Constructing Multi-Structure

Design-Build Healthcare Campus at Kedren Children’s Village in Watts

MAJOR BUILDING PROJECTS

ISSUE

Constructing Multi-Structure

Design-Build Healthcare Campus at Kedren Children’s Village in Watts

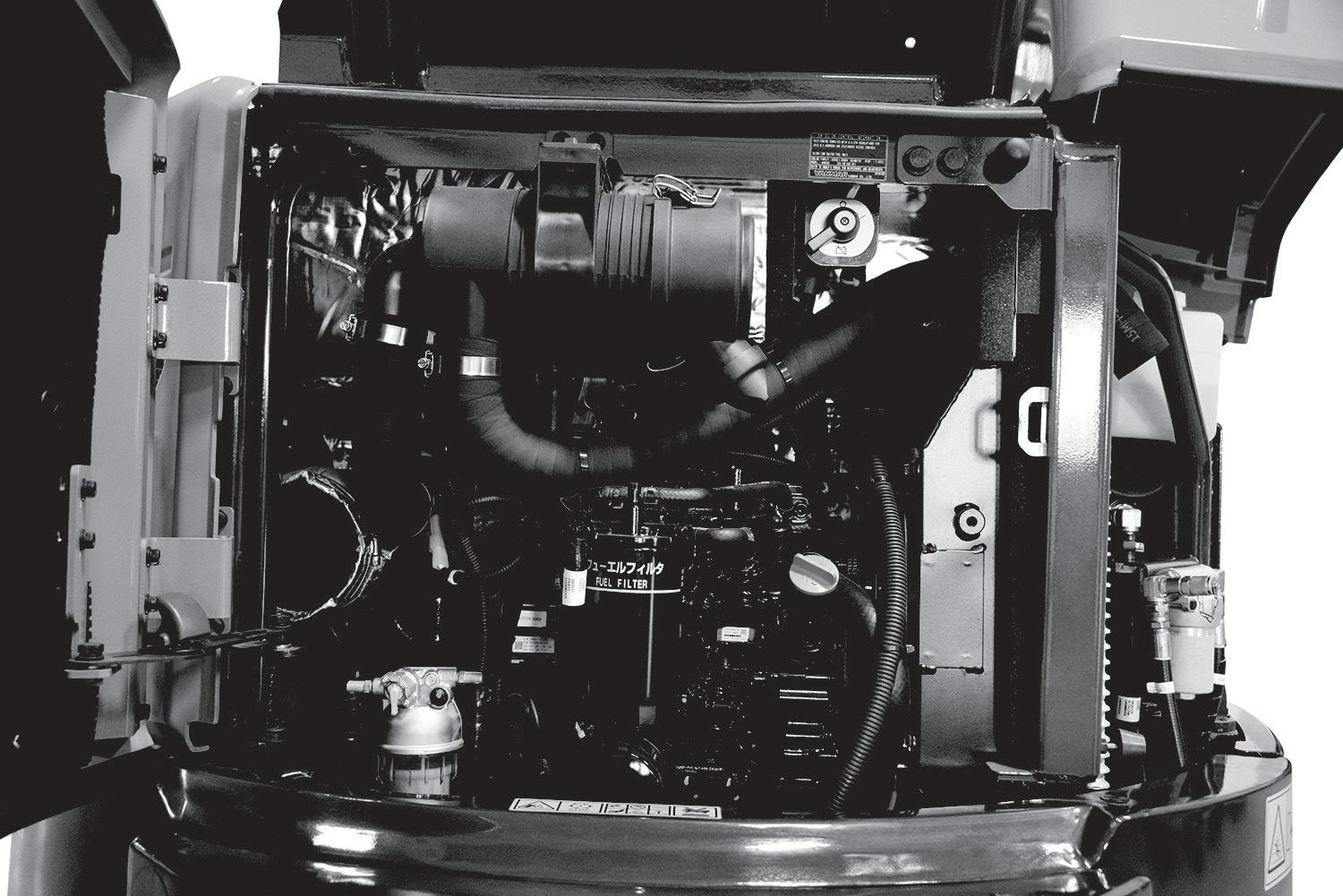

The EC400 represents the next level of heavy-duty Volvo excavation—combining precision control, exceptional breakout force, and class-leading operator comfort. Engineered for efficiency and built for longevity, it provides the performance large earthmoving operations demand, shift after shift.

C ontact your nearest VC E S location today

By Brian Hoover

In the heart of Watts, on a tightly constrained urban site surrounded by residential streets and active rail infrastructure, McCarthy Building Companies Inc. is delivering the most significant pediatric behavioral health project in California. The 145-milliondollar Kedren Children’s Village represents not only a major healthcare investment, but a technically complex, multi-structure campus that places McCarthy’s self-performed construction capabilities at the center of its execution.

Led by Senior Project Manager Joshua Osorio, the project is being delivered under a progressive design-build model for Kedren

Community Health Center Inc., marking McCarthy’s second behavioral health design-build with architect HOK. The 103,000 square foot facility will ultimately bring inpatient psychiatric care, outpatient medical services, transitional housing and structured parking together on a single site, a rare configuration for pediatric focused behavioral healthcare facilities. “This project really started long before we ever mobilized in the field,” says Osorio. “Through the progressive design-build process, we were involved from the earliest validation phase, working through site massing, budget alignment and constructability so the project could move forward

with clarity and confidence once construction began.” McCarthy’s involvement began well before physical construction. Validation work started in September 2023, during which the design-build team developed the base design, site massing and cost alignment prior to formal drawing production. That early phase set the foundation for a multi-stage design progression that advanced through schematic design, design development and construction documents before full construction mobilization began in February 2025. The phased approach also allowed McCarthy to begin early packages such as demolition, grading and utilities while the

more complex inpatient hospital drawings continued through state level review. “A major advantage on this project has been our ability to self-perform critical scopes of work. From utilities and foundation excavation to concrete placement and framing, that level of control allows us to manage sequencing, quality and schedule much more effectively on a tight urban site,” continued Osorio.

The first major field operation involved demolition of Kedren’s former 44,027 square foot facility, which previously occupied the site. After abatement of legacy materials, the structure was fully removed and exported off site. Southern California Grading followed with over excavation and site preparation, establishing finish grades across the campus footprint. With grading complete, McCarthy transitioned quickly into vertical work, beginning with the parking structure on the southwest corner of the property.

That structure, a 204 stall, 71,089 square foot cast in place concrete garage, was constructed using a Cunningham Beam system and was fully self-performed by McCarthy’s concrete crews. Work began in June 2025 and wrapped

up by the end of the year, providing early onsite parking and freeing up limited street frontage for the remainder of construction. The garage set the pace for the project, allowing the team to sequence subsequent building work efficiently within the tight site boundaries. “Because the site is surrounded by an active neighborhood, sequencing was everything,” says Osorio. “Completing the parking structure early helped relieve staging pressure and allowed us to move the rest of the campus forward without overwhelming the surrounding streets.”

North of the garage, McCarthy is building the two story, 13,875 square foot transitional housing building using a structural coldformed steel system. The building contains 24 studio units intended for patients and families served by Kedren’s programs. Aside from slab-on-grade concrete, the structure relies entirely on cold formed steel framing, a choice driven by construction efficiency and long-term durability. McCarthy self-performed all framing for this building, further emphasizing the firm’s hands on delivery approach.

Above: Rendering of the future campus of Kedren Children’s Village —an innovative design-build project by McCarthy and HOK that unites care, housing, and healing in a pediatric-focused behavioral healthcare setting.

The outpatient services building followed, a three story, approximately 30,000 square foot steel framed structure with slab on metal deck floors. This facility will house primary health care, mental health urgent care and outpatient services and a pharmacy, and is currently advancing through slab and structural framing operations. At the time of the interview, slabon-grade forming was underway and the team was preparing to transition into steel erection, supported by crane services. The most complex element of the campus is the three-story inpatient psychiatric facility, which falls under state jurisdiction and defines the project’s critical path. This building requires extended review and approval timelines, with final permit approvals occurring in June 2025 and final build out scheduled through mid 2027. Its structural system mirrors the outpatient building with steel framing and elevated concrete decks, but the interior build out is significantly more detailed due

to regulatory and operational requirements. McCarthy’s ability to coordinate design, permitting and construction under a single contract has been essential in maintaining schedule alignment.

“It’s not often you’re building four distinct structures with four different uses on one compact site. Having mental health inpatient, outpatient and urgent care services, a primary care clinic, transitional housing and parking all integrated into a single campus adds complexity, but it also makes the project unique,” says Osorio. “The inpatient facility drives the overall schedule, particularly with state review timelines. Even though the project duration may appear long, coordinating permitting, design and construction within those review windows makes the schedule extremely tight.”

Across the entire site, McCarthy has self-performed all underground utilities, including sewer, domestic and fire water, storm drain and landscape infrastructure. While Los Angeles Department of Water and Power and SoCalGas handle their respective service connections, McCarthy crews are responsible for installing the supporting infrastructure, along with

excavation and backfill to keep work moving ahead of vertical construction.

Logistics remains one of the project’s defining challenges. As construction progresses and the campus footprint fills in, staging and worker parking become increasingly constrained. Noise, traffic control and community

[ Continued on page 10 ]

{ Continued from page 8 }

coordination are ongoing considerations, particularly given the project’s proximity to active rail lines and surrounding neighborhoods. Despite these constraints, Osorio reports that the work is tracking to plan, with incremental permitting allowing the team to advance demolition, grading, utilities and early building packages while the inpatient facility continues through state review.

Beyond the technical execution, the project carries a broader community focus. Kedren Children’s Village is designed as a

As construction progressed, site logistics required precise sequencing and coordination to maintain schedule efficiency, while supporting local participation in delivering a facility that will serve South Los Angeles for decades.

fully integrated primary and mental health care campus for children and youth ages 5 to 12. The plan includes an outdoor garden for patients, as well as therapeutic outdoor space and a gym that adds a restorative component beyond clinical treatment . McCarthy is also emphasizing local workforce participation, aligning with Kedren’s mission to invest in the surrounding community during construction as well long after completion. “Beyond the construction itself, there’s a strong focus on community involvement. This is a project that’s being built for the neighborhood, and we’re

proud to support local participation as part of delivering a facility that will serve South Los Angeles for decades,” concludes Osorio. When finished in summer 2027, Kedren Children’s Village will stand as one of the few pediatric focused behavioral health hospitals in the country and the first comprehensive facility of its kind in Los Angeles County. For McCarthy, the project reflects the firm’s ability to self-perform critical scopes, manage complex healthcare construction and deliver a multi-building campus within one of the region’s most demanding urban environments. Cc

At G3 Equipment AC Specialists, we provide expert AC repair services for commercial fleets. Our skilled technicians ensure your systems operate safely and efficiently— keeping your vehicles running smoothly and your drivers safe and comfortable.

RED DOT Roof Top

Air Central

Mobile AC Hoses

By Dr. James Doti and Dr. Raymond Sfeir, A. Gary Anderson Center for Economic Research

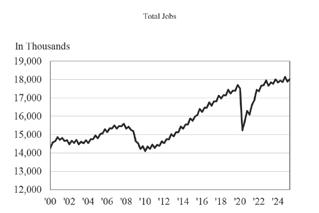

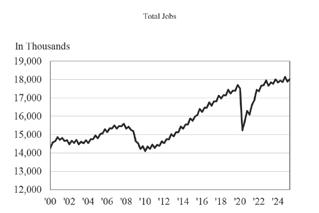

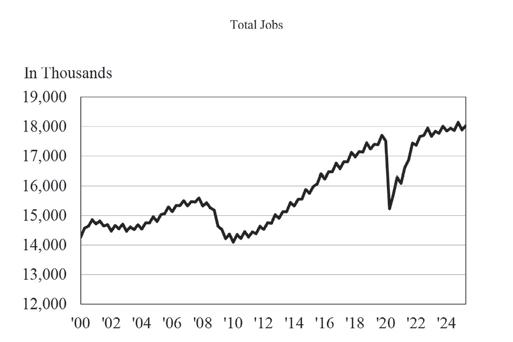

Over the 2000 to 2025 period, the number of California jobs increased by 26.3 percent. That growth was slightly greater than the U.S. average of 23.1 percent. As a result, California’s job growth in the new millennium ranked 18th highest of all 50 states.

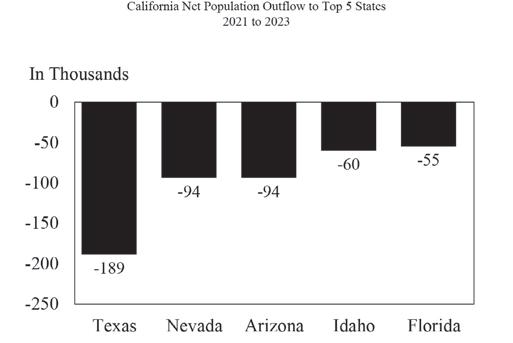

Since the rapid recovery following the COVID recession, however, California’s job growth slowed appreciably. Over the 2022Q2 to 2025Q2 three-year period, California’s job growth was only 2.0 percent. In a ranking of all 50 states, that lackluster growth placed California at a rank #48. It’s not a coincidence that California’s rank of #48 in job growth over the 2022Q2 to 2025Q2 period is the same as California’s rank in overall taxation (48) according to the Tax Foundation’s 2024 State Business Tax Climate Index. High relative state taxes not only drive out jobs, but they also drive out people. According to the U.S. Census Bureau, the net population outflow (inflow minus outflow) from California from 2021 to 2023 was more than one million, with the top five outbound destinations being states with zero or very low state income taxes: Texas, Arizona, Nevada, Idaho, and Florida.

The most recent IRS data on net income flows is 2022, where the average adjusted gross income (AGI) for those leaving California was $134,000 versus $113,000 for those entering the state. The total AGI leaving California in 2022 was $52.9 billion, as compared to an inflow of $28.9 billion, resulting in a net loss in California’s AGI of $24 billion. That loss adds

CALIFORNIA’S NET POPULATION OUTFLOW TO TOP 5 STATES 2021 TO 2023

to the net loss in California’s net AGI of $20.2 billion in 2021.

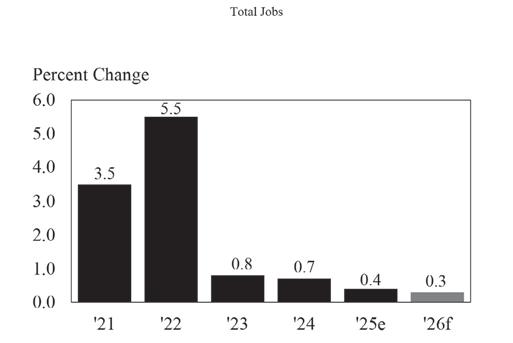

Our forecast calls for California’s weak job growth to continue into 2026. On average, the 0.3 percent increase in our jobs forecast in 2026 translates to a net gain of only 62,000 new jobs.

TOTAL JOBS

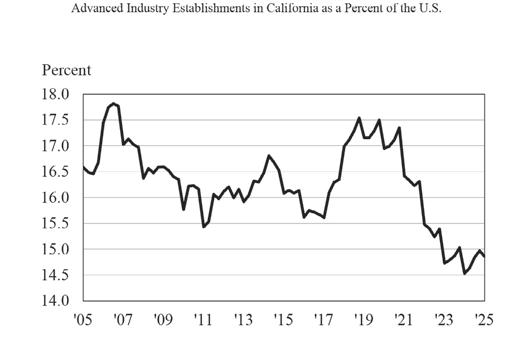

More unsettling for California’s economic future is the sharp decline in the number of Advanced Industries establishments in California as a percentage of all such establishments in the U.S. “Advanced Industries” refers to the number of establishments in high-value-added sectors, such as technology, software development,

aerospace, and medical products. This Advanced Industry series for 50 different MSAs has been tracked by the Chapman-UCI Innovation Index.

The percentage of advanced establishments in the 7 MSAs we track in California (Orange County, Los Angeles, Sacramento, Riverside-San Bernardino, San Diego, San Francisco, San Jose) has dropped from 17.5 percent of all advanced establishments in the U.S. in 2018Q4 to 14.9 percent in 2025Q1.

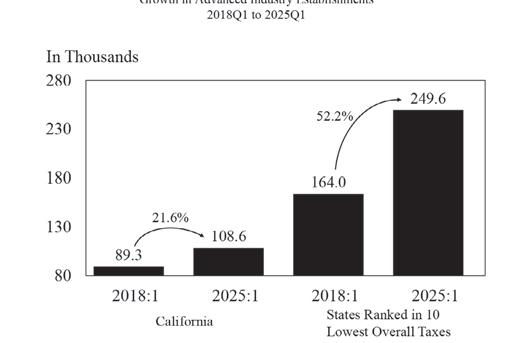

During the 2018-2025 period, the number of advanced industry establishments increased by 21.6 percent in California, about half the 42.7 percent increase in the U.S. (net of California). The MSAs located in the 10 states ranking lowest in state and local overall taxation exhibit even higher relative growth: California’s 21.6 percent increase from 89,300 to 108,600 advanced industry establishments compared to an increase of 52.2 percent for the low-tax states from 164,000 to 249,600 establishments over the same period.

GROWTH IN ADVANCED INDUSTRY ESTABLISHMENTS 2018Q1 TO 2025Q1

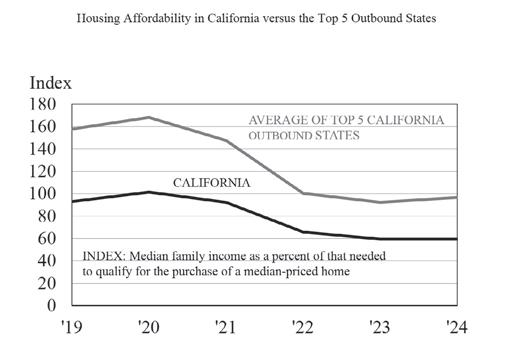

A critically important measure for assessing the health of real estate-related services is the number of resale homes sold. Our forecast calls for a 2.3 percent increase in homes sold from 270,000 to 276,000 units, an increase of 6,000 housing units sold. While this increase is a bit of good news for the real estate sector, it’s well below the annual sales rate of approximately 400,000 units following the 2007 to 2009 financial crisis.

California housing affordability, as compared to the top 5 outbound states, is too low to support a more meaningful recovery in home sales.

Chapman University 2026 U.S. Economic Forecast is an independent, model-driven outlook used by business and policy leaders for 48 years, offering vital insights as the nation faces one of its most unpredictable economic periods.

Presented by President Emeritus and Professor of Business and Economics Jim Doti, Ph.D., the Chapman Economic Forecast projects real GDP growth of 2.0% in 2026 (vs. 1.8% in 2025). The anticipated growth is driven by record-setting investments in artificial intelligence (AI) infrastructure and sustained consumer spending from a $55 trillion surge in household wealth since 2020. These are just a few elements powering the U.S. economy into 2026 despite ongoing uncertainty around tariffs and interest rates.

• Technology Investment Fuels Opportunity: Record spending on artificial intelligence (AI) infrastructure is expected to create new jobs and business opportunities, helping to keep the economy growing even as other sectors face headwinds. This wave of innovation could lead to new industries and more demand for skilled workers around the country.

• Rising Household Wealth Supports Spending: American families, especially those who own homes or investments, have seen their wealth grow sharply over the past five years. This has helped many households weather higher prices and interest rates, keeping consumer spending strong, a vital engine for the broader economy.

• Tariffs Mean Some Goods May Cost More: Recent increases in tariffs, the highest in nearly a century, are likely to raise costs for certain imported products. This could affect both businesses that rely on overseas materials and consumers who may see higher prices on everyday goods.

• Job Growth Slows, but Labor Market Remains Stable: While the job market is expected to remain generally healthy, Chapman’s forecast suggests hiring may slow in 2026. Most people looking for work should still be able to find jobs, but wage growth may moderate, and some industries could see less expansion.

• Brighter Prospects for Homebuyers: As mortgage rates are forecasted to dip below 6% in 2026, buying a home may become more affordable for many families. This could spark a recovery in the housing market and make homeownership a reality for more Americans, especially in regions like California and Orange County.

• Top Cities for Growth: Atlanta, Tampa, Raleigh and Charlotte, NC, and Salt Lake City are the leading larger cities for job seekers and businesses, with strong economic and population growth expected in 2026. Louisville, Oklahoma City, Providence, Hartford, and Kansas City are the top five smaller-sized cities projected for job growth next year.

“With mortgage rates projected to dip below 6 percent in 2026, our forecast suggests a meaningful recovery in home sales is on the horizon,” added Dr. Raymond Sfeir, Ph.D., Director of the Anderson Center for Economic Research at Chapman University. “Lower borrowing costs will make homeownership more accessible for many families and could help stabilize prices in key markets.”

“As we look ahead to 2026, investors will need to navigate a landscape shaped by both new opportunities and persistent risks,” said Fadel Lawandy, Director of the C. Larry Hoag Center for Real Estate and Finance at Chapman University. “Staying disciplined and avoiding overexposure to any single sector will be key to managing volatility and capturing long-term growth.”

Founded in 1861, Chapman University is a nationally ranked private university in Orange, California, about 30 miles south of Los Angeles. Chapman serves nearly 10,000 undergraduate and graduate students, with a 12:1 student-to-faculty ratio. Students can choose from over 100 areas of study within 11 colleges for a personalized education.

The Economic & Business Review, published annually by the A. Gary Anderson Center for Economic Research, is owned and provided as an educational service by Chapman University. Contents reflect the views and opinions of the contributors and do not necessarily represent those of The Argyros College of Business & Economics or Chapman University.

The economic forecasts in this Review are prepared and written by Dr. James Doti and Dr. Raymond Sfeir. The editorial board invites the submission of manuscripts from Chapman faculty, administrators, students, alumni and guest lecturers. Inquiries regarding manuscript submission and subscriptions to the Review may be emailed to acer@chapman.edu, or telephone (714) 997-6693. Cc

The Economic & Business Review, published annually by the A. Gary Anderson Center for Economic Research, is owned and provided as an educational service by Chapman University. Contents reflect the views and opinions of the contributors and do not necessarily represent those of The Argyros College of Business & Economics or Chapman University. For more information go to https://economicforecast.chapman.edu/

The economic forecasts in this Review are prepared and written by Dr. James Doti and Dr. Raymond Sfeir. The editorial board invites the submission of manuscripts from Chapman faculty, administrators, students, alumni and guest lecturers. Inquiries regarding manuscript submission and subscriptions to the Review may be emailed to acer@chapman.edu, or telephone (714) 997-6693.

By Brian Hoover

California is in the midst of one of the most ambitious infrastructure investment cycles in its history. Driven by population demands, economic growth, aging systems, and the need for reliable transportation, water, and public facilities, the state is deploying unprecedented public and private capital to modernize its built environment. From urban redevelopment and transit expansion to large-scale water storage and freight corridors, today’s projects represent a coordinated effort to strengthen California’s competitiveness and quality of life. Backed by voter-approved measures, state and federal funding, and private investment, these multi-billiondollar undertakings are redefining what large-scale civil engineering looks like in the nation’s most complex construction market.

In Anaheim’s Platinum Triangle, the $4 billion OC Vibe development is redefining what an entertainmentcentric mixed-use district looks like around a major sports and transit hub. Anchored by the iconic Honda Center and the Anaheim Regional Transportation Intermodal Center (ARTIC), this 92- to 100-acre project weaves new housing, retail, dining, offices, parks and plazas into a walkable district designed to be a 365-day destination. Civil engineering in the first phase includes new parking structures, utility upgrades, street realignments and public open space, essential infrastructure that supports future vertical development such as a 5,700-seat concert venue, restaurants and riverfront parks. Construction began in 2023 with the first parking garages under

way and public spaces and entertainment venues slated to open through 2028. The project is expected to generate roughly 10,000 construction jobs and thousands of ongoing local jobs once complete, as well as increased transit access and community connectivity.

Sacramento Railyards Project — Multi-BillionDollar Urban Renewal

The historic Sacramento Railyards, a 244-acre infill site adjacent to downtown Sacramento, is being transformed into one of the most ambitious mixeduse projects in the state. With a multi-billion-dollar economic impact that analysts estimate at over $8 billion in one-time construction output and more than

$4 billion in annual economic activity, the scale of this redevelopment transcends a single project. The plan calls for up to 12,000 housing units, millions of square feet of office and retail space, a flagship Kaiser Permanente medical campus, hospitality space, public parks, and a major soccer stadium and entertainment venues. Civil works include environmental remediation of contaminated industrial lands, extensive roadways and utility systems, stormwater and drainage systems, pedestrian and bike connections, and transit access integration. The project’s phasing is expected to unfold into the late 2020s and beyond, knitting this onceisolated rail yard back into the fabric of Sacramento’s vibrant downtown.

Stretching through the heart of Los Angeles, the Los Angeles River has been historically confined to concrete flood channels, disconnected from neighborhoods and habitat alike. The Los Angeles River Ecosystem Restoration initiative aims to reverse decades of ecological degradation along roughly 11 miles of river corridor, reestablishing functional riparian habitat, restoring wetlands, improving water quality and reconnecting the river to its historic floodplains while maintaining critical flood protection infrastructure. Civil work associated with restoration includes earthworks to reshape riverbanks, construction of wetlands and habitat zones, trail infrastructure, and bridges for pedestrians and cyclists. Current planning and early construction cost estimates for various segments of the river corridor are in the range of about $1 billion to $1.2 billion depending on scope and delivery approach, with continued funding efforts underway to support phased implementation across multiple reaches of the river. When completed, the project is expected to support ecological biodiversity, enhance recreation and active transportation options, and improve water management outcomes in densely urbanized areas.

In San Diego, the Mid-Coast Trolley Extension has extended light rail service north from downtown through key urban corridors to the University City and UTC districts. At an estimated cost of $2.2 billion, this extension involved complex civil work including elevated guideways, new station foundations, bridge structures, utility relocations, and traffic reconfigurations where the rail intersects busy roadways. The project enhances multimodal mobility in one of Southern California’s busiest employment and education centers, significantly reducing vehicular congestion and supporting regional goals for reduced greenhouse gas emissions. The extension integrates with existing transit systems and provides millions of additional passenger trips annually, creating a backbone for continued transit-oriented development in the region.

Los Angeles is executing one of the country’s most complex and far-reaching rail and transit expansion programs, with investments totaling in the tens of billions across multiple corridors. From subway extensions to new light rail lines and station upgrades, the scope of civil engineering includes deep tunneling, viaduct construction, heavy trackwork, major station excavation, grade separations, drainage and

stormwater systems, and extensive utility coordination in dense urban environments. These projects collectively aim to improve connectivity across a vast metropolitan area, reduce reliance on automobiles, and advance sustainability goals. Whether expanding connections to underserved communities or preparing for future regional rail linkages, the civil infrastructure component drives real economic and mobility gains that ripple through the local economy.

In the Sacramento Valley, the Sites Reservoir stands as perhaps the most significant new water infrastructure project in California in decades. With an estimated cost of about $3.9 billion, the off-stream reservoir will capture and store excess river flows for use during droughts and dry periods, significantly enhancing statewide water reliability. Civil construction involves major earthmoving to form the reservoir basin, construction of two primary dams and auxiliary dikes, conveyance facilities to move water from the Sacramento River via existing canals, and associated environmental mitigation. Once completed, the reservoir is expected to hold up to 1.5 million acre-feet of water, enough to serve millions of residents and agricultural operations across the state, and reduce pressure on other water systems during peak demand years.

Conveyance Project — $20+ Billion Water

Infrastructure Initiative

The Delta Conveyance Project is one of the largest proposed infrastructure efforts in California history,

with estimated costs exceeding $20 billion. The project would construct a modernized water conveyance system beneath the Sacramento-San Joaquin Delta, including a roughly 45-mile tunnel and associated intake facilities. Designed to improve system reliability and operational flexibility, the project represents a generational investment in the State Water Project and would involve extensive tunneling, pumping, and civil works over multiple decades.

Stretching through Northern San Diego County, the North Coast Corridor is a $6 billion, multi-decade program combining highway improvements, rail upgrades, transit enhancements, and environmental restoration along the I-5 corridor. Civil construction includes freeway expansions, bridge replacements, rail infrastructure improvements, pedestrian and bicycle facilities, and large-scale lagoon restoration projects. The corridor approach reflects a comprehensive strategy to improve mobility, safety, and regional connectivity while coordinating multiple infrastructure systems within a constrained coastal environment.

Along California’s North Coast, plans are advancing for a $2.1 billion tunnel project to bypass the landslideprone Last Chance Grade segment of U.S. Highway 101. The proposed tunnel would span roughly 6,000 feet, making it the longest highway tunnel in the state.

[ Continued on page 24 ]

The project addresses long-standing safety and reliability concerns along a critical transportation corridor that serves remote communities, freight movement, and emergency access, highlighting how large-scale civil solutions are being deployed even in rural regions.

California’s statewide highway and multimodal improvement programs represent a continuous stream of civil infrastructure investment totaling billions annually. Recent funding packages exceed $1 billion per biennial cycle, supporting critical pavement rehabilitation, bridge replacements, interchange modernizations, safety upgrades, complete streets projects, and expansion of bicycle, pedestrian and zero-emission transit facilities. These enhancements are not single flagship projects but rather a coordinated portfolio that strengthens the backbone of California’s transportation network, improves freight fluidity, enhances safety outcomes, and supports resilient travel corridors from rural regions to major metropolitan centers.

Across the state, universities and local jurisdictions are advancing civil-heavy projects worth hundreds of millions of dollars that reflect innovation at community scales. University campuses are constructing modern research and academic facilities, housing, utility upgrades and stormwater management systems that support sustainability goals and student populations. Municipal civil programs are rebuilding aging streets, upgrading water and sewer infrastructure, and building multimodal networks that link neighborhoods to jobs and services. Collectively, these projects drive incremental but meaningful impact, providing local jobs, improving quality of life, and serving as testbeds for new technologies and sustainable practices that will influence future statewide investments.

Together, these projects illustrate the scale and ambition of California’s current infrastructure moment. Through sustained public-private investment, coordinated planning, and advanced civil engineering, the state is strengthening its transportation networks, securing water supplies, revitalizing urban centers, and modernizing public facilities. For contractors, engineers, and industry partners, this era represents not just opportunity—but a defining chapter in building the next generation of California infrastructure. Cc

The skill, precision, and pride of North America’s best heavy equipment operators were on full display this fall as the 2025–2026 Caterpillar Global Operator Challenge reached its North American semifinal round. Held September 29 at Caterpillar’s Edward J. Rapp Customer & Training Center in Clayton, North Carolina, the event brought together 32 elite operators from across the United States and Canada, each representing their local Cat dealer after months of qualifying competitions.

Divided into Eastern and Western regions, the semifinals tested operators across four demanding

challenges designed to measure accuracy, adaptability, and mastery of Cat equipment and technology. At the conclusion of the day, Brian Hayden of Maine and Brock Leclerc of British Columbia emerged as the Eastern and Western Region champions, earning their spots in the Global Operator Challenge Finals to be held March 4, 2026, in Las Vegas during CONEXPO-CON/AGG.

While the spotlight ultimately shone on the two regional champions, California’s presence was unmistakable, with operators representing Hawthorne Cat, Quinn Company, and Holt of California competing against the very best in North America.

A skyview of the Global Operator Challenge Finals at CONEXPOCON/AGG 2023. The framework for an event’s obstacle course is set up and machines used in the events are scattered across the area.

Champions Advance to the Global Stage

Brian Hayden of Hayden Excavating and Welding Inc., representing Milton Cat, captured the Eastern Region title with the lowest overall point total of the competition. His steady performance across all four challenges underscored the discipline and consistency required at this elite level.

“What makes me proud is bringing recognition to the operators that devote their time and lives to what they do,” Hayden said. “This is about showcasing their skills.”

In the Western Region, Brock Leclerc of Quattro Constructors, representing Finning Canada, rose to the top with a commanding showing that combined speed, precision, and composure under pressure.

“It’s beyond exciting what we’ve accomplished here as a group,” Leclerc said. “The sportsmanship, the energy, it’s been an unreal experience.”

Both champions now advance to the global finals in Las Vegas, where they will compete against

top operators from Europe, South America, and Asia Pacific inside Caterpillar’s 70,000-square-foot outdoor exhibit.

Among the standout competitors were several operators representing California Cat dealers, reinforcing the state’s reputation for producing highly skilled professionals across grading, excavation, rental, and demolition work. Representing Hawthorne Cat was Danny Younghusband of Star Equipment Rental, a Californiabased operator who advanced through the competitive dealer qualification process to earn his place among North America’s elite. Hawthorne Cat was also represented by Lako Miller of Goodfellow Brothers, competing under the dealer’s broader regional footprint in Hawaii.

Quinn Company was represented by Cody Boyster of Golz Construction, whose performance reflected the depth of operator talent cultivated across Northern California’s heavy civil and construction markets. Holt of California was represented by Troy Lea of Lea’s Demolition, who delivered one of the most notable performances of the semifinals

Left: Brian Hayden, holding first place trophy for Caterpillar’s Global Operator Challenge Eastern Regional semifinal.

Right: Brock Leclerc holding first place trophy for Caterpillars Global Operator Challenge Western Regional semifinal.

by capturing first place in the Western Region’s Load ‘N Loader Challenge, showcasing exceptional adaptability and precision with Cat wheel loader equipment.

“These events are about creating a level playing field,” said Jason Hurdis, global industry solutions manager for Caterpillar. “Every operator faces the same machines, the same technology, and the same challenges. What separates them is talent, grit, and performance.”

The North American semifinals featured four meticulously designed challenges, each highlighting a different facet of operator expertise. From the fast-paced, multi-attachment Over-the-Top Challenge using a Cat compact track loader, to the urban-inspired City Streets excavator course, competitors were pushed to demonstrate finesse, control, and efficiency.

The Load ‘N Loader Challenge tested adaptability with a Cat wheel loader, requiring both material handling and precision placement, while the Centennial Push Challenge paid tribute to Caterpillar’s dozer legacy with a series of demanding blade and

grading tasks that left no room for error.

Collectively, the events reflected the real-world conditions operators face every day on jobsites, while celebrating the craft that defines the construction industry.

The North American semifinals represent the culmination of months of dealer-level competitions held worldwide, with record participation across the Caterpillar dealer network. Nine operators from around the globe will ultimately compete in the finals, where the winner will receive either a $10,000 cash prize or an equivalent-value trip to a Caterpillar facility of their choice.

For California’s operators and dealers, the semifinals were more than a competition, they were a statement. From Hawthorne Cat to Quinn Company and Holt of California, the state’s representatives proved they belong on the industry’s biggest stage, carrying forward a tradition of excellence that continues to define California construction.

For more information on the Global Operator Challenge, visit cat.com/operatorchallenge. Cc

CASE Construction Equipment is doubling down at CONEXPOCON/AGG 2026, March 3-7 in Las Vegas with an impressive machine lineup purpose-built to help crews work smarter, safer and more efficiently than ever before. The company will feature more than 40 machines across 40,000 square feet in West Hall booth #W40701, highlighting nearly 20 new or upgraded models. The display will offer contractors, municipal crews, utility teams, landscapers and rental businesses of every size a first-hand look at CASE’s gamechanging innovations in equipment, technology and attachments to take on today’s toughest jobs.

Highlights include new D Series 3-ton mini excavators, a new midi

excavator and new models to the E Series full-sized excavator lineup. Visitors can also see the latest addition to CASE’s growing list of electric equipment: the all-new TL100EV electric mini track loader. Powerful new G Series compact wheel loaders with operator-friendly cab improvements will be at the show, along with upgraded large wheel loaders featuring operatorassist features like AutoDig and rear object detection. Show attendees

will also be able to preview new N Series dozers expected to arrive in late 2026, with big upgrades to performance management, visibility and the operator experience. Among the exclusive highlights will be the very first J.I. Case Signature Edition 580 Super N backhoe loader — a collector’s item honoring the brand’s rich heritage, as well as the heavy-metal inspired Hetfield Limited Edition TV450B compact track loader. Cc

John Deere ushers in a bold new era of earthmoving with the debut of its New Generation P-Tier Midsize Excavators. Redesigned, developed and tested in-house, this distinguished lineup goes all in to deliver the most advanced John Deere excavators yet. Launching with the 210, 230 and 260 P-Tier

models in the 20-metric-ton class, the new generation sets a standard for jobsite performance, operator experience and next-level features and technology.

The new P-Tier models offer smooth, powerful hydraulics and smart design enhancements for impressive overall performance. The combination of structures, hydraulics and integrated technology is optimized to support a balance of performance and total cost of ownership. Featuring increased dig force and lift capacity,

the new P-Tier excavators offer excellent power and performance for trenching, grading, craning and truck loading while refined hydraulic tuning enables fast, smooth cycle times. Performance modes, including Dig, Lift and Eco, help match jobsite power and manage fuel usage. Operators can also adjust the hydraulic response with speed and control modes, allowing operators to match the performance of the machine to the response rates they choose, based on operator preference or applications the machine is working in. Cc

• New lower improvements including: 'Swing-out axle extenders' & carbody counterweight!

• Attachment improvements:

Boom pendant storage retainers

Button style rope ends/quick reeve

• New upper counterweight package-improved capacities

• New