2026 reflects a market reaching equilibrium after years of volatility.

2026 reflects a market reaching equilibrium after years of volatility.

The U.S. housing market continues toward a steady pace of normalization in 2026. Mortgage rates have transitioned from a period of volatility into a fairly stabilized range. Inventory continues its deliberate climb from the record lows of the early 2020s. Home prices have moderated in most markets, increasing at more historical norms. Homeowners remain exceptionally strong on paper, with near record equity and historically low delinquency levels supporting overall market stability.

Buyers face improved choices compared to recent years. Sellers benefit from substantial equity. And the broader market benefits from demographic demand that remains sturdy.

The following pages outline the major forces shaping the real estate market in 2026, supported by data, context and practical implications for consumers.

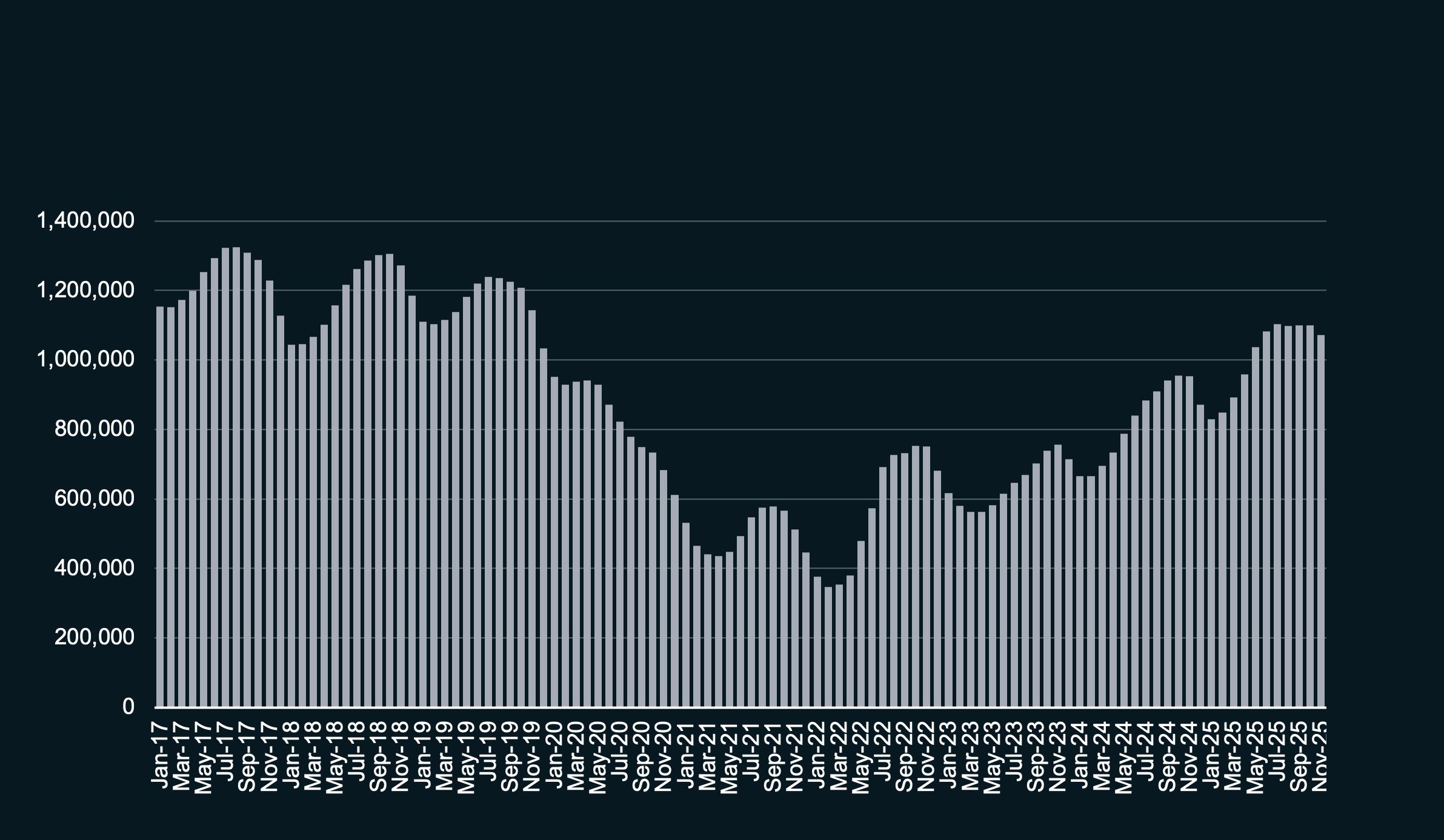

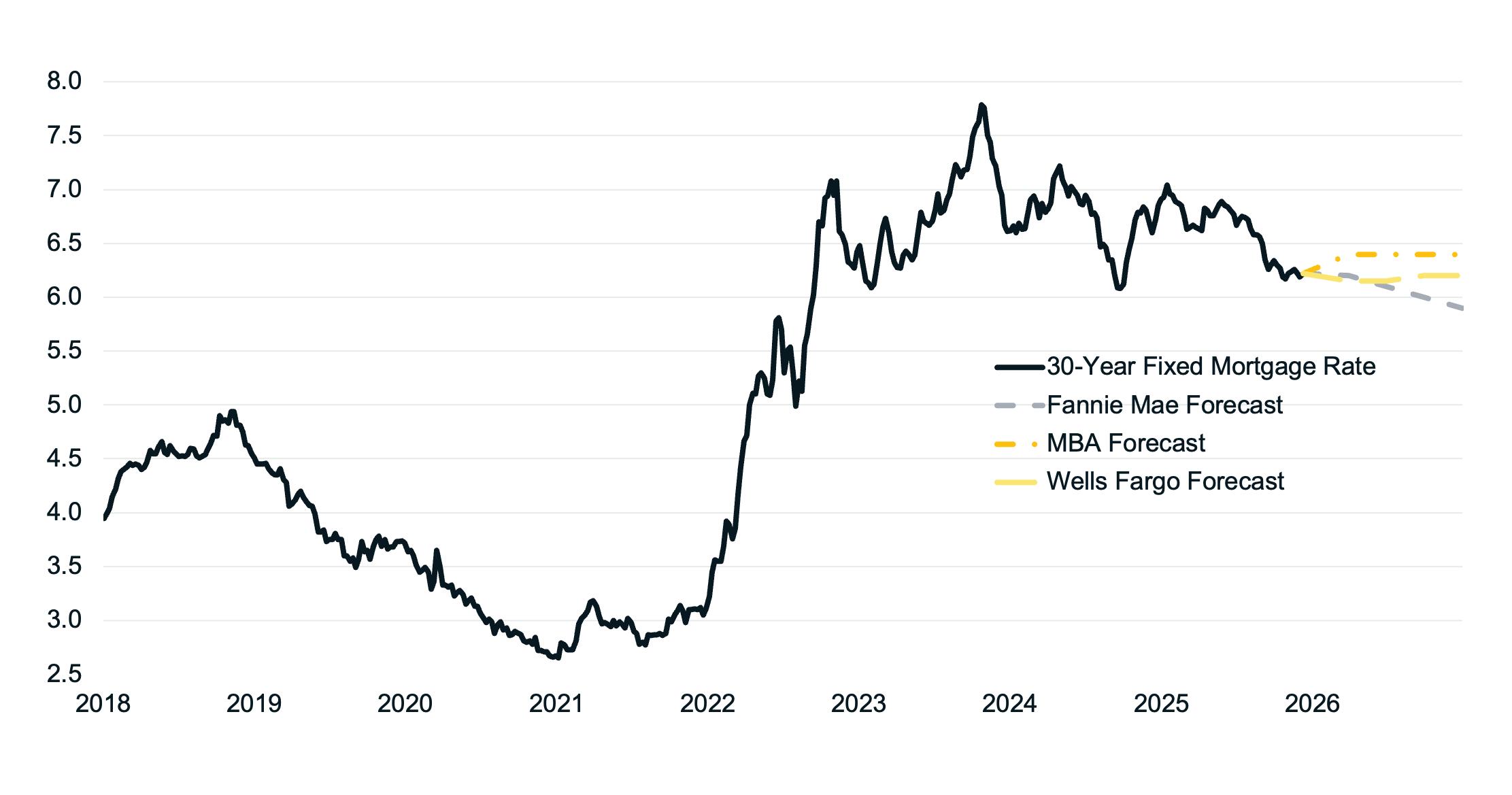

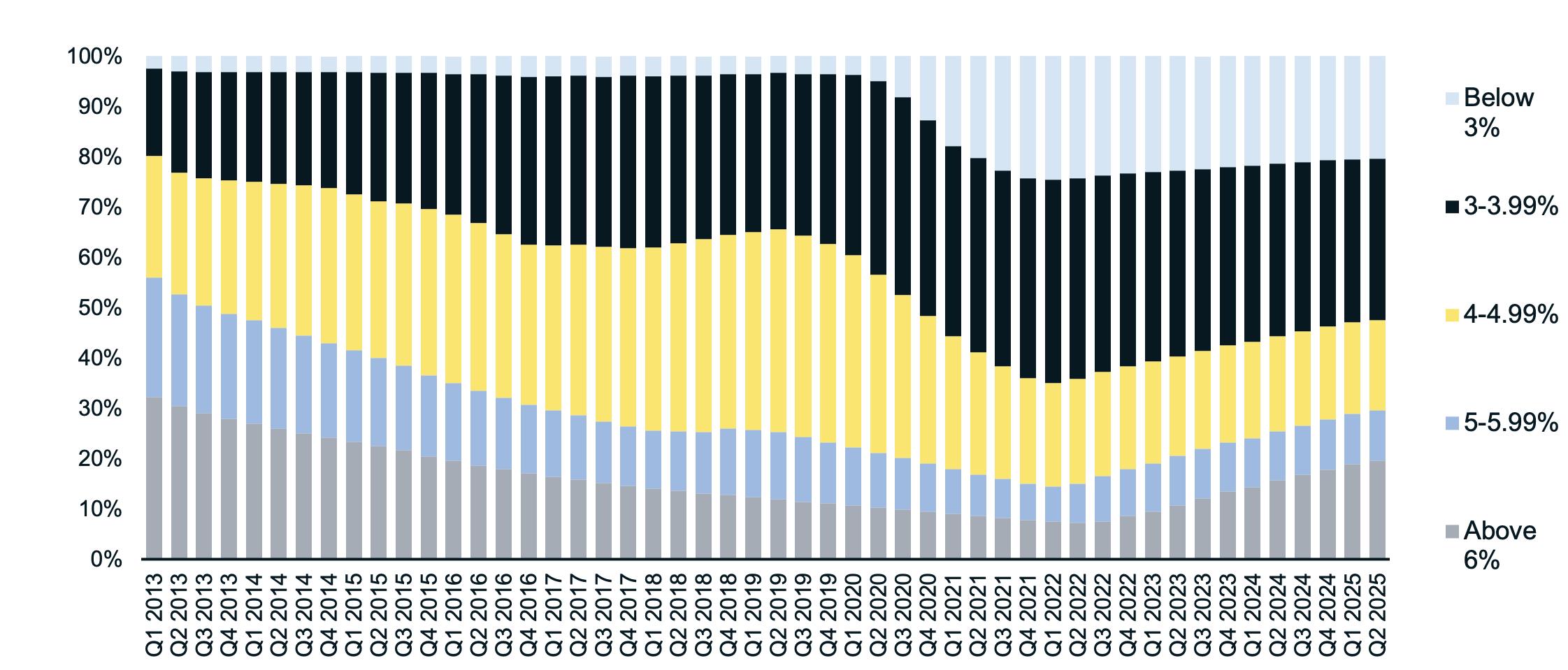

The trajectory of mortgage rates over the past four years has been anything but predictable. After surging from historic lows in 2020–2021 to multi-decade highs in 2023–2024, rates spent two years drifting downward. By 2026, Americans have largely accepted that 3 to 4 percent mortgages were an extraordinary anomaly. The conversation now focuses on stabilization and affordability, not a return to the past.

For context, 30-year fixed mortgage rates have averaged 6% - 7% since 1990. That year, the average rate was 10.13% - still elevated from the high inflation of the 1980’s. By 1998 the average plunged to around 6.91% and continued a downward trajectory as the Fed intervened during the Great Recession and then the pandemic. Between 2015 and 2022 mortgage rates were unusually low, levels not likely to be repeated any time soon.

MORTGAGE RATES ARE LIKELY TO CONTINUE STABILIZING

» Inlation remains above the Fed’s long-run target in several service categories.

» Treasury yields have adjusted to a higher baseline as the U.S. economy proves resilient.

» Post-pandemic mortgagebacked securities risk premiums remain elevated.

» The Fed continues to signal caution rather than urgency.

uencing

» Core inflation trends

» Global capital flows and demand for U.S. Treasuries

» Labor market cooling

» Federal Reserve balance sheet policy

Today’s mortgage rates are likely to continue their stabilization into 2026, with most forecasts estimating 6% to 6.4% throughout most of the year. However, there are a variety of mortgage ARM products offering rates in the high 5% range for those consumers open to alternatives to a 30-year fixed rate. As consumers consider their future housing plans, it is worth noting that nearly all major industry forecasts project mortgage rates to remain in the 6% range through 2028. This has meaningful implications for market behavior. And while current efforts by the Administration to improve housing affordability, including directing GSE’s to purchase mortgage backed securities, could have a positive impact on mortgage rates, it is not anticipated these efforts would result in dramatic rate reductions.

Today, the share of homeowners with mortgage rates at or above 6% is the highest it has been since 2016. Each passing year will gradually reduce the gap between existing mortgage rates and prevailing market rates, easing the psychological and financial resistance many potential sellers feel about giving up historically low, pandemic-era interest rates. As more homeowners carry mortgages that resemble current market conditions, mobility should improve and inventory constraints may begin to ease.

Average Spread: 1.76

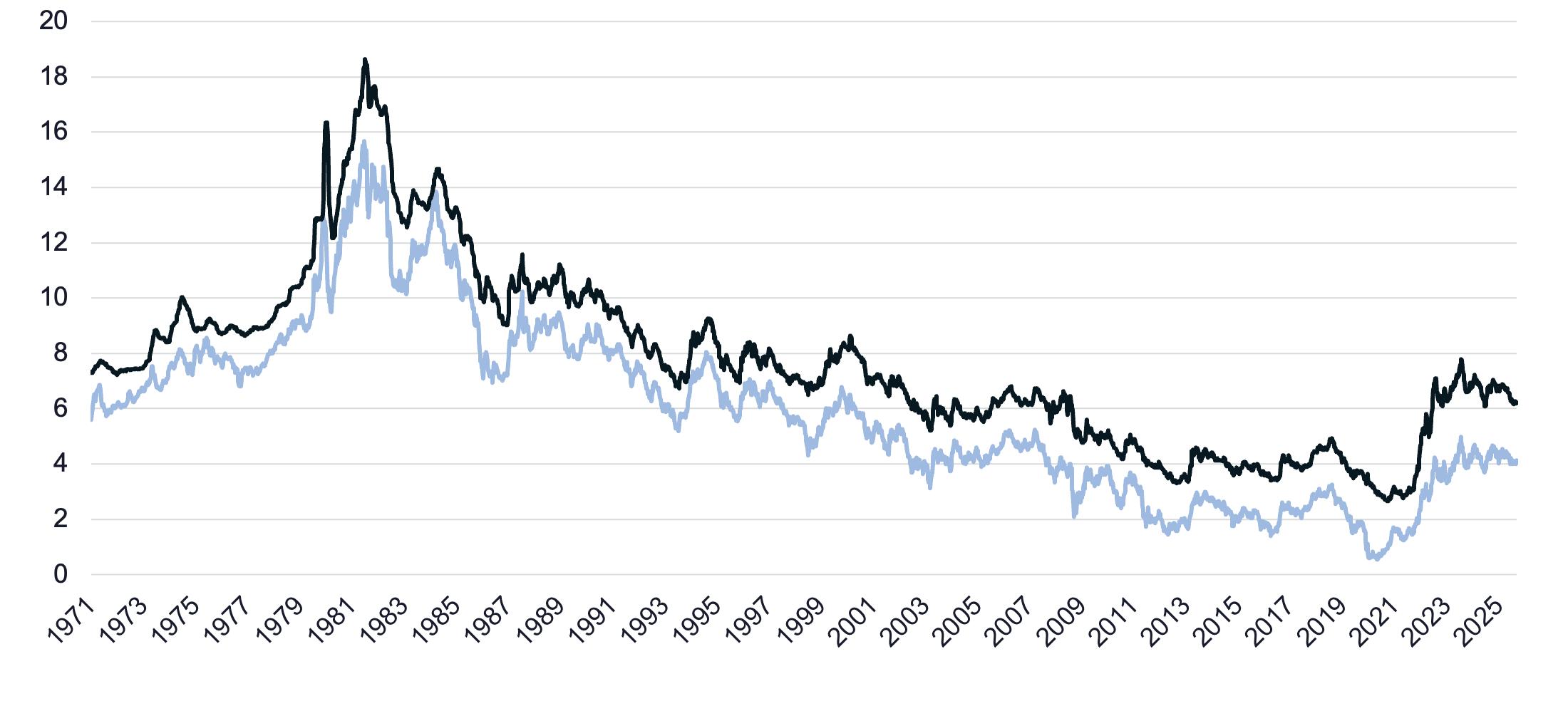

The inventory imbalance is easing, though not disappearing.

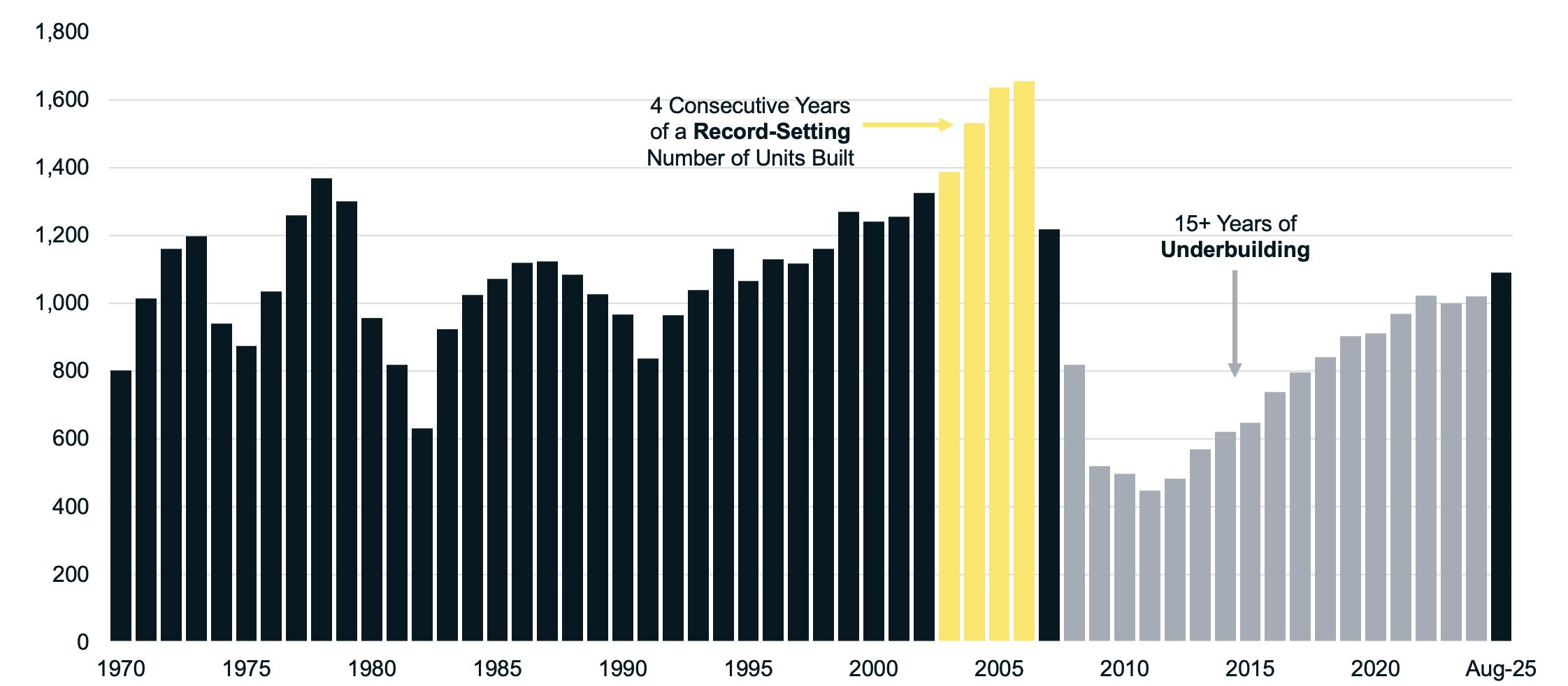

America’s housing inventory problem was more than a pandemic story. It has been the result of more than a decade of underbuilding, rapid household formation and low homeowner mobility. While the country is finally starting to see signs of improvement, more measurable progress is expected in 2026. New listings are climbing, new construction is steady and more homeowners are deciding that life events matter more than a sub-4% mortgage rate. The inventory imbalance is easing, though not disappearing.

We’ve all heard that “real estate is local” and this adage has proven especially true over the recent 24 months. Inventory levels and buyer demand are dramatically varied across U.S. markets. Affordability is impacted by mortgage rates, but also by scarcity. As rates continue to stabilize in the year ahead, more buyers will start to come off the sidelines, which will put moderate upward pressure on prices in markets with lower inventory.

This complexity emphasizes why hiring a professional real estate agent or broker is imperative to gain in-themoment, real world insight into your local market dynamics.

» Realtor.com reported inventory up 30% year-over-year through mid-2025.

» Early 2026 projections show inventory reaching early 2020 levels, though still below long-term norms.

» The largest gains appear in the South and West regions.

» U.S. Census/HUD data shows completions increasing in 2025 as builders worked to make up for years of underbuilding.

» Builders continue offering incentives, especially rate buydowns.

» New construction remains a critical pressure valve for supply, especially in the South.

SINGLE FAMILY HOMES COMPLETED, IN THOUSANDS

SOURCE: CENSUS

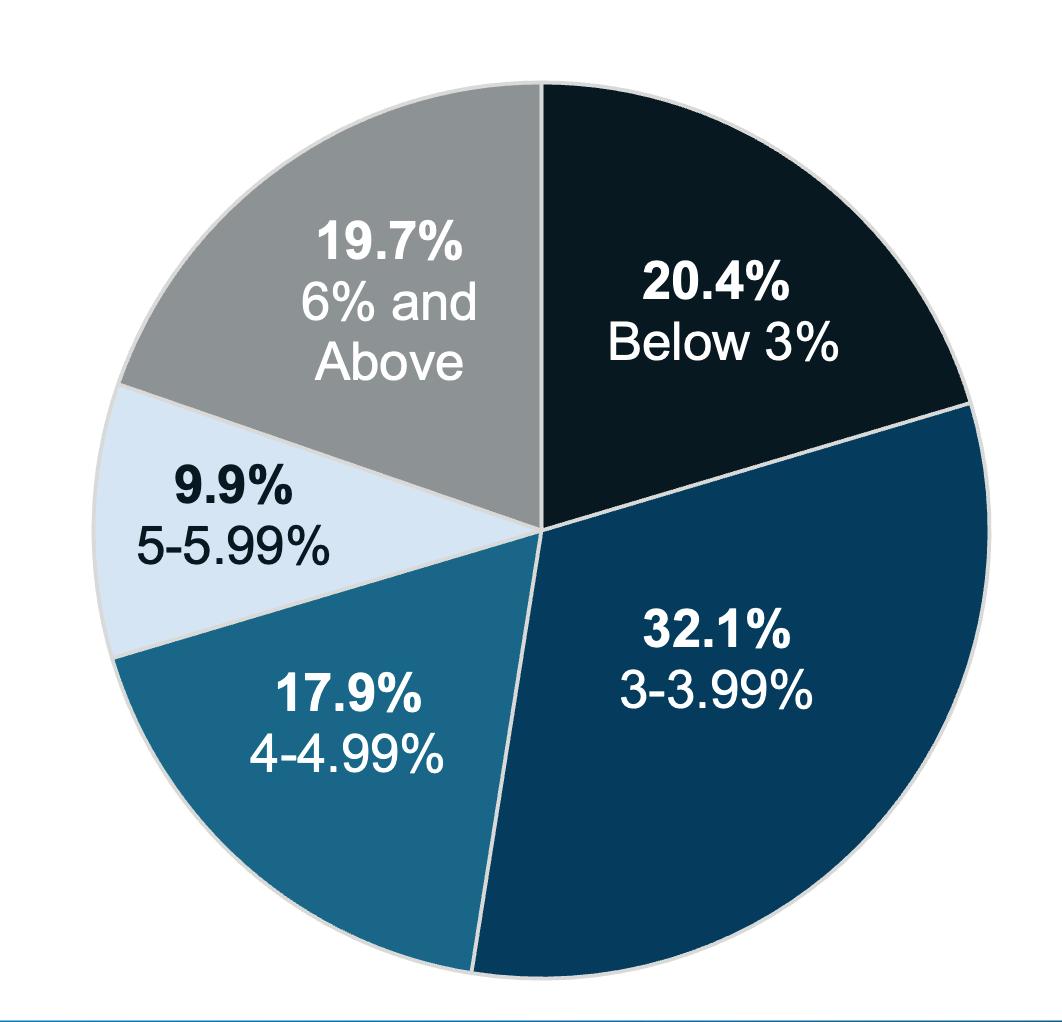

SHARE OF OUTSTANDING RESIDENTIAL MORTGAGES BY MORTGAGE RATE AT ORIGINATION

SOURCE: FHFA

» According to FHFA (The Federal Housing Finance Agency,) 80-plus percent of borrowers still hold rates below current market levels.

» Life events are now overriding financial hesitation: births, deaths, divorce, remote work reversals and relocations.

» According to the Harvard Joint Center for Housing Studies, the median age of U.S. owner-occupied homes is 40 years.

» Only 2% of homes in the U.S. were built after 2020.

» Aging homes are driving increased renovation investment and modernization.

Aligning expectations with buyer behavior in today’s market will be essential to achieving a successful sale.

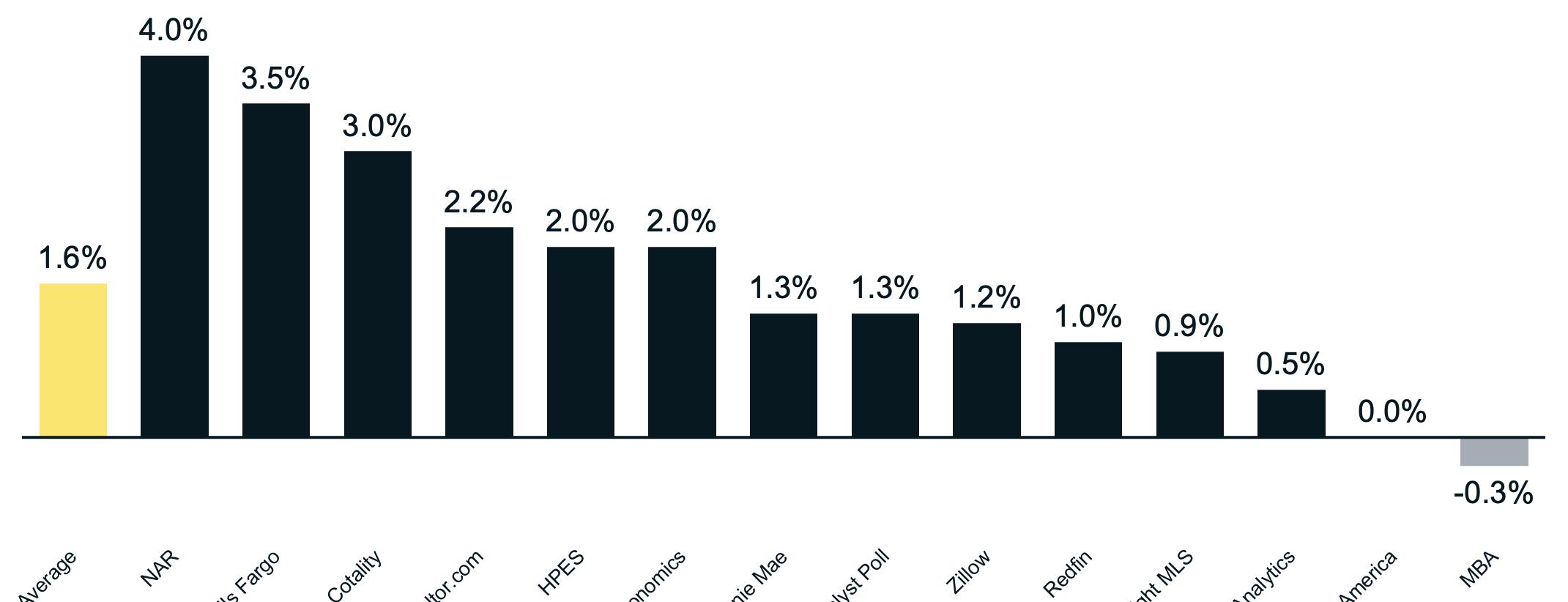

The double-digit housing price appreciation of 2020–2022 is firmly behind us. The sharp deceleration of 2023–2024 gave way to modest but steady price growth in 2025. In 2026, the market will likely behave more predictably, similar to the 2015 – 2019 real estate markets. Home prices will continue rising nationwide, but at a pace more aligned with historical averages and regional economic fundamentals.

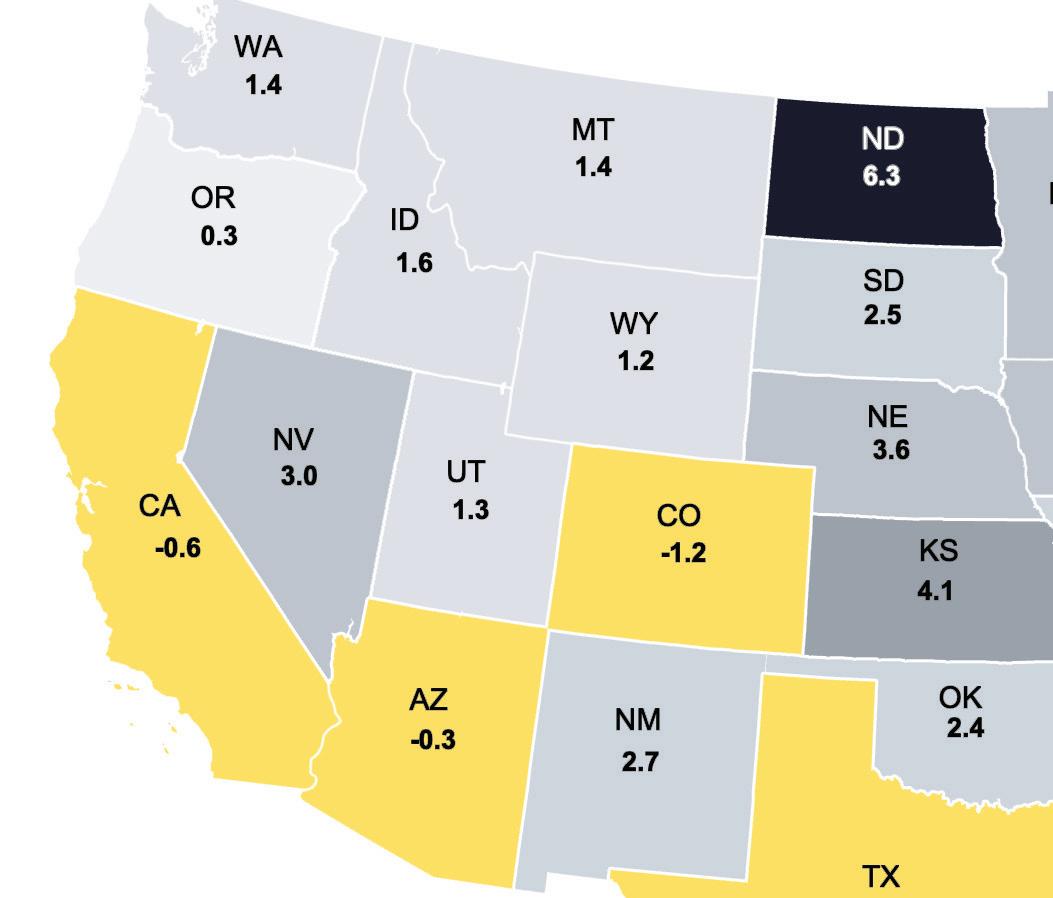

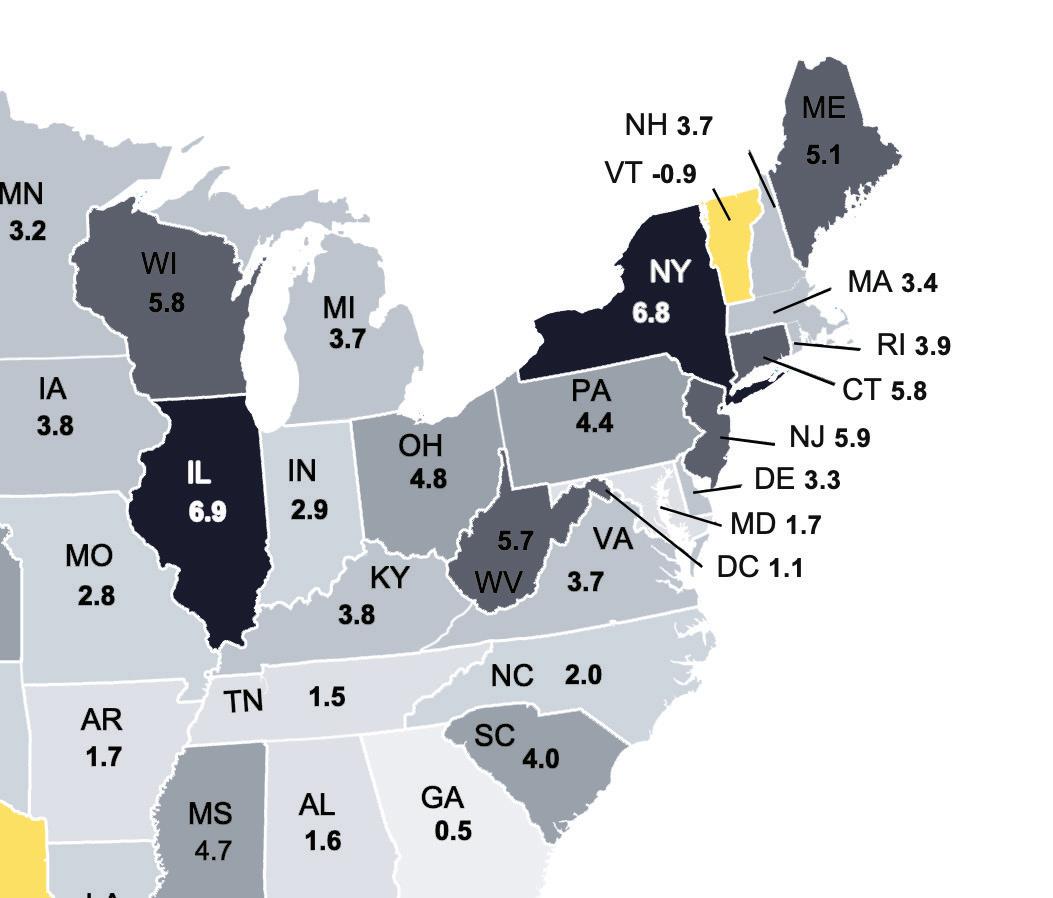

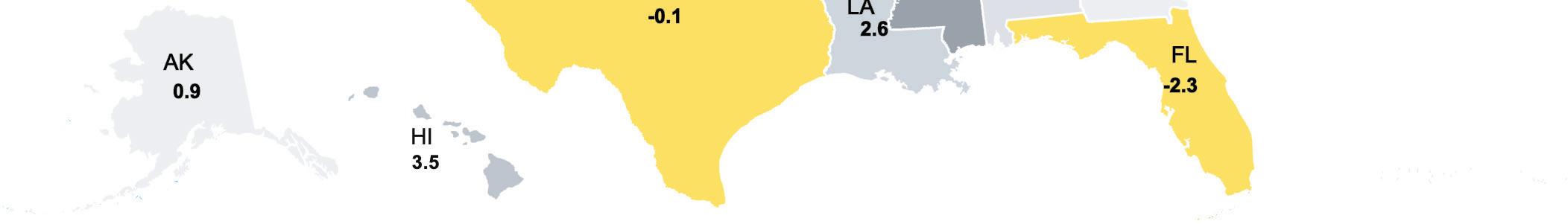

PERCENT CHANGE AS OF 12/19/2025

SOURCE: NAR, WELLS FARGO, COTALITY, REALTOR.COM, FANNIE MAE, CAPITALE ECONOMICS, REDFIN, REUTERS, MORTGAGE BANKERS ASSOCIATION, BANK OF AMERICA, HOME BUYING INSTITUTE, RESICLUB ANALYTICS

Will continue to see lower appreciation after outsized pandemic gains.

SOUTH: Strong population inflows will drive moderate price growth.

NORTHEAST: Tight supply will support continued increases in housing prices.

MIDWEST: Will remain being the United State’s affordability anchor.

INTEREST RATE ON ALL MORTGAGES

(VALUES WEIGHTED BY NUMBER OF LOANS)

SOURCE: FHFA (Q2 2025) 80% Of U.S. Mortgages Have a Rate Under 6%

» Wage growth is positive but cooling.

» Mortgage rates remain elevated compared to 2010–2021 norms.

» Entry-level buyers continue facing a shortage of homes under the median price point.

» Rising home values and growing homeowner equity will result in more sellers finding themselves above the $250k/$500k exemption unless Congress acts to increase the exemption thresholds.

» Cotality reported 8% of 2024 transactions exceeded the cap and this is growing.

» High-equity states see the greatest impact, causing some homeowners to pause and evaluate before determining whether selling is financially beneficial.

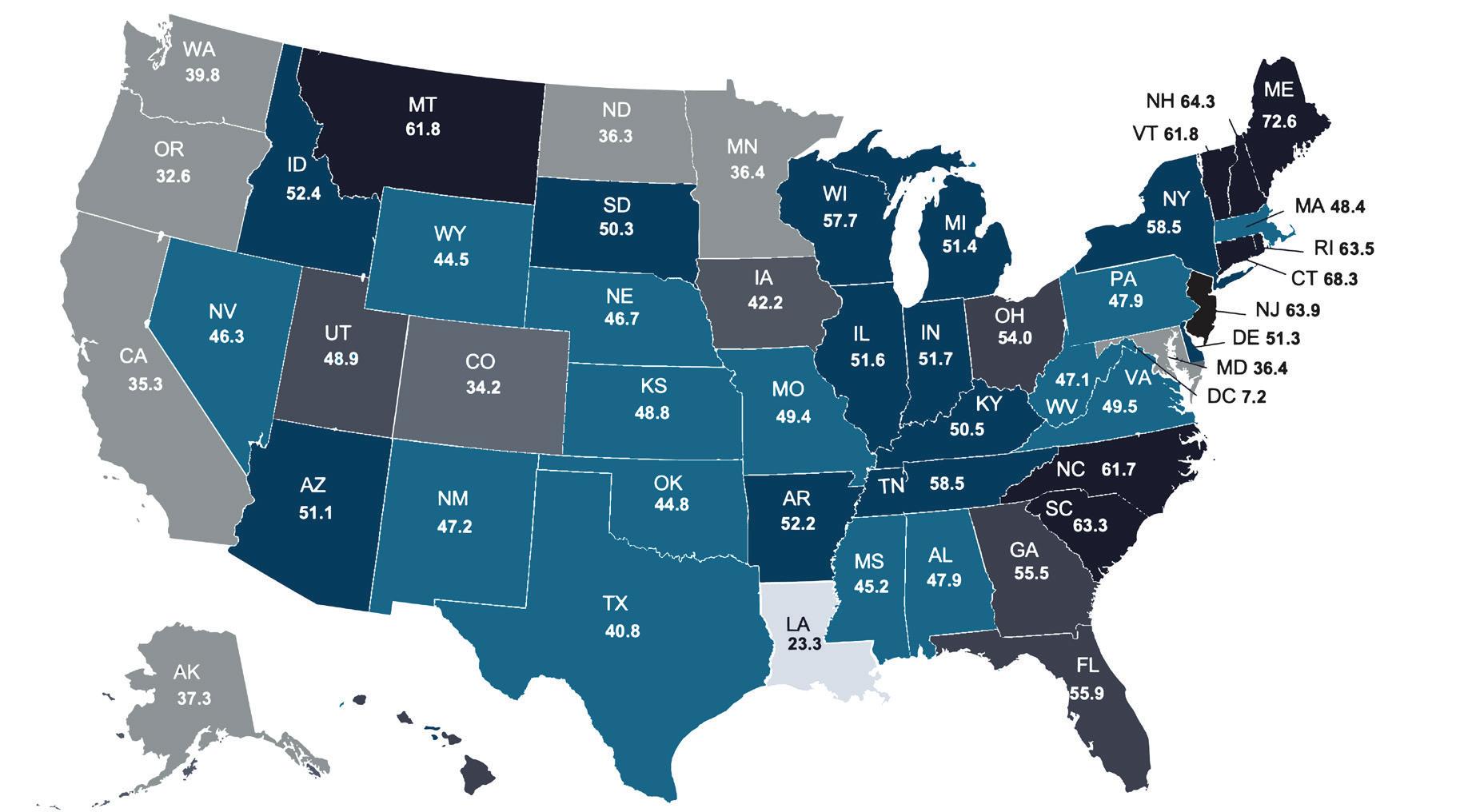

Prices Are Up Almost 50% Over the Past 5 Years

PERCENT CHANGE IN HOME PRICES, OVER 5 YEARS, Q3 2025

SOURCE: FHFA

48.5%

NATIONAL AVERAGE

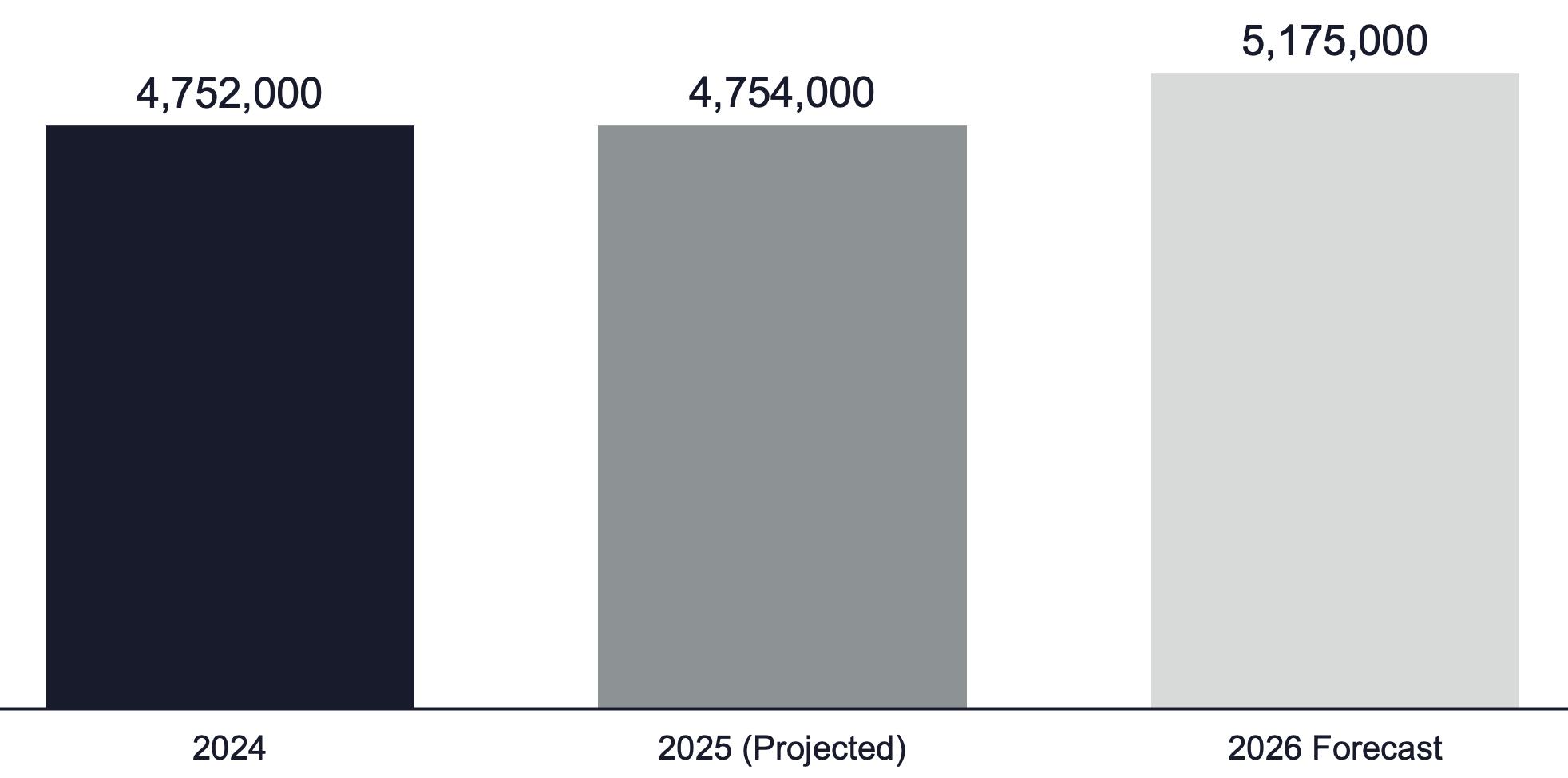

Home sales in 2026 will reflect a market in recovery. As rates ease and inventory improves, buyers are telling us they’re ready to re-engage. Builders will continue offering additional inventory and incentives. Sellers who plan to list in an area competing with new construction should remain mindful of how to position their property in the market.

2026 Buyers and Sellers will find themselves able to make deals happen to meet their goals and expectations. Consumers who are well-coached, possess localized market data, and approach negotiations with flexibility in mind will successfully navigate the market. The spring 2026 market will prove to be more robust than spring 2025 in most areas of the country.

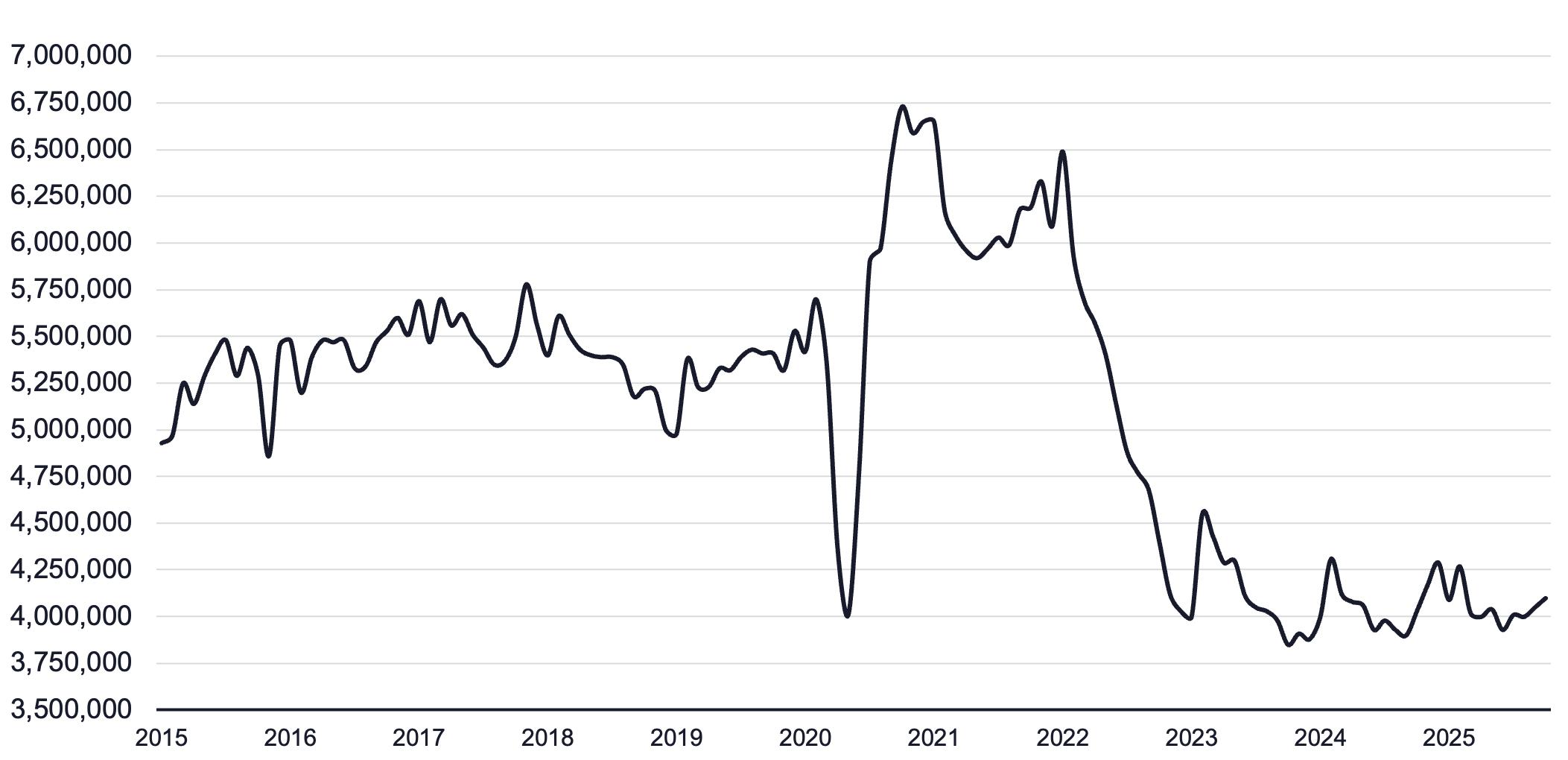

» NAR projects existing-home sales to go up 14% in 2026. Additional economists predict a more modest increase of 3% - 9%.

» This is an improvement from the lows of 2023–2025 but still below the historical average 5 to 5.5 million annual pace.

» The highest number of existing homes sold in the U.S. was 7.07 million in 2005. Resale home sales slid to 5 million by 2007. During the 2021 pandemic boom, sales spiked to 6.12 million. 2025 ended with annual sales at around 4.1 million

» Conditions suggest that 2026 will see a slight improvement over 2025.

» U.S. Census/HUD forecasts around 760,000 to 800,000 new home sales.

» Builders continue using rate buydowns to attract entry-level and move-up buyers.

» Millennials are at peak homebuying age and entering the market ready to be homeowners.

» Gen Z is dipping into the market with significant student loan burdens but with a strong belief in the value of homeownership.

» Baby boomers continue to dominate homeownership share and will influence mobility trends in 2026.

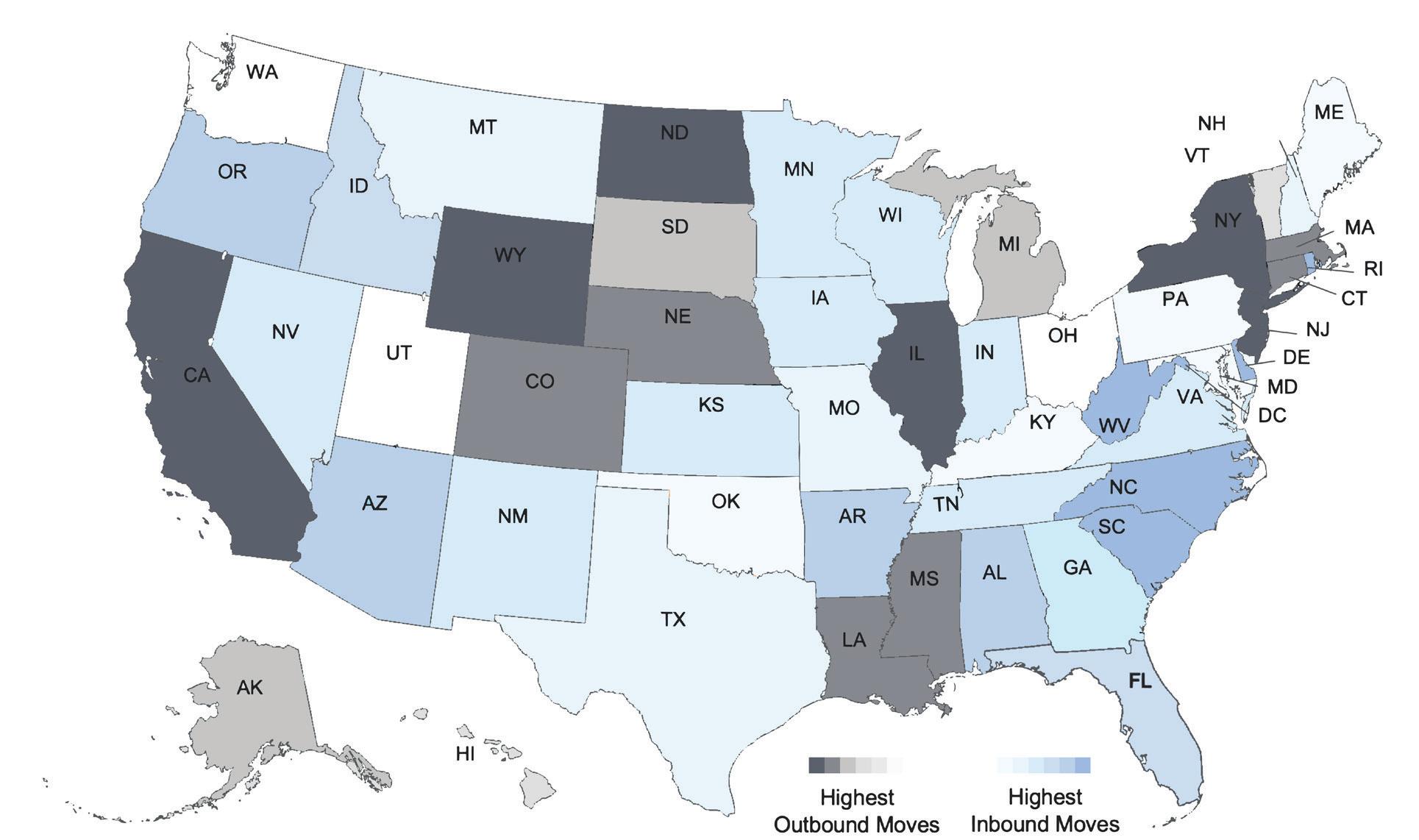

» Sun Belt and Mountain West inflows remain strong and in 2026 will continue to be the beneficiaries of migration trends.

» High-cost coastal markets are predicted to stabilize after outward migration surges during 2020–2022.

» Work-from-home flexibility will persist but at lower levels from 2021–2022.

TOTAL HOME SALES (FORECASTS AS OF 12/18/2025)

SOURCE: FANNIE MAE, MBA, NAR

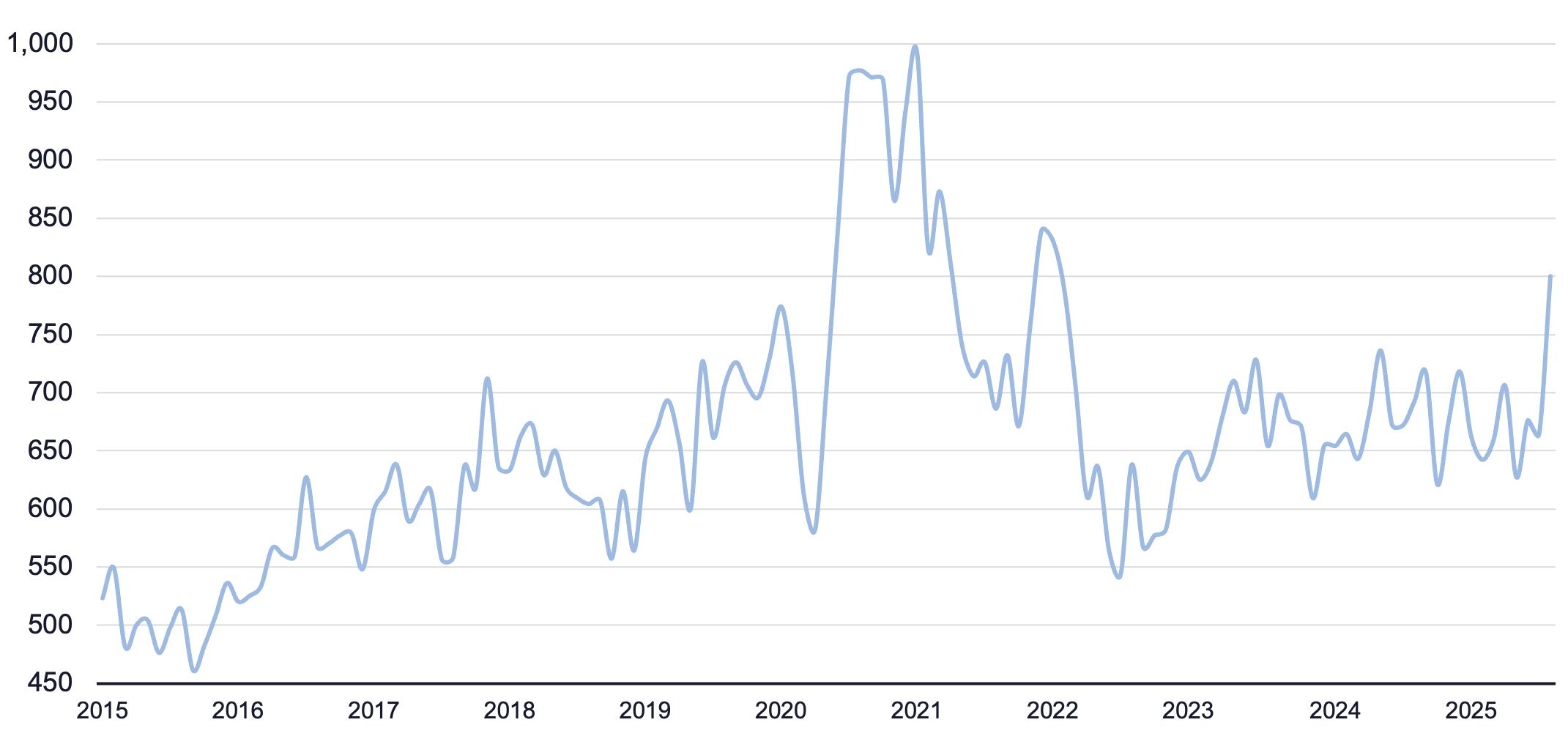

SEASONALLY ADJUSTED ANNUAL RATE OF EXISTING HOME SALES, 2015-NOW

SOURCE: NATIONAL ASSOCIATION OF REALTORS

SEASONALLY ADJUSTED ANNUAL RATE OF NEW HOME SALES, IN THOUSANDS, 2015-NOW

SOURCE: CENSUS

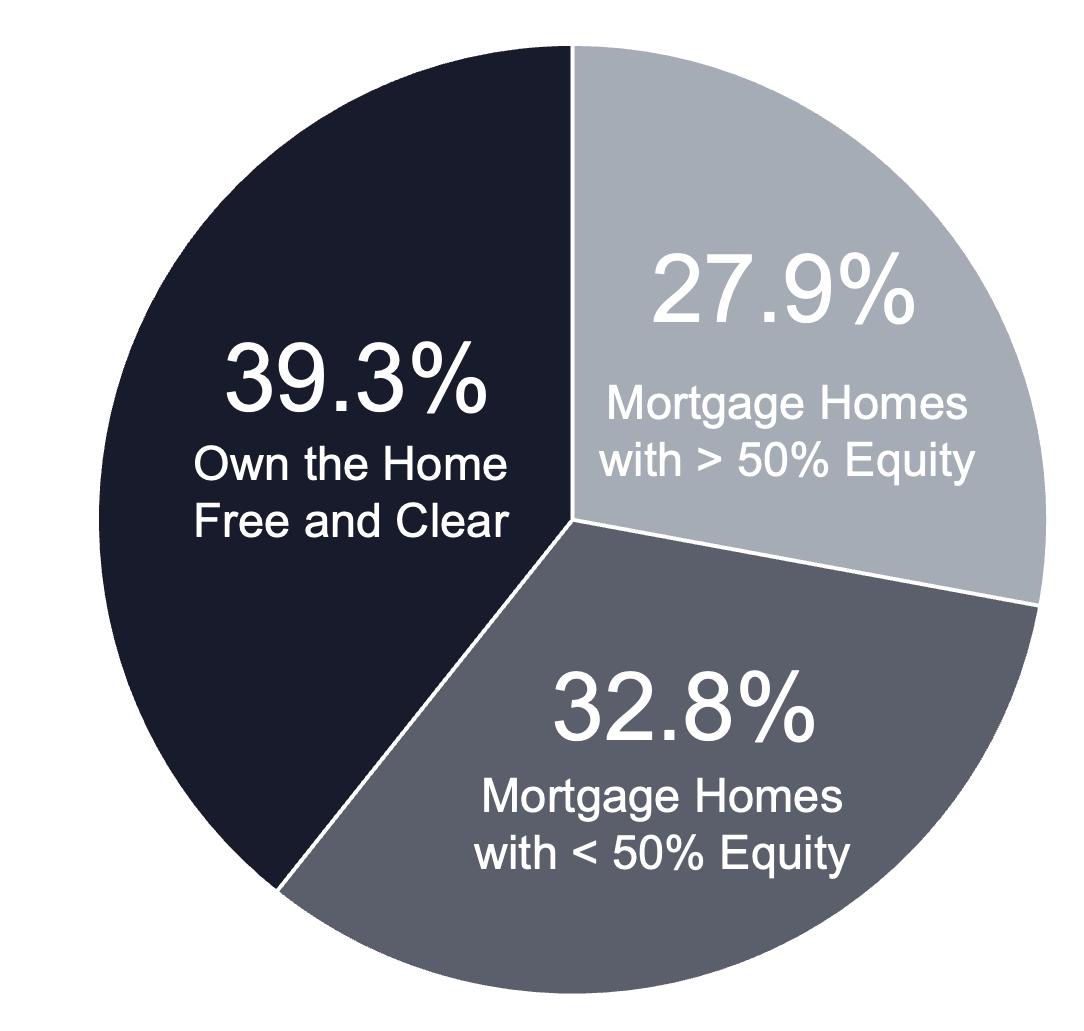

Over 2/3 Have Paid off Their Mortgage or Have at Least 50% Equity

Despite the current economic uncertainty, the American homeowner remains financially strong. Equity levels are at near record highs; mortgage quality is superior to pre-2008 loans and delinquency rates remain historically low. These conditions insulate the market from systemic risk and explain why experts across the industry reject comparisons to the Great Recession.

SOURCE: CENSUS, ATTOM

» The Federal Reserve reports combined homeowner equity exceeding $34 trillion.

» Nearly 70% of owners have 50 percent or more equity.

» Post-2010 loan underwriting is materially stronger.

» Credit scores for recent originations average above 740 (Fannie Mae).

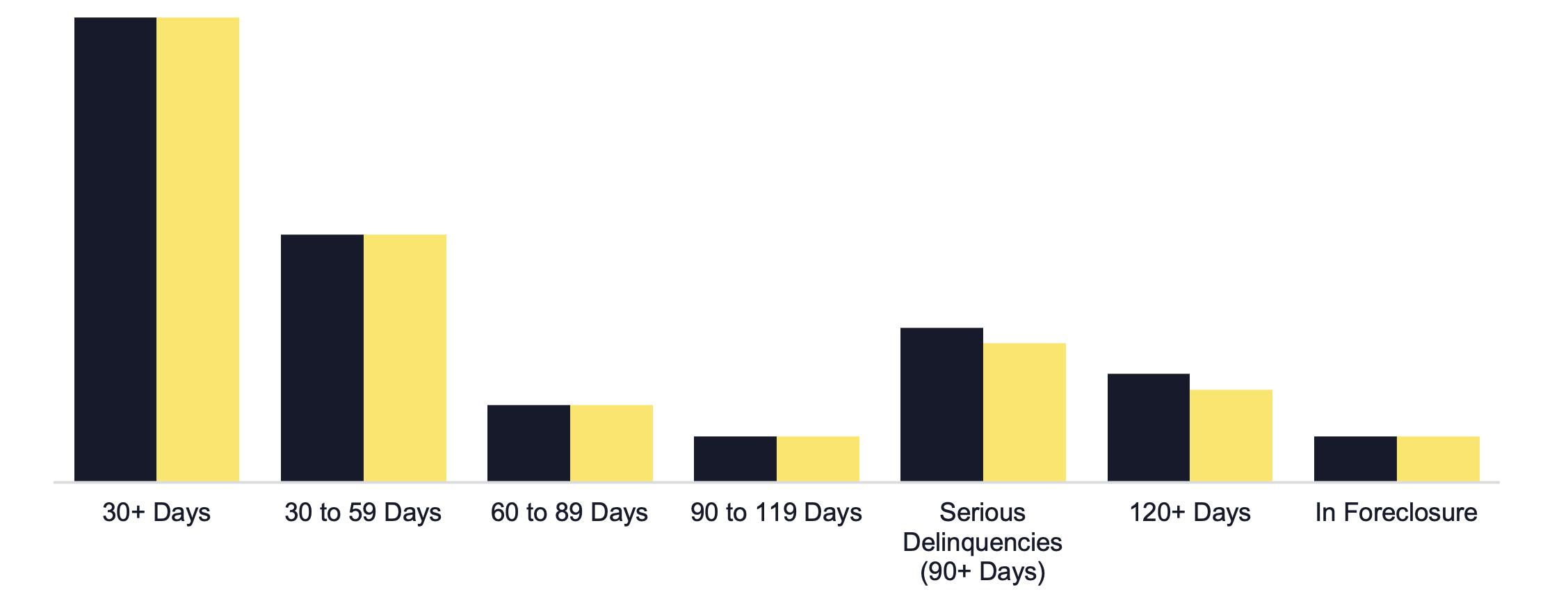

» Cotality reports near-record-low national delinquency.

» Foreclosure rates remain far below mid-2000s levels.

» FHFA shows the average existing mortgage rate around 4.2 percent.

» More homeowners are choosing to move despite giving up low rates, driven by life circumstances rather than financial optimization.

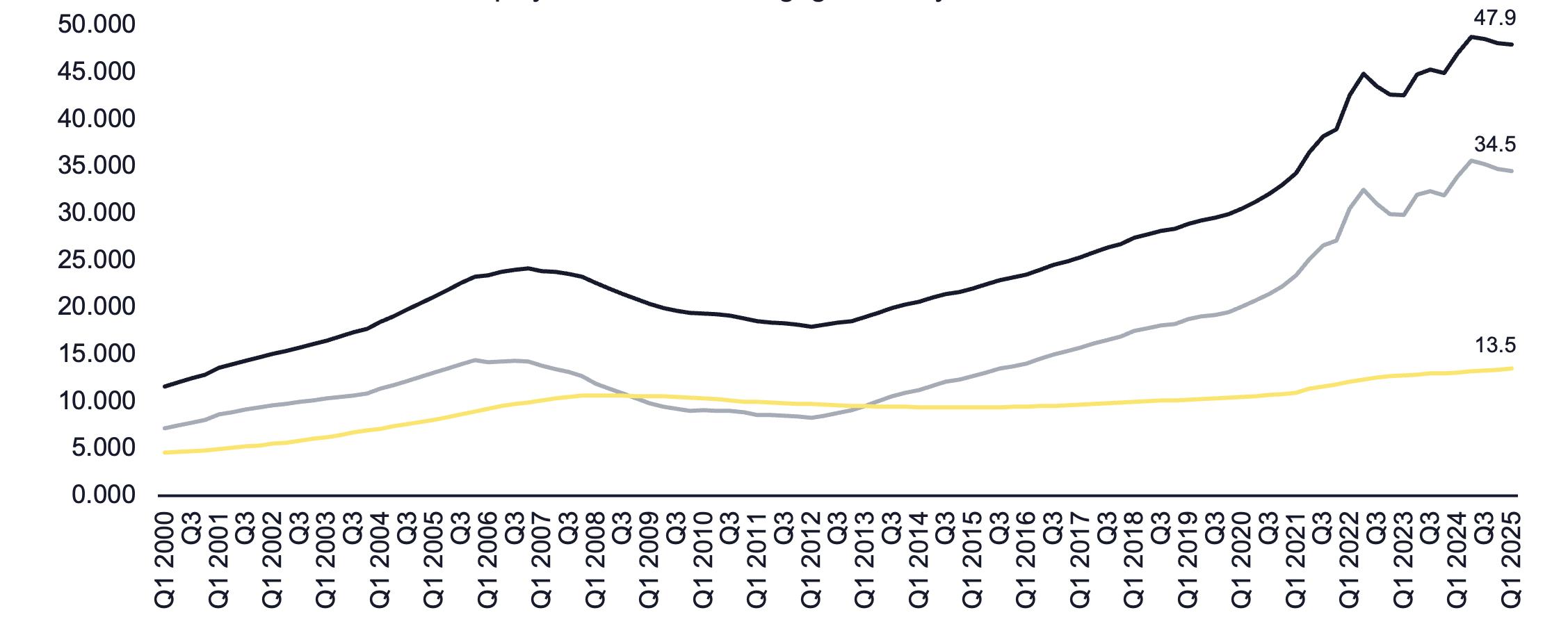

SOURCE: ST. LOUIS FED

National Delinquency Rate by Stage

SOURCE: COALITY

The national story provides important context, but housing is fundamentally local. In 2026, regional differences are predicted to remain pronounced, shaping affordability, migration, construction and price dynamics.

Compared to Pre-Pandemic Norms, Inventory in the West and South Has Effectively Recovered

» Slowest price growth in the nation.

» Inventory rising fastest, bringing balance back.

» Tech-driven markets continue to stabilize after volatility.

» Moderate appreciation, improved inventory.

» Strong inbound migration, particularly to Idaho, Utah and Colorado metro areas.

» New construction remains a major influence.

» Most affordable region in the U.S.

» Stable prices and strong first-time buyer activity.

» Inventory remains tight in larger metros.

» Highest rates of population inflow.

» Strong builder presence keeps supply more fluid.

» Prices continue moderate upward trend.

» Limited land and slow construction create chronic inventory shortages.

» Price growth remains steady.

» Older housing stock drives renovation demand.

SOURCE: FHFA

Percent Change in Home Price

YEAR-OVER-YEAR, Q3 2025

2.3% NATIONAL AVERAGE

SOURCE: FHFA

Lifestyle preferences continue evolving, influenced by aging homes, hybrid work patterns and growing interest in energy efficiency. In 2026, homeowners will be focused on comfort, durability, sustainability and classic design.

SOURCE: REMODELING MAGAZINE COST VS. VALUE REPORT

» HVAC conversion and efficiency upgrades

» Midrange kitchen updates

» Moderate bath remodels

» New garage door

» Manufactured stone veneer

» Energy-efficient window replacements

SOURCES: SHERWIN

WILLIAMS, BENJAMIN MOORE, ZILLOW HOME TRENDS, HOUZZ

» Neutrals with depth: warm grays, smoky taupe, balanced creams

» Deep accents: evergreen, charcoal, navy

» Organic materials: natural wood, stone, plaster finishes

» Textural contrast: boucle, linen, matte metals

» Demand is rising for heat pumps, induction cooking and low-E windows

» Homeowners are renovating aging homes with modern upgrades

» Solar tax incentives have supported rooftop adoption which may slow if incentives wane

» Flexible rooms for work or multigenerational living

» Expanded mudrooms and storage

» Outdoor living investments in four

-season design

» Home Technology

» AI-enhanced security systems

» Smart HVAC and energy management

HVAC

» Whole-home mesh WiFi for hybrid work reliability

work reliability

The 2026 housing market will be defined by stabilization, increased choice and strong homeowner fundamentals. While affordability remains a challenge in several regions, gradual rate easing and rising inventory support a more balanced and predictable year. Buyers should prepare for competition on well-priced homes. Sellers can leverage strong equity positions while pricing wisely to the market, not to the headlines. Homeowners should continue investing in modernization and efficiency.

This year marks a return to normalcy, shaped not by extremes but by steadier economic and demographic forces.

HomeServices of America, headquartered in Eden Prairie, MN, is one of the country’s premier providers of homeownership services, including brokerage, mortgage, title, escrow, insurance and relocation services.

The family of companies that comprise the HomeServices enterprise are among the most stable in the industry. Each shares the common guiding principles of honesty, integrity and commitment to delivering a complete real estate experience.

Allie Beth Allman & Associates

Bennion Deville Homes

BHHS Ambassador Real Estate

BHHS Arizona Properties

BHHS Beach Properties of Florida

BHHS California Properties

BHHS Carolinas Realty

BHHS Chicago

BHHS EWM Realty

BHHS First Realty

BHHS Florida Network Realty

BHHS Florida Realty

BHHS Fox & Roach Realtors

BHHS Georgia Properties

BHHS Hudson Valley Properties

BHHS Nevada Properties

BHHS New England Properties

BHHS New York Properties

BHHS Northwest Real Estate

BHHS Pinehurst Realty Group

BHHS Real Estate Professionals

BHHS York Simpson Underwood Realty

BHHS Yost Little Realty

Dave Perry Miller Real Estate

Ebby Halliday

Edina Realty

First Weber Realtors

Harry Norman Realtors

HEGG Realtors

Home Real Estate

Houlihan Lawrence

HUFF Realty

Intero Real Estate Services

Iowa Realty

Kentwood Real Estate

Long & Foster Real Estate

Long Realty

Northrop Realty

RealtySouth

Rector Hayden Realtors

ReeceNichols

Roberts Brothers

Semonin Realtors

Willimas Trew

Woods Brothers Realty

Agave Title Agency

Alliance Title Group

Canopy Title, LLC

Edina Realty Title

Florida Title & Guarantee Agency

Fort Dearborn Land Title Company

Gibraltar Title Services

HomeServices of Nebraska

RGS Title, LLC

Sage Title Group, LLC

HomeServices Insurance (Main Branch)

HomeServices Insurance Agency (CA)

Edina Realty Insurance (MN/WI)

ReeceNichols Insurance (KS/MO)

Prosperity Home Mortgage

HomeServices Lending

Thank you to Keeping Current Matters for their collaboration on this report and providing all data, charts and graphs.

Sage Premier Settlements

Infinity Title Agency

Midland Escrow Services

Iowa Title Company

Pickford Escrow Company

Priority Title Corporation

Thoroughbred Title Services

Trident Land Transfer Company

Attorneys Title

InsuranceSouth (AL)

Trident Insurance Agency (PA/DE/MD)

Long & Foster Insurance (primarily VA)

©2026 HomeServices of America. All rights reserved. No part of this document may be reproduced without permission.