Digital infrastructure of tomorrow, today

Digital infrastructure of tomorrow, today

K2 Strategic is a global developer, owner, and operator of hyperscale digital infrastructure assets.

We specialise in delivering the critical physical infrastructure that underpins today’s internet, cloud services, and emerging digital technologies. From advanced data centre environments to renewable energy and connectivity solutions – we are a comprehensive digital infrastructure partner.

DATA CENTRES (PORTS)

DATA CENTRES

State-of-the-art hyperscale campuses across Ireland, Thailand, Malaysia, and Indonesia — engineered to support the evolving needs of global enterprises.

World-class data centre campuses in Ireland, Indonesia, Malaysia, and Thailand — purpose-built to meet the dynamic demands of global hyperscalers.

Extending our reach beyond data centres, we invest in regional connectivity infrastructure to ensure seamless, secure data exchange across international markets.

Driving sustainable innovation through renewable energy solutions that power our data centres in strategic global markets. RENEWABLE ENERGY

CIRCULATION: 18,000

ONLINE READERSHIP: 410,000 monthly unique clicks through Google Analytics

The SingaporeBusinessReview is the highest circulating and best read business magazine in Singapore. Our online readership has an average of 215,000 unique viewers, according to Google Analytics. We won the Business Trade Media of the Year Award at the 2017 MPAS Awards.

Do reach out to us if you would like us to tell your story to our readers via print and online advertising or events.

PUBLISHER & EDITOR-IN-CHIEF Tim Charlton

EDITORIAL MANAGER Tessa Distor

PRINT PRODUCTION EDITOR Eleennae Ayson

LEAD JOURNALIST Noreen Jazul

JOURNALISTS Diana Dominguez Frances Gagua

Vincent Mariel Galang

Alec Maquiling-Cruz

Marielle Medina Jaleen Ramos Olivia Tirona

EDITORIAL RESEARCHER Angelica Rodulfo

GRAPHIC ARTIST Simon Engracial

EDITORIAL ASSISTANT Vienna Verzo

COMMERCIAL MEDIA TEAM Jenelle Samantila Dana Cruz Danielle Goh

ADVERTISING CONTACTS Shairah Lambat shairah@charltonmediamail.com

AWARDS Julie Anne Nuñez-Difuntorum awards@charltonmediamail.com

ADMINISTRATION Eucel Balala accounts@charltonmediamail.com

EDITORIAL sbr@charltonmediamail.com

SINGAPORE

Charlton Media Group 101 Cecil St. #17-09 Tong Eng Building Singapore 069533 +65 3158 1386

HONG KONG Room 1006, 10th Floor 299 QRC, 287-299 Queen's Road Central, Sheung Wan, Hong Kong +852 3972 7166 www.charltonmedia.com

MIDDLE EAST

FDRK4467, Compass Building, Al Shohada Road, AL Hamra Industrial Zone-FZ, Ras Al Khaimah, United Arab Emirates

PRINTING

Times Printers Private Limited 18 Tuas Avenue 5, Singapore 639342 www.timesprinters.com a member of Times Publishing Limited

Editorial Enquiries: If you have a story idea or press release, please email our news editor at sbr@charltonmediamail.com. To send a personal message to the editor, include the word “Tim” in the subject line.

Media Partnerships: Please email sbr@charltonmediamail.com with “Partnership” in the subject line.

Subscriptions: Please email subscriptions@charltonmedia.com.

Singapore Business Review is published by Charlton Media Group. All editorial materials are covered by copyright and may not be reproduced without consent. Contributions are invited but copies of all work should be kept as Singapore Business Review can accept no responsibility for loss. We will, however, take the gains.

Sold on newsstands in Singapore, Malaysia, Hong Kong, London, and New York. Also out in sbr.com.sg with an online readership of 215,000 monthly unique visitors*.

Institutional investors are pivoting to alternative assets like worker dormitories, fuelled by Singapore’s booming construction sector. Learn why worker dormitories are a strong investment, and which other assets are attracting investor interest in our cover story on page 24.

A shift is also taking place in the private equity landscape as fund managers redirect their focus towards resilient, impact-driven sectors such as healthcare and education. Experts note a renewed sense of optimism in the PE market, buoyed by the Singapore Exchange’s efforts to revitalise listings. Read the full story on page 18.

The Singapore Exchange has also seen a wave of new listings this year, including NTT DC REIT and Info-Tech Systems. We spoke with the leaders of these companies to learn what’s next for them following their Singapore debut. Read more on page 50.

Another CEO we were able to speak with is Realion Group’s Desmond Sim, who offered insights on why building a unified proptech platform is critical to the industry’s digital transformation. Read more on page 52.

Sim’s call for digital transformation resonates strongly with Singapore’s real estate agents, who are now pushing for greater digitalisation and standardisation of property data across the sector. Find out more on page 32.

Tim Charlton

Business Review is a proud media partner and host of the following events and expos:

Business Review is available at the airport lounges or onboard the following airlines:

Singapore Business Review is available at the following clubs and hotels:

*Source: Google Analytics

Co-creating Singapore’s first ‘Borderless University’ with StarHub’s Ubiquitous Network.

StarHub and the National University of Singapore (NUS) have co-created Singapore’s first ‘Borderless University’, a breakthrough initiative that is reshaping the future of education.

The ‘Borderless University – Powered by Infinite Technology’ initiative leverages StarHub’s modern digital infrastructure, powered by Cloud Infinity — a hybrid multi-cloud architecture – to deliver ultra-fast, secure, and uninterrupted connectivity for staff and students anytime, anywhere, both in Singapore and abroad.

At the heart of this initiative is a private 5G network exclusively built by StarHub for NUS — a first-of-its-kind in Singapore. Using eSIM technology, students and staff can instantly and securely connect to NUS’s digital resources and the internet without the need for physical SIM cards, complex configurations, or VPNs.

A simple QR code scan is all it takes.

Leveraging 5G backhaul technologies, the solution also ensures seamless connectivity even for devices that are not 5G-enabled. By integrating directly into NUS’s existing network, it fosters a truly mobile, flexible, and borderless learning environment from lecture halls to living rooms.

“The 5G network has completely transformed how I learn at NUS. I can seamlessly access study materials, quizzes, and exams anytime, whether I’m on campus or at home. With secure and reliable connectivity, I can take exams or complete assignments on the go confidently using my 5G-enabled PCs or

devices without disruptions. This convenience has also significantly boosted my productivity, saving me about three hours each week. The extra time has allowed me to focus more on my studies,” said Year 3 Faculty of Dentistry student, Chua Sim Ying.

The Borderless University is not just a leap forward in connectivity — it is a stride towards building a greener, smarter campus.

By potentially reducing the need for physical cabling and wired infrastructure, StarHub’s solution supports NUS’s efforts to lower its carbon footprint and create a greener digital ecosystem.

The network was rigorously tested with NUS focus groups to ensure optimal performance, security, and user experience — reflecting StarHub’s commitment to delivering human-centric innovations that align with NUS IT's mission to drive the New Digital for

“This collaboration with StarHub aligns with our vision for a future-oriented learning environment. Both staff and students will benefit from seamless access to NUS’s resources and the internet, wherever they are in Singapore; and in the future, overseas, without the need for VPN or other remote access technologies” — Ms Tan Shui-Min, Chief Information Technology Officer, NUS

StarHub’s partnership with NUS was recently recognised at the SBR Technology Excellence Awards 2025, where the project won the Connectivity – Telecommunications category.

The accolade celebrates the bold reimagining of what a campus network can be — borderless, intelligent, and future-proof.

“Partnering with the National University of Singapore to co-create Singapore’s first Borderless University has been a truly exciting journey. This award reflects not just the strength of our collaboration, but the real impact that StarHub’s Modern Digital Infrastructure can deliver. By combining secure, seamless connectivity with future-ready innovation, we’re helping to set a new standard

3

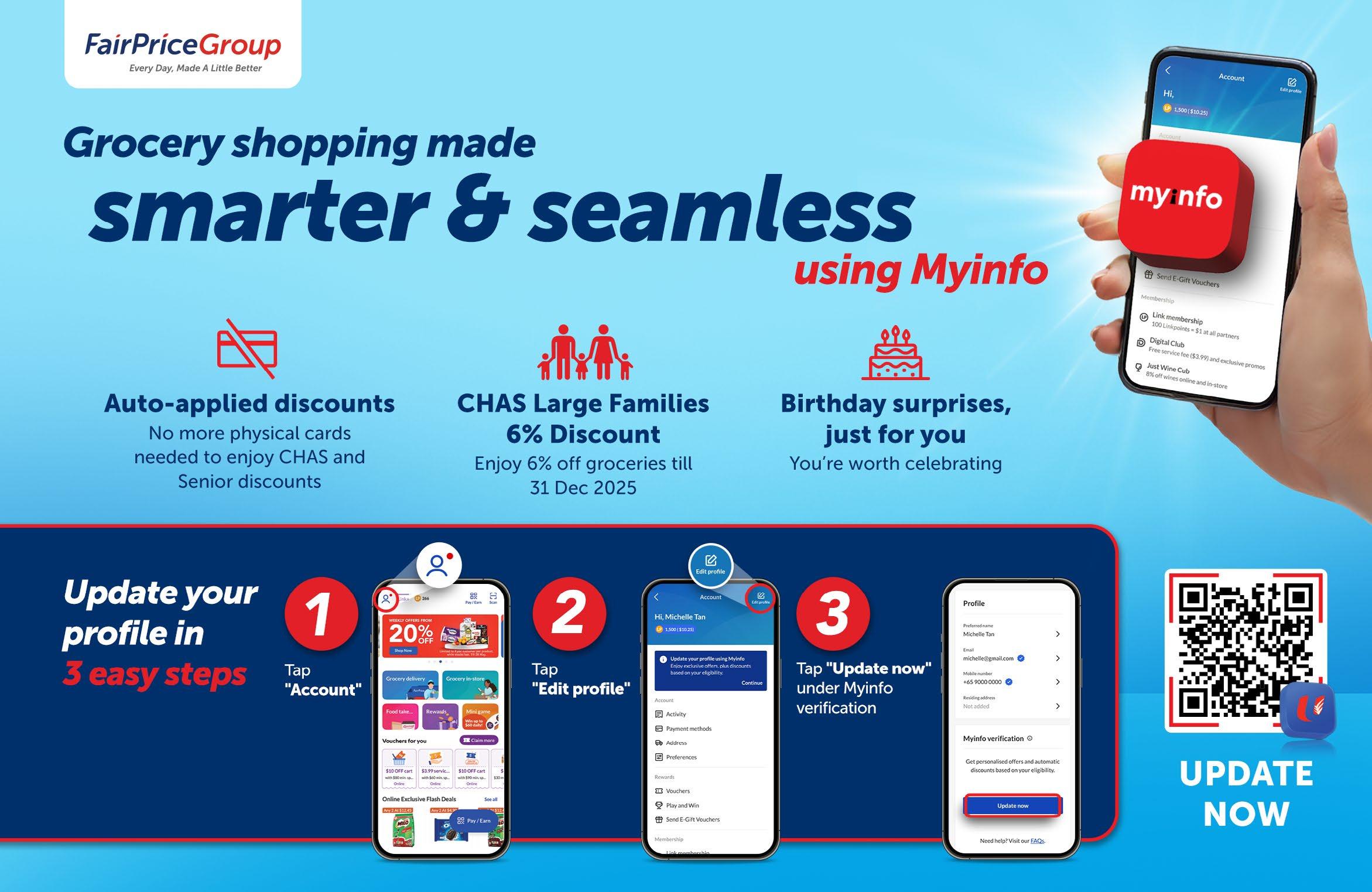

FairPrice Group has announced the return of its Save Every Day campaign, this time featuring over 100 SG60 edition vouchers as part of Singapore’s 60th anniversary celebrations. Running from 12 June to 10 September 2025, the campaign offers customers more than $1,000 in savings through over 400 unique In 2024, the campaign generated nearly $1.4m in customer savings.

What today’s C-suite can learn from tomorrow’s leaders

BY Tom Murray

In a world defined by rapid technological change, evolving workforce expectations, and complex global challenges, standing still is not an option – especially for those at the helm. Business leaders today are not only expected to respond to disruption, but to anticipate it and adapt with it. In Singapore, Gen Z already makes up 16% of the workforce as of 2024.

Three in five workers in Singapore, or 60%, lived paycheck to paycheck in 2024, surpassing the Asia-Pacific average of 48%, according to ADP’s People at Work 2025 report. More than a quarter of the participants, or 26%, held multiple jobs to cover basic expenses, manage additional costs, or save for retirement. Some also cited the need to gain work experience for taking on extra work.

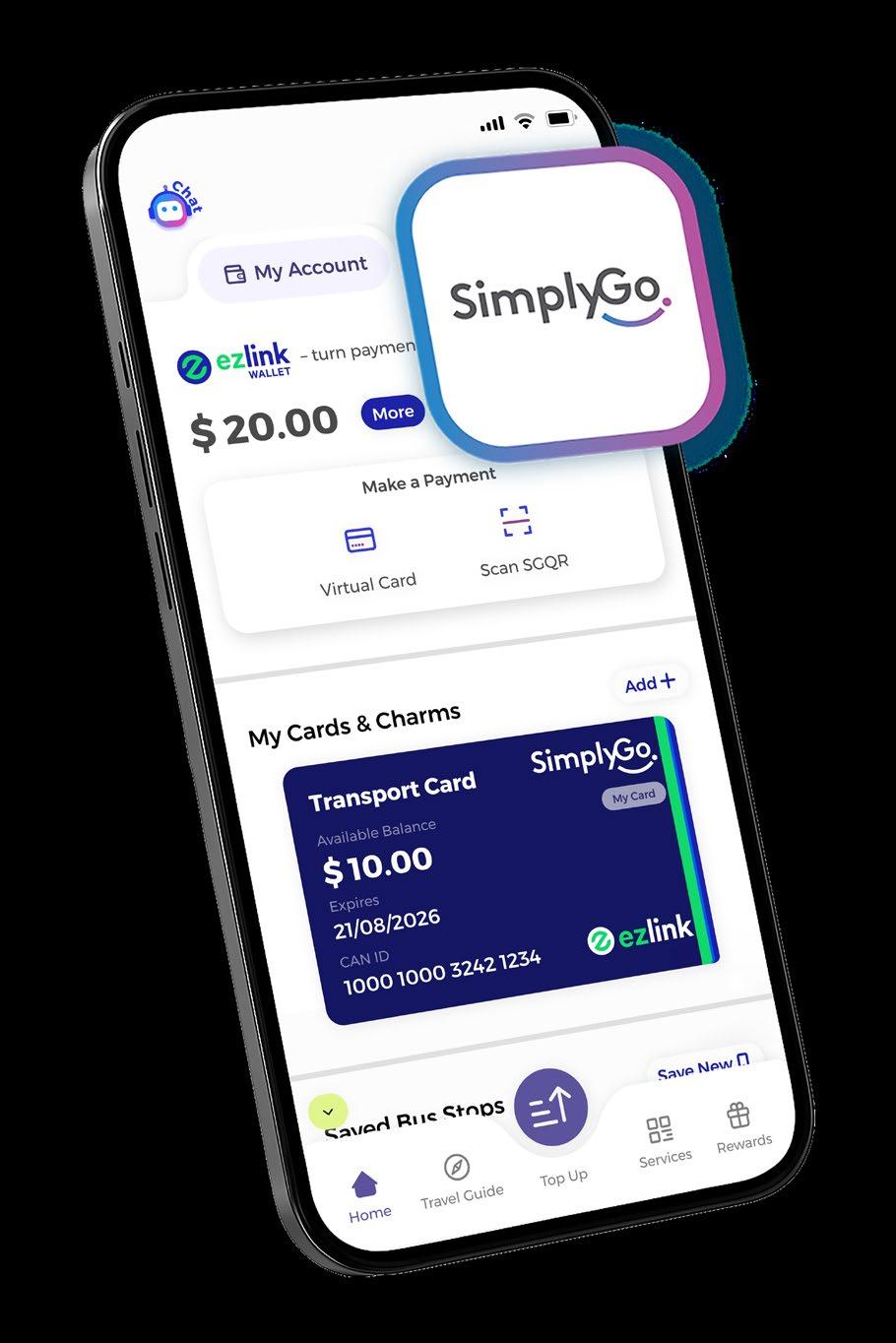

Mobile-first web design: Why Asian brands can't afford to ignore it in 2025

BY Dhawal Shah

Over 90% of Singaporeans own a smartphone, and mobile devices account for more than 70% of all web traffic in the country. Across Asia, mobile is no longer just another channel, it’s the primary gateway to customers. Mobile-first web design is not just best practice, it is a survival strategy. Ignoring mobilefirst web design could mean missing out on your most valuable audience.

elite art buyers

Auction houses like Sotheby’s, Christie’s, and Bonhams are luring the growing pool of wealthy Southeast Asian collectors who pay top dollar for art produced by globally and regionally renowned artists. Affluent Millennials and Gen Zers have sharply increased their spending on art. They have emerged as a key clientele for international auction houses.

The economic cost of inaction on gender parity in Singapore

BY Datin Seri Umayal Eswaran

Why is progress on gender parity panels still so slow — even when we already know the solution? Despite all the data, resources, and collective brainpower dedicated to closing gender gaps, real, systemic change continues to lag. In Singapore, women make up nearly half the workforce, yet hold only 13% of chief executive roles.

No green light for Grab: Is it time to lift the cross-border ride-hailing ban?

Analysts backed Singapore’s decision to keep a ban on cross-border private ride-hailing service with Johor Bahru, Malaysia, citing adequate options and potential risks to the local taxi industry.

Terence Fan, assistant professor of strategy and entrepreneurship at Singapore Management University, said licensed taxis are sufficient to meet the demand.

“During certain festive seasons, demand seems to outstrip current supply,” he told Singapore Business Review. “However, outside of this season, the current supply of crossborder taxis seems to be more than capable of handling the demand," he continued.

The government on 3 August said it would not open the route to private-hire cars, keeping cross-border travel limited to licensed taxis under the Cross Border Taxi Scheme, which allows about 200 taxis from each side.

The city-state is unlikely to allow ridehailing vehicles to cross the border unless alternatives can’t handle demand regularly, Fan said in an exclusive interview.

Daniel Chow, principal at Arthur D. Little Southeast Asia, said commuters already have other licensed public transport options,

including cross-border buses and the Johor Bahru–Singapore Rapid Transit System, scheduled to begin service by late 2026.

He said opening the route to private-hire vehicles could erode taxi ridership, which is already below capacity. “The decision, whilst restrictive, is justified and strategically sound from a transport policy perspective.”

Masaki Honda, vice president of mobility at Frost & Sullivan, said cross-border ride-hailing would be difficult to enforce.

“It is very complex to harmonise regulations between Singapore and Malaysia,” he said. He also told the magazine that restrictions ensure safety, keeping oversight within Singapore’s transport ecosystem.

Fan agreed that enforcement would be difficult. “How can we catch nonconforming vehicles or drivers if they are out of Singapore, or if they are in Singapore for only a short amount of time?” he asked.

Timothy Wong, a senior economics lecturer at the National University of

Singapore, emphasised the importance of keeping safety and driver standards.

“If Malaysian cars are allowed to provide trips into Singapore and return to Malaysia with passengers, our safety and driver standards should still be upheld,” he said in a separate interview. Lowering these standards, he added, could undermine consumer confidence in ride-hailing services.

Fan said letting private-hire operators work across the border could draw more drivers away from taxis, given lower rental costs and greater flexibility. Singapore’s taxi fleet had fallen to 12,261 as of July from 13,343 a year earlier, whilst the number of private-hire cars rose to 93,966 from 85,881.

Restricting cross-border access helps protect the taxi sector, he said. “It creates reasons for taxi drivers to feel that at least, some of their business is protected.”

Chow said local taxi firms, even those with their own booking apps, would be disadvantaged compared with regional players such as Grab, which could more easily use cross-border networks.

He also noted that Malaysian operators benefit from lower fuel and maintenance costs, whilst Singapore’s stricter licensing raises compliance expenses.

The Frost & Sullivan expert warned that liberalisation could see Malaysian drivers offering lower fares, leading to “significant trip losses” for Singaporean drivers.

The Land Transport Authority said it is working with Malaysian counterparts to improve the Cross Border Taxi Scheme, including measures like introducing appbased bookings for licensed taxis and adding more boarding and drop-off points.

Cross-border taxis can only operate between Ban San Street Terminal in Singapore and Larkin Sentral in Johor Bahru.

Honda said the quota is underused partly because of the single pick-up and drop-off point on each side. He proposed revising licensing and using platforms such as Grab or Gojek to make transactions transparent.

Wong also suggested encouraging shared taxi rides. “There might be many people who are willing to share a ride to get across the border, and to some extent, the authorities may want to encourage that,” he said.

Allowing more taxis without promoting ride-sharing could worsen congestion, he said. “If two people from a similar location in Singapore are heading to a similar location in Johor Bahru, you should incentivise them to share a taxi for that trip," Wong added.

The decision, whilst restrictive, is justified and strategically sound from a transport policy perspective

Reverie on the Hill (ROH), Singapore’s first creator-led retail concept at Dempsey Hill, aims to bring in more than 500 active creators by the end of the year as it expands its product lineup and forges various brand partnerships.

“After managing millions in marketing spend for various retail campaigns, one metric stood out: authentic user-generated content and reviews consistently outperform flashy ads,” ROH founder Gene Kwok told Singapore Business Review

“At the same time, I saw how hard it is for product brands to seed authentic reviews at scale, and how creators struggle to monetise consistently,” he

Asaid in an exclusive interview.

ROH, a boutique skincare studio and creator-powered retail space, was built around the idea that authentic, user-generated content is more powerful than traditional advertising. Launched in July, the store provides personalised facial treatments, including deep-cleansing facials, barrier-repair therapies, and noninvasive skin care services.

It combines physical retail with immersive digital engagement, offering a space where creators can test products, share feedback, and earn rewards for participation.

For brands, the model provides a way to enter the market without

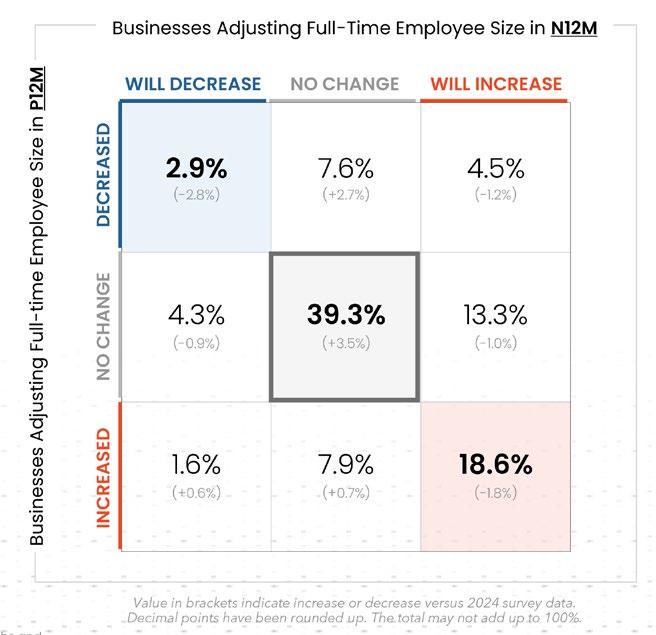

bout 41% Singapore businesses plan to freeze wages in the next 12 months, up from 35% last year, as economic uncertainty weighs down confidence and hiring plans, according to the Singapore Business Federation’s (SBF) National Business Survey 2025 – Manpower and Wages Edition.

Fewer companies intend to raise salaries, with 59% planning increases compared to 64% last year. The only exception is for lowerwage workers, with two in three firms still planning to increase their pay.

The overall business sentiment index dipped 1.1 points from 56.5 in the first quarter of 2025 to 55.4 in the second quarter.

At least 35% of companies expect conditions to worsen in the year ahead, whilst only 14% see improvement.

Many are holding back on hiring, with

hefty listing fees, whilst for shoppers, it promises a “more authentic, community-driven way to discover products,” Kwok said.

ROH accepts creators of all sizes, from nano to established influencers, through applications on its website. “There is no minimum follower count because we believe everyone has a sphere of influence,” Kwok said.

Accepted members get access to curated product drops, discounts, affiliate commissions, and brand collaborations. The retail store operates on a tiered membership system: the Storyteller tier offers a 20% discount for one to two approved content pieces per month, whilst the Curator tier gives 30% off for three or more monthly posts.

An invite-only Reverie Black Card will soon be introduced for top creators and tastemakers, offering exclusive benefits such as early product access, private event invitations, and partner perks.

Shoppers are also included through the Dreamer tier, which gives 5% discounts, early sale access, beauty newsletters, event invitations, and rotating “Brand of the Month” offers.

We wanted ROH to feel like a clubhouse for creators rather than just another retail shop

“We wanted ROH to feel like a clubhouse for creators rather than just another retail shop,” Kwok said.

ROH integrates digital interaction with in-store shopping. Customers can scan QR codes on products to access reviews, post content, and earn commissions when their recommendations lead to sales.

just 36% planning to expand their full-time workforce, compared to 40% in 2024.

The downturn is most evident in the hospitality sector, where the hiring outlook dropped sharply from 67.4 in the first quarter to 51.6 in the second quarter this year.

Companies in hotels, restaurants & accommodations, administrative & support services, and IT-related services are the most pessimistic, whilst the health & social services and education sectors remain relatively more upbeat, according to the SBF report.

Although concerns over US tariffs have eased, about 59% of firms still see them as negative, down from 81% in April this year—trade uncertainty and margin pressures continue to weigh on business confidence.

Law firms are seeing a surge in client demand for sustainabilityrelated advice as companies scramble to comply with tighter environmental, social, and governance (ESG) requirements.

Law firm Dentons Rodyk & Davidson LLP said more clients are seeking advice on carbon projects and international trade, where compliance with overseas rules is considered critical.

“Those impacted by commercial considerations, like businesses investing in carbon projects or involved in international trade… are the sectors most actively seeking sustainability legal assistance,” Jean Nie Ho, a partner at Dentons Rodyk and head of its ESG practice, told Singapore Business Review in an interview.

The city-state's sustainability legal service market is expected to grow 10% annually to as much as $500m by 2033 from 2023, according to a study published by PwC Singapore.

Key drivers and challenges

The report cited key drivers such as Singapore’s Green Plan 2030, the 2050 net-zero target, and the Carbon Tax Act, along with the implementation of Article 6 of the Paris Agreement, all of which create new compliance requirements for businesses.

These shifts have generated more work for law firms, particularly those advising on carbon tax, emission projects, and regulatory alignment.

Despite the growth outlook, PwC highlighted hurdles for law firms. Gaps in technical expertise, strong competition from international players, and client pressure to keep fees low remain major challenges.

The study found most lawyers know sustainability concepts but lack formal technical training for complex ESG work. PwC said clients want advice blending legal and commercial insight, though cost still influences their choice of counsel.

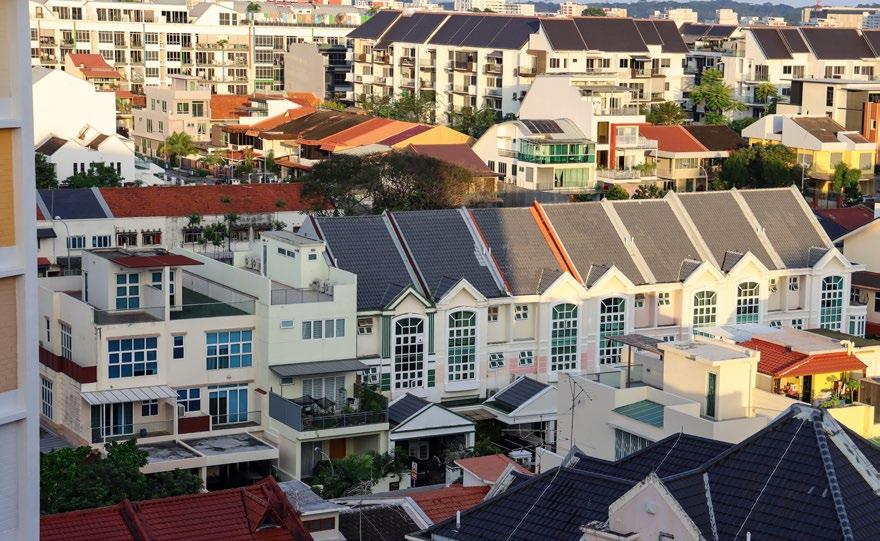

Arevision to Singapore’s seller’s stamp duty (SSD) rules that extends the minimum holding period for residential properties from three to four years is expected to dissuade short-term investors and complicate exit strategies for some buyers, analysts said.

“Condo construction periods are typically three to four years, and the extension of seller’s stamp duty to four years would likely dissuade investors who are only interested to hold and sell after three years,”

Wong Xian Yang, head of research for Singapore and Southeast Asia at Cushman & Wakefield, told Singapore Business Review

The rule change, which took effect on 4 July, raises seller's stamp duty rates by four percentage points for each tier of the holding period.

For residential properties sold within twelve months of purchase, the rate increased to 16% from 12%. For those sold after a year but within two years, the rate rose to 12% from 8%.

Units sold after two years but within three years now incur an 8% rate, up from 4%, whilst a 4% rate applies to

properties sold after three years but within four years—previously exempt.

Wong noted that investors who prefer not to rent out their units are the most likely to be affected, though he said they form only a “minority.”

“Most investors are likely to hold on for an additional year rather than deter them from investing in the private residential market, as they remain optimistic about its long-term prospects,” he added.

Wong expects the revised SSD to affect Singapore’s subsale market, where original buyers sell their units to second buyers before completion.

Subsales reached 321 units or 4% of total residential transactions in the first quarter, down from 9% a quarter earlier. They made up 11% to 13% of transactions from 2007 to 2009, the C&W head of research added.

Realion Group Chief Executive Officer Desmond Sim expects subsales to dip below 5% of total residential sales after the SSD revision.

However, Wong said some level of subsale activity might continue in the near term since the change only applies to transactions from July 2025 onward.

“Barring a sharp rise in property prices over the next few years, subsale levels are likely to fall over time as most would hold on for an additional year to avoid paying SSD," he told the magazine.

Sim said subsales and property flipping—often seen as speculative activity—could distort the market.

“When a person flips a property for profit, that will distort prices and add to the price growth that the government is targeting,” he said in an interview.

Beyond inflating prices, excessive speculative activity could also “squeeze out genuine buyer-occupiers,” Wong told Singapore Business Review.

Tricia Song, head of Research, Southeast Asia at CBRE, said the measure will curb investors who may be eyeing to replicate shortterm flips, making them think twice before buying if they can’t hold the property for four years.

Most investors are likely to hold on for an additional year rather than deter them from investing

Huttons’ Senior Director of Data Analytics Lee Sze Teck projects subsales to fall below 2% by 2026 as a direct result of the policy. He added that buyers who might have turned to the subsale market will likely shift to new launches instead, given the expected drop in subsale listings.

Fintech startup Seedflex Technologies Pte Ltd. seeks to facilitate lending to 50,000 micro, small, and medium enterprises (MSMEs) in Malaysia by year-end based on the enterprises' sales performance.

“Cash flow is a central part of micro and small businesses,” Seedflex co-founder and CEO Ritwik Ghosh told Singapore Business Review. “That is their asset, which has now become very widely digitised, cashless, and available for data understanding, available for credit underwriting," he added.

“We are building at the centre of that with the pay-as-yousell concept,” he said in an exclusive interview.

Seedflex’s platform, called Pay-As-You-Sell Advance, lets merchants access funding via its 12 partners, with borrowing limits and repayments based on their sales. It had 6,000 merchants in Malaysia as of June.

“It is not based on a fixed monthly repayment schedule,” Ghosh said. “If their sales go higher, they pay back faster. If sales go lower, they pay back, to a certain extent, slower.”

Sauvik Datta, co-founder and chief operating officer at the Singapore startup, said repayment occurs “almost daily,” as a share of each sale goes towards repaying the loan.

Although it helps small businesses access credit, Seedflex doesn’t position itself as a credit fintech, Datta said. Rather, it integrates into existing ecosystems that merchants already use, providing insight into their cash flow.

Seedflex plans to use the $4.1m (US$3.2m) it raised from its seed extension round early this year to to continue scaling its growth in Malaysia and to support its expansion to Indonesia. Its seed extension round was co-led by Z Venture Capital (ZVC) and Iterative, with participation from existing investor 500 Global and several strategic angel investors.

In June, Seedflex obtained registration from Indonesia’s financial services authority, Otoritas Jasa Keuangan (OJK), as an authorised provider of aggregated financial product and service information. Armed with regulatory approval, Seedflex Indonesia is moving quickly to partner with local players, expand its product portfolio, and attract new customer demographics through its OJK-backed fintech platform.

“We welcome all interested financial institutions, fintech providers, and other technology platforms to join us on this shared mission to innovate and enhance financial access and inclusion for all Indonesians,” Ghosh said.

Ghosh said Seedflex is working on features that would let merchants use credit in different ways, whether for long- or short-term financing. It is also trying to attract more merchants.

“That is the direction that we are taking—to get closer to our partners and add more value to them,” he said.

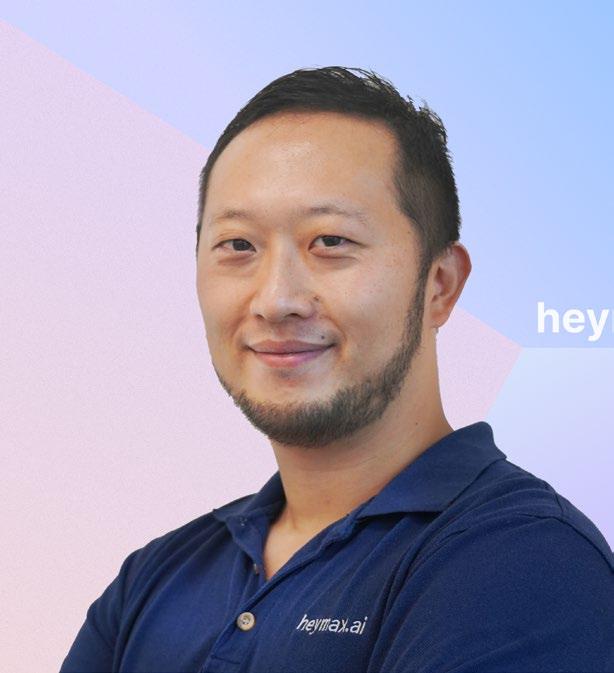

Fintech startup HeyMax, which lets travellers earn rewards seamlessly across several merchants, plans to enter Japan and Hong Kong later this year, and Korea and Taiwan by 2026 to tap into the growing travel economy.

“There's strong, organic demand globally for more travel, so we want to be able to meet our customers’ needs and to help them simplify and aggregate more travel rewards,” HeyMax CEO Joe Lu said.

The Asia-Pacific region accounts for a third of global travel volume and is also the fastest-growing market, with annual growth of 10%, he pointed out.

“The traveller economy is a force to be reckoned with,” he said in an exclusive interview. “It's really embedded in all our day-to-day life.”

“If I'm just buying a coffee, swiping a card, the card earns me miles. I am actually participating in this aggregation of my future travel,” the chief executive officer added.

The Travel Forward 2025 report by research firm Phocuswright forecasts sustained growth in the global travel market through 2026, with yearly gains of as much as 9%.

“If you’re a traveller, whether you’re based in Singapore or anywhere in the world, when you go to another market, you will also be able to earn Max Miles from local merchants, beyond online or global merchants,” Lu said.

Lu expects HeyMax users to hit a million by 2026 from 120,000 currently, and plans to double partner merchants to around 1,000.

“We have quite a lot of really enthusiastic partners in the pipeline to bring more of these consolidated and interoperable rewards and top-notch reward experiences to users,” he said.

The CEO expects double-digit revenue in US dollars by 2026.

In May, the startup said its yearly revenue was expected to top $7.7m (US$6m). It also seeks to exceed $642.4m (US$500m) in facilitated transaction volume next year from $256.9m (US$200m) in May.

ByteGenie Pte Ltd. seeks to raise $837,000 (US$650,000) to help more sales teams in the hospitality sector connect with companies and business travellers using artificial intelligence (AI) tools.

The Singapore startup had raised $515,000 (US$400,000) as of early June, Jiale Tan, co-founder and CEO at ByteGenie, told SingaporeBusinessReview

“We help corporate sales teams generate leads in real time, saving them 85% of time back for closing deals,” she said in an interview, citing feedback from a large hotel chain client. “Our AI agent can do the work of the entire data team.”

The number of qualified leads for the hotel chain also grew 10 times, she pointed out to the magazine.

“Before, sales representatives would spend an entire week manually researching

events, exhibitors, and potential customers to sell hotel rooms and venue spaces to, often ending up with only around 30 qualified leads,” Tan said.

“With ByteGenie, they can now get over 300 highly qualified leads, along with strong intent signals like what kind of events are happening, who the exhibitors are, and what specific information those exhibitors are engaging with,” she added.

Celebrating a Decade of Progress

Building Pathways for Growth

Addressing Unresolved Challenges

Secure your spot with 20% discount on your Delegate Pass

Code: SFFSMPSBR

The space is designed for certification under Green Mark, WELL, and LEED standards.

CBRE Singapore has relocated to Marina Bay Financial Centre (MBFC) after 24 years at Six Battery Road, unveiling a 21,000-square-foot office designed around data, sustainability, and well-being.

The new workspace, which is 75% larger than its previous office, is equipped with sensors that monitor air quality, occupancy, energy use, lighting, and noise levels in real time. This data-driven approach allows CBRE to improve comfort and efficiency while informing future workplace design.

Energy meters track consumption by zone, whilst dimmable lights and photocell sensors can reduce electricity use by up to 20%. Vertical hydroponic gardens

and living walls respond to air quality data, supporting CBRE’s target certifications for Green Mark Platinum, WELL, and LEED Gold.

“Some well-being-focused features include quiet workspaces to accommodate hyper-sensitive employees, as well as a social hub for those who need to be stimulated,” Moray Armstrong, CBRE Singapore’s managing director for advisory, told Singapore Business Review

The office has an in-house barista who makes freshly brewed coffee for both clients and employees.

“The Marina Bay location places us right at the heart of Singapore’s business community, allowing us to enhance our client and employee experience,” Armstrong said.

1 Stylish lobby with digital displays, showcasing CBRE’s modern and techenabled workplace design.

2 Striking emerald digital display embodies CBRE’s “Emerald of the City” concept at MBFC.

3 Sleek locker corridor supporting flexible work arrangements in CBRE’s new MBFC office.

4 Open-plan workspace with greenery, natural light, and modern design for productivity and well-being.

5 Smart meeting room with panoramic skyline views for collaborative discussions and client meetings.

6 In-house barista counter offering fresh coffee, creating a welcoming hub for clients and employees.

North Rhine-Westphalia (NRW), Germany's most populous and economically strongest federal state, is Europe's most important energy region and therefore the largest arena for the modernisation and decarbonisation of key industries. With over 170,000 greentech employees, NRW offers international companies a unique investment environment, for example, for technologies for the efficient storage, transmission and use of energy, water and recycling management.

Key to green transformation in Europe

In NRW, greentech is one of the powerful drivers of change.

The aim of NRW is to become the first climate-neutral industrial region in Europe. Mines are being transformed into recycling sites, and plasma technology is being used to turn non-recyclable plastic packaging into 100% recyclable material.

Success and profitable growth thrive where companies benefit from all the advantages of an ideal location: from innovative start-up energy and a skilled workforce to established knowledge

networks and international partnershipssuch as with Singapore.

A vibrant partnership

The links between Singapore and NRW are already strong, as both share a trade volume of EUR1.4B. Chemicals and mechanical engineering, both key elements of greentech, make up the majority of this. Singapore is one of the most important partners for NRW amongst the ASEAN economies.

Companies from Singapore, such as Green Li-ion, Aerogen, and Niessing, are already working successfully in NRW.

In NRW, you will find an excellent university and research landscape with around 70 institutions that also focus on the circular economy, water technology and resource efficiency. This means that you will find a large pool of highly qualified specialists who are entering the job market with new ideas. Business and science are mutually inspiring. For example, startups and companies from the fields of energy, sustainability and mobility come together

at the Euref Campus in Düsseldorf, which is to develop into a European energy forum. Circular Valley in Wuppertal brings together startups, established companies, science and politics to accelerate concrete solutions and the transition to a circular economy.

International greentech companies are becoming part of a vibrant innovation landscape in NRW.

Advice on the use of renewable energies in industry, apps for digital waste management, increasing the thermal efficiency of buildings by means of more accurate indoor climate data, and innovative coating technologies to make packaging recyclable – these are just some of the technologies that NRW's greentech sector is currently advancing.

Dynamic greentech location

Where so much green transformation is driving an enormously diverse business location in the heart of Europe, NRW.Global Business shows the best way forward and helps international greentech companies find their place amongst the many opportunities. You can't have everything. Except in NRW. NRW.Global Business provides you with competent and trustworthy support to explore your opportunities in NRW and build up your business.

NRW.Global Business ASEAN Service Desk

Sherena Wong Phone: +603 277 453 87 contact@nrwglobalbusiness-asean.com www.nrwglobalbusiness-asean.com

The office in Capital Square features open spaces that encourage interaction.

Etiqa Insurance's new Capital Square office turns its principles of protection, continuity, and customer-centricity into spatial experience.

Sphere-shaped lighting and circular planters symbolise warmth and guardianship, whilst the recurring circular motifs throughout Levels 1 and 2 echo Etiqa’s “with you” brand promise. “The lighting shaped as warm spheres near the entrance represents protection, much like a nest egg,” said Shirley Tan, chief marketing officer at Etiqa Insurance Singapore.

The ground-floor location houses the customer care centre for easier visibility and access, whilst upper floors

5 Open-space collaboration corner at Etiqa's Capital Square office.

6 Meeting room at Etiqa’s Capital Square office, designed with collapsible walls for flexible configurations.

feature open workspaces, flexible layouts, and breakout zones that encourage collaboration.

Meeting rooms with collapsible walls allow reconfiguration for town halls and larger events, supporting agility and teamwork.

The office consolidates all Singapore teams, such as operations, distribution, customer service, and digital innovation-into one environment.

Tan said the space was designed as “a meeting point for the hearts and minds of customers and staff,” reflecting Etiqa’s goal of building a connected, transparent, and human-centred workplace.

It’s also designed to enhance the health and well-being of its occupants.

Paya Lebar Green, the latest office development by Lendlease, combines sustainability, wellness, and advanced digital infrastructure as it positions itself as a premier business destination beyond Singapore’s central business district (CBD).

Tenants can optimise space use and reduce energy costs through smart Internet-of-Things (IoT) sensors embedded throughout the building, Richard Paine, head of development at Lendlease, told Singapore Business Review

“The IoT smart sensors will help the building be climateresponsive and inform tenants on occupancy and the utilisation rate of spaces,” he said in an interview.

Paine said they wanted to make the building as energyefficient in operation as it was during construction.

To minimise environmental impact during the build phase, Lendlease used biodiesel and electric-powered equipment, including battery systems for tower cranes and solar-powered lighting. The building was also built using low-carbon concrete, which traps carbon within the mix, and eco-certified finishes.

These efforts contribute to Paya Lebar Green’s achievement of the Building and Construction Authority (BCA) Green Mark 2021 Platinum-Super Low Energy certification, Singapore’s highest green building standard.

Paya Lebar Green isn’t just energy-efficient; it’s also designed to enhance the health and well-being of its occupants. It earned a WELL Core Silver pre-certification, an international standard for wellness-focused buildings.

1 Paya Lebar Green provides easy access to amenities in and around the precinct.

2 Lobby of the new 12-storey Paya Lebar Green South building.

3 Thoughtful design combining refined aesthetics and technology.

4 Paya Lebar Green North, a fully refurbished 8-storey building.

5 Smart technology for a seamless workplace experience.

6 End-of-trip facilities and shared mobility solutions encourage greener commutes. (Photos by Steve Redstone)

DEAL #1: QUADRIA CLOSED ITS THIRD HEALTHCAREFOCUSED FUND IN MAY AT $1.38B (US$1.07B)

DEAL #2: XCL EDUCATION HOLDINGS RAISED $516M (US$400M) IN A PRIVATE CREDIT FACILITY

The shift reflects resilience in a market where volatility has become the norm.

Fund managers in Singapore are steering more capital into healthcare, education, and technology as private equity firms adjust to slower exits and tighter deal pipelines across Southeast Asia.

The pivot reflects resilience in a market where volatility has become the norm, Bhavik Vashi, managing director for the Asia-Pacific and Middle East and North Africa at Carta, Inc., said.

“Healthcare provides flexibility for both buyouts and growth equity deals, making it especially appealing," he told Singapore Business Review.

Healthcare is amongst the most active private equity sectors this year, with Quadria Capital closing a $1.38b (US$1.07b) fund in May and a Temasek-backed firm acquiring a 16% stake in AC Health, the healthcare arm of Ayala Corp. in the Philippines, in August.

Healthcare accounted for 27% of Southeast Asia’s $1.29b (US$1b) deal value in the second quarter, according to Luke Pais, EY-Parthenon Asean private equity leader, said demand underpins the activity.

“Healthcare has been very active,” he said. “The driver for that is the public wants quality healthcare and people are willing to pay for it.”

He added that universal healthcare schemes in several countries have lifted sector prospects.

KPMG’s head of asset management and private equity, Andrew Thompson, told the magazine that the shift also reflects the expansion of Southeast Asia’s

middle class, which is driving long-term structural demand for healthcare and education.

He noted that as incomes rise, more households are spending on private health and training services. A 2021 United Overseas Bank report projected that 65% of Southeast Asia’s population will achieve middleclass status by 2030, strengthening the investment outlook for both sectors.

Education is steadily gaining traction alongside healthcare, particularly in areas tied to workforce upskilling and lifelong learning. According to Vashi, a combination of policy support and corporate demand are helping the sector become an investment hotspot.

“From an investment standpoint, education has proven relatively resilient during economic downturns, as companies and individuals prioritise skill development to stay competitive” he added.

Prime Minister Lawrence Wong’s National Day Rally 2025 speech reinforced the trend, pledging support for AI workforce training and small and medium enterprise adoption of digital technologies.

Recent deals underscore this momentum. In May, XCL Education Holdings raised $516m (US$400m), in a private credit facility from Apollo Global Management, Inc., Partners Group Holding AG, Deutsche Bank AG, and Nomura Holdings, Inc. By August, Keppel Ltd. announced $6.3b in private funds, partly allocated to education assets and data centres.

Technology investments, particularly in AI and data centres, are accelerating. Vashi said adoption of AI and cloud computing is fuelling stable yields and long-term growth for infrastructure such as data centres.

Justin Tan, a partner and head of Asia-Pacific financial services at L.E.K Consulting, expects Southeast Asia’s data centre capacity to triple to 5.2 to 6.5 gigawatts by 2030, spurred by a tenfold increase in AI computing demand. The broader technology sector is also seeing gains, with areas like software as a service, fintech, and enterprise tech continuing to attract private equity flows.

“AI-driven innovation is no longer viewed as a ‘nice to have’ but as core to the business model, with value creation tied to how effectively companies integrate and scale technology,” according to Vashi. He noted that early-stage AI startups are already securing higher valuations with less dilution, signalling investor confidence that could influence later-stage deals.

Singapore’s startup ecosystem remains strong. Neha Singh, chairperson and managing director of Tracxn Technologies, said private equity firms invested $876m (US$680m) in Singapore’s tech startups in the first half.

Fintech led the activity at $618m (US$480m), followed by enterprise applications at $451m (US$350m), and retail at $386m (US$300m).

“The government aims to foster research and partnerships to scale these sectors further, providing a conducive environment for private equity investments,” she said in an exclusive interview.

Fund managers are increasingly adopting strategies aimed at boosting flexibility. Vashi said secondary transactions and continuation funds, once niche, are now mainstream. These let managers provide liquidity to investors whilst extending the life of assets.

Pais said exits remain sluggish in Southeast Asia. “The exit pipeline is clogged at the moment, and that has affected fundraising,” he said.

“As exits unlock, fundraising will unlock as well, and the cycle will return to normal.”

Secondary deals, where one private equity firm buys from another, are bridging gaps, whilst continuation funds give managers more time with existing assets.

Private credit is another growing strategy. Vashi said its rise reflects Southeast Asia’s maturing private equity ecosystem, offering managers and portfolio companies alternatives to traditional financing.

Fund managers remain cautiously optimistic about Singapore and Southeast Asia’s private equity landscape. Vashi and Singh said stabilising interest rates and improving public markets would support deal activity in the next six to 12 months.

They expect the Singapore Exchange’s push to revitalise listings to further attract quality issuers.

Thompson predicted a pickup in deal flow and exits, noting that Southeast Asia is well positioned relative to China, with lighter tariff exposure and competitive costs. Tan said growth would be concentrated in selected themes such as healthcare, education, and AI.

With fewer free claims, patents are likely to be shorter and easier to interpret.

PROFESSIONAL SERVICES/LEGAL

Singapore is tightening the rules on patent applications by lowering the threshold for free claims and raising related fees, a move analysts say will improve clarity for businesses and make it easier for new entrants to assess potential risks.

For applicants, the higher costs and lower claim allowance will likely push businesses to be more selective.

“This clarity will benefit the innovation ecosystem, including third parties who may wish to enter a certain field, but avoid infringement of existing patents,” Jasper Lim, a partner for intellectual property at Lee & Lee, told Singapore Business Review. Since 1 September, the Intellectual Property Office of Singapore (IPOS) has reduced the number of free claims in a patent application from 20 to 15.

At the same time, excess claim fees will double to $80 per claim. Renewal fees for patents will also rise by about 7%, with increases ranging from $11 to $90 depending on the renewal year, according to Cantab IP.

Patent claims define the scope of protection for an invention.

“Normally, we have one or two independent claims which are the broadest definitions of the invention that the applicant wants to protect,” said Jonas Lindsay, a partner at law firm Marks & Clerk. “Then we have a number of dependent claims that have a narrower scope and include more details about the invention.”

With fewer free claims, patents are likely to be shorter and easier to interpret. Lindsay said this could simplify the process for companies reviewing competitors’ patents when considering whether their own products infringe existing rights.

“For a third party who has a product they want to put on the market, when they look at competitors’ patents, those patents are likely to have fewer claims,” he told Singapore Business Review. “So that process may be simpler.”

“There may also be fewer patents they need to review when conducting a freedom-to-operate exercise to see what patents their competitors hold,”

the Marks & Clerk partner added.

The changes place Singapore below major jurisdictions in terms of claim thresholds. The US allows 20 free claims per application, whilst the UK allows 25 free claims.

Lim said businesses could expect faster outcomes from the application process. “Businesses will obtain their registrations, or clarity that an application is not viable, sooner,” he said in an exclusive interview.

According to Lindsay, the number of claims heavily affects examiner workload at IPOS since each claim must be checked against prior art and existing documents.

“This encourages the patent applicant or attorney to file a relatively small number of claims that precisely define the invention, which potentially makes the examiner’s work smaller so they can process more applications more efficiently,” he added.

The higher renewal fees are also expected to prompt companies to reassess which patents are worth maintaining and can be let go.

Increased renewal fees may lead to businesses abandoning trademark and patent registrations that are no longer in use, which will then free the IP for use by other businesses, Lim said. He added that smaller firms could government support schemes such as the Enterprise Development Grant (EDG) by Enterprise Singapore, the Enterprise Innovation Scheme (EIS) by the Inland Revenue Authority of Singapore, as well as IPOS initiatives like IP Start, the WIPO Inventor Assistance Programme (IAP), and the IP Management Clinic.

Industry experts said the measures would encourage clearer, more concise patent filings whilst keeping Singapore’s intellectual property framework competitive.

Lim also expects the fee adjustments to enhance Singapore’s appeal to foreign investors and multinational companies.

“The fee increases should shorten IPOS’ turnaround times, encourage clear and concise delineation of IP rights and motivate the abandoning of inactive IP, which would allow new entrants more freedom to file new IP and operate in Singapore,” he said.

Seamlessly accept all payments

• Local and international card payments.

• QR payments from local banking apps and mobile wallets as well as overseas payment apps from China, India, Indonesia, Malaysia and Thailand.

Enhance operational efficiency

• Manage your entire store from one integrated POS terminal, with an intuitive digital menu you can customise to fit your exact business needs.

• Receive real-time notifications, detailed transaction reports and settlement updates instantly via our online platform.

• Simplify record-keeping with our digital receipt management system.

Transform how you do business

• Convert your NFC-enabled Android device into a secure, cost-effective POS terminal with our SoftPOS solution.

By Paul Hadjy, Vice President of APAC and Cybersecurity Services at Bitdefender

Cybersecurity can no longer be treated as a reactive discipline. In an era of increasing digital complexity and AI-driven threats, organisations must shift from a “detect and respond” model to a “predict and prevent” mindset. This is not only a technical shift— it’s a strategic business decision that can dramatically reduce risk, preserve brand trust, and deliver measurable ROI.

Gartner® recently projected that “by 2030, preemptive cybersecurity solutions will account for 50% of IT security spending, up from less than 5% in 2024, and replace traditional ‘stand-alone’ extended detection and response (XDR) solutions as the preferred approach to defend against cyberthreats.” 1 This fundamental transition mirrors a growing realisation: In the age of AI-accelerated attacks, reacting to threats after they’ve infiltrated your systems is often too little, too late.

The real risk lurking in your own tools Every organisation today runs on a stack of applications and tools.

It’s alarmingly common for employees to retain access to hundreds of risky utilities and applications they never use—leaving up to 95% of the attack surface unnecessarily exposed. Team changes, project transitions, and special exceptions often lead to a bloated permissions landscape. Each unmonitored app is a doorway for attackers—one they can exploit without setting off alarms.

This is where Living-off-the-Land (LOtL) techniques come into play. These are cyberattacks where adversaries exploit legitimate tools and applications already present in your environment to move stealthily through systems. And this is not an exception; a recent analysis of 700,000 cyber incidents revealed it is now the dominant attack method. Because these LOtL techniques blend in with normal behaviour, these attacks are notoriously hard to detect until damage is done.

The bigger issue? If you manage a growing organisation, you know that exceptions are the norm: people need unique tools, access levels, or workflows. That’s fine—for productivity. But unless you’re proactively managing and reviewing these exceptions, you’re quietly increasing business risk.

A preemptive approach to risk reduction

Bitdefender’s GravityZone PHASR is the industry’s first preemptive cybersecurity

platform designed to shrink your attack surface before an incident occurs. It doesn’t wait for attackers to make the first move—it continuously analyses your digital environment to identify unnecessary exposure through unused applications that are enabled. This approach, known as Proactive Hardening and Attack Surface Reduction (PHASR), gives your leadership team the ability to finally measure the reduction of business risk over time—an ability that’s been elusive in traditional cybersecurity programmes.

With PHASR, executive leaders can confidently say: “We’ve reduced our attack surface by 32% over the past quarter,” or

“We’ve eliminated 12 unnecessary tools or applications with elevated privileges that posed potential breach risks.”

As regulatory environments evolve globally, compliance is no longer just a checkbox—it’s a continuous, auditable process. External Attack Surface Management (EASM) is an approach that provides visibility into your exposed assets—both internal and external—so you know exactly what could be seen and exploited by attackers.

This visibility is not just technical; it’s strategic. When you know which assets are at risk and why, you can align your cybersecurity investments with business priorities and regulatory requirements. This makes your organisation not only safer, but smarter.

Boards and C-level leaders must start treating proactive risk reduction as a strategic lever, not just a technical necessity.

The organisations that succeed over the next decade will be those that recognise this shift early and take action. Thankfully, innovation in security enables leaders to move from guesswork to precision, from passive defence to active risk reduction. It offers the tools to identify weak spots, reduce unnecessary exposure, and prove cybersecurity ROI with clear, quantifiable metrics.

Find out more here on how PHASR redefines endpoint security.

Bitdefender’s GravityZone PHASR is the industry’s first preemptive cybersecurity platform designed to shrink your attack surface before an incident occurs.

Redevelopment interest grows alongside logistics and storage plays.

Industrial sites with potential for redevelopment into worker dormitories are drawing stronger institutional interest, buoyed by Singapore’s construction upcycle and persistent housing demand from foreign workers.

“Alternatives such as worker dormitories remain quite strong,” Yangliang Chua, head of research and consultancy for Southeast Asia at Jones Lang LaSalle, Inc. (JLL), told Singapore Business Review. “The state is also making significant capital investments in road improvement works and other infrastructures, ensuring steady demand for foreign workers," he continued.

“On top of that, policy measures will continue to support the demand for worker dormitories. This is not just for construction workers, but increasingly for healthcare and other activities, which will further support this cluster of demand,” he added.

Singapore’s construction industry is projected to grow 4.1% annually through 2029, supported by projects such as Changi Terminal 5, according to Research and Markets. That growth is already translating into pressure on worker accommodation.

The city-state had 1,441 facilities providing 439,198 beds as of end2024, according to a report by the Dormitory Association of Singapore Ltd. and Knight Frank LLP. Purposebuilt dormitories accounted for almost two-thirds of capacity.

Occupancy remained tight at 96.7% on average, with monthly rents climbing to $390 to $510 per bed, averaging $460—well above $270 before the COVID-19 pandemic. Central locations commanded the highest rents at $510 per bed.

To ease the shortage, the Ministry of Manpower announced in April that six new purpose-built dormitories would add 45,000 beds over the next six years, starting with a 2,400-bed facility at Jalan Tukang in early 2026.

“Worker’s dormitories may offer attractive returns amidst the shortage of beds and construction boom, and Singapore’s reliance on foreign

workers,” Catherine He, head of research at Colliers Singapore, said in an exclusive interview.

Best-performing segments

Beyond dormitories, investor interest is expanding across logistics, cold chain, and self-storage, Shaun Poh, Cushman & Wakefield’s executive director of capital markets, told Singapore Business Review.

“Investors are expected to show keen interest in industrial sites that offer redevelopment opportunities or can benefit from asset enhancement initiatives,” he told the magazine.

He added that industrial properties remain one of the best-performing segments in Singapore’s property landscape, backed by “secular tailwinds such as e-commerce, life science, and the expansion of highvalue manufacturing.”

Industrial yields are at 6% to 7%, higher than office at 3.5% to 4.5% and retail at 4% to 5%, making the sector particularly attractive to investors.

Alan Cheong, executive director for research and consultancy at Savills Singapore Pte. Ltd., said yields remain higher than borrowing costs, which makes the sector very attractive to foreign investors.

JLL data showed $1.9b in industrial transactions were recorded in the first half of the year, or 14% of all

investment sales.

Major deals included CapitaLand Ascendas REIT’s $245m acquisition of 5 Science Park Drive, its $455.2m purchase of Galileo-Tele Centre, along with Brookfield Asset Management’s $280m acquisition of The Strategy office complex.

“Industrial is the stronger player in the market right now because logistics spaces as well as manufacturing spaces have continued to outperform,” Chua told the magazine.

Colliers’ He noted that many buyers acquire industrial assets for their own use, but “assets with potential for redevelopment or change of use are seeing growing popularity.”

Hotels are one example. Poh said hotels with potential for repositioning into co-living spaces are increasingly becoming attractive.

“The co-living sector is gaining traction as a preferred investment option amongst institutional real estate investors, who are drawn to its potential for steady and recurring income streams,” he said.

Retail properties, especially Tier 1 suburban malls near rail stations, remain another focus. Vacancy in suburban retail stood at just 5.2% as of the second quarter, the lowest amongst all retail submarkets.

“Investors are targeting toptier suburban malls that offer

at 96.7% on average

opportunities for value-add, drawn by their stable performance and scarcity,” Poh said. JLL reported that average rents for prime suburban retail space rose 1.7% year-on-year in the first half to $37.72 per square foot per month.

Cheong expects retail deal activity to rise, with borrowing costs dipping into the low threes whilst yields remain above 4%. The narrowing gap is also reviving interest in offices.

“Office yields have been in the 3.25% to 3.5% range, whilst borrowing costs have remained well above that,” he said in an interview. “As of late, borrowing costs have fallen, and we may see some transactions in the office space moving forward.”

He added that buyers might gravitate towards strata offices, buying them for their own use.

Chua and Poh said the office market is interesting to watch given stable leasing momentum despite hybrid work. Grade A rents in the central business district (CBD) are still edging higher, with vacancy at 5.2% in the second quarter.

“Given the constrained office supply pipeline and office net yields potentially starting to exceed borrowing costs, Singapore's office market is steadily coming back onto

the radar of institutional investors,” according to Poh.

JLL projects just 5 million square feet of new office supply between the years 2025 and 2029.

“In 2026–2027, there will be very limited new supply,” Chua said. “Some larger projects are expected in 2028, but these will mostly be in the suburban areas. Over this time horizon, I believe there is potential for leases to strengthen.”

Investors should also look beyond the downtown core, he said, citing the government’s polycentric development model under the draft Master Plan 2025. Bishan, for example, has been earmarked for 2 million sq ft of office space, a polyclinic, and a new hawker centre.

“If you follow the latest Master Plan, you’ll notice an emphasis on new growth areas,” Chua said. “The government is taking a polycentric approach to urban development, with activity centres spread across the island,” he continued.

This points to investment prospects beyond the downtown core.

Whilst established funds may continue to concentrate on CBD assets, outlying areas also present strong potential, he pointed out.

The strata commercial market is expected to see more activity in the coming months, lifted by various factors such as lower interest rates that have boosted investor returns.

“We see more strata-titled properties being put on the market as owners who have held these assets for some time look to extract profit, given the stable capital growth over the years,” Daphne Poh, capital markets director at Cushman & Wakefield Property Services (Singapore) Pte. Ltd., told Singapore Business Review

Older trading firms and private families are emerging as the main sellers of units in larger buildings, often in preparation for retirement or succession planning.

Huttons Asia Pte. Ltd. Chief Executive Officer Mark Yip noted that strata offices continue to draw “steady interest,” though supply remains limited. Amongst recent offerings are 108 Robinson Road, 137 Cecil Street, Ascent 456, Fortune Centre, One Sophia, The Golden Mile, and Visioncrest.

“Declining interest rates have resulted in positive carry for funds, and that is spurring demand in the strata office market,” he said in an interview.

Knight Frank LLP recorded 189 strata office transactions in the first half of the year worth $699.6m, including 15 deals above $10m.

Notable transactions included multiple units at 20 Collyer Quay ($91.8m), Tokio Marine Centre ($67.5m), as well as 108 Robinson Road ($55.8m).

Beyond offices, co-living is emerging as a growth area. Investors are shifting into the hospitality-led housing segment, with Jones Lang LaSalle, Inc. (JLL) reporting more than $1.4b in co-living deals since 2022.

Retail is also evolving. According to JLL Senior Director Zoe Ho, demand is moving away from traditional shopping formats towards mixeduse, lifestyle-driven spaces that blend retail with entertainment and community elements.

In the industrial sector, Cushman & Wakefield Director for Industrial Leasing Darren Lu sees stronger activity in data centres and high-specification assets, spurred by growth in technology, artificial intelligence, and life sciences. Ho added that life-science real estate would benefit from ageing populations and biotech advances.

These buildings let tenants tell their stories in ways conventional buildings cannot.

Heritage shophouses in Singapore are attracting renewed interest from luxury, wellness, and lifestyle brands, as developers restore conserved buildings to create distinctive retail and dining experiences that modern structures cannot replicate.

Real estate investment firm 8M Real Estate, whose portfolio is 90% shophouses, said these properties allow tenants to tell their brand stories in ways conventional buildings can’t.

“They are seeking very unique locations, especially those with heritage or with a rich culture or history behind them,” Xin Rui, executive director of asset management at 8M, told Singapore Business Review in an interview.

“For them, it is important because they want to connect with the local markets,” she continued.

Beyond food and beverage, operators in the wellness industry are moving into heritage units.

“One of the trends that has been growing in recent times is the wellness industry — for example, fitness and sports recovery,” according to Rui, noting that such tenants value community connection.

Other experiential concepts, such as pottery studios and DIY (do-ityourself) craft shops, are also driving demand for shophouses.

Mary Sai, executive director of capital markets at Knight Frank Singapore, described heritage shophouses as “trophy assets” whose prices have been climbing in the past 15 years due to factors like scarcity and the branding benefits of enclave gentrification.

High-net-worth people and family offices often accept lower yields in exchange for capital preservation and prestige ownership, she said.

Conservation rules keep supply tight, which supports long-term values, said Yap Hui Yee, executive director of investment sales and capital markets at Savills Singapore. Shophouses’ flexibility— accommodating uses from retail and

offices to hotels or serviced residences with approval—adds to their resilience.

Compared with other property types, they typically offer lower returns but higher potential for capital gains over time, Sai said.

“They carry higher illiquidity risk but are typically not affected by supply cycles that are characteristic of other asset types, such as offices.”

interest

Darren Sabom, managing director of investment management at 8M, said his firm is moving from acquiring single units to buying entire rows or blocks, such as a cluster of 15 shophouses in Tanjong Pagar, to create distinctive precincts.

Whilst these properties can be costly to adapt, the payoff is in the unique atmosphere they create.

“A high-end restaurant in a shophouse provides an authentic experience that you don’t get in a hotel or office building,” the managing director said.

Institutional investors including 8M Real Estate, Clifton Partners, as well as HSBC Asset Management have built significant shophouse portfolios, reflecting growing confidence in the asset class amongst major players.

Foreign interest has also increased alongside the expansion of family

offices in Singapore, which now number over 2,000.

Many buyers see shophouses as a hedge against currency depreciation and political uncertainty, especially since the COVID-19 pandemic.

Strict Urban Redevelopment Authority conservation requirements limit redevelopment and can make renovations costly, especially when preserving heritage facades with modern materials.

Even after upgrades for fire safety, accessibility, and mechanical systems, maintenance continues.

Yap cautioned that a property’s approved use can be a major risk. Converting ground-floor spaces to food and beverage outlets, for instance, requires official approval and may be rejected.

“To avoid costly surprises, it is advisable to engage an experienced shophouse broker who can verify permissible uses and guide investors through the regulatory process,” she told the magazine.

8M has tried to align each site with its neighbourhood’s cultural identity during tenant curation.

“We look at the location, the neighbourhood’s unique culture and identity, and also accessibility,” Rui said.

In search of the most notable real estate agents under 40, Singapore Business Review reached out to more than 35 property firms in the city-state.

After rigorously reviewing submissions from the firms, 10 women and 10 men made it to the final cut.

Agents on this year’s list come from Cushman & Wakefield, Huttons Group, JLL, MindLink Groups Pte Ltd, OrangeTee, and Savills. Leading the pack are Huttons Group and OrangeTee, with six representatives each. The youngest on the list is from JLL.

Realtors in the residential market took the lead, taking nine spots.

This year’s honourees are million and billion sellers and have handled big clients such as Maritime Port Authority, National Environment Agency, Ho Bee Land, CapitaLand, JTC, P&G, and LVMH.

Notable deals by this year’s honourees include the sale of an office floor at Solitaire on Cecil, which achieved the highest per square foot price ever recorded for a full floor in the Central Business District.

Here are this year’s honourees, arranged from youngest to oldest.

Chloe has been on JLL's Office Leasing Team for a year, after spending two years in Project and Development Services. She has quickly established herself as a valuable professional, building strong client relationships and contributing to the team's success. As both a tenant and landlord representative, she has gained a comprehensive understanding of the market. Chloe's notable transactions include closing 25 deals totalling around $780,000 with deals in key buildings like IOI Central Boulevard Towers and Millenia Tower.

Felicia has over seven years of real estate experience, specialising in tenant and landlord representation. She has successfully managed the full transaction cycle for numerous high-profile projects. Clocking 150,000 square feet in annual transactions, her track record includes major clients like Hewlett Packard Enterprise and Horiba. She has also secured exclusive mandates with CapitaLand and JTC, consistently driving higher occupancy rates. As a trusted adviser, Felicia provides market research and consultancy reports.

Esther specialises in Singapore's commercial office leasing market, bringing a 360-degree perspective from her work in both landlord and occupier representation. She has been the top-earning non-director-level broker for two years in a row. Her notable landlord representations include prominent buildings such as One George Street, Keppel South Central, and Hong Leong Building. On the occupier side, she has represented major corporations across diverse sectors, including AIG, ANT Financial, AET Tankers, and IPG. Esther delivers tailored real estate solutions by strategically understanding clients' business objectives.

Jian Hao is a direct and results-driven agent known for his straightforward approach to difficult listings. With a year of experience at his current firm, he believes every property is sellable. His recent transactions highlight this tenacity, including the sale of a mid-floor unit at Penrose that faced the PIE expressway, amounting to $2.03m, which he sold above the highest previously transacted price for that stack. He has also successfully moved other "difficult" units, including a property in Jurong West amounting to $775,000, earning a reputation for delivering results in the toughest deals.

Sophia has been in real estate since 2017 and, in just eight years, has risen to lead a dynamic team while consistently ranking as a top achiever. Known for her sharp market acumen and strategic thinking, she has achieved record prices in competitive segments, swiftly secured tenants for challenging commercial spaces, and guided clients toward cost-saving financing solutions. Notable deals include selling her first strata shop at 2 Fowlie Road within a month above expectation and assisting an overseas client to purchase Park Place Residence fully online. With nearly 200 transactions, Sophia continues to earn lasting client trust.

Zen is a results-driven real estate leader known for strategic thinking and a deep commitment to client success. With a strong track record in both residential and investment sales, he has achieved above-market prices for sellers and secured premium properties for buyers. Notable achievements include helping clients acquire two units at Jalan Terang Bulan Terrace for $5.7m, negotiated $300,000 below asking against competition, and securing a record-price rental at 28 Imperial Residences within a month through effective staging. With ethical practices, transparent communication, and sharp market analytics, Zen has earned a reputation as a trusted adviser in Singapore’s real estate market.

Qing Jie joined the industry in 2017, bringing his economics and finance background with a genuine passion for helping his clients. A consistent top achiever since 2020, he led as Project IC for the remarkable launch of Lentor Central Residence. His highlights in 2025 include achieving record price at Sims Urban Oasis within a month and realising close to $1m profit for a family that moved to Cabana from their Punggol HDB several years ago. Valued for his honesty and clientfirst approach, Qing Jie makes complex transactions seamless and rewarding. He has also consistently achieved premium sales prices for his clients, often well above market expectations.

Since entering real estate in 2020, Sam has quickly emerged as a high-performing leader with a proven track record in both residential and investment deals. Known for reliability and client trust, he now leads a dynamic team with fresh perspectives and a collaborative spirit. His portfolio showcases standout achievements, including securing a record-high $1.86m sale for a 3-bedroom unit at Sunny Spring Condo for Mdm Rosni and negotiating a rare 2-bedroom patio unit at Miltonia Residence below market value for Mr Lim. With sharp marketing strategies and market analysis, Sam consistently delivers optimal outcomes for first-time buyers, investors, and upgraders.

For Clarie, real estate is about people and relationships. Over the years, he has built a reputation for integrity and genuine commitment to clients. Clarie leads a team of 25 agents. Specialising in Singapore’s core central districts, he primarily serves highnet-worth clients, offering well-researched advice. A key milestone was the $4.8m sale of a home in Tribeca by the Waterfront, completed without any physical viewing. Another notable deal was the $6.08m sale of a unit in Volari, the highest transaction in the development. Clarie's success is rooted in his service-first approach and a focus on building long-term relationships.

Jon is consistently ranked amongst the top producers, with a strong track record in both residential resale and new launch markets. One of Jon’s most fulfilling transactions involved helping a young couple upgrade their home. Through detailed planning, timeline mapping, and financial analysis, he guided them to sell their existing unit within a day, securing a $1.56m unit at Sol Acres at one of the lowest PSFs, and building a financial safety net for eight years. He also guided a client with a $3.5m budget for a 3-bedroom resale condo to instead secure a brand new 5-bedroom at Parc Komo for about $3m.

Adora has built a decade-long career in real estate since joining the company in 2014. She quickly established herself as a trusted adviser and team leader, combining sharp business acumen with a results-driven approach. As Lead IC for the RiverGreen launch, she steered a high-performance campaign that exceeded sales projections. Her track record includes achieving a record-high $1.13m sale for a 4-room HDB at Skyville@Dawson and securing a $3.2m dream home at Nava Grove. Known for her patience and meticulous attention to detail, Adora delivers standout results while mentoring a growth-oriented team and inspiring client confidence.

12 Damien Tan 35, OrangeTee & Tie Pte Ltd

Within just three years in real estate, Damien has established himself as a dynamic young leader and consistent top achiever. He achieved over $100,000 in sales commission in a single month and leads the high-profile One Marina Garden project while also serving as Project IC for Elta. His portfolio spans both new launches and resale, including helping buyers secure a prime unit at One Shenton in District 1 below listed price and closing dream homes in launches such as The Opus. Known for persistence, patience, and sharp analysis, Damien consistently exceeds expectations while delivering exceptional client service.

15 Zoe Ho 36, JLL

With 14 years of experience in the commercial real estate sector, Zoe has built a reputation for excellence through her expertise in market dynamics and client relationship management. Zoe's portfolio includes numerous highprofile transactions, with notable tenant representations for multinational corporations such as P&G, LVMH, Moet Hennessy, and Ripple. She has also successfully represented prominent landlords, including 18 & 20 Cross Street, 60 Anson Road, and Shaw Tower. Her consultative approach and commitment to client service have been instrumental in driving significant value in Singapore's competitive office market.

13 Frederick Neo 35, Huttons Group

Since entering real estate in 2021, Frederick has emerged as a consistent Top Producer and Huttons Rising Millionaire. A former research engineer, he applies his analytical mindset and practical approach to guide clients in making confident property decisions. His business acumen and creative marketing have driven record-breaking results, including a $4m landed home sale at Springleaf estate despite its challenging traits. Beyond sales, his investment foresight has grown clients’ wealth, such as an HDB upgrader’s $3m Parc Clematis purchase that appreciated by $700,000 in under three years. Today, Frederick leads a dynamic team of 13, championing collaboration and growth.

16 Foo Shi-Yin Samantha 36, Savills