MCS® is a Portuguese-based multi-mineral, ceramic raw material mining and processing company.

However it o ers more than ceramic raw materials and ceramic bodies, it is commi ed to sustainable mining principles and providing “Minerals For Life”. Our success is built on innovation, R&D and collaborative partnerships to overcome industry challenges.

Bangladesh’s ceramics industry has emerged as one of the nation’s most dynamic growth sectors, steadily expanding its footprint across domestic and international markets. Over the past two decades, the industry has transformed from a modest manufacturing base into a recognised exporter, supplying tableware, sanitaryware and tiles to countries around the world. Yet, behind this success lies a fundamental challenge: its heavy dependenceonimportedrawmaterials.Coreinputs such as kaolin (china clay), ball clay, feldspar, quartz and zircon are predominantly sourced from India, China, Thailand, and New Zealand. This reliance exposes local manufacturers to global pricevolatility,currencyfluctuationsandlogisticalbottlenecks.Theparadox,however,is that Bangladesh is not lacking in mineral resources. Geological surveys have identified over 100 million tonnes of ceramic clay, including premium-quality white kaolin, across regions such as Mymensingh and Sylhet.

Industry experts argue that the next phase of growth depends on unlocking these indigenous resources. Strategic investments in mineral exploration, modern extraction technologies and supply chain optimisation could significantly reduce reliance on imports. Furthermore, energy atural gas, ideally supported by government eness against nations with abundant raw d's view, proactive policies and targeted e-dependent to a resource-based global market.

st-growing segments, revolutionising sets them apart. Advances in production ivering efficiencies that allow manufacturers to h Malik concludes that large-format tiles are dern living where artistry meets practicality. t hold ceramics during firing – plays a hter and stronger kiln furniture, manufacturers ten firing cycles, and even improve finished y sustainability and cost optimisation, t, kiln furniture is transitioning from a

uce its environmental footprint. One ects. By recycling broken or wasted tiles back raw material demand, reduce reliance on waste. Across Asia, leading producers are ing them to combine waste materials with . As Rohan Gunasekera notes, sustainability that eco-friendly practices can enhance

ted to Asia. From the heart of Mexico, NUTEC heat. Specialising in cutting-edge kilns for ity alloys, as well as industrial ovens and bustion and control systems and highwith Asian Ceramics, Alberto Cantú, vice out the company’s innovative products, r global growth.

EDITOR

Editor Isaac Hamza

Email: ihamza@asianceramics.com

ADVERTISING AND DESIGN

Advertising Sales Paul Russell

Email: prussell@asianceramics.com

Direct line: + 44 (0) 787 621 2193

Valerie Adamson

Email: vadamson@asianceramics.com

Direct line: + 44 (0) 207 664 4574 Mobile: +44 (0) 7774 255 0514

Production and design Tim Mitchell www.corpsvector.co.uk

OVERSEAS OFFICES

Bangladesh Jahir Ahmed jahir@asianglass.com

India Yogender Singh Malik yogender@asianglass.com

Sri Lanka Rohan Gunasekera rohan@asianglass.com

Research Manager Andy Skillen

Email: askillen@bowheadmedia.com

HEAD OFFICE

27 Old Gloucester Street, London WC1N 3AX, UK.

Directors:

Valerie Adamson and Paul Russell.

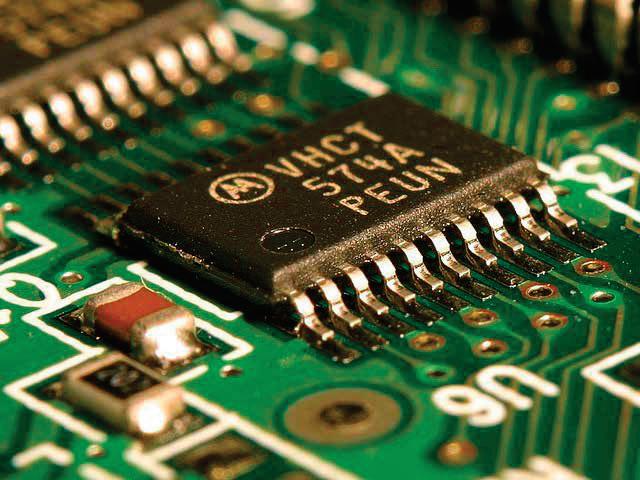

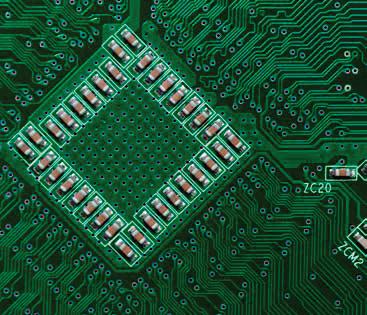

The future of ceramic decoration passes through Creadigit Infinity, the new digital printer with a computing power never seen before. Thanks to CoreXpress, the latest-generation platform, key information, useful for image reproduction on the ceramic surface, is exchanged and processed in real time with sophisticated processors and a dense network of sensors

More flexibility and more variation with over 12 color bars and the management of different heads on each individual machine with a resolution of up to 600 dpi. Towards the maximum level of performance. Visit systemceramics.com to discover more!

Large format tiles have rapidly grown in popularity, becoming a preferred choice in premium commercial and residential projects. Yogender Singh Malik highlights their rising demand

relies on kiln furniture to simultaneously enhance product quality and reduce production costs. Recent advancements in kiln furniture technology have further strengthened its role as a critical accessory in achieving these twin objectives, says Yogender Singh Malik.

Sustainability is more than a buzzword for ceramic tile manufacturers—it’s a business strategy. Companies are increasingly repurposing ceramic scrap, transforming production rejects into high-value products while signalling their commitment to a greener supply chain, remarks

With rising global demand and competitive production costs, Bangladesh’s ceramic sector’s access to kaolin, feldspar, quartz, and long-term competitiveness, writes Jahir Ahmed.

An expanding range of applications across established as well as emerging areas is driving the growing demand for ceramic

plus tile market, says techno-marketing specialist Dinesh Vyas.

shares insights with Asian Ceramics on the company’s latest product developments, strategic plans, and the talented team driving its growth.

Andy Skillen, special correspondent for Asian Ceramics, questions whether Bangladesh’s ceramic industry has potential to be transformational for the country, noting that the sector faces constant pressure and limited government support.

industriebitossi.com

Tech Mahindra, a global provider of technology consulting and digital solutions to enterprises across industries, announced that it has been selected by Dixon Technologies (India) Limited, one of India’s largest contract manufacturers, to enable AI-powered Industry 4.0 automation across all their manufacturing plants and research and development centres in India.

Tech Mahindra will serve as Dixon Technologies' digital transformation partner, driving the next wave of industrial innovation through its deep expertise in AI-enabled Industry 4.0 solutions and smart factory services. This collaboration aims to streamline and unify Dixon's digital journey, enabling smarter operations, faster decision-making, and sustainable outcomes.

operational resilience and adaptability are essential. Manufacturers who embrace these changes will thrive and bolster economic growth.

“In line with this, we are delighted to partner with Dixon Technologies to shape the future of smart manufacturing in India. Our AI-enabled Industry 4.0 automation solutions are designed to provide integrated intelligence throughout the production lifecycle. This collaboration underscores our commitment to helping

consolidated investments, and a transformation roadmap focused on achieving cost savings, productivity improvements, and other outcomes. Additionally, the initiative is designed to eliminate data silos, enable

proactive decision-making, and create intelligent manufacturing environments. committed to staying at the forefront of technological innovation in manufacturing. Our partnership with Tech Mahindra

“With their proven track record in delivering next- generation digital manufacturing solutions, we aim to build futureready, agile and smart factories that aligns with global best practices and are driven by innovation.”

This collaboration aims to establish a standard for how manufacturers can leverage AI, automation and digital and improved customer value. It further reinforces Tech Mahindra's leadership in AI innovation, aligning with the company's ‘AI Delivered Right’ strategy.

Dixon Technologies (India) Limited is a home-grown design-focused and solutions company engaged in manufacturing consumer electronics like LED TVs; Home appliances like washing machines; lighting products like LED bulbs and tube lights, down lighters; mobile phones; wearables and hearables refrigerators; telecom and IT hardware products. Dixon also provides solutions in reverse logistics, i.e. repair and refurbishment services of LED TV panels. While Dixon Technologies (India) Limited primarily focuses on the manufacture of electronics, some of their products have an indirect in components such as LED packaging. Dixon's reverse logistics services also include the repairing and refurbishing of LED televisions, which are also made up of ceramic components.

Tech Mahindra offers technology consulting and digital solutions to global enterprises across industries, enabling transformative scale at unparalleled speed. The company employs 148,000+ professionals across 90+ countries helping Carta Seal, which recognises global companies that are actively leading the charge to create a climate and nature-positive future. Tech Mahindra is part of the Mahindra Group, founded in 1945, one of the largest multinational federations.

Engineers have converted lowgrade clay into a high-performance cement supplement, opening a potential new market in sustainable construction materials.

The global production of cement – a key ingredient in concrete – is responsible for eight per cent of global CO₂ emissions.

Replacing some cement with clay reduces the environmental impact, but the high-grade kaolin clay best suited for cement replacement is in increasingly high demand for ceramics, paints, cosmetics and paper. Now the RMIT team has demonstrated cheaper and more abundant illite clay can be mixed with low-grade kaolinite clay, to make stronger concrete.

Tech breakthrough towards a low-carbon future

The study published in Construction and Building Materials introduces a new process, where low-grade illite and kaolin clays are mixed at an equal ratio then heated at 600 Celsius.

Processing the two ingredients together, rather than separately, led to several improvements in the material's performance, the study found.

Project lead Dr Chamila Gunasekara, said low-grade illite clay does not normally bind well with cement and water, but that the joint heating, or co-calcination, process greatly enhances illite clay’s binding ability, known as pozzolanic reactivity.

“Based on this approach, we are able to replace 20% of cement usage using low-grade illite and kaolin combinations, while achieving even better performance of the yield product,” said Gunasekara, from RMIT’s School of Engineering. There was an 18% increase in the amount of disordered material in the new clays, which is beneficial for strength and durability. The material also holds more water in a chemically stable form, which points to better long-term reactions that help the structure stay strong.

“Porosity is reduced significantly by 41%, with its compressive strength increased by 15%, where changes in the way iron compounds formed help create a tighter and more compact internal structure,” Gunasekara said. These enhancements demonstrate that the co-calcined illite-kaolin blends can match or surpass the performance of traditional kaolin-based substitutes. Demand for kaolin is steadily growing, with the market projected to be worth US$6 billion by 2032 and its hoped, thanks to this research, a market for illite clay could follow suit.

Study lead author Dr Roshan Jayathilakage said the technique was also more energy efficient.

“Since raw materials are processed together, it streamlines industrial operations and lowers fuel use compared to multiple calcination steps,” Jayathilakage said.

“This makes the method not only technically sound but also economically and environmentally scalable.”

New computational tool accelerates green transformation

The research also showcases computational advancements in material science.

Underpinning the group’s work is an advanced computational tool for analysing and designing concrete, developed in partnership with Hokkaido University, Japan.

The tool allows the team to evaluate performance in various activated clays in concrete mixtures, providing detailed insights into their mechanical properties, durability and energy-efficiency, where currently available approaches had struggled.

Dr Yuguo Yu, from RMIT’s School of Engineering, said their computational tool enabled a more efficient assessment of material performance, reducing the reliance on extensive laboratory tests.

“By predicting how different clay compositions affect concrete behaviour, engineers are able to better design energy-efficient mixtures tailored for local clay types and specific environmental conditions,” he said.

"This virtual tool could enable the construction industry to accelerate the adoption of ecofriendly materials, paving the way of greener transformation for a more sustainable future.”

Building on collaborations with global partners including European Synchrotron Radiation Facility in France, the RMIT team is continuing to investigate how different clay types and activation techniques influence concrete behaviour at multiple scales, while expanding performance testing in real-world conditions.

This research was enabled by the ARC Industrial Transformation Research Hub for Transformation of Reclaimed Waste Resources to Engineered Materials and Solutions for a Circular Economy (TREMS).

Led by RMIT’s Professor Sujeeva Setunge, TREMS brings together top scientists and industry experts from nine Australian universities and 36 state, industry, and international partners to minimise waste and repurpose reclaimed materials for construction and advanced manufacturing.

The Royal Melbourne Institute of Technology (abbreviated as RMIT University) is a public research university based in Melbourne, Victoria, Australia. The University of Sydney was established in 1887 by Francis Ormond and is the seventh-oldest institution of higher learning in Australia. It is a member of Universities Australia and the Australian Technology Network.

Toto Group ‘turns on’ new plant in Dalian with SACMI-Riedhammer • Stratasys launches tooling centre of excellence

With SACMI-Riedhammer, Toto has ‘turned on’ its new plant located in Dalian in north China. This highlyautomated factory, developed as a greenfield project and a strategic part of the company's development plan, was officially opened on 16th December. Toto, founded in Japan in 1917 and considered among the leading global manufacturer in the sector, marked the occasion with a firing ceremony during which the burners of the new kilns were turned on.

Each of these companies, namely, SACMI, Riedhammer and the Toto Group, has been

in operation for more than 100 years and shares many common traits, including wellestablished leadership in the marketplace for their products and technologies. Through the recent collaboration with the creation of the new factory at Dalian, Toto has reached another strategic milestone in its Asian expansion plans. The Dalian plant is characterised by total automation, where the new Riedhammer roller kilns are equipped with cutting edge heat recovery systems and the EMS 400 energy management system. This is the top of Riedhammer

energy management range for reducing and optimising energy usage.

While Toto is renowned in the industry for its capability to manufacture all the technology required for the production process by itself, it has neverthelesschosentoinvestin Riedhammer’s industrial firing solutions for over 30 years. Currently, 48 Riedhammer kilns are in operation in various Toto Group plants throughout the world, including roller, tunnel and intermittent kilns.

During the firing ceremony, the plant was turned on by the Toto team together with the SACMI-Riedhammer team.

This gesture represents the continuous synergy that has characterised the relationship between the companies over the years, contributing to the achievement of the Japanese multinational’s growth and development plans on the global stage.

Stratasys announced the launch of the North American Stratasys Tooling Center (NASTC), a new collaboration with Automation Intelligence, LLC (AI), at AI’s manufacturing site in Flint, Michigan. The purpose of this dedicated tooling hub is to assist manufacturersinvalidatingand scaling practical applications of additive manufacturing in production environments. NASTC operates both the Stratasys F3300 and F900 3D printers, providing handson access to engineering resources, as well as creating applications for critical tooling solutions such as jigs, fixtures, end-of-arm tooling and North American Automotive Metric Standards (NAAMS) blocks. Those in the automotive and industrial sectors can now explore how additive manufacturing can streamline operations, reduce costs, and improve production efficiency.

Fadi Abro, director of global automotive and mobility

at Stratasys, said: “This Center of Excellence will have a significant impact for manufacturers showing how additive fits into their production environment.

“With the launch of the NASTC, we are addressing real-world challenges at this new center. This incubator for advanced manufacturing is designed to enable teams to iterate, validate and scale tooling applications rapidly. It sets the stage for designing solutions to meet the growing demand for localised, on-demand production solutions worldwide.”

Tooling often determines how quickly and costeffectively products get to market. The NASTC will give manufacturers validated proof that additive polymer tooling is both viable and an ideal choice for production. With manufacturers and suppliers under constant pressure to become more efficient, the NASTC is structured

to deliver speed, flexibility, and confidence, combining additive manufacturing technologies with traditional capabilities.

Jeff McGarry, managing partner at Automation Intelligence, said: “Tooling is the heartbeat of manufacturing. The NASTC offers an environment where manufacturers can see for themselves how additive tools can address today’s challenges with faster turnaround times, digital flexibility, and lower costs. We believe this partnership will demonstrate the positive impact additive can have across production.”

Automation Intelligence facilitates manufacturers' adoption of advanced technologies. Working with several large manufacturers, AI helps customers navigate digital §transformation by providing practical implementation and production experience.

In addition, the NASTC is expected to serve as a blueprint for similar tooling hubs around the world.

AnAmerican-Israelicompany, Stratasys, manufactures 3D printers, software, and materials used in polymer additive manufacturing, as well as 3D-printed parts on demand. Incorporated in Israel, the company offers innovative3Dprintingsolutions for a wide range of industries, including defence, aerospace, automotive, consumer products, and healthcare.

Reliance Power Limited (Reliance Power) subsidiary, Reliance NU Energies

Private Limited (Reliance NU Energies), has won the largest allocation in SJVN’s tariff-based competitive bidding process, securing an allocation of 350 MW of solar generation capacity coupled with 175 MW/700 MWh of battery energy storage system (BESS).

Once commissioned, the platform will add 600 MWp of installed solar PV capacity, and 700 MWh of energy storage to Reliance Power’s portfolio, consolidating its leadership in new energy solutions. The company’s total clean energy pipeline now stands at 2.5 GWp solar and >2.5 GWhr BESS, making it India’s largest player in the integrated Solar + BESS segment.

The winning tariff was discovered at INR 3.33/ kWh, fixed for a 25-years, positioning the project among

the most competitively priced offerings in India’s energy transition landscape. The Letter of Award (LoA) from SJVN is currently awaited. This allocation represents a material step-up in Reliance Power’s strategic pivot toward renewable power. The project is part of a broader 1,200 MW solar + 600 MW / 2,400 MWh BESS ISTSconnected tender floated by SJVN, one of the leading Navratna Public Sector Enterprise which saw participation from 19 entities, with 18 qualifying for the e-reverse auction. The tender was oversubscribed by more than 4 times, reflecting heightened industry interest in dispatchable renewable energy solutions.

The awarded project requires a minimum four-hour daily discharge window, effectively enabling assured peak power delivery to state distribution utilities (Discoms) and will be developed under a build-own-

operate (BOO) framework following the standard bidding guidelines prescribed by the Ministry of Power.

This successful bid underscores Reliance Power’s continued progress and commitment to becoming a leading player in India’s renewable energy sector. It marks a significant milestone in the company’s strategic vision to transition toward cleaner energy sources and play a pivotal role in shaping the country’s sustainable energy future.

Reliance Power’s, 100% subsidiary Reliance NU Suntech Private Limited, has recently signed a definitive 25-year Power Purchase Agreement (PPA) with the Solar Energy Corporation of India (SECI) to develop Asia’s largest integrated Solar and Battery Energy Storage System (BESS) project.

The transformational project willhaveasolarpowercapacity

of 930 MW, paired with 465 MW/1860 MWh BESS, and will have an investment outlay of up to INR 10,000 crore. The project will operate at a competitive fixed tariff of INR 3.53/ kWh for the full PPA term of 25 years, providing longterm revenue visibility.

Positioned as Asia’s largest Solar + BESS installation, the project reinforces Reliance Power’s strategic commitment to renewable energy leadership, while delivering sustainable value creation across stakeholders.

Reliance Power Limited, part of the Reliance Group, is one of India's leading private sector power generation companies. The company has an operating portfolio of 5,305 megawatts, that includes 3960 megawatts Sasan Power Limited (world's largest integrated coal-based power plant). For the past seven years, Sasan Power has consistently ranked as the best operating power plant in India.

Eriez has appointed Mary Ann De Lunas as country manager for its Magnetics division in the Philippines, indicating the company's commitment to expanding its footprint and improving customer service throughout Asia-Pacific (APAC).

As part of her new role, De Lunas will lead the company's growth initiatives in the Philippines, focusing on enhancing its presence in Southeast Asia, cultivating strong customer relationships, identifying new business opportunities, and providing sales assistance to its valued representatives in order to meet the specific

needs of local markets.

Ezio Viti, Eriez regional sales director for the APAC region, said: "This marks an exciting chapter for Eriez Australia as we continue to grow our global footprintandenhancesupport for our customers across Asia Pacific.

"Bringing extensive experience and a deep understanding of the Southeast Asian market, Mary Ann is well prepared to drive growth strategies for Eriez in the region. Her customercentric approach and regional expertise will be instrumental in further strengthening Eriez’ position in the Philippines."

“Through ongoing strategic

investments in personnel, Eriez is strengthening its worldwide presence, delivering expert local support backed by the resources and innovation of a global leader,”Viti added.

Established in 1942, Eriez is a global company operating in separation technologies.

With over 1,000 employees, the company provides technical solutions to the mining, food, recycling, packaging, aggregate, and other processing industries.

With headquarters in Erie, Pennsylvania, USA, Eriez designs, manufactures, and markets on six continents through 12 wholly owned

subsidiaries and a global network of sales representatives.

RAK Ceramics one of the largest ceramics and porcelain lifestyle solutions provider in the world, announced its financial results for the second quarter ended 30 June 2025 on 13th August.

The company said its financial performance in Q2 has been strong, demonstrating the resilience of the business in the face of a tough macroeconomic environment. Total revenue increased by 6.4% YoY to AED 826.8 million and by 2.9% to AED 1.6 billion in H1 2025 as a result of strong demand from the UAE and Middle East as well as effective cost management.

In Q2 2025, the gross profit margin increased by 110bps to 40.6% YoY and in H1 2025, it increased by 70bps to 40.2%, drivenbyenhancedoperational efficiencies which have contributed to higher gross profit margin, reinforcing RAK Ceramic’s market leadership.

EBITDA increased by 17.5% to AED 160.8 million in Q2

2025 compared to AED 136.9 million in the same period last year. Similarly, in H1 25 EBITDA increased by 2.9% to AED 296.4 million, while EBITDA margins have increased by 1.9% to 19.5% in Q2 2025 up from 17.6% in Q2 2024. In H1 2024, EBITDA margin remained consistent at 18.5%.

Profit before tax increased by 45.0% YoY to AED 86.7 million, compared to AED 59.8 million in Q2 2024. Net profit after tax increased by 30.1% YoY to AED 66.4 million, compared to AED 51.0 million in Q2 2024. In line with the increased profitability across the businesses. UAE Corporate tax was AED 17.2 million in Q2 2025, up from AED 6.5 million in Q2 2024. Net debt position rose by AED 120.6 million to reach AED 1.56 billion in Q2 2025, compared to Q1 2025, primarily driven by increased capital expenditure and working capital requirements.

Abdallah Massaad, Group CEO, RAK Ceramics said: "I am

pleased to report that Q2 2025 delivered solid revenue growth alongside strong operational performance, a reflection of the strength and adaptability of RAK Ceramics across the globe. Our ability to drive both volume and value growth in key markets, while successfully navigating regional headwinds, further underscores the effectiveness of our diversified strategy.

“Our teams have demonstrated resilience in adapting to local market conditions, leveraging growth opportunities in stable regions and implementing corrective measures where needed.

“The shift towards highquality and innovative offerings is strengthening our margin profile and reinforcing our competitive positioning. Our investments in advanced manufacturing capabilities, including upgraded facilities, continue to drive efficiencies and set new benchmarks for quality.

“Looking forward, we are continuing to innovate our operations and accelerate initiatives that will strengthen our position in the market and continue to drive profitability across all divisions."

RAK Ceramics is one of the largest ceramics’ brands in the world. Specialising in ceramic andgresporcelainwallandfloor tiles, tableware, sanitaryware and faucets, the company has the capacity to produce 118 million square metres of tiles, 5.7 million pieces of sanitaryware, 36 million pieces of porcelain tableware and 2.6 million pieces of faucets per year at its 23 state-of-the-art plants across the United Arab Emirates, India, Bangladesh and Europe. Founded in 1989 and headquartered in the United Arab Emirates, RAK Ceramicsservesclientsinmore than 150 countries through its network of operational hubs in Europe, Middle East and North Africa, Asia, North and South America and Australia.

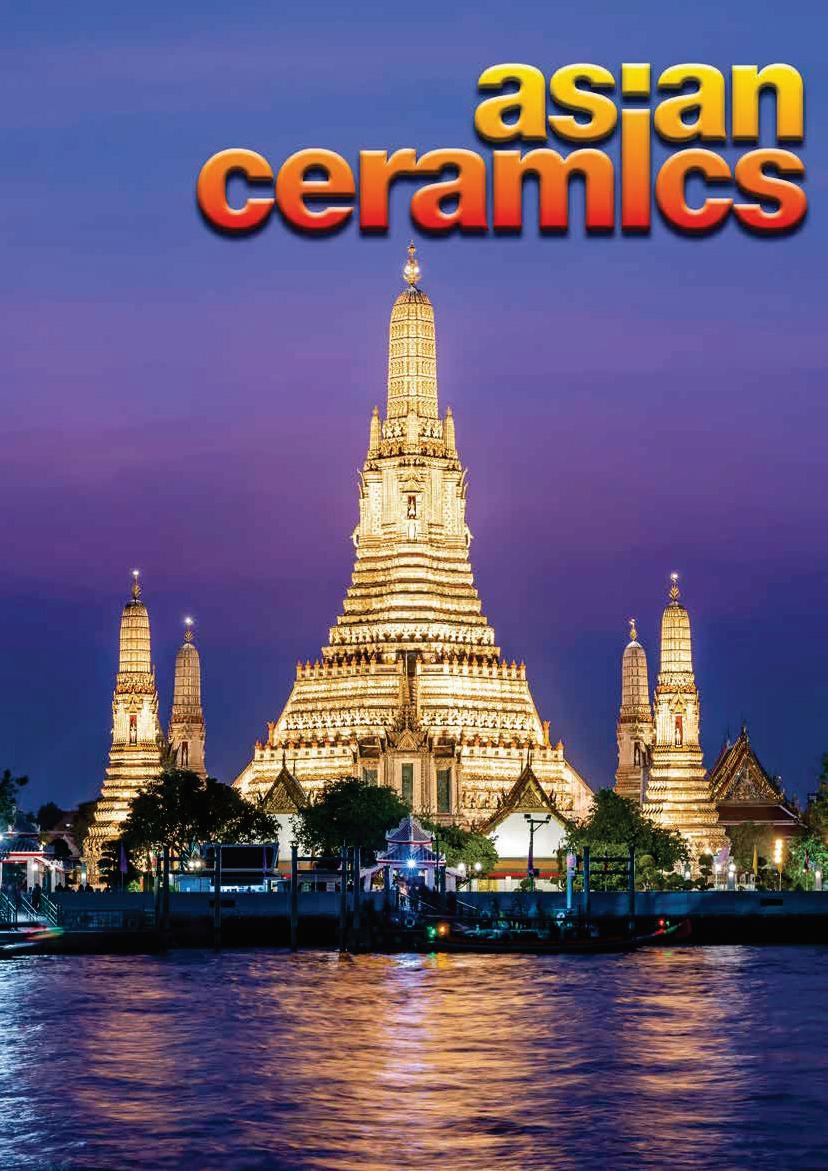

The ASEAN Ceramics and ASEAN Stone 2025 exhibition is being organised by MMI Asia, a regional subsidiary of Messe Munchen GmbH, in collaboration with Asian Exhibition Services (AES), and will take place at the IMPACT Exhibition & Convention Center, in Bangkok, Thailand, from 15th17th October.

The show is endorsed by the FTI-CICT, the Mining Industry Council of Thailand, the Thai Ceramic Society, Confindustria Marmomacchine, the Association of Italian Manufacturers of Ceramic Machinery and Equipment (ACIMAC) and the Chinese Council for Promotion of International Trade, Building Sub-Council (CCPIT), and will continue to support Southeast Asia in the ceramics and natural stone industries worldwide as they continue to grow in size

and influence.

Recently, the exhibition's press conference was held in Bangkok, Thailand, with support from its long-term association partner, the Thai Ceramic Society (TCS), and sponsor Puresil India. Furthermore, the exhibition is part of ceramitec's international cluster, which forms a global network for the ceramic industry.

Michael Wilton, managing director and CEO of MMI Asia, said: "We are excited to introduce a fresh wave of business opportunities and innovations to Thailand, empowering companies to lead in the Southeast Asian market while strengthening the local ceramics and natural stone communities."

Atuk Chirdkiatisak, chairman (FTI-CICT), said: "With ASEAN Ceramics returning to Bangkok and the new addition of ASEAN

Stone, FTI-CICT is proud to support the event in uniting the local and international ceramics and natural stone sectors. Together, we will showcase the latest manufacturing advancements and drive global sustainability efforts."

The theme of this year's colocated events is ‘Pioneering a Sustainable and Innovative Future for Ceramics and Stone in Southeast Asia’, bringing together leading companies, well-known brands, industry associations, and think tanks to highlight cutting-edge developments and strengthen the ceramic and stone value chain in the region.

The event will include two conference stages: the International Conference of Traditional and Advanced Ceramics (ICTA) and the Main Conference Stage. ICTA will cover a broad

spectrum of ceramic-related topics, from Ceramic Art and Design to Industrial Ceramic Technologies. Meanwhile, the Main Conference Stage will feature industry spotlight panels, cutting-edge tech talks, market insights, innovations in quarrying, architecture and designdiscussions,andproduct innovationshowcases–bringing together the full spectrum of ceramics and stone. The conference programme will include an exclusive factory tour, strategy business matching, and premium networking opportunities for exhibitors.

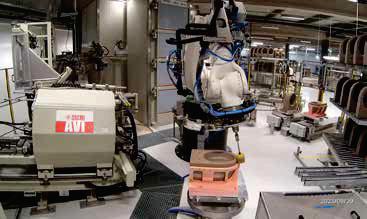

KAJISEKI has built asystem capable of manufacturing tableware without the need for skilled engineers. Operation using an interactivedisplay not only allows you to manage the manufacturing process, but also gives you control over aspects of the production system such as production quantity and production errors.

Head Office : 2-2-1 Hachiman-cho, Takahama, Aichi 444-1302, Japan

URL : http://www.takahama-ind.co.jp

E-mail : info@takahama-ind.co.jp

TEL : +81-566-52-5181

LG Chem announced that it has co-developed a highperformance silver paste with Japan’s Noritake, designed specifically for bonding silicon carbide (SiC) chips to substrates in automotive power semiconductors.

Noritake is a Japanese company with over 120 years of experience in advanced ceramics, supplying grinding wheels, materials for electronic components, and kilns (thermal processing equipment) for applications in the semiconductor and automotive industries.

As the automotive electrification and autonomous driving technologies experience

TAIWAN

a rising trend, the demand for power semiconductors is growing rapidly. However, traditional soldering methods, which rely on melting metals to join components, have become less effective as the operating temperatures of power devices increase. This has created a growing need for paste that can maintain stability and performance under high thermal conditions.

The silver paste co-developed by LG Chem and Noritake is a high-performance paste containing nano-sized silver (Ag) particles, combining LG Chem’s particle engineering technology with Noritake’s particle dispersion expertise.

The two companies achieved superior heat resistance and thermal conductivity in a single formulation.

Unlike conventional silver pastes, which require cold storageandhaveashortstorage life that complicates inventory management, the new product offers long-term stability at room temperature. This improvement enhances transportation and storage efficiency, while also extending the usable time within customer processes, ultimately reducing material loss.

Building on this successful collaboration, LG Chem and Noritake plan to pursue further joint development of nextgeneration materials for future

automotive applications.

The global silver paste market for automotive power semiconductors is expected to grow from KRW 300 billion in 2025 to KRW 850 billion by 2030.

“Leveraging our accumulated technological expertise and advanced materials design capabilities, LG Chem has provided customized solutions across various industries, including automotive electronics,” said Shin HakCheol, CEO of LG Chem.

“Through our partnership with Noritake, we aim to strengthen our differentiated competitiveness in the global automotive materials market.”

PJH(asubsidiaryofChengLin Enterprise Co., Ltd), announced a new distribution partnership with VitrA, a global bathroom manufacturer. Starting in June 2025, PJH officially introduced a range of VitrAbranded bathroom products to its retail network, further expanding its market-leading product portfolio and offering customers a more diverse and high-quality selection.

VitrA is an internationally renowned bathroom brand, known for its innovative design and superior quality. Through this partnership, PJH will introduce the VitrA Bathroom Collection and

the Vitality Collection to its retail customers. While not included in PJH's own-brand portfolio, these two collections will effectively complement its existing product line and expand its retail selection. The VitrA Bathroom Collection will be fully available to PJH retail customers, while the Vitality Collection will be exclusively available at VitrA partner stores.

Kim Cooper, marketing director at PJH, said: "We are thrilled to add VitrA to PJH's bathroom brand portfolio. VitrA is a partner who shares our values of quality, innovation, and customer-first service.

Through this partnership, our retail customers will have access to premium global brands while enjoying PJH's industry-leadinglogistics,nextday delivery capabilities, 'First Choice' service promise, and easy-to-use Partners Portal ordering system."

PJH will stock a wide selection of VitrA products, with most available for next-day delivery and some available by special order. Product categories include washbasins, toilets, faucets, showerheads, and flush panels. Furthermore, participating retailers can order VitrA catalogs, display samples, and color swatches

through PJH's online platform, easily supporting sales promotions.

Ruth Davies, UK representative for VitrA, said: "We are delighted to be partnering with PJH and developing the UK market together. PJH has strong distribution capabilities, an extensive nationwide inventory and delivery network, and provides a seamless customer service experience. They are the ideal partner for promoting VitrA's high-quality bathroom solutions. We look forward to working closely with PJH to introduce VitrA to the wider retail market."

LIXIL Corporation, a maker of water and housing products, opened its International Competence Center (ICC) in Guangzhou on 4th July. The cross-functional R&D hub will facilitate deeper collaboration with Chinese suppliers and integrate global expertise.

Kinya Seto, president and CEO of LIXIL, emphasising China’s strategic role in LIXIL’s innovation capabilities, said:

"China isn’t just one of LIXIL’s key markets – it’s where many of our innovative ideas originate. The ICC marks a significant milestone in strengthening local development and global innovation collaboration, advancing our commitment to make better homes a reality for everyone, everywhere."

To enhance speed-to-market, the centre is strategically located within South China's

kitchen and bathroom industry cluster.

With 1,654 square metres of space, the ICC offers advanced labs for product testing, material analysis, and technical validation that support brands like GROHE and American Standard. Incorporating cross-team collaboration, it streamlines consumer insights and supply chain delivery for international markets. The

centre will also develop talent with international perspectives and multidisciplinary skills.

Bijoy Mohan, leader of LIXIL International, said: "This hub enhances our R&D agility and cross-border co-creation. By integrating international engineers with local suppliers and resources, we can rapidly translate consumer insights into solutions for international markets."

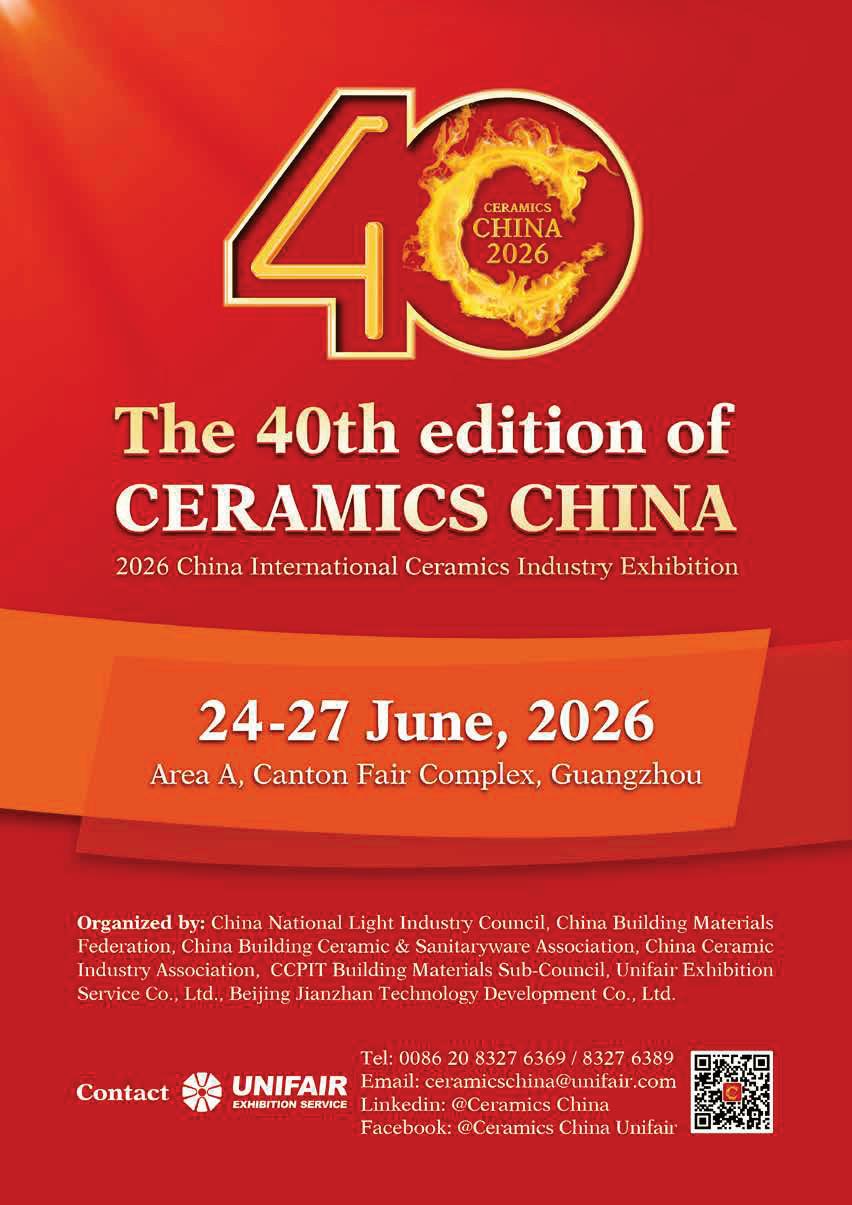

Ceramics China 2025, the trade show for ceramic equipment and materials, concluded successfully on 21st June in Guangzhou, in what the event organisers described as 'an exceptional edition featuring unprecedented international engagement and vibrant business exchange'. In a statement, the organisers noted the event's position as the essential global platform for innovation, collaboration, and networking across the entire ceramics value chain.

A total of 786 exhibitors from 21 countries and regions participated in this year's exhibition, including mainland China, Belgium, Germany,

France, Korea, Malaysia, Japan, Slovenia, Turkey, Spain, Italy, India, Indonesia, UK, Vietnam, Bangladesh, Russia, USA, Brazil, Taiwan China and Hong Kong China.

A total of 80,240 industry professionals from 94 countries and regions attended Ceramics China 2025 during the fourday event held from 18th to 21st June. Visitors from major manufacturing hubs, industry associations, leading ceramic manufacturers, and import/export giants attended this year's event. This year's extensive participation indicates a dramatic increase in the event's global reach and appeal, the organisers said.

In addition to showcasing evolving products and technologies, the exhibition also offered visitors insight into market trends and industry trends that influenced their purchasing decisions.

With a wide range of participants, the exhibition has been validated as a truly global microcosm showcasing innovative solutions, cuttingedge technologies, and innovative products, including intelligent production equipment, eco-friendly materials, digital manufacturing processes and end-to-end service systems, according to the organisers.

The exhibition highlighted

three defining trends within ceramic industry development: the comprehensive artificial intelligence-driven intelligence integrated throughout production workflows to enhance efficiency and strengthen quality control; the sprouting compact equipment designed for eco-friendly operations, cost reduction, and flexible manufacturing; the cross-sector diversified expansion dominated by traditional equipment manufacturers to cultivate sustainable market growth in different sectors.

Ceramics China will hold its next edition in Guangzhou from 24th to 27th June 2026.

Keda's Bozuyuk Factory, located in the industrial zone of Bozuyuk City, Bilecik Province, Turkey, has successfully completed the construction of its production and office facilities and officially put them into use. The spare parts and consumables workshop was the first to begin operations. All inventory from the former Eskisehir warehouse has been relocated to the new facility and isnowbeingshelved.Thismarks anewchapterinKeda'slocalised service strategy in Turkey.

Keda's consumables products have gained strong recognition

among local Turkish customers, with sales showing rapid growth. Today, Turkey has become the largest single international market for Keda's polishing line consumables.

Meanwhile, construction of the Kami Turkey Ink Workshop, located within the same factory, is entering its final stage. Machinery installation, commissioning, and supporting infrastructure are all underway, with production scheduled to begin by the end of August.

Once operational, the factory will rely on its advanced ink processing workshop and local

laboratory to deliver highperformance, vibrant, and costeffective inks for local customers tailored to the growing needs of the Turkish market. In addition, construction of the main office building is also progressing rapidly and is expected to be fully operational by September.

Keda Industrial Group have been developed from a singleproduct manufacturer into a diversified company who is committed to becoming an advance-machinery provider and an innovative technical problem-solver for multiple business sectors. Starting from

ceramic machinery, Keda’s business has been explored into something different, including wall material machinery, stone machinery, building materials, lithium-ion battery materials, lithium-ion battery materials machinery, coal gasification, hydraulic pump, smart energy, etc.

HLT&DLT signed a cooperation agreement with Vietnam's PTG Granite to supply a high-end complete plant solution for the production of glazed and speckled tiles. The project covers the entire process from raw material preparation to forming and thermal systems, delivering a comprehensive solution and creating a new chapter in ChinaVietnam cooperation in the field

of intelligent manufacturing.

The PTG site covers 250,000 square meters and is equipped with three large-scale intelligent production lines. It is estimated that once the facility is fully operational, it will be able to produce 20 million square meters of ceramics annually. This will significantly reshape the ceramics industry in Vietnam.

HLT&DLT integrated its

strengths in intelligence, automation, and digitalisation to meet the specific demands of the Vietnamese market. The complete solution includes a continuous feeding system, energy-saving intermittent and continuous ball milling systems, intelligent spray pulverising system, 2 YP7890 hydraulic presses, EM high-efficiency self-circulating seven-layer dryers, a 4.0 Smart Energy-

Efficient Firing Kiln with pre-kiln drying, glaze line drying and other auxiliary machinery. It is possible to achieve both intelligent production and environmental sustainability with this setup. The production base will support rapid switching between formats including 800mm by 800mm, 1000mm by 1000mm, and 600mm by 1200mm, meeting PTG's quality standards.

Hyundai Mobis announced on 7th May that it has opened an R&D base dedicated to software in Hyderabad, Telangana, which is known as the Silicon Valley of India. Following the launching of its first Technical Center of India in 2007, Hyundai Mobis established its second Indian center in 2020 and has since operated those two centres.

The new integrated largescale R&D centre aims to accommodate the increasing number of software R&D personnel and combine the company’s dispersed R&D centres to maximise synergy.

Located in the centre of Hyderabad, the new integrated R&Dbasehasatotalfloorareaof about 24,000 m2 and is located in a commercial area where global technology giants are concentrated, making it easy to secure excellent software talent. The 10-story building houses research spaces, data centres, labs and training rooms, partner workspaces, and break rooms. Behind the company’s decision to build the R&D base was the rapidly growing Indian automotive market. According

to a global research firm, India’s annual new car sales volume is 5.2 million vehicles, the third largest in the world, and is expected to grow to 6.2 million by 2028.

In particular, as the Indian automobile market has shifted from small cars to SUVs and EVs, the application of new level 2 autonomous driving features such as large displays and advanced driver-assistance systems (ADAS) is becoming more active. Accordingly, Hyundai Mobis is putting in a lot of effort to make its Technical Center of India a strategic hub for boosting global sales.

To this end, the company plans to develop it into an R&D hub that drives product cost competitiveness, performance, quality, and technology based on its abundant software R&D personnel. Hyundai Mobis planstocollaboratewithvehicle software companies near its R&D center in Hyderabad, creating an external ecosystem and continuing to hire talented people.

The strategy is to develop the Technical Center of

India as a global software hub with its own business capabilities and use it as an advanced base to provide integrated solutions to global carmakers.

Hyundai Mobis plans to expand the scope of software R&D at the center by increasing its participation from the early stages of new product development, developing software for local vehicles at the center, and focusing on streamlining productivity through the introduction of artificial intelligence.

Jong-keun Lee, head of HyundaiMobisTechnicalCenter of India, said: “The Technical Center of India has a large pool of developers, so it is a place where many new R&D attempts are made. Based on our nearly 20 years of experience in developing production vehicles, we will promote the advancement of software and contribute to improving product competitiveness.”

Currently, Hyundai Mobis is

accelerating the development of a hardware and software integrated platform that reflects the trend around softwaredefined vehicles (SDVs). This integrated platform is expected to emerge as a onestop solution that supports the reduction of development costs and the convenience of the R&D environment for global customers with a customized system that can respond to each customer and vehicle segment flexibly.

Meanwhile, Hyundai Mobis not only operates its Korean R&D centres, such as the Technical Center of Korea Mabuk and the Technical Center of Korea Uiwang, but it also operates overseas R&D centres in India, Germany, and China.

As the UAE advances toward its net-zero emissions target by 2050 and enforces stringent green building standards, the demand for eco-conscious construction materials is steadily rising. Spanish ceramic tiles are playing an increasingly prominent role in this transformation, known for theirsustainablemanufacturing processes, energy-efficient properties, and design versatility. Projects such as Abu Dhabi’s Al Qana development exemplify how these materials combine durability, cultural sensitivity, and sustainability within the region’s architectural landscape.

The 24th edition of the Tile of Spain Awards recognising excellence in Architecture, Interior Design, and Final

Degree Projects (MTP) is now open for entries. Organised by ASCER (Spanish Ceramic Tile Manufacturers’ Association), the international competition champions innovation in the use of Spanish ceramic tiles across global design and architecture projects.

This year’s awards present a timely opportunity for design professionals in the UAE, where material innovation is a growing focus. The inclusion of Spanish ceramics in local projects continues to align with the country’s push for aesthetically distinctive, technically robust, and environmentally responsible design solutions.

The 2025 edition introduces new subcategories in the Architecture and Interior

Design segments, distinguishing projects based on the type of ceramic used such as dry-pressed porcelain and other ceramics including mosaics, terracotta, and extruded stoneware.

The Tile of Spain Awards are supported by the Regional Ministry of Finance of the Generalitat Valenciana. The jury will be chaired by the architect Julio Touza Rodríguez and includes several leading figures from the fields of architecture and design.The deadline for submitting projects is 20 October 2025.

Tile of Spain is the voice of the Spanish tile industry, encompassing more than 120

tile manufacturers. Renowned worldwide for an inspiring blend of aesthetic and technical innovation, Spanish tiles, manufactured in Spain, embody the spirit of an industry that prides itself on proposing beautiful, meaningful and high-performance solutions to flooring, wall coverings, furnishing and external paving and cladding.

Asia’s largest kiln furniture manufacturer

Trusted supplier to major names

Reliable global partner

ISO accredited - validated systems

R&D customer support centre

Tel:+86

Sanipak, a Turkish manufacturer of personal hygiene products, announced it has taken an important step towards protecting water resources by establishing the Yalova Wastewater Recycling Facility.

Completed with a 1 million investment, the new facility supports the responsible use of the region's clean water resources by recycling 70% of its wastewater. It is estimated that the facility will save 400,000 m3 of water each year. The amount is equal to the daily water consumption of approximately two million people.

Sanipak CEO Bulent Kozlu said: “Water, the most important input in our production processes, is a critical and crucial natural resource for both our planet and our company. In this

SAUDI ARABIA

context, efficiency projects for the responsible use of spring water and the evaluation of water recycling opportunities are at the forefront of our agenda.

"Thanks to our investments in tissue machines and efficiency projects, we have achieved a 40% improvement in water use per ton in Yalova over the last 10 years and a 30% improvement in Manisa over the last five years.

"At Sanipak, we set ambitious goals to further reduce our water use every year. We also implemented our new Wastewater Recycling Facility investment in Yalova with the same goal in mind. We continue to work to reduce our water use per ton by 50% by 2028.”

Its motto 'Our Promise to Tomorrow' guides Sanipak's environmental, social, and governance (ESG)

sustainability activities, the company said.

In addition to developing environmentally friendly solutions across all production and product lifecycle processes, Sanipak also pursues concrete targets for environmental sustainability through water and energy efficiency, renewable energy use, waste

A Turkish personal hygiene products company, Sanipak, specialises in tissue paper, baby care and wet wipes, personal care, household cleaning, and outdoor use. Its portfolio of brands includes Selpak, Solo, Silen, Viva, Servis, Pandoo, Dally,

Sany, Uni Baby, Selin, OKEY, Detan, Defans and Selpak Professional. With three production facilities in Turkey and two in Morocco, the company employs more than 2,000 people. In addition to exporting to more than 60 countries and holding a 40% share of Turkey's tissue export market, Sanipak is part of the 2 billion turnover

The Desert Architecture Forum, a first-of-its-kind platform aimed at defining the future of urban development through the lens of heritage, sustainability, and national identity, will take place in Saudi Arabia, under the strategic support of the Architecture and Design Commission and Urban Heritage Association. This forum, organised by Creative Connect Exhibitions & Conferences and coorganised by Great Minds Event Management, will bring together leading architects, developers, government decision makers, and urban planners from 20th21st October 2025 at JW Marriott in Riyadh. It will serve as the principal stage in the advancement of the Architectural Character Map, an initiative launched by Crown Prince Mohammed bin Salman that categorises the kingdom's architectural identity

into 19 culturally distinct regional styles.

This event is expected to be instrumental in advancing Vision 2030's vision for cultural and urban development by translating architectural policy into construction, design, and planning strategies that will yield real-world results.

The Desert Architecture Forum will be built around four core messages namely Saudi Arabia as a Global Pioneer: Establishing the kingdom as a global reference point for culturally grounded, environmentally sustainable architecture; From Vision to Execution: Highlighting the transition from strategic planning to implementation on the ground; Tradition Meets Modernity: Merging Saudi Arabia’s rich architectural past with contemporary design innovation and smart city planning; and Cultural Sustainability in Practice:

Reinforcing the importance of architecture in shaping societal identity, economic growth, and environmental responsibility.

With keynote addresses from senior officials from the public and private sectors, the Forum aims to encourage active dialogue between them in order to create Saudi cities that are future-ready and reflect the Kingdom's values.

Sumayah Sulaiman AlSolaiman, CEO of the Architecture and Design Commission, said: “At the commission, we believe architecture is not just a discipline, but a driver of cultural identity, economic resilience, and environmental harmony.

“Initiatives such as the Desert Architecture Forum, which are aligned with the ambitions of Saudi Vision 2030, showcasing Saudi Arabia’s architectural narrative, rooted in heritage, shaped by sustainability and

propelled by innovation.

“As a strategic partner, we reaffirm our commitment to cultivating a design ecosystem that transforms our natural landscape into a canvas for excellence where tradition and modernity coexist.”

This year, Esmalglass-Itaca isreturningtoCersaiewith proposalsaimedatcreating amorecreative,innovative andsustainableceramicindustry, where excellence is key to the evolution of materials and the advancement of the ceramic industryasawhole.

AmemberoftheAltadiaGroup, Esmalglass-Itaca has become theGroup'stechnologicalengine through its development of high value-added products. This activity has helped the company establish itself as a strategic and trustedpartnerformanufacturers worldwide, enabling them to gain competitive advantages. The company's service-driven approach demonstrates its ability to transform processes and its expertise and knowledge in the field of frits, glazes and

digitalinks.

For this edition of Cersaie, the company o ers eco-sustainable products based on research and theuseofnewtechnologies.

The development of waterbased digital glazes, the reduction of emissions, and the optimisation of resources are someoftheexamplesofhowthe company translates its values into action. The following are someofthecompany'ssolutions and products that can be found atthisneweditionofCersaie.

DigitalGlass, is a set of waterbaseddigitalglazesappliedusing the Inkjet technology, unlike the traditional method, which uses organicsolvents.Thissystemcan reduce water consumption by up to 10 times, eliminate odours by 90%, reduce hydrocarbon emissions, and minimise waste

byupto40%.

In addition to facilitating automation, this proposal has led to higher model changes in a short amount of time, which has resulted in reduced labor costs and increased marketadaptability.

The Esmalglass-Itaca ink sets are designed to address the current challenges of ceramic decoration, and to meet market demands for sustainability, performance,andaesthetics.The sets are designed to minimise emissions and eliminate odors at chimney outlets. In addition, they o er greater colour intensity, more e cient ink use, and greater versatility in digital applications, even with high inkloads.

The Slim-Body solution is included in the fully digital

proposals for large-format, thin-body tiles that reduce gas consumption by 15%, CO2 emissions by 12%, and improve productivityby30%.

The proposal can be used in ventilated facades, countertops, aswellasflooringorwallcladding foralltypesofspaces.

Theindustrialsectorwillbenefit from these three solutions by reducing environmental impact and costs associated with waterconsumption.

Corning Incorporated announcedacollaboration with Broadcom Incorporated, a supplier in the semiconductor field, on a co-packaged optics (CPO) infrastructure that will significantly increase processing capacitywithindatacentres.

Corning will supply cuttingedge optical components for Broadcom’s Bailly CPO system, the industry’s first CPO-based 51.2 terabit per second (TBps) ethernet switch. This combination will deliver significant improvements in optical interconnection density and power savings, making it ideal for large-scale artificial intelligence(AI)clusters.

CPO infrastructure is meeting the needs of AI workloads by improving networking and processing bandwidth, density, and power e ciency inside data centres by placing optics and electronics closer together in a processingsystem.CPOcantake AI to the next level by enabling higher speeds and densities while improving overall power e ciencyindatacentres.

Broadcom’s Bailly CPO system incorporates eight

silicon photonics-based, 6.4 TBps optical engines that are co-packaged with Broadcom’s StrataXGS Tomahawk 5 Ethernet switchchip.

Corning is now a qualified supplier of the optical infrastructure that is needed to bring fibres to these optical engines. The fibre harnesses that make up this optical infrastructureincludeconnectors for the front-plate and external laser modules, single mode and polarization maintaining fibres, and fibre array units (FAUs) that connect the fibres to the optical engines with a high degree of precisionandreliability.

Benoit Fleury, Director, CPO business development, Corning OpticalCommunications,said:“As AI-enableddatacentrescontinue to scale, Corning has been collaborating with Broadcom to ensure CPO connectivity needs are met with a high degree of performanceandreliability.

“With this latest collaboration, we're delivering an optical connectivity solution that enables unprecedented speeds and bandwidth concentrations with lower power consumptions andcosts.”

Sheng Zhang, chief technology o cerofopticalsystemsdivision, Broadcom, said: “The explosive growthofAIworkloadsisdriving unprecedented demands on interconnect bandwidth. Our multi-year collaboration with Corning on high density fibre connectivity solutions for the TH5-Bailly CPO system has resulted in breakthrough performanceatscale.

“We are thrilled to deepen this relationshipasweworktogether onthenext-generation200Gper lane CPO solutions, unlocking even greater power e ciency and bandwidth density for the next generation of AI-powered datacentres.”

Corning o ers a wide range of optical fibre, cable, and connectivity solutions for data center networking, and continues to unveil new innovations as these networks rapidly evolve. For example, in addition to its collaboration with Broadcom on their CPO product development, Corning has also launched theCPO FlexConnect Fiber, a single mode fibre that is engineered for superior bend performance while mitigating multi-path interference (MPI)

impairments to enhance the overall system performance of the optical infrastructure within aCPOsystem.

Corning is a global innovator in materials science, with a 170yeartrackrecordoflife-changing inventions.Thecompanyapplies its expertise in glass science, ceramic science, and optical physics. Corning's markets include optical communications, mobile consumer electronics, display, automotive, solar, semiconductors, and lifesciences.

Lhyfe,aproducerofgreenand renewablehydrogenforthe decarbonisation of mobility andindustry,announcedin Julythatithastakenasignificant step forward with the first tests of green hydrogen combustion as a replacement for fossil gas combustion, and has made its first delivery of renewable hydrogeninSpain,intheValencia region. The company said this first experiment, successfully deployed in the ceramics sector, can now be replicated in other sectors using combustion, due to the mixing kit developed byLhyfe.

The combustion of fossil fuels, mainly natural gas, is used in many industries (e.g. ceramics, frit, cement, steel, glass, nonferrous metals, etc.) to reach the high temperatures required by their processes (between 400°C and 1550°C). Like many energyintensivesectors,theseindustries are now seeking to reduce their carbon intensity by replacing naturalgaswithgreenhydrogen. Burninggreenhydrogenemitsno CO2,unlikeburningnaturalgas.

Spain’s Valencia region is

home to many manufacturers of ceramics and frit (a glaze materialthatgivestilestheirshine andstrength).

Lhyfe delivered three tonnes of green hydrogen in just three weeks to the Valencia region to decarboniseoneoftheplayersin thisceramicssector.Thisisitsfirst deliverytotheIberianPeninsula.

The green hydrogen was produced at the Lhyfe site in Bessieres, Haute-Garonne (France), which came on stream in 2024 and has a production capacity of up to two tonnes of green hydrogen a day (5 MW).

Lhyfe transported the three tonnes of hydrogen using its advanced logistics capabilities, in particular its fleet of hydrogen bulk containers, which is one of the largest and most modern in Europe(withnearly70containers).

Lhyfe is a pioneer in its sector whichbeganproducingrenewable green hydrogen in 2021. It is regularly asked to take part in pioneeringhydrogenexperiments andhasthusdevelopedtheability to adapt to all its customers’ decarbonisationneeds.

These combustion tests, the

firstcarriedoutbyLhyfe,involved mixing combustion gases and gradually increasing the proportion of green hydrogen as a replacement for natural gas. To achievethis,Lhyfehasdeveloped a ‘mixing kit’ that gradually increasestheproportionofgreen hydrogen in the mixture from zeroto100%.

The tests were carried out successfully, requiring only the burnerstobechanged.

This system can now be deployed in many industries that use high-temperature gas combustion (at between 400°C and1550°C).

Frederic Naudi, industry key account manager at Lhyfe, said:“These combustion tests, usingupto100%greenhydrogen, representanimportantmilestone forLhyfe,whichisthussupporting the first trials to decarbonise manufacturing processes in an industry that consumes a lot of fossilgas.

“Wecannowdeploythissystem inmanyindustriesthatburnfossil fuels.In this way, we continue our mission to decarbonise as of today, as well as that of

On 17th June 2025, Ceramics UK hosted itsDelivering Net Zero Conferenceat Sta ordshire University, bringing together around 115 delegates from across the UK ceramics industry, Government, technology providers other stakeholders. The event provided a vital platform for sharing insights into sustainable practices,cutting-edgeresearch, and the regulatory landscape shapingthesector’sfuture.

The conference was chaired by well-known analyst, writer, and broadcasterSepi GolzariMunro, who introduced the key themes and objectives and facilitated expert presentations and panel discussion focused on accelerating the UK ceramics industry’stransitiontonetzero.

Highlights from the day included Lee Brownsword,

Ceramics

UK’s associate director, providing an update on the UK ceramics industry's developmentsandprogressover thepasttwodecades,addressing current challenges and outlining thestrategicpathforward.

EdmundWard,deputydirector, industrial decarbonisation at the Department for Energy Security and Net Zero (DESNZ), spoke aboutkeyemergingGovernment policiesandinitiativesrelevantto thesector.

Malin Cunningham from Hattrick shed light on the complexities of greenwashing and the regulatory landscape, emphasising the importance of transparency and credibility of sustainability claims forcompanies.

Richard Goodhead, Lucideon’s chiefmarketingo cer,presented on overcoming sustainability challengeswithinthefoundation

industries, highlighting real-world applications and innovativesolutions.

In a discussion panel hosted by Sepi Golzari-Munro on hydrogen for the UK ceramic industry, Clare Jackson (CEO of Hydrogen UK), Chloe Tindale (strategic marketing manager for hydrogen in the UK at Air Products), David Manley (head of sustainability at Forterra), and Harriet Culver (hydrogen lead at DESNZ) discussed the introduction of hydrogen to the economy and the UK ceramicsindustry.

Jonathan Morris, national energy system operator’s insight lead for Future Energy Scenarios (FES), discussed the future of energy to 2050 and engagement routes for ceramicsmanufacturers.

Theconferencealsocelebrated significant achievements within

supportingmanufacturersintheir decarbonisationexperiments.”

Lhyfe,whoseSpanishsubsidiary openedin2022andhaso cesin MadridandBarcelona,isworking on several projects in the Iberian Peninsula. One has already been announced in Vallmoll (Tarragona), with an installed capacity of 15 MW, producing up to 4.5 to 5 tonnes of green hydrogenaday.

Scheduled to come on stream in 2027, the project has been selected under the H2 Pioneros programme to receive a €14 million grant from the Spanish government. This project aims to decarbonise the uses of industrial players, particularly in the chemicals sector, but also inmobility.

theindustry:

Brownsword said: “It is crucial that UK ceramics producers can continue to innovate and invest to reduce emissions, which they have done over many decades, but they must also stay competitive versus companiesoverseas.

“The conference brings all issuestothefore,whetherthat’s Government policy, research activities or sector progress, and highlights key needs/ challenges so companies in the sector can continue the l ow-carbontransition.”

The University of Missouri’s transformative initiative to build a new, state-ofthe-art research reactor, NextGen MURR, is o cially underwaywiththesigningofthe first agreement, announced on 16thApril.

Mizzou will partner with a consortiumthatincludesHyundai Engineering America, the Korea Atomic Energy Research Institute (KAERI), the Hyundai Engineering Company and MPR Associates forthedesignandlicensingofthe newreactor.

University of Missouri president Mun Choi said: “This is a historic moment for our university, our state and the future of nuclear scienceandmedicine.

“NextGen MURR represents our commitment to research that changes lives. It will allow Mizzou to lead the nation in producing critical medical isotopes while opening new frontiers in science, engineeringandpatientcare.”

The announcement comes as global demand for radioisotopes continues to rise, with growing recognition of their role in

precisiondiagnosticsandtargeted cancertherapies.Thenewreactor and supporting infrastructure will be the largest capital investment in the university’s history and will position Missouri as a national hub for innovation, investment and manufacturing in nuclear healthtechnologies.

Todd Graves, chair of the UM Board of Curators, said: “NextGen MURR is more than a reactor; it’s an engine of progress. It will enhance Missouri’s role as a leader in nuclear science medical research, economic development and education for generations tocome.”

The consortium brings proficiency in developing and designing research reactors throughKAERI,globallyrenowned engineering and construction services by Hyundai Engineering, and nuclear regulatory and licensing expertise found in MPRAssociates.

HanGyuJoo,presidentofKAERI, said:“Thisremarkablepartnership is made possible through the relentless dedication of experts involved in this project as well as

the firm partnership between our twocountriesandpeople.

“Building upon this opportunity, wewillworkcloselytogetherwith MizzouforNextGenMURR,saving andimprovinglives.”

The initial agreement with the consortium covers the design studies phase to develop the ‘roadmap’ for the new reactor. It willincludedetailedprogramming studies and a preliminary site evaluation and will establish an initial project cost and schedule estimate for the entire site. This $10millionagreementisexpected to take approximately six months to complete, and the results will beintegratedintothepreliminary design and licensing phase under a separate contract, overseen by theBoardofCuratorsandMizzou leadership.The total initiative is expectedtotakeeightto10years.

Michael Hoehn II, programme director for NextGen MURR, said: “The new reactor will be designed to meet the needs of thefuture.

“From isotope production to advanced materials testing and workforce development,

this reactor will be a platform for innovation that empowers the next generation of scientists, engineers and healthcare providers…and most importantly, improve the lives of US patients. It is more than infrastructure; it is a strategic nationalassetinthemaking.”

“Throughout this project, we promisetohonourMizzou’score values, respecting our partners, taking responsibility, fostering discovery and striving for excellenceateverystep,”

In-cheol Lim, project executive of the consortium, said. “We are committed to building a partnership rooted in trust, collaboration and sharedpurpose.”

Building on the legacy of the University of Missouri Research Reactor, the only U.S. producer of critical medical isotopes used totreatvarioustypesofcancers, the second reactor will play a vital role in securing a domestic supply of radioisotopes and advancing new discoveries in cancer treatment and nuclear medicineforgenerations.

Quantum Systems, a company operating in artificial intelligence (AI)-powered aerial intelligencesystemsfordefence, emergency services, and industry,hasraised€160million innewfunding,ledbyBalderton Capital, with participation from Hensoldt, Airbus Defense and Space, Bullhound Capital, LP&E AG and existing investors, including HV Capital, Project A, PeterThiel,DTCP,OmnesCapital, Airbus Ventures, Porsche SE andNotion.

The funding, which brings the total raised by the company to €310 million, will be used to accelerate global expansion, scale production, and advance the company’s autonomous dronesystems,so wareandAI. Foundedin2015byateamwith experience in drones, robotics, andimagerycollection,Quantum Systems’ family of modular, dual-use unmanned aerial

systems (UAS) bring together the latest advances in eVTOL technology, AI, edge computing, andautonomytohelpcustomers makebetterdecisions,fasterand moreaccurately.

Quantum Systems’ drones and intelligence systems are currently used by NATO-aligned forces – including those in Germany,Ukraine,Australia,New Zealand and Spain. Following the acquisition of Germany’s AirRobot in March, Quantum Systems is a tier-1 supplier to theUKMinistryofDefence.More recently, the firm expanded into the UK market with the acquisition of Nordic Unmanned UK,aglobalproviderofhigh-end droneproductsandservices.

Commercial applications of Quantum Systems’ solutions include mapping drones across mining, agriculture, and infrastructure. Notable clients include RocketDNA and the Indiangovernment’sDepartment

forScienceandTechnology.

Since launching its flagship Vectorplatformin2019,Quantum Systems has continuously innovated in response to the growing demands of its customers, and the shi ing defenceandbusinesslandscapes. Its latest iteration, Vector AI, debuted earlier this year and has already been combattested in Ukraine, o ering real-time ISR (intelligence, surveillance, reconnaissance) capabilities in areas where GPS and communications are notavailable.

The new funding follows severalyearsofexceeding100% year-over-year revenue growth for the company, which now has 550 people across sites in Germany,Australia,Ukraineand Romania.

Florian Seibel, co-CEO and cofounder,QuantumSystems,said: “The need for sovereign, aerial intelligence has never been

more pressing. Our systems, a powerful blend of hardware and so ware, are built for the realities of modern defence and security challenges; they are autonomous, interoperable, and provenunderharshconditions.

“Withsupportfromournewand existinginvestors,wearereadyto become the European leader in robotised and AI-powered aerial intelligence solutions, providing both public and commercial customers with the high-quality, accuratedatatheyneedfordaily decisionmaking.

Sven Kruck, co-CEO, Quantum Systems, said: The successful completion of our C Series marks a significant milestone in our company's history. This investment allows us to follow our vision. We will increase our global production capacity to meet the growing demand for our AI-powered drone systems and expand our market presenceworldwide.”

Specialist electronics manufacturer,KemptronOy (Kemptron)hasdeployeda brand-new production line usingPanasonicFactorySolutions’ NPM-GP/L printer and NPM-W2 pick-and-place machines. Installed by longstanding Panasonic partner and specialist SMT equipment provider, SMT House, the automated turnkey solutionfuture-proofsKemptron’s productioncapabilities,delivering theagilityrequiredtothriveinthe hyper-competitive electronics manufacturingsector.

Founded in 2024, Kemptron Oy, is based in Lahti, Finland and employs 130 specialists in electronics manufacturing for industrialOEMclients.Itproduces printed circuit boards (PCBs), subassemblies, and transformers, in addition to DC fast chargers for EVs, o road vehicles, boats, andaircra .

Using Panasonic’s advanced line management so ware, PanaCIM-EE, SMT House has connectedKemptron’sproduction line to a third-party warehouse

The German Association of Jewellery, Watches, Silverware and Related Industry (BVSU) and ceramitec have entered into a strategic partnership. ceramitec is an international fair for highperformanceceramicsheldevery twoyearsattheexhibitioncentre in Munich. The next exhibition will be held from 24th to 26th March2026

The focus, among other things, will be on technical ceramics. Medical and dental technology, automobiles, aviation, jewellery and watchmaking, among many otherbusinesssectors,relyheavily on these materials. ceramitec will also feature powder metallurgy, an important manufacturing processformanyBVSUmembers.

The ceramitec exhibition will feature leading global exhibitors showcasing innovative solutions and processes along the entire valuechain,fromrawmaterialsto finishedproducts.

Withmorethan13,000exhibitors from 84 countries, the trade fair

management system, in addition to its manufacturing execution systems, ERP so ware, and inventorymanagementtools.This allows crucial data to be shared in real-time across all areas of its connectedfactory.

Using a High Mix, Low Volume (HMLV) production structure, Kemptron creates approximately 2.000 individual boards produced every day. With more than 10 set-up changes needed per shi , increasing production speed and flexibilityarecrucial.

Panasonic’s fully automated, high precision NPM-GP/L stencil printer provides high-quality printing, delivering remarkable print repeatability and consistent precision. It supports both automated model changeover to streamlinethetransitionbetween di erent production runs, and in-time machine monitoring to minimisedowntime.

With increased feeder capacity and advance warning systems when components are running low, the NPM-GP/L significantly increases production uptime and

e ciency, enabling Kemptron to respond to customer supply and demand changes in realtime through continuous, autonomousupdates.

Panasonic’s NPM-W2 highspeed, modular pick-and-place machine delivers e cient and preciseSMTassembly.Placingup to77,000componentsperhour,it integratescomponentplacement, solder paste inspection (SPI), automated optical inspection (AOI), and adhesive dispensing intoasingleplatform.

Ideal for handling larger PCB assemblies, the NPM-W2 automatically receives order information, andthe materials required for specific PCBs in real-time, thanks to Panasonic’s line management so ware. Using a pay-per-use model for components, this increases flexibility, and reduces unnecessary waste, and overall productiontime.

Jari Takala, general manager at KemptronOy,said:“Weneededan automatedsolutionthatincreased speedofassembly,whilstreducing

changeover times. Panasonic Connect’s autonomous factory solutions were exactly what we werelookingfor.

Furthermore, the flexibility of renting these machines from SMT House, not to mention the fantastic service a orded to Kemptron before, during, and a er installation, made this an easydecision.”

SMT House Group was founded in 2012 and specialises in solutions with SMT, THT and Smart Material Handling solutions for the electronics manufacturingindustry.

The company was founded in 1918 and today develops innovative technology and solutions for a variety of applications in the consumer electronics, housing, automotive, industry, communications, and energy sectors worldwide. As of 1st April 2022, Panasonic Group has switched to an operating company system, with Panasonic Holdings Corporation serving as a holding company and eight companiesunderitsumbrella.

providesanopportunitytoexplore the latest technologies and materials.Inthisregard,theBVSU partnership becomes important.

According to ceramitec, the aim is to promote a transfer of technology between exhibitors and visitors to the trade fair and membersoftheassociation.

MarittaLepp,exhibitiondirector of ceramitec, explains: “The jewellery and watch industry opensupanewtargetgroupforus in the field of technical ceramics, which still has a lot of potential. TheBVSUistheidealpartnerand multiplierforusintheindustry.”

BVSU managing director Guido Grohmann said: “ceramitec is an ideal platform for our member companies to find out about the latest technologies and materialsfortheirownproduction processes and to meet potential businesspartners.Wearelooking forward to exciting moments and encountersatceramitec.”

More than ever, ceramitec is positioning itself as the central platform for the high-

performance material ceramic and its growing importance in high-tech applications. The exhibition is facing a structural change, with technical ceramics, additive manufacturing, and powder metallurgy in particular opening up new growthprospects.

The trade fair is using this development to reposition itself.

In addition to the ceramics industry,theaimistoincreasingly reach user industries such as mechanicalengineering,medical technology, the automotive industry, aerospace, electronics, and the energy sector, markets in which ceramics are o en still underestimated as a highperformancematerial.

As part of its strategic development, ceramitec is also significantly expanding its range oftopicsfor2026.Inadditiontothe previousfocusondecarbonisation and energy e ciency, there will be a stronger focus on the topic of the circular economy. Digitalisation, automation and

artificial intelligence will play a central role, especially in the conferenceprogram.

Another focus will be on the new special topic ‘Calcined clays asacementsubstitutetoreduce CO in cement production’. It will be implemented in close cooperation with clay suppliers, equipment manufacturers, and theVDMAandVDZassociations.