166

Notes to the Company financial statements

Ferguson plc Annual Report and Accounts 2020

Year ended July 31, 2020

1 – Corporate information Ferguson plc (the “Company”) was incorporated and registered in Jersey on March 8, 2019 under the Jersey Companies Law as a limited company under the name Alpha JCo Limited with company number 128484. On March 26, 2019 the Company was converted to a public company and changed its name to Ferguson NewCo plc (subsequently changed to Ferguson plc on May 10, 2019). The principal legislation under which the Company operates is the Companies (Jersey) Law 1991, as amended, and regulations made thereunder. The address of its registered office is 26 New Street, St Helier, Jersey, JE2 3RA, Channel Islands. The Company is headquartered in the UK. The principal activity of the Company is to act as the ultimate holding company of the Ferguson Group of companies.

2 – Company accounting policies Basis of accounting The separate financial statements of the Company are presented in compliance with the requirements for companies whose shares are traded on the London Stock Exchange’s main market. They have been prepared on a going concern basis and under the historical cost convention and in accordance with the Companies (Jersey) Law 1991 and United Kingdom Generally Accepted Accounting Practice (“UK GAAP”) including FRS 102 (Financial Reporting Standard 102) “The Financial Reporting Standard applicable in the UK and Republic of Ireland” as issued by the FRC. As permitted by FRS 102, the Company has taken advantage of the disclosure exemptions available under that standard as a qualifying entity in relation to share-based payments, financial instruments, presentation of a cash flow statement, key management personnel and related party transactions. Note 4 (Operating profit) on page 131, note 8 (Dividends) on page 134, note 24 (Share capital) on pages 152 and 153 and note 30 (Events after the reporting period) on page 157 of the Ferguson plc consolidated financial statements form part of these financial statements. Foreign currencies The financial statements are presented in US dollars which is the functional currency of the Company at July 31, 2020. Foreign currency transactions entered into during the year are translated into US dollars at the rates of exchange ruling on the dates of the transactions. Monetary assets and liabilities denominated in foreign currencies are retranslated at the rate of exchange ruling at the balance sheet date. All currency translation differences are charged or credited to retained earnings. Investments in subsidiaries Fixed asset investments are recorded at cost less provision for impairment. The Company assesses at each balance sheet date whether there is objective evidence that an investment or a group of investments is impaired. Cash at bank and in-hand Cash at bank and in-hand includes cash in-hand and deposits held with banks which are readily convertible to known amounts of cash. Bank overdrafts are shown within borrowings in current liabilities on the balance sheet to the extent there is no right of offset or intention to net settle with cash balances. Share capital The Company has one class of shares, ordinary shares, which are classified as equity. Incremental costs directly attributable to the issue of new shares or options are shown in equity as a deduction from the proceeds, net of tax.

Where the Company purchases the Company’s equity share capital, the consideration paid, including any directly attributable incremental costs (net of tax), is deducted from equity attributable to shareholders of the Company until the shares are canceled, reissued or disposed of. Where such shares are subsequently disposed or reissued, any consideration received, net of any directly attributable incremental transaction costs and the related tax effects, is included in equity attributable to shareholders of the Company. Share-based payments Share-based incentives are provided to employees of the Group under the Group’s long term incentive plans and all-employee sharesave plans. The Company recognizes a compensation cost in respect of these plans that is based on the fair value of the awards, measured using Binomial and Monte Carlo valuation methodologies. For equitysettled plans, the fair value is determined at the date of grant (including the impact of non-vesting conditions such as the requirement for employees to save) and is not subsequently remeasured unless the conditions on which the award was granted are modified. Generally, the compensation cost is recognized on a straight-line basis over the vesting period. Adjustments are made to reflect expected and actual forfeitures during the vesting period due to the failure to satisfy service conditions or achieve non-market performance conditions. Dividends payable Dividends on ordinary shares are recognized in the Company’s financial statements in the period in which the dividends are paid or approved by the shareholders of the Company. company of the Ferguson Group of companies.

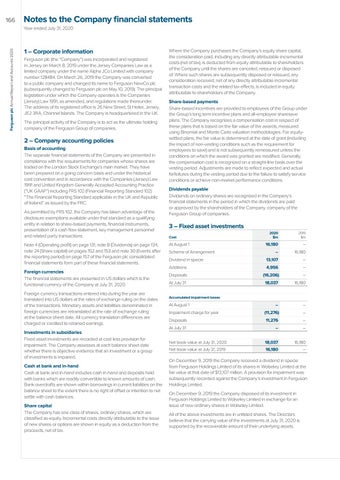

3 – Fixed asset investments Cost

At August 1 Scheme of Arrangement

2020 $m

2019 $m

16,180

–

–

16,180

Dividend in specie

13,107

–

Additions

4,956

–

Disposals

(16,206)

–

At July 31

18,037

16,180

Accumulated impairment losses

At August 1

–

–

(11,276)

–

Disposals

11,276

–

At July 31

–

–

Net book value at July 31, 2020

18,037

16,180

Net book value at July 31, 2019

16,180

–

Impairment charge for year

On December 9, 2019 the Company received a dividend in specie from Ferguson Holdings Limited of its shares in Wolseley Limited at the fair value at that date of $13,107 million. A provision for impairment was subsequently recorded against the Company’s investment in Ferguson Holdings Limited. On December 9, 2019 the Company disposed of its investment in Ferguson Holdings Limited to Wolseley Limited in exchange for an issue of new ordinary shares in Wolseley Limited. All of the above investments are in unlisted shares. The Directors believe that the carrying value of the investments at July 31, 2020 is supported by the recoverable amount of their underlying assets.