•

•

Built on industry-leading delivery performance, Weyerhaeuser is the distribution partner you can count on to get you the best building materials available.

PRESIDENT/PUBLISHER

Patrick Adams padams@526mediagroup.com

VICE PRESIDENT

Shelly Smith Adams sadams@526mediagroup.com

PUBLISHER EMERITUS

Alan Oakes

MANAGING EDITOR

David Koenig • dkoenig@526mediagroup.com

SENIOR EDITOR

Sara Graves • sgraves@526mediagroup.com COLUMNISTS

James Olsen, Kim Drew, Dave Kahle CONTRIBUTORS

Hakan Ekstrom, Lance Grimm, Glen O’Kelly, Paige McAllister

ADVERTISING SALES

(714) 486-2735

Chuck Casey • ccasey@526mediagroup.com

Nick Kosan • nkosan@526mediagroup.com

John Haugh • jhaugh@526mediagroup.com

DIGITAL SUPPORT

Katherine Williams kwilliams@526mediagroup.com

CIRCULATION/SUPPORT info@526mediagroup.com

151 Kalmus Dr., Ste. J3, Costa Mesa, CA 92626 Phone (714) 486-2735

CHANGE OF ADDRESS Send address label from recent issue, new address, and 9-digit zip to address below. POSTMASTER Send address changes to Building Products Digest, 151 Kalmus Dr., Ste. J3, Costa Mesa, CA 92626. Building Products Digest (USPS 225) is published monthly at 151 Kalmus Dr., Ste. J3, Costa Mesa, CA 92626 by 526 Media Group, Inc. Periodicals Postage paid at Santa Ana, CA, and additional post offices. It is an independently-owned publication for building products retailers and wholesale distributors in 37 states East of the Rockies. Copyright®2025 by 526 Media Group, Inc. Cover and entire contents are fully protected and must not be reproduced in any manner without written permission. All Rights Reserved. We reserve the right to accept or reject any editorial or advertising matter, and assumes no liability for materials furnished to it. Opinions expressed are those of the authors or persons quoted and not necessarily those of 526 Media Group, Inc. Articles are intended for informational purposes only and should not be construed as legal, financial or business management advice, nor an endorsement of any company, product, service or individual referenced. Volume 44 • Number 12

Update your subscription

YellaWood® brand pressure treated pine stands unrivaled in providing the best available protection against rot, fungal decay and termite attack. Enjoy the uncompromising beauty of a backyard made with high quality natural wood products from YellaWood ® brand pressure treated pine. Visit yellawood.com for more information.

Dillard, OR - Douglas-fir Studs

Weldon, NC - Southern Pine Dimensional Lumber

We’re proud to offer Made in the USA lumber: grown, manufactured, and shipped to you from right here in the USA. This means you get high-quality, dependable products sourced from sustainable forests with shorter lead times - because your work deserves nothing less.

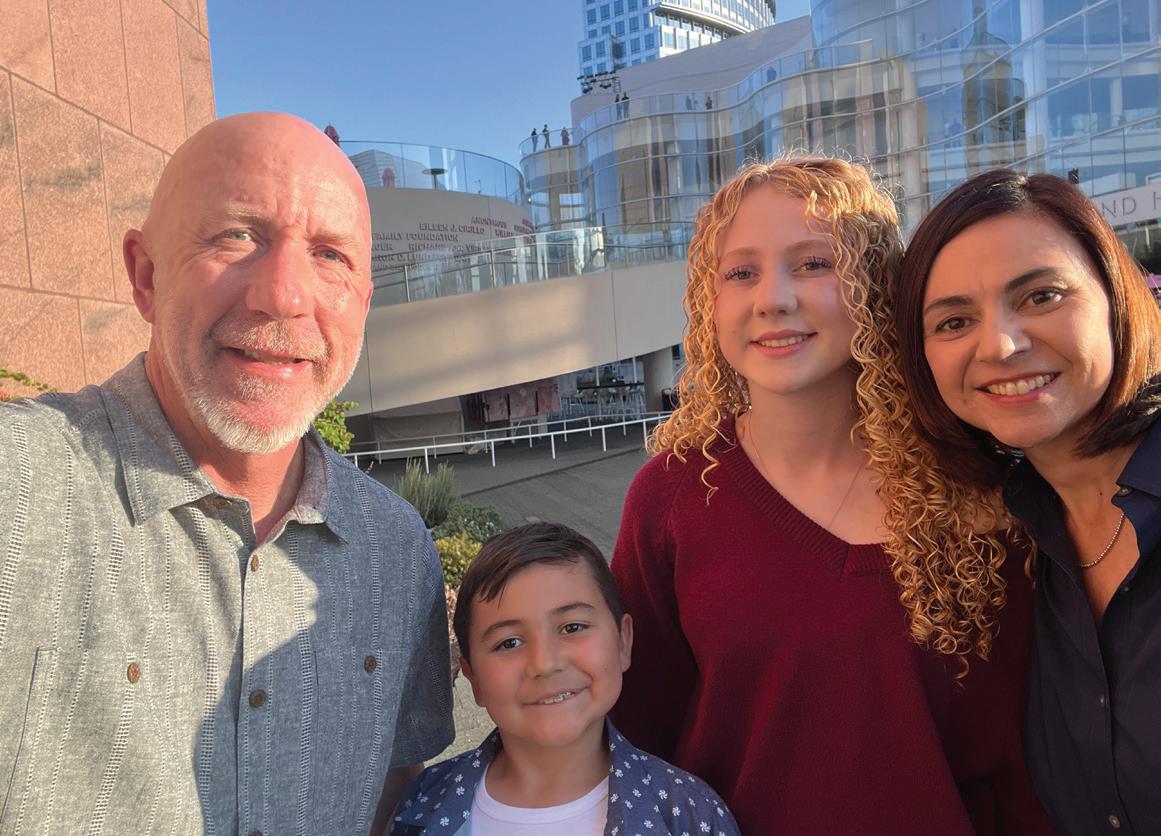

------------ BY PATRICK ADAMS

RECENTLY, ON THE WAY to drop my daughter off at high school (which still feels impossible to say), we were listening to an interview with a young country singer. She talked about how, since she was eight years old, she had dreamed—relentlessly—of singing on the stage of the Grand Ole Opry. And now, she finally had.

I glanced at my daughter and asked, “Do you have a dream?”

She thought for a second. “What is a dream? Is it like a goal?”

I told her that in my opinion, a dream is much bigger than a goal. A dream is something so large it usually takes dozens—maybe hundreds—of goals to get there.

I should’ve seen it coming. She turned to me and asked, “Daddy… did you have a dream?”

To be honest, I don’t think I’ve spent a single minute of my adult life considering that question. Yet the second she asked it, the answer hit me instantly. A flood of emotion washed over me. Nothing in a very long time has rattled me like that question.

“Yes, sweetheart,” I said quietly. “I did have a dream.”

As I’ve shared before, my childhood was far from ideal. We were poor. My parents carried demons that shaped far too much of our lives. I grew up in a rough area, in a time very different from today’s world of helicopter parents and protective laws. All I dreamed of back then was escaping that life. I wanted to stop feeling scared. I wanted a home filled with people I love, who love me back. I wanted stability, peace and the simple things most people take for granted. I wanted to break the cycle and someday give my own kids the kind of life I could only imagine.

But it wasn’t the memories or the emotions that hit me hardest—it was the realization that, without even recogniz-

ing it, I’ve spent my entire life pursuing that dream. And at some point, quietly, without announcement or celebration, I achieved it.

There was no single moment when it happened. No finish line. It didn’t look like a promotion, a bank balance, or a passport filled with stamps. It just… happened. Slowly. Silently. And I never realized it until that moment in the car.

Looking back, that dream has guided nearly every decision I’ve ever made. It’s why I’m driven. Why I fight for what’s right. Why I protect the people I love so fiercely. Why I refuse to compromise on right and wrong. Why I try to be kind and generous—because we rarely know what storms someone else is navigating.

My daughter was still waiting for my answer. I held back the emotion, steadied myself, and said, “Yes, sweetheart. I had a dream. And that dream was to have the life I have today—our life. You, your brother, your mother, our home, our laughter, our blessings, and all the love we share.”

She seemed satisfied, because her response—perfectly timed—was, “Oh! Can you turn this up? I love this song.”

As we enter this holiday season, I hope you take a moment to think about your childhood dream. I hope, like mine, it has quietly come true. And if it hasn’t yet, remember—it’s never too late.

It is my greatest honor to serve this incredible industry and each of you. Your kindness and support remind me every day that there are still so many good people in this crazy world. From all of us, may you have the happiest of holidays.

PATRICK S. ADAMS, Publisher/President padams@526mediagroup.com

Like the foods we buy, when it comes to decking, we want natural and real. Redwood is always available in abundance of options. So stock the shelves! Unlike mass-produced and inferior products, Redwood is strong, reliable and possesses many qualities not found in artificial products. They maintain temperatures that are comfortable in all climates.

Redwood Empire stocks several grades and sizing options of Redwood.

------------ BY GLEN O’KELLY & HÅKAN EKSTRÖM

GLOBAL SOFTWOOD lumber markets are entering a period of significant change. After years of weak demand and high volatility, the 2025–2030 outlook points to a gradual recovery—driven by economic improvement in Europe and China, supply constraints across North America, and new trade flows emerging from tariffs and policy shifts, according to the new report Softwood Lumber – Tariffs, Turbulence, and New Trade Flows

Softwood lumber remains a $80 billion global industry, growing only 1.8% per year in nominal terms since 2000. Beneath this modest headline, demand and trade are transforming. Consumption has shifted toward Asia, while North America and Europe remain the backbone of global supply. Construction dominates in developed markets, while furniture and packaging are key in emerging economies. Per-capita use has plateaued at 0.2–0.4 m3 in mature markets but remains below 0.1 m3 in developing regions— leaving room for growth, particularly in mid-income Southeast Asia and MENA. Regional policies, tariffs and forest resource limits will shape how demand is met.

The U.S. accounts for 27% of global softwood lumber demand but only 20% of supply. After steady post-recession growth, U.S. consumption dipped in 2022, but is expected to rebound later this decade as housing starts recover. The recent implementation of new import tariffs will restrict supply and push lumber prices in the U.S. higher. While southern mills are expanding, growth is constrained by labor shortages and log costs in other regions of the country. Sawmill expansion in the South appears to be slowing in 2025–27. However, there could be significant expansion not yet announced due to higher lumber prices in the coming years. Imports will increasingly need to come from Europe toward the end of the five-year period.

Canada’s lumber sector faces a structural downturn.

Higher U.S. duties (from 14% to 45% for most producers) and limited log supply in British Columbia will accelerate mill closures and shift investment toward the U.S. South. Efforts to diversify exports to Asia and Europe are slow and costly due to distance and differing standards. Canada’s overall production will likely contract further. As B.C. sawmills become less competitive in the U.S., there are opportunities to expand domestic sales and production of value-added products through government incentives. Europe, which accounts for one-third of global supply, is poised for modest growth as construction confidence improves. But production in Northern and Central Europe is near its sustainable ceiling, and beetle-related harvests in Central Europe are declining. Expansion will depend on Eastern Europe and the Baltics.

China’s lumber demand, down 34% since 2017, is expected to recover modestly after 2027 as the property market stabilizes. Russia will remain its dominant supplier, with marginal increases from Canada. Demand in MENA and mid-income Asia (e.g., Vietnam, India) will also grow. Limited by local forest resources, they will predominantly rely on imports.

Overall, global lumber demand is projected to grow 1.2% annually from 2024 to 2030, reaching 335 million m3. Seventy percent of this increase will come from the U.S., Europe and China. Meeting that demand will require roughly 22 million m3 of new supply—mostly from the U.S. South, Eastern Europe, and Russia’s Far East.

The decade ahead will be defined not by strong growth but by redistribution—as tariffs, trade barriers, and forest policy reshape traditional supply chains. The winners will be those who adapt fastest to this new geography of wood. BPD

– Glen O’Kelly is CEO of O’Kelly Acumen, Stockholm, Sweden, and Håkan Ekström president of Global Wood Trends, Seattle, Wa. Their full report is available at www.okelly.se/shop/lumber2025.

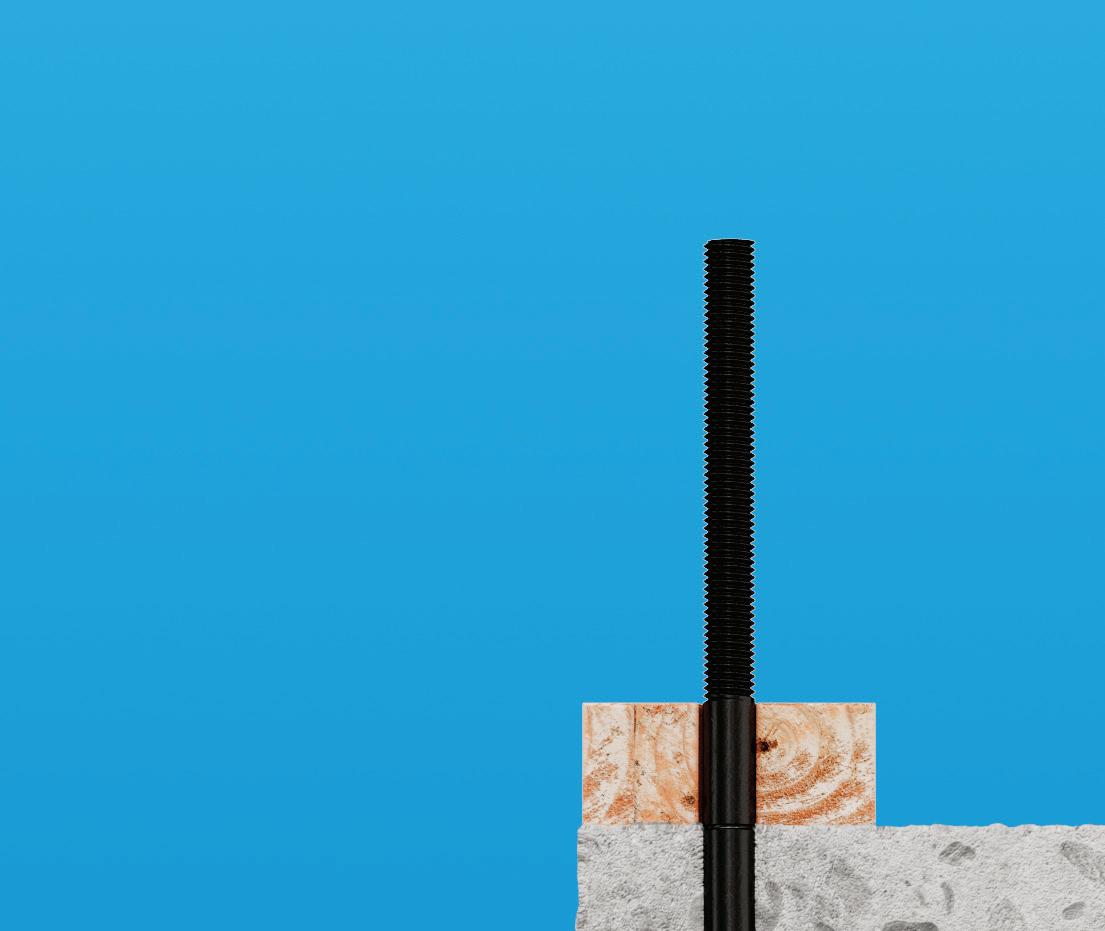

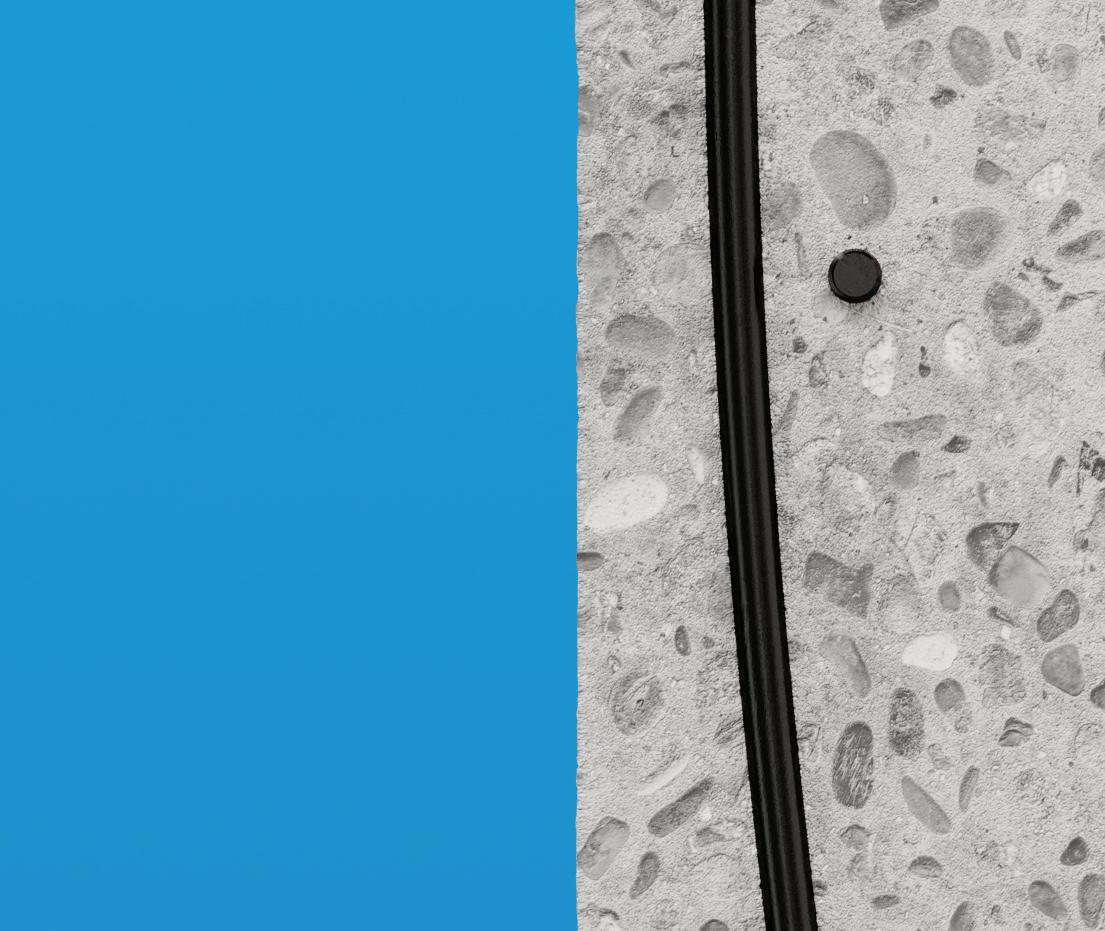

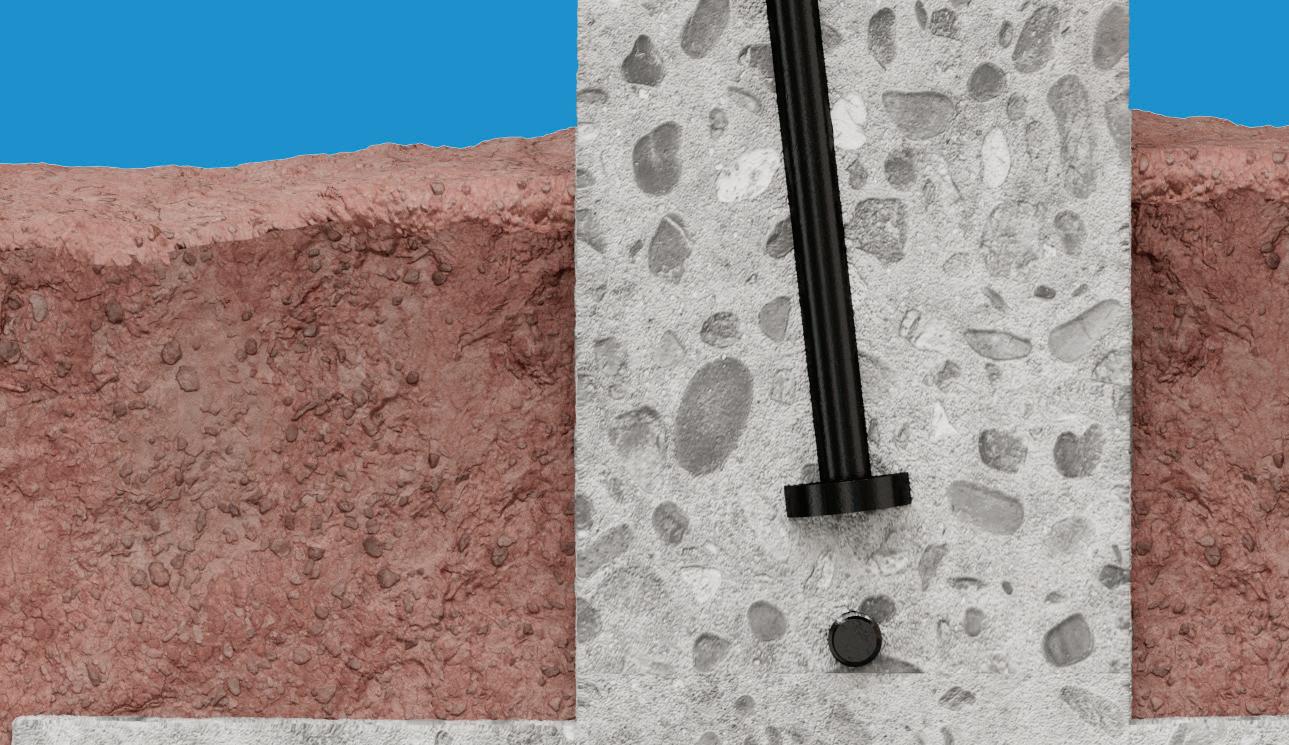

Introducing the HDUE™ holdown and SABR™ anchor bolt solution from Simpson Strong-Tie. Now you can give customers a stronger, faster way to secure shearwall end studs to concrete foundations in residential and light-frame commercial projects. Engineered for higher loads, our new HDUE is ideal for modern structures with more windows and smaller areas for shearwalls. As a direct replacement to our HDU holdown, the HDUE comes packaged with fasteners and washers. Builders attach it to the foundation with our new SABR anchor bolt. The SABR, a cast-in-place bolt also made for higher loads, replaces our SB and SSTB anchor bolts. With just one diameter for each length, the SABR is simpler to order and stock. The HDUE holdown and SABR anchor bolt are code listed, widely available in several sizes, and backed by our expert service and support. To learn more, contact your representative or visit go.strongtie.com/hdue-sabr

------------ BY LANCE GRIMM

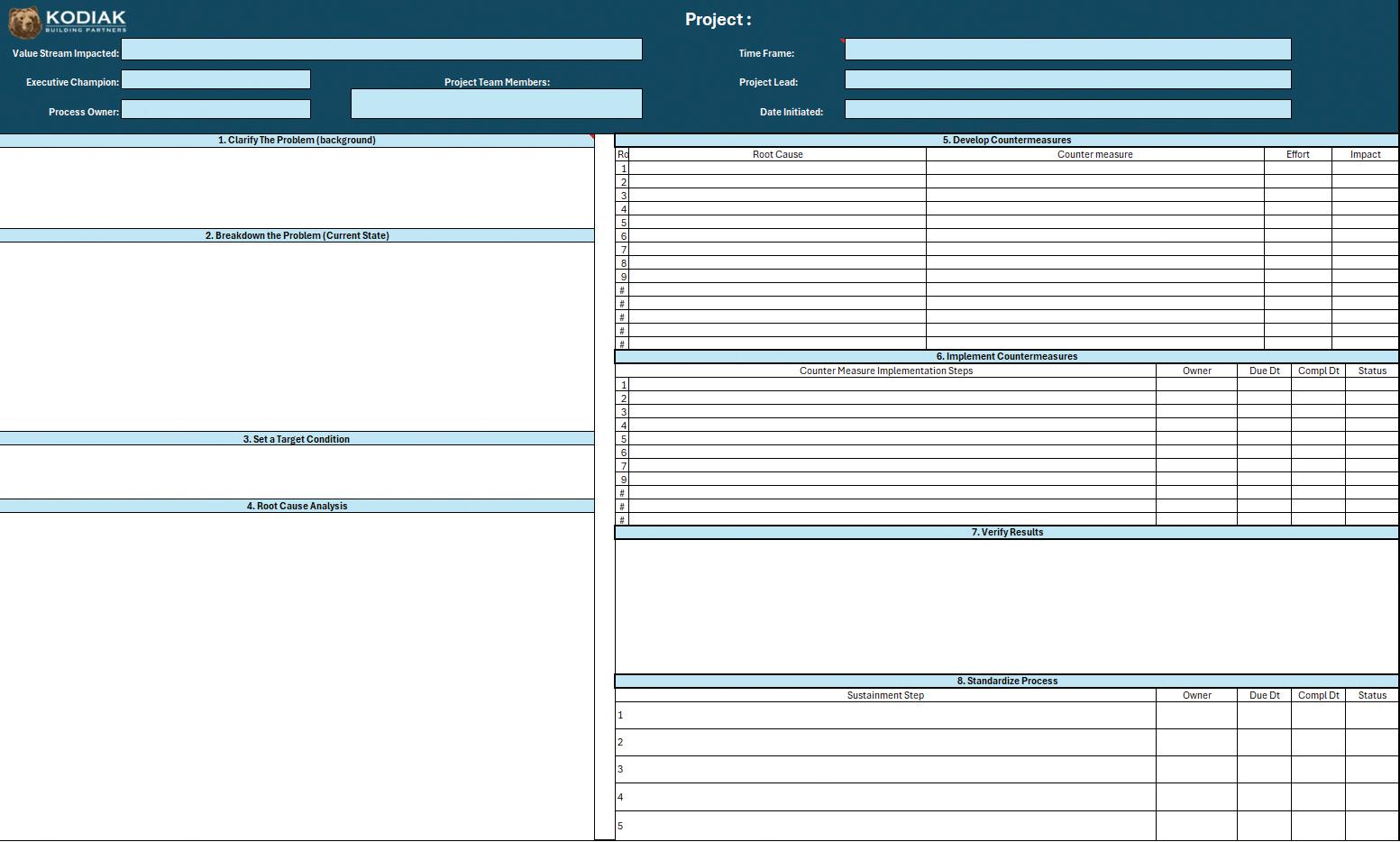

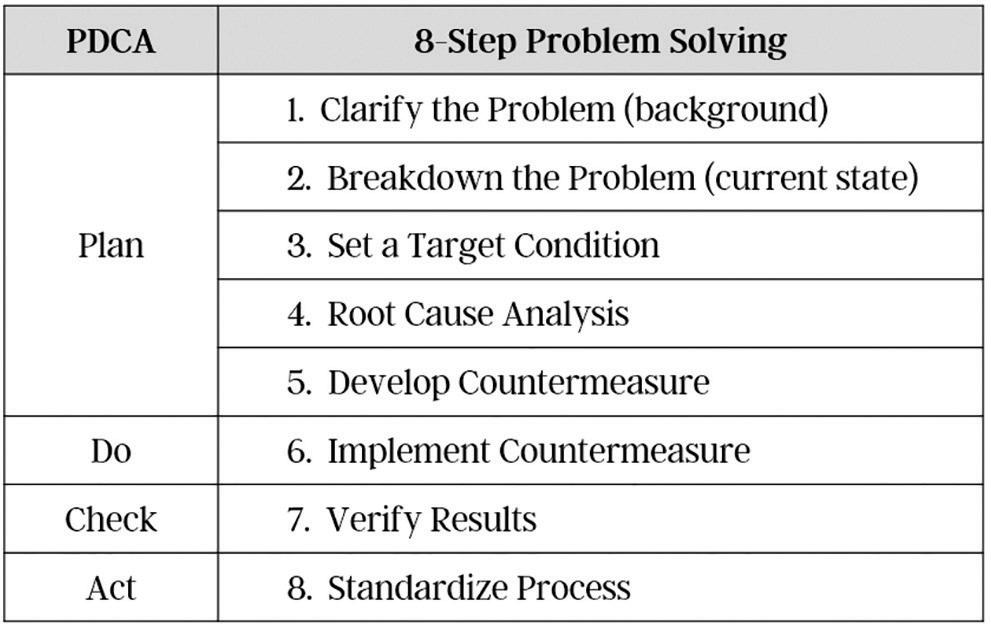

IN TODAY’S COMPETITIVE building products marketplace, companies are under constant pressure to do more with less—delivering exceptional service, optimizing operations and preserving margins. While some leaders respond to these challenges with sweeping cost-cutting measures, a more sustainable strategy has emerged: embracing a continuous improvement (CI) mindset.

CI isn’t just a process; it’s a way of thinking. Rooted in manufacturing and quality control principles like Lean and Six Sigma, CI emphasizes incremental improvements across systems, processes and activities to achieve better outcomes over time. In the distribution world—where success often depends on efficiency, accuracy and customer experience—CI can be the difference between a company that merely survives and one that thrives.

Why Continuous Improvement Matters

Value creation is the end goal for any business, but how you get there matters. Traditional approaches to growth, such as cost-cutting after an acquisition, might deliver short-term gains but often erode culture and destabilize operations. Continuous improvement, on the other hand, promotes incremental, measurable changes that compound over time—building operational resilience, boosting margins and empowering employees.

Adopting a CI mindset means treating improvement as an ongoing strategic priority, not a one-off initiative. Each

improvement sparks curiosity for what comes next, creating a regenerative cycle of progress. For building products distributors, this approach can significantly improve metrics such as on-time and in-full (OTIF) rates, order accuracy and operational efficiency.

One recent example from Kodiak Building Partners underscores the power of CI in action. At American Builders Supply (ABS), a standardized set of metrics was implemented across the company along with a daily management process to check and adjust as necessary to meet established targets. Teams used Pareto charts to identify the highest-impact issues behind missed targets and where to focus collaborative efforts to address them.

The results were significant: profitability improved substantially as the organization aligned around clear goals and used data to guide decisions. This structured approach to problem-solving didn’t just fix isolated issues—it created a foundation for ongoing improvement and margin growth. Now, these principles are being extended to Kodiak’s door shop companies, piloting a similar system to drive consistency and value across the network.

Implementing CI effectively requires more than enthusiasm—it demands discipline and structure. Here are three critical components:

(1) Define the Problem, Identify the Systemic Root Cause

Start with clarity and inspiration. A vague problem statement leads to vague solutions and uninspired team members. Whether addressing production delays, inventory inaccuracies or order entry bottlenecks, take the time to diagnose the systemic root cause. It’s critical to engage the people who perform the work at the location where the work is done. For instance, a recent analysis revealed that inefficient equipment layout—not a labor shortage—was the culprit behind missed production deadlines. Correcting the layout generated annual savings of $180,000.

(2) Tailor the Tactics

There’s no one-size-fits-all fix. The people who do the work should be the ones solving the problem. Also, pilot potential solutions that address the systemic root cause before rolling them out broadly, and tailor strategies to the unique root causes of each business. For example, a company dealing with repetitive order entry errors on purchase orders might benefit from text recognition technology (also known as optical character recognition, or OCR) to automate order entry, dramatically reducing these errors and freeing employees to focus on higher-value tasks.

(3) Measure the Results

Continuous improvement projects don’t end at implementation. The intended results need to be validated against the metrics within the defined problem and then standardized to check and adjust hourly, daily, weekly and monthly until ready for the next improvement to keep raising the bar on performance. In distribution, metrics such as OTIF, cycle times and order accuracy provide a clear lens into whether improvements are sticking, and where to check and adjust efforts.

While process and data are essential, culture ultimately determines whether CI endures. Companies that build a culture of trust, curiosity and collaboration see the strongest results. When employees at every level, from executives to shop floor teams, feel empowered to problem-solve, CI becomes a shared mission rather than a topdown directive.

When building a CI culture, keep in mind data inspires more than mandates and data will set each of us free to innovate. Each person needs to be given the chance to understand the why, believe in the why, and become willing to support and engage in the why, paired with proof of its impact to accelerate adoption. Combine that with peer-

to-peer benchmarking and knowledge sharing, and CI becomes part of daily operations—transforming improvement from isolated projects into a continuous, company-wide practice. This is exactly what Kodiak’s Building Up Individuals for Locally Driven (BUILD) Excellence CI development program is all about—creating a united team throughout the company of deeply rooted and inspired problem-solvers. In building up these leaders to speak a common CI language, they bring focus to seeing opportunities for improvement through a collaborative lens in every area of the business.

Continuous improvement is more than a tool—it’s a mindset that transforms obstacles into opportunities for growth. For building products distributors navigating tight margins, labor shortages and evolving customer demands, CI offers a path to sustainable success. When done right, it’s not about cutting costs—it’s about creating value for employees, customers and stakeholders alike. BPD

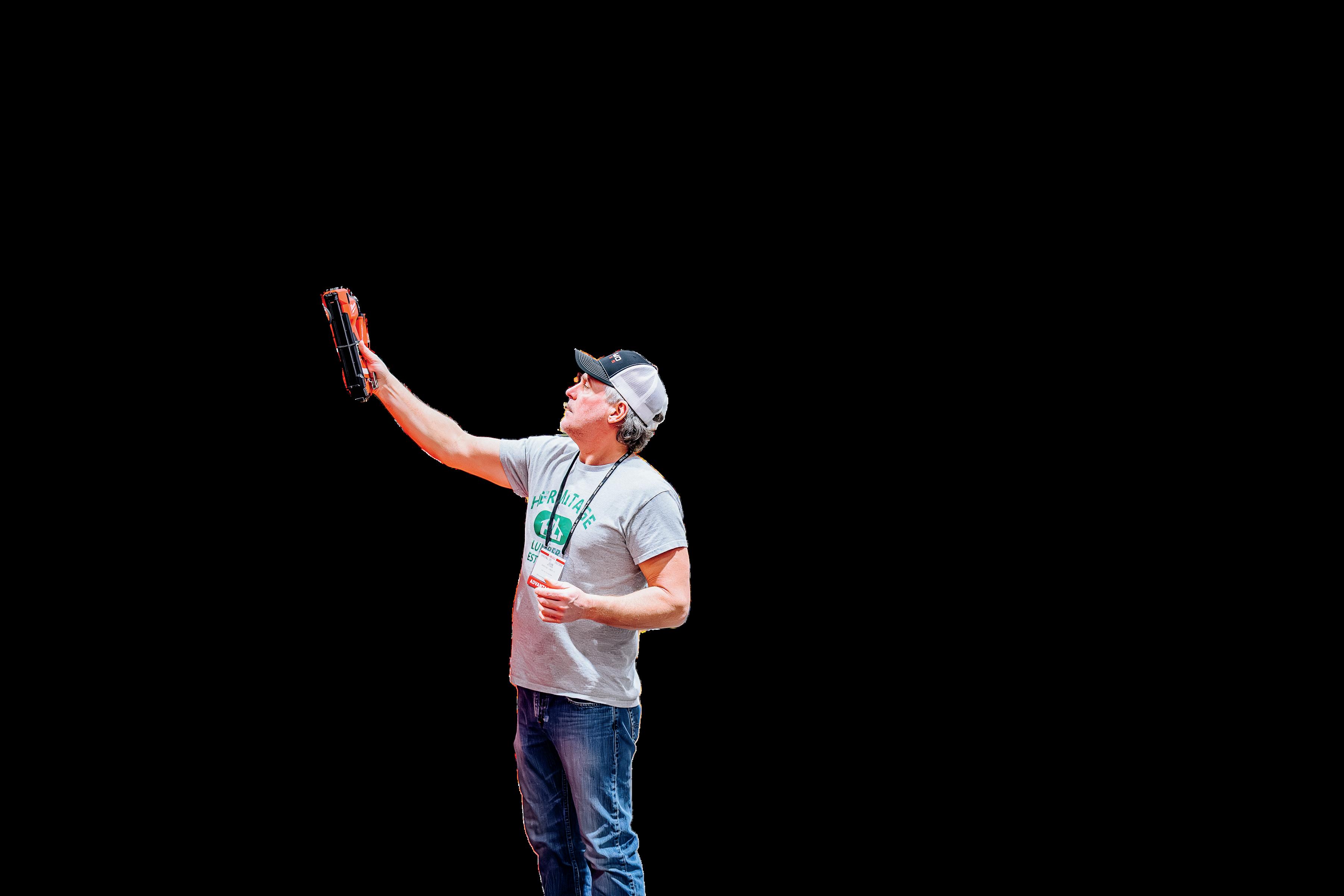

IN A MARKET where innovation is powering forward at full speed, power tools retailers must stay ahead of a rapidly shifting landscape if they’re to capitalize on the next phase of growth. The power-tools sector is now being reshaped by the surge of lithium-ion batteries, cordless equipment, and collaborative platforms that allow an entire family of tools to use the same battery, voltage and charger.

With the professional and DIY segments converging, dealers should align their assortment, merchandising and sales strategies. BPD asked two experts at Milwaukee Tool—group manager of product marketing Zafir Farooque and senior product manager Bryan Bunner—to share their insight into the trends promising to deliver the biggest impact.

Farooque: The biggest trend in battery advancements is the push for greater energy and power density. These innovations enable more runtime, increased power for demanding applications, and faster performance—all within the same or smaller battery sizes. One breakthrough is tabless lithium-ion cell technology, recently adopted by some power tool companies. An example of this innovation is Milwaukee Tool’s M18 RedLithium Forge XC8.0 and HD12.0 batteries, which leverage these advanced technologies to unlock enhanced power and runtime. As a result, cordless solutions are now capable of replacing—and even outperforming—corded, pneumatic, and gas-powered options.

The growing demand for batteries that deliver more power, longer runtime, and faster application speeds—without increasing size—drives this shift. Advances in energy density and power output have enabled smaller, lighter, yet more capable batteries. This progress allows cordless solutions to surpass traditional technologies, offering

professionals greater efficiency and performance while eliminating the constraints of cords, gas and air hoses.

Bunner: As the construction industry continues to embrace cordless innovation, solutions like cordless nailers are going to continue leading the charge in redefining traditional processes and workflows. Their ability to combine advanced technology with practical benefits like portability, safety, versatility and ease of use makes them an ideal choice for professionals striving to meet the demands of the modern jobsite. Investing in manufacturers who are committed to innovation and reliability ensures users have a solution that supports both immediate needs and future growth. As technology continues to advance, cordless nailers are poised to become an indispensable asset across a wide range of industries.

Tool

Bunner: When evaluating a brand, it is important to look beyond individual solutions and consider their broader approach to innovation. Manufacturers that invest in disruptive technology and system-wide advancements demonstrate a strong commitment to their users and to insights grounded in real-world jobsite experience. This growth mindset often leads to advanced features, enhanced performance, and durable solutions capable of delivering a wide range of professional demands.

Additionally, a manufacturer’s ongoing dedication to innovation is a strong indicator of their long-term reliability and value. By consistently introducing new solutions and updating their existing lineup of products, these brands ensure their ecosystems stay ahead of the ever-changing demands of the industry, making them a dependable choice for professional users BPD

THE 13TH ANNUAL Pro Tool Innovation Awards recognized the industry’s most innovative power tools, hand tools, fasteners and accessories. This year’s awards proved that manufacturers are charging full speed ahead, inventing bold new categories that stretch the boundaries of software, tech, and battery-powered solutions. The winners included:

Accessories & Fasteners

Circular Saw Blades: CMT 7-1/4" Zero Gravity Fiber Cement Blade

Reciprocating Saw Blades: Milwaukee AX w/NITRUS Carbide Teeth SAWZALL Blade for Wood with Nails

Table Saw Blades: CMT 8" x 24T Locked Precision Dado

Metal Drill Bits: Drill America GSC Series Gold Stepped Point Cobalt Drill Bits

Wood Drill Bits: Fisch FSA-367208 16-piece Black Shark Forstner Bit Set

Drill Guides: Fisch Tools Heavy Duty Tilting Drill Guide

Drilling: DeWalt Black & Gold Countersinks

Drills/Driver Attachments: SiteH3ro Modular Platform

Driver Bits, Holders/Extenders: DeWalt Keyring Bit Holder Set

Impact-Rated Driver Bits: GripEdge Tools 12-piece Impact Triple Square Driver Set

Nut Driver Bits: Ryobi MaxView Lag Driver Set

Specialty Driver Bits: GripEdge Tools 1/4" Drive LowProfile Dual Action Driver Bit Set

Hole Saws: Milwaukee Quik-Lok Arbor Set

Pocket Joinery: Kreg 20V Ionic Drive Rebel Pocket-Hole Joiner Kit

Router Bits: CMT Super-Duty Flush Trim Bit 3/4"x2"

Sanding: Gator Reptilion Ceramic Sanding Discs

Stands, Tables & Bases: Bora Tool PM-3310 Jobhorse Brackets

Step Bits: Toolant Four Spiral Step Drill Bits

Adhesives–General: DAP Weldwood 2-in-1 Wood Glue & Filler

Adhesives–Tape: Hillman Power Pro Joist Tape

Hidden Fastening System: Deckorators StealthLock Universal Deck Clip

Wood Screws: SPAX PowerTrim finishing-composite-PVC Screws

Specialty Fasteners: SCRAIL Chipboard fasteners Hand Tools

Utility Knives: Klein Tools FlickBlade 2-in-1 Utility Knife/ Scraper with Blade Storage

Landscaping: WorkPro Crack Weeder, 12.5" Stainless Steel Crevice Weeding Tool

Levels: LevTech Mag Dog 8 Conduit Bending Level

Marking: Tracer ProScribe APST2

Tape Measures & Rulers: Crescent ShockForce Nite Eye

25' Tape Measure

Nut Drivers: Klein Tools 32914HD 14-in-1 Impact-rated

Flip Socket Set

Pliers: Knipex 87 51 180 Cobra ES Pliers

Screwdrivers: MetMo Pocket Driver

Precision Screwdrivers: Craftsman CMHT68011 50-piece

Precision LED Multi-Bit Screwdriver

Squares: The Morgan Square

Tie Down/Strap: Keeper Products Retractable Ratchet

Tie-Down

Vises: MetMo Fractal Vise

Cordless Power Tools

Batteries: Greenworks Optimus CORE400 5.5 Ah Battery

Battery Accessories: DeWalt FlexVolt to PowerShift

Adapter

Battery Chargers: Kress Commercial KAC843 4-port

Extended Charging Case

Drills/Drivers: DeWalt DCD801B 20V MAX XR Brushless

Cordless 1/2" Drill

Multi-Head Drill/Drivers: DeWalt DCD803B 20V MAX

Atomic Multi-Head Drill

Cordless Screwdrivers: Craftsman CMHT66720 4V

Precision Screwdriver

Specialty Drills/Drivers: SKIL DL6300D-12 12/20V Flip Drill

Impact Drivers: Makita XDT20 18V LXT Brushless

Quick-Shift Mode 4-speed Impact Driver

Circular Saws: Makita GSH06Z 40V max XGT Brushless 16-5/16" Circular Saw

Reciprocating Saws: Ryobi PBLRS02 18V ONE+ HP

Brushless Reciprocating Saw

Pneumatic Tools & Nailers

Electric Air Compressors: FNA Compressors DeWalt Xtreme Quiet Compressor DXCMS13513US

Cap Nailers/Staplers: Senco CS61H1 1-1/2" Cap Stapler

Cordless Finish Nailers: Metabo HPT NT1865DSA 18V 16GA Straight Finish Nailer

Framing Nailers: Beck Fastening LignoLoc F33 System

Cordless Framing Nailers: Metabo HPT NR1890DRA 21° Plastic Strip Framing Nailer

Roofing/Siding Nailers: Senco RoofPro 445XP Coil Roofing Nailer

Cordless Roofing/Siding Nailers: Metabo HPT NV1845DA 18V Coil Roofing Nailer

Cordless Staplers: Worx WX844L Nitro 20V 18GA Narrow Crown Stapler

Door Hardware

Hardware–Doors: Wright Products Ventana Mortise Leverset

Hardware–Commercial Doors: Hampton Products All-inOne Closer with FlexPlate BPD

DOWN MARKETS can be difficult to sell in. Let’s call them contracting markets, because that’s what markets do; they expand and contract. We are in a contracting market right now. What is the solution? Get back to the basics:

Cast a wider net. If we are to grow our business in contracting markets, we will have to call more customers, not just the same customers more often. Many of us who have established connections haven’t prospected in a while. This won’t play in a contracting market. The good news is we are going to be better prospectors than we think we are. We have experience. We must use it. An experienced seller will have a much better chance to break into accounts and break into them quicker than a rookie salesperson. Prospect, you’ll be pleasantly surprised by the results.

Go to customer need. As salespeople, we need to get off the “Wow, this is a terrible market” conversations and start talking about customer need. So many sellers join in the negative conversations started by customers. Don’t be one of them. Negative, down market conversations do not lead to sales. Get off the negative and talk about customer need. We will have to dig. If we find out that the person we are talking to doesn’t have an immediate need, let’s find out when they will have a need, end the conversation, and move on.

Start positive. This may seem very simple, but is often overlooked by salespeople. We need to go into conversations with a positive first sentence. “John, I’ve got something that I know will make you money.” “Judy, I’ve got

------------ BY JAMES OLSEN

exactly what you’ve been looking for.” Even with negative customers, we have control of our first sentence; we need to make it a positive one.

Treat contracting markets as opportunities. “Yes, some people have lost faith in this market. Isn’t it great, Mr. Customer? This is a great opportunity for us to make great deals. Speaking of great deals...”

Pick something and promote it. Going to customers in any market and asking them, “Do you need anything?” is the worst salesperson’s opening of all time. The “What are you needing?” opening is even worse in down markets. We must promote something to our customers. Even if customers deny our initial promotion, they will open up to us, and tell us what they do need. Push for volume. When we reach agreement with customers on a price that works, we must push for volume. Tying customers down to a price can be difficult. In contracting markets it can seem impossible, so when we do get our customers to agree on a price, we must push for one more, two more or a contract at the given price. The rookie mistake is to be overly thankful or satisfied with the single order. The professional seller pushes for volume on any agreement.

Take all offers. When markets are good we may fight for a better price. This is good salesmanship. When markets are contracting, we must take the offers we get and work them to death. When we can’t meet the terms of our customers’ offers, it is imperative that we come back to our customers talking about the positives. Three mistakes

made by sellers when coming back on an offer to a customer whose specifications haven’t been met:

(1) Starting with the negative. “Well, John, we couldn’t get the price done ...” It doesn’t matter what we say next. We’ve started negative and have given our customer permission not to buy. Instead of starting negative, let’s start positive: “John, great news, we got the tally you wanted, the shipment you wanted and we got very close to the price we are looking for…”

(2) Acting embarrassed. We are not embarrassed if the specifications aren’t met. We accentuate the positive and keep selling (with our heads high).

(3) Stop asking for offers. Many sellers will be embarrassed when they don’t meet their customers’ offers and will stop asking for offers. This is a mistake. Contracting markets call for offers. Keep asking for them and keep working them. Not all of them will work out, but some of them will.

Champion sellers will continue to sell in the face of negativity. The rest will let the market dictate their success. Which kind of seller are we? Contracting markets will tell us. BPD

JAMES OLSEN

James Olsen is principal of Reality Sales Training, Portland, Or., and creator of SellingLumber.com. Call him at (503) 5443572 or email james@realitysalestraining.com.

------------

BY PAIGE McALLISTER

PAID TIME OFF is a common benefit offered by many companies to their employees as part of their total compensation package. While federal law does not require any such paid time off, many states have regulations that require employers to offer employees paid time off and/or paid leaves of absence in some form.

We know it can be challenging to track what is required, so we have compiled state sick and family/medical leave below. We are also including highlights of recent or upcoming changes within those categories to help you make necessary adjustments.

Sick time: While federal law does not mandate sick time, some states do require employers to provide certain employees paid sick time to use for covered reasons, such as for their own or a family member’s diagnosis or treatment of a health condition or preventative care. Those states include Arizona, California, Colorado, Connecticut, Delaware, Maryland, Massachusetts, Michigan, Minnesota, New Jersey, New Mexico, New York, Oregon, Rhode Island, Vermont, Washington and Washington, D.C. In addition, Illinois, Maine and Nevada offer similar time-off policies that employees can use for any purpose.

Alaska: New Paid Sick Time (effective July 1, 2025) All employers must provide all employees (including fulltime, part-time, temporary, and seasonal) with paid sick time, accrued at a rate of one hour for every 30 hours worked. Sick time can be capped based on the company’s total number of employees. The cap for employers with 14 or fewer employees is 40 hours, and for those with 15 or more employees, the cap is 56 hours. Any unused sick time must carry over into the next benefit year with no cap or loss of benefit. Employees can use this sick time for covered reasons and cannot be required to provide documentation for absences shorter than three days.

Maine: Increases to Paid Time Amounts (effective Sept. 24, 2025) Currently, employees can accrue up to 40

hours of paid time off in a benefit year and can carry over up to 40 hours of unused paid time off into the following benefit year; however, employers can cap an employee’s total balance to only 40 hours. Under the new changes, employees will be able to accrue up to 40 hours on top of carrying over up to 40 hours, which means they could have a balance of up to 80 hours after two years of accrual with no use.

Missouri: Sick Leave Law Rescinded (effective Aug. 28, 2025) The new law, which went into effect May 1, 2025, was rescinded as of Aug. 28, 2025. Any sick time accrued during this period must be provided, but no additional time must be accrued or provided.

Nebraska: New Sick Leave Law (effective Oct. 1, 2025) Under the Nebraska Healthy Families and Workplace Act (HFWA) employers with 11 to 19 employees must provide up to 40 hours of sick time to all employees who work at least 80 hours for their company, and employers with 20 or more employees must provide up to 56 hours of paid sick time each year. (Employers with 10 or fewer employees are currently exempt from providing sick time.) Accrual starts after the employee completes 80 hours of employment. Employees must be allowed to carry over all unused sick time into the next benefit year.

Oregon: Sick Leave Expanded to Blood Donation (effective Jan. 1, 2026) Employees can use paid leave for time off to donate blood.

Washington: Sick Leave Reasons for Use Expanded (effective July 27, 2025) Employees can use mandated sick leave to prepare for or participate in any judicial or administrative immigration proceeding for the employee or their family member.

(Effective Jan. 1, 2026) Employees can use available paid sick time for time taken due to them or a family member being a victim of a hate crime.

Medical or family leave: Under the Family and Medical Leave Act (FMLA), federal law requires all employers with

50 or more employees to offer job- and benefit-protected leave to eligible employees for covered reasons. This time is not paid.

In addition to FMLA, several states mandate additional paid and/or unpaid leave for employees taking covered reasons. These states include Alabama, Alaska, California, Colorado, Connecticut, Hawaii, Kentucky, Massachusetts, Minnesota, New Jersey, New York, Oregon, Rhode Island, Vermont, Washington and Washington, D.C.

Changes to Established Paid Leave Laws

Colorado: FAMLI Revisions (effective Jan. 1, 2026) Employees will be allowed to take an additional 12 weeks in addition to the 12 weeks of bonding time (so 24 weeks total of FAMLI) if their newborn child is in the neonatal intensive care unit (NICU).

Washington: Updates to PFML (effective Jan. 1, 2026) Several changes including:

• Job restoration protections for all employees in PFML who have worked 180 days are being phased in as follows:

o Current: Employers with 50 or more employees;

Q. We allow employees to decorate their workstations, cubicles, and desks with personal items to help them feel more comfortable at work. However, a couple of people take it to extremes, especially during the holidays. They bring in scented candles, which irritate a co-worker with allergies, and have so many knickknacks across their work surface that they don't have room to work. Is there anything we can do to get this under control without completely prohibiting personal decorations?

A . This sounds like a classic situation: there are always one or two employees who need to push the limits of any perk or flex. As with most of those, you can set limits for personal decorations.

Consider limiting the number of items a person can have in their workspace. You can also limit the size and type to whatever you think would allow them to express their personality while also giving them the room to work without being distracting to others. For example, allow one or two small pictures and/or any diplomas. If they want to decorate for the holidays, allow one or two small pieces of decor. When they want to bring something new in, they need to remove something else.

You should strictly prohibit any discriminatory items, harassment, or sexual harassment (no more swimsuit or fireman calendars), as well as anything that would create a health or safety risk for any or all employees. You can also prohibit other items that impact the environment, such as those with scents, that make noise, that have flashing lights, or that are just distracting.

You shouldn't blame another coworker's needs for your decision (i.e., “You can't bring in anything scented because of Susie’s allergies”) but instead make it a general statement about making the workplace more comfortable for all.

If employees still cannot control their workspace, you can start disciplinary action or institute a strict prohibition on everything.

o Jan. 1, 2026: Employers with 25 or more employees;

o Jan. 1, 2027: Employers with 15 or more employees; and

o Jan. 1, 2028: Employers with 8 or more employees.

• Employers can count time taken under FMLA toward the PFML job restoration protections if they notify the employee of this intention within five days of receiving a request, even if the employee is not receiving PFML benefits.

• Health benefits must be continued for the entirety of PFML regardless of any FMLA protection.

• Employees can take PFML in increments of at least four consecutive hours.

Delaware: New Paid Family Medical Leave (PFML) Payroll deductions started Jan. 1, 2025; claim submissions begin May 1, 2026.

Employees who work at least 60% of their time in Delaware and have worked for their employer for 12 months or longer and have at least 1,250 hours of employment in the past 12 months are eligible for up to 12 weeks a year of paid leave. Employees can use a combination of up to 12 weeks in a lump-sum or intermittently to care for a new child (the full 12 weeks) and up to six weeks for their own serious medical condition or injury, to care for a family member with a serious health condition, or to take time when a family member is overseas on a military deployment. Employees must file through the state’s LaborFirst Claimant Portal for paid benefits, but must also provide their employer with advanced notice when possible.

Maine: New Paid Family and Medical Leave Payroll deductions started Jan. 1, 2025; claim submissions begin Jan. 1, 2026.

Employees who work in or whose operations are based in Maine are eligible to up to 12 weeks a year of paid leave for family leave, medical leave, safe leave, or military family leave. Leave can be taken in a lump sum or intermittently with job protection if they were employed for more than 120 days prior to going on leave. Employees must file through the state’s Paid Family and Medical Leave Benefits Authority and provide their employer with advanced notice when possible.

Maryland: Family and Medical Leave Insurance (FAMLI) program Payroll deductions delayed until Jan. 1, 2027; benefits delayed until Jan. 3, 2028.

When implemented, FAMLI will provide eligible employees with job protection and pay replacement of up to $1,000 per week for up to 12 weeks for covered leave. BPD

is vice president for compliance with The Workplace Advisors, Inc. Reach her at (877) 660-6400 or paige@theworkplaceadvisors.com.

IT SEEMS AS IF thousands of new building products hit the market each year, and many of them make claims about how green they are. The option to choose green products is increasingly important to both consumer perception and business resilience in the lumber retail world. How much of these green claims are true, and how do you best choose and promote products your customers want that meet their environmental demands?

On the forest products side, choosing lumber harvested under sustainable forestry practices is gaining ground. From a retail perspective, stocking lumber products with sustainable storylines that include knowing the stops in the supply chain is one way to differentiate your yard from others.

In lumber retail, green credentials refer to the verified environmental responsibility of your products and operations. These signal to your customers that the lumber you sell comes from responsibly managed forests, has a low environmental impact (think: sourcing, milling, transport), and supports sustainable forestry and biodiversity.

On the consumer side, homeowners, architects and builders increasingly ask for proof of sustainable sourcing. Offering traceable lumber shows credibility and aligns with growing client wants, needs, and values.

It’s common for lumberyards to compete on price and availability. Taking it a step further, green credentials create a story, a value proposition beyond the normal “here’s what we have in stock.” By promoting your focus on environmental products, you’re selling purpose as well as product.

When builders and developers must meet green-building standards, offering regionally grown wood can help them earn sustainability points. Municipalities, schools, corporations and the like often have sustainability requirements for their projects and products. Stocking regionally grown lumber can help them meet their environmental goals.

Big picture: lumberyards that commit to regionally grown, regionally sourced, regionally procured lumber have the opportunity to earn reputation benefits that can potentially outlast the ups and downs of market cycles.

Lower carbon footprint. Regionally grown lumber requires less transportation, dramatically reducing emissions. The “low-miles lumber” message resonates with sustainably focused customers.

Resource efficiency. Maximizing regional species supports natural forest cycles and reduces dependency on long-haul lumber species that, while being trucked across the country, carry higher environmental costs.

Climate resilience. Regionally managed forests often follow stricter reforestation and stewardship standards tailored to their exact ecosystem. This can include protecting water quality, wildlife and soil health. And for the record: across the U.S., the standard is planting three to five trees for every one harvested. Which totally explains why our forests are stronger and heartier than they were 100 years ago.

Buy local/regional, support local/regional. Purchasing from regional mills sustains local jobs, reinforces tax bases, and sustains rural communities. What a great story to share with your customers.

Buy local/regional, receive local/regional! Regionally sourced lumber is less vulnerable to international tariffs, currency fluctuations, global shipping delays, and more, offering increasingly critical advantages.

Authentic storytelling. Lumberyards that promote regional wood can quite literally sell the story. For example: “This eastern white pine came from a family-managed forest right here in Maine, it was harvested (and replanted!) sustainably, and it was milled right down the road at a family-owned lumber mill.”

Telling Your Green Story: Next Steps

Wondering how to leverage these points in your retail strategy? Here are just a few ideas.

Do This The Impact

Label and promote sustainably sourced or regional lumber clearly Create signage/digital content with local origin stories Educate your sales team

Highlight these stories in marketing

Customers can make informed choices and your yard is viewed as an expert resource

Adds perceived value and meets customer green product desires

When staff can speak to the “why” of green and regional lumber, it builds trust and differentiates service

Reinforces credibility, appeals to ecoconscious contractors and homeowners

Choosing regionally grown lumber isn’t just a sustainability statement, it’s a smart business move. Supporting local businesses, local mills, local foresters—all of this keeps rural economies strong. Supply-chain resilience is realized by the availability of regionally sourced wood that isn’t affected by national and international demands.

When coupled with education and executed correctly, the green story behind “regional” can become a powerful selling tool. Customers appreciate that their lumber products are from close to home, and lumber origin stories service to build customer loyalty that’s rooted in authenticity and sustainability BPD

------------

BY DAVE KAHLE

has increased, the growth in complexity has multiplied, and information has proliferated at an unprecedented pace. We are in extraordinary times. And unprecedented times call for unique and disciplined approaches if we are to survive and thrive.

The only sure way to deal with this pace of change is to nurture the skill of changing ourselves as rapidly as the world is changing around us. And that makes learning the ultimate success skill for our generation.

When most of us hear the word “learning,” we often associate it with formal school, or perhaps seminars and company-sponsored training programs. While these are all means of facilitating learning, they don’t capture the essence of what I’m talking about.

Product knowledge is the decisive advantage that turns a good salesperson into a trusted advisor. Among the best resources are:

1. NAWLA Academy. Online courses tailored to LBM wholesalers, covering product categories, best sales practices, negotiations, inventory management, marketplace trends, and more.

2. SellingLumber.com. Selling Lumber: The Virtual Sales Manager packages a full program of sales materials from James Olsen of Reality Sales Training, including 46 video lessons, quizzes, two downloadable ebooks, plus 200 short videos.

3. Dealer associations. All the state and regional dealer associations, including NRLA, BMSA, LAT, FBMA, CSA and BLD Connection, present periodic courses and webinars on sales, estimating and operations, and several host an online repository of past seminars.

4. NELMAtv. YouTube channel with a treasure trove of tips to help sell wood, including DIY videos, installation videos, trends pieces, and Maine Cabin Masters spots.

The kind of teaching/learning that is done in academia revolves around the transfer of information. The focus is on what you know, and the measurement is the score on an exam.

For adults, on the job, the focus is different. Here it is all about behavior change. I often tell salespeople in my seminars, “I don’t care what you know. You are not paid for what you know. You are paid for what you do.”

Learning is the ability, on the part of the individual, or the organization, to absorb new information about the world or oneself, and to change one’s behavior in positive ways in response to it. The key is behavior change. Learning without action is impotent. Knowledge that doesn’t result in changed action is of little value.

The key is behavior change. Learning without action is impotent. Knowledge that doesn’t result in changed action is of little value.

Let’s say, for example, that you invest in a new software program. You bring in the trainers and dedicate time to training your staff on the new program. The trainer gives a final exam, and everyone passes with 100%. The next day, no one uses the new software. They learned it intellectually, but never made the leap to changed behavior. For adults, on the job, knowledge that doesn’t result in changed action is worthless.

So, changed behavior is synonymous with learning. Whenever we speak of learning, we are talking about changing behavior.

This kind of learning, which I call Professional Learning, manifests itself as both a personal discipline, as well as a strategic piece of an organization’s culture.

Professional describes both the mind-set of the learners and the approach to the challenge. It’s like golf. Everyone can golf just like everyone can learn. Eventually the ball will go into the hole.

However, if you were going to make your living at golf, you would take on a whole different approach. You would seriously devote time, energy and money to the process

of improving your golf game. Rather than being an occasional event, golf would become a key focus in your life. You’d invest in the best clubs, hire the best coaches, practice regularly, and create the necessary disciplines and habits. Improving your golf game would be a necessary avenue to financial survival and success.

So, it is with learning in our frenetic world. Like golf, one can do it occasionally, or decide to be a professional. A professional learner understands that learning is the key to survival and success. He/she decides to make it a key focus in life, investing time, money and energy in the routines, habits and tools that will enable greater and more rapid learning.

A professional golfer engages with some aspect of the game every day. So, too, a professional learner is occupied with the attitudes, disciplines and tools of learning.

This kind of learning is intentional.

Intentional means that the learner, or the learning organization, decides to learn. It doesn’t happen by osmosis. Just like one doesn’t accidentally become a tournament level golfer, so too one doesn’t unconsciously stumble into becoming a professional learner. It is easy to understand the decision to learn a specific skill—say a new software program—as something that circumstances require occasionally. Occasional requirements to keep up with company dictates is not what I’m talking about.

That’s a watered-down version of the kind of commitment to which I’m referring. This kind of commitment is to a lifetime of continuous growth. The intentional learner understands that the need to continually learn is the ultimate skill for success and survival in our hyper-frenetic age. So, he/she makes an intentional commitment to the life-long pursuit of continuous growth, deciding to build in habits, attitudes and skills that will enable continuous and life-long behavior change.

This kind of learning is proactive. It’s one thing to react to an employer’s requirement to learn a new software program, and it’s

quite another to decide to develop the skill necessary for a potential promotion. The pro-active learner narrows in on a goal to be accomplished or an interest to be developed and takes the steps to acquire the skills and competencies necessary.

Just like professional golfers are continuously focusing on one aspect of the game at a time, so professional learners keep a list of things to be learned. The list is dynamic, continuously evolving. Items on the list come from multiple sources: introspection, goal setting, and the stimulant of regularly engaging with new information.

In a world that is changing as rapidly as ours is, the ability of every individual to learn and grow, at least

as rapidly as the world is changing around us, is the fundamental skill we must master if we are going to survive and prosper in these turbulent times. BPD

Dave Kahle is a leading sales authority, having presented in 47 states and 11 countries and written 12 books including How to Sell Anything to Anyone Anytime and The Good Book on Business. For more information, visit davekahle.com.

Over 100 Years in Business

West Fraser Timber will permanently close its lumber mill in Augusta, Ga., as well as its facility in 100 Mile House, B.C., by the end of 2025 following an orderly wind-down. This decision is the result of timber supply challenges and soft lumber markets.

West Fraser is also announcing that the 2024 indefinite curtailment of its lumber mills in Huttig, Ar., and Lake Butler, Fl., will now be permanent, and the mills will be dismantled and the sites sold. The replacement mill in Henderson, Tx., has commenced start up and the adjacent mill has ceased operations.

The closure of the Augusta lumber mill is a result of challenging lumber demand, and the loss of economically viable residual outlets, which combined has compromised the mill’s long-term viability. The closure will impact approximately 130 employees at the site and reduce

West Fraser’s capacity by 140 million bd. ft.

The 100 Mile House lumber mill is no longer able to reliably access an adequate volume of economically viable timber. Challenging softwood lumber demand, higher duties and additional tariffs have compounded this situation. The mill closure will impact approximately 165 employees at the site and reduce West Fraser’s capacity by 160 million bd. ft.

West Fraser expects to mitigate the impact on affected employees by providing work opportunities at other company operations, where available.

The company said the closures should better position it to compete in this challenging environment. The company expects to record restructuring and impairment charges in the fourth quarter of 2025 as a result of the moves.

Do it Best and True Value have opened a new regional technology center in the Dallas-Fort Worth area, reinforcing its commitment to digital transformation, attracting top-tier talent, and delivering long-term growth for its Do it Best and True Value store owners.

The new tech center is part of the company’s broader strategy to expand its capabilities and drive operational excellence across its significantly larger enterprise. Located at the Cypress Waters campus near the DFW airport, the facility provides a flexible, modern space where new team members can onboard effectively, collaborate in person, and immerse themselves in the company’s culture.

“Building for the future requires both vision and action,” said CEO Dan Starr. “By opening this tech center in Dallas-Fort Worth, we’re expanding our IT capabilities, accelerating critical initiatives, and ensuring all our dealers have the innovation and operational strength they need to succeed in today’s competitive retail marketplace.”

“The Dallas/Fort Worth region was chosen for its unmatched advantages. In addition to being home to

more than 100 of Do it Best Group’s technology and vendor partners, along with two distribution centers in Corsicana and Waco, the area offers one of the strongest IT and retail technology labor markets in the country,” said CIO Ken Widner. “This allows the company to recruit top talent while maintaining close proximity to key partners and resources.”

Do it Best and True Value are immediately recruiting for IT positions, with a goal to build out the team over the next year. These roles include software engineers, analysts, and leadership positions.

Leaders from the company will guide the new hub’s development, instilling its values, culture and growth mindset as the team comes online. The hub will play a critical role in advancing technology initiatives, improving efficiencies, and creating momentum across the enterprise.

“This expansion demonstrates our transformational thinking and our confidence in the future of the Do it Best Group,” added Starr. “Our store owners can be assured that we are making the right investments in technology and talent to help guide everyone’s businesses forward with strength, stability and innovation.”

Mead Lumber held a Dec. 2 grand opening celebration at its new lumberyard in Sioux Falls, S.D.—its 54th location overall.

Home Depot plans to begin construction next year on a new home center in Huntsville, Al.

Sayers Hardware, Independence, Ks., has been placed up for sale with the coming retirement of fourth-generation owners Steve and Vava Sayer.

Stoughton True Value, Stoughton, Ma., is liquidating.

Hometown Hardware is set to break ground this month on a 20,000-sq. ft. Ace store in Brookshire (Houston), Tx.

Ace Hardware is nearing completion of new stores in Traverse City, Mi., and Cedar Knolls, N.J.

Gavin’s Ace Hardware held a grand opening celebration Nov. 13 at its new branch in Fort Myers Beach, Fl.

Sullivan Ace Hardware, Sullivan, Mo., is rebranding as R&R Ace, three years after the store was purchased by the Parks family, owner of R&R Ace, St. Clair, Mo.

Hendersonville Ace Hardware, Hendersonville, Tn., owner Greg Yandell has leased space to open a branch in Tullahoma, Tn.

Toccoa Hardware & Power Equipment, Toccoa, Ga., will convert to an Ace Hardware location early next year.

Harris Ace Hardware, Brevard, N.C., is closing after 53 years. The store was acquired two years ago by McNeely Companies, which operates another location in town.

Anderson Hardware, Anderson, Mo., has opened.

Lakeview Ace Hardware, Lakeview, Oh., opened store #3 in Cortland, Oh.

Windows & More opened a new showroom Nov. 11 in New Bern, N.C.

Matt’s Cash & Carry Building Materials, Palmview, Tx., was voted Best Building Supply Store by CommunityVotes Mission 2025.

Holston Hardware, Bristol, Tn., is celebrating its 90th anniversary.

AS 2025 COMES TO A CLOSE, WE WANT TO THANK OUR VALUED CUSTOMERS FOR YOUR CONTINUED TRUST AND PARTNERSHIP THROUGHOUT 2025. DESPITE FACING INDUSTRY CHALLENGES, YOUR SUPPORT HAS REMAINED THE FOUNDATION OF OUR SUCCESS.

WE LOOK FORWARD TO AN OPTIMISTIC 2026 AND ARE HERE TO SERVE YOUR NEEDS IN COMMODITY PLYWOOD, SIDING, SANDED PANELS, INDUSTRIAL PRODUCTS, STUDS, CONCRETE FORMING, SIGN-MAKING PANELS, VENEER, AND BY-PRODUCTS

WISHING YOU A JOYFUL HOLIDAY SEASON AND A SUCCESSFUL NEW YEAR!

Builders FirstSource has acquired the assets of Lengefeld Lumber, Temple, Tx.

A fourth-generation, family-owned business serving Central Texas since 1951, Lengefeld is known for its integrity, teamwork, and dedication to helping customers and partners.

Rentner Lumber & Supply Co., Holland, Oh., is closing after more than 70 years and liquidating its assets with the coming retirement of longtime owner John Rentner.

Pamela Rose Auction Co. accepted bids on a range of stock, including delivery trucks, forklift, pallet racking, woodworking tools, saws, hardware and lumber. Bidding ended Dec. 1.

Rentner has served as president since 1988. The business was founded in the mid-1950s in Sylvania, Oh.

ProTec Panel & Truss, Bremen, In., acquired Barry County Lumber/Brown’s Carpet One, Hastings, Mi., Nov. 1.

Since 1945, Barry County Lumber has been a cornerstone in its community, known for quality products and trusted relationships.

The addition will enable ProTec to:

• Serve builders directly in North-Central Indiana, Southwest Michigan, and the commercial market

• Continue its two-step partnership model with lumberyards across Northwest Indiana, the Lafayette area, and Eastern Michigan

• Strengthen purchasing, logistics, and service across every region it serves

Barry County Lumber will retain its current name and personnel, but now backed by the manufacturing power and customer focus of ProTec.

Separately, one week later, the first trusses rolled off the line at ProTec’s new $3-million facility in Battle Creek, Mi. The new capability allows the company to serve the Hastings market with a fully integrated solution that combines local lumber supply with ProTec-built trusses, wall panels, and engineered wood.

Great Lakes Ace Hardware agreed to buy Macomb Ace Hardware, Macomb Township, Mi. The transaction is expected to close on January 11, 2026.

Founded in 2007 by Greg Oman following a successful corporate career, Macomb Ace Hardware has served as a trusted resource for Macomb Township and neighboring communities for more than 18 years.

Oman said, “Our goal was to be a difference maker and trusted neighbor in our community by providing real value through knowledgeable service, quality products, and convenient access to home improvement solutions. I am incredibly proud of what we’ve built. Most of all, I’m grateful to our team members who brought that vision to life each day by delivering on the Ace Helpful Promise.”

Headquartered in Farmington Hills, Mi., Great Lakes Ace currently owns and operates more than 75 stores in Michigan, Ohio, Indiana, Illinois, and Kentucky. Great

ABC Supply opened a new location in San Antonio, Tx. (Joseph Martinez, branch mgr.).

CMPC is investing $30 million into Powell Valley Millwork’s facilities in Clay City and Jeffersonville, Ky., which are anticipated to double their production capabilities.

Southern Forest Industries temporarily idled its sawmill in Smarr, Ga., after its tenant and largest customer, PalletOne, discontinued pallet manufacturing at the site.

RSS Millworks, Prospect, Ct., will relocate to a larger, 30,660-sq. ft. facility it acquired in Cheshire, Ct.

Southern Veneer Specialty Products, Fitzgerald, Ga., plans to shutter its plywood and veneer mill in Moncure, N.C., on Dec. 5. It acquired the facility from Boise Cascade in 2019.

Lawrence Lumber Co. has placed its 29-acre hardwood lumber concentration yard in Newton, N.C., up for sale.

Walton Lumber, Millington, Mi., has acquired Wallick Post & Lumber, Peru, In., and is combining the companies as Legacy Post & Supply. Former owners Randy Wallick and Ruby Martin are retiring.

Irving Forest Products’ sawmill in Dixfield, Me., suffered extensive damage from a Nov. 1 fire.

Hampton Lumber broke ground Nov. 5 on its $225-million, 375,000-sq. ft. lumber mill in Allendale County, S.C.

Pleasant River Lumber’s mill in Dover, Me., is adding a second Automated Lineal Grading System from USNR as part of a project to replace an older Autolog grader.

BlueLinx has expanded its distribution of RDI Railing and MoistureShield decking from eight to 16 locations. MoistureShield is new to Long Island, N.Y., while RDI coverage now includes Long Island and Buffalo, N.Y.; Akron and Cincinnati, Oh.; and Pittsburgh, Pa.

Weekes Forest Products is now stocking Trex decking and railing at its St. Paul and Moorhead, Mn., branches, expanding its distribution of the products into Minnesota, Wisconsin, Iowa and North Dakota.

Specialty Building Products has expanded its distribution of Trex decking and railing products in Michigan through its Amerhart distribution centers in Jackson and Traverse City, Mi.

Boise Cascade has expanded its distribution of AZEK Exteriors and TimberTech decking and railing products to Pittsburgh, Pa.; Baltimore, Md.; and Washington, D.C.

Lakes Ace is a wholly owned subsidiary of Ace Retail Holdings. A division of Ace Hardware Corp., Ace Retail Holdings currently owns and operates more than 250 Ace Hardware stores nationwide under the Breed & Co., Buikema’s Ace, Dennis Company Ace, Great Lakes Ace, Westlake Ace, and Outer Banks Ace brands.

Re Reddwwood i ood is o

It thrives in some of the most productive timberlands in the world. Redwood is known for its timeless durability without the use of chemicals. Due to its flawless formation, there has never been a Redwood recall. There is a grade of Redwood for every application, every budget, and every customer.

“Growing beyond measure.”

Call or visit us today. Our family of Redwood timberland owners will continue to be your reputable and reliable source of Redwood.

Scott Poole has been appointed CEO of RoyOMartin, Alexandria, La. , effective Jan. 1, 2026, marking the first time a non-Martin family member will lead the company in its century-long history. He succeeds Dr. Roy O. Martin III, who will continue to serve as chairman of the board and assume additional responsibilities as chief investment officer.

Elizabeth Grant, ex-L&W Supply, has joined Hoover Treated Wood Products, Fairfield, Tx., as regional business mgr. for Texas.

Tony Sheffield, chief financial officer, The Westervelt Co., Tuscaloosa, Al., will add the title of president, effective Jan. 1, 2026. He succeeds Cade Warner, who will expand his role as CEO to place greater emphasis on long-term value creation across the organization. Ray Colvin has been named VP, real estate & resource investments, and Mike Williams, VP, corporate strategy, improvements & development.

Corey Johns, ex-Weyerhaeuser, has moved to Rex Lumber, Brookhaven, Ms., as purchasing mgr.

Buddy Stewart, ex-Nation’s Best, has been named store mgr. of Cain Hardware & Lumber, Carthage, Tx.

Justin Smith, ex-LBM Advantage, was appointed VP of purchasing for Guys Lumber & Hardware, Centerville, Tx.

Amanda Conklin, ex-ABC Supply, is now in outside sales with Carter Lumber, La Vergne, Tn. In Columbia, S.C., Thomas Ashley has been promoted to purchasing/ inventory mgr., and Heath Cundey, ex-Harbin Lumber, is new to outside sales.

Todd Durost, ex-Home Depot, is now with Raymond Building Supply, Kissimmee, Fl., as a central Florida territory mgr.

Jennifer Turner-Ozimek, ex-LP, has been named VP of sales for Allura USA, Houston, Tx.

Jenlian Chadwick will be promoted to president of Seaboard International Forest Products, Nashua, N.H., effective Feb. 1, 2026. She will replace Jim Dermody, who is retiring after 32 years with SIFP, the last 16 years as president. He will continue as a senior advisor. Ricky Leclerc will step into the role of VP of trading.

Andrew Choquette, ex-National Vinyl, has been named general mgr. of Suffield Lumber, West Suffield, Ct.

Michael Isaacs has joined the outside sales force at Totem Lumber & Supply, Wood Dale, Il.

Dwayne Wilson has been promoted to branch mgr. of Tri-State Forest Products, Hubbard, Oh. Ed Atwell, ex-Richland Laminated Columns, is now in outside sales with Tri-State.

Kaci Nichols, ex-Snavely Forest Products, is new to Boise Cascade, Hondo, Tx., as millwork account mgr.

Pierson Duce, ex-Manning Building Supplies, has moved to outside sales at Tibbetts Lumber, Jacksonville, Fl.

Jason Ringblom, president, LP Building Solutions, Nashville, Tn., will succeed Brad Southern as CEO when Southern retires on Feb. 19, 2026. Alex Walter, ex-Cameron Ashley Building Products, is now with LP, as Columbia, S.C.-based territory sales mgr. Parry Healy at LP in Columbus, Oh., is transitioning to territory sales mgr. after a decade on the marketing side.

Will Bierwirth has joined the sales team at Longleaf Lumber, Cambridge, Ma.

Troy Stoike, ex-Bloedorn, is now director of branch operations for Carhart Lumber Co., Wayne, Ne.

Tristan Mullen is now co-mgr. of 84 Lumber, Asheville, N.C. Ethan Lewis, ex-Builders FirstSource, has moved to outside sales at 84 in Austin, Tx.

Joe Burlison, ex-LBM Advantage, has been named president of Southland Lumber Co., Conroe, Tx.

Ryan A. DeBee, ex-Simpson Strong-Tie, has joined the sales team at Walker Lumber & Supply, Nashville, Tn.

Bruce Baker has retired after 42 years in eastern North Carolina sales with National Gypsum.

Connor Foley, ex-Sherwin-Williams, has moved to inside sales at Suburban Lumber Co., Cedar Rapids, Ia.

Caitlin Smith has been promoted to siding & trim product mgr. at BlueLinx, Dallas, Tx. Logan Bevis is a new national accounts rep with BlueLinx in Marietta, Ga. Lou Anne Liles, territory mgr. for BlueLinx in Butner, N.C., has retired; she started in the industry in 1930 with Carolina Builders.

Trent Larch, ex-Dock Supply Co., is the new branch mgr. at Decks & Docks, Chattanooga, Tn. Robbie Shoe has transferred as branch mgr. from Des Moines, Ia., to Rogers, Ar. Ian Pontious, ex-Huston Lumber & Supply, is now branch mgr. for Decks & Docks in Butler, N.J. New to inside sales are: Denny Pennycuff, Indianapolis, In., and Jakob Schmidt, Downington, Pa.

Sierra Tommas has joined Sterling Doors & Windows, Englewood, Fl., as strategic account mgr.

David Kraus is now in outside sales with Overseas Hardwoods Co., Mobile, Al.

Ryan Steed, ex-Bienville Lumber, has been named inside sales coordinator for Mid-States Wood Preservers, Simsboro, La.

Charles Johns has been promoted to director of special wood products for LMC, Wayne, Pa. He succeeds Ron Thompson, who retired after 25 years with the company. Lauren Brady is now director of corporate meetings.

Casey Morgan has been promoted to store mgr. of Ace Hardware, Port Royal, S.C.

Matthew Guertin, ex-Vicwest, joined Atlas Building Products as territory sales mgr. in the Southeast.

Addie Atkins, ex-Boral, has joined Benjamin Obdyke, Horsham, Pa., as market development mgr. for eastern Massachusetts.

Jim O'Donnell, ex-SRS Distribution, has joined the sales force at ABC Supply, Pottstown, Pa. Also new to sales for ABC: David Etley, Dallas, Tx.; Paul Seegott, Atlanta, Ga.; and Thomas Madden, Memphis, Tn.

Aaron McClain has been promoted to mill mgr. at Church & Church Lumber Co., Wilkesboro, N.C.

Judy Haney, Boise Cascade Building Materials Distribution, Boise, Id., was elected chair of the North American Wholesale Lumber Association. She is joined on the executive committee by 1st vice chair Warren Reeves, Wholesale Wood Products, Dothan, Al.; 2nd vice chair Grant Phillips, Wildwood Trading Group, Tualatin, Or.; secretary/treasurer Derek Cone, Capital Lumber Co., Phoenix, Az.; at-large member Thomas Mende, Binderholz Timber, Atlanta, Ga.; and immediate past chair Kyle Little, Sherwood Lumber, Melville, N.Y. The board consists of Kent Beveridge, Skana Forest Products; Brian Boyd, Manufacturers Reserve Supply; Bobby Byrd, RoyOMartin; Tracey Crow, UFP Industries; Harris Gant, Claymark USA; Gavy Gosal, Terminal Forest Products; KayCee Hallstrom, Zip-O-Log Mills; Paul Odomirok, Great Lakes Forest Products & Lamination; Aaron Sulzer, Sierra Pacific Industries; Matt Vaughan, Buckeye Pacific; Morgan Wellens, Nicholson & Cates; Mike Wilson, BlueLinx; Chelsea Zuccato, Patrick Lumber; and Steve Rustja, Cedar Mills Investments.

Brian Pertman is the new president of Top Notch Distributors, Honesdale, Pa.

Jane May is new to outside sales at Lansing Building Products, Tampa.

Jaymien Kelly is new to PrimeSource Building Products, Atlanta, Ga., as national account mgr.-Home Depot. Brendan Johnson is a new territory rep in Tampa, Fl. Skye Svenningsen has been named VP channel marketing & e-commerce.

Jade Verville-Peloquin was named store mgr. at Ace Hardware, Charlevoix, Mi.

Brandon Nicholson is new to outside sales at QXO, Columbia, S.C.

Devin Brady has come onboard to Tando Composites as VP of sales, national accounts.

Eric Murphy, purchasing mgr., East Coast Lumber, East Hampstead, N.H., was elected president of the New Hampshire Retail Lumber Association.

Shanda Lear is new to the lighting department at Mungus-Fungus Forest Products, Climax, Nv., report co-owners Hugh Mungus and Freddy Fungus.

When Griffin Lumber set out to double their impact at their new Georgia facility, they partnered with CT Darnell to turn their bold ambition into reality.

The result? A state-of-the-art facility— combining a full-service lumberyard and a comprehensive 54,400 SF truss manufacturing plant—delivered through a seamless design-build process.

CT Darnell’s LBM expertise and creative design meant smarter storage, efficient SKU management, and optimized facility flow.

THE 2025 LMC EXPO ignited a powerful gathering in Philadelphia, Pa., uniting the champions of the LBM industry, dealers, suppliers, and the LMC team, to set the stage for a breakthrough year in 2026. Over three impactful days, LMC dealers picked up exclusive market insights from forest product leaders, boosted their purchasing strategies with LMC contracts and programs, and connected with top dealers from coast to coast.

The Expo also delivered expert insights on the latest building innovations and product trends, helping members stay ahead of the curve. The event kicked off with a Component Alliance roundtable, Supplier Forum, Business Continuity Panel, and a session on Futures. Additionally, the LMC Kitchen and Bath department hosted a focused, design-sales training tailored specifically for kitchen & bath professionals.

When the show floor opened, the atmosphere was electric. Dealers, suppliers and staff filled the Pennsylvania Convention Center, turning every booth into a busy hub of conversation as they gathered to shape their 2026 purchasing strategies.

Joe Miles, president of rk Miles, West Hatfield, Ma., and LMC chairman of the board, said “The LMC Expo is where our network comes alive. It’s more than buying power, it’s about people connecting and sharing ideas. The tools and opportunities here set us up for real growth in 2026, but it’s the relationships that move our industry forward.”

The convention floor buzzed with direct access to top suppliers, many senior leaders, setting the Expo apart from other events. The LMC team actively supported dealers in leveraging exclusive programs and contracts to build stability in an ever-evolving marketplace.

The Expo concluded with LMC CEO and president Paul Ryan sharing key insights, accomplishments and plans for 2026.

He was followed by a keynote from Jesse Wade, CBE, economist and director of tax and trade policy analysis for NAHB. Wade discussed trends shaping the industry, including the impact of state and federal tax policies, international trade dynamics, and the future of building materials.

Sean Tighe, LMC’s senior vice president of purchasing, remarked, “The LMC Expo prepares dealers for the next year by bringing them face-to-face with all members of the network. When dealers share their challenges and solutions in real time, they realize the strength they gain from being part of LMC. The relationships formed at the Expo are the backbone of our competitive advantage. Helping our dealers buy better and connect deeper makes us stronger together.”

As one of the final celebrations of LMC’s 90th anniversary, the Expo marked both a milestone and a launchpad. Attendees left not only with plans for the future, but also with the tools to execute them.

LMC looks forward to welcoming members to the 2026 LMC Annual in Chicago, March 10–12.

LMC is the longest-standing forest products and building materials buying group in the U.S., serving independent lumber and building material dealers since 1935. In addition to its core dealer base, the organization has long supported component manufacturers and has expanded to serve millwork shops, gypsum specialists, commercial packaging companies, and post-frame building manufacturers, and—added most recently— modular manufacturers. BPD

Cameron Ashley Building Products, Greenville, S.C., has opened a new distribution center in Jacksonville, Fl., strengthening its service capabilities across North Florida and Georgia’s coastal markets.

The expansion gives customers faster, more reliable access to a full suite of residential and light commercial building products. The Jacksonville facility is a core market location, stocking roofing, gypsum, insulation and related accessories.

“This new Jacksonville facility enhances our statewide network, allowing us to deliver faster and more reliably across Florida,” said John Gambone, regional vice president. “By stocking our Core 3 products, we’re giving customers the tools they need to compete and win—backed by same-day or next-day delivery and the product knowledge and service they expect from Cameron Ashley.”

The new facility will be led by distribution center manager Mark Mixon, a veteran professional in the roofing and insulation industries.

Cameron Ashley operates more than 70 distribution centers nationwide.

Rayonier, Wildlight, Fl., and PotlatchDeltic, Spokane, Wa., have entered into a definitive agreement to combine in an all-stock merger of equals, creating a leading domestic land resources owner and top-tier lumber manufacturer.

The combined company will operate under a new name, to be announced prior to closing.

Based on the companies’ most recent stock prices, the deal is worth roughly $8 billion, creating the second-largest publicly traded timber and wood products company in North America. Rayonier shareholders will own approximately 54% and PotlatchDeltic shareholders will own approximately 46% of the combined company.

Together, the combined company will have a diverse, productive timberland portfolio comprising 4.2 million acres, including 3.2 million acres in the U.S. South and 931,000 acres in the U.S. Northwest. In addition, it will

operate seven wood products manufacturing facilities, including six lumber mills with total capacity of 1.2 billion bd. ft. and one industrial plywood mill.

The executive leadership team of the combined company will comprise roughly equal representation of top talent from both Rayonier and PotlatchDeltic. Upon closing of the transaction, Mark McHugh, president and CEO of Rayonier, will continue to serve as president and CEO as well as a member of the board of directors of the combined company. Wayne Wasechek, currently CFO of PotlatchDeltic, will serve as CFO of the combined company; Rhett Rogers, currently senior VP, portfolio management of Rayonier, will serve as executive VP, land resources; and Ashlee Cribb, currently VP, wood products of PotlatchDeltic, will serve as executive VP, wood products.

Eric Cremers, currently president and CEO of PotlatchDeltic, will be executive chair of the board of directors of the combined company for 24 months after closing. The board will be comprised of five existing directors from Rayonier (including McHugh) and five existing directors from PotlatchDeltic (including Cremers). Rayonier will designate the lead independent director.

Corporate headquarters of the combined company will be located in Atlanta, Ga., with significant regional offices maintained in Spokane and Wildlight.

The transaction is expected to close in late first quarter or early second quarter of 2026.

The International Woodworking Fair Atlanta will produce an all-new trade show and conference built to extend and expand IWF’s long-running Atlanta franchise.

IWF West will debut Aug. 25-27, 2027, in San Antonio, Tx., in a three-day trade show built to serve both the burgeoning southwestern U.S. marketplace and IWF’s large national customer base. The new show, which will include a broad selection of educational and social/ networking events echoing the Atlanta Conference programming, will bring the best of the Atlanta product mix together with manufacturers making their IWF debut. But the San Antonio event will also deliver its own unique blend of features and focus, separate and apart from Atlanta.

IWF West is created largely in response to growing exhibitor and attendee customer demand for a new trade show experience timed between the biennial IWF Atlanta stagings and sited in a major southwestern city central to Sunbelt business. To meet those and related customer requirements, IWF West will deliver:

• A concentrated three-day show scheduled for convenience, efficiency and impact.

• A carefully curated mix of manufacturers representing the best of IWF Atlanta plus new first-time exhibitors making their IWF debut.

• A perfectly scaled show floor providing buyers quick and easy access to an extensive mix of machinery, machinery-related products and services, components, supplies and non-machinery related products.

• A more relaxed show environment, in pace and scale, allowing buyers time to explore the products and services they might have missed at IWF Atlanta... and to make more productive connections with new exhibitors.

Enhanced networking opportunities in a show en-

vironment created to help buyers find new ideas, new solutions and new ways to grow their business.