Canada’s supply chain overhaul could reshape FDI, with nearshoring and tariffs redefining its role in global trade.

short on job or investment targets? Incentive compliance is tightening.

From Greensboro to Brownsville, the U.S. is seeing a new wave of aerospace manufacturing activity. This feature examines the regions driving that growth, profiles recent mega-deals, and offers site selectors a roadmap to the industry’s future.

As EV momentum slows and tariffs rise, automotive companies are reworking supply chains, production plans, and location strategies to adapt to a rapidly changing market

52 Investors

Food-Focused

Food proves to be more than a staple—it’s a safe haven for commercial real estate investors seeking resilience in uncertain times.

Consumer trends and labeling laws are pressuring manufacturers to build flexible, future-ready facilities that can pivot quickly and meet evolving market demands.

Art and cold storage in Chicago Inside a coffee creamer hub in AZ Mississippi’s space infrastructure Landing a lithium refinery in OK

A Note on AI in our Magazine At Area Development, we use AI tools to support—but not replace—our editorial process. We employ AI for copy editing, style checks, and condensing transcripts, always under human supervision. We do not use AI for independent fact gathering or unsupervised content creation. All reported content is reviewed by experienced editors to ensure accuracy, integrity, and journalistic quality.

This issue arrives at a time when every sector we cover is in motion.

The forces at play — technology shifts, policy changes, and supply chain realignments — are rewriting the rules of competition.

In aerospace, shifting defense and commercial priorities are reshaping supply chains — and site selection now demands as much agility as engineering skill. In automotive, Greg Burkart examines a market being pulled in multiple directions by electrification, consumer trends, and policy shifts.

On the manufacturing floor, the changes are just as sharp. Scott Kupperman looks at how food labeling trends — influenced by consumer health concerns, regulatory pressure, and even the rise of GLP-1 medications — are prompting companies to rethink production lines and packaging strategies

Gregg Healy and J.C. Renshaw widen the lens, charting supply chain volatility that’s forcing real estate and operations teams to make faster, more complex decisions.

Scott Kupperman Founder KUPPERMAN LOCATION SOLUTIONS

Eric Stavriotis Vice Chairman, Advisory & Transaction Services CBRE

Brian Corde Managing Partner ATLAS INSIGHT

Amy Gerber Executive Managing Director, Business Incentives Practice CUSHMAN & WAKEFIELD

Alexandra Segers General Manager TOCHI ADVISORS

Dennis Cuneo Owner DC STRATEGIC ADVISORS

Courtney Dunbar Site Selection & Economic Development Leader

BURNS & MCDONNELL

Stephen Gray President & CEO GRAY, INC.

Bradley Migdal Executive Managing Director, Business Incentives Practice CUSHMAN & WAKEFIELD, INC.

Marc Beauchamp President SCI GLOBAL

David Hickey Managing Director HICKEY & ASSOCIATES

Publisher Dennis J. Shea

dshea@areadevelopment.com

Sydney Russell, Publisher 1965-1986

Events / Business Development Director

Matthew Shea (ext. 231) mshea@areadevelopment.com

Media / Accounts Director

Justin Shea (ext. 220) jshea@areadevelopment.com

Editor Andy Greiner editor@areadevelopment.com

Staff and Contributing Editors

Kimberly Graulein

Amy Matias

Garrison Partridge

Mark Schantz

Steve Kaelble

Circulation/Subscriptions circ@areadevelopment.com

We also step across the border, where Marc Beauchamp outlines how Canada is positioning itself to capture new waves of investment — a signal that U.S. regions must stay competitive, not just with each other, but globally.

The common thread is clear: location decisions today are about far more than square footage and incentives. They’re about resilience, adaptability, and finding the ecosystems that will sustain a business through disruption. That’s why our annual Top States for Business rankings remain essential reading — they highlight where companies are most likely to find those conditions, regardless of sector.

The pace isn’t slowing. Success will go to those who can see change coming, move decisively, and partner with regions ready to move with them.

Andy Greiner

Chris Schwinden Partner SITE SELECTION GROUP

Chris Volney Managing Director, Americas Consulting CBRE

Matthew R. Powers, Lead Site Selection Consultant REDI SITE SELECTION

Scott J. Ziance Partner and Economic Incentives Practice Leader VORYS, SATER, SEYMOUR AND PEASE LLP

Chris Chmura, Ph.D. CEO & Founder CHMURA ECONOMICS & ANALYTICS

Alan Reeves Senior Managing Director NEWMARK

Lauren Berry Senior Manager, Location Analysis and Incentives MAXIS ADVISORS

Courtland Robinson Director of Business Development

BRASFIELD & GORRIE

Dianne Jones Managing Director, Business and Economic Incentives JLL

Joe Dunlap Chief Supply Chain Officer, LEGACY INVESTING

Production Manager Jessica Whitebook jessica@areadevelopment.com

Web Designer Carmela Emerson

Print Designer

Victoria Corish

Business/Finance Assistant

Barbara Olsen (ext. 225) olsen@areadevelopment.com finance@areadevelopment.com

Halcyon Business Publications, Inc.

President Dennis J. Shea

Correspondence to:

Phone: 516.338.0900

Toll Free: 800.735.2732

Fax: 516.338.0100

Brad Migdal

Brad Migdal of Cushman & Wakefield specializes in corporate site selection, workforce strategy, and developing innovative solutions for industrial real estate. Page 88

Hector Ibarra, Azad Khan & Sven Gerzer

Hector Ibarra, Azad Khan, and Sven Gerzer of Parker Poe advise executives on foreign direct investment, U.S. expansion strategy, and site selection. Page 80

Marc Beauchamp

Marc Beauchamp, of SCI Global, is based in Canada and advises corporations and governments on FDI strategy, supply chain shifts, and competitive investment climates. Page 78

Brooklin Salemi & Joe Gioino

Brooklin Salemi and Joe Gioino of Newmark advise corporations on industrial site selection, incentives strategy, and manufacturing real estate trends. Page 64

Larry Gigerich

Larry Gigerich, of Ginovus, is a leading advisor on incentives procurement, economic development strategy, and corporate facility decisions. Page 68

Greg Burkart

Greg Burkart of Walbridge specializes in site readiness, incentives negotiations, and complex capital investment strategies. Page 60

Scott Kupperman

Scott Kupperman, founder of Kupperman Site Solutions, focuses on food industry site selection, supply chain optimization, and manufacturing facility development. Page 54

Ermengarde Jabir

Ermengarde Jabir, of Moody’s Analytics, provides economic forecasting and market analysis to guide corporate expansion and site selection decisions. Page 52

Joe Dunlap

Joe Dunlap, of Legacy Investing, leads supply chain and logistics real estate consulting, specializing in automation, industrial distribution, and next-generation warehousing strategies. Page 24

Gregg Healy & J.C. Renshaw

Gregg Healy and J.C. Renshaw of Savills advise global manufacturers on supply chain strategy, site selection, and commercial real estate resilience. Page 22

Jeff Troan

Jeff Troan of Vista Site Selection blends global trade expertise with strategic site selection insight. He has decades of experience advising aerospace and defense related projects. Page 10

America makes far less aluminum than it recycles and that’s a strategic advantage for EV and aircraft manufacturers

84% That’s how much of U.S. Aluminum comes from recycling, not smelting.

700,000 tons of

EVs use 30% more aluminum than gas powered cars

Recycled aluminum is cheaper, cleaner and made in the USA

Source: U.S. Geological Survey, International Aluminium Institute, The Aluminum Association, U.S. Department of Energy

$4 billion – that's how much is being invested to grow U.S. aluminum manufacturing and recycling

By Jeff Troan Partner & Managing Director at Vista Site Selection

One of the pillars of the Trump administration has been a desire to rebuild the shipbuilding and repairing business in the United States. This echoes earlier concerns raised by the U.S. Navy (which must build and repair all its ships in the United States) about the lack and age of the country’s shipbuilding and repair infrastructure.

In response, the White House recently issued an executive order to establish Maritime Prosperity Zones (MPZs) across the United States. The approach is similar to the Federal Opportunity Zone program created under the first Trump administration. According to the order, the MPZs benefits will be outlined by November 2025.

For those unfamiliar with economic development legislation, zone legislation is enabling legislation. It limits tax advantages and other business incentives to well-defined geographic areas, preventing a broad swath of tax shelters. Once defined, targeted incentives can be applied to the zones, creating a concentrated framework for driving specific economic transformation — in this case, new maritime construction, maintenance, repair, overhaul, and conversion (MROC).

Based on conversations with several states, Vista believes the July 8 deadline is a target for the U.S. Commerce Department to define the criteria for what can constitute

a zone. States will likely follow with proposals for specific geographies. Designing MPZ boundaries promises to be far more complex than the 2018 effort that shaped Federal Opportunity Zones (OZs). That process aimed simply to direct investment into distressed communities, using low-income census tracts as the primary filter. Even so, the census data used was already dated, and the geography of some tracts — particularly university towns — didn’t always align with state and local development strategies. MPZs, by contrast, must start at ports and reach back through the national maritime supply chain — an infrastructure network that stretches across all 50 states and Puerto Rico. The zones will need to capture inland hubs like Crane Naval Surface Warfare Center in Indiana, as well as heritage contractor facilities and small businesses that support both the U.S. Navy and commercial shipyards. Vista is currently developing AI algorithms to help identify these qualifying geographies and assist states in making their final designations. For private industry, rebuilding the commercial shipbuilding and MROC sectors presents a high-risk proposition. Success will depend heavily on how the MPZs are drawn and the nature of the incentives offered. By contrast, military-related shipbuilding offers a more stable path. For more than a century, U.S. commerce has relied on naval dominance and the freedom of global maritime movement. Allowing that control to shift to

China or Russia would disrupt both American and global trade. As the world grows more unstable, the need for a larger, more active Navy becomes increasingly certain.

With that in mind, shipbuilding and MROC firms would be wise to structure new infrastructure investments around military business as a reliable foundation — then gradually layer in commercial capacity over time. This dualtrack approach benefits the Navy as well. Military demand fluctuates. Commercial work could help fill production gaps and sustain the skilled workforce needed to scale when military orders surge.

So what should MPZ incentives actually include? The executive order hints at a structure similar to the 2018 OZ program. Those incentives were threefold: First, a qualified investor could place capital in a Qualified Opportunity Fund (QOF) and defer unrelated capital gains for up to a decade. Second, the deferred gains qualified for a 10 to 15 percent tax discount. Finally, after 10 years, QOF owners could sell their businesses without paying federal long-term capital gains. That model worked well for startups seeking equity capital, and for founders hoping to cash out post-growth without triggering tax liabilities. However, it was far less useful for legacy companies that used internal capital and never planned to spin off the QOF entity.

That kind of incentive structure would fall short in the context of MPZs. Shipbuilding and MROC are capital-intensive

sectors led by long-established firms. While there is room for startups — particularly in emerging maritime technologies like sea and subsea drones — the sector needs something closer to the New Markets Tax Credit (NMTC) program.

Ideally, MPZs would offer a salable federal tax credit, modeled after NMTC but without requiring Community Development Entity intermediaries. In this structure, both startups and heritage companies would receive a tax credit in return for infrastructure investments within MPZs. They could use the credit against their own federal tax liability or sell it to other high-liability taxpayers at a discount.

Additional tools could further encourage ship construction and MROC work in U.S. ports. For example, MPZs might include a temporary tariff waiver on cargo shipped by vessels that were built, significantly overhauled, or converted domestically.

Ultimately, MPZs have the potential to revitalize U.S. shipbuilding and MROC for both commercial and military purposes. But the window to influence these zones is closing fast. Once the U.S. Commerce Department and the states finalize boundaries and incentives, companies left outside those lines will face serious disadvantages. If the federal government follows precedent, there will be no opportunity to revise the zones after they’re set.

Now is the time to take action. Make sure your existing operations — and your future plans — fall within potential MPZs.

By Amy Matias Area Development Staff

In the heart of Chicago’s Central Manufacturing District, a once-vacant industrial site is being transformed — not just with concrete, steel, and insulation, but with color, storytelling, and soul.

Karis Cold’s latest development, Stockyards Cold, is a nearly 100,000-square-foot cold storage facility that delivers on all the core requirements of modern cold chain logistics: 50-foot clear heights for dense pallet storage and automation, blast freezing capabilities for rapid throughput, advanced temperature monitoring, and roughly 14,500 pallet positions across customizable zones. Strategically located near two major highways, it’s built for both last-mile delivery and regional logistics.

But what makes Stockyards Cold truly distinct in a national landscape of boxy warehouse facilities isn’t hidden behind the loading docks — it’s right out front, emblazoned across the building’s insulated exterior.

Twelve large-scale murals by internationally recognized artist David Banegas now grace the building’s facade, turning a next-generation logistics hub into a vibrant public landmark. The murals celebrate iconic moments and places in Chicago’s history, from the Art Institute lions to the White Sox scoreboard, from the Water Tower to a visual resurrection of the long-demolished Continental Can Company tower that once occupied the same site. “The first time I came to

the United States, I came to Chicago,” Banegas said. “This is my home in many ways. These murals represent a shared vision — and my old stomping grounds.”

Born in Bolivia, Banegas first came to Illinois as a teenage exchange student and has gone on to paint largescale works around the world. Still, he considers this one of his most meaningful projects — both because of its location and its unlikely setting.

“Each mural is about 20 feet tall. You’re painting on cold storage insulated panels, which is not like painting a regular wall,” he explained. “They had to specially treat the walls so the paint would adhere without compromising the insulation. That’s not easy — and not cheap.”

To make the public art possible, Karis Cold worked closely with Banegas and design-build contractor DSI, which modified the cladding and prepped the surface for long-term outdoor durability without affecting the building’s thermal performance. The murals are expected to be completed in early July 2025.

“We didn’t just slap art on a wall,” said Ken Verne, vice president of assets at Karis Cold. “We wanted to make a statement. This isn’t just a box. It’s a landmark.”

Beyond its design and art, Stockyards Cold also reflects a broader trend in industrial real estate: developers pursuing urban infill projects that balance performance with visibility, making logistics hubs part of the communities they serve.

The project represents a different kind of thinking in industrial real estate, where aesthetics are often sacrificed in the name of speed, scale, and cost. But for Karis, the decision to integrate art wasn’t an afterthought — it

was part of a broader vision for “purpose-built, peopleconscious” development.

“This is a leap forward,” Verne said. “Not just for cold storage in Chicago, but for how we approach integrating functionality and placemaking. It’s like comparing a foam cooler from the ’80s to a Yeti. And David’s work brings a layer of identity that’s rarely seen in industrial development.”

The location is equally strategic. The Central Manufacturing District is one of the oldest planned industrial parks in the country, dating back over a century. Its legacy as a hub for factories and logistics made it an ideal setting for an infill redevelopment that nods to the past while building for the future.

Karis Cold acquired and cleared the long-dormant site, replacing the original Continental Can Company facility with new infrastructure tailored to high-volume food, grocery, and pharma logistics users. Stockyards Cold is currently co-listed by NAI Hiffman and Food Properties Group, and has drawn active interest from a mix of tenant users and investment groups.

The building is expected to be fully turned over by mid-August 2025, aligning with the anticipated mural completion. According to Karis, the goal is to position the facility not only as a functional asset, but as part of a broader effort to humanize industrial environments — especially in urban infill locations where residents and workers engage with these buildings daily.

For Banegas, the opportunity to contribute to that effort was personal — but also philosophical.

“Industrial buildings are often the backdrop of a city, but they don’t have to be invisible,” he said. “This

project shows what happens when you bring emotion and memory to the walls.”

For the team at Karis, it

may not be the last time they do so.

“This worked because the community, the artist, and the builder all understood what we were trying to do,” Verne said. “It’s something we’re proud of — and something we might replicate again.”

By Kimberley Graulein Area Development Staff

When Nestlé USA began evaluating potential sites for a new beverage manufacturing and distribution center, the company wasn’t just looking for space—they were looking for speed, flexibility, and longterm sustainability. Glendale, Arizona delivered all three.

In January 2025, Nestlé officially opened a $675 million, 630,000-square-foot facility that now produces more than 50 flavors of Coffee mate®, natural bliss®, and Starbucks® creamers. The project created 300 jobs and positioned Nestlé closer to West Coast customers—but what makes it stand out is how advanced the facility is, and how quickly the city helped bring it online.

From the start, Nestlé designed the Glendale facility with flexibility and precision automation in mind. According to city building official Djordje Pavlovic, the plant can switch between dozens of flavor profiles with minimal downtime, thanks to an internal sanitary piping system and

A ROBUST NETWORK THAT FULLY CONNECTS YOUR SUPPLY CHAIN

/ 700+ RAIL-SERVED SITES

/ SERVICE IN 22 STATES

/ 19,200 MILES OF NS TRACK

/ 260 SHORT-LINE PARTNERS

/ BUILT FOR SUSTAINABLE SHIPPING

/ READY TO POWER YOUR BUSINESS

We offer more than 700 development-ready sites and the expertise to help you grow sustainably with rail. We’re ready to help you build your business for the future. Find your next location at NorfolkSouthern.com.

efficient changeover protocols.

“You throw whatever flavor you want, they’ll make sure that in a week you’ll get that creamer,” said Pavlovic. “They can produce any beverage that they have in that facility with basically just a little bit of the tweaking in the industrial engineering component.”

What’s more, the facility operates almost like a cleanroom. Human activity is limited to designated zones, while an array of autonomous systems handles mixing, filling, bottling, labeling, wrapping, and storing. The building includes a 120-foot-tall automated storage and retrieval system (ASRS) served by robotic vehicles. “Once you get into the manufacturing, the humans are in the part where they actually do their patented mixes,” said Randy Huggins Jr., who managed the project for Glendale during site selection and development. “But then it runs in, when the materials go into the facility, it becomes 100 percent automated.”

Originally, Nestlé had not planned to build its own water recycling system—but when local utility EPCOR raised concerns about sewer discharge limits, the company responded with a game-changing addition: a self-contained water reuse facility.

“They are right now discharging about 5 percent max from the facility,” said Pavlovic. “The rest is being used for air conditioning, cooling systems, and irrigation—so very energy efficient.”

This infrastructure now supports not just the existing operations, but also future expansions already envisioned on the south side of the site. It also reflects Nestlé’s broader

goal to reduce environmental impact across its global footprint.

Nestlé first contacted Glendale through the Greater Phoenix Economic Council and the Arizona Commerce Authority in early 2021. By mid-year, they had selected the site. The city moved quickly—offering an expedited permitting process, phasing flexibility, and creative solutions like an “at-risk agreement” that allowed early construction work on geotechnical foundations.

Glendale also developed a unique “hostage permit” strategy to allow phased occupancy while ensuring remaining site work stayed on track. “We had to make sure that once employees come and start doing their work and testing… we don’t want them to interfere with construction, or construction workers to interfere with the operations,” said Pavlovic.

Glendale’s economic development team wasn’t sure if Nestlé’s would have concerns about proximity to Luke Air Force Base, so they addressed it head on and turned it into an advantage. “The very first thing we did when we met them is we introduced Luke Air Force Base,” said Huggins. “We invited Nestlé and Luke to meet us at the Luke Air Force Base golf course, and we talked about the ways the two could actually partner.”

Through the Department of Defense’s SkillBridge program, airmen transitioning out of service—as well as their spouses and family members—are now being connected to manufacturing roles at the facility.

From automation and

water reuse to workforce integration and speed to market, Nestlé’s Glendale plant represents more than a capital investment—it’s a blueprint. From automation and water reuse to workforce integration and speed to market, Nestlé’s Glendale plant represents more than a capital investment—it’s a blueprint. And as the company eyes future expansion on the site, Glendale is proving that advanced manufacturing, sustainability, and smart permitting aren’t mutually exclusive—they’re mutually reinforcing. In an era of global uncertainty, this kind of alignment may be the most innovative strategy of all.

By Garrison Partridge Area Development Staff

Mississippi’s Hancock County is proving that the next giant leap in space exploration might not come from Silicon Valley or Cape Canaveral—but from a deepwater port town on the Gulf Coast. At the heart of the resurgence is NASA’s Stennis Space Center, a Cold War-era rocket testing facility now being repositioned as a launchpad for commercial innovation.

Long known for testing engines that powered the Apollo missions, Stennis is undergoing a transformation. Thanks to companies like Relativity Space—backed by $267 million in new investment—Stennis is now a proving ground for AI-powered manufactur-

ing, 3D-printed rockets, and next-gen propulsion systems. But what’s happening in Hancock County goes well beyond a single company.

“This is a new chapter for us,” said Blaine LaFontaine, executive director of the Hancock County Port and Harbor Commission. “We’re shifting from a purely federal operation to a blended model that includes commercial space companies building, testing, and staying right here in Mississippi.”

Relativity’s lease of the historic E-2 test stand in 2023 marked a turning point—not just for the company, but for the region. It signaled that aging infrastructure at Stennis could be revitalized, not razed. Until recently, many facilities at the space center sat underused or at risk of demolition, victims of federal belt-tightening and a lack of dedicated NASA missions.

Now, those assets are being handed over to commercial tenants who can move fast, invest heavily, and pay taxes locally.

“The old NASA model didn’t allow for investment—much less maintenance—of facilities without an active mission,” LaFontaine explained. “But commercial companies bring their own missions. They’re breathing new life into places we were in danger of losing.”

Rocket Lab has also announced plans to operate at Stennis, joining Relativity and others as part of a broader ecosystem. These companies bring new jobs, new taxable property, and the kind of momentum that can transform a local economy.

But revitalization doesn’t

happen by accident. Hancock County is doing the hard work behind the scenes— working with NASA to renegotiate long-term leases, ensuring infrastructure upgrades, and preparing new sites for future tenants.

“We’ve got power infrastructure that used to be considered excessive,” LaFontaine said. “Now it’s a major selling point for testing and manufacturing propulsion systems.”

By expediting lease negotiations and pre-permitting land near the center, the county is making it easier for companies to set up shop quickly—and stay for the long haul. LaFontaine’s team is also coordinating with utility partners to ensure pad-ready development and co-location potential. The long-term vision? A vertically integrated space corridor where companies can test, assemble, and ship from a single footprint.

The workforce piece is also evolving. The region boasts a strong base of skilled technicians from decades of federal aerospace contracts and defense work. But there’s still a gap in engineering talent—especially in specialized fields like propulsion and space systems.

To close that gap, Mississippi is investing in a new junior college aerospace program and other workforce pipelines. The state is also working to attract aerospace degree holders through incentive packages, partnering with universities to build a deeper talent pool.

“There’s already a strong manufacturing base here,” said LaFontaine. “Now we’re working on the next step—making sure these companies can find the

engineering talent they need to grow.”

The stakes are high. With competition mounting across the U.S.—from Florida’s Space Coast to the Mojave Desert—Hancock County is betting that its infrastructure, workforce, and forward-thinking leadership can carve out a permanent place in the new space economy.

And the shift isn’t just from public to private—it’s from backend testing to full-cycle aerospace manufacturing. For decades, Mississippi tested engines made elsewhere. But the future could involve designing and building those systems locally, then testing and shipping them straight from the Gulf Coast.

“If we can get this right,” LaFontaine said, “ten years from now, we’ll be known not just as a test site, but as a commercial launchpad for America’s space future.”

By Amy Matias Area Development Staff

When Stardust Power went looking for a site to build its $1 billion lithium refinery— one of the largest proposed in the U.S.—it needed land, logistics, and labor. What it found in Muskogee, Oklahoma, was something more rare: a city that had quietly built the kind of alignment

between infrastructure, incentives, and workforce that could support not just a project, but a long-term industrial strategy.

The refinery will create 300 jobs and produce batterygrade lithium crucial to the EV and energy storage supply chain. But the real story isn’t just about lithium—it’s about how Muskogee pulled together the pieces to win the deal.

Muskogee already had strengths in its corner. The selected site at Southside Industrial Park West offered rail access and proximity to I-40. The Port of Muskogee emphasized the region’s multimodal advantages, including barge access via the McClellan-Kerr Arkansas River Navigation System.

But what tipped the scales was the willingness to invest in targeted infrastructure. The city and county created two Tax Increment Financing (TIF) districts to fund major upgrades: one to improve a key industrial road corridor, and the other to rehabilitate the long-dormant Midland Valley Branch Line, bringing it up to federal standards and reconnecting it with Union Pacific.

“These improvements benefit Stardust Power—but they also position us for future industrial growth,” says Heather McDowell of the Port of Muskogee.

While infrastructure helped land the site, Muskogee’s most forward-thinking move may be on the workforce side. Alongside partnerships with Oklahoma State University Institute of Technology and Indian Capital Technology Center, the Port is launch-

ing a program called Elevate 18—a five-week training initiative for high school seniors who want to go directly into the workforce.

The program teaches safety, soft skills, and manufacturing basics to prepare students for entry-level industrial work. “We’re meeting students where they are—and building a workforce that stays rooted here,” McDowell says.

In a sector where talent is often imported or retrained mid-career, Muskogee’s focus on pre-college talent development offers a local-first model others could follow.

Even with the right infrastructure and workforce, major industrial projects often face public resistance. Stardust Power leaned into transparency—attending community meetings, responding to questions, and partnering with local emergency services to discuss safety protocols.

They’ve also committed to exceeding environmental regulations, including dust control and fire suppression systems, and have become early sponsors of local events and workforce programs.

“They’re not just building a plant,” McDowell says. “They’re becoming part of the community.”

The Stardust deal may be remembered for the lithium, but the innovation lies in how Muskogee moved as one. Infrastructure, education, business, and government came together early, with a shared sense of purpose.

“When those pieces align,” McDowell says, “you can win projects that change your future.”

Lunar industrialization will play a key role in building a trillion-dollar private space economy. Astrobotic delivers payloads to the Moon and has a plan to develop it. We sat down to discuss site selection on the Moon, Earth-based supply chains, and why Pittsburgh has an edge in the space economy.

Area Development: In terrestrial site selection, proximity to infrastructure, resources, and talent drives decisions. What makes a location on the Moon strategically valuable?

John Thornton: When you go to the Moon, it’s basically going to a new world. You want to set up near resources so you can live off the land. Right now, the most important resources are sunlight and water ice.

The Moon’s equator only gets 14 days of light, 14 days of darkness. But at the poles, some areas receive near-continuous sunlight—great for solar power. Shadowed craters near the poles harbor water ice, which can be turned into drinking water, oxygen, or split into hydrogen and oxygen for rocket fuel.

You also want a flat, safe landing area. And if you could find a cave near sunlight and water ice, that would be ideal—it offers natural shelter from radiation and temperature extremes.

You’ve said space will soon be a trillion-dollar industry. How does that growth translate into real-world activity?

Thornton: The global space industry just hit $600 billion. It’s expected to reach $1 trillion by 2040—or even 2035. Most of that today involves satellites—for imaging, communications, internet, TV, and

radio. That’s helping drive down launch costs, which is opening new frontiers like the Moon.

The next phase is about building reliable, routine access to the Moon. Then comes resource scouting and eventually extraction at scale—for use in space and possibly back on Earth.

Back on Earth, where are the key manufacturing hubs for the space industry?

Thornton: The major U.S. hubs are Texas, California, Colorado, Florida, and Ohio. These regions often develop around NASA centers or Space Force sites—they create a strong space culture and innovation ecosystem.

Pittsburgh is more of an exception. It doesn’t have as much traditional space

activity, but that’s an opportunity. We’re tapping into the region’s strengths in AI and robotics to bring new technology to space.

What gives your Pittsburgh facility an advantage?

Thornton: Pittsburgh still has a strong advanced manufacturing base. Our lander is 99 percent sourced for machined parts in the area. We’ve also built a strong supply chain for avionics and other components.

We have a class 10K clean room where we build our landers. It’s standard in aerospace but unique for Pittsburgh. And we’re fueled by top-tier tech talent from Carnegie Mellon, Pitt, and Penn State.

Does this point to a shift—where tech acumen is becoming as critical as traditional aerospace skills?

Thornton: They go hand in hand. New tech pushes manufacturing to its limits. Advanced components need advanced methods. So tech development and manufacturing have to be co-developed.

Let’s return to that ideal Moon site— near sunlight, ice, and a cave. What does development look like there?

Thornton: Humans would likely live underground, in a cave, for protection. Robots would operate on the surface. Power would come from solar panels placed on peaks of persistent light. Over time, nuclear may play a role, but solar will likely dominate early due to cost and simplicity.

Robots would extract water ice from shadowed craters—using reflected light, power cables, microwaves, or cold fingers. That water would be stored and converted into fuel to support travel to lunar orbit, Earth, or even Mars. The

Moon becomes a gateway to the rest of the solar system.

Would launching from the Moon require a major infrastructure build?

Thornton: The Moon’s gravity is onesixth of Earth’s, and it has no atmosphere. So you don’t need aerodynamic vehicles, and you don’t need as much fuel. You could launch from a crater. It’s very different from launching here—and far more efficient.

How soon could we see infrastructure or mining operations on the Moon?

Thornton: Right now, we’re focused on reliable delivery through NASA’s Commercial Lunar Payload Services (CLPS) program. That success will spur demand—for science, then for commercial activity.

If there’s political will, infrastructure could begin this decade. Mining and large-scale use of lunar resources is likely a few decades out—but we need to start now, and some of that work is already underway.

Is the U.S. ahead or behind internationally?

Thornton: I believe China is ahead. They’ve had more successful Moon landings in the last decade, including the first on the far side. They’re discovering materials we didn’t know existed and are moving aggressively on infrastructure and resource exploration.

The U.S. has strong pieces in place, but CLPS is funded at around $250 million annually, a small slice of NASA’s $25 billion budget. We need more missions, bigger robots, and a real push for permanent infrastructure.

Is adaptability still key in lunar manufacturing?

Thornton: Absolutely. Each mission teaches us something new. Until we reach routine, commercial lunar operations, we need flexible, adaptable facilities.

But we’re moving in that direction. You’ve seen it with rockets and satellite constellations. The Moon is next. Longterm manufacturing at scale is coming.

JLL recently launched an Advanced Manufacturing group to meet the moment, and Area Development spoke with group leaders Greg Matter, Vice Chair for Site Selection and Industrial Leasing, and Meaghan Elwell, Division President of Global Industrials, to get their real estate playbook for the new era. This conversation has been edited for space and style; listen to the entire conversation on AreaDevelopment.com

Area Development: Why now? What makes this moment different for manufacturing site selection?

GM: There’s been a decade of talk about reshoring and regionalization, but the last four years made it real. First it was clean energy. Now it’s national security. Clients aren’t just interested — they’re under pressure to get to market fast. That speed has exposed how limited our existing site and power infrastructure really is.

Area Development: How is that pressure playing out inside the facilities themselves?

ME: Many of our clients are in plants that are 50+ years old. We’re still maintaining pre-WWII boilers. So, when a company wants to expand or modernize, they’re not starting from scratch — they’re patching systems and racing the clock. What they often need is a capital strategy that prioritizes uptime and innovation.

Area Development: So greenfield isn’t always the answer?

ME: Not unless you have three years to wait. We’ve seen clients adapt spec logistics buildings into advanced manufacturing with some structural upgrades — new slab, added power. It’s faster than building new and offers better flexibility than most aging manufacturing stock.

GM: The average age of our manufacturing buildings nationally is 55 years old. Several of the top infrastructureready buildings got picked off fast after the Inflation Reduction Act. Since then, everyone else has had to get more creative — or more patient.

Area Development: What makes a site “ideal” right now?

GM: We use a simple framework: people, place, and power. That’s your scorecard. If any one of those is weak — labor, ecosystem, or energy — the project is going to struggle.

Area Development: What’s the biggest blind spot you see among corporate leaders?

GM: Underestimating the timeline. CEOs often think of site selection as a six-month decision. It’s not. Grid capacity, workforce pipelines, permitting — these things don’t happen on executive timelines unless you start early.

ME: And not considering the people on the plant floor. There’s been so much focus on corporate return-to-office amenities. Meanwhile, your operators never left. Break rooms, outdoor access, lighting — if you want to retain skilled labor, the facility has to support them, too.

Area Development: Has the Inflation Reduction Act changed the game for your clients?

GM: Absolutely. It triggered a frenzy for existing sites with infrastructure in place. The best power-ready buildings got picked off fast. Since then, everyone else has had to get more creative — or more patient.

Area Development: What advice do you give mid-sized manufacturers entering the market now?

ME: Be ready to retrofit. A logistics box with the right bones — clear height, column spacing — might be your best option. Don’t wait for a perfect building. Build your team around the ability to adapt what’s available.

GM: And do your diligence. A site that worked for warehouse use doesn’t necessarily work for your machinery. You might need a 24-inch slab, reinforced roof, or 5,000 amps of power. That’s not plug-and-play. We’re seeing facilities blend solar with storage and traditional grid access to stay flexible and resilient.

Area Development: Let’s go deeper on talent. Are clients thinking enough about workforce development?

ME: Some are. We had a client retraining their entire floor staff to operate CNC routers and laser machines — that’s real transformation. But others still treat labor like a fixed input. That doesn’t work in advanced manufacturing. You need to invest in training, in the workplace experience, and in partnerships with community colleges and workforce boards. We help with that planning, too.

GM: Meaghan’s exactly right. A lot of companies still think labor is a plug-and-play equation. It’s not. You’re either building pipelines in these markets, or you’re going to lose your advantage.

Area Development: Is power availability now a bigger issue than power cost?

GM: Yes. There was a brief pause following the original tariff announcement, but since then the pace has picked up. There’s more competition for the same handful of viable properties.

ME: And the gap is only growing. We’re not building enough modern industrial stock, and what we are building tends to be designed for logistics — not the power or process needs of advanced manufacturing.

Area Development: One innovation that keeps you up at night — in a good way?

GM: AI on the production floor. It’s going to help us bring more work back to the U.S. — better stability, better security, better jobs.

Area Development: Biggest misconception about advanced manufacturing?

ME: That it’s completely different from regular manufacturing. It’s not. It’s still manufacturing — just done smarter. We’re using AI in facilities too — predictive maintenance, better uptime, smarter systems.

For a full transcript and audio of this talk, head to AreaDevelopment.com

By Greater Orlando Aviation Authority

Or lando may be globally recognized as a leisure destination, but corporate leaders are quickly discovering that its airport is also one of the most strategically located and development-ready commercial assets in the country. Orlando International Airport (MCO) is more than a gateway for travelers — it’s a launchpad for business expansion, industrial development, and global logistics.

W ith more than 40 million annual passengers and nonstop flights to key business hubs across Europe, South America, and the Caribbean, MCO already functions as one of the busiest airports in the United States. But what truly sets it apart is its footprint. The airport spans over 13,000 acres, making it one of the largest commercial aviation properties in the nation. While other major airports struggle with land constraints and congestion, MCO offers scale, speed, and flexibility — all backed by a development-friendly governing body in the Greater Orlando Aviation Authority (GOAA).

GOAA is actively marketing developable land across the airport campus — sites suitable for air cargo, maintenance and repair operations (MRO), cold chain logistics, light manufacturing, or even corporate headquarters. With parcels available both airside and landside, companies can tap into global air connectivity and Florida’s growing freight and rail infrastructure in the same location.

Recent projects signal a new era of airport-aligned development. Frontier Airways has expanded operations at MCO, United Airlines has recently invested in a state-of-the-art TechOps campus and new logistics partners are arriving to support the growing demands of e-commerce and international trade. The airport’s proximity to the Space Coast, along with Central Florida’s aerospace and defense manufacturing ecosystem, creates added strategic value for advanced industries that depend on secure, multimodal transportation options.

W hat makes MCO especially competitive for site selectors is the ability to move fast. GOAA has prioritized a proactive, partneroriented approach to commercial development, offering build-to-suit options, permitting support, and real-time coordination across agencies. That kind of responsiveness is hard to come by — especially for companies with complex infrastructure needs or aggressive timelines.

The airport’s land availability also enables long-range planning. Companies that commit today can expand over time without relocating — a key differentiator for firms managing multi-phase industrial footprints or scaling logistics capacity in the face of growing e-commerce and supply chain complexity. MCO is not a landlocked operation hemmed in by growth; it’s a dynamic property with room to evolve.

For companies exploring Southeast expansion, reshoring advanced capabilities, or establishing global logistics hubs, MCO delivers a rare combination of connectivity, acreage, and alignment. And in a market increasingly defined by speed and flexibility, that combination is invaluable. Orlando has long been a place people visit. Now, it’s a place where global companies come to stay.

This story was written with assistance from Area Development’s editorial staff for Greater Orlando Aviation Authority, which sponsored and approved this post.

With over 1000 acres (400+ hectares) of centrally located land available for development, Orlando International Airport (MCO) presents an exceptional opportunity for your growing business.

Customizable Land Parcels Available For

• Aerospace

• Aviation

• Advanced Air Mobility

• Manufacturing

• Office/HQ

• FTZ Operations

• Logistics and Warehouse

• Mixed-Use

A premier aviation destination, Orlando boasts beautiful, yearround weather, an attractive cost of doing business, and a talented workforce in an innovation-based ecosystem.

MCO is Home to Leading Aviation & Aerospace Companies

• Aerospace Manufacturing

• Flight Training

• MRO/TechOps

• AMT Training

• Research & Development

• Simulation

Considering a Future at MCO? Contact Paul Mitchell Manager, Business Development

Orlando International Airport paul.mitchell@goaa.org View Available Parcels

MCO-Real-Estate.short.gy/parcels-ss

By Gregg Healy, Executive Vice President, & JC Renshaw, Senior Supply Chain Consultant at Savills

Manufacturing and logistics executives know uncertainty has always been part of global supply chains. Yet today’s volatility—influenced by dramatic swings in transportation costs, sudden geopolitical disruptions, shifting tariffs, climatological events, and significant energy shortages— is uniquely challenging. These are not theoretical concerns—they are concrete issues directly impacting supply chain companies’ real estate strategies, location decisions, and ultimately their profitability.

Consider ocean freight costs. Container shipping rates have swung wildly from about $3,000 per container to peaks near $30,000, disrupting corporate budgets and forcing rapid adjustments to sourcing strategies. These unpredictable cost changes mean that a facility strategically located one year ago might suddenly become economically unviable the next. When logistics costs spike without warning, even the most efficient facilities can become financial burdens. Geopolitical events such as the Suez Canal blockade, the Ukraine conflict, and tensions in the Middle East have intensified these disruptions, injecting unpredictability into global supply chains and forcing executives to reconsider their long-term facility planning.

Tariffs, too, have played an outsized role in recent volatility. For example, when tariffs soared by 145 percent on goods from China, shipping activity slowed dramatically. Companies paused shipments and re-evaluated sourcing strategies. Then, when certain tariff enforcement windows were paused or adjusted, companies scrambled to front-load cargo ahead of potential changes, flooding ports with inventory and overwhelming distribution capacity. The reaction to trade policy shifts—first halting, then rushing to accelerate—underscores the unpredictability facing executives today.

These abrupt changes illustrate a core challenge: demand signals are no longer consistent or easy to interpret. In addition to the aforementioned supply disruptions and risks, variability in those signals has become the norm. A spike in consumer demand may be fleeting, or it may represent lasting structural change—companies are no longer sure. This introduces real risk to network design and real estate strategy.

COVID-19 was a case in point. Many companies adopted a “just-in-case” approach, adding inventory and warehousing capacity in anticipation of ongoing disruptions. As conditions stabilized, many reverted rapidly to “just-in-time,” releasing vast amounts of leased warehouse space back onto the market. That pendulum swing, driven by demand signal variability, has led to significant misalignments between supply and space utilization.

Subleasing activity, for example, has reached all-time highs. As of Q2 2025, 225.2 million square feet of sublease space was available nationwide—up 3.7 percent from the previous quarter and 25.3 percent year over year, according to Savills Research. Companies are simultaneously offloading excess space in one region while seeking space in another. It’s not just a mismatch of supply and demand—it’s a reflection of how variable demand signals and supply chain risks are influencing strategic decisions.

The real estate market has mirrored supply chain instability. Industrial real estate absorption had been growing steadily in the years leading up to the pandemic, driven by the rise of e-commerce. It then surged during and after lockdowns, as increased consumer spending on household goods combined with supply chain bottlenecks to create a perfect storm. The sudden influx of demand resulted in aggressive construction of industrial buildings, leading to overcapacity. Construction starts peaked in 2022, but many of those facilities came online in late 2023 and early 2024, just as demand began to taper off.

Markets such as Phoenix and Atlanta now face high vacancy rates due to this oversupply, while markets anchored by smaller, localized industrial buildings or very large fulfillment centers remain resilient. Detroit, for example, has maintained a more stable market due to incremental, demand-driven growth. The I-85 corridor between Montgomery, Alabama, and Virginia absorbed over 70 million square feet annually during the peak. But that pace is no longer sustainable, and vacancy rates are rising.

These fluctuations highlight a critical need for executives to reassess and recalibrate their real estate strategies, focusing on precise market timing and flexibility in lease structures Generally speaking, mid-size buildings (200,000 - 750,000 square feet) appear especially vulnerable

$225.2 MILLION

that’s the number of square feet available for sublease nationwide in Q2 2025

in the current climate due to oversupply. Smaller buildings continue to serve trades, service providers, and last-mile delivery well, and have seen limited recent development. Meanwhile, the supply-demand dynamics for massive e-commerce hubs—often purpose-built for specific users—remains relatively strong. Size matters, but so does specialization.

The current uncertainty has led companies to prefer shorter-term, tactical real estate moves rather than strategic, long-term commitments. An increasing number of firms are turning to third-party logistics providers (3PLs) for their warehousing needs. This approach allows companies to scale operations up or down quickly without significant capital expenditure or long-term obligations, providing much-needed flexibility during uncertain times.

Similarly, foreign trade zones and bonded warehouses have become increasingly attractive amid tariff volatility. These facilities allow companies to defer tariff payments until products leave the warehouse, enabling more strategic timing of market entry and tariff management. Bonded warehousing is not a long-term solution, but it is a valuable mitigation strategy in the current policy environment. Many companies are using this tool to buy time while they assess whether new tariffs will stick or be reversed after election cycles.

Additionally, the trend toward nearshoring is gaining momentum, with Mexico emerging as a favored alternative to China due to lower labor costs and proximity to the U.S. market. Cross-border trade with Mexico, particularly through Texas, has surged dramatically, necessitating increased warehouse and logistics capacity along these routes. The inland port of Laredo now handles more freight than many coastal ports, and demand for industrial real estate in border towns has skyrocketed. Site selectors evaluating locations along southern supply chains are increasingly prioritizing truck access and intermodal infrastructure over traditional port access. However, the 2026 renegotiation of the USMCA looms.

Amid all these supply chain and real estate considerations, one critical but often overlooked factor is rapidly emerging as a decisive siteselection criterion: power availability.

The growth of energy-intensive industries—electric vehicles, data centers, artificial intelligence facilities—has created staggering demand for electricity. In recent years, companies have queued up for about 2.6 terawatts of new power capacity—more than double the existing U.S.

generation capacity. This means that even if a site has ideal logistics, labor, and incentives, a lack of power can disqualify it. Companies are increasingly walking away from attractive deals simply because there isn’t enough electricity available—or it will take too long to bring it online.

Power availability is becoming a filter, not a footnote. Some companies now begin the site selection process by asking utilities for substation and transmission capacity before any other criteria are reviewed. In power-constrained markets like Northern Virginia, Phoenix, and parts of California, that early disqualification is becoming more common.

Rather than react to disruptions after the fact, executives are beginning to adapt in more forward-looking ways. Some are investing in advanced network modeling and digital twins to simulate future supply chain scenarios and risks. These tools enable organizations to evaluate their current footprint, identify potential bottlenecks, and visualize alternative configurations that optimize speed, resilience, and cost. One client we worked with discovered through digital modeling that their redundant regional distribution network was adding significant (i.e. >40%) transportation costs without improving customer service. By realigning responsibilities among sites and adjusting service areas, they improved efficiency and freed up capital.

Others are leaning into automation to mitigate workforce uncertainty and handle volume fluctuations more effectively. Unlike labor, which can be difficult to scale up or down quickly, automation infrastructure can be adjusted to meet demand in real time. Investing in automation also allows companies to maintain operations during labor shortages or policy-driven wage spikes. For some of our clients, automation is not just a productivity play—it’s a strategic hedge against volatility.

Finally, companies are making more strategic decisions about location. Instead of pursuing tax incentives or labor alone, many are looking for regions that offer long-term sustainability. That includes rail-served industrial parks, inland ports, and multi-modal hubs. While rail isn’t ideal for all businesses—some see it as too slow or unpredictable—it remains essential for heavy manufacturing sectors such as plastics and metals. Those that rely on bulk raw materials are increasingly seeking rail-connected sites, despite concerns about service predictability.

Today’s heightened volatility underscores a vital truth: companies must evolve beyond simply reacting to disruptions. Those that embrace flexibility, proactively adjust their real estate strategies, and integrate advanced supply chain insights into facility planning will thrive.

Adaptability is no longer a competitive advantage—it is a requirement. Businesses prepared to pivot rapidly and strategically will gain significant operational stability and resilience. The past few years have shown us that supply chains are no longer invisible back-end systems. They are strategic assets, and how companies manage their physical footprint—where they locate, how they lease, how they mitigate risks, and how they plan for growth—will define who wins the next decade.

The key to navigating the current environment isn’t brute strength or mere intelligence—it’s flexibility. As we often tell our clients, the companies that succeed are not the biggest or the fastest. They are the ones most willing to evolve. And in this market, nothing is evolving faster than the intersection of supply chain and industrial real estate.

Embedding automation into leases may offer companies a smarter way to balance risk, cost and productivity

By Joe Dunlap, Chief Supply Chain Officer at Legacy Investing

In my decades of experience providing supply chain network design and operations design, I’ve repeatedly encountered one major challenge that businesses struggle to overcome: balancing the high cost of automation with the pressure to improve productivity, capacity, accuracy, safety and speed, particularly in distribution operations.

Automation’s appeal is clear — companies seek lower cost, faster fulfillment, lower error rates, improved worker safety, and reduced reliance on increasingly scarce labor pools. Yet, implementing automation has historically been prohibitively expensive, causing even sophisticated operations to scale back ambitious plans due to financial constraints. In many cases, companies face sticker shock when presented with a comprehensive automation solution costing tens of millions of dollars, leading them to settle for less-than-ideal compromises.

However, an emerging approach offers businesses a financially savvy way to overcome these hurdles: integrating automation investments into real estate leases. While this model has been around for years in other property types, it is not widely adopted in industrial real estate. It’s gaining traction due to its logical alignment with long-term operational and financial goals.

Typically, companies approach automation investment separately from real estate considerations. A common scenario might involve a manufacturer or distributor first selecting a site and leasing a building. Concurrently, they would contract with consultants or integrators to design and implement automation solutions. Often, these automation systems are financed through short-term equipment loans or funded directly from company capital.

This segmented strategy leads to substantial upfront costs and relatively high short-term financial burdens, as traditional equipment financing terms are usually limited to five years at elevated interest rates. Consequently, the overall cost per unit handled remains high, and the flexibility to scale or adapt can be significantly constrained.

The alternative — and increasingly attractive — model treats automation infrastructure similarly to real estate fixtures like HVAC or lighting systems. This approach bundles the cost of substantial automation systems into the long-term lease of the facility itself, allowing tenants to spread the financial impact over a longer period, typically aligned with real estate amortization schedules of 10, 12, 15, 20 years or more. This lowers the monthly cost compared with other options and creates a long-term, predictable cost forecast with less variability or surprises.

Connecticut is home to Sikorsky, Pratt & Whitney, and hundreds of aerospace firms manufacturing everything from helicopters to jet engines. Nearly ¼ of all U.S. aircraft engines and parts are made here by the most highly productive and skilled aerospace workforce in the world. Quite literally, nothing flies without Connecticut.

This method offers notable advantages. First, companies can avoid hefty initial investments or expensive equipment loans, making automation more accessible even to smaller operations. Second, because automation infrastructure can be amortized over an extended period at lower real estate rates, the total monthly expense is significantly lower than traditional financing options. Third, companies can align their financial strategy with their operational reality. Automation infrastructure embedded into the building lease naturally encourages tenants to plan for long-term use and benefit from operational stability.

Consider a 500,000-square-foot distribution facility scenario with a comprehensive automation investment of $100 million. Traditional financing through equipment loans and real estate leases could result in combined monthly expenses of around $3 million. By bundling these costs into a long-term facility lease, however, companies could reduce monthly expenses dramatically, often achieving a significant internal rate of return (IRR) and substantial net present value (NPV) savings.

From an operational perspective, automated facilities dramatically reduce reliance on large, low-skilled labor pools. For instance, a typical manual fulfillment center might require 800 material handlers and forklift operators across three shifts, while an automated equivalent could achieve the same output with just 80 skilled mechanics, technicians, and programmers. This shift benefits regions facing labor shortages, particularly smaller counties or rural areas that struggle to attract large numbers of manual laborers but can support skilled technical roles.

Naturally, businesses considering this integrated approach must weigh certain risks and practical considerations that come with automation and change. One frequent concern is the adaptability of automation infrastructure to future tenant requirements or changes in product mix. However, because most automated fulfillment solutions for picking and packing operations handle relatively uniform cube for sellable eaches — small to medium-sized items — the likelihood of reuse remains high.

$100 MILLION

that’s the automation investment bundled into a facility lease in one real-world example

Additionally, companies need to plan for technology evolution. Core automation systems like multi-shuttle storage and retrieval solutions have decades-long life cycles, while some peripheral technologies like robotic arms or vision-guided picking systems might need periodic upgrades. A flexible lease agreement that accommodates planned technology refreshes ensures operations remain competitive without incurring massive financial shocks.

W hile automation is sometimes viewed skeptically as a job eliminator, a nuanced view reveals more complex realities. Automated facilities shift labor from numerous lower-paying, manual tasks toward fewer but higher-paying skilled positions such as mechanics, technicians, programmers, and integration specialists. For companies, this labor shift presents a strategic opportunity to reduce churn, elevate workforce productivity, and capture more value from each hire — especially in smaller communities challenged by labor scarcity.

Indeed, far from merely eliminating jobs, automation reshapes them — often leading to increased job quality, improved workplace safety, higher retention, and greater worker satisfaction.

Ultimately, the integration of automation into real estate leases represents a strategic shift rather than just a financial tactic. It aligns business operations closely with long-term financial planning, facilitating smarter capital allocation decisions. For companies, economic developers, and landlords alike, understanding and embracing this model can provide substantial competitive advantages.

As automation continues its inexorable advancement, reshaping industries and redefining economic landscapes, integrating it seamlessly with real estate strategies offers both financial efficiency and operational excellence. It’s not just about managing today’s operational challenges — it’s about strategically positioning businesses and communities for tomorrow’s successes.

Chad Schneider CEO & Founder, Root3 Labs

From the Port of Baltimore, which allows for really large parts to be imported and exported, to the international airports and main roadways, Maryland is the place to be if you want to be globally connected. you

By Kimberly Graulein Area Development Staff

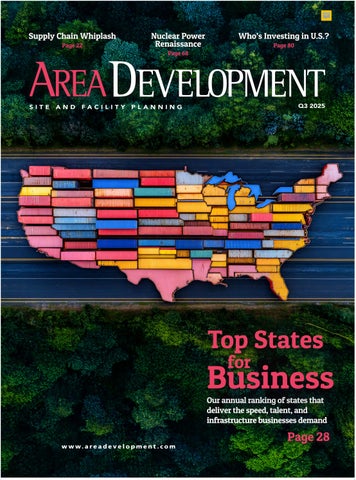

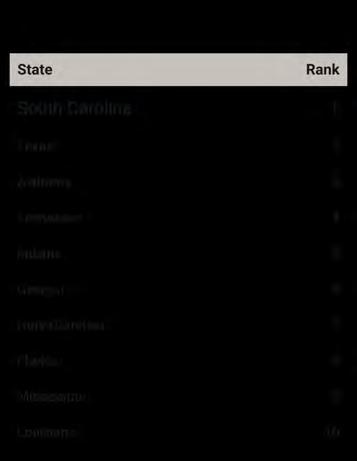

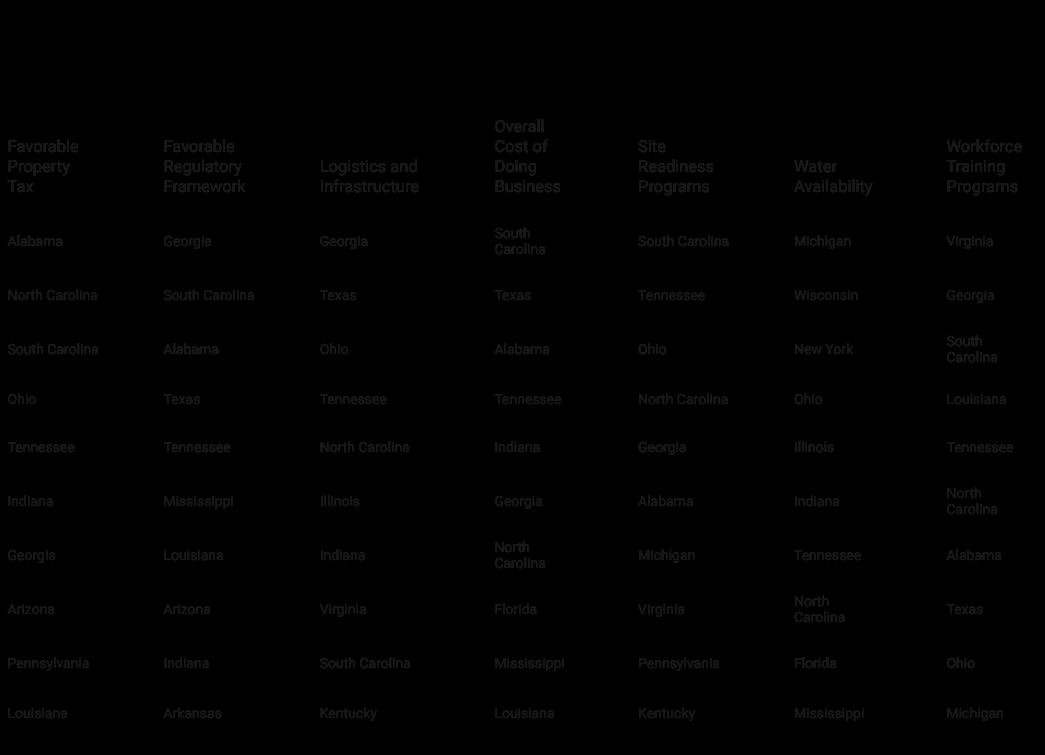

Georgia is back on top — again. For the 12th consecutive year, the state has claimed the No. 1 overall ranking in Area Development’s annual Top States for Doing Business survey. While Georgia’s consistency speaks volumes, the real story in 2025 is just how competitive the field has become beneath the surface.

This year’s rankings reflect a rapidly evolving economic development landscape — one shaped by pressure on timelines, power infrastructure, and workforce pipelines. The consultant panel behind the survey made clear that states no longer rise to the top simply by offering low taxes or generous incentives. Today, it’s about execution: how quickly and reliably a state can align land, labor, logistics, and leadership behind a fastmoving project.

That’s a shift from a decade ago, when low costs and business-friendly branding often drove rankings. As the challenges facing manufacturers and logistics companies have grown more complex, the metrics for evaluating a “top state” have evolved in kind. Site selectors today are looking for integrated solutions — energy infrastructure that can scale, workforce systems that deliver talent on demand, and permitting pathways that reduce friction without sacrificing oversight.

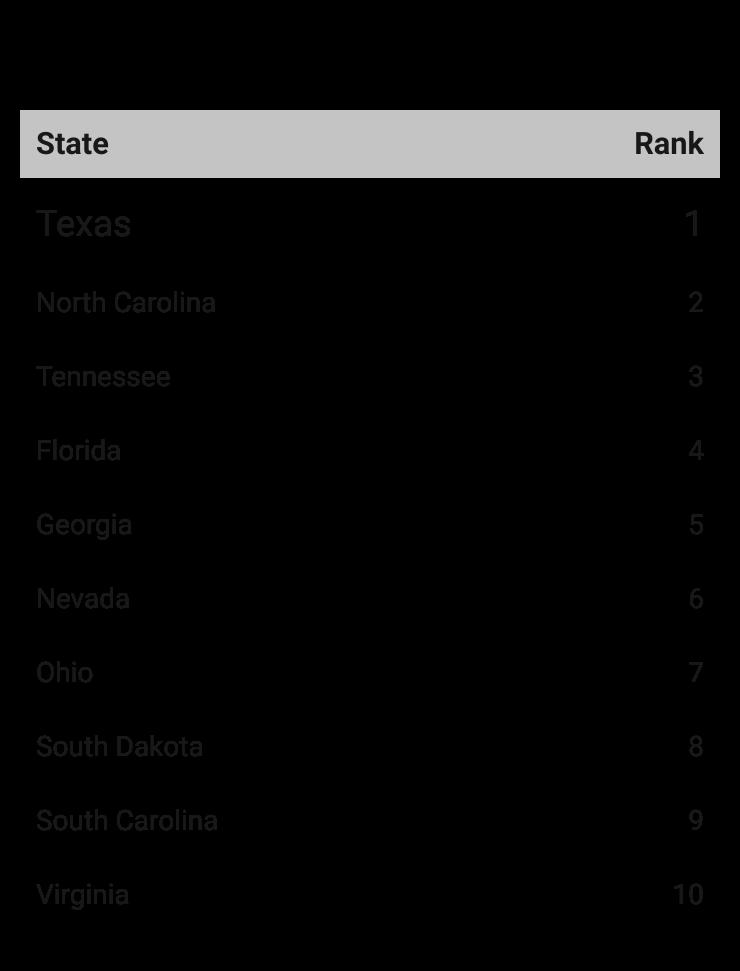

This year’s methodology reflects that evolution. For the first time, we’ve split energy infrastructure into two separate categories — “Energy Availability” and “Energy Cost” — to better capture the unique challenges posed by the modern grid. We also continue to elevate the importance of water access, permitting speed, and site readiness — all increasingly make-or-break factors in large capital investment decisions.

The states that perform well aren’t just “pro-business.” They’re aligned. That word —

Partner with a state that understands the importance of preparing your business for the future. Georgia’s pro-business environment and collaborative spirit are just some of the reasons why companies that locate here, expand here.

Learn why people are choosing Georgia at Georgia.org

alignment — came up repeatedly in consultant feedback this year. It’s not enough to have programs on paper. It’s about whether those programs translate into on-the-ground responsiveness across agencies, utilities, and educational institutions. And whether that alignment holds under pressure.

“Our clients’ decisions continue to be guided by three essential pillars: strong access to qualified talent, consistent pro-business policy at both the state and local level, and aggressive site development efforts,” says Alex Miller, manager at KSM Location Advisors.

“ The top-ranked states in this year’s list excel in all three areas, offering companies the predictability, speed to market, and scalability they demand in a competitive global landscape.”

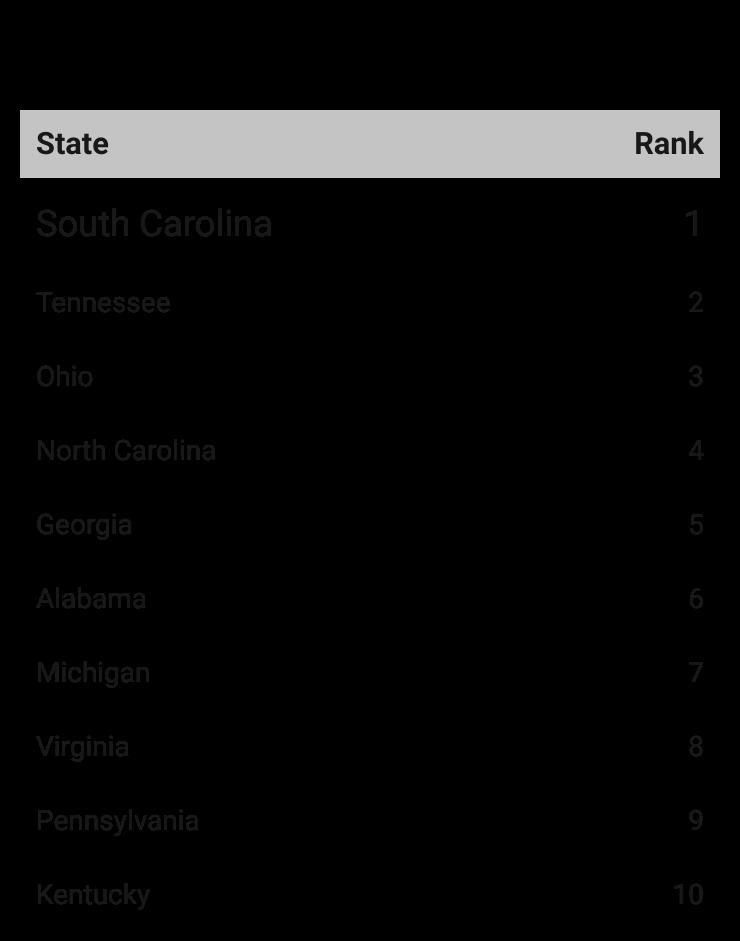

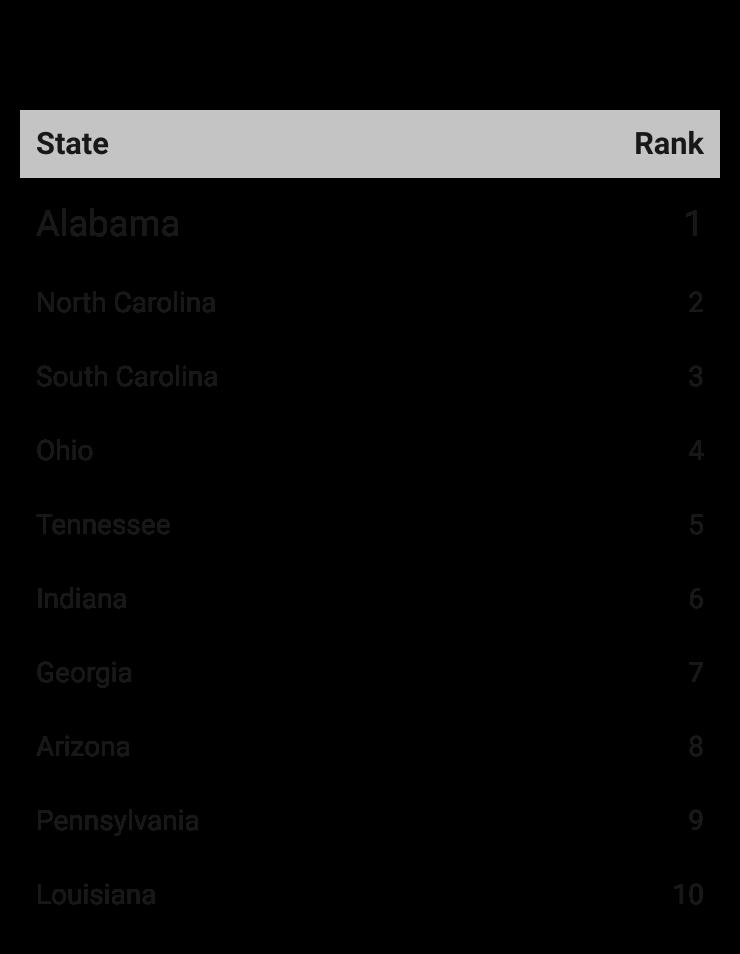

The 2025 rankings again reflect the dominance of the Southeast, with South Carolina, Texas, North Carolina, and Ohio rounding out the top five. But they also spotlight rising performers like Virginia, Indiana, and Michigan, and show sharper distinctions within categories that matter most to consultants today: workforce development,

energy infrastructure, site readiness, permitting, and long-term resilience.

This year’s package breaks down the 14 ranked categories into four editorial themes: Speed, Sites & Permitting; Workforce Wins; Energy, Infrastructure & Resilience; and Business Climate & Government Support. Within each, we’ve woven direct insights from the consultants who guide capital investment decisions every day — those helping companies answer not just where to grow, but why. While the survey data ranks states based on performance, the commentary reveals something deeper: that even among the top states, the bar is rising.

“In today’s evolving economic landscape, predictability is paramount,” Miller adds. “These fundamentals continue to shape corporate expansion decisions and position top-ranked states as enduring leaders in business climate and competitiveness.”

I n the pages ahead, we’ll explore which states are delivering — and what it will take for others to catch up in 2026 and beyond.

For many corporate expansions, the question is no longer where to go — it’s who can move fast enough. In 2025, speed to market isn’t just an advantage. It’s the baseline. As project timelines compress and permitting hurdles grow more complex, states that offer ready-to-go sites, transparent permitting paths, and aligned local coordination are separating from the pack.

Project Ready® Certified Sites. Vetted. Powered. Ready to go.

In today’s world, speed-to-market is everything. Mississippi Power knows that when you’re choosing a new location, you need confidence not questions. That’s why we created the Project Ready® Certified Sites program: to deliver development-ready sites that are thoroughly vetted, risk-free and independently verified by the longest running economic development group in the state.

Discover the power of building in Mississippi.

Available, reliable, affordable power

Mississippi ranks in the top 10 for overall cost of doing business

Customizable contracts & fast-track permitting

Top 5 in logistics — prime SE location with port, rail and interstate access

Explore available sites

Texas takes the top spot for availability of sites, with South Carolina, Georgia, North Carolina, and Ohio close behind. Each of these states has made deliberate investments in land banking, utility mapping, and statewide inventory systems that help consultants and companies quickly evaluate large parcels.

“Speed to market is a key goal for an increasing number of our clients,” says John Boyd, principal of The Boyd Company. “Government — especially planning and zoning units — needs to be responsive and learn to move at the speed of business.”

But having land isn’t enough. States that perform well in site readiness programs go further by proactively clearing hurdles like due diligence, environmental review, and utility extension planning. In this category, South Carolina, Georgia, Tennessee, Indiana, and Ohio rank at the top — each known for strong collaboration among state agencies, utilities, and economic development teams.

States at the forefront are also offering standardized site certification programs, with pre-qualified sites that minimize uncertainty for manufacturers. Several consultants noted that projects with high capital intensity — such as EV battery, semiconductor, or biotech facilities — are particularly sensitive to permitting timelines and utility access. That’s led to greater scrutiny not just of current readiness, but of how quickly infrastructure can be extended or scaled on demand. In some cases, the existence of a fast-track permitting protocol or inter-agency strike team can be a deciding factor.

“ With so many good sites already acquired over the past five years, it is vital for regions and states to identify the next generation of sites to ensure that their areas are prepared for site selection projects,” says Larry Gigerich, executive managing director of

Ginovus. “Companies need to move very quickly once a location decision has been made, and the places that are ready will be the big winners in economic development.”

Permitting remains one of the biggest chokepoints in the development process — but some states are finding ways to turn it into an advantage. Georgia leads the 2025 rankings for speed of permitting, followed by South Carolina, Ohio, North Carolina, and Texas. Consultants praise states that streamline review across agencies, offer point-of-contact case management, and demonstrate a culture of responsiveness.

“Over the past five years, both site readiness and energy availability have become increasingly important factors in site selection,” says Jonathan Gemmen, senior director at Austin Consulting. “The remaining sites often present obstacles to becoming development-ready in the near term. As a result, identifying suitable sites for large industrial projects — especially those requiring rail access — is becoming increasingly complex.”

“ The start of this year has been slower than anticipated, primarily due to the Administration’s unsteady rollout of new tariffs and uncertainty around U.S. tax policy,” adds Ford Graham, managing director at McGuireWoods Consulting. “Communities who win will be those that have development-ready sites and existing buildings, AND who have been in ongoing communications with target companies despite the natural tendency to wait until things start moving again.”

Lancaster County offers a skilled workforce, prime location, and pro-business environment that attracts companies and supports long-term growth. Scan the QR code to find out why industry belongs in Lancaster County, South Carolina.

Across these categories, the strongest performers share one thing: alignment. When agencies, utilities, and local partners work together with urgency, companies notice — and reward that collaboration with investment.

In the 2025 rankings, states that win on talent do so in two key ways: by developing a robust pipeline of skilled workers and by helping companies access and train that talent with precision. Workforce is no longer just about population or unemployment rates. It’s about alignment, customization, and delivery.

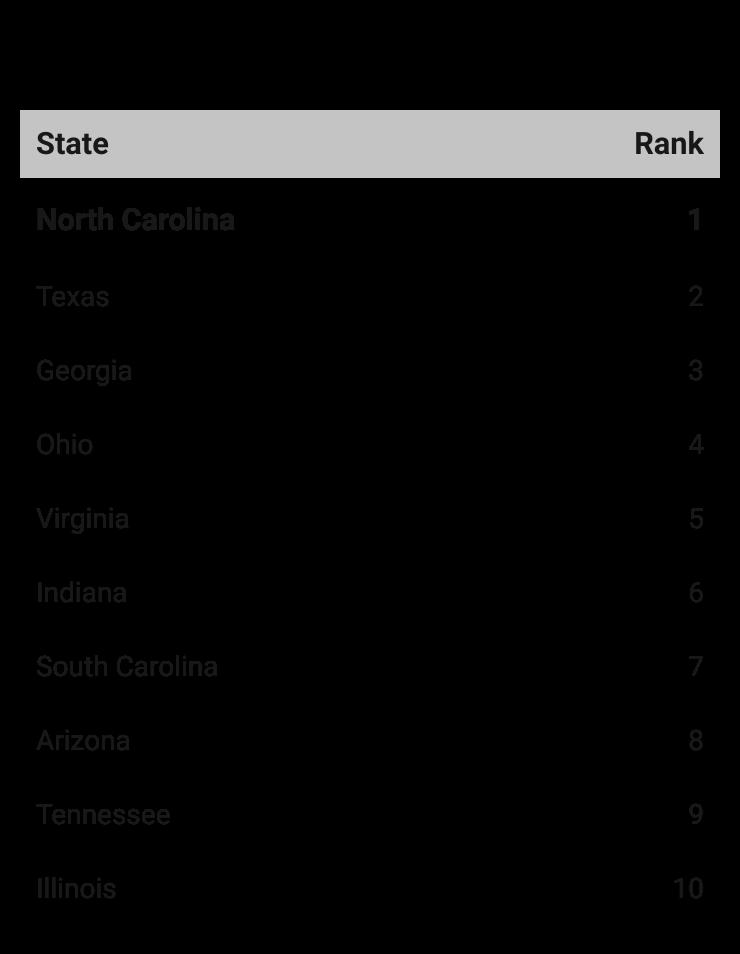

V irginia takes the No. 1 spot in workforce training programs, followed by Georgia, South Carolina, Tennessee, and North Carolina — all states with well-regarded, state-supported programs that align closely with employer needs.

“Industrial companies increasingly look for existing ecosystems and concentrations of similar businesses — and therefore available talent — in a given location,” says Brooklin Salemi, senior managing director at Newmark.

“That’s key, although in some cases it takes a backseat to infrastructure needs like water and power.”

Access to qualified labor, another closely watched category, is led by North Carolina, Texas, Georgia, Ohio, and Virginia — a mix of states that combine high population growth with a growing base of skilled technical and manufacturing workers. Consultants also note that labor availability is now weighed alongside long-term demographic trends, automation adoption, and proximity to training centers.

“ The U.S. is experiencing a manufacturing plant building boom due to reshoring, the Inflation Reduction Act, and subsidies to the nation’s EV and semiconductor industries,” says Alexandra Segers, general manager of Tochi Advisors. “But large projects face three main issues: labor shortages, few site options, and power availability. Site inventory is low, and due to changed energy concepts — for example, gas-free production — power demand is much higher nowadays.”

“Although discussions about incentives will never go away, workforce availability, recruitment support, and training programs will be the most important parameter set over the next 12 months,” adds Ford Graham.

Customization is another area of growing importance. Increasingly, states are judged not just by the presence of training programs but by their ability to tailor those programs to new and emerging sectors. Life sciences, advanced manufacturing, clean tech, and AI-driven industries often require specialized skill sets

that aren’t easily sourced from generic training pipelines. That’s led some states to offer “concierge-style” workforce solutions — forming partnerships with companies pre-announcement to codevelop curricula, fast-track credentialing, and coordinate with local school systems and community colleges.

Moreover, the most successful workforce ecosystems don’t just serve new employers; they support career progression for local residents. States that invest in stackable credential programs, apprenticeships, and adult re-skilling pathways are building resilience into their labor markets, which consultants say can be just as important as current headcount.

“Despite the recent economic turbulence that brings a degree of uncertainty to investment projects, the fundamentals remain relatively unchanged for an investor,” says Marc Beauchamp, president of SCI Global. “From a Canadian site selector’s perspective, workforce readiness, site availability, and business-

The City of Norfolk offers a premier solutions for companies

friendly policies are increasingly relevant for manufacturers seeking U.S. expansion options.”

In short, workforce wins aren’t won on size alone. They’re won on strategy.

W hile workforce development rightly focuses on training and recruitment, top-tier states are also addressing the barriers that keep workers from showing up. In 2025, that means looking beyond classrooms and into the community.

Affordable housing, reliable childcare, and transportation access are fast becoming factors in site selection conversations. Executives are asking not just where they can find talent, but where that talent can live and thrive. States like Georgia, Virginia, and Texas are beginning to incorporate workforce enablement

Halfway between Athens and Atlanta sits Rowen — offering 2,000 acres of flexible site options where the dreamers, thinkers and doers of tomorrow converge. rowenlife.com

into their economic development strategies — partnering with housing authorities, childcare providers, and transit agencies.