TECHNOLOGY TRANSFORMATION

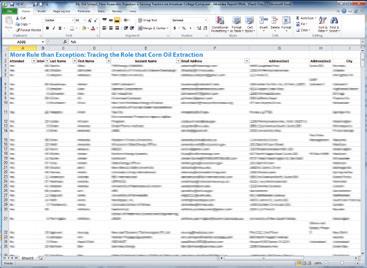

Evolution Through Analysis CTE InSight

Data drives innovation. Th rough CTE InSight , advanced statistical analysis identifies opportunities for improvement and predicts the most impactful change for plant performance. Better data clarity enables optimization. Turn InSight into action.

EDITORIAL

President & Editor Tom Bryan tbryan@bbiinternational.com

Senior News Editor Erin Voegele evoegele@bbiinternational.com

Contributions Editor Katie Schroeder katie.schroeder@bbiinternational.com

Features Editor Lisa Gibson lisa.gibson@sageandstonestrategies.com

DESIGN

Vice President of Production & Design Jaci Satterlund jsatterlund@bbiinternational.com

Senior Graphic Designer Raquel Boushee rboushee@bbiinternational.com

PUBLISHING & SALES

CEO Joe Bryan jbryan@bbiinternational.com

Chief Operating Officer John Nelson jnelson@bbiinternational.com

Senior Account Manager Chip Shereck cshereck@bbiinternational.com

Account Manager Bob Brown bbrown@bbiinternational.com

Senior Marketing & Advertising Manager Marla DeFoe mdefoe@bbiinternational.com

Customer Service Coordinator Brandon McGarry brandon.mcgarry@bbiinternational.com

EDITORIAL BOARD

Ringneck Energy Walter Wendland Commonwealth Agri-Energy Mick Henderson Western Plains Energy Derek Peine Front Range Energy Dan Sanders Jr.

Advertiser Index

Upcoming

Events

2026 International Fuel Ethanol Workshop & Expo June 2-4, 2026

St. Louis, MO (866) 746-8385 | www.fuelethanolworkshop.com

Now in its 42nd year, the FEW provides the ethanol industry with cutting-edge content and unparalleled networking opportunities in a dynamic business-to-business environment. As the largest, longest running ethanol conference in the world, the FEW is renowned for its superb programming—powered by Ethanol Producer Magazine —that maintains a strong focus on commercialscale ethanol production, new technology, and near-term research and development. The event draws more than 2,300 people from over 31 countries and from nearly every ethanol plant in the United States and Canada.

2026 Sustainable Fuels Summit June 2-4, 2026

St. Louis, MO (866) 746-8385 | www.sustainablefuelssummit.com

The Sustainable Fuels Summit: SAF, Renewable Diesel, and Biodiesel is a premier forum designed for producers of biodiesel, renewable diesel, and sustainable aviation fuel (SAF) to learn about cutting-edge process technologies, innovative techniques, and equipment to optimize existing production. Attendees will discover efficiencies that save money while increasing throughput and fuel quality. Produced by Biodiesel Magazine and SAF Magazine, this world-class event features premium content from technology providers, equipment vendors, consultants, engineers, and producers to advance discussions and foster an environment of collaboration and networking. Through engaging presentations, fruitful discussions, and compelling exhibitions, the summit aims to push the biomass-based diesel sector beyond its current limitations. Co-located with the International Fuel Ethanol Workshop & Expo, the Sustainable Fuels Summit conveniently harnesses the full potential of the integrated biofuels industries while providing a laser-like focus on processing methods that deliver tangible advantages to producers. Registration is free of charge for all employees of current biodiesel, renewable diesel, and SAF production facilities, from operators and maintenance personnel to board members and executives.

2026 Carbon Capture & Storage Summit

June 2-4, 2026

St. Louis, MO (866) 746-8385 | www.carboncapturestoragesummit.com

Customer Service Please call 1-866-746-8385 or email service@bbiinternational.com. Subscriptions Subscriptions to Ethanol Producer Magazine are free of charge with the exception of a shipping and handling United States. To subscribe, visit www.EthanolProducer.com/Subscribe, send an email to subscriptions@bbiinternational.com or call 866-746-8385. Back Issues, Reprints and Permissions Select back issues are available for $3.95 each, plus shipping. Article reprints are also available for a fee. For more information, contact us at 866-746-8385 or service@bbiinternational.com. Advertising Ethanol Producer Magazine provides a specific topic delivered to a highly targeted audience. We are committed to editorial excellence and high-quality print production. To find out more about Ethanol Producer Magazine advertising opportunities, please contact us at 866-746-8385 or service@bbiinternational.com. Letters to the Editor We welcome letters to the editor. Send to: Ethanol Producer Magazine Letters to the Editor, 308 2nd Ave. N., Suite 304, Grand Forks, ND, 58203, or editor@bbiinternational.com. Please include contact information. Letters may be edited for clarity or space.

Please recycle this magazine and remove inserts or samples before recycling

COPYRIGHT © 2025 by BBI International

Capturing and storing carbon dioxide in underground wells has the potential to become the most consequential technological deployment in the history of the broader biofuels industry. Deploying effective carbon capture and storage at biofuels plants will cement ethanol and biodiesel as the lowest carbon liquid fuels commercially available in the marketplace. The Carbon Capture & Storage Summit will offer attendees a comprehensive look at the economics of carbon capture and storage, the infrastructure required to make it possible and the financial and marketplace impacts to participating producers.

In This Issue

Diversification In Wide Array

In this issue of Ethanol Producer Magazine, we lean on diversification—of processes and products. This industry has come a long way in the past 50-plus years and has seen myriad new technologies and techniques. Some thrived, some survived and others fell away. Alongside DDGS, corn oil became ubiquitous while other promising coproducts and processes didn’t quite get off the ground. But ethanol producers’ appetite for growth has always been healthy.

Starting on page 12, we explore the evolution of dry fractionation. Once drawing the full industry’s attention, the technology hit roadblocks in economic feasibility, as producers faced high costs and low margins. Some of the more promising fractionation technologies, however, set the stage for, or even fully morphed into, new front-end diversification processes that could find a better fit in our modern biorefineries. Tech companies have adapted wet-mill technologies and explored hammer mill alternatives to achieve value-added systems offering flexibility and increased yield.

Diversification can also come without plant expansion. Chippewa Valley Ethanol Co., historically a standout in innovation and process improvements, continues to forge ahead with corn kernel fiber cellulosic ethanol, decarbonization and efficiency upgrades. Some technologies—such as gasification of corn stover to produce syngas blended with natural gas for energy production—have come and gone with evolving markets and energy prices, while others have proven beneficial longer term—such as low energy distillation. Find out more about CVEC’s diversification strategies, starting on page 18.

Technology experts are innovating beyond traditional coproducts such as corn oil and DDGS, forging new paths for advanced food protein, feed additives, new textiles, fibers, biopolymers and commercial-grade pigments and even cosmetics. It’s done through precision fermentation, with one featured modular technology designed to operate alongside an ethanol plant using leftover fermentation yeast to produce microbial proteins and food-grade yeasts. A handful of companies are in the space, partnering with research labs to bring their technologies to commercial scale. It’s a new twist on coproduct diversification and it starts on page 24.

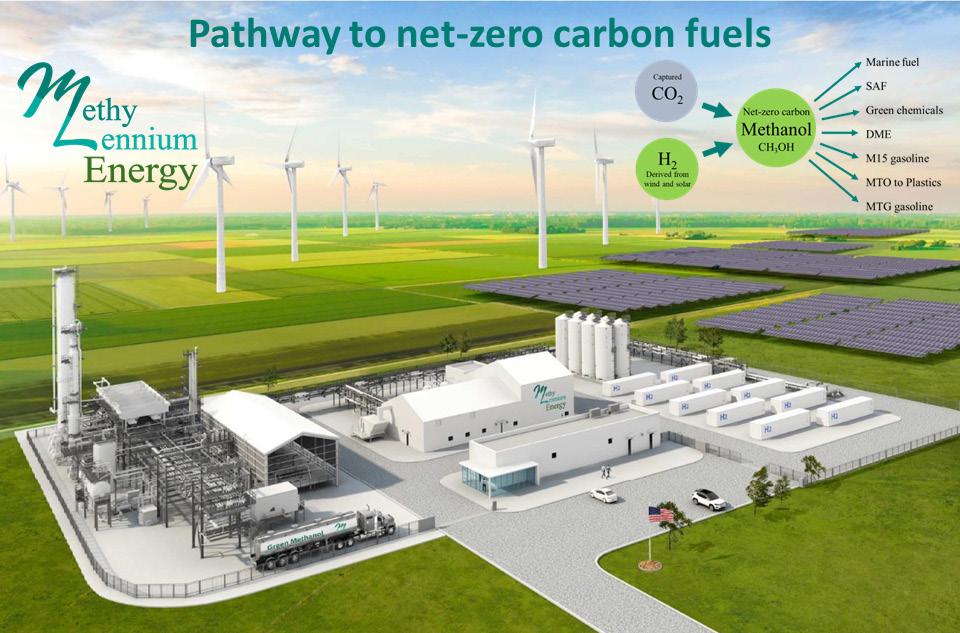

Finally, this issue delivers updates on the green methanol production process launching in Luverne, Minnesota, at an ethanol plant idled since 2022. A collaboration among AgriEnergy Innovations, CapCO2 Solutions and Methylennium Energy, the project is full steam ahead, with promise in sustainable aviation fuel and maritime markets. It will use a water-based electrolyzer to produce hydrogen for combination with waste CO2 to generate green methanol. The project’s developers hope it will be a blueprint for the industry and for further expansion. Find out more on page 30.

Our coverage of diversification this month is diverse, delving into several avenues for increased value. We hope you find it helpful.

Enjoy.

-The Editors

E15 Is Approved In California— Here’s What Comes Next

After the passage of AB 30 and the legalization of E15 in the state of California, Growth Energy has been hard at work ensuring that these major shifts in the nation’s largest fuel market actually translate into more biofuels making it into Californians’ fuel tanks—and more gallons of ethanol flowing into the state’s fueling infrastructure.

As a first step in this process, the California Air Resources Board held its first workshop titled “Scoping Workshop on E15 Use in California” on Oct. 14 to discuss implementation of AB 30 and the larger rulemaking that was funded in this year’s budget.

Growth Energy’s Director of State Government Affairs Dallas Gerber and Technical Director of Market Development Reid Wagner provided verbal comments during the workshop that focused on addressing the remaining regulatory hurdles that may prevent E15 from going to market in California. Gerber and Wagner urged CARB to work with all the relevant and related agencies to ensure timely implementation of AB 30 and to deliver on the law’s stated intent to allow the sale of E15 in California and address any regulatory questions that might prevent that from happening.

“With the right approach, California can become the leading market in E15, which is why getting this right—for consumers, retailers and the environment—is critical. We believe part of that approach is providing written guidance, giving fuel retailers and the entire supply chain confidence that they can offer E15 without concern over ambiguous regulation,” said Gerber in his testimony at the October workshop. Gerber went on to note that a blueprint for how California can successfully get E15 to market already exists, and that the state should apply its own example on E10 to E15.

“We encourage CARB to follow a regulatory path that mirrors E10 and California Reformulated Gasoline, as E15 is a viable option for nearly all passenger vehicles on the road today as opposed to alternative fuels,” he said. “Additionally, E15 is defined by the U.S. Environmental Protection Agency in 40 CFR § 1090.80 as ‘gasoline that contains more than 10 and no more than 15 volume percent ethanol.’ Due to the high rate of equipment and vehicle compatibility with E15—in addition to California regulations such as the permanent closure of single walled underground storage tanks—a vast majority of retail infrastructure is [already] able to store, handle, and dispense E15 safely.”

Wagner also provided CARB with more information on EPA’s Misfueling Mitigation Plan requirements, reiterating that the labeling required by the EPA is sufficient and that additional labeling requirements should not be developed by CARB.

Between our continued work with CARB, including additional comments submitted in early November, Growth Energy is working tirelessly to remove any regulatory roadblocks that might limit the potential market benefits of California’s decision to allow the sale of E15. Growth Energy’s Market Development, Government Affairs and Regulatory Affairs teams will continue to partner with key stakeholders across the fuel supply chain and with equipment manufacturers, legislators and regulators to help navigate the complex regulatory landscape and ensure the widespread sale of additional gallons of E15 across the Golden State.

Emily Skor CEO of Growth Energy

Pragmatism’s Payoff: How Canada’s Climate Reset Favors Ethanol

If I had to choose one word to describe 2025, it would be uncertainty. The world has seen some notable change, including Canada. The country has a new prime minister, Mark Carney, who promised action with pragmatism. His government maintains that the environment is still a priority, but the approach must feel realistic for Canadians facing affordability pressures. As an industry at the intersection of clean energy and agriculture, we should see this shift not as a retreat but as a reset—one that puts ethanol back at the center of Canada’s energy story.

Canada’s policy pivot began in April 2025, when the government wound down the federal consumer carbon tax while keeping industrial carbon pricing and the Clean Fuel Regulations. Carney’s “re-grounded” approach protects both climate and competitiveness. “We can’t hit pause on climate,” he said, “but we can be smarter about how we hit our targets.” That is where ethanol fits perfectly: homegrown, proven and, at its core, pragmatic.

Ethanol as Canada’s Most Practical Climate Solution

Global volatility has underscored the importance of energy security and domestic supply. In Canada, that means strengthening our renewable-fuel system—farmers, ethanol producers and their value chains. Organizations like the Farms & Fuels Alliance are leading this shift. By bringing together corn growers and ethanol producers, the Alliance shows how pragmatic climate policy can serve rural prosperity while meeting environmental goals.

And if affordability is the test, ethanol passes. Ethanol has consistently traded 14 cents per liter below gasoline at wholesale since the CFR began. Yet this price advantage is routinely obscured by CFR cost estimates that lump together the entire clean-fuel regime rather than isolating ethanol’s affordability. For costconscious lawmakers and consumers, that distinction matters.

Global Lessons

Canada’s recalibration echoes similar shifts abroad. The U.S. has leaned into industrial policy through the 45Z Clean Fuel Production Credit. COP30 in Brazil highlights a country that has long shown how ethanol can power both progress and prosperity. These policies show that pragmatism does not mean stepping back from ambition. It means focusing on production, innovation and local benefits—and ethanol qualifies on all counts.

2026: From Uncertainty to Results

If 2025 was a year of uncertainty, 2026 must deliver results. For policymakers, that means clear blending mandates and effective CFR implementation. For industry and growers, it means collaboration through partnerships like the Farms & Fuels Alliance. For investors, it means recognizing ethanol as a practical renewable-fuel asset with expansion potential into sustainable aviation and marine fuels.

Most of all, pragmatism must not be mistaken for passivity or an excuse for the status quo. It should be forward-thinking, anchored in what works today and ambitious about what is possible tomorrow. Canada has every reason to lead with ethanol: a proven solution for short-term stability and a pathway to long-term economic and environmental gains. What could be more pragmatic than that?

Andrea Kent

Past-President and Board Director

Renewable Industries Canada

BUSINESS BRIEFS

PEOPLE, PARTNERSHIPS & PROJECTS

Lincolnway Energy Implements Whitefox Technology for Higher Capacity and Lower Energy Use

Lincolnway Energy and Whitefox Technologies have announced the successful installation and startup of the Whitefox ICE membrane dehydration system at Lincolnway’s ethanol plant in Nevada, Iowa. This advanced technology supports the ethanol plant’s commitment to increasing ethanol production from locally-grown corn and improving operational efficiencies.

With the Whitefox ICE system now fully integrated, Lincolnway is preparing to celebrate a significant milestone—surpassing 100 million gallons of ethanol produced per year. The system

RFA Congratulates Western New York Energy on Billion-Gallon Milestone

The Renewable Fuels Association recently congratulated member company Western New York Energy LLC, based in Medina, New York, for reaching a significant milestone. The company recently produced its billionth gallon of ethanol.

Led by President and CEO Tim Winters, who also sits on the RFA Board of Directors and currently serves as board secretary, WNYE is a locally owned company founded in 2004 to develop

MAAPW Marks First CO2 Shipment on Trailblazer Pipeline

Mid America Agri Products/Wheatland has announced the start of carbon dioxide capture at its Madrid, Nebraska, ethanol facility, with volumes to be transported on the Tallgrass Trailblazer Pipeline for permanent sequestration in Wyoming.

For MAAPW, becoming the first customer to deliver CO2 to the Trailblazer pipeline represents more than a technical achievement—it fulfills the vision of founder Robert “Bob” Lundeen. A pioneer in Nebraska’s ethanol industry, Lundeen believed ethanol’s future depended on continuous innovation and bold investment.

works by targeting water-rich recycle streams and relieving stress on the distillation, dehydration and evaporation unit, enabling greater overall plant capacity and efficiency, positioning the facility for continued success.

With more than 20 Whitefox systems installed across the world and 1 billion gallons of ethanol produced with its membranes, Whitefox continues to drive progress in sustainable biofuel production.

the full potential of western New York’s renewable energy resources. Production at the $90 million facility began immediately after the completion of construction in November 2007. WNYE was the first biofuel plant in the Northeast U.S. and is currently the only large-scale facility in New York, producing over 60 million gallons of ethanol annually.

“This achievement honors my father’s belief in acting boldly for the future,” said Tina Lundeen Smith, chairperson of the board and executive vice president of business development at MAAPW. “By partnering with Tallgrass on the Trailblazer project, we’re securing value for our employees, creating stable demand for local corn growers, and ensuring benefits flow directly into the community that supports us.”

Newsom Signs Bill Allowing Availability of E15 in California

California Gov. Gavin Newsom on Oct. 2 signed AB 30, a bill that will allow E15 to be sold within the state while the California Air Resources Board completes its ongoing work to study whether the fuel blend can meet the state’s clean air requirements. E15 is now approved for use in all 50 states.

AB 30 was passed unanimously by both the California Senate and California Assembly earlier this year.

According to Newsom’s office, the availability of E15 could help bring down the cost of gasoline in California. A study con-

Japan Airlines Invests In Ethanol-to-Jet Project

Japan Airlines Co. Ltd. has invested in Morisora Bio Refinery LLC to advance sustainable aviation fuel produced from domestically sourced woody biomass bioethanol.

Morisora Bio Refinery is a joint venture established in July 2025 by three companies: Nippon Paper Industries Co. Ltd., Sumitomo Corp. and Green Earth Institute Inc. The joint venture, dubbed Project Morisora, seeks to commercialize the production and sale of bioethanol and biochemical products derived

ducted by the University of California, Berkeley and the U.S. Naval Academy showed E15 could lower gasoline prices by up to 20 cents per gallon and save Californians as much as $2.7 billion annually. A separate study at the University of California, Riverside found that increasing ethanol blending in gasoline would not affect NOx emissions and would reduce particulate emissions.

from woody biomass feedstock. A demonstration plant will be constructed within Nippon Paper’s Iwanuma mill in Miyagi Prefecture, using sustainable forest resources such as wood processing residues from the Tohoku region. Utilizing GEI’s low-carbon, low-cost bioethanol production technology, the plant aims to produce over 1,000 kiloliters of bioethanol annually starting in 2027.

Thermal Kinetics’ NEXT Platform Pushes DDE Capacity Past 100 MMgy

RCM Thermal Kinetics completed its first project under the trademarked NEXT engineering platform, setting a new benchmark in distillation, dehydration and evaporation (DDE) performance. Using old-world process optimization methods, the company brought a DDE line originally designed for 40 MMgy to more than 100 MMgy during the initial commissioning phase—without adding parallel columns or replacing major equipment.

The NEXT platform integrates precision engineering rooted in petroleum refining techniques to unlock hidden capacity and improve energy efficiency within existing plant footprints. The breakthrough demonstrates how legacy infrastructure can be optimized to deliver world-class output and lower cost per gallon.

FINE-TUNING FRACTIONATION

As wet milling adaptations gain traction, aspects of dry fractionation still hold appeal.

By Susanne Retka Schill

Dry fractionation was the technology du jour some years ago, seen as a way to lower energy costs and survive high feedstock prices, while gaining efficiency, capacity and coproduct revenue. Ethanol Producer Magazine wrote about it in 2009, when several companies were promoting their technologies and the first system had been installed by Cereal Process Technologies. That system is still the only such dry fractionation system in a U.S. ethanol plant.

What Happened?

“With the dry fractionation, the vision was right,” says Chuck Gallop, director of innovation at ICM, which pursued dry fractionation strategies years ago, parallel to competing firms like CPT. “Not only

us, but other companies had the same vision with dry fractionation, but there was a perfect storm of uncontrollable events at the time. We had corn that got as high as $11 a bushel. We had natural gas that was between $7 and $11 per MMBtu. We had a market crash in 2008 at the same time, and a lot of plants were still in their infancy and had debt to service. Ethanol margins on a per-gallon basis were just not there.”

“There was truth to it back then,” says Neal Jakel, president of Fluid Quip Technologies. “But when we tried to really push this technology into the marketplace, we had a lot of headwinds.” The capital required for the buildouts in the mid-2000s meant most plants were carrying big debt loads. “They really didn’t have a lot of excess capital available to spend on other technologies.”

Working for Delta T Corp. at the time, Jakel led its dry fractionation team, but it

wasn’t his first exposure to the technology. “I first worked on dry fractionation in a joint venture between Cargill and Monsanto, which was formed in 1999,” he says. “From there, I joined Delta T, where I led their whole fractionation technology group. They had partnered with Ocrim and, at that time, it was really around ethanol— how do we push more ethanol and can we get more starch into the fermenters? One of the ways is to remove non-fermentable components.” Removing the germ on the front end would also diversify coproducts and create a higher protein distillers grains.

If companies had installed the technology before the spike in natural gas prices, they might have done better during the downturn, suggests ICM’s Adam Anderson, director of sales. ICM’s dry fractionation technology approach included the option of using the separated fiber in a gasifier to reduce natural gas load. “If a plant

had implemented that at the right time, two years prior, they would have had that gasification opportunity to insulate themselves from the natural gas costs. Those plants that were disadvantaged by 20, 30, 40 cents could have been advantaged and been winners.”

FUNDAMENTALS:

mill technology to augment or even replace hammer mills.

Wet Mill Adaption

With the timing off for successful deployment of dry fractionation, technology providers pivoted. Jakel began working with Fluid Quip Technologies, where several team members began adapting wet

From a cost and horsepower perspective, hammer mills were the standard in the ethanol industry, Jakel explains. “It’s the cheapest per-horsepower to yield the particle size to feed your fermenters.” But the random particle sizes created by hammer mills had a downside. “Over time, we’ve learned that achieving a more uniform and smaller particle size adds more value by improving starch extraction. When the particles are consistently sized, enzymes can more effectively break down

the starch into simple sugars. Additionally, reducing particle size helps release starch that is trapped inside the germ.”

FQT applied that understanding in developing its Selective Grind Technology. The patented SGT system, applied during the mash cook process, utilizes a liquid/solids separation process followed by a proprietary disc mill. The approach allows fine particles and liquid to bypass the mill, focusing mill energy on grinding the larger particles, including the germ, to achieve optimal and uniform size.

FRACTIONATION

Dry fractionation, separation of the corn kernel components, including germ (pictured), got a lot of attention around 2009, but market conditions left the technology uneconomical for ethanol producers.

PHOTO: CEREAL PROCESS TECHNOLOGIES

Chuck Gallop Director of Innovation, ICM

Neal Jakel President, Fluid Quip Technologies

Adam Anderson Director of Sales, ICM

FILL UP WITH CHEER

While ethanol producers don’t need the pure starch that wet millers seek, Jakel explains, there is an advantage to producing more uniform particle size while releasing more starch and oil. “We use a wet phase because it’s easier, offers better control and gives you more flexibility on adjusting yields for more oil, protein, starch or sugars.” SGT increases ethanol yields up to 3% and oil yields up to 22%.

FQT is focused on maximizing yields of ethanol and coproducts, Jakel says, but also on driving down carbon intensity. He questions whether energy-intensive dry fractionation technologies, which require multiple grinding and separation steps, make sense in today’s market.

Seeking Flexibility

When ICM began working with dry fractionation, one of the goals was to degerm the corn, which could then be sent to a solvent extraction process to improve

the half-pound oil recovery rates being realized at the time. The other thought process was to make better use of the lowest value coproduct, Gallop recalls.

Separating the fiber was being assessed as an energy source in a boiler or gasifier, or to be used as animal feed. “When you fractionate that fiber before fermentation, it bypasses the entire ethanol process,” Gallop says. “It doesn’t require energy to heat it up or cool it down. You don’t have to introduce a lot of enzymes to get the starch off the fiber, and when you combust that fiber, that material doesn’t have to go through a steam tube or a gas fire dryer. The fiber makes up roughly onethird of the distillers grains pile, so if using it for feed, it’s already been separated in a dry state, thus bypassing the dryers.” The drawback, the ICM team learned, was that too much starch was being lost with the fiber, pulling down ethanol yields.

SELECTIVE SORTING: Fluid Quip Technology’s Selective Grind Technology selects the proper size particles for the mill while allowing fine particles and liquid to bypass the milling process.

PHOTO: FLUID QUIP TECHNOLOGIES

'In today’s wet fractionation processes, we try to design and implement technologies that put the control back into the plant.'

- Chuck Gallop Director of Innovation, ICM

At the time, guaranteed ethanol yields were around 2.75 gallons per bushel and oil recoveries were around 0.5 pounds per bushel. Anderson remembers it as an exciting time to introduce ICM’s wet mill adaptations. “So there was a ripe opportunity on the front end of the plant to do Selective Milling Technology— de-water the product, get those particles that were most likely to have the recalcitrant starch and the unexposed oil, and free up that opportunity with the mechanical action of SMT. The ethanol yield significantly increased, 3 to 5%. And on the corn oil side, we would see increases of 25% or greater.” Ethanol yields of 2.85 and 2.9 and oil yields of 0.8 pounds per bushel were “high opening numbers” back then, he says.

SMT could be installed as a standalone technology, and provide impressive results, but also served as a platform for subsequent technologies that continued to develop fractionation. “With partnerships, we started developing a wet fractionation process after dry fractionation to convert all the residual starch from the fiber to sugars for fermentation, with the fiber bypassing the entire ethanol process and going out as feed,” Gallop says. “That technology was FST, Fiber Separation Technology, which is the foundation for the Advanced Processing Package we have now. “

In that system, the hammer mills standard in the early days are replaced. “Early

on, the hammer mill was the preferred methodology of grinding that corn,” Gallop says. “But that was before we started analyzing and implementing advanced downstream processes where we’re using advanced centrifugation techniques and filtration devices and processes. In the advanced process suite of technologies, we needed to find a new milling technology that had very uniform particle size. And so we’ve switched from hammer milling to roller milling.”

Like its industry counterparts, ICM has gone on to develop multiple technologies, much of them still focused on fine-tuning fractionation. “In today’s wet fractionation processes, we try to design and implement technologies that put the control back into the plant,” Gallop says, giving plants flexibility in which technology platforms to install as well as which coproduct options to pursue. “We’re continuing to develop and optimize for efficiency and coproduct diversification, with a focus on increasing values of each product,” Gallop continues. “So the distillers grain is the largest pile of most imperfect feed ingredients, and we’re continuing to fractionate that. Not only fractionate the fiber and the protein and the oil, but fractioning proteins into different piles, fractioning oils into different piles and figuring out how to improve that fractionation.”

Our team of experts have over 20 years of ethanol plant maintenance expertise. We o er full service and parts for all Fluid Quip equipment to ensure peak performance.

• OEM Parts Warehouse

•$2 million+ inventory on-hand

•Factory Trained & Certified Techs

•MZSA™ Screens

•Paddle Screens

•Grind Mills

•Centrifuges

•Gap Adjusters

agribusiness solutions

For over 20 years, Beyond has been the innovative and trusted experts in selling, implementing and suppor ting grain processing ERP software solutions.

We provide tailored expertise and innovative technology to plants across North America 80+ Ethanol Plants

10,000+ Transactions

We process more than 10,000 digital transactions per daymore than any competitor

From advanced grain processing to strategic financial tools, we provide comprehensive solutions tailored to your needs Tailored Solutions

YOUR AGRIBUSINESS FURTHER www.beyond.biz

New Outlook

But does the success found with wet milling adaptations mean dry milling has no future?

Not at all, says Pete Moss, president of Cereal Process Technologies. The company’s dry fractionation technology has been operating at an ethanol plant in Jefferson, Wisconsin, since 2007, along with several other installations at corn milling and processing plants.

“I’m very appreciative of the owners and leadership of Aztalan Bio, which purchased the ethanol plant that utilizes our technology in Jefferson, Wisconsin,” Moss says. “Their vision for biorefining reflects the vision that CPT has had for some time.”

As the industry focuses more attention on carbon intensity reduction, Moss says interest in dry fractionation is being rekindled. “Fractionation makes ethanol

FIRST, DEGERMINATE: Cereal Process Technologies’ patented fractionation technology removes the germ first, then runs the remaining kernel through roller mills.

PHOTO: CEREAL PROCESS TECHNOLOGIES

plants more efficient because the starch stream is concentrated and the non-fermentable components are removed on the front end,” he says. When combined with mechanical vapor recompression (MVR), a plant’s carbon intensity can be cut by 10 to 20 points. MVR focuses on reducing steam consumption in the plant, he explains, “whereas we’re reducing actual natural gas consumption. We’re freeing up basically half the dryer capacity, half the cooling tower capacity and half the steam-generation capacity. That is a significant improvement to the ethanol plant, especially if they’re looking to expand, or if they’re currently having dryer capacity issues or cooling capacity issues.”

There are major misconceptions about the technology’s capital cost, Moss says. Traditional dry fractionation relies on repeated grinds and separations. “When you grind and sift and grind and sift and grind and sift, all that takes a lot of equipment.” But he describes CPT’s dry fractionation as a short-flow process that requires a lot less equipment.

CPT’s patented technology removes the germ first, then runs the remaining kernel through roller mills. “Since the fiber is light and fluffy, it gets aspirated off,” Moss says. “There’s a distinct difference between traditional dry milling and our technology, which is really designed for the ethanol industry to get the highest yield germ, the highest yield starch, the highest yield of fiber, and do it very efficiently in a short-flow process.”

By removing the germ first, CPT sees yields of approximately 1.2 pounds of oil. While most of the oil in the germ is removed at the front end, Moss adds that distillers corn oil can still be extracted on the back end. Removing the germ at the front end also opens the market for food-grade applications. Other options include using the fiber stream for energy by making renewable natural gas or potentially in food products.

“There’s many options that open up for the ethanol plant,” Moss says. “We still believe that’s important—the more diversification, the more options, the better. But the real driver is carbon intensity reduction.”

Author: Susanne Retka Schill writer@bbiinternational.com

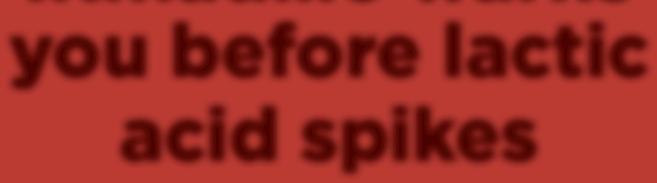

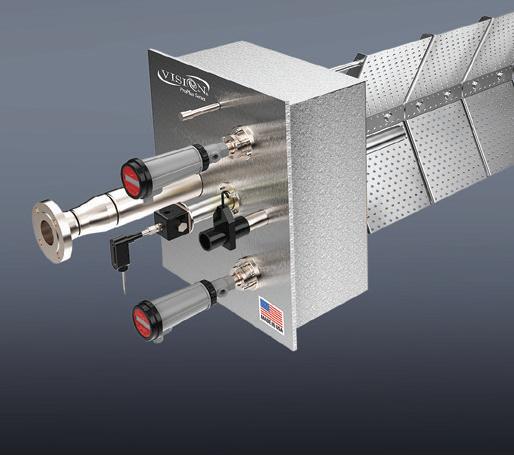

IRmadillo warns you before lactic acid spikes

Think of IRmadillo™ as your early warning system. Always monitoring what’s going on inside your fermentation tanks. Instantly alerting you to anything out of the ordinary IRmadillo gives you lab-grade accuracy in real time, continuously measuring the concentrations of lactic acid, ethanol and more. All from a device that’s been called “the most robust instrument we’ve seen.”*

So while other plants wait 8 hours for the HPLC to inform them of a disaster that’s already started, get ahead of the lactic acid curve while you can still do something about it. Buy an IRmadillo

*Julian Parra, Engineering Manager, Pannonia Bio

Real-time analysis for total process control

info@IRmadillo.com • IRmadillo.com Keit Ltd. Zephyr Building, Harwell Campus, Oxon OX11 0RL, UK

Pete Moss President, Cereal Process Technologies

DRIVING PRODUCT DIVERSITY

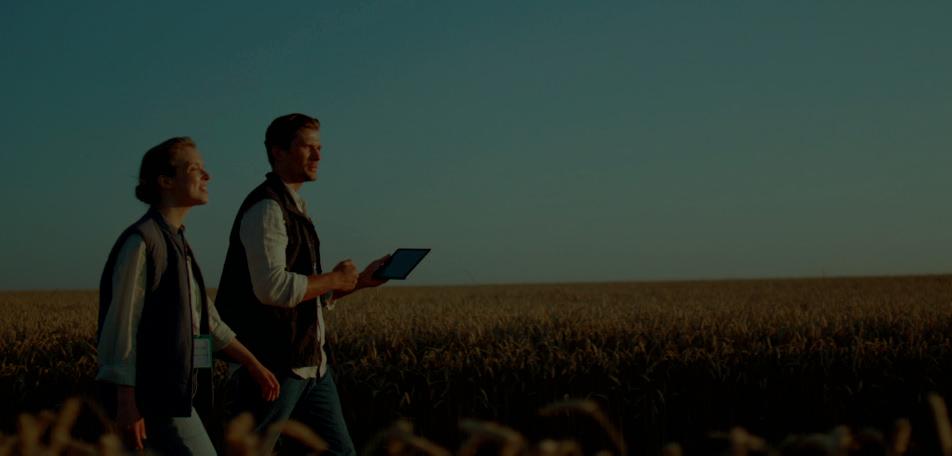

Chippewa Valley Ethanol Co.'s long history in the ethanol industry is intertwined with innovation and diversification.

By Katie Schroeder

Ever since startup in 1996 with a 15 MMgy capacity, diversification has been Chippewa Valley Ethanol Co.’s modus operandi, according to Chad Friese, general manager and CEO of CVEC. Located in Benson, Minnesota, the plant’s current 50 MMgy capacity and product portfolio reflects a focus on diversification over expansion. Built in a pre-Renewable Fuel Standard environment, CVEC leadership is accustomed to

maximizing products and profits within the plant’s compact footprint.

“We’re a smaller plant,” Friese says. “When the RFS came out, rather than expand and get big, [the company chose to] drive cost structures down. We took an approach of, ‘Well, let’s diversify, let’s find niche markets, let’s add revenue wherever we can to help offset those cost structure pieces [associated with being a] smaller plant.’”

Chippewa Valley Agrafuels Cooperative built the ethanol plant two years after

the cooperative formed in 1994 and still owns the facility. The cooperative operates the ethanol plant and serves as the parent company of Glacial Grain Spirits, which produces organic alcohol used for spirits and preservatives; food-grade ethyl alcohol, which can be used for beverages, cleaners and cosmetics; and specially denatured alcohols, which are used in non-edible product manufacturing.

Since partnerships drove several of CVEC’s diversification choices, Friese calls these new product pathways “relationship-

INNOVATIVE HISTORY: Chippewa Valley Ethanol Co. in Minnesota has focused on innovation and efficiency through diversification since it was established in 1996.

PHOTO: CHIPPEWA VALLEY ETHANOL CO.

led.” For anyone looking to develop a market in their area, Friese recommends consistent operations and high-quality product to help maintain demand.

“If there’s customers that are looking for a solution that you can provide, and you can find common ground, that’s a value add that you can put in your tool bag,” he says. “It diversifies you, it adds some additional revenue, and it meets a market need.”

The plant’s diversification innovations over the years range from long-term technology installations to short-term problem

solving. From 2006 to 2010, CVEC gasified corn stover to make syngas, blending it with natural gas streams and bringing down energy costs. “That was back in a day when natural gas was $10 to $12 per MMbtu,” Friese recalls. Due to cheaper natural gas prices, the plant shut down the gasification system in 2013.

In situ corn kernel fiber (CKF) cellulosic ethanol production is among the facility’s latest diversification developments. CVEC added the enzymes required to extract ethanol from CKF into its process,

giving the facility additional volume that increases capacity, adding lucrative D3 RINs alongside the D6 RINs earned by starchderived ethanol.

The industry’s recent focus on decarbonization was not a sudden shift for the facility, Friese explains. CVEC’s presence in the industrial ethanol space drove an interest in sustainability before decarbonization became a major goal for the fuel ethanol industry. This sustainability focus translated well into a good CI score for selling into Low Carbon Fuel Standard markets, includ-

ing California, Oregon and Washington. CKF also helps bring down the facility’s overall CI score in LCFS markets, Friese explains.

One of the challenges CVEC has dealt with when diversifying product streams is transportation. Fuel ethanol—often transported in tank cars via railroad—is fairly straightforward to measure and inexpensive to transport, but beverage-grade alcohol is more costly to track and transport.

Diversification can be risky and technology options do not always work out. “We’ve had our pitfalls over the years,” Friese says. Sometimes, after putting in a lot of time and effort, the technology turns out to be unfeasible. “The effort can be worth it if you’re willing to put in that view of something different and not just fitting into the standard market process,” he adds.

The gasifier was one “outside the box” technology that required problem-solving, since it had not been done before. There were a lot of questions related to permitting, regulations and tracking that needed to be answered. Innovating outside of the ethanol industry’s typical model can be intimidating, so Friese recommends buy-in from staff and boards of directors, and a thorough understanding of the steps required.

Efficiency Upgrade

CVEC has pursued technological upgrades throughout its long history in the industry in an effort to increase efficiency. “There has a been a huge advance in efficiency over the years, especially towards steam and heating and drying, those highenergy areas,” Friese says. “Newer boilers are way more efficient than older boilers. New dryers are way more efficient than old dryers.”

Over the years, CVEC has updated computer systems, operating panels, burners and more. Some of the original machinery from the plant’s startup is still operating. However, as the costs of maintenance go up and components reach the end of their operating lives, the profit gains from in-

creased efficiency eventually make a larger infrastructure replacement worthwhile.

Friese recommends detailed planning and building a budget for larger infrastructure upgrades. “If you’re trying to time it out to the market, I can assure you that’s never going to work,” he says. “So, you just need to put your plan in place. This is what we need to do, and the process by which we’re going to do it, whether that’s equipment replacement, upgrades, whatever. And again, communicate, get the buy-in, and just work your plan.”

Fluid Quip Technologies is one of the technology providers serving ethanol producers as they update process components that have reached the breaking point. FQT’s optimization study service provides ethanol producers with an engineering analysis of their facility. Andrew Nohns, engineering manager at FQT, oversees these studies and helps ensure they are executed correctly. He and his team provide producers with recommendations, some that can be applied immediately by plant operators, some being small projects that necessitate capital

expenditure, and others being larger projects that require more time and money to implement.

“Those [studies] are all customized to what the plant is looking for,” Nohns says. “That’s our package that we use for working primarily with new clients. We can build some trust with them through that process, and we can execute on the larger capital development and engineering design and execution of those projects as the plant has those needs.”

Aging infrastructure gives producers an opportunity to do more than simply replace existing technology with more of the same, he explains. FQT’s Low Energy Distillation system offers producers a more energy efficient option when replacing their distillation system, along with the possibility of increased capacity. “Our LED technologies are some of the lowest energy users for an integrated distillation process,” he says.

The LED Technology platform offers a variety of solutions. One of these uses a high-pressure rectifier, eliminating the need for a vaporizer to run through the mole

EFFICIENCY IN ACTION: As CVEC has updated aging equipment through the years, it has used those opportunities to install technologies to improve efficiency and diversify coproduct offerings.

PHOTO: CHIPPEWA VALLEY ETHANOL CO.

ENHANCING OIL: Fluid Quip Technologies’ DCO Technology increases the amount of oil extracted from the fiber.

PHOTO: FLUID QUIP TECHNOLOGIES

sieves. “Eliminating that condensing and reevaporation step is a good energy saver, and then running a vacuum beer column lowers the temperature compared to a typical Delta T plant where you see less fouling and longer run times between needing to [clean-inplace] your beer column,” Nohns says.

Coproduct Maximization

An early adopter of distillers corn oil extraction technology, CVEC installed its first DCO system in 2006. In 2025, CVEC enhanced its DCO production by bringing FQT’s DCO Technology online. Nohns explains that the company saw its DCO recovery rate increase by 35% without the use of additional chemistry. The installation upgraded the thin stillage clarification FQT had installed in 2018, reusing some components in the new DCO system. Reutilizing previous Capex expenditure components

'Pursuing increased DCO recovery is certainly an easy option because it’s already established [and] there’s already an established market for it.'

- Andrew Nohns, Engineering Manager at FQT

is a standard of FQT solutions, and in this case simplified the timeline and improved the return on investment.

“Pursuing increased DCO recovery is certainly an easy option because it’s already established [and] there’s already an established market for it,” Nohns says. “Renewable green diesel and biodiesel are preferentially using it as a feedstock because of its CI value, so it’s kind of an easy one just to

improve the recoveries there and produce more oil.”

FQT’s DCO Technology uses a twostage fiber wash on the whole stillage alongside thin stillage clarification to increase the amount of oil extracted from the fiber by sending suspended solids to the dryer and oil to the evaporator. Nohns explains that ethanol producers have observed an improvement in their evaporator systems af-

ter installing DCO Technology because it removes the suspended solids in the thin stillage, helping the evaporator run more efficiently and potentially lowering energy usage.

FQT developed DCO Technology after the company observed high oil yields in plants running their Maximized Stillage CoProducts system, which focuses on recovering protein. MSC served as the foundation for DCO Technology but was adapted to “focus solely on oil recovery,” Nohns explains.

“Anything you can do to improve your oil recovery and sell that as DCO is going to improve your bottom line and reduce the net corn cost, as we like to talk about when looking at coproduct credits, so that you can just kind of get the gallons more efficiently.”

Handling Risk

In a pre-RFS environment, CVEC diversified to mitigate risk by creating additional marketing pathways, Friese explains. Plant leadership has not ruled out expansions, particularly with the possibility of year-round E15, which could undergird continued fuel ethanol demand. The buzz around expansion in the industry makes sense, according to Friese. “I think there’s indicators out there that suggest we’re going to continue to support and strengthen the fuel ethanol market, not that that should dissuade [ethanol producers] from taking a diversified approach either,” he says.

With decarbonization becoming the new buzzword for many ethanol producers, decarbonization and carbon utilization technology platforms are multiplying on the market. Moving forward, ethanol producers will need to apply diversification strategies to the decarbonization front,

finding the right solution for their plant and local market.

In the ethanol industry, diversification historically implied the addition of more products and more markets. But Friese says that meaning may shift. As ethanol producers pursue unique strategies that reduce carbon emissions and increase efficiency, “diversifying” might mean assembling the right pieces to reach the lowest carbon score.

“We’re all probably heading to the same focus, but the partners, the technologies, some of those things that we utilize to get there may be different than what we’ve seen,” Friese says. “Diversity might not mean new markets; it may mean different technologies to get us to that end goal.”

Author: Katie Schroeder katie.schroeder@bbiinternational.com

LEVERAGING PRECISION FERMENTATION

From new products to better yeast performance, precision fermentation could help ethanol producers rethink and revamp their sugar streams.

Precision fermentation technologies available today can do more than turn corn into ethanol. A range of technology developers in, and adjacent to, the biofuels industry has proven out specialized processing techniques or technologies to create advanced food protein, feed additives, new textiles, fibers, biopolymers and commercial-grade pigments or cosmetics.

“Precision fermentation is a gateway technology for the ethanol industry as opposed to an endpoint,” says Russ Zeeck, cofounder of AgVault, a precision fermentation company with ties to the ethanol sector. With new technology, approaches and knowledge, special fermentation processes like AgVault’s can help expand the ethanol industry, Zeeck says.

“It’s a way to leverage the existing sugar stream by producing products that are more valuable than ethanol, while creating multiple product diversification opportunities,” he says.

AgVault Breaks In

Zeeck and AgVault President Kevin Dretzka have been involved in the biofuel sector for decades. Zeeck previously helped manage and run ethanol plants. He says the

By Luke Geiver

industry has generally prioritized efficiency gains over the discovery of new pathways for product diversification. The industry has done well improving distillers grains and integrating corn oil, corn kernel fiber and even CO2 into operations, and now precision fermentation is the next step to turn a standard plant into a modern biorefinery, he says. Zeeck says the microorganism required for AgVault’s patented aerobic precision fermentation process is common to all ethanol producers: yeast.

AgVault has spent more than four years developing and testing a process that can run alongside an ethanol plant to produce microbial proteins, animal feed, food-grade yeasts and other products. The process uses a slip stream, integrating leftover fermentation broth after separation, returning it to the ethanol plant. This leftover fermentation broth contains micronutrients and yeast.

A 100 MMgy plant could produce 16,000 tons per year of AgVault yeast product, by using roughly 3% of the plant’s carbohydrate output. Each AgVault co-located plant would require a three- to four-acre footprint, depending on site specifics. The AgVault approach creates an advanced yeast compositional product with up to 25% more protein per unit compared to other protein

sources, greater amino acid availability, improved nutrient content and increased complex carbohydrate content.

Zeeck has designed the technology to work within existing infrastructure. The system will rely on standard decanters along with special instrumentation and probes—all of which are familiar to ethanol operators. The technology’s monitoring probes ensure better dissolved oxygen uptake and patterning and growth of yeasts, which allows the process to reach operating parameters more quickly, using less air volume. Zeeck says they have essentially sped up the fermentation curve while also creating a reliable and robust operational profile. The proprietary fermentation medium monitoring system allows AgVault to constantly adjust sugar, dissolved oxygen and nutrient levels to maintain cell quality, output volume and specifications. The system can run on any starch provided, from grain sorghum to corn.

The modular system can be tailored to each plant, with minimal technology alteration to the existing infrastructure. With the technology installed and operating, an ethanol plant could see a 35% ROI, according to AgVault.

From start to finish, the process requires 18 hours, reducing the traditional fermenta-

PURPOSEFUL PRECISION: Research groups and technology companies, such as Hydrosome Labs, have partnered to bring precision fermentation to the ethanol industry, diversifying coproducts and introducing revenue streams.

tion cycle time by half in some cases. It also generates a better return on capital, Zeeck and Dretzka say, as the process produces twice the biomass during the same time period as an anaerobic fermentation process, using existing technology.

“The world is very long on carbohydrates and short on bio-available protein and complex carbohydrate production components,” Dretzka says.

He adds that AgVault is engaged in discussions with European prospects and ready to start development on a commercial site after securing off-take agreements.

“We are ready to break ground,” he says. “We are commercialized.”

Expertise and Opportunity

The University of Illinois UrbanaChampaign’s Integrated Bioprocessing Research Laboratory (IBRL) has expanded its precision fermentation expertise and offerings to the commercial sector to help solve a dilemma: fermentation tank size.

FROM LAB TO LINE: The Integrated Bioprocessing Research Laboratory at University of Illinois UrbanaChampaign was formed to expand biomanufacturing capabilities using corn feedstock and other biobased products.

IBRL helped form the Illinois Fermentation and Agriculture Biomanufacturing Hub (iFAB) to lead work in precision fermentation and the manufacturing of biobased products. The consortium is comprised of 24 industry partners with a goal

of creating a lab-to-commercial line. The idea is to find new ways to turn corn feedstock into high-value, customized proteins and other products. In total, the tech hub has a team of nearly 70. Along with testing infrastructure, iFAB has industry-leading

PHOTO: INTEGRATED BIOPROCESSING RESEARCH LABORATORY

PHOTO: HYDROSOME LABS

expertise, according to Beth Conerty, regional innovation officer for iFAB and associate director of business development for IBRL.

Conerty has helped increase the reach and understanding of precision fermentation in the region and across the country, often participating in trips to D.C. She says iFAB’s expertise has ties to ethanol production but a scope of work that extends far beyond biofuels. “The reality is we need other markets for corn grind and to bolster markets across the board,” she says.

iFAB can make biostimulants, textiles, cosmetics, industrial chemicals, acrylic acid and food through fermentation. The organization also focuses on government relations, access to capital, strategy, operations and infrastructure. “We’ve had clients that want to build facilities on their own and they may not have thought about steam or wastewater or how big a dock needs to be for shipping and receiving,” Conerty says.

iFAB has also adapted sites to tie into existing infrastructure for precision fermentation or biomanufacturing in Illinois. In addition, iFAB has received more than $50 million in funding from the U.S. Economic Development Authority to expand. “We are always trying to explore how to connect technologies,” she says.

According to research provided by IBRL, the market opportunity in precision fermentation is in the billions and it will grow. In 2022, the opportunity was valued at $1.6 billion. By 2048, the industry will grow by more than $10 billion, potentially reaching $11.8 billion, according to IBRL.

Monitoring Fermentations

North Carolina-based Sennos, a company formed to create artificial intelligencebased sensing, control and analytics for the fermentation and biomanufacturing industries, has devloped an advanced sensing technology to better analyze batch fermentation. The SennosMS module, now being offered to several industries, connects to the Sennos system that provides ferm control and predictive insights. Initially, the system was meant for brewers. Today, it is set up for biofuel producers, cosmetics and others.

SennosMS captures gravity, pH, temperature, pressures, dissolved oxygen and more. According to Jared Resnick, CEO and founder, the system acts as both a scientist and technician.

Ultrafine Bubble

In 2019, Hydrosome Labs was formed following the purchase of a unique ultrafine bubble technology. Since then, Bob Jacobs, president, has been leading the growth of a company that serves the fermentation industry (along with cosmetics, beverages and controlled environment agriculture sectors) with nanoscale bubbles. Initially, Hydrosome Labs was focused on skin care. Roughly one year ago, however, the company realized its importance to fermentation.

“Ultrafine bubbles is a pretty new area of science,” Jacobs says. “It has only been around 30 years or so.”

In some cases, a continuous supply of nanobubbles in fermentation can increase biomass by up to 100%. The technology itself can be retrofitted to existing technology, requiring only entry and exit ports.

The bubbles are essentially a mass transfer technology, Jacobs explains. They measure 100 nanometers, a tiny size where physics behave differently, delivering gases and nutrients to the cell wall more efficient-

ly. The ultrafine bubbles have 30 times the gas carrying potential of a normal bubble.

“It enables a lot more interaction between the bubbles and the cell walls,” Jacobs says. The smaller bubbles open the cell walls better, allowing in more nutrients and improving the process.

“The resonate time in a fermentation tank takes longer with larger bubbles because the larger bubbles quickly make their way to the surface because they float,” Jacobs says. “Ultrafine bubbles don’t float, so they stall in the tank and interact more.”

To date, Hydrosome Labs has worked primarily with yeast and bacteria. Despite its novelty, Jacobs says the company’s prospects are good.

“There is a lot of demand in the precision fermentation space,” he says. “There have been billions of dollars focused on the upstream and downstream process. Now the question is, how do we get more out of the process, out of fermentation itself? I think we’re getting answers.”

Author: Luke Geiver writer@bbiinternational.com

ANSWERS FROM YEAST: Working with common yeast helped Hydrosome Labs understand the value of its ultrafine bubble technology. This test unit sits at IBRL.

PHOTO: HYDROSOME LABS

LAUNCHING IN LUVERNE

Green methanol from waste CO2 could create new opportunities while transforming an idled ethanol plant in Minnesota.

By Luke Geiver

If CapCO2 Solutions’ approach to green methanol production from waste CO2 works at its first ethanol plant—in Luverne, Minnesota—the technology could become a lighthouse for the industry, according to Jeff Bonar, CEO of the green methanol developer.

The 18 MMgy facility started as an ethanol plant, pivoted to other biobased products under the ownership and direction of Gevo Inc., was purchased by AgriEnergy Innovation in May and will now house the CapCO2 Solutions technology. The plant has been idle since 2022.

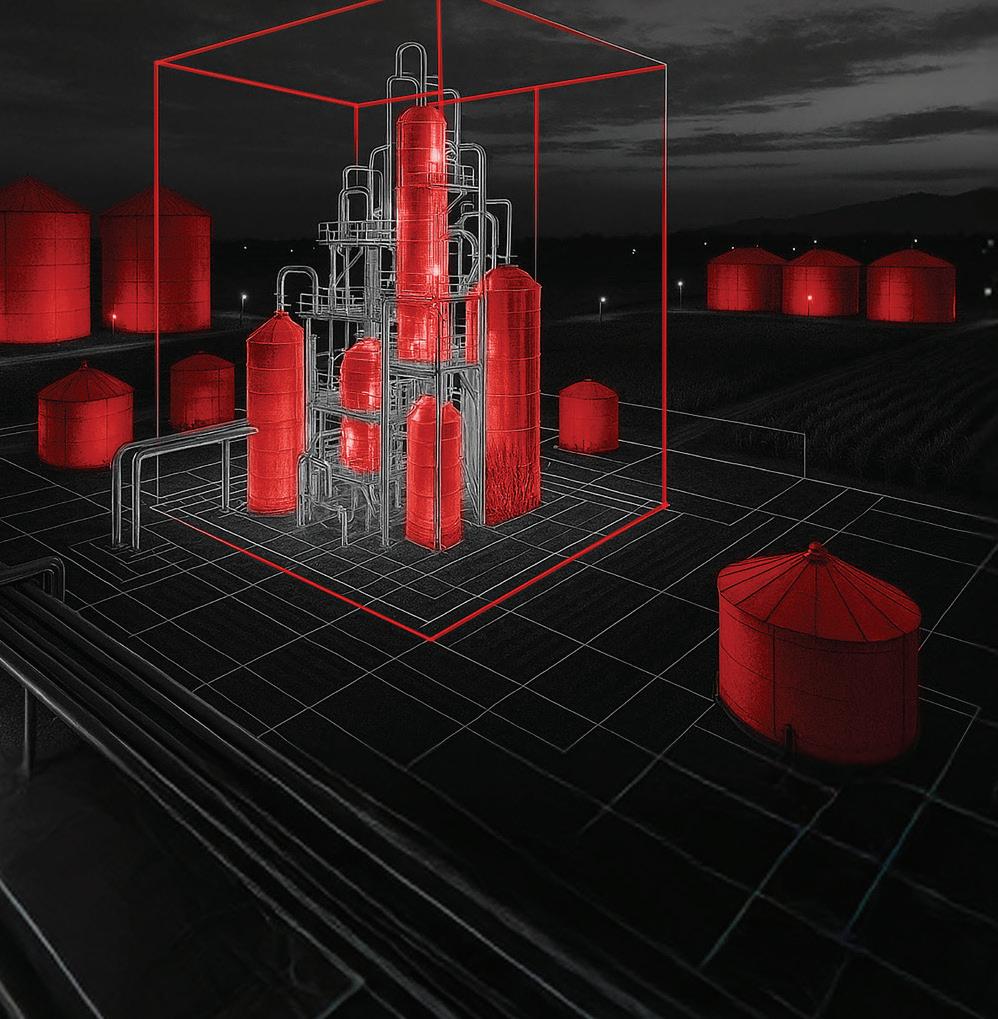

Central to CapCO2’s modularized green methanol conversion process will be

Bosch’s water-based electrolyzer that produces hydrogen for combination with CO2 to produce green methanol. Bosch says technologies like this will help the world ramp up hydrogen use and potentially generate revenues in the billions by 2030.

Proven Starting Point

CapCO2 and AgriEnergy, led by longtime industry veteran David Kolsrud, will partner with Methylennium Energy, which will provide a methanol synthesis approach it has developed to integrate with renewable power and water electrolysis. To ensure the project remains achievable, CapCO2 has added an experienced ethanol engineer who spent years with the industry’s top builder. Doug Edwards, now vice president of engineering and construction at CapCO2, will

provide oversight of engineering, procurement and construction in Luverne.

“I was involved in the design of 20plus ethanol plants,” Edwards says. “I’m a nuts-and-bolts guy. I’m a project manager and work to get projects built.”

Maxim Lyubovsky, president and CEO of Methylennium Energy, has been a chemical engineer in the fuel reforming and hydrogen industries for more than 25 years and has worked with fuel cells and skid-mounted methanol projects in the oil and gas sector. The patented technology Lyubovsky’s team will deploy in Luverne has been in use for more than 15 years.

The Luverne project is in a detailed design phase with plans for operation in 2027.

In August, all of the parties involved in the project gathered in Minnesota at the

AgriEnergy plant to launch their work. It was the first time the chemical engineers, plant management team and other stakeholders from the multi-party group were able to meet in person. Nearly 100 people attended the introduction event, including mayors and Midwestern ag leaders. Kolsrud provided context on the Luverne plant’s latest transformation, telling those in attendance that the facility was a leader 30 years ago when it launched and will soon be a leading innovator in the next-generation biofuels space again. His vision is to use the plant as a launching point for innovative technologies, he said.

AgriEnergy Innovation acquired the plant for $7 million from Gevo. Gevo retained certain isobutanol production-related assets and a portion of some vacant land

near the plant. At the time of the transaction, Kolsrud described the Luverne site as being well suited for the practical scale-up of new technologies.

“We were looking for a site that was smart, quick and easy to build,” Bonar says of Luverne.

Technology Detailed

Although the system in Luverne will not be the largest or most advanced green methanol facility, it will allow the industry a chance to “kick the tires,” Bonar says.

The modularized setup can potentially use wind or solar to power electrolysis to create hydrogen. The hydrogen is then combined with waste CO2 in methanol synthesis to produce green methanol that can be used as a feedstock for several products,

including sustainable aviation fuel or maritime applications.

The Bosch electrolyzer uses ultrapure water flows around a proton exchange membrane, according to the company. The membrane is located between an anode and a cathode. Electric voltage is applied and the anode produces oxygen, free ions and hydrogen. Then, the ions all pass through the membrane, combine with electrodes from the cathode and form pure hydrogen gas. The hydrogen can be stored, used in fuel cells or converted through other processes, such as the CapCO2 process.

As the national grid continues to face power supply issues, areas across the U.S. will continue to see power shortages, blackouts and rising power costs. The Luverne system, designed to run independent of the

TALKING DESIGN: The idled ethanol plant in Luverne, Minnesota, will become the site of a green methanol production system, a collaboration among CapCO2 Solutions, AgriEnergy Innovations and Methylennium Energy.

PHOTO: NANCY LEHRER PHOTOGRAPHY

grid when necessary, will be able to remain flexible during intermittent power and pull its heaviest load during off-peak hours and when other electrical users in the area are operating at lower capacity.

“In past lives, I’ve had the chance to look at other technologies from other providers,” Edwards says. “A lot of technology people show up with big hopes and dreams. Too often they shoot for the moon. In Luverne, we’ll be smart and practical and up and running as soon as possible.”

Bonar says their work will help create a blueprint for a system that can be expanded in multiple ways. The Luverne location could also help CapCO2 show how its system works in conjunction with wind power, which is abundant in the region.

“There is a lot of wind there and a lot of the turbines get turned off at night,” Bonar says. “They call that curtailed electricity and we’ll happily buy that from them.”

The team hopes to source as much renewable electricity to power the electrolysis stack as possible. Projected numbers provided by CapCO2 indicate the system can reduce an ethanol plant’s carbon intensity score by 25 points.

To date, there have been no issues with equipment sourcing for the project. Everything is commercially available in the U.S.

And, because the CO2 stream produced in ethanol is so pure, added scrubbing and clean-up technology is not required, Lyubovsky says.

Field, Fleet, Flight

Sally Hart, vice president of communications and outreach for CapCO2, says the team is already looking at additional proj-

ects while work is underway at the Luverne plant. There is interest in green methanol, she says, due to large-scale end-users in air and sea. In addition to its potential as a feedstock for SAF production, large maritime shippers remain committed to finding a green hydrogen or methanol solution to power their global fleets, according to Hart and Lyubovsky.

PROJECT LAUNCH: In August, CapCO2 Solutions members, along with chemical engineers from Methylennium Energy and the plant management team from AgriEnergy Innovations, met to go over initial design plans for the plant.

PHOTO: CAPCO2 SOLUTIONS

GREEN DESIGN: Methylennium Energy has designed a modularized methanol reactor built to produce green methanol from waste CO2 and hydrogen.

PHOTO: METHYLENNIUM ENERGY

In Luverne, CapCO2 will pay for the equipment, install it on the plant site and then create a revenue-sharing model with the ethanol plant. CapCO2 will also place personnel on-site if necessary.

“We are open to different frameworks as well,” Bonar says.

The CapCO2 Solutions team is currently raising funds for additional plants and has talked with investment groups in the agriculture sector.

“There is real opportunity here,” Edwards says. “Is the heyday of ethanol going to happen again? I hope so, especially with a lot of the lessons learned about how you make a smart design. Our job is to come up with a design that can be duplicated.”

Edwards believes the designs will remain modularized, space-efficient and utilize a construction process that includes several portions of the design system built off-site.

Once built, the green methanol operation will be CapCO2’s first in the Midwest. Adkins Energy out of Lena, Illinois, is also working on a green methanol production process that utilizes waste CO2 from its ethanol and biodiesel production facility. Adkins is working with Norwegian-based company Real Carbon Tech on a demonstration project expected to produce 800 to 1,000 tons per year. The pilot plant could morph into a commercial producer of 123,000 tons per year of green methanol, along with renewable dimethyl ether (DME). The renewable DME is of interest to Glocal Green AS, a supplier of green methanol to maritime and industrial clients in Norway and Europe. Glocal Green has already signed an MOU with Real Carbon Tech for future production of green methanol.

Red River Energy near Rosholt, South Dakota, has been in talks with CarbonSink to develop a different version of the green methanol production process using the ethanol plant’s fermentation CO2. The last update on that project was released in 2023.

“CO2 is incredibly valuable,” Bonar says. “CO2 is not something that should be thrown away.”

Author: Luke Geiver writer@bbiinternational.com

BIG PICTURE: The team restarting the 18 MMgy Luverne, Minnesota, ethanol plant hopes to showcase the process for utilizing on-site CO2 to produce green methanol via renewable power.

PHOTO: AGRIENERGY INNOVATIONS

BEYOND THE BID

The Strategic Value of Long-Term Contractor Partnerships

By Nathan McAlpine and Chuck O’Rourke

The ethanol industry is constantly changing. As the market puts a bigger focus on efficiency and diversification, the role of a general contractor for ethanol plants has to be more than just a one-off transaction. For owners tackling complex upgrades and expansions, a longterm partnership offers a major competitive edge. This kind of strategic alliance turns a contractor into a trusted steward of your plant’s unique operational identity—

its “special sauce”—and allows for more cost-effective projects with less disruption to your core business.

The Power of Proactive Partnership

A long-term partnership fundamentally changes the way a plant operates. It transforms the relationship from that of a simple service provider to an embedded part of your team, able to anticipate

needs and act as a “quick reaction force” for operational problem-solving. When a contractor is consistently engaged with your team, through an on-site presence or regular meetings, they start to understand the plant’s unique DNA. This deep knowledge allows them to spot potential issues or opportunities before they even come up, enabling them to suggest solutions that are more efficient and better suited for your long-term goals.

CONTRIBUTION: The claims and statements made in this article belong exclusively to the author(s) and do not necessarily reflect the views of Ethanol Producer Magazine or its advertisers. All questions pertaining to this article should be directed to the author(s).

SOLVING PROBLEMS: McGough and KFI Engineers worked to solve an equipment issue at Golden Grain Energy, pictured here, and get the plant's project back on track.

PHOTO: GOLDEN GRAIN ENERGY

This proactive approach is especially valuable for managing downtime. A longterm partner can help owners and plant managers plan outages strategically by recommending critical tie-ins for a future project during a scheduled shutdown. A well-integrated contractor might spot this opportunity several months before construction even begins. Advance planning ensures that the new project can be brought online seamlessly without an additional, unplanned shutdown later on.

Practical Tips for Successful Collaboration

Building this kind of partnership requires a shift in mindset from a simple transaction to a collaborative alliance. It’s not about handing over blueprints and waiting for a final product; it’s about collaboration, transparency and trust.

Here are a few pieces of advice for ethanol producers:

● Involve Your Partner Early: Bring the construction and design teams to the table as soon as possible to review engineering plans and offer their perspective on how to build and operate the project. This collaborative approach, which McGough likes to call the “three-legged stool” of owner, engineer and contractor, ensures that everyone is working together to find the best possible outcome.

● Choose a Transparent Partner Who Challenges You: The biggest mistake a project owner can make is to blindly follow one path without seeking and considering feedback. Find a contractor who is transparent and won’t just be a “yes” person. While bad news happens in construction, “bad news late” is the real problem. A partner you can trust to communicate honestly about challenges and potential issues will save you time and money.

● Provide Open Access to Information: The more integrated your contractor is, the better they can serve you. Giving them access to operational meetings, long-

PHOTO:

'Instead of turning away, they ran headfirst into fixing it, and that’s a level of commitment you can build a lasting partnership on.'

- Chad Kuhlers, CEO of Golden Grain Energy

range planning sessions and even internal conversations, so they have the information they need to help with everything from future planning to daily challenges.

Golden Grain Energy: A Case Study In Trust

The Problem

At the beginning of the relationship with Golden Grain Energy in Mason City,

Iowa, an equipment issue led to a significant problem on a project, which could have easily led to a prolonged dispute or project delays.

The Solution

McGough and KFI Engineers worked tirelessly with Golden Grain Energy to resolve the issue and get the project back on track. The solution was rooted in collaboration and transparency. All parties—

CONSTRUCTING COLLABORATION: Ethanol plants can build collaborative relationships with their contractors by involving them early, choosing a transparent partner and providing open access to information.

GOLDEN GRAIN ENERGY

the owner, the engineer and McGough— worked together to brainstorm solutions and optimize the design on the fly. This collective commitment to honest communication and problem-solving ensured that the challenge was addressed directly rather than allowed to spiral into more significant issues.

“I knew we had the right team for us when a big problem came up on a small project,” said Chad Kuhlers, chief executive officer at Golden Grain Energy. “Instead of turning away, they ran headfirst into fixing it, and that’s a level of commitment you can build a lasting partnership on.”

The Outcome

Since that time, McGough experts have remained at the facility, continuously

managing projects of varying sizes. They now take part in the plant’s operations meetings and have ongoing conversations about future capital expenditures.

A Look to the Future

The importance of these long-term partnerships is even clearer when considering two major industry trends: the push for lower CI scores and the rise of new markets. Carbon capture and storage (CCS) is a huge investment for any plant, and a long-term contractor can help navigate the complexities of this multi-phase project, from engineering to construction and integration.

The emerging market for ethanol as a feedstock for sustainable aviation fuel (SAF) also presents a new opportunity. Whether you require a full-scale plant ex-

pansion or a strategic retrofit, a contractor who understands your plant can help you best position yourself to produce the lowcost gallons needed to compete. Ultimately, the success of an ethanol plant isn’t just about equipment and technology; it’s about the strength of core partnerships. By choosing a contractor that is not just a builder but a strategic ally, producers can get the agility, foresight and problem-solving skills they need to thrive in this dynamic market.

Author: Nathan McAlpine, Director of Industrial Operations, McGough NMcAlpine@mcgough.com

Chuck O’Rourke, Business Development Director, McGough chuck.orourke@mcgough.com

BUILDING FOR THE FUTURE: Building for new markets becomes easier when ethanol plants create a reliable contractor relationship.

PHOTO: GOLDEN GRAIN ENERGY

Comple te Solutions.

Trusted Suppor t Ever y Step of the Way

Fr om f er mentation to final y ield, P hibr o deliv er s a w ide r ange o f solutions tailor ed to y our plant’s speci fi c needs. Our compr ehensi v e por tf olio is backed b y hands-on suppor t and t echnical e xpertis e to help y ou driv e consist en t perf or mance and unlock long-ter m e cienc y. Count on Phibro Ethanol for:

An timicr obials

De -Emulsifier s Cleaning Enzy mes Yeas t

Ask your Phib ro Account Manager about

A new day is dawning for ethanol production. Our industry-leading lineup of yeasts, yeast nutrition, & enzymes are pushing the limits of fermentation and reaching levels of performance never achieved before. Paired with our renowned educational programs and expert services, we’re setting a course for even greater yields and performance.

With LBDS, THE FUTURE OF FERMENTATION IS BRIGHT AND THE POSSIBILITIES ARE ENDLESS.

©2025 Lallemand Biofuels & Distilled Spirits