Meet Scott.

Scott works hand-in-hand with community banks in the Southeast to find ICBA member benefits that help them achieve their bank’s goals.

When he’s not exploring new ways to connect with bankers, he’s spending time in the great outdoors, hiking, camping, and adventuring.

Let Scott help you explore all the many options ICBA has to offer your community bank. Learn more at icba.org/membership

3. FROM THE PRESIDENT’S DESK: A Year of Progress and Connection for Georgia’s Community Banks

4. FLOURISH: Battling the Many Faces of Fraud, Together ADVOCACY

11. Honoring Our 2025 Advocacy Fund Contributors - THANK YOU!

23. 2026 Advocacy Events Preview SPOTLIGHTS

21. Get to Know Mike Sale 2025-2026 CBA Chairman

31. Beyond the Bank: Cortez Sherrod on Music, Connections, and Community Banking

5. Highlights from CBA’s CONNECT 2025 Convention

7. Save the Date for the 2026 CONNECT Convention

19. Finish Strong and Look Ahead

25. Get Ready for a Game-Changing 2026 at CBA of Georgia!

32. ICBA Education 2026 Certification Institutes Schedule

9. Mike Sale, The Commercial Bank, Elected Chair of the Board of Directors of Community Bankers Association of Georgia

10. 2025-2026 CBA Board of Directors

15. Leverage Debit Card Optimization to Maximize Non-Interest Income

27. New Debanking Order Could Reshape Compliance for Financial Institutions

33. The Rule of Three

36. Trusted Partners: Explore CBA’s Preferred Service Providers

John McNair President & CEO john@cbaofga.com

Lori Godfrey Chief Operating Officer lori@cbaofga.com

Lindsay Greene Director of Development lindsay@cbaofga.com

Ellen Shea, CMP Director of Association Services ellen@cbaofga.com

Gwen Lanaghan Accounting Manager gwen@cbaofga.com

Becky Soto Professional Development Manager becky@cbaofga.com

Connie Shepard Member Engagement connie@cbaofga.com

John McNair President & CEO Community Bankers Association of Georgia

The Community Bankers Association of Georgia lit up Amelia Island this September with its highly anticipated CONNECT 2025 Annual Convention & Trade Show. Held at the luxurious Ritz-Carlton, this multi-day event brought together Georgia’s finest community bankers, associate members, legislators, and industry innovators for a powerhouse week of networking, education, and celebration.

From dynamic keynote speakers to hands-on sessions and a bustling trade show floor, CONNECT 2025 was more than a conference—it was a movement. Attendees explored cutting-edge solutions, shared best practices, and strengthened relationships that fuel the heart of community banking. The energy was electric, the ideas were flowing, and the commitment to excellence was palpable.

If you missed it, don’t worry - CONNECT 2026 will be here before you know it! We’re scheduled for September 23–27 at the amazing Grove Park Inn in Asheville, NC. Keep an eye out for registration and sponsorship opportunities in the coming weeks.

As we close out 2025, I’m proud to report that your association accomplished a great deal on behalf of Georgia’s community banking industry. We secured passage of significant legislation in the form of intangible tax relief and successfully contributed to the defeat of the flawed interchange and debanking bills.

Our progress in expanding technology-based education and solutions is paying off— community banks have seen their average efficiency ratio decline by 10%. Additionally, the health insurance solutions offered by CBA are driving down coverage costs while boosting overall employee satisfaction.

While we’re finishing the year on a high note, our drive to represent and serve to the highest standard possible remains unwavering. I’m excited about what the New Year will bring and deeply grateful for your continued support and contributions!

Rebeca Romero Rainey President & CEO ICBA

“When community bankers alert their peers to a new type of fraud or a rise in a particular form of attack, they empower the community to act.”

When it comes to fraud, we are being hit on all fronts with scams that range from the very basic to the most sophisticated. We’re at this unique place in time where a bank needs both the technological tools to thwart AI-generated digital attacks and the knowledge to battle old-school check washing and forgery schemes. It means that our mitigation strategies must combine advanced monitoring with good old-fashioned gut instinct to help our teams and customers protect themselves and our banks. In short, we must educate our customers, prepare our teams, shore up our digital defenses, and monitor transactions, all while continuing to run the business of banking.

It’s a lot in any environment. Fortunately, we are not alone. As a community of community bankers, we have strength in numbers.

Consider that one of the most powerful tools in the fight against fraud is information sharing. When community bankers alert their peers to a new type of fraud or a rise in a particular form of

attack, they empower the community to act. Supported by this firsthand knowledge, community bankers can prepare stronger defenses for their own organizations. By sharing these stories and experiences, we help others learn and prevent it from happening somewhere else.

That’s where ICBA Community (community.icba.org) comes into play. Created as a secure platform for member communication, ICBA Community offers a way to disseminate information on fraud scams and tips for addressing them. It is like having eyes and ears out there, delivering insights into what others are seeing and what has worked to prevent losses. It’s not just a forum for understanding current threats; it delivers that ability to learn through others’ firsthand experiences and makes fraud real.

Yet, fighting fraud requires more than information alone, and ICBA’s core pillars of advocacy, education and innovation support community banks in their risk mitigation. For instance, on the advocacy side, we worked

closely with the Federal Financial Institutions Examination Council to ensure that when they phased out the Cybersecurity Assessment Tool, there were alternatives available. We offered a webinar series highlighting solutions created in collaboration with regulators. Our education offerings include prevention training to teach staff the latest fraud identification and mitigation techniques. Our innovation work through our ThinkTECH program, solutions directory (solutions.icba.org) and Preferred Service Providers also empowers community banks to identify the latest fraud mitigation tools.

The Community Bankers Association of Georgia (CBA) proudly hosted its annual CONNECT Convention September 10–14, 2025, at the Ritz-Carlton, Amelia Island. This year’s event brought together bankers, partners, and exhibitors from across the state for a week filled with networking, professional development, and celebration of community banking.

INCLUDED:

z Engaging Education – From the inspiring leadership lessons shared by top-tier speakers like Billy Boughey and Don Yaeger, to the political insights offered by Brian Robinson and Tharon Johnson, and the forward-thinking perspectives on AI and the future of community banking—this event delivered a powerful blend of knowledge across industries.

z Networking Opportunities – From the lively opening Sponsorship Reception to casual gatherings throughout the week, attendees enjoyed countless opportunities to connect with peers and industry partners.

z Signature Events – We wrapped up the event with the most exciting tailgate party in the South watching UGA defeat Tennessee! And for those not interested in the game, we enjoyed the folks from Olive Amelia who were on hand to educate the benefits of olive oil from their local store and handing out samples to attendees as well as our wellness station where attendees made salt scrubs with essential oils to take home with them. CBA couldn’t have planned a better ending to such a successful week!

z New CBA Leadership – Membership voted on Thursday and installed the 2025 – 2026 Board of Directors on Saturday at the conclusion of business. CBA thanked our 2024 – 2025 Leadership, led by Frank Griffin of Flint Community Bank, and then welcomed our new Chairman Mike Sale from The Commercial Bank.

z Celebrating Community Banking – CBA CONNECT 2025 was a true reflection of the strength of Georgia’s community banks and their commitment to serving their communities.

[continued]

Abram was founded with the specific purpose of transforming the cash in transit industry, through the heart of a ser vant. Our vision is to positively transform lives in the communities we serve.

We invite you into our story and our vision, to partner with one another to make an impact.

We extend our heartfelt thanks to our sponsors, exhibitors, and attendees who made this year’s convention a success. Their support and engagement are what make CONNECT such a meaningful and memorable event each year.

Be sure to mark your calendars for next year’s convention: SEPTEMBER 23–27, 2026

The Omni Grove Park Inn Resort & Spa – Asheville, NC We look forward to seeing you at CONNECT 2026!

Mike Sale, President & CEO, The Commercial Bank , Crawford, was elected Chairman of the Board of Directors of Community Bankers Association of Georgia (CBA).

Nominations for the 2025-26 CBA Board of Directors were announced and approved at CBA’s Annual Convention held September 10 – 14, 2025, at The Ritz-Carlton, Amelia Island, FL. His term began September 11, 2025.

“The CBA Board of Directors consists of true community bankers. As leaders of their respective communities, they are asked to serve on many different boards and committees. Recognizing the importance of having a community bank-only focused association in Georgia, CBA is honored that they have chosen to devote their time and talents to guide CBA. It is a privilege to serve as their President/CEO,” stated John McNair, President & CEO, Community Bankers Association of Georgia

CBA is delighted to welcome the following new members to the Board:

z Ms. Clare Easterlin, Queensborough National Bank and Trust

z Mr. Andy Flowers, Oconee State Bank

z Ms. Kasey Blackburn, Family Bank

z Ms. Angie Kahrmann, State Bank of Cochran

z Mr. Jeff McGhee, The Merchants and Citizens Bank

Additionally, CBA would like to thank the following who are stepping off the Board for their exemplary service:

z Ms. Jolene Carroll, Magnolia State Bank

z Mr. Zac Frye, Citizens Bank of Swainsboro

z Mr. Ron Quinn, Peach State Bank & Trust

z Mr. Neil Stevens, Oconee State Bank

z Mr. Doug Williams, SouthState Bank

Board members are selected from two divisions across the state of Georgia, ensuring all Georgia community banks are equally represented. Board members are elected to a one-year term. During the year, Directors will be involved in several items on behalf of the CBA membership, such as responding to proposed rules and regulations from the various regulatory agencies, reviewing services which will benefit the community banking industry, and weighing in on proposed legislation.

CBA President/CEO: John McNair, CBA of GA

Corporate Secretary: Lori Godfrey, CBA of GA

General Counsel: Dan Brannan, James Bates Brannan Groover LLP

Since 1969, Community Bankers Association of Georgia (CBA) has remained steadfast in our mission to advocate for Georgia’s community banks.

CBA plays a vital role in addressing challenges, shaping the future, and ensuring the continued strength of community banking. None of this work would be possible without the generous support of our Advocacy Fund contributors.

We extend our sincere gratitude to the banks, companies, individuals, and silent auction donors whose commitment fuels our efforts and strengthens our voice on behalf of Georgia’s community banks.

BANK/COMPANY DONATIONS.............................. City

Affinity Bank Atlanta, GA

Altamaha Bank & Trust Vidalia, GA

Arctic Wolf Networks .................................... Sunnyvale, CA

Bank of Camilla Camilla, GA

Bank of Dawson ................................................ Dawson, GA

Bank of Wrightsville Wrightsville, GA

BHG Financial Syracuse, NY

Carr, Riggs & Ingram, LLC .................................. Atlanta, GA

Cash Transactions, LLC Austell, GA

Citizens Community Bank .................................. Hahira, GA

College Ave Student Loans Wilmington, DE

Consolidated Banking Services, Inc. Cumming, GA

Douglas National Bank .................................... Douglas, GA

Elliott Davis Greenville, SC

F & M Bank .................................................. Washington, GA

Family Bank Pelham, GA

Farmers State Bank Lincolnton, GA

FINBOA Houston, TX

First Chatham Bank Savannah, GA

First Southern Bank ....................................... Waycross, GA

Fiserv Alpharetta, GA

Flint Community Bank ........................................ Albany, GA

FNB South Alma, GA

Georgia Community Bank Dawson, GA

Guardian Bank ..................................................Valdosta, GA

Hutchins Clenney Rumsey Huckably, P.C. Blakely, GA

Hyperion Bank Atlanta, GA

IBT Apps ....................................................... Cedar Park, TX

Jack Henry Banking Monett, MO

Kasasa .................................................................. Austin, TX

Liberty Technology Griffin, GA

Magnolia State Bank Eastman, GA

National Bank Products, Inc. ............... Warner Robbins, GA

NFP Executive Benefits Palm Beach Gardens, FL

Nichols, Cauley & Associates LLC ..................... Dublin, GA

Northeast Georgia Bank Lavonia, GA

Pentegra Retirement Services White Plains, NY

Peoples Bank ........................................................ Lyons, GA

Point to Point Environmental McDonough, GA

PrimeSouth Bank ......................................... Blackshear, GA

Sheridan Construction Macon, GA

South Coast Bank & Trust Brunswick, GA

SunMark Community Bank Hawkinsville, GA

The Citizens Bank of Cochran Cochran, GA

The Commercial Bank ................................... Crawford, GA

The Farmers Bank Greensboro, GA

The Four County Bank .................................. Allentown, GA

TIB, N.A. Dallas, TX

Touchmark National Bank Alpharetta, GA

United Community Bank ............................... Greenville, SC

None of this work would be possible without the generous support of our Advocacy Fund contributors.

continued from previous page... Thank You Advocacy Fund Contributors

Tina Aldrich Vidalia, GA

Dianne Barton Kennesaw, GA

Scott Beaver Crawford, GA

Kasey Blackburn ................................................. Pelham, GA

Jennifer Burel Crawford, GA

Bill Cabaniss ................................................... Crawford, GA

Bobby D Cook Crawford, GA

Robert D Cook Crawford, GA

Heath Fountain ............................................. Fitzgerald, GA

Jonathon Guthrie Willacoochee, GA

Jessica Hudson ................................................ Douglas, GA

John McNair Marietta, GA

Russ B Moon Crawford, GA

Josh Osborne Atlanta, GA

Robbie B Paine Crawford, GA

Jonathan Pope ........................................... Milledgeville, GA

Mike Sale Crawford, GA

Joseph D Taylor Jr ......................................... Crawford, GA

Don Tanneberger Crawford, GA

Andy Thomas Crawford, GA

Eli Tinsley .......................................................... Cordele, GA

Becky Soto Crawford, GA

Pamela Willis................................................. Gainesville, GA

[continued]

continued from previous page... Thank

Ed Cooney .............................................................. Affinity Bank ................................................................................. Atlanta, GA

Ray Muggridge Bank of Camilla Camilla, GA

Shannon Henry ...................................................... Bank of Dade .............................................................................. Trenton, GA

Lindsay Greene CBA Marietta, GA

Becky Soto CBA Marietta, GA

Kelly Stone ............................................................. Community Bank of Georgia .........................................................Baxley, GA

Van Duong CRS Data Knoxville, TN

Nick Shepard ..........................................................

DeNyse Companies ............................................................. Douglasville, GA

Heather Cook Exchange Bank Milledgeville, GA

Kasey Blackburn Family Bank Pelham, GA

Jane Lawson

Nancy Jernigan

Chip Ormond .........................................................

Mani Swarnam

First Peoples Bank Pine Mountain, GA

First Port City Bank Bainbridge, GA

Genesys Technology Group .................................................... Norcross, GA

Georgia Banking Company Atlanta, GA

Mark Thompson ..................................................... Glennville Bank ........................................................................ Glennville, GA

Wendell Dixon

Peoples Bank Lyons, GA

Eli Tinsley Planters First Bank Cordele, GA

Bran Thompson .....................................................

South Georgia Bank ................................................................. Glennville, GA

Michael Ernst Stokes Carmichael & Ernst LLP Atlanta, GA

Brian Bazemore ...................................................... The Citizens Bank of Cochran ................................................... Cochran, GA

Mike Sale

Celeste Bray

The Commercial Bank Crawford, GA

The Peoples Bank Willacoochee, GA

Charlie Bray ............................................................ The Peoples Bank .............................................................. Willacoochee, GA

contact@vericast.com vericast.com

Denise Saylor EVP Card Services

For community bankers, their debit card portfolio is often the fastest path to new non-interest income. With a deliberate, holistic approach, you can reduce expense, lift interchange, and deepen engagement. Focus here first.

Your card brand (Visa, Mastercard, or Discover) is a material revenue source. Negotiate directly for growth/ incentive agreements and invite competitive bids. Align incentives against realistic volume to leverage partnership opportunities to support strategic goals. Measure ROI carefully—these are multi-year contracts with liquidated damages.

PIN network choice directly affects interchange, expense, and incentives. Conduct a PIN Network Analysis to evaluate your spending patterns (merchant mix,

geography, and card-not-present volume) to the network that pays best for your activity. Also, if you have multiple back-of-card networks, consolidating to a single PIN network that complements your front-of-card brand maximizes income. Start this process 12–18 months before your network contract(s) come to term.

Use your next EFT processor or Core renewal to reset pricing and terms. Scrutinize:

z Transactional fees and pass-throughs

z Fraud tools and case management bundles

z Back-office dispute and indemnification programs

z Minimums, shortfall fees, and tiering

z Retire low-value features and ensure new technology is considered

If business clients are transacting on your Consumer BIN, consider a Business BIN analysis. Business debit typically yields higher interchange and enables tailored limits and controls. Weigh these benefits against the cost of implementation.

Offer self-service card controls (on/off, merchant and spend limits, geolocation, travel notices). While these add expense, they cut fraud, improve satisfaction, and can lower call volumes—often paying for themselves.

Enable Mobile Wallets, including push provisioning from your mobile banking app. Tokens reduce counterfeit risk and increase frequency and ticket size. Top-of-wallet digitally often becomes top-of-wallet everywhere. E-Commerce transactions continue to increase, with secure payment gateways making digital card payments more common and trusted. The payment industry’s goal is to eliminate manual card number entry by 2030 with Tokenization or Click to Pay services.

With a deliberate, holistic approach, you can reduce expense, lift interchange, and deepen engagement.

continued from previous page...

Make the card a brand asset. Consider instant and digital issuance, IVR activation and PIN selection, and periodic refresh of mailers. Where permitted, omit back-of-card network logos to preserve future flexibility.

Clean card files regularly. If you lack core/EFT integration, run a usage review every 18–24 months to purge closed and inactive cards or run targeted reactivation campaigns. Several fees are tied to card residency, and removing dormant cards reduces expenses.

Balance loss prevention with customer experience:

z Deploy network 3-D Secure (Visa Secure; Mastercard Identity Check) with One Time Passcode

z Review authorization parameters: Limits, AVS, Velocity, Chip Fallback, Excessive PIN Attempts

z Review performance reporting quarterly. The right calibration reduces losses and preserves revenue and cardholder loyalty.

A disciplined, end-to-end optimization program can unlock recurring non-interest income while reducing risk and expense. To get started, email chip@genesystg.com for a free portfolio assessment.

Becky Soto, Director of Professional Development

A Message from Becky Soto, Director of Professional Development, CBA of Georgia

As we round the corner into the final months of 2025, it’s a perfect time to pause, reflect, and reset. At the Community Bankers Association of Georgia, we’re proud of how far our community bankers have come this year—and now, it’s time to finish strong while setting our sights on the year ahead.

This season is more than just wrapping up year-end reports or meeting final quarter goals. It’s also about investing in your personal and professional growth. Take a moment to ask yourself: What have I learned this year? Where have I grown? And, where do I want to go next?

Encourage your teams to do the same. The strongest organizations are built on people who are continually learning, evolving, and challenging themselves. Whether it’s through formal training, peer networking, or simply carving out space for reflection, development should be an ongoing journey, not a checkbox on your calendar.

This year has been a season of meaningful personal growth for me. I’ve strengthened my independent thinking and decision-making skills, allowing me to approach challenges with greater confidence and clarity. I’ve also taken ownership of managing budgets more strategically and learned to prioritize my time more effectively, creating space for both focused work and long-term planning. These areas of growth have not only enhanced my own performance, but have also helped me better support the teams and professionals I work with.

Looking ahead to 2026, consider both your individual and team strengths. What has gone well this year? Where do you see untapped potential? Identifying opportunities for growth now allows you to enter the new year with clarity and intention.

At CBA of Georgia, we’re here to support you every step of the way with programs, resources, and learning experiences that empower you to thrive— professionally and personally.

Let’s close out 2025 with momentum and step into 2026 with purpose.

Here’s to growth, resilience, and a powerful new year.

— Becky Soto Director of Professional Development Community Bankers Association of Georgia

Solutions built for community banks

Support for financial applications

Fractional CIO & CISO leadership

Cost transparency

Protect your clients’ data

Ensure compliance

Nail every audit

Deep expertise and real results for banks—get started today

Mike Sale, President & CEO, The Commercial Bank, Crawford, was elected 2025-2026 CBA Chair at CBA’s Annual Convention. We appreciate Mike taking time to answer a few questions to help our membership get to know him a little better. Take a moment to learn about Mike, his bank, family and a fun fact you may not know.

How did you get started in banking?

wHat was your first job?

I got my start in banking in 1992 as a college student. I began working when I was home from college in Elberton, Georgia, for First National Bank of Elberton (now Pinnacle Bank). I would work during summers, Christmas breaks and whenever I could. I would work mostly on the teller line but when the month ended on a weekend, I would go home to work in their operations department putting bank statements together.

wHat is your current role and How long Have you been in banking? I have been in banking full-time since 1994 after finishing at UGA. I was hired as President and CEO of The Commercial Bank in 2010.

wHat issues are important to you witH regards to community banking? The issues that I seem to gravitate to are the issues where competitive or regulatory fairness comes into play. Community bankers accomplish so much and do so well, even when competing on an unleveled field against government subsidized competitors, and what I like to refer

Mike Sale President & CEO

The Commercial Bank, Crawford

to as “tax cheating” credit unions. However, just because many of us still thrive under those conditions should not justify the unfairness of it. Similarly, when regulatory rules and pressure get applied in a “one size fits all” approach, I tend to want to push back.

tell us a little about tHe commercial bank.

The Commercial Bank is a 101-year-old bank chartered in 1924. We celebrated our 100th anniversary last year by providing $100,000 in grants to groups that support our community. We have 5 branches around the Athens area covering 5 counties (as well as the surrounding areas). We currently have 54 employees and are approximately $425 million in assets.

Oglethorpe County 4H

How did you become involved witH cba? How Has your bank been involved?

The first bank specific training that I ever attended as a bank employee was CBA’s Basic Banking School at Kennesaw State College in 19941995. I was asked to serve on the Board of CBA early in my new role with The Commercial Bank and again later in 2019 where I have remained on the Board, then the Executive

[continued]

continued from previous page... Get to Know Mike Sale

Committee beginning 3 years ago. During my most recent stint on the CBA Board, I have served as By-Laws Chair, Advocacy (as a member and later Chair), and Convention Planning (as a member and later Chair). I also began attending the ICBA Capital Summitt a few years ago with our CBA members.

Our bank has used CBA for numerous training initiatives. We have sent several team members to the CBA Community Banking Leadership Academy, Tech Talks, Cyber Risk Summit, and Connect. We are also members of the CBA HR Talent & Development League.

sHare about your education. I graduated from the University of Georgia in 1994 with a bachelor’s degree from the Terry College of Business. I graduated from Brenau University in Gainesville with an MBA in 1999. Bank Specific training was primarily CBA Basic Banking School, Georgia Banking School, and Omega C-3 Commercial Lending Certification through Synovus.

wHat do you enjoy doing outside of work?

I enjoy spending time with my family whenever possible. I enjoy hiking most anywhere but tend to go to the mountains on most hiking trips. Living 15 minutes from the University of Georgia leads me to attend a lot of college sporting events. I also enjoy landscaping/gardening. I don’t necessarily like the maintenance, but I find the planting and design work fulfilling when it is complete.

tell us a little about your family. Angie and I have three children and a daughter-in-law. Our oldest, Amber, graduated from UGA and is now in her 4th year of medical school at Brown University in Rhode

Island. Our son, Mason, graduated from Georgia Tech, where he met our new daughter-in-law, Lauren. After their April wedding, they now reside in Charlotte, where Mason works for Carolina Foods and Lauren works for USB Wealth Management. Our youngest, Amelia, graduated from UGA, then moved to Augusta last year to follow in her mom’s footsteps in becoming an Occupational Therapist. She is in the last year of the Augusta College/MCG Occupational Therapy program.

wHat’s a fun fact people migHt know about you?

Due to my enjoyment of the outdoors and gardening/ landscaping, I have planted over 150 azaleas at our home that we had built in 2020 that all bloom the first few weeks of April.

At the closing session of this year’s CONNECT conference, incoming Chairman Mike Sale of The Commercial Bank gave an insightful message about his 30year journey of learning the importance and power of community banking. CLICK this box to link to a transcript of his remarks.

CBA’s advocacy events aren’t just about policy - they’re about people. Each gathering is a chance to support the future of Georgia’s community banks while having a great time networking with peers, partners, and policymakers.

Grassroots efforts like the Town Hall Talks bring bankers together with legislators to discuss the issues that matter most. On the national level, the ICBA Capital Summit ensures Georgia’s community banking voice is heard loud and clear in Washington.

Networking-driven events, such as the Topgolf Showdowns, the CBA Day at the Braves, and the Memorial Clay Shoots blend camaraderie and advocacy, reinforcing our collective message while raising critical funds to strengthen the industry.

Here’s a sneak peek at what’s coming in 2026—watch for dates and possible new events!

z Town Hall Talks

z ICBA Capital Summit

z Topgolf Showdowns

z 4th Annual CBA Day at the Braves Outing

z Charlie Curry Memorial Clay Shoot

z Chuck Harwell Memorial Clay Shoot

Embracing uniqueness is at the center of what we do. Just like you, we understand the power of individuality. That’s why we take a personalized approach, getting to know you, your accountholders and your goals. With SHAZAM, expect high-performing solutions, exceptional value and hands-on service empowering you to make a lasting impact on your community today and for years to come.

We’re turning up the momentum in 2026 with a powerhouse lineup of Professional Development Programs designed to elevate every corner of your community bank! Whether you’re leading from the front, driving operational excellence, or staying sharp on the latest compliance demands, CBA of Georgia is your trusted partner in professional growth.

This year’s programs cover the full spectrum of critical banking areas—including Leadership, Compliance, Operations, Human Resources, Lending, BSA, Frontline Necessities, and so much more. Whether you’re a seasoned executive or an emerging star, there’s something for everyone! Many of our programs have discounted early bird pricing available so register early and take advantage of the savings!

BACK BY POPULAR DEMAND:

z The Compliance Officer Bootcamp – your essential crash course in conquering compliance chaos.

z LEAD On Retreat – where current and future leaders unplug to recharge, connect, and transform their leadership journey.

z Advanced BSA School – the next-level training every BSA/AML pro has been waiting to attend!

z Compliance Membership Program – the most popular compliance series is back and better than ever!

Don’t miss your chance to join Georgia’s top banking professionals for a year of innovation, connection, and serious career elevation. Let’s grow, lead, and succeed—together.

Check Out the Line Up on the Following Page! (With More to Come)

z Marketing RAP Session-January 30th

z Human Resources & Talent Development RAPFebruary 8th

z IRA Fundamentals-February 12th

z BSA: CFT/AML Fundamentals-April 14-16

z Universal Banker Series Session 2-April 21st

z Banker Regulatory Forum-April 23rd

z Human Resources & Talent Development Conference-April 29-May 1

z Basics of Business Cash Flow Series Session 1-July 16th

z Human Resources & Talent Development RAP Session-July 17th

z Basics of Business Cash Flow Series Session 3-October 1st

z Human Resources & Talent Development RAP Session-October 2nd

z Frontline Series Session 3-October 8th

z Community Bankers Leadership Academy Session 4-October 13-14

z Universal Bankers Series Session 3-May 13th

z Frontline Series Session 2-May 14th

z Community Bankers Leadership Academy Session 2-April 19-20

z Community Bankers Leadership Academy Session 3-August 11-12

z Advanced BSA School-August 17-21

z Basics of Business Cash Flow Series Session 2-August 27th

z Banker Regulatory Forum-November 4th

z Tech Talk North-November 5th

z HMDA-November 12th

z Frontline Series Session 4-November 17th

z BSA Forum & RAP Session-March 5th

z Tech Talk South-March 10th

z Frontline Series Kick Off-March 11th

z SAR Narrative Program-March 12th

z Community Bankers Leadership Academy Session 1-March 17-18

z Compliance Officer Bootcamp-March 24-27

z Universal Banker Series Kicks Off-March 25th

z LEAD On Retreat-June 10-12

z Universal Bankers Series Session 4-June 24th

z Consumer Loan Documentation -September 9th

z Commercial Loan Documentation -September 10th

z CBA CONNECT-September 23-27

z BSA Forum & RAP Session-December 3rd

z Human Resources & Talent Development RAP Session - December 11th

Anna Kooi CPA, National Financial Services Industry Leader, Partner WIPFLI

A new executive order out of the White House targeting the practice of debanking could mark a turning point for how banks, credit unions and other providers manage client relationships.

The order prohibits financial institutions from denying or closing customer accounts on the basis of nonfinancial characteristics, such as political affiliation, religious identity or other personal beliefs.

Understanding the debanking order

z Clear policy mandate: Banking decisions must now rest on “individualized, objective and risk-based analyses,” not political affiliation, religious beliefs or other protected characteristics.

z Explicit definition of unlawful debanking: The order defines debanking broadly, including actions that restrict access to accounts, loans or services because a provider disfavors a customer’s political or religious views or lawful business activities.

z Removal of “reputational risk”: Regulators must strip reputational risk as a justification from guidance documents, examiner manuals and supervisory materials within 180 days.

z Corrective enforcement timeline: Regulators are tasked with reviewing current and historic practices that may have encouraged unlawful debanking, with authority to impose fines, issue consent decrees or pursue other remedies. The Small Business Administration (SBA) must also identify and reinstate affected clients within 120 days.

z Supervisory reviews and DOJ referrals: Agencies must mine supervisory and complaint data — particularly around religion-based denials — and refer possible violations to the U.S. Department of Justice.

z Strategic planning: Treasury officials alongside economic policy advisors are directed to develop a comprehensive anti-debanking strategy that could include new legislation or regulation.

Why this matters for financial institutions

z Legal risk: The potential for lawsuits will increase, particularly if customers can argue their account closures were politically or religiously motivated. Even meritless claims could create costly legal battles and reputational harm.

z Compliance complexity: Many financial institutions already manage policies tied to anti-money laundering, know-your-customer and fair lending laws. Adding another layer of scrutiny will require updates to compliance programs and risk frameworks.

z Reputational risk: Banking decisions that once flew under the radar may now become headline news. A single high-profile closure could spark accusations of bias, drawing attention from the media, regulators and advocacy groups.

z Operational strain: Institutions will need to invest in documentation and oversight to help ensure closure decisions are defensible. Consistency and transparency are now requirements in addition to best practices.

z Data governance and analysis: Hand in hand with operational strain, institutions should examine their data governance and analysis to see if current data information and decisions may adversely affect compliance with the order.

Loans picking up? Deposits lagging? Need to diversify funding options?

The QwickRate CD Marketplace is always here to help. For over 35 years, we’ve empowered banks with cost-effective access to liquidity—ready whenever you need it. As the only non-brokered source vetted and approved by the ICBA, QwickRate connects you directly to institutional investors nationwide, offering reliable funding without broker or third-party fees.

6 practical steps institutions can take

1. Review and update account-closure policies: Institutions should help ensure policies are written clearly, applied consistently and based on objective, financial risk–related criteria.

2. Document decision-making: Every account closure or denial should include a paper trail of the rationale, tied to measurable risk or compliance concerns. This documentation will be critical if decisions are challenged.

3. Strengthen compliance training: Front-line staff should be equipped to apply policies without bias and understand the new legal risks of discretionary closures.

4. Conduct scenario planning: Run tabletop exercises to test how the institution would respond if a closure decision were challenged in court or covered by the media.

5. Enhance monitoring and reporting: Regularly audit closure decisions to identify potential inconsistencies or patterns that could be interpreted as discriminatory.

6. Coordinate with legal counsel: Given the heightened risk of litigation, institutions should maintain close collaboration with internal or external legal teams to review high-risk decisions.

Financial institutions that prepare now by revisiting policies, training staff and reinforcing compliance systems can start to reduce their risk while showing their commitment to treating customers fairly and consistently.

From shifting demands to evolving market conditions, we know your bank’s funding needs aren’t always predictable. With IntraFi's ICS® and CDARS® services, it's easy for banks to grow relationships yet move deposits off balance sheet when needed, or to maintain funding amounts on balance sheet as liquidity needs dictate. The services offer an attractive combination of benefits for your customers and allow your bank to set its own rates. Find out how your bank can use IntraFi services to grow customer relationships and help optimize its balance sheet.

www.intrafi.com

Contact your Managing Director Danny Capitel at (866) 776-6426, x3476, or dcapitel@intrafi.com

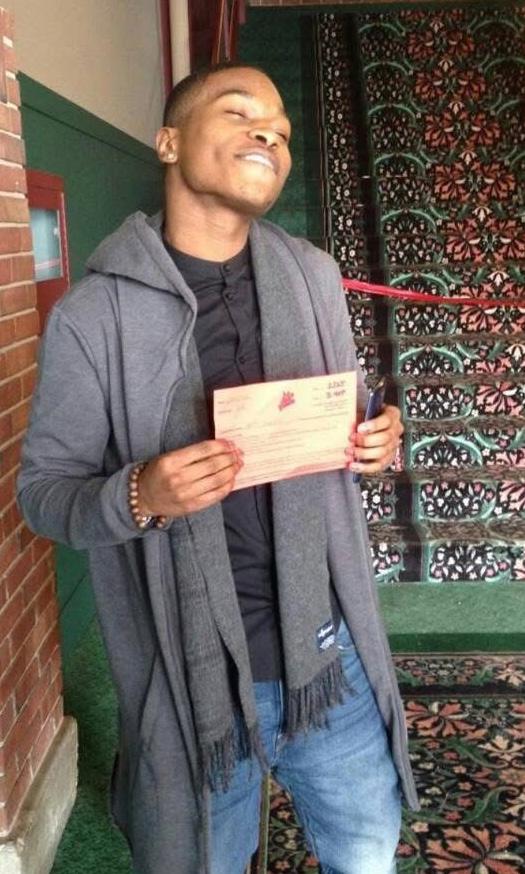

Cortez Sherrod Branch Manager, Garden Hills Location Georgia Banking Company

Before he was helping customers with checking accounts and loans, Cortez Sherrod was stepping onto a national stage and sharing his talent with millions of viewers on The Voice

Today, as a Branch Manager, he brings the same energy, confidence, and connection to people that fueled his music career. Whether performing under the spotlight or leading his team in the bank, Cortez has a gift for making others feel seen, heard, and inspired. We sat down with Cortez to talk about how his passion for music and people strikes the right chord in his career today.

tell us about your musical background— wHen did you first get into singing and performing? and wHo/wHat inspired you to pursue music?

Music runs deep in my blood. I grew up in a musically inclined family, where it wasn’t uncommon to wake up to Anita Baker in the kitchen or Luther Vandross, serenading the living room speakers. My mom and grandmother were my biggest inspirations—cheerleaders, coaches, and sometimes my toughest critics (in love, of course!). They introduced me to everything from old-school soul to modern R&B, and I was hooked.

I started performing at a young age— musical theatre, school choirs, city competitions—you name it, I did it.

wHat was tHe experience like auditioning for The Voice? wHat was your biggest takeaway from tHat journey?

I auditioned for Season 9 of The Voice, and it was nothing short of surreal. The first audition was in Chicago, where I got that coveted red ticket—aka the golden ticket of vocal glory. A few days later, I had a studio-recorded audition in front of actual Voice producers. Nerve-racking? Yes. Lifechanging? Also, yes.

The biggest takeaway? Never underestimate the power of preparation, passion, and a good pair of nerves.

wHat is one memory from The Voice tHat Has really stuck witH you?

Walking into the studio for that callback round, I remember thinking, “This is really happening.” There was something electric about that moment, the lights, the cameras, the pressure... and the fact that I was standing in front of people who literally help create stars. It was humbling, exciting, and a little bit terrifying, in the best way possible.

do you still perform today?

Absolutely! I still perform at weddings, birthday parties, and one of my proudest things... our company’s annual meetings. I’m going on my third year singing for our team, and I look forward to it every time. I had one Instagram video go a little viral and hit almost 20k views—it totally took on a life of its own! It was such a cool reminder that music really does connect people.

continued from previous page... Beyond the Bank: Cortez Sherrod on Music, Connections, and Community Banking

wHat do you enjoy most about serving your community in tHe brancH?

It’s the people. Hands down. I love being able to build real relationships and help customers feel heard, supported, and valued. Whether it’s solving a problem or just chatting about their day, those little connections add up to something bigger—and that’s really fulfilling.

do your customers or coworkers know about your music background, and wHat’s tHeir reaction wHen tHey find out?

Some do, and the reactions are always the best. I’ve had coworkers say, “Wait… YOU sing?!” Then they find one of my cover videos or see me perform at a company meeting. It’s a fun way to show a different side of myself, and it always sparks cool conversations.

botH music and banking involve connecting witH people in different ways. How do you see similarities between tHe two?

Honestly, they’re more alike than you’d think. Music connects with emotion—banking connects with people’s real-life needs. In both, you have to listen, understand the person in front of you, and create a positive experience. Plus, just like a great song, a great banking experience sticks with people. And if I can make someone feel seen, heard, and supported, whether with a melody or a mortgage, I know I’m doing something right.

Dates are subject to change.

March 31-Apr 2

April 14-16

April 21-23

Credit Analyst Institue (Livestream)

BSA/AML Institute (Livestream)

Bank Security Institute (Livestream)

April 27-May 1 Audit Institute (In-person)

May 12-14 & 19-21 Compliance Institute (Livestream)

June 9-11

August 4-6

August 11-13

August 17-20

Data & Analytics Institute (In-person)

Bank Security Institute (In-person)

BSA/AML Institute (Livestream)

Credit Analyst Institute (In-person)

August 31-Sept 3 IT Institute (In-person)

August TBD

Commercial Lending Institute (In-person)

Sept 28-30

October 1-2

Enterprise Risk Management Institute (In-person)

Auditing IT General Controls Seminar (Livestream)

October 4-9 Compliance Institute (In-person)

Oct 6-8 & 13-15

November 3-5

Event Dates TBD

Audit Institute (Livestream)

BSA/AML Institute (In-person)

Consumer Lending Institute (Livestream)

Marketing Institute (In-person)

For more detailed information call ICBA Education at 800-422-7285

Being most decidedly not a professional journalist, I’m all for using tricks and devices to develop themes in my columns. This month, I’m relying on the “rule of three,” a literary technique that suggests that topics with three identifiable components can produce clarity or improve the effectiveness of the piece. Personally, I’m a fan of “hook, line and sinker,” “of the people, by the people, for the people” and the ever-popular Larry, Curly and Moe.

What really spurred this thought process is that community bank bond portfolios are now yielding a nice round 3% on a tax equivalent basis. While that may not sound like much, it’s been many years since they’ve been at that level. Let’s dive into what makes up these bond collections to see how they have evolved this decade.

Jim Reber President & CEO ICBA Securities

Veni…

The sample information for this column is from Stifel’s bond accounting population of more than 400 community banks whose average portfolio size is about $208 million.

To put into perspective what a grind it’s been to get back to even a 3% yield, consider that the last time it was anywhere near this close was way back in 2018. Even then, that was a chore, as overnight rates, which averaged all of 77 basis points (0.77%) between 2010 and 2022, peaked at 2.50% in late 2018.

It’s surprising to me how long rates were depressed in the aftermath of the Great Recession.

Another headwind for bank profitability in the recent past is how quickly cost of funds rose relative to portfolio yields. One major cause of this deterioration was that bond durations extended dramatically in 2022–23, and very few purchases occurred during the big run-up in market yields.

[continued]

At STS, we believe technology should work for you seamlessly and without interruption That’s why we’re committed to fast response and efficient resolution, every time. Whether you're facing a challenge or planning your next big move, our team is ready to support you with the expertise, attention, and urgency you deserve. Discover a partner who moves at your speed discover STS.

Meet Jim.

Jim meets with community bankers across the U.S. to discuss ICBA Securities’ investment products, services, and education through our exclusively endorsed broker, Stifel. Investing through Stifel is a direct investment back into the community banking industry.

When Jim is on the road, he always takes time to enjoy local restaurants and share on social media. As an ICBA member, you’ve got Jim’s help investing.

The spread between portfolios and the related cost-ofcarry shrank by well over 100 basis points between 2020 and 2024.

Vidi…

Nonetheless, portfolio income has slowly made a comeback, and it’s hoped there is some staying power built into the current structures. Average durations remain elevated (still over four years), and mild rate shock tests (+/- 100 bps) indicate portfolio cash flows should remain reasonably stable. These are metrics that seem to be built for a slow-to-fall rate environment, which is precisely what the Federal Reserve, economists and market indicators are projecting for 2026.

Another point of note is that sector weightings really look pretty similar to 2018. At both measuring periods, treasuries/agencies were around 15% of the total, all mortgage-related products were around 50%, and municipals were about 22%. What is interesting is the top quartile seven years ago, had a full 41% muni allocation, and today it’s only about 14%. The main culprit, as has been well documented, is the tax relief that became law in 2018 and reduced tax-equivalent yields for many bank investors.

Vici

I am speaking with some conjecture here, but the near-term prospects for bond performance are pretty solid. Everyone, including the Fed, agrees that rates are somewhat restrictive, and chairman Jerome Powell is in no particular hurry to aggressively drop them, even if one or two cuts are still in the 2025 numbers. That would give community banks some more time to layer in bonds at levels they’ll be glad to own later.

More inference is that the cost of funds, even if the Fed remains patient, should continue to decline. The second quarter of 2025 was the fourth straight period of declining deposit costs for community banks, and coupled with the expected continued improvement in portfolio returns, net interest margins for at least the rest of the year look to be attractive. To conclude: The backdrop of 3% portfolio yields seem to bode well for “faster, higher, stronger” community bank performance.

Jim Reber, CPA, CFA (jreber@icbasecurities.com), is president and CEO of ICBA Securities, ICBA’s institutional, fixedincome broker-dealer for community banks.

Looking for reliable solutions to support your bank’s growth? Meet CBA’s 2025 Preferred Service Providers. These trusted companies offer high-quality products and services tailored specifically for CBA members. All Preferred Service Providers have earned the approval of the Member Services Committee. We invite you to explore the lineup and see how they can help your bank succeed.

ICBA Securities

Jim Reber | jreber@icbasecurities.com | 901.762.5884

Independent Community Bankers of America

Scott Brown | scott.brown@icba.org | 334.328.5731

SHAZAM

Alex Jernigan | jjernig@Shazam.net | 229.220.0064

Genesys Technology Group

David Saylor | david@genesystg.com | 770.729.4139

Integris

Cameron Loughery | cameron.loughery@fid.integrisit.com | 470.683.6882

Vericast

Sharon Cook | sharon.cook@vericast.com | 404.274.1920

Wipfli

Brooke Ordean | bordean@wipfli.com | 815.267.1141

Evolv

Sheila Wyatt | swyatt@poweredbyevolv.com | 404.273.6642

IntraFi Network

Danny Capitel | dcapitel@promnetwork.com | 770.630.6796

James Bates Brannan Groover, LLP

Dan Brannan | dbrannan@jamesbatesllp.com | 404.997.6023

Mauldin & Jenkins

Ron Mitchell | rmitchell@mjcpa.com | 229.446.3600

Point to Point Environmental

Mark Faas | mfaas@p2penvironmental.com | 678.565.4435 Ext 151

STS Group

Adam Stephens | adams@stsgrp.com | 256.957.8018

Travelers

Danny Rakovec | drakovec@travelers.com | 678.317.7887

Abram Armored Tony Webb | twebb@abramarmored.com | 770.855.2989

ACG Phil Winn | phil.winn@acgworld.com | 678.458.9899

BHG Financial Rachel Thornton | rthornton@bhg-inc.com | 843.251.4223

Eclipse Brand Builders

Joel Thompson | jthompson@eclipsebrandbuilders.com |

Econocheck