energy focus

FROM ENERGY INDUSTRIES COUNCIL

FR OM

VIEW FROM THE TOP EIC CEO Stuart Broadley looks back on 80 eventful years

TO

ENERGY TRANSITION

Five countries leading the way in carbon capture and storage

OIL AND GAS

Amid the energy crisis, is gas the new green fuel?

NUCLEAR

New nuclear is essential for global energy security

Celebrating 80 years of history, continued evolution and a fi rm commitment to build the world’s most powerful energy community

ISSUE 49 WINTER 2023

EN ER Five the wa P d ley

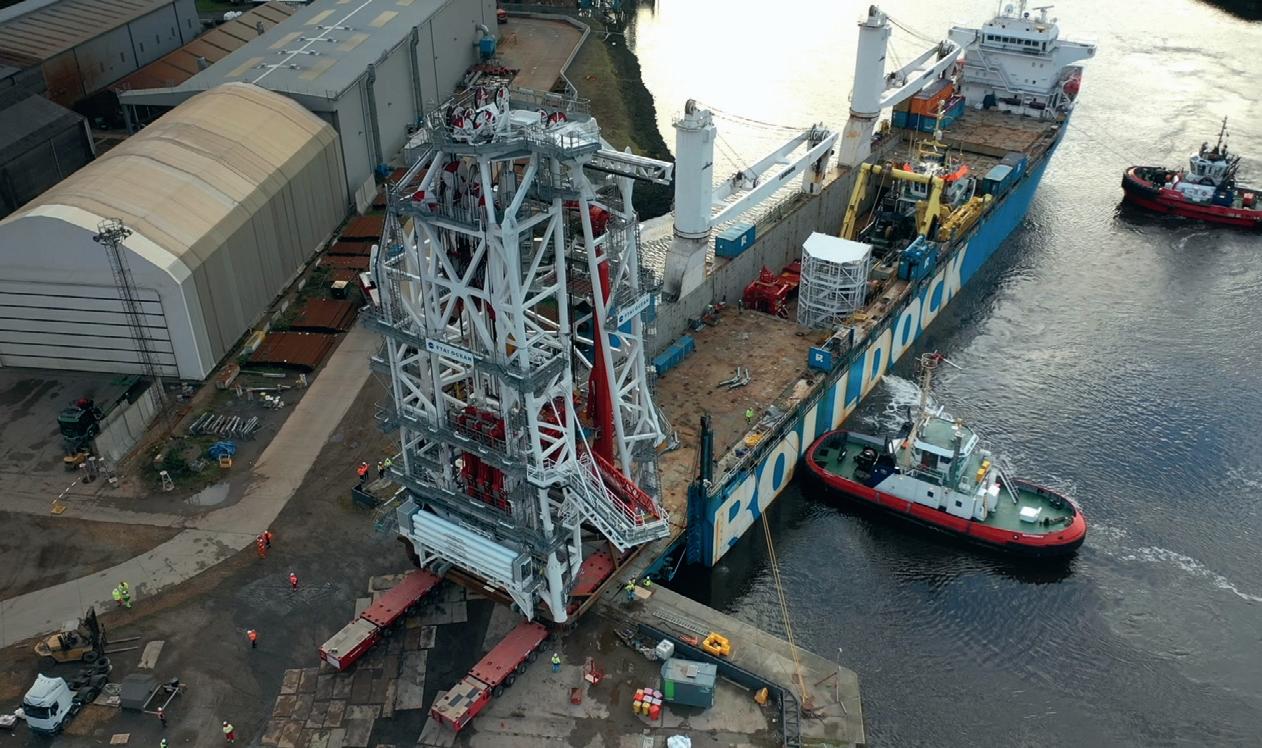

An excellent operational performance does not need many words of explanation, but one simple answer: Bertling. Track the Ecological Footprint for all transports you handle with us to know your emissions, proactively reduce and offset them to strive towards carbon neutrality.

Visit www.bertling.com/sustainability to find out more.

FROM THE EIC

5 Foreword

From the Chief Executive

6 View from the top Stuart Broadley, CEO, EIC

9 EIC: From acorn to oak tree

Retiring Chairman Hugh Saville looks at the five factors that have spurred EIC growth in the last 25 years

10 News and events

Updates from EIC

12 Committed to delivering value, as always

Nicola McGeown and Diveena Danabalan on how new departments – EIC Events Solutions and EIC Consult – are providing members with added value

14 Happy 80th Anniversary EIC!

Founders, partners and friends help celebrate eight decades of EIC

18 Special Feature Energy Focus looks back on 80 years of Energy Industries Council

22 The big question Is ‘net zero’ more greenwashing than reality?

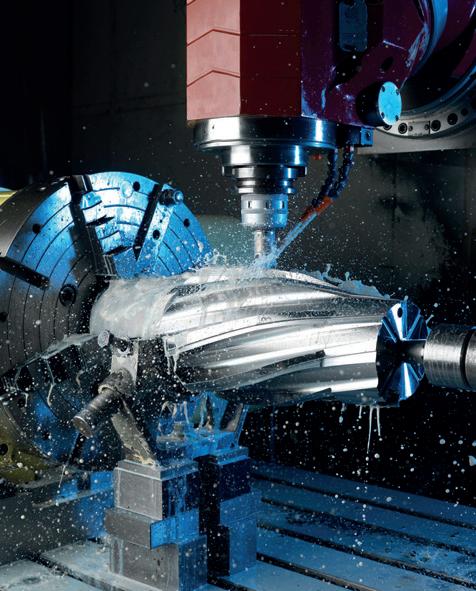

42 My business Matthew Cooper, Sales Director, Cutting & Wear

18 EIC at 80

ENERGY TRANSITION

26 Energy transition starts at home

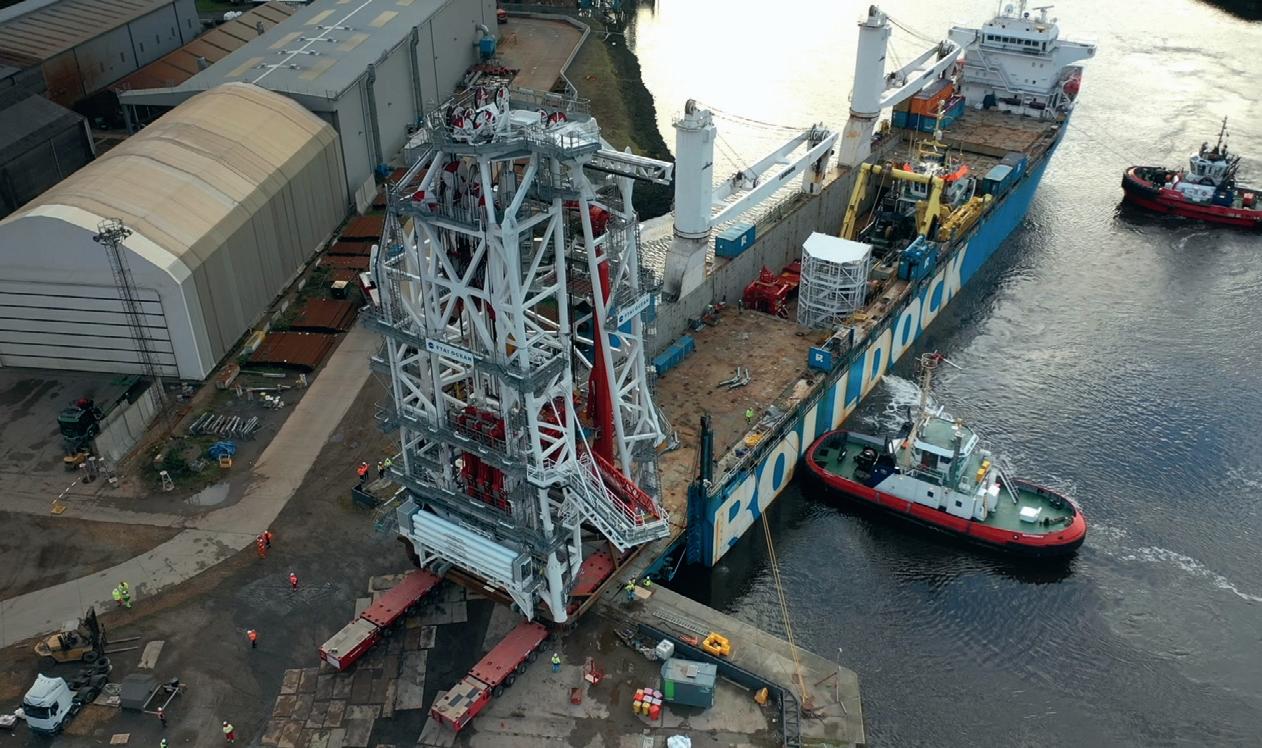

Greg Guthridge, EY Global Energy & Resources Customer Experience Transformation Leader

26

Consumers drive energy transition

View from the top: Stuart Broadley

34 Massive connector offers UK energy crisis lifeline Simon Morrish, CEO, Xlinks

OIL AND GAS

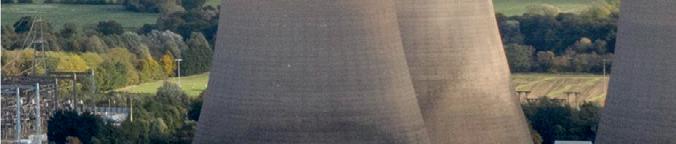

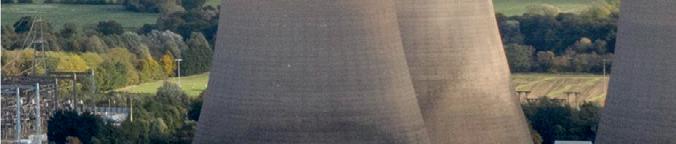

36 Is gas the new green fuel?

Dawn Summers, Chief Operating Officer, Wintershall Dea and President, GasNaturally

Should

30

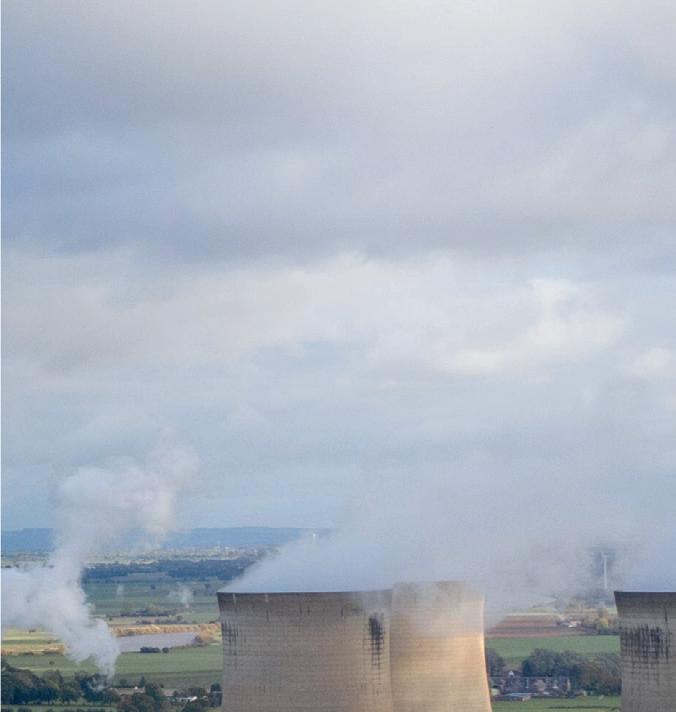

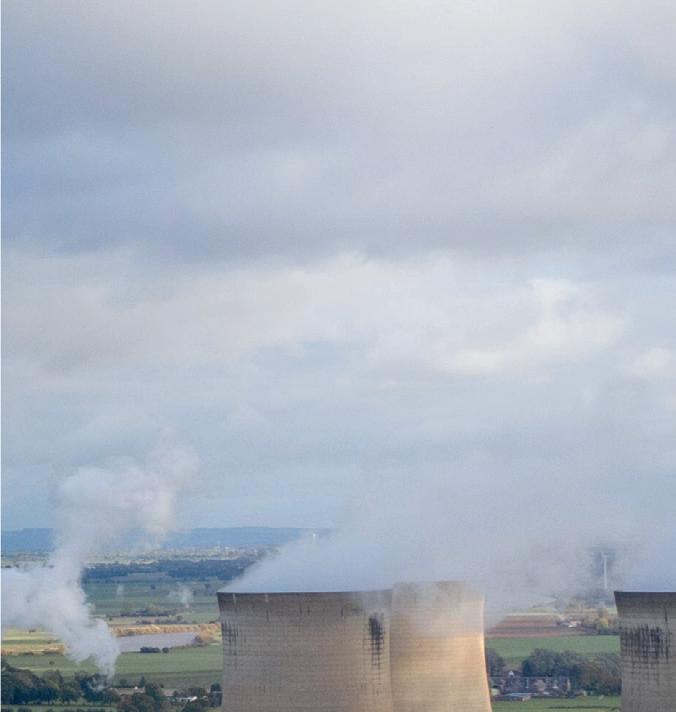

Five countries leading the way in carbon capture and storage

Joanne Sivanathan, Energy Analyst, EIC

Lucas Machado +55 21 3265 7402 lucas.machado@the-eic.com

Production director Jane Easterman

Energy Focus is online at energyfocus.the-eic.com

ISSN 0957 4883

© 2023 The Energy Industries Council

Energy Focus is the official magazine of the Energy Industries Council (EIC). Views expressed by contributors or advertisers are not necessarily those of the EIC or the editorial team. The EIC will accept no responsibility for any loss occasioned to any person acting or refraining from action as a result of the material included in this publication.

38 Overhauling Europe’s energy system

Cillian Totterdell, Climate and Energy Policy Lead, FleishmanHillard

NUCLEAR

40 Nuclear is quietly making a big return Tim Yeo, Chairman, New Nuclear Watch Institute

Publisher Redactive Media Group, Fora, 9 Dallington Street, London EC1V 0LN www.redactive.co.uk

RENEWABLES

POWER

Contents

49 WINTER 2022 06

ISSUE

38 Repowering Europe’s energy system 36 Gas goes green

Energy Industries Council 89 Albert Embankment, London SE1 7TP Tel +44 (0)20 7091 8600 Email info@the-eic.com

executive:

The

Chief

Stuart Broadley

your views,

you wish to send

please email: info@redactive.co.uk Editors Sairah Fawcitt +44(0)20 7880 6200 sairah.fawcitt@redactive.co.uk

Account director Tiffany van der Sande

Senior designer Gene Cornelius Picture editor Akin Falope Content sub-editor Kate Bennett Sales and advertising Richard Hanney +44(0)20 7324 2763 richard.hanney@redactive.co.uk

your magazine’s plastic wrap – check your local LDPE facilities to find out how.

Recycle

www.the-eic.com | energy focus 3

VISIT

TO FIND OUT MORE

services

“Richest gathering of industry experts I have experienced”

Peter Davies, EM&I

If you are interested in one of our sponsorship opportunities, or to book, get in touch with a member of the team today! Email internationaltrade@the-eic.com

Energy Exports Conference 2023 P&J Live Aberdeen I 6 – 7 June 2023 www.the-eic.com/EEC2023 SPONSORHIP OPPORTUNITIES AND BOOKING NOW AVAILABLE

Energy Exports

a

for

to:

The

Conference provides

unique opportunity

companies like yours

CONTACT US

“A truly global smorgasbord of opportunities to engage and indulge with key players in traditional and future markets” Mark Light, UnitBirwelco THE EIC WEBSITE

From the Chief Executive:

In this edition of Energy Focus, EIC is glad to bring readers a celebration of its 80-year history. Initially called the Council of British Manufacturers of Petroleum Equipment, our journey was started in 1943 by 13 founding members – including current members Siemens Energy and ABB – with the core purpose of helping UK oil and gas manufacturers to win a higher share of project work both domestically and around the world

Today, that core purpose is the same. Now with more than 800 members, EIC is still working hard every day across our 110 people and five regional offices to assist members in growing and winning business.

Some things, on the other hand, have changed: the energy mix has expanded to embrace technologies beyond oil and gas. The society we live in now is very energyagnostic, something that EIC recognised and adapted to more than 40 years ago – and today we continue to adapt, embracing the latest developments such as hydrogen, carbon capture and floating offshore wind.

EIC has also become a much more global trade association over the past 25 years. This is vitally important to our members, given the world we’re now living in – it ensures that we are part of global discussions and can facilitate new international relationships and friendships across our network of customers, suppliers and partners.

That’s why our 80th anniversary milestone is going to be celebrated everywhere we are in 2023. We’re planning a special calendar of events, about which you’ll get to know more in upcoming editions or by checking our website and following EIC on social media.

For now, I am privileged to be the View from the top interviewee for this commemorative issue. I am EIC’s 12th CEO and take my role seriously, but I can’t say that I don’t have a huge amount of fun, too. This is mainly due to working closely with all the amazing people who work across all EIC regions, all sharing the same objective of making EIC the go-to energy supply chain trade association, globally. Thanks

to them, we’ve been able to grow fast as we witness our members growing fast, and we have laid out a clear strategy to enhance member benefits and grow our global presence and voice into the future.

This is an impressive time for the global energy industry. All sectors and regions are booming at the same time, bringing countless challenges in terms of converting those opportunities to profits. These challenges include a shortage of critical talent, cost and salary inflation, a lack of investment clarity around net zero, concerns about geopolitical stability, and many more.

I’m sure these obstacles will be overcome by EIC and its members, as has happened at other moments of uncertainty during our 80-year history. Speaking personally, as we navigated challenging markets, I have been fortunate to work with and have the support of EIC Chairman Hugh Saville – undoubtedly the best chairman I have had the privilege of working with. Making tough decisions and having the confidence to invest and change is so much easier when you have strong and trusting interpersonal relationships with your key stakeholders. Hugh retires from EIC in 2023 after nearly 20 years of EIC service, and he will be sorely missed.

Stuart Broadley Chief Executive Officer, Energy Industries Council stuart.broadley

@the-eic.com

www.the-eic.com | energy focus 5

Foreword

Stuart Broadley CEO

View from the top

The Survive & Thrive initiative is something I’m very proud of and is the result of true teamwork across all EIC’s regional teams

Stuart Broadley, Chief Executive

Offi cer, Energy Industries

Council

Stuart Broadley, Chief Executive

Offi cer, Energy Industries

Council

6 energy focus | www.the-eic.com From the EIC

Stuart Broadley

Stuart Broadley talks to Energy Focus about the evolution and diversification of Energy Industries Council during the past 80 years, and how it will continue to support the energy community in the years ahead

EIC has changed significantly since it was founded in 1943. Looking back on its eventful 80-year history, what have been the key developments?

Celebrating EIC’s jubilee has allowed us the chance to research our history in more detail. As Winston Churchill said, “The further backward you look, the further forward you can see.” This research has highlighted three key decisions that we now know were pivotal to EIC’s survival and success today.

Firstly, it’s our energy agnosticism. We were set up in 1943 by 13 founding members as the Council of British Manufacturers of Petroleum Equipment, with a sole focus on oil and gas. It was not until 1981 that EIC, under Chairman Barry Bovey OBE, expanded its focus from oil and gas to all energy sectors, including nuclear and renewable energy. We changed our name that year to Energy Industries Council and since then have been uniquely able to embrace new technologies and energy transitions without missing a beat, without having to change our brand or purpose as so many others have had to do in more recent times.

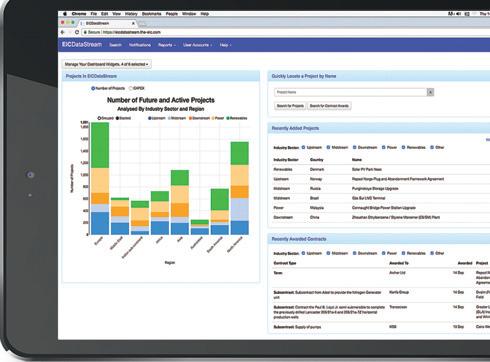

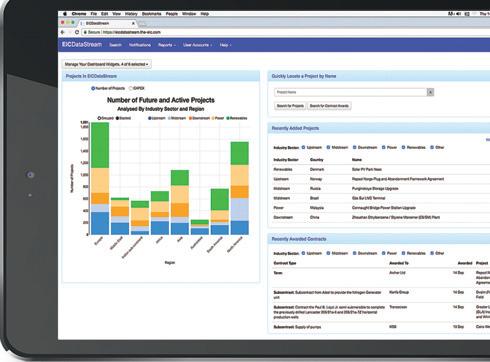

Secondly, it’s our market intelligence. In 1993, membership reached a record low after the financial crisis and CEO Dai Somerville-Jones was looking for alternative sources of revenue. One idea was to analyse contract details published in journals and circulate only the most relevant information to members, at a lower cost. This new subscription service grew quickly, but it was not until the internet and a good website that we launched our online projects database in 2000. EICDataStream, as it is now badged, has become a primary source of market intelligence that helps our members to make smart business development, with 12,000 projects managed by our 30 analysts and consultants.

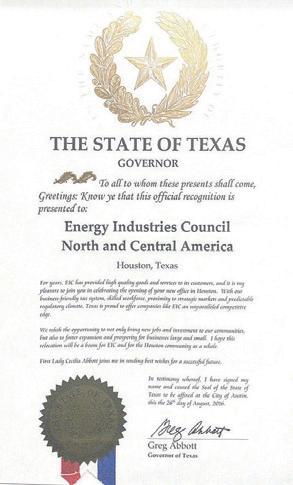

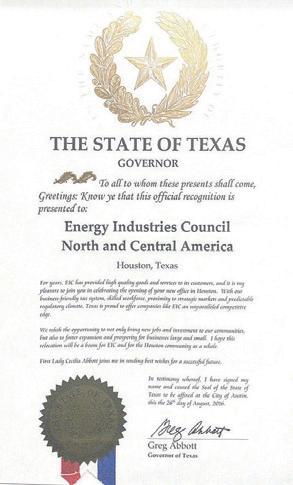

Thirdly, it’s our globalisation. We were set up in 1943 by Thomas Lacey Bonstow as a UK-focused business and it was not until 1994 that the Board approved the first establishment of an EIC office outside the UK, in Houston. Regarded as successful, this led to the Vision 99 strategy and the opening of further offices in Singapore, Rio and Dubai. These new regional offices, combined with EICDataStream, drove

a doubling of our membership in 10 years. The second phase of our globalisation was approved by our Board in 2017, opening up EIC membership to non-UK businesses for the first time. Today, 300 of our 800 members are headquartered internationally and we are working to build the world’s most powerful energy community of customers, suppliers and partners.

You are the author of the annual EIC Survive & Thrive insight report and have interviewed 250 company bosses during the last six years. What have you learnt from these discussions with the supply chain?

The Survive & Thrive initiative is something I’m very proud of and is the result of true teamwork across all EIC’s regional teams and departments, but it started out as a simple idea. I joined EIC in 2016 in the aftermath of the 2014–15 oil crisis, and businesses were really struggling. As I toured the UK, meeting with members, I was struck by how inspiring their survival strategies were, in spite of, or sometimes because of, the severe market challenges they faced –and yet no one seemed to know about the amazing work they were doing. That is how Survive & Thrive was born; why couldn’t we help to promote the inspiring work of these leaders, tell their stories, recognise their successes, and make policymakers aware of their needs, challenges and innovations?

During the past six years I have learnt so many things from these leaders, and with the seventh edition just starting, I am excited to hear the latest member success stories in 2023. The most striking thing I have learnt is that there is not a single, ‘best’ leadership approach. Instead, I keep meeting business leaders who reinvent the way they run and grow their businesses, adopting totally new strategies with increasing determination and creativity – indeed with increasing entrepreneurialism.

There are, however, three common threads that come up again and again. Firstly, talented teams and a positive culture are worth their weight in gold. Secondly, businesses with clear, unique and wellcommunicated strategies do best. Thirdly, remaining highly client-focused is more crucial than ever in times of rapid and disruptive change and market shocks.

About Stuart Broadley

Stuart joined EIC as CEO in 2016, after a 25-year career in oil and gas, power, renewables and defence with RollsRoyce, Wood, REpower and Hoerbiger. Together with the UK Export and Energy Ministers, he co-chairs the UK Energy Supply Chain taskforce, amplifying the UK energy supply chain’s voice to support policy development, boost investing, seeding and rooting of the supply chain in the context of energy transition, and step change internationalisation.

Stuart is Energy co-chair of the UAE–UK Business Council in the build-up to COP28, architect of the Energy Exports Conference, which brings US$500bn of opportunities to the UK each year, and author of the annual Survive & Thrive report on growth in challenging markets. Stuart has various nonexecutive director roles and in 2019 was invited to become a Fellow of the Energy Institute.

IMAGE: RORY RAITT

www.the-eic.com | energy focus 7

Q&A Stuart Broadley: From the EIC

EIC seems to be growing fast and getting a louder voice. Was this planned, and what is EIC’s strategy going forward? What are you hearing now from your members that needs to be heard by government? EIC was originally set up in 1943 to be the voice of the oil and gas supply chain and passionately represented those companies until the 1980s, when we expanded to represent all energy sectors, not just oil and gas. The Board at the time felt we could then no longer lobby one energy sector against another, so we stopped being a vocal advocate and instead focused on helping our members more directly, with our data, events, missions, national pavilions and networks.

This view about our purpose has reverted in the last couple of years, as it has become clear that energy and export policies are not working, and that supply chain leaders, whether in oil and gas, nuclear, renewable or other technologies, are unable to get their voices heard. The entire energy supply chain, companies of all sizes, places and strategies, need a voice to represent their views directly to policymakers, and so EIC has stepped up once again. We are proud to once again be the voice of the energy supply chain.

Members we speak to feel that the energy market is broken and that it is

increasingly difficult to confidently make investment decisions. This is heart-breaking when you think that net zero requires all of us to make smart, fast, significant and courageous decisions now, for the good of the planet, and to ensure our members achieve leading positions in the energy markets of the future.

Therefore, EIC will now be raising its voice relentlessly again, to get the views of our members heard and to ensure supply chain needs are addressed as a priority.

You are a strong advocate for encouraging more companies to invest in export and international growth. Why this focus? EIC’s slogan is Export – Diversify – Grow. Export comes first intentionally. Since our inception in 1943, our core purpose has been to help our members to win a higher share of business in key energy projects around the world. That core purpose has not changed in 80 years but today it seems harder than ever for businesses to grow their export and international share of business, and this is a challenge that all of us at EIC care about.

We know from our Survive & Thrive research that companies tend to choose faster, lower investment and lower risk strategies to grow when markets are challenging, which they certainly continue to be. Strategies such as innovation, diversification, digital and collaboration are often preferred over export growth. Every year for the past six years, the development of new export and international markets has been the least used, or the hardest, growth strategy. The consequence of this is that companies over-rely on domestic markets for the majority of their revenues, and this makes them far too vulnerable to market shocks.

All the evidence shows that global businesses are more profitable and resilient and faster growing than domestically focused businesses. We have the data, networks, insight and events, such as the Energy Exports Conference on 6–7 June 2023 in Aberdeen, to help our members break this log jam, and we will never stop working at this.

You have been CEO of EIC for nearly seven years – are you still enjoying it?

I feel privileged and fortunate to carry the CEO baton at EIC, and I am absolutely still enjoying it. I hope my enthusiasm and passion for this business, our amazing team and our world-class network of international members comes across in everything I say and do. With 80 years of heritage, EIC has already helped thousands of businesses in that time to adapt, grow and lead in their field. The most important role I can have now is surely to continue that legacy successfully into the future.

the EIC:

8 energy focus | www.the-eic.com

The entire energy supply chain, companies of all sizes, places and strategies, need a voice to represent their views directly to policymakers, and so EIC has stepped up once again

From

Q&A Stuart Broadley

1

Data

High quality project data has increased greatly in volume, coverage and quality.

In the late 1990s, such information was gathered and shared with members via four ‘committees’ – UK, European, Overseas and Power. Open to member company representatives, these met quarterly to review and update paper copies of project lists. The quantity of information varied, with the Overseas committee having more than 250 pages of projects listed by country. Data was sourced primarily from international engineering contractors, many with a UK base at the time, supplemented by information gleaned from members and publications.

In 2001, Alan Lewendon and Bob Gear joined EIC and, soon afterwards, Alan suggested moving the paper-based project information to an electronic format, enabling easier interrogation and addition of data. Alan christened the new product ‘EICDataStream’ and Bob applied his IT talents to develop the process, with many subsequent iterations to follow. That was the catalyst for a broad range of increasingly sophisticated electronic business information services that are now both routine and highly advanced.

2

Communication

Twenty-five years ago, communication was achieved principally by post, landline telephone and fax. The internet was in its infancy (EIC’s first website appeared in 1999) and email only superseded fax in the early years of the millennium. These new developments had

a significant impact on EIC communications, as information could now be sent instantaneously to members and other contacts globally. Suddenly communication had become much easier and faster, and EIC capitalised on that.

3

Global coverage

EIC has moved from a Londonbased operation with a Houston office (opened in 1995) to a global presence. Offices opened in Rio, Singapore (subsequently closed in favour of Kuala Lumpur) and Dubai (chosen over Abu Dhabi because of better availability of international flights from Dubai at the time). Offices in Macaé (Brazil) and Beijing existed briefly, while others considered for Calgary, Moscow, Venezuela and Hamburg did not materialise.

4

generated a range of engineering studies and EPC contracts – providing EIC member companies with significant sales opportunities.

Simultaneously, as ‘mega plants’ started operating in the Middle East, Asia and elsewhere, the UK refining and petrochemical industries contracted, while in the power sector, supply of flue gas desulphurisation plants for large coal-fired power stations dried up. It was therefore very exciting to see the UK government step up more recently, becoming world-leading in the production of offshore wind, and latterly setting high ambition for hydrogen, carbon capture and floating offshore wind.

The EIC acorn has indeed grown into a mighty oak tree that continues to spread its branches into new markets and opportunities across the globe.

Membership

The EIC’s decision in 2017 to expand membership to companies outside the UK (unthinkable even 10 years ago!) has been absolutely crucial in generating many new memberships and by raising our profile. Compared with 25 years ago, our international connections are now immeasurably better.

5

Market changes

The UK energy industry has changed significantly during the past 25 years. Initially, many international engineering companies had a UK operation, but due to acquisition, restructuring into other areas, or moving away, many no longer exist here. These companies routinely

Hugh Saville Chairman, Energy Industries Council

www.the-eic.com | energy focus 9

From the EIC From our Chairman

A word from our Chairman: From acorn to oak tree As the EIC celebrates its 80th anniversary this year, retiring Chairman Hugh Saville looks at FIVE factors that have led to the highest-ever growth of the leading energy trade association during the past 25 years

news&events

Conferences from EIC coming up in 2023

Egypt Petroleum Show 2023

Date: 13–15 February 2023

Location: Egypt International Exhibition Centre, Cairo, Egypt

About the EIC

Established in 1943, the EIC is the leading trade association for companies working in the global energy industries.

Our member companies, who supply goods and services across the oil and gas, power, nuclear and renewables sectors, have the experience and expertise that operators and contractors require. As a not-for-profit organisation with offices in key international locations, the EIC’s role is to help members maximise commercial opportunities worldwide.

Events

EIC LIVE events

You might have already noticed that 2023 is a special year for the EIC. And if our 80th anniversary is not enough to keep everyone excited for the upcoming months, we also have an incredible programme of events.

Following the return of in-person events in 2022 and the success of events, including our very own Energy Exports Conference, ADIPEC, OTC and Rio Oil & Gas, as well as networking meetings, training, masterclasses and market update sessions, the bar is indeed set high for this special year.

You will find all our in-person events, webinars and EICorganised pavilions at leading conferences and expositions worldwide, in our calendar at www.the-eic.com/events/calendar

Why attend? Egypt Petroleum Show is the most important oil and gas exhibition and conference in North Africa and the Mediterranean. It is a crucial platform in the energy calendar, bringing together government representatives, global CEOs, NOCs, IOCs, international service providers, EPCs, consultants and financiers to address the evolving opportunities in global energy markets.

Attendees will be able to gain direct access to primary stakeholders involved in detailing the region’s upcoming project plans, budget allocations, timelines, technical challenges and business opportunities to win contracts.

The EIC is organising the UK and EIC Pavilion. If you are interested in exhibiting with us or want more information, email international trade@the-eic.com to contact the International Trade team.

www.the-eic.com/Events/Exhibitions/ EgyptPetroleumShowEGYPS

Wind Energy Asia 2023

Date: 8–10 March 2023

Location: Kaohsiung Exhibition Centre, Kaohsiung City, Taiwan

Why attend? Wind Energy Asia is the first exhibition dedicated to developing the supply chain in Taiwan’s wind

10 energy focus | www.the-eic.com

UPDATES FROM THE ENERGY INDUSTRIES COUNCIL

Egypt Petroleum Show

Report

NEW REPORTS OUT NOW

EIC Report:CountryMozambique

Much has changed in Mozambique’s energy space since the EIC published its first report on the country in 2017. In only five years, more players have entered the market, projects have been sanctioned and new sectors are attracting investments.

energy industry. It intends to provide a platform for companies to expand into neighbouring East Asian markets such as Japan and South Korea, which are closely watching the country as a likely blueprint for future development.

In three years, Wind Energy Asia has established itself as the largest, most international wind energy exhibition in Taiwan and the second largest in Asia.

Send an email to international trade@the-eic.com to contact the International Trade team and register your interest.

www.the-eic.com/Events/Exhibitions/ WindEnergyAsia2023

WIND EXPO Japan 2023

Date: 15–17 March 2023

Location: Tokyo, Japan

Why attend? WIND EXPO is Japan’s largest wind energy trade show. As a well-established business platform for the latest technologies, information and people, the event contributes to the development of the wind energy industry in the country.

WIND EXPO gathers a wide range of products and services for wind power generation, from wind turbines and wind farm construction to maintenance and operation, and offshore wind technologies. The event is aimed at companies looking to develop new business opportunities, gain technical insights and consultations, and build and strengthen early business relationships.

The EIC is proud to be hosting the UK Pavilion and Trade Mission to WIND EXPO Japan 2023 in partnership with

the Department for International Trade. Contact the International Trade Team by emailing internationaltrade@ the-eic.com if you want to join us.

www.the-eic.com/Events/Exhibitions/ WindExpoJapan2023

External Aff airs

As we wait for the latest round of ministerial announcements, it has been a busy few months. The energy policy landscape and conversations are more important than ever, and within the External Affairs team we are busy engaging with a wide range of stakeholders to ensure that our members’ voices are properly heard.

We have engaged with a number of departments on what is happening across the sector and have worked directly with you to ensure that the feedback we provide, and the policy direction we take, is led by you. If you wish to be involved in these conversations and forums, please email Rebecca.Groundwater@the-eic.com.

Our work with all governments and regions is only increasing; we have been working on several consultations and are feeding into several policy areas. If you are not already aware of the work that we do in this area or would like to be involved in a bigger way, please do get in touch. Rebecca Groundwater, Head of External Affairs Rebecca.Groundwater@the-eic.com

The country continues to progress with its liquefied natural gas (LNG) developments despite the existing challenges, while actively exploring the potential of large-scale renewables. From its substantial offshore gas reserves to its burgeoning renewables sector, Mozambique is poised to become a nation to watch in the coming years.

Realising its full potential is critical to ensuring an economic recovery postCOVID-19 and establishing Mozambique as an LNG powerhouse and renewables competitor. Download this in-depth country report to learn why all eyes are now on Mozambique.

EIC Insight Report: ASEAN Operational

The Association of Southeast Asian Nations (ASEAN) is a regional organisation promoting greater cooperation between countries in South-East Asia across several policy areas. Since its creation in August 1967, ASEAN has expanded its membership and overseen the strategic integration of its member states.

ASEAN consists of Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, the Philippines, Singapore, Thailand and Vietnam. Collectively, it is on track to be the fourth largest economy by 2030, with a growing population of around 650 million people and one of the world’s largest middle classes.

Find out about ASEAN’s offshore and onshore wind, solar, hydropower, biomass, biofuel, energy from waste, energy storage, hydrogen, power and oil and gas in this free report: www.the-eic. com/MediaCentre/Publications/Reports

From the EIC News and events www.the-eic.com | energy focus 11

is a crucial platform in the energy calendar

Committed to delivering added value, as always

Since its founding 80 years ago, the EIC has grown to represent companies in all energy sectors. It is a journey that the EIC is proud of, and although energy priorities have changed since 1943, the EIC’s core purpose remains the same as when it began: to help members export, diversify and grow to win business across the globe. As we reflect on how the EIC has constantly evolved to meet continuous growth in its members’ demands, Energy Focus talks to the heads of two new departments launched in 2022: Nicola McGeown at EIC Event Solutions and Diveena Danabalan at EIC Consult.

Nicola McGeown

Interim DirectorRegional for UK & Europe EIC Event Solutions

Can you tell us more about EIC Event Solutions?

EIC Event Solutions came about as more and more member companies were looking to raise brand awareness, create a platform to talk about their products and services, and target the right audience by hosting in-person or online events.

We have a dedicated team of event professionals offering a bespoke event management service to simplify the entire event planning process from start to finish, allowing our clients to focus on their day-to-day jobs.

How can companies leverage EIC Event Solutions to effectively reach potential clients and partners?

Our bespoke event management offering allows clients to use as much or as little of the service as required and provides for a range of budgets. Some companies use the service as a marketing tool to reach energy supply chain companies in a specific region or on a global scale. Others require a full service, from event conception to completion.

We work very closely with the EIC Consult division, offering webinars and events that complement their market intelligence service. One example of our collaboration involved a recent report on nuclear newbuild opportunities in Europe, compiled by Diveena and her team for member company TÜV SÜD. The Event Solutions team worked closely with Consult to create a webinar platform, allowing TÜV SÜD to present details of the report, along with invited key industry speakers, to a carefully targeted audience.

What have been your greatest accomplishments so far?

Providing a service to our members that not only gives the brand awareness they are looking for but has also delivered post-event opportunities and led to winning business.

How is your service part of the EIC’s 80-year journey?

It is a natural progression in EIC’s service to the energy sector. Many energy companies have taken a step towards diversifying their business into the clean energy marketplace, and our services can both guide and promote this transition for the future.

Diveena Danabalan Head

EIC Consult

What sets EIC Consult apart from other consulting services?

Consult has hit the ground running due to the years of industry experience that EIC already has under its belt. Our Market Intelligence database offering – EICDataStream, EICAssetMap and EICSupplyMap – is well known, and our depth of knowledge is second to none, giving us a solid starting point.

12 energy focus | www.the-eic.com

Many energy companies have taken a step towards diversifying their business into the clean energy marketplace, and our services can both guide and promote this transition

UPDATES FROM THE ENERGY INDUSTRIES COUNCIL

Like all EIC’s offerings, Consult’s business model is specifically built to benefit our members, but we have also had success with non-members. We pride ourselves on our flexible, collaborative relationship with clients, tailoring our approach and offerings project by project.

No two clients are the same, which gives us an edge in customer service. I am proud to say that we have produced exemplary work for our clients throughout the year, which keeps them coming back for more!

Can you tell us more about the synergy between EIC Consult and EIC Event Solutions?

As two teams that produce bespoke offerings, it was only a matter of time before Consult and Event Solutions collaborated! One of our sweet spots is informing a client’s business development direction/strategy – Nicola highlighted a great example involving our joint client, EIC member TÜV SÜD.

Before becoming Head of EIC Consult, Diveena Danabalan (left) worked with EIC’s renowned market intelligence databases: EICDataStream, EICAssetMap, and EICSupplyMap Meanwhile, led by Nicola McGeown (right), EIC Event Solutions helps deliver a seamless, flexible and fresh event experience in-person and online

Another example of our synergy in action is that Consult successfully conducted a UK supply chain mapping exercise for a non-member operator to support the development of its Phase 2 application for the Cluster Sequencing for carbon capture, utilisation and storage deployment. Off the back of this, Event Solutions ran a very successful supply chain procurement event with the same client plus others in the Humber Cluster. Together, our teams are the dream valueadd for clients!

What have been your greatest accomplishments so far?

For me, it’s satisfied clients – we’ve grown and maintained some unique relationships because our clients love our work, with repeat work despite being just over one year old! It’s very much a two-way street; while we add value for our clients, our work with them forces us to utilise our databases in different ways, which inevitably leads to new ideas around our products and the bettering of our data, ultimately benefiting our members.

How is your service part of the EIC's 80-year journey?

EIC has been on an 80-year journey since its inception, and these consulting services are a natural part of that evolution. We’ve identified a need for it from members and non-members, and both offerings build on our existing market intelligence and events strengths. As both of our services are flexible in their clientele, I am convinced this will open up new avenues to EIC as it strives to become the global go-to trade association for the energy supply chain.

Two new businesses, one aim

EIC Consult

EIC Consult provides in-depth market intelligence outputs to members and nonmembers using EIC’s proprietary databases, its global network of contacts and its in-house analytics knowledge of global energy markets.

EIC Event Solutions

EIC Event Solutions offers expert event services, supporting EIC clients and other companies that can benefit from the EIC’s extensive experience.

With these two new businesses, EIC now offers exclusive consulting services with customised insights augmented by EIC’s well-known rigorous approach to energy market data gathering and analysis.

By continuously adding value to member companies, the EIC further develops its ambition to be the global go-to trade association for the energy supply chain.

From the EIC News and events www.the-eic.com | energy focus 13

Our work forces us to utilise our databases in different ways, which leads to new ideas around our products and the bettering of our data, benefiting our members

Happy 80th Anniversary EIC!

This year marks EIC’s 80th anniversary, and Energy Focus could not be more excited to celebrate all that EIC has accomplished in collaboration with members, partners, employees and friends. It is because of their continued support that EIC has been able to evolve continuously since its founding.

We asked two founding member companies and some of EIC’s key stakeholders and partners around the world for their reflections on EIC’s 80th anniversary. To keep the celebrations going, we will share all their kind words and congratulatory messages in every edition of Energy Focus this year.

As a founding member of EIC back in the 1940s, ABB has enjoyed and cemented a strong relationship with the organisation over the years, and across our many businesses throughout the world.

We view EIC first and foremost as one of the strongest sources of market and business intelligence for the global energy industries. The tool we use most, with hundreds of subscribers globally, is EIC’s daily updated EICDataStream energy project database, covering all energy sectors and countries.

EICDataStream is invaluable, helping us to track CAPEX projects from inception through to completion while also identifying new business opportunities. We also have access to EIC’s professional team, who are always on hand to answer queries and perform demonstrations of their suite of intelligence tools.

We have also used EIC’s procurement database as a valuable platform to promote ABB products and services. We have participated extensively in EIC trade shows, trade delegations, masterclasses and UK pavilions all over the world. We have also hosted our own events in conjunction with EIC and submitted multiple articles and conducted numerous interviews across a broad range of energy topics.

EIC is a trusted brand that ABB is proud to be associated with. It unites the industry and helps the supply chain to win business worldwide. That the organisation it is approaching its 80th year of existence is proof that it has carved out a successful niche as a leading voice in our industry. Happy anniversary!

Looking forward, the need to provide quality information for both clients and suppliers is even more important amid a rapidly evolving energy landscape and efforts to decarbonise step by step.

Keep up the good work, EIC! We certainly intend to be on hand as an integral member company for the next 80 years!

Troy Stewart, ABB Process Automation UK Lead, Head of Energy Industries UK and Ireland

Troy Stewart, ABB Process Automation UK Lead, Head of Energy Industries UK and Ireland

From the EIC EIC at 80 14 energy focus | ww.the-eic.com

EIC is the leading trade association for the energy industry, providing dedicated services to help members understand, identify and pursue business opportunities globally.

Throughout its 80 years, it has gone from strength to strength, playing a pivotal role in championing the industry through the highs and lows of industrial transformation.

Its support has helped Aberdeen build its reputation as a world-class oil and gas hub and its work will be key in driving success as we reposition ourselves as a leading location for investment in green energies.

Sir Ian Wood, Chairman, ETZ Ltd, UK

Congratulations to the EIC team on celebrating their 80th anniversary!

For us at the World Forum Offshore Wind it has been an enormous pleasure working with EIC and promoting offshore wind energy in the UK and around the world. As one of the world’s leading offshore wind markets, the UK is uniquely positioned to drive the industry forward and pioneer new technologies such as floating offshore wind on a commercial scale. We thank EIC for being a wonderful partner and look forward to many more joint offshore wind events!

Gunnar Herzig, Managing Director, World Forum Off shore Wind, Germany

On behalf of the Carbon Capture and Storage Association (CCSA), I would like to offer my congratulations to EIC on its 80th anniversary.

EIC is a key stakeholder for the carbon capture, utilisation and storage (CCUS) industry, representing the supply chain companies that will supply the goods and services for the net-zero energy transition.

CCSA has a strong working relationship with EIC, in particular as partners on the UK Energy Supply Chain Taskforce. We look forward to continuing this relationship in the coming years to enable the CCUS supply chain to deliver the roll-out of projects and clusters necessary to achieve our climate goals.

Today, the relationship between EIC and Siemens Energy is as strong as when it was first formed and has expanded beyond the UK, with Siemens Energy employees worldwide supporting EIC events and using EICDataStream and EICSupplyMap to aid growth and collaboration across the sector.

The role of EIC and its members will be important in the energy transition, working together to improve energy security and decarbonising the supply chain to achieve net zero. Siemens Energy recently collaborated with EIC, BEAMA and Aurora Energy Research on a report that sets out the scale, infrastructure, speed, capability and capacity that the supply chain needs to deliver net zero in the UK by 2035.

Thank you to EIC for all your support over the years. Happy birthday, and here’s to the next 80 years.

DIT has worked closely with the EIC for many years across multiple energy segments, and as the world moves toward a renewable future, it is great to see that the organisation has positioned itself to track, inform and support the incredible UK supply chain to succeed in markets globally.

Congratulations to EIC on its 80th anniversary, and I look forward to our continued collaboration supporting the British energy sector to export its expertise around the world.

Shozey Jafferi, Head of Energy Transition & Network Infrastructure, Exports and UK Trade, Department for International Trade

Ben Hill, Head of Sales Electrification, Automation and Digitalisation UK & IE, Siemens Energy

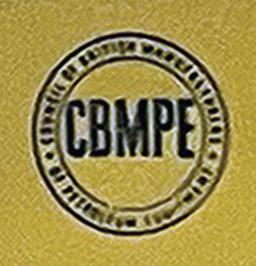

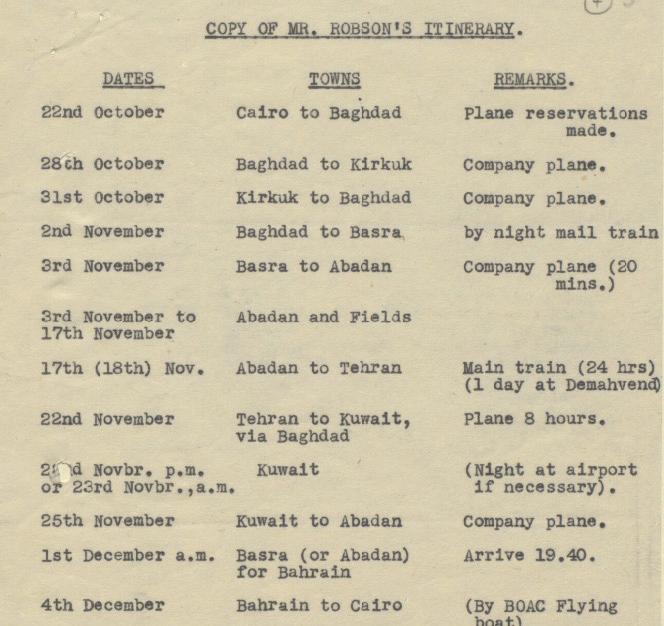

In February 1943, during the height of the Second World War, 13 companies came together at a meeting in London to form the Council of British Manufacturers of Petroleum Equipment (CBMPE).

They arrived with a clear and urgent sense of purpose: to explore how businesses could contribute and thrive when the post-war reconstruction of the oil industry began.

Today, that same organisation is known as Energy Industries Council (EIC), and has become the go-to energy supply chain trade association on a global scale. It helps firms up and down the value chain to export, diversify and grow across the globe.

EIC today employs 110 staff across five regional offices, and has more than 800 members spread across

Looking back on 80 years of Energy Industries Council

more than 50 countries. It is responsible for hosting 130 worldwide events each year, and is tracking 12,000 projects on EICDataStream. Through these efforts, EIC continues to facilitate understanding, dialogue and action that will help the world to address current and future energy challenges.

And the future will be challenging. We find ourselves in volatile times that are distinctly lacking the sort of certainty that businesses crave and traditionally revolve their strategic decision making around.

Nobody can be certain when the conflict in Ukraine will relent. Meanwhile, the fallout from the pandemic will be felt for quite some time as economies and supply chains recalibrate after two years of unprecedented shocks and shutdowns.

TIMELINE: 10 KEY EIC MILESTONES

1943

13 companies form the Council of British Manufacturers of Petroleum Equipment

1946

The first overseas trade mission is undertaken, by boat to the Caribbean. More followed that decade, including a journey to the Middle East in 1947

1959 British Oil Equipment Credits is formed

1972

The council forms the North Sea Action Committee

To achieve its goals of helping members to understand, identify and pursue business opportunities globally, EIC will need to continue operating with a powerful sense of purpose – akin to the same mission that the organisation first began to target when it was founded in 1943.

Celebrating 80 years of milestones

Indeed, the further back you look, the further forward you can see when it comes to EIC’s past.

Over the course of eight decades, the same core aim of supporting the hard working and wealth creating businesses that operate up and down the energy sector has not wavered. Today, that objective is more important than ever in underpinning what EIC does.

18 energy focus | www.the-eic.com

As we look ahead, EIC stands taller and stronger than ever, all the while staying true to the same values and purpose that brought 13 companies together during the height of war in 1943

Special Feature EIC at 80 1 Br Eq is 1 Th fo Se Co

As EIC celebrates a milestone anniversary, Energy Focus takes a look at the sense of purpose that has allowed the organisation to evolve, transform and grow

(Left)

Malaysia, 2018. Thailand and Vietnam also received the Connect event model in that year. The EIConnect model was first conceived in 2003

Indeed, it is a highly collaborative organisation, no better demonstrated than through such initiatives as the Energy Exports Conference and the UK Energy Supply Chain Taskforce, which bring together government and industry to maximise opportunities and mitigate challenges.

companies with £1m-plus

revenue. Next year EIC will be launching an app-based version, and we are preparing a refreshed dataset for 2024.

Within a year of being set up, the CBMPE had already expanded its membership base to 100 companies and formed a finance committee. Operating with two full-time staff, one of its main services was to send periodical summaries of important industry news to members, a core informative focus which remains to this day.

(Centre) The 1961–62 edition of the CBMPE’s Guide to British Petroleum Equipment. The first edition of the Guide was published in 1947, featuring 176 members. It can be considered a predecessor of the Procurement Guide, an online directory of EIC members

A year before the inaugural procurement guide was released, the first overseas trade mission to the Caribbean was completed, an undertaking that took three months via ship. More international missions followed in the ensuing decade, including journeys to the Netherlands in 1950 and Canada in 1957, inspring inspired EIC’s first Country Report.

Collaboration and cooperation have always been in EIC’s roots. This is no better underlined than by what the council’s Chairman stated as a core value back in 1949: “Make every effort to promote joint working,” he said.

So, how has EIC got to the point where it is celebrating its 80th birthday? The journey has been full of discovery, evolution and growth, and here we will chart just some of the key moments that have come to define EIC’s story to date.

In 1947, long before the days of the internet, the council launched its first ‘Guide to British Petroleum Equipment’, a procurement guide showcasing British engineering and manufacturing prowess to petroleum project decision-makers. This has been ever-present, today’s incarnation being EICSupplyMap –a fully searchable, online database of the detailed capabilities of all 3,500 British energy supply chain

1995

EIC opens its first office outside the UK in Houston, US

(Right) The CBMPE registered with Companies House in 1951. We would only adopt the Energy Industries Council name later, in 1981 1981

CBMPE broadens its member base and activities, renames as the Energy Industries Council

The EIC Projects Database is launched, later being upgraded to EICDataStream

The first EIConnect event is held. EIC Global Energy magazine (now Energy Focus) is launched

A major commercial milestone arrived in 1959 with the creation of British Oil Equipment Credits, a wholly owned subsidiary of the CBMPE that was designed to unlock international export opportunities for UK plant and equipment manufacturers. This facilitated major deals, including £7 million in orders from Mexico state oil firm Pemex in 1961.

International exhibitions grew in popularity during the 1960s, with the CBMPE attending and exhibiting at numerous international tradeshows and completing landmark missions to

2016

The first edition of EIC’s Survive & Thrive series is launched 2021

ExxonMobil joins EIC as our first operator member

www.the-eic.com | energy focus 19

2000

2002

EIC at 80: Special Feature EICConnect

2 T D la u E www.the -

markets in the Middle East and Latin America.

Then came EIC’s first serious foray into the North Sea. In 1971, three of its members decided to, in their words, ‘take the plunge’ into the field of servicing and supplying equipment for North Sea operations. The council also arranged for energy giants Shell and bp to talk to member companies about the huge opportunities for British manufacturers in their backyard, later creating a dedicated North Sea Action Committee.

Different name, expanded scope

By 1981, membership had swelled to 250 companies. It was at this point that a major decision was made to realign and rename the CBMPE to Energy Industries Council, or EIC.

The move was symbolic and important. As well as opening a new office in London at Notting Hill Gate, EIC formed the Energy Advisory Committee to widen the scope of its activities and help embrace the entire energy sector.

In 1987, EIC held its first seminar on energy and the environment, covering atmospheric emissions, water pollution, government attitudes, onshore exploitation of energy resources, nuclear energy, and alternative energy. Today, the council remains energy-agnostic and operates with the same purpose, but with an equally if not broader scope across the entire energy ecosystem.

A milestone was met in 1995 with the opening of EIC’s first

international office in Houston, Texas. Meanwhile, to solidify its commitment to the North Sea sector, the organisation opened up its Aberdeen office before the millennium.

The turn of the century marked the launch of another landmark EIC initiative that has gone on to provide insight and highly valuable knowledge to members. The Projects Database, a forerunner of what would become EICDataStream, is a vital CAPEX project tracking which builds on EIC’s rich legacy of communicating up to date, relevant information.

Just two years later, in 2002, the first ever EIConnect event took place in Manchester before the launch of this very publication, which was originally released under the name EIC Energy Global magazine.

Alongside this expansion of information sharing, EIC opened several offices in the 2000s, including in Rio, Dubai and Singapore – all important moves which brought the organisation closer to potential markets for members to grow into.

A decade of modernisation

Recent history, especially the past decade, has seen EIC modernise its offering and make smarter and more effective use of technology to serve its purpose.

In 2015, the third major version of EICDataStream was launched, adding new capabilities, greater depth to project data and a new, simpler user interface. By 2018, this asset had amassed data on

21,000 projects collectively worth US$10tn globally.

In 2017, the council opened up to members its EICAssetMap offering, which today maps 27,500 global facilities across all energy sectors and their associated service opportunities for members. That was followed by EICSupplyMap in 2019. In the same year, EIC welcomed its first non-UK legal entity into its membership in the form of the UAE’s Al-Yaseah, the company now being present on the council’s board. Meanwhile, EIC Connect events were held in Indonesia and the US for the first time.

The context to these more recent EIC developments was the ‘lower for longer’ oil crisis of 2014, which forced all businesses, including EIC, to further automate business models, listen even more closely to clients’ changing needs, and diversify and internationalise wherever possible. Determined to support members through this immensely difficult period, EIC launched its Survive & Thrive initiative. First published in 2016, today it is seen as a critical annual assessment of the successful growth strategies used by energy supply chain leaders to adapt to challenging market conditions.

The next chapter

As we look ahead to 2023, EIC stands taller and stronger than ever, all the while staying true to the same values and purpose that brought 13 companies together during the height of war in 1943.

EIC’s mission statement is clear: ‘To be the go-to energy supply chain trade association, globally’. As market uncertainty still looms large, EIC will continue to play a crucial

facilitating role in the growth, expansion and success of its members, helping them to navigate through choppy waters.

EIC promises continued investment, creativity and absolute professionalism to meet its members’ ever-adapting needs, amplifying the voice of the supply chain, and always promoting the best business opportunities around the world, across all energy sectors.

Special Feature: EIC at 80

(Left) EIC’s first serious North Sea foray came in 1971, when three members started servicing and supplying equipment for operations in the area

(Right) A job advertisement for EIC’s Rio office, opened in 2000. Besides representing EIC in the South American region, Rio is currently a base for nearly 30 staff

20 energy focus | www.the-eic.com

$

21,0

Celebrating 80 years

80 YEARS: THE ENERGY INDUSTRIES COUNCIL

1943: One office in London

2023: International offices in five regions

1943: The EIC is formed by 13 member companies working in the oil and gas industry

800

2023: Over 800 member companies worldwide in all energy sectors

2017: EICAssetMap launched – the only O&M database to map all major UK facilities across all energy sectors

2023: EICAssetMap coverage expanded to Africa, Asia-Pacific, Brazil, Europe and more

2016: Rebranded as Inside Energy, the EIC monthly magazine is now published in a digital format

1947: The first edition of British Petroleum Equipment News comes out. 2023: Now named the Procurement Guide –an interactive digital tool enabling access to supplier and contractor contact details via the EIC website

The EIC

Celebrating 80 years of enabling our members to win work in the global energy industries

2019: EICSupplyMap launched – the only database of all 3,500 British energy supply chain businesses and their detailed capabilities

2023: Ongoing works for expanding EICSupplyMap coverage in Brazil, Texas, Malaysia and the UAE

1957: EIC publishes the Canada Report, its first countryspecific industry report

2023: 12 Insight and Country reports issued each year

1943: 1 UK event

2002: First EIConnect event in London

By 2023: EIC Connect events are held worldwide

2023: 130+ global events; participating in 15+ international exhibitions and EIC flagship event Energy Exports Conference (launched in 2018)

2000: EICDataStream launched, tracking 1,100 ongoing projects

2023: 12,000+ ongoing projects being tracked, worth a cumulative

US$13tn

www.the-eic.com | energy focus 21 From the EIC

The BIG question

Is ‘net zero’ more greenwashing than reality?

Reaching net zero is about more than just balancing carbon emissions; it involves bringing about a transformation in the way businesses of all sizes operate. As the UN calls for a crackdown on greenwashing of net-zero pledges at COP 27, Energy Focus puts the big question to four members

Jonathan Brindley

Chartered Marketer at JBPRM Ltd

Chartered Marketer at JBPRM Ltd

In simple terms, greenwashing refers to a company advertising itself as being greener and more sustainable than it is in reality.

The purpose of this is to tap into green public sentiment and, in doing so, increase its sales and income.

So, when it comes to net zero and the energy transition, some might say that the energy transition is just a way for big business to make lots of money from infrastructure that we don’t really need. However, climate change is very real and has been proven to be anthropogenic –which means we have a responsibility to reverse it.

Due to the work I do, I am aware of the hard work being expended in trying to build supply chains to enable the adoption of less carbon-intensive power generation, the adoption of carbon capture and storage, and a switch to greener fuels

such as hydrogen for powering energyintensive processes.

From this perspective, is net zero more greenwashing than reality? No way! It’s happening on the ground – maybe I could be bold and say there is not enough ‘shouting’ going on.

JBPRM Ltd is a resultsbased industrial marketing consultancy delivering value-for-money business growth services for start-ups and SME businesses operating within the power, process and energy sectors. The company off ers a complete digital marketing service, as well as a virtual business development office for developing sales funnels quickly and eff ectively.

Andy Howell

EVP Technology at KBC

(a Yokogawa company)

In a word, no – it’s not greenwashing. It is, however, a journey, and one that starts with semantics. Some have interpreted net zero as involving no ‘extra carbon’ being emitted than today, or companies becoming ‘carbon neutral’ from paying fines or offsets. I am afraid that is greenwashing!

For KBC it is more than that. Net zero means that our industry contributes zero towards global warming and does not emit any more produced carbon to the atmosphere than we remove from it.

The journey our industry needs to take will involve reducing emissions from producing, refining and using petroleum products, implementing carbon capture and storage initiatives, and moving to low carbon and then no-carbon fuels.

Net zero is a chemical engineering challenge that will be solved by chemical engineers, and we are well on the way, with

22 energy focus | www.the-eic.com From the EIC Members’ comment

I am aware of the hard work being expended in trying to build supply chains to enable less carbon-intensive power

smart energy reduction, multiple asset heat and energy integration, synthetic methanol from captured CO₂, gas turbine heat integration with ethylene furnaces, biofuels from cooking oils, and the emerging hydrogen and ammonia economy. KBC is passionate about driving sustainable change for the planet and has removed more than 400m tonnes of CO₂ from being emitted.

Define the journey – take the first steps.

KBC , a wholly owned subsidiary of Yokogawa Electric Corporation, is all about excellence in the energy and chemical industry. Fusing technology with talent and best practices, the company makes excellence real for its customers. KBC provides leading software and expert services, powered by the cloud, to assure process operations achieve their full potential.

Nick Shorten

COO Asset Solutions at Petrofac

regulatory frameworks is also recognised by governments and key stakeholders around the world.

We’re using the skills we’ve developed in oil and gas to support the development of low-carbon and renewable energy infrastructure. Whether enabling first-of-akind green hydrogen or waste-to-value projects, or delivering close to 4GW of offshore wind power, we’re operating at the cutting edge and at scale.

For us that means good business, in both senses of the word. Superficial changes are easily outed as greenwashing, but fundamental changes at the heart of business strategy deliver real results.

Petrofac is a leading international service provider to the energy industry, helping clients meet the world’s evolving energy needs. Using engineering know-how and project management expertise, Petrofac designs, builds and operates world-class energy facilities that are engineered for safety, optimal efficiency and low emissions. The company has been delivering projects across the renewables sector for more than a decade.

In the corporate world, decarbonisation is now a boardroom imperative, and companies are making commitments to net zero across multiple industries. Despite this, scepticism remains on whether this constitutes actual progress or is just superficial greenwashing.

In my opinion, the commitment is genuine, but the reality is that setting a target is just the first step. The bigger challenge comes in defining how to drive down emissions in the near term and ultimately build a roadmap to net zero that is practical, affordable and achievable.

At Wood, we use our proprietary SCORE advisory tool to help clients on this journey. It helps them break a challenge of this magnitude down into actionable steps and execution plans that can bring their commitments to life. This is key to addressing the cynicism – we are in a world of ‘show me’ rather than ‘tell me’.

Jennifer Richmond Executive President, Strategy & Development at Wood

From a Wood perspective, net zero is a compelling business opportunity. We have a purposeful role to play in helping clients drive real progress around emissions and ultimately help to design a better future. That’s an inspiring mandate that we fully embrace.

Petrofac will be a net-zero business by 2030, with all the difficult real-world choices that implies. We are also working to help decarbonise our customers’ activities and those of our supply chain. Our ongoing contribution to policy development and

The transition to a net-zero future will be one of the defining challenges of our generation. It’s also a challenge we must meet head on to secure the future of our planet.

Wood is a global leader in consulting and engineering, helping to unlock solutions to critical challenges in energy and materials markets. The company provides consulting, projects and operations solutions in 60 countries, employing around 35,000 people. Wood has world-leading expertise in decarbonisation and works with clients across multiple industries to shape a path towards a lowercarbon future.

For us, the journey towards net zero is a scientific, moral and business imperative. We know it is a long road and needs real commitment. Processes need to change, equipment needs to be retired and replaced, and investment decisions need to be taken. And that means belief and resolve, placing energy transition at the core of our strategy.

Net zero is a chemical engineering challenge that will be solved by chemical engineers

In my opinion, the commitment is genuine, but the reality is that setting a target is just the first step

www.the-eic.com | energy focus 23 Members’ comment: From the EIC

Fundamental changes at the heart of business strategy deliver real results

Advertising feature

What is needed to scale up hydrogen?

Thorsten Harder, Product Manager at Burckhardt Compression, offers his thoughts on what is

decarbonising key industrial processes

energy density in liquid or gaseous form and produces zero emissions at the point of use.

support the integration of renewables into the energy system.

“There is no chicken and egg problem with hydrogen for decarbonising heavy industry,” Harder continues. “When it comes to hydrogen as fuel for heavy vehicles, it is much more challenging. But for industry we have demand, we have a way of producing hydrogen to guarantee supply... we just need to change the way of producing hydrogen to reduce the greenhouse gases that are produced or released. That’s the easiest way to decarbonise quickly.”

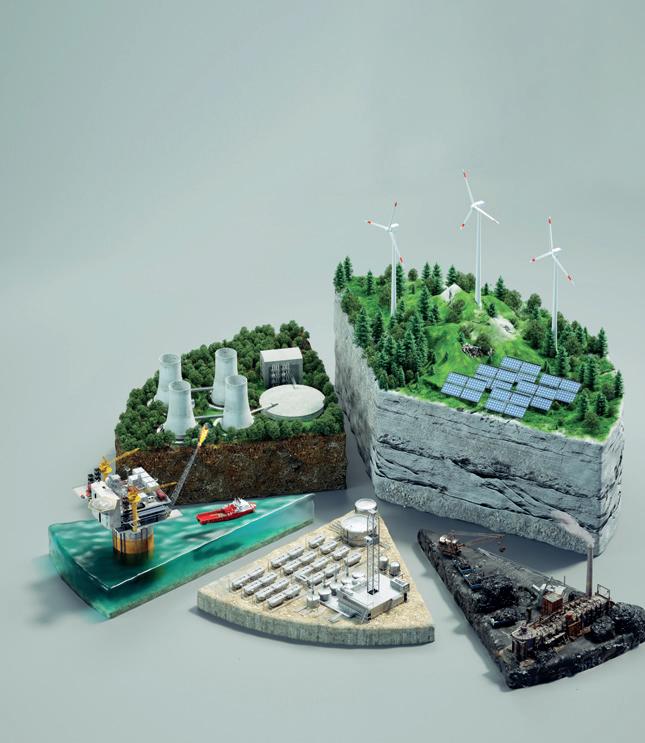

A strong energy mix is critical to ensuring the world can meet both energy security and sustainability demands simultaneously.

Technology advances in solar and wind and enhanced efficiencies in more traditional forms of energy generation are contributing to these goals, yet all component parts must continue to evolve if we are to be successful. That, undoubtedly, includes the successful harnessing of new energy sources such as hydrogen.

“Hydrogen today is already used in different industries,” explains Thorsten Harder, Product Manager at Burckhardt Compression – the worldwide market leader for reciprocating compressor systems. “This includes refineries and the chemical industry, gas production for semiconductor manufacturing and, of course, fertiliser production.”

At present, natural gas, coal and oil provide the majority of energy for many such industrial processes that, combined, are responsible for approximately 20% of global emissions.

If used optimally, hydrogen has incredible potential to decarbonise these industries and the transportation sector. Indeed, it is a versatile and clear fuel that can be stored and transported at high

However, the challenge today is that the majority of hydrogen is grey, meaning it has been created from carbon-abated fossil fuels.

According to the European Commission, 96% of hydrogen production is powered by natural gas. Furthermore, the International Energy Agency (IEA) reports that hydrogen production is currently responsible for 830m tonnes of CO2 emissions per year – the equivalent of the annual carbon emissions of the UK and Indonesia combined.

Moving from grey to green

Clearly, at present, hydrogen is not as clean as it can be. So, how can we improve its viability as a sustainable fuel moving forward?

“The easiest way to decarbonise these industries is with greener production processes,” Harder explains. “This is commonly achieved in two ways. One, you use electrolyser-produced green hydrogen, or two, you can try to capture the CO2 coming from the steam methane reformers and store it permanently deep underground (blue hydrogen).”

Indeed, these methods are beginning to gather momentum. The IEA further reveals that in the past two decades, more than 200 projects have started operation to either convert electricity and water into hydrogen to reduce emissions, or

Green hydrogen is key to making hydrogen a more viable energy transition fuel long term, although journeying down this route poses a different challenge.

“Accessing green hydrogen is highly dependent on location and infrastructure,” Harder explains. “If you’re close to the product site, you may only need a small pipeline. However, for distances of a few hundred kilometres or more, it’s more economical to transport compressed gaseous hydrogen by road using trucks and pressurised tube trailers.

“Equally, if you have high-quality hydrogen and the right infrastructure for fuelling, you may want to have liquefied hydrogen, but that requires the availability of liquefied hydrogen and the right fuelling station technology next to it.”

Harder then turns his attention from access to production, outlining similar challenges. “You can produce ‘green’ hydrogen from electrolysers, of course. But it’s difficult when you have limited renewable resources close to the site where you need it. In Switzerland, for example, we don’t have a lot of solar and wind. We may have hydropower, but if you want to extend the capacity on green hydrogen in Switzerland, it’s not so easy.”

There are work arounds available. Pyrolysis technology can be used to convert natural gas into ‘turquoise’ hydrogen without emitting CO2 – yet this is a technology that remains in its infancy.

Of course, these developments are promising, highlighting the increasing

24 energy focus | www.the-eic.com

required to scale up hydrogen so that it may play a greater role in

support of the hydrogen economy in making hydrogen a viable fuel source. However, for Harder, the priority needs to be focused on establishing key production centres that the entire sector can then begin to scale from.

“We’re already using huge amounts of hydrogen at refineries, in ammonia plants, and other industrial applications,” he explains. “Here, you have a constant demand for hydrogen. If you can make that hydrogen green, then you can begin to create desirable hydrogen epicentres in clusters from which the rest of the hydrogen economy may develop.”

Opportunities, barriers and the importance of compression technologies

Several studies are being explored that could see hydrogen clusters become established.

Harder points to promising investigations into producing hydrogen at offshore wind parks with dedicated offshore platforms that are built to accommodate electrolysers and feed into storages. In the Netherlands, for example, Vattenfall has proposed to build the world’s first offshore green hydrogen cluster that would see the integration a 45 MW hydrogen cluster into an offshore wind farm, with three turbines equipped with electrolysers.

“Producing electricity offshore, bringing it onshore and transferring it through high voltage power lines is more costly and less efficient than feeding hydrogen into a pipeline and then using repurposed natural gas pipes,” Harder affirms.

“It’s something I see offshore a lot. Big utility companies, instead of feeding electricity into the grid, they plan big electrolyser stations offshore, pipeline feeds, compressors and then a pipeline to the shore to feed into the natural gas or dedicated hydrogen pipeline grid of Europe.”

Functioning cross-border energy infrastructure such as this will be critical. According to the Hydrogen

Council, approximately 30% of global primary energy supply is currently traded internationally – a need that will persist with the capacity of renewable energy production varying wildly between countries.

Indeed, some countries like the UK are planning to develop a ‘hydrogen backbone’ that would see gas transmission pipelines repurposed to link industrial clusters domestically. However, if an international trade network is to become consolidated, the lack of liquidity in the hydrogen market must be addressed.

“Right now, we only have point-to-point trading between molecule producers and customers,” Harder explains. “There isn’t really a hydrogen market that has been established yet. But for hydrogen to work, we would need to have some sort of free trade and transportation policies of the molecules within key regions. Not only that, but we also need aligned emission regulations and aligned CO2 costs.”

Technologies also need to continue to evolve to make hydrogen more of a commercially viable reality for many – an area where several promising developments are being pursued.

The ongoing improvement of compression technologies stands as a prime example, as Harder explains: “Compression solutions play a very important role. It doesn’t matter which format you want to use hydrogen – from liquefied hydrogen to gaseous hydrogen, you need compressors.

“A major question facing the hydrogen sector currently is surrounding how to scale critical infrastructure, and that debate revolves around deciding which technology fits best for various flows.

Technology choice is critically important, and compressors provide us with that ability to choose.”

A European outlook

Indeed, it is safe to say there are plenty of challenges and opportunities ahead – particularly when looking at the European market.

Owing to areas of dense populations, the expansion of renewable energies into these places is a major social challenge on the continent. For this reason, the World Economic Forum outlines that the region will remain an energy importer, focused on building a strong and interconnected grid infrastructure while also improving its powerful technology position.

Recent moves from Germany show some logic here. Indeed, the country has signed several global agreements as it moves aggressively towards importing hydrogen products, technologies and capabilities from global players including the UAE, India, Japan and Scotland.

Generally speaking, however, there is still a long road ahead in establishing a more effective and expansive hydrogen economy on the continent.

“I think we are at the very beginning,” Harder muses, concluding with his forecasts for the future. “However, we have major subsidies and proven feasibility studies on our side now, and I think we’re poised for lift off – a lot of things are now conceptually worked out.

“If I had to say one thing was key moving forward, it would be improving access to green hydrogen, not only domestically, but equally via a global infrastructure network facilitating crossborder trade. If Europe is to successfully establish a thriving hydrogen economy, this is vital.”

For more information, contact:

Tel: +41522615500

E: info@burckhardtcompression.com

W: www.burckhardtcompression.com

Advertising feature

www.the-eic.com | energy focus 25

Green hydrogen is key to making hydrogen a more viable energy transition fuel

Energy transition starts at home

Consumers will lead this energy transition, and energy providers can light the path, says

Customer Experience

Transformation Leader

Greg Guthridge

EY Global Energy & Resources

Energy transition Consumer power

26 energy focus | www.the-eic.com

Energy transitions and disruptions are nothing new.

In the 80 years since EIC formed, the way we produce, transport and use energy has evolved dramatically.

The use of coal to drive steam power and thermal power plants, and to heat homes, grew from the 1930s to the 1950s. Oil leapt forward in the 1950s and 1960s as petrol-powered vehicles became more affordable and accessible. The slow expansion of natural gas pipelines through to the early 2000s, and the technological advances since then, have led to significant growth in shale gas during the past 20 years.

These transitions have characteristics in common – they have been relatively slow, more evolutionary than revolutionary, and impacts such as changes in the fuels used to generate energy were either somewhat unseen or felt in only very specific parts of consumers’ lives.

The energy crisis today has multiple dimensions

Now we are in the midst of another leap forward, but this energy transition is markedly different. The pace, scale, innovation and direct impact on consumers are unlike anything we have ever seen. Significant investments in clean energy, new transmission infrastructure and smart distribution networks are well underway, and the timeline for transformation is now just a couple of decades – or even less.

While many speculated that the current energy crisis in some nations would slow investment and create backsliding, the opposite appears to be true. The International Energy Agency’s forecast in its World Energy Outlook 2022 report shows demand for every fossil fuel peaking or plateauing during the next decade.

Omnisumers are on the rise as consumer confidence wanes

However, the most significant difference in this transition is the central role of consumers. In the coming years, the energy transition will hit home. Infrastructure such as wind farms and transmission lines will increasingly appear, solar

panels will dominate the rooftops, more electric cars and bikes will be in garages, and new digital technologies will be installed in homes. And consumers will face an exponential increase in opportunities to shift their energy use and take advantage of greater choice, convenience and control, while also enhancing system flexibility and resilience. What it means to be an energy consumer is fundamentally changing, and we see the emergence of a new, more active and engaged energy omnisumer – a person or business that participates in a dynamic energy ecosystem across multiple places, solutions and providers.

The EY Energy transition consumer insights research of 70,000 consumers in 18 markets during the past two years found that they are not just ready for this change – they are leading the way. Rising prices and market disruption have fueled their interest in clean energy and in adopting new solutions such as electric vehicles and rooftop solar.

At the same time, volatility has taken a toll on consumer confidence in an industry that has been taken for granted for years. Since 2021, more than 80 energy providers have gone out of business in competitive markets and, across the world, US$550bn has been spent on government intervention to support consumers and providers. For consumers, this has raised concerns about affordability and equity, and caused them to question what their future energy experience will look like.

Reinventing the energy experience

For energy providers and industry stakeholders, this is an urgent call to action. Energy consumers are accelerating their transition to the future, and now is the time to keep pace or risk being left behind. The key to success is to put consumers at the centre of the energy transition. And the place to start is by reinventing the energy experience.

EY’s survey results reveal that a key opportunity for providers to improve the consumer experience lies in new energy products and services. Consumer interest in a variety of new energy solutions – including renewable energy, rooftop

www.the-eic.com | energy focus 27

Consumer power: Energy transition

IMAGE: GETTY

We are in the midst of another leap forward, but this energy transition is markedly different. The pace, scale, innovation and direct impact on consumers are unlike anything we have ever seen

solar, energy-efficient appliances, heat pumps, electric vehicles and charging – is growing. However, only 28% of consumers who were involved in a new energy product or service experience with their energy provider during the past year were highly satisfied. The problem is that adopting just one new product often requires consumers to deal with multiple parties, including a retail store or speciality provider to purchase it, a contractor or other organisation to install it, and government departments or energy providers to provide construction permits, process rebates or inspections.