AUSTIN BUTLER WEARS

GranTurismo Trofeo fuel consumption in l/100 km: combined 10.1 – 10.0; CO2 emissions in g/km: combined 229 – 226; CO2 class: G

WATCHMAKING ONCE AGAIN FINDS BRITISH SHORES

The Limited Edition Bremont Longitude is a groundbreaking timepiece that not only looks back at our country’s legacy but also forward to an exciting future of British watchmaking. The watch’s case back incorporates brass from the original “Flamsteed Line,” in Greenwich, the very spot where the first Astronomer Royal made his celestial observations in pursuit of an aid to navigation.

It has long been the goal of Bremont to bring watch manufacturing back to Britain. The Longitude represents a milestone in that journey, a homecoming of sorts, and proof that, to get where you’re going, you need to know where you came from.

First Thoughts

The World Trade Organization (WTO) suggests that artificial intelligence (AI) could boost global trade by a significant 37 percent by 2040. The projection is genuinely exciting and points to a more interconnected, efficient global economy. Yet the WTO’s accompanying warning—that these advances could exacerbate global inequality—deserves immediate, thoughtful attention. The potential for a new era of prosperity is undeniable, but it carries a serious risk of deepening the divide between the world’s haves and have-nots.

AI’s promise lies in its ability to automate complex tasks, optimise supply chains with unprecedented precision, and sharply reduce the costs of international transactions. Such gains can unlock new markets and opportunities, particularly in services. However, benefits are unlikely to be distributed evenly. Wealthier nations, with robust digital infrastructure, access to vast datasets and established technology industries, are best placed to invest in and deploy advanced systems. Their corporations will gain a substantial competitive edge in efficiency, innovation and market reach.

By contrast, developing countries—and smaller businesses in emerging economies—may struggle to keep pace. Many lack the financial capital, technical expertise and foundational digital infrastructure required to adopt and integrate sophisticated technologies. As a result, the very tools that promise a more connected world could, ironically, widen the economic gap. There is a genuine risk that AI centralises economic power rather than democratises it, leaving many nations and communities on the margins of the new global trade landscape. Higher trade volumes are not inherently positive if the gains accrue to a narrow cohort while others fall further behind.

To ensure the benefits of AI-driven trade are more broadly shared—and to mitigate the risk of widening inequality—policy must prioritise equitable access and skills development at global scale. That requires

coordinated action by governments, international organisations and the private sector.

Promote open-source AI and data sharing. High costs and proprietary software remain binding constraints for developing nations. Governments and multilateral bodies should advocate for—and fund— the development of open-source models and platforms to widen access and reduce dependence on a few dominant firms. Shared data repositories and rulesbased, international data-sharing agreements can help level the field, ensuring that valuable data—the fuel of AI—is not hoarded by a handful of entities.

Invest in digital infrastructure. Many developing nations lack the basic building blocks—reliable internet, modern data centres and secure power grids—needed to leverage AI. International development finance and public–private partnerships should be strategically directed to these foundations. Without them, AI adoption remains theoretical for large parts of the world. Such investment is about more than technology; it creates the essential pathways for economic participation.

Support AI education and training. An AI-enabled economy will demand new skills. Global programmes to build AI literacy and technical training in developing markets are critical. Priorities include investment in vocational pathways, partnerships between universities in developed and developing countries, and accessible online learning. The focus should be on upskilling and reskilling workers to move from automatable roles into higher-value tasks that involve creating, managing and leveraging AI—empowering individuals and nations to participate actively rather than remain passive bystanders.

By taking these steps, stakeholders can work towards a future in which AI supports inclusive growth and shared prosperity, rather than entrenching existing inequalities. The WTO’s warning is not a cause for despair but a clear call to action—one that demands thoughtful, collaborative and forward-looking policy.

Correspondence

“ “

I am writing in response to the recent actions taken by the administration regarding the H-1B visa programme and the simultaneous announcement of the "Trump Gold Card" visa. This latest development represents a concerning and contradictory shift in U.S. immigration policy.

The core issue is one of fairness and national priority. On one hand, the administration proposes to drastically hike the H-1B fee to $100,000 for new applicants, effectively placing a punitive tax on companies seeking to hire highly skilled workers. This move will disproportionately hurt smaller businesses, start-ups, and non-profits, while forcing the entire programme away from being an essential tool for filling genuine skill gaps and into an unaffordable burden.

On the other hand, we see the creation of the Gold Card program, which grants an expedited path to residency for individuals willing to make a $1 million financial contribution.

This dual approach sends a clear and troubling message: the door is being slammed shut on skilled professionals who seek to come to the U.S. to work and create value through their expertise, while simultaneously being opened wide to those who can simply buy their way in.

The U.S. immigration system should be based on merit, skill, and the needs of the economy, not on auctioning off residency to the highest bidder. If the goal is to protect American workers and raise wages, the focus should be on reforming the H-1B to prioritise salary levels and genuine shortages, not replacing a flawed system with one that exchanges skill for cash.

This policy direction prioritises the collection of revenue over attracting the globally competitive talent and innovation necessary for our long-term economic prosperity.

GLEN RIVERS (Portland, Oregon, US)

The recent State Visit by President Trump was, quite simply, a masterclass in international diplomacy and tradition, showcasing the unrivalled pomp and ceremony for which Great Britain is justly famous. It was a truly breathtaking spectacle that served as a powerful reminder of the enduring, majestic quality of the British Monarchy.

No other nation can execute such high-stakes pageantry with the seamless precision and historic depth demonstrated last week. The sight of the President and First Lady being escorted by the Household Cavalry in gilded carriages to Windsor Castle—a fortress of a thousand years of history—was utterly captivating. The sheer scale of the ceremonial welcome, involving over 1,300 troops and 120 horses, set a new benchmark for diplomatic grandeur.

The attention to detail, from the 41-gun Royal Salute to the special exhibition of items from the Royal Collection connecting U.S. and British history, transcended mere formality; it was a profound gesture of respect for the Anglo-American alliance. The evening State Banquet, with its white-tie formality and speeches in St George’s Hall, served not merely as a dinner but as a potent theatrical display of soft power.

In a world increasingly dominated by digital communication and casual politics, Britain's commitment to such historic rituals provides a vital grounding point. This glorious spectacle reminds global leaders—and the public— of the stability, continuity, and solemn gravity underlying the relationship between our two great nations. It is a diplomatic tool that no amount of economic or military might can replicate. The pomp endures, and long may it continue to do so.

GRAHAM MILES (Adelaide, Australia)

I am writing to you regarding the inclusion of yet another piece—this time focused on "Meghan's Brand Narrative"—in your recent summer issue.

“With the greatest respect to your publication's thoughtful coverage of wider business and cultural topics, I must confess that I have reached a point of profound media fatigue with the constant analysis, dissection, and promotion of every step taken by the Duchess of Sussex, whether it be a new product line or a subtle shift in public persona.

Frankly, I am simply not interested.

I suspect I am not alone among your readership in feeling that this continuous coverage has become a tiresome echo chamber. While I appreciate that the Sussexes generate clicks and sell copies, there is a substantial audience in the UK that is exhausted by the incessant focus and would prefer our national conversations—and indeed, your magazine’s editorial space—to be devoted to more substantive, pressing matters.

The concept of her "brand narrative" feels increasingly tenuous and irrelevant to the concerns of everyday British readers. I sincerely hope that in future issues, your publication will cease to give this matter any further air and redirect your considerable journalistic talents toward subjects that truly warrant our attention.

CLAIR GREGORY (Portsmouth, UK)

I read your recent First Thoughts editorial on the future of remote working with great interest and appreciation for its thoughtful and well-reasoned perspective. The piece rightly highlighted the complexities and benefits of flexible working models, and the significant shift in employee expectations.

“However, I must respectfully disagree with the prevailing notion that employees should be the primary arbiters of where work is performed. While flexibility is a valuable benefit, ultimately, the decision to mandate a return to the office, a hybrid approach, or full remote work must remain with the employer.

A company's location strategy is intrinsically linked to its operational requirements, culture, team synergy, security needs, and ultimately, its commercial success. These are factors best understood and managed by the leadership responsible for the organisation's overall performance.

Offering remote work is a business decision, not an inherent employee right. When a business decides on its working model—be it a full return to the office or a different arrangement—it is setting the conditions of employment. The onus is then on the employee to decide whether those conditions are acceptable. They are, of course, entirely free to seek employment elsewhere if they are not.

By placing the final say with the employer, we ensure that the working model aligns with the organisation's strategic goals, while still respecting the fundamental principle of choice for the individual: stay and accept the terms or seek a new opportunity.

BERNARD JONES (Devon, UK)

IBM Thought Leadership Transparency Makes the Invisible Hand Visible Again,

And Inclusive

Paolo Sironi

Editorial Team

Sarah Worthington

George Kingsley

Tony Lennox

Brendan Filipovski

John Marinus

Ellen Langford

Helen Lynn Stone

Naomi Snelling

Columnists

Otaviano Canuto

Lord Waverley

Production Director

Jackie Chapman

Distribution Manager

William Adam

Subscriptions

Maggie Arts

Commercial Director

John Mann

Director, Operations

Marten Mark

Publisher Anthony Michael

COVER STORIES

Paolo is the global research leader in Banking and Financial Markets at IBM, Institute of Business Value. IBV is the thought leadership centre of IBM. by

Sironi

Capital Finance International

Meridien House

69 - 71 Clarendon Road

Watford WD17 1DS

United Kingdom

T: +44 203 137 3679

F: +44 203 137 5872

E: info@cfi.co

W: www.cfi.co

Otaviano Canuto The Global Economy

Paolo

Berenberg

SegurCaixa

Sironi

Paolo is the global research leader in Banking and Financial Markets at IBM, Institute of Business Value. IBV is the thought leadership centre of IBM. by Paolo

> Paolo Sironi: What Derailed Banking Modernisation

— And a Way Forward

Cloud-native modernisation of core banking remains a priority investment as institutions try to escape the limits of legacy architectures, embrace realtime processing, and open up to the API economy. Yet, while most banks expect higher cloud adoption and are re-platforming core operations, the last decade is littered with false starts. IBM Institute for Business Value (IBM IBV) research, based on a survey of 500 Chief Information Officers globally, shows initiatives have frequently gone off the rails for the same three reasons: escalated costs, delayed timelines, and underwhelming outcomes.

ESCALATED COSTS

More than half of CIOs report that modernisation has cost far more than planned. The drivers are familiar. Unforeseen security issues were cited by 56 percent; the complexity of untangling critical dependencies and legacy systems by 53 percent; and shortages of cloud skills by 52 percent. Programme budgets are further strained when economic models for technical consumption collide with traditional subscription practices. Vendors’ transaction-based pricing can misalign with business reality: a shift from batch to realtime payments lifts transaction counts while lowering average values, creating new peak periods. Margins per transaction shrink, but platform costs do not fall proportionately.

BREAKING THE MODERNISATION BOTTLENECK

Fintech’s pace of innovation pressures banks to accelerate core modernisation for operational efficiency, but delays steadily erode competitiveness. In multi-year programmes, budgets overrun as platform ownership and upgrade costs rise—reported by 51 percent of CIOs. Thirty-eight percent point to system complexity that forces continual task and timeline re-planning, while 37 percent highlight rigid operating models that resist new workflows. Extended timelines create a dangerous illusion of safety: leaders believe they have time, but delivery slippage outpaces decision-making and value capture.

BURNING THROUGH BILLIONS — FOR MIXED RESULTS

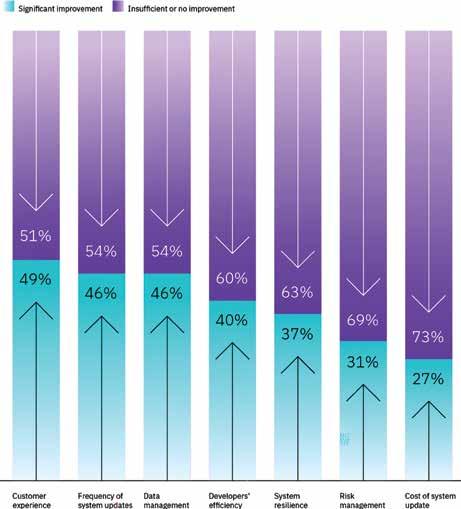

Despite heavy investment, more than half of CIOs say outcomes have been underwhelming, and some report degraded operational capability. There is, however, a clear bright spot: nearly half of banks that pursued aggressive “front-toback” modernisation, coupled with calibrated “back-to-front” transformation, report tangible

Figure 1: Key causes of delay in multiyear projects of core banking modernisation

gains. Forty-nine percent cite improved client experience via real-time capability; 46 percent report more frequent updates through agile deployment; and 46 percent say cloud-native analytics have accelerated data access.

Set against those gains are persistent headwinds. Seventy-three percent say system update costs have risen due to vendor lock-in and limited process portability. Sixty-nine percent report greater riskmanagement complexity in cloud environments.

Sixty-three percent have seen platform resilience dented by unstable data centres. Success is achievable—but the gradient is steep.

CRITICAL LESSONS TO ACCELERATE SUCCESS

The glass is, nonetheless, half full. The IBM IBV findings surface three practical shifts that can reset programmes and shorten the path to value.

First, design hybrid cloud intentionally. Choose platforms proven for high-frequency transaction

"Years of uncoordinated application evolution leave banks with opaque interdependencies. AI-assisted discovery can identify and optimise these linkages, decoupling services from the core."

loads, and build governance in from the start so resilience, scalability, and cost visibility are engineered—rather than discovered late as “surprises”.

Second, lean on industry standards to de-risk migration. A thorough mapping of legacy estates against standard process and data models clarifies hidden complexity, avoids bespoke traps, and reduces cut-over risk.

Third, use AI for dependency management. Years of uncoordinated application evolution leave banks with opaque interdependencies. AI-assisted discovery can identify and optimise these linkages, decoupling services from the core. This is no longer speculative: in 2025, 51 percent of CIOs already use AI to accelerate IT development, and 92 percent expect to do so by 2028.

BUILD AN ASYMMETRIC ADVANTAGE WITH AI

AI can be the difference between yet another rewrite and a genuine step-change. Core platforms often conceal decades of business logic in dense, monolithic code with poor traceability. As experts retire, tacit knowledge disappears and technical debt compounds. Agentic AI— embedding orchestration logic above the core— can convert implicit know-how into explicit artefacts, speeding code translation and creation while preserving system intent. Done well, this becomes an asymmetrical advantage: faster modernisation with lower regression risk.

The risks are real. Without architectural clarity and senior engineering oversight, generative tools can amplify complexity, mask security flaws, and weaken resilience. Automated code without robust review is how banks drift toward an “event horizon” where complexity devours

value. Strategic adoption—pairing AI speed with reference architectures, testing discipline, and clear quality gates—is essential. Think of it as training for a diving competition: AI can raise the platform, but you still need to know how to swim.

THE NEW REMIT: FROM RISK MANAGER TO AI RISK MANAGER

In the AI era, every banker—and especially every CIO—must evolve from traditional risk manager to AI risk manager. That means governing model bias, data provenance, drift, and explainability alongside cybersecurity and operational resilience. It means treating responsible AI as an enterprise control system, not a compliance afterthought.

Banks that internalise these lessons have a credible route out of the modernisation maze: architect hybrid cloud deliberately; standardise to simplify; apply AI where it clarifies, not where it obscures; and govern the whole with the same rigour used for capital and liquidity. Do that, and cloud-native core modernisation can finally deliver its promise: real-time capability, faster change, lower run-costs, and a platform that compounds value rather than cost. i

Readthefullreport:ibm.biz/core-banking

ABOUT THE AUTHOR

Paolo Sironi is the global research leader in banking at IBM, the Institute for Business Value, and he is author of business literature. His latest Banks and Fintech on Platform Economies has been Amazon bestseller in banking books worldwide.

Figure 2: Not even in one category do the majority of banks report modernisation benefits

Author: Paolo Sironi

De-risking Urban Water Infrastructure: Freetown’s Blue Peace Financing Model

In the hills and crowded valleys of Freetown, Sierra Leone’s bustling capital city, access to safe and reliable water remains one of the city’s most persistent challenges.

Following the civil war, rapid urbanisation, an overstretched public utility system and climate-related pressures have left thousands of Freetonians (mostly women and youth) vulnerable to the daily struggles of finding clean water.

Access to clean water in Freetown remains a major challenge. According to a 2015 report by the African Development Bank, only 11 percent of Sierra Leoneans have water on their premises, while 58 percent rely on unsafe sources. The Blue Peace Financing Initiative seeks to change this by investing in solarpowered water kiosks and public toilets across the city. This initiative not only enhances water access but also reduces carbon emissions by reducing reliance on fossil-fuel-based power or grid electricity. Early evaluation of kiosk usage in Freetown shows measurable benefits: a 0.6 percent improvement in microbial water quality and an 8.2 percent uplift in household water security metrics.

Amid these challenges, a quiet revolution is underway. The Freetown Blue Peace Financing Initiative, a pioneering collaboration between the United Nations Capital Development Fund (UNCDF) and the Freetown City Council (FCC) funded by the Swiss Agency for Development and Cooperation (SDC) and further supported by United Nations Peacebuilding Fund, is changing how the city approaches water access and infrastructure financing.

By combining concessional financing tied to sustainability outcomes with communitydriven service models, the initiative integrates solar-powered water kiosks to reduce carbon emissions while expanding access to water to local communities.

These design choices were built into the project’s financing framework, making

environmental sustainability a core condition of capital deployment. Revenue projections from affordable water sales demonstrate the initiative's potential to generate returns and support FCC’s long-term investment case, showcasing how UNCDF’s early-stage investments can de-risk public infrastructure and catalyse financially viable, socially inclusive solutions.

INVESTING IN CLIMATE-SMART INFRASTRUCTURES

UNCDF provided a $1.1 million reimbursable grant to the Freetown City Council, marking the first time the Council was able to access this form of catalytic financing to build its credit profile and demonstrate financial readiness for future investments. Building on this momentum, UNCDF, through the Peacebuilding

Secretariat, successfully mobilised an additional $1.49 million grant from the United Nations Peacebuilding Fund, crowding in new capital to deepen the initiative’s impact.

The Blue Peace Financing Initiative, which commenced in 2020, seeks to change this by investing in solar-powered water kiosks and public toilets across the city. This initiative not only enhances water access but also reduces carbon emissions by reducing reliance on fossil-fuel-based power or grid electricity. Early evaluation of kiosk usage in Freetown already shows measurable benefits: a 0.6 percent improvement in microbial water quality and an 8.2 percent uplift in household water security metrics.

"Mexico is modernising to sustain manufacturing leadership and capture near-shoring under USMCA. The Maya Train integrates

Completed water kiosks in Freetown, Sierra Leone, September, 2025. Photo credit: James Kabia/UNCDF.

WOMEN-LED OPERATIONS

The project places communities at the centre of decision-making. Local councillors and 746 residents from 24 neighbourhoods actively participated in selecting kiosk locations, ensuring that the infrastructure serves the greatest number of people. Public agreements were signed in community meetings, fostering trust and collaboration. As Aminata Bangura, a community leader from Crab Town, Lumley, notes, "We feel heard and valued, which motivates us to support the initiative fully."

For the first time in Freetown’s history, women are not just water collectors but operators of the water kiosks, a shift that directly challenges the traditionally male-dominated water value chain. In the past, women and girls, despite being the primary users of water, were relegated to the role of carriers, facing significant vulnerabilities, including sexual exploitation and abuse as they had to trade their bodies for access to scarce water resources.

The Blue Peace Financing Initiative is turning this dynamic on its head by placing women at the forefront of water access and management. With 20 water kiosks already handed over to women-led operations, these kiosks empower women with both economic independence and decision-making power. As Hawa Kamara, a kiosk operator in Calaba Town, states, "We are decision-makers now, not at the mercy of an unreliable system."

“A GAME CHANGER”

Currently, about 65,000 to 70,000 residents of the targeted communities are accessing clean and affordable water thanks to these kiosks. The integration of women into the operational side of these kiosks not only ensures a more sustainable water distribution system but also provides a platform for women to thrive in leadership roles as highlighted by Alhassan Kalokoh, FCC Councillor "Women now have a voice in decisions about water access. It’s a game-changer for equity in our city."

"Freetown is setting an example for other cities in the region. This project shows that local governments, with the right financial tools and community support, can solve even the most entrenched challenges."

A SCALABLE FINANCING MODEL FOR OTHER AFRICAN CITIES

The innovative financing model behind the Blue Peace initiative ensures long-term sustainability. Through affordable water sales, kiosks generate income which will sit in an escrow account creating a self-sustaining cycle of investment and maintenance. This aligns with UNCDF’s broader vision of blended finance solutions, enabling FCC to scale up to address financing needs for other infrastructure across the city. The model could also be replicated in other cities across Sierra Leone and the continent.

As UNCDF’s Alfred Akibo-Betts notes, "Freetown is setting an example for other cities in the region. This project shows that local governments, with

the right financial tools and community support, can solve even the most entrenched challenges."

The Blue Peace initiative is more than just a water project. It is a scalable model for inclusive, bottom-up sustainable urban development and an innovative financial model to recycle capital and extend its impact on communities in frontier markets.

Meanwhile, in Freetown, every drop of water is a symbol of empowerment, innovation, and hope—a bold step toward a brighter, more resilient future. i

ABOUT UNCDF

United Nations Capital Development Fund (UNCDF) mobilises and catalyses an increase in capital flows for impactful investments in high-risk markets, especially in Least Developed Countries, Small Island Developing States and countries in special situations. By crowding in capital through the deployment of risk-absorbing financial instruments, mechanisms and structuring advisory, UNCDF contributes to job creation and sustained economic growth in more than 70 countries.

In partnership with UN entities and development partners, UNCDF operates with speed and agility to deliver scalable, blended finance solutions to drive systemic change and pave the way for commercial finance and scale up by development finance institutions and multilateral development banks.

Learn more atuncdf.org or follow @UNCDF

Aminata, Community Activist and Water Kiosk Operator, Sierra Leone. Photo credit: James Kabia/UNCDF.

Otaviano Canuto: The Global Economy on a Two-Way Track

This

Global economic growth has proved more resilient than anticipated, with artificial intelli-gence-led investment offsetting much of the drag from escalating trade conflicts. Yet overstretched asset valuations and slowing job creation suggest that balancing these two opposing forces may soon become more difficult.

UNEXPECTED RESILIENCE IN GLOBAL GROWTH

The OECD’s Economic Outlook Interim Report (September 2025) notes that global growth has surpassed expectations. Compared with June projections, the OECD raised its 2025 global growth forecast from 2.9 percent to 3.2 percent, while keeping the 2026 forecast at 2.9 percent. Growth expectations for the United States increased to 1.8 percent for 2025 (up 0.2 points), and remained at 1.5 percent for 2026. The euro area was upgraded to 1.2 percent in 2025 before moderating to 1 percent in 2026. Brazil, India and China also saw modest upward revisions, with China now forecast to grow 4.9 percent this year and 4.4 percent next.

The OECD attributes this resilience to three main factors: the front-loading of industrial ac-tivity ahead of tariff increases; robust AIrelated investment in US data infrastructure; and China’s expansionary fiscal policy, which has cushioned the property sector downturn and trade headwinds.

Global merchandise trade also rose sharply in early 2025, led by shipments to the United States. However, by mid-year, US and Canadian import volumes began to fall, and Latin American exports weakened. Meanwhile, labour markets across advanced economies are softening, with unemployment rising modestly in the US, Canada, Germany and France but falling to historic lows in the euro area. Inflationary pressures, while muted, have proved stubborn, with goods prices re-accelerating and services inflation remaining sticky.

THE US: DUAL RESILIENCE AND EMERGING STRAIN

The US economy remains the central engine of global momentum. Revised Bureau of Economic Analysis data show annualised GDP growth at 3.8 percent in the second quarter, up from 3.3 percent. Yet underlying growth across the first half of 2025 averaged a more mod-est 1.65 percent—well below historical norms.

Tariff measures have further complicated the picture. The average effective tariff rate reached 19.5 percent in August—the highest since 1933. While the OECD expected a resulting drag on output, most effects have yet to

"Global merchandise trade also rose sharply in early 2025, led by shipments to the United States. However, by mid-year, US and Canadian import volumes began to fall, and Latin American exports weakened."

materialise. Firms initially absorbed much of the cost through compressed margins. However, real wages are now under pressure as unemployment edges higher and job openings decline.

Inflation remains sticky. The August Personal Consumption Expenditures Index rose 0.3 percent month-on-month and 2.7 percent year-on-year, with Core PCE inflation reaching 2.9 percent—above the Federal Reserve’s 2 percent target. The Fed’s September decision to cut rates by 25 basis points reflected concern over slowing job creation, which has aver-aged just 29,000 monthly net new jobs over the past quarter.

THE TARIFF SHOCK AND SHIFTING TRADE FLOWS

The impact of tariff escalation is most visible in US-China trade. Economist Robin Brooks estimates the effective tariff rate on Chinese goods at 44 percent—up from 17 percent in December 2024—while tariffs on other countries rose to 15 percent from 4 percent. As a result, nominal US imports from China fell 48 percent year-on-year by June, with the bilat-eral trade deficit shrinking by 61 percent to a twodecade low of $9.5bn.

Total US goods imports dropped $184.5bn in the second quarter, reducing the current ac-count deficit by a record 42.9 percent to $251.3bn, or 3.3 percent of GDP. Imports have shifted toward emerging Asian markets and Mexico, reflecting re-routing and substitution effects. These changes, combined with new trade pacts with Japan, Vietnam, Indonesia and the EU, have significantly redrawn the global trading map.

FINANCIAL MARKETS AND THE AI BOOM

In contrast to trade turbulence, financial markets have remained buoyant. The Bank for In-ternational Settlements’ September report highlights improved liquidity, narrow credit spreads and strong equity valuations across advanced and emerging markets. US equities have led the rally, with large-cap technology stocks—the so-called “Magnificent Seven”— propelling indices to record highs.

Emerging market equities, after years of underperformance, have joined the rally.

Analysts attribute this to three factors: a weaker US dollar, prudent fiscal management across emerging economies, and investor diversification away from the US amid fiscal uncertainty in advanced markets.

However, the extraordinary AI investment surge is the defining feature of the US economy. Capital spending on information processing equipment and software—now roughly 4 per-cent of GDP— accounted for an astonishing 92 percent of US GDP growth in the first half of 2025. These energy-intensive data-centre investments have more than offset the drag from tariffs and policy uncertainty, but also raised electricity demand by 7 percent year-on-year.

THE TWO-WAY TRACK

The US economy—and by extension, the global economy—appears to be running on two tracks: an AI-fuelled investment boom and a simultaneous slowdown in employment and consumption. The first drives innovation, capital formation and asset appreciation; the second risks undermining household demand and social stability.

Both the OECD and BIS warn that asset valuations now look stretched. If anticipated AI-driven productivity gains fail to materialise, today’s exuberance could resemble the early2000s dot-com bubble. Meanwhile, data-centre saturation could slow capital spending just as job growth falters. Fiscal vulnerabilities in the US and other advanced economies add to the uncertainty.

The coming year will test whether AI can deliver sustained productivity growth without trig-gering asset bubbles or inequality shocks. For now, the global economy remains resilient—but precariously balanced on a two-way track. i

ABOUT THE AUTHORS

Otaviano Canuto, based in Washington, D.C., is a senior fellow at the Policy Center for the New South, a non-resident senior fellow at the Brookings Institution, a lecturer at George Washington University’s Elliott School of International Affairs, and a former vice-president and executive director at the World Bank, IMF and Inter-American Development Bank.

Nouriel Roubini & Brunello Rosa:

Money Will Not Be Revolutionised

hat does the future hold for money and payment systems? While it will surely feature unprecedented technologies, foreseeing the full picture requires historical context.

Traditionally, money and payment systems have run on a combination of base money (issued by a central bank) and private-sector money, typically issued by commercial banks through demand deposits, credit cards, and so forth. Since newer fintech payment systems such as

Alipay, WeChat, Venmo, or PayPal are still linked to bank deposits and credit cards, they represent evolution, not revolution.

As for Bitcoin and other decentralised crypto assets, none has become a currency because none is a unit of account, scalable means of payment, stable store of value, or numeraire (a benchmark for other similar assets). El Salvador went so far as to declare Bitcoin legal tender, but, at best, some 5 percent of transactions for goods and services are settled with it.

True, with the Trump administration creating a Strategic Bitcoin Reserve, and with more institutional investors adding it to their portfolios, some commentators believe that Bitcoin will become a store of value over time. But this has yet to be tested.

What other possibilities do distributed-ledger technologies (DLTs) create? Leaving aside crypto assets, which will remain volatile tokens for speculative activities, three other options have emerged: central bank digital

currencies (CBDCs), stablecoins, and tokenised deposits.

Fears that CBDCs would disintermediate banks or facilitate bank runs in times of financial panic have diminished now that limits are likely to be imposed on CBDC balances. In most cases, central banks will aim only to provide a public safe asset for people’s digital wallets, rather than an alternative to private-sector payment systems; and most CBDCs will not be “programmable” or interest yielding.

That means private-sector solutions will continue to dominate payments. Fintech can offer cheap, safe, and efficient options that are not necessarily based on DLT; and now governments are offering real-time payment rails for banks and corporate firms that facilitate cheap and immediate settlement. And even in the DLT domain, the tokenisation of money-market funds or interest-bearing “flatcoins” (pegged to a basket of assets) may drive adoption of new forms of quasi or broad money that can be seamlessly converted into digital moneys that provide payment services.

But preferences differ markedly across jurisdictions. In the United States, the Trump administration’s ideological opposition to CBDCs has led it to favor stablecoins (prompting warnings from the Bank for International Settlements (BIS) of a return to the shambolic free banking of the nineteenth century, only in a digital format). In Europe, by contrast, worries about stablecoin risks – such as a new doom loop between the treasury and stablecoin issuers, and poor anti-money laundering and “know your customer” practices – imply a preference for CBDCs and tokenised deposits. And in China, an aversion to potentially decentralised stablecoins has led the government to favor a CBDC, plus fintech payment solutions.

Ideally, each of these solutions would co-exist and play a different role within a well-organised system of digital currencies. A CBDC would be the public safe asset in people’s digital wallets, providing a foundation of trust for the entire system. Stablecoins would then be used for domestic peer-to-peer or international payments, and tokenised deposits would be used for interbank transactions.

So far, one of the only jurisdictions that seems to have recognised the importance of implementing this “pyramid” of digital currencies is the United Arab Emirates, which is creating the most welcoming environment for digital assets at the global level. In this context, it bears mentioning that while new digital forms of money are based on some form of DLT, most run on centralised rather than decentralised ledgers, and they tend to be permissioned by authorised and trusted validators, rather than through permissionless and trustless transactions. Or put another way, they are closer to traditional centralised ledgers than to a true DLT.

Still, many of those tokenising real-world assets do seem to be opting for DLT as the preferred “unifying platform,” with digital assets being denominated in native-digital currencies. Thus, rather than focusing on the race for dominance over domestic or cross-border payment systems, we suggest watching the geopolitics of digital currencies, given their potential to serve as global reserve assets.

Seeking a greater global role for the renminbi, in part to mitigate the risk of future US financial sanctions, China is pushing for its CBDC, the e-CNY, to be used in cross-border transactions among countries involved in China’s Belt and Road Initiative (and its sister project, the Digital Silk Road). With m-Bridge, a technology originally designed with the BIS, the e-CNY could be used to bypass dollar channels and the SWIFT system for cross-border transactions; in fact, China already has its own alternative to SWIFT: CIPS (Cross-border Interbank Payment System).

These moves suggest that the eurozone could be squeezed between a still-dominant dollar (whose role would be boosted by the widespread adoption of dollar-pegged stablecoins) and a rising e-CNY. Europe is therefore moving fast to introduce a digital euro, which could help maintain the single currency’s global reserve role and grant some “strategic autonomy” to the European Union.

Finally, the Trump administration is pushing stablecoins (through the recent GENIUS Act) to preserve the dollar’s dominant role in global payments and as a reserve currency. With dollar-based stablecoins now re-dollarising the global economy, both China and the eurozone are re-considering their earlier skepticism and contemplating issuing their own stablecoins.

The future of money and payment systems will be characterised by evolution, not some radical crypto revolution. Network effects give current systems an incumbency advantage. Over a decade and a half after Bitcoin’s launch, the main advance in crypto is the stablecoin, which is just a digital version of fiat currency; and even the adoption of stablecoins will be gradual. Money is too much a public good and too much a nationalsecurity concern to be left to private, anonymous, decentralised actors. One way or another, it will remain within the state’s purview. i

ABOUT THE AUTHORS

Nouriel Roubini, Professor Emeritus of Economics at New York University’s Stern School of Business, is Chief Economist at Atlas Capital Team, CEO of Roubini Macro Associates, CoFounder of TheBoomBust.com, and author of the forthcoming MegaThreats:TenDangerousTrends ThatImperilOurFuture, and How to Survive Them (Little, Brown and Company, October 2022). He is a former senior economist for international affairs in the White House’s Council of Economic Advisers during the Clinton Administration and has worked for the International Monetary Fund, the US Federal Reserve, and the World Bank. His website is NourielRoubini.com, and he is the host of NourielToday.com.

BRUNELLO ROSA

Brunello Rosa is CEO of Rosa & Roubini and the co-author (with Casey Larsen) of Smart Money: HowDigitalCurrenciesWillShapetheNewWorld Order (Bloomsbury Publishing, 2024).

Jorge Arbache & Otaviano Canuto: The Myth of American Deindustrialisation

onventional wisdom holds that the United States has undergone a massive deindustrialisation in recent decades, with the country’s manufacturing sector supposedly withering as it lost ground to China. This narrative has fueled debates about industrial policy, economic nationalism, and the reshoring of manufacturing production. But what if it is only partly true? What if, instead of disappearing, American industry simply changed its address?

A closer look at the data suggests that what the US lost in domestic manufacturing, it may have gained in global productive presence. Rather than collapsing, American industry internationalised.

True, manufacturing as a share of US GDP has declined. In 1970, the sector accounted for about 24% of the American economy; by 2023, it represented less than 11%. Industrial employment also fell sharply – by nearly seven million jobs since the peak in the 1970s.

These figures have supported the idea that the US “abandoned” its industry. But two additional points should be noted. First, as technology has evolved, manufacturing employment per unit of output shrunk in many countries. For example, Germany’s continued success in manufacturing was nevertheless accompanied by declining employment.

Second, US real (inflation-adjusted) manufacturing value added (the difference between input costs and the value of the net output) has been rising over the past four decades, even as factory jobs declined. The sector’s composition has been characterised by a rising share of higher-value goods, like advanced technologies and aerospace products, manufactured with fewer workers and higher levels of automation.

During this period, China became a manufacturing powerhouse. In 2023, it was the world’s largest industrial producer, with estimated value added reaching $4.6 trillion – almost double America’s $2.8 trillion. But to conclude that this signals the decline of American industrial leadership overlooks a crucial fact: The data used here – such as

industrial value added – are calculated on the basis of national territory, which means that they measure only what is physically produced within a country’s borders. This is akin to the distinction between GDP and GNP but applied to manufacturing.

The problem with this method is that it misses a major feature of the twenty-first-century economy: the internationalisation of production chains. Large American companies maintain extensive production networks abroad, whether through subsidiaries, joint ventures, or contracts with local suppliers. This production is often shaped, overseen, and controlled by engineers, designers, and executives in the US, even as it physically occurs in other parts of the world.

Servicification of US Manufacturing

So, American manufacturing did not disappear, it relocated. American factories operating in Europe, Asia, Latin America, and elsewhere are supplying local and global markets and integrating global value chains.

Data from the US Bureau of Economic Analysis (BEA) indicate that, by 2024, the stock of US direct investment in manufacturing abroad was about $1.1 trillion, while the corresponding figure for China was estimated to be around $200 billion. These overseas industrial operations don’t appear in national accounts. By measuring only what is produced domestically, we underestimate the true scale of US-controlled manufacturing. In fact, BEA statistics suggest that if we include overseas production controlled by US companies, the “global manufacturing value” of the US could reach $3.9 trillion – much closer to China’s total. The high relevance of US manufacturing abroad is supported by different data sources and may help explain why US stock markets suffered less than US-based workers.

Moreover, not all of China’s exports are entirely “Made in China.” According to OECD data, part of the value of Chinese exports corresponds to inputs imported from third countries, which could mean that less than 65% of the value of Chinese manufactured exports is generated within China. In the case of the US, this share is around 80%, indicating that the US captures more value added in the stages under its control.

Some of the confusion about US “deindustrialisation” also arises from how we measure sectoral GDP. A significant share of the value added in industrial production – especially high-value activities – is classified as “services.” Logistics, research and development, engineering, software, patents, branding, distribution, design, and supply-chain management (among others) are fully integrated into manufacturing, but are counted under a different economic category.

So, when a company like Boeing coordinates production using global suppliers, most of the value added in the US is not recorded as manufacturing, even though it is deeply tied to it. Aggregating manufacturing capabilities with service functions directly tied to the sector implies a US industrial footprint that appears to surpass China’s.

The real question, then, is not just how much is produced and where (US President Donald Trump’s obsession). It is about who controls and captures value from industrial supply chains. From this perspective, the US remains highly industrialised, albeit through a sophisticated and globalised business model.

This reality has important implications for debates about reindustrialisation, trade, tariffs, and industrial policy. The issue is not just “bringing factories back,” but understanding who is in control, where value is generated, and how production networks can be organised in more resilient, efficient, and sustainable ways.

However politically convenient the deindustrialisation narrative may be, the reality is more complex and less gloomy than many assume. The US may have lost factories, but it did not lose industrial capacity. Its capacity simply became transnational.

At a time of geopolitical realignment, trade tensions, and the energy transition, understanding this nuance is essential. The future of manufacturing is not only about factory floors, which are increasingly populated by robots. More importantly, it is about where, how, and with whom to produce, and about who captures the resulting profits and influence.

Efforts to reshore labor-intensive parts of the supply chain through reshoring policies and tariffs have had minor impacts in US manufacturing. The sector’s renaissance would come at the expense of higher-value activities, because US businesses will need to reallocate limited labor resources. Low-income households that currently benefit from low-cost imported goods will face higher prices, with or without the establishment of domestic supply chains. Trying to recreate the manufacturing sector of old will not only fail; it will make Americans poorer. i

ABOUT JORGE ARBACHE

Jorge Arbache, Professor of Economics at the University of Brasília, is a former deputy minister and chief economist at Brazil’s Ministry of Planning, vice president for the private sector at the Development Bank of Latin America and the Caribbean, board member at BNDES, and senior economist at the World Bank.

HOW SANAE TAKAICHI, A DRUMMER FROM NARA, ROSE TO BECOME JAPAN’S FIRST FEMALE PRIME MINISTER BREAKING THE BAMBOO CEILING:

The election of Sanae Takaichi as the President of the Liberal Democratic Party (LDP) in October 2025, and her subsequent appointment as Prime Minister, marks a watershed moment in Japanese political history. At 64, she shattered the decades-old "bamboo ceiling," not only becoming Japan’s first female Prime Minister but also one of the very few post-war Japanese leaders who ascended to the top without the advantage of a political dynasty—a striking contrast to the customary Tokyo political elites. Her remarkable journey from a heavy metal drummer in Nara to the nation's highest office is a testament to her tenacity, political skill, and strong connection with the LDP’s conservative grassroots base, forging a new, distinctly non-establishment path to power.

A LIFE OUTSIDE THE INNER CIRCLE

Japan’s political landscape has long been dominated by a relatively small group of powerful families and hereditary politicians, particularly within the LDP. Former Prime Ministers like Shinzō Abe, Tarō Asō, and others benefited from multigenerational political networks and inherited seats. Takaichi, however, arrived in the Diet as an outsider, making her ascent all the more notable.

Born in 1961 in Yamatokōriyama, Nara Prefecture, a region steeped in ancient history and far removed from the immediate political hub of Tokyo, Takaichi’s background was solidly middle-class and professional. Her father worked for an automotive firm, and her mother served in the Nara Prefectural Police. This grounding in the realities of a working family, rather than the rarefied air of Tokyo's political kaki (cliques), has often been cited as a source of her perceived authenticity and popular appeal.

Her early life was unconventional for a future conservative leader. A graduate of Kobe University, she pursued interests far from the traditional political track. An accomplished musician, Takaichi played the drums and piano, famously performing in a heavy metal band during her university years. This unusual resume—heavy metal drummer and a motorcycle enthusiast—stands in stark opposition to the staid, conformist image often associated with Japanese political elites.

THE PATH TO THE DIET: INDEPENDENT AND SELF-MADE

Takaichi's formal training for public life came from the Matsushita Institute of Government and Management, an academy founded by Panasonic's Konosuke Matsushita to train future leaders outside the traditional bureaucratic track. Her time there included a stint in Washington D.C., working as a legislative aide for a Democratic Congresswoman, providing her with invaluable exposure to Western politics and governance.

Even after completing her fellowship and working as a newscaster and political analyst for TV Asahi, she did not immediately align herself with the LDP machine. When she first ran for the House of Representatives in the 1993 general election, she was elected as an independent candidate for the Nara at-large district. This initial victory, achieved without the backing of a major party, underscored her ability to connect with local voters based on her own merits and platform.

She later joined the LDP in 1996, eventually aligning herself with the Seiwakai (later the Mori and then the Abe Faction), the party’s largest and most conservative faction. This pragmatic political choice provided the necessary institutional backing, but Takaichi’s foundational political identity remained rooted in her grassroots origins and her unwavering, hard-line conservative principles, which resonated with the core of the LDP’s national membership.

THE ABE CONNECTION AND A RISING STAR

Takaichi's career trajectory gained significant momentum through her close alignment with former Prime Minister Shinzō Abe, a fellow conservative and one of her longest-serving political mentors. They were both first elected in 1993, sharing similar ideological beliefs, particularly a desire for constitutional revision and a more assertive national defence posture. Abe championed her career, appointing her to various influential posts, including Minister for Internal Affairs and Communications and, more recently, Minister of State for Economic Security.

Her repeated appointments to these highprofile roles—often as the first woman to hold them (e.g., first female head of the LDP's Policy Research Council)—established her as a competent administrator and a formidable conservative voice. However, unlike many of her predecessors, Takaichi did not benefit from a powerful political dairi (surrogate) to push her

through. She leveraged her political competence and her authentic connection to the conservative grassroots, who viewed her as a figure of strength and clear ideology, a refreshing change from the often-compromised centrists who emerge from behind-the-scenes factional bargaining.

THE 2025 VICTORY: GRASSROOTS OVER GEOPOLITICS

Takaichi’s path to the LDP presidency was a classic upset, largely powered by the party's rank-and-file members outside the Diet. In the 2025 LDP leadership election, she defeated the younger, more establishment-friendly Shinjirō Koizumi in a runoff. At 64, she was not the youngest candidate, but she successfully channeled the political mood among LDP members and conservative voters disillusioned with the LDP’s handling of recent crises and scandals under her predecessors.

Her victory demonstrated that the LDP's membership base was willing to look beyond

hereditary privilege and establishment consensus, opting instead for a leader with unflinching conservative convictions and a compelling, selfmade narrative. Playing up her background—a "woman of Nara" who grew up outside the Tokyo bubble—she effectively contrasted her life with that of the blue-blooded Koizumi, whose name alone symbolised political heritage.

This triumph—the first woman to lead the LDP and, by extension, become the Prime Minister—is a powerful narrative of a political outsider breaking the most stubborn of ceilings. It is a win for the self-made politician over the scions of the Diet, signalling a possible, albeit cautious, shift in the LDP’s internal power dynamics, demanding a leader with conviction whose story resonates far beyond the polished halls of Kasumigaseki. Takaichi, the heavy metal drummer from Nara, now wields the baton of power, a profound symbol of change in a nation famously resistant to it. i

Prime Minister of Japan Sanae Takaichi (APPhoto/EugeneHoshiko)

The Iron Lady of Japan Decoding Sanae Takaichi’s Unyielding Conservatism

Sanae Takaichi's rise to become Japan’s first female Prime Minister has inevitably earned her a sobriquet that evokes both admiration and trepidation: "The Iron Lady of Japan." This comparison to former British Prime Minister Margaret Thatcher is no accident; it is one Takaichi openly encourages, viewing the iconic British leader as a revered role model. The label reflects not just her gender in a male-dominated political sphere but, more crucially, her uncompromising, hardline conservative ideology and her reputation for resolute, unyielding political resolve.

THE POLITICAL AND PERSONAL PARALLELS TO THATCHER

The comparison between the two "Iron Ladies" rests on several distinct pillars of philosophy and personal style:

• Unflinching Ideology: Just as Thatcher was a champion of small government and monetarism in Britain, Takaichi is the standard-bearer for the right-wing nationalist wing of the Liberal Democratic Party (LDP). Her political stances are clearly defined and rarely waver. She is a hawk on security, a proponent of muscular fiscal policy, and a staunch defender of traditional Japanese social values.

• Political Outsider Status: While Thatcher came from a modest background as a grocer's daughter, Takaichi, too, lacks the typical aristocratic or dynastic connections of many of her LDP colleagues. Both women achieved the highest office through sheer personal drive and an appeal that cut across established political elites, relying instead on the party's conservative grassroots base.

• Decisive and Uncompromising Leadership: Takaichi is known for a tenacious work ethic and a take-no-prisoners approach to policy debates. After her LDP presidential victory, she famously declared her intent to "scrap my work-life balance and work and work and work and work and work," echoing the image of a leader entirely devoted to the national cause, a trait that defined the Thatcher era.

This admiration is not merely rhetorical; Takaichi has been observed to emulate the Iron Lady’s style, sometimes wearing clothing and accessories that invoke the former British premier.

THE PILLAR OF HARD-LINE CONSERVATISM

Takaichi's policies and political philosophy

"This comparison to former British Prime Minister Margaret Thatcher is no accident; it is one Takaichi openly encourages, viewing the iconic British leader as a revered role model."

firmly place her at the right end of Japan's political spectrum, making her an ideological successor to her mentor, the late Shinzō Abe. Her conservatism is multifaceted, encompassing national security, economic strategy, and social tradition.

SECURITY HAWK AND NATIONALIST

On security and foreign policy, Takaichi’s views are perhaps her most hard-line:

• Constitutional Revision: She has long advocated for the revision of Article 9 of Japan's pacifist Constitution to explicitly codify and strengthen the status of the Self-Defense Forces (SDF), pushing for a more assertive military role for Japan in the region.

• Defence Spending: Takaichi fully supports the goal of increasing Japan's defence spending to 2 percent of GDP, aligning it with NATO standards—a clear response to the perceived security threats posed by China and North Korea.

• Historical Issues: Her regular visits to the Yasukuni Shrine, which honours Japan’s war dead, including convicted Class A war criminals, have drawn consistent, sharp condemnation from Beijing and Seoul. This stance is seen as a rejection of Japan's post-war apology diplomacy and a firm embrace of historical revisionism, further cementing her nationalist credentials.

ECONOMIC INTERVENTIONIST (SANAENOMICS)

While Thatcher championed fiscal austerity and privatisation, Takaichi's economic conservatism, often dubbed "Sanaenomics" or "New Abenomics," is a more interventionist version suited to Japan's unique challenges. She advocates for:

• Fiscal Expansion: Proactive, massive government spending, particularly "crisis management investment" in strategic sectors like semiconductors, AI, biotechnology, and defence, often proposing to fund this through bond issuance, raising concerns among fiscal moderates.

Kyoto, Japan: Kiyomizu Dera Temple

• Economic Security: She is a fervent champion of economic sovereignty, proposing tighter restrictions on foreign investment and stricter rules to protect Japanese technology from being siphoned off by foreign powers.

SOCIAL TRADITIONALIST

Takaichi's social conservatism contrasts sharply with the "progressive" optics of her gender breakthrough. She has consistently opposed:

• Same-Sex Marriage: Viewing it as a deviation from traditional Japanese family structures.

• Separate Surnames: She opposes reviewing the law that requires married couples to share one surname, supporting the preservation of traditional marriage norms.

• Female Imperial Succession: Takaichi maintains that imperial succession should be strictly limited to the male line.

A PARADOX OF PROGRESS

The "Iron Lady of Japan" thus presents a fascinating political paradox. Her historic victory as the first female Prime Minister breaks the country's highest "bamboo ceiling," yet she is no feminist champion in the liberal sense. Instead, her rise is a reflection of the LDP’s shift to embrace a powerful, clear-cut conservative agenda to energise its base, often by co-opting the energy of rising right-wing populist movements.

Her uncompromising style, while appealing to the party faithful, is simultaneously a source of political turbulence, having already been cited as a major factor in the collapse of the LDP's long-standing coalition with the dovish Komeito party. Like her British inspiration, Sanae Takaichi is poised to be a deeply polarising figure whose resolute conviction will define—and likely divide—Japan’s future. i

'Sanaenomics':

The Abenomics 2.0 Shift from Deflation to Security >

The economic platform of Prime Minister Sanae Takaichi, quickly dubbed 'Sanaenomics', is not a radical break but a clear continuation and evolution of the policies pioneered by her mentor, Shinzō Abe. Where Abenomics was primarily an aggressive strategy to combat decades of deflation, Sanaenomics is positioned as an expansionary, pro-growth agenda tailored to a new era of cost-push inflation and heightened geopolitical insecurity.

THE CONTINUITY OF THE 'THREE ARROWS' Takaichi's plan maintains the conceptual structure of Abenomics, often framed around 'three arrows', but with a significant shift in emphasis:

• Monetary Easing: Like her predecessor, Takaichi favours continued loose monetary policy by the Bank of Japan (BOJ). She believes the current inflation, driven largely by import costs and a weak yen, is "cost-push" rather than the "demand-pull" inflation necessary for confirming Japan has permanently escaped its deflationary trap. Her cautious stance is seen as pushing back against an immediate, aggressive interest rate hike by the BOJ, although she has stated the central bank retains autonomy in choosing policy tools.

• Expansionary Fiscal Policy: This is the most pronounced aspect of Sanaenomics, mirroring the first arrow of Abenomics but with an even greater push for government spending. Takaichi advocates for a "responsible proactive fiscal policy" and has indicated a willingness to issue deficit bonds to fund crucial measures.

• Structural Reform and Investment: While Abe struggled with the "third arrow," Takaichi is reframing it entirely. Her focus is less on deregulation and more on state-backed "crisis management investment" in strategic areas vital for national and economic security.

THE NEW ECONOMIC CORE: SECURITY-FIRST SPENDING

The defining feature of Sanaenomics is the merging of economic policy with national security. This goes beyond mere defence budgets and aims for self-sufficiency and technological sovereignty in an increasingly volatile world.

Priority Area Sanaenomics Goal

"Her cautious

stance is

seen

as

pushing back

against an immediate, aggressive interest rate hike by the BOJ, although she has stated the central bank retains autonomy in choosing policy tools."

This heavy reliance on state-directed spending, especially in technology and defence, caused the Nikkei 225 to surge and the Yen to weaken immediately following her election, as markets factored in higher inflation expectations and prolonged monetary easing.

FISCAL

POLICY: POPULIST RELIEF VS. FISCAL DISCIPLINE

Takaichi's economic plan is designed to directly address the cost-of-living crisis—the key domestic issue that has undermined the LDP's support. She plans to put money back into households' hands through:

• Refundable Tax Credits: A mechanism that acts as a form of "negative income tax," providing cash payments to low-income households that don't earn enough to benefit from standard tax cuts.

• Tax Relief: Abolishing the provisional gasoline

Defence Increase spending to 2 percent of GDP or more

tax rate and increasing the basic income tax deduction.

• Wage Policy: She prefers a 'high-pressure economy' (maintaining tight macro supplydemand conditions) to naturally push up wages, rather than the more direct governmentmandated minimum wage increases favoured by her predecessors. Her philosophy is focused on rewarding the working middle class.

However, this push for expansive fiscal policy runs a high risk of stoking inflation and further ballooning Japan's already immense national debt, creating tension with the Ministry of Finance's (MoF) drive for fiscal discipline.

RELATIONSHIP WITH THE BANK OF JAPAN (BOJ)

Perhaps the most controversial aspect of Sanaenomics is Takaichi’s assertive stance toward the central bank. She has explicitly stated that the government bears responsibility for both fiscal and monetary policy, sparking concern over the BOJ's independence.

While she acknowledges the BOJ's autonomy in selecting tools, her assertion that the direction of policy should be coordinated with the government is seen by critics as a direct attempt to lean on the central bank to delay any further rate hikes. This is crucial as the BOJ is currently navigating the tricky path of normalising rates after years of ultra-loose policy—a path Takaichi's expansionary fiscal impulse makes significantly more challenging. In effect, Takaichi is demanding BOJ compliance to keep the nominal interest rate below the nominal growth rate, a key condition for managing Japan's debt pile. i

Economic Impact

Massive procurement and R&D spending, boosting Japan's (aligning with NATO standards). defence industry and related technology sectors.

Technology Targeted investment in fields like AI, semiconductors, Fostering high-value domestic industries, reducing reliance on China quantum computing, and nuclear fusion. and other foreign suppliers, and promoting next-generation growth.

Resilience Strengthening economic security laws to guard against Increased state control over strategic supply chains, potentially foreign tech acquisition and ensure stable supplies of leading to domestic production subsidies. food, energy, and pharmaceuticals.

An Unflinching Trajectory: Assessing the Likely Transformation of Japan under Takaichi

Sanae Takaichi’s premiership, if she can navigate the immediate challenge of forging a working parliamentary coalition, is unlikely to usher in a new era of reformist politics. Instead, it is poised to accelerate a major ideological shift already underway, moving Japan towards a more nationalist, security-driven state that is prepared to take bolder, more divisive steps on the global stage. Her tenure will be a test of whether hardline conservatism can address the deep-seated economic and demographic vulnerabilities of modern Japan.

FOREIGN POLICY: THE RISE OF AN ASSERTIVE JAPAN

Takaichi's impact will be most keenly felt in foreign and security policy, where she promises a departure from the measured pragmatism of recent predecessors:

• Constitutional Revision (Article 9): Takaichi will use the full weight of the Prime Minister’s office to push for the formal revision of the pacifist Article 9 of the Constitution. While Shinzō Abe laid the groundwork, Takaichi’s unwavering commitment to the issue makes it a central pillar of her mandate. If successful, this would be a watershed moment, fundamentally redefining Japan’s self-defence capabilities and its role in global security.

• Security-First Diplomacy: The commitment to increase defence spending to 2 percent of GDP or more is non-negotiable. This will translate into large-scale investment in counter-strike capabilities and advanced military hardware, significantly enhancing Japan's deterrent posture.

• Regional Tensions: As a renowned China hawk and a strong supporter of Taiwan, Takaichi's diplomacy is likely to be assertive and confrontational. Her historical revisionism, particularly her stance on the Yasukuni Shrine, risks undoing the recent,

fragile thawing of relations with South Korea and will undoubtedly draw ire from Beijing, leading to a potential spike in regional tensions and military 'testing the waters' by adversaries.

• US Alliance as a Cornerstone: Despite the potential volatility of the Trump administration, Takaichi's focus on burden-sharing and her own hardline stance make her an ideologically compatible partner for Washington. She will strengthen the US-Japan alliance and push for deeper multilateral cooperation through blocs like the Quad.

DOMESTIC ECONOMY: THE SOVEREIGNTY-GROWTH TRADE-OFF

On the domestic front, the transformation under 'Sanaenomics' will be an experiment in boosting growth through targeted state intervention, with two key long-term implications:

• Securitised Economy: As former Minister for Economic Security, Takaichi will permanently embed security concerns into economic policy. Expect massive state-backed investments in strategic technologies (semiconductors, AI, nuclear power) aimed at achieving national self-sufficiency and protecting supply chains. This represents a partial retreat from free-market globalisation towards a more state-capitalist, national-interest model.

• Fiscal Risk and Inflation: Her expansionary fiscal policy, coupled with her pressure on the Bank of Japan to delay rate hikes, poses a significant risk to Japan’s already precarious financial situation. While it may provide short-term relief to households and a boost to the stock market, the long-term danger is that it locks Japan into a permanent cycle of debt-fuelled spending and a persistently weak yen, exacerbating imported inflation and undermining the fragile push for fiscal discipline by the Ministry of Finance.

Takaichi's election as the first female Prime Minister is a historic symbol, yet her conservative social agenda suggests she will not be a torchbearer for broad liberal social transformation:

• Limited Gender Reform: While she has pledged to appoint more women to her cabinet, her opposition to gender equality reforms such as legalising separate surnames for married couples and female imperial succession means that the underlying patriarchal norms of Japanese society and the LDP will remain largely unchallenged. Her premiership embodies the paradox of descriptive representation without substantive reform.

• Immigration Hardening: A crucial area where Takaichi promises a definite shift is immigration. Capitalising on populist sentiment, she has called for tighter restrictions and stricter enforcement against overstayers and illegal migrants. This stance risks further complicating Japan’s chronic labour shortage, a demographic time-bomb that requires increasing, not restricting, foreign workers. Instead of facilitating long-term integration, her policies may intensify the divide between an aging Japanese core and the foreign workforce it desperately needs.

In essence, Sanae Takaichi’s likely transformation of Japan is one of hardening resolve—nationally, economically, and ideologically. She is poised to be a pivotal figure who consolidates the nationalist, conservative legacy of Shinzō Abe, seeking to forge a more assertive and resilient Japan, even if it means sacrificing internal consensus and international stability with key neighbours in the process. The question for Japan is whether her Iron Lady conviction can overcome the structural headwinds and political instability of a fractured Diet. i

SOCIETY AND CULTURE: A PARADOX OF MODERNITY

Autumn 2025 Special The Power of the Maverick: How Thinking Differently Drives Business Success

Inaworldthatprizesconformityandconventionalwisdom,enduringsuccessoftenbelongstothosewho refusetofollowthecrowd.Thisseriesexploresthelivesofsixbusinessleaders—fromRichardBransontoTemple Grandin—whonotonlysucceededbythinkingdifferentlybutturnedtheirdistinctiveperspectivesintoaforcefor innovation,growthandchange.

In business, as in life, there is a powerful gravitational pull towards the familiar. We are taught to follow best practice, learn from case studies and adhere to established industry norms. On the surface, this makes sense: it minimises risk, reduces friction and offers a well-trodden path. But in a rapidly changing world, that path can lead to a dead end.

The modern challenge is not to be the best at what everyone else is doing; it is to create something genuinely new. That demands the courage to break from the herd, challenge assumptions and spot opportunities invisible to others. This is the domain of the maverick— the iconoclast who thinks differently.

This series is dedicated to such individuals. They are not defined by their backgrounds or formal education, but by how they see the world. They looked at stale industries and found better ways to serve customers. Some embraced their neurodiversity as a source of strength. They refused to accept the status quo and chose to write their own rules.

BEYOND THE BOX: A DIFFERENT KIND OF MINDSET

Thinking differently is not merely about creativity; it reflects a distinct cognitive style—often intuitive, lateral or visual—less constrained by linear, rule-bound approaches. It connects seemingly unrelated ideas and discovers novel solutions to old problems.

Consider Richard Branson. A leader who struggled with the written word, he built an empire on judgement, simplicity and human connection. Dyslexia, which made traditional learning a challenge, became an advantage:

it pushed him to distil complexity and focus on the big picture. He did not build a better airline by poring over a rival’s balance sheet; he built one by creating an emotional bond with customers.

Likewise, Barbara Corcoran turned dyslexia and ADHD into assets in New York’s cutthroat real-estate market. She relied less on spreadsheets and more on visualising potential and crafting compelling narratives. She viewed real estate not as a set of properties, but as a portfolio of dreams—spotting prospects others missed.

The value of this mindset is evident in the “first principles” approach popularised by Elon Musk, which helped reshape automotive and aerospace. Operating on the autism spectrum, his method deconstructs complex systems and rebuilds them from fundamentals, free of legacy assumptions. He did not refine the petrol engine; he reimagined the car.

THE NEURODIVERGENT ADVANTAGE

These leaders challenge conventional definitions of success. They demonstrate that a different mind is not a flaw but a formidable asset. In an increasingly complex world, the ability to view problems from alternative angles creates disproportionate value.

Temple Grandin transformed the livestock industry by “thinking in pictures”. By understanding the sensory experience of animals, she designed humane handling systems that were ethically sound and operationally efficient—achieved not through traditional engineering templates, but through deep empathy and observation.

David Neeleman leveraged ADHD to become a serial airline entrepreneur. His restless, idea-rich mind—ill-suited to rigid corporate environments—thrived in the dynamism of start-ups. He saw puzzles rather than problems, connecting disparate insights to build airlines that were more efficient, more customercentric and more profitable.

Luke Manton showed how businesses can not only accommodate neurodiversity, but thrive because of it. After a brain injury led to Tourette’s syndrome, he built a successful virtual-assistant agency tailored to the way he works best. His journey underlines how authenticity and resilience can power commercial success—and how perceived weakness can become profound strength.

A SERIES FOR A NEW ERA

As artificial intelligence automates routine tasks, human advantage shifts to creativity, empathy and the capacity to think beyond the obvious. The leaders profiled here are more than business icons; they are pioneers of a different way of thinking. Their stories suggest that the greatest competitive edge is not simply a better product or a lower price, but a distinctive perspective.

The purpose of this series is to inspire—to show entrepreneurs, leaders and teams that it is not only acceptable to be different; it is often decisive. Change rarely comes from those who only follow the rules. It comes from those prepared to question them. The future belongs to mavericks and visionaries—people unafraid to be themselves. This series is an ode to that courage, and a celebration of the power of a different kind of mind. i

>

BARBARA CORCORAN

The School of Hard Knocks: Turning Dyslexia into a Business Superpower

Barbara Corcoran, the real-estate mogul and “Shark Tank” investor, has built a multi-million-pound empire on grit, charisma and an unrelenting drive to succeed. The secret to her unconventional edge? Dyslexia and ADHD—traits she credits with giving her the creative vision and distinctive perspective needed to thrive in a cut-throat industry.

THE UNDERDOG’S JOURNEY

Corcoran’s story is not one of inherited wealth or Ivy League credentials. It is a classic underdog tale, forged in a large, working-class family in Edgewater, New Jersey. The second of ten children, she learned resourcefulness and resilience early. School was a struggle: dyslexia meant she could not read as quickly or comprehend as easily as her peers. Labelled “the dumb kid”, she spent much of her academic life feeling insecure. Yet outside the classroom she was a natural leader with an instinctive ability to connect— a duality that would define her career.

Her early working life was a whirlwind of odd jobs—diner waitress, high-school dropout, receptionist—a self-taught curriculum in human behaviour and sales. The turning point came with a receptionist role at a real-estate office, where she saw the chance to combine people skills with a sharp, visual mind. Borrowing a thousand pounds from her then boyfriend, she founded The Corcoran Group in 1973. The first office was a tiny Manhattan space; capital was minimal, vision was not.

THE CREATIVE ADVANTAGE

Conventional wisdom in New York real estate held that success depended on networks, connections and encyclopedic market knowledge. Corcoran leaned on different strengths. Dyslexia, she believes, gave her a unique creative lens. Unable to process information in a strictly linear way, she learned to see patterns and opportunities others missed—thinking in pictures, visualising potential and uncovering the story behind each home.