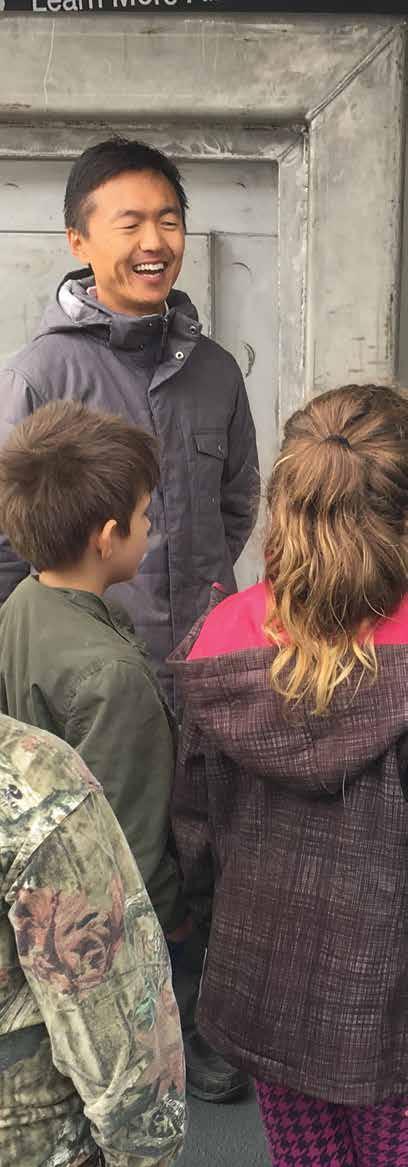

Kidd Operations had the privilege of hosting the 2025 Ontario Mine Rescue Provincial Competition and was proud to have our own team win this year’s competition for the first time since 2013.

The competition setup underground and on surface was successful thanks to the combined efforts of all Kidd personnel involved along with meticulous planning and safe execution which had no impact on mine production and gave us the opportunity to showcase Kidd to the seven visiting teams and their supporters.

As Kidd was the winner of this year’s competition, they were invited by Ontario Mine Rescue to compete in 2026’s International Mine Rescue Competition hosted in Zambia next spring

The scenario first required safely extracting a pinned worker from underneath a large boulder using anchor bolts and Hurst spreaders on surface and then underground there was a simulated fire on a Toyota truck and two casualties which had injuries that needed to be treated. One casualty was found unconscious inside a cement hauler which needed to be carefully extracted from the confined space and the other was pinned behind the Toyota which required moving with lifting bags.

Minister of Northern Economic Development and Growth

local MPP George Pirie also visited the site on June 18th to present the team members with congratulatory certificates.

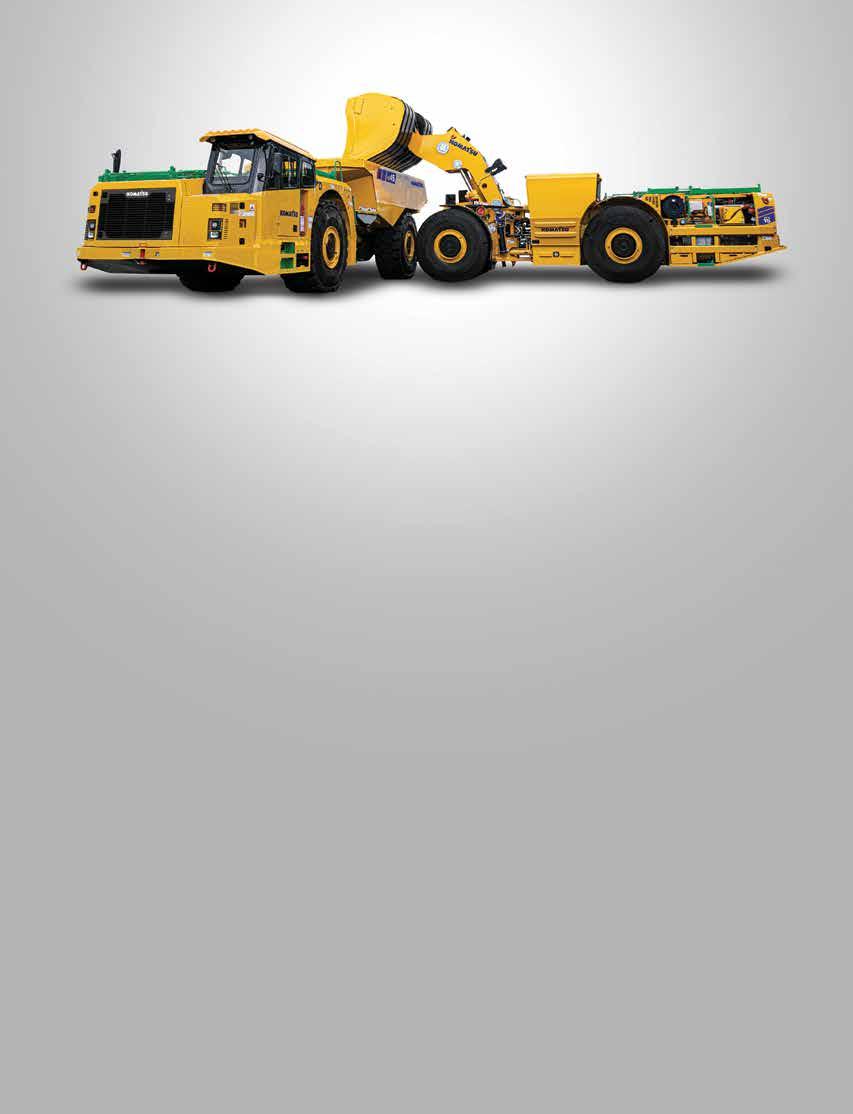

Komatsu’s WX15 underground hard rock 15-tonne LHD and HX45 45-tonne underground mining truck deliver reliable results in harsh environments, with the added benefit of a global support network you can count on. Breaking up hard rock.

ko matsu.co m/hardrock Visit

Publisher-Glenn Dredhart

ThunderBay once again becomes the meeting ground for Canada’s mineral sector this September as the CEN-CAN Mining Expo returns— Central Canada’s most hands-on marketplace for the people, projects, and ideas driving the future of mining. While the season on Lake Superior’s north shore is always electric, this year’s momentum feels unmistakably different.

Across core shacks, community offices, and capital markets, the conversation has shifted—from if we can deliver the metals a low-carbon world needs to how fast. That urgency is not just about geology or policy—it’s about relationships. In just the past year, we’ve seen a wave of new impact-benefit agreements, equity partnerships, and Indigenous-owned service contracts move from signature to full implementation. These are not pilot projects—they are becoming the new normal for how mining is developed and operated across the north.

This shift is unfolding against a volatile global backdrop. Geoeco -

nomic tensions and strained supply chains have pushed gold and copper to new heights, while battery metals are rebounding with fits and starts. For everything from electric vehicles and wind turbines to defence applications, securing critical minerals is no longer just an economic issue— it’s a question of national security. Canada, and Ontario in particular, offer what buyers are seeking: political stability, transparent regulation, renewable power, and world-class technical capacity. Governments have responded. The federal Critical Minerals Infrastructure Fund, Indigenous equity loan guarantees, Ontario’s $500-million Processing Fund, and the province’s “One Project, One Process” permitting initiative are clear signs that public institutions are working to reduce risk and accelerate timelines. These policies aren’t abstract—they have direct impacts on the companies, suppliers, and innovators filling this year’s expo floor.

Still, questions of pace and process remain. Many Indigenous com-

munities have raised important cautions: while capital can move quickly, ecosystems, traplines, and cultural legacies cannot be rebuilt on the same schedule as a lithium refinery. Their input is not a roadblock, but a necessary guide—ensuring development proceeds with care, trust, and long-term vision.

As companies continue exploring, negotiating, and deploying new technologies across the north, three priorities are rising to the top: partnership, prudence, and purpose. Those who embrace all three will navigate today’s uncertainty with integrity—and build the kind of shared prosperity that defines a sustainable resource economy.

What’s unfolding here in Thunder Bay is more than a trade show. It’s a reflection of a sector—and a region—stepping into a leadership role on the global stage. We look forward to having you join us at this year’s CEN CAN Expo, September 10th and 11th at the Fort William Gardens Complex.

Ontario Renews Push for Discovery with $10M Boost to Junior Exploration Program

Evolving Northwestern Ontario Major Exploration and Mine Developments in Q2!

RAINY RIVER MINE: Hits Strategic Milestones as Underground Expansion Advances

ALAMOS GOLD Advances Island Gold District Toward Next-Generation Production

“This Is Our Time” Northern Ontario’s Defining Moment Has Arrived!

NEXGOLD Advances Goliath Gold Complex with Strong Drill Results

Cameron and Springpole Driving FIRST MINING’s Development Agenda

Hemlo’s Last Stand: BARRICK Prepares to Exit Its Final Canadian Mine

GOLDSHORE RESOURCES Delivers Strong Results from QES Up Zone Drilling at Moss Gold Project

WESDOME Expands Ιts Reach in Wawa with Eagle River at the Core

KESSELRUN Sharpens Focus on Historic Huronian Gold Zone

LANDORE Targets Higher Grades at BAM Gold Project in Northwestern Ontario

How a New Regulation in the Ontario Mining Act Helps Turn Tailings and Waste Rock into Golden Opportunities

SUGAR ZONE Potential Strengthens with High-Grade Drilling Results at Sugar South

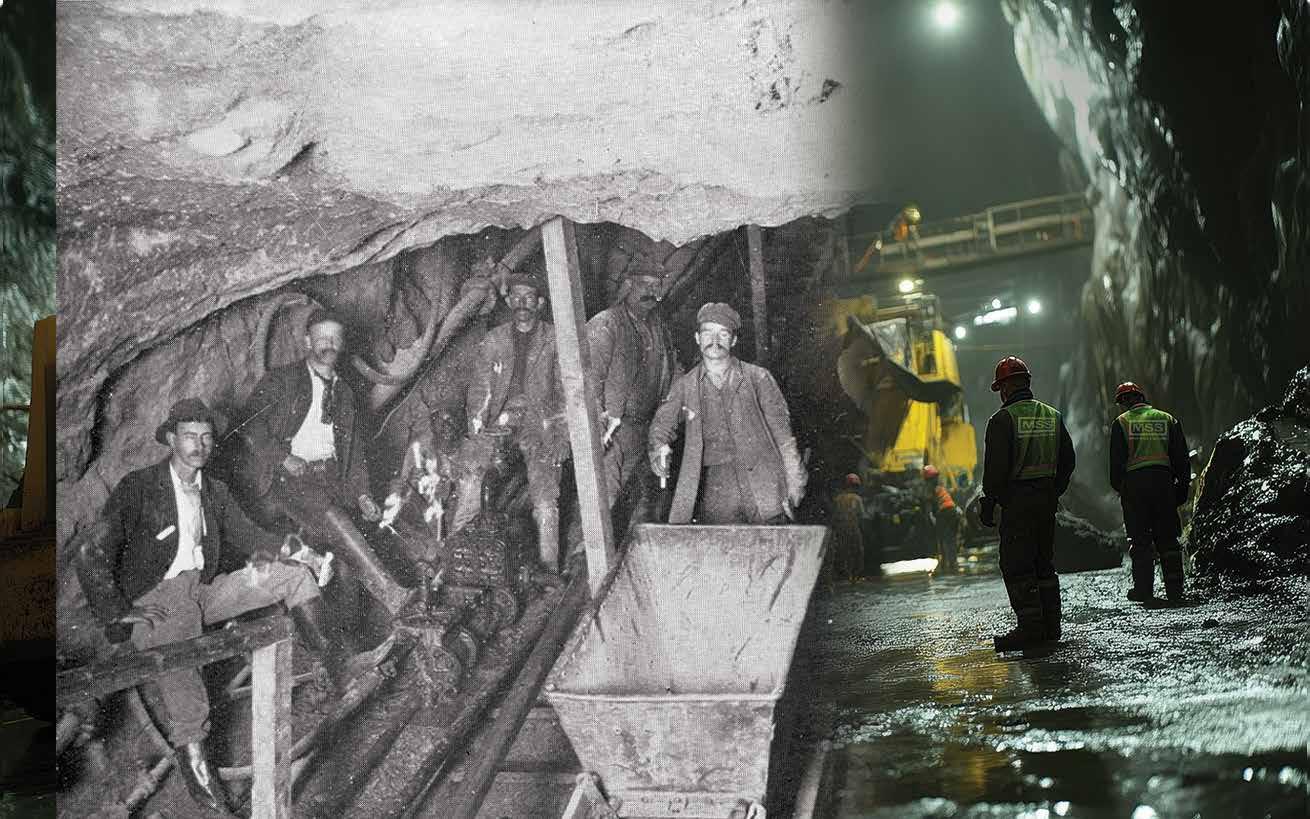

A CENTURY OF RED LAKE’S MINING LEGACY

Timeline: A Century of Mining in Red Lake

Gold Fever Ignites the North: The Birth of a Boomtown in Red Lake, Ontario

Red Lake’s infamous citizen: Ken Leishman – Gold, Sky, and Redemption in Red Lake

How a $575K Online Contest Sparked a $6 Billion Gold Boom in

FORGING NEW RELATIONSHIPS WITH SUCCESS

Building the North Together: Minister George Pirie Charts Bold, Inclusive Future for Ontario’s Mining

Northern Ontario has always rewarded hard work, determination and adaptability for the people who call it home. These values define the region and the Northerners who pursue the economic opportunities this great land has to offer. We continue to realize the potential of developing the North’s rich resources and enviable agricultural lands to grow a strong, resilient, and self-reliant economy.

This amazing region has incredible untapped potential that will be essential to Ontario as it overcomes the current trade war and uncertainty brought on by tariffs between Canada and the United States. The North has what the world needs and we must showcase the North’s extensive industry sectors – such as mining, agriculture, forestry, energy and manufacturing – while making strategic investments to bolster economic development.

Economic development programs such as those delivered through the Northern Ontario Heritage Fund Corporation (NOHFC) have never been more important. With an increased budget of $110 million for this year the NOHFC is one of our key tools for supporting a strong economy in the North. With a new strategic approach that will protect northern industries and jobs, mitigate the impact of trade disruptions and ensure the long-term prosperity and security of the northern economy. Through the NOHFC, we’ve made significant investments in the mining supply and services sector totaling $82.4 million since 2018. We’ve also made significant investments in critical minerals development by approving $8.8 million in funding support.

Meanwhile, our transportation and infrastructure initiatives, the Northern Highways and Winter Roads programs help develop the required infrastructure to bring prosperity, accessibility and connectivity to every region, while attracting investment to the North. Our road networks are the lifeblood of

resource development, being able to move goods and services quickly and efficiently through out the North is a priority. The Winter Roads Program encompasses nearly 3,200 km and links 32 remote Indigenous communities, and the Town of Moosonee, to the provincial highway network. These roads serve approximately 24,000 residents and enables critical economic opportunities.

Mining has been the pillar of the northern economy in years past and has supported immense growth over the last century. With the growing demand for critical minerals and the steadfast economic strength of gold, Northern Ontario has the minerals, expertise and talent to become a vital part of the growing supply chain for critical minerals and clean technology in North America and beyond.

To power these ambitions, Northern Ontario must meet the rising demand for electricity in a region continuously growing in importance to the province, country and more over the world. Through the Northern Energy Advantage Program (NEAP), we are supporting Northern Ontario’s largest industrial electricity consumers with competitive, stable and predictable electricity price rates. Ontario will continue to increase localized electricity generation for the North to power current and future economic growth, including future mines under consideration, in partnership with local communities and First Nations.

These challenging times offer an amazing opportunity. By building on our strengths and embracing innovation, we are transforming the North. We will continue to deliver forward-looking government programs and services in the North to realize our full potential. The future of the mining industry and the Ontario economy will not be the work of one company, one organization or one government… It will be the result of what we can do, together. We are all protecting Ontario and building a stronger, more resilient and self-reliant North.

On behalf of my colleagues on City Council and the people of Thunder Bay, I’d like to welcome everyone to the 2025 CEN-CAN Expo, an opportunity to network and learn about the latest innovations and initiatives in the mining and energy industries in Central Canada and beyond.

Participants and exhibitors will enjoy opportunities to connect and learn through interactive demonstrations, presentations and more. It is refreshing to see the success of companies and their commitment to smart, sustainable growth. It’s an exciting time as mining and metals continue to rev up as the world looks to a greener future.

All roads lead to Thunder Bay and the CEN-CAN Expo is a key contributor to greater prosperity in Thunder Bay and our region.

On behalf of the City of Thunder Bay, many thanks to everyone, past and present, for bringing this important event to Thunder Bay. Best wishes for another successful show.

Sincerely,

Mayor Ken Boshcoff City of Thunder Bay

On behalf of the Thunder Bay Community Economic Development Commission (CEDC), it’s my pleasure to welcome you to Thunder Bay and the 2025 CEN CAN Expo.

We are proud to have you here, gathered on the traditional territory of Fort William First Nation, signatory to the Robinson-Superior Treaty of 1850. We honour and acknowledge the land and its enduring relationship with the Indigenous Peoples who have called this region home for generations.

To all business leaders, community partners, and industry experts—whether you’ve travelled from near or far—thank you for joining us. We’re thrilled to host this exciting event that shines a spotlight on Thunder Bay’s strength in the Natural Resources sector and our diverse, high-quality service and supply companies that support it.

The CEN CAN Expo is your opportunity to connect, collaborate, and do business—driving growth and helping build a resilient and sustainable economy for Thunder Bay and Northwestern Ontario.

While you're here, I encourage you to take some time to experience all that Thunder Bay has to offer. Enjoy our vibrant local restaurants, explore unique shops, and discover the activities and natural beauty that make this city so special.

And don’t forget—keep an eye out for the CEDC team in the blue blazers. We’re here to support your business success in Thunder Bay and are always happy to connect.

Thank you for being part of this dynamic event—we’re glad you’re here!

Sincerely,

Jamie Taylor, Chief Executive Officer

Thunder Bay Community Economic Development Commission

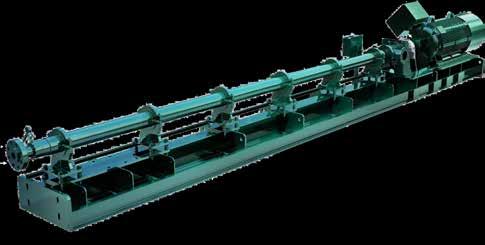

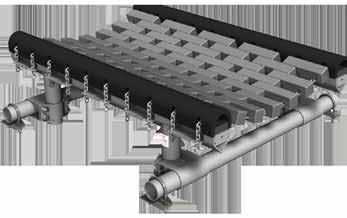

Experience the power of Cannon Mining equipment, engineered for those who demand the best from their tools. Our machines combine robust durability with streamlined technology, ensuring you have the reliability and performance necessary to conquer any underground mining challenge. Designed with user-friendly features, Cannon equipment simplifies operations and maintenance, saving you time and resources. With a commitment to quality and service, Cannon Mining stands by your side, empowering you to achieve exceptional results every time. Discover the difference of equipment that’s as tough as you are.

TheOntario government is injecting up to $10 million into its popular Ontario Junior Exploration Program (OJEP), doubling down on its support for early-stage mineral exploration and increasing opportunities for Indigenous participation. The move is part of a broader plan to solidify Ontario’s place as a global leader in critical minerals development.

“Ontario is sitting on some of the most valuable critical mineral deposits in the world — and the global economy is knocking at our door,” said Minister of Energy and Mines Stephen Lecce. “Supporting early exploration is how we unlock that potential.”

Now entering its sixth intake, the 2025 edition of OJEP includes two key enhancements: a new funding stream for prospectors and increased support for Indigenous involvement in mineral development. Licensed Ontario prospectors can now apply for up to $50,000 per project, with an additional $15,000 in Indigenous Participation Support, bringing total possible funding to $65,000. Junior mining companies remain eligible

for up to $215,000 per project with enhanced Indigenous participation. Applications opened in early July and are being processed on a firstcome, first-served basis.

“This investment will help expand Ontario’s mining sector and support the growth and success of our workers and businesses,” said Minister of Finance Peter Bethlenfalvy. “We are protecting Ontario’s economic prosperity for future generations by unlocking our province’s vast critical mineral resources.”

The expansion of OJEP is a central piece of Ontario’s Critical Mineral Strategy. Early-stage exploration is high-risk work, with only 1 in 1,000 projects becoming a mine. By covering up to 50% of eligible project costs, the province is removing key financial barriers that often prevent companies from progressing in remote, infrastructure-scarce terrain.

“Today’s announcement strengthens our commitment to leveraging every tool at our disposal to create lasting economic opportunities for First Nations communities,” said Minister Greg Rickford. “We are empow-

ering Indigenous partners to play a leading role in developing the province’s world-class critical mineral resources.”

The 2025 OJEP round builds on $35 million already announced in late 2024 and aligns with the government’s $500 million Critical Minerals Processing Fund. This broader investment framework is aimed at ensuring that minerals discovered and mined in Ontario are also processed in-province by Ontario workers.

Industry leaders welcomed the move

“This funding is a clear signal of the province’s commitment to supporting the early-stage explorers who drive Ontario’s mining future,” said William MacRae, President of the Ontario Prospectors Association.

Charla Robinson of the Thunder Bay Chamber of Commerce called the announcement “a vital investment in early-stage exploration to help unlock new opportunities, support Indigenous partnerships, and drive long-term economic growth.”

The province’s mining sector currently contributes $14.4 billion to GDP and supports approximately 74,000 jobs. The Ring of Fire, a nearly 5,000 km² region northeast of Thunder Bay, remains a focal point for Ontario’s critical mineral ambitions. The government is investing $3.1 billion in financial tools to support Indigenous equity and partnership in the supply chain.

“The targets we’re preparing to drill this year are a direct result of the groundwork made possible through last year’s OJEP funding,” said Stefan Sklepowicz, CEO of Kirkland Lake Discoveries. “Programs like this are critical for turning early-stage ideas into real discovery opportunities.”

By bolstering its junior exploration strategy, Ontario is laying the groundwork for long-term growth and reaffirming its global leadership in responsible mineral development.

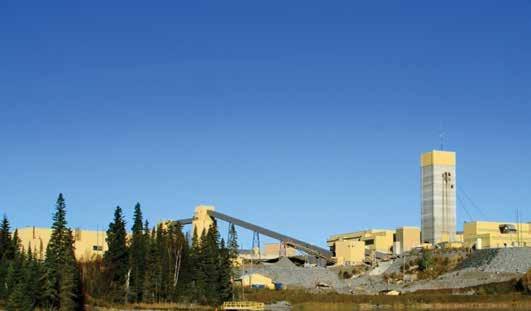

West Red Lake Gold Mines at the Madsen Mine, became Northwestern Ontario’s newest gold producer. On May 11 the company commenced a ramp up of operations with bulk sample material as initial mill feed. The South Austin and McVeigh zones are feeding the mill at a rate of 650 t/day, with head grades at 6.5 g/t. The company also released a positive Preliminary Economic Assessment (PEA) for the Rowan Project.

Alamos Gold released a Base Case LOM Plan for the Island Gold District operation. The mine, as expansion continues, is forecast to be one of the largest, lowest cost and most profitable gold mines in Canada. By 2026 annual gold production will be 411,000 ounces per year for 12 years with a total life of mine (LOM) of 20 years. The Island Gold underground deposit and Magino open pit host a 6.3 million ounce gold reserve; all in sustaining cost (AISC) is $1079 per ounce (CDN).

Wesdome Gold at the Eagle River Mine are on track to meet guidance for 2025, at 100,000-110,000 ounces of gold production. Head grade is a remarkable 15.6 g/t, with mill capacity at 1200 t/day. Grades in the 300 Zone have exceeded expectations. On June 27th Wesdome completed

Authored

the purchase of Angus Gold, adding significantly to the Eagle River Mine claim package.

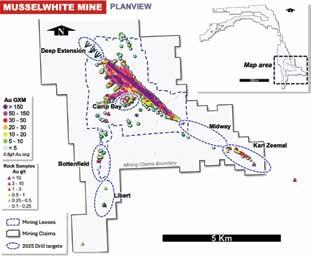

Orla Mining Ltd. have embarked on an aggressive exploration program at Musselwhite Mine. The $25M exploration budget is being executed on three fronts: 1)underground drilling to expand resources and reserves, 2)directional deep drilling to prove open down plunge extensions of the PQ Zone (mine trend), and 3)diamond drill near surface brownfield mine targets for future mill feed. Q2 production at the mine was 52,666 ounces of gold.

Equinox Gold announced on June 17th the successful completion of the previously announced business combination, where Equinox has acquired all of Calibre Mining Corp’s shares. At the Greenstone Mine

open pit productivity and equipment availability have hampered ramp up. There have been delays in accessing higher grade ore, as well as some unexpected dilution. Guidance for 2025 therefore has been revised to 220,000-265,000 ounces of gold. 51,274 ounces of gold were produced in Q2.

New Gold Inc. announced, within a recently released Sustainability Report, that their indigenous employment participation is at 24% at the Rainy River Mine. Production continues from underground and open pit.

Evolution Mining, Lac Seul First Nation and Wabauskang First Nation signed a new Mining Agreement with respect to the Red Lake Mine.

Barrick’s Hemlo Mine is for sale. Hemlo mines have produced over 21 million ounces of gold since the

Sandvik is the leading partner in mine electrification. Our constantly expanding range of electric equipment produces zero diesel emissions and reduces ventilation and cooling needs in your mine. Our BEV loaders and trucks are designed from the ground up entirely around their battery system and electric driveline. The patented self-swapping battery system enables the industry’s fastest and easiest pit stop.

Go Electric. Go Sandvik.

mid 1980s. Williams Mine production for 2024 was 143,000 ounces. Barrick considers the mine a non-core asset but an estimated 10 years of ore remain.

Impala Canada CEO Tim Hill announced that the company is "now executing a plan that anticipates commercial production ending at the Lac des Iles Mine around May 31, 2026," but added "The final date of operations is dependent on several factors, including available tailings capacity and our ability to meet production targets."

Vault Minerals, owners of the idle Sugar Zone Mine, near White River, reported that the Black Rock Group have a significant ownership position in the company.

Kinross Gold, at Great Bear, is focused on regional exploration work including the discovery of new open pit and underground targets outside of the LP, Hinge and Limb areas on Kinross’ 120 square kilometre land package. The regional exploration program is ongoing with more than 50,000 metres anticipated to be drilled by year-end.

Nexgold Mining Corp. drill intersected high grade gold mineralization at the Goliath West Zone including 10.25 g/t gold over 4.78 m., as well as extending mineralization at the Far East Prospect including 1.71 g/t gold over 6.02m.

Dryden Gold announced that the Elora Gold System has a 1 km strike length of multiple stacked gold bearing structures . Diamond drilling revealed 28.6 g/t gold over 0.5 m. in the Laurentian Target and 2.26 g/t over 8.8 m. in the Pearl Zone. In addition, a second stacked visible gold mineralized intercept was encountered in the Jubilee Zone.

Goldshore Resources raised an impressive $36.08M to fund a 50,000 m. diamond drill program at Moss Lake. The current indicated and inferred resource totals 6.15 million ounces of gold. VP Peter Flindell stated, "Goldshore Resources is

building a generational gold project through its three-pillar strategy of resource growth through efficient exploration, definition of economic value through engineering studies, and de-risking ahead of permitting with comprehensive environmental baseline studies and transparent collaborative partnerships with our host indigenous communities." An updated MRE (Mineral Resource Estimate) will feed an anticipated Q4 PEA (Preliminary Economic Assessment).

Mishkeegogamang and First Mining Gold signed a Long Term Relationship Agreement covering the Springpole Gold Project, located in northwestern Ontario. The Agreement sets out a collaborative approach for the development of one of Canada's largest gold resources, through construction, operations, and closure, in a manner that respects the environment and provides direct benefits to the First Nation.

Delta Resources announced that a May diamond drill program confirmed the potential for a large open pit gold deposit at Shabaqua. Drilling has expanded the mineralized envelope at the Eureka Zone to 400m.and a new gold zone has been identified immediately south of Eureka.

Ardiden Limited undertook minimal exploration on the Eastern and Western Hubs of the Pickle Lake Project, as they assess new project acquisition opportunities in the gold space.

Laurion Mineral Exploration Inc. initiated a 7000 m. drill campaign on the Ishkoday Project. Past producing gold bearing veins and prospective gold mineralized systems are being targeted. The Brenbar and Sturgeon River Mines are the focus.

Tombill Mines continued with an exploration program of grid sampling, with backhoe, auger and shovel, of historical tailings and waste rock on the former Talmora and Tombill mines.

Riverside Resources Inc., holder of gold occurrences in the Longlac

and Jellicoe areas, completed a plan of arrangement spinning out shares of Blue Jay Gold Corp to Riverside shareholders. The Pichette Project is Blue Jay’s flagship asset.

Thunder Gold raised $1M for exploration at the Tower Mountain Gold Project, located west of Thunder Bay.

Landore Resources announced results of a 3549 metre diamond drill program on the BAM Gold Deposit, located north of Lake Nipigon. Gold mineralization can now be extended a further 150 m. to the east, as well as a down dip extension also in the east.

Tartisan Nickel completed Phase 2 construction on the Kenbridge Mine all access road. Tartisan also completed an airborne geophysical program, on the project located east of Kenora.

Generation Mining at the Marathon copper-palladium deposit, have all permits in place for future construction; the financial structure is being finalized. In addition, the Province of Ontario released a formal statement to Canada that Marathon is a shovelready strategic mining project (as is the Ring of Fire).

Clean Air Metals diamond drilled high grade zones at the Current Deposit, Thunder Bay North. Intercepts include: 7.8 m. of 4.86 g/t Pt and 4.77 g/t Pd, 16.8 m. of 2.95 g/t Pt and 2.89 g/t Pd. High grade areas termed “Ballrooms” are being targeted via precise diamond drilling.

Frontier Lithium have reiterated economics for the PAK lithium deposit, located north of Red Lake. The Definitive Feasibility Study (DFS), completed in May, illustrates a 31 year mine life (LOM) and a remarkable forecast $11B net mine revenue. In addition, Frontier holds a letter of intent from Federal/Provincial officials specific to funding of $240M toward construction of a lithium conversion facility on Mission Island, Thunder Bay. PAK lithium concentrate will ultimately feed the facility.

NewGold’s Rainy River Mine in northwestern Ontario is delivering on its 2025 roadmap, with a mine life extension, an advancing underground ramp-up, and the successful completion of key infrastructure milestones.

“At Rainy River, our efforts to sequence waste stripping in the early months of the year have allowed us to remain on-track for a step-up in production starting in the second quarter, and to deliver an improved second half of the year,” said President and CEO Patrick Godin. “Additionally, underground development continues to advance, and I’m pleased to report the successful pit portal breakthrough occurred in early April, an important catalyst that enables the underground ramp-up to advance throughout the year.”

Rainy River produced 33,908 ounces of gold in Q1 2025 (the latest figures available at press time), representing roughly 12% of its annual production guidance of 265,000 to 295,000 ounces. While down from the 52,719 ounces in Q1 2024, the production levels were slightly ahead of plan for the quarter, largely due to a scheduled focus on capitalized waste stripping and the use of lowgrade stockpiled ore.

Mill operations processed 24,468 tonnes per day at a recovery rate

of 89%, down slightly from 25,023 tonnes and 91% in Q1 2024. Average head grades also declined to 0.54 g/t Au from 0.83 g/t a year earlier. All-in sustaining costs per ounce sold rose to $2,758 from $1,638 in Q1 2024, reflecting the impact of lower sales volumes and higher sustaining capital tied to stripping activity.

Cash costs per gold ounce sold rose to $1,764 from $1,165 in the prior year. Operating expenses followed the same trend, reaching $1,861 per ounce compared to $1,223 in Q1 2024.

Rainy River recorded a $12.8 million free cash flow net outflow in Q1, including a $6 million stream payment. Total capital expenditures jumped to $51.3 million from $29.6 million in Q1 2024, driven by both sustaining work on the tailings dam and waste stripping, as well as continued growth capital on the Underground Main and Intrepid zones.

Underground development is gaining momentum. The mine achieved 1,440 meters of lateral advancement in Q1, up from 950 meters a year earlier. Daily underground ore production held steady at 785 tonnes.

One of the year’s most pivotal events was the pit portal breakthrough, completed in April. The new access significantly reduces haulage distances, improves ventilation, and

provides a second means of egress. It also unlocks access to new mining zones expected to begin production in late 2025.

Godin noted that the open pit, originally slated for depletion in early 2025, has been extended to 2028 thanks to a redesigned Phase 5 pit. Low-grade stockpiles will keep the mill running at full capacity through 2029. Underground reserves have grown to 1.34 million ounces, and while open pit reserves saw a minor 2% decline, total gold resources increased by 76%.

Exploration drilling in Q1 focused on the NW Trend, and technical studies are evaluating additional pushbacks south of the main pit.

Looking ahead, Rainy River is expected to contribute significantly to New Gold’s consolidated guidance of 325,000 to 365,000 ounces in 2025. Over the next three years, Rainy River is forecast to average 300,000 ounces per year, bolstered by increased stope access and improved operational flexibility.

Godin added, “The life-of-mine plans successfully outline New Gold’s strong production profile with reducing costs, strong free cash flow generation and increasing net asset value, while also highlighting exciting opportunities to build on over the longer-term.”

Alamos Gold Inc. continues to solidify its position as a leading intermediate gold producer with a disciplined focus on growth, operational excellence, and sustainability. At the forefront of this strategy is the Island Gold District in northern Ontario—a high-grade, long-life asset undergoing transformational expansion. The company’s vision and recent developments were presented by Austin Hemphill, General Manager of Alamos Gold, during his address at the Canadian Mining Expo in Timmins this past June, where he provided a comprehensive update on the company’s progress and direction. “Island Gold continues to outperform, both in terms of production and value creation,” said Hemphill. “We’re expanding our footprint, consolidating operations, and preparing for the next 20 years of sustainable, high-grade production.”

Alamos Gold has built a reputation for steady execution and responsible development. The company’s operations span Canada and Mexico, anchored by three primary Canadian sites: the underground Island Gold Mine, the Magino open-pit operation, and the Young-Davidson Mine near Matachewan. In Mexico, the Mulatos District provides stable production and near-term growth through its PDA underground project.

Earlier this year, Alamos made a formal construction commitment on its Lynn Lake Project in northern Manitoba. This marks the next

step in a broader pipeline of low-cost, low-emission gold production. The project is already seeing expanded resources and reserves, with construction activities accelerating ahead of a targeted 2026 commissioning.

A defining feature of Alamos’ strategy is its environmental and safety profile. The company reports one of the lowest GHG intensities in the industry—just 0.17 tonnes CO2e per ounce compared to an industry average of 0.83. Additionally, Alamos consistently maintains top-tier safety performance, with one of the lowest lost-time injury frequency rates among gold producers.

The Island Gold Mine, located near Dubreuilville, Ontario, is undergoing a major expansion through its Phase III and Phase III Plus projects. Originally producing around 900 tonnes per day in 2018, the mine is set to increase throughput to 2,400 tonnes per day by late 2026, unlocking significant operational and cost efficiencies.

Initially announced in 2020, the Phase III expansion targeted 2,000 tonnes per day. Following substantial reserve and resource growth, Alamos raised the target to 2,400 tonnes in the Phase III Plus plan—without adjusting the original timeline.

“The timing gave us a competitive edge,” Hemphill noted. “While many companies were cancelling or delaying projects due to COVID, we locked in long-lead items and secured engineering services early. That discipline helped us hold both schedule and budget.”

Shaft sinking is currently over 1,000 meters deep, with stations completed at the 840- and 1,050-meter levels. Full shaft completion is expected by

year-end, with equipping and commissioning scheduled throughout 2026. The new infrastructure will enable Alamos to transition from ramp haulage to shaft hoisting, cutting emissions and improving underground haulage efficiency.

The expansion also includes the addition of a paste-fill plant and underground waste handling system, both critical for supporting 2,400 tpd production. These upgrades are expected to reduce all-in sustaining costs (AISC) at Island Gold by approximately 40%.

The 2024 acquisition of the Magino open-pit project marked a turning point for the district. The integration of Magino and Island into a single operational hub has unlocked significant synergies, including consolidated processing at the Magino mill and shared infrastructure.

The Magino mill is being expanded from 10,000 to 12,400 tonnes per day, with enhancements to leaching, gravity recovery, and refining systems. With nearly identical metallurgical profiles and recovery rates exceeding 90%, the combination of Island’s high-grade underground ore and Mino’s open-pit feed enables Alamos to scale up without sacrificing performance.

• Island Gold (Underground): 1,200 tpd @ ~11 g/t Au

• Magino (Open Pit): 10,000 tpd @ ~1 g/t Au

The combined operation is expected to produce approximately 400,000 ounces of gold annually once fully ramped up.

“From a cost perspective, we’re already competitive,” Hemphill added. “But with this expansion, we’re positioning Island Gold as a cornerstone asset with significant long-term margin.”

Current AISC at Island stands at ~$1,100/oz, with the district-wide average at ~$1,400/oz. Post-expansion, these figures are expected to drop meaningfully.

The Island Gold District now spans nearly 60,000 hectares, following a series of strategic acquisitions: Richmont Mines (2017), Trillium Mining (2020), Manitou Gold (2023), and Magino (2024). This consolidation has unified the geological corridor

and enabled continuous exploration across a high-potential land package.

The deposit remains open at depth and along strike, particularly eastward. A centralized shaft location supports long-term mining flexibility and expansion potential.

“The resource and reserve base has grown 71% since we took over,” Hemphill explained. “But the most compelling stat is a 700% increase in net present value. Island Gold is a world-class asset that keeps getting better.”

While focus remains on delivering Phase III Plus, Alamos is already evaluating future growth. A potential “Phase IV” expansion is in earlystage review, with optimization studies underway for both the Magino site and broader district development.

“When I arrived at Island in 2018, our team asked when we’d sink a shaft,” Hemphill recalled. “I told them: ‘Now.’ And here we are—making it happen.”

Alamos Gold’s execution at Island Gold exemplifies a disciplined approach to growth—built on highgrade resources, operational integration, and environmental responsibility. As the company prepares for a new chapter of production at scale, the Island Gold District is firmly positioned as a cornerstone of Alamos’ long-term future.

• Repair Capabilities for ALL Major Pump Brands

• Test Tank & Rigorous Testing Protocols

• Transportation Logistics Covered!

“This

WhenMinister George Pirie stepped onto the stage at the 2025 Canadian Mining Expo in Timmins, he brought more than just a speech—he brought a message, a challenge, and a clear-eyed vision for the future of Northern Ontario. “This is our time,” Pirie declared to a packed audience of mining professionals, Indigenous leaders, suppliers, and government officials. And in many ways, he’s right: this is a watershed moment for the North. With gold prices nearing $5,000 CAD per ounce and global demand for critical minerals at an all-time high, Northern Ontario is not only relevant—it’s essential. But as Pirie reminded the crowd, this moment isn’t just about market conditions. It’s about momentum.

From the Periphery to the Center Northern Ontario is no longer a remote outpost—it’s becoming a hub for innovation, production, and global trade. Whether it’s nickel and lithium from the Ring of Fire or the phosphate, graphite, and cesium deposits fueling the EV and aerospace sectors, the North is emerging as a cornerstone of Canada’s critical mineral strategy. Pirie emphasized that the region’s strategic position—and its infrastructure—can no longer be overlooked. “James Bay pierces the continent,” he said, noting that the region offers some of the shortest trade routes to Asia and Europe. Timmins, with its link to the Ontario Northland Railway and highway corridors, is at the center of that transformation.

Much of Pirie’s speech focused on infrastructure—not just what’s needed, but what’s already underway. Permanent roads into the Far North, expanded rail capacity for bulk ores, and energy investments are setting the stage for long-term, sustainable growth. The Northern Ontario Heritage Fund Corporation (NOHFC),

which Pirie now oversees, has already invested over $95 million into the region since 2018—supporting over 11,000 jobs and attracting nearly $3 billion in private investment. With a new $30 million top-up, the NOHFC’s annual budget rises to $110 million, giving more fuel to projects across the North.

Energy is another key pillar. The Northern Energy Advantage Program is being expanded to $260 million for 2025–26, responding directly to the needs of mining and manufacturing companies that require affordable, reliable power to compete globally.

One of the most striking—and important—parts of Pirie’s address was his commitment to Indigenous partnership. Drawing on his experience developing the Musselwhite Mine in the 1980s, he offered a simple truth: nothing in Northern Ontario moves forward without Indigenous collaboration. That means more than consultations—it means co-leadership, revenue sharing, and meaningful involvement in infrastructure planning

and development. In projects like the road to the Ring of Fire or the port at James Bay, Indigenous voices must be central. Pirie made clear that the mining industry already has a strong track record in this area—but also that more needs to be done.

In a direct appeal to financial institutions, Pirie challenged analysts to “come North” and see for themselves. “They should be walking the booths, talking to the real people who know this business,” he said, adding that the Canadian Mining Expo could rival PDAC in scope and relevance if capital markets fully appreciated the opportunities on offer.

It was one of the more unexpected— but widely quoted—lines from the speech: “Northern Ontario is sexy. Everybody wants a piece of it.” While delivered with a smile, Pirie’s message was serious: the North is no longer a quiet corner of the province. It’s at the forefront of global mining, trade, and clean technology. The political winds have shifted, too. Two-thirds of Ontario’s most recent throne speech focused on Northern sectors—including mining, forestry, and manufacturing.

Pirie ended his speech with a call to action: “This is our time. This is our day. Seize it.” For the mining industry, Indigenous partners, and communities across the North, those words aren’t just aspirational. They’re a roadmap. The pieces are in place—resources, infrastructure, government support, and growing global demand. What’s needed now is collaboration, continued investment, and a collective belief in the future of Northern Ontario. Because as Minister Pirie made clear: this isn’t just a boom. This is a moment of transformation.

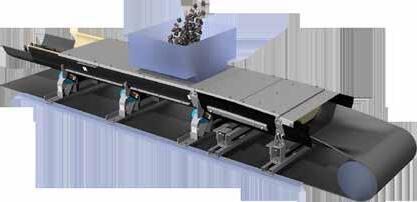

We’re fully committed to improving bulk material handling through every service and product we offer. We aim to boost productivity and increase profitability. Everything from design, drafting, engineering, and fabrication to project management and utilization of Red Seal tradespeople, our team’s broad expertise allows us to handle your project requirements from conception to completion.

We’re flexible and able to line components right in our shop or install rubber lining in the field. Our highly knowledgeable and skilled field services team is always prepared to support your needs for wear solutions, including: tanks, chutes, hoppers, pump boxes, mills, and more. Trust Viacore for all your material handling needs, our services:

Over 50 years of experience, 6 locations in Ontario and 35 locations across North America.

• Conveyor Maintenance

• Mechanical Services

• Rubber Lining

• Engineering & Design

• Industrial Hose & Fitting Services

• Technical Services

Learn more at Viacore.com or scan this code:

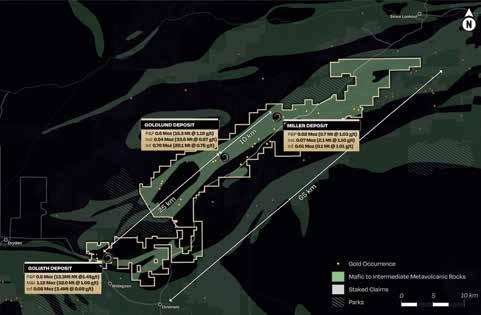

NexGold Mining Corp. continues to solidify its position as one of the most exciting emerging players in Canada’s gold sector with promising new drill results from its flagship Goliath Gold Complex in Northwestern Ontario. With key mineralization intersected at shallow depths and new targets taking shape nearby, the project is showing the hallmarks of long-term, expandable potential. The Goliath Gold Complex—home to the Goliath, Goldlund, and Miller deposits—is at the heart of NexGold’s Canadian strategy. These assets are not only located in a toptier jurisdiction but are supported by strong local infrastructure, meaningful community relationships, and access to a skilled regional workforce. Now, with over 21,000 metres completed in a 25,000-metre 2025 drill campaign, the Company is seeing

tangible progress toward de-risking and growing the project ahead of development.

Recent drilling at the Goliath Deposit focused on infill work within shallow, under-drilled areas of the existing mineral resource. These zones— located within the planned open-pit area—are crucial for refining early mine planning and economic modeling. Intercepts such as 1.05 g/t gold over 21.20 metres, including highgrade subintervals, and 13.67 g/t gold over 1.75 metres, underscore the project’s near-surface gold continuity and grade consistency.

“These latest results provide a greater level of confidence in the shallow mineralization within the proposed open pit,” said Kevin Bull -

ock, NexGold’s President and CEO. “That kind of certainty is essential as we prepare for future development.”

Equally encouraging are the results from the Eastern Alteration Corridor (EAC)—a developing prospect located just one kilometre northeast of the Goliath Deposit. Though outside the current infrastructure envelope, the EAC sits within striking distance of the planned mine and mill footprint, offering the potential for low-cost resource expansion in the future.

Recent holes at the EAC confirmed additional gold-bearing zones, including 0.53 g/t gold over 8.35 metres, further validating NexGold’s geological model. While early-stage, the EAC has emerged as a valuable exploration target that could potentially be folded into the broader development plan as work progresses.

Although these new results are not included in the current Feasibility Study, they are already shaping post-feasibility planning. “Results from the EAC and from the infill program won’t inform the ongoing study,” Bullock noted, “but they’re instrumental in preparing for development, expansion, and operational flexibility after the mine is built.”

This forward-thinking approach aligns with NexGold’s broader strategy—maximizing project efficiency while positioning itself to adapt quickly to new discoveries across its growing land package.

Community, Commitment, and Vision

Beyond the geology, NexGold is positioning itself as a modern min -

ing company—grounded in values of community engagement, sustainability, and long-term regional partnerships. The Company is working in active collaboration with Indigenous Nations and local communities to build trust, create jobs, and deliver shared economic value throughout the life of the Goliath Gold Complex. With its 100% interest in the highgrade Niblack VMS Project in Alaska and other Canadian explorationstage assets like Weebigee-Sandy Lake and Gold Rock, NexGold offers an increasingly diversified portfolio. However, the Goliath Gold Complex remains its flagship—and for good reason.

As the 2025 drill program nears completion, attention will turn toward finalizing feasibility work and integrating new data into long-term development plans. The Company

is also evaluating potential additions to its resource base from adjacent zones like the EAC, which could enhance overall economics and mine life.

With strong leadership, excellent infrastructure, and an expanding

footprint in one of the safest mining jurisdictions in the world, NexGold is proving that the Goliath Gold Complex is more than just a promising project—it’s a foundation for a new Canadian gold success story.

From exploration to closure and everything in between

From exploration to closure and everything in between

Services you’d expect, and some you wouldn’t.

Services you’d expect, and some you wouldn’t.

• Exploration & Resource Assessment/Modeling

• Environmental Services

• Exploration & Resource Assessment/Modeling

• Environmental Services

• Environmental, Social & Governance Advisory

• Climate Change Scenario Analysis

• Environmental, Social & Governance Advisory

• Water Management

• Climate Change Scenario Analysis

• Tailings & Waste Management

• Water Management

• Underground & Open Pit Mine Design & Planning

• Tailings & Waste Management

• Sustainable Mining by Design

• Underground & Open Pit Mine Design & Planning

• Operations Optimization

• Sustainable Mining by Design

• Energy Consumption Audits

• Operations Optimization

• Geotechnical & Rock Mechanics

• Energy Consumption Audits

• Simulations & Modeling

• Geotechnical & Rock Mechanics

• Ventilation

• Simulations & Modeling

• Ventilation

• Project Delivery & EPCM

• Processing

• Project Delivery & EPCM

• Mine Closure & Remediation

• Processing

• Mine Closure & Remediation

Connect with us at the CEN CAN Expo 2025

Arena 1 Booth #R1-02 &-03

Connect with us at the CEN CAN Expo 2025 Arena 1 Booth #R1-02 &-03

First Mining Gold Corp. is advancing two of Canada’s most significant undeveloped gold projects—Springpole in northwestern Ontario and Cameron Lake, also in Ontario. While Springpole leads the portfolio, Cameron Lake is emerging as a key growth story amid strategic consolidation and renewed exploration.

With feasibility and environmental permitting well underway, the Springpole Gold Project is being positioned as one of Canada’s largest openpit gold developments. According to company officials, Springpole could deliver over 300,000 ounces of gold annually for more than a decade.

“We’re grandfathered under the old act, which means the federal government actually has 365 days statutorily to review the project,” said CEO Dan Wilton, referencing the 2012 Canadian Environmental Assessment Act. The final Environmental Impact Statement was submitted in November 2024.

Springpole holds Probable Reserves of 3.8 million ounces of gold and 20.5 million ounces of silver. A 2021 Pre-Feasibility Study outlined a post-tax NPV of US$995 million and a 29.4% IRR at a US$1,600 gold price. All-in Sustaining Costs are

projected at just US$577 per ounce, net of silver.

Drilling continues to uncover new mineralization, with 2024 exploration expanding the East Extension zone. Notable intercepts include 2.77 g/t Au over 11.1 metres and 1.41 g/t Au over 11.9 metres.

The Birch-Uchi district surrounding Springpole—spanning over 70,000 hectares—is central to First Mining’s long-term regional vision.

Often overshadowed by Springpole, the Cameron Gold Project is quietly emerging as a compelling second front in First Mining’s Ontario strategy. Fully owned and located 80 km north of New Gold’s Rainy River mine, Cameron features excellent infrastructure, including highway access and power within 20 kilometres.

The current resource includes 464,000 ounces of Measured and

Indicated gold at 2.61 g/t, and an additional 533,000 ounces Inferred at 2.54 g/t. Importantly, First Mining has recently consolidated the land package with the acquisition of the East Cedartree claims, adding more than 32,000 hectares.

An exploration program is now in the planning stages. Company officials view Cameron as a long-term asset that complements Springpole and strengthens First Mining’s future production profile in Ontario.

CEO Dan Wilton believes First Mining is strategically positioned with two of the top ten largest undeveloped gold projects in Canada. With a market cap of just C$168 million and no debt as of May 2025, the company sees a substantial gap between intrinsic value and share price.

The estimated Net Asset Value of the company—including Springpole, Cameron, and Duparquet—is nearly C$2 billion. Management believes this disconnect offers a compelling opportunity for investors seeking leverage to a rising gold price.

Ina move signaling the end of an era, Barrick Gold Corporation has confirmed it is seeking buyers for its last remaining Canadian asset—the Hemlo Mine in Northwestern Ontario. The planned sale, managed by CIBC and launched in April 2025, marks a pivotal step in Barrick’s strategy to streamline its portfolio and prioritize high-margin, Tier 1 operations. “Hemlo remains a strong performer, but it no longer fits our long-term strategy,” said Barrick CEO Mark Bristow earlier this year.

While Hemlo accounts for only 3.5% of Barrick’s global production (143,000 ounces in 2024), it holds a legacy status within Canada’s mining history. Discovered in 1981 and in continuous operation since 1985, Hemlo has produced over 21 million ounces of gold, shaping both regional development and the company’s early identity.

Yet, as Barrick evolves into a globally agile mining powerhouse with ambitions for 30% production growth by 2030, Hemlo is no longer viewed as central to its future.

The Hemlo mine’s gradual shift from flagship to non-core asset has mirrored Barrick’s post-Randgold merger transformation. Since 2019, the company has sold off over $5 billion in non-core assets, shedding smaller, higher-cost operations to focus on scalable, high-return projects—like

its Cortez and Carlin complexes in Nevada and major developments in Africa, Latin America, and Asia. Hemlo, with estimated all-in sustaining costs (AISC) nearing $1,000/ oz, lags behind Barrick’s global average and well below the sub-$800/ oz performance of its Tier 1 assets. The mine’s complex, narrow ore bodies—particularly in the B and C Zones—require precision underground mining and continual capital investment. Despite these challenges, Hemlo remains operationally stable. A recent AUD$200 million contract extension with Barminco ensures underground mining services will continue through 2027. Additionally, Barrick has proposed a new open-pit operation, with first ore targeted by 2027, pending environmental approvals.

Industry analysts say Hemlo represents a unique opportunity for mid-tier or junior producers seeking a permitted, producing asset with near-term development upside. The mine’s strong infrastructure, experienced workforce, and long-standing environmental compliance—including adherence to Ontario’s Toxics Reduction Act and GHG reduction initiatives—make it particularly attractive to ESG-focused investors.

“There is still considerable untapped potential at Hemlo,” said a Toronto-based mining analyst. “For

the right buyer—particularly one with exploration vision and operational discipline—this could be a strategic acquisition.”

Recent interest has reportedly come from Canadian and international bidders, including sustainabilitydriven funds and emerging producers with regional growth ambitions.

Although the Hemlo sale would mark Barrick’s formal exit from Canadian operations, the company maintains exploration and partnership ties in the region. In early 2025, Hemlo Explorers Ltd. extended its collaboration with a Barrick subsidiary, signaling continued interest in grassroots discovery near the mine footprint.

“It’s not about cutting ties with Canada,” Bristow emphasized. “We remain committed to partnerships and exploration.”

Barrick’s broader growth pipeline remains focused on high-grade deposits and massive development corridors globally. Projects like PascuaLama and new ventures in Tanzania and Pakistan demonstrate the company’s clear strategic shift toward complex, long-life assets with multibillion-ounce potential.

As gold prices remain near decade highs and the global mining landscape becomes increasingly competitive, Barrick’s Hemlo divestment appears both pragmatic and strategic. For Barrick, it’s a clean step away from a maturing asset. For the broader sector, it opens the door for new ownership to revitalize a mine with a storied past and viable future.

Whether through open-pit development, deeper exploration, or technological upgrades, Hemlo’s next chapter will depend on a buyer’s vision and capacity. What’s clear is that, after four decades of production and leadership in Canada’s mining narrative, Hemlo’s story is not over— just ready for a new author.

Barrick consistently delivers sector-leading returns to its shareholders while the benefits it generates for all stakeholders drives economic development and social upliftment in its host countries. Its ability to sustain the profitability which enables this is secured by the world-class growth projects embedded in its asset portfolio. Organic growth alone is expected to increase its attributable gold and copper production by some 30% by the end of this decade, a likely peerless achievement.

Positive Winter Assay Results Reinforce Near-Surface Potential and Support Expansion Ahead of 50,000-Meter Drill Program.

Northwest Ontario, Canada –Goldshore Resources Inc. has announced final assay results from its 20,000-meter winter drill program at the Moss Gold Project, highlighting significant gold mineralization from the QES Up zone. The program targeted the near-surface extension of northern QES shears, aiming to enhance resource potential within the current conceptual open pit model.

Two key holes, MQD-25-155 and MQD-25-157, infilled important gaps along the eastern flank of the QES Zone and confirmed the thickening and structural complexity of the mineralized system. The results validate the eastern extension and orientation of multiple gold-bearing shear zones,

ASSAY HIGHLIGHTS:

Expanding Width and Continuity

with several intercepts demonstrating both strong widths and grades.

“We’re pleased with the continued positive results from the winter drilling,” said Michael Henrichsen, CEO of Goldshore. “Follow-up holes at the QES Zone intersected wide intercepts of gold-mineralized structure with some shears providing higher mineralization closer to surface. These results further support the potential for this region to support rapid payback in the early years of mining.”

Drilling at QES Up targeted the northern extension of deeper-modeled shear zones. Both MQD-25-155 and

Hole MQD-25-155 returned multiple broad zones of gold mineralization, including:

• 42.7m @ 1.09 g/t Au from 241.6m

- Including: 20.0m @ 1.77 g/t Au and 2.3m @ 1.98 g/t Au

• 46.05m @ 0.60 g/t Au from 290.0m

- Including: 8.0m @ 1.46 g/t Au

• Near-surface hits:

- 9.45m @ 0.73 g/t Au from 156.0m, including 5.0m @ 1.03 g/t Au

Hole MQD-25-157, drilled 100 meters east of MQD-25-155, intersected:

• 31.9m @ 0.95 g/t Au from 231.2m

- Including: 15.1m @ 1.53 g/t Au

• 47.4m @ 0.58 g/t Au from 271.6m

- Including: 5.4m @ 1.44 g/t Au

• Additional intervals:

- 3.25m @ 2.60 g/t Au from 392.5m

- 11.7m @ 1.48 g/t Au from 102.0m, including 9.75m @ 1.71 g/t Au

- 22.0m @ 0.74 g/t Au from 154.0m, including 6.9m @ 1.72 g/t Au

MQD-25-157 collared into altered diorite and intersected the namesake QES quartz-eye granodiorite, characterized by sericite-silica-hematite alteration and 3–5% pyrite-chalcopyrite mineralization within the shears. These shears, which host the majority of mineralization, extend well within the conceptual open pit limits, presenting a significant opportunity to convert what was previously modeled as waste into resource-grade material.

A 50,000-Meter Drill Campaign

Buoyed by the winter program’s success, Goldshore has launched a 50,000-meter summer drill program. This campaign includes:

• 29,000 meters for resource expansion

• 21,000 meters for grade control drilling

These efforts will lay the groundwork for a 2026 infill drilling program, anticipated to underpin future economic studies and development decisions.

Goldshore’s winter drill results at the QES Up zone not only demonstrate solid grades and widths but also highlight the potential for resource growth in areas previously untested or underexplored. The confirmation of near-surface mineralization within open-pit boundaries strengthens the Moss Gold Project’s development case, particularly in terms of early cash flow potential. With a significantly expanded drill program now underway, Goldshore is positioning itself to unlock further value from this emerging gold district in Northwestern Ontario.

70+

75,000+

63,000+ Raise Meters Driven since 2000

70+ Pieces of heavy underground mobile equipment

WesdomeGold Mines is doubling down on its commitment to Ontario’s prolific Wawa Gold Corridor with a landmark move in 2025—quadrupling the size of its Eagle River land package. At the center of this expansion is its flagship Eagle River Mine, a high-grade underground operation that continues to deliver strong results.

“The acquisition of the prospective Angus property adjacent to our Eagle River Mine represents an exciting addition to our portfolio, enhancing our long-term growth potential through greenfield opportunities,” said Anthea Bath, President and Chief Executive Officer. “This regional land package consolidation supports our disciplined growth strategy, and we’re pleased to welcome key members of the Angus team as we work to unlock meaningful value for our shareholders.”

The strategic leap came in April 2025, when Wesdome announced it would acquire Angus Gold Inc. in a $40 million all-share transaction.

The deal, which closed in June following strong shareholder support, brings Angus’ Golden Sky Project directly into Wesdome’s fold—an asset immediately adjacent to Eagle River. The addition creates a 400 km² contiguous land position, amplifying Wesdome’s potential for district-scale discoveries.

Earlier in the year, Wesdome reported record gold production of 172,034 ounces for 2024, up 39% from the previous year. For 2025, the company expects to produce between 190,000 and 210,000 ounces at an all-in sustaining cost of US$1,325 to $1,475 per ounce. Those projections are backed by promising exploration at Eagle River, where high-grade extensions and new targets were confirmed during the 2024 program.

Wesdome’s Eagle River Mine demonstrated the geological continuity of high-grade zones, and now with this expanded land package, their focus is on testing multiple highpriority targets.

The Golden Sky Project had shown its own momentum prior to the acquisition. In early 2025, Angus Gold reported several highgrade intercepts, including 15.6 g/t Au over 3.5 metres at Dorset West. Their success in expanding the strike length of new gold zones provided much of the rationale for Wesdome’s timely move.

Wesdome plans to leverage its existing infrastructure to accelerate development across the newly consolidated property. The company also emphasized maintaining strong relationships with local stakeholders and First Nations partners as it scales up exploration.

With exploration programs ongoing and a strong production base at Eagle River, Wesdome’s bold strategy signals that the Wawa Gold Corridor remains a vital piece of Ontario’s mining future.

Resources is zeroing in on one of northwestern Ontario’s most storied properties — the historic Huronian Gold Project — with a slate of exploration work designed to unlock the potential of a former producer that hosted the region’s first gold mine.

“The detailed UAV magnetic survey and follow-up boots on the ground has enabled the Kesselrun team to re-interpret the far western extents of the Huronian Gold Trend,”

said President and CEO Michael Thompson. “What had previously been interpreted as one zone, over 50 years ago, has now been confirmed as two separate zones. This parallel zone, and the possibility of other similar zones throughout the property, increases the exploration potential immensely.”

The Huronian Project, 100% owned by Kesselrun, spans approximately 4,600 hectares. It is adjacent to Goldshore Resources’ Moss Gold

Project and sits on the same lithological package of rocks, making it a prime target for both high-grade and bulk-tonnage gold mineralization. Kesselrun has outlined several known zones that remain open at depth and along strike, including newly interpreted parallel structures.

Kesselrun’s recent 2024 exploration program combined UAV-based magnetic surveys with ground mapping and sampling, focusing on five key areas: McKellar West, Huronian North, Span North, Span South, and Moss South. The most notable developments emerged from McKellar West, where the team identified two separate parallel zones — McKellar West and Minoletti — extending the known mineralization to the far west boundary of the property.

This reinterpretation has opened up approximately 1,400 metres of untested strike extent on McKellar West, and several additional kilometres of prospective ground on the Minoletti zone, significantly boosting the project’s exploration potential.

The project also hosts a historic resource estimate from 1998 by Minescape Exploration Inc., which outlined:

• 44,592 oz gold at 15.3 g/t (indicated)

• 501,377 oz gold at 14.4 g/t (inferred)

While Kesselrun does not treat these figures as current mineral resources under NI 43-101, they serve as a reference for future drilling campaigns.

Just to the northeast, the adjacent Moss Gold Project hosts a current NI 43-101 resource of 1.23 million oz gold indicated and 4.92 million oz inferred. Kesselrun is cautious not to equate neighboring results to its own, but the regional potential is clearly heating up.

The company plans to build on 2024’s momentum with follow-up work in 2025 to advance selected targets to drill-ready status. A drilling campaign is anticipated later in the year.

we transform complex challenges into powerful sustainable solutions.

CIMA+ is growing its local presence in Northern Ontario to support a more innovative, sustainable mining sector. We’re committed to decarbonization, innovation, and community impact—delivering smart, tailored solutions. With over 300 people involved in all aspects of mining, we cover all fields of engineering expertise, from mine to port.

Learn more

Landore Resources is tightening its focus on resource expansion and higher-grade potential at its flagship BAM Gold Project, 235 km northeast of Thunder Bay, on the company’s 100%-owned Junior Lake Property.

“The BAM Gold Project is central to our growth strategy,” said CEO Alexander Shaw. “We see immense opportunity to upgrade our resource and economic model in light of high gold prices and recent exploration success.”

Landore’s efforts come amid renewed global interest in low-cost, open-pit gold operations, with Ontario recognized among the world’s top mining jurisdictions. The BAM Project sits within a highly prospective Archean greenstone belt and was awarded the 2016 Discovery of the Year by the Northwestern Ontario Prospectors Association.

The BAM Zone was first discovered in 2003, with the deposit itself identified through drilling in 2015. It lies 2 km east of the B4-7 deposit and 1 km north of the VW deposit, all on the Junior Lake Property. The deposit is characterized as an Archean-aged mesothermal system, with visible gold found in quartz-rich veinlets hosted within sheared ultramafic and metasedimentary rocks.

Since its discovery, the BAM Gold Deposit has seen over 70,000 metres of drilling. Notable programs include 24,171 metres drilled between 2020 and 2021, and 14 additional holes completed in Spring 2025 totalling 3,549 metres. Regional soil sampling and magnetic surveys have identified new targets in the Grassy Pond and Felix Lake areas.

The most recent NI 43-101 Mineral Resource Estimate from February 2022 shows:

• 1.5 Moz gold at 1.0 g/t across 49.2 million tonnes.

• A 47% increase from the 2019 estimate.

• Indicated: 1.03 Moz @ 1.0 g/t (30.9Mt)

• Inferred: 467 Koz @ 0.8 g/t (18.3Mt)

The 2022 Preliminary Economic Assessment, based on US$1,800/oz gold, revealed:

• Post-tax NPV: US$231.2M; IRR: 66.7%

• Payback: 2.25 years (project start)

• Capex: US$85.4M

• AISC: US$1,177/oz

• Mine life: 10.75 years

• Recovery: 98% With gold hovering near US$2,500/oz in 2025, Landore is working toward updated PEA and MRE reports later this year.

Landore confirmed additional mineralization to the east and west of the BAM resource in its Spring 2025 program. Channel and soil sampling continues along strike to the east, guided by UAV magnetic data. A 3,500-metre diamond drill campaign began in March 2025, and historical drill core is undergoing infill sampling in areas reinterpreted by the company’s new geological team, including structural geologists from TECT Geological Consultancy.

Metallurgical studies confirm 98% gold recovery using gravity and cyanide leach, with low reagent consumption. Recent data suggest the potential for higher-grade zones (3-4 g/t), which could significantly boost economics in future estimates.

The next steps include:

• Q3 2025: Updated Mineral Resource Estimate

• H2 2025: Updated PEA

• 2026: Additional drilling, metallurgy, geotechnical, and environmental/social baseline work

• 2027: Prefeasibility Study (PFS)

Landore raised £4.28 million in 2024 and a further £3.68 million in June 2025 to fund continued exploration and development.

How a New Regulation in the Ontario Mining Act Helps Turn Tailings and Waste Rock into Golden Opportunities

By: Andrew Kane

We all know how difficult it can be to finance a new mining project. But what if that financing is lying right there like a million ounces of loose change in your living room couch?

That’s the position STLLR Gold finds itself in. STLLR is one of several companies finding high-grade metals and mineralization in old waste rock. The company describes its Hollinger Tailings Project in Timmins, Ont. as a “game changer” with near-term cash flow potential.

At one point, Hollinger was the largest gold mine in the world producing over 19 million ounces between 1910 and 1968. Today, there are 50-60 million tonnes of tailings with recent assays revealing about 0.5 grams of gold per tonne. With current gold prices (over $4,500/oz or $3,300 USD) and modern processing techniques, what was once

waste rock represents potentially a million ounces of gold for the company – and that would go a long way towards funding its Tower and Colomac gold projects.

Thanks to recent changes to the Ontario Mining Act, STLLR now can unlock its literal gold mine with less regulatory red tape. It’s just one of the estimated dozens of waste rock and tailing sites in Northwestern Ontario and hundreds in the province that could benefit from the new regulation.

“The best place to look for a new mine is in the shadow of a headframe…”

That adage took new meaning on July 1, 2025 when the Ontario government officially opened up applications for mineral recovery permits.

Successful applicants will be able to go through the tailings and waste rock of old mining operations to recover metals and minerals – including critical minerals – not practically accessible or financially viable before. Other sources include stamp mills, which historically were wildly inefficient. Mineral processing and metallurgy has changed over the years. Low-grade but valuable assets such as gold, silver, cobalt, and nickel were left in waste rock because they were not accessible with existing methods. Crucially, waste rock can also contain other critical minerals including Rare Earth Elements needed for today’s modern technologies. The Ontario government sees this regulation change as part of its Critical Mineral Strategy to bring more critical minerals to market faster.

Outside of the application process, other steps vital to success include early Indigenous consultation, accommodation, and joint venture partnerships as needed.

The ministry published a guide to help companies prepare their applications for mineral recovery permits. Here’s a short overview: Purpose: A recovery permit grants the holder the right to recover minerals from mine waste without needing an exploration permit or a filed closure plan. If the waste is on Crown land, the holder can also exploit the minerals commercially without a mining claim or lease.

• Step 0: Pre-submission meeting (optional but recommended)

• Step 1: Application screening

• Step 2: Circulation and feedback consideration

• Step 3: Decision on permit application

• Step 4: Submit financial assurance (if requested)

Stop by our booth at the CEN-CAN Expo R6-04 in Arena 1

AlumaSafway delivers a full range of sca olding & work access, forming & shoring, computerized stud welding, specialty coatings, fireproofing, and advanced digital planning. We safely deliver value-added core services to facilitate our client project needs across markets, regions, and project types, ready to serve with any mining needs.

AlumaSafway is dedicated to serving customers with an extensive branch network across Canada. Providing reliable coverage and service.

Contact us today at (705) 207-9990 or visit AlumaSafway.com for more information.

A closure plan is not required, but recovery project information and remediation plans are, along with technical reports and mapping. Site remediation is a component of the new regulation. The expectation is that this regulation will allow for partial and in some cases full rehabilitation of mines sites abandoned decades ago.

Owner consents are required; the Ministry will determine if Indigenous consultation is required. Activities on Crown land can be completed without claims or leases. Some lands are excluded such as retired uranium mines.

Photo STLLR Gold: STLLR Gold personnel surveying the tailing impoundments

Processing is another consideration that should be determined early. Options include:

• Engaging a custom milling partner

• Purchasing a portable processing facility to operate on site

• Negotiating an arrangement with an existing mine to process the tailing and or waste rock

The new regulation is an opportunity for low-hanging fruit that could be, as STLLR feels, a game changer for many in Ontario’s mining industry.

View the complete Guide to Applying for a Mineral Recovery Permit here and contact Andrew Kane of Kane & Associates at (807) 630-1306 or andrewkane@tbaytel.net to learn more.

INSTRUMENTATION SERVICES

• Certified Red Seal Instrumentation Technicians

• Complete services: design, build, calibration, maintenance, startup, and commissioning

• Continuous Emissions Monitoring (CEM) systems – installation and service

ELECTRICAL FIELD SERVICES

• High and Low Voltage protection and control: design, upgrades, and testing

• System acceptance testing, commissioning, and startups

• Relay testing and panel installations

• Inspection, testing, and servicing of switchgear, transformers, and circuit breakers

VFD’S, PLC’S & SCADA INTEGRATION

• WONDERWARE – The only Certified Systems Integrator in Northwestern Ontario

• ROCKWELL AUTOMATION – Recognized Systems Integrator, exclusive to NWO

• TOSHIBA – Authorized local representative for VFD commissioning and maintenance

• EMERSON INDUSTRIAL AUTOMATION – Official Solution Provider

• SCHNEIDER ELECTRIC – Certified Integration Partner

• INDUCTIVE AUTOMATION (Ignition) – Registered Integrator

We supply, install, commission, and provide warranty support for all drive systems. In-stock consignment drives available up to 100 HP.

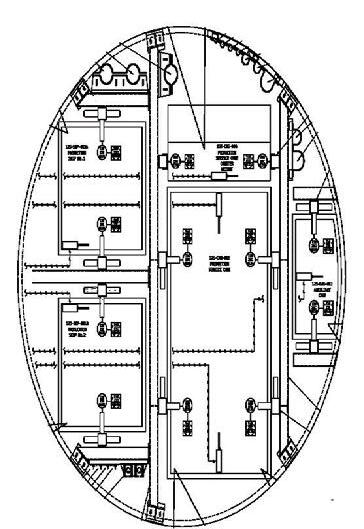

CUSTOM PANEL & E-HOUSE SOLUTIONS

• CSA-Certified panel fabrication facility

• Turnkey– custom design and build of E-Houses and containers

• Custom control panel design and fabrication for pneumatic, hydraulic, PLC, and instrumentation applications

ELECTRICAL CONTRACTING & MAINTENANCE

• Certified Red Seal electricians and technicians

• Full-service solutions: design, construction, and ongoing maintenance

general@automationnow.ca

Suppression

The right combination hasn’t been set - yet. It’s still a goose egg.

Vault Minerals is doubling down on the long-term potential of Wawa’s Sugar Zone Mine, with promising results from its ongoing exploration program at Sugar South, a new zone adjacent to the existing deposit.

As of now, 28 holes have been completed, with assay results from the first eight holes already returned.

“The shallow, high-grade intercepts at Sugar South continue to validate our belief in the broader Sugar Zone corridor,” said the most recent company statements.

Drilling at Sugar South resumed in February, targeting a 43-hole, 6,492-metre campaign. Making

Initial highlights include:

• 2.44 metres at 119 grams per tonne (g/t) gold

• 1.95 metres at 29.1 g/t gold

• 1.50 metres at 25.3 g/t gold

The early results confirm Sugar South’s potential to evolve into an additional mining front outside the scope of the current 2024 Ore Reserve, strengthening the case for a phased restart of the Sugar Zone Mine.

Vault has defined a mineral reserve of 1.9 million tonnes grading 5.2 g/t for 325,000 ounces of gold. Its broader mineral resource estimate stands at 4.8 million tonnes grading 8.2 g/t, containing approximately 1.28 million ounces.

While the mine remains on care and maintenance, officials say the exploration results underscore the “untapped potential” of the Sugar Zone corridor. No timeline has been confirmed for a full restart.

Put CAA to work for you and your business with savings on our smart enterprise solutions and benefits.

Commercial Roadside

Commercial Pit Crew

Group Benefits

Employee Membership

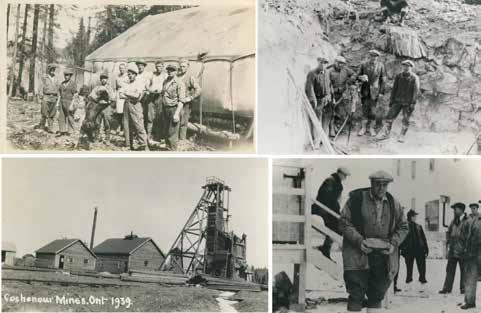

AsRed Lake marks its 100th anniversary, we look back at the foundations that built more than a town—they built a legacy. Nestled in the heart of northwestern Ontario, Red Lake has long been defined by its rich geological fortune and the resilient people who mined it.

In 1925, whispers of gold beneath the surface of Red Lake sparked a rush that would forever change the destiny of a northern Ontario town. One hundred years later, that same spirit of discovery and determination continues to shape the community. This centennial is more than a celebration of mining — it is a tribute to the people, progress, and perseverance that built Red Lake.

1925: Gold Discovered at Red Lake

A group of prospectors strike gold near the shores of Red Lake, triggering a northern rush.

1930: Boomtown Begins

The first mines—including Howey, Hasaga, and Madsen—go into production. Red Lake is accessible only by bush plane or winter roads.

1940–1950: Growth & Development

Major operations like Cochenour-Willans and Campbell Mines begin. Red Lake becomes a key player in Canadian gold production.

1970–1980: Modernization & Transition

Technological advancements and deeper exploration renew interest, while older mines begin winding down.

1990–2000: The Goldcorp Era

Goldcorp revitalizes the Red Lake Mine, turning it into one of the world’s richest gold-producing assets.

2010–PRESENT: Exploration Renaissance

New players like Evolution Mining and Kinross (Great Bear Project) breathe fresh life into the region, with modern exploration driving future potential. Orla Mining purchases Newmont Musselwhite assets in Northwestern Ontario and West Red Lake Gold Mines ramps-up operations at the Madsen Mine.

2025–100: Years of Red Lake

Red Lake celebrates a century shaped by mining—its past written in gold, and its future rich with promise.

Red Lake can lay claim to being one of the richest gold legacies in Canadian history, a tale born in the heart of Northwestern Ontario that still echoes through its mines, the airstrip, and town hall.

“Red Lake didn’t just strike gold— it reshaped how we understood the North,” notes an official at the Red Lake Regional Heritage Centre.

From its ancient Indigenous roots to a modern mining powerhouse, Red Lake’s development was neither swift nor easy—but it was relentless.

Archaeological surveys indicate that the Red Lake region has been home to Indigenous peoples for over 2,000 years. Originally the land of the Sioux and Cree, it eventually became home to the Ojibwe roughly 200–300 years ago. These First Nations communities mined and traded minerals long before European arrival, using gold and other resources for tools, ceremonial artifacts, and trade. Their connection to the land predates any mine shaft or airstrip and serves as a reminder of the long-standing human footprint in the region.

European settlement began in 1790, when the Hudson’s Bay Company established a trading post near what they called Lake Rouge—also known as Asa-tena-a-sat or Red Paint Lake. The name “Red Lake” itself, officially adopted in 1909, originates from a Chippewa legend in -

volving a slain moose and its blood turning the lake’s waters red.

While there were signs of gold as early as 1897, it wasn’t until the 1920s that Red Lake’s status as a gold capital began to take shape. A Department of Mines geologist, Dr. Everend Lester Bruce, confirmed gold-bearing quartz in the greenstone formations surrounding the lake in a 1924 report. But it was the Howey discovery on July 25, 1925, that triggered the gold fever.

Brothers Lorne and Ray Howey, with partners George McNeely and W.F. Morgan, discovered a quartz stringer with visible gold beneath the roots of an upturned tree. Their find was announced in the Ottawa Journal in October 1925. By January 1926, the stampede had begun. Over 18,000 mining claims were filed between 1926 and 1927. Red