Welcome!

2025 has been a fantastic year for Asset TV. We’ve reached new audiences and experienced continued growth, particularly in the U.S. market where we now connect with over 430,000 advisors across wirehouses, broker dealers, and RIAs, as well as asset owners in the institutional channels.

Supporting investment professionals with great content and CE Credits for their continuing education and professional development has always been our mission, helping the industry grow stronger.

The topics sparking the most viewer interest this year have been Private Markets, ETFs, Fixed Income, and insurance solutions, with Annuities proving particularly popular.

Globally, Asset TV serves markets across North America, the UK and Europe, Asia, and South Africa. We’re proud to partner with the global investment community.

Looking ahead to 2026, we’re excited to continue expanding our reach, working with more asset manager partners, and delivering the insights you depend on. We’re especially thrilled to welcome Kristin Myers to our team as ETF Editor in Chief, and look forward to launching a series of new ETF programs.

Thank you for your continued support.

Sincerely,

Neil Jeffery

Logan Capital’s latest visit to the Asset TV NYC Studio distilled the firm’s playbook into four crisp ideas: lead with earnings in largecap growth, stay disciplined with dividend performers, lean into international tailwinds, and keep income portfolios ahead of the curve as the rate cycle evolves.

Stephen Lee

Founding Principal & Treasurer

Founding Principal Stephen Lee underscores how Logan’s growth approach anchors on “earnings leadership” and rigorous macro cross-checks that help frame positioning and risk.

Chris

O’Keefe

Managing Director

Managing Director Chris O’Keefe brings the dividend lens: consistent growers, valuation discipline, and a willingness to let time in the market do the heavy lifting.

CATALYSTS SUPPORTING THE LOGAN INTERNATIONAL STRATEGY

William Fitzpatrick Managing Director

William (“Bill”) Fitzpatrick surveys catalysts across exU.S. markets - policy cycles, currency dynamics, and sector leadership that’s diverging from the U.S.

Stephen Lee Founding Principal & Treasurer

Stephen Lee’s income update ties it all together: stay flexible across duration and credit, and let portfolio construction reflect today’s dispersion rather than yesterday’s regime.

Experts from MassMutual Strategic Distributors discuss demographic shifts transforming the industry, managing retirement risks in the current macroeconomic environment, and potential ways to bolster retirement income.

Daken Vanderburg Chief Investment Officer

MassMutual

Wealth Management

“Historically, shutdowns have mostly been a nonevent economically, and markets have reflected that historical reality. So the markets thus far have largely shrugged this off. We don’t have a strong reason to believe that will change, but we’ll continue to watch both. Of course.”

Joel Liu Head of Advanced Sales MassMutual Strategic Distributors

“A well-funded 401(k) won’t help if a disability happens or a long-term care event happens that wipes out your savings. So, risk management is not optional. It’s foundational.”

Matt O’Brien

Regional Vice President

MassMutual Strategic Distributors

“Variable annuities, especially those with GLWBs or the RetirePay benefit, can significantly enhance retirement income. I mean, there may be clients in your practice that are being underserved in their current investment solutions.”

Briana Zackai

Key Account Manager Annuity Solutions

MassMutual Strategic Distributors

“Women prefer to use and utilize income protection and contractual safety more so than men when it comes to their investment choices, hence the rise in annuities. And a really interesting fact is by 2028, women will control most of the discretionary spending.”

Ericka Spann

Regional Vice President

MassMutual Strategic Distributors

“Advisors have a great opportunity, especially partnering with the age lab and helping clients really envision that complete total picture, not just the risks, but what it may look like throughout that whole retirement journey to rely on a more holistic approach.”

The power of Asset TV to deliver research to a network of more than 430,000 investment professionals in the U.S. allows them to make better informed investment decisions. Viewers from all major wirehouse, broker-dealer, and RIA

firms watch for their investment due-diligence and to benefit from an accredited source of continuing education.

#01

Kent White Thrivent Asset Management

Jeff Schulze ClearBridge Investments #02

Jack Janasiewicz Natixis Investment Managers #03

Brian Hess Natixis Investment Managers #04

Steve Lowe Thrivent Asset Management #05

David Spangler Thrivent Asset Management #06

Ed Coyne Sprott Asset Management #07

Anne Walsh Guggenheim Investments #08

Benedek Vörös S&P Dow Jones Indices #09

Dan Ivascyn PIMCO #10

We explore the latest thought leadership from PIMCO on the trajectory of monetary policy, the outlook for municipal bonds, and attractive opportunities in global fixed income.

Dan Ivascyn

Group CIO

“Our base case thinking is the Fed is increasingly focused on weakness on the employment side, is willing to look through what we expect to be slight to moderate increases in inflation over the short term as tariffs do begin to roll through into consumer prices.”

Dr. Richard Clarida Global Economic Advisor

“They felt that on risk management considerations that they wanted to not only deliver the 25, but also signal an additional 50 basis points of cut.”

David Hammer Portfolio Manager, Municipal Bonds

Sachin Gupta Portfolio Manager

“Global bond markets are about 150 trillion in size. This is the public bond markets. The size outside of U.S. is about a hundred trillion. So by investing internationally, a U.S. based investor gets to triple the opportunity set.”

The best opportunities we see today are to take advantage of that cheapening of the long end in the municipal market, where investors can own an A-rated or AA rated Muni bond somewhere between four and a half and 5% tax free, and expect to earn not just the simple yield, but also some role down in carrier or price appreciation.

Alfred

Murata Portfolio Manager

“So the objective is to try to have less volatility in the low duration income strategy than income strategy. So it’s not just an income strategy with less interest rate risk, it’s also in general trying to have less credit risk.”

We dive into strategies for investors looking to do everything from capitalize on megatrends to manage risk during times of heightened volatility and geopolitical uncertainty.

Aram Babikian Head of Xtrackers Wealth, US Onshore Xtrackers by DWS

“Geopolitical volatility has increased in a tremendous way. And it’s one of those areas where if you ask an investor how are they managing that risk in their portfolio, there are very few ways to do it where you stay 100% invested in something.”

Sonali Pier Portfolio Manager PIMCO

“The starting level of yield remains elevated and a good indicator of potential forward returns. While many fixed income markets have rebounded, significant uncertainty remains as investors grapple with the full economic impact from tariffs, other policy changes and ongoing focus on deficits.”

Mark Carver Managing Director, Global Head of Equity Solutions

“In the U.S. market, non-U.S. equities had $26 billion of positive inflows to non-U.S. equity linked ETFs in June alone. Looking at a report from State Street Investment Management, for example, they know that’s the second best period in history.”

John Love President & CEO USCF Investments

“Turmoil is often good for commodities. And what’s happened this year has had direct effects on commodities, and maybe some secondary effects as well.”

Sarbjit Nahal Portfolio Manager/Analyst Lazard Asset Management

“Think about the biggest changes that you are seeing in your day-to-day lives. What we are trying to do as investors is identify and capture those changes. Everything from semi-conductors through to smart glasses, through to artificial intelligence.”

We share perspectives from S&P Dow Jones Indices on leveraging direct indexing, assessing fixed income performance, understanding sustainability trends, and analyzing market dynamics to inform innovative, customized investment strategies.

Brandon Hass Managing Director and Head of Direct Indexing and Model Portfolios

“Within a direct index, you own the underlying securities, and, so, what you’re able to do is address this concept of scale that we’ve talked about with financial planning and rules-based structures, but also customization.”

Benedek Vörös Director, Index Investment Strategy

“We’ve seen U.S. corporate credit indices outperforming both in the investment grade and the high yield space. And that outperformance over Europe came despite the fact that European credit spreads themselves did better than the U.S. ones.”

Maya Beyhan Global Head of Sustainability, Index Investment Services

Tim Edwards Managing Director and Global Head of Index Investment Strategy

“If you look over the very long term, which party holds the presidency, the Senate, Congress, on average, doesn’t seem to make an enormous amount of difference to the overall market. However, policy, political whims do impact different industries and sectors very differently.”

“What we have noticed is that there has been a shift in the narrative in the recent years toward energy transitions. A lot of conversations are revolving around that topic, and what we also see is that because it’s such a complex topic, there will likely not be a single solution.”

Mike Willis CEO & Co-Founder Cyber Hornet ETFs

“The new digital asset class, it’s a high-risk, highreturn potential category…. So what we’ve done is we’ve taken the S&P 500, mixed it in with the digital asset to buffer that volatility, and that way we believe it can be made available to a larger investor base.”

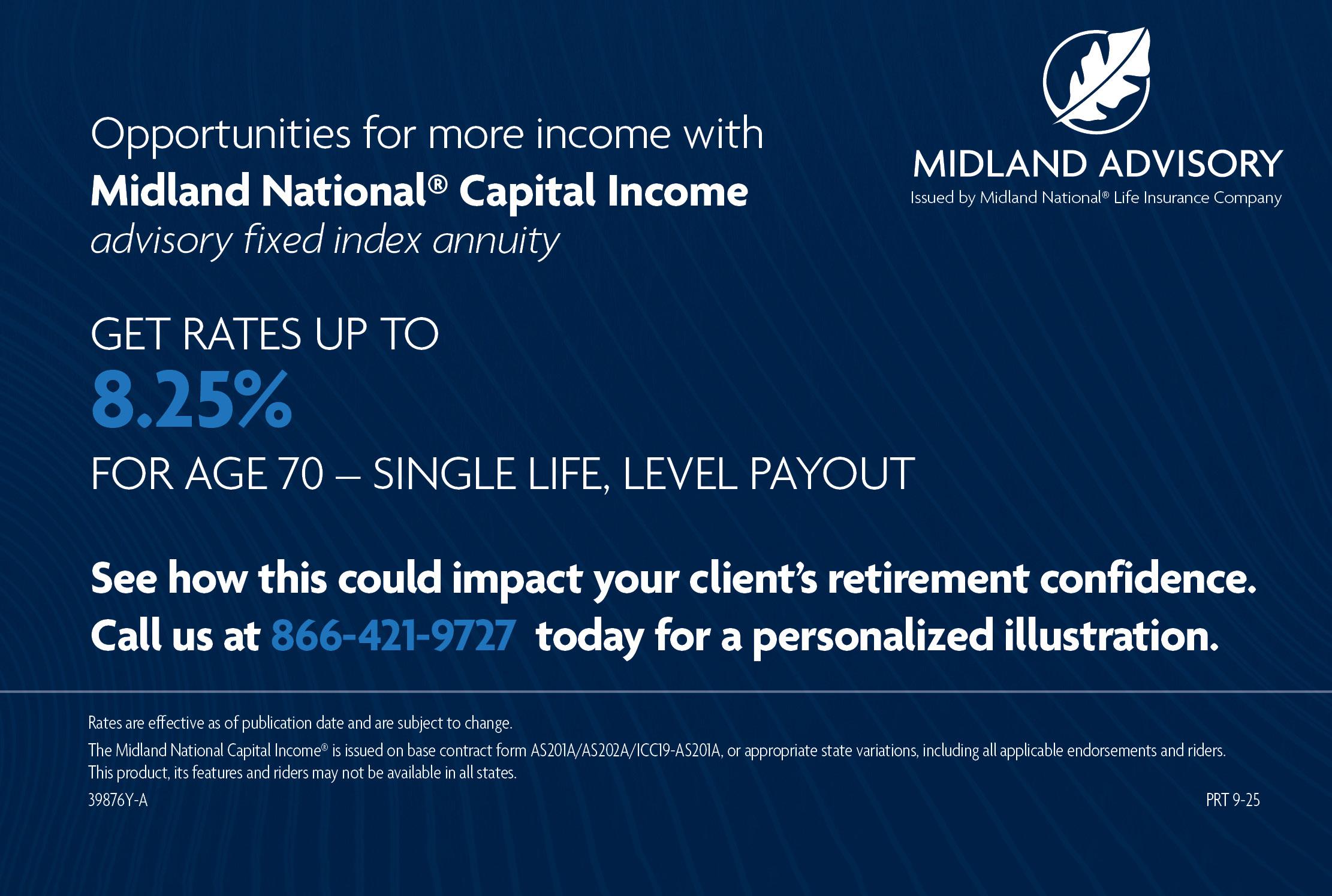

Midland Advisory provides flexible retirement solutions offering growth potential with asset protection, guaranteed income, and unique features that can help clients prepare for health-related events. Annuities built to integrate within your practice.

Kevin Sullivan

National Sales Manager

Midland Advisory at Midland National® Life Insurance Company

Kevin explains how shifting a portion toward guaranteed income can reduce portfolio stress, increase certainty, and better protect against outliving savings.

Cooper Sinclair, Head of Strategy for Midland Advisory Robert DeChellis, Founder and CEO of Bonsai

Become the kind of advisor that clients can’t live without. Cooper and Robert share Bonsai’s approach to asset-liability management and ways in which you can transition from a vicious cycle to a virtuous one to gain client trust and strengthen your advisory practice.

Cooper Sinclair, Head of Strategy Gene Hauser, AVP of Product Development

Cooper and Gene discuss why now is a great time to consider fixed income alternatives. This video is part two of the series. Check out our channel for part one: Advisory Workshop: Mechanics of FIAs.

Carlye, Guggenheim Investments, PGIM, StepStone Private Wealth Solutions, and TCG Real Estate offer insights into the benefits, performance, and strategic opportunities of private credit, private equity, and real estate. TRENDING

Daniel Wilk Senior Vice President, Head of Private Equity Solutions, Future Standard

“We’ve spent the last 30 years allocating to the US midmarket. So we view transactions as a way to get specific exposure, and I think structurally you can do that in a variety of ways. You can own different vintages that are dedicated to a specific transaction type, LP led or GP led secondaries. You can own a direct or a co-investment book. You can commit to a GP’s latest primary round. There are a number of different ways to get that exposure. I think the evergreen will touch facets of each.”

Dianna Carr-Coletta Managing Director & Dedicated Partner PGIM

“In the US alone, there’s more than 200,000 middle market family-owned businesses that are operating that and only 10% or less of those are private equity sponsor-owned, so when you think about the white space that’s available for originating deals, those privately held businesses offer a lot of opportunities to help offset the ebbs and the flows that you get from the M&A activity that you’re seeing in the sponsored transactions.”

Bob Long CEO StepStone Private Wealth Solutions

“For the last 20 years, private credit has generated a net return annualized compounded of about 10% with about 3% per year annual volatility in comparison to the S&P 500 with about an 11% annualized return and a 16% volatility.”

Joseph

O’Connor

Managing Director – Partner, Primary Fund Investments, Carlyle

“Maybe 80 to 90% of companies of material size, companies with revenues of a hundred million dollars or more, are private….If you’re not looking at the private markets, you’re ignoring a large part of the investable universe today.”

Jackson Fallon

Managing

Director and Head of RIA Key Accounts, Blue Owl Capital

“The Nest by Blue Owl, which we recently launched, is a great resource to help advisors learn about private markets, learn how to implement those in portfolios, comes with educational models, portfolio tools, as well as general thought leadership.”

Natixis Investment Managers explores current market dynamics, highlighting gradual changes in the labor market, value stock opportunities across sectors, and strategies for portfolio customization and risk management in a cautious yet resilient investing environment.

Brian Hess

Portfolio Manager

Natixis Investment Managers Solutions

“If you look at a chart of the unemployment rate, historically, it typically bounces around at a low level for a long period of time, and then when it starts to rise, it rises very rapidly. That’s what you’re talking about with respect to the asymmetry. And we have not seen that. It’s been a very gradual rise in the unemployment rate so far.”

Nick Elward Senior Vice President, Head of Institutional Product Development and ETFs

Natixis Investment Managers

“Institutional investors at this point are thinking similarly to some more sophisticated retail investors where they’re getting a little concerned about how the equity markets have been so strong in the last few years. So they’re cautious. And with that level of cautiousness, they’re being sure to make sure that they’re rebalancing on a regular basis”

Brian Kennedy

Portfolio Manager, Full Discretion Team

Loomis, Sayles & Company

Bill Nygren Portfolio Manager

Harris | Oakmark

“A lot of times value is just in one or two sectors. But today, if you move away from technology, most everything in the market looks unusually attractive. So we’re finding value not just in some of the traditional value sectors, like financials or oil and gas, but also in media, in technology, consumer non-durables, consumer durables.”

“The credit markets have held up really well. We’re coming off a period of exceptionally pristine balance sheets in corporate America going back the last few years. So, what we’re starting to see now is a little bit of an off-the-top kind of a condition where profit margins are weakening a little bit, leverage is up, interest coverage is down.”

Direct indexing can support Environmental, Social, and Governance investing as well, by actively including certain companies or sustainable industries through positive screening based on ESG ratings. Negative screening can be based on ratings, but can also use business involvement screening or revenue thresholds of controversial companies.

SPONSORED BY:

Beacon Pointe, Cerity Partners, Stonebriar Wealth Management, Integrated Partners, MarshBerry and Hue Partners highlight how RIAs are enhancing advisor development, navigating record-setting M&A activity, and helping coordinate complex financial plans.

Andree Mohr President Integrated Partners

“We help our advisors partner with CPAs to work with their most complex clients to bring significant collaboration and clarity to those clients’ lives. We also do a significant amount of coaching, training, and development of our advisors and their team members.”

Kurt Miscinski CEO Cerity Partners

“We have a very clear path. We call it path to partnership, that we are a true partnership and want every colleague to be able to achieve optimal fulfillment. Sometimes that is in their roles and responsibilities. Sometimes that’s also an economic success, but in order to achieve any form of fulfillment, there needs to be a clear path.”

Tina Hohman Director MarshBerry

“Private capital’s dominance has certainly been a game changing trend. At MarshBerry, we tracked record-setting paces in the wealth advisory M&A to August of this year. There have already been 240 announced transactions, which is an uptick of 20% from last year.”

Ryan Halls Co-Founder Hue Partners

“Trends in the space right now are really unlike anything we’ve seen before from a volume perspective. This year, 2025 will, I think, really just dwarf all previous records as far as volume of activity, diversity of activity.”

Grant Lyon, CFP® Wealth Advisor Beacon Pointe

“It’s really digging into the details of someone’s financial plan and looking across all areas and then coordinating with each of those professionals, whether it be an estate planning attorney, a CPA, even home and auto insurance, coordinating with the insurance agent that they have.”

Delaware Life, Eagle Life, Guardian, Transamerica, and TruStage

share how annuities can provide personalized investment strategies, downside protection, guaranteed income, and peace of mind, helping clients navigate market volatility.

Colin Lake President and CEO

Delaware Life Marketing

“We like the idea of telling people exactly the way a product works, helping them have the right expectations walking into it. So all throughout the life of the contract, they’re never surprised but always pleased.”

Jon Cressman Head of Annuities and Asset Management Transamerica

“And I think the other thing it does is it gives them peace of that when volatile times do hit and you’re in retirement and that’s when it can be the most scary as an investor, you can afford to stay the course.”

Elle Switzer Director of Annuity Product Management TruStage

“It is designed to help clients personalize their investment approach by balancing market growth potential with downside protection. It helps provide simplicity and flexibility for every market environment, ensuring clients have access to investment strategies that align with their financial goals.”

Kelly Chapple Divisional Sales Manager

Eagle Life Insurance Company

“Because of the interest rate environment and the benefits associated with annuities, they’ve become much more lucrative than they were in the past. And what’s happened is, more and more advisors are opening up to the idea of leveraging an annuity as a fixed income alternative as a portion of their portfolio.”

John Neumann National Sales Manager Guardian

“If you want to start talking income to a client, one question I like to bring into the fold is to simply ask the client, when you retire, how much of your income do you want guaranteed? And how much do you want at risk?”

ClearBridge Investments, Guggenheim Investments, MassMutual Investments, PGIM Investments, and Sprott share insights on precious metals, active vs. passive strategies, asset-backed finance, fixed income, high-yield credit, and the growing impact of active ETFs in today’s markets.

Ed Coyne Senior Managing Partner

Sprott Inc.

“We have over four decades of experience in this space, and we’re one of the largest firms out there that focuses just on the metals and materials markets. We have over $40 billion in assets under management.”

Jeff Schulze, CFA® Head of Economic and Market Strategy ClearBridge Investments

“This is a tremendous environment for active managers to be able to gain on their passive counterparts because there’s a durable competitive advantage that I think is going to last over the next three to five years. So far, year to date, over 50% of active managers are beating the passive indices.”

Adam Bloch Portfolio Manager Guggenheim Investments

Adam Schauer Managing Director and Portfolio Manager MassMutual Investments

“When you think about the credit quality of the market, roughly about 53%, over 50% of our market is BB rated. So that’s the highest component of the rating categories across high-yield markets.”

“We continue to expect a low but positive growth environment for the overall U.S. economy and the continuation of a relatively low unemployment rate. Part of that comes from dynamics like labor hoarding, changing immigration dynamics, but overall low unemployment rate.”

Matt Collins VP & Head of ETFs PGIM Investments

“Active ETFs, while they’re only 10% of the assets within the total ETF industry, they’re taking 40% market share of flows. And it has the third year running, where the flows have exceeded 25% of industry flows, despite only being anywhere between 6% and 10% of AUM.”

For 174 years, MassMutual® has provided clients with a diverse portfolio of solutions offering flexibility, dependability, and growth. Now you can meet your clients’ needs with MassMutual’s annuities, life insurance, and disability income insurance solutions.

Let’s work together to build your business and your clients’ financial future.

WITH MASSMUTUAL STRATEGIC DISTRIBUTORS’ RETIREMENT EXPERT: ALEX SAMOILA

EXPERT PROFILE

As an expert in annuities, Alex Samoila understands the complexities and challenges facing retirees today. The Vice President, National Sales Manager at MassMutual Strategic Distributors joined Asset TV’s Hot Seat to answer questions from financial professionals about issues surrounding retirement solutions.

RICH ROMANO, CEO OF FIDX

As you look at annuities and all the various product types and all the features and benefits, how do you best select the right product, the right set of investments, and the right benefits for your client?

ALEX SAMOILA:

“There’s a lot of products out there. There’s a lot of really great solutions out there. As a matter of fact, at MassMutual, and all of our peers in the industry, we’re constantly working to try to develop solutions that fit a need that we anticipate clients are going to have as they age and as they move to and then through retirement. So a lot of the product features that are out there, although a lot of them are similar, there’s a lot that are different and designed for very specific needs. So the first thing that you would want to do in assessing this is, one, understand what the client’s goals and objectives are, and then through the various carriers out there, the insurance companies that create these products, is identify the ones that really speak to the need that the client has today and the needs that they’re going to have as they continue to age. When it comes to the actual investments and how do I select an investment, I know at MassMutual we have the ability to allow you to choose portfolios that we create, or you could select your own investments, and this is similar to all the annuities that are out there. The best thing to do is the way that you do a risk profile when selecting your mutual funds or ETFs, do the exact same thing for annuities, because the investments, the underlying investments work very, very similarly. So again, assess the needs that the clients have, look at the benefits that annuities offer as you get into retirement and through retirement, and make sure that the risk that you’re taking with the underlying investments aligns with the risks that clients are comfortable to take in your non-annuity solutions, because they work very, very similar.”

We’d love to discuss with you how our audience reach can support your content creation and distribution strategies. Please reach out to a member of our team to learn more.

Neil Jeffery

EVP Head of Americas neil.jeffery@asset.tv

Jillian Ball SVP Sales jillian.ball@asset.tv

Jenna Dagenhart Program Anchor jenna.dagenhart@asset.tv

Jason Brandt SVP Head of Sales jason.brandt@asset.tv

Michelle Richard SVP Strategic Partnerships michelle.richard@asset.tv

Jocelyn Garcia Sales Operations jocelyn.garcia@asset.tv

Kristin Myers ETF Editor in Chief kristin.myers@asset.tv

Laura Kline Audience Development laura.kline@asset.tv