California Politics in 2026: A Year of Uncertainty and Opportunity

PAGE 18

CALIFORNIA GROCERS ASSOCIATION

When State Demographics Stop Being Destiny

PAGE 24

Rich Wardwell to Chair CGA Board

PAGE 30

A Political Earthquake with Economic Roots

PAGE 36

California Politics in 2026: A Year of Uncertainty and Opportunity

PAGE 18

When State Demographics Stop Being Destiny

PAGE 24

Rich Wardwell to Chair CGA Board

PAGE 30

A Political Earthquake with Economic Roots

PAGE 36

EXECUTIVE COMMITTEE

CHAIR APPOINTMENTS

Chair

Richard Wardwell

Superior Grocers

Immediate Past Chair

Michel LeClerc

North State Grocery, Inc.

Joe Mueller Kellanova

Independent Operators Committee Chair Chang So Hollister Super

DIRECTORS

Ryan Adams

Gelson’s Markets

Joe Angulo

El Super/Smart & Final

Steve Brancamp UNFI

Elaina Budge

Costco Wholesale (Bay Area)

Adam Caldecott

Good Food Holdings, Inc.

Rocky Campbell

C & K Market, Inc.

Dorothy Carlow

Mother’s Market & Kitchen

Taylor Chappell

Anheuser Busch InBev

Adam Deardorff

FMS Solutions

Chris Dehoff

Dehoff’s Key Markets

Dom Engels

Bronco Wine Co.

CALIFORNIA GROCERS ASSOCIATION

President/CEO

Ronald Fong

Senior Vice President &

Chief Operating Officer

Doug Scholz

Executive Director Events & Sponsorship

Beth Wright

Vice President

Communications & Public Affairs

Nate Rose

Director Local Government Relations

Tim James

First Vice Chair

Jonson Chen

Tawa Supermarket, Inc.

Second Vice Chair

Bertha Luna

Stater Bros. Markets

Subriana Pierce C.A. Fortune

Anthony Escobar

NuCal Foods

Shant Fermanian

Super King Markets

Jon Gianinni

Nutricion Fundamental

Amber Hammond

KeHE Distributors, LLC

Justin Hyer

Molson Coors

Tyler Kidd

Mar-Val Food Stores

Andrew Knight Instacart

Brandon Lombardi

Sprouts Farmers Markets

Nick Malm

Reyes Coca-Cola Bottling

Brady Matoian OK Produce

Brendan McAbee

Bimbo Bakeries USA

Senior Director CGA

Educational Foundation

Brianne Page

Vice President

People Operations &

Administration

Jennifer Gold

Senior Manager

Marketing & Membership

Sunny Porter

Communications Manager

Grace Becker

Controller

Scott Inman

Administrative Assistant Delilah Augustine

Treasurer

Elliott Stone Mollie Stone’s Market

Secretary

Sergio Gonzalez Northgate Markets

Brenda Palomino Amazon

Kelli McGannon

The Kroger Company

JR Medina Super A Foods

Candace Minto PepsiCo Beverages

Michael Molinar Food 4 Less Stockton

Tim Nowell Procter & Gamble

Bethany Pautsch

Tyson Foods, Inc.

Eric Pearlman C&S Wholesale Grocers

Karen Reid

Post Consumer Brands

Adam Salgado

Heritage Grocers/Cardenas Markets

Nick Sass The Hershey Company

Senior Accountant & Assistant Office Manager

William Quenga

California Grocer is the official publication of the California Grocers Association.

1005 12th Street, Suite 200 Sacramento, CA 95814 (916) 448-3545 (916) 448-2793 Fax cagrocers.com

For association members, subscription is included in membership dues. Subscription rate for non-members is $150.

Casey Scharetg Gallo

Karl Schroeder Albertsons Companies

Kristen Sherwood Grocery Outlet, Inc.

Diane Snyder Whole Foods Market

Brad Thomas

Kimberly-Clark Corporation

Joe Toscano

Nestle Purina PetCare

Steve Tsujimoto

Berkeley Bowl Marketplace

Priyanka Vijay

Keurig Dr Pepper

Stephanie Wu The Save Mart Companies

Kevin Young Young’s Payless IGA

© 2025 California Grocers Association

Publisher Ronald Fong rfong@cagrocers.com

Editor Nate Rose

nrose@cagrocers.com

Managing Editor Grace Becker

gbecker@cagrocers.com

For advertising information contact: Beth Wright bwright@cagrocers.com

RON FONG PRESIDENT AND CEO

CALIFORNIA GROCERS ASSOCIATION

While California’s elected officials must protect society from technology’s pitfalls, they must also ensure they aren’t hamstringing businesses and shoppers.

There’s a famous quote about the future that goes something like this, “We wanted flying cars, instead we got 140 characters.” It captures the idea the 21st century looks a lot different than we imagined it would as kids. But a quarter of the way into this century, it appears we’re starting to approach some of those farfetched ideas from the last midcentury becoming reality. There are humanoid robots that can fold clothes available for order. Robots can scan store shelves for out-of-stocks while you sleep, and we can launch rockets into space and also bring them home to be used again.

Progress may not be a given, but it does seem like humans have always been bent toward the invention of tools and technologies in one form or another. We like to find new ways of doing things. Ways that make us more efficient; methods that unlock us from life’s drudgery. That’s not to say there aren’t downsides sometimes.

There is no business as competitive as running grocery stores. A mature industry, we all know too well just how challenging it is to operate in a low-margin business. Despite these conditions, society relies on your work to sustain and nourish itself. Beyond the food put on tables, grocery stores are also community makers, anchoring

retail locations, driving foot traffic to small businesses, and offering job opportunities. If these benefits are to persist, we should not take the hard work of grocers for granted. Nor should we ignore the need for grocers to continually optimize operations. It’s also easy to miss the fact shoppers’ desires are in lockstep with grocers’ aims. Shoppers want lower costs, frictionless purchasing but also human experiences, and around the clock access to goods.

It’s the grocers’ job to deliver for the shopper, yet the industry faces a political environment that is out of step. Paradoxically, California is both the home of the technological future and its potential demise. Let me explain.

Last year, the Association battled legislation targeting self-checkout restrictions, datadriven marketing, and digital coupons at both the state and local levels of government in California. I’m forecasting these fights will continue in 2026. In fact, I think they will only escalate.

While it’s an oversimplification, the public and elected officials tend to lump automation and artificial intelligence into a single policy bucket. This is a powerful frame for grocers to contend with because it’s a catch-all that leads to much confusion.

For example, self-checkout is not some Jetson’s style technology. There are probably many shoppers today who do not know a world where self-checkout kiosks do not exist. Even legislative restrictions governing the technology have been in place for over a decade. Nevertheless, labor advocates have worked to lump self-checkout into the AI and automation policy space.

Similarly, data-driven marketing tactics designed to save shoppers money and offer them relevant discounts has been conflated with dystopian surveillance pricing that no grocer in California practices. Yet, when the buzzword “AI” is added to the rhetoric, the appetite to intervene grows stronger.

There’s no doubt society must be tackling challenging conversations concerning the future of work, how AI will change all facets of our lives, and the ability for humans to flourish amidst a technological revolution. But society and its elected officials must be sure sincere anxiety about technology is not hijacked by special interests.

It’s more important than ever to be engaged with the Association because the future you’re forecasting for yourself and your business relies on a regulatory environment that allows grocers to thrive. ■

MICHEL LECLERC NORTH STATE GROCERY, INC.

When the 2025 legislative session commenced last year, the buzz word in Sacramento was “affordability.”

Legislators correctly acknowledged that the cost of living in the Golden State has become too steep for many of our citizens. Sadly, this insight not only failed to generate any meaningful action, but, perhaps even more telling, failed to generate any ideas for solving the affordability crisis in California. This probably shouldn’t be surprising given the significant role the California legislature has played in creating the problem in the first place. It’s no secret that Sacramento legislation such as CEQA has made it all but impossible to build housing at scale, leading to a huge housing shortage. Instead of addressing electricity rates that are nearly twice the national average and gasoline prices a dollar-per-gallon higher than the rest of the nation, California legislators prioritize ever-increasing rules and regulations that often include mechanisms for predatory lawsuits, all of which adds to the cost of running a business in California. Seemingly lost on legislators is the fact that the costs of doing business get passed on to the end user/consumer in the form of higher prices. And it will likely get worse before it gets better.

SB 54 is scheduled to commence in the next few months. This legislation mandates that all producers of goods (including food) be

charged fees based on the weight and type of packaging used in California. The fees to be charged represent the full “cost” of consumer packaging (which includes the cost of disposal, recycling and/or composting). These fees will be added to the price of goods. While no one yet knows exactly what that “cost” number is going to be or how much it will increase prices for California consumers, one thing is for sure: Prices will rise and California consumers will be expected to absorb those increases in family budgets already stretched too thin. It couldn’t come at a worse moment in time.

So where is this heading?

As the cost of living continues to escalate and outpace earnings and wage growth, the number of dissatisfied voters will increase along with it. So far, California voters have not punished the Democratic party for California’s high cost of living, but history tells us there is always a tipping point where dissatisfied voters unhappy with the status quo punish the party in power. Thus, in the absence of any meaningful change, the 2026 election cycle might find Democrats on the defensive in the California legislature. Conversely, Republicans in Washington are also starting to feel the wrath of voters as Congressional cutbacks to ACA medical

insurance premiums and food programs further stress voter pocketbooks across the country.

Should the affordability crisis be worsened by either a nationwide or statewide recession, the odds of a political reckoning for the party in power will increase substantially.

In the meantime, until voters send a clear message of their dissatisfaction to their elected officials, it is CGA’s job to continue to educate and advocate at the California State Legislature. As grocers, we pride ourselves on our ability to operate on small margins, providing food to our customers at low, competitive prices. However, those small margins mean that as our costs continue to escalate, so will our prices. If we don’t communicate this fact to our elected officials, who will? ■

KEVIN COUPE FOUNDER MORNINGNEWSBEAT.COM

Most forecasts focus on what people think will happen.

As in…

“We’re going to go into recession.”

Or…

“We’re not going to go into recession.”

Or…

“AI is going to enable the industry to be both more efficient and more effective at the same time.”

Or…

“AI is going to be like a runaway train, and by the end of 2026 we’re going to be hunted by Terminator-style robots that believe humans basically are bad for the planet.”

Or some combination thereof.

It seems like a pretty safe bet that there will be a lot of posturing and politicking around the question of recession in the coming year, during which mid-term elections will determine which party controls Congress, not to mention the 36 gubernatorial races that will take place around the country. Including, of course, in California.

It also seems likely that the issue of AI will remain front and center, especially as the Trump administration works hard to make sure states cannot implement their own AI safeguards. There are a lot of good reasons for federalization of the AI regulatory

landscape, though I must confess that I worry that a national approach will be way too lax in reining in the tech bros. (I’ve developed a real antipathy for the executives who lead many of these technology companies—especially in the social media and AI spaces—believing that they essentially are mendacious, avaricious people with an overwhelming concern for their bottom lines and little regard for the cultural repercussions of their innovations. But maybe I’m just getting cranky in my old age.)

Rather than forecast where I think things are going to go, let me for a moment suggest an area on which I think retailers ought to focus.

I firmly believe that how retailers deal with this issue will be determinative in how they are perceived by their customers over the short and long terms: Transparency.

I was heartened recently when FMI-The Food Industry Association, along with the Center for Food Integrity (CFI), came out

with new consumer research, conducted by Circana, about “how consumers perceive gene editing in food and agriculture and what drives their willingness to buy,” concluding that “consumers are significantly more open to gene-edited products when the benefits are clear, personal and values-based.”

Here are two phrases that stood out to me: “Context drives comfort.”

“Trust requires transparency.”

No kidding.

It always has been my argument that for GMOs to be really accepted by shoppers, it was critical for retailers and manufacturers to be transparent about when and why they are used, and their value to shoppers.

Some in the industry thought I was wrong, and actually said things like “that kind of transparency will just scare shoppers.” Which is an astounding statement on its face—when explaining facts to people is seen as scary, then there is a core problem that has to be dealt with, not ignored or obscured.

The conclusions of this study are right— and not just when it comes to gene-editing. I believe it actually applies to pretty much everything.

As you read this, tariffs may not be as much of an issue as they’ve been for the past

10 months or so. Not only has the Trump administration announced the rolling back of tariffs on hundreds of imported foods, but to a great extent the impact was not as severe on as many products or for as many consumers as expected, in part because suppliers and retailers absorbed many of the cost increases. It always was my belief, however, that if prices went up because of tariffs, to the best that it could be determined, retailers needed to explain why prices were going up. A perfect example is imported pasta, which has not seen a tariff rollback and in fact (as of this writing) an increase in tariffs of more that 90 percent. If you carry imported pasta, and you a) feel it is important to keep it in your mix and b) cannot afford to eat the increased costs, then you should be explaining the situation and rationale to your shoppers. And when a rollback of tariffs allows you to lower prices, then you ought to explain that, too.

This approach can cover so many situations in the store.

• If you put in new energy-efficient cases, explain how they work and what the benefits are to the shopper.

• If you have out of stocks, give customers the ability to ask to be informed when the products are back in the store (and maybe even allow them to reserve some).

• When there are recalls, explain with specificity what and why—don’t just leave the space empty, or replace it with other product.

Admittedly, I have a bias. I am, by nature and profession, a storyteller.

But you have to realize that if you are not telling your story, someone else may be telling it. Now, more than ever. And using AI and/or social media to amplify their narrative in a way that does not benefit your business.

Once again:

“Context drives comfort.”

“Trust requires transparency.”

You want to engender trust and comfort in your customer base. Which means being transparent and creating context.

This may not be in your business plan for 2026. You may be far more focused on strategizing around AI and catering to recession-minded shoppers. In both cases, I think, you can weave a story that fits into your broader business narrative, appealing not just to people’s minds and wallets, but to their hearts and minds. And, of course, stomachs. ■

JENNIFER HATCHER

In June, the U.S. Mint, very quietly and with no fanfare, minted the last pennies.

This final minting was done at the demand of the U.S. Treasury Department which was following a directive from President Trump. The complexity and seriousness of this situation is likely clear to each of you. The federal government did not give thought to or plan for how stopping the minting of the penny would impact grocery customers, services in our stores, and our nation’s interstate commerce.

Cash is still used in grocery stores of all sizes around the country.

Providing our grocery customers with the ability to use cash for purchases is an important service and the law in several states and localities.

There is also a myriad of operational, legal and compliance issues that grocers and other retailers are facing because the federal government has ceased minting the penny.

Not only do grocers accept cash at the register and need coins, including pennies, to make change, but they also need coins to operate self-checkout stations and vending machines, and to cash checks. Many grocery stores offer check-cashing services to customers and employees. Under federal law, checks must be cashed to the exact penny.

The final inventory of pennies was sent to Federal Reserve regional distribution vaults in the summer and since September, this inventory has decreased dramatically. As of this writing, 109 of the 165 Federal Reserve vaults have suspended penny ordering and/ or depositing. This means that retailers across the country are not receiving an adequate supply of pennies to make exact change to cash-paying customers in stores. Many are undertaking creative ways to get pennies from customers’ couch cushions, but that supply will fade as well.

This permanent disruption in inventory of the one-cent coin is beginning to cause a cascade of negative events in stores across the country.

Without exact change, stores have no choice but to round to the nearest nickel on the total or change for cash-paying customers.

FMI is acutely concerned about how rounding for cash transactions could pose serious implications for Supplemental Nutrition Assistance Program (SNAP) retailers including possible exposure to litigation and potential violation of the SNAP equal treatment provisions. The SNAP equal treatment provisions prohibit both negative treatment and preferential treatment toward SNAP participants. Without exact change, grocery stores have no choice but to round on the total or change to the nearest nickel for cash-paying customers, meaning these customers would be paying a slightly different total than SNAP customers who use a SNAP EBT card for purchases.

Grocery stores and other merchants need critical guidance and changes in law now from federal, state and local governments to address the growing lack of pennies in circulation. FMI and our member companies, and state and national association partners, are calling on all levels of government to act swiftly on the following:

• U.S. Treasury Department: Issue guidance officially notifying businesses and the public about the ceased minting of the one-cent coin and provide additional directives on how to proceed with cash transactions and the use and deposit of pennies.

• U.S. Department of Agriculture: Issue guidance to provide SNAP retailers with flexibility under the SNAP equal treatment provisions.

• U.S. Congress: Enact a federal law that will allow businesses to round cash transactions to the nearest nickel; ensure rounding for cash customers does not violate terms of SNAP; and facilitate check cashing at retail locations.

• State and Local Governments: Issue guidance and/or modify laws regarding tax collection and transmission, minimum pricing, price accuracy, and deceptive trade practices.

As FMI noted in a blog a few years ago when the pandemic was compounding our nation’s coin shortage, the public can help by taking coin out of your house, car, and office and spend, donate, or redeem it. The penny is a valid U.S. currency and will remain so. Please help make cents of the situation by using your pennies and other coins! ■

GREG FERRARA PRESIDENT AND CEO NATIONAL GROCERS ASSOCIATION

In November, our industry faced a challenge without precedent.

The federal government shutdown caused the first lapse in Supplemental Nutrition Assistance Program (SNAP) funding, which created an immediate strain on millions of families and on the community grocers who serve them. Many independent grocers across California felt the impact as in-store traffic dropped, benefit transactions stalled, confusion set in, and households worried about whether they could afford their next grocery trip.

In this moment, the National Grocers Association (NGA) moved quickly and provided steady leadership. From our headquarters situated between the doorsteps of Congress and the White House, NGA made sure lawmakers and administration officials understood that the unprecedented lapse was not only a hardship for families, but also a threat to the local economies that

rely on community grocers. At the same time, stores across our nation showed once again why independent grocers are pillars of their communities. Grocers reached out to food banks, helped connect families with local resources, adjusted inventory planning, and maintained a commitment to customer service even as sales dipped.

How the lapse unfolded

When benefit issuance stopped on November 1, roughly 42 million Americans faced an unexpected gap in food assistance. For many independent grocers, SNAP accounts for a meaningful share of weekly sales, especially in rural and lower income neighborhoods. NGA immediately warned that the loss of benefits would disrupt household food access and destabilize store operations. The situation required urgent action to reopen the government and restore SNAP funding.

How NGA led the industry response

NGA organized around the clock advocacy to secure a full restoration of SNAP benefits through fiscal year 2026 (September 30). This included direct outreach to Congress, coordination with the Department of Agriculture, and close communication with allied food industry groups. NGA also used its member newsletters to share timely

updates, outline contingency planning steps for stores, and elevate real world examples of hardship facing independent operators and their customers.

These efforts produced significant results. Congress moved to restart the government, and the final agreement secured SNAP funding through FY 2026. Key lawmakers acknowledged the central role of independent grocers in maintaining food access during the lapse. NGA’s presence throughout this process ensured that the voice of community grocers was heard clearly and that policymakers understood the ripple effects a lapse creates for families and local businesses.

While NGA worked in Washington, California’s community grocers, and others from across the nation, upheld their commitment to neighbors. Some coordinated with regional food pantries, others extended small scale credit or flexible purchasing options, and many took to social media to communicate openly with their members of Congress, urging them to reopen the government. Grocers worked to keep operations steady, reassured shoppers, and maintained a focus on fresh food and dependable service. These actions reinforced what customers already know. Independent grocers are not just retailers. They are partners in local food security and trusted institutions during periods of uncertainty. What the industry should take from this moment

The return of SNAP benefits not only provides much needed stability, but also serves as a powerful reminder that food assistance programs are deeply tied to the health of many local supermarkets. For California grocers, the months ahead will require continued attention to policy developments, from benefit delivery systems to potential shifts in eligibility or administrative rules. The advocacy strength of NGA and the community presence of independent stores during the shutdown demonstrated the power of collective action. NGA not only secured federal clarity and long-term benefit funding, but community grocers showed compassion, flexibility, and resilience. Taken together, this response reaffirmed why independent grocers matter so much to the communities they serve.

Local grocers across the country kept their doors open during a historically difficult period and helped families bridge the gap until benefits resumed. That commitment reflects the best of our industry. It also sends a clear signal that independent grocers will continue to stand for access, stability, and community strength, no matter the challenge presented. ■

LOUIE BROWN IN

Grocers again find themselves at the intersection of significant political and economic headwinds.

The past year has reminded us that nothing in Sacramento stays static for too long. From a rapidly changing voter base to the return of high-profile debates on artificial intelligence, privacy, and workplace technology, the terrain ahead promises both challenges and opportunities for those serving California’s consumers every day.

The demographics of California continue to evolve faster than many policymakers can adjust. For the grocery sector, this means a consumer base that is more diverse in age, culture, and purchasing behavior than ever before.

Population declines in several counties, coupled with modest growth in inland regions, are reshaping legislative priorities.

Lawmakers increasingly represent communities where affordability, food access, and access to employment dominate discussions.

This demographic shift was evident throughout 2025’s policymakers’ decision making. Legislators are responding to constituents who are younger, more mobile, and more digitally connected. They expect quick answers and an increasingly personalized customer experience. These expectations drive state proposals ranging from precluding the deployment of new technology in the workplace to prohibited uses of consumer data. As we prepare for the 2026 session, we anticipate these trends will only intensify.

Few issues generated as much legislative attention last year as artificial intelligence. While several proposals were shelved, as it is with Sacramento, even bad bills are never gone for good. In fact, we expect comprehensive AI legislation to reemerge early in the 2026 session as Legislators have called for further action since the session convened in September.

For the grocery industry, the stakes are high. AI touches everything from supplychain optimization and product inventory to automated checkout, training tools, and digital marketing. While some policymakers are curious about AI’s potential, most are quick to paint it as the boogieman. The 2026 session will likely bring renewed debate on transparency on pricing and scheduling, consumer-facing disclosures, restrictions on self-checkouts, and greater privacy considerations, which may impact pricing or loyalty programs.

CGA’s goal will be to ensure these conversations remain grounded in operational reality. Innovation must be allowed to flourish, but new obligations should be workable, consistent, and carefully crafted to avoid unintended impacts on access and affordability.

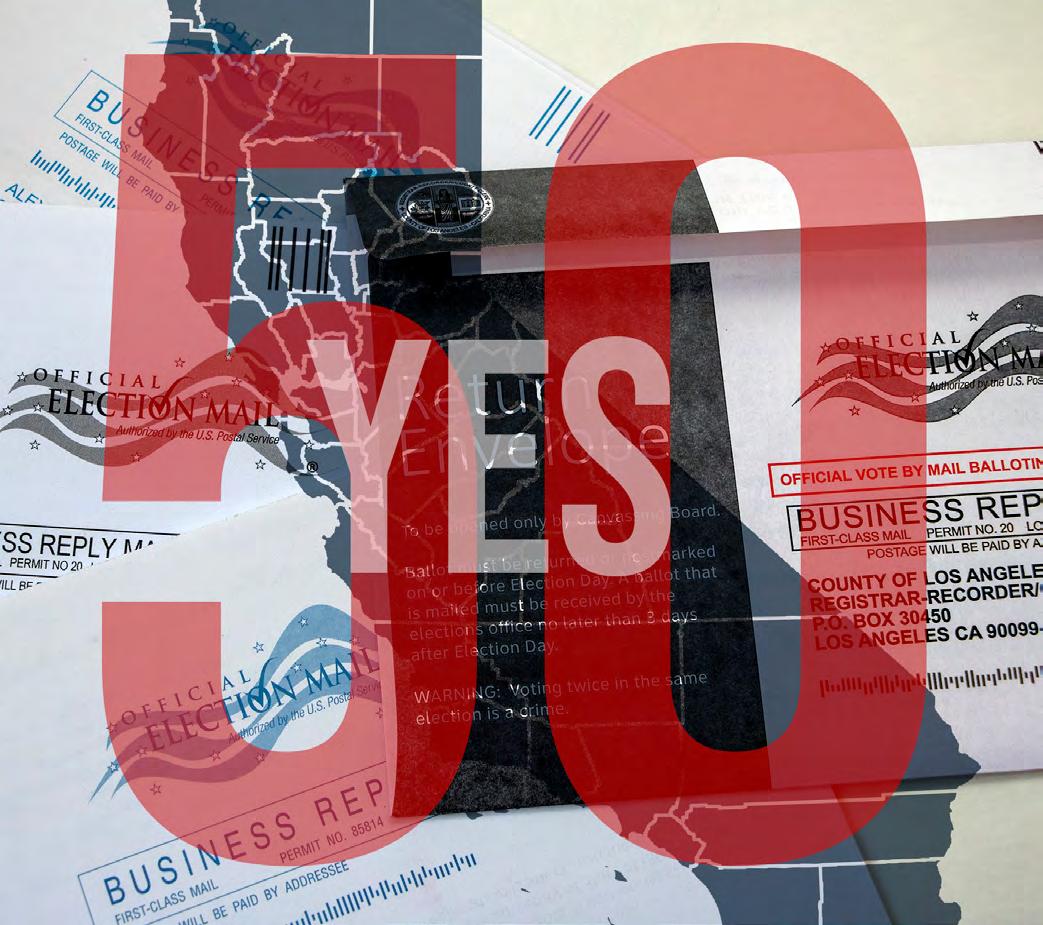

And while policy proposals have another year to be realized, many legislators’ focuses are no longer on their day job at the State Legislature, but on higher offices. California’s special election for Proposition 50 unfolded against the backdrop of an unusually active political reshuffling, with several state

legislators positioning themselves for newly drawn congressional seats. The redistricting changes, some subtle, others dramatic, have prompted early maneuvering as sitting Assemblymembers and Senators test their viability in districts that now look markedly different from previous cycles. This dynamic shaped the messaging and coalition-building around Proposition 50 and will continue in 2026.

Congressional candidates will use the State Legislature as their bully pulpit to elevate their visibility, appeal to new constituencies, and demonstrate policy leadership for impending congressional campaigns. For the grocery industry, understanding how these political ambitions intersect with legislative behavior will be critical in 2026.

And the 2026 gubernatorial campaign is already reshaping the political climate in Sacramento, long before voters cast a ballot.

With an open seat and a field that includes several high-profile officials, major-city mayors, and a few wealthy politicos, the race is accelerating. Candidates are drawing sharp contrasts on affordability, public safety, homelessness, climate policy, and the future of California’s economy. For the grocery industry, the campaign’s early focus on cost-of-living could open the door to pragmatic conversations. But it may also encourage ambitious proposals designed to appeal to primary voters, requiring careful engagement from our sector. And of course, Governor Newsom’s final year in office will be his legacy-setting opportunity, while simultaneously positioning himself on the national stage for potential presidential ambitions amid the gubernatorial transition.

As 2026 begins, California stands at a moment of transition, and so does CGA.

As we welcome a new board chair, Rich Wardwell, we do so with immense

appreciation for the vision and steady guidance of Michel LeClerc and his predecessors. The grocery industry is uniquely complex—part retail, part logistics network, part community anchor—and the Chair plays a critical role in translating that complexity to lawmakers.

The new year will require clear communication, a strong grasp of policy nuance, and the ability to engage constructively with a Legislature facing mounting pressures.

New realities will shape the decisions made in the Capitol. For the grocery industry, our role will be there to ensure lawmakers understand the operational, financial, and consumer impacts of every proposal placed before them. CGA will remain at the table, offering practical solutions and constructive engagement as we enter another consequential year. ■

How the governor’s race, a $20B deficit, and public anxiety over AI will shape California’s retail landscape in 2026

By Tim Townsend

For the first time since the 1970s, it’s anyone’s guess who will next occupy the Governor’s Mansion. That’s a big deal in California, which rarely sees competitive high-profile elections for the state’s top job.

With no clear front-runner and potentially even more candidates preparing to enter, this is the most wide-open gubernatorial race in half a century. For grocers, this unusual uncertainty means less predictability around technology mandates, labor priorities, new tax proposals, and mandates that directly affect store operations.

This unprecedented governor’s contest will cast a long shadow over every bill considered in 2026, including priorities that affect grocers, like imposing new self-checkout rules or limiting so-called surveillance pricing. Whoever emerges as the winner will inherit a state facing a nearly $20 billion structural deficit, sluggish revenue growth from a cooling tech sector, voter frustration over the rising cost of living, and public anxiety about how artificial intelligence and emerging technologies will impact jobs.

Given that California’s Legislature is one of the most progressive in the nation, the next governor’s veto pen—or lack thereof—could make all the difference between preserving operational flexibility for grocers and new mandates.

“It’s going to be a weird year,” said Brooke Armour, who closely monitors business-related legislation as executive vice president for the California Business Roundtable, about the unique dynamics caused by the governor’s race.

A Democrat in the mold of Gavin Newsom might continue the occasional business-friendly veto, which has blocked new laws that grocers have opposed. A more progressive successor could fundamentally shift the balance toward bills favored by labor and consumer advocates.

Add to that the fact that Governor Newsom is all but running for president, and an outsized focus will remain on California and every decision he makes next year on legislation.

All of this makes for a very interesting 2026 in Sacramento.

The good news for grocers: the industry heads into this unpredictable era riding a wave of defensive victories. Despite a legislature reshaped by term limits—with nearly one-third of members new and a large influx of progressives— no seismic industry shifts like the $20 fast-food minimum wage hit the grocery sector.

“Thanks to the voices of grocers from across the state, we were able to successfully defeat our priority bills in 2025,” said Ronald Fong, president of the California Grocers Association (CGA), about their lobbying efforts in 2025. “When we provide first-hand experience from the people on the ground running our grocery stores about why a proposed law will raise prices or harm consumers, legislators listen. That’s why grassroots engagement from our industry is so critical for success at the Capitol.”

Two of the biggest wins came against bills that would have restricted grocers’ ability to use cost-saving technology and personalized discounts:

■ Assembly Bill (AB) 446 targeted so-called “surveillance pricing” by proposing to ban the use of personal data for dynamic pricing or marketing. Grocers showed how the bill would disrupt loyalty programs and personalized discounts that deliver real savings to customers. The bill was ultimately pulled, but can be considered again in 2026.

■ Senate Bill (SB) 442 aimed to restrict self-checkout technology with item limits and other requirements. Strong opposition from grocers and business allies stalled the bill, but the proposal can also be considered again in the new year.

No win in Sacramento is ever final. Both AB 446’s surveillance-pricing concepts and SB 442’s self-checkout restrictions are expected to resurface in 2026.

These bills do not exist in a vacuum. They are riding a much larger wave of anxiety about artificial intelligence, data privacy, and workplace automation. Because pricing tools, loyalty programs, and self-checkout equipment use data or

automation, they often get lumped into statewide AI conversations— even if they are fundamentally different from the AI systems dominating headlines.

With Washington still gridlocked on comprehensive federal AI policy, California lawmakers are determined to write the nation’s toughest rules themselves. The California Labor Federation, led by President Lorena Gonzalez, has already declared 2026 the year of an “AI policy blitz” as part of a coordinated national push by the AFL-CIO.

“We’re not letting up,” Gonzalez told Politico when outlining labor’s ambitious plans.

Grocers can expect proposals that once again characterize personalized discounts as predatory surveillance pricing and selfcheckout kiosks as job-killers, even as grocers continue to show they are valuable tools for keeping prices competitive at a time when families are struggling.

“The Legislature saw what happened when social media companies were allowed to grow unchecked, only to become too powerful to regulate later. Legislators want to ensure they don’t follow the same path with AI. But they also know they must keep these leading AI companies in California,” said Armour about the broader debate in the State Capitol on tech regulation. “It’s a difficult balancing act because the AI industry is propping up the entire state budget, and California cannot afford to lose it.”

For grocers, the danger is that narrow, retail-specific bills get swept into this broader philosophical debate about whether emerging technologies lower costs for everyone—or simply concentrate benefits among a handful of winners. Overregulation in Sacramento could drive AI investment and talent to more welcoming states, eroding the very tax base the state desperately needs while simultaneously forcing retailers to raise prices or cut services.

But there are hopes for a more comprehensive approach to technology regulation than addressing one-off topics like grocery store pricing.

“There are too many bills on different AI-related topics not to produce a larger compromise,” Armour predicted when asked about the outlook for dynamic-pricing and other technology measures.

Everything in 2026 flows through the open contest to succeed term-limited

Governor Gavin Newsom, with no candidate strong enough to establish a front-runner position as of writing.

“The race is currently defined by the candidates who have chosen not to run—Vice President Harris, Senator Padilla, Lt Governor Kounalakis. It has opened the door for candidates that likely weren’t looking at the race three or four months ago,” said Tom Ross, a political consultant focused on business issues, as the field of candidates is still in flux heading into 2026.

The unpredictable race means state legislators who were once deferential to Newsom—and before him, Jerry Brown—now find themselves with some influence to shape the next governorship. Advocacy groups understand this dynamic perfectly. Election years always amplify pressure, but with a new governor on the horizon, labor, consumer, and privacy organizations will push their top priorities, knowing that it’s important how they position themselves for the incoming administration.

One veteran lobbyist involved in this year’s self-checkout machine debate observed that even if a revived SB 442 clears the Legislature next year, Governor Newsom would almost certainly veto it. He has repeatedly shown more sensitivity to business impacts than many legislators. Whether his successor would wield the veto pen the same way is the central question hanging over every vote in 2026.

California’s financial challenges will continue in 2026, with the state vulnerable to a pullback in the AI stock market boom that has generated billions for the budget. The Legislative Analyst’s Office already projects annual operating deficits of nearly $20 billion and growing deficits for the years beyond—a projection that assumes no dramatic slowdown in the economy.

“The next governor will have a tough job,” Armour said of the state’s fiscal situation and that the state’s business community is very concerned about tax hikes.

There are already tax-increase proposals circulating for the 2026 ballot, including a wealth tax and an extension of the income tax on high earners that may go before voters. Democratic lawmakers might also consider using their supermajority to enact new taxes on businesses, such as a proposal to tax large companies with employees enrolled in Medi-Cal. However, these are likely to face challenges since Governor Newsom has consistently opposed broad-based tax increases.

Because the state’s deficit means every dollar is scrutinized, bills that create new state or local costs—like oversight and enforcement—face higher hurdles. This dynamic can give the business community additional leverage when arguing that new mandates would raise costs for both the state and consumers.

What to watch in 2026:

■ Renewed attempts to restrict self-checkout (Senate Bill 442)

■ Proposals to limit dynamic pricing or personalized discounts (Assembly Bill 446)

■ Broader AI/data-privacy bills that could sweep in retail technologies

■ Tax proposals aimed at high earners or large employers

■ Higher scrutiny on bills with state or local costs due to the deficit

For grocers, 2026 will be a critical year: a competitive governor’s election colliding with budget challenges, all centered on the flashpoint of technology regulation. With the politics of the Legislature unlikely to change anytime soon, the next governor will play a starring role in shaping California’s future direction, with very different visions from the moderate and progressive candidates. The industry’s priority remains defeating future attempts to impose self-checkout restrictions and surveillance-pricing bans that would eliminate proven tools for keeping prices low and lines moving. The playbook that delivered victory in 2025—grassroots mobilization, real-world stories from stores, and a focus on how bad laws increase the cost of living—will be needed again in 2026.

2026 promises to be a year of transition, but how it all plays out is uncertain, even by California standards. ■

By Mike Madrid

n 1992, California voters sent Dianne Feinstein and Barbara Boxer to the United States Senate, making history as the first state to elect two women senators simultaneously. But the “Year of the Woman” was merely the most visible manifestation of something far more profound happening beneath California’s surface that was ushering in a new political chapter in the state that would last a generation. Three tectonic shifts were occurring that would define the political culture in the state: Demography, technology and the economy. The state stood at the edge of a transformation that would fundamentally reshape not just its politics, but the daily relationship between businesses and the communities they served.

The numbers told an unmistakable story. California’s non-white population was surging, driven primarily by Latino growth that would eventually make them the state’s largest plurality. Meanwhile, the blue-collar aerospace manufacturing economy that had powered the postwar boom was collapsing as defense contracts dried up with the Cold War’s end. And in Northern California, a nascent technology sector was beginning its inexorable rise, shifting the state’s economic center of gravity away from Southern California for the first time in generations.

Any one of these shifts would have challenged the Republican Party’s decades-long dominance of California politics. Together, they created a seismic rupture. Democrats would control the governorship for all but five years after 1998, and by the 2010s held supermajorities in both legislative chambers. The political realignment seemed complete and permanent. Except history and recent elections might be telling us otherwise.

Today, California stands at another precipice. But this time, each of the three forces that created the last generation’s political culture are moving in a different direction—away from the party structures that currently dominate the state’s power centers. And nowhere is this more visible than in both the ballot boxes and the grocery aisles where Californians make their most noticeable economic decisions.

The most significant movement comes from Latino voters, who are emerging as the nation’s largest swing constituency. But they’re not swinging toward Republicans in any traditional sense. Instead, they’re rejecting both major parties with equal frustration, united not by ethnic identity politics but by a single overwhelming concern: they can’t afford to live.

Recent Pew Research polling confirms what grocers see in their sales data every day. When voters are asked what matters most, groceries top the list. Not immigration policy. Not cultural issues. Not the identity politics that defined the previous generation of Latino political engagement. Groceries. The weekly shock at the checkout counter has become the defining political experience of working-class California.

This represents a fundamental break from the assumptions that shaped the last thirty years of California politics. The demographic wave that swept Democrats to dominance was built on an implicit assumption: that racial and ethnic minorities would form a durable coalition based on shared experiences of marginalization and shared progressive policy preferences. Latino voters were expected to remain reliably Democratic, motivated by immigration reform, prioritize opposition to racially discriminatory government policies, and a natural affinity for government programs. But today’s Latino voters—particularly younger ones born in the United States—are expressing a more complex political identity. They’re economic populists who punish whichever party happens to be in power when prices rise and opportunities shrink. They’re not ideologically conservative or liberal in the traditional sense. They’re pragmatic, transactional, and increasingly frustrated with both parties’ inability to address the daily economic pressures that define their lives.

For California’s grocers, this shift mirrors a transformation they’ve been navigating in their own businesses. The old model of the “ethnic aisle”—a single section where Mexican and Asian products were cordoned off from “mainstream” American foods— is disappearing. In its place, stores are integrating ethnic offerings throughout their layout. Tortillas sit beside sandwich bread. Chipotle peppers share shelf space with traditional seasonings. The separation that once seemed natural now feels artificial and outdated. But here’s where many businesses and politicians are getting it wrong: saying “Latinos want what everybody else wants” misses something essential. Latinos don’t want an either/or proposition. They want

both. They want to be recognized as simultaneously the same and distinct—and that’s not as contradictory or difficult as it sounds. Latinos are, by definition, a blended culture. The very term “mestizo” describes people of both European and indigenous ancestry. Being both is literally a defining characteristic of Latino identity. It’s baked into the culture, the history, the food, the language, the music and our DNA. Forcing a choice between one heritage or the other isn’t just uncomfortable—it’s impossible. It denies the fundamental reality of what it means to be Latino.

This is why the old ethnic aisle model no longer works. It wasn’t just that it segregated products. It forced customers into an identity box: you’re either shopping “ethnic” or you’re shopping “mainstream.” But Latino customers were always doing both, moving back and forth between sections, assembling shopping carts that reflected their actual lives rather than some marketing department’s demographic assumptions.

And as every data driven grocer knows, non-Hispanic customers were visiting the ethnic aisle too.

The successful grocers are the ones who understand this duality. In the very near future, the ethnic aisle will become the ethnic store and early adopters will have considerable advantages. They will stock both “masa harina” and all-purpose flour because the same customer needs both. They carry Mexican crema and sour cream, knowing these aren’t substitutes but different ingredients for different dishes that might appear at the same dinner table. They recognize that a third-generation Mexican American family might want organic produce and grass-fed beef alongside authentic Mexican cheeses and fresh tortillas—not because they’re confused about their identity, but because their identity encompasses all of it.

Call it the Bad Bunny effect.

The Puerto Rican reggaeton artist became the biggest musical act in the world while singing exclusively in Spanish. His Super Bowl halftime performance coming early next year isn’t a niche cultural moment: it’s the main event, and will be watched by over 100 million Americans, most of them non-Latino. You can’t become the largest

singing artist in America with songs exclusively in Spanish unless English speakers are buying your songs. No different than the ethnic aisle becoming an ethnic store.

Bad Bunny succeeded not by crossing over into English but by making Spanish-language music so compelling that the mainstream came to him. He didn’t choose between his Puerto Rican identity and global stardom. He insisted on both, and the entire world met him there.

This is precisely the moment California finds itself in. The old categories— minority and majority, ethnic and mainstream, us and them—are dissolving into something more complex and fluid. But that doesn’t mean Latino Californians want their specific cultural identity erased in the name of universalism. They want recognition of their particularity within a broader American identity. They want carne asada tacos and hamburgers. They want Thanksgiving turkey with mole sauce. They want politicians who speak to their economic anxieties without pretending their cultural heritage is irrelevant.

For grocers, this means rethinking not just product placement but the entire relationship with customers. It’s not about abandoning Latinofocused products or marketing. It’s about understanding that Latino customers exist in a both/ and space rather than an either/ or framework. They want the store to carry specific regional products from Jalisco or Oaxaca or El Salvador—and they want those products displayed with the same care and prominence as any other premium offering. They want bilingual staff who can help them find specialty items—and they want to be treated as valued customers rather than as representatives of a demographic category.

The same principle applies to politics. Latino voters aren’t asking politicians to ignore their cultural identity. They’re asking politicians to recognize their economic reality. They want candidates who understand that immigration policy matters—and that the cost of groceries matters even more. They want to be seen as workers and parents and homeowners facing the same affordability crisis as everyone else—without pretending that their family’s journey to California, or their grandmother’s accent, or their connection to their ancestral homeland is somehow irrelevant.

This is the same challenge facing California’s political class. The old playbook of ethnic outreach—Spanish-language ads, appeals to immigrant identity, assumptions about policy preferences based on surnames—is increasingly ineffective not because cultural identity doesn’t matter, but because it was always understood too simplistically. Latino voters are asking the same question as all working-class Californians about affordability and opportunity, but they’re asking it from a specific cultural position that shapes how they think about family, work, community, and belonging.

Remember: Blended. Separate and distinct but mixed together. Yes, Latinos are becoming more American but Americans are also becoming more Latino—and at a faster rate.

The demographic transformation that reshaped California politics 30 years ago was real and profound. But demographics were never really destiny. They were a framework that organized politics for a generation because they aligned with economic and cultural forces that made ethnic identity politically salient. As those forces shift, so does the political landscape. Not toward some post-ethnic future where cultural differences disappear, but toward a more sophisticated understanding of how identity and interests interact.

For California’s grocers, who interact with these demographic and economic realities every single day, the message is clear: the customers walking through your doors are more complex than any simple demographic category can capture. They don’t want to choose between their cultural heritage and their American identity. They don’t want to choose between ethnic authenticity and contemporary tastes. They want both, because being both is who they are. Understanding them requires moving beyond either/or thinking to engage with the lived reality of contemporary California life— where the biggest concerns cross all demographic lines and meet at the checkout counter, and where cultural identity and economic anxiety exist not in tension but in conversation. ■

Thank You

Michel LeClerc

Congratulations for your service as 2025 CGA Board Chair on your new role as 2026 CGA Board Chair

Rich Wardwell

It is our honor and pleasure to support the CGA Board of Directors!

By Dorsey Griffith

One recent morning, Rich Wardwell was alerted to a LinkedIn post mentioning him by name. He didn’t immediately recognize the man who wrote the post but was intimately familiar with the headline: “It’s just a store. It’ll be there tomorrow.”

These are words Wardwell has shared hundreds of times with colleagues and employees in his long grocery career. In his post, Jason Grice, a former employee, recalled a difficult time in his life more than 15 years ago when Wardwell acted compassionately, teaching him a value that has guided him throughout his years as a business leader.

“If you happen to see this, Richard Wardwell, thank you,” Grice wrote. “You have affected my life more than you will ever know.”

Wardwell will bring that compassion, along with humor, heart, and intensity, to his new role as Chair of the California Grocers Association Board of Directors. Wardwell, who has been on the CGA Board for six years, said he opted to serve “because I wanted to be more involved in strategic decision-making and evaluate the way that different paths are considered. I’m looking forward to the role.”

Now the President and Chief Executive Officer of Superior Grocers, based in Santa Fe Springs, Wardwell still believes that it’s just a store. Still, he wants the California State Legislature to understand and respect the impact of its legislation on the grocery industry, its employees, and customers.

“I want to strengthen CGA’s influence in the legislature and set the tone for new laws that support our businesses,” he said. “I don’t like the way the government is meddling in the grocery industry.”

Wardwell cited previous mandates for hero pay, self-checkout, and plastic recycling policies, proposed fines for stolen carts that are found off-site, as well as a proposed tax on cut fruits and vegetables packaged in plastic as examples of legislation that adversely impact grocery stores, employees, and customers.

“As Chair, I will be an advocate, working with legislators, educating them to bridge the gap in understanding about what the grocery industry does to support diverse communities,” he said. “I want to strengthen our relationships with legislators on both sides of the aisle so that together we make this a better industry and lower grocery prices.”

Wardwell has always wanted to do what’s best, but the grocery business wasn’t part of that vision—at first. As a child, Wardwell dreamed of becoming a Highway Patrol Officer.

“I wanted to help people. I wanted law and order,” he said. He was close to attaining his goal, studying criminal justice at a college in Reno, Nev., and working at Raley’s, when his boss at the grocery store offered him a management position. Newly married with a baby on the way, Wardwell decided to abandon his dream of joining law enforcement and accepted the promotion. Buoyed by inspirational managers and mentors, Wardwell spent the next 25 years with Raley’s. He later held management roles at Albertsons, SaveMart, and Walmart before Raley’s recruited him as Vice President of Operations for its Food Source division, where he worked for four years.

When Mimi Song, founder and CEO of Superior Grocers, called in 2014, he pulled his car over to the side of the road to hear her pitch. What had been planned as a brief conversation ended over an hour later, after a highway patrol officer pulled up and asked him to get moving.

“It’s God, family, and work,” he said. “Not work, family, and God. Respect is very critical. They are great people. I have such a blast.”

Not only has Wardwell embraced Hispanic culture, but the father of three has also later married a Mexican woman. The two often visit her hometown of Guadalajara to celebrate weddings, visit family, and enjoy the delicious tortas and tacos at local restaurants around the central plaza.

“Mimi is such a charming son of a gun,” he said in typical Wardwell style. “It was one question after the other. I liked her. When you like someone, it becomes a much different game.”

Superior is a value-focused operator serving urban Latino and Asian communities across 74 locations. The stores feature a wide selection of fresh fruits and vegetables, hot foods—including Korean-style chicken—a bakery, and a meat department. Wardwell said the company encourages employees to aim high by offering management training, good salaries and wages, a 401(k) match, and health benefits.

As a Hispanic grocer, Superior’s customer base was not one that Wardwell understood well, but he leaped, guided consistently by Song. Since joining the company 11 years ago, he has gained extensive knowledge about Hispanic culture, products, as well as the shopping behaviors of its customers and the values that matter most to its employees.

As Superior’s President, Wardwell hasn’t wavered from his trademark good humor and diplomacy, skills he learned from working with both good and bad mentors. His earliest mentor was his brother, he said, who told him, “Choose your words wisely. They matter. Every person, good, bad, or indifferent, they mentor you. The worst managers taught me the most,” he said, describing the self-important types who boss employees around— the kind he does not want to be. “The great mentors prop you up, lead you, motivate you.”

He recalls a former boss, who was the senior vice president of the company, who spent the day with him, visiting stores and teaching him and other employees as they examined every inch of each store. What Wardwell did not know was that it was his boss’s last day.

“What a class act,” Wardwell said. “He didn’t say a bad thing about the company, just that he had made a decision and wanted to spend his last day with me. It’s something you take with you.”

Wardwell has a genuine fondness for everyone he works with.

As he says, “I don’t have favorites, only least favorites.” When someone in his office has a birthday, for example, the employee can expect balloons and a boisterous birthday song.

“It takes just 20 seconds to say, ‘It’s your birthday,’ and sing ‘happy birthday to you,’ at the top of your lungs,” he said. “It’s cringeworthy. My voice is horrible, like scratching the chalkboard. But they look forward to it. It’s a minute of recognition.”

Another of Wardwell’s core values is integrity. “You can have passion and skill, but if you don’t have integrity, you don’t have anything,” he said. Although friendly and humorous, Wardwell said he has a Type A personality. “I want to get things right,” he said. “If the situation needs micromanagement, that is the style I manage to. If people are hitting the goal markers, I stand back and let my team do its best work.”

After decades in the grocery business, what he loves most are the people he’s met at every level—from those stacking cans and meat cutters working in 38 degrees with a smile, to the cashiers who memorize every code, and the managers who make sure customers are appreciated and cared for. He looks forward to the holidays when he visits each store, bringing Christmas bonuses and end-of-year cheer.

His biggest lesson? It’s the same one he taught Jason Grice: “It’s just a grocery store,” he said. “We’re not solving world peace. It’s all about the people.” ■

By Matt Rodriguez, CEO, Rodriguez Strategies

The story many commentators will try to tell about this November’s election is that Democrats are suddenly ascendant again. But that narrative misses the fundamental driver of voter sentiment—not just in California, but nationally. What voters expressed, loudly and consistently, was economic anxiety. Voters turned to Trump and the GOP in 2024 to remedy the trauma of inflationary pressures unleashed by the Biden Administration.

The off-year elections represent the first report card on the Trump Administration’s efforts to curb price increases: a solid F. One year after throwing Democrats out of office, the GOP finds itself in the same position: they’re in power right now, so they’re taking the brunt of voter anger.

For grocers, retailers, and the broader business community, that reality is far more important than the red-blue scorecard pundits like to focus on. Because when voters are stressed economically, two things tend to follow:

1) They become more open to “tax the rich” policy frames, even when those proposals ultimately reach much further down the income ladder than advertised

2) Local governments start looking for revenue wherever they can find it.

Add to that a darkening budgetary outlook for California, and we could see both dynamics accelerate in 2026.

If there was one consistent message from exit polling this year, it was that voters don’t feel like the cost of living is under control. Groceries, gas prices, housing, insurance, utilities—it’s hitting families all at once.

That sentiment helped fuel Zohran Mamdani’s victory in New York, with his relentless focus on NYC’s staggering cost of living. This surging “left populism” will lead to more than just an increase in leftist candidates. Sure to follow are ballot measures, tax increases, and regulatory efforts aimed at wealth creators and corporations.

In California, this has already begun: a potential statewide wealth tax initiative is circulating for the 2026 ballot. At the same time, dozens of local jurisdictions— cities, counties, school districts, and transportation agencies— are quietly exploring sales-tax increases, parcel taxes, and bond measures for next year.

For industries like grocery and retail—already operating on razor-thin margins—this alignment of voter frustration and policy ambition represents a flashing bright yellow warning light.

Nowhere was the shift more consequential than in California with the passage of Proposition 50, the mid-decade redistricting measure that reordered the state’s political map triggering seismic shifts in state political maps and partisan representation.

Prop 50’s approval triggered an immediate re-evaluation of the state’s congressional landscape. Within hours, nonpartisan analysts at Sabato’s Crystal Ball and the Cook Political Report revised their ratings—and the results were striking: a dozen California House seats moved toward Democrats. Eleven of Sabato’s revised ratings now favor Democrats; Cook shifted 10 races in the same direction.

For Democrats, Prop 50 is the single biggest structural advantage they’ve gained in a decade. For Republicans, it reshapes their national math. And for industries operating in California—including grocers—it signals a likely continuation and potentially an expansion of California’s aggressive regulatory posture.

Except for one outlier—Southern California’s 40th District, which became more solidly Republican—Prop 50 tilted the map leftward across almost every competitive region. That single safer GOP district was enough to prompt Rep. Ken Calvert to announce he’ll run there after his longstanding Riverside County-based seat was effectively drawn out from under him.

Prop 50 immediately scrambled California’s congressional landscape, prompting incumbents to shift districts, new contenders to jump in, and several long-stable seats to become unexpectedly competitive. Multiple regions—Northern California, the Sacramento suburbs, the Bay Area, and parts of Southern California—are now seeing overlapping primaries, open-seat battles, and reshaped political coalitions.

In short, nearly half the state’s delegation is now in flux, setting up one of the most volatile and unpredictable cycles California has seen in years.

For the grocery industry, Prop 50 matters for three core reasons:

1) A more progressive congressional delegation will shape federal regulatory debates.

Even though food policy is heavily influenced by Washington, the people sent from California often drive the agenda. Expect a louder push on issues like packaging, labeling, climate reporting, labor standards, and supply-chain practices.

2) A leftward shift in congressional districts mirrors what we can expect statewide.

If Democrats feel politically emboldened, and the activist left feels validated, voter initiatives targeting “corporate profits,” “price gouging,” or “excess returns” are likely to follow.

California has tested this messaging before. It works with voters when they feel economically stretched.

3) Local tax increases are inevitable in this environment. Cities and counties have weathered inflation, rising labor costs, and softening commercial-property tax revenue. They’re looking for new revenue streams, and sales-tax increases are often the first tool they reach for. The results hit grocers hardest—both in terms of operating costs and consumer spending behavior.

Democrats undeniably gained vote share on election day. But interpreting those gains as a sign of national ideological momentum misses what voters were telling us.

This wasn’t a vote of confidence in any one party. It was a warning shot: make meaningful progress on affordability or else. And Democrats are likely to respond to these pressures with tax proposals, regulations, and ballot measures aimed at businesses and high networth individuals in an effort to raise more revenue.

Prop 50 ensures California will be at the center of those debates in 2026. For grocers and retailers, the next year will require vigilance, coalition building, and a willingness to speak clearly about how rising costs and regulatory mandates affect consumers.

California Democrats were the big winner in November, and the political landscape calls for more wins next November. That forecast, though undeniably sunny for Democrats, means a potentially stormy 2026 and beyond for business and consumers. ■

By Delilah Augustine

Every morning on college campuses students carry something with them other than books or a backpack; some carry a sense of uncertainty about whether they’ll be have access to the food they need to power their academic success.

At Sacramento State, approximately 25% of college students experience food insecurity, meaning they don’t always know when their next meal will come. This statistic has sparked a transformative partnership between the university and one of its own alumni: California Grocers Association President and CEO Ronald Fong has partnered with his alma mater to address this issue and help change these statistics one day at a time.

supply the opening of the center. From the initial outreach, a partnership formed to make a lasting impact on the Sacramento State community.

The Basic Needs Resource Center opened its doors in September of 2025, serving nearly 200 students a day. The center offers a wide selection of canned goods, non-perishables, fresh produce, and meat options. Beyond the free groceries, students also have access to clothes, shoes, and toiletries offered at no cost.

There’s even formula and baby food for student parents, ensuring every Hornet at each stage of life has the essentials they need.

In the early stages of planning, Sacramento State President Luke Wood reached out to Fong for support and advice on connecting with grocers to

The timing of the center was no coincidence. With 2025 marking a legislative focus on affordability, CGA members seized the opportunity to address rising grocery costs and support their local communities in meaningful ways.

According to CEO Ron Fong, several major partnerships played a key role in bringing the center to life. Companies including Kimberly Clark Corporation, C&S Wholesale Grocers, and PepsiCo. made generous contributions to launch the center and now maintain ongoing relationships with the center as they restock every week to serve students in need.

What makes this center unique and innovative is that the resources and support go beyond food. In addition to clothing and shoes, students can participate in classes that teach them how to prepare cost-efficient, healthy meals using the items they receive. The classes are hands-on and teach students to make quick, homemade meals on a budget. This ensures that students not only have access to essential resources, but also gain knowledge about nutrition and cooking.

Upon request, students can meet with certified nutritionists. There are also additional resources available in person and online to help with SNAP and CalFresh benefits, ensuring students have a resource for financial literacy education.

Fong sees this innovative program as truly just the beginning.

“This partnership isn’t something I want to see confined to Sacramento State. I think our members all across the state have the opportunity to build relationships with the other CSU campuses and turn this program into something bigger.”

This center reshapes the relationships between grocers and their communities. For many CGA members, a contribution is more than just a donation, it is a statement that they are fighting hunger and uplifting a future generation.

Anyone on campus can understand the center’s impact on a personal level as they watch classmates balance jobs, skip meals, or stretch meals where they can as sometimes that’s all they have. Or, put groceries back on the shelf because the total is just a few dollars too high.

Life for college students isn’t always just calculating what grade you need to get on your midterm. It can also be calculating what you can afford to eat that will last you until your next check.

Thanks to Dr. Jeanne Harris Van Dahlen, the Vice President for Student Health, Counseling and Wellness Services, the CGA team was able to do a private tour of the center earlier this month. With the opening of the center there’s been a shift. There’s now a place for students who don’t feel seen, who don’t feel supported from all walks of life to have an extra sense of comfort and community. The center provides a blanket, literally, and figuratively to students who need one, whenever they need it.

The center has become a symbol for the campus, a symbol of what can happen when universities, industries, and communities share the same ideas. The staff that works this center, every volunteer, every distributor, every single person involved can confidently say that they are fighting to make sure that no student goes hungry, and that no student will have to choose between an education and their next meal. ■

On the last weekend of September, CGA kicked off the first Gather California in Rancho Mirage. This reimagined conference brought the California grocery community together at a premium resort location for three days of connection, productive business meetings, and fresh insights. We hope those who attended feel more connected than ever to grocery peers and prepared to thrive in the California market.

In addition to our brand-new venue, our reimagined event featured several new events and connective networking experiences, including the Collaboration Kickoff, DIY Networking Adventure, and Dine For A Cause. The popular Emerging Brands Pitch Contest made its return for the fourth year, with Maple Pop! taking home first place. Our General Session program featured an insightful panel discussion between President of Food 4 Less/Foods Co. Kendra Doyel, CGA Board Chair and Chief Administrative Officer of North State Grocery, Inc. Michel LeClerc, and author and political strategist Mike Madrid about what makes doing business in California unique.

Keynote speakers Brent Gleeson, Victoria LaBalme and Chris Failla offered their perspectives on leadership and adaptability through our evolving industry over a series of education sessions. Though we made several changes to this year’s event, Gather also reprised our crowdfavorite Independent Grocers Forum and Enterprise Risk Protection Executive Summit.

Thank you to all of those who were a part of the first Gather California. Save the date for the next Gather California, taking place September 27-29, 2026 at the Westin Mission Hills Golf Resort and Spa in Rancho Mirage, California. We can’t wait to gather again!

CGA wishes to recognize and thank the many sponsors that helped to make this year’s conference a tremendous success.

PREMIUM SUITE HOLDER

Anheuser-Busch InBev

Bimbo Bakeries USA

C&S Wholesale Grocers

Carl Buddig and Company

Chobani

Constellation Brands, Beer Division

Flowers Foods

Happy Egg Co.

Jel Sert Company

Kellanova

Kimberly-Clark Corporation

Loacker USA

Molson Coors Beverage Company

Nestle Purina PetCare

PepsiCo North America

Reyes Coca-Cola Bottling

RMS

The Hershey Company

Tyson Foods

UNFI

EXECUTIVE LEVEL

Classic Wines of California

Primo Brands

PRESIDENT LEVEL

A-Gas

Built Brands LLC

California State Lottery

ClearDemand

Concept Store Fixtures

Crystal Creamery

ECOS

Frito Lay

Keurig Dr. Pepper

Niagara Bottling LLC

NuCal Foods

OK Produce

Old Trapper Smoked Products

Olé Mexican Foods

Ottimate

Perfect Hydration Alkaline Water

Red Bull North America

SymphonyAI

Taper

TruConnect Communications Inc.

Truno Retail Technology Solutions

WK Kellogg Co

DIRECTOR LEVEL

Barsotti Family Juice Company

Bunzl California

California Dairies

Certified Federal Credit Union

GALLO

Gavina Coffee Company

Go Energy Foods

Idahoan Foods, LLC

IMIS Trading, Inc. (Cleanlogic)

LAVAZZA

Monster Energy Company

PepsiCo North America

ReaderLink Distribution

Services LLC

Reyes Coca-Cola Bottling Science

Tony Chachere Creole Foods

Twang

Vilore Foods

Vital Farms

SUNDAY OPENING RECEPTION

General Mills

Sushi Avenue

Thrifty Ice Cream

MONDAY MORNING GENERAL SESSION

The Mahoney Group

NETWORKING LOUNGE

Specialty Food Association

CONFERENCE REGISTRATION

Instacart

CONFERENCE HOTEL ROOM

KEY CARD

Instacart

WIFI

Crown Poly

CONFERENCE APP

Post Consumer Brands

SHOW PHOTO BOOTH

Flashfood

DOOR DROP

Warmies

Whole Foods Market

I’ve personally benefited from the networking opportunities. Attending the annual CGA Independent Operators Symposium each year, spending time with independent retailers, and hearing from industry leaders is always a highlight for me. For suppliers doing business in California, being part of this incredible organization is a must. The government relations team actively lobbies on behalf of its members to shape state and local policies affecting the grocery industry. By joining CGA, members gain a strong voice in the industry, access to valuable resources, and opportunities to build partnerships that strengthen their businesses.

I am so thankful to be part of this organization and for all the valuable friendships and connections I have made over the years. It has been an excellent return on investment for me personally and for my company.

Lori Brown NuCal Foods

CGA welcomes the following members:

Allan Company Recycling 14620 Joanbridge St

Baldwin Park, CA 91706-1750

Contact: Melissa Marroquin, Account Manager

E-mail: mmarroquin@allancompany.com

Phone: (626) 962-4047

Website: allancompany.com

Brewery X

3191 E La Palma Ave

Anaheim, CA 92806-2803

Contact: Clayton Welbank, Chief Executive Officer

E-mail: claytonw@brewxco.com

Phone: (949) 842-2267

Website: brewery-x.com

Epax Systems

14641 Arminta St

Panorama City, CA 91402-5901

Contact: Stefan Nielsen, President

E-mail: stefan@epaxsystems.com

Phone: (800) 220-6776

Website: epaxsystems.com

BY GRACE BECKER

A new Circana report projects that by 2030, 35% of households will have a member using GLP-1 drugs like Ozempic or Wegovy. Currently, around 23% of U.S. households have a member using GLP-1 drugs. While GLP-1 users are buying fewer groceries, Circana found that they still spend more than non-users, as they are willing to pay more for products that provide added health benefits.

Wildgrain brings wholesome, bakery-quality goods right to your doorstep so there’s no need to plan ahead. Every loaf, croissant, and cookie goes straight from your freezer to your oven and bakes in under 30 minutes. Simply schedule a delivery for your favorite staples, receive your flash-frozen items, and bake when the time is right for you. Wildgrain partners with small bakers and pasta makers across the country to keep the tradition of artisanal and nutritious food alive.

According to Fizzics, not all foam is created equal. Fizzics Micro-Foam™ converts any canned or bottled beer’s carbonation into uniformed sized micro-bubbles that deliver enhanced aroma, flavor, and mouth-feel. DraftPour makes every beer taste better. The at-home tap is battery operated so you can take it anywhere on the go.

Think of W4 Pro AI Interpreter Earbuds—the world’s first earbuds for phone and remote meeting translation—as your global business assistant. With W4 Pro, you can now have a two-way assisted translation of the caller’s language and see real-time transcription subtitles making it easy to understand and engage in conversations. The earbuds support 43 languages with 96 accents.