CONNECTING THE MIDDLE EAST’S MEGA PROJECTS

Blue Water Shipping’s Humeira Aidarous Al Hashmi on Breaking Through Barriers to Lead in Project Logistics

THE MIDDLE EAST ISSUE

Breakbulk Middle East

The Making of a Project Cargo Powerhouse

42

Blue Water Shipping’s Humeira Aidarous Al Hashmi – Built for the Middle East

12 Movers and Shakers

Highlighting Recent Industry Hires, Promotions and Departures

14 Women in Breakbulk

How to Make AI Work at Scale in Logistics Operations

Q&A With Dataiku’s Umut Şatir Gürbüz

16 Women in Breakbulk

The Road Less Traveled Lessons in Resilience, Leadership and Transformation From Rita Al Semaani Jansen

17 The Logistics Lens by Hatch Chaos Versus Control Incoterms Strategy As A Risk-Control Lever, Not Just a Legal Clause

18 Waves of Cargo From Coast to Hinterland

Navigating One of India’s Most Complex Cargo Routes

20 News Bites

Quick Hits, Big Impact! A Roundup of Breakbulk Shippers and Exhibitors in the News

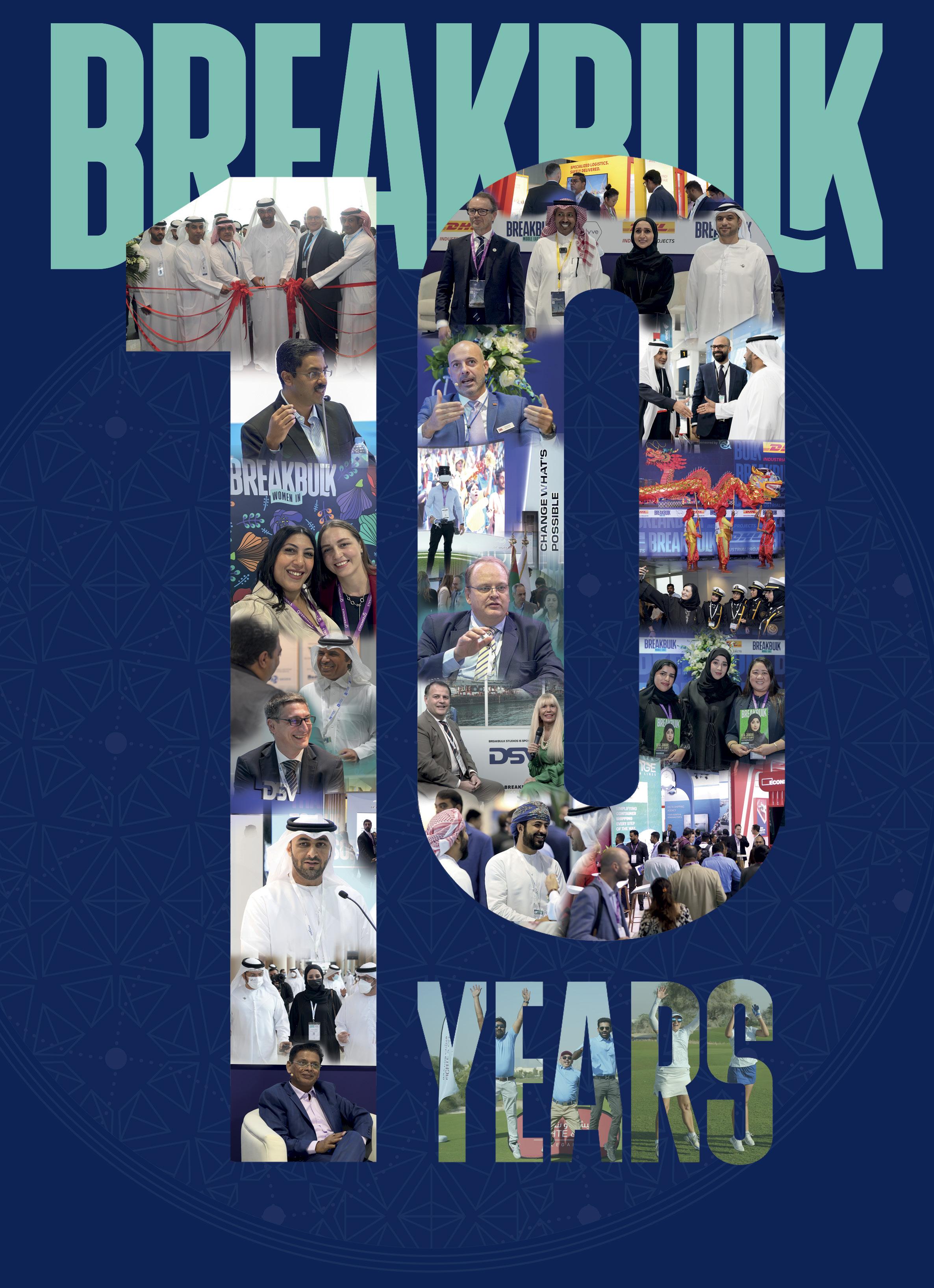

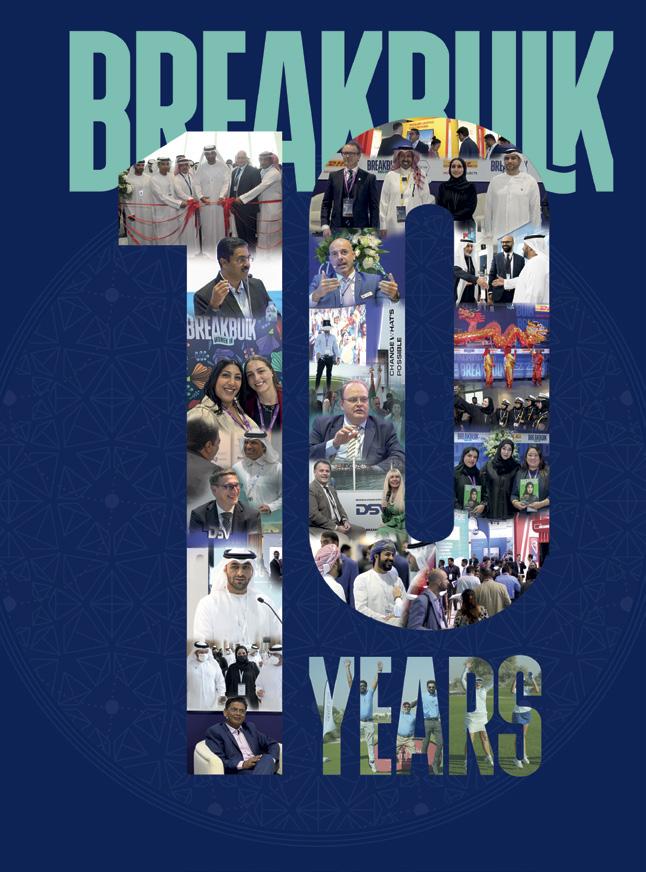

22 Anniversary Special 10 Years of Breakbulk Middle East

The Making of a Project Cargo Powerhouse

24 Anniversary Special 10-Year Timeline

Event Milestones, Expert Insight, World Events and the Projects That Shaped Each Year

36 Middle East A Golden Age for Middle East Rail? Investment Accelerates Shift From Long-Haul Trucking to Integrated Freight Rail

42 Middle East Built for the Middle East

Blue Water Shipping’s Humeira Aidarous Al Hashmi on Breaking Through Barriers to Lead in Project Logistics

47 Middle East From Import Hub to Export Machine

GCC Manufacturing Surge Drives New Outbound Project Cargo

52 Middle East Preparing for a Tech-Driven Future

Mohammad Jaber on Navigating Change in Project Logistics

Breakbulk Europe June 16-18

Rotterdam Ahoy Rotterdam, Netherlands

Breakbulk Americas

September 22-24

George R. Brown Convention Center Houston, USA

Breakbulk Asia November 18-19

Sands Expo and Convention Centre, Singapore

54 Africa

Egypt’s Mega Fertilizer Project Hits New Milestone Surge in Project Cargo Demand as NCIC’s Vast Complex Nears Completion

58 Global

The Basement Start-Up That Took Flight

Air Charter Service’s Global Growth Story — And What Comes Next

64 Global Thinking Inside the Box

Why Container Ships Are Carrying More Project Cargo Than Ever Before

70 Europe

Nuclear Power’s Second Act

Decommissioning Creates a New Pipeline of Opportunity

74 Americas Upgrade or Fade? Investments Critical to Sustain Panama Canal’s Market Position

78 Asia

Japan’s Atomic Turnaround New PM Moves Forward With Reactor Restarts, Endorses Next-Generation Nuclear

83 Asia

Megamove Powers India’s Energy Buildout Feat of Engineering as Prism Logistics Delivers 400-Tonne Coke Chambers Across India

90 Back Page The Last Look Great Photo, Innovative Project

A new year brings a sense of momentum, and this one comes with a milestone we are excited to celebrate.

Welcome to the first issue of 2026, marking the 10th anniversary of Breakbulk Middle East. Back in 2015, Breakbulk placed a big bet on the GCC as the next location for a signature event. We arrived in the right place at the right time. The energy transition was just beginning, the region’s leadership moved quickly and the world came to the GCC to build projects. And we were there to bring everyone together.

Breakbulk Middle East became the fastest-growing event in Breakbulk history. Attendance has grown more than fivefold, from 2,000 participants at the inaugural edition to more than 10,500 today. But numbers only tell part of the story.

The real key to success was the support we received from government, industry, most importantly, Abu Dhabi Ports and DP World, and a small group of influential advocates. These women and men helped shape the event to fit the local culture, were among the first speakers and opened doors to their own contacts to widen the circle of project cargo professionals involved in Breakbulk Middle East. You will recognize many of these longtime contributors throughout our Anniversary Special.

Before the launch of Breakbulk Middle East, our editorial rarely covered the region, but today the GCC is an integral part of the global industry with many stories to tell. In

this issue, you will find an in-depth look into the region’s innovative rail initiative. You’ll gain an understanding of the region’s manufacturing drive to increase exports. You’ll meet Blue Water Shipping’s Humeira Aidarous Al Hashmi and see into the future of logistics with Combi Lift Project’s Mohammad Jaber.

In a recent survey of senior executives, many said they are more interested in what is happening in other parts of the world than in their home markets. With that in mind, this issue also looks at why Japan’s nuclear pivot could reshape the global energy race and how rising energy decommissioning activity points to a source of high-volume, long-lasting service contracts.

For a bit of lighter reading, turn to our company profile of Air Charter Service to meet Chris Leach, the character behind the wildly successful firm. He started the business in his basement, under pressure to meet the needs of his growing family – never underestimate the power of a man with many mouths to feed.

Don’t miss “The Logistics Lens,” a new column from Hatch. In this first installment, Rick Caporiccio reframes Incoterms as a practical risk-control tool. It’s a compelling read, and you may never think of Incoterms in the same way again.

Looking ahead, our next issue will focus on opportunities in Africa, particularly in the mining sector, and the challenges and opportunities around sustainability across the breakbulk sectors. Until then, best wishes for a productive and successful year, and thank you for being part of the Breakbulk community.

Best,

Leslie Meredith Product and Editorial Director

Editorial Director

Leslie Meredith Leslie.Meredith@breakbulk.com

Senior Reporter

Simon West simon.west@breakbulk.com

Designer Mark Clubb

Reporters

Don Horne

Luke King

Iain MacIntyre

Amy McLellan

Malcolm Ramsay Liesl Venter

Contributing Editor

Jonathan Cournoyer Hatch

Breakbulk Magazine Editorial Board

John Amos Amos Logistics

Tina Benjamin-Lea Eli Lilly and Company

Fayçal Boumerkhoufa Ascent Global Logistics

Dea Chincuanco Miura Projects Corp.

Elisabeth Cosmatos Cosmatos Group of Companies/ The Heavy Lift Group

Dennis Devlin DT Project America

Payne Fischer Kuehne+Nagel

Dharmendra Gangrade Larsen & Toubro

John Hark Bertling North America / Texas A&M University

Itoro Ibanga Air Liquide

Margaret Kidd San Jacinto College

Jake Swanson DHL Global Forwarding

Edward Talbot Trans Global Projects

Grant Wattman Jade Management Group, Inc.

Andrew Young Bechtel Corporation

Portfolio Director Jessica Dawnay Jessica.Dawnay@breakbulk.com

To advertise in Breakbulk Media products, visit: http://breakbulk.com/page/advertise

Subscriptions

To subscribe, go to https://breakbulk.com/page/ breakbulk-magazine

A publication of Hyve Group plc.

The Studios, 2 Kingdom Street Paddington, London W2 6JG, UK

Exhibitors and Breakbulk Global Shipper Network members in this issue:

Movers & Shakers (p. 12)

AD Ports Group, Allelys, Aramex, Gebrüder Weiss, deugro, Africa Global Logistics, Maersk, DHL Global Forwarding, Ports of Indiana, TGP, UTC Overseas, Vallourec

From Coast to Hinterland: Navigating One of India’s Most Complex Cargo Routes (p.18)

The Heavy Lift Group (THLG)

A Golden Age for Middle East Rail? (p.36)

Saudi Port Authority, Red Sea Gateway Terminal, Saipem, Tecnimont, Siemens Mobility

Built for the Middle East (p.42)

Blue Water Shipping, Kanoo Shipping, CEVA Logistics, CMA CGM, KBR, Fluor

From Import Hub To Export Machine (p.47)

Al Faris, DHL Global Forwarding

Preparing for Tech-Driven Future (p.52) Combi Lift Projects

Egypt’s Mega Fertilizer Project Hits New Milestone (p.54)

DP World, Chipolbrok, KBR

The Basement Start-Up That Took Flight (p.58) Air Charter Service

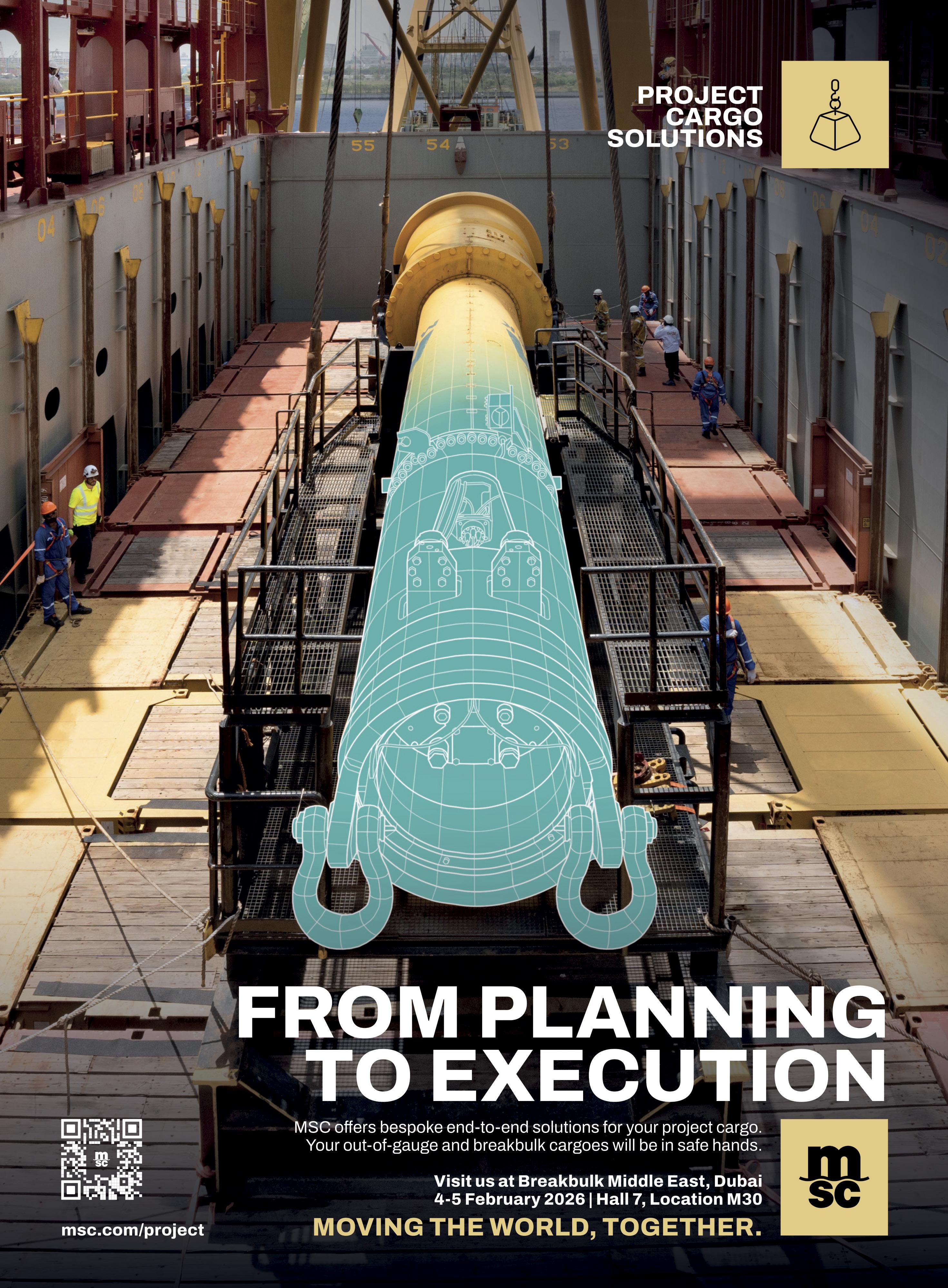

Thinking Inside the Box (p.64)

MSC, Maersk Project Logistics, CMA CGM, Protranser, Fluor

Nuclear Power’s Second Act (p.70)

Mammoet, EDF Energy

Upgrade or Fade (p.74)

COSCO Shipping, DP World, MOL, PSA International, SSA Marine-Grupo Carrix, MSC, CMA CGM, Hapag-Lloyd, HMM, Maersk, OOCL, Port of Houston, The Heavy Lift Group, Global Project Logistics Network, Cross Ocean

Japan’s Atomic Turnaround (p.78)

JGC Corporation

Megamove Powers India’s Energy Buildout (p.83)

Prism Logistics, Goldhofer, JSI Alliance

Key: Exhibitor

Breakbulk Global Shipper Network Member

Movers & Shakers

Women in Breakbulk: Rita Al Semaani Jansen and Umut Şatir Gürbüz

The Logistics Lens: Hatch Waves of Cargo: Total Movements News Bites

10 Years of Breakbulk Middle East

Former DB Schenker chief Jochen Thewes has been named the new CEO of AD Ports Group’s logistics cluster. He was scheduled to start his new role on Dec 1. Thewes began his logistics career nearly three decades ago at Kuehne+Nagel, joining DB Schenker in 2010 where he later served as CEO for more than a decade.

Gebrüder Weiss has appointed industry expert Justyna Marczyk as its new national import compliance manager in the U.S. Marczyk joins the transport and logistics company from DB Schenker where she served as customs and compliance manager. In her new role, Marczyk will support clients navigating supply chain shifts by offering strategic guidance on import compliance.

After nearly nine years at chemical producer Azelis, Salim Raiss is embarking on a fresh pursuit as Africa Global Logistics’ managing director for Morocco. The move is part of AGL’s strategy to build its regional presence ahead of an expected slew of major investment projects in Morocco.

Allelys has reorganized its leadership structure, with Richard Beardmore promoted to CEO and former chief David Allely stepping into the role of group chairman. Former Royal Engineer Beardmore had been serving as commercial director at the UK transport specialist, which he joined in May 2021 after executive stints with Mammoet, deugro and ALE.

Amadou Diallo is taking on a new challenge as group CEO of global logistics and transportation specialist Aramex. Set to begin his new role on May 1, 2026, Diallo joins Dubaiheadquartered Aramex after eight-anda-half years with DHL Global Forwarding, where he served as CEO for the Middle East and Africa. Nicolas Sibuet will continue as acting group CEO until Diallo formally assumes his new role.

Electric Hydrogen, a global manufacturer of industrial-scale electrolyzer facilities, is expanding into Latin America with the appointment of Maria Gabriela da Rocha Oliveira as general manager for the region. Based in Brazil, she will lead Electric Hydrogen’s commercial and partnership strategy across Latin America, where green hydrogen projects are advancing at “gigawatt” scale, the company said.

deugro has announced a shake-up of its leadership team in the Americas, with Jeff Smith stepping up to the position of vice president and country manager of deugro USA. Smith joined deugro in mid-2011, most recently serving as global head of supply chain. Meanwhile, Ryan Blewett, who joined the project forwarder in mid-2016, has taken on the new role of vice president of strategy and development for deugro in North America.

Maersk has named Thomas Theeuwes as managing director for India, Bangladesh and Sri Lanka, succeeding Christopher Cook, who takes on the same role for Maersk in the UK and Ireland. Theeuwes joined Maersk in 2007 as a management trainee and has since held senior positions across Europe, China and Africa, most recently as managing director of the West Africa area.

Steel tubes maker Vallourec, a member of the Breakbulk Global Shipper Network, has chosen Nathalie Delbreuve as its new chief financial officer. Delbreuve takes over from Sascha Bibert, who is leaving the company to pursue other opportunities. Delbreuve was previously CFO of Verallia, the world’s third-largest producer of glass packaging for beverages and food products. She began her new role on Dec 1.

UTC Overseas has appointed Ralph Stierli as director of special projects in Houston, where he will help expand the company’s footprint in the energy, battery energy storage and data center industries across North America. Stierli brings more than 30 years of experience in global forwarding and project logistics, having held senior roles at Fracht, Solaris Global and chemical research firm Renewco2.

Peel Ports Group, the UK’s second largest port operator, has named Jonathan Rayner as its new chief commercial officer. Rayner joins the company from London Luton Airport, where he served as CCO since 2020. “There is enormous opportunity ahead for the supply chain, and my focus will be on leading a strategy that shapes Peel Ports Group’s next chapter of growth, collaborating with colleagues and customers alike,” Rayner said.

DHL Global Forwarding has gone with a familiar face after choosing Henk Venema as executive vice president of global airfreight. Venema joined DHL in mid-2016, during which time he has held various senior positions including CEO Western Europe and CEO Benelux. The executive has also enjoyed stints at GEODIS and UTi Worldwide.

Ports of Indiana in the U.S. has hired Kent Ebbing to lead a foreign trade zone initiative supporting the growth of global trade in Indiana. Ebbing will be part of Ports of Indiana’s new foreign trade department, which backs Indiana firms involved in international trade through developing new FTZs and container shipping services. The statewide authority operates three ports on the Ohio River and Lake Michigan — Burns Harbor, Jeffersonville and Mount Vernon.

Eddie Talbot has moved into a new role as senior vice president North America at Trans Global Projects. Talbot had been serving as U.S.-based managing director of Roll Group. His focus at TGP will be enhancing project delivery and developing new business, as the project logistics specialist seeks to expand its presence across North America.

Project Logistics Engineering Solutions has appointed DuWayne Murdock as VP of strategy and innovation, a move aimed at bridging the gap between complex engineering and regulatory execution. A former director of Texas’ oversize/overweight permit section, Murdock brings decades of regulatory expertise to bear at the design phase, solving transport challenges before they reach the road.

To be considered for future editions of Movers & Shakers, email: simon.west@breakbulk.com

Q&A With Dataiku’s Umut Şatir Gürbüz presented by Breakbulk in collaboration with Logifem

1. How is AI currently transforming logistics operations, and which use cases are delivering the most immediate value?

AI is reshaping logistics by bringing intelligence into processes that were historically manual and fragmented. The fastest ROI today comes from use cases that combine data from multiple sources and automate decisions at scale.

Forecasting, inventory optimization, predictive maintenance and document automation are becoming mainstream because companies now have tools that allow operations teams, data experts and business users to work together on a single flow, from data preparation to model deployment.

More recently, multimodal GenAI has unlocked faster resolution in customer and technical support by analyzing text and images in one environment. When organizations can build, test and operationalize these solutions in a governed, repeatable way, the impact becomes both immediate and sustainable.

2. What are the biggest challenges logistics companies face when adopting AI solutions, and how can they overcome them?

Many organizations underestimate the importance of a strong foundation. AI requires clean, connected data and a collaborative environment where teams can explore, prototype, validate and deploy without friction.

The second challenge is operationalizing AI. Pilots often fail not because the model is weak, but because there is no structured path to deploy, monitor and maintain it. Companies that rely on manual handovers between teams face delays and inconsistencies.

To overcome this, logistics companies need an end-to-end framework that brings data, analytics and operations together. When governance, versioning, automation and monitoring are built into the workflow, AI adoption accelerates dramatically.

3. Many logistics organizations struggle to scale pilots into production. What separates successful AI-driven companies from the rest?

The most successful organizations don’t treat AI as isolated experiments, they build reusable components, shared data pipelines and standardized workflows that reduce the time from idea to production.

They empower business and domain experts to participate directly in the process through guided, self-service interfaces, while ensuring IT and data teams maintain control through built-in governance and oversight.

And importantly, they industrialize AI with strong MLOps practices: automated deployment, continuous monitoring, retraining and lifecycle management. When these elements are integrated, scaling becomes a natural progression rather than a reinvention for every use case.

4. With the rise of GenAI, how should logistics companies rethink customer experience, customer support and knowledge management?

GenAI represents a major shift toward intelligent, contextual, real-time assistance. Support teams can analyze customer queries, documents, images and historical interactions in a unified workspace, rather than juggling disconnected tools.

Knowledge management becomes dynamic rather than static: every resolved case, every operational insight and every document update can feed back into the system automatically. This creates a continuously improving knowledge fabric that AI can tap into.

Companies that centralize their knowledge flows, including data, documents, images and logs, and provide governed access to GenAI workflows, see dramatic improvements in first-response accuracy, case routing and resolution times. It transforms both customer experience and internal productivity.

5. What ethical considerations should logistics leaders keep in mind when deploying AI?

Ethics and responsibility must be embedded from the start. AI systems should be transparent, interpretable and continuously monitored, not only at launch, but throughout their lifecycle. A mature approach includes drift detection, alerting, traceability and documentation as built-in elements, not optional add-ons.

Data privacy is equally important. Logistics organizations deal with sensitive operational and customer data. Platforms that provide controlled access, clear lineage and well-governed collaboration protect both the company and the customer.

Finally, leaders should ensure employees are included in the journey through training, guided tooling and human-in-theloop processes. This ensures AI augments people rather than creating uncertainty around its role.

6. As a female leader in data and AI, how do you see women shaping the future of logistics, and what advice do you have for new talent entering the space?

Women bring a systems-thinking mindset that is incredibly valuable when working with AI. Successful AI initiatives require orchestration, connecting data, processes and people, and women often excel in roles that bridge technical and operational teams.

I see women leading transformation projects, driving innovation in analytics and advocating for responsible use of AI. They naturally bring structure, collaboration and empathy into cross-functional teams, which is essential when delivering solutions that must be adopted on the ground.

For new talent, my advice is to embrace platforms and tools that let you experiment safely, collaborate widely and learn continuously. The logistics industry is evolving fast, and those who understand how to turn ideas into operational solutions in a structured, governed way, will shape its future.

About the Author

Umut Şatir Gürbüz is a principal sales engineer at Dataiku, an enterprise-level AI integrator, specializing in machine learning, data analytics and agentic AI.

Logifem Society Network stands out as a pioneering force dedicated to empowering women in logistics and freight forwarding. Founded in Istanbul, Logifem has quickly grown into a vibrant international community, connecting more than 150 members across continents.

With expertise spanning air, land, and sea transport, the network provides a platform for collaboration, business and professional growth. Its mission is clear: to empower women’s voices, foster leadership and reshape the future of supply chain management.

Through annual networking events, business relations and global partnerships, Logifem is not just building connections, it is building a movement. By joining, members gain access to a supportive community that champions equality, innovation, and resilience in the logistics sector.

Logifem Society Network is more than a professional association; it is a symbol of progress, proving that when women lead, industries thrive.

For membership information, visit www.logifem.com.tr/

By Rita Al Semaani Jansen

I began my career at a time when fax machines were the primary mode of communication and days could pass before a response was received.

Little did I know then that my journey would start in the maritime industry. I did not know the difference between manned and unmanned vessels, yet this was where my shipping experience began.

In a male-dominated sector, I learned to find my place. Driven by curiosity and a desire to understand the technical aspects of the marine business, I boarded vessels, entered engine rooms and walked through dry docks and repair sheds.

Reflecting on my journey, I realize I took the road less traveled. It was not without challenges or pain. Being the only young and inexperienced woman sitting on a board of directors, the only woman in a conference room, and the only woman negotiating deals was not the easiest path. There were moments when being heard required more effort than expected. Working across complex sectors demanded not only technical understanding, but also consistency, resilience and sound judgment.

There were situations where assumptions were made before my contributions were recognized. Convincing counterparties who were unaccustomed to dealing with women in the industry required learning how to communicate value clearly and confidently.

What helped me navigate these challenges was a commitment to understanding the industry in depth. I focused on learning its commercial realities, building trusted professional relationships and delivering dependable outcomes. Over time, credibility followed. This, however, did not come without hard work, perseverance and dedication. I also learned the importance of making deliberate career choices, setting boundaries and accepting that meaningful

progress does not always come quickly, but it does come with focus and direction.

My ambition and passion have always driven me forward. The trust I earned from those I worked with and for was, and remains, my greatest reward.

As life presented its own challenges, I overcame most through perseverance. My greatest personal challenge, however, was balancing professional commitments with family responsibilities. Unfortunately, many women of my generation faced the same dilemma; this was often the price a career woman was expected to pay. Gender bias around family responsibilities was common. I recall a time when my two-year-old son was admitted to the hospital, and I was still asked by my managing partner to attend a client meeting. It is encouraging to see that, despite ongoing industry challenges, greater accommodation is now being made for parents.

Today, my focus is on contributing in a way that is practical, sustainable and aligned with long-term value. I am also conscious of the responsibility to support other women in the industry by being honest about the challenges and about the persistence required to overcome them.

Success, for me, is no longer defined solely by titles or milestones. It is reflected in credibility earned through consistency, the ability to create space for others to contribute and a willingness to continue learning and evolve. Barriers still exist, but they are not immovable. With patience, clarity and the right support, they can be navigated and, over time, reshaped.

Success evolves with change: Embrace it and thrive.

Rita combines broad commercial capability with niche mastery of maritime and port-sector mandates. Clients rely on her for practical, high-impact advice on shipping operations, concession structures and regulatory frameworks across the GCC. Rita is a member of WISTA UAE, an official Women in Breakbulk partner.

Through a strategic practitioner’s lens, Hatch Logistics’ global experts explore the forces shaping project and breakbulk logistics: from risk and execution to geopolitics, sustainability and decision-making in complex cargo environments.

By Rick Caporiccio

Incoterms Strategy as a Risk-Control Lever, Not Just a Legal Clause

Over the years while working in the logistics field, I have attended many presentations on Incoterms, and afterwards someone often asks a simple question, “What Incoterm should I use?”

A valid question but one that misses the point. The correct Incoterm isn’t chosen in isolation; it should be selected to manage logistics risks in line with project realities. When you view Incoterms as a strategic risk control lever, you move from chaos to control.

Breaking down a supply chain into its components reveals that each part manages some form of risk that has been identified. Purchase orders are issued with terms and conditions that address the commercial and legal obligations. Vendor quality ensures packages meet technical specifications as agreed in the purchase order. Expediting focuses on keeping fabrication on schedule. However, when it comes to logistics, risk is often overlooked. Too often, I hear, “We shouldn’t take the risk, let the supplier manage the freight.” In a world that is constantly changing, projects should start with assessing risk, rather than asking “Which Incoterm should we use?”

So, what is risk? Risk is an uncertain event or condition that, should it occur, can affect the achievement of the project’s objectives — either negatively as a threat or positively as an opportunity. Defining risks increases the likelihood of meeting objectives while providing assurances that risks affecting the delivery of material have been properly identified, assessed, prioritized, treated and managed.

Wouldn’t a project be better served to first identify the risks associated with transporting materials to your project site, and then develop an Incoterm strategy that offers flexibility to mitigate those risks? Logistics risks come in many forms. Some can be identified prior to the start of a project through route studies, site visits, review of import/export compliance issues, etc. Other risks may not be identified until after the project begins such as changes in customs/tariffs practices, severe weather events, geopolitical conflicts, port strikes, etc. All projects are unique with different sets of risks. International

projects have different risks than domestic ones, so being able to adapt to risks on an ongoing basis would serve a project well.

Those risks may be as follows:

• Economic: transportation rates, insurance arrangements, detention/demurrage, storage limitations, warranty return logistics, site receiving constraints (e.g., maximum deliveries/ day) and site congestion.

• Technical: specialized vehicle selection, route engineering and bridge checks, carrier safety compliance, lashing/securing plans, and load certification.

• Environmental: severe weather, seasonal limitations (freeze/ thaw roads, hurricane season), tarping/packaging standards and sustainability obligations.

• Political: export/import compliance, tariffs, local content, geopolitical issues such as sanctions, embargoes, regional conflicts.

• Social: road closures for heavy haul, public safety, community notifications, infrastructure damage risks and repair obligations.

There is no single “correct Incoterm.” However, you can develop an Incoterm strategy that aligns responsibilities with risks. Your approach should provide authority and flexibility to adapt to changing conditions. Start with risk. An effective Incoterm strategy can be the difference between chaos and control.

Rick Caporiccio is a traffic, logistics and materials manager at Hatch with more than 30 years of international EPCM experience. His expertise spans all phases of project logistics development for large-scale projects across domestic and international markets. Throughout his career, Rick has held progressively senior leadership roles, managing logistics teams responsible for the successful delivery of complex projects, including power generation facilities, potash and gold mining operations, electrical infrastructure such as transmission lines, and oil and gas facilities.

In the remote, unforgiving terrain of Assam in northeast India, where fragile road infrastructure constrains the movement of industrial cargo, Total Movements is pushing the limits of heavy-lift logistics. The company is currently executing the multimodal transport of more than 45,000 freight tons of cargo for the Numaligarh Refinery Expansion Project (NREP), one of India’s most ambitious refinery upgrades. Total Movements’ CEO Satish Kumar Singh shares insight into the scale and complexity of this remarkable operation.

Q: Can you walk us through the scope of this project?

SKS: The 45,000 freight tons for the NREP comprises some 25 super over-dimensional cargoes (ODCs), with components measuring up to 70 meters and

weighing up to 1,286 tons. With conventional road movement unfeasible due to terrain and infrastructure constraints, the team has developed a custom route involving road, coastal shipping and riverine barging via Bangladesh. The ongoing scope includes innovative solutions such as vessel conversion, barge reinforcements, jetty construction and a 1,550-ton-capacity bridge build.

Q: Can you describe the exact route the cargo is taking from origin to site?

SKS: In the first phase, handled entirely by Total Projects, the components are moved by SPMTs and barges from the supplier’s factory in western India to Mumbai Port. The units are then shipped from Mumbai to Kolkata Port, a distance of some 2,100 nautical miles. In the second phase, carried out with ABC India, the cargo is transferred to riverine barges and carried 900 nautical miles north through Bangladesh and back into India to a jetty near the project site, before completing the journey by road to the final destination.

Q: What innovative approaches are you employing to ensure the success of the operation?

SKS: To transport the 1,286-ton Super ODC along the Indian coastline, we chartered the Jumbo Fairmaster, one of only two vessels globally with a lifting capacity of 3,000 tons. As Indian regulations mandate the use of Indian-flagged vessels for coastal shipping, we successfully facilitated the vessel’s conversion from a foreign to an Indian flag, enabling compliant movement from the West Coast to the East Coast. A second example was how we modified our barges. Prior to this project, riverine barges in the Kolkata region were designed to handle single pieces up to 500 tons. To accommodate Super ODCs exceeding this weight, we structurally modified the available barges to meet the required deck strength for safe river transport. Additional

innovations have included the design and construction of a jetty to reduce the impact of river currents on moored barges, dredging in the Brahmaputra River to overcome shallow waters and the installation of a bridge over the Kalyani River.

Q: What has been the most rewarding aspect of the project for you and your team?

SKS: Despite navigating through complex terrain, dynamic river conditions and intricate cross-border regulations, the project continues to progress safely, efficiently and on schedule. Every milestone achieved underscores the synergy of innovation, planning and technical excellence that defines Total Movements’ approach.

ACWA Power and partners Badeel and Saudi Aramco Power Company (SAPCO) have announced financial close on seven giga-scale renewable projects across Saudi Arabia. The projects comprise five solar PV facilities and two wind power plants boasting a combined capacity of 15 GW, said ACWA Power, the world’s largest privately-owned desalination company and a major player in green hydrogen. The total investment value of the projects is US$8.2 billion.

The solar projects include the 3-GW Bisha plant in Asir, the 3-GW

Humaij project in Madinah, the 2-GW Khulis plant in Makkah and two 2-GW facilities — Afif1 and Afif2 — in Riyadh Province. Wind power will come from the 2-GW Starah project and the 1-GW Shaqra site, both also located in Riyadh Province. The projects are slated to start operations in the second half of 2027 and the first half of 2028.

The Trump administration’s pledge of renewed access to Venezuela’s vast oil reserves for U.S. energy companies following the ousting of President Nicolas Maduro in early January could prove more trouble than it’s worth, experts believe.

Despite housing the world’s largest crude reserves — some 303 billion barrels — years of chronic mismanagement, underinvestment and sanctions have left Venezuela’s oil sector operating far below potential.

Oil producers will look to Chevron, the only U.S. company to remain after Venezuela nationalized its oil industry, as an indicator for their next move in the country.

“The oil industry is a longterm business,” said Jaime Brito, executive director of refining and oil products at Dow Jones Energy. “Any company that could potentially participate in Venezuela needs to see that there’s rule of law and certainty for their investments.”

Gulftainer is in advanced talks with the Uganda government to develop the country’s first rail-connected dry port, a project aimed at easing cargo bottlenecks and cutting logistics costs in the landlocked East African nation. Gulftainer CEO Farid Belbouab met President Yoweri Museveni and senior cabinet members in Kampala to discuss plans for a logistics hub that would connect industrial zones to seaports and shift container traffic from road to rail. The facility would “enhance Uganda’s competitiveness as a gateway for East African trade,” Gulftainer said.

Saipem has been awarded two offshore contracts worth some US$600 million, part of an existing long-term agreement with Aramco. A first contract, lasting 32 months, is for the engineering, procurement, construction and installation (EPCI) of 34 km of pipeline and related works on topside infrastructure at the Berri and Abu Safah oilfields. A second, year-long deal includes subsea interventions at the Marjan field and the EPC of onshore pipelines and associated tie-ins. Alongside partner Offshore Oil Engineering, Saipem has also won an EPCI contract with QatarEnergy LNG for the COMP5 package of the North Field Production Sustainability Offshore Compression Complexes project. Saipem’s share is worth about US$3.1 billion. The five-year deal covers the delivery and offshore installation of two 68,000-ton compression complexes each comprising a compression platform, living quarters, flare platforms and interconnecting bridges.

Galveston Wharves in Texas is investing more than US$100 million to overhaul its breakbulk-handling West Port Cargo Complex, with the project slated for completion in 2026. The investment, its largest in decades, aims to improve dilapidated waterfront infrastructure, add acreage for cargo handling and extend berthing space, allowing port tenants to move more cargo through the area and put more people to work on the waterfront.

The project, which began in 2024, includes the installation of a new 1,424-foot-long berth and the addition of 30 acres of waterfront cargo laydown area for breakbulk and other cargoes. Located at the entrance to Galveston Bay and the Houston Ship Channel, the Port of Galveston is one of the busiest ports in Texas.

CEVA Logistics has agreed to acquire Italy-based transport specialist Fagioli Group, a move aimed at expanding its heavy-lift and project cargo capabilities. CEVA said the acquisition would add around 450 employees, including more than 40 engineers, and enable it to cover the entire project value chain from design phase to final delivery. Fagioli’s owned and leased fleet includes cranes,

modular transporters, barges and other heavy equipment used in complex project cargo operations.

The deal is expected to strengthen CEVA’s logistics push in the Middle East through its CEVA Almajdouie Logistics JV in Saudi Arabia, while supporting operations in East Africa thanks to its 2022 acquisition of Spedag Interfreight. Financial terms were not disclosed, and the deal is subject to regulatory approvals.

ABB has signed contracts with Rotterdam Shore Power, a JV between the port of Rotterdam and Eneco, to design and build what is slated to be the world’s largest shore power system by total capacity, exceeding 100

megavolt-amperes, at Europe’s busiest port. Scheduled to begin operations in the second half of 2028, the custom-built installations will supply clean electricity across three major deep-sea container terminals, with 35 connection points capable of powering up to 32 container ships simultaneously during cargo operations.

The project will significantly cut port-side emissions and support compliance with the EU’s FuelEU Maritime Regulation, ABB said. Rotterdam Shore Power estimates that supplying shore power for at least 90 percent of vessels’ time at berth could cut annual CO2 emissions at the three deep-sea container terminals by around 96,000 metric tons from 2030.

Ørsted is challenging a U.S. order that halted its Revolution Wind Project off the coast of Rhode Island, saying the suspension is unlawful. Revolution Wind, a JV between Ørsted and Skyborn Renewables, has filed a court complaint in Washington and plans to seek an injunction against the Interior Department’s Bureau of Ocean Energy Management, which issued the lease suspension in late December.

Ørsted said the project received the

required permits in 2023 after years of review and is about 87% complete, with all offshore foundations and 58 of 65 turbines already installed. Export cable installation is complete, and both offshore substations have been installed. At the time of the lease suspension order, the project was expected to begin generating power as soon as January 2026. Experts warn the halt could raise power prices and weaken grid reliability.

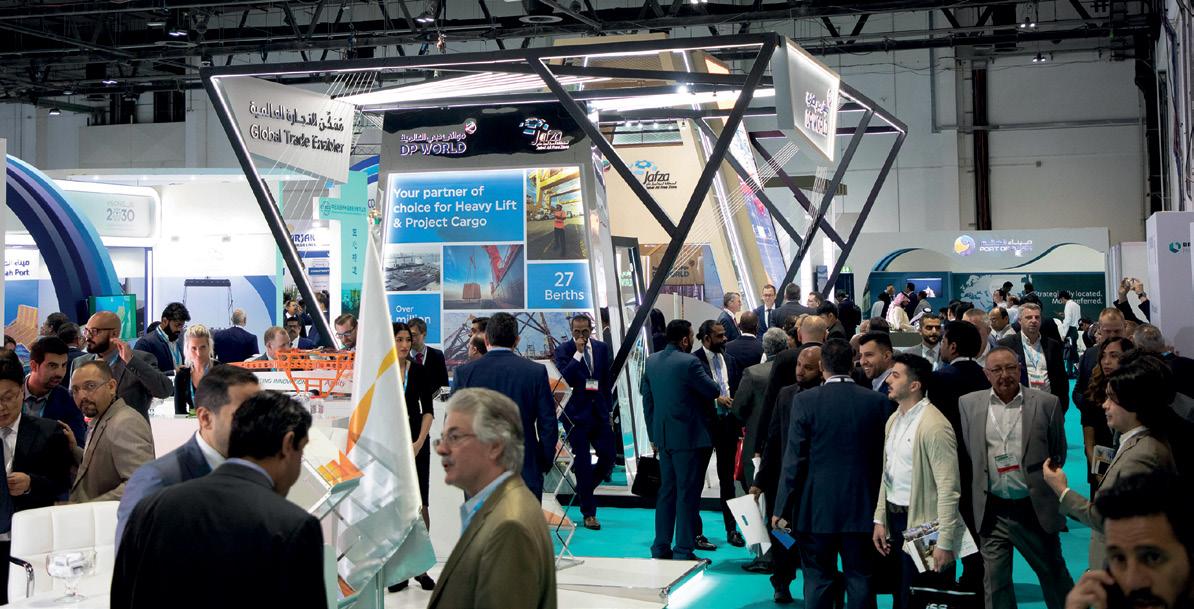

When Breakbulk Middle East launched in 2015 in Abu Dhabi, the goal was simple: provide a dedicated meeting place for the region’s project cargo community, similar to the Breakbulk events we hosted in other parts of the world. The inaugural event attracted 2,000 attendees, a good start. We never imagined the phenomenal growth that was in store, especially in light of the dismal economic situation.

At the time, oil prices had reached lows of around US$26 a barrel for Brent crude, putting project budgets around the world under pressure. How bad was it? “I daresay the situation in

By Leslie Meredith

the oil and gas sector is worse than what it was in 2008 when there was a global meltdown,” said Mandar Apte, Technip project manager, one of the original advocates for the event.

Project owners, EPCs and logistics providers were being forced to reassess their expenses, reduce risk and tighten timelines. As were governments in the GCC. It was this belt tightening that led to the diversification from burning hydrocarbons to adding renewables and nuclear to the region’s energy mix, an insight that would be shared by MEED at the upcoming event, and in turn, open a major opportunity for project cargo specialists.

What the region lacked was a dedicated forum where project cargo specialists across transport, logistics, ports, heavy-lift and engineering could meet to work through those challenges together. Breakbulk Middle East entered the market at a moment when collaboration mattered more than ever.

Early conference sessions reflected the concerns of the time, with speakers addressing fiscal restraint, risk mitigation and the need for closer collaboration as the region adjusted to what many described as a “new normal” for oil prices. Still, optimism prevailed. As long-time supporter Cyril Varghese of Fluor said in his first interview with

Breakbulk’s Leslie Meredith, “There’s never a dull day in this industry.”

But by 2018, project prospects had improved, bringing a rosier outlook to the industry. “As an EPC contractor, we’re receiving many invitations to bid on projects from companies like ADNOC and Kuwait Oil Company. The oil price is now very stable. All this means more projects are on the track. We feel oil projects are very hot right now in the Middle East,” China Petroleum Engineering Co.’s Ding Wei said in an interview in Breakbulk Studios that year.

With the continued support of UAE Federal Transport Authority – Land & Maritime, which became the UAE Ministry of Energy and Infrastructure, Breakbulk earned its reputation as the industry connector. “It is a good chance for the decision-makers to meet with shippers, producers and suppliers all in one place,” H.E. Dr. Abdulla Salem Al Katheeri, director general of the UAE Federal Transport Authority – Land & Maritime, said following the 2018 opening ceremony. “The event will have positive benefits for everybody.”

In 2019, the event moved to Dubai where attendance increased by 83% to reach 3,408.

The profile of the event remained consistent even as it expanded. The same core sectors continued to anchor the exhibition and conference, but at a much larger scale. What changed was the level of investment. Over time, the show floor evolved from simple stands into a highly professional environment featuring double-decker exhibition spaces, large-scale LED displays and increasingly sophisticated technical demonstrations. The transformation reflected growing confidence in the region’s project outlook and in the value of the event itself.

By the early 2020s, conversations at Breakbulk Middle East had broadened to include energy transition technologies alongside conventional projects. Speakers discussed wind, solar, hydrogen, carbon capture and grid infrastructure, while acknowledging

that oil and gas continued to dominate regional investment. The common thread remained execution: early engagement, engineering-led logistics planning and collaboration across multiple stakeholders.

Today, Breakbulk Middle East remains the only event in the region dedicated exclusively to the transport and logistics of project cargo. More than 10,500 professionals attended the 2025 edition, tripling in size post-pandemic. More than 120 countries are represented, elevating the event to the international level, reflecting the growth of this resource-rich and resilient region.

The market continues to evolve. Project portfolios are expanding amidst a sea of geopolitical turmoil, and collaboration across the supply chain is only becoming more critical. Ten editions on, the purpose of Breakbulk Middle East is unchanged: to provide a place where the industry can come together to plan what comes next. If you want to be a part of the future of project cargo, it starts at Breakbulk Middle East.

Leslie Meredith is the product and editorial director for Breakbulk Events & Media. She is also the founder of the Women in Breakbulk program.

Event milestones, expert insight, world events and the projects that shaped each year as Breakbulk Middle East grew from a start-up to a powerhouse for networking.

Breakbulk Middle East launched in Abu Dhabi and attracted 2,000 attendees. Sessions focused on cost pressure, risk mitigation and coordination across EPCs, transport, ports and heavy-lift, proving a collaborative forum was just what the region needed as oil reached new lows. There was plenty to discuss, with two conference stages running simultaneously.

“In Saudi Arabia you are not given the opportunity to make mistakes more than once. They will hold up cargo for six months if need be. You will learn the rules very quickly.”

— Corey Henry, Group Logistics Manager, Fluor Corporation.

Sub-US$50-per-barrel oil prices prompted what Höegh Autoliner analyst Teresa Lehovd described as a “paradigm shift” in the Middle East. “The current prices expose the risks of overdependence on one single commodity and emphasize the need to diversify,” she said. Infrastructure projects were expected to thrive, while refining and petrochemicals faced pressure.

The global oil price collapse put some projects on hold and shifted resources toward diversification. Saudi Arabia’s leadership change and the launch of Vision 2030 signaled a longer-term rethinking of project priorities.

Upper Zakum, the world’s second-largest offshore field, located on artificial islands off Abu Dhabi. Petrofac’s Matteo Pollara presented the logistics case study, which included transporting 194 modules manufactured in South Korea, Singapore, China and Italy for ADNOC.

The event returned to Abu Dhabi and recorded a 20% jump in attendance as word spread about the new industry gathering. Ongoing carrier bankruptcies brought a sobering tone and renewed focus on risk mitigation. Project timelines stretched, front-end engineering slowed final investment decisions and patience became a recurring theme across sessions.

“We’ve seen Hanjin file for bankruptcy over the last couple of months. We’ve seen Flinter declare bankruptcy. What kind of risks are we facing as cargo owners?” — Cyril Varghese, Global Logistics Director-Commercial & Strategy, Fluor Corporation.

Oil prices began to improve, but the downturn proved “much longer than we thought it could be, particularly given the long lead times between engineering, contract awards and construction,” Cyril Varghese said.

No event in 2017 as the event timeframe shifted from October to February

“When you look at a project in Iraq, pre-planning is most of the work, not the execution.”

— Tina Benjamin-Lea, Logistics Manager, SNC Lavalin

With oil prices more stable, previously delayed projects began moving again. Programming shifted from surviving the downturn to preparing for projects returning to market. UAE government patronage was secured, bringing wider attention to the event and reinforcing its role as an industry meeting point. Conference sessions asked, “Is it time to invest in the GCC?” and addressed the special requirements for logistics personnel working in post-conflict environments such as Iraq, where timelines, security and access could not be taken for granted.

Upstream projects underway: Barzan Gas Development in Qatar and Bul Hanine field redevelopment in Qatar, both representing US$10 billion in investment. These projects and more were discussed in “Capital Project Outlook for the GCC” byTerry Willis, regional director for the Energy Industries Council.

Oil prices began a gradual upward trend, projected to reach between $50 and $60 per barrel by 2020, easing approvals for new projects.

“Breakbulk Middle East represents a platform that brings significant value to the industry and can therefore be very effective in reinforcing collaboration between the UAE and Saudi Arabia upon shared goals for maritime advancement.” — Rayan Qutub, CEO, King Abdullah Port.

Mohammad Jaber, then with Agility, highlighted the “huge expansion of the refining sector,” including Saudi Arabia’s Jazan Refinery and Terminal Project. Jaber is now CEO of Combi Lift Projects MEA and a founding member of Breakbulk’s Future Thinkers group.

Breakbulk Middle East moved to Dubai and attendance increased 83% to 3,408. While the sector mix stayed consistent, the event expanded and added new community programming, including the launch of Women in Breakbulk. The conference also featured its first dedicated spotlight on Saudi Arabia.

Vision 2030 continued shaping Saudi project pipelines, with emphasis on giga-projects, public–private partnerships and non-oil sectors.

“There are several key misconceptions about working on projects in Africa, and perhaps the most common one is the assumption of what basic infrastructure is present.” — Lars Greiner, Consultant, HPC Hamburg Port Consulting GmbH.

Breakbulk Middle East took place just before COVID-19 became a global pandemic. Sessions focused on sequencing, modularization and fixed delivery schedules, with logistics planning framed around immovable timelines. The official Breakbulk MEET app was introduced, and Education Day welcomed 122 students, including a surprise visit by H.E. Eng. Ahmed Al Khouri.

For the first time, the event actively encouraged participation from Africa, reflecting growing project and logistics ties between the regions. A practical session, “Preparing for Big Project Work in Africa,” delivered muchneeded advice.

The Africa panel with representatives from JGC and ExxonMobil, discussed the proposed Rovuma LNG project in Mozambique, slated to become the world’s largest project of its kind. The project was subsequently delayed until recently due to an insurgency. ExxonMobil now targets FID in 2026, with first LNG production around 2030.

No event in 2021 due to the pandemic

Breakbulk Middle East returned to Dubai as projects restarted unevenly and the world struggled for normalcy. Discussions focused on rebuilding schedules, labor constraints and the acceleration of technology adoption, a silver lining to pandemic restrictions. Saudi Arabia remained a major topic of interest for project opportunities.

“The market is growing, Saudi Arabia is the land of opportunity, there is so much construction, there is so much investment – and it is fast-tracked.”

— Sue Donoghue, Arab Cluster CEO, (Bahrain, Kuwait, Saudi Arabia), DHL Global Forwarding; Vice Chair European Chamber of Commerce Kingdom of Saudi Arabia.

Unit 4 at the Barakah Nuclear Power Plant in the UAE was under construction, due to start commercial operations in 2023. This marked the first nuclear power plant in the Arab world and an important piece energy diversification, discussed in the “Regional Outlook, Project Financing, and Investment” session.

Russia’s invasion of Ukraine boosted demand for Gulf oil and LNG as Europe reduced Russian imports, improving availability of funds for new energy and infrastructure projects.

“Breakbulk Middle East has been one of the best events we have attended.” —

Anfal Zahir Al Affani of Oman’s Ministry of Transportation, Communication and IT.

Ruwais Derivatives Park in Abu Dhabi and the Ras Al Khair crude oil-to-chemicals project in eastern Saudi Arabia, each calling for investments of around US$20 billion. EIC’s Ryan McPherson discussed these and more in the standing-room-only session “MENA Project Review” and in Breakbulk Studios.

With the pandemic firmly in the rearview mirror and an active project landscape, interest surged. Attendance jumped 93% year over year to 6,496, while country representation rose from 55 to 98.

The first Breakbulk Golf Day and Welcome Reception at the Monkey Bar were held, both quickly becoming permanent fixtures on the Breakbulk Middle East agenda.

Elevated energy prices continued to support project development across the GCC.

Attendance reached 7,197, while a 101% rebook rate signaled further growth ahead. Heavy rain delayed the opening and flooded parts of the exhibition hall, but staff cleared the water and dried the carpeting. Within hours, the doors opened and the networking began.

Participation by Chinese companies increased. Greatkun, a freight forwarder, delighted attendees with a traditional dragon dance that made its way throughout the exhibition hall, a first at Breakbulk Middle East.

Programming focused on what shippers need from suppliers and the path to decarbonization in the maritime sector, while Women in Breakbulk tackled how to become a more influential leader. Panelist Alia Janahi, vice president of HSE at DP World in the GCC and the first female Emirati to join the company’s HSE department, shared how early in her career she designed a new uniform after realizing her abaya was not suitable for climbing aboard vessels. Others followed her lead, a great example of influential leadership.

“In my experience, having ladies in the department makes a difference. And you should be really proud!” — Alia Janahi, vice president of HSE, DP World

Ruwais LNG project in Abu Dhabi, the first facility in the MENA region to run on clean power. US$5.5 billion EPC contract awarded to a joint venture between Technip Energies, JGC and NMDC Energy, included in this year’s MENA project opportunities session.

Red Sea attacks forced vessels to reroute around southern Africa, increasing transit times and insurance costs. “Rerouting is adding an extra 20 days to the Middle East to Mediterranean routes. On supply chains that has a big impact and is effectively reducing the fleet,” AAL Shipping’s Christophe Grammare said during the session “The Balancing Act: Demand, Supply and Economy.”

Attendance surpassed 10,500 from more than 120 countries. Five countries — the UAE, India, Saudi Arabia, Türkiye and China — accounted for around 80% of attendees. The event hosted 193 exhibitors, four times as many as in 2015, along with a record number of shippers. Programming included core topics: MENA projects, risk management, Africa opportunities and Saudi giga-projects, and introduced AI strategies and a new perspective on energy transition projects.

“I believe that in the next 10 to 20 years, Saudi Arabia will become a leading exporter of cutting-edge decarbonization technologies to the world.” — Kohki Uemura, president and CEO, DENZAI

Red Sea security incidents persisted, keeping insurance premiums high, while other global disruptions had limited impact on the region.

Panelists pointed to a potential US$50 billion spend on energy transition projects by the end of the decade, including carbon capture, battery storage and energy systems. “These new technologies are actually changing the way projects used to happen and the way logistics service providers used to traditionally work,” said Fluor’s Vineet Bakshi.

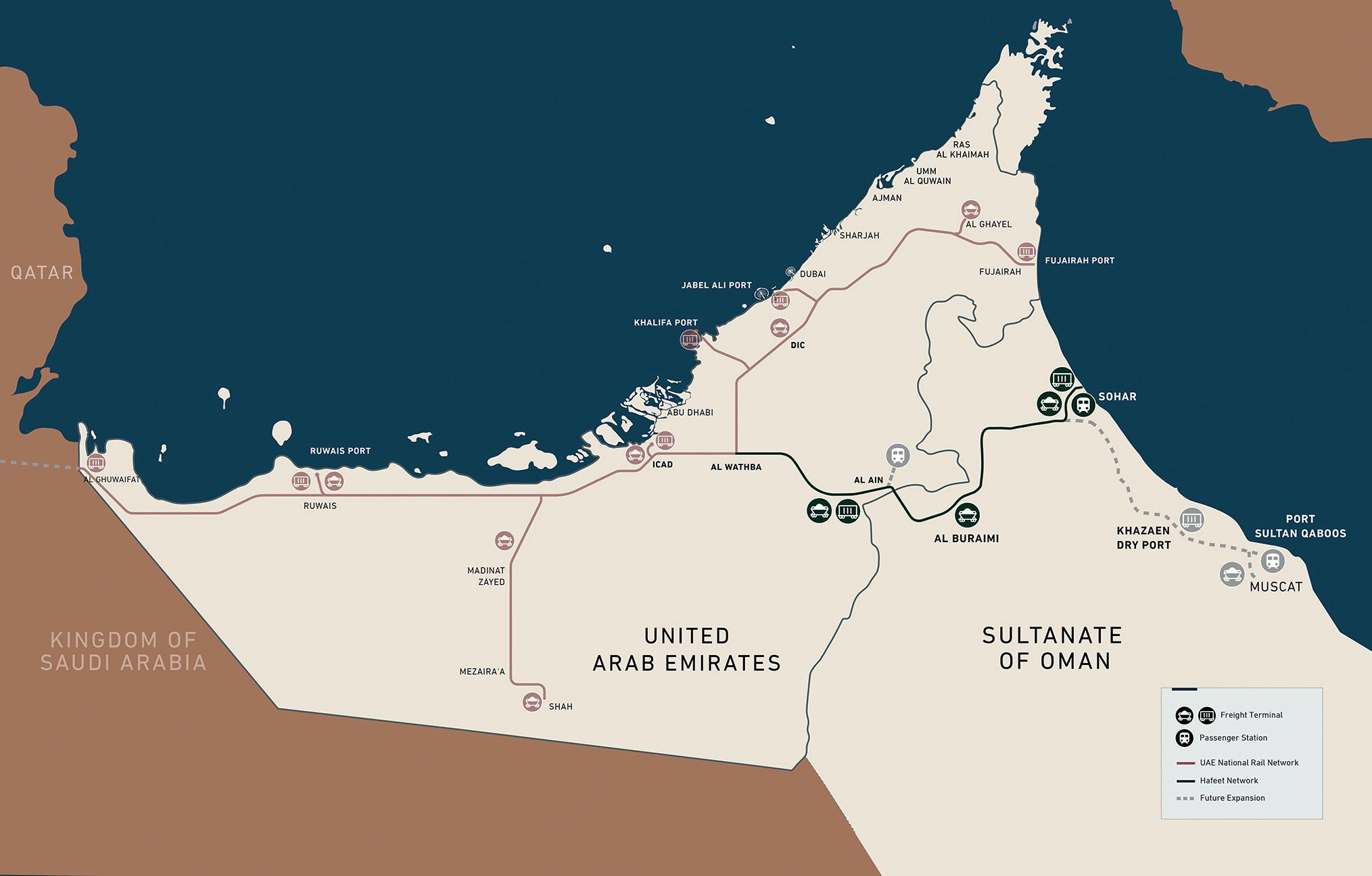

By Liesl Venter

Rail has long carried a sense of nostalgia, perhaps more so in the Gulf, where the desert lies in silence while new towns, ports and industrial zones rise around it. In this setting, the return of rail feels both familiar and new. Saudi Arabia and the UAE are leading the charge, expanding freight rail beyond bulk minerals and into a wider logistics role.

“This is the golden age of rail in the GCC (Gulf Cooperation Council),” says Edward James, head of content and research at MEED.

“Over the last 10 years there’s been a realization that expanding rail capacity, for both passengers and freight, is an important economic driver for each country.”

There are significant large-scale investments with long-term strategic intent, aimed at building economic competitiveness and strengthening regional connectivity. “The longterm objective for Saudi Arabia, for example, is to increase the contribution of the entire transport and logistics sector to 10% of non-

oil GDP by 2030, a key metric for its Vision 2030,” said Juwairiya Fatima, consulting analyst, supply chain and logistics practice at Frost & Sullivan.

Projects such as the US$7 billion Saudi Land Bridge, a major new railway line linking Jeddah Port with Riyadh, are more than infrastructure schemes; they are economic enablers designed to unlock new industrial zones and improve supply chain resilience. “The sheer volume of investment signals a calculated effort to secure a greater and more predictable share of global freight movement by offering a reliable land bridge alternative to sea routes, especially for traffic moving between Asia and Europe,” said Fatima. “This financial commitment underscores the nation’s resolve to diversify its economy and cement its role as a pivotal logistics hub.”

What began as separate national projects are now evolving into integrated corridors that connect ports, free zones and borders, creating a rail system with genuine potential to move oversized equipment,

energy-transition components and megaproject cargo at scale.

“The most obvious example is the Etihad Rail project in the UAE,” said James. “It was originally built to transport sulfur from an oilfield in Abu Dhabi to the coast, but has since been expanded and now links the Saudi border with Abu Dhabi, Dubai, Sharjah and Fujairah. A lot of that is about taking cargo off the roads and linking the UAE’s major ports, Fujairah, Jebel Ali and Khalifa, and creating a more reliable way for freight to move both coast-to-coast and cross-country.”

“The long-term intention is for these freight lines to connect with neighboring countries and move goods across the region,” he said. “This is now happening for the first time through the Hafeet Rail project, which will link the Etihad Rail freight network through Al Ain and into northern Oman, terminating at Sohar Port. It will be the first inter-country freight railway in the region.”

Etihad Rail has already proven its utility as a bulk-haul system and a port connector, with freight now moving on scheduled services across the country. The network was built in stages, with a first stage carried out simultaneously with the construction of the Shah gas plant and a ship-loading facility at Ruwais.

Feb. 5

10:30am - 11:15am

More than 4,000 workers and 30 subcontractors took less than three years to complete the 264-km line. The excavation of more than 90 million cubic meters of earth and the installation of civil works, tracks and systems were carried out by lead contractor Saipem alongside partners Tecnimont and UAE-based Dodsal.

“The railway from Shah, Habshan and Ruwais carries granulated sulfur for export, making the UAE the world’s largest exporter of this commodity after the line opened,” said Kevin Smith, editor-in-chief at the International Railway Journal. “While exact traffic volumes are not publicly disclosed, the wider 1,200-km network from the Saudi border to Fujairah is operational, and multiple commercial agreements are already in place.”

Meanwhile, construction of Hafeet Rail, a joint venture between Etihad Rail, Mubadala Investment Company and Oman’s Asyad Group, is more than 50% complete, with the 238-km crossborder line making “fast development progress,” Etihad Rail CEO Shadi Malak was quoted as saying by local sources.

Among the project’s contractors, Siemens Mobility was picked to work alongside Egypt’s Hassan Allam Construction (HAC) to deliver the design, build and integration of the network’s ETCS Level 2 signaling, telecom and power supply systems.

Rail investments across the region are not short-term experiments. They are capital-intensive, longhorizon programs backed by national industrial policy.

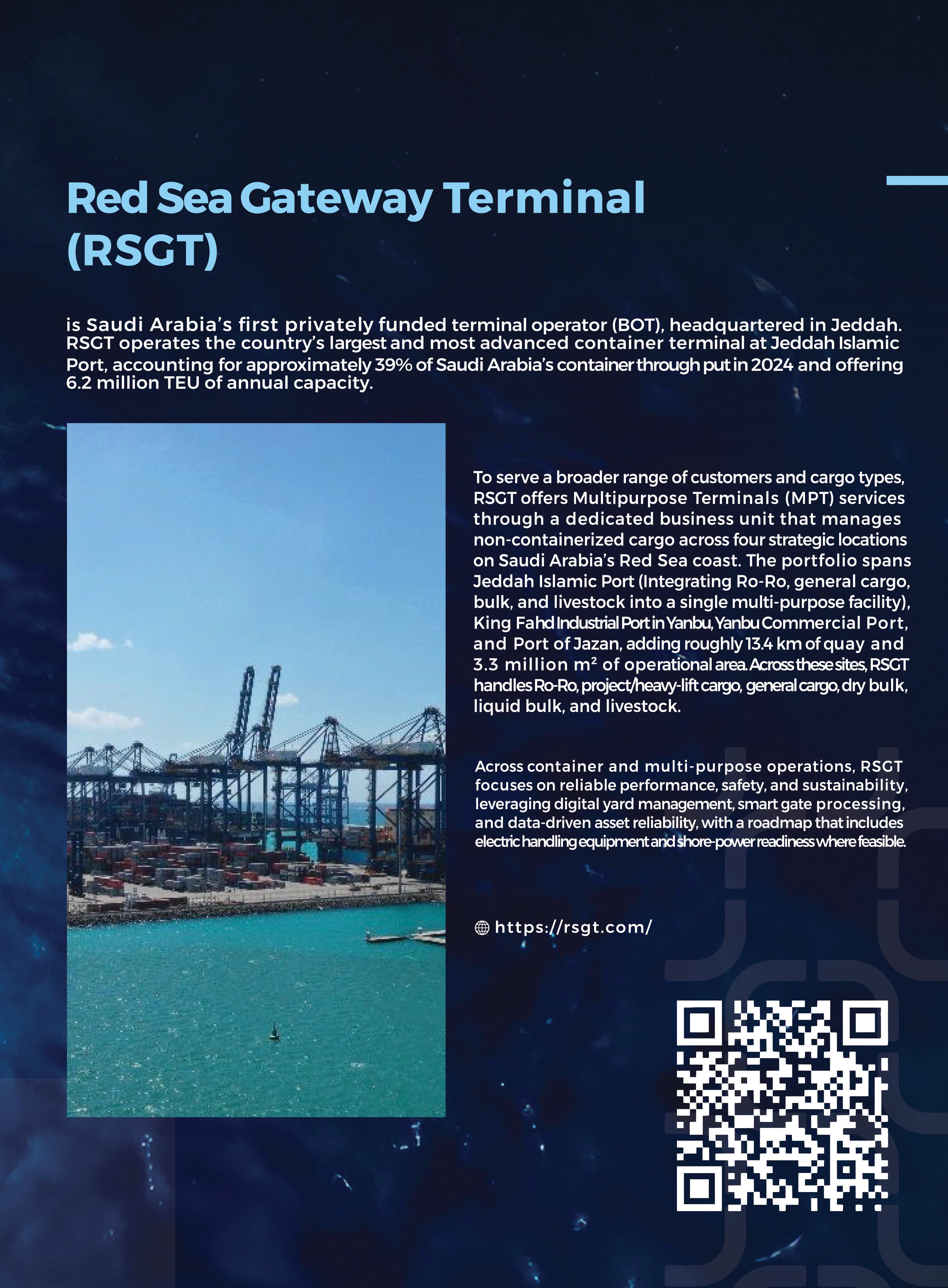

According to Moayad Musalli, commercial director for Red Sea Gateway Terminal’s (RSGT) multipurpose business in Saudi Arabia, the current investments are measured in the billions and are strategic, rather than tactical.

“These networks are designed as long-term national assets that will reshape freight flows, diversify economic activity and unlock new inland industrial zones. They support national logistics strategies and are central to

energy transition and industrial diversification agendas,” he said.

“Construction of a wider GCC freight network that will eventually connect all six states is significant,” said Smith. “Different sections are at different stages of development. The UAE has completed its link to Saudi Arabia and is working with Oman on a cross-border freight line from Abu Dhabi to Sohar. Kuwait and Qatar recently confirmed plans to develop their respective sections. Bahrain is targeting a second causeway to Saudi Arabia that will carry

a rail link. Saudi Arabia has promised to complete connections to the UAE border, but it is unclear whether these projects are proceeding.”

While activity across the GCC is significant and several sections are advancing, industry observers caution that a fully harmonized 2,117-km regional network remains a long-term ambition rather than an imminent milestone.

“There is no central organization set up for this GCC railway,” said James. “The GCC secretariat has tried to influence things and push progress along, but there is no dedicated body overseeing development, harmonization or regulatory alignment.”

With no supranational rail authority, each country is responsible for building its own section and then connecting at the borders. Over time, the GCC freight network will require harmonized customs procedures,

immigration controls, safety standards and operational protocols to ensure seamless cross-border movement.

“I wouldn’t say there is harmonization necessarily,” said James. “To illustrate this, Etihad Rail is now considering building a causeway from the far west of Abu Dhabi to offshore islands and then a ferry network to Qatar, bypassing Saudi Arabia completely. That shows the extent of the challenges in building a full GCC railway network.”

Rail development across the region also shows different levels of maturity. The UAE and Saudi Arabia are furthest ahead, with operational freight networks and active passenger expansion. Other states are in the nascent stages of their programs.

“Qatar, Bahrain and Kuwait do not have operational railways and until recently Oman did not either,” said James. “The UAE only built its first railway in the last 15 years. Saudi Arabia has expanded beyond its original Dammam–Riyadh route, but its newer

lines, such as mineral and fertilizer corridors, are still relatively recent.”

These differences do not indicate lack of commitment but rather reflect the varied size, geography and industrial priorities of each state. “Institutional integration and an uneven project velocity across GCC member states, does create scheduling risks for the unified 2030 network deadline,” said Fatima.

Cross-border rail freight also demands a more nuanced regulatory framework than standardized container flows. “Breakbulk and over-dimensional cargo require specialized handling, escorts, route surveys and bespoke permitting, which must be aligned to prevent stop-start delays at border crossings. While the GCC operates under a Common Customs Law, the practical application of the 12-digit Integrated Customs Tariff to complex rail consignments will need gradual harmonization to support predictable long-haul scheduling,” said Fatima.

Despite the complexity of multicountry regulation, stakeholders stress that coordination is progressing in phases rather than all at once. Bilateral agreements, shared infrastructure planning and gradual standards alignment are becoming more visible as freight volumes grow and commercial incentives strengthen.

“Bilateral cooperation between neighboring states, such as the UAE and Oman, is gaining momentum, and structured GCC-level committees are now emerging to guide long-haul freight connectivity,” said Musalli. “Public–private partnership models and private-sector-led corridor development are also gaining traction, particularly where large industrial flows guarantee demand.”

As regional rail corridors mature, project-cargo capability will evolve in structured phases, driven in no small part by private-sector capital and operational expertise.

“The current focus remains on developing the Land Bridge, with container and passenger volumes taking initial priority,” explained Musalli. “Non-containerized rail development is largely advancing through private

sector investment on corridor-specific legs. The first phase involves constructing heavy-lift capable terminals and rail sidings and reinforcing pavements and storage for oversize units.

“This will be followed by expanding rollon, roll-off (RoRo) -compatible rail sidings and open yards, integrating rail scheduling into port community systems, and developing dedicated project cargo services with guaranteed capacity.”

According to Fatima, the single most transformative development that will redefine freight dynamics across the Middle East is the full commissioning of the Saudi Land Bridge.

“This is no mere expansion of a rail network; it is the strategic reengineering of the global trade route across the Arabian Peninsula. It will make Saudi Arabia a true continental logistics hub by offering a dedicated, high-capacity, east-west freight corridor that crosses the kingdom,” she said.

The Land Bridge will connect Red Sea ports such as Jeddah and King Abdullah Port to Arabian Gulf gateways and Riyadh, establishing a land-based alternative to the costly and geopolitically complex maritime detours around the Strait of Hormuz and wider Peninsula.

“It enhances transshipment competitiveness with far faster and more predictable passage times, potentially shifting transit windows from days to hours,” Fatima continued. “This makes it a highly competitive alternative to long ocean hauls for Asia–Europe cargo. The shift is crucial for securing a predictable share of global freight movement.”

Amid intensifying geopolitical pressures, rail has re-emerged as a strategic freight asset across the region. But Fatima highlights one trend that is far less visible yet enormously consequential for heavy and project cargo: the rapid rollout of rail-linked logistics parks and dry ports.

These facilities are designed to resolve one of the sector’s structural bottlenecks: the complex and expensive last-mile movement of large, non-standard cargo. The Saudi Ports Authority (MAWANI) is currently supervising the development of 11 integrated logistics zones, including a US$347 million logistics park at King Abdulaziz Port in Dammam.

As these logistics parks and rail-linked inland zones move from construction toward operational maturity, private-sector participation becomes central to their success. According to Musalli, PPP models bring operational agility, customer-focused service design and flexible capital deployment, ensuring predictable throughput and faster network readiness.

Fatima adds that the technical conditioning achieved through heavyhaul mineral movements already provides a scalable engineering foundation for oversized modules, significantly reducing operational risk. “Once major EPC companies are aware of the full range of economic predictability, superior scale and reduced environmental impact that rail offers compared to longhaul road transport, the share will irrevocably shift,” said Fatima.

For the GCC’s heavy industry, that shift signals rail’s emergence as a core mode for project cargo rather than a peripheral alternative.

Liesl Venter is a transportation journalist based in South Africa.

*Breakbulk Exhibitor

*BGSN Member

By Luke King

“I

t hasn’t been easy,” said Humeira Aidarous Al Hashmi, regional general manager for Blue Water Shipping she reflected on her two decades in the often male-dominated logistics industry.

“In fact, people would fall off the chair when I walked into the room. A woman? An Arab woman? Dressed like that!”

After months of email exchanges discussing solutions and pricing for complex project cargo shipments, clients would often arrive expecting to meet a man — only to be stunned when the woman in in traditional Emirati dress extended her hand.

“My name doesn’t give it away, so a lot of them actually thought I was a man until we met face to face,” Al Hashmi said. “But once you get into the conversation, they immediately connect me with the person who sent the email, with the solution, with the price.”

That ability to win over clients has defined Humeira’s 23-year journey through the world of project logistics in the Middle East. Now heading Blue Water’s regional operations out of Dubai, the 40-something Emirati has built a reputation for delivering results while mentoring the next generation of logistics professionals.

Humeira’s introduction to project cargo came through TransOceanic, an American family-owned company where she cut her teeth on major projects for engineering, procurement and construction giants like KBR, Foster Wheeler and Fluor

“I started from the bottom up,” she said. “I went in as a secretary of the SVP, and within a month I was doing operations because we were just winning so much work, and we were short-handed.”

That 13-year tenure with TransOceanic in Dubai, later acquired by Agility, provided intensive training across the region. Al Hashmi moved between different roles and locations, soaking up knowledge from mentors who recognized her potential. But the high-pressure environment eventually took its toll. After leaving Agility, she joined Kanoo Shipping, where she helped transform the regional player from a pure shipping agent into a project forwarder working directly with EPCs. The experience of building a team from scratch and creating new business opportunities proved invaluable.

A subsequent move to CEVA Logistics brought new challenges, including navigating the company’s acquisition by CMA CGM and the chaos of COVID-19. “We were doing great in

CEVA, but I felt it was growing too big, too fast,” Al Hashmi said.

When Blue Water Shipping approached her, the opportunity felt like coming full circle. Like TransOceanic, the Danish family-owned company emphasized values over sheer scale — prioritizing people and long-term relationships over aggressive expansion.

“You’re recognized, you’re appreciated, and we love our people and that’s our biggest asset,” she said. The company’s Scandinavian culture, with its emphasis on work-life balance, also resonated. “I’ve realized that the only thing I need outside of work is family.”

Since joining Blue Water in 2023, Al Hashmi has focused on developing the company’s Middle East presence. One ace up her sleeve is Blue Water’s recently-opened warehouse facility in Jebel Ali, featuring 5,000 square meters of covered space and 11,000 square meters of compacted open yard suitable for heavy lift cargo.

“Our project clients tend to require space to stage their cargo if their site’s not ready or the ship’s not coming in for a while,” she explained. “Most of them want a one-stop shop solution.”

Breakbulk Middle East: AI in Action: From Pilot to Performance

Thursday, Feb. 5

Main Stage 2:00pm – 2:45pm

Being a woman in project logistics has been “colorful,” Al Hashmi acknowledges. Beyond the initial shock of clients expecting a man, she’s faced subtle and not-so-subtle resistance throughout her career.

“I’ve had people literally put bets on how long I’m going to stay in a particular position in different organizations,” she said. The key, Al Hashmi believes, isn’t proving a point but simply being good at the job. “In this industry, you’re learning something new every single day from every single person in the organization — your customer side, your vendors. It’s a never-ending classroom session.”

Al Hashmi believes women bring particular strengths to project logistics. “I just think we’re a bit more organized, a bit more structured. My OCD is very well known in my company,” she joked.

Today, women remain relatively scarce in senior logistics roles across the Middle East, though Al Hashmi sees progress. Foreign women increasingly hold critical positions, bringing diverse perspectives. Among Emirati women, customs and port authorities attract the most talent, but field operations and heavy cargo movements remain predominantly male domains.

“A lot of them think it’s a man’s world — getting down and dirty, crazy hours, no sleep, no work-life balance,” she said.

“But we need to change the mindset. The only way we can do it is to encourage more women to get involved in the hardcore, the heart of the operations. I’m telling you, their minds will be blown because this is something you cannot get out of once you’re in it.”

The Middle East project cargo landscape has transformed dramatically since Al Hashmi entered the industry. Two decades ago, American and European EPCs dominated. Today, Chinese, Korean, Indian and Spanish companies have joined the mix, while many traditional Western players have shifted toward project management consultancy and front-end engineering (FEED) work.

“I think having all of this diverse exposure is super important,” she said. “It’s great for trade between economies.”

The shift has brought both opportunities and challenges. More diverse EPCs mean more companies can secure work in a competitive market. But pricing pressures have intensified, squeezing margins for freight forwarders.

“Back in the day, you could count the number of project forwarders on one hand,” Humeira noted. “Now it doesn’t matter how many digits you’ve got, you’re going to run out.”

Geopolitical disruptions add another layer of complexity. The Red Sea crisis, tariff wars and trade restrictions force clients to shift procurement patterns, while shipping lines consolidate power through vertical integration, such as buying ports, aircraft and forwarding companies.

“The carriers are controlling the business,” she said. “There is a bit of a monopoly. The true essence of being a project forwarder is somehow being diluted when you see all of this.”

Despite challenges, Humeira sees enormous potential, including in Saudi Arabia. “It’s my second home, literally,” she said. “There is

so much to do there. Anything you touch can be turned to gold.”

She believes Saudi Arabia’s vast geography, large population and ambitious development plans create project cargo opportunities that will last decades. “Saudi is thirsty for qualitybased solutions,” Al Hashmi said.

Blue Water is involved in Saudi Arabia’s renewable energy sector, particularly through its work at the Port of NEOM in Oxagon, the kingdom’s industrial city in the northwest. The forwarder was contracted to support cargo handling capabilities for wind turbine components, leveraging more than 30 years of experience managing wind turbine logistics for offshore projects globally.

Blue Water provided on-ground training to support the port’s talent development program, delivering a two-week training course for 24 staff that covered all aspects of wind logistics, including correct lifting, safety procedures, storage area coordination and layout optimization.

Al Hashmi sees further potential for wind-related work across the region. “The wind conditions are perfect along the west coast of Saudi Arabia, the Jeddah side where we already have NEOM. The hills and valleys mean the wind conditions are very good in Oman, too.”

Back home in Dubai, an Emiratization drive aims to develop local talent while leveraging expatriate experience. Having grown up with limited educational options, Al Hashmi sees today’s abundance of international universities and training programs as transformative for young Emiratis considering private sector careers. “Here the UAE is pushing for more Emirati participation in the private sector.”

Al Hashmi’s management philosophy centers on creating opportunities for others. “Your growth is my legacy,” she tells her team. “I’m very passionate about training people. That will be the greatest legacy that I could ever leave behind.”

Her door stays open regardless of time zones or circumstances. Having started at the bottom herself, she understands the importance of giving respect to newcomers and creating space for them to develop.

“It’s alright to make a mistake as long as you get up and move forward,” she said. “Every day could be different. If you can accept that, acceptance is a huge thing in this business.”

Looking ahead, Al Hashmi envisions an industry transformed by infrastructure development like the GCC rail network, which she says will reduce carbon footprints while simplifying cross-border movements. Artificial intelligence and digitization will increasingly reshape operations, from automated warehousing to emissions tracking.

For Blue Water, the focus remains on sustainable growth aligned with

company values. With new leadership — Thomas Bek as CEO and Ryan Foley as COO (energy, ports and projects) — the company continues its measured expansion while maintaining its family-business culture.

“We’re not expanding on the scale of some of our other forwarder friends,” Humeira said. “But we’re taking the right steps. We’re maintaining the Blue Water values, making sure our people are taken care of, making sure we take care of our clients.”

As the industry gathers for the 10th anniversary of Breakbulk Middle East in February 2026, Al Hashmi reflected on how the event has evolved over the last decade, and the importance of the region.

“Forget North, South, East, West — the Middle East is the hub. This is the middle of everything and we’re

seeing that either your clients are based here, your cargo’s coming out of here, or your cargo’s moving through here. There’s always some touch point having to do with the Middle East.

“Everybody’s growing, everybody’s having fun, and I think that’s how it should be,” she said. “I’m very excited to see where Breakbulk Middle East goes next.”

Meet Humeira Aidarous Al Hashmi at Breakbulk Middle East and watch her full interview with Voices of Breakbulk Middle East, a podcast produced with Project Cargo Professionals, on YouTube. https://www.youtube.com/ watch?v=BaghLTh7Ct4&t=941s

Involved in the project cargo industry since 2007, Luke King is a regular contributor to Breakbulk magazine.

*Breakbulk Exhibitor

*BGSN Member