Slow and Steady

3Q 2025 | Market Update

Pebble Beach and Carmel continued to weather the storm this quarter, in the face of macroeconomic uncertainty. We saw many buyers who have been circling for a while get off the sidelines this quarter as both Pebble Beach and Carmel had stronger quarters over Q3 2024. Overall, there were 77 deals that closed this quarter in Pebble Beach, Carmel, the Carmel Highlands, Preserve, Quail Lodge/Meadows, Tehama and Monterra, for a total of $291M, which is level with deal flow in Q3 2024, but down from the $326M invested. The difference in dollars invested this quarter was primarily due to a pull back of deals in the Valley, which tends to feel shifts in the economy faster than Pebble or downtown Carmel. However, we currently have two deals in escrow in the Preserve and have seen an uptick in interest in Tehama and Monterra, so we anticipate this trend shifting through the end of the year.

Carmel had 45 deals close for $141M this quarter, outpacing Pebble Beach a little bit, which is fairly standard for this time of year. However, Pebble Beach had a strong quarter with 25 deals closing for $122M, as the top of the market started to wake up this quarter. The $122M is a 22% increase over Pebble sales last quarter and 11% higher than this time last year. Pebble Beach has been struggling with inventory levels for a few years now, so it’s encouraging to see more options for buyers to see to get a sense for values and the market - a process that’s much more difficult when inventories are tight. Demand appears to be growing in Pebble, as the average days on market this quarter dropped 20% from last quarter, to 38 days. This is, of course, price dependent, but an encouraging sign for the next few months. The Carmel Highlands have slowed down from last year, with just 3 sales closing for $9.7M and taking an average of 213 days to sell. This market is more price and market sensitive than other areas, so it’s not atypical for that region to have an off quarter. The Preserve had two sales for $10.5M this quarter, over double that of last quarter but about a third of what we saw this time last year. Quail had 2 sales for a total of $7.75M, including our sale in Quail Meadows that sold quickly for $5.75M. Tehama and Monterra were quiet this quarter with no sales, but we’ve seen a strong spike in showings and new buyers coming to the area to preview lots and available inventory, so we also anticipate an uptick in sales in both regions in the near future.

Demand is continuing to climb the price spectrum in this area, with the $4-6M price bracket surging to 15 sales, up from the 9 that closed at this time last year. Additionally, we’ve seen the bottom of the market drop with just 8 sales below $1.5M, down from the 13 sales we saw in Q3 2024. This has resulted in a lift of median sales prices from $3.19M in Q3 2024 to $3.97M this quarter. Part of this shift is also due to fewer sellers stretching their list prices and targeting closer to perceived market value, as the list price discount (sales price off original list price) has dropped to 3% off list. This area has always negotiated off list price, unlike in other areas, but if the house is priced well, we are still seeing deals get multiple offers and closing above list. One thing we’re watching very carefully is how many deals fall out of escrow - there were 11 this quarter alone. This is a trend we’ve been tracking all year as the dynamics between buyer and seller shift.

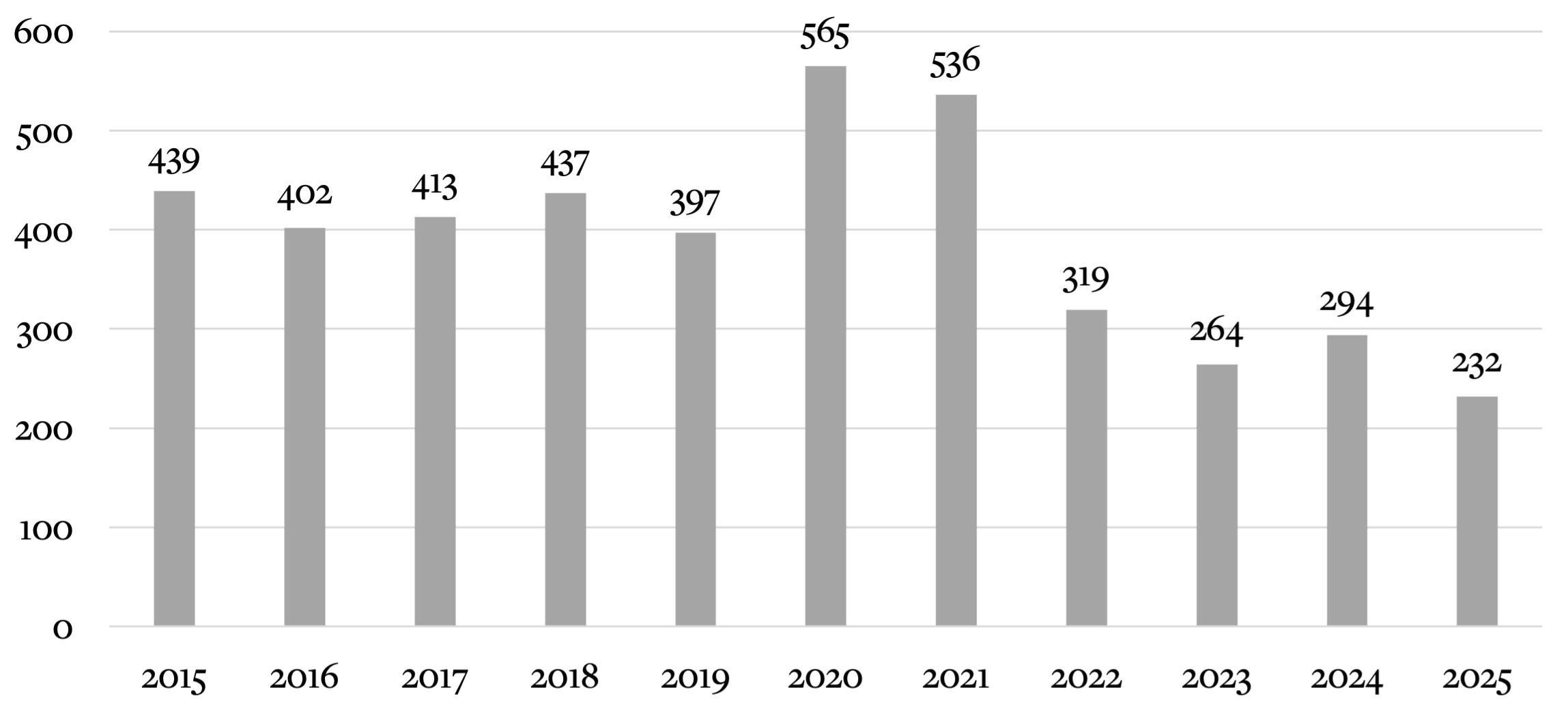

Overall, we’re seeing a steady deal flow in this area and will likely come close to matching total invested in 2024 ($1.15B) but will be a far cry from the $1.8B we saw in 2021.

Total Annual Sales 3Q 2025 Update

Quarterly Sales by Region

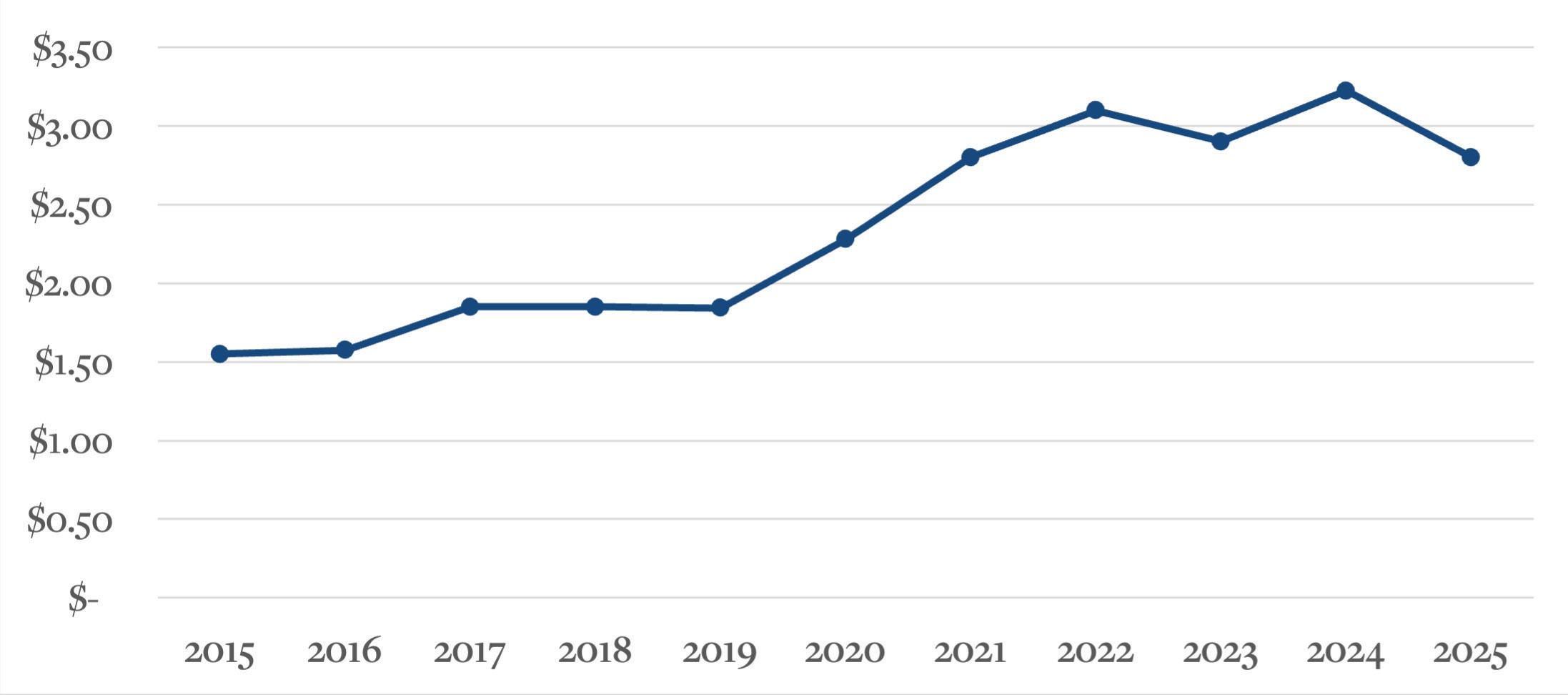

Median Sales Price ($M)

Historic Sales Averages by Price Range

3Q Region Overview

“ Carmel had another strong summer with 85 deals closing in 2Q and 3Q of 2025, which is the most activity we’ve seen over a two quarter span since the Summer of 2021. The Golden Rectangle was particularly strong, as we finally got more inventory to sell, which resulted in 12 sales this quarter. Northeast Carmel also had a strong quarter with 14 deals, up from just 8 last quarter. The $4-6M price bracket was particularly strong this quarter, representing 9 of the 15 deals that closed in that price bracket across the key regions. Given the demand we’re seeing, we anticipate this continuing to build through the end of the year.”

Pebble Beach

“The Pebble Beach market eased slightly this quarter with a mild dip in deal flow but activity in the upper price points (5 sales above $8M+) pushed total dollar volume up from last quarter. With a 47% absorption rate in Q3, the market showed resilience while favoring sellers overall. For reference, an absorption rate above 20% is considered a seller’s market. Active inventory hovered at 46 homes (-4% QoQ) - balanced by matching demand across all sub-markets. Market dynamics were more nuanced this quarter: move-in ready homes in prime locations generated premiums, while project properties lingered on the market and saw deeper discounts.”

WHERE LEGACY MEETS LUXURY | PEBBLE BEACH

1500VISCAINO.COM | OFFERED AT $9,495,000

3Q Region Overview

“Slower demand for the Highlands stalled sales this quarter while widening discounts (+64.2% QoQ) and stretching average days on market. As we enter Q4 with 2 sales pending above $10M, we anticipate a mild rebound to finish the year.”

Nic Canning carmel

$9.75 m

“Every listing has a different marketing approach that we curate to maximize the property’s exposure in its best light while tailoring it to our clients’ lifestyle needs. For the sale of 30680 Aurora Del Mar, our clients desired a more discreet approach, so we customized a campaign employing available marketing tools/channels that strategically targeted key demographics and feeder markets. We also leveraged our robust agent network for optimal exposure and were able to deliver exceptional results while ensuring privacy for our clients.”

Be the first to find out about discreetly listed available properties at

3Q Region Overview

Santa Lucia Preserve

$5.25M

“ The Preserve had two home sales this quarter, including 3 Rancho San Carlos that sold after about a year on the market, for $5.5M. This home had a very nice setting and close proximity to the front gate, while being a single level house, which the market likes. We were proud to represent the sellers of this home as they enter a new chapter as a family. The other home sale was 20 Long Ridge, which closed at $5M, off considerably from their original list price of $9M. The buyers of this property also purchased the furniture and furnishings for an all-in sales price of $6.4M. We currently have two more houses in escrow in the Preserve, so it’s great to see traction building in this very special community.”

Quail Lodge / Meadows

$7.75

2

“There were two sales in Quail this quarter, including our listing at 5473 Quail Meadows Drive which sold for $5.75M. The only other sale was the last of the Wolter lots, located between Baja Cantina and Poplar Lane, which sold for $2M each. We were honored to represent the owners of 5473 Quail Meadows Drive on this sale, which we were able to sell in just 6 days, with multiple people talking about bringing offers. This home was a striking contemporary with nice valley views - just what the market is looking for. We just brought a condo to the market at $1.5M and are bringing another house to the market in a couple

months. Watch our weekly newsletter for more information on that home.”

A PRIVATE RETREAT ABOVE IT ALL | QUAIL MEADOWS 5473QUAILMEADOWS.COM | SOLD FOR $5,750,000 IN 6 DAYS

2025 Summary

Teháma – 2025 Summary

$13.2M

Total Dollar Volume Total Dollar Volume

“While Teháma didn’t have any sales this quarter, we did see a nice uptick in showings at the vacant lots and continued interest in finished homes. The market continues to pay a premium for move-in and proximity to the Carmel gate - a trend we anticipate holding steady through next year. There is one new home listed for sale at 53 Marguerite for $13.5M. With a single level floorplan, pool and views, this will make for a strong sale in Teháma.”

Monterra – 2025 Summary

$849K Total Units Sold Total Units Sold 3 1 Average Days on Market Average Days on Market

“Demand in Monterra pulled back this year, surprisingly. While we saw $39M in sales last year, we’ve only seen $849K so far this year. There are three homes actively listed on the market, each with their advantages and disadvantages. Over the past couple of months, we’ve seen a renewed interest in both land and houses in Monterra. While they don’t show up in the stats yet, I do anticipate this changing in the near future.”

Our Marketing Approach Delivers Global Reach with Local Precision

• Story-first creative: High-end photos and video, custom brochures & website landing page.

• Phased launch: Quiet pre-market buzz followed by a full scale blitz once live on MLS.

• Precision digital & print: Targeted email/social/ TV ads + local and national print publications.

• Exceptional Reach: Leveraging Sotheby’s International Realty’s global outreach and press, plus our private network of 18,000+ clients.

“We provide in-depth market knowledge to clients and prospective buyers to educate on market trends and defend pricing. We have also developed a proprietary database to track off-market sales and buyer trends, which keeps us well informed and ready to react to changes in the market.

Having sold the best in our markets for 35 years, we know how buyers respond to different views, weather patterns, proximity to amenities, shifts in designs/style preference and we use our expertise to your benefit.

Integrating multi-generational knowledge of our area with a passion for local architecture and real-time economic dynamics, we continually strive to provide our clients with unparalleled knowledge and expertise.”

1 BACKED BY AN INTERNATIONAL NETWORK LEVERAGED TO MAXIMIZE EXPOSURE AND ENGAGED TO SELL FASTER

2 EXPERT ADVISORS SUPPORTED BY A DEDICATED TEAM

3 OUR PASSION AND GOAL IS QUALITY, NOT QUANTITY. WE LIMIT OUR LISTINGS TO PROVIDE SUPERIOR SERVICE

The #1 TEAM in 2020, 2021, and 2022 TOP 10 TEAM for Sotheby’s International Realty for 9 years