Trade barriers impact on CDMOs and CROs

OUTSOURCING The Trump administration’s trade policy has hit CDMOs and CROs hard. Trade barriers against Chinese service providers and raw material suppliers have increased biologics production costs and caused supply shortages. Small biotech firms dependent on these contractors are particularly affected. Although the US suspended its restrictive tariff policy in early October, China remains classified as a security risk, and a government paper suggests plans to make FDA recognition of studies conducted in China more difficult.

"We share the concerns of European industry representatives, who warn that trade restrictions jeopardise both the security of supply for patients and global innovation," says Benedikt von Braunmühl, CEO of Rentschler Biopharma SE/Inc. Like global Big Pharma companies, Rentschler

Biopharma is in a similarly privileged position: "Five years ago, we deliberately expanded our production network in order to be able to respond flexibly to the needs of our markets and customers, enabling us to serve the international market from Germany and the US”.

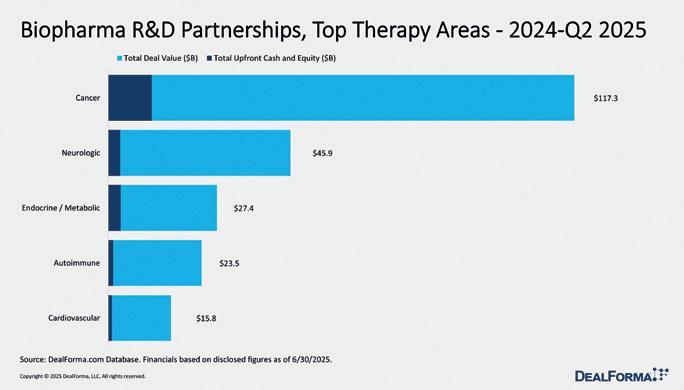

Figure 1: From 2024 through Q2 2025, R&D partnerships were dominated by biologics, which accounted for 274 of 592 deals (46%), generating $160.6bn of $277.4 bn total value and $13.4bn of $20.6bn upfront spend (average $126m). Small molecules ranked second with 151 deals worth $55.6bn and $4.8bn upfront (average $80m). Together, these two modalities represented 72% of transactions, 78% of deal value, and 88% of upfront commitments. Platform and data technologies (genomics, sequencing, screening) ranked third with 74 deals worth $29.4bn but saw milestone-heavy structures, delivering just $900m upfront (average $50m). Gene therapy, though limited to 20 deals, delivered high value density at $14.4bn total ($720m per deal on average) but with minimal upfronts ($39m), highlighting option-driven, back-loaded economics. Cell therapy recorded 39 deals ($10bn total, $600m upfront, average $65m). Immunotherapy (23 deals; $3.8bn; $66m average upfront) and CRISPR (11 deals; $3.7bn; $58m average upfront) remained niche but showed solid per-deal terms.

However, a company survey by the US biotech association BIO shows, around 90% of US biotech SMEs source pharmaceutical raw materials, APIs or services from Chinese companies. They are at great risk if trade restrictions affect collaboration with domestic Chinese CROs and CDMOs, as comparable services elsewhere could be significantly more expensive.

Supply chain problems

That's because service providers must factor in supply chain problems and uncertainties in US business into their pricing. For CDMOs and CROs, this represents a paradigm shift, as they have simply grown on the back of flourishing biologics sales in the past (see figure 1). Last year, CDMOs generated US$22-US$26bn for biologics, according to market estimates by various market analysis institutes. Geographically, North America dominated with a market share of 35–40%, followed by the APAC countries with 20–25%, and Europe (25%). The geographical dominance of the US was even stronger in clinical trials conducted by CROs. Fortyfour per cent took place in the US, followed by 30% in the APAC countries and 25% in Europe. However, the US's leading role is crumbling. IQVIA reports that China's share of global clinical trials grew by 57% over the last five years, compared to a 17% increase in North America's share and a 21% decrease in Western Europe's share. In the most important segment of the US$65bn global market (2024), oncology, China has al-

ready overtaken North America (35%) with a 39% share. This is a development that even trade restrictions will do little to change.

Europe's potential role

In addition Donald Trump’s MFN policy is causing great uncertainty in the industry. The US President wants to reduce USdrug prices significantly, in what has been the most lucrative pharmaceutical market to date. Pfizer and AstraZeneca have already announced they will reduce their US drug prices for certain products in exchange for a US tariff moratorium on products produced out of the US. Han Steutel, head of the German pharmaceutical association vfa, has no doubt that this will make the US less attractive as a pharmaceutical location.

Martin Krauss, head of the German CRO association BVMA, however, sees positive aspects to the restrictive US trade policy and isolation from China. "If there is indeed greater isolation from China, orders could shift to Europe," he said at BioSpain 2025, and Federico Pollano, Chief Commercial Officer (CCO) at IDT Biologika, confirms a significant increase in orders. However, the reality is different when you look at where European biotech founders are heading. "I spend most of my time in the US because that's where the best companies for in vivo CAR-Ts are," says Patrick Dietz, founder and CEO of in

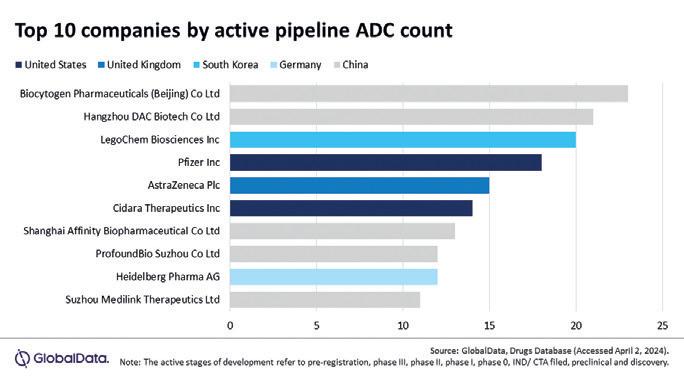

Antibody drug conjugates (ADCs) are a rapidly growing modality, and Chinese companies are leading the ADC trend, accounting for half of the top 10 developers. According to Global Data, China overtook the US in terms of the number of oncology trials in 2023, the most relevant market for biologics and leads the market with 39% of all cancer trials, and 42% of ADC trials globally.

vivo CAR-T specialist CPTx GmbH. Like other start-ups, his priority is what is fast and inexpensive. That is why he is planning an initial investigator-initiated clinical trial with an in vivo CAR-T cell therapy in China. It is half the price and six months faster than in the US. Belgian company Esobiotec SA has already done something similar. The results of the clinical trial with Eso-T01 in China were so promising that the British company AstraZeneca plc acquired the company in March for a whopping US$1bn. Following the rapid trials in China, the com-

panies are now seeking INDs in the USA. There is no mention of Europe – barely features in these plans — seen as too slow, too bureaucratic, and too costly.

A warning sign for Europe? The EU Commission is currently mobilising billions for biotechnology as part of its Life Sciences Strategy, while Germany, Europe’s largest pharmaceutical market, launched a similarly ambitious strategy this summer. The next step is to become faster and less bureaucratic. ■

t.gabrielczyk@biocom.eu

15+ YEARS OF EXPERIENCE

Advanced Pichia protein production strain & process development

UNLOCK PICHIA® TOOLBOX

Broad and versatile Pichia pastoris protein expression platform

CUSTOMER-ORIENTED SERVICES

Customized project setup suitable for every industry

Strategic Value of Isolator Lines in Manufacturing

EQUIPMENT In the face of a rapidly evolving pharmaceutical landscape, the demand for safe, sterile, and scalable manufacturing solutions has never been greater. As the industry continues to shift towards more complex biologics and injectable therapies, isolator lines have emerged as a cornerstone technology –offering not only enhanced sterility but also operational efficiency and safety.

› Marcel Langner, Head of Manufacturing at IDT Biologika, shares insights into their implementation and impact.

Isolators are engineered to maintain sterility by physically separating operators from the production process. Interaction occurs via glove ports, preventing direct contact with products or containers. This minimises microbial risk – essential for biologics and potent compounds. Equipped with Class A air supply, isolators ensure contamination-free vial filling and fluid transfers. They allow longer production runs, reduce cleaning and downtime, and are crucial in high-risk settings such as handling live viruses.

Implementation Challenges

Introducing a new isolator line involves more than just equipment – it requires a facility infrastructure that supports high-

speed operations. “Media supply and material logistics must be precisely aligned with the line’s throughput,” says Langner. Storage space for auxiliary equipment is another often-overlooked factor. Skilled personnel are also essential, as continuous operation requires round-the-clock staffing. Proper configuration of control systems is key to smooth performance.

Automation is the key

Automation plays a vital role in modern pharmaceutical manufacturing, helping to overcome operational challenges and enhance product quality. By reducing manual intervention, it lowers contamination risks and ensures precise control over each vial.

Advanced vision systems and real-time monitoring detect deviations early, enabling corrective action before product quality is affected. Automation also supports longer production runs, resulting in higher output and lower per-unit costs –key advantages in today’s cost-sensitive healthcare market.

Looking Ahead: Why IDT Biologika

At IDT Biologika, isolator lines are just one part of a broader strategy to deliver endto-end manufacturing solutions for global pharma companies.

The company’s newest isolator line ranks among the fastest globally, capable of producing up to 100 million vials annually. With batch sizes of 500,000 vials, integrated air filtration, and H2O2 decontamination, it sets a new standard in sterile manufacturing. A fully automated visual inspection unit adds another layer of quality assurance. “It’s not just about speed,” says Marcel Langner, Head of Manufacturing. “It’s about consistent, highquality output at scale.”

For instance, IDT Biologika has successfully scaled up production of its Dengue vaccine using isolator technology, proving that existing processes can be adapted for large-scale manufacturing without compromising sterility or efficiency.

With deep expertise and a collaborative approach, IDT Biologika ensures smooth project onboarding and reliable drug-substance and product manufacturing. ■

Dedicated Biotech team: Your project gets exclusive attention from a specialised biotech team

Single point of contact: Experience full accountability with a dedicated contact person

End-to-end integrated services: Enjoy a comprehensive suite of services for seamless study support Expertise on demand: Access a wide range of scientific and therapeutics expertise tailored to your study needs

Agile and responsive approach: Benefit from a flexible and responsive approach to tackle any challenges head-on

Data-driven excellence: the cornerstone of clinical research

CLINICAL RESEARCH Essential areas such as study planning, interpretation, regulatory guidance, and key study design decisions remain human responsibilities although AI increasingly supports routine tasks.

X-act gets involved after the preclinical phase supporting clients in all clinical research phases from Phase I to IV and beyond. Their service ranges from initial planning to final analysis, reporting, and regulatory submission.

EuropEan BiotEchnology spoke with Jasmin Atarodi, Managing Director of X-act Cologne Clinical Research GmbH, about the benefits of partnering with experienced data specialists.

EuroBiotech_ As a specialised CRO, what are your core areas of expertise, and how do these services benefit your clients throughout the clinical study process?

Atarodi_ Our main strengths are in four areas – clinical data management, biostatistics, statistical programming and medical writing:

In clinical data management, we ensure data is captured accurately and in full compliance with all rules. Our workflows keep data quality and integrity high throughout.

Our biostatisticians design smart studies and select endpoints to effectively answer each scientific question.

Our statistical programmers create efficient, tailored analysis packages ready for submission. Our medical writing team delivers all documentation clearly and professionally, meeting regulatory requirements.

Close teamwork across these fields gives clients seamless support from a trusted partner throughout their study.

EuroBiotech_What advantages do specialised CROs have over full-service providers?

Atarodi_Specialised CROs provide genuine expertise in their chosen areas. Clients benefit from personal contact and quick decisions. Our experience in data management and biostatistics means we offer efficient, high-quality, and customised solutions, whether it’s data strategies, innovative statistics, or clear medi-

Jasmin Atarodi is a co-founder and the managing director of X-act Cologne Clinical Research GmbH, an independent CRO headquartered in Cologne, Germany, since 1994.

cal writing. Clients consistently tell us this specialisation makes their projects more efficient and cost-effective, while reducing error risks and providing greater planning security.

EuroBiotech_How do you ensure clients are well informed and personally supported in every project phase?

Atarodi_Strong project leadership starts with clear responsibility. Each client has a dedicated project leader at X-act, who acts as their main point of contact and link to all our specialists.

We keep clients updated with regular meetings and open communication on project status, milestones, issues, and next steps. Our flat structure and digital tools help us stay agile and responsive to changing client needs, ensuring involvement at every step.

EuroBiotech_From past collaborations with biotech and biopharma companies, what are the most important factors for success?

Atarodi_Success depends on real partnership, working together as equals. Our proactive approach makes a difference: we spot potential issues early and offer solutions before problems arise. Honest communication, efficient collaboration between all disciplines, and a clear focus on shared goals are essential. Our expertise lets us quickly understand individual client needs and provide targeted support. Clients often describe us as a responsible, forward-thinking partner who brings real value to their development. ■ Contact business@x-act-cologne.com

YOUR PRODUCT — OUR COMPETENCE AND DEDICATION FOR MORE THAN 35 YEARS!

RichterBiologicsisyourprofessionaland experiencedpartnerofferingCDMOsolutions fromgenetoproductallfromonesource.

RichterBiologics:expertforlatestage andcommercialproduction.

RICHTERBIOLOGICS

Suhrenkamp59,22335Hamburg,Germany

Phone:+494055290-801

BusinessDevelopment@richterbiologics.eu

CONTACT US TO BRING YOUR PROJECT TO SUCCESS!

CDMO: An SAP S/4HANA transformation in <10 months

CDMO TRANSFORMATION In Life Sciences, SAP transformations for midsize CDMOs are nothing short of complex. But integrating a newly acquired site into an existing SAP landscape is a different matter entirely. At Tenthpin, we took a bold step by designing a new SAP S/4HANA template from the ground up to a new site for a leading CDMO; and then successfully deploying it to another newly acquired site in less than 10 months.

› Patrick Wolf, Partner at Tenthpin

When the CDMO approached Tenthpin, they were operating across multiple established manufacturing sites. Each site was running on a different ERP system, with one that was poorly implemented with S/4HANA. But growth was on the agenda. Why? Because the CDMO had acquired a new site from a global pharma company, thus initiating the requirement for a rapid integration under a 12-month Transition Services Agreement (TSA).

Their newly acquired site ran a highly customized version of SAP ECC. Therefore, the CDMO had to choose between adapting the existing systems or starting fresh – taking the opportunity to build a new, scalable SAP S/4HANA system.

Most importantly, the CDMO decided to build on Tenthpin’s CDMO Industry Template that guarantees robustness, compliance, and extendibility.

When the CDMO acquired a stake in another manufacturing site, this approach was more than validated and created the ideal scenario to execute the first rollout of the new SAP S/4HANA template.

Not all challenges are the same

SAP S/4HANA transformations in general are complex and intense programs. That isn’t new. The project faced three critical challenges:

1. Complexity of legacy systems: The heavily customized SAP ECC system

on the site highlighted that need for a carefully designed carve-out and clean data migration strategy to ensure a smooth transition to the new S/4HANA template.

2. Alignment of processes: The site needed to adopt standardized processes coming from our Tenthpin CDMO template, especially across finance and procurement, without disrupting core operations.

3. Tight timeline: A deadline of less than 10 months from start to finish demanded strict time management to ensure the team could execute validation and testing milestones without compromising on system readiness or compliance.

Fit-to-Template works best

We selected a Fit-to-Template rollout strategy for this project. This rollout strategy is where an enterprise template is developed, with subsequent rollouts on different sites adopting it with minimal changes. In practice, this would enable us to avoid redesigning processes from scratch and ensure consistency with future possible rollouts – saving time and focusing our efforts on where it matters most.

We applied this rollout strategy by:

› Targeting essential business processes like finance, procurement, inventory, manufacturing, and quality management – so that the site could operate effectively from day one without any disruption.

› Deferring non-essential or complex requirements to post-go-live enhancement phases – maintaining project focus and avoiding scope creep.

› Installing a streamlined and lean governance model that empowered decision-makers to act quickly – resolving

Patrick Wolf, Partner at Tenthpin

issues in no time and keeping the project on track.

This rollout strategy led to local deviations of only 4% compared to the enterprise template.

Fighting speed and resistance

There are two elements that stick out in any integration (CMDO or not): speed and resistance to change.

The tight deadline of less than 10 months was always at the back of our mind. Strategic clarity wasn’t enough; we needed executional speed to reach the milestones set by the CDMO. That’s where Tenthpin’s industry accelerators played a vital role – developed based on our deep Life Sciences industry experience and SAP best practices.

Think of our implementation accelerators as pre-configured solutions, validated templates, process models, testing scripts, data migration tools, and established methodologies designed for the complex industry and processes of Life Sciences. Using relevant accelerators, our experts drastically reduced the time spent on baseline configuration, process design workshops, documentation and testing. This provided more time to focus on unique integration challenges and

site-specific requirements – without compromising on business readiness or regulatory requirements.

And then there’s the human elements that every new site integration faces: resistance to change. Our proven Organizational Change Management (OCM) methodology was the key to solving this; ensuring user adoption, minimizing operational disruption, and achieving the project's intended business benefits. Here’s what our structured OCM approach focused on:

› Providing clear and consistent communication to different stakeholder groups at all sites.

› Engaging with key users and site leadership from the acquired entity throughout the process.

› Delivering comprehensive training programs that addressed both system usage and new standardized processes.

› Established feedback mechanisms to address any concerns from stakeholders quickly.

Overall OCM was instrumental in bridging potential cultural gaps between the acquiring group and the new site. Without sticking to our OCM approach, fostering a sense of shared purpose and transitioning to standardized global processes would have been more cumbersome and protracted. This way, we could respect

local expertise but still ensure globalized procedures were in place.

Evolving CDMO quality with T/QME

An essential component for process automation was our own GxP-compliant software, Tenthpin Quality Management Evolved (T/QME). It’s the new standard for QM in SAP S/4HANA, offering a seamless integration into existing quality control and quality assurance processes.

For the CDMO client, T/QME was key to improving their quality management operations within SAP S/4HANA. Our solution enabled the CDMO to gain greater transparency on lab performance, accelerate sample identification, increase compliance, ensure traceability, and more. Now, our client has a tailored solution for lab processes from sample creation to batch data management.

Multiple gains across the board

So, what did blending a template roll-out approach with specialized accelerators and robust OCM delivered for our CDMO client? Everything that they expected:

› Go-live was achieved within less than 10 months.

› A robust, standardized S/4HANA template has been proven and ready to support future site integrations with minimal disruption.

› Fit-to-Template approach provided a repeatable blueprint for similar projects.

› The collaboration with Tenthpin was central to success, bringing in proven tools, deep expertise, and the momentum to drive transformation at pace.

But more than that, the CDMO has experienced significant gains comparable to other S/4HANA transformations Tenthpin did:

› >20% decrease in operational costs.

› >5% increase in customer service (OTIF).

› >30% increase in manufacturing and quality staff productivity.

This case study clearly shows how Tenthpin enables CDMOs to leverage bold decisions, best practices, and expert partnerships that transform complexity into capability. See what Tenthpin can do for CDMOs here.

How Tenthpin’s T/QME improves quality management for CDMOs

Biomanufacturing in Switzerland

PRODUCTION Switzerland is a key hub for biomanufacturing, with immunological products like antibodies and vaccines making up 18.5% of 2024 exports. Swiss companies drive biotech innovation and biocatalysis across sectors globally, extending the traditional focus on pharmaceuticals to fine chemicals, fragrances and food tech. The development is supported by national collaborations and international coalitions.

› Dr Annette Luther, President of scienceindustries

Switzerland has been home to important scientific developments laying the foundation for biomanufacturing activities worldwide. In addition, state-of-the-art biomanufacturing sites throughout the country enable Switzerland to contribute to the global healthcare supply with therapeutic monoclonal antibodies, biologicals, vaccines and innovative gene therapies. The importance of biomanufacturing in Switzerland is reflected in the proportion of its exports that are biomanufacturing products. In 2024, immunological products accounted for 18.5% (CHF 52.3bn) of Swiss exports. To supply local markets, Swiss companies are also extending their biomanufacturing abroad. Traditionally, the focus of Swiss biomanufacturing has been on high-value pharmaceuticals. However, biotech approaches are finding wider applications. For instance, Swiss companies have played a key role in the fermentative production of vitamin B2 that has now replaced classical chemical

synthesis globally, and they are advancing technologies further. Swiss companies have also been at the forefront of using industrial biotechnology for the sustainable production of flavour and fragrance compounds.

Beyond pharmaceuticals

Furthermore, an increasing number of Swiss companies across sectors integrate biocatalysis into production processes, with key synthesis steps being carried out by enzymes or whole-cell biocatalysts. A key driver has been the Swiss Industrial Biocatalysis Consortium (SIBC). Currently comprising eight companies from the pharmaceutical, fine chemicals, agrochemicals, and flavour and fragrance industries, its members share expertise in a non-competitive setting. With close ties to leading Swiss academic research in biocatalysis, this supports the application of biocatalysis for more efficient and sustainable production processes.

The potential of biomanufacturing and biotechnology-based carbon capture and utilisation (CCU) technologies to replace climate-damaging fossil raw materials with biomass and renewable resources is increasingly being recognised by industry. In the food sector, applications of biomanufacturing, such as biomass- and precision fermentation to produce food and valuable components like animal-free alternative proteins, are progressing from research to development and production. This is being driven by a thriving Swiss foodtech ecosystem.Unlike major economies around the world, Switzerland does not (yet) have a national bioeconomy strategy.

Towards a bioeconomy strategy

The concept of bioeconomy is not yet familiar to political decision-makers or the public. However, a bottom-up development could change this: the Swiss canton of Fribourg, with a strong focus on agriculture and the food sector, is supporting the bioeconomy as a central pillar of its economic development strategy. Positive results could set an example for other Swiss regions. To extend its support for development of biomanufacturing applications, scienceindustries, the Swiss business association Chemistry, Pharma and Life Sciences, recently joined the European Biosolutions Coalition that supports innovation-friendly framework conditions for biotech applications and biomanufacturing beyond the pharma sector in Europe. ■

B Medical Systems is a global manufacturer and distributor of medical-grade devices with over 40 years of industrial experience. Contact us now!

Meeting global market challenges

EFFICIENCY BY DESIGN

The global biologics industry is entering a new phase of maturity. As costs tighten and timelines accelerate, CDMOs must deliver uncompromised quality while driving efficiency.

Rezon Bio, an EU-based biologics CDMO with state-of-the-art facilities and a client-centric approach, was established to meet biotech and pharmaceutical client needs with agility, pragmatism, and trust.

Biologics have transformed treatment for numerous life-threatening conditions such as cancer. With biosimilars accelerating competition, regulators streamlining pathways and pharmaceutical and biotechnology companies demanding affordability, the biologics market is entering a new phase of maturity.

Biologics market in transition

What was once a race for innovation at any cost is now a discipline of efficiency. Speed, quality and cost are no longer trade-offs; they must be delivered in balance. For CDMOs, this means rethinking how projects are developed, transferred and commercialised and how partnerships are structured for long-term success.

At the same time, global supply chains are being re-evaluated. Regionalisation, reliability and trust are increasingly valued alongside technical capability. Clients are asking not only if CDMOs can manufacture a product but also if they are willing to stand by them as pressures increase and markets evolve.

Rezon Bio: small, focused, disruptive

It is within this environment that Rezon Bio was launched, not as a start-up without foundations, but as an evolution of Polpharma Biologics’ biosimilars division. With two mirrored facilities in Gdańsk and Duchnice-Warsaw, Rezon Bio offers clients a streamlined path from cell line development through GMP manufacturing

to commercial supply. Rezon Bio’s Gdańsk facility is EMA certified and US FDA approved, while its Warsaw-Duchnice site is EMA certified and planned for future FDA licensing.

Both sites were designed with scalability in mind, giving Rezon Bio the ability to expand rapidly to seven GMP lines as client demand grows. This scalability, combined with proven expertise in commercial launches, means Rezon Bio enters the CDMO market with assets and credibility that most new entrants lack.

The name itself reflects the company’s philosophy. “Rezon” echoes reason –a commitment to rational, efficient processes that remove chaos from biologics development and manufacturing. It also reflects determination, signalling the drive to create value for clients and their patients.

What truly sets Rezon Bio apart is its people. The company has built a highly educated and experienced workforce, with many employees contributing their expertise for years and carrying invaluable institutional knowledge. This continuity gives clients confidence that projects will be executed with consistency, avoiding the disruptions or repeated mistakes that can arise from frequent turnover.

Pragmatic biologics manufacturing

The biologics market is maturing into a more standardised, efficiency-driven space. For clients, this means they are no longer willing to tolerate uncontrolled costs or unnecessary complexity. They expect reliable delivery, competitive economics and compliance without compromise.

Rezon Bio's FDA certified Gdánsk facility

GMP-compliant upstream operations

Rezon Bio has been established precisely for this environment. Its GMP systems are robust and fully compliant, ensuring patient safety and regulatory confidence, avoiding the over-engineering that drives costs up without adding value. At the same time, the company’s single-use technology platforms, lean processes, and advanced digitisation enable programs to move from early development to market with speed and reliability. Digital tools, including process modelling and digital twins, further optimise performance and reduce timelines.

An end-to-end CDMO partner

Rezon Bio’s capabilities allow the company to create value across the entire biologics lifecycle, including:

› Process development: Modern laboratories and high-throughput systems enable rapid, data-driven optimisation of upstream and downstream processes.

› Clinical and Commercial Manufacturing: Flexible, single-use bioreactors ensure scalability and consistency, supported by mirrored sites that provide supply continuity.

› Drug Product Capabilities: Integrated inhouse teams and established external partners offer formulation, fill-finish and packaging services.

› Regulatory Expertise: With successful regulatory approvals already secured, Rezon Bio brings proven experience in

navigating global filings, inspections and launches.

The company’s end-to-end capabilities give clients flexibility and the support they need. Whether outsourcing a single stage of development or partnering across the entire journey, Rezon Bio is structured to deliver speed, compliance and cost competitiveness at every step.

The advantage of Poland

Poland’s biotechnology ecosystem is rapidly gaining momentum, positioning the country as a rising force in Central and Eastern Europe. With over 300 biotech companies and a robust, expanding R&D landscape, Poland now covers the full value chain from early-stage research and technology transfer to advanced manufac-

turing and commercialisation. Anchored by a vibrant network of life sciences hubs in Warsaw, Kraków, Wrocław, Poznań and Gdańsk, and supported by around 40 universities offering biotechnology programmes and over 250 R&D institutions, the country provides a robust foundation for scientific and industrial growth. This academic strength translates into a steady pipeline of highly skilled graduates fuelling both established companies and a dynamic startup scene.

The country’s competitive advantages –high-quality talent, cost efficiency, strong work ethic, and a growing culture of innovation – are driving rapid progress. As Poland continues to invest in infrastructure, education and international partnerships, it is well positioned to strengthen its role as a regional leader in life sciences and biomanufacturing.

Rezon Bio leverages this momentum, combining the geographic and regulatory advantages of operating in Europe, with Poland’s exceptional talent base and competitive cost structure. This strategic positioning enables the company to deliver high-quality, cost-effective biologics development and manufacturing services without compromise.

Through close collaboration with leading universities, robust apprenticeship programmes and ongoing internal training, Rezon Bio has cultivated a workforce that blends global biopharma expertise with local ambition and resilience. The company’s teams consistently go the extra mile for clients, bringing technical excellence and a cli-

ent-centric mindset that translates into real value across every project.

From Polpharma to Rezon Bio

With roots dating back to 1935, when Polpharma was founded in Poland, the company’s heritage is built on nearly a century of scientific excellence, quality and innovation. Under the ownership of visionary entrepreneur Jerzy Starak since 2000, the company has transformed from a national pharmaceutical company into a global biotechnology leader. The opening of the first biotech R&D centre in Gdánsk in 2012, the acquisition of Bioceros BV in 2016, and the establishment of the state-of-the-art Warsaw-Duchnice manufacturing site in 2018 laid the foundations for this transformation. In 2019, Polpharma Biologics was formally spun off from Polpharma, establishing itself as an independent entity focused on biosimilars and biologics innovation. In 2025, Polpharma Biologics underwent a major transformation, splitting into two independent entities: the biosimilars business relocated to Switzerland to operate under the original brand, while the CDMO operations in Poland were rebranded as Rezon Bio. This strategic evolution is powered by 90 years of scientific excellence and the vision of a committed founder.

In today’s competitive outsourcing landscape, smaller mid-sized biotech companies often struggle to secure the attention they need from the largest CDMOs. Too frequently these innovators are treated as “filler pro-

jects”, slotted into idle capacity or deprioritised when larger, more lucrative contracts come along. This creates uncertainty, delays and risks for companies whose programs are highly time-sensitive and resource constrained. Rezon Bio addresses this gap by providing smaller “innovators with the same level of commitment as larger firms enjoy. Positioned as a mid-sized CDMO, the company is structured to offer flexibility, responsiveness and direct access to senior scientific and operational leadership.

Looking ahead

As the biologics sector matures, success increasingly depends on efficiency, reliability, and trust. Rezon Bio enters this new chapter with a rare combination of world-class facilities, regulatory approvals, and a workforce whose dedication consistently deliv-

ers value. By uniting European standards with Poland’s cost advantages and scientific talent, the company offers excellence without compromise.

More than a service provider, Rezon Bio positions itself as a true partner that treats every programme with ownership, transparency, and urgency. For innovators seeking to bring life-changing therapies to patients faster and more sustainably, Rezon Bio represents a new kind of CDMO, efficient by design, driven by excellence, and built on the belief that dedication creates lasting value.

About Rezon Bio

Rezon Bio is a biologics CDMO specialising in mammalian drug substance development and GMP manufacturing, with drug product coordinated via qualified external partners. Headquartered in Poland, the company operates two mirrored-capability facilities in Gdańsk and Warsaw-Duchnice audited by EMA and FDA. Drawing on a legacy of biosimilars development and global commercialization, Rezon Bio combines proven experience, digital transparency, and costto-value efficiency to help clients move from concept to market with confidence. Learn more at www.rezonbio.com or contact us at bd@rezonbio.com. ■

Contact us:

Rezon Bio

ul. Trzy Lipy 3 80-172 Gdańsk, Poland www.rezonbio.com

GMP | GLP CERTIFIED | GCLP COMPLIANT

Business Development

Tentamus Group

VelaLabs

DI (FH) Markus Roucka

AGC Biologics Team Fuels Shigella Vaccine Trials

VACCINE TRIALS Shigella, a drug-resistant bacterial threat causing deadly diarrheal disease in children, is under renewed scientific focus. AGC Biologics’ Heidelberg team is advancing vaccine innovation by supplying drug substance for Valneva’s clinical trials—offering hope for a breakthrough in global pediatric health.

› Jörg

Ohl, Senior Director of Business Development, AGC Biologics

In "A gut-wrenching problem we can solve", Bill Gates wrote about discovering the impact of dangerous bacteria on young children around the world. While advances have been made, he singles out Shigella as a dangerous, persistent threat:

“And new challenges make the fight against diarrheal diseases even harder than it was 25 years ago. Shigella – one of the nastiest bacterial causes of diarrhea –is becoming more and more resistant to antibiotics, and we still don't have a vaccine.”

Shigellosis, or Shigella, is the second leading cause of fatal diarrheal disease

worldwide, strongly contributing to pediatric morbidity and mortality. It is estimated that up to 165 million infections are due to Shigella, of which 62.3 million occur in children younger than five years.

For decades, researchers around the world devoted their efforts to stopping this deadly disease. Developing an effective vaccine would replace suffering with normal childhood development. As Gates points out, the effect of this disease does not happen in isolation:

“For families barely scraping by, diarrhea is both a medical crisis and an economic disaster. Parents miss work to

care for sick kids. Kids miss school. Expenses pile up. It's one of the ways that disease keeps families trapped in poverty – and one of the reasons that a country’s public health is key to its development.”

The talented team at AGC Biologics' Heidelberg facility is hard at work supplying the drug substance for Valneva SE’s investigational four-valent Shigella bioconjugate vaccine, producing phase II supply for two important studies:

› A randomized, controlled, and blinded study with infants conducted at a single study site in Kenya.

› A controlled human infection model (CHIM) study with adults age 18-50. Results of the study are expected in the second half of this year, according to Valneva’s April 9 announcement. Valneva exclusively licensed the vaccine candidate from LimmaTech Biologics AG, which previously worked with AGC Biologics to establish GMP-compliant manufacturing and quality control of the vaccine’s complex protein-polysaccharide conjugates for first-in-human studies.

AGC Biologics' Heidelberg site’s ability to handle complex molecules and multi-valent assets can help this potentially life-saving program reach its next clinical milestone. Valneva has entrusted the team of experts at the site with this challenge, recognizing their contribution to efforts aimed at preventing millions of deadly infections. ■

AGC Biologics Heidelberg has 40 years of experience in drug substance and API production.

• Recombinant Proteins • Monoclonal Antibodies

Ultra low freezer for intensive use

CRYOPRESERVATION Safeguarding temperature-sensitive materials is critical, and Ultra-Low Freezers (ULTs) ensure sample integrity at very low temperatures. Today’s customers demand not just reliability but also sustainability under intensive use. The new U701V from B Medical Systems, with variable-speed technology, delivers the perfect balance: uncompromised performance, reliability, and sustainability.

› Lekshmi Padmavathy – Head of Marketing, B Medical Systems

Ultra-Low Temperature (ULT) freezers store temperature-sensitive specimens at temperatures as low as –80 °C, preserving their viability and integrity for longterm research and clinical use. Common in laboratories, biobanks, and pharmaceutical settings, ULTs feature advanced refrigeration and insulation to maintain precise storage temperatures.

Challenges of intensive use

ULTs often face intensive use in clinical labs, pharmaceutical R&D, and biobanking, where multiple users access the freezer frequently, sample rotation is high, or workflows are time-sensitive. Examples include:

› Frequent door openings: High sample turnover, inventory checks, and ongo-

ing sample management increase daily door cycles.

› Extended door openings: Fully loaded or poorly organized freezers require longer retrieval times.

› Adverse environmental conditions: High ambient temperatures stress the cooling system.

These conditions can cause temperature fluctuations, frost buildup, higher energy use, and mechanical wear, reducing reliability and lifespan.

Intensive use and energy efficiency

Energy efficiency is critical in modern labs, not just for cost savings, but also to meet sustainability goals. Intensive use exposes the freezer interior to am-

bient air, requiring the cooling system to work harder to maintain the –80 °C setpoint. This increases energy consumption and can shorten the life of components if the freezer isn’t designed for heavy use. Consequently, reliable, energy-efficient ULTs are essential infrastructure, balancing performance with operational and environmental considerations.

The U701V, created by B Medical Systems, is a durable and sustainable ULT freezer that combines reliability with energy efficiency under intensive use. Its variable-speed compressor enables operation from –86 °C to –20 °C while maintaining superior temperature uniformity and rapid Door Opening Recovery (DOR). Certified as an EU MDR Class IIa device with an SN/T climate classification, it operates efficiently even in ambient temperatures up to +43 °C.

The U701V uses natural hydrocarbon refrigerants, reducing environmental impact compared with conventional refrigerants.

By integrating advanced cooling technology, insulation, adaptable temperature range, and eco-friendly refrigerants, the U701V sets a new standard in ULT freezers. It delivers uncompromised performance and sustainability, meeting the evolving demands of modern research and clinical labs, even under intensive usage. ■

ADC transactions surging

The hype around antibody–drug conjugates (ADCs) shows no signs of abating in 2025. The annual sales of the 21 approved ADCs rose in H1 2025 to US$8bn, nearly reaching the 2023 annual sales (US$10bn). This, along with technological advances, appears to be boosting investor confidence in targeted cancer therapies. According to Jasper Morley, Pharma Analyst at GlobalData, “recent advancements in linker technologies and conjugation methods have revitalised interest in this space. As such, ADCs are leading a new era of targeted cancer therapy, with sales forecast to increase by 433% and generate over US$45bn in revenue by 2030.”

Big deals and financings

Since 2020, there have been 31 ADC transactions worth US$45bn, according to GlobalData. Asian start-ups in particular are reported by GlobalData to be agile in development: half of the eight ADC developers with the most advanced pipelines at the end of 2024 were from Asia – Biocytogen, Hangzhou DAC Biotech, Legochem (South Korea), and Shanghai Affinity Biopharmaceutical. In Europe, Munich-based Tubulis AG recorded the largest funding round of a European ADC developer in mid-

October, totalling €308m (see page 74). The company has development partnerships with Gilead Sciences (2024), Bristol-Myers Squibb (2023), and Biocytogen (09/2025).

Filled pipeline

Currently, around 200 drug candidates are undergoing clinical testing, targeting approximately 50 antigens. However, 40% are directed against ten classic cancer targets with limited tumour selectivity.

Already, 41 ADCs are in approval-relevant Phase III studies.

Particularly interesting: this year and next, decisions are expected regarding the first four bispecific ADCs, which promise greater cancer selectivity than ADCs with a single antibody. According to GlobalData, all four Phase III bsADCs are being developed for East Asian markets. Systimmune and Bristol Myers Squibb’s izalontamab brengitecan, Shanghai JMT-Bio Technology’s JSKN-003, and Chia Tai Tianqing Pharmaceutical Group’s TQB-2102 are focused on China, whereas Amgen’s maridebart cafraglitide targets the Japanese market.

Boehringer Ingelheim has also been pursuing the avoidance of dangerous offtarget effects through more selective binding or activation mechanisms in target tissue since September 2025. A licence option agreement with the Canadian company Tegmine LLC secures the pharmaceutical giant the rights to candidates that bind not only to cancer antigens but also to cancer-specific surface glycans. The glycans identified using the AI-supported discovery platform TegMiner are incorporated into an ADC that functions like a multistage rocket: only after the glycan attaches the ADC to the cancer cell does an antibody bind to cancer cell receptors, triggering uptake of the covalently linked topoisomerase inhibitor, which kills the cancer cell.

Celonic's Strategic Alliance in ADCs

ALLIANCE The Celonic Group and CARBOGEN AMCIS AG have formed a strategic alliance to offer a fully integrated Antibody Drug Conjugate (ADC) development and manufacturing platform. This partnership combines Celonic’s biologics expertise with CARBOGEN AMCIS’s payload synthesis and conjugation capabilities, creating a seamless, end-to-end solution for ADC developers.

In the evolving landscape of oncology drug development, few modalities have generated as much excitement—and complexity—as ADCs. These sophisticated biopharmaceuticals combine the targeting precision of monoclonal antibodies with the cytotoxic power of small-molecule drugs, offering a potent and selective approach to cancer treatment. ADCs are designed to deliver their payload directly to tumor cells, minimizing damage to healthy tissue and reducing systemic toxicity. This targeted mechanism has established ADCs as one of the most promising therapeutic classes in on-

cology, with several blockbuster drugs already on the market and hundreds more in development.

Yet despite their promise, ADCs present formidable challenges in development and manufacturing. Their complexity spans multiple disciplines, including biologics, high-potency chemistry, conjugation, sterile fill-finish, and regulatory compliance. Fragmented supply chains and siloed contract development and manufacturing organisation (CDMO) services often lead to delays, quality issues, and increased costs. “This strategic alliance is a direct re -

sponse to the evolving needs of ADC innovators,” said Dr. Samanta Cimitan, CEO of Celonic Group. “By integrating Celonic’s advanced biologics platforms with CARBOGEN AMCIS’s world-class payload and conjugation capabilities, we’re enabling a fully harmonized development and manufacturing pathway—from DNA to drug product.”

The Rise of ADCs in Oncology

ADCs have emerged as a transformative modality in oncology, enabling targeted delivery of cytotoxic agents to cancer cells

Samanta Cimitan, CEO of the Celonic Group and Stephan Fritschi, CEO of CARBOGEN AMCIS

while sparing healthy tissue. The success of approved ADCs, such as:

› Adcetris (brentuximab vedotin)

› Kadcyla (trastuzumab emtansine)

› Enhertu (fam-trastuzumab deruxtecan)

› Trodelvy (sacituzumab govitecan)

has validated this therapeutic class and spurred a wave of innovation across the biopharmaceutical industry.

Growth and Pipeline Expansion

Analysts project the global ADC market to exceed $20 billion by 2030, with more than 200 ADC candidates currently in clinical development. This growth is driven by:

› Advances in antibody engineering and linker technology

› Improved understanding of tumor biology and target selection

› Regulatory support for accelerated approval pathways in oncology

› Demand for personalized and precisionbased therapies

Challenges in ADC Development

Despite their potential, ADCs are among the most complex therapeutic modalities to develop and manufacture. Key challenges include:

› Biologics production: High-yield, scalable antibody manufacturing

› Payload synthesis: Complexity and safe handling of highly potent cytotoxins

› Conjugation: Precise attachment of payloads to antibodies

› Sterile fill-finish: Safe and aseptic processing under strict containment

› Regulatory compliance: Harmonized documentation across global markets

These challenges demand deep expertise, specialized infrastructure, and seamless coordination across disciplines—capabilities that few CDMOs can provide under one roof.

Complementary Company Strengths

The Celonic Group stands for: Innovationdriven biologics development and drug

substance manufacturing. Founded in Basel, Switzerland, Celonic Group is a biologics-focused CDMO offering end-to-end services from DNA to drug product. With development and non-GMP manufacturing in Basel and GMP clinical and commercial manufacturing in Heidelberg, Germany, Celonic provides:

› GS CHOvolution™ cell line platform for high-productivity antibody production

› Upstream and downstream process development and process optimization

› Analytical method development and validation

› GMP manufacturing for clinical and commercial supply, including fed-batch, intensified and perfusion processes

› Classical and process optimization tech transfers, including regulatory support

Celonic’s Heidelberg site features multiple biomanufacturing suites with fermenters ranging from 200L to 6 x 2,000L, as well as

full perfusion reactors up to 1,000L scale for continuous processing.

“We pride ourselves on providing the technical expertise of larger, well-known CDMOs, but with the agility and collaborative mindset of a family-owned business,” said Dr. Cimitan.

CARBOGEN AMCIS: Payload and Conjugation Leadership

Headquartered in Bubendorf, Switzerland, CARBOGEN AMCIS is a global provider of high-potency APIs, ADC payloads, and conjugation services. The company operates facilities in Switzerland, France, the UK, China and the Netherlands, offering:

› Custom synthesis of cytotoxic payloads (e.g. auristatins, maytansinoids)

› Linker design and scale-up (cleavable and non-cleavable)

› GMP conjugation in segregated cleanroom suites

cGMP Bioconjugation Suite at CARBOGEN AMCIS Bubendorf site

› Sterile filtration and aseptic fill-finish for both liquid and lyophylized drug products

› Analytical characterization and regulatory support

CARBOGEN AMCIS has made significant investments in infrastructure to support ADC manufacturing, including the expansion of its Aarau and Neuland sites, together with a long-standing customer.

“The rise of targeted cancer treatments has fueled growing demand for ADCs, and this alliance positions us to meet that demand with unmatched technical depth and operational agility,” said Stephan Fritschi, CEO of CARBOGEN AMCIS.

Why This Partnership Matters

The decision to form this strategic alliance was driven by several key factors:

› Market demand: The ADC pipeline is expanding rapidly, with biotech startups and large pharma companies seeking turnkey solutions

› Supply chain complexity: ADCs require coordination across biologics, chemis-

try, and sterile manufacturing—often involving multiple vendors

› Regulatory pressure: Agencies such as the FDA and EMA are emphasizing integrated CMC documentation and quality systems

› Speed to market: Oncology programs often operate under accelerated timelines, making delays costly and potentially life-threatening

By combining their capabilities, Celonic and CARBOGEN AMCIS provide a “one-stop-shop” for ADC development, reducing risk, improving quality, and accelerating timelines.

Scaling for Commercial Demand

Celonic has recently expanded its Biologics Development Center (BDC) in Basel, featuring Cytiva’s Xcellerex XDR single-use bioreactors, including advanced perfusion technologies. The Heidelberg site now includes both small-scale suites (200L to 1000L) as well as a larger 6 x 2000L asset for scaling up and out to support late-phase and commercial supply. Celonic’s GMP facility in Heidelberg is equipped with state-of-the-art next-gen-

eration bioprocessing technologies and offers capabilities to significantly increase the amount of active ingredient produced. This reduces the cost per gram of finished drug substance, an important factor for ADCs.

CARBOGEN AMCIS’s Expansion

CARBOGEN AMCIS, together with a longstanding customer, is investing $32 million to expand its Aarau and Neuland sites, scheduled to be operational by 2027. These expanded facilities will support:

Sterile Fill & Finish Manufacturing at Saint-Beauzire,

Single use 2000L bioreactor in Celonic's Heidelberg GMP facility

France

› Commercial-scale linker and payload synthesis

› Additional capacity to strengthen supply chain resilience

› Enhanced containment and safety systems

› Expanded conjugation capacity suitable for late-phase and commercial supply

“By investing in both Aarau and Neuland, we are ensuring that our infrastructure keeps pace with our customers’ ambitions,” said François Baduel, Chief Business Officer at CARBOGEN AMCIS.

Building the ADC Value Chain

The partnership operates under a joint, integrated program management model, with cross-functional teams managing client projects from early development through to commercial scale-up. Key integration points include:

› Cell line and mAb process development (Celonic)

› Drug substance manufacturing (Celonic)

› Payload synthesis (CARBOGEN AMCIS)

› Conjugation and fill-finish (CARBOGEN AMCIS)

› Quality and regulatory support (Joint)

This operational synergy is expected to shorten development timelines, an important advantage in the competitive oncology space.

The Difference Compared with Larger CDMOs

While global CDMOs offer scale and geographic reach, the Celonic–CARBOGEN AMCIS alliance provides a distinct set of advantages:

› Deep specialization in ADCs

› Agility and speed

Deep dive with Sam

› Personalized collaboration

› Purpose-built infrastructure

› Regulatory expertise

› Strategic location in the heart of Europe

› End-to-end integration

Together, these advantages translate into accelerated timelines, higher quality, and stronger client relationships, providing a credible alternative to the traditional “onestop shops” offered by larger CDMOs. ■

Contact us:

Media Contact – Celonic Group

Elisa Witt; Marketing & Communications

Elisa.Witt@celonic.com

+41 76 588 67 59

Media Contact – CARBOGEN AMCIS

Denise Neufeld

Marketing & Communications Officer denise.neufeld@carbogen-amcis.com

+41 58 909 0384

CHALLENGES Biopharmaceuticals need to be produced. That sounds easier than it is. The complexity is increasing due to the growing diversity of molecules. Technical implementation, regulatory frameworks and quality assurance pose major challenges. EuropEan BiotEch nEws spoke with Celonic CEO Dr Samanta Cimitan about those major challenges and new trends.

EuroBiotech_Small and mid-sized CDMOs found their niche in being more flexible and agile to the customers' needs. Now we have times of uncertainty, strict budget control, tariffs … It´s getting a bit rougher for the SMEs?

Samanta Cimitan_Today’s environment demands more from all of us. In times of uncertainty and tighter budgets, biotech companies are looking for partners who can deliver speed, adaptability, and costefficiency. That’s precisely where midsized CDMOs like Celonic can show their strength. We’re built to be responsive, col-

laborative, and focused while maintaining the highest standards of expertise and quality. Biotech companies need partners who can adapt quickly and think creatively. That’s exactly where we thrive.

EuroBiotech_Where is your positioning in a CDMO market that is consolidating, as we hear from some experts?

Cimitan_Celonic is a pureplay biologics technology-driven CDMO with a clear focus on innovation, speed, and scientific depth. While consolidation in the market often leads to scale, it can also slow down

decision-making and dilute technical agility. We’ve chosen a different path—one that prioritizes advanced platforms and next-generation manufacturing strategies, which is key to speed and reducing cost of goods sold per gram particularly suited for small to large biotech and biosimilar companies.

Our strength lies in our ability to rapidly implement high-throughput screening combined with intensified upstream and downstream technologies. We are a pioneer in full perfusion and process conversions. We’re not just executing – we’re op-

timising. And we’re doing it in a way that’s modular, scalable, and tailored to each client’s molecule. Celonic is building the future of biologics manufacturing, one innovation at a time.

EuroBiotech_You have been busy in setting up your new plant and development center in Basel. How well established do you feel already?

Cimitan_We’re not just established –we’re operational and already delivering with impact.

The Biologics Development Center (BDC) in Basel was designed from the ground up to reflect the future of biologics development: high-throughput, integrated, and built for speed. We’ve equipped it with a state-of-the-art non-GMP pilot plant, advanced upstream and downstream process development and optimization labs, and a robust analytical platform that supports everything from early-stage characterization to late-phase tech transfers to our GMP facility in Heidelberg, Germany. We’re already onboarding new programs, including process conversions, scaling production, and hosting client visit – and the feedback has been phenomenal.

The past 12 months at our Heidelberg GMP site have been marked by growth and operational delivery. One of our significant milestones was supporting the commercial manufacturing of a bispecific antibody in oncology. Our team in Heidelberg has played a central role in bringing it to market.

We’ve also continued to strengthen our infrastructure. Our mid-scale asset – featuring six 2000L single-use bioreactors – is now fully operational, offering clients robust scale-up and scale-out options for late-phase and commercial programs. Combined with our small-scale perfusionready platforms, Heidelberg now offers one of the most flexible and high-performing biologics manufacturing setups in Europe.

EuroBiotech_Is there something that customers are looking for that no one in the CDMO sector is really delivering? I mean, do you sense some new trends in demand?

Cimitan_Absolutely. Clients aren’t just buying capacity – they’re searching for ex-

Dr Samanta Cimitan

CEO Celonic Group Dr Samanta Cimitan is an expert in the CDMO industry, holding a deep and unique combination of scientific, commercial, and operational expertise. Prior to Celonic, she held several leadership positions at Lonza for almost 13 years including Vice President of Lonza Group Operations Strategy, developing and leading transformational programs across R&D, Operations, and Commercial functions.

pertise, collaboration, and co-creation. The old model of transactional outsourcing is broken. Biotech innovators want strategic partners who challenge assumptions, anticipate risks, and build with them – not for them. At Celonic, we’ve sensed this shift early.

One example is in the area of next-generation perfusion. Next-gen perfusion isn’t just a technical upgrade – it’s a strategic leap. At Celonic, we’ve invested in intensified upstream and full perfusion platforms that deliver ultra-high cell densities, consistent product quality, and control. This isn’t perfusion for the sake of novelty – it’s perfusion with purpose. For clients devel-

oping biosimilars, complex biologics, or just wanting to reduce the cost of goods per gram on monoclonal antibodies (mAbs), this technology is transformative.

EuroBiotech_Europe itself seems to refocus on drug production in the European area. On the other side, China and others will always show lower price tags. How can producing biopharmaceuticals in Europe be sustainable in the long term, or do we have to ignore Asian offers?

Cimitan_We don’t ignore Asian offers. We respect them. But we don’t try to mimic them.

Competing on price alone is a bottomless spiral. Europe’s strength isn’t in being the cheapest – it’s in being the most trusted, the most innovative, and the most resilient. At Celonic, we believe long-term sustainability comes from building a value proposition that goes beyond cost: quality, reliability, flexibility, regulatory alignment, and strategic proximity to key markets. We also see a growing trend toward reshoring – not just for strategic autonomy, but for speed and control.

Asian CDMOs will continue to offer attractive price tags, but there are tradeoffs – for example, IP and supply chain risks, geopolitical uncertainty, and also the time zone misalignment. European biomanufacturing offers something different: stability, transparency, and a regulatory environment that’s harmonised with global standards. That’s not a cost – it’s a competitive advantage. That’s how we stay sustainable. That’s how we stay relevant.

EuroBiotech_What’s one leadership principle you live by that shapes how Celonic operates?

Cimitan_Leadership isn’t about being everywhere—it’s about being exactly where you’re needed. At Celonic, we have built a culture where leadership isn’t about being ahead of the curve—it’s about shaping it. It’s about seeing what others miss, saying what others won’t, and building what others fear. At Celonic, we don’t follow trends. We create momentum. And we do it with purpose, precision, and passion. ■

Antibodies: Cornerstone of ADC Precision and Efficacy

ADC Antibody-drug conjugates (ADCs) hinge on the antibody, not merely the payload or linker. Antibody precision defines efficacy, safety and therapeutic window. Emerging antibody formats –bispecifics, conditional designs and TCR-mimics – expand target space, demanding rigorous engineering to realise next-generation ADC potential.

› Dr Oliver Hill, Senior Director of Protein Engineering, YUMAB GmbH

Antibody-drug conjugates (ADCs) continue to evolve as a therapeutic modality that marries cytotoxic potency of small molecule drugs with targeted delivery. Considerable effort has historically focused on payload potency and linker chemistry, yet the decisive factor in determining ADC success is often the most underappreciated: the antibody itself. The antibody dictates the “where, when, and how” of action. It defines the therapeutic index by directing cytotoxic payloads toward malignant cells while ideally sparing normal tissues.

Tumour targeting

A recurring obstacle lies in so-called dirty targets, antigens expressed both in tumours and in healthy tissues. In these contexts, strategies such as affinity tuning, dual-targeting, or conditional activation become essential to balance selectivity and safety. The complexity is compounded by additional variables –including antigen density, internalisation efficiency, accessibility, and cross-reactivity – which must be resolved early in discovery. Clinical experience has shown that inadequately optimised antibodies can undermine otherwise elegant ADC architectures, leading to suboptimal efficacy or unacceptable toxicity.

Advances in antibody engineering now offer promising solutions. Bispecific and biparatopic antibodies can enforce tumour selectivity and accelerate internalisation.

Conditionally active designs – exploiting pH-sensitivity, protease-cleavability, or affinity modulation – further refine the therapeutic window by minimising systemic exposure. Together, these approaches represent a deliberate shift from “antibody as simple carrier” toward “antibody as engineered determinant of outcome.”

New formats

Exploration of TCR-mimic (TCRm) antibodies extends this logic to the intracellular antigen space, enabling ADC development against peptide-MHC complexes. While this broadens the target landscape, formidable challenges remain: low epitope density, inefficient presentation,

and heightened off-target risk. To succeed, TCRm-based ADCs will demand unprecedented antibody precision, achieved through rigorous screening and structureguided engineering. Their eventual clinical viability may hinge on pairing with ultrapotent payloads and highly controlled activation mechanisms.

Looking forward, the role of antibodies in ADCs will expand as development moves beyond oncology into autoimmune and inflammatory diseases. The next wave of ADC innovation will therefore depend less on “what is carried” and more on “who carries it”– with modern antibody engineering positioned as the decisive force shaping efficacy, safety, and clinical translation. ■