By Victoria Mejicanos AFRO Staff Writer vmejicanos@afro.com

With economic uncertainty high, many are hesitant to take a risk with the money they do have by making investments.

But that doesn’t mean one should shy away from the conversation altogether.

So why do people “invest in the stock market,” or purchase shares of a company?

According to information released by the U.S. Securities and Exchange Commission (SEC), “investors buy stocks for various reasons.”

Those reasons include:

Capital appreciation, which occurs when a stock rises in price

Dividend payments, which come when the company distributes some of its earnings to stockholders

• Ability to vote shares and influence the company

The SEC also reports that “companies issue stock to get money for various things,” such as :

• Paying off debt

• Launching new products

• Expanding into new markets or regions

• Enlarging facilities or building new ones

This week, the AFRO spoke with experts who say making any kind of investment is all about education, discipline and perspective.

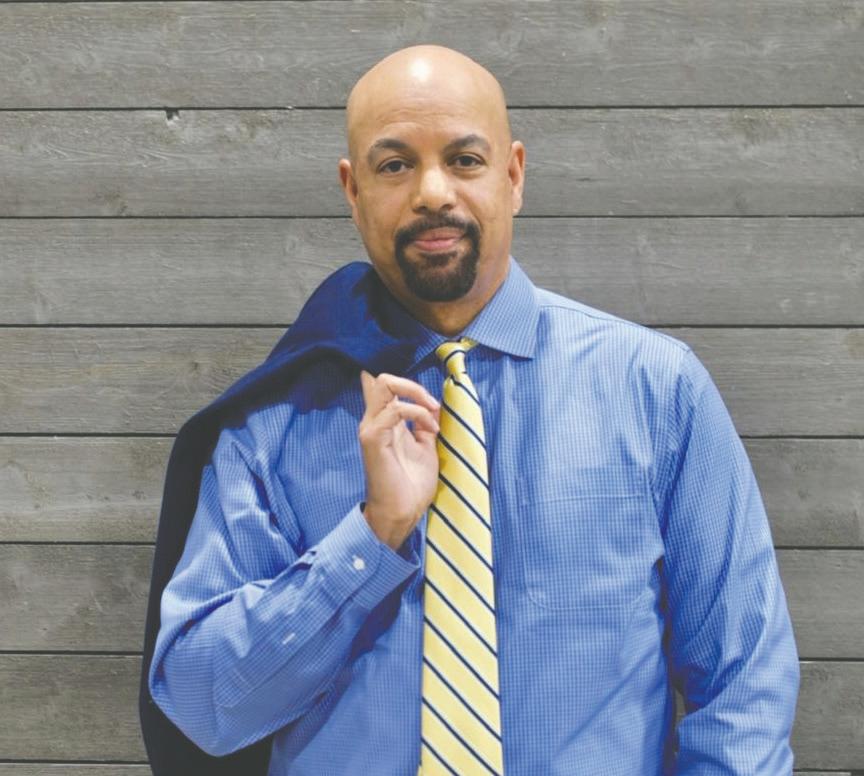

J.R. Fenwick is founder and CEO of a stock market education program called FLip that Stock. He believes that the stock market is “America’s great equalizer.”

Fenwick saw that people of color were hesitant to invest, thinking it isn’t for them and viewing it as gambling. However, he realized that the stock market is how many CEO’s maintain their wealth and net worth.

“If all we do is just have ‘a job,’ we’re at maximum risk,” Fenwick said. “A stock is nothing but a slice of ownership in a company.”

With this in mind, he aimed to teach people about how to use the stock market to their advantage in a fun and engaging way. Through his company, FLip That Stock, Fenwick works to reframe the act of investing in the stock market

Your History • Your Community • Your News

The Afro-American Newspapers

Baltimore Office • Corporate Headquarters

233 E. Redwood Street 6th Floor, Suite 600G Baltimore, Maryland 21202

410-554-8200 • Fax: 410-554-8213 afro.com

Founded by John Henry Murphy Sr., August 13, 1892

Chairman of the Board/Publisher - Frances Murphy Draper

(Publisher Emeritus - John J. Oliver Jr.)

President - Benjamin Murphy Phillips IV

VP of Marketing and Technology - Kevin E. Peck

Director Digital Solutions - Dana Peck

Receptionist - Wanda Pearson - 410-554-8200, ext. 246

Director of Operations

Andrè Draper - 410-554-8200

Director of Finance

Bonnie Deanes - 410-554-8242

Executive Director/Director of Advertising

Lenora Howze - 410-554-8271 - lhowze@afro.com

Director of Community & Public Relations

Diane W. Hocker - 410-554-8243

Editorial

Managing Editor - Alexis Taylor - 410-554-8257

Special Projects Editor - Dorothy Boulware - 410-554-8231

Editorial Assistant - Ama Brown-Parson

Archivist - Savannah Wood- 410-554-8277

Baltimore Circulation/Distribution Manager Andrè Draper - 410-554-8200

Creative Design and Content

Matthew McDonald

Washington Office 1140 3rd Street, N.E., 2nd Floor Washington, D.C. 20002-6723

202-332-0080 • Fax: 410-554-8213

(Washington Publisher Emerita - Frances L. Murphy II)

Director of Operations - Andrè Draper - 410-554-8200

Customer Service, Home Delivery and Subscriptions: 410-554-8200

and educating people on how to do it safely.

“It’s just like going to the store, they have dollar items… all the way up to items that cost thousands,” Fenwick said.

The entrepreneur says that viewing stocks through a regular shopping lens can take away some of the fear of investing.

For Willie Jolley, award-winning speaker and author of “Rich is Good, Wealthy is Better!,” investing all starts with a person’s mindset and discipline.

“Wealth starts in your mind, then it manifests in your bank account,” said Jolley. “If you’re going to create wealth before you invest, you have to have discipline. Discipline means that this isn’t something you do haphazardly.

“You don’t jump into something because your cousin told you about a hot stock,” said Jolley. “You must get the discipline to do your research and to learn how investments work and how money works.”

Jolley says there are eight different types, and people need two to safely invest:

1. Earned income: Money made from a job.

2. Profit income: Money generated by buying something and selling it at a profit.

3. Interest income: Money earned from loaning money and collecting interest.

4. Dividend income: Money generated from stocks, bonds, or other assets that pay dividends.

5. Rental income: Money generated from renting something to someone else.

6. Capital gains income: Profit from assets that increase in value, such as real estate.

7. Royalty income: Money from books, music, ideas, or other intellectual property.

8. Residual income: Money that continues to come in

after the initial work, such as insurance sales or network marketing.

Both Fenwick and Jolley say that common myths abound. But unlike what some may think, the decision to begin investing does not take a lot of time and money. People can open free investment accounts with places like Fidelity, Charles Schwab, and

Robinhood. These companies will also often offer free advice when an account is opened.

Fenwick says when it comes to investing, people should start with what they know.

Companies that consumers are fond of are solid places to start.

“Stocks come in all different price ranges, right?” said

Fenwick. “If you have $50, $100, $1,000, you can get started. You can find a stock in any price range to fit your budget.”

As a new year approaches, experts say the biggest barrier to investing is hesitation. Getting over initial hesitation and staying educated about one’s investments can pave the way to long term wealth.

Every holiday season, we search for the perfect gifts for the children in our lives. We want the joy and the surprise. But most of what we buy doesn’t last. Sneakers lose their shine, video games get replaced and toys are forgotten by spring. As families stretch their budgets, this year offers a chance to give differently— and more meaningfully.

During my years as a stockbroker—one of the few Black women in that field at the time—I learned a lesson I’ve never forgotten: consistent saving and steady investing work. I saw investment clubs and community groups put away small amounts month after month. They relied on discipline, not windfalls and their persistence paid off.

That instinct toward preparation didn’t start with us. It lived in the habits of our elders— people like my Aunt Sis, born in 1914. She lived through the 1929 market crash at just 15, the Great Depression, and an era when Black families had little reason to trust financial institutions. So she kept a $100 bill—or two—under her mattress. That was her safety net. Her way of staying ready in uncertain times. Her method reflected the wisdom of her generation. Today, we honor that same spirit while recognizing that we now have more tools to help our resources grow.

This Christmas, instead of gifts that fade, we can give children something with staying

power. Opening a 529 college savings plan, a custodial brokerage account or even purchasing a single share of stock in a recognizable company can plant a seed that matures over time. And when teenagers work part-time or earn income, some families explore long-term savings tools for minors. One example is a custodial Roth IRA, which legally requires the child to have earned income. I mention this only as general information—not as investment advice—but to highlight that families today have more options than earlier generations ever did.

And we do not have to do this alone. Black families have always relied on the village. Grandparents, godparents, aunts, uncles and close family friends often welcome the chance to support a child’s future. They simply need to know there’s an option beyond toys or electronics that won’t last. A contribution of $10, $20 or $25 to a child’s savings or investment account can matter far more than anything wrapped in paper.

As we give, we can also teach. We can help children understand what it means to build assets, why ownership matters and how money grows over time. These early conversations help them see themselves not just as consumers, but as stewards of their own possibilities. Wealth rarely appears all at once. It grows through simple, consistent steps.

This Christmas, let’s choose gifts that don’t break or fade. Let’s give our children—and grandchildren—something that grows.

By Megan Sayles AFRO Staff Writer msayles@afro.com

Credit scores affect everything from interest rates to major purchases, like houses and cars, but the rules that shape them continue to evolve. This week, the AFRO spoke with Bonita Grant, founder and owner of Cure My Credit Score, about changes in 2026 and the smartest strategies to stay on track.

AFRO: What are the most important factors that will determine a person’s credit score in 2026, and have any of these changed in recent years?

Bonita Grant: I’ve noticed in the past that it was a lot easier to pay down your credit card, and then your scores will go up. Right now, payment history—like being on time—is very heavy. It’s heavier than it’s ever been. Before COVID-19, you could just write a letter and things would just melt off. Since COVID, things aren’t melting off by you disputing them online. If you get a 30-day late notice, it’s going to highly impact your score. The score may drop 100 points, and it’s going to highly impact your score for the first three months. If you’re 60 days late, it will

highly impact your score for six months.

Making sure that everything is on time is paramount. It is the most important thing you can do to help your credit report.

AFRO: What are the best ways for someone to check their credit report without hurting their score?

BG: There’s apps, like Credit Karma. Or, if you have a credit card or even a bank account, most bank accounts allow you to see your credit score every month. Sometimes they don’t allow you to see your credit report, but at least knowing your score will tell you if there’s something that’s impacted it. When you pull your own credit, it does not impact your credit score. It’s called a soft pull. A hard pull is when a bank pulls your credit to see if they can approve you for whatever loan product they have or credit card product they have. A hard pull can affect your credit score.

AFRO: What are the most effective strategies for someone looking to improve their credit score?

BG: One of the best ways to boost your scores is by paying down your credit card. We hear that we’re supposed to keep our credit cards at 30 percent utilized.

Thirty percent is the maximum they want to be on your credit card. They really want you to be closer to 10 percent of the limit. When you’re at 10 percent of your limit on your credit cards, that’s how you get to, like the 700 and 800 scores. They want you to keep your credit card balances extremely low, and the good number is between one and 10 percent of the limit. They don’t want you to be at zero because it looks like you’re not using the card, and they can’t really score you.

If you’re trying to buy a house or a car or do anything strategic with your credit, you want to get all your cards down to 10 percent as soon as possible and leave them there.

AFRO: Are there common mistakes or misconceptions people make that actually hurt their credit score more than they realize?

BG: One of the craziest things I’ve heard was the “waterfall effect,” where you get six credit cards in one day to raise your credit score. Don’t do that, it hurts

your credit. The reason why it hurts your credit is because you have all these new inquiries that are showing up. After getting the second credit card, it alerts other banks that you’re doing this.

A lot of times, your limits are also going to be really low. You might get six $300 credit cards, which doesn’t help you at all and damages your average age of file—a big part of your credit score. They take all of your open cards or open accounts, and they average the age. Most people who

have 800 credit scores have an average age of file that is older than seven years. If you have a 10-year-old card and a two-year-old auto loan, that’s 12 years over two accounts, which gives you an average age of six years. If you do the waterfall effect and get six new cards that show up on your credit report, they’re all one month old. Now you’re taking that 12 years and you’re dividing it over eight accounts. Your average age of six years drops to less than a year old.

By Laura Onyeneho

Nnenna Anosike once worked at the top echelon of pharmaceutical research, where high-stakes clinical trials were her daily currency.

For six years, the work was so stable that she never had to apply for a job; recruiters always sought her out. Earlier this year, after nine months of unemployment, her reality involved navigating the anxieties of dropping off food deliveries for DoorDash, while the high salary she once enjoyed ran dry.

Anosike’s abrupt transition from a clinical research associate to a gig worker is the human face of a sudden, brutal layoff crisis that disproportionately impacts Black professionals nationwide.

The financial loss was preceded by severe physical and psychological strain. The first red flags at her former employer, which she noted was struggling with contract losses and legal troubles, appeared when a wave of superiors was laid off.

“I

The situation escalated when she was transitioned to a new department with an impossibly heavy workload, a tactic often referred to as “quiet firing.” She was assigned more than 50 clinical sites across eight study protocols, far exceeding the industry standard of 15 sites and two protocols.

“Everybody just had an extremely large load of work,” she said. “Soon after that, you would see those people either being let go or those people resigning abruptly.”

The constant pressure took a severe physical toll. Anosike developed plantar fasciitis in her right foot, and, more alarmingly, pulsatile tinnitus —a condition in which she can hear her own heartbeat in her

right ear. The stress resulted in chronic anxiety, for which she now takes medication.

The final layoff meeting, disguised as a “weekly check-in” via Microsoft Teams, came as no surprise. An HR representative was present, confirming her fate. Anosike received no severance pay and immediately entered survival mode to attend to personal and financial responsibilities, including enrolling in online courses to pursue certifications in Python and Project Management.

A systemic crisis

Between February and June 2025, an alarming 318,000 jobs held by Black women were eliminated in the U.S., driving the African American unemployment rate to soar from 6 percent to 7.5 percent. Experts point to the chilling effect of mass layoffs across corporate giants like Amazon, Microsoft and Intel, coupled with broader systemic shifts, including federal workforce cuts, that uniquely harm Black workers.

Kyra Rènel Hardwick, an award-winning business strat-

days): Grant yourself at least five days to process before jumping into frantic action. Use this time to establish control through routine.

• Hardwick leveraged a nine-month career gap to build her current system, having been laid off from her corporate role before transitioning into entrepreneurship.

“I kept a calendar, a morning, midday, and evening routine. I still got fully dressed every day,” she said. “This regimented schedule prevented idle time and negative mental loops.”

This regimented schedule, including designated hours for job applications, resume fine-tuning and networking, kept her on her toes for when the opportunity arose.

The wave of corporate restructuring driven by AI and automation confirms that job loss is less about individual performance and more about industry restructuring, demanding a strategic pivot.

egist and CEO of The Kyra Company, insists that managing the internal shock is the first step toward regaining control. She frames a layoff as a “transition” and a “bridge,” a temporary event leading to the next stage, and offers a three-step mental strategy for the first 30 days:

• Reestablish self-esteem: Do not internalize the job loss as a reflection of skill or worth. Reiterate that the layoff is a circumstance beyond personal control. Create psychological safety: Maintain positive selftalk and communicate honestly with your support system (family, friends, partner) about your feelings and plans.

• Establish a plan (Take five

Esther Olubi is the director of people at Black On The Job, a platform that helps Black professionals build six-figure careers with expert coaching, resume services, and career strategies to level up success.

She said that her community members, or “Bees,” are seeking “confidence coaching” and a strategy to move from obsolete roles into in-demand skills. Olubi states that many professionals, particularly those affected by cuts to the federal workforce, are now facing acute fear about transitioning back to the corporate world.

Black On The Job has shifted its focus from “job searching” to “career strategy.”

• Leverage certifications: Olubi encourages utilizing the broader availability of discounted or free

programs in trades like plumbing, electrical work, or nursing to build a resilient skill stack.

• Skills are translatable: Olubi insists that professionals should “Note everything you’ve done down,” focusing on quantifiable metrics and achievements rather than outdated job descriptions.

• Advocate for development in severance: Olubi advises professionals to request career development services (like coaching or courses) as part of their severance package,arguing,“If they’re letting you out, they are

responsible for getting you back in the door.”

Find guided career advice and community: “It’s okay not to be able to go at this alone,” Olubi insists. Find tested and trusted expert communities that offer strategy specific to your demographic and current market needs.

• Anosike launched a consulting company and utilized SNAP benefits and family support. The experience has led to a firm decision against returning to the “dehumanizing” clinical research field. The collective wisdom

distilled from these experiences motivated her to prioritize wellness, secure necessary support and pivot with aggressive intention.

“Take some time to get some good rest, work on your diet, hop in the gym because you’re going to need your strength to do everything that you need to do,” Anosike said. By focusing on wellness and intentional upskilling, professionals can convert a moment of crisis into a strategic opportunity.”

This article was originally published by The Houston Defender.

By Megan Sayles AFRO Staff Writer msayles@afro.com

As the year winds down, many taxpayers may assume it’s too late to make decisions that will change their tax refund next spring. But, the final weeks of the year offer a time for individuals to seize opportunities to lower their taxable income, claim overlooked credits and prepare for a smooth tax filing season.

LaTasha Hibbert, CEO and founder of LTH Accounting Services in Towson, Md., spoke with the AFRO about the most effective last-minute moves, the biggest mistakes she sees each December and how households can still take steps to yield a larger refund before the year ends.

AFRO: As we head toward the end of the year, what are the most

effective last-minute steps individuals can still take to potentially increase their tax refund for 2026?

LaTasha Hibbert: Even toward the end of the year, there’s still a lot people can do. A few simple moves include: putting a little extra into a 401(k) or individual retirement account (IRA), making charitable donations before Dec. 31, using or adding to your Health Savings Account (HSA) or flexible savings account (FSA) and checking your withholding to make sure it reflects any changes from this year.

These aren’t complicated steps, but they really can make a difference when tax season rolls around.

AFRO: What are some common tax mistakes you see people make around November and December that end up hurting their refund the following year?

AP File Photo/Patrick Sison Tax season will officially start at the end of January with returns due on April 15, 2026. Before 2025 comes to a close, there are still steps taxpayers can take to prepare and potentially boost their refunds.

LH: A big one is waiting until the last possible minute to think about taxes — that’s when people miss opportunities. Others include not adjusting your W-4 after changes like a new job or new baby, forgetting to use their FSA funds before they expire, not keeping track of deductible expenses—especially charitable donations or mileage—and freelancers missing their estimated tax payments.

AFRO: For middle- and low-income households especially, what credit or deduction opportunities often get overlooked?

LH: There are some really valuable credits that people don’t always realize they qualify for. These include the Earned Income Tax Credit (EITC), Child Tax Credit, Saver’s Credit, which rewards people for contributing to retirement even in small amounts; education credits, like the American Opportunity Tax Credit (AOTC); and more energy-efficient home improvement credits than people realize.

Tax credits can add up quickly and make a big difference in a family’s refund.

AFRO: For freelancers or gig workers, what year-end financial moves should they be making now to avoid surprises and possibly improve their refund?

LH: For freelancers, the end of the year is a great time to get organized. I recommend making sure their final estimated tax payment is on track; gathering all business receipts, mileage records and expenses before they get lost;

buying equipment or supplies this year if they know they’ll need them early next year; and considering a Simplified Employee Pension (SEP) IRA or solo 401(k) if they want to save on taxes and build retirement savings. Freelancers have a lot more control — and responsibility — over their taxes, so good record-keeping really pays off.

AFRO: What’s one piece of advice you’d give someone who thinks it’s “too late” to make a

difference in their taxes before the year ends?

LH: It’s not too late. Even in December, there are still plenty of options. You can increase retirement contributions, make charitable donations, organize receipts and plan for next year. A few small steps now can absolutely reduce stress and possibly increase your refund when tax time comes.

The key is just not waiting until you’re actually filing your taxes. A little attention now goes a long way.

Clark Sponsored by JPMorganChase

As 2025 draws to a close, it’s a great time to reflect on the year and set yourself up for success in 2026. Whether you’re building new habits or refining your financial strategy, Aja Clark, Chase Community Manager in DC, shares practical tips to strengthen your financial health journey.

Q: What’s been a key financial health learning for you in 2025?

A: This year, I’ve been really inspired by the enthusiasm in Greater Washington for financial education. People here aren’t afraid to dream big—buy a home, save for retirement, plan for college, or grow their business—and are really excited about the process to get there. One of the most rewarding parts of my job is helping connect them with the tools and knowledge to turn those dreams into reality One trend that stands out is the increasing complexity of fraud and scams. These can have a serious impact on anyone’s financial wellbeing. That’s why I’ve made it a priority to host workshops focused on fraud prevention—covering the latest scams, warning signs, and practical steps to help safeguard your personal information. Staying informed and proactive is the best way to keep yourself and your loved ones safe.

Beware of unrealistic deals

Q: As the year wraps up, what should the D.C. community keep in mind about their finances?

A: The new year is a fresh start, and it’s the great time to build habits that set you up for success. Here are a few ways to get started: Think of your budget as your personal roadmap—it shows you exactly where your money is going and helps you steer toward your goals. Take a little time each month to track your income and expenses. When you set a budget that truly reflects your priorities, you’re not just managing money—you’re empowering yourself to make confident decisions

• Saving doesn’t have to be overwhelming. Even small, consistent deposits can grow into something meaningful over time. Try automating your savings so it happens without you even thinking about it—like paying yourself first. Watching your savings grow, no matter the amount, is a powerful way to build financial security and peace of mind. Your credit score is more than just a number—it’s a key that can unlock new opportunities, from buying a home to starting a business. Strengthen your credit by paying bills on time and keeping your balances manageable.

Q: What are some tips for your neighbors to start the new year on the right financial foot?

A: No matter where you are in your financial journey, I think everyone should do a year-end financial check-up. Review your budget and savings, set realistic goals, and make a plan you can stick to in the new year. Anyone can visit their local Chase branch and ask about getting access to a financial health check-up at no cost—available to all, no matter who you bank with. Our teams live, work, and are rooted here – and we are deeply committed to uplifting the communities and serving our neighbors every day. As Community Manager, I’m focused on financial education and community partnership to help strengthen financial health journeys. I host free workshops on essential topics like budgeting, saving, building credit, and preventing fraud and scams. These workshops are open to all, not just Chase customers, and can help you start the new year on the right foot.

Q: What financial health initiatives are you excited about in 2026?

A: I’m especially excited to help demystify credit for our community. Credit can feel intimidating, but it’s actually a powerful tool that can help you unlock new opportunities—whether that’s buying a home, starting a business, or simply getting better rates on everyday purchases. In my workshops, I break down the basics: why it’s important to know your credit score, how to check it, and simple steps you can take to improve it—like paying bills on time, keeping balances low, and avoiding unnecessary debt. We also talk about how your credit score can be a stepping stone to achieving your biggest goals. My advice? Don’t shy away from learning about credit. The more you understand, the more control you have over your financial future.

Q: How can neighbors get involved and benefit from your community work?

A: Getting involved is easy—and it can make a real difference in your financial journey. We have Community Managers in every state and D.C., all dedicated to supporting their local neighborhoods. Our free workshops cover essential topics like budgeting, saving, building credit, and protecting yourself from fraud and scams. These sessions are open to everyone, not just Chase customers, and are designed to be practical and welcoming. Whether you’re looking for guidance, want to ask questions, or just want to connect with others who are working toward similar goals, we’re here for you. I encourage you to join us, bring a friend, and take advantage of the resources and support available right in your community

Q: If you could give one piece of financial advice to the community for 2026, what would it be?

A: My top advice is to be proactive: take the time to review your finances, set clear and achievable goals, and create a plan to reach them. Don’t wait for a crisis or a big life event to get started—small steps today can lead to big results tomorrow. And remember, you don’t have to do it alone. Our team is here to help, whether you need a quick check-up, want to talk through your options, or need help building a plan. You don’t need to be a Chase customer to benefit from our expertise and support. We’re committed to helping our neighbors build a stronger, more resilient financial future—one step at a time.

The bottom line

The end of the year is the perfect time to reset your financial goals and take positive steps toward a stronger future. Stop by your local Chase branch for a free financial check-up, sign up for one of my free workshops, and let our team help you start 2026 with confidence.

By Andrea Stevens AFRO Staff Writer astevens@afro.com

In cities across the country, many Black households say rising prices are reshaping their daily routines. Costs for food, housing and health care continue to rise faster than wages. People are now making difficult choices about expenses that once felt ordinary.

According to the September 2025 Consumer Price Index from the Bureau of Labor Statistics, Americans are paying more for gasoline, energy and food, and the price increases don’t stop there. The latest

“My income has increased, but not as much as the cost of living. I work more to maintain the same standard of living I already had.”

report shows an uptick in costs associated with “shelter, airline fares, recreation, household furnishings and operations, and apparel.”

For a Prince George’s

County native Sydney Robinson, a single woman with an associate’s degree and a career in finance, the shift has been sharp. Yet even with making changes, the reality

of inflation hits her in small –but painful – ways.

“I’ve opened a high yield savings account to stack my savings in order to grow my money faster,” she said. “I have had to cut back on some of my simple pleasures like solo dates, eating out and beauty supply trips. I tend to wear longer lasting hairstyles instead of switching it up like I used to.”

For Robinson, the most immovable cost is health care.

“Health insurance has been the biggest most important cost that I have to maintain no matter what. It is not something you can’t compromise on because of the risk that comes with not having it,” she said.

She said the gap between her pay and expenses continues to widen.

“My income has increased, but not as much as the cost of living. I work more to maintain the same standard of living I already had,” she said.

Like Robinson, Olivia

Dreux, a junior at Morgan State University, is also cutting where she can from her budget. The 22-year-old Baltimore native purchased her first home this year. Dreux said rising prices forced her to tighten her budget. She has made changes to how she maintains her appearance. What was once routine maintenance has turned into a category many now treat as a luxury.

“I have been doing my own hair a lot more. Spending money on my hair had to go,” she said. “It shocked me how something that used to be simple now feels like a financial decision.”

Dreux said the housing market offered another surprise when she was required to put down more money than planned. Family inheritance helped, but she noted that her situation was rare.

“It is not realistic anymore to see people in their early 20s move out,” she said. “Rent prices are out of this world.”

For Baltimore locals Rya and Eric Greene, as newlyweds, new parents and homeowners, rising prices forced a similar reset. Eating out was the first cut.

“One thing we have changed is how we use consumer credit and how we save. We had to make sure we had enough accessible funds in case of an emergency,” Rya said. “Meals at home can be just as good and much more budget friendly,” she said. Rya added that she wishes she had been taught more about financial tools earlier in life.

“I would have liked better guidance on responsible credit card use and the value of maintaining a strong savings account,” she said.

Many Black families are rethinking the basics and wondering how much further they can stretch, but across different households the message remains consistent: Everyday costs are rising faster than wages.

This holiday season, we’re here to help you manage what matters most: family, community, and financial peace of mind. However you celebrate, let’s make it brighter together. PREPARE FOR THE HOLIDAYS WITH CONFIDENCE! Move Forward With Us™

By Maurie Backman

Financial freedom can mean a few different things. It could mean freedom from debt, freedom from a job you can’t stand or freedom from money-related worries.

Financial freedom is just as much about your state of mind and outlook as it is about the number in your bank account.

It’s a great thing to know that you can spend money on something you love without having to stress about paying it off, or that you can tackle an unplanned expense without worrying about needing debt relief afterward. If your goal is financial freedom in 2025, Freedom Debt Relief shares some key steps to take.

Key takeaways: Financial freedom could work wonders for your mindset and outlook. Focus on budgeting, mindful spending and savings.

• Aim to pay off debt and invest your money so it goes to work for you.

1. Get onto a budget

Following a budget might seem like the opposite of financial freedom. In fact, a budget empowers you to take control of your finances and understand where your dollars go. And the more knowledge you have, the less financially stressed you might feel.

You have several options for budgeting hacks, and it pays to experiment with different methods to find a good fit. You can list your expenses on a spreadsheet or sheet of paper, use the envelope system to put physical cash aside for different expenses or download a budgeting app you’re comfortable using.

2. Reexamine your spending

The U.S. economy is in a weird place. Though unemployment is low and inflation has calmed down a bit this year, the threat of tariffs looms over us all. Tariffs could drive up the cost of certain products, not to mention lead to shortages. You can set yourself up to manage the impact of tariffs by not only budgeting, but also practicing mindful spending. This doesn’t mean cutting back on all of the things you love. Rather, it means making sure that when you do spend, it’s for a good reason. You get to be

the one to decide if a reason is good enough to justify the cost. That’s the magic of a budget. You might get takeout once a week to save time in the kitchen. Or hire a babysitter for a few hours so you can go grocery shopping without your kids, thereby getting a mental break. In any case, you think clearly and carefully each time you spend money, and make a conscious choice to spend it on that thing, rather than anything else that might also be important to you.

3. Pay off costly debt

When you owe money on credit cards, you’re beholden to the companies that issued them to you. When you owe money on a personal loan, your lender gets a chunk of every paycheck you earn. Paying off expensive debt gives you freedom from your lenders and credit card companies. Once you have your budget in place, you can come up with a plan to attack your debts. You might spend less on expenses, earn more money or both. If the debt you have is overwhelming and you can’t envision yourself paying it off even with significant changes to your spending and income, then it may be time to seek debt relief. A debt expert can walk you through your options, which may include debt

settlement or consolidation. Every extra dollar that you can apply toward your debt could get you over the finish line sooner.

4. Build an emergency fund

Easier said than done, right? It’s worth your energy to focus on this goal, even if you start small.

Knowing you have money in the bank to cover an unplanned expense or financial hiccup could give you peace of mind. And in today’s economy, that’s important.

Many people are worried about a recession. It’s not guaranteed to happen, and not all recessions are drawn-out, painful events. The economy could slump for a few months and recover quickly, but it helps to be prepared in case things worsen.

An emergency fund could serve as your financial and mental safety net. Some experts suggest saving up a threemonth emergency fund, which could get you through a period of unemployment. But it may take a while to save enough money to cover three months’ worth of living expenses, so try not to stress if it’s slow going. Set small goals and celebrate each one.

If your ideal emergency fund requires $6,000, celebrate your first $100, and then work toward

the $200 mark as you can.

Don’t think of it as a race. It’s meant to be an ongoing effort.

5. Put your savings on autopilot

Automate your savings (which means setting up a direct transfer to your savings account each time you get paid). That could make it easier to meet your emergency fund goal and knock down debt.

But there’s another benefit: feeling free to spend your remaining money as you wish.

Let’s say you set a monthly savings goal of $200, and that money gets transferred into your savings automatically at the start of the month when your paycheck arrives. Once that money is gone from your checking account, it’ll be harder to spend. If you avoid the habit of pulling that money back out of savings, it could be easier to build up funds and hit your goals.

Also, automating your savings could make it possible to splurge with less guilt. If you know you’ve met your savings goal for the month, you notice something you want to buy, and you can afford to pay for it in full, why not go for it?

6. Put your money to work by investing

If your dream is to one day have the option to stop working for a paycheck, you’re in

good company. Money that doesn’t come from work is passive income. The more passive income you earn, the less you’ll have to actively earn by working.

Investing your money is a way to create financial freedom. If your money is growing while you’re out living your life, you’ll eventually have more of it.

In time, investing could be your ticket to a retirement with enough money to pay your bills without worry. Not having to work for a living is a great way to experience financial freedom.

Explore your options for investing with an employer-sponsored plan like a 401(k). Your employer might even match a portion of your contributions. You can also open a retirement account on your own to invest in your future.

The journey to financial freedom starts today

Financial freedom doesn’t only mean reducing your debt and hitting a specific number in your savings account. Rather, it’s a mindset and way of life. These moves could fuel your journey to financial freedom so you can feel fantastic about where you stand. This story was produced by Freedom Debt Relief and reviewed and distributed by Stacker.

By The Associated Press

A man accused of shooting two National Guard troops near the White House pleaded not guilty Dec. 2 to murder and assault charges during his first hearing before a judge, appearing remotely by video from a hospital bed.

Rahmanullah Lakanwal, a 29-yearold Afghan national who was also shot during a Nov. 26 confrontation, said through an interpreter that he was in pain and couldn’t open his eyes. A court-appointed defense attorney entered Lakanwal’s plea on his behalf during a brief hearing in Washington, D.C. Lakanwal is charged with first-degree murder, assault with intent to kill and illegal possession of a firearm in the shooting that killed Specialist Sarah

Beckstrom, 20, and wounded Staff Sgt. Andrew Wolfe, 24.

Another National Guard member heard gunshots and saw Beckstrom and Wolfe fall to the ground as Lakanwal fired a gun and screamed, “Allahu Akbar!” according to a police report filed in court Dec. 2. Lakanwal chased after and shot at another Guard member before troops detained him as he tried to reload his gun, the report says. D.C. Superior Court Judge Renee Raymond ordered Lakanwal held without bond. His case is due back in court Jan. 14.

Beckstrom and Wolfe were deployed with the West Virginia National Guard for President Donald Trump’s law-enforcement surge in the nation’s capital, which has flooded the city with federal

agents and troops since August. Authorities were investigating a possible motive for what they described as an ambush-style attack.

A prosecutor, Ariel Dean, described the shooting as a “shocking crime” and said it appears that Lakanwal “traversed the city to some extent” before approaching the troops and shooting them. Raymond ordered him detained, citing the “sheer terror that resulted” from Lakanwal’s actions. The magistrate said it appears that Lakanwal, a resident of Washington state, travelled across the country “with a specific purpose in mind.” She described the government’s case against him as “exceedingly strong.”

By D. Kevin McNeir Special

to the AFRO kmcneir@afro.com

Several hundred residents, business owners, and city officials participated in a public scoping meeting for the redevelopment of the Robert F. Kennedy Memorial Stadium Campus on Wednesday, Nov. 19, at St. Coletta of Greater Washington in Southeast D.C. It served as the first public meeting since the project was approved in September by the D.C. Council and the Washington Commanders, who also in September, chose global design firm HKS, Inc., as the lead architect. Matthew Bell, Professor of Architecture at the University of Maryland and Principal at Perkins Eastman in D.C., led an informative slide show presentation to kick off the evening that summarized public comments received at the previous community meeting on Oct. 22.

“We’re here to further the National Environmental Policy Act and the National Historic Preservation Act and allow the community to express its views on the impact the redevelopment of the stadium will have on the environment and their lives,” Bell said. “As we continue to shape a master plan for the project, we want the public to participate and offer their comments.”

In public meetings, which first began in February 2025, a host of concerns have been identified including traffic and parking, greenspace, the expansion of mixeduse facilities along the riverfront, and job

By

Prince George’s County Councilwoman Krystal Oriandha was unanimously elected to serve as the new chair of the Prince George’s County Council during the Dec. 2 Exchange of the Gavel meeting. The annual election and ceremony, held at the Wayne K. Curry Administration Building in Largo, Md. drew an overflow crowd, and was attended by Prince George’s County Executive Aisha Braveboy. Oriandha will serve as council chair through Dec. 1, 2026.

The Kenyan American activist, elected in 2022 to represent District 7 in Prince George’s County, got right down to business in outlining her vision and priorities for the coming year.

“Our theme this year is ‘prototype for what is possible.’ This is more than a slogan,” Oriandha said. “It is a declaration. This year, Prince George’s County will shift from reacting to situations to becoming pro-active,” she declared.

Recent decisions over which the county had no control, including massive federal government layoffs and the federal government shutdown lasting from Oct. 1 to Nov. 12, have left county officials scrambling to meet the needs of laid off and furloughed workers all year.

Oriandha’s primary focus will be to lead the council in adopting an approach to child-care access and affordability that she hopes will become a national model.

The county is currently home to 71,000 children under the age of five, with close to 13 percent of those children living in families below the poverty line, according to the 2025 Maryland Child Care Resource Network (MCCRN) report for the county.

“Entire neighborhoods in Prince George’s County are considered childcare deserts,” Oriandha added. The MCCRN report lists more than 20 legal districts throughout the county having

two or fewer licensed child-care centers.

Other initiatives include strengthening the county’s capacity by launching a county-wide asset mapping initiative, strengthening the county’s economic capacity with workforce initiatives, and modernizing council processes.

Oriandha was most enthusiastic in her hopes for a county-wide listening tour and survey to connect with every resident in Prince George’s County.

“This will keep us grounded in a simple truth. Effective government starts with listening,” she said.

Long time council member, Eric Olsen (D-District 3) was elected for his third round as council vice chair, having previously held the role from 2008-2009 and 2022-2023. Olsen was first elected to the council in December 2006 – December 2014 and was re-elected in 2022.

Braveboy supported Oriandha in closing comments for the day’s session and set a respectful and collaborative tone during her remarks.

“We are going to have some long but exciting days ahead,” said Braveboy, who will need to work closely with the council in the coming months on another tough annual budget. In May 2025, the county council passed a 5.46-billion-dollar budget, after plugging a 171-million-dollar budget deficit. The county is expected to face another deficit going into the coming year’s budget negotiations.

Braveboy closed with high hopes for the council that she will work with to secure a bright future for the county that has faced the blow of federal government personnel and program cuts throughout 2025, added to the decision by the Trump Administration to rescind the FBI headquarters relocation to Greenbelt.

“The best is really yet to come in Prince George’s County,” Braveboy said.

By Brandon Henry AFRO

Washington, D.C. Mayor Muriel Bowser recently announced that she will not seek reelection after 10 years in office.

In a Nov. 25 letter to Washingtonians, Bowser noted the big achievements that have taken place during her tenure.

“I’m running for mayor because D.C. is worth fighting for.”

“We drove unemployment to its lowest levels, achieved AAA bond rating and strong reserves, quadrupled CBE spending and completed the largest infrastructure project in our city’s history with the Frederick Douglass Memorial Bridge,” said Bowser, in part of her letter. “Throughout this remarkable journey, I’ve been honored to serve with countless dedicated city executives and extraordinary front-line workers, the incredible people who keep Washington, D.C. thriving every day.”

Bowser concluded, saying that while her time in office will officially end on Jan. 2, 2027, she will “keep winning for D.C.”

Now, Janeese Lewis George

(D-Ward 4) has announced that she wants to lead the nation’s capital after Mayor Bowser exits. In a video posted to social media, Lewis George elaborated on her upbringing in D.C. and her family ties to the city. She also spoke on her time as assistant attorney general in the District, and her experience representing the 4th Ward since 2021.

In her video, Lewis George said she decided to run for mayor when she became “tired of watching politicians make plans that left the rest of us out.”

“D.C. is worth fighting for,” she continues.

Though the video is critical of those who have been in charge of Washington, D.C., in a letter responding to Mayor Bowser’s announcement, Lewis George said “D.C. is a place that honors and celebrates its leaders. We will

always be grateful for Mayor Bowser’s devoted public service and impactful leadership.”

Other individuals who have filed to be a candidate in the D.C. mayoral

Continued from B1

Community perspectives illustrate wide range of concerns

Landen McCall, Principal/COO for the D.C. architectural company, Brant Mitchell, PLLC, said while he has since moved from the District to Prince George’s County, Md., he remains interested in seeing if the new sports complex will benefit residents as currently indicated.

“It’s important for us to participate in these meetings to ensure that promises now being made to the community are kept,” he said. “I also urge homeowners, Blacks in particular, to hold on to their property because this area is going to gentrify quickly, and the value of land is going to skyrocket.”

Amy Warden, principal of St. Coletta, the site where the meeting was held, expressed her excitement about forging new connections with other stakeholders.

“Because of our close proximity to the stadium, we’re very interested in developing a relationship with the Commanders,” she said. “And given the amount of community meetings that have already been held this year, we’re convinced that the planners and principal partners behind the project care about the needs and views of the community. So, it makes sense for me to be here to represent the school and the families whose children are part of our student body.”

Lora Nunn, a longtime local activist who’s married and lives just blocks away from the stadium in the popular Ward 7-based community of Kingman Park, said she’s been a vocal participant in meetings throughout the city since her neighborhood’s civic association hosted D.C. Mayor Bowser several years ago –even before the project had been approved.

“This new stadium campus has the potential to offer something for every age group – from playgrounds for children, designated paths for

walking seniors, and lanes for bicyclists, to fitness areas with equipment for adults,” she said. And with three fields already located on the RFK campus, there’s plenty of room.

“I have been pleased to hear that the planners are listening to us and even heeding our concerns about protecting the environment which includes our beautiful trees. Still, it remains to be seen whether the things we’ve stated as priorities will be included in the final plan.”

Patricia Stamper, an Advisory Neighborhood Commissioner (7C06) and single parent with two sons, 10 and 6, said she attended the meeting as an advocate for parents.

“This project will bring a lot of money to the District and parents like me want to make sure that our children benefit so that programs like out-of-school sports, tutoring, and financial literacy projects are fully funded,” she said. “If we provide more structured activities for children after school including more non-traditional sports and provide instruction for jobs like carpentry and plumbing while they’re in school, they’ll be able to earn sufficient wages for themselves and their own families after they graduate. They won’t need to venture to Navy Yard for something to do.

“The revenue D.C. gets from the Commanders needs to be reinvested in our community and not go toward building more businesses in other parts of the District or investing in things like casinos or gaming ventures. Recreation centers east of the river are struggling to keep their doors open and their buildings up to spec.” Nunn added that while she’s pleased with the enthusiastic participation of the community, she urges her neighbors to remain involved until the project is completed.

“It has been encouraging to see my neighbors – Black middle-class families – coming out and getting involved,” she said. “I’ve seen a lot of familiar faces and there have been some robust conversations including several about bringing more pickleball courts to the campus. see full story on Afro.com

Defense attorney Terrence Austin noted that Lakanwal doesn’t have any prior criminal record.

After the hearing, U.S. Attorney Jeanine Pirro said Lakanwal will be taken to a correctional facility that can address his “medical concerns” once he is well enough to leave the hospital. Pirro said Lakanwal could face additional charges in federal court as the investigation continues. Attorney General Pam Bondi ultimately will decide whether to seek the death penalty in the case, according to Pirro.

“That is a very weighty decision. That is a decision that comes later in time,” she said.

The rare shooting of National Guard members on American soil came amid court fights and a broader public policy debate about the Trump administration’s use of the military to combat what officials cast as an out-of-control crime problem.

Lakanwal entered the U.S. in 2021 through Operation Allies Welcome, a Biden administration program that resettled Afghans after the U.S. withdrawal from the country, officials said.

He was granted asylum in April under the Trump administration, according to #AfghanEvac, a group of veterans and others working to get Afghans who helped the U.S. out of the

country in exchange for their help. Trump called the shooting a “terrorist attack” and criticized the Biden administration for enabling Afghans who worked with U.S. forces during the Afghanistan War to enter the U.S. The president has said he wants to “permanently pause migration” from poorer nations and expel millions of immigrants from the country.

This article was originally published by the Associated Press.

By Dr. Deborah Bailey AFRO Contributing Editor

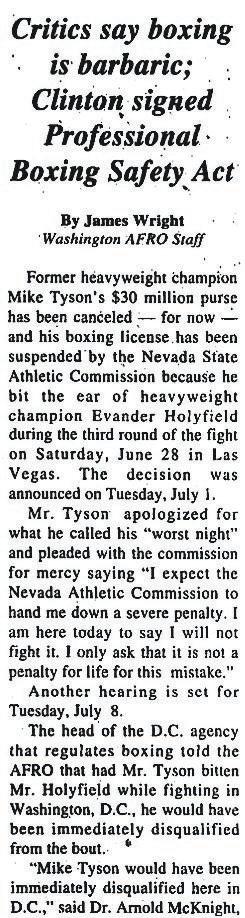

James L. Wright Jr., the internationally respected former AFRO reporter and editor, has died at age 63.

Wright was a resolute and focused sports, political and public affairs reporter who also served as a city editor for the AFRO American Newspaper for many years. At the time of his death, he worked as business and political correspondent for the Washington Informer. Wright, who died of natural causes at his home in Seat Pleasant, Md., will be greatly missed by his AFRO News family.

Dr. Frances “Toni” Murphy Draper, AFRO CEO and publisher, spoke to Wright’s time with publication.

“I remember James Wright as a young reporter working under my mother, Frances L. Murphy II—eager to learn, eager to serve our readers and always determined to get the story right,” said Draper.

“Over the years, James grew into a trusted voice at the AFRO, serving as a reporter, our D.C. editor, and later as a dedicated freelancer. In every role, he remained a consummate professional whose work reflected both integrity and deep love for the community.”

AFRO Publisher Emeritus, John Jake Oliver Jr. reflected on Wright’s impact on the AFRO enterprise.

“James was a great journalist and major contributor to the AFRO’s growth and successes during my tenure as publisher,” said Oliver. “His talented journalism will be greatly missed.”

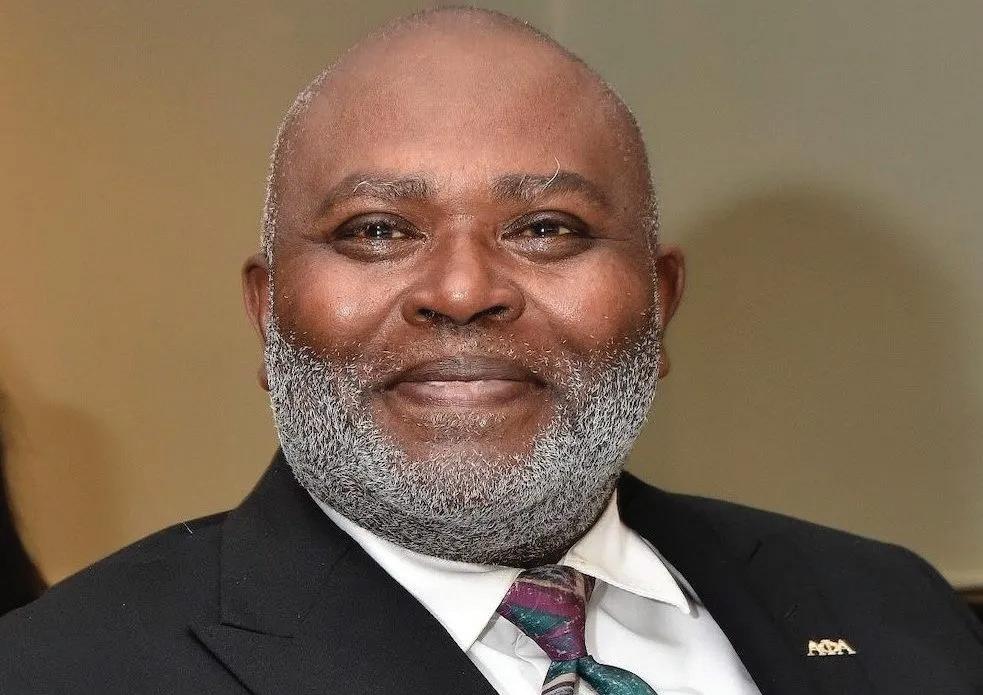

Wright captured the political, business and community life of the Washington and Baltimore regions as well as national and world news for more than three decades. His work with both AFRO News and the Washington Informer took him to Capitol Hill and beyond. Wright worked throughout the United States, but also delivered on the ground coverage from Africa and the Middle East. In July 2006 he traveled to Afghanistan to provide the AFRO with coverage of what was happening in the war torn country. But that wasn’t his first time representing the Black Press on the international stage.

In January 1998 Wright interviewed Muammar al-Qaddafi, who — at the time — was the leader of Libya.

His travels as a Black journalist also took him to Iraq, South Africa and Zimbabwe.

AFRO freelancer Kevin McNeir, another veteran of the Black Press, worked with Wright at both the AFRO and the

Washington Informer and deeply respected Wright personally and professionally.

“James loved talking to people, authoring stories that gave voice to the voiceless and always approached his work with integrity,” said McNeir. “We both were members of the same fraternity, Alpha Phi Alpha Fraternity, Inc., so we connected pretty quickly. But what I really admired about him was his willingness to do whatever was necessary to master his craft.”

“James was passionate about doing all he could to bring local stories that improved the paper and which were often overlooked by mainstream media. He was a Black Press reporter in every sense of the word,” said McNeir.

Veteran Washington Post and Black Press reporter Hamil R. Harris worked with Wright at all of his major reporting stops in the Washington D.C. region: The AFRO, The Washington Post, and the Washington Informer.

“James was a consummate professional in his work ethic. But what I loved and admired most about James in every role was his humility, and his love for everyday people,” said Harris. “James was effective, yet he was gentle. His life and work reflected the voice of the communities he loved.”

Wright not only reported on communities throughout the Washington D.C. region, he served his community with diligence and integrity. Recently, Wright stepped out of his role of reporter to serve the residents of Seat Pleasant as a member of the Seat Pleasant City County (2022 to 2024). On the same council, he also served as vice president.

Wright was a life member of

Church

By D. Kevin McNeir

Special to the AFRO kmcneir@afro.com

On Sept. 19, 2023, April Hurley was spending time with a friend, Jonte Gilmore, in the room she was renting in a Baltimore boarding house when the maintenance man knocked on her door. He had discovered a leak.

What happened next changed her life forever.

After the maintenance man, Jason Billingsley, forced his way into her room and restrained her, Hurley was brutally assaulted, doused with gasoline, and then set afire alongside her guest, Gilmore, who was also restrained. Billingsley vacated the premises, probably believing that both of his victims would perish.

Miraculously, both Hurley and Gilmore survived.

Though their lives have been changed forever, the two recently received some type of compensation for the pain, suffering and anguish they’ve faced since that knock on the door. With the help of Malcolm P. Ruff, who led a team of talented attorneys from the Baltimore-based Murphy, Falcon, and Murphy, Hurley and Gilmore have secured an impressive victory.

A jury has found Billingsley and two property companies, Eden’s Homes LLC and Property Pals LLC, guilty on all counts. Then they awarded $21.5 million to Hurley and Gilmore.

Still, Ruff said the pain his clients suffered and continue to experience

could have been avoided if not for the ineptitude of the property owners and their total disregard for the safety of their tenants.

“This was a grueling twoplus years where we had to fight to make sure that justice was served,” Ruff said. “The jury issued a resounding message: landlords cannot and will not be allowed to ignore their duty to keep their tenants safe and make every effort to do so.”

Ruff was on a mission to hold the company that hired Billingsley accountable.

“They hired a repeat violent sex offender and utterly failed to vet him and do any background research on him. Because of their negligence, Billingsley was able to use his position as a maintenance person to lure April out of

By Victoria Mejicanos AFRO Staff Writer vmejicanos@afro.com

Baltimore city officials released Mayor Brandon M. Scott’s 10-year financial plan Dec. 3, outlining three core priorities meant to stabilize the current budget, improve city services, and support Baltimore’s long term growth. The plan also aims to improve affordability for residents and businesses.

The plan seeks to address a $100 million deficit and generate $2.5 billion in savings, reinvesting $1.5 billion into three cornerstones with a total of 85 initiatives in service delivery, infrastructure development, and tax competitiveness.

Faith Leach, city administrator, expanded on the 10-year financial plan and the three cornerstones.

“While not only preserving but also improving the delivery of our essential services, we’re going to be leveraging technology, investing in our employees

her apartment,” he said.

“The jury let people know that in Baltimore, when you are entrusted with someone else’s life, you will be held accountable – you must meet your duty to every single tenant.”

Ruff and his associates held a press conference after the jury rendered its verdict during which Hurley spoke about her ordeal and the $10 million she will receive.

“It’s extremely hard to talk about what happened and when I had to share the details in front of the jury, I had flashbacks that brought back terrible memories,” she said.

“But I feel like justice has been served and I am grateful to the jury.”

“No amount of money can

By Andrea Stevens AFRO Staff Writer astevens@afro.com

Funeral services for Gregory Turnispeed will take place this month.

Wylie Funeral Home has announced that a viewing for the popular family man and Baltimore City Department of Transportation (BCDOT) employee will take place at 9200 Liberty Road on Dec. 15 at 5 p.m., followed by the funeral at the same location Dec. 16 at 12:30 p.m. Turnipseed died following injuries he suffered in an assault that took place while he was on duty.

According to information

released by the Baltimore Police Department (BDP), it was nearly 1 p.m. on Oct. 17 when officers were alerted to “a common assault in the 400 block of St. Paul Street.” Officers made contact with Turnipseed, 71, and he told authorities what happened. BPD says officers were told that the victim in the attack “was walking on St. Paul Street when he observed a vehicle waiting for another car to pull out of a parking space. The victim approached the parked vehicle and informed the

“The city’s am is to have a more efficient and better paid workforce to improve and streamline city services.”

and right sizing and streamlining city operations,” said Leech.

The first cornerstone is service delivery. The city’s aim is to have a more efficient and better paid workforce to improve and streamline city services. There are 43 initiatives in service delivery which aim to save a projected $346.7 million over the 10 year period.

Some of these streamlined services include improving emergency response times, and investing in technology for traffic safety, cracking down on illegal dumping and making bills and services easier to pay online according to Leach.

“Our plan calls on the city to modernize our operations, improve customer service, eliminate waste, all as an effort to provide a better overall experience for our

taxpayers,” said Bob Cenname, the deputy director of the department of finance.

Some of these streamlined services include improving emergency response times and investing in technology for traffic safety, cracking down on illegal dumping and making bills and services easier to pay online.

In addition to streamlined

services, the second cornerstone will invest in infrastructure such as libraries, parks, roadways and recreation centers according to Leach.

Other initiatives include some that have already begun to take place, such as the remediation of vacant properties. Others are still

By Megan Sayles AFRO Staff Writer msayles@afro.com

It’s been a little over a month since Lester Davis, former vice president and chief of staff for CareFirst BlueCross BlueShield (Carefirst), took over as Maryland Gov. Wes Moore’s chief of staff. Davis brings more than a decade of public service experience, including serving as deputy chief of staff for the Baltimore City Mayor’s Office, sitting on the board for Maryland Economic Development Corporation (MEDCO) and being appointed to the Baltimore Regional Water Governance Task Force.

Moore announced that he tapped Davis for the position on Sept. 8, highlighting his ability to meet the challenges facing Maryland today.

“Lester is a known problem-solver, and his proven ability to secure improved outcomes for the people he serves will build on the progress our administration has made over the past two and a half years,” said Moore in a statement. “He brings a commitment to building strong partnerships, uplifting communities and delivering data-driven

results that are in lockstep with priorities our administration has championed since day one.”

The AFRO spoke with Davis about his first 100-day priorities, how he plans to leverage past experiences in this new role and his strategies for addressing Maryland’s most pressing hurdles.

AFRO: What are your top priorities in these first 100 days as Governor Moore’s chief of staff?

Lester Davis: It all starts and ends with the budget. That’s been the lion’s share of my focus since the announcement back in September and certainly since I assumed this role on Oct. 15. Constructing the budget and working with the legislature around priorities for the budget has been what’s kept me busy throughout the days.

I’ve also been working with our legislative team on the legislative agenda for the session that’s coming up in January. I spend a lot of time talking and meeting with members of the General Assembly, getting advice and counsel from them. Lastly, I’ve been thinking about the orientation of the staff and how we’re preparing ourselves to do the work and keep making progress.

AFRO: You’ve led in both Baltimore

City government and at CareFirst. How do you think your experiences in the private sector and in Baltimore shape your approach to this role?

Lester Davis: The city of Baltimore is a great training ground. I spent a decade working at the city and did just about every job you can think of. I’ve been no stranger to Annapolis. I was the person who was charged with budget formulation and shepherding at the local level. Conversely, my time in the private sector has been helpful because of the focus on process improvement, including how we orient ourselves for greater impact, what it looks like to build teams and how to get the best out of talent. I think it’s been a good marriage of both those skillsets.

AFRO: How would you describe your working relationship with Governor Moore so far?

Lester Davis: The working relationship is collaborative. The governor wants to hear the best and brightest ideas. He’s very inquisitive and wants to think about how the state can innovate and push ourselves to do more for the people that we represent.

It’s refreshing and invigorating to work for someone like the governor.

He has a lot of energy. The calls start early in the morning, and they go well past 11 p.m. I think it’s exciting to have someone who is passionate and lives and breathes this 24/7.

AFRO: From your perspective, what are Maryland’s most urgent challenges heading into 2026, and how do you plan to help the administration tackle them?

Lester Davis: It may sound repetitive, but the challenges that we face really do start and end with the budget— even those around the severed relationship between our state and Washington. I think the growing rate of budgets is going to continue to be a challenge, as well as health care.

We’re going to have to get through this together. We have everything in the state that we need to be able to position ourselves for growth and vibrancy in Maryland. We’re going to have to make some tough decisions, and we’ll have to do that collectively.

AFRO: When you think about this chapter of your career, what does this moment mean to you personally?

Lester Davis: It’s humbling. To be in a position of leadership at this time— a time unlike any other that any of us

have faced before and when the challenges are at their highest— is pretty sobering. I wake up every day excited to get to work and with a sense of understanding that we do not have time to waste and that the folks we represent, particularly the most vulnerable, are counting on us to do more today than we did yesterday. I enjoy every day I get to spend in the state house, and I have an immense sense of gratitude.

occupants that another vehicle was waiting for them to vacate the space.”

That’s allegedly all it took for a brutal assault to begin.

“After a verbal exchange, both individuals in the vehicle exited and assaulted the victim, with one of the suspects being an adult female and the other a juvenile female (approximately 15 years old),” said BPD, in the information released to the AFRO “Both suspects re-entered their vehicle and fled the scene.”

Turnipseed then sought medical attention after the assault, but the damage was done.

On Oct. 20, he underwent surgery at the University of Maryland Shock Trauma Center to stop the bleeding in his brain. Although the surgery was deemed successful, Turnipseed unfortunately succumbed to his injuries on Nov. 26.

City leaders including Mayor Brandon M. Scott, State’s Attorney Ivan J. Bates, Police Commissioner Richard Worley and Transportation Director Veronica McBeth released a statement on Nov. 28, mourning the death and noting that Turnipseed was “an exemplary public servant” who “served Baltimore with dignity and integrity.”

President of the City Union of Baltimore, Antoinette Ryan-Johnson, weighed in on the death and the timing of the statement released by city leaders, over a month after the attack.

“As president of a union, to get the call after the fact is unacceptable, absolutely unacceptable,” said Antoinette Ryan-Johnson, in an interview with WJZ. “At the end of the day, he was my member. He belonged to this union. But he was somebody’s personal family member. They now don’t have a father to come home. He should have been able to come home at the end of the day and spend Thanksgiving with them, but that will no longer happen.”

Family members said Turnipseed was well known and deeply loved both within the community and among relatives. His cousin, Carl Turnipseed, said the loss has left a profound void for those who knew him.

“This is a devastating loss. Greg was admired and loved by so many in Baltimore and especially his family,” said Carl Turnipseed. “In fact, he was one of the most popular of ‘The Turnipseeds.’ At any family gatherings and opportunities to help others, Greg Turnipseed was there. He will be so sorely missed.”

A close family friend echoed that sentiment.

“My heart is broken beyond measure. Someone I loved and cared for deeply was brutally taken from me and his life was cut short in a way that no one should ever have to endure.”

“My heart is broken beyond measure. Someone I loved and cared for deeply was brutally taken from me and his life was cut short in a way that no one should ever have to endure,” said the family friend, who asked to remain anonymous. “Greg wasn’t just important to me but to his family. He was a

part of my heart, a source of love, laughter and strength. Losing him like this is a pain I would not wish on anyone.”

City officials said support services are being offered to staff as the department grieves the loss of a respected coworker.

taking shape, such as modernizing the Baltimore City Convention Center.

“A lot of our economy, especially in that downtown vicinity, is dependent on the visitors we get from the convention center,” said Cenname. “We do think there will be some revenue source needed to do that, likely a regional revenue source, but we don’t know what that will be quite yet.”

According to Cenname, the General Assembly has already tasked a work group to begin looking

change what happened, but it sends a message to the property management company and others that they must follow the standards in place when hiring people who will be around their tenants,” Hurley continued. “It feels good to know that I had a team that fought long, hard days and who were behind me and Jonte. They gave every effort to get this ruling.”

Ruff fears that justice in Baltimore is not always for all.

Ruff said he believes that the landlord may have been negligent because of the rooming home’s location in West Baltimore.

“The rooming house was located in the ‘Black Butterfly’ on the other side of MLK, where folks [are] making a profit from renovating houses and splitting them up into individual rooms,” said Ruff, referring to the term Dr. Lawrence Brown coined to describe the image that appears over the Black sections of East and West Baltimore when disparities are mapped out.

Ruff believes those responsible for hiring Billingsley “willfully and deliberately ignored their duty to April.”

In addition, Ruff still questions the initial steps

at options for financing the improvement of the convention center.

The city calls the plan ambitious yet achievable and subject to change. 14 of the 85 initiatives need state approval.

“We don’t shy away from the idea that this is an ambitious plan,” said Cenname. “We have to be aggressive about looking at all these options. It’s possible that we’ll fall short on some of these. It also is possible that other initiatives will come up over the 10 year period that we’ll discover and add to the plan. This could be a living document.”

taken by Baltimore law enforcement.

“In the case involving April and her friend, the crime was essentially considered as an arson investigation and from what we could gather, the police commissioner allegedly viewed the attack by Billingsley on her as either targeted or a robbery gone wrong – a statement he later retracted,” Ruff said.

Just days after attacking Hurley and Gilmore, Billingsley murdered Pava LaPere, an American businesswoman who was the founder and CEO of the tech startup EcoMap Technologies.

LaPere’s body was found on the roof of her Mount Vernon apartment building in late September 2023 after she was reported missing by friends. According to Ruff, investigators linked Billingsley to the murder through surveillance.

“Had a background check been done properly, perhaps Billingsley may not have been able to continue his string of horrendous acts,” said Ruff.

Billingsley pleaded guilty to first-degree murder to LaPere’s death in August 2024 and was sentenced to life in prison. Several days before his murder conviction for the death of LaPere, he pleaded guilty to the brutal attack on Hurley and Gilmore. He is serving three life sentences concurrently in both cases.

When I was a child, I was determined to become the first Black woman on the Supreme Court.

For a Black child growing up in Richmond, Va. — the capital of the Confederacy, with its long history of Jim Crow laws and other racist policies and practices — it was perhaps an audacious goal. But in some respects, it was simple. After all, I was just aspiring to a federal job.

I can thank my mother for that. She worked for the federal government for 35 years, at the Departments of the Treasury and Defense. After my dad died when I was in middle school, my mother raised three girls on her own. She didn’t have a college degree, but she excelled at jobs that offered security and stability in return. My family was by no means wealthy, but my parents owned our home, and we had health care. It was enough for our family, and it allowed a little girl to have big dreams.

Many Black families in America have a similar story.

Courtesy photo

A graduate of Georgetown University Law Center and Wellesley College, Kisha A. Brown, Esq. was the first woman to lead the Baltimore City Civil Rights Office. This week, she continues her thoughts on access to justice.

of federal workers. Reductions in force. Restructuring. Reform.

The more accurate term is the word they don’t say out loud: racism.

“The principles on which our Government is based require a policy of fair employment throughout the Federal establishment, without discrimination because of race, color, religion, or national origin.”

Federal employment as a reliable path to the middle class has been central to our economic progress for generations. But the Trump administration’s systematic purge of Black federal workers imperils that progress. It is a big part of why Black Americans are facing such difficult economic challenges right now.

Calling “the purge” what it is

The administration has many descriptors for its mass firings

These words were the foundation of Executive Order 9980, signed by President Truman in 1948, which established fair hiring practices within the federal government. For decades prior, Black Americans seeking federal jobs encountered the typical discriminatory barriers to employment and fair wages. With these executive orders, however, the federal government was sending a long-overdue message to Black workers: You are welcome here.

The impact has been significant. Black Americans represent 13 percent of the U.S. population but nearly 20 percent of the federal workforce. In some agencies, it is significantly higher: In 2024, Black workers comprised 36 percent of the

Departments of Education and Housing and Urban Development. To be clear, progress does not equal perfection: Black people are far less likely to have higher-paying federal jobs, and are significantly underrepresented among the ranks of military leaders and top congressional staff. But the federal government has for generations offered Black workers job security and protections too often denied by the private sector.

Stability is gone I know from my own life how much that stability matters. The fact that I could go to college, earn a doctorate, and now run a nonprofit organization dedicated to women’s economic empowerment can all be traced back to my mother’s federal job. But families today are not as fortunate as mine. Many of these protections have been eviscerated.

Since his second term began, President Trump has signed dozens of executive orders eliminating federal Diversity, Equity, and Inclusion initiatives. He has directed mass firings of career government employees,

disproportionately targeting agencies where women and people of color make up the majority of staff. He seems to take particular delight in targeting Black women leaders, such as his persistent attempt to fire Governor Lisa Cook from the Federal Reserve Board. It is no surprise that his political appointees are overwhelmingly White men.