the flimsiest of reasons, rather than careful fulfilment of a range of interconnecting criteria. A top Bordeaux from a great vintage also being highly rated is not enough on its own to justify investment: if for example it is released at an egregiously high price, or sees only small production levels in one year, then market demand and liquidity for a potential exit are affected.

At Clos our approach is agnostic, based on best practice and absobption & analysis of all available data. We are beholden to no particular producer and will only ever recommend wines that we would have in our personal investment portfolios. Our key criteria are thus:

Outstanding vintages

The very best vintages ensure wines of a higher quality with greater longevity. Similarly, the best vintages are always in demand, particularly as worldwide supplies diminish over time, pushing up their value. Recent excellent vintages in Bordeaux include 2019, 2016, 2009 & 2010, whilst 2013, 2012, 2008 & 2004 are Champagne vintages in high demand.

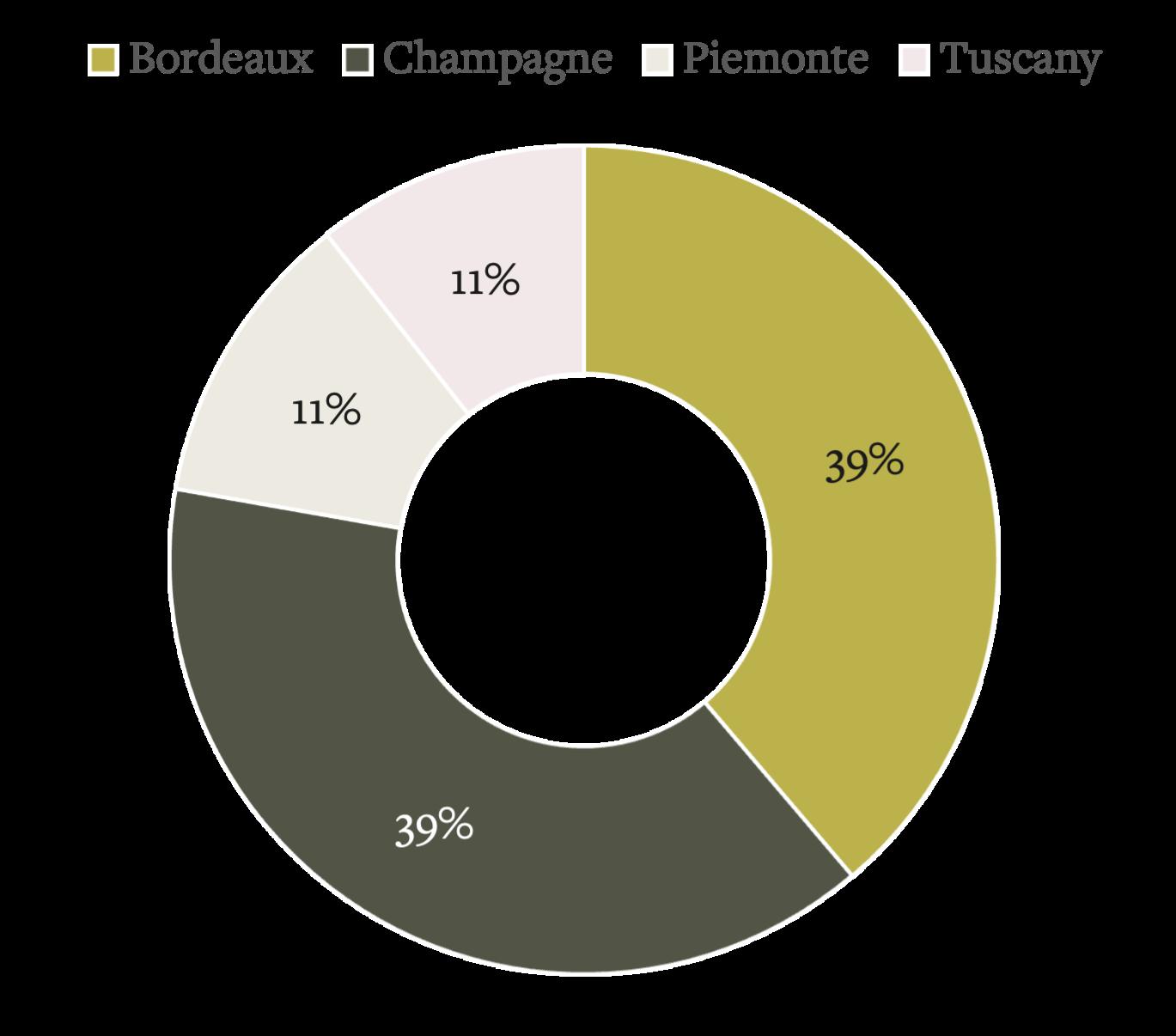

A robust mix of regions

Whilst the best of Bordeaux should arguably be the cornerstone of any Fine Wine investment portfolio, given the decades of data that accompany it, a balanced portfolio should now include a substantial holding of vintage Champagne and the stars of Italy, whilst the best of the Rhône and Burgundy should be considered, too.

Excellent liquidity

To be considered serious investment options, wines must have excellent liquidity, demonstrating a history of facilitating a timely exit from the market when the time comes. Specific production levels, as well as vintage factors can affect market liquidity enormously.

The highest rated wines

Critical consensus is a substantial driver behind the demand, or lack thereof, for Fine Wines hoping to be considered ‘investable’. A critical score nearing, or even reaching 100 points from a top critic, like Neal Martin of Vinous or Jane Anson of Inside Bordeaux can set, or change, the prospects and thus value of a wine overnight, as can a poor review.

Sub-index outperformers

We are constantly looking for wines which outperform their peer group. For example, across the past 3 years the Champagne 50 index has appreciated by 30%, whilst at the same time the Salon brand of champagne has risen in value by about 75%: more than double. Identifying sub-index outperformers gives portfolios a competitive advantage in the market.

Classification changes

Many top wine regions have established classification systems which won’t change, given they often refer to specific vineyards. Some areas, however, are subject to re-evaluation, a process which can see wines demoted or promoted, with an instant impact on their market value. Promoted to Saint-Emilion Grand Cru Classé ‘A’ in 2022, Château Figeac saw value of its back vintages soar overnight.

Case Studies

Château Lafite Rothschild 2014

Region: Bordeaux, France

Score: 92 points, Neal Martin

Production levels: 17,500 bottles

Peer group index growth over same period: 56% (Bordeaux 500)

Lafite Rothschild is one of the world’s top wine ‘super brands’, driven by high desirability in Asia. The 2014 vintage in Bordeaux was very good but as the successor to a disastrous 2013 vintage was sold at heavily discounted prices. As the market has seen a wine like Lafite 2014’s true worth in the intervening years, value has shot up and early adopters have benefitted, in spite of a lower score from Neal Martin.

Salon, Le Mesnil 2004

Region: Champagne, France

Score: 97 points, Antonio Galloni

Production levels: 42,000 bottles

Peer group index growth over same period: 109% (Champagne 50)

Salon is arguably the finest producer of Champagne in the world, only making its titular ‘Le Mesnil’ in the very best vintages, like 2004, ensuring extraordinary quality. This and smaller than average production levels for the region drive demand, as do consistently high scores and a consistent ability to outperform its peer group.

Giacomo Conterno, Monfortino Riserva 2008

Region: Piemonte, Italy

Score: 99 points, Antonio Galloni

Production levels: 7,000 bottles

Peer group index growth over same period: 75% (Italy 100)

‘Monfortino’ is Giacomo Conterno’s iconic Barolo, proving that not all criteria must be adhered to when selecting Fine Wines as assets. Tiny production levels here are offset by a feverish demand for the wine around the world, near-perfect scores, and its ability to outperform the Italy 100 index.

Image: Magnums of Château Lafite Rothschild 1982, one of the greatest wines from arguably one of the greatest Bordeaux vintages. A sought-after treasure for collectors, magnums have a current market value of £7,325 each, in bond.

04. EXAMPLE PORTFOLIOS

Fine Wine should be seen as a medium to long term investment, a period which we suggest begins at around five years and continues to ten or more, where most assets in the sphere see most growth and negate any shorter-term financial headwinds, playing to Fine Wine’s strengths of inverse supply.

At Clos Fine Wine there is no minimum investment amount, a demonstration that Fine Wine is accessible as an alternative investment. Naturally the more capital invested at the start of a portfolio’s life, the greater the range of vintages, regions, and cases in a holding, diversifying the investment further. The most popular initial capital investments with Clos Fine Wine are £10,000 and £25,000, and are depicted in the example portfolios on the following pages.

These portfolios show the success of our assiduous approach, not being swayed by shorter term trends but instead being led by data, experience, and our own proprietary data tool. All current market value data is taken from Liv-Ex, correct as of December 2023.

Headline Figures

10 YEAR PORTFOLIO

peer

Le Mesnil 1999

Le Mesnil 1996 Moët & Chandon, Dom Perignon 2002

2010

Conterno, Barolo Riserva 'Monfortino' 2006

de Lafite 2010

Mouton Rothschild 2000

Beychevelle 2012

2008

Lafite Rothschild 2005

Lynch Bages 2006

This Clos Fine Wine portfolio demonstrates the diversity of wines that a larger initial investment can provide, whilst also showcasing the myriad global events that have shaped the Fine Wine indices (see pp. 10-11) across a ten-year period.

Formed at one of the lowest points for the index post China’s crackdown on gift-giving, many of these wines were purchased at keen prices before being swept up in the market’s ascendancy post Brexit vote and Sterling’s weakness, and then through the coronavirus pandemic where people had more money to spend.

Champagne is clearly the performance outlier, driven by Salon ‘Le Mesnil’ with average growth in this holding of 415%, driven by a renewed interest in the region in 2018 as investment brokers like us looked for potential edge in a market crowded with Bordeaux.

The performance of the Italian wines from Tuscany and Piemonte is not to be sniffed at, nor is an unusually recalcitrant Bordeaux bloc which nevertheless outperformed the market-leading Fine Wine 100 index by 71% to 63%, due to the inclusion of strong Bordeaux brands from critically acclaimed vintages.

This demonstrates the potential of a diversified holding held for close to ten years, encompassing the period when ‘decade on’ critical retrospectives drive both the interest in, and value of wines in a market where supply has usually already been diminished over time.

Salon,

Salon,

Sassicaia

Giacomo

Gaja, Barolo 'Sperss'

Carruades

Château

Château

Château

Château

5 YEAR PORTFOLIO £25,000

This five-year portfolio demonstrates both the unerring rise of the Champagne 50 index since 2018 and how the coronavirus pandemic influenced the Fine Wine market, driving up demand and value across multiple regions.

A bullish market across 2020 drove huge levels of appreciation for all wines in this investment portfolio, following a more placid 2019. The increases in disposable income caused by national lockdowns coupled with low interest rates saw the holding rise by 46% in value in 2020 alone.

Aside from Champagne, whose impressive growth has been covered in the 10-year example portfolio, Sassicaia 2013 saw remarkably consistent appreciation year-on-year, with compound annual growth of 15%.

Château Beychevelle demonstrates that it is possible for certain wines to buck the trend in vintages deemed middling, as 2017 was in Bordeaux. Its popularity in Asia due to the dragon on the bowsprit on the label, sees it as a ‘must-have’ wine of the region, delivering for investors even when blue chip neighbours struggle in poorer years.

This portfolio showcases how a carefully composed Fine Wine holding can hedge against wider sub-index volatility by including key cases from sought after producers. In this case, although Bordeaux performed well at 6.5% growth per annum, Tuscany and Champagne supercharge the investment, outperforming the leading Fine Wine 100 index by over 2:1.

Château

THE TAXATION ANGLE

Investors are strongly encouraged to seek out independent advice from a registered financial advisor regarding the interpretation of HMRC’s rules on wasting chattels and Capital Gains Tax exemption. Our interpretation below is intended purely to provide additional context and does not constitute financial advice. The following guidance was issued by Inland Revenue (now HMRC) in its Tax Bulletin 42:

“Where bottled wine is purchased, each bottle is a chattel for Capital Gains Tax purposes. As gains on the disposal of chattels which are also wasting assets are generally exempt from Capital Gains Tax, Section 45(1) Taxation of Chargeable Gains Act 1992 (TCGA), then the first question is whether bottled wine is a wasting asset or not.

For CGT purposes a wasting asset is one whose predictable life, from the point of view of the person acquiring it, does not exceed 50 years, Section 44(1) TCGA. Whilst this definition would clearly apply to cheap table wine which may turn to vinegar within a relatively short period, even in unopened bottles, our view is that it would certainly not apply to port and other fortified wines which are generally recognised to have a very long storage life.

Between these extremes, there are a number of fine wines which are quite drinkable after a substantial period […]. With these the basic consideration […] is whether the wine has turned to vinegar or has merely matured. […] in practice, most wine is drunk well below the age of 50 years and in that sense, it is very difficult to consider the issue in isolation.

However, where the facts justify it, we would normally contend that wine is not a wasting asset if it appears to be fine wine which not unusually is kept (or some samples of which are kept) for substantial periods sometimes well in excess of 50 years. If a particular bottle of wine is not a wasting asset, then any gain accruing on its disposal may nevertheless be exempt where the disposal proceeds for that single bottle do not exceed £6,000, Section 262(1) TCGA”.

Whilst the guidance above from HMRC is helpful, it covers an area of huge contention. For example, Château Lafite Rothschild 2016 (which features in the five-year portfolio on the previous two pages) was only bottled in 2018 and with some critics has been given a drinking life of up to 2066, in this case denoting a predictable life of under 50 years. Whilst critical drinking dates for individual wines are clearly a subjective topic, HMRC’s guidance suggests that Fine Wine has an edge over a myriad other alternative asset classes thanks to the potential in many cases for it to be considered a wasting chattel and thus CGT exempt.

PROVENANCE & STORAGE

When putting together resilient and high-performing investment portfolios of Fine Wine, provenance and storage are high on the agenda at Clos Fine Wine. Investment-grade wines are either secured en primeur (as futures each year) direct from the Château, or are bought on the secondary market via Liv-Ex, the London International Vintners Exchange, or other trusted major brokers.

Liv-Ex has a rigorous system in place to ensure that wines traded on the exchange pass the very highest level of provenance and condition checks. Only once a wine passes a check can it be awarded an SIB (Standard In Bond) passport, enabling it to be bought and sold on the exchange. An SIB check will look at everything from the case the wine arrives in, to the paper and font used for labels, to cork conditions, wine levels and any damage or scuff marks.

This assiduous approach to checking for provenance and quality ensures that we can trade on the exchange with peace of mind.

Once a portfolio has been designed and secured for our clients, it is stored at Vine International, the logistics arm of Liv-Ex and the Gold Standard in Fine Wine storage in the UK, with comprehensive temperature and humidity control. As well as taking charge of the provision of SIB checking, wines at Vine are stored and insured to full replacement cost.

One aspect which sets Clos Fine Wine apart from a great number of other Fine Wine investment brokers is that our clients own their own wines, and they are stored in their own name: this is a vitally important distinction. Clients are provided with a UID (Unique Identifying Descriptor) for each physical case of Fine Wine stored in their segregated client account within Vine International.

When the time comes to liquidate assets and draw off capital, the SIB passport system allows for an expedited process of sale on Liv-Ex, reducing lead times by two weeks.

OUR SERVICES

Embarking upon Fine Wine investment with Clos is a simple and transparent process, allowing anyone to utilise Dominic’s years of investment expertise and his proprietary data tool to create robust and diverse portfolios, whether you have experience with alternative investments and Fine Wine, or not.

Once clients get in touch with us, we establish parameters for their initial capital investment and set about analysing the latest data to put together a comprehesive proposal document which outlines in great detail why each wine is worthy of investment. Other brokers, sadly, tend simply to allocate wines from stock without any real thought or explanation, and so our approach seeks to communicate, explain and reassure at every stage.

Once clients sign off on our the porfolio proposal we begin the process of securing wines, only invoicing for wines and our managment fee once a portfolio is in place (though with some larger investment amounts we will sometimes ask for an initial deposit).

Our Five Year Portfolio Management Fee

Clos Fine Wine offers a one-off, upfront portfolio management fee of 12.5% (equivalent to 2.5% per annum) which provides:

Five years’ worth of storage at Vine International, the Gold Standard in Fine Wine storage

Five years’ worth of insurance to full replacement cost at Vine International

No performance fees at any time

No selling fees for five years, allowing you to liquidate cases to release capital without penalty

Quarterly independently generated portfolio valuations & market reports

An annual report

Ongoing active management and advice

Invitations to dinners, tastings and trips

Primary allocations of sought-after, investment-grade wines