INTERNATIONAL ACCOUNTANT

SUPPORT WHEN IT MATTERS MOST

We believe no aspiring accountant should be held back by financial barriers. The AIA Educational & Benevolent Trust supports those working towards the AIA Qualification, offering help when it’s needed most. Apply for support today, or donate to inspire someone’s journey.

the Financial Accounting and Reporting 2 exam

This guides students through the five essential steps for success: mastering the technical content, developing exam technique, adopting a clear strategy, maintaining a positive mindset and performing under pressure.

Failure to prevent fraud

Caroline Black (Gherson Solicitors) reviews the UK’s new corporate offence under the Economic Crime and Corporate Transparency Act. Large organisations must now show they have reasonable procedures in place or face unlimited fines.

Sustainability

Why sustainability matters for SMEs

Martta Ääri (Aila) explains why accountancies are key in helping SMEs to manage growing ESG demands and can make sustainability reporting practical and valuable for small businesses in a changing market.

Sustainabilityreporting

The Voluntary Standard for SMEs in Europe

(AIA).

The European Commission has a voluntary framework designed to ease the pressure on SMEs from sustainability reporting. A proportionate approach with flexible modules should enable businesses to build credibility while boosting resilience and competitiveness. Practicemanagement

Managing challenging clients

Anna Goodwin (Anna Goodwin Accountancy) draws on her 30 years of experience to offer practical advice on handling difficult clients. She outlines strategies to reduce stress, improve practice efficiency and foster healthier, more productive client relationships.

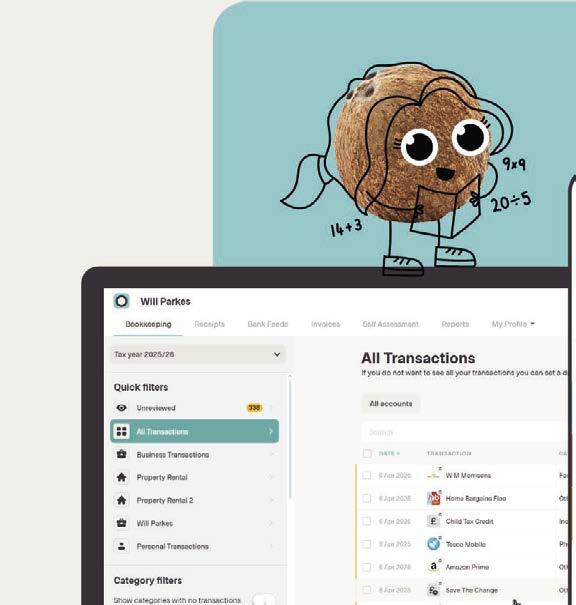

Practicemanagement

The art of onboarding

Eva Mrazikova (IRIS) argues that effective onboarding sets the tone for lasting client relationships. Accountants can use onboarding to build confidence, trust and loyalty while creating opportunities for growth and referrals.

AI virtual assistants

Dylan Brown (LexisNexis) examines how AI-powered assistants are reshaping accountancy by streamlining administrative work, producing reports and improving responsiveness.

NFRA’s new programme

India’s National Financial Reporting Authority is shifting its focus from reactive enforcement to proactive oversight. Aiming to raise audit quality nationwide, these reforms will affect both global networks and smaller domestic firms.

Concerns with the EU Omnibus Sunita Devi (Devcom Trends) critically examines the EU Omnibus legislation, which reduces reporting obligations for many smaller firms. While intended to cut costs, the package raises serious concerns about transparency.

A profession at the crossroads

As the pace of change accelerates in both regulation and technology, the role of accountants and financial professionals has never been more pivotal. The features brought together in this issue highlight just how wide ranging – and pressing – the challenges are: from building sustainable business practices to navigating new fraud legislation, from embracing artificial intelligence to rethinking how we serve clients.

Several contributors remind us that sustainability is no longer a niche concern. Martta Ääri underlines how SMEs, long exempt from complex disclosure rules, are increasingly expected to supply environmental and social data to banks, clients and consumers. Accountants, with their trusted role and data handling expertise, are uniquely placed to translate daunting frameworks into practical action for these businesses.

Sunita Devi, meanwhile, sounds a sharp warning about the EU Omnibus –legislation that may simplify requirements, but risks diluting accountability at a moment when climate urgency is peaking. Taken together, these pieces argue that our profession is not a passive observer of sustainability change but a central actor in ensuring it has teeth.

Another strong theme is trust. Caroline Black’s analysis of the new UK corporate offence of ‘Failure to Prevent Fraud’ lays out the high stakes for large organisations.

No longer can firms treat fraud prevention as a compliance afterthought: regulators expect documented risk assessments, training and top-level commitment to integrity. The message is clear – as enforcement is tightening, prevention must become part of business DNA. If regulation is one side of the coin, innovation is the other. Dylan Brown explores how AI virtual assistants are reshaping professional services, offering speed and efficiency gains that can free human expertise for higher-value work. Yet he cautions against blind enthusiasm. Without governance, training and proper measurement, these tools could introduce new risks rather than reduce them. Responsible adoption will determine whether AI is an asset or a liability.

But amid all this change, one constant remains: the client relationship. Eva Mrazikova reminds us that onboarding is the foundation of lasting partnerships. In a digital-first, regulated world, first impressions count more than ever. Thoughtful communication, streamlined processes and human reassurance can transform onboarding from a burden into a strategic advantage.

The threads woven through these contributions – sustainability, integrity, innovation and client trust – show a profession at a crossroads. External pressures are mounting, but so too are opportunities to lead. Accountants are not simply responders to regulatory shifts; they are shapers of more sustainable, ethical and efficient economies.

Contributors to this issue

Martta Ääri is the Co‑Founder of Aila, a company developing digital tools that make sustainability reporting accessible for SMEs.

Caroline Black is a recognised leader in business crime and corporate investigations, and a consultant at Gherson Solicitors LLP.

Dylan Brown has over 12 years’ experience in content marketing and thought leadership for LexisNexis Legal & Professional.

Sunita Devi is a Certified Sustainability Reporting Specialist at Devcom Trends, working with public listed companies to adhere to reporting standards.

Anna Goodwin at Anna Goodwin Accountancy has 30 years of experience in accountancy, supporting businesses, accountants and individuals.

Eva Mrazikova is a Director of IRIS Product Marketing, and practicing accountant with 20 years’ experience in industry and the practice environment.

Angela Partington Editor, IA

MARTTAÄÄRI

CAROLINEBLACK

DLYANBROWN

SUNITADEVI

ANNAGOODWIN

EVAMRAZIKOVA

Auditors warned about weak oversight of AI tools

The Financial Reporting Council (FRC) has issued a warning to large audit firms after publishing its ‘Thematic review on the certification of automated tools and techniques’ (ATTs), which exposed shortcomings in how firms validate and monitor AI-enhanced technology in audit work.

The review, covering the six largest UK firms – BDO, Deloitte, EY, Forvis Mazars, KPMG and PwC – found that although procedures exist to certify ATTs before deployment, their quality varies significantly. Most concerning was the absence of formal metrics or key performance indicators linking ATT use to audit quality outcomes.

Certification is usually handled centrally for widely deployed tools, while bespoke applications are certified at engagement level. However, some firms lack formal policies and often fail to conduct UK-specific re-certification of

Singapore expands reduced disclosure option

Singapore’s Accounting and Corporate Regulatory Authority (ACRA) and Accounting Standards Council (ASC) have announced a significant amendment to FRS 119, broadening the scope of entities eligible to apply reduced disclosures in their financial statements.

The revised standard, ‘Subsidiaries and small entities without public accountability: disclosures’, was issued on 8 September 2025 and will apply to annual reporting periods beginning on or after 1 January 2027, with earlier adoption permitted.

Previously, FRS 119 was available only to subsidiaries that were not publicly accountable and whose parent company produced consolidated financial statements. Under the new guidance, small entities without public

global tools. Maintenance and monitoring also remain limited: oversight typically measures usage statistics, such as licensing, rather than whether tools improve audit quality. No firm has yet introduced robust systems to assess quality impact, and recertification tends to occur only when tools are updated, rather than following a regular review cycle.

The FRC emphasised that the rise of AI within ATTs — such as machine learning for journal entry analysis or generative help tools — brings fresh risks around bias, transparency, training, explainability and model provenance. It urges firms to reinforce their certification frameworks, incorporate AI-specific checks, and ensure audit teams understand tool limitations.

For practitioners, the message is clear: incorporating automation and AI into audits carries opportunity, but must be matched with strong governance, ongoing evaluation and documented risk controls.

Audit reform stalls again in the UK

accountability will also be able to opt in, provided they satisfy at least two of three criteria for the two preceding years: revenue of S$10 million or less; total assets of S$10 million or less; and 50 or fewer employees.

The move is intended to ease compliance costs while maintaining the integrity of financial reporting. For many small or less complex businesses, full FRS disclosure requirements can be burdensome, producing lengthy reports of limited relevance to users. By allowing simplified reporting, regulators hope to strike a better balance between transparency and efficiency.

ACRA noted that take-up of the Singapore Financial Reporting Standard for Small Entities has been relatively low, with many small firms choosing to prepare full FRS financial statements instead. The revised FRS 119 is designed to provide a ‘middle ground’, offering the recognition and measurement principles of full FRS with a lighter disclosure load.

Plans to establish the Audit, Reporting and Governance Authority (ARGA), the long-promised successor to the Financial Reporting Council (FRC), have been delayed once more after the government confirmed that the draft Audit Reform and Corporate Governance Bill will not progress to pre-legislative scrutiny this parliamentary session.

ARGA was first proposed in 2018 following the Kingman Review, which concluded that the FRC lacked sufficient independence and powers to tackle systemic failings exposed by collapses such as Carillion and BHS. The new regulator was expected to have enhanced enforcement powers, including the ability to sanction company directors, expand oversight to large private firms, and strengthen governance requirements across the market.

However, ministers told the Business & Trade Committee in July that ‘the volume of legislation before Parliament’ meant the bill could not be prioritised. Instead, the government will launch further consultations with stakeholders, leaving the timetable for reform uncertain. Industry observers now believe ARGA may not be operational until 2026 or later.

Finprov Learning to be AIA’s new study provider in India

AIA welcomed Anand Kumar, CEO of Finprov Learning, and Sharon Jandu, AIA Council member, to the AIA Head Office to solidify an agreement that will bring AIA qualifications to more students across India. This important step builds on AIA’s recent visit to India and reflects a shared commitment to making high-quality accountancy education more accessible. The agreement confirms Finprov Learning as an approved AIA study provider, allowing students in India to study for AIA’s globally recognised qualifications through a trusted local partner.

Finprov Learning is a respected education provider in India, known for its practical, career-focused training in finance and accounting. AIA and Finprov discussed how they can work together to support students and professionals through innovative learning, international collaboration and a shared focus on high standards.

This partnership is part of AIA’s wider strategy to grow its global network and create real value for students and members through strong international relationships.

AASG Risk Outlook: Anti-Money Laundering Guidance Update

The Accountancy AML Supervisors’ Group (AASG) has published its latest ‘Risk Outlook – High Risk Circumstances’, dated 22 September 2025, outlining the evolving landscape of money laundering, terrorist financing and proliferation financing risks in the UK accountancy sector (see tinyurl.com/bde2scmt).

AASG is comprised of the 13 accountancy professional body supervisors (PBSs) who are supervisory authorities under the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017 (MLR17). These bodies work together to develop consistent policies and best practices for anti-money laundering and counter-terrorist financing supervision in the accountancy sector.

The impact of money laundering is devastating. It enables serious organised crime such as modern slavery, drugs trafficking, fraud, corruption and terrorism. By knowing and understanding the risks to which the accountancy sector is exposed, the government, law enforcement and professional body supervisors, as well as the accountancy firms themselves, can work together to ensure that criminals find it difficult to exploit accountancy services.

This updated guidance is essential reading for all AIA members, particularly those working in external accounting, tax advisory, and trust or company services. It highlights:

● emerging threats, such as cryptoasset misuse, AI-driven fraud and sanctions evasion;

● high-risk services, including payroll, tax advice, company formation and accountants’ certificates of confirmation;

● red flag indicators for client behaviour, including secrecy, complex ownership structures and links to high-risk jurisdictions;

● sector-specific vulnerabilities, including cash-based businesses; and ● new obligations around identity verification for Companies House.

The document also reinforces the importance of professional scepticism, robust AML policies and tailored risk assessments. Firms are reminded to regularly review their exposure and update procedures accordingly.

David Potts, AIA Director of Policy and Regulation and MLRO, said: ‘This is a vital resource for AIA members. It reflects the increasingly complex threats facing the accountancy sector, from cryptoassets and AI-driven fraud to sanctions evasion. All firms should review the guidance and ensure their AML policies and risk assessments are updated.’

AIA members are strongly encouraged to read the full AASG Risk Outlook and integrate its findings into their firm-wide risk assessments and AML controls. The document complements the UK’s National Risk Assessment (NRA) and should be used alongside it. Additional supplementary guidance has also been released relating to verifying the beneficial owners of clients. Further guidance is available for AIA members by logging in and accessing the AML hub

INDIA

Celebrating 18 years of volunteering excellence

At AIA, we are proud to champion members who embody the highest standards of the accountancy profession not only in their professional work, but in the positive impact they make in their communities. One such inspiring

HONGKONG

figure is Muhammad Bilal, a dedicated accountant, AIA Fellow, and tireless volunteer who has devoted the past 18 years to charitable service.

From leading fundraising campaigns and providing retail support to offering expert bookkeeping for charitable organisations, Bilal’s contribution has been as varied as it is impactful. His work has earned him multiple honours, including the Flame of Hope Award and the Shipley Community Award.

Bilal sees volunteering not just as a personal passion but as a civic duty, a belief closely aligned with AIA’s own values of integrity, service and responsibility. Extending his ethos of service to the profession, he mentors trainee accountants and supports newly qualified professionals, generously offering his time and expertise free of charge.

Recognising his dedication, Bilal was recently invited to the prestigious Royal Garden Party, where he met members of the Royal Family, diplomats, community leaders and

others celebrated for outstanding public service.

Bilal said: ‘As someone from a humble background and a first-generation British Pakistani, I never imagined attending such a prestigious event. I am passionate about serving my community in a way that reflects the values of equality, compassion and public service. This experience has strengthened my commitment to inclusive civic leadership.’

At AIA, we know that members like Bilal are living proof of how professional accountants can make a difference beyond the workplace. Through our global network, professional development programmes and peer support, we aim to empower all our members to lead with purpose – whether that’s in boardrooms, communities or voluntary service.

Bilal’s story is more than a celebration of one member’s achievements; it is a testament to what the profession can achieve when expertise is combined with compassion and civic responsibility.

AIA Members Connect and Learn at Hong Kong Workshop

On 5 September 2025, members and friends of the AIA Hong Kong Branch came together for a day of learning, connection and community engagement. The event brought together 20 participants.

The day began with a guided tour of the Legislative Council Complex,

introduced by Hon. Edmund Wong, where members explored the architecture and gained a first-hand understanding of the institution’s operations. The visit offered participants a valuable opportunity to deepen their understanding of the city’s legislative framework, encouraging engagement with civic life beyond their professional roles as accountants.

Following the tour, Hon. Edmund Wong also hosted a practical training workshop on cardio-pulmonary resuscitation and automated external defibrillation. Members learned essential life saving techniques through hands on practice, reinforcing the importance of emergency preparedness in both

personal and professional settings.

The event reflects AIA’s wider mission to support members not only in their professional growth but also in their personal development and wellbeing. By providing opportunities to learn outside the field of accountancy, AIA continues to foster a close knit community where members can broaden their horizons, gain practical skills and enjoy enriching experiences together.

The Hong Kong Branch looks forward to hosting more activities that strengthen connections, expand knowledge and equip members with tools to contribute meaningfully, both to their profession and to society at large.

Muhammad Bilal FAIA

Passing the Financial Accounting and Reporting 2 exam

Success in exams hinges on thorough preparation, effective exam techniques, a strategic approach, a positive mindset and strong performance on exam day.

While you’ve been studying for the Financial Accounting and Reporting 2 exam, have you found yourself asking ‘How will I ever pass this?’ or ‘What’s the secret to success?’

Like so many things in life, preparation is key! A methodical, well-planned and well-executed approach will have you walking into the exam room feeling confident and ready. You’ll know exactly what to do to pass the exam.

So, how do you get to that point? It comes down to these five key factors:

● understand the technical content of the syllabus;

● develop solid exam technique;

● devise an exam strategy;

● adopt a positive mindset; and

● deliver on the day.

Each of these factors is considered below.

1.Understandthetechnicalcontentof thesyllabus

You must develop a sound understanding of the syllabus content. This requires more than just rote learning rules from the accounting standards. Instead, you need to actively practise

applying these standards to different scenarios using the practice and exam questions banks.

To get the most out of your question practice, it’s important to review the model solutions carefully to check your technical understanding. When you review a model solution, remember that your answer doesn’t have to be perfect. You are not aiming to reproduce the model solution; however, the model solutions can be a useful learning tool.

Firstly, identify any technical errors you’ve made, such as mistakes in your calculations. Next, check whether your answer addresses all aspects of the question and covers the relevant IFRS Accounting Standards. If your answer falls short, go back to the question and find the clues in the scenario that would prompt you to identify the issue next time.

For example, in a scenario requiring you to discuss the financial reporting treatment of a loan to a subsidiary, you might focus solely on the recognition and measurement of the loan and forget to discuss related party transactions. Next time you encounter a similar scenario, you want to check whether there is a related party relationship between the two entities.

By prioritising question practice over rote learning, you’ll develop the essential skills needed to identify key issues in a scenario and apply your knowledge effectively under pressure.

2.Developsolidexamtechnique

Good solid exam technique can make the difference between passing and failing. Exam technique is not something that can be memorised or learned simply by reading a set of instructions. You will develop your exam technique over time by practising exam standard questions.

Some key elements of exam technique are discussed below.

Timemanagement

The exam is 3 hours and 15 minutes, which equates to 1.95 minutes per mark (including reading time). You should use this as a guide to work out how much time to spend on each question and how much time to spend on each requirement within each question.

Each question typically has several parts to it. You should plan your time so that you can attempt each part, even if you do not have time to fully finish each part. Be strict with yourself and move onto the next question once your time is up!

Methodicalapproach

For questions that require the preparation of group accounts or other numerical requirements, it is important to be methodical in your approach. Once you have identified what you need to do from the requirements, you should aim to set up the proforma and relevant workings and insert any ‘easy’ numbers.

This might include adding together the parent and subsidiary balances on the face of the proforma or inserting figures that do not need to be calculated into the proforma or workings. For example, you might insert the cash consideration into a goodwill working, or the subsidiary’s share capital and retained earnings into the subsidiary’s net assets working. You will learn to gauge which numbers you want to start with by practising these types of questions.

Any workings that you use should be set up in a sensible order and should be clearly labelled so the marker can follow your workings. Show your workings as you go, as this will enable the marker to award any follow through marks if you make a mistake. Follow through marks can really add up, so do not lose them by failing to show your workings!

Answerstructure

When producing responses to written questions, you answer should be structured in a way that makes it clear and easy for a marker to follow. Use short sentences and short paragraphs, spacing out your points as you write.

In terms of the content of your answer, you should aim to set out the relevant rules from the IFRS Accounting Standards that are applicable to the scenario and then apply those rules to the scenario. It is important to avoid ‘knowledge dumping’ everything you know about a particular topic and instead focus on the rules relevant to the scenario.

For example, when discussing revenue recognition in line with IFRS 15 ‘Revenue from Contracts with Customers’, focus on which steps from the five-step model are relevant to the scenario. You may only need to focus one of the steps, so don’t waste time listing out all five steps.

To get sufficient depth to your answer, think about the distinct stages of accounting for a transaction. Your answer should cover both the initial and subsequent treatment of the transaction. When discussing the initial treatment of a transaction, you may need to consider the recognition rules, the measurement rules or both.

The subsequent treatment of a transaction involves explaining how the items recognised initially should be measured at the reporting date. You should also state the amounts to be recognised in the statement of profit or loss, or other comprehensive income, and the statement of financial position.

For example, with regards to the treatment of a lease, your answer should explain that a lessee recognises a right-out-use asset and lease liability upon initial recognition. Then it should set out the subsequent treatment of both the right of use asset (i.e. depreciate the asset) and lease liability (i.e. amortise the liability), including the impact on the statement of profit or loss and the statement of financial position.

3.Deviseanexamstrategy

The Financial Accounting and Reporting 2 paper contains four questions. You should consider the order in which you want to attempt the questions. You might prefer to start with Question 1, which involves the preparation of consolidated financial statements, particularly if you feel confident with this topic.

While there’s no issue with starting here, it’s vital to manage your time effectively and not overrun. It’s tempting to finish every single working, but that extra time is better spent on the next question. You’re far more likely to earn easier marks on a new question than to gain the last few, more difficult marks on the question you’re already working on. It’s also advisable to be flexible in your approach,

so if an unexpected topic or requirement comes up, it doesn’t throw you off course. Be prepared to change the order in which you attempt the questions or even leave a particular requirement and come back to it later after you’ve had more time to think.

4.Adoptapositivemindset

It is easy to become fixated on the idea of answering every question perfectly or getting all the numbers 100% correct. This is not necessary to pass the exam, and the reality is it is extremely unlikely, if not impossible, that you will achieve perfection in your exam!

Take the pressure off yourself and try to adjust your mindset to ‘doing enough’. Remember that you want to attempt every requirement, but you will likely run out of time to answer every sub-requirement fully. You need to have enough knowledge, but you do not have to remember every single detail of all the accounting standards in order to produce a good answer to a question. Knowledge of the ‘Conceptual Framework’ can be useful in instances where you are struggling to recall the relevant IFRS Accounting Standard. You should learn the key features of the Framework (definitions of the elements, recognition criteria, measurement criteria, derecognition) so that you can apply these rules to a scenario if needed. Accept that there will be challenging aspects of the exam. You may run out of time, you may forget to include something in your answer, or you may not remember a particular topic or accounting standard. How you deal with this on the day is what makes the difference.

Try to stay calm and keep moving through the exam, picking up the ‘easy marks’ where possible and knowing that by attempting as much of the exam paper as possible you will maximise your chances of passing.

5.Deliverontheday

By this point, you have nailed down your exam strategy and exam technique, so you know what you need to do. Stick to these regardless of the contents of the exam. Remember to keep going, look for the more straightforward parts and try to avoid dwelling on the trickier parts. Do what you can in the time available and then move on.

If you find yourself veering off track, stop and pause for a moment. Take some deep breaths, then go back to answering the question.

Summary

This exam is your opportunity to demonstrate the financial reporting knowledge and skills that you have worked hard to build. It’s natural to feel nervous before an exam, but by following the guidance in this article, you can walk into the exam room feeling well-prepared and confident that you have done everything possible to set yourself up for success. ●

Failure to Prevent Fraud

Caroline Black considers the territorial application of the new corporate offence of Failure to Prevent Fraud.

The much-heralded new corporate offence of Failure to Prevent Fraud came into force on 1 September 2025 (Economic Crime and Corporate Transparency Act (ECCTA) 2023 ss 199-206).

Failure to Prevent Fraud makes it an offence for large organisations to fail to prevent the fraudulent behaviour of individuals and entities acting for or on their behalf, in circumstances where the fraud is intended to benefit the organisation or its clients.

The UK courts have jurisdiction if there is a UK nexus to the fraud, meaning the fraud: ● must include an act that occurs in the UK; or ● results in a gain or loss in the UK.

In a joint statement issued by the Fraud Minister, the Solicitor General, the Serious Fraud Office and the Crown Prosecution Service, the

British authorities have made it clear that they are keen to pursue offenders using this new tool (see tinyurl.com/jc72umyb).

The Solicitor General Lucy Rigby KC MP said:

‘Fraud undermines our British values of fairness and playing by the rules. It hurts individuals and businesses, and harms business confidence. This new legislation sends a clear message that large organisations must take responsibility for preventing fraud, and those that fail to do so will be prosecuted with the full force of the law... We’re determined that those who don’t play by the rules will be brought to book.’

On conviction, a company will be liable to an unlimited fine. The only defence available

CarolineBlack Consultant,Gherson SolicitorsLLP

Practicalexamples

UK jurisdiction: A large US based financial services firm has a strong client base in the UK. An employee operating out of New York (acting for or on behalf of the US firm) fraudulently mis-sells investments in a US fund. The victims of the fraud are in the UK.

The US financial services firm can be prosecuted in the UK for a failure to prevent fraud.

Non-UK jurisdiction: A UK headquartered conglomerate has global operations. An employee of an overseas subsidiary commits fraud intending for it to benefit the overseas subsidiary.

The UK authorities cannot prosecute the fraud as there is no UK nexus to the conduct.

to a large organisation is to prove that it had reasonable fraud prevention procedures in place.

Largeorganisations

Under ECCTA 2023 s 201, large organisations include those which meet two or more of the following criteria during the financial year prior to the year of the base offence:

● more than 250 employees;

● more than £36 million in turnover (the amount derived from the provision of goods and services falling within the ordinary activities of the commercial organisation or subsidiary undertaking, after deduction of trade discounts, value added tax and any other taxes based on the amounts so derived); and

● more than £18 million in total assets.

The government’s ‘Guidance to organisations on the offence of failure to prevent fraud’ (November 2004) makes it clear that the criteria for large organisations ‘apply to the whole organisation, including subsidiaries, regardless of where the organisation is headquartered or where its subsidiaries are located’ (see tinyurl.com/y56x282v). Accordingly, organisations with only a small presence or customer base in the UK could be caught by the Failure to Prevent Fraud offence.

Whatis‘fraud’?

The base conduct covered by the Failure to Prevent Fraud offence is listed in ECCTA 2023 Sch 13. Offences include but are not limited to: fraud by false representation (Fraud Act 2006 s 2); fraud by failing to disclose information (Fraud Act 2006 s 3); cheating the public revenue (common law); and false accounting (Theft Act 1968 s 17). Broadly speaking, the most typical offences are likely to be fraud by positive misrepresentation (or omission), false accounting and tax fraud.

There is no de minimus amount of gain set out in the legislation and there is no requirement for the underlying conduct to be prosecuted.

Whosefraudulentconductmustbe prevented?

The action of individuals and entities will attribute liability to the organisation where the associated person is acting for or on behalf of the organisation in the course of their duties (not in a personal capacity), and where the fraud is intended to benefit the organisation. This will include the actions of employees (wherever they sit within an organisation), agents and other third parties.

For multinational organisations, it is important to determine for whose corporate benefit an individual, agent or subsidiary was acting when committing the fraud. The entity which is intended to benefit has the corresponding liability and must have reasonable procedures to prevent the fraud.

The benefit to the organisation does not need to be the sole or dominant motivation for the fraud; it suffices that the organisation was intended to be a beneficiary. Accordingly, a sales agent who misleads customers in order to achieve higher personal commissions will also attribute liability to his employer company where that entity will also benefit from his or her actions.

Locationoffraudulentconduct,loss orbenefit

It is the location of the conduct, loss or benefit which is important for UK jurisdiction, not the location of the corporate seat.

Any entity which is a large organisation should undertake a review of its operations to assess if the UK courts could have jurisdiction for Failure to Prevent Fraud. The following factors should form part of that determination:

● Are there any operations in the UK?

These include UK based offices, employees, subsidiaries and associated persons who act for the benefit of the organisation.

● Are there potential victims in the UK (i.e. customers, shareholders or others)?

● Is there a vehicle for corporate benefit in the UK (bank accounts, etc)?

If the answer to any of the above is ‘yes’, the organisation should consider further steps to design and implement reasonable fraud prevention procedures, as this is the only defence available to the otherwise strict liability offence (ECCTA 2023 ss 199(4) and (5)).

Compliancedefence:reasonable procedures

What is considered reasonable in any particular case will depend on how much control and supervision the large organisation has over the relevant offender. The guidance sets out that

policies and procedures should be designed and implemented in accordance with the following well versed compliance principles:

● Top level commitment: The board of directors, partners and senior management should be committed to preventing associated persons from committing fraud. They should foster a culture within the organisation in which fraud is never acceptable and should reject profit based on, or assisted by, fraud.

● Risk assessment: The organisation should assess the extent of its exposure to the risk of employees, agents and other associated persons committing fraud in scope of the offence. The assessment should be dynamic, documented and kept under regular review.

● Proportionate risk-based prevention: An organisation’s procedures should be clear, practical, accessible, effectively implemented and enforced. It should draw up a fraud prevention plan, with procedures to prevent fraud being proportionate to the risk identified in the risk assessment.

● Due diligence: The organisation should undertake due diligence procedures, taking a proportionate and risk-based approach, in respect of people who perform services for or on behalf of the organisation. Those with exposure to the greatest risk may choose to clearly articulate their due diligence procedures specifically in relation to the corporate offence.

● Communication, including training: The organisation should seek to ensure that its prevention policies and procedures are communicated, embedded and understood throughout the organisation. Training and maintaining training are key.

● Ongoing monitoring and review: The organisation should monitor and review its fraud detection and prevention procedures and make improvements where necessary. This includes learning from investigations and whistleblowing incidents and reviewing information from its own sector.

The first step is ensuring that there is commitment, at the highest level, to combatting fraud by the company, not merely against the company. This can be shown in a variety of ways by the board and senior management, not least through clear statements on zero tolerance for financial crime and the allocation of sufficient practical resources to compliance in this area.

A well thought through and documented risk assessment, setting out the areas of risk is appropriate in almost all circumstances. Even where risks are assessed as low, the fact and

Theriskassessmentwillidentify areaswhichrequiremitigation bywayofenhancedpolicies, proceduresandcontrols.

records of the assessment will be essential evidence in any compliance defence.

Once complete, the risk assessment will identify areas which require mitigation by way of enhanced policies, procedures and controls. This could include thorough due diligence on employees, officers or third parties, communication by way of contractual terms and training, and ongoing monitoring and review by way of sophisticated AI tools or corporate whistleblowing procedures.

Any incidents uncovered must be investigated swiftly with appropriate remediation measures put into place, including consequential management. Careful consideration should also be given to the need to report significant failures to regulators or others such as the Serious Fraud Office.

Will there be a flood of cases?

The Failure to Prevent Fraud is the third ‘failure to prevent’ offence on the UK statute books, attributing strict liability to companies for financial misconduct by their employees, agents and those acting on their behalf.

A key aim of such legislation is to shift the compliance and crime prevention burden onto companies – and to make it easier for prosecutions to be successfully brought by the authorities once issues come to light. Nick Emphgrave, the Director of the Serious Fraud Office, has stated that he will be ‘out hunting’ for cases as soon as the new law becomes effective.

However, as with any deception-type offence, there is likely to be some considerable time lag from detection to prosecution. This means that cases are unlikely to be before the courts for several years. Indeed, we are only now seeing the first contested case of failure to prevent bribery under the Bribery Act 2010 (R v United Insurance Brokers Ltd ); and the first case of failure to prevent the facilitation of tax evasion under the Criminal Finances Act 2017 (R v Bennett Verby Ltd ) coming before the courts.

Nevertheless, the authorities are keen to use their new tools and companies falling within the remit of the new offence should ensure that compliance policies and processes are amended to provide a defence should the worst happen. ●

Author bio CarolineBlackisa consultantatGherson SolicitorsLLP.

Why sustainability matters for SMEs

Martta Ääri considers the role of accountancies in guiding SMEs

towards sustainable compliance.

Sustainability reporting has often been regarded as a matter reserved for listed companies and multinationals. Yet the world of business is changing fast, and the expectations placed on small and medium-sized enterprises (SMEs) are growing just as rapidly.

SMEs are the backbone of the global economy. In the EU, they account for 99% of all businesses and employ around 100 million people. Their role in achieving sustainability targets is undeniable, even though most SMEs are not directly under binding legislation such as the Corporate Sustainability Reporting Directive (CSRD).

The reality is that SMEs face increasing indirect pressure from stakeholders. Larger companies must report on their environmental, social and governance (ESG) performance and so need reliable information from their subcontractors and value chain partners. Banks and other financial institutions are increasingly asking for accurate ESG data when evaluating loan or funding applications. Consumers, too, expect transparency from the companies they buy from.

In this shifting landscape, accountancies are emerging as crucial guides. Having built trust with SMEs over decades through financial reporting and compliance, accountants are in a unique position to extend that trust to sustainability.

ThecomplexitychallengeforSMEs

For most SMEs, sustainability compliance feels like entering a regulatory jungle. Regulations,

MarttaÄäri Co-FounderofAila

voluntary standards and stakeholder expectations create a maze that is difficult to navigate without expert guidance. Acronyms such as CSRD, ESRS (European Sustainability Reporting Standards), EU Taxonomy and TNFD (Taskforce on Nature-related Financial Disclosures) appear overwhelming, especially for business owners who are already stretched thin managing operations, finances and people.

Unlike large corporations, SMEs rarely have in-house sustainability officers. They may not even have a dedicated finance department. As a result, when new compliance questions arise, their first instinct is to turn to their accountant. Accountants already translate financial legislation, tax rules and auditing standards into actionable steps for their clients. Extending this role into sustainability is a natural progression. Just as accountants help SMEs to stay compliant with financial obligations, they can now help them simplify sustainability compliance, making it understandable and manageable.

Whyaccountanciesarekeyactors

Trust is the cornerstone of the accountant SME relationship. SMEs often see their accountant not just as a service provider but as a trusted advisor who knows their business inside out.

Sustainability reporting shares many similarities with financial reporting, and the latest frameworks are increasingly designed to integrate the two, strengthening the link between financial and sustainability disclosures. Both require structured and verifiable data, transparency and accuracy, as well as regular

Author bio

MarttaÄäriisthe Co-FounderofAila, acompanydeveloping digitaltoolsthat makesustainability reportingaccessible forSMEs.

updates and comparability over time. This alignment means that accountants are well placed to incorporate ESG considerations alongside financial statements.

For SMEs, this means they can respond more effectively to requests from clients, banks and regulators, thereby strengthening their competitiveness. For accountancies, the expansion into sustainability creates opportunities to broaden their service offering, build stronger client relationships and position themselves as frontrunners in a changing market.

For the wider economy, a greater flow of reliable ESG data from SMEs improves the quality of reporting by larger companies and enables financial institutions to make better-informed decisions.

Howtechnologycansimplify sustainabilitycompliance

One of the main barriers for SMEs is complexity. Without technical knowledge, ESG reporting feels like a task that only consultants or large corporations can manage. Collecting data across invoices, suppliers and operations is often time- consuming and confusing.

This is where technology becomes a game-changer. Just as cloud-based platforms have transformed bookkeeping, payroll and tax filing, sustainability reporting is entering its own digital era. For accountancies, technology makes sustainability services scalable. One professional can support dozens of SME clients without becoming a sustainability expert themselves. It ensures consistent outputs, since each ESG report is generated according to the same methodology, which strengthens comparability across clients. Most importantly, it creates value by turning sustainability reporting from a compliance headache into a competitive advantage and a new service line. The digitalisation of sustainability compliance mirrors the evolution of financial compliance: what was once manual and error-prone can now be streamlined and automated.

Futureoutlook:fromoptionaltoessential

At present, most SMEs are not legally obliged to produce sustainability reports. However, the direction of travel is clear. Sustainability information is rapidly shifting from optional to business critical. Large companies are increasingly requiring ESG data from their suppliers in order to complete their own mandatory reporting. Banks and financiers are making sustainability disclosures a standard part of loan and investment processes. Public procurement increasingly favours suppliers who can demonstrate ESG performance. Meanwhile, consumers are becoming more informed and are rewarding transparency while punishing greenwashing.

TheEC’sVoluntaryStandardforSMEs

On 30 July 2025, the European Commission adopted a recommendation on voluntary sustainability reporting for SMEs. The standard adopted in the recommendation will reduce the administrative burden on SMEs by making it easier for them to respond to requests for sustainability information from large companies and financial institutions which are subject to mandatory reporting under the Corporate Sustainability Reporting Directive (CSRD) and which have such SMEs in their value chains.

The Commission encourages large companies and financial institutions that seek sustainability information from SMEs to base their requests on the voluntary standard as far as possible. SMEs may also wish to voluntarily report sustainability information to improve their access to sustainable finance and better understand and monitor their own sustainability performance, thereby improving their resilience and competitiveness. For further information, see: tinyurl.com/mw62nvsb

Although the Voluntary SME Sustainability Reporting Standard (VSME) framework was originally designed in the EU and was approved by the EU Commission, frameworks like this set a global precedent. The VSME framework is already being considered as a basis for national sustainability legislation in other countries.

For SMEs, sustainability reporting is therefore no longer only about compliance. It is becoming a gateway to access markets, finance and growth opportunities. Accountancies that prepare their clients today will give them a competitive edge tomorrow. In many ways, sustainability is becoming as fundamental to business health as financial stability. Just as ignoring accounting obligations is unthinkable, neglecting ESG transparency will soon carry tangible risks.

Conclusion

SMEs form the backbone of our economies, and their contribution to sustainability cannot be overlooked. While most are not directly bound by legislation, the expectations from value chains, financiers and consumers are rapidly increasing.

Accountancies are in a unique position to help SMEs navigate this new era. By integrating sustainability reporting into the trusted processes they already manage for financial reporting, accountants can make ESG compliance both practical and valuable. With technology simplifying complexity, the future of accountancy is no longer only financial – it is sustainable. Firms that embrace this shift will not only strengthen their own business but also empower SMEs to thrive in a changing economy.

Aila has developed a tool built on the Voluntary SME Sustainability Reporting Standard that translates complex frameworks into a solution for SMEs and their accountants. Aila’s tool guides companies through clear questionnaires, provides automated hints and benchmarking to give context, and produces ready-made templates aligned with international standards but simplified for small businesses. ●

The Voluntary Standard for SMEs in Europe

Welookinmoredetailattherecommendations madebytheEuropeanCommission.

The European Commission has issued recommendations to support small and medium-sized enterprises (SMEs) in dealing with growing demands for sustainability reporting.

While the Corporate Sustainability Reporting Directive (CSRD) only imposes legal obligations on large companies, SMEs are increasingly being asked to disclose environmental, social and governance (ESG) information by banks, investors and larger corporate clients. This is sometimes referred to as the ‘trickle-down effect’, since SMEs are indirectly impacted by the obligations of bigger players in their value chains. To ease this pressure and provide SMEs with a clear, proportionate framework, the Commission has introduced a Voluntary Sustainability Reporting Standard (VSME).

Accountants advising SMEs have a central role to play in explaining this new standard, guiding adoption and helping clients to use sustainability reporting to their advantage.

Structureofthevoluntarystandard

The voluntary standard is structured around two modules. The first is the basic module, which represents the minimum reporting requirement under the framework. For micro-enterprises, use of the basic module is entirely flexible, and they may choose to adopt only certain elements. For SMEs more broadly, the basic module is expected to be the starting point and is considered the minimum requirement if they choose to engage with the standard.

The second is the comprehensive module, which builds on the first with more detailed disclosures. This allows SMEs with greater capacity, or those that face heavier reporting demands, to provide

AccountantsadvisingSMEshave acentralroletoplayinexplaining thisnewstandard.

fuller information. EFRAG has also developed practical guidance to help SMEs understand and apply the framework in practice, which should prove especially useful for smaller businesses with limited in-house expertise.

KeyrecommendationstoSMEs

The Commission recommends that SMEs should adopt the VSME on a voluntary basis when they decide to publish sustainability information. Importantly, the VSME is designed to remain proportionate to the SME’s size and resources. For example, SMEs can rely on

self-declarations rather than costly external assurance, which keeps compliance affordable. They may begin with the basic module and expand their reporting over time as they become more comfortable with sustainability disclosures. In addition, the guidance material provided alongside the standard offers practical tools to streamline the process, which accountants can use when assisting clients in the preparation of sustainability reports.

BenefitsforSMEs

The potential benefits for SMEs are significant. By adopting the VSME, businesses can strengthen their credibility with banks and investors, improving access to sustainable finance. They will also be better positioned to maintain relationships

ByadoptingtheVSME,businesses canstrengthentheircredibility withbanksandinvestors.

with larger corporate clients who increasingly demand ESG information from their suppliers.

On a strategic level, reporting helps SMEs to monitor their own risks and opportunities, thereby improving resilience and competitiveness. Looking ahead, SMEs that voluntarily disclose sustainability data may even be able to publish it on the European Single Access Point, which would make them more visible to investors and expand their funding opportunities.

Benefitsforaccountants

For accountants, the implications are clear. Accountants advising SMEs should focus on:

● Materiality: They should help SMEs to identify which sustainability topics are most relevant to their operations and stakeholders.

● Efficiency: Use the VSME standard to avoid duplication of effort when responding to multiple requests.

● Capacity building: Train SME staff to integrate sustainability data collection into routine business processes, ensuring that reporting is both proportionate and efficient.

● Digital tools: Encourage the adoption of software solutions that facilitate compliance with the standard.

Rather than treating sustainability reporting as a compliance burden, accountants can position it as a tool for building trust with partners, enhancing financing prospects and gaining competitive advantage. Knowledge of digital reporting solutions, national support measures and the evolving regulatory landscape will be essential.

Lookingahead

The Commission’s recommendations are also forward-looking. Discussions are underway to simplify existing sustainability reporting requirements so that only very large companies with over 1,000 employees remain subject to mandatory rules.

If this proposal is adopted, voluntary reporting through the VSME will become even more important for SMEs. In time, the VSME may itself be formalised into delegated legislation, and so accountants should view current recommendations as both a practical solution for today and a likely foundation for the future. ●

Managing challenging clients

Setting

clear boundaries

is essential for maintaining a successful and less stressful practice.

Sometimes you get the feeling that life would be fine if it wasn’t for the clients! However, they are a necessity for a successful practice.

We all have those good clients who pay on time, provide what’s needed and respect your work boundaries. However, we also have those clients who make your work life more difficult and stressful.

The key is to manage your clients so that they never become challenging – or, alternatively, change them from ‘challenging’ to ‘good’ clients. You may have to part ways with those who are unwilling to change.

Howisaclientchallenging?

There are many different behaviours that can make your working day more difficult. Some of the most difficult relate to money – they either pay late or don’t pay at all. There are also issues to do with ‘scope creep’, when they want you to work on specific areas that aren’t included in the quote but don’t want to pay extra.

The information they send you may be late or incomplete. And we have all had clients who are too demanding – for example, they are late in sending over their information and then are immediately on the phone wanting to know how much tax they owe.

Some of the problems are to do with communication. Clients may not do what you want them to do – for example, they don’t send all the information you need or even send figures for the wrong year! And some clients ask for feedback but then don’t do what you suggest.

Clients may expect to receive responses out of working hours when that is not what has been agreed. But the most difficult problem to contend with, of course, are those clients who may treat you badly by being rude, inconsiderate or aggressive.

Challenging clients tend to take up a greater proportion of your time, which has an impact on your bottom line and your cashflow. You can become stressed, frustrated, less efficient and less able to help those clients who also need your help and have done everything that has been agreed.

Having fewer challenging clients and more ‘good’ clients will make your work life more pleasurable.

Whattodoaboutchallengingclients

Set the terms and conditions for your contract at the start of your relationship with the client and make sure that they understand them. It is important to set your boundaries from the outset!

Make sure that your system is not letting you down. It should make quoting, invoicing and chasing debtors easy. Finally, give your clients clear guidance on what you need from them and what is included in your fee –which has been agreed before work commences.

The most effective things to do is to take ‘the carrot and stick’ approach.

TheStick:takingatoughapproach

Sack them: If you’ve had enough of a client, why keep working for them? You’ve given them loads of chances, been patient with them, explained what is expected, but to no avail. They need to go. Otherwise, you’re wasting your time and energy. I know this is difficult, but it must be done.

Charge them extra for late information: Only do this if you’re prepared to lose them. I did this with three clients who always gave the information late. They all paid the extra amount but then found another accountant. In reality, this was good as my time was freed up and it was less stressful, but you need to watch you don’t shoot yourself in the foot! This approach has to be mentioned in the terms and conditions when you start working together.

Refuse to work with them unless they use the software you prefer: If a client is consistently late but you have access to their software, then you can monitor what has been entered and the quality of the

Author bio AnnaGoodwinatAnna GoodwinAccountancyhas 30yearsofexperiencein accountancy.

AnnaGoodwin AnnaGoodwinAccountancy

information. If they are working on spreadsheets that aren’t in a shared file, you have no way of tracking their progress. They can tell you they will get the information over to you in the next few weeks but, in reality, you have no way of knowing. Personally, I don’t like this approach as it feels like bullying, but if it suits you then go for it!

Keep increasing your fees: By doing this, you will still have a difficult client but may be prepared to put up with them as you’re earning more from them. However, I’m not sure that any financial recompense is worth a really bad client!

TheCarrot:makethemfeellovedand wanted

Give an early payment discount: It’s amazing how this can motivate people to get organised!

Give them clear feedback on what you need: Ring them and go through the process so they know what’s expected. Remind them to contact you if they have any questions. You can ask them to repeat what is required so that you are sure they have understood. Send a follow-up email so there is no confusion.

Training: Challenging clients can be broken down into the ones who don’t care and can’t be bothered and the ones who don’t understand. In the latter case, an hour of your time training them can work wonders! Drill down and find out what’s stopping them from giving you the information. Sometimes it’s the fear of making a mistake.

Howcanyouimproveyourcommunication?

● What are you trying to communicate? What do you want them to understand?

● Can you express it more simply?

● What is the best way to relay the information? A telephone call or Zoom gives the client an opportunity to ask questions and is the best way to explain complicated information, rather than in an email.

● Practise before your session with your client.

● Ask people who know you well what you could do better.

● Watch good communicators and consider what they do that makes them good at it.

● Be clear and concise in your message. Are you making assumptions of what they know?

● Be kind without a superior attitude. You may think that the information you are giving is obvious, but it may not be to your client. We all have different skills and talents!

● Keep emails brief and use bullet points. Read through what you have written before you send it and see it from the client’s perspective.

● If you’re not in the correct frame of mind, don’t reply. Do it later when you’re calmer!

Areyoupartoftheproblem?

Take an honest look at yourself. It’s easy to jump to blaming the client when the issues could be with you.

If you have many challenging clients, ask yourself:

● Is there a reason why you’re getting such challenging clients?

● Do you know the profile of your ideal client?

● Do you feel like you don’t deserve good clients?

● Do you think you need to help clients to the detriment of your own wellbeing?

Effective communication is crucial – as important as understanding numbers. I suspect one of the main reasons that some accountants struggle to communicate well with their clients is that we understand the numbers inside out and deal with them daily. Many people find numbers daunting and they need you to put them at ease by explaining and communicating clearly. They are often sharing personal information, so trust is essential.

There are real benefits from communicating openly and honestly with your clients:

● It’s easier to work together.

● Good communication builds trust.

● Clients appreciate what you are doing.

● There’s satisfaction when someone has that ‘aha’ moment because of something you have explained.

● It’s more productive.

Good luck with those challenging clients. Don’t bury your head in the sand. Instead, be proactive and follow this advice and you will soon be happier.

If you’d like support in understanding how to deal with clients, contact us at annagoodwinaccountancy.co.uk/ ●

The art of onboarding

Eva Mrazikova examines the issues of mastering onboarding in a regulated, competitive world.

In today’s competitive market, where clients are used to the ease and speed of digital-first experiences, accountants have a golden opportunity to make the right impression from day one. Onboarding is more than an administrative task – it’s the first step in building trust, confidence and long lasting relationships.

Settingthetone

Accountants operate in a landscape shaped by rising regulatory demands and clients who expect the same seamless service they experience in other industries. This environment makes first impressions matter more than ever. And for firms, nowhere is this more important than when welcoming new clients.

Handled well, onboarding can be a moment filled with optimism, momentum and reassurance. It’s the point where a client’s decision to put their trust in a firm is validated through smooth processes, clear communication

EvaMrazikova Director,IRISProduct Marketing,andPracticing Accountant

and an experience that inspires confidence. Yet, when overlooked or treated as a boxticking exercise, the process can feel clunky, dampening enthusiasm just when excitement should be at its peak.

Far from being a hurdle, onboarding is a springboard. It sets the tone for the entire client relationship and creates the conditions for loyalty, referrals and growth. With regulators requiring due diligence and clients more willing than ever to switch providers, firms that invest in this stage stand apart. In fact, onboarding has become a strategic differentiator – one that can empower stretched teams, strengthen client trust and give practices a crucial edge.

Get it right, and a firm begins the journey on a wave of confidence and collaboration. Get it wrong, and the opportunity to build a lasting connection risks being lost.

Commonchallenges

Onboarding is already a key moment of opportunity for firms, yet it is one where many still have untapped potential. The process

often involves multiple steps – from proposal creation and engagement letters to anti-money laundering (AML) and customer due diligence (CDD) checks. Each of these steps represents a chance to demonstrate professionalism, build trust and reassure clients that they are in safe hands.

For many practices, however, the way onboarding is managed leaves room to elevate the experience further. According to our own poll of accountants, 42% of firms still rely on paperbased systems to manage onboarding, with a further 23% using spreadsheets. Moving beyond these manual methods creates opportunities to eliminate duplication, avoid bottlenecks and deliver a smoother journey for clients.

The same applies to proposals. When tailored carefully and delivered promptly, they showcase a firm’s understanding of the client’s needs. But when the process is slow or overly generic, that impact is lost. Streamlining proposal creation is not only more efficient for the practice but also makes a strong early impression.

Communication is another area rich with opportunity. Clients do not always know what is expected of them or how long each stage will take. By proactively setting expectations and updating clients regularly, firms can turn what might otherwise feel like waiting time into a period that builds trust and confidence.

Even workflows themselves present opportunities for improvement. Standardising and integrating processes ensures that everyone is working from the same data, which means that clients receive consistent information. For firms, this also helps to reassure regulators that compliance steps are being followed rigorously.

In other words, what might once have been seen as pain points can now be reframed as touchpoints where firms can shine. Every step of onboarding is a chance to build reassurance, demonstrate expertise and reinforce the client’s decision to choose the firm.

Towardsbestpractice

The good news is that firms can turn onboarding into a powerful differentiator by adopting a client-first mindset and modernising their approach.

The first step is to take a look under the hood. Practices need to review their existing workflows honestly, identifying where they currently face bottlenecks and points of frustration for clients. Speaking to staff and gathering feedback from clients themselves can highlight pain points that may otherwise go unnoticed, and creates the foundation for meaningful change.

Once the picture is clear, firms can begin to reshape their process.

Central to this is recognising that onboarding should not be designed around the convenience of the practice, but around the experience of the client. Maintaining regular communication, setting clear expectations and involving clients in the journey helps to sustain the excitement that led them to choose the firm in the first place. Clients want reassurance that their accountant is compliant, but they also want to feel valued. Delivering both is essential.

Technology has a crucial role to play in achieving this balance – and clients agree. Research from Salesforce shows that 77% of B2B clients now believe that technology has transformed how companies should interact with them.

Far from depersonalising the process, automation and integration free accountants to spend more time with clients. Tasks such as generating proposals, sending reminders or chasing documents can be streamlined, saving hours of work and reducing errors. Integrated systems also remove silos, ensuring data flows across proposals, AML checks and client records.

The best firms are those that humanise this increasingly digital process. Technology takes care of the background, but the human element must remain at the centre. Accountants who use the time saved to update and reassure build loyalty that lasts well beyond onboarding. This also helps to prevent scope creep – one of the most common frustrations for firms – because clear, consistent onboarding makes it harder for expectations to drift later in the relationship.

Digital-first firms are setting new benchmarks, creating the risk that the practices standing still will be left behind. So, measures like regularly auditing workflows and adjusting processes to reflect client feedback should therefore become second nature. And this can be simple as introducing a short questionnaire during the first months of the relationship, providing invaluable insight into what clients appreciate, where frustrations arose and what they will value as you move forward together.

Firstimpressionscount

Onboarding may once have been seen as an unavoidable chore, but today it is a critical touchpoint in the client journey. Done well, it accelerates compliance, creates efficiency and lays the foundations for a strong relationship.

For accountants, that means less time bogged down in administration and more time delivering insights and advice. For clients, it means a partnership that begins not with frustration, but with confidence and excitement.

In an industry where competition is intense and compliance paramount, that is the kind of first impression no firm can afford to overlook. ●

Formany practices,the wayonboarding ismanaged leavesroom toelevatethe experience further.

Author bio

EvaMrazikovaisaDirector, IRISProductMarketing,and practicingaccountant.

Artificial intelligence is reshaping professional services, but how can accountants harness AI virtual assistants for genuine productivity gains while navigating regulatory risk?

As artificial intelligence becomes more deeply embedded in business operations, accountancy is beginning to move beyond adoption and into implementation. Virtual assistants powered by AI are now supporting a range of back-office and client-facing tasks.

From managing deadlines to drafting reports, these systems offer the potential to significantly streamline workflows. Yet alongside these benefits come legal, ethical and operational questions that accounting professionals cannot afford to ignore.

Operationalgains,ifusedwithcare

AI virtual assistants are already being deployed to handle repetitive administrative work, including summarising meeting notes, producing draft communications and initiating routine financial analyses. In the context of a profession increasingly shaped by cost pressure and regulatory oversight, this automation brings real advantages.

AI virtual assistants

Dylan Brown examines how AI virtual assistants can help to streamline the accountant’s workload without losing control.

DylanBrown LexisNexisLegaland Professional

In ‘The tipping point: Measuring the success of AI in tax’, a recent survey by Tolley of over 350 tax professionals, 74% reported that the main benefit of generative AI was faster delivery of work (see tinyurl.com/fzecw8k3).

Enhanced speed, however, is not an end in itself. For accountancy teams, it means improved responsiveness, greater consistency in outputs, and the ability to reallocate human expertise to more complex issues.

What is critical is understanding where AI should augment, rather than replace, the judgement of a qualified accountant. Tasks involving compliance interpretation, client-specific recommendations or ethical discretion still require human oversight. The goal is to support decisionmaking, not to delegate it entirely.

Thedualchallengeoftrustandtraining

One of the persistent tensions in professional adoption of AI is the balance between innovation and reliability. In the same study, tax professionals identified their top concerns with AI as hallucinations (60%), over-reliance (59%) and the potential for data leakage (43%). These issues are equally relevant for accountants, particularly in regulated environments or when handling sensitive client information.

Author bio DylanBrownworks incontentmarketing andthoughtleadership forLexisNexisLegal& Professional.

Despite the risks, adoption is increasing. Nearly nine in ten tax professionals surveyed are now using, or planning to use, generative AI in their work. But uptake is uneven, and training is a major barrier. Almost two-thirds said they would use AI more often if they had appropriate training. This gap between potential and practice is likely to be mirrored in the accounting profession.

For firms exploring AI assistants, developing a structured programme of education and governance is essential. This should include guidance on how AI tools operate, how to interrogate and validate outputs, and when to escalate for manual review. As Hayley McKelvey, Partner at Deloitte, put it: ‘This isn’t about turning our tax practitioners into data scientists, but it is about building a high level of understanding that promotes confidence and trust.’

Measuringeffectiveness,notjust efficiency

Initial enthusiasm can quickly fade if outcomes are unclear. The LexisNexis survey found that almost half of firms had not established any formal metrics for assessing AI success. Without benchmarks, firms risk falling into two traps: either continuing to invest in tools that deliver minimal value, or under utilising tools with untapped potential.

Effective measurement should consider both traditional and qualitative indicators. Time saved is easy to track, but so too is error reduction, internal adoption rates and client satisfaction. As one BDO partner noted, true success lies in ‘how it helps us deliver a better, more responsive service to our clients’.

The case for monitoring usage is particularly strong in finance and accounting, where seemingly small inaccuracies can result in significant compliance risk. Transparency, auditability and documented oversight are all critical components of a responsible AI strategy.

Strategicadoptionmeansplanning forrisk

Accountants are used to balancing risk. But AI introduces a new category: the risk of doing nothing. One in five tax professionals said they would consider leaving their firm if it failed to invest adequately in AI. As client expectations evolve and younger professionals seek out technology-forward environments, failing to adapt could create not only operational inefficiencies but also talent drain.

Conversely, blind enthusiasm can be just as dangerous. Using AI tools without appropriate data controls or review protocols introduces legal, reputational and ethical vulnerabilities. Responsible deployment must include limits on sensitive data inputs, clear accountability

TopbenefitsofAIfortaxprofessionals

StepsthatwouldencourageAIadoption

training

Better communication around use guidelines

More transparency on how Al models work

Easier integration with existing workflows Conducting my own research Hearing use cases

structures, and transparency with clients regarding the use of AI in service delivery.

According to Paul Aplin, Vice President at the Chartered Institute of Taxation, the professional responsibility lies in knowing how to assess AI output critically. ‘Knowing which sources you can and cannot rely on is a basic professional skill, and it is as applicable to the output from AI as any other tool.’

Fromexperimentationtoimplementation

AI virtual assistants are no longer speculative technology. Used wisely, they offer real benefits in speed, accuracy and insight. But successful integration into accountancy requires more than just access to tools. It demands a commitment to training, a framework for risk management, and a strategy for demonstrating tangible outcomes.

The profession is at a tipping point. Strategic adopters will not only reduce inefficiencies, but also improve staff retention and client satisfaction. ●

NFRA’s new programme in India

We examine the changes taking place in financial reporting in India and why the world Is watching.

ITheAuditFirmsSurvey2025

ndia’s National Financial Reporting Authority (NFRA) is recalibrating its approach to audit oversight. We examine what’s changing, what it means in practice, and how firms – whether global networks or small regional practices –should prepare.

The NFRA has until now focused its activities on issuing inspection reports – highlighting shortcomings in documentation, independence and procedures –as well as issuing related penalties and sanctions. As a result, the regulator was largely reactive. Auditors were only forced to engaged meaningfully with NFRA when something had already gone wrong.

However, the NFRA intends to raise the quality of audit across India through a mixture of proactive outreach, feedback mechanisms and stricter expectations. For accountants and audit professionals, these changes will affect their daily working practice, client relationships, and the economics of audit work.

Thenewstrategy

From 26 September 2025, NFRA will launch a series of city-based outreach programmes, starting in Hyderabad, then moving to Indore on 6 October and beyond. These initiatives mark a deliberate shift from reactive regulation to collaborative engagement, though against a backdrop of mounting scrutiny.

Outreachprogrammes

Under the title ‘Creating a better financial reporting world’, these outreach programmes are structured workshops and technical sessions designed to address practical audit challenges. They are intended to clarify NFRA’s expectations, and build a baseline of best practices across firms of all sizes. They signal a focus on auditor behaviour and professional scepticism, rather than mere technical compliance.

This survey, the first of its kind, seeks to gather feedback on audit quality issues, and to identify firm-level challenges and resource gaps. It offers firms a chance to shape the regulator’s guidance agenda.

Importantly, these initiatives don’t mean that there will be less enforcement. The NFRA will still continue to inspect for insufficient documentation and weak scrutiny, and penalties or debarments will still be on the table. Rather, the NFRA is adding a forward-looking dimension to its oversight. Accountants should view this as help with accountability, not as a softening of the rules.

Whythismattersforaccountants

Raising standards of audit quality: The NFRA is emphasising the qualitative aspects of auditing: the use of professional scepticism, quality of judgment, and the completeness of documentation. Firms will need to demonstrate not just that procedures were performed, but that they were performed thoughtfully, contemporaneously and with clear rationale.