ANNUAL OUTLOOK

Featuring commentary from: AAL Shipping, Al Faris, BBC Chartering, Combi Lift Projects, deugro, DHL Global Forwarding, GEODIS, Jade Management Group, JGC Corporation, Methanex, Mitsubishi Power Americas, Port of Rotterdam, Project Logistics Engineering, Technip Energies, Trans Global Projects and UTC Overseas

Panelists from Women in Breakbulk’s 3 Pressing Topics Shaping Our Industry

Left to right: Diana Davila, UTC Overseas; Jennifer Schuster, Edwards Moving & Rigging/SC&RA; Janet Rojas Galati, Baton Rouge Area Chamber (BRAC); Geanean Ordonez, Technip Energies; Lorena Alvarez, Fluence

4-5

Breakbulk Middle East Feb. 4-5

Dubai World Trade Centre Dubai, UAE

Breakbulk Europe Jun 16-18

Rotterdam Ahoy Rotterdam, Netherlands

Breakbulk Americas Sept. 22-24

George R. Brown Convention Center Houston, USA

Breakbulk Asia Nov. 18-19

Sands Expo and Convention Centre, Singapore

66 Asia

Indonesia’s Nickel Gamble Pays Off Export Ban Creates Processing Hub, Disrupts Global Markets

70 OUTLOOK Americas

Rocket City Ready For Space Command

Huntsville Provides Huge Opportunities as the Center of US Space Logistics

74 OUTLOOK Americas

Scope 3 Reporting To Test

Breakbulk Operators

California Sets 2027 Deadline for Full Supply-Chain Emissions Disclosures

79 Americas

Breakbulk Americas Recap

Highlights and Insights From The 35th Anniversary of Breakbulk Americas

LOOKING AHEAD

Welcome to the annual Outlook issue. Our central story is the 2026 Outlook, built from the perspectives of 16 thought leaders across our Breakbulk community.

You’ll find varying levels of optimism, but also a common frustration with uncertainty that continues to delay project development. My favorite comment comes from Grant Wattman who says, “Just make a decision!” It’s a sentiment many of you may share as you plan for the coming year.

This issue is filled with forwardthinking content. In UpFront, we take you behind the scenes of the very first Future Thinkers meeting, which brought together industry leaders and academics to consider what our industry might look like in 2045. This group will evolve into an international think tank with a mission to help the community understand where opportunities are building and what risks need attention. It’s big-picture thinking with practical applications. Look for analysis and advice from the group in future issues, as well as at all Breakbulk events in 2026.

For quick reads, don’t miss new tech for rail and ports (yes, rail!), “extreme” locations for data centers, a drone-filming guide from Hyve’s head of video (and a familiar face at Breakbulk events), and the seven latest AI trends from Huntsman’s Gulshan Singh, who is also a founding member of Future Thinkers.

In an increasingly connected world, cybersecurity continues to be a top industry concern. AI agents are only exacerbating the problem. Ports Under Siege reveals what cybersecurity experts recommend for the maritime sector as threats become more complex. Future fuels remain a challenge. Despite the IMO’s decision to postpone adoption of its Net Zero Framework for a year, the UAE is pressing ahead with its development of e-methanol. Roll of the dice or a sure thing? Learn more in The Gulf’s Green Bet

Following our global mining overview in the last issue, we zoom in on Indonesia’s move from a nickel exporter to a domestic refiner, a shift already reshaping regional and global supply chains. And there is no question that the U.S. has played an outsized role in the supply chain this year. At Breakbulk Americas in Houston, industry leaders discussed a mix of concerns and opportunities. See the recap starting on page 79 for a candid look at regional perspectives.

We are in the midst of planning our 2026 editorial calendar, which will expand alongside our events portfolio with the launch of Breakbulk Asia in Singapore. You can expect more coverage of Asian markets, along with strong reporting from the Middle East, Europe and the Americas. You’ll also see a tighter integration of media and events as we bring more magazine stories to life on conference stages around the world.

Here’s to a wonderful holiday season. I look forward to seeing you in 2026.

Best,

Leslie Meredith Product and Editorial Director Breakbulk Events & Media

Product and Editorial Director

Leslie Meredith Leslie.Meredith@breakbulk.com

Senior Reporter

Simon West simon.west@breakbulk.com

Designer Mark Clubb

Reporters

Don Horne

Luke King

Iain MacIntyre

Amy McLellan

Malcolm Ramsay Liesl Venter

Breakbulk Magazine Editorial Board

John Amos Amos Logistics

Tina Benjamin-Lea Northvolt Drei Project GmbH

Fayçal Boumerkhoufa Ascent Global Logistics

Dea Chincuanco dship Carriers

Elisabeth Cosmatos Cosmatos Group of Companies/ The Heavy Lift Group

Dennis Devlin DT Project America

Payne Fischer Kuehne+Nagel

Dharmendra Gangrade Larsen & Toubro

John Hark

Bertling North America / Texas A&M University

Itoro Ibanga Air Liquide

Margaret Kidd Houston Maritime Center & Museum

Jake Swanson DHL Global Forwarding

Edward Talbot Roll Group

Grant Wattman Jade Management Group, Inc.

Andrew Young Bechtel Corporation

Portfolio Director

Jessica Dawnay Jessica.Dawnay@breakbulk.com

To advertise in Breakbulk Media products, visit: http://breakbulk.com/page/advertise

Subscriptions

To subscribe, go to https://breakbulk.com/page/ breakbulk-magazine

A publication of Hyve Group plc. The Studios, 2 Kingdom Street Paddington, London W2 6JG, UK

Leslie Meredith

Exhibitors and Breakbulk

Global

Shipper Network members in this issue:

New Tech for Project Logistics (p.10)

DP World, Mitsui OSK Lines (MOL), NYK Group

Movers & Shakers (p.12)

Blue Water Shipping, DHL Global Forwarding, Expeditors, GEODIS, Logistics Plus, Maersk Project Logistics, Rhenus Group, Trans Global Projects, WR Logistics

Stars Aligned for Space Shipping Mission (p.28)

The Heavy Lift Group (THLG)

Global Outlook 2026 (p.33)

AAL Shipping, BBC Chartering, Combi Lift Projects, deugro, DHL Global Forwarding, GEODIS, JGC Corporation, Methanex, Mitsubishi Power Americas, Port of Rotterdam, Technip Energies, Trans Global Projects, UTC Overseas

Ports Under Siege (p.46)

Maersk, Port of Antwerp-Bruges, Port of Bremen, Port Hamburg, Port of Rotterdam

Ten Projects. Ten Months (p.52)

AAL Shipping, AsstrA-Associated Traffic, BBC Chartering, Blue Bell Shipping, CF&S, Collett & Sons, DSV, Goldhofer, JSI Alliance, Mammoet, Port of Antwerp, Técnicas Reunidas, QatarEnergy

The Gulf’s Green Bet (p.58)

AD Ports, CMA CGM Group, DHL Global Forwarding

Indonesia’s Nickel Gamble Pays Off (p.66) Maersk

Rocket City Ready for Space Command (p. 70) DSV

Scope 3 Reporting To Test Breakbulk Reporting (p. 74)

DHL Global Forwarding, Hapag-Lloyd

Breakbulk Americas recap (p. 82)

AAL Shipping, Barnhart & Crane Shipping, BNSF Logistics, DHL Global Forwarding, dship Carriers, Fluence, Fluor, Infyz, Mitsubishi Power Americas, MSC, Siemens Energy, Technip Energies, Wallenius Wilhelmsen

Best of BreakbulkONE (p. 93)

DP World, deugro

Key: Exhibitor

Breakbulk Global Shipper Network Member

New Tech for Project Logistics

Movers & Shakers

How to Shoot Better Drone Footage

Breakbulk Launches Future Thinkers

7 Latest AI Trends

Best of Breakbulk Studios

Energy Explainer: e-Methanol NewsBites

Throwback: James Webb Telescope Transport

Women in Breakbulk Americas

This year saw the opening of the Harbor Bridge Project, the longest cable-stayed bridge in the United States.

Credit: Corpus Christi

NEW TECH FOR PROJECT LOGISTICS

From orbital data centers to autonomous railcars, UpFront gives you a glimpse into some of the most exciting developments driving change across the industry.

Powering Tomorrow’s AI

The last five years have seen exponential growth in demand for data centers, driven by the insatiable computing power requirements of AI, cloud services and global digitalization. To meet this surge, a new wave of solutions is emerging, placing data centers in some of the most extreme environments on Earth … and beyond!

The idea of floating data centers has long attracted designers due to the huge cooling requirements of modern servers. In Yokohama, Japan, a consortium led by NYK Group, alongside NTT Facilities, Eurus Energy and MUFG has begun construction on one of the world’s first commercial offshore floating data centers. With operations slated to start in March 2026, the project will see a containerized data center deployed on a minifloat and powered entirely by solar panels, battery storage and potentially offshore wind.

“We believe the growth challenges data centers face can be overcome by deploying them offshore,” Martin Malmfors, head of communications at NYK Group Europe, tells Breakbulk, noting that they “leverage the maritime industry’s supply chains for production and generate ripple effects that stimulate logistics activity around the installation site.”

The logistics of deploying this new infrastructure — transporting prefabricated data center modules, renewable energy equipment and installation platforms — will inevitably require heavy-lift vessels, specialized trailers and precision project cargo handling.

Meanwhile, Mitsui OSK Lines (MOL) signed a partnership in July to deliver a large-scale floating data center based on retrofitting a car carrier vessel. This is scheduled to launch in 2027 with capacity of 73 megawatts (MW). U.S. firm Nautilus Data Technologies has already launched smaller floating data centers in Stockton, California, and Limerick in Ireland, using barges and water-based cooling to slash energy use and emissions.

If floating data centers represent the cutting edge, then space-based data centers may well be the next horizon. Amazon Web Services (AWS) founder Jeff Bezos has publicly mused about the potential for gigawatt-scale data centers in orbit, where the near-absolute-zero temperatures of space could provide unparalleled cooling efficiency, and solar power could deliver energy without interruption.

“One of the things that’s going to happen — it’s hard to know exactly when, it’s 10-plus years, but I bet it’s not more than 20 years — is we’re going to start building these giant gigawatt data centers in space,” Bezos said. “These giant training clusters, those will be better built in space, because we have

Artist’s rendition of Nautilus floating barge. Credit: Nautilus

A mock-up of a floating green data center using 100% renewable energy.

Credit: NYK Group

solar power there, 24/7. There are no clouds and no rain, no weather.”

Given the scale of these next-generation clusters, transporting and deploying these systems in space will undoubtedly present unprecedented challenges. Yet, if history is any guide, breakbulk providers, with their unmatched expertise in heavy-lift, modular transport and complex logistics, will be at the heart of making these ambitious visions a reality.

Stacking up for the Future

Back on firm ground, DP World has introduced a new solution at its London Gateway hub designed to automate operations and improve loading times at the port. The Empty Superstack system utilizes automated electric stacker cranes to handle empty containers inside a fully enclosed facility at Berth 4 of the port. Each stack can be up to 16 tiers high, and the new system will be capable of holding up to 27,000 TEUs in total, making more room available in the hinterland and reducing moves at the port.

The novel solution has been developed by BOXBAY, a joint venture between DP World and Germany’s SMS group. The technology has completed extensive trials at DP World’s Jebel Ali Port in Dubai, handling nearly 500,000 TEUs, and the partners predict it will greatly improve truck processing times at London Gateway.

“This £170 million investment underscores DP World’s commitment to innovation at London Gateway,” said Stephen Whittingham, EVP, North Europe, DP World. “The BOXBAY Empty Superstack will boost reliability for our customers, minimize truck visit times in port and create a safer, smarter working environment for our people.”

Innovation on Track

Rail transport has long been a steady but unglamourous component of global logistics and one that does not always favor breakbulk. However, a new wave of solutions may be poised to change that. One of the most promising advances for the sector is the arrival of autonomous railcars offering the potential to take cargoes from A-to-B with greater efficiency while avoiding many of the pitfalls of road transport.

Companies like Parallel Systems are already testing selfdriving, platooning railcars on U.S. tracks, with commercial operations expected by 2026. These systems are designed to move intermodal containers short distances, for example at ports or for warehouse-to-rail transfers, without the need for traditional locomotives or couplers. And this promises faster turnarounds, lower emissions and the ability to serve routes previously dominated by trucks.

While currently optimized for containers, the technology’s flexibility hints at future potential. Matt Soule, founder and CEO of Parallel, said there were no “significant technical barriers” to adding breakbulk to the solution. While the firm’s vehicles are currently designed for “lightweight intermodal loads” — equivalent to around two containers in weight — they can be “modified to carry heavier loads as well as provide interfaces for securing breakbulk instead of intermodal containers” should there be “sufficient market demand and the business case to make these accommodations.”

Meanwhile, a new intermodal rail system created by Massachusetts-based developer RailRunner offers potential for breakbulk cargoes to be transported by rail more easily. Their unique chassis system allows standardized trailers to roll directly onto railcars, taking cargoes from road to rail without fuss.

While innovations such as these promise a more flexible future, breakbulk still faces hurdles. Rail systems are normally constrained by gauge limitations, such as bridges, tunnels and station buildings, can all restrict cargo dimensions. Center of Gravity (COG) concerns also loom large for outsized cargoes. Charles Foskett, CEO of RailRunner, said although “palletized or bulk material is much easier to handle” there is still a potential business case for breakbulk. “We’re always open-minded,” he added.

*Breakbulk Exhibitor

RailRunner broad gauge intermediate unit bogie. Credit:RailRunner

MOVERS AND SHAKERS

Highlighting Recent Industry Hires, Promotions and Departures

DHL Global Forwarding

Martyn Lawns has begun his new position as CEO of DHL Global Industrial Projects, succeeding Ryan Foley. Lawns boasts more than two decades of experience in logistics and procurement and has held various executive positions with DHL since joining the company in mid-2014. In his new role, he will focus on expanding DHL’s capabilities in sectors driving the energy transition and infrastructure growth, while also leading the company’s groupwide New Energy growth initiative, which aims to strengthen its role in areas such as electric vehicles, battery supply chains and renewable energy logistics.

“Martyn’s leadership will be instrumental in scaling our Industrial Projects business to meet rising global demand,” said Oscar de Bok, CEO DHL Global Forwarding, Freight. “His appointment supports our ambition to lead in high-value, complex logistics.”

LPX Partners

LPX Partners, the investment and advisory arm of U.S.-headquartered Logistics Plus, has brought in private equity investment professional Nemuulen Tsolmon as its vice president. Tsolmon had been serving as an associate at Cerberus Capital Management, where she contributed to the acquisition and management of Mongolia’s largest telecommunications and fast-moving consumer goods (FMCG) business. She also played a key role in supply chain

transactions spanning subsea cable and shipbuilding projects across the U.S., Asia-Pacific and the Middle East.

“At LPX, Nemuulen will be contributing across both our investment advisory and consulting platform, evaluating strategic opportunities, supporting client engagements, and helping us drive impact across global markets,” LPX Partners said on LinkedIn.

Expeditors

Expeditors has named David Hackett as senior vice president and chief financial officer, replacing Bradley Powell, who was set to retire at the end of September. Hackett joined Expeditors in May 2024 as vice president of finance. Prior to that, he enjoyed lengthy stints at NIKE and KPMG.

“The Expeditors culture is unique, and I appreciate getting to know so many people throughout the organization,” Hackett said. “I’m humbled and honored to build on Brad’s legacy in leading the finance and accounting function as part of the executive team of this great company. I’m also excited to help shape strategy that drives sustainable, profitable and capital-efficient growth for our employees and shareholders.”

WR Logistics

WR Logistics has brought in Yang Jung Min as its new head of Asia, part of the logistics provider’s bid to consolidate its operations in the region. Based in Seoul, Yang will oversee WR Logistics’ operations in Korea and across Asia, leading project execution, customer engagement and market development throughout the region. His focus will be on strengthening WR Logistics’ presence in key sectors such as oil and gas, energy, manufacturing and engineering, while expanding partnerships and client relationships across Europe, the Middle East, the CIS, Africa and Latin America.

“Yang’s appointment marks an important milestone in our strategy for Korea and Asia,” said Wadim Rosenstein, chairman of WR Group Holding. “His leadership, deep expertise and proven ability to execute complex projects will strengthen WR Logistics’ position in one of the world’s most critical regions. We look forward to building further momentum under his guidance.”

Martyn Lawns

Nemuulen Tsolmon

Yang Jung Min

David Hackett

Rhenus Group

Rhenus Group has appointed Peter Nordstrom as CEO for its Air & Ocean division in North America. Prior to joining Rhenus, Nordstrom held senior positions at CEVA Logistics, GEODIS and Kuehne+Nagel and was most recently executive vice president of Ocean Freight Americas at DB Schenker. In his new role the CEO will oversee regional operations and ensure alignment with the company’s global strategic vision.

“North America is a vital region for the organization and plays an important role in our industry as it serves as a connection to global trade, especially in today’s market landscape,” said Jan Harnisch, board member for Air & Ocean. “Strong leadership experience like Peter’s will enhance our market position across the region, driving the next phase of growth and new opportunities to develop.”

Maersk Project Logistics

Rafael Vicens has joined Maersk’s specialized project division, Maersk Project Logistics (MPL), as vice president for India, the Middle East and Africa (IMEA). Vicens has more than 20 years of experience in logistics and shipping, mostly spent in the Middle East for companies including ALE, Almajdouie, Panalpina and, most recently, DB Schenker, where he served as head of global projects and industry solutions for the Middle East and Africa (MEA).

“I feel truly honored and humbled to become part of Maersk. This moment means a lot to me, and I’m filled with gratitude and excitement as I step into this new chapter,” Vicens said on LinkedIn. “I come with an open heart, eager to grow and contribute with passion and commitment. I deeply believe that together we can achieve great things, and I’m proud to now call myself part of the Maersk family.”

GEODIS

Amaury Valicon is set to start his new role in November as executive vice president of Europe at GEODIS. Valicon joined the project forwarder in early 2018, serving firstly as chief financial officer, then chief operations officer. Prior to that, he worked for over six years at SNCF Logistics as their chief financial officer.

GEODIS’ European leadership has been further bolstered by the appointments of Marc Meier as managing directors of Germany-Austria-Switzerland, and Italy, respectively. Meier and Bortolan, who began their new roles on October 1, will report to Valicon.

Blue Water Shipping

Blue Water Shipping has named Milton Santos as new country manager for its energy, ports and projects business in Brazil, based in Rio de Janeiro. With more than 21 years of experience in forwarding and transporting heavy-lift and oversized cargo, Santos has led and expanded industrial projects across multiple countries in Latin America. His background spans oil and gas, infrastructure, power, renewables, mining sectors and EPCs.

“Brazil has enormous potential, and I look forward to building on Blue Water’s strong foundation to deliver tailored project logistics that create value for our clients and partners,” Santos said.

Ryan

Trans Global Projects

Ryan Wilkinson has taken on a new challenge as group compliance manager at Trans Global Projects (TGP). Based in Sevenoaks, UK, Wilkinson will oversee compliance initiatives across the company to strengthen operational integrity and ensure regulatory alignment. The

executive boasts over 18 years of experience working on large-scale heavy-lift and specialist transport projects with companies including BES Group, Phoenix HeavyLift and Allelys.

“Ryan’s appointment reinforces our dedication to excellence in compliance and safety. His industry knowledge and leadership will be invaluable as we continue to grow and evolve,” said Peter Fritschi, TGP's group chief operating officer.

Milton Santos

Wilkinson

Rafael Vicens

Peter Nordstrom

Amaury Valicon

HOW TO SHOOT BETTER DRONE FOOTAGE

A Q&A with Hyve’s head of video, Ulysses Venturin, for project cargo professionals

First things first, do you need special permissions to fly your drone?

Each area may have different permission requirements depending on the state, country and proximity to an airport. My recommendation is to use a drone under 249g, such as those in DJI’s Mini Series. These typically fall under lighter regulations. You can also check the DJI FlySafe Geo Zone Map, a global resource, to research any flight restrictions in the area before takeoff.

Loading and unloading cargo is typically a very long process. What do you recommend to capture the most interesting footage?

Most camera drones can film for less than an hour, so you’ll want to pick a couple of segments that tell the story of your cargo. You might choose arrival (on a ship or vehicle), a point in the heavy-lift when there is plenty of space between the lifting surface and the cargo, a mid-air shot away from the discharge point and as it settles on the waiting barge, vehicle or ground support. Be sure to bring extra battery packs.

Would you recommend filming at ground level with a camera, whether you’re using a phone or camera equipped to shoot video, in addition to a drone? Why or why not?

Yes, absolutely. The drone provides stunning aerial perspectives and a sense of scale, while filming at ground level allows you to capture close-up details, textures and human activity that bring your story to life. Combining both viewpoints makes your final video much more dynamic and engaging.

Ulysses Venturin

Any special settings for the drone?

Yes. I recommend filming in D-Log, 4K resolution and 30 FPS for high-quality footage that’s easy to color grade later. Set the shutter speed around 1/100 and above while keeping the ISO as low as possible to reduce noise and maintain crisp image quality. I would also recommend using ND filters if filming during sunny days to avoid overexposure.

What are the ideal conditions for filming outdoors?

Today’s camera drones, especially the DJI Mini 5 Pro, are surprisingly capable of handling moderate to strong winds despite their small size. The main limitation is rain; you should avoid flying in wet conditions.

DJI Mini 5 Pro Fly More Combo | DJI Air 3S

DJI Mini 5 Pro has a 50MP 1-inch CMOS sensor, 48mm Med-Tele mode with 2x zoom, supports 4K slow-motion recording, good in low light conditions

Limited availability in the United States, not sold on DJI’s U.S. website due to trade complications. Amazon U.S. price: USD $1742; at BPS in UK £979

An alternative is the DJI Air that has dual cameras (adds a 70mm medium tele camera to the primary camera), and can shoot at night.

USD $1099 www.dji.com/air-3s

What essential features should a drone have to take good video? What can you skip?

A good drone should be able to record in D-Log and 4K resolution for professional-quality results. You can skip advanced obstacle avoidance or zoom features if you’re primarily focused on wide, cinematic aerial shots, though they can be useful for safety and creativity.

What are your three top recommendations for a first-time purchase?

I recommend the DJI Mini series of drones, which fall into the camera drone category, often considered consumer-level or prosumer drones. They are lightweight, compact, beginnerfriendly, but still capable of producing high-quality video and photography. All meet the 249g weight limit.

DJI Mini 4 Pro (DJI RC-N2)

4K/60fps HDR and 4K/100fps video, ActiveTrack 360° with new Manual Mode, 20km FHD video transmission, omni-obstacle sensing

From USD $759 store.dji.com

DJI Mini 3 (DJI RC)

4K HDR video, controller with HD display USD $549 store.dji.com

FUTURE THINKERS: PLANNING FOR 2045

In October, some 17 industry leaders and academics gathered for the first Future Thinkers Summit, a new long-term initiative to help the industry prepare for the opportunities and challenges most likely to occur during the next 20 years.

Over the next year, this initial group will evolve into an international think tank as we introduce the program at each Breakbulk event: Middle East, Europe, Americas and Asia, attracting the brightest minds in our industry. This represents a new level of collaboration, uniting the event regions in an effort to bring more certainty to the market. It’s a big task, but one that could have a huge impact on business strategy.

“The goals outlined for the group are ambitious and crucial for the future of the project cargo industry and surely, I would like to share my thoughts on how I see future trends in the project cargo industry,” Larsen & Toubro’s Dharmendra Gangrade said. He is a founding member of Future Thinkers.

Attendees to Breakbulk events will hear an update at each gathering. A white paper will be published with initial findings from the first summit to be shared at Breakbulk

Middle East in February. The next annual international summit will be held next fall with a location to be decided.

Laying the Groundwork

At the Houston summit, participants were organized into three working groups: Maritime & Ports, Logistics & Supply Chain, and Projects, to identify the major challenges, opportunities and skills that will determine the industry environment in 2045.

Their discussions revealed a mix of realism and optimism. While workforce shortages, digital disruption and regulatory uncertainty dominated near-term concerns, the tone for 2045 was confident: a belief that adaptability, cross-sector collaboration and technology-driven innovation could turn volatility into progress. As one participant observed, “We’re a people business—but in 20 years, success will depend on how well people and machines work together.”

Mohammad Jaber, Combi Lift MEA; Margaret Kidd, Houston Maritime Center & Museum; Geir Eilif Kalhagen, Texas Department of Transportation; Srividhya Vaidyanathan, Shell; Marco Poisler, UTC Overseas; Dorothy Jiang, C.T. Bauer College of Business, University of Houston; Jonathan Cournoyer, Hatch Ltd.; Anders Hyrup, Jumbo-SAL Alliance USA; Leslie Meredith, Breakbulk Events and Media; Steve Hill, McDermott; Jessica Dawnay, Breakbulk Events and Media; John Hark, Bertling North America and Texas A&M Galveston; Lucas Strom, DHL Global Forwarding; Samira Gadouchi, McDermott; Cyril Varghese, Fluor.

(L-R):

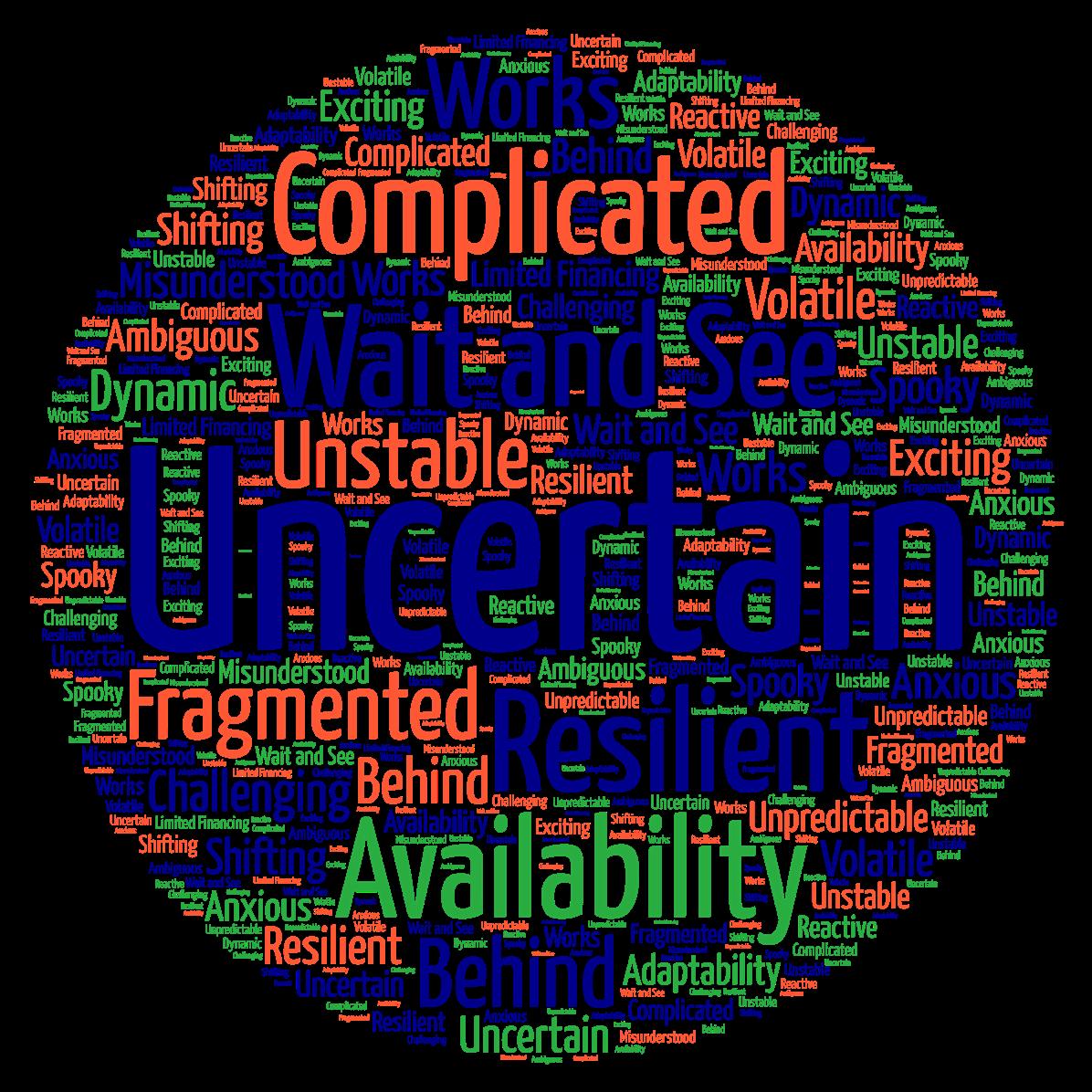

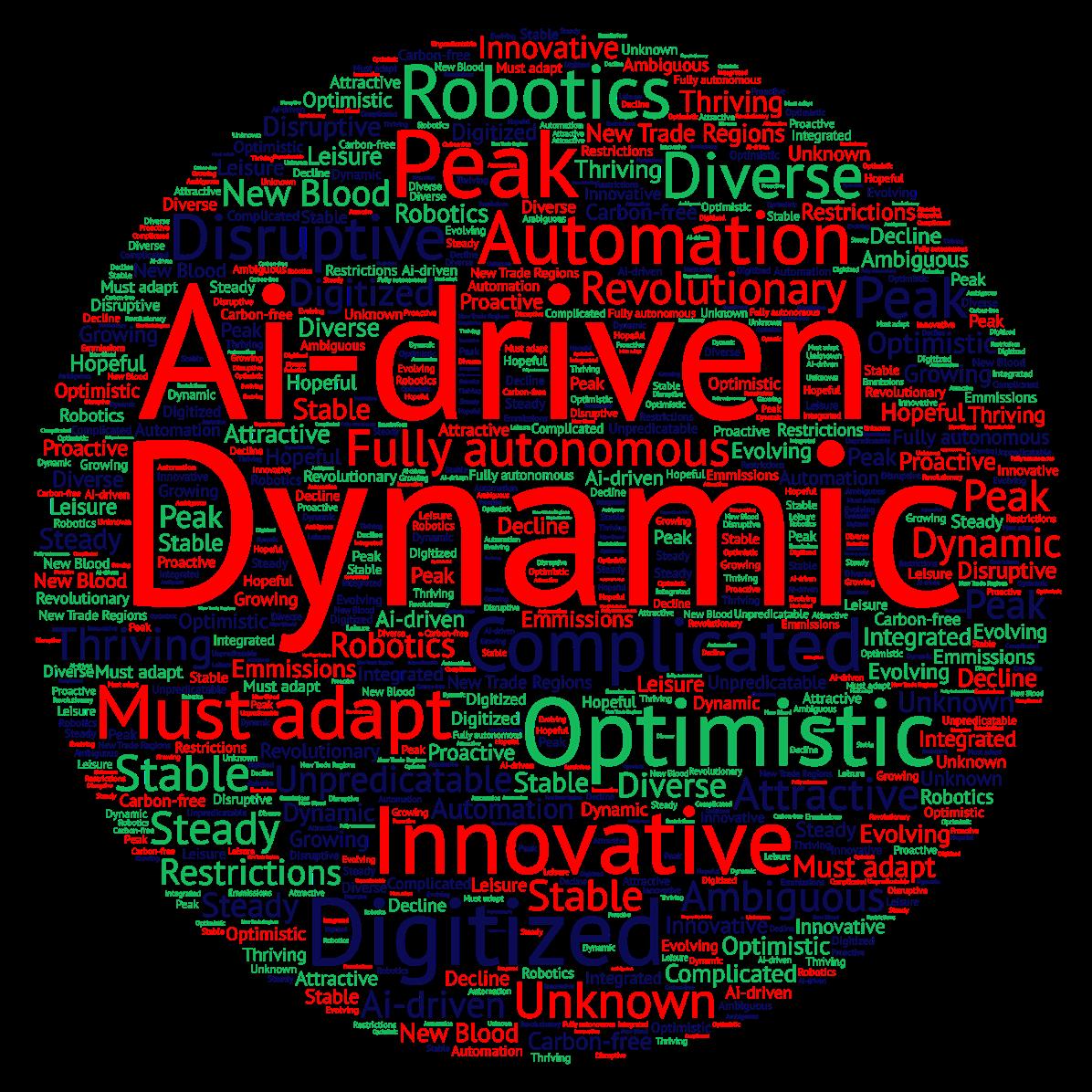

Industry Snapshot: Today and 2045

We asked each participant to give us three words to describe the industry today and another three to describe the landscape 20 years from now. Today’s responses were heavily oriented around unpredictability and risk, while the future is depicted as dynamic, techdriven and requiring adaptation, suggesting optimism about mastering transformation even amidst ongoing complexity.

But complexity persists. Both eras are described as complicated, ambiguous and unpredictable, implying continuing challenges with a future marked by innovation and adaptation.

When we split the group into two (negative and positive about today), those frustrated by the present express the strongest optimism for 2045, while those already positive, remain confident.

Sentiment Snapshot: Today and 2045

Top concerns today include attracting and retaining skilled people, AI’s impact on the workforce, and business continuity. The consensus: resilience, collaboration and continuous learning will matter as much as technical

Maritime & Ports Working Group (Clockwise from center back): Margaret Kidd, Geir Eilif Kalhagen, Lucas Strom, Anders Hyrup, Dr. Mehdi Azimi

To get a better understanding of the group’s perspectives, here is a list of the participants organized by their area of expertise, along with their top concerns.

Maritime & Ports

Dr. Mehdi Azimi

Texas Southern University

USA | Academia | Technology

Preparing education and workforce for a connected, data-driven future.

Anders Hyrup

Jumbo-SAL Alliance USA

USA | Industry | Maritime

Uncertainty from regulation and fuel transition in ship design.

Geir Eilif Kalhagen

Texas Department of Transportation

USA | Industry | Government

Need for focus and critical thinking to adapt in a fast-paced world.

Margaret Kidd

Houston Maritime Center & Museum

USA | Industry & Academia | Ports & Supply Chain

Declining work ethic and loyalty among younger generations.

Jean-Paul Rodrigue

Texas A&M University

USA | Academia | Maritime

Struggling to stay relevant amid rapid change.

Lucas Strom

DHL Global Forwarding

USA | Industry | Forwarder

Recruiting and retaining talent while preserving relationship culture.

Logistics & Supply Chain

Jonathan Cournoyer

Hatch Ltd.

Canada | Industry | EPC

Developing hands-on, real-world skills alongside technology.

Samira Gadouchi

McDermott

Qatar | Industry | EPC

How to adequately manage and secure expanding data volumes.

Frank Guzman

C.H. Robinson

USA | Industry | Forwarder

Building depth and communication skills in an aging workforce.

John Hark

Bertling North America and Texas A&M Galveston

USA | Industry & Academia | Forwarder

Staffing shortages threatening industry continuity.

Mohammad Jaber

Combi Lift MEA

UAE | Industry | Forwarder

Adapting to technologies that could disrupt logistics entirely.

Projects (Energy & Infrastructure)

Steve Hill

McDermott

USA | Industry | EPC

Adapting to redefined energy markets and technologies.

Marco Poisler

UTC Overseas

USA | Industry | Forwarder

Balancing technology adoption with workforce training.

Gulshan Singh

Huntsman and University of Houston Cullen College of Engineering

USA | Industry & Academia | Chemicals/Technology

Weak IT infrastructure slowing innovation and adoption.

Srividhya Vaidyanathan

Shell

USA | Industry | Energy

Training people to bridge the gap between humans and AI.

Cyril Varghese

Fluor Corporation

USA | Industry | EPC

Staffing challenges amid new opportunities through technology.

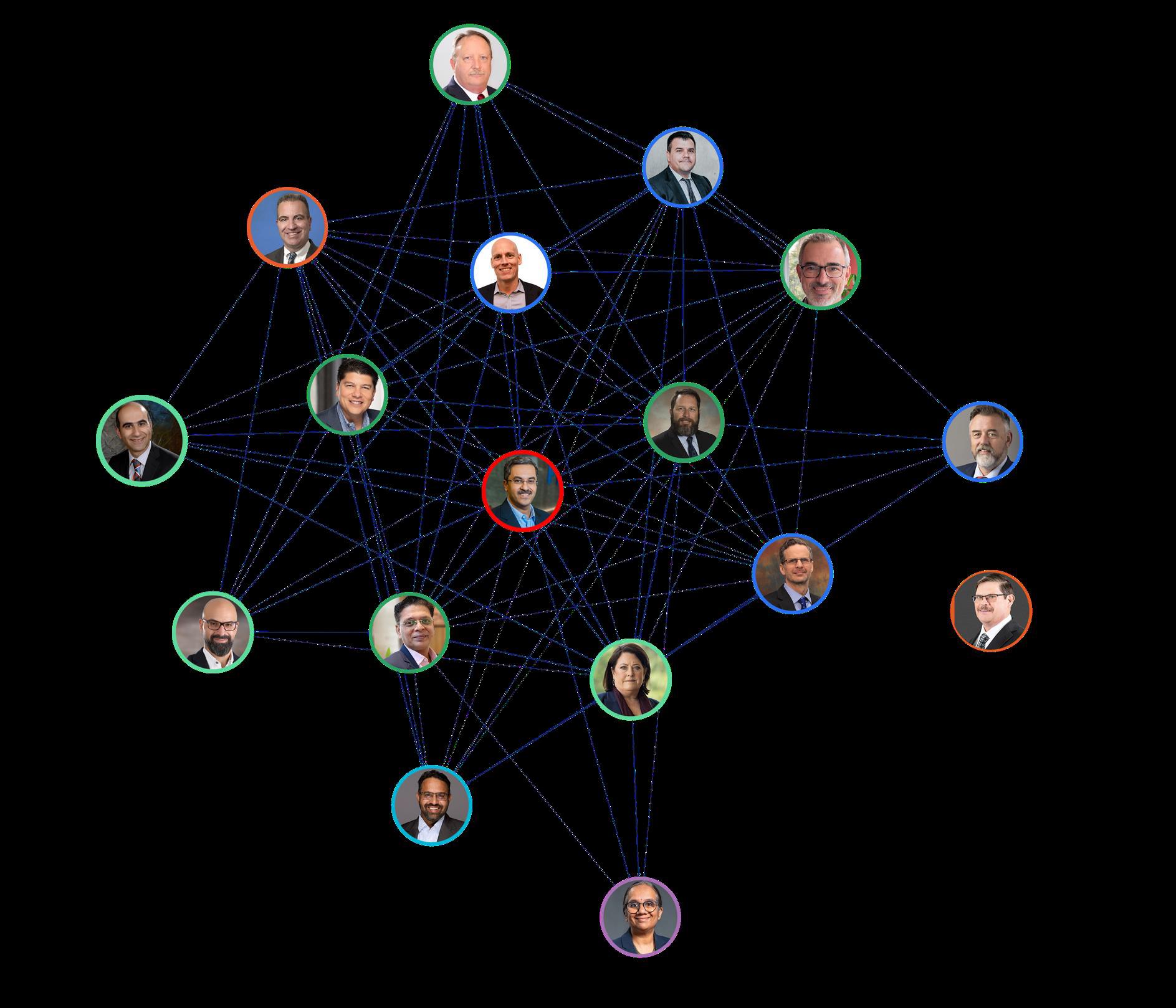

CONNECTION S & EXPERTISE

17 mem bers

74 existing conne cti ons

82 pot enti al connect ions

Eco nomi cs, Forecastin g, Data Analy sis

En erg y & Infrastru cture

En gin eeri ng, Procu rement an d Con structi on

Lo gisti cs

Mariti me

S up ply Ch ain

Transp ortatio n

Breakbulk: It’s a Small World

The Connections graph illustrates how closely linked these 17 Future Thinkers already are, through shared projects, research, and involvement in Breakbulk. Seventy-four existing connections show a web of collaboration that crosses regions and disciplines, supported by indirect connections. Indeed, it’s a small world.

As new participants join from the Middle East, Europe and Asia, we can expect the connections to proliferate while offering plenty of opportunities for new connections. Further, if the whole is greater than the sum of the parts, we can only imagine the powerful advice that will come out of this program year after year. Advice you can take advantage of as a part of the Breakbulk community.

7 LATEST AI TRENDS

Breakbulk’s Leslie Meredith talks with Dr. Gulshan Singh, Procurement Data Analytics Manager, Huntsman and Adjunct Professor, University of Houston Cullen College of Engineering

Dr. Singh is not your typical reserved data expert, which I learned on our call to discuss this topic. His friendly manner and quick wit make him an instantly likeable guy. He’s full of ideas grounded in years of industrial experience. And if you want to talk about AI, he’s the one.

While the long-term outlook for the human workforce will have its challenges, you won’t leave a conversation thinking “the end is near” like after a session scrolling through headlines on your news app. Instead, you’ll be thinking of possible solutions.

AI capabilities are rapidly evolving. What are the most important trends to watch?

1. Agentic AI

The future workforce will create millions of intelligent agents capable of performing a wide range of tasks, both knowledge-based and physical. These autonomous agents will reshape industries, redefine job roles and significantly impact livelihoods, driving a profound transformation in how work gets done.

2. Very Large Models

Large Language Models with trillions or more parameters represent the next frontier in AI. These ultra-scale models will possess the capability to tackle highly complex problems across diverse domains — from science and engineering, logistics to business and healthcare — unlocking solutions that were previously beyond reach.

3. Very Small Models

We also see highly specialized models designed to tackle narrow, well-defined challenges. Deploying a massive LLM for simple, everyday tasks is inefficient and costly — like using a semi-truck for a quick grocery run. Small models provide lightweight, cost-effective solutions for routine operations without sacrificing performance.

Dr. Gulshan Singh

4. Near-Infinite Memory

Imagine advanced chips or massive data centers capable of storing data at almost unimaginable scale. This could mean capturing and preserving every detail of a person’s lifetime, essentially creating a personalized digital archive, much like JARVIS from the Iron Man movies, but available to everyone.

5. Human-in-the-Loop Augmentation

This describes the merging of biological and artificial intelligence. These systems work collaboratively with humans, who provide oversight and decision-making while AI handles repetitive and complex tasks.

6. Inference Time Compute

This capability is essential for real-time AI applications such as autonomous vehicles, fraud detection, healthcare monitoring, cybersecurity and voice recognition. While some predictions require minimal resources, others demand significant computing power. Delivering accurate inference instantly is a major challenge, but rapid advancements in hardware and distributed computing are paving the way for true real-time AI at scale.

7. More Advanced Use Cases

Imagine Large Language Models evolving into autonomous systems capable of orchestrating complex projects, managing global workforces, running entire fleets, and overseeing procurement with minimal human involvement. Beyond operational mastery, these models could push the frontiers of human knowledge—venturing into realms once thought unreachable and solving problems long deemed unsolvable.

What practical steps should companies take now to plan for AI implementation, and how should they prioritize their selections?

Practical steps for companies depend on their readiness in hardware, software and workforce. Within the Breakbulk community, three key priorities stand out: (1) Exploitation and Exploration, (2) Enhancing IT and OT infrastructure, and (3) Upskilling the workforce.

As one of the instructors at the recent AI workshop at Breakbulk Americas in Houston, you described a future scenario when a project could be predominantly managed by AI systems. Will there be enough jobs for “upskilled” workers?

“AI transition will take time in many industries. Therefore, the up-skilled experienced employee will have work for many years. The challenge is going to be for the next generation that is joining the workforce now.”

Does this scenario also point to the creation of new jobs? If so, what might some of those industries be?

• Robotics (hardware, software, and maintenance)

• Personalized education and healthcare

• AI-driven drug discovery and bioengineering

• AI-driven cybersecurity

• AI-augmented mobility and manufacturing

As we wrapped up, it was clear that in Dr. Singh’s view, AI’s advance isn’t a question of if or when, but how far it will go before the rest of us adapt. For industry, that means planning for disruption that’s already underway.

BEST OF BREAKBULK STUDIOS 2025

Breakbulk Studios brings you the conversations that matter from across the global project supply chain. Discover the most-watched interviews of 2025, filmed live at Breakbulk events worldwide.

Event: Breakbulk Europe, Rotterdam

Title: EWA Group: Inside Egypt’s Logistics Powerhouse

Featuring: Ahmed Ghoneim, CEO, EWA Group

Event: Breakbulk Middle East, Dubai

Title: RAK Ports’ Saqr 2.0: A Circular Economy

Game-Changer

Featuring: Hugh Cox, CCO, RAK Ports

Event: Breakbulk Middle East, Dubai

Title: No IT? No Problem. Logiswift Puts Data Power in Your Hands

Featuring: Ziad Abourizk, founder and CEO, Logiswift

Event: Breakbulk Americas, Houston

Title: Opportunities in Military Logistics: The Government Can’t Do Everything

Featuring: Pat Roche, founder and CEO, KB John

Event: Breakbulk Americas, Houston

Title: ILA Offers a Future You Can Build On

Featuring: Alan Robb, president, South Atlantic and Gulf Coast District of the International Longshoreman’s Association

ENERGY EXPLAINER: E-METHANOL

The Transition to Cleaner Energy

E-methanol is emerging as a practical low-carbon fuel alternative for industries looking to cut emissions, particularly the maritime and chemical sectors. Unlike traditional fossil fuels, it can be produced at scale using renewable electricity, green hydrogen and captured carbon dioxide, making it one of the most promising alternatives for reducing the carbon footprint of hard-to-abate industries.

What Is E-Methanol?

E-methanol is a synthetic form of methanol created using three key ingredients: renewable electricity, water and carbon dioxide (CO2). Electricity from wind or solar power is used to produce green hydrogen, which is then combined with captured CO2 to form methanol. Because the CO2 used in production is recycled rather than newly released into the atmosphere, e-methanol is considered a near-carbon-neutral fuel.

How E-Methanol Is Produced (Diagram explained)

Renewable Energy > Electrolysis

Renewable power from wind or solar farms feeds an electrolyser, which splits water (H2O) into green hydrogen (H2) and oxygen.

CO2 Capture

Carbon dioxide is captured either from industrial flue gases or obtained from biogenic sources and purified for use in synthesis.

Methanol Synthesis

In a methanol reactor, green hydrogen and captured CO2 react under controlled heat and pressure to produce methanol (CH2OH) and water (H2O).

Distillation

The crude mixture is distilled to remove water and by-products, ensuring a high-purity methanol output.

Final Product: E-Methanol

The resulting liquid is e-methanol, a transportable, energydense fuel compatible with existing storage and handling systems.

E-Methanol vs Biomethanol: What’s the Difference?

While both fuels can offer significant carbon reductions, their production pathways differ:

E-Methanol (Electrofuel):

Produced using renewable electricity, green hydrogen and captured CO2. Its carbon footprint depends largely on the carbon intensity of the electricity used. When powered by renewable energy, it offers a near-closed carbon loop.

Biomethanol:

Produced from biomass through gasification or fermentation of materials such as agricultural waste, forestry residues or biogas. It is considered low-carbon, though its footprint varies based on feedstock origin and processing methods.

Why E-Methanol Matters

E-methanol is gaining momentum globally because it is a liquid fuel that can slot into many existing supply chains with minimal adaptation. Its high energy density, ease of transport and compatibility with current methanol infrastructure make it a practical pathway for decarbonization, especially for shipping, which requires scalable, clean fuels capable of being stored and bunkered safely. As renewable energy capacity expands, e-methanol is expected to play an increasingly central role in the transition to cleaner, more sustainable energy systems.

Discover how Abu Dhabi is backing a bold e-methanol pilot project in “The Gulf’s Green Bet,” on page 46.

NEWS BITES FROM AROUND THE WORLD: QUICK HITS, BIG IMPACT!

The U.S. government has entered into a strategic partnership with the Canadian owners of Westinghouse Electric Company to accelerate the deployment of nuclear power, with at least US$80 billion earmarked for the construction of new nuclear power reactors. The deal with Brookfield Asset Management and Cameco marks one of the largest U.S. investments in nuclear power in decades.

According to the terms, the U.S. government will arrange the financing and facilitate the permitting and approvals for the new facilities, while Westinghouse will provide its reactor technology for the plants.

Cameco said the reactors would “reinvigorate” America’s nuclear power base and support soaring power demand from data centers and AI infrastructure.

The International Maritime Organization (IMO) has voted to adjourn discussions on its Net-Zero Framework (NZF) for one year, a move reports say was heavily influenced by the U.S. and supported by Saudi Arabia and the UAE. The

extraordinary session will reconvene in 12 months’ time, with member states expected to continue their work towards consensus on the framework.

The NZF, whose draft regulations were approved by the Marine Environment Protection Committee (MEPC) in April 2025, aims to achieve net-zero shipping by or around 2050, in line with the IMO’s 2023 strategy. The framework also calls for a global fuel standard and a mechanism for pricing greenhouse gas emissions.

Noatum Logistics, part of AD Ports Group, has signed a preliminary agreement with Hafeet Rail to establish a new rail freight service linking Sohar in Oman with Abu Dhabi in the UAE. The deal, formalized during the Global Rail 2025 exhibition in Abu Dhabi, marks a key step toward launching the first dedicated rail corridor between the two Gulf neighbors.

Under the proposed plan, Noatum Logistics will run a daily service using Hafeet Rail’s network, which is currently under construction. The service will operate seven container trains per week, each with a capacity of 276 TEUs, equivalent to an annual throughput of around 193,200 TEUs.

China’s COSCO Shipping has unveiled a massive US$1.7 billion shipbuilding spree, commissioning 23 methanolready Kamsarmax bulk carriers and six dual-fuel very large crude carriers (VLCCs) from domestic shipyards. The move expands COSCO’s earlier 2024 investment wave, which included 10 Newcastlemaxes and 30 multipurpose vessels.

The 87,000-dwt bulkers, ordered from Dalian COSCO Shipping Heavy Industry for more than US$1 billion, will be delivered between May 2027 and late 2028 and chartered to COSCO Shipping Bulk for 20 years. The six 307,000 dwt VLCCs will be built at the Dalian Industry Co (DSIC), with deliveries of the methanol and LNG dual-fuel ready ships beginning in April 2027.

EL SALVADOR MULLS SITES FOR FIRST NUCLEAR POWER PLANT

El Salvador is pressing ahead with plans for its first nuclear power plant (NPP), marking a major step in its bid to diversify the national energy mix. The government’s energy authority, DGEHM, said several potential sites have already been identified, with progress bolstered by technical support from the U.S. and the International Atomic Energy Agency (IAEA).

Salvadorian lawmakers in 2024

has launched a new business unit aimed at providing installation solutions for large-scale and complex industrial projects across Europe’s

high-tech, process, energy and heavy industries. The unit, dubbed Industrial Solutions, will support sectors including semiconductor fabrication, data centers and hydrogen and ammonia plants. It will also serve the pharmaceutical, food and beverage and paper and packaging industries with specialized installation and machinery relocation services.

passed legislation to create a regulatory framework for building and operating NPPs. Earlier this year, U.S. Secretary of State Marco Rubio signed a memorandum of understanding (MoU) with Salvadoran Foreign Minister Alexandra Hill Tinoco to cooperate on strategic civil nuclear development — the first nuclear energy deal between the U.S. and a Central American country.

“We will continue to meet the complex installation requirements of our clients in the petrochemical, nuclear and power industries,” Mammoet said. “At the same time, Industrial Solutions enables us to bring this expertise to dynamically growing sectors across European industry.” The division will be managed by Mammoet from Germany.

OIL TO INVEST US$3.9 BILLION IN DRILLING DRIVE

Kuwait Oil Company (KOC) plans to pour US$3.9 billion into exploration drilling by 2030 as part of a wider US$32 billion investment drive to drill and maintain more than 6,000 wells by the end of the decade, KOC’s deputy CEO Khaled Al-Mulla told Reuters. The push supports Kuwait’s goal of lifting oil production capacity to 4 million barrels per day by 2035, up from the current 3.2 million, and sustaining that level through 2040.

Al-Mulla said AI tools are unlocking deeper, previously uneconomic reserves, citing the Mutriba field’s long-delayed production start in 2025. KOC has achieved a 100% success rate in its first offshore exploration phase, which involved drilling six wells, and now plans to ramp up drilling to reach 150,000 barrels per day offshore by 2035. Al-Mulla pointed to “promising discoveries” such as the new AlJazah offshore natural gas field.

The port of Rotterdam reported a slight increase in breakbulk throughput in the first nine months of the year, despite a slip in total freight volumes. Excluding roll-on, roll-off (RoRo), breakbulk edged up 1.1% to 4.6 million tonnes, driven by monopile deliveries, steel pipes for the Porthos carbon capture and storage (CCS)

initiative and a rise in steel plate imports for offshore operations.

The rise in breakbulk handling came amid a 2.6% fall in overall throughput to 320 million tonnes. “Although total volumes showed a slight decline in the first nine months of this year, developments in areas such as container throughput and the

throughput of renewable fuels confirm the resilience and strategic value of the port of Rotterdam,” said Boudewijn Siemons, CEO of Port of Rotterdam Authority. “At the same time, European industry is still under enormous pressure, which underscores the need to continue investing jointly in innovation, sustainability and logistical efficiency.”

Mammoet

In the latest in our series of Breakbulk Throwbacks, Compagnie Maritime Nantaise, a member of The Heavy Lift Group, recounts its most challenging project yet: transporting the US$10 billion James Webb Space Telescope to its launch pad in French Guiana.

The most powerful space observatory ever built, the James Webb Space Telescope (JWST), is now orbiting the sun about a million miles from Earth and sending images that offer special insights into the birth of stars and planets. Less spectacular, but still special, was the remarkable journey this precious cargo made before launch.

French ship owner and manager Compagnie Maritime Nantaise (CMN) specializes in the transportation of high value, sensitive and dangerous goods, personnel and military sealift, and the JWST mission demanded absolute precision with zero margin for error.

Headed by Mathias Audrain, CMN’s commercial and business development manager, the project was one of the most challenging ever handled by the company. CMN had to safely load the cargo in its ultra-sensitive Space Telescope Transporter for Air, Road and Sea (STTARS) container and deliver it intact to Europe’s Spaceport in Kourou.

Breakbulk Throwback

The largest telescope ever launched into space is rolled onto the barge at Eel Pt. before its transfer to the MN Colibri Credit: CMN

The US$10bn project to design and build the largest telescope in space had begun in 2003, and the planning for its transport to the launch pad in French Guiana started nearly a decade before CMN loaded it onboard the 4,171-dwt roll-on, roll-off (RoRo) vessel MN Colibri south of Long Beach, in September 2021.

The 2,000-built MN Colibri was specially designed and built to transport components of the launcher Ariane 5, with its 336-ton capacity axial stern ramp and its guaranteed draft of 3.8 meters ideal for Kourou. However, to handle the JWST, garage modifications were required.

The loading operation also demanded far more than a standard port-to-port shipment. Under strict NASA requirements and a binding non-disclosure agreement, the partners had to identify a loading site that offered a flat and structurally sound pier, adequate draft depth, controlled ramp angles for RoRo operations and complete security with minimal public exposure.

Several piers in Long Beach were ruled out due to factors including aging infrastructure, shallow waters, or proximity to the public, but after an exhaustive search, NASA identified the Seal Beach Military Pier as the only site that met both the technical requirements and strict security protocols.

Special Loading Solution

However, without proper facilities for the vessel’s ramp, CMN and its partners needed to engineer a unique and highly specialized loading solution. This involved the design of a custom bridge structure to span the gap between the pier and a barge so as to create a seamless, secure pathway.

Loading day was a symbolic event in its own right with several dozens of engineers, technicians and mission staff, some of whom had worked on JWST for over two decades, gathered to witness the telescope’s departure.

“What made this project unforgettable wasn’t just the scale of the logistics,” said Audrain. “It was the people. You could feel the emotion in the air as this long-awaited journey to space finally began.”

The operation to move the containerized JWST into the MN Colibri required absolute precision, with every aspect meticulously validated through photogrammetry, 3D modeling, on-site measurements and load simulations to ensure that vibrations, tilt or misalignment risks were fully mitigated.

After a detailed lashing and stowage plan was developed to secure the cargo at sea without inducing stress or imbalance, it was finally rolled onto the barge at Eel Pt., secured by a spud barge, which then had to be turned to allow it to be gently rolled across into the MN Colibri garage via its axial stern ramp.

A 16-day, specially routed 5,800-mile voyage followed, via the Panama Canal, with the JWST’s electrical connections monitored by NASA technicians with the help of vessel’s crew who ensured cleanroom-level isolation throughout. The telescope arrived at Port de Pariacabo in French Guiana in October 2021 ahead of its launch on Christmas Day.

“Compagnie Maritime Nantaise’s role in the transport of the James Webb Space Telescope demonstrated not only technical mastery, but also the critical value of foresight, collaboration and innovation under pressure,” Audrain said. “It is such a pleasure to see our efforts were part of such a hugely successful project that is now paying off with the telescope detecting some of the most distant known galaxies, black holes and new planets which could not before be seen.”

MN Colibri was deployed to transport the cargo, which was loaded into an ultra-sensitive STTARS container. Credit: CMN

WOMEN IN BREAKBULK

WOMEN IN BREAKBULK AMERICAS TACKLE TODAY’S CHALLENGES

The Women in Breakbulk luncheon at Breakbulk Americas was far more than a pre-event meal. More than 200 female professionals from across the breakbulk supply chain came together to connect, exchange ideas and set their intentions for the week ahead.

Now in its fourth year, Women in Breakbulk has evolved into a powerful network of professionals ready to tackle the realities of an industry in flux. The conversations showed why women are not just managing in this high-pressure industry but actively shaping its present and its future.

a second panel hosted

the importance of collaboration, trust and clear communication during the execution of large-scale projects.

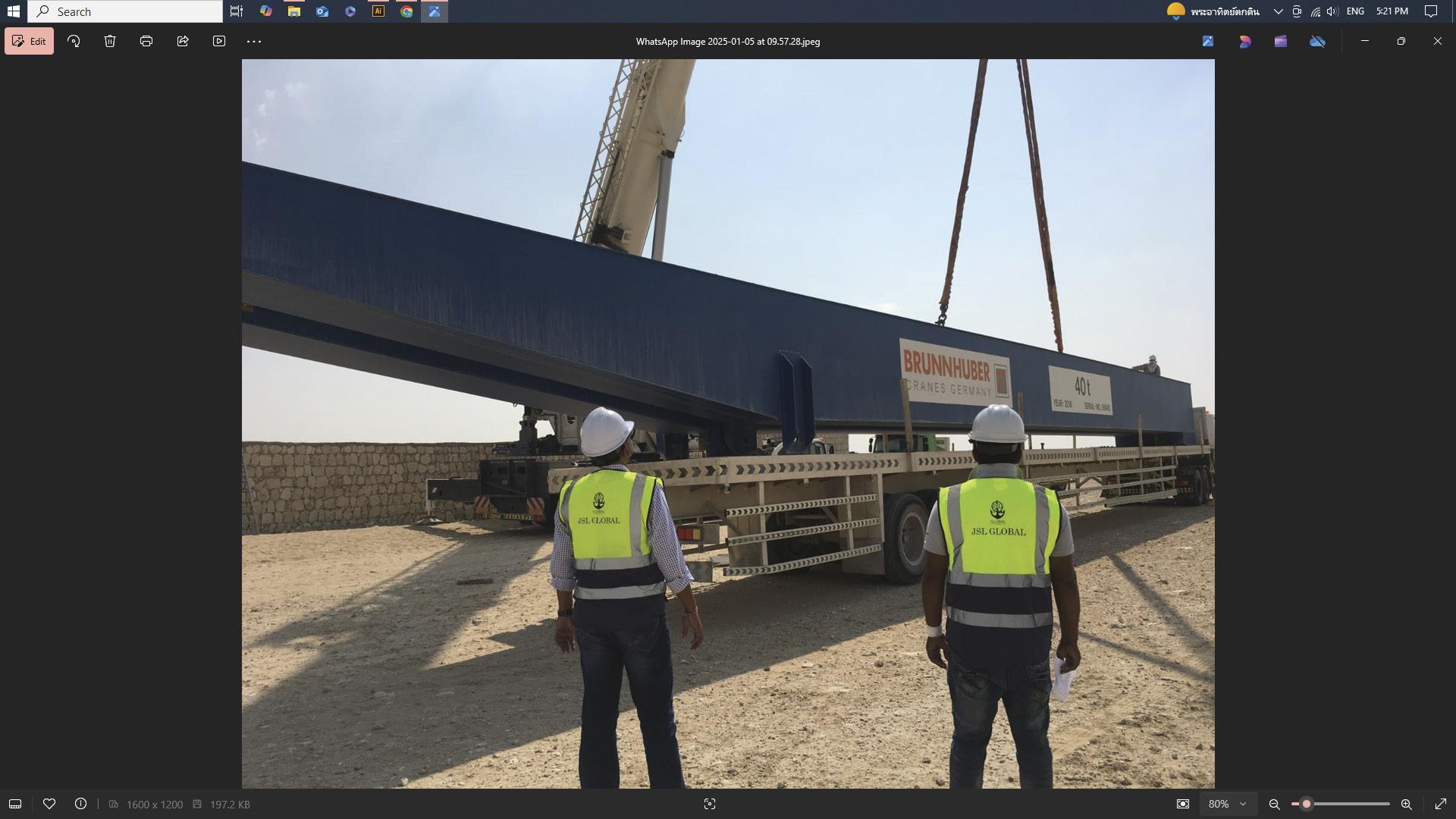

Jennifer Schuster (Edwards Moving & Rigging), Geanean Ordonez (Technip Energies), Diana Davila (UTC Overseas), Janet Galati (Greater Baton Rouge Economic Partnership) and Lorena Alvarez (Fluence) speak on the luncheon’s first panel session about the opportunities and challenges of reshoring.

In

by Houston Sports Authority, Leah Fagnio (Toyota Center) and Rachel Quan (Houston Astros) drilled home

Audience members got the chance to share their own insight and experiences during the collaborative sessions.

The ladies of Table 20 led by Catherine James (pictured center in green), founder of Dixie Cullen and the first sponsor of Women in Breakbulk Americas, 2019.

All photography: Marco Wang

Women in Breakbulk ambassadors raise a glass to toast the success of another Women in Breakbulk event.

Rayna Seamans Campbell, Chief Mate AGT, struck the hearts of the industry panel when she said she was having difficulty finding a job on land after being at sea. Everyone offered to help!

Women in Breakbulk’s wellness coaches Kattya Distefano, founder, Kattya & Co. (left), with her sister Lupita Almuhana, founder & CEO, Stressie App, lead a Blend & Bond workshop guiding women in making custom essential oil blends and sharing their stories with one another.

Georgine Guillory, the first female president of the Port of Beaumont Board of Commissioners, was recognized as an original member of Women in Breakbulk. She became a Women in Breakbulk legend for her famous “blue jacket” story.

Guests mix their own perfect scents from the Blend & Bond workshop.

OUTLOOK 2026

BREAKBULK EVENTS & MEDIA

Featuring commentary from: AAL Shipping, Al Faris, BBC Chartering, Combi Lift Projects, deugro, DHL Global Forwarding, GEODIS, Jade Management Group, JGC Corporation, Methanex, Mitsubishi Power Americas, Port of Rotterdam, Project Logistics Engineering, Technip Energies, Trans Global Projects and UTC Overseas

Outlook Photo of the Year, Editor’s Choice Under the towering Sunnmøre Alps, Wilson Caen makes its way into Ørsta, where deep fjords meet breathtaking landscapes. Credit: Wilson ASA

By Simon West

As 2026 approaches, the breakbulk and project cargo market is evolving rapidly. Soaring demand from the energy and power sectors is tempered by structural challenges and shifting policy landscapes. In this section, industry leaders share their outlook on growth and the forces shaping the year ahead.

Ulrich Ulrichs, CEO, BBC Chartering

As we look ahead to 2026, the business outlook for breakbulk and project cargo remains cautiously optimistic, both globally and within our key markets. The sector continues to benefit from a relatively balanced supply-demand scenario, supported by reasonable

freight and charter rate levels. Fleet renewal is underway, with new vessels joining our operations while older tonnage is gradually phased out.

Energy-related cargoes, particularly from the wind energy, oil and gas and mining sectors, remain the primary drivers of demand. These segments continue to generate robust volumes, reinforcing their role as the backbone of our industry’s growth.

Globally, we anticipate markets to maintain a decent performance. That said, Europe faces structural challenges, including sluggish economic growth, high energy and labor costs, and the increasing impact of environmental regulations such as the EU ETS and FuelEU Maritime. These factors are beginning to weigh more heavily on operational margins and competitiveness.

The U.S. market presents a more complex picture. Trade volumes are under pressure due to shifting policy landscapes, with tariffs on

commodity imports, restrictions targeting specific countries and sanctions on vessels built in China introducing a layer of unpredictability. Moreover, renewable energy projects in the U.S. are encountering delays and potential cancellations, further clouding the outlook.

Geopolitical tensions and ongoing conflicts continue to cause uncertainty in global trade flows. These factors will surely continue to be visible in 2026, requiring agility, foresight and resilience from industry stakeholders.

Kyriacos Panayides, CEO, AAL Shipping

The global wind energy industry is projected to expand by an average of 8.8% annually, adding a total of 982 gigawatts (GW) of new capacity (both onshore and offshore) over the next five years. For onshore wind, the Global Wind Energy Council (GWEC) projects annual installations of around 138 GW, with China set to account for

Ulrich Ulrichs, BBC Chartering

close to half, and Europe at a distant second with 15%. Meanwhile, the compound annual growth rate (CAGR) of offshore wind is estimated to be at 27%, again led by China and Europe.

In Europe alone, more than 51 GW of offshore wind capacity is scheduled to be built between 2025 and 2030, with the UK contributing approximately 42%. Looking ahead, we expect demand for power to increase by about 80% in the next 25 years, with the Asia-Pacific region accounting for 60% of that growth. At the same time, natural gas power capacity is projected to increase

by 38 GW per year from 2025 to 2050.

In the medium term, we expect shipping demand linked to power generation to grow as countries reduce emissions from coal and other traditional sources. At the same time, the rapid expansion of AI-linked infrastructure is accelerating global electricity consumption. These dual trends reinforce the need for cleaner, more efficient energy generation and, by extension, smarter, more specialized shipping solutions.

Danny Levenswaard, director of Breakbulk, Port of Rotterdam Authority

The Port of Rotterdam expects a resilient and forward-looking breakbulk and project cargo market in 2026. Several key factors contribute to this outlook, with energy transition the real growth driver. Rotterdam is seeing increasing volumes of components related to offshore wind, hydrogen infrastructure and carbon capture projects. These developments are fueling demand for complex and heavy cargo logistics.

We’re seeing this stable growth despite market volatility. In the first

half year of 2025 other general cargo increased by 3% to 3.2 million tons. This increase was due in part to the delivery of offshore wind foundations, steel conduits for the Porthos carbon capture and storage (CCS) project and increased transshipment of steel plates for the offshore industry.

Still, challenges remain, especially those that relate to workforce and skills. The ability to attract and retain skilled labor remains key, especially as cargo types become more complex and specialized.

Kyriacos Panayides, AAL Shipping

BBC Houston passes through St. Lambert Lock, Canada, with a full shipload of windmill blades. Credit: BBC Chartering

Danny Levenswaard, Port of Rotterdam Authority

NAVIGATING UNCERTAINTY

Project logistics faces a world in flux, from geopolitical strains and shifting trade dynamics to infrastructure limitations and stricter regulation. We asked industry leaders what challenges will shape the industry in 2026 and how companies can stay ahead to keep projects and cargo on track.

Geanean Ordonez, project logistics manager, Technip Energies

On a geopolitical level, we will see the same challenges in 2026 that we are currently facing. Globally, Israel seems to have struck a peace treaty with Gaza, and we remain cautiously hopeful this remains in place. Otherwise, we could see another blockade at the Suez Canal. The war between Russia and Ukraine continues, resulting

in sanctions hindering sourcing of supplies and exports from that region. The U.S. continues to revise tariffs, USTR vessel fees are imminent, and import documentation is more complex than ever. And China continues to pivot and remain competitive.

The project outlook in 2026 is modest now, but the pipeline of upcoming projects will keep everyone busy for the foreseeable future between 2027 and 2030. As a result, we anticipate suppliers’ orderbooks will be full during this period. Procurement teams should be working with suppliers now to get on their orderbooks ahead of this coming busy season. Compliance teams should be actively working with their procurement teams and suppliers to ensure documentation is adequate to meet the CBP requirements for entry into the U.S. They should be monitoring the derivatives list and providing a framework for suppliers to properly report steel and aluminum content.

We do expect the dust to begin to settle on the topic of tariffs in the U.S. in 2026. At which time we will finally

“WE DO EXPECT THE DUST TO BEGIN TO SETTLE ON THE TOPIC OF TARIFFS IN THE U.S. IN 2026. WE WILL FINALLY HAVE SOME CLARITY AND CAN PROVIDE SOME ASSURANCE AND SOLID GUIDANCE FOR OUR CLIENTS.”

GEANEAN ORDONEZ, TECHNIP ENERGIES

have some clarity and can provide some assurance and solid guidance for our clients. Take this opportunity to review lessons learned and prepare your teams for the coming wave!

CEO, Combi Lift Projects MEA

The breakbulk and project cargo industry is heading into 2026 with no shortage of challenges and opportunities. The sector is being tested by a perfect storm of geopolitical tensions, economic headwinds and logistical constraints. Globally, we’re seeing continuing supply chain volatility, limited vessel capacity and rising project costs driven by inflation, the energy transition and tighter environmental regulations. Decarbonization and environmental, social and governance (ESG) commitments are reshaping fleet deployment, while financing for capitalintensive projects or logistics modern assets is getting harder to secure.

Mohammad Jaber,

Mohammad Jaber, Combi Lift Projects

Geanean Ordonez, Technip Energies

Infrastructure congestion and a global shortage of specialized equipment and skilled crews are further stretching timelines and costs. Yet, the Middle East, especially the Gulf, remains a growth engine. Massive investment in renewables, downstream industries and mega-projects is keeping the region vibrant. But disruptions in the Red Sea, sanctions, higher fuel prices and interest cost and shifting China–Gulf–Europe trade routes are forcing everyone to rethink logistics strategies. To stay ahead, Combi Lift is investing heavily in robotics, AI and automation. Digitalization is not a luxury anymore. It’s how we offset inflation, boost efficiency and stay competitive. Realtime visibility, predictive maintenance and smarter capacity use will define the winners. Ultimately, success in 2026 will belong to companies that combine agility, technology and deep regional understanding — a balance Combi Lift is determined to lead!

Grant Wattman, president, Jade Management Group

Recently I was asked for one word that I would use to describe 2026. My answer was “dynamic.” Not one big challenge, but many, many challenges. Whether they be workforce management, net-zero emissions, supply chain disruptions, regulatory and trade

“IF I COULD PULL ONE WORD FROM THESE CHALLENGES, IT WOULD BE “INDECISION.”

GUILTY PARTIES PRIMARILY BEING GOVERNMENTS AND REGULATORS.”

GRANT WATTMAN, JADE MANAGEMENT

complexity, technology and digital transformation or just simply rising costs in an inflationary period. Wrap these issues with geopolitical shifts and unrest, global trade wars and changing markets, and you have a mosaic of interconnected challenges in the industrial, capital project markets.

Grant

Wattman, Jade Management

If I could pull one word from these challenges, it would be “indecision.” Guilty parties primarily being governments and regulators. Not always indecisive due to too many choices, but indecisive to disrupt the market and drive policy globally. Our industry is resilient and nimble. It can adapt quickly in realigning its global supplier base and trade routes, regardless of the decisions being made. Just make a decision!

The long-term market is looking to increased project cargoes of all types. Unpredictability pushes major capital investments forward. Delaying decisions for one year does little, if anything, to minimize the disruptions. Overall, this could dampen global growth, resulting in cargo demand retrenching and vessel capacity increasing.

As a mentor of mine coached me: be agile, iterate, iterate, iterate and be comfortable with being uncomfortable. What an exciting time to be in our business!

SHIFTING OPPORTUNITIES

As emerging energy markets expand and the world’s appetite for power intensifies, opportunities for project logistics continue to soar. Here, industry experts from across the supply chain identify the sectors poised to drive breakbulk and project cargo volumes in the year ahead.

Felix Schoeller, chief commercial officer, AAL Shipping

The global breakbulk and project cargo market in 2026 will be defined less by a single macro trend and more by regional opportunity shaped by the energy transition, infrastructure reinvestment and nearshoring.

Renewable energy projects remain strong in Oceania, intraAsia and Europe, supporting ongoing shipments of turbines, transformers and other heavy components. The U.S. will remain challenging for 2026 and years to come. Sustained investment in oil, gas and construction will underpin demand in the Persian Gulf. North America is also showing promise, with growth in oil, gas and power.

We see significant opportunity emerging in developing markets, where major infrastructure and industrial strategies are translating into greater breakbulk and project cargo shipments. The Middle East and the Persian Gulf remain key pivotal growth corridors for us, despite geopolitical tensions. Renewed infrastructure and energy project construction continues to generate heavy-lift and breakbulk demand across ports and charter markets.

Indonesia’s transition from a

resource-export model to valueadded onshore manufacturing is producing a steady pipeline of projects that require inbound components, heavy equipment and specialized logistics, while India’s drive for infrastructure and energy investment is increasing demand for transformers, modules and industrial equipment. At the same time, we are seeing stronger domestic manufacturing capability in the renewable and non-renewable energy sectors. Together with higher foreign industrial investments, these trends are contributing to an increase in demand for project cargo imports.

Across Southeast Asia, we continue to see the manufacturing and fabrication of project cargo components expand as stakeholders diversify away from dependence on China amid ongoing geopolitical risk. Over recent years this trend has gathered steady momentum, and with the Trump administration’s renewed trade tariffs and protectionist stance, we are now seeing an even greater push to source from this region, further diluting China’s dominance.

Koichi Kaizu, logistics subject matter expert for module transportation, JGC

Based on our company’s business lookahead viewpoint, we observe LNG continuing to play a central role in Asia’s energy transition, as nextgeneration fuels such as hydrogen and ammonia remain in early stages of commercialization. Their full supply chains, from production to end-

Felix Schoeller, AAL Shipping

use, are still under development. In contrast, LNG infrastructure projects are active and expanding, especially in Southeast Asia and South Asia, driving consistent demand for project logistics.

Asian countries will remain key sourcing hubs for materials and equipment, including fabricated modules, contributing to a stable base volume in breakbulk, heavy-lift and module transport segments. Project cargo demand in Asia will remain strong and diversified through 2026 and beyond.

Kieve Pinto, chief operating officer, Al Faris

As we move into 2026, the heavy transport and project logistics

industry across the Middle East is positioned for sustained and strategic growth. The region’s infrastructure and industrial pipeline remain robust, driven by ambitious national visions and economic diversification efforts. Across the GCC, large-scale investments in renewable energy, green hydrogen, petrochemicals and advanced manufacturing are reshaping the landscape of heavy transport and project logistics.

Where once cargo flows were primarily import-driven, we now see increasing intra-regional and export movement as local fabrication and manufacturing capabilities mature. This shift demands advanced technical expertise, precision planning and integrated heavy-lift solutions that

combine engineering, transport and installation under one umbrella.

At Al Faris, we continue to align with this transformation by expanding our fleet, enhancing our digital capabilities and investing in people and technology. Our focus remains on safety, reliability and innovation, enabling us to support our clients in delivering complex, high-value projects that power the region’s next chapter of growth and energy transition.

Kasper Heiselberg, head of global wind renewable energy, deugro

Europe will remain a key driver for wind logistics, but we’re seeing new frontiers emerging in Korea, Japan, Taiwan and Australia. The next big opportunity lies in smarter, more collaborative supply chains, combining engineering, transport and data to enable faster renewable growth worldwide.

Beyond 2026, Northern Europe and Europe in general will continue leading demand for wind logistics, with AsiaPacific rapidly gaining ground. The biggest opportunity ahead is to industrialize and standardize offshore wind logistics, linking global manufacturing with regional installation in a sustainable way.

Kieve Pinto, Al Faris

Kasper Heiselberg, deugro

Koichi Kaizu, JGC

Credit: Al Faris

CARGO WITH A CONSCIENCE

Will new fuels, tighter regulations and digital tools finally push the sector toward real change?

GEODIS’s Luke Mace shares how meaningful emissions reductions can be achieved most immediately, while Methanex’s Roger Strevens reacts to the IMO’s decision to postpone the adoption of its net-zero framework.

Luke Mace, senior vice president, freight forwarding / project logistics, GEODIS

One of the main challenges lies in finding a balance between growth ambitions and reducing greenhouse gas (GHG) emissions. There is a clear imbalance between transit times and cost efficiency versus customer expectations.

If we look at short-term and impactful actions, it’s about using the most efficient solutions available today, such as prioritizing sea or rail transport over air whenever possible, selecting the most energy-efficient aircraft or vessels (for example through GEODIS AirSmart), increasing the use of available low-carbon fuels such as sustainable aviation fuel (SAF), sustainable marine fuel (SMF) or hydrotreated vegetable oil (HVO), which can reduce GHG emissions by up to 80%, and ensuring space utilization so we don’t ship empty space.

GEODIS AirSmart is a great illustration. The company has recently launched this new low-carbon airfreight solution, designed to significantly reduce GHG emissions by optimizing aircraft performance and routing. By selecting the most energy-efficient aircraft and leveraging external flight data and advanced analytics, GEODIS AirSmart enables smarter routing decisions and enhances performance.

This innovation represents a major step forward in GEODIS’s journey toward decarbonization and supports customers in achieving their climate goals. With GEODIS AirSmart we can achieve up to 40% reduction in GHG emission per shipment.

Roger Strevens, director, low carbon regulation and advocacy, Methanex

In mid-October, the International Maritime Organization (IMO) held a meeting to consider the adoption of the Net Zero Framework (NZF), the regulatory package that is intended to deliver on the goals of its 2023 GHG strategy, which was unanimously supported by member states. The NZF had been approved, the first step in the regulatory process, by a large majority back in April at Marine Environment Protection Committee (MEPC) 83. However, due to widely reported pressure from the U.S., many member states changed their positions. The outcome was that a vote was called to adjourn the adoption meeting by a year, and it was carried 57-49.

While adjournment of the adoption meeting was disappointing to many, it is important to note the NZF has not been rejected, rather member states are not in a position to adopt it yet. Critically, there is now time to develop the NZF to a point where there is consensus for adoption. It is important for the IMO not to lose momentum. Work continues on the supporting guidelines, and the IMO Secretariat will consult closely with member states to determine the best path forward. The consistent support from global shipping organizations highlights the industry’s readiness to advance sustainability and clean fuels. A unified global approach for a global industry is

“ONE OF THE MAIN CHALLENGES LIES IN FINDING A BALANCE BETWEEN GROWTH AMBITIONS AND REDUCING GREENHOUSE GAS (GHG) EMISSIONS.”

LUKE MACE, GEODIS

Luke Mace, GEODIS

“CONSISTENT SUPPORT FROM GLOBAL SHIPPING ORGANIZATIONS HIGHLIGHTS

THE INDUSTRY’S READINESS TO ADVANCE SUSTAINABILITY AND CLEAN

FUELS.”

ROGER STREVENS, METHANEX

economically and environmentally preferable to fragmented regulations that are separated by national and regional borders.

For breakbulk shipping companies, the NZF deferral may temporarily pause decisions around retrofitting or ordering vessels for alternative fuels, but it also offers a window to monitor developments like the upcoming review of FuelEU Maritime. Given the long-term nature of fleet investments, it remains prudent to anticipate the growing prominence of decarbonization regulations.

In this context, methanol stands out as a compelling option for breakbulk vessels due to its favorable overall cost, lower complexity and minimal impact on cargo space. It is compatible with tramp operations due to the relatively low cost of port infrastructure needed, making it an attractive choice. Methanex is committed to supporting shipping companies as they navigate these decisions.

In summary, given that the shipping industry wants to progress and leading clean fuel producers are poised to deliver, the pace of political alignment will be crucial for future progress.

Roger Strevens, Methanex

Credit: GEODIS

TECH TALK

Project professionals pinpoint the biggest opportunities for innovation and digital transformation in 2026 and beyond, and the barriers that still limit wider digital adoption in the breakbulk and project sector.

Dharmendra Gangrade, thought leader on global shipping and logistics and a member of the Breakbulk Advisory Board

The biggest opportunities for innovation or digital transformation in 2026 and beyond lie in the realm of Logistics-as-a-Service (LaaS) for global shipping, which is fundamental to nearly 90% of global trade.

The post-COVID digitalization journey has equipped stakeholders with robust systems capable of application programming interfaces (API) integration, paving the way for the development of industry-wide digital platforms. These platforms can be customized for specific needs and integrate seamlessly with ERPs or other systems via a robust middleware. This creates a connected ecosystem, surpassing blockchain capabilities by facilitating not only the exchange of commercial documents but also the real-time transmission of events, enhancing visibility and control over shipping transactions.

Furthermore, the application of AI in supply chain and logistics has evolved from being a buzzword to a reality, transitioning from basic automation

Dharmendra Gangrade, member of the Breakbulk Advisory Board