South Africa’s energy security demands speed and certainty. The Energy One Stop Shop (EOSS), supported by BUSA, is designed to cut through bureaucratic complexities, giving you coordinated information on the permitting process and facilitating approvals.

The Energy One Stop Shop (EOSS) serves several critical functions in the renewable energy sector:

• Facilitating Authorisation: Acts as the centralised conduit or interface between renewable energy developers/Independent Power Producers (IPPs) and the relevant competent authorisation authorities.

• Streamlining Processes: Aims to signi cantly reduce administrative challenges developers face during the permitting and authorisation process.

• Expediting Timelines: Works to shorten timeframes for obtaining renewable energy project authorisations by fast-tracking the process and proactively removing bureaucratic blockages.

Visit our website to register your project, check regulatory requirements, and access our full suite of tools.

www.energyoss.gov.za

The MAN XHD TGS 33.520 is purpose built for the realities of mining and quarry operations. Whether operating as a high output production vehicle or hauling bulk commodities over long distances, the TGS 33.520 delivers unwavering reliability.

Driven by the new D26 efficiency engine delivering 2600 Nm, the truck is equipped for maximum productivity with wider steer tyres for enhanced stability on uneven terrain, long range double fuel tanks, and heavy duty hypoid axles designed for demanding, continuous workloads. Built strong. Built smart. Built for your mine.

Functions effectively in challenging environments due to the wide range of features and technologies it incorporates.

Steinmüller Africa is a B-BBEE level 1 contributor.

Built-in Visual

Add-Ons: UT, Surveying,

LiDAR-based Stabilisation

Live Situational Awareness

Location-Tagged Data

Collision-Resilient

Confined Space Access

GPS-Denied Flights

4K Camera (Built-In)

Providing clean and renewable energy sources within South Africa and abroad, and improve the quality of infrastructure through the technological advancements of engineering.

• Power transmission

• Power distribution

• System control

• Substation design

• Protection system design and Commissioning

• Network analysis

• Transmission lines

• High, medium and low voltage electrification

• High, medium and low voltage reticulation

• Power factor correction design and installation

• Specialized cable installation, testing, fault finding and repairs

• Maintenance work on High Voltage and Medium Voltage equipment

• Emergency HV,MV and LV assistance and repairs

• Authorized switching, isolation, and earthing

• Residential installations and repairs

• Solar Renewable energy design, installation, and testing

We also offer a range of Site Maintenance Services. Contact us today and start a reliable partnership with trusted professionals in engineering.

Contact 082 534 2121

Email adk@rpbservices.co.za

Head Office 131 The Paddock, Woodmead, Sandton

In an industry where risk is inherent, downtime is costly and safety is non-negotiable, Integrated Fire Technology has positioned itself as a trusted specialist at the intersection of safety technology, compliance and operational reliability. “At the heart of everything we do is reliability,” says John Russell, managing director.

Did you know Bell Equipment’s range of Articulated Dump Trucks and Motor Graders are designed by South African engineers and locally manufactured in Richards Bay, KwaZulu-Natal?

As a homegrown, South African family company, we understand the critical importance of growing local business, contributing to our local economy and creating employment for South African people.

Ashley Bell, Group CEO

Tel: +27 (0)11 928 9700

Did you know our B40E ADT moves more tonnes using less fuel?

WITH LOCAL CONTENT OF OVER 70% , THEY CREATE SIGNIFICANT JOB OPPORTUNITIES AT BELL AND THE OVER 1 000 SOUTH AFRICAN SUPPLIERS FEEDING INTO THE BELL FACTORY DAILY. PERHAPS MORE IMPORTANTLY FOR CUSTOMERS, THESE MACHINES COMPETE GLOBALLY AND ARE WORLD CLASS FROM A PERFORMANCE, ERGONOMICS, DURABILITY, AND QUALITY PERSPECTIVE.

E-mail: sales@bellequipment.com www.bellequipment.com

34 OUTLOOK

From critical minerals and green energy integration to new regulatory regimes and logistics upgrades, 2026 marks a decisive turning point for Africa’s mining future

40 ECONOMICS

How geopolitics, technology, workforce shifts and ESG pressures are redefining competitiveness across the continent’s mineral sector

48 REGULATORY

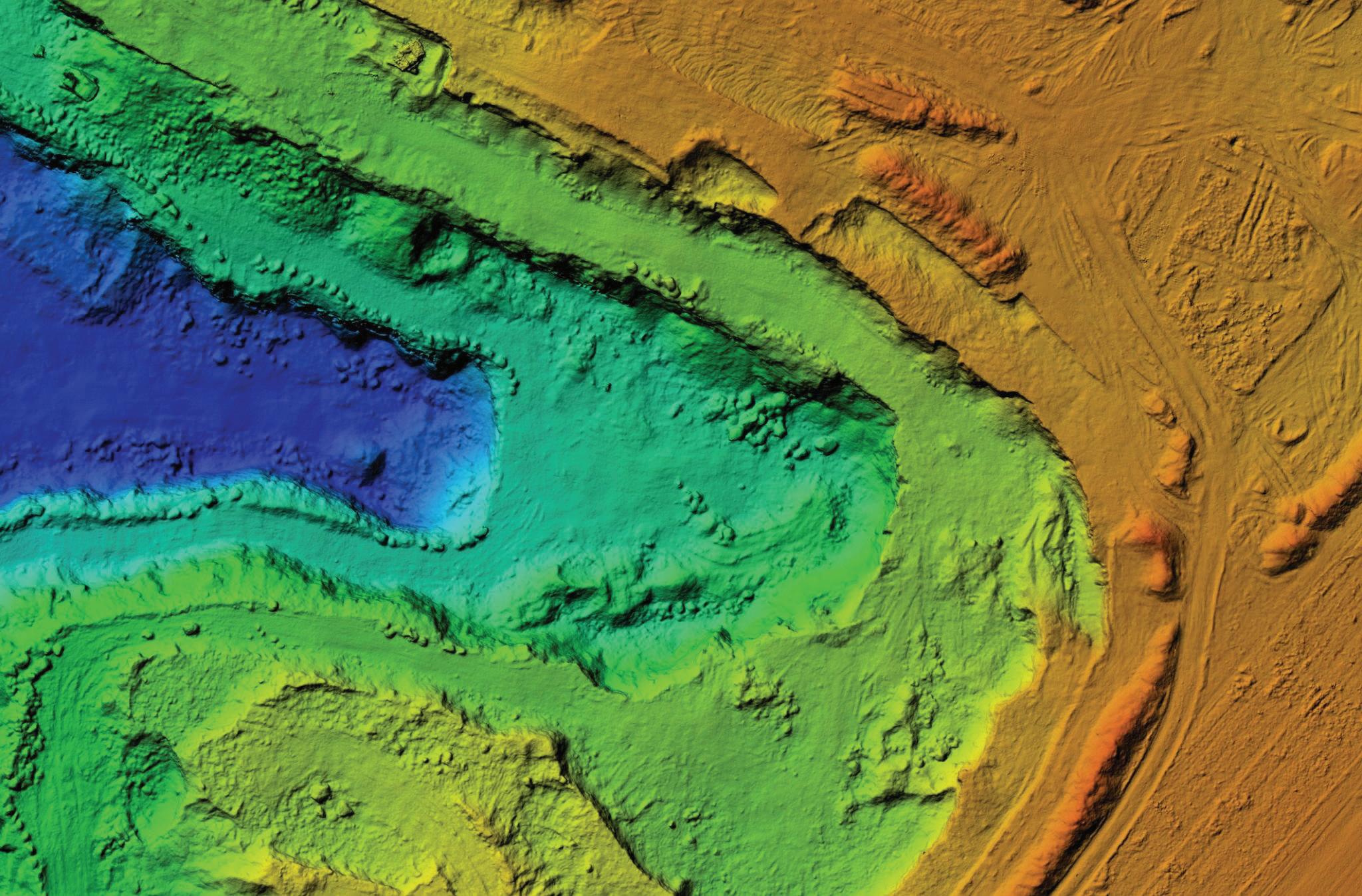

Angola’s Digital Cadastre ushers in a new era of transparent, investorready mining regulation

54 SUSTAINABILITY/ESG

Southern Africa’s ESG year in review: Momentum, markets and the hard work ahead

60 CLEAN ENERGY

Geothermal energy has huge potential to generate clean power— including from used oil and gas wells

66 CRITICAL MINERALS

A new Zambian geological guide reveals vast reserves of cobalt, lithium, graphite and other strategic minerals—positioning the country as a key supplier for the world’s clean energy transition

72 OIL

African refining: A promising yet unexploited investment opportunity

78 GAS

How Nigeria’s Decade of Gas, expanding pipeline networks and LNG megaprojects are positioning natural gas as the engine of continental energy security, industrialisation and long-term economic growth

82 TRANSPORT

How the Lobito Corridor will unlock a new lifeline for southern Africa’s mining trade

88 TECHNOLOGY

The role of big data and analytics in modern mining

92 WATER

How Namibia and South Africa can turn an appetite for desalinated water into energy and mineral security, without draining coastal ecosystems or local communities

98 WOMEN

Top South African businesswomen in the mining and energy industries, advocating for female empowerment, gender equality and mentorship

102 SOCIAL DEVELOPMENT

How a cobalt mining town in the DRC is reclaiming childhood and rebuilding hope

110 HEALTH

How the Masoyise Health Programme Strategy is ensuring mines are not just productive but places where every worker can thrive—physically, mentally and socially

114 SAFETY

Why mining safety demands a shift from compliance to information ecology to achieve zero harm goals

For us it’s no problem.

From large stones to the smallest grains: Bulk solids come in all types, shapes and sizes, but choosing the right measurement technology is surprisingly easy. With our level and pressure sensors, you can effortlessly keep an eye on all your important process values – and still have time to crack the really hard rocks.

Everything is possible. With VEGA

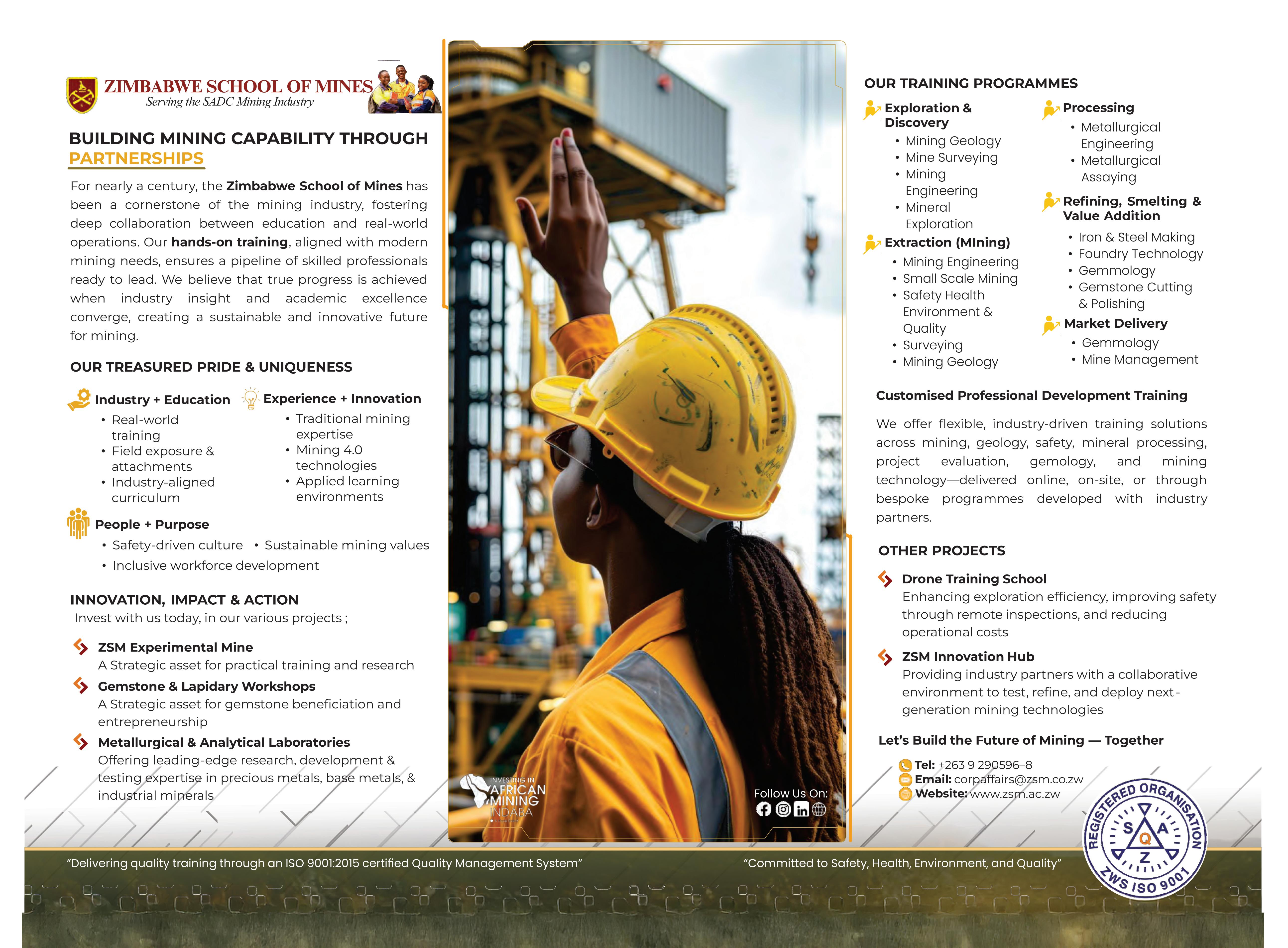

Southern Africa’s mining sector has always been about more than what lies beneath the ground. It’s about people, infrastructure, skills, capital, policy—and, increasingly, the quality of collaboration between all of these moving parts.

In an era defined by energy transition pressures, capital constraints, infrastructure bottlenecks and rising community expectations, no single company, government or supplier can build a resilient mining value chain alone.

The future of mining in the region depends on partnerships that stretch beyond traditional transactional relationships. Producers need to work more closely with equipment suppliers, logistics providers, power developers, financiers, research institutions and host communities to unlock shared value. Governments, in turn, must collaborate with industry to align policy, permitting and infrastructure development with long-term national and regional priorities.

When these pieces move in isolation, the value chain fragments. When they move together, the entire system becomes stronger, more competitive and more investable.

This is particularly true as southern Africa positions itself as a supplier of critical minerals for global decarbonisation. From exploration to beneficiation, energy supply to water security, the scale and complexity of the challenge demands co-ordinated action. Partnerships can reduce risk, accelerate project timelines, enable technology transfer and ensure benefits are more broadly distributed—helping mining retain its social licence to operate.

This is where platforms such as Investing in African Mining Indaba play a vital role. Beyond deal-making, Mining Indaba creates a rare convening space where miners, governments, investors, service providers and development institutions can engage as equals. Conversations that begin in conference halls often translate into joint ventures, public-private partnerships, infrastructure corridors and cross-border initiatives that strengthen the entire value chain.

This year’s theme, “Stronger together: Progress through partnerships”, is more than a slogan. It’s a recognition that collaboration is no longer optional—it is the industry’s most strategic asset.

If southern African mining is to grow sustainably, competitively and inclusively, it will be built not by individual players but by partnerships that understand that shared progress is the only progress that lasts.

mining news

PUBLISHER: Donovan Abrahams

MANAGING EDITOR: Tania Griffin

DESIGN: Erin Esau

EDITORIAL SOURCES: TheConversation.com, African Energy Chamber, African Development Bank, Merel van der Lei, Gaby Paton-Thomas

STAFF WRITER: Matthew van Schalkwyk

IMAGES: iStockPhoto, WIkimedia Commons

PROJECT MANAGER: Viwe Ncapai

ADVERTISING EXECUTIVES: Viwe Ncapai, Lunga Ziwele, James Stone, Brian Mckelvie

ONLINE CO-ORDINATOR: Tania Griffin

CLIENT LIAISON: Majdah Rogers

ACCOUNTS: Benita Abrahams, Bianca Alfos

HUMAN RESOURCES MANAGER: Colin Samuels

PRINTER: Novus Print

DISTRIBUTION: www.africanminingnews.co.za, www.issuu.com

DIRECTORS: Donovan Abrahams, Colin Samuels

PUBLISHED BY: Aveng Media

Boland Bank Building, 5th Floor 18 Lower Burg Street Cape Town, 8000

Tel: 021 418 3090

Fax: 021 418 3064

Email: reception@avengmedia.co.za

Website: www.avengmedia.co.za

DISCLAIMER:

© 2026 African Mining News magazine is published by Aveng Media (Pty) Ltd. The Publisher and Editor are not responsible for any unsolicited material. All information correct at time of print.

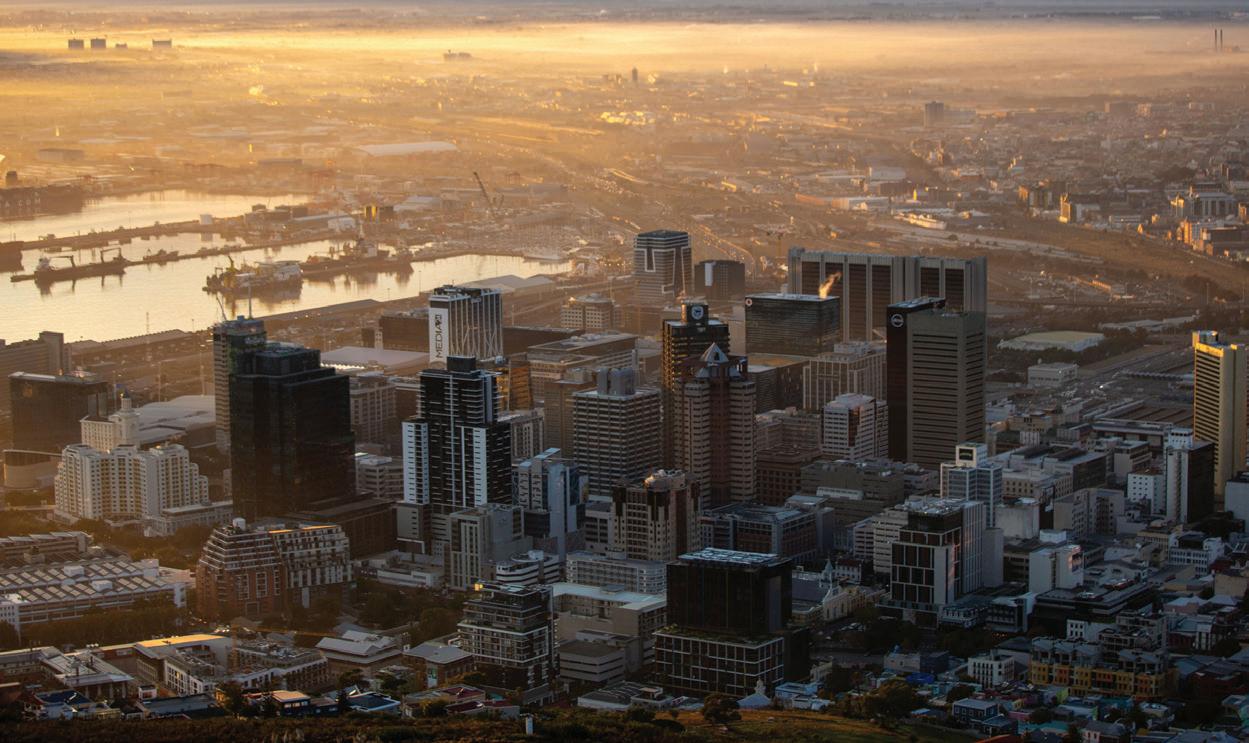

Rub shoulders and conduct business with the high-flyers in the African mining industry

Investing in African Mining Indaba 2026

9 to 12 February

Cape Town International Convention Centre, South Africa miningindaba.com

Mining Indaba 2026 is your gateway to the most powerful connections in the African mining industry. Whether you’re building partnerships, exploring new opportunities or getting ahead of market and policy shifts, this is where it happens. With the continent’s most influential mining companies, governments and global investors all under one roof, Mining Indaba is where conversations turn into deals, and ideas become action.

2026 Conference

3 & 4 March

Indaba Hotel, Spa & Conference Centre, Johannesburg, South Africa www.saimm.co.za

Despite recent achievements in the field, tailings dam failures persist— signalling there is still much work to be done and lessons to learn. As we look to the future, the 2026 Tailings Conference will ask: Where to now? What opportunities lie ahead? What residual risks need addressing? How can we further reduce, reclaim or reuse tailings? How can we accelerate the adoption of new technologies and set a new benchmark for the industry? Explore these critical questions and engage in meaningful discussions with key role-players in the tailings industry.

Africa Energy Indaba 2026

3 to 5 March

Cape Town International Convention Centre, South Africa africaenergyindaba.com

The continent’s flagship event dedicated to the energy sector. Through the conference, side events, exhibition

and networking forums, delegates exchange knowledge and collaborate on solutions driving sustainable growth. As a world-class platform for innovation and partnership, the event unites CEOs, ministers, investors and experts to share insights and shape Africa’s energy future.

Africa Gas Forum

5 March

Cape Town International Convention Centre, South Africa africaenergyindaba.com

Aligned as an official side event to the Africa Energy Indaba, this forum serves as a crucial platform for industry leaders to discuss and contribute to the continent’s growing energy sector. The event addresses country-specific opportunities and regional challenges, covering exploration, licensing, gas transition, tax changes, infrastructure and security.

Zambia International Mining & Energy Conference 2026

25 & 26 March

Garden Court Hotel, Kitwe, Zambia zimeczambia.com

ZIMEC remains dedicated to providing the audience with the latest information on developments within the mining and energy sectors, highlighting new opportunities and providing a platform for public and private sector players to network. The 13th edition will be held under the theme: “Promoting responsible investment and partnerships to sustainably grow Zambia’s Mining and Energy sectors”.

Congress

14 to 17 April

DoubleTree by Hilton Cape Town, South Africa

www.fpsonetwork.com/events-fpsoafrica-congress

Organised by the FPSO Network—the world’s longest established community for floating production systems— this congress is the continent’s most influential gathering dedicated to floating production, storage and offloading vessels (FPSOs). It brings together national and international oil companies, FPSO operators, financiers, technology providers among others— creating a platform to shape offshore industry, drive innovation and unlock FPSO opportunities across Africa.

Mozambique Mining and Energy Conference and Exhibition 2026

6 & 7 May

Joaquim Chissano International Conference Centre, Maputo, Mozambique mmec-moz.com

MMEC is the country’s most established premier platform for mining, oil & gas and energy. The theme of the 12th edition is, “Mozambique: Open for Business – Unlocking Natural Resources for Industrialisation, Diversification and Inclusive Growth”. The event aims to deepen collaboration among policymakers, state-owned enterprises and private sector leaders.

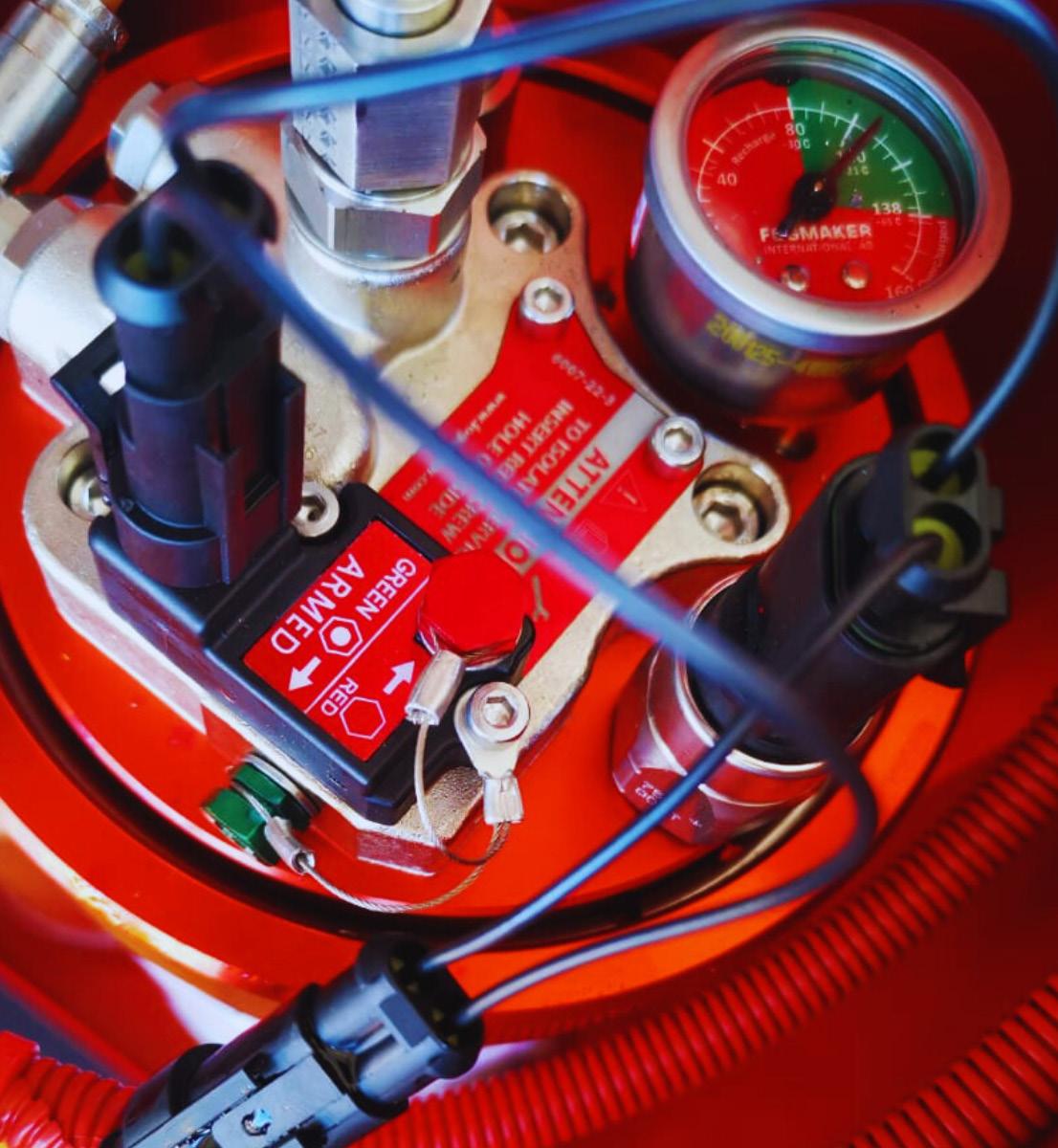

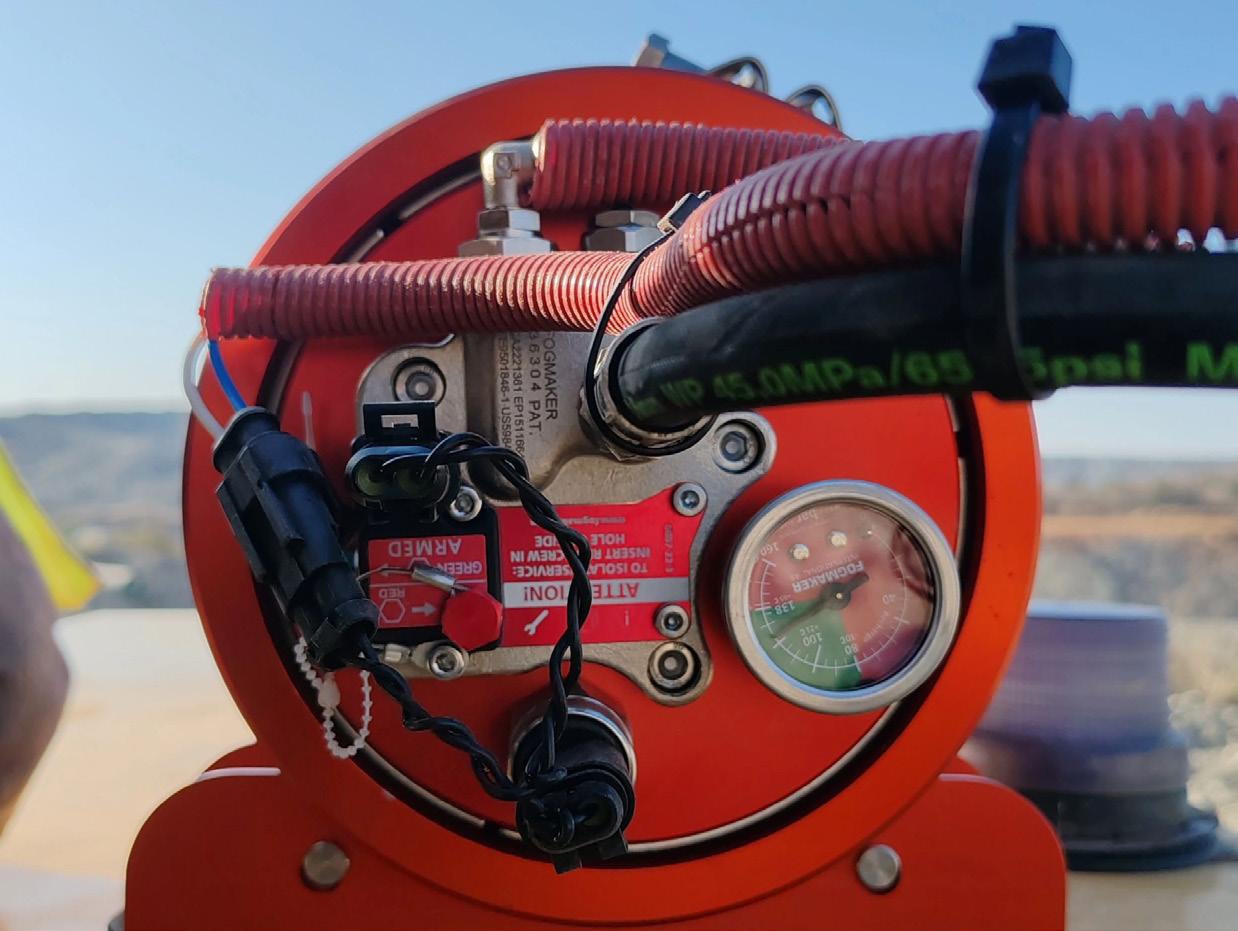

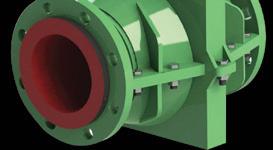

In an industry where risk is inherent, downtime is costly and safety is non-negotiable, Integrated Fire Technology (IFT) has positioned itself as a trusted specialist at the intersection of safety technology, compliance and operational reliability. From mobile mining equipment operating deep underground to fixed fire suppression solutions protecting surface infrastructure, IFT’s offering has evolved into a comprehensive, end-to-end fire protection ecosys-

tem tailored to the realities of African mining. With a growing footprint across southern, central, East and West Africa, IFT has earned its reputation by delivering globally certified fire detection and suppression systems that perform in the harshest conditions. Its product and service offering spans mobile and fixed applications across mining, forestry, harbour operations and heavy industry: sectors where fire incidents can result in catastrophic asset loss, prolonged production stoppages and serious safety consequences.

“At the heart of everything we do is reliability,” says John Russell, managing director of IFT. “Each fire prevention system we design and install must meet the specific requirements of the customer and adhere to required global standards, while delivering the highest possible level of certainty.”

Mining remains a cornerstone of IFT’s business. The company’s deep engagement with the sector reflects both regulatory momentum and heightened awareness around risk management, driven by insurance requirements and high-profile fire incidents.

“It’s one of the industries that adheres to the requirements to put fire suppression on

both their mining equipment and, more recently, on fixed applications,” Russell explains. “That’s been driven by very high-profile fire incidents, as well as increased insistence by insurance companies that high-risk assets be protected.”

The shift is particularly evident in conveyor belt systems, electrical cabinets, transformers, gensets (generator sets) and diesel storage areas: assets that were historically underprotected, but are now recognised as critical fire risks. “Whereas before, global players would have taken this approach from the onset, there’s now been a large drive to retrofit fire suppression on these high-risk items,” says Russell. “The mining segment is, firstly and by large, an important segment for us.”

This dual focus on mobile and fixed fire protection has defined IFT’s evolution over the past several years.

Expanding beyond mobile fire suppression

IFT is widely recognised for its strength in mobile fire suppression—particularly on heavy-duty mining machinery and yellow equipment. However, the company’s strategic expansion into fixed fire suppression applications has significantly broadened its value proposition.

“As we’ve expanded our footprint and our customer base, we’ve focused on fire applications outside of the mobile space, which we term as fixed fire,” Russell notes. “Our expanded product and solution offering over the last two years has been in this area.”

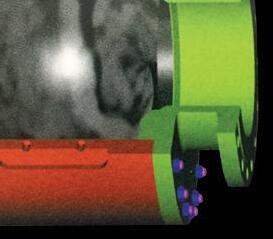

This has included the introduction of aerosol-based solutions such as AF-X for electrical cabinets, as well as gas suppression and fixed-system installations across processing plants and infrastructure. These technologies are designed for early detection and rapid suppression in enclosed or high-risk environments, where conventional methods may be ineffective or environmentally problematic.

One of IFT’s strongest differentiators is its emphasis on certification and compliance. In mining environments, where equipment operates continuously under extreme vibration, dust and temperature fluctuations, certifications are not optional—they are essential.

Fogmaker—IFT’s premium solution for mobile equipment—has secured FM Approvals Standard 5970:2022 for fire suppression systems on heavy-duty mobile equipment, a globally recognised benchmark that tests systems for fire performance, vibration resistance and environmental durability. In addition, the company holds SPCR 199 certification: a Swedish third-party standard for fire suppression in engine compartments of heavy vehicles.

“These certifications confirm Fogmaker’s efficacy and reliability for use in the mining industry,” says Russell. “Fogmaker International in Sweden is very proactive in ensuring systems are designed and certified globally to ensure the system is accepted by mining houses with operations from the Americas to Australia.”

For mining houses and insurers alike, this provides confidence that installed systems will perform as intended, even under the most demanding operating conditions. “These standards are a key component for customers

and end users, who have found comfort in the fact that our systems meet these stringent global requirements,” Russell adds.

As global regulations tighten around environmentally harmful fire suppression chemicals, Fogmaker and IFT have taken a proactive stance on sustainability. The fire industry has historically relied on fluorinated compounds (PFAS, see sidebar), particularly in foams and suppressants—substances now facing bans in multiple jurisdictions.

“So as an environmentally conscious organisation, we have introduced our ECO 1 suppressant into the market last year,” sales manager Dave Coates explains. “The new suppressant has been tested and certified to meet the stringent requirements in the industry.”

Coates notes the transition is already well underway. “Integrated Fire Technology has been rolling out Fogmaker’s new environmentally friendly suppressant, ECO 1, from early 2025. This suppressant is 100% fluorine-free (PFAS-free). All new Fogmaker installations are pre-charged with ECO 1, and there is a retrofit programme underway for existing customers.”

For mining companies under increasing ESG (environmental, social & governance) scrutiny, this shift offers both compliance and reputational benefits.

Regional growth and on-the-ground suppor t

IFT’s expansion strategy is firmly rooted in proximity to customers. In 2017, IFT’s Zambian company was established and the office opened in Solwezi in the North-Western Province of the country. This office supports the growing customer base operating on Kanshanshi, Kalumbila and Lumwana mines in the area.

“In South Africa, we opened branch offices in Steelpoort and Durban during 2025 – and with our expan-

sion in the Rustenburg and Brits area, we intend to open branches there this year to support our key customers in these critical areas,” Russell says.

This expansion aligns closely with Africa’s continued investment in energy transition minerals such as copper, nickel, cobalt and lithium: commodities that are driving new mine developments across the continent.

Durban and the forestry legacy

Regional manager Shantelle Alberts highlights IFT’s growing KwaZulu-Natal operations, anchored by the new Durban branch established at the end of 2025.

“For over 10 years, we’ve had a strong footprint in the forestry sector across KwaZulu-Natal, the Western Cape and the Eastern Cape,” she says. “We are now expanding our offering with a key focus on strengthening our fixed fire suppression systems.”

The expansion includes team growth to ensure fast response times and dedicated local support—a critical factor in high-risk industries.

As battery energy storage systems become more common across mining and industrial sites, IFT is responding with specialised solutions for lithium-ion fire risks.

“Lithium-ion battery fire risk stems from their high energy density and flammable electrolytes, leading to thermal runaway,” notes Coates. “This can cause toxic gas release, overheating and potential explosions.”

IFT’s aerosol-based suppression systems manufactured by AF-X offer an effective alternative. “They are completely non-toxic, safe for humans and do not reduce oxygen levels during deployment,” Coates explains. “Neither do they require room integrity testing, resulting in a lower total cost of ownership.”

In a move that underscores its systems-based thinking, IFT has recently added automated lubrication solutions to its portfolio through a partnership with SKF Lincoln.

“Integrated Fire Technology has commenced supply and installation of automatic lubrication systems for all types of mobile machinery,” Coates says. “Automated greasing delivers reduced wear and tear, fewer unplanned breakdowns, and increased operational safety.”

As global regulations tighten around environmentally harmful fire suppression chemicals, IFT has taken a proactive stance on sustainability.

The strategy is to install lubrication systems alongside fire suppression, sharing components to lower total cost of ownership while enhancing reliability.

Engineering confidence into the future

As mining operations become larger, more mechanised and more scrutinised, the role of fire protection continues to evolve. For IFT, the future lies in integrated, certified and environmentally responsible solutions that protect people, assets and productivity.

“We’re protecting machines worth millions of rands and ensuring limited downtime for these assets,” Russell concludes. “That’s what ultimately matters to our customers.”

By combining global technology with local expertise and African reach, Integrated Fire Technology is not only responding to risk—it is redefining how fire protection is engineered into modern mining operations.

For further information, visit ift.africa

Matthew van Schalkwyk

As global legislation tightens around fluorinated compounds used in fire suppression, Integrated Fire Technology has taken a proactive lead with the rollout of ECO 1, a next-generation environmentally responsible suppressant.

Why ECO 1 matters:

• 100% fluorine-free (PFAS-free).

• Fully certified to international mining standards.

• Reduced environmental and longterm liability risk.

• Supplied as standard on all new Fogmaker installations.

• Retrofit programme underway for existing customers.

PFAS (per- and polyfluoroalkyl substances) are synthetic chemicals commonly used in firefighting foams and industrial applications. Known as ‘forever chemicals’, they do not break down in the environment, can contaminate water sources and pose long-term environmental and health risks—prompting global moves toward PFAS-free fire suppression alternatives

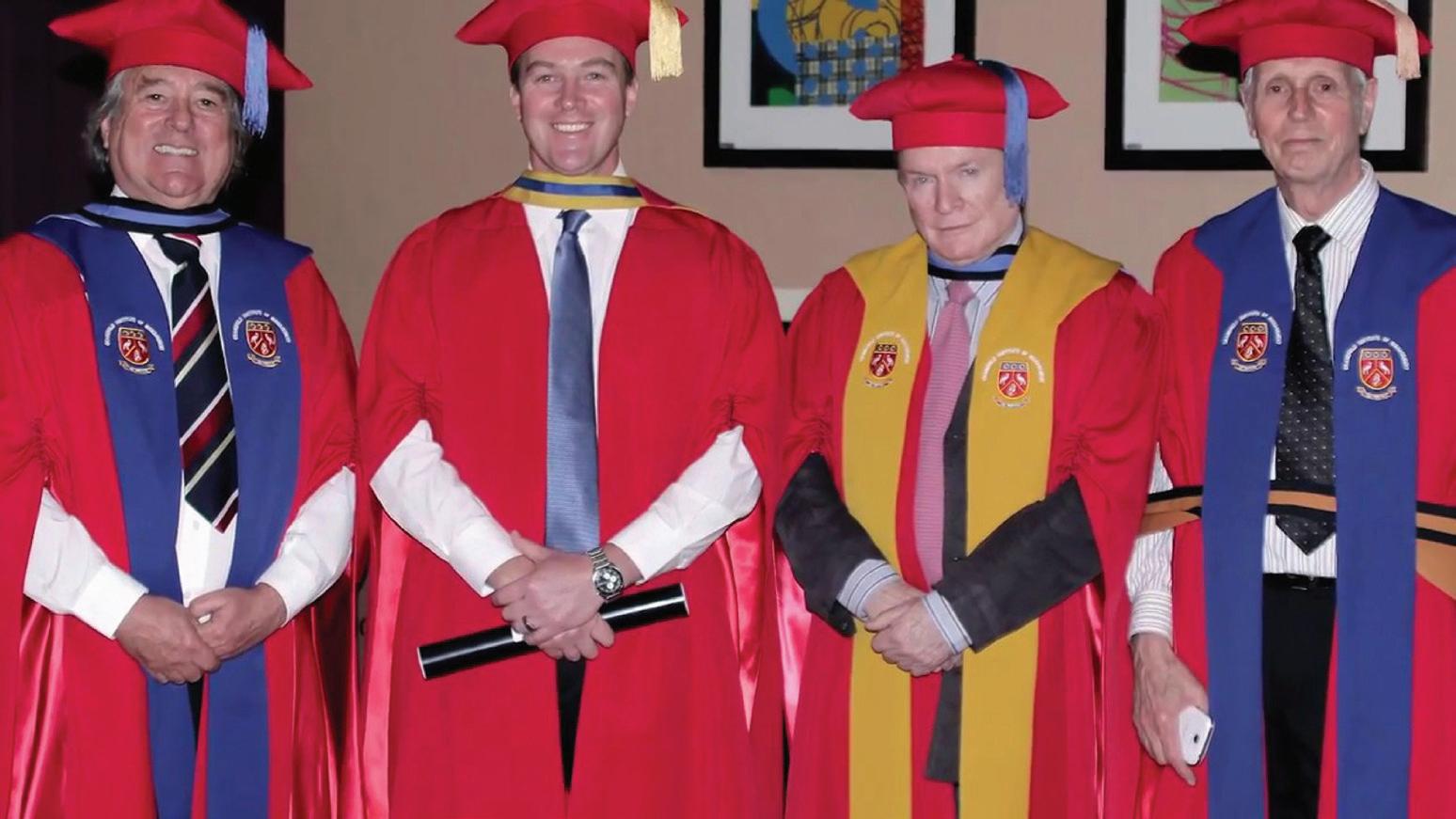

As the Fourth Industrial Revolution (Industry 4.0) reshapes southern Africa’s mining sector, Cranefield College—led by pioneering academic and engineer Professor Pieter Steyn—is preparing a new generation of leaders capable of driving organisational transformation, digital integration and sustainable competitiveness across the region.

A LEADERSHIP INSTITUTION BUILT FOR THE NEW INDUSTRIAL ERA

Southern Africa’s mining industry stands on the brink of an economic reordering. From the boom in critical minerals to rising ESG (environmental, social & governance) expectations and the pressures of decarbonisation, mining companies must navigate unprecedented technological and organisational change. Many of the constraints facing the sector—declining ore grades, complex stakeholder environments, infrastructure bottlenecks and skills shortages—are compounded by rapid digitalisation driven by Industry 4.0.

Two decades before these pressures intensified, Cranefield College had already begun developing an academic model that fused leadership, value chain management, project and programme governance, organisational behaviour and emerging technologies. Founded in 1998 by Prof. Steyn, Cranefield positioned itself early as a specialist institution dedicated to improving leadership, management and governance excellence across the private and public sectors. Its approach has centred on equipping working professionals— many of them engineers, project managers and executives—with the ability to immediately apply new learning in their organisational contexts.

From the outset, Prof. Steyn emphasised that education must be job-relevant. Employers, he argued, invest in skills development only when their

staff are able to translate classroom principles into measurable productivity and performance improvement. Cranefield has therefore structured its programmes to ensure practical application is embedded in every lecture, assignment and case analysis.

To understand Cranefield College’s trajectory, one must look to its founder. Prof. Steyn is not only a veteran academic but also a registered professional engineer with a long record in senior consulting and public sector transformation work. His early experience includes major infrastructure projects such as the First National Bank and Standard Bank head offices, Mandela Square and multiple commercial developments across South Africa, and later, his leadership roles in government transformation programmes.

He was also one of the first academics in South Africa to pioneer project management as a postgraduate university subject in the late 1970s. Over the years, he has served on global research bodies such as the International Project Management Association, contributed to international operations management handbooks, and published extensively in leading journals. His longstanding network of academic collaborators—from Europe to India, the United Kingdom, the United States and the Middle East—forms the intellectual backbone of Cranefield’s internationally benchmarked curriculum.

Practical application is embedded in every lecture, assignment and case analysis

This global academic footprint is not merely symbolic. Quarterly knowledge exchanges with international partners ensure Cranefield’s programmes remain responsive to shifts in management science, digital transformation and organisational design. The college’s annual Knowledge Management Festival, now in its 22nd year, brings together global academics, industry leaders, alumni and postgraduate researchers to test new ideas and present research aligned with Industry 4.0 realities. Cranefield students and alumni attend these events free of charge, ensuring lifelong learning beyond formal qualifications.

MINING LEADERSHIP THROUGH INTEGRATED, DIGITAL-AGE

Mining houses across South Africa, Namibia, Botswana, Zambia and Zimbabwe are wrestling with systemic constraints that go far beyond the technical domain. Reports such as PwC’s SA Mine 2025 (tinyurl.com/3hwcp6uk) and BDO’s Annual Mining Report 2025 (tinyurl.com/2t3y8698) outline the industry’s pressing organisational weaknesses: ranging from siloed structures and ageing assets to supply chain disruptions and misaligned stakeholder management. Many mines are still managed through vertical hierarchies unsuited to the digital era, with fragmented operational departments and limited cross-functional collaboration.

Cranefield addresses these challenges by teaching leaders how to design and manage Industry 4.0 virtual dynamic learning organisations (VDLOs): structures built around agile, horizontal value chains rather than outdated silos. The concept is grounded in the understanding that competitiveness

in the Fourth Industrial Revolution no longer depends on optimising individual functions, but on integrating entire organisational ecosystems, including suppliers, communities, logistics partners and regulators.

Cranefield’s VDLO framework is supported by the college’s Balanced Scorecard–Programme Management (BS-PM) system, which trains professionals to oversee interconnected processes, manage transformation portfolios and embed continuous improvement. For mining organisations transitioning into digital, data-rich operations—whether through automation, advanced analytics, robotics or remote operations—this approach provides a powerful foundation for organisational redesign.

FROM CLASSROOM TO MINE SITE: PRACTICAL LEARNING THAT DELIVERS IMMEDIATE IMPACT

The college’s teaching method is as modern as the concepts it teaches. Cranefield uses a technology-enhanced distance learning model designed around the needs of working professionals. Live virtual classes are held once every three weeks, with recordings available for later review. Case studies, group discussions and problem-solving sessions allow geographically dispersed students—from Johannesburg to Windhoek to Perth—to apply concepts directly to their work environments.

Cranefield’s learning platforms, including Blackboard Learn and Collaborate, enable interactive lectures, seamless access to course material, and paperless assignment submission.

Importantly, students typically view their studies not as an academic detour but as an extension of their professional roles. Steyn notes that many employers sponsor employees precisely because the three-week lecture cycle and applied learning model minimise downtime while maximising return on learning investment.

The proof of this approach is visible in the career progression of Cranefield alumni. Many now hold senior positions in mining, government, financial services and multinational engineering environments. One is a member of South Africa’s Government of National Unity Cabinet. Another, Dr Martin Tjipita—now an ex -

CRANEFIELD COLLEGE

ecutive at Rössing Uranium in Namibia—completed PhD research aligned with Cranefield’s Industry 4.0 methodologies, identifying systemic gaps in uranium mine asset lifecycle management and offering digitally driven solutions that have shaped ongoing transformation efforts at mine level.

LEADERSHIP: THE CORE OF CRANEFIELD’S RELEVANCE TO MINING

What sets Cranefield apart is its holistic view of organisational performance. Mining is an inherently complex value chain: Exploration, project development, operations, logistics, marketing, community relations and environmental stewardship all intersect. Failures at any point— whether delayed capital projects, poor stakeholder engagement, procurement inefficiencies or order fulfilment breakdowns—can undermine competitiveness.

Cranefield’s curriculum reflects the interconnected nature of these processes. Rather than treating project management, supply chains, digital transformation and leadership as isolated disciplines, the college teaches them as interdependent components of an integrated organisational system. This philosophy aligns closely with the structural and operational reforms urgently needed across Africa’s mining sector, particularly in environments where regulatory pressure, infrastructure challenges and ESG

Cranefield has structured its programmes to ensure practical application is embedded in every lecture, assignment and case analysis. “

expectations are tightening simultaneously.

Mining executives across the region increasingly identify infrastructural asset management as a critical capability gap. Ageing equipment fleets, electricity instability, water scarcity, illegal mining impacts and global supply chain tensions have placed immense strain on asset reliability and operational continuity. Companies are also under pressure to improve environmental compliance, reduce carbon emissions and strengthen their ESG reporting frameworks.

Cranefield’s Infrastructural Asset Management module (see sidebar), also offered as a CPD short course, addresses these challenges directly. The module aligns with ISO 55000 and teaches asset lifecycle strategy, risk-based decision-making, predictive maintenance, information management systems and cross-functional logistics co-ordination. Students learn to evaluate the economic, envi -

ronmental and human implications of asset decisions: skills that translate immediately into improved safety, reduced downtime and enhanced ESG performance at mine sites.

With an average student age of 38, Cranefield’s programmes appeal strongly to mid-career professionals seeking to advance into senior management roles. These learners are often production managers, project leads, engineers, supply chain specialists or supervisors ready to move into organisational leadership. For mining employers, sponsoring such staff is a strategic investment: Cranefield-trained leaders are taught to think systemically, collaborate across functions and design transformation initiatives grounded in real organisational data. Whether students choose a postgraduate diploma, the MCom or a CPD-certified short course, the emphasis remains on building competence that is immediately deployable within their work environments.

The principal reflects on leadership, Industry 4.0 and Cranefield’s impact on the mining industry:

You’ve spent decades shaping leadership and management education. What motivated you to establish Cranefield College?

Steyn: When I founded Cranefield in 1998, industry after industry—especially engineering and mining—was struggling with leadership and organisational challenges that traditional academic programmes weren’t addressing. Companies needed practical, value chain–oriented management education. Our mission has always been to bridge that gap by providing qualifications that deliver immediate workplace impact.

Cranefield is known for its international collaborations. Why is this so important?

Steyn: Leadership and programme management are global disciplines. Through partnerships with institutions and academics in Europe, India,

the UK and the US, we continuously benchmark our programmes internationally. This global engagement enriches our content and ensures our graduates can operate confidently across borders.

What do mining companies misunderstand most about Industry 4.0?

Steyn: Many still view Industry 4.0 as a technological add-on—automation, artificial intelligence, robotics—rather than an organisational transformation. The real challenge is redesigning structures and processes to allow these technologies to deliver value. Without leadership transformation, digital transformation stalls. That’s where Cranefield’s VDLO and programme management systems become essential.

What keeps your academic work exciting?

Steyn: Seeing graduates— whether in mining houses, government or multinationals—use Cranefield’s teachings to transform organisations. That, and the continuous innovation that comes from collaborating with global academic partners.

Infrastructural Asset Management (NQF 8)

Mining operations depend on asset reliability, lifecycle optimisation and predictive maintenance. This module provides a comprehensive grounding in ISO 55000–aligned asset strategy, information systems, risk management and decision frameworks. It is particularly relevant to mines dealing with ageing equipment, energy instability, safety compliance and ESG expectations. (Also offered as a CPD short course.)

Digital Transformation Management (NQF 9)

Focused on Industry 4.0 technologies and organisational change, this module teaches leaders how to integrate digital systems—into mine value chains. It emphasises structural redesign, leadership behaviour and cross-functional collaboration needed to achieve digital maturity.

Managing Virtual Dynamic Learning Organisations (NQF 9)

Mining operations often struggle with silos and fragmented communication. This module provides a framework for designing agile, horizontal, collaborative organisations where information flows freely and teams operate as integrated networks rather than isolated departments. The VDLO approach is central to Cranefield’s leadership philosophy.

Strategic Manufacturing Management (NQF 8)

For mines engaged in processing and beneficiation, this module strengthens understanding of production flow, system efficiency, quality management and operational optimisation. It is especially valuable for organisations seeking to modernise processing plants or transition to predictive and data-driven operational control.

Leadership for the mines of the future

As southern Africa’s mining industry navigates rapid technological shifts, rising ESG expectations and deep organisational complexity, the need for agile, systems-thinking leadership has never been greater. Cranefield College’s approach—rooted in value chain integration, digital readiness and transformational leadership—offers exactly the kind of capability uplift the sector now requires.

Under Prof. Pieter Steyn’s guidance, the institution continues to shape mining leaders who can bridge silos, drive innovation and build learning cultures able to withstand the pressures of the Fourth Industrial Revolution.

In his own words, a reminder that transformation is no longer optional but essential: “In today’s economic environment, organisations that fail to move away from bureaucratic practices toward a learning culture, strongly supported by transformational leaders, will not survive.”

For further information, visit www.cranefield.ac.za.

From the outset, Prof. Steyn emphasised that education must be jobrelevant

Leader in manufacturing of respiratory and filtering products

Hazmat Protective Systems (Hazmat), a subsidiary of Armscor under the leadership of Advocate Solomzi Mbada, is a major manufacturer and supplier of purpose-designed quality respiratory and filtering products to the commercial and defence industries.

Activated carbon is impregnated in Hazmat's purpose-designed advanced carbon impregnation plant for use in a comprehensive range of commercial and military respirator filter canisters and cartridges. Hazmat is one of only a few companies capable of impregnating activated carbon in respiratory and filtering products, and is a sole manufacturer of canisters in South Africa.

With a 30 year history of excellence, Hazmat is one of only a few companies capable of impregnating activated carbon for use in their comprehensive range of commercial and military respirator filter canisters and cartridges. As an ISO 9001:2015 certified facility, Hazmat is customer-centric, with processes in place to ensure that clients consistently receive high quality safe products at competitive prices.

Hazmat utilises in-house testing facilities and internal technical support from Protechnik Laboratories (an Armscor subsidiary). All canister and cartridge batches are compliance tested on site against the applicable South African Bureau of Standards (SABS) respiratory specifications.

Hazmat offers a wide range of services to various industries, including mining, pharmaceutical and health services, agriculture, pulp and paper, textiles, beverages, engineering; and chemical, including petrochemical commodities, pesticide chemicals, organic/inorganic chemicals, explosives, paint adhesives, sealants and cleaning chemicals, amongst others.

Hazmat’s product range consists of the following cat egories:

• Full Face Mask Respirators

• Double and single half mask

• Respirator filter canisters

• Respirator filter cartridges

From critical minerals and green energy integration to new regulatory regimes and logistics upgrades, 2026 marks a decisive turning point for Africa’s mining future

Africa enters 2026 with unprecedented strategic relevance in the global minerals landscape. As demand for copper, cobalt, lithium, manganese, platinum group metals (PGMs) and graphite accelerates under the clean energy transition, the continent is rapidly shifting from a repository of raw materials to an emerging hub for integrated value chains, green industrialisation and energy-secure mining.

The African Special Mining Report 2025 (by Energy Capital & Power and global accounting, audit and advisory network Moore Global) outlines a sector undergoing profound reinvention: shaped by geopolitical realignments, ESG-linked investment, new regulatory architectures and the race to build resilient mineral supply corridors. Together, these forces position 2026 as a pivotal year for African mining.

1. Critical minerals: Africa moves up the battery value chain

Africa’s mineral endowment remains unmatched: 30% of the world’s known reserves and an outsized share of the minerals essential for electric vehicle batteries, grid technologies and clean-tech manufacturing.

Countries such as the Democratic Republic of the Congo (70% of global cobalt supply), Zimbabwe (lithium), South Africa (PGMs), Gabon (manganese) and Mozambique (graphite) are

attracting intensified attention from original equipment manufacturers and governments seeking to diversify away from China’s dominance in refining and processing.

Offtake agreements signed in 2023–25—including Glencore-Premier African Minerals (Zimbabwe), Marula-Fujax (South Africa) and Black Rock Mining’s Tanzanian graphite supply—signal aggressive positioning by buyers ahead of looming European Union and United States supply chain regulations. The report emphasises that these deals increasingly demand beneficiation, logistics investment and transparent supply chains, signalling that African countries are gaining leverage in negotiations.

By 2026, the continent’s competitive edge will lie not in extraction alone but in localisation. Gigafactory plans in Morocco, cobalt refining in Zambia and battery precursor initiatives under the DRC–Zambia–US partnership reflect a decisive shift toward industrialisation. If scaled, such downstream hubs could capture 12% of global mineral revenues and significantly expand gross domestic product.

2. Copper’s resurgence redefines the Copperbelt

Copper demand is projected to grow more than 40% by 2040, yet supply bottlenecks outside Africa have positioned Zambia and the DRC as cen-

tral to global energy system build-out. China retains first-mover advantage through multi-decade offtake agreements and integrated supply chains, but Western governments are now competing aggressively through new infrastructure investment and security partnerships.

The Lobito Corridor—upgraded and re-concessioned to a US/EU–backed consortium—is expected to be transformative in 2026, reducing transit times by over 60% and offering the first credible Atlantic export alternative to China-dominated routes. This infrastructure shift, combined with high-grade deposits at Kamoa-Kakula and new developments such as Zambia’s Mingomba project, positions the

The report positions ESG not as compliance but as a strategic value driver reshaping investment flows.

Copperbelt for continued production growth.

For 2026, the key trend will be convergence: rising Chinese consolidation on one side, and Western-backed transparent supply chains on the other—pushing African governments to strengthen governance, contract stability and local participation.

3. Logistics corridors: The continent’s make-or-break constraint

While mineral demand surges, logistics remains Africa’s most persistent bottleneck. The report highlights

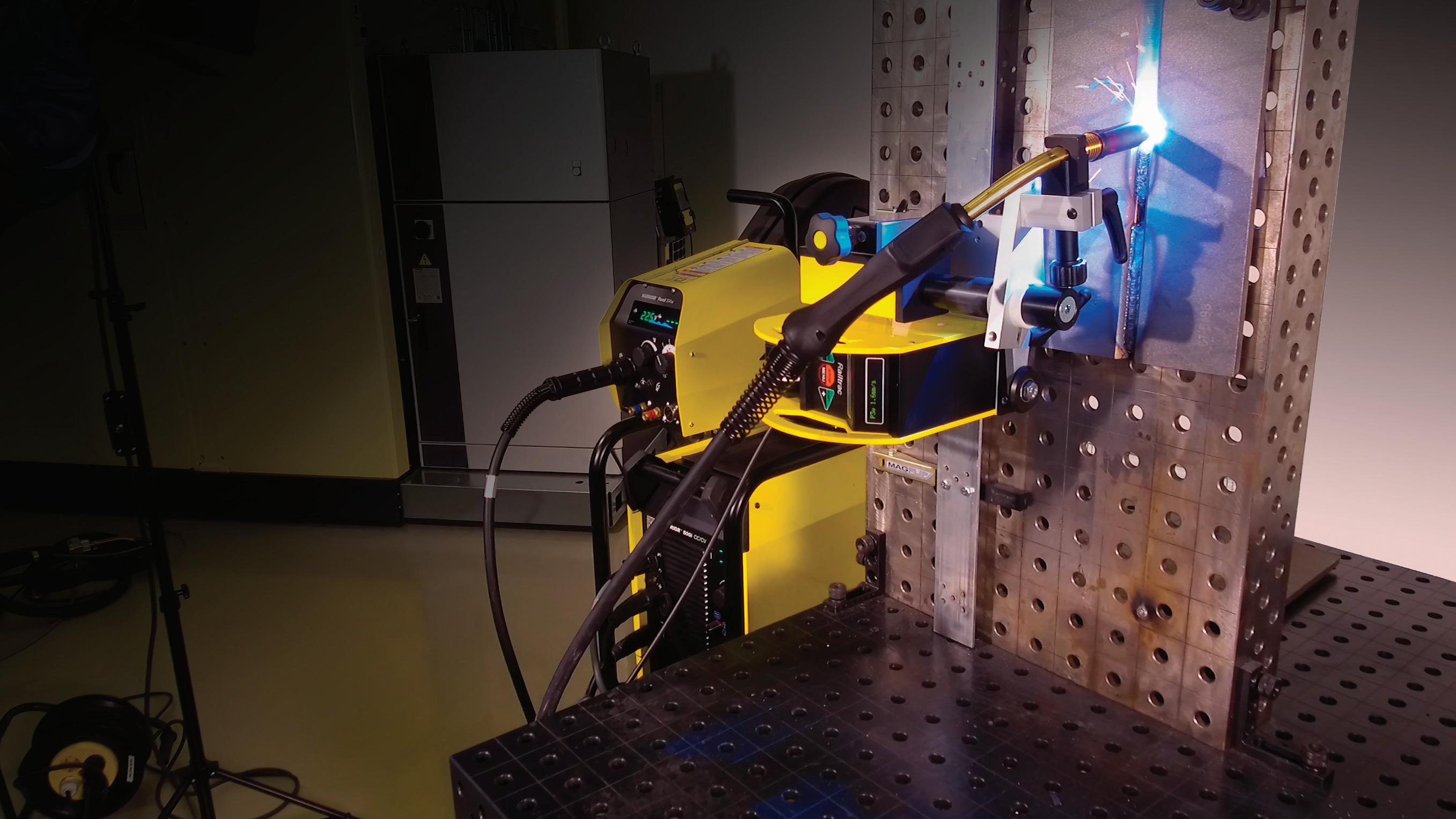

Trusted technology. Proven performance. Africa-wide support.

CONTACT US

Michel Harel

Export Sales Lead (External)

WhatsApp / Mobile: +27 82 744 8774

michel.harel@esabsa.co.za

• Full and comprehensive welding and cutting solutions

• Gas equipment and accessories

• Guaranteed availability of wear parts and spare parts for all equipment and accessories

• echnical support for all welding automation solutions

• Project-specific application solutions tailored to customer needs

Kegan Maduraimuthu

Export CSC (Head Office)

WhatsApp / Mobile: +27 72 241 2483

kegan.maduraimuthu@esabsa.co.za

• Technical support for equipment setup post-purchase (Available across Sub-Saharan Africa)

• Ongoing technical support and welder training

• (Available across Sub-Saharan Africa)

• Welding Procedure Specification (WPS) write-up and welder qualification

• Facilitation of welder qualification training in:

For every process and application:

• Stick (MMA)

• MIG / TIG

• Gouging

• Multi-Process Systems

• Automation Solutions

• Engine Drives

• Laser Welding Welding Solutions

Cutting Solutions

• Gas Cutting

• Plasma Cutting

• Handheld & Automated Systems

Personal Protective Equipment (PPE)

• Welding-specific PPE

• Quality and safety approved

A comprehensive network of authorised ESAB distributors and resellers, supported by ESAB South Africa (Pty) Ltd, operating in:

Botswana | Eswatini | DR Congo | Kenya | Mozambique | Namibia | Tanzania | Zambia | Zimbabwe

chronic congestion, outdated rail networks, customs delays and fragmented infrastructure as major impediments to competitiveness. Strategic corridors—Lobito, North-South, Central, Beira/Nacala and the Trans-Sahelian—require accelerated investment to meet 2026 export pressures.

For mining companies, reliability is becoming a core ESG (environmental, social & governance) and commercial metric. Investors no longer consider logistics peripheral; in 2026, a mine’s viability will increasingly hinge on corridor integration, port efficiency and resilience to climate and security risks.

4. ESG and green mining become core to profitability

The report positions ESG not as compliance but as a strategic value driver reshaping investment flows. Private equity is returning to African mining—but with strict ESG conditions, a preference for critical minerals and increasing use of green bonds, carbon-linked financing and blended capital.

A continental shift toward renewable-powered mining is under way. Solar, wind and hydro projects across Mali, the DRC, Zambia, Morocco and South Africa are cutting fuel reliance, lowering operating costs and enabling mines to meet global emissions standards. Examples include B2Gold’s 52MW solar plant at Fekola, First Quantum’s 430MW renewables project in Zambia, and Tronox’s 400MW programme in South Africa.

Meanwhile, carbon markets are emerging as a high-value frontier, with methane abatement, reforestation and renewable energy offsets

enabling up to $6 billion–$9 billion in potential annual revenue for the sector. Yet, integrity concerns and community share deficits remain significant risks. By 2026, transparency and third-party verification will be non-negotiable for credit-generating mines.

5. Policy shifts: From licensing reform to resource sovereignty

African governments are entering a new regulatory era, streamlining licensing systems while pushing harder for local value capture. Zambia’s Integrated Mining Information System, Angola’s Digital Cadastre and Rwanda’s Inkomane Digital platform exemplify a drive toward transparency to attract investment in 2026.

Simultaneously, beneficiation mandates are expanding across Zimbabwe, Namibia and the DRC. The trend is not outright nationalisation, but recalibrated sovereignty—with rising state equity, stricter export controls and stronger community expectations. Contract stability remains largely intact, but investors must adjust models to incorporate downstream infrastructure, shared value mechanisms and political risk insurance.

6. The capital crunch for juniors

Early-stage exploration companies face the harshest conditions entering 2026. Global risk aversion, geopolitical uncertainty and tightening financing flows have pushed juniors toward joint ventures with majors, development finance institution–backed blended finance, and alternative capital models.

This consolidation will likely con-

tinue, favouring projects aligned with critical minerals, transparent governance and ESG-ready operational plans.

Conclusion: 2026 as a defining year

Africa’s mining sector stands at a rare inflection point. In 2026, success will hinge on three imperatives: logistics modernisation; ESG-centred value creation; and policy environments that balance investor certainty with national development goals.

The continent has the resources, the geopolitical relevance and growing industrial ambition—and with co-ordinated strategy, it can shift from global supplier to global architect of mineral value chains.

The African Special Mining Report 2025 can be downloaded at tinyurl. com/24984mex

By 2026, the continent’s competitive edge will lie not in extraction alone but in localisation.

How geopolitics, technology, workforce shifts and ESG pressures are redefining competitiveness across the continent’s mineral sector

Together, these forces are not simply influencing strategy; they are reshaping the economics of mining itself

Africa’s mining industry stands at the centre of a profound realignment of global economic, geopolitical and sustainability priorities. As the African Mining Trends Report 2025 highlights, mining companies across the continent are operating in a landscape defined by uncertainty, competition for critical minerals, supply chain fragmentation, rising ESG (environmental, social & governance) scrutiny and rapidly evolving expectations of leadership and workforce capability.

Together, these forces are not simply influencing strategy; they are reshaping the economics of mining itself, determining where capital flows, how value is created and what it takes to remain competitive in a high-risk, high-opportunity environment.

1. Geopolitical realignment and the new economics of critical minerals

The first major macrotrend—geopolitical realignment—is fundamentally altering the economics of mineral demand, trade routes and investment flows. As detailed in the report, governments in the United States, European Union and China are accelerating policies to secure cobalt, lithium, copper, graphite and rare earths. Chi-

na’s Belt and Road Initiative (tinyurl. com/48867jr7) alone represents US$21.7 billion in African investment, with up to half aimed at critical minerals projects.

At the same time, African governments are asserting resource nationalism. Guinea’s cancellation of 46 mining licences in 2025 (tinyurl. com/mwz43zrs) underscores the rising emphasis on local beneficition and state oversight. Export bans and domestic processing mandates in Namibia, Zimbabwe and others are shifting project economics by linking mineral extraction to national development priorities.

For miners, these shifts mean that capital planning, trade flows and stakeholder engagement now hinge on navigating volatile regulatory and geopolitical environments. Agility— both in project sequencing and supply chain planning—has become a strategic asset rather than a technical consideration.

2. Safety plateaus and the rising cost of operational risk

Despite technological advancement, safety performance across the global sector has begun to stagnate. International Council on Mining and Metals member companies recorded 36 fatalities in 2023, up from 33 the previous year (tinyurl.com/mr7hvfxd).

The report stresses that the industry continues to see severe incidents among contractors and during periods of organisational change—often exacerbated by unevenly understood or inconsistently applied safety systems.

For mineral producers in Africa, where complex, labour-intensive operations intersect with infrastructure constraints, the economic implications are significant. High-potential incidents disrupt production, increase insurance and compliance costs and can lead to community conflict or regulatory sanctions.

The report argues that reducing serious injury and fatality exposure— through critical control management, contractor integration and leadership visibility—is now a core requirement for cost control and investor confidence.

3. The talent imperative and longterm productivity

A third macrotrend shaping the sector is talent scarcity. As the report outlines, African mining faces acute skills shortages, rising labour costs, digital literacy gaps and an ageing workforce. Contractors—essential to production—remain statistically twice as likely to suffer accidents in African mines.

Economically, these workforce gaps erode productivity, weaken safety performance and increase turnover costs. They also threaten the continent’s competitiveness in a mining world trending toward automation, AI-driven processes and increasingly complex regulatory demands.

Mining companies are now expected to build inclusive, psychologically safe, digitally capable workforces that can adapt to rapid organisational and technological change. Diversity and inclusion are evolving from social goals into economic levers that

strengthen decision-making, innovation and workforce stability.

4. The challenge of operationalising technology at scale Digitalisation continues to hold vast economic promise across the mining value chain: from automation and remote operations to predictive analytics and real-time risk monitoring. But as the report stresses, technology is not the constraint. Organisational readiness is.

Poor integration between digital tools, safety systems and operational governance often results in stalled adoption, inconsistent behaviours and new unintended risks. Without leadership alignment, updated risk controls and large-scale workforce upskilling, even the most advanced digital investments may fail to deliver cost, productivity or safety gains.

For mining houses increasingly pressured to do more with less— particularly in ore bodies with declining grades—digital readiness has become a key determinant of future competitiveness.

5. Structural supply chain disruption and the end of ‘just-in-time’ mining

Mining companies across Africa are experiencing unprecedented supply chain volatility. As the report notes, Red Sea shipping disruptions, export restrictions in Asia and tariff escalations in the US are driving up input costs and destabilising planning cycles. The US tariff of 25% on steel and aluminium, effective March 2025 (tinyurl. com/37dfjeav), has significantly increased equipment costs. Meanwhile, China’s new licensing rules for seven rare earths (tinyurl.com/ ysy79u9r) have disrupted downstream electric vehicle and defence supply chains.

Climate shocks compound these pressures. Drought-related hydropower disruptions in southern Africa and flood-damaged transport routes in Mozambique and Madagascar demonstrate the fragility of African mining infrastructure un-

der climate change.

The economic result is clear: Operational resilience now hinges on supply chain resilience. Inventory strategies, sourcing diversification, logistical redundancy and regional infrastructure partnerships are becoming central components of mining competitiveness.

6. ESG as a determinant of capital access and licence to operate

The sixth and increasingly dominant trend is the shift from ESG compliance to ESG competitiveness. According to the report, more than 80% of institutional investors now consider ESG performance a decisive factor in long-term capital allocation.

Governments are tying permits, incentives and expansion approvals to sustainability outcomes, while communities demand transparent value-sharing and responsible environmental stewardship. At the same time, artisanal and smallscale mining has become a material factor in social licence strategy, particularly where informal mining co-exists with formal concessions.

For mining companies, the economic imperative is to embed ESG into core governance, investment decisions and operational key performance indicators. Those that treat ESG as a parallel reporting exercise risk losing competitiveness, facing permit delays or being ex-

cluded from increasingly stringent global supply chains.

The bottom line

The six macrotrends outlined in the African Mining Trends Report 2025 point to a mining industry undergoing systemic transformation: one in which execution, adaptability and leadership discipline define economic success as much as geology or capital.

Africa’s mining companies must now operate as resilient, integrated systems capable of aligning safety, governance, digital innovation, workforce capability and ESG delivery under volatile conditions. Those that can make this shift will not only secure competitiveness in global markets but position themselves as leaders in the future of sustainable mineral development.

Download the report at tinyurl.com/33vrnhxj

Angola’s Digital Cadastre ushers in a new era of transparent, investor-ready mining regulation

Last year, during the Angola International Mining Conference (AIMC, angolaimc. com) in Luanda, the country’s government unveiled a landmark reform: the Angola Digital Mining Cadastre. More than a technical upgrade, the Cadastre represents a conscious pivot toward transparency, regulatory efficiency and investor-friendliness— signalling that Angola aims to recast itself as a competitive destination for mining investment in the 21st-century global commodities market.

The Angolan Digital Mining Cadastre is a cloud-based platform that consolidates previously disparate and paper-heavy processes into a unified digital system. From licence applications and registrations to demarcation, inspection, geological and spatial data, the Cadastre brings everything onto a single portal managed under the oversight of the Ministry of Mineral Resources, Petroleum & Gas.

The software platform, known as Landfolio eSuite, was developed with partners OceanGeo and Spatial Dimension.

At AIMC 2025—attended by more than 1 000 delegates including government officials, mining operators and foreign investors—the Cadastre was formally launched. In his keynote address, Minister of Mineral Resources, Petroleum & Gas Diamantino Pedro Azevedo described the system as a “landmark step in modernising our mining sector” and vital in “ensuring Angola remains a competitive

player on the global stage.”

According to the published rollout plan, the digital platform integrates not only licensing and permit processes but also traceability and certification mechanisms—a critical consideration especially for export-oriented commodities such as diamonds.

One of the key promises of the new Cadastre is increased transparency. By creating an auditable, public record of all seismic, geological, licensing and compliance data, Angola seeks to reduce the discretionary power historically held by different agencies—a perennial concern for investors and a barrier to timely approvals.

As noted by industry observers in coverage by Mining Review Africa, this move is expected to “unlock Angola’s mining potential” by creating a regulatory framework where rights allocation is predictable, legible and fair.

More efficient regulation equates to reduced processing times. In previous years, mining licences in Angola—especially for exploration permits—were often delayed by layers of bureaucracy, sometimes taking 18 to 36 months to clear. According to proponents of the Cadastre, these timelines could now shrink significantly, with some licences being approved in 6 to 12 months.

In doing so, Angola aligns itself with global best practice, and with international transparency efforts such as those advocated by the Extractive Industries Transparency Initiative.

The timing and ambition of the Digital Mining Cadastre coincide with a broader strategy to diversify Angola’s economy. Historically dependent on oil and diamonds, the country is now actively promoting mining of a wider spectrum of minerals including copper, rare earths, gold, iron ore and more.

Indeed, at AIMC, Angola’s first planned underground copper mine—a

From licence applications and registrations to demarcation, inspection, geological and spatial data, the Cadastre brings everything onto a single portal

partnership between Angolan and Chinese interests—was announced. Industry insiders say this new copper venture, and others under discussion, stand to benefit immediately from the improved regulatory clarity and faster approval cycle the Cadastre promises.

Moreover, by embedding traceability and certification capabilities into the Cadastre, Angola signals its intention to support responsible mining practices, and ultimately to add value locally: for example, through processing, beneficiation and possibly downstream manufacturing of minerals rather than purely raw commodity exports.

This has knock-on benefits for employment, local industrial development and reinvestment into communities and infrastructure, making the Cadastre not only a governance reform but a tool for shared economic development.

Angola signals its intention to support responsible mining practices, and ultimately to add value locally

While the Digital Mining Cadastre holds much promise, its success will depend on several variables. Firstly, the technical infrastructure: Internet connectivity, data security, interoperability of multiple datasets (geological, environmental, compliance) across remote and often under-equipped regions.

Implementation will require training, support and possibly phased deployment to ensure all stakeholders—from large international mining houses to smaller domestic operators—can use the system effectively. Institutional buy-in will be equally critical. Transitioning from long-established paper-based procedures to a digital system may meet resistance within agencies accustomed to legacy workflows. Ensuring transparency in decision-making, and avoiding informal practices slipping back under new guises, will require strong oversight – and perhaps, most of all, a genuine political commitment.

Finally, the system must be built to evolve. As mineral exploration intensifies—and as interest grows in critical minerals like rare earths—the Cadastre needs to integrate environmental impact assessments, community consent tracking and compliance monitoring.

Angola’s commitment to sustainable mining and local content development gives cause for optimism; but it remains to be seen how well these ambitions translate into durable practice.

For mining companies and investors in southern Africa—including neighbours such as South Africa, Namibia, Botswana and others—Angola’s Digital Mining Cadastre sets a potential benchmark. A transparent, efficient regulatory system reduces entry barriers, lowers risk and enables better project planning. For those already operating regionally, Angola now emerges as a more predictable and administratively credible destination for new investments.

For downstream stakeholders— refiners, fabrication plants and value-addition players—the new Cadastre may herald a growing supply of minerals, delivered under transparent and traceable regimes. That

could support regional mineral supply chains beyond borders, boost local beneficiation and potentially encourage co-operative regional infrastructure (transport corridors, energy, beneficiation hubs).

Lastly, from a governance perspective, Angola’s reform could inspire similar digital transformations elsewhere: a shift away from ad hoc concessions and opaque processes, toward systems that support accountability, community interests and longterm sustainable development.

The launch of the Angola Digital Mining Cadastre represents a pivotal moment in Angola’s mining history. Far more than a bureaucratic upgrade, it is a bold bid to reposition the country: not merely as a supplier of raw minerals but as a modern, investment-ready mining hub committed to transparency, sustainability and value addition.

If the platform is implemented with technical rigor, institutional integrity and real stakeholder engagement, it could mark the beginning of a new chapter—not only for Angola but for the broader southern African mining landscape.

Now, the promise is on the table; what remains is disciplined execution and committed follow-through.

Safety-ready vehicles and proactive fleet management for zero-downtime mining.

Mining is precision work. Every vehicle, every movement and every shift has to work in perfect rhythm to keep people safe and production on track. Avis Fleet Solutions provides mine-spec bakkies and heavy-duty vehicles that are maintained, monitored and managed to the highest safety standards. We handle everything from procurement to servicing and replacement, so your teams can focus on the work underground and on site. Visit avisfleet.co.za for details.

Responsible mining in southern Africa: 2025 progress and the road to 2026

Last year, the mining sector in the Southern African Development Community (SADC) operated under an increasingly public spotlight. Governments, financiers and communities are no longer content with output and jobs alone; they demand real, measurable progress on environmental stewardship, social benefit and accountable governance.

In 2025, several of the region’s leading miners moved beyond glossy pledges to tangible programmes: cutting emissions where feasible, expanding community education and livelihoods initiatives, and strengthening disclosure.

At the same time, global commodity shifts—falling prices for some precious metals and rising demand for battery- and grid-related minerals—are reshaping strategic priorities.

FROM COMMITMENTS TO DELIVERY: WHAT CHANGED IN 2025

Across South Africa and the wider SADC region, major producers sharpened their sustainability architecture. Anglo American, Sibanye-Stillwater and Harmony, among others, published fresh reporting and rolled out local projects that show a shift from

professionalisation of social investment. Instead of one-off donations, companies are designing multi-year partnerships that target measurable outcomes: early childhood education, vocational training tied to mine-adjacent supply chains, and small enterprise incubation.

Sibanye’s reported initiatives (school Wi-Fi, teacher training and enterprise support) and Anglo’s “thriving communities” programmes are examples of investments that explicitly aim to increase local employability and diversify local economies beyond mining. These programmes also reflect a pragmatic governance shift: Social investment is being tied to measurable key performance indicators and external stakeholder forums.

That said, civil society watchdogs

compliance to integrated sustainability planning.

Anglo’s 2024/25 reporting cycle reiterated its Sustainable Mining Plan pillars, with a renewed focus on “thriving communities” through health, education and livelihoods programmes, and clear public targets for community impact and biodiversity.

Sibanye-Stillwater’s public materials emphasise a four-pillar sustainability approach (Planet, People, Prosperity, Governance) backed by concrete community inputs: skills training, school upgrades and civic infrastructure projects that purportedly reached hundreds of thousands of beneficiaries in recent years. The company also made operational adjustments in 2025 as it navigated weaker palladium markets and restructuring challenges, highlighting a trend: ESG (environmental, social & governance) programmes are increasingly being designed to be resilient to commodity cycles.

Harmony continued to foreground water management and local development in its sustainability framing, updating its sustainable development framework to link operational water stewardship and community health with long-term social licence to operate. That emphasis on resource

remain sceptical. Activist groups and local constituencies continue to demand stronger evidence that benefits accrue equitably, that land and water rights are protected, and that grievance mechanisms actually resolve disputes rather than papering over conflict. In short, community engagement is maturing—but verification and trust building remain unfinished work.

Technological and managerial measures to reduce environmental footprints gathered pace in 2025. Companies are reporting targeted emissions reductions, more rigorous tailings management practices, and pilots for circular-economy approaches—both

stewardship is consistent across the region: water and biodiversity management moved from peripheral reporting items to central operational considerations in 2025.

There are SADC mining companies outside South Africa that are getting closer to being exemplary in responsible mining. But being exemplary implies consistency at scale, transparent accountability, robust environmental and social safeguards, and resilience to external shocks.

First Quantum Minerals Zambia— through its subsidiaries including Kansanshi and Trident mines—and Vulcan International (operator of the Moatize Coal Mine in Mozambique) are perhaps the closest so far. They have measurable, certified practices, public reporting and relatively mature community engagement.

A recurring theme in 2025 was the

to reduce waste and to retain more value locally.

Regional policy signals also intensified: SADC’s strategic planning documents and a nascent regional circular economy strategy are nudging miners and policymakers toward integrated resource management that supports socio-economic development while limiting environmental harm. These policy frameworks, when implemented, will provide important leverage for consistent environmental standards across borders.

In 2025, several of the region’s leading miners moved beyond glossy pledges to tangible programmes

2025 saw a stronger appetite for auditability and credible reporting. Leading firms are aligning disclosure with international frameworks, and local regulators are increasingly signalling a willingness to scrutinise environmental licences, labour practices and benefit-sharing arrangements.

That trend matters: Investors and downstream technology firms (which now source battery minerals) require traceability and verified ESG performance as a precondition for contracts and capital. Companies that fail to provide transparent, independently verifiable data risk losing access to premium markets and capital.

Global commodity dynamics in 2025 altered strategic calculations. Prices for some platinum group metals and palladium have remained volatile after 2022 peaks and subsequent corrections, and that pressure affected company profitability and asset valuations (Sibanye’s impairments being a high-profile example).

At the same time, demand for copper, lithium and other battery-relevant minerals continued to climb as the energy transition accelerated, prompting producers to prioritise deposits that feed electrification and renewable technology supply chains. The upshot: Miners are redeploying capital toward critical minerals while using sustainability credentials as a differentiator in a competitive global market.

What should business leaders and policymakers expect in 2026?

1. A sharper split between legacy and transition metals. Expect capital and policy attention to concentrate on copper, lithium and cobalt projects that can be proved up quickly and mined with decent ESG practices. Projects perceived as high-risk on social or environmental grounds will struggle to attract finance.

2. Tighter reporting expectations and conditional capital. Lenders and offtakers will increasingly condition access to capital on credible, audited ESG performance and community-benefit metrics. Firms that can show independent verification will win lower financing costs and better commercial terms.

3. Regional policy co-ordination. SADC’s policy frameworks for sustainable environment management and circularity provide a platform for harmonised standards; 2026 should see more cross-border initiatives (resource corridors, shared water management projects) that reduce regulatory arbitrage and encourage investment flows.

4. Community expectations will harden. Communities will expect long-term economic diversification plans, not only temporary jobs. Companies that co-design enterprise development and education programmes with local stakeholders will have a clearer social licence to operate.

5. Operational resilience to price swings. Given the volatility of some metal prices, miners will continue to rationalise portfolios, divest non-core or underperforming

assets, and prioritise operational efficiencies that reduce costs without undercutting environmental or safety standards. Recent restructuring moves by major players illustrate this necessary realism.

Responsible mining in SADC is no longer a moral addon; it is a commercial imperative. In 2025, leading companies demonstrated that credible ESG practices, when embedded into core strategy, reduce operational, reputational and financing risk—and open doors to critical markets tied to the energy transition.

The challenge for 2026 will be to translate improved reporting and pilot projects into system-wide practice: enforceable community agreements, verified environmental performance, and capital allocation aligned with the global shift toward electrification.

For regional policymakers and industry leaders, the task is clear: Keep raising the bar on transparency and stakeholder inclusion; align incentives so that sustainable, community-oriented projects attract capital; and support cross-border policy frameworks that lower regulatory uncertainty.

Done well, responsible mining will not only preserve ecosystems and livelihoods—it will also unlock the region’s strategic role in a greener global economy.

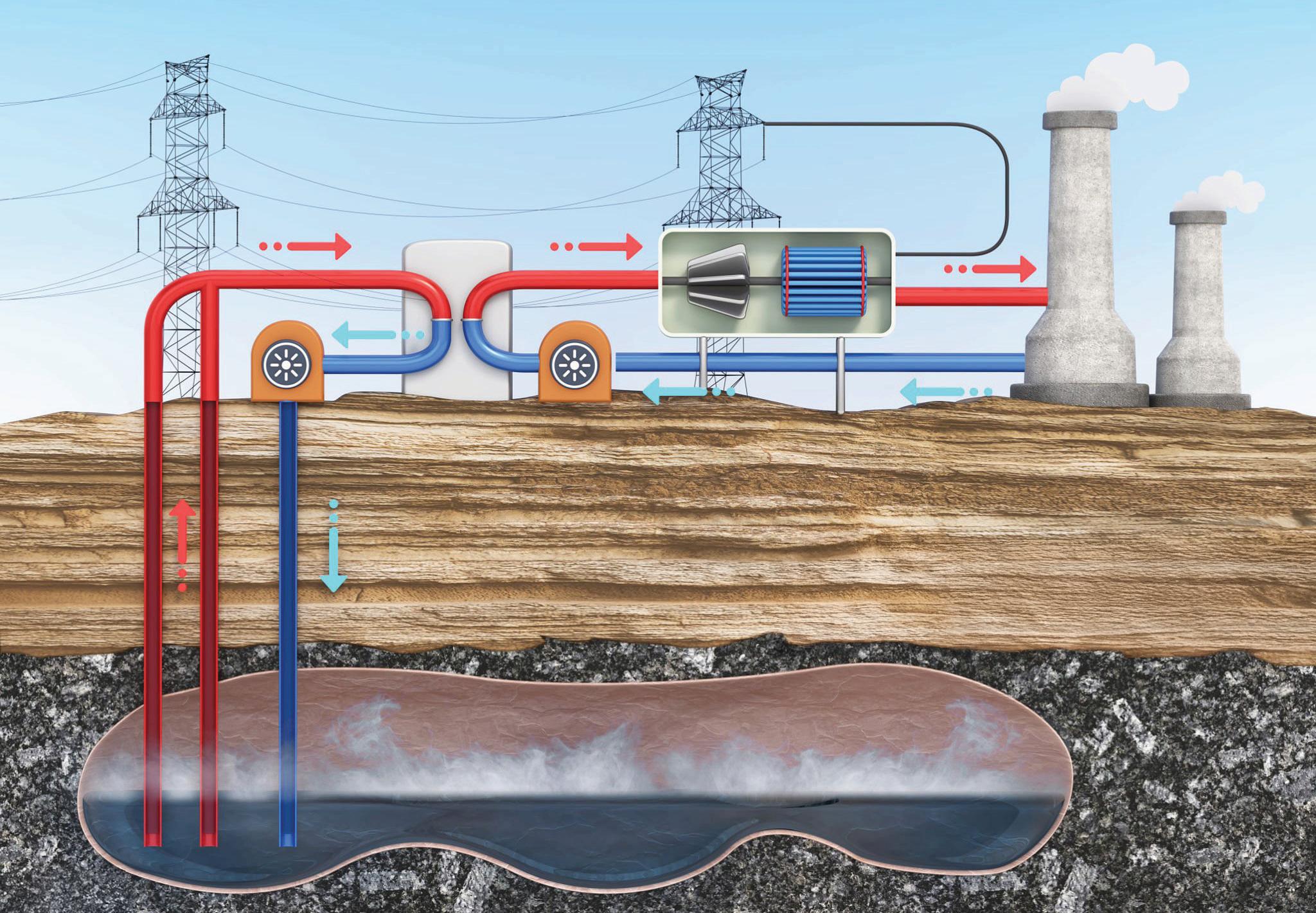

Geothermal energy has huge potential to generate clean power— including from used oil and gas wells

Moones Alamooti

Assistant Professor: Energy and Petroleum Engineering

University of North Dakota

How do places like Africa get what they want without erasing progress toward net zero?

As energy use rises and the planet warms, you might have dreamt of an energy source that works 24/7, rain or shine, quietly powering homes, industries and even entire cities without the ups and downs of solar or wind — and with little contribution to climate change.

The promise of new engineering techniques for geothermal energy—heat from the Earth itself—has attracted rising levels of investment to this reliable, low-emission power source that can provide continuous electricity almost anywhere on the planet. That includes ways to harness geothermal energy from idle or abandoned oil and gas wells.

In the first quarter of 2025, North American geothermal installations attracted US$1.7 billion in public funding, compared with $2 billion for all of 2024, which itself was a significant increase from previous years, according to an industry analysis from consulting firm, Wood Mackenzie (tinyurl.com/3ndpdpuh).

As an exploration geophysicist and energy engineer, I have studied geothermal systems’ resource potential and operational trade-offs firsthand. From the investment and technological advances I am seeing, I believe geothermal energy is poised to become a significant contributor to the energy mix around the world, especially when integrated with oth-

er renewable sources. The International Energy Agency (IEA) estimates that, by 2050, geothermal energy could provide as much as 15% of the world’s electricity needs (tinyurl. com/bpadsxmv).

Geothermal energy taps into heat beneath the Earth’s surface to generate electricity or provide direct heating. Unlike solar or wind, it never stops. It runs around the clock, providing consistent, reliable power with closed-loop water systems and few emissions.

Geothermal is capable of providing significant quantities of energy. Fervo Energy’s Cape Station project in Utah (tinyurl.com/4xjn7t97), the world’s largest geothermal power station under construction, is reportedly on track to deliver 100 megawatts of baseload, carbon-free geothermal power by 2026. That is less than the amount of power generated by the average coal plant in the US, but more than the average natural gas plant produces.

And it is becoming economically competitive. By 2035, according to the IEA, technical advances could mean energy from enhanced geothermal systems could cost as little as $50 per megawatt-hour—a price competitive with other renewable sources (tinyurl.com/48mjcsde).

There are several ways to get energy from deep within the Earth: