16 minute read

A Year of Surging Trends for the Banking sector

By Mariam Umar

In the middle of a tumultuous year for the economy and a highly unstable socio-political environment, Pakistan’s banking sector managed to have a year of relative financial stability in 2022. In a new report the PWC has reported that most benchmarks have signified a sustainable year.

Advertisement

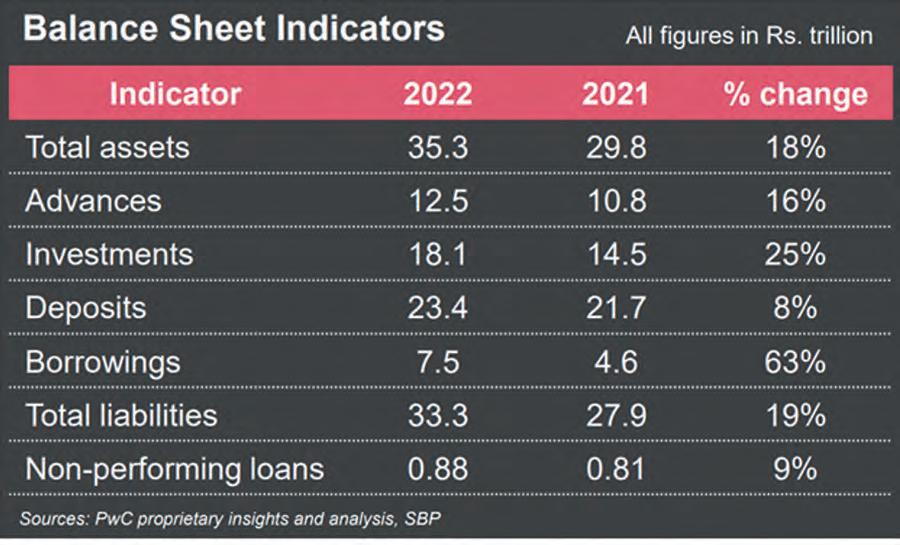

On the balance sheet side, both assets and liabilities grew moderately. Profitability also increased by more than 20%. We will look at each of these indicators in detail. But there were also very particular anomalies and unique trends in the banking sector’s 2022 performance. So what were the findings of the report and what are the future challenges and opportunities that need to be navigated?

Deposits

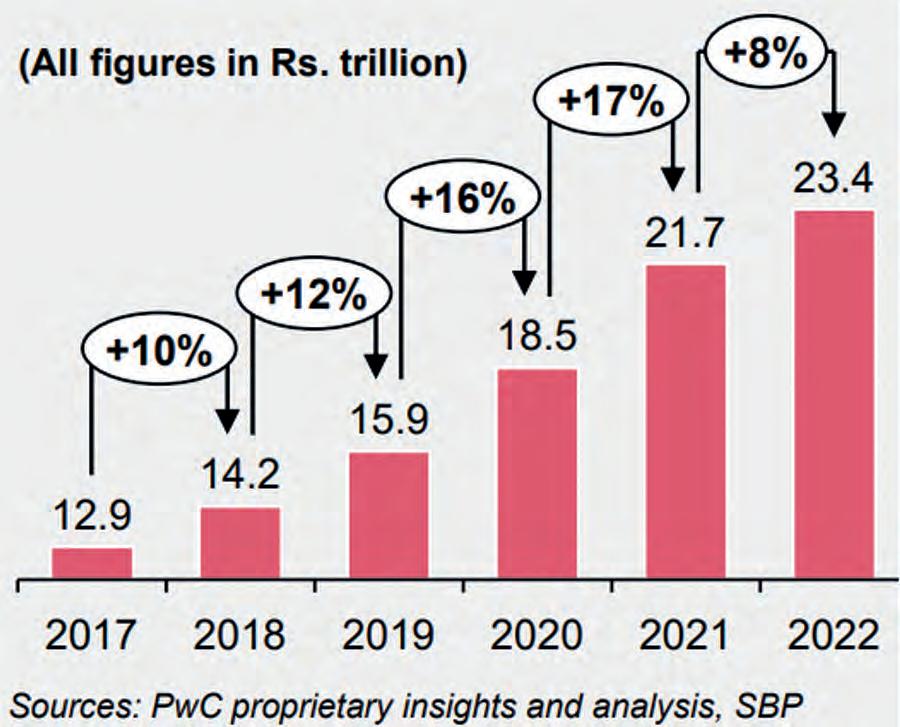

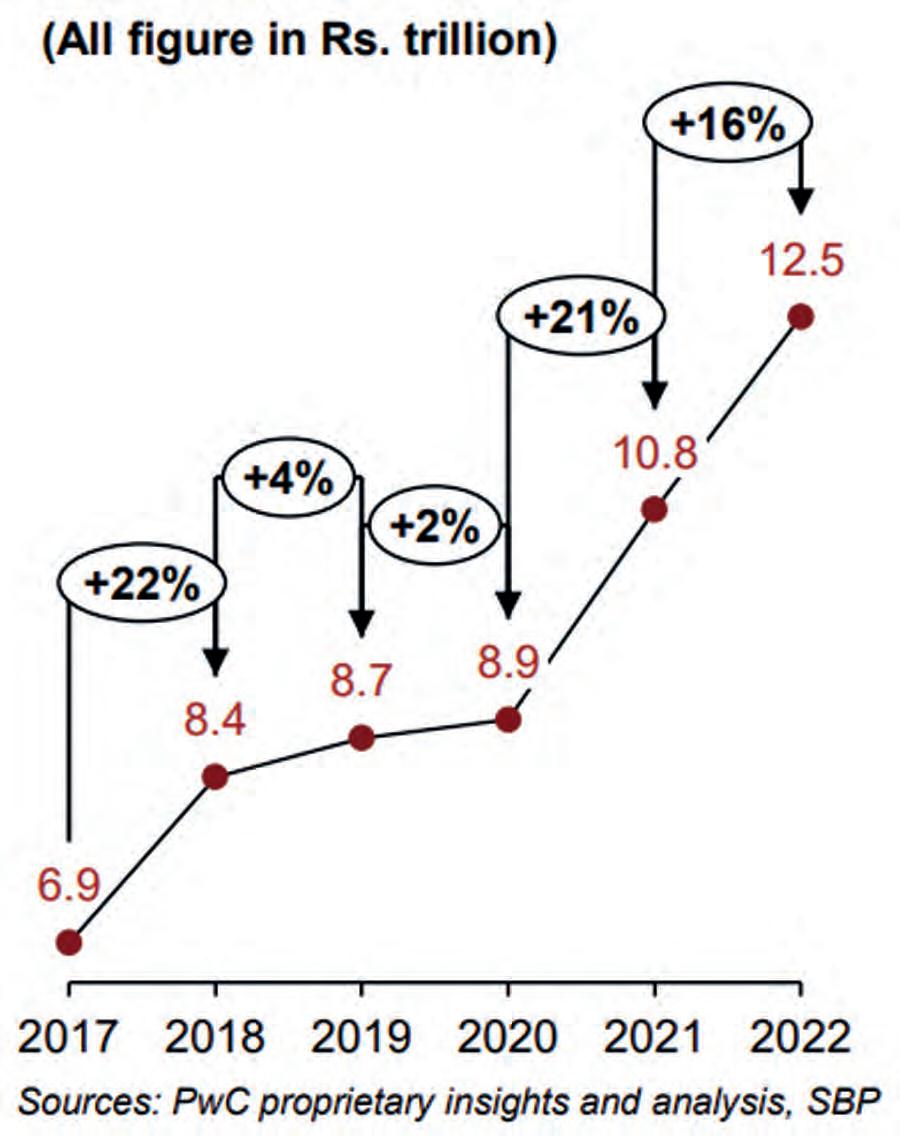

On the liabilities side, deposits have recorded steady accretion over the last five years. In 2022 there was a modest rise of 8% which is the smallest increase in the last five years. In the preceding years, the increase in deposits had been in double digits. The small increase can be attributed to the Advance to Deposit ratio (ADR) tax that was levied on the banking sector. Banks were supposed to maintain an ADR of at least 50%, failing to do so would result in higher taxes.

Theoretically, there were two ways through which the banks could improve this ratio: by either increasing advances (loans to the private sector) or decreasing deposits. Hence for the first time in the last twenty-one years (prior data is not available), in the last month of a financial year, banks opted to decrease their deposits. This also marks a break from the traditional pattern where banks would artificially hold onto deposits to meet performance goals and inflate their deposits in December, only to release them in January was a first.

This is also evident from the graph below where deposits increased by only 8% in 2022.

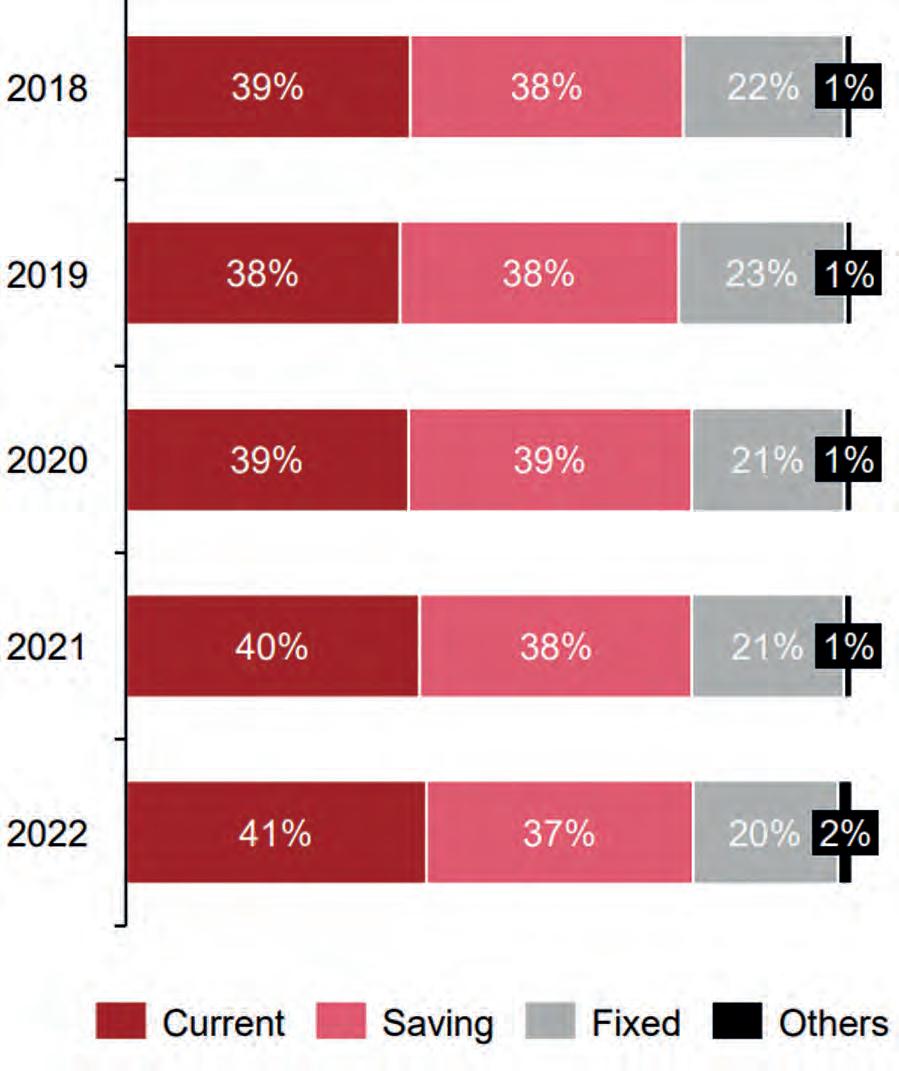

The customer deposit mix remained broadly consistent, with low-cost deposits i.e. current account deposits and saving deposits accounting for 78% of total deposits. Current account made up for majority of deposits at 41%.

Advances

Advances are loans extended to the private sector. Advances (loans) exhibited year-on-year growth of a whopping 16% in 2022.

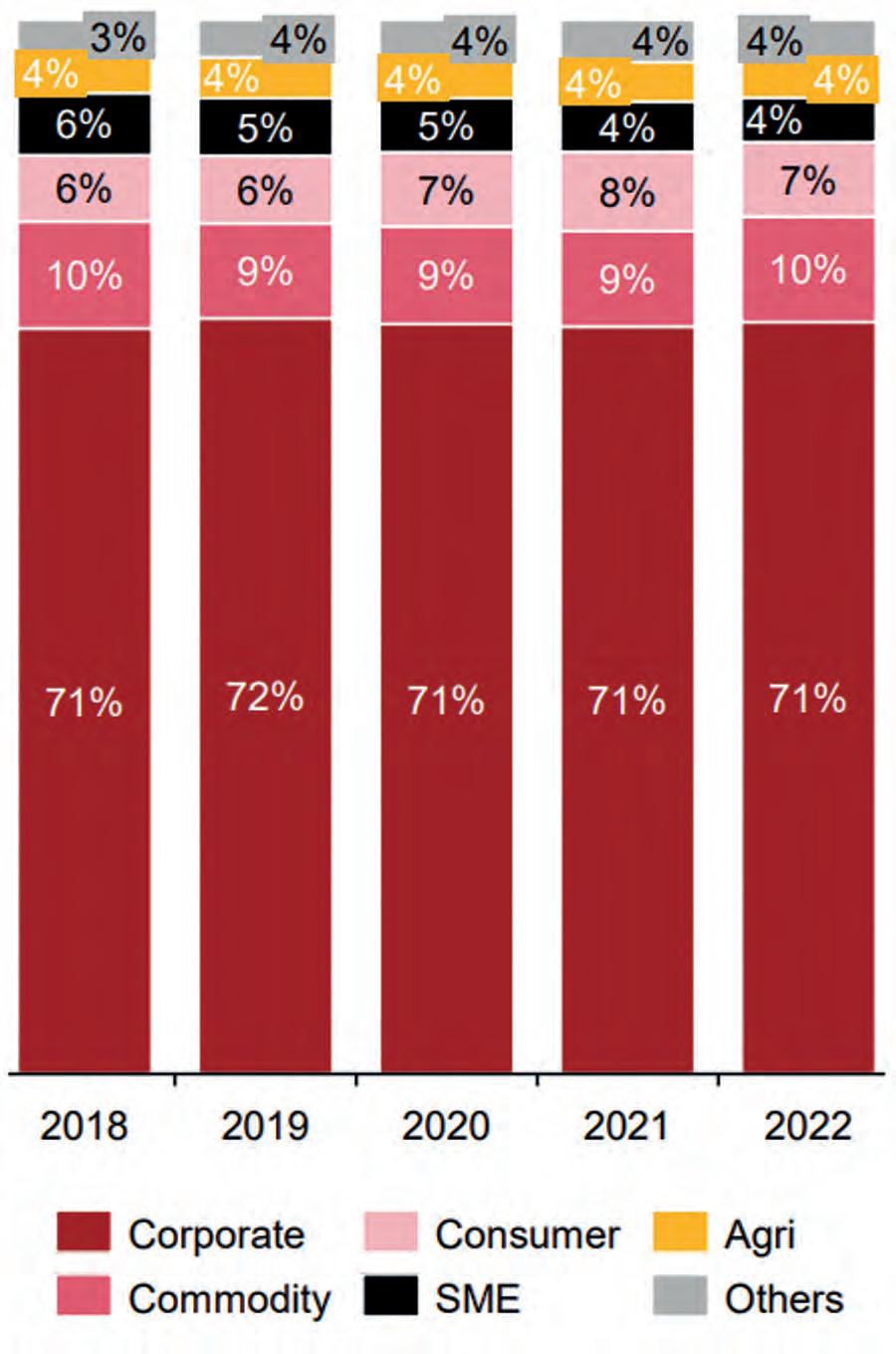

For the past five years, there has been a consistent trend in the allocation of loans, with approximately 70% of them consistently directed towards corporates. The financing type for corporates is as follows:

Banks seem to be tactfully handling their exposure by being cautious with loan financing in fixed investment, which exhibits a higher Non-Performing Loan (NPL) ratio of 9.2% as concentration of loans for fixed investment has decreased by 200 basis point. On the other hand, it appears that trade finance is constrained, possibly as a response to the import restrictions imposed in the latter part of 2022. However, in response to changing circumstances, there has been a noticeable shift in funding towards working capital, which carries a relatively lower NPL ratio of 7.4% as the concentration of loans for working capital has increased by 300 basis points.

The credit portfolio of the banks is predominantly allocated to a select group of industries, which together make up more than 50% of the portfolio. These key industries include textile, energy production and transmission, individual borrowers, agri-business, and financial services.

Lending to SMEs and Agri-business

The allocation of loans to priority segments, namely Small and Medium Enterprises (SME) and Agriculture, has been relatively low, accounting for less than 8% of the total loans. Specifically, SME loans constitute 4.2% of the portfolio, while Agriculture loans account for 3.6%. Moreover, these penetration levels have been witnessing a decline over the past several years. This declining trend highlights the need for attention and support to bolster lending in these crucial sectors to foster their growth and development.

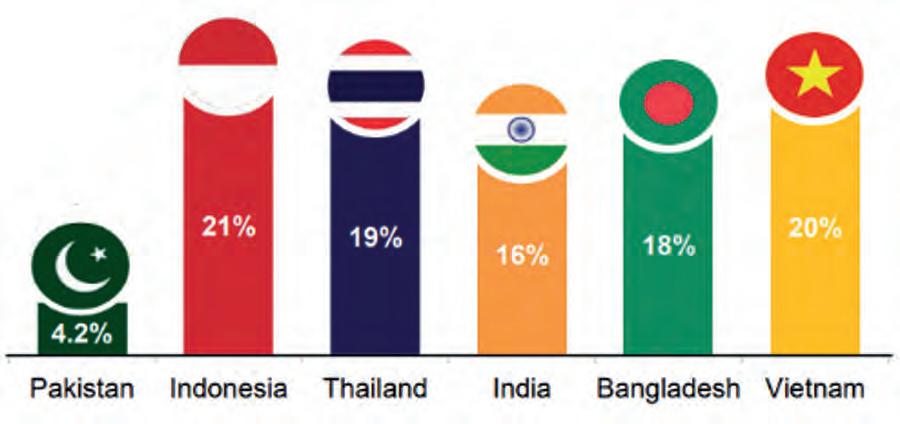

The state of SME credit intervention in Pakistan, when compared to certain regional economies, is disheartening, presenting a significant untapped opportunity. A mere 4.2% of loans have been directed towards SMEs in Pakistan, making it the lowest among its regional counterparts. This concerning situation has seen a gradual decline since 2007, attributed to various factors.

Among the primary reasons for this contraction are the historical experiences with Non-Performing Loans (NPLs) that have influenced risk perceptions, as well as limited credit appetite and capabilities. Additionally, the lack of access to reliable and credible data has hindered effective decision-making in lending to SMEs.

Nevertheless, there are promising examples in the industry where innovative approaches have led to successful service of SME and agri segments. Niche business models, tailored risk assessments, skilled workforce, and advanced technology integration have proven effective in catering to the needs of these segments. Recently, the emergence of collaborations with fintech and agritech companies has also contributed to improved access and support for SMEs and the agricultural sector. These partnerships leverage technology to bridge the gap and address the challenges faced by SMEs and agri-businesses, potentially paving the way for their growth and prosperity.

In the current precarious economic climate, where credit risks may be heightened owing to ever-increasing policy rate which increases costs for businesses and other business costs, banks would have to improvise their credit appetite and readiness to lend to such segments and work on real capacity augmentation for effective penetration.

To improve lending to SMEs and agri-businesses, some major enablement support is required to create the right ecosystem in relation to SME and agri lending.

Mr. Salim Raza, Former Governor State Bank of Pakistan has expressed his insights on the subject “In Brazil, China, India, Turkey and other major emerging jurisdictions, development finance is also fueled by public sector development banks. For example, in India there is a separate institution for SMEs and another one for agriculture. Our development banks are very small with next to zero contribution. To rejuvenate priority segments, we need to have a fully functional Planning Commission and a priority-sector led industrial policy with clear objectives for next 3-5 years, vitalisation of special enterprise zones and specialised banks to deal with SME and Agri,” he says.

“Another key imperative is to support data enabled credits/ digital credits. For this, a national level collaborative effort has to be put in place for big data/ registry, with the intervention of Government, regulators, banking and all industry stakeholders who can enable/ contribute alternate data for optimum credit bureau infrastructure.”

Consumer finance

Consumer finance posted a modest growth of 9%. It accounted for 7.1% of total advances which is a slight decrease as compared to the preceding year figure in 2021. Notably, mortgage finance witnessed remarkable traction, soaring by approximately 50% during the year. Additionally, the credit cards portfolio experienced a significant boost of 32%. However, auto loans experienced a contraction, declining by 5% during the same period.

Overall Lending to private sector

The lending to the private sector in Pakistan, amounting to 15% of GDP, is notably lower when compared to certain other jurisdictions. As previously discussed, adopting a more inclusive credit strategy targeted towards priority sectors and segments could play a pivotal role in elevating this crucial benchmark to a more reasonable level in the medium to long term. By strategically focusing on priority areas, such as SMEs and agriculture, and implementing supportive policies and measures, the potential for a substantial increase in lending to the private sector becomes feasible. This not only fosters economic growth but also enhances financial inclusivity and stability, ultimately contributing to the nation’s overall prosperity.

“With Pakistan’s private sector credit to GDP ratio of 15% (as of Dec-20) and ADR at 50% (as of Dec-22), its positioning relative to certain emerging economies reflects large untapped potential to scale development finance.” explains Salim Raza

It is a sentiment echoed by others. According to Muhammad Aurangzeb, Presi-

Yousaf Hussain, President and CEO of Faysal Bank

dent and CEO of HBL, as a front-runner the banking sector has to rethink and revamp business models. “A deeper sector understanding is required to penetrate the SME and agriculture space. Banks have historically been inclined to a collateral based lending model. This approach warrants a complete transformation towards more interactive, cash flow based lending to better serve these sectors,” he says.

Non-Performing Loans

The enhanced performance in managing Non-Performing Loans (NPLs) indicates that banks have adeptly navigated the current challenges by exercising cautious financing on a limited scale. However, it’s important to note that credit allocation to vulnerable sectors remains minimal.

“The prevailing economic situation in the country suggests that while banks may be inclined towards lending and expanding their balance sheets, an initiative incentivised by support from SBP, they may be confronted with the challenge of NPLs over the next couple of years,” commented Mr Yousaf Hussain,

President & CEO, Faysal Bank Limited Investment

Investments usually refer to investments in government securities like Pakistan Investment Bonds (PIBs) and Treasury bills (T-bills). Investments surged by 25% with ~90% concentration in government securities. Investments in government securities offer risk-free returns which incentivises banks to place funds, resulting in a lower ADR. Another reason for the high IDR is the government’s reliance on domestic debt.

Consequently, Investments to Deposits Ratio (IDR) has been rising. IDR in Pakistan is the highest as compared to other regional countries like Bangladesh, Sri Lanka and India. According to the recent data released by the State Bank of Pakistan, as of June 2023, IDR stands at 82%. On the other hand, ADR has been decreasing consistently. ADR decreased from 70+% in 2007 to 50% in 2022. According to the recent data released by the State Bank of Pakistan, as of June 2023, ADR stands at 48%.

Borrowing

Borrowing increased dramatically in 2022, an increase of 1100 basis points. A striking upward trend in borrowings has been observed, particularly evident in the last two years. Notably, there has been a remarkable exponential increase of 63%, amounting to Rs. 7.5 trillion, compared to Rs. 4.6 trillion as of December 2021. These borrowings were most probably to finance investments in government securities.

Profitability and taxation impacts

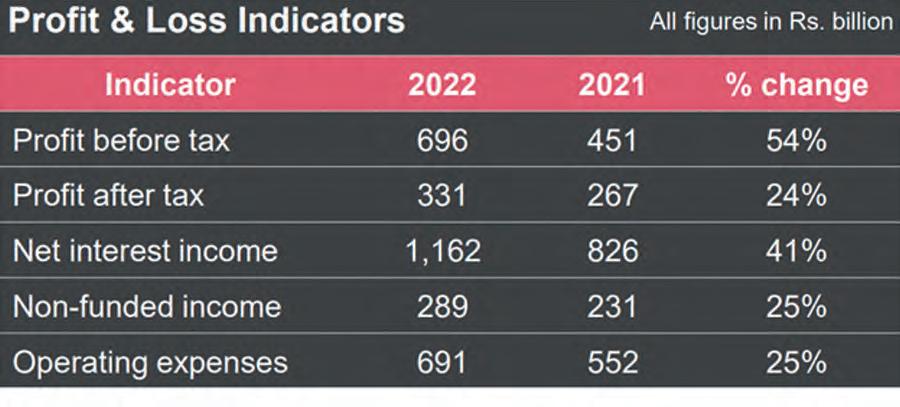

Profitability, Return on Asset (RoA), and Return on Equity (RoE) amplified sharply on the back of higher spreads and non-funded income from different avenues. However, it is worth noting that the TEXTILES positive trajectory of baseline profitability was somewhat dampened by tax charges. These tax implications had a disproportionate impact, moderating the overall profitability growth, despite the other favourable factors contributing to the amplified financial performance.

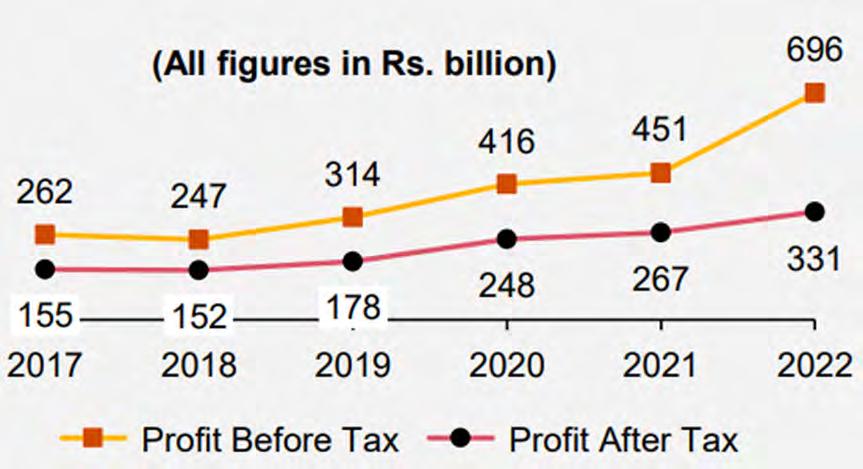

As the following graph shows, profit before tax increased from Rs 451 billion in 2021 to Rs 696 billion in 2022, an increase of more than 50%. However profit after tax in 2022 was only Rs 331 billion, which is approximately 50% of the profit before tax figure. This means that banks paid almost 50% of their profits in taxes.

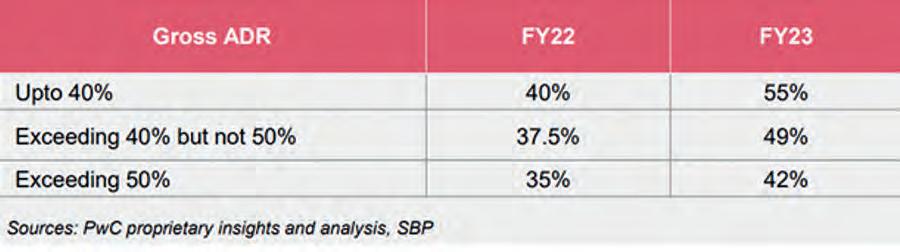

For FY22, tax rates were raised from 35% to 45% (effective tax rates jumped to 49% from 39% in 2021). Moreover, as mentioned earlier, an additional tax on income from federal government securities, linked with ADR was also introduced which increased the tax burden on the banking sector. Nevertheless, the sector was still able to maintain its profitability.

Markup Income

Mark-up income is the interest based income. It is the core income for the banking sector. Mark-up income increased considerably to Rs 3.4 trillion, at the back of rising policy rates. Below provides a comparison of mark-up income from advances and investments, along with SBP policy rate and one-year KIBOR as of Dec-22 vs. Dec-21.

Policy rate further increased to 21% in April 2023, in the backdrop of economic uncertainties and rising inflation, generating a cumulative impact of 1,400 basis points since June 2021.

The policy rate in Pakistan as of Dec-22 is much higher relative to certain other economies, even higher than that of Sri Lanka. This resulted in improved earnings for the banking sector.

Operating expenses

Operating expenses registered an increase of 25% in 2022, which is the highest increase as compared to relatively lower variations during the last few years. However, with a strong revenue base (75% growth in mark-up income), the industry’s cost-to-income ratio improved to 48% compared to 53% in Dec-21.

Conclusion

The banking sector in 2022 demonstrated remarkable resilience and growth. Despite taxation challenges, the sector’s adaptability and strategic focus on key areas are key drivers of its continued success. n

By Zain Naeem

It started quite inconspicuously. At a regular meeting of parliament’s Public Accounts Committee (PAC), the committee’s chair called for a probe into a unique facility that the State Bank of Pakistan (SBP) had provided back in 2020.

Within days the term TERF — which stands for Temporary Economic Relief Facility — was on everyone’s mind. Camps were set up, battle plans were readied, and lines were drawn.

On one side are the architects of the scheme like former State Bank Governor Raza Baqir and former finance minister Shaukat Tarin. They are joined by industrialists, large investors and others who feel the facility achieved many of the objectives it had been created for. On the other side are critics who feel the facility was dead on arrival and it ended up being just another scheme where industrialists got to enrich themselves with free money.

The reality is that the investigation initiated by the PAC was little more than a political witch hunt. The Noor Alam Khan led committee was more interested in sniffing around and trying to dig up some dirt on the financial team that was running the show during the Pakistan Tehreek i Insaaf government and the TERF scheme seemed to be a good place to start.

But to understand entirely what the entire fuss was about, it is important to understand what TERF was. Launched in 2020 during the Covid-19 pandemic, it was essentially a facility launched by the SBP with the help of the government that provided nearly interest free loans to businesses so they could keep the wheels turning and not lay off their employees. Over time, more than 600 businesses took advantage of this facility and the SBP lent over $3 billion for this purpose. Major businesses took them up on this offer, including giants such as Interloop, Nishat, the Lucky Group, Ismail Industries, and many others.

The question here is not whether there was something shady going on with TERF as the PAC has tried to claim (hint: there isn’t). The real question is that outside all the mud slinging and shrieking about corruption, how was the TERF scheme on merit as an attempt to keep businesses afloat and unemployment low?

Profit investigates.

TERF facility

Let us start at the beginning. In 2020 the economy was tanking. The Covid-19 pandemic had hit Pakistan and the rest of the world and halted most businesses. According to a report, “Special Survey for Evaluating Socioeconomic Impact of

COVID-19 on Wellbeing of People”, the labour market of Pakistan dropped by 13 percent in the April–June quarter of 2020.

According to the Economic Survey 202021, prior to Covid-19, the working population was 55.7 million. During the pandemic, this number declined to 35.04 million which indicates that 20.71 million people either lost their

TEMPORARY ECONOMIC REFINANCE FACILITY (TERF)

jobs or were not able to work.

With falling demand some businesses found themselves reeling worse than others. Retailers were closed down, malls barred their doors, and demand was in the dumps. The government was facing an unprecedented crisis in which people were losing out on jobs as well as on business. This is where TERF was introduced. This was a facility provided by SBP in order to promote investment and expansion of industrial capacity of the country.

The time this facility was introduced, the pandemic was ravaging the world with lockdowns being announced on a daily basis. It was feared that the pandemic would slow down economic growth and a facility was provided by the SBP to SMEs and industries to borrow at low interest rates. In a time where economic uncertainty was high, no one would be willing to invest and the scheme was a way to incentivize investment.

So what exactly did the SBP do?

The mechanism which had been used by the SBP was to allow banks and DFIs to carry out financing across all sectors. The banks had the ability to carry out their own due diligence and scrutinise the companies themselves before granting a loan under this facility. The facility was to be used to either purchase imported or locally manufactured plants in order to complement existing projects or set up new projects from scratch. Later the scope of the loan was also expanded to include Balancing, Monitoring and Replacement (BMR) to be carried out.

These funds could be used to finance all Letter of Credit that had been established after the announcement of the scheme from March 17 till March 31, 2021. Banks were allowed to give a loan of Rs. 5 billion per project and the rate that would be charged was 7% a year which was later reduced to 5%. The SBP charged a refinance rate of 1% while the remaining 4% was charged by the banks as the spread above the refinancing rate. The period of the loan was set to be 10 years with a grace period of two years.

According to SBP’s own record, it can be seen that the bank has a record of 626 borrowers still left in its books with Rs. 398 billion disbursed and Rs. 19 billion already repaid. The program has seen an increase in employment by nearly 200,000 workers directly and it is expected that the program will see export potential increase by $12 billion and import substitution by $3.5 billion.

Demystifying the headline figure of $3 billion

One of the pertinent questions that needs to be asked at this stage is where does the $3 billion come in. The loans that had been given out to the investors were worth Rs. 436 billion according to the records of SBP at the end of Mar 2021 when the facility was supposed to expire. Mr. Chairman Noor Alam Khan seems to be considering the dollar against Pak Rupee as it stood at March end 2021 which would make this figure true to a certain extent that loans of $3 billion were granted.

The problem with the figure is that it is being presented as an amount that has been given away by the government. The $3 billion amount has been portrayed and amplified as being the loss that the government made while the industrialists were able to use this facility to get away with these funds. That is not true. These are loans and these loans have to be paid back by the companies when they mature in 2032 or even before that. Once these loans are paid back, the $3 billion would be returned and interest of 1% would be earned back by the SBP.

Granted the State Bank will be making a loss compared to earning a higher interest rate and that criticism has its merit but the goal of these loans was to boost investment. To state that these funds have been wasted or handed out is a blatant lie. The goal of the statement was to parade around the $3 billion figure as a loss to the country and create a ripple in the political discourse of the country which it has sadly done.The PAC was going to go on vacation in mid July and the government would be ending its tenure in mid August which would have made this probe futile in itself. This all was known well in advance and the PAC was able to create a political storm in a teacup.

Who is actually paying the cost?

This issue might have a political motive behind it but the question still needs to be asked who is actually paying the cost and what the cost is. The scheme was introduced in March of 2020 and interest rates had fallen from 12.5% to 7% within 3 months by June of 2020. The government had initially given these loans at 7% but seeing the base interest rates fall, the rates were revised to 5%. As the refinance rate was 1%, banks that had given the loans were able to earn a spread of 4% with these loans.

The initial model seemed sound enough as the interest rates remained steady for more than a year when they were increased by 25 basis points in September 2021. The rates have significantly ramped up since then and stand at 22% in June 2023. There are borrowers who were able to use the facility and are paying a measly 5% interest on these loans while the rest are borrowing at 22% and higher. The banks are still earning their spread on a principal that they did not have to put up and it is free money for them as well.

These loans are being refinanced by the SBP and the central bank was able to fund these loans through money supply. The central bank has the power to print money and using this ability, they have been able to make these loans. Based on this, it is evident that SBP and ultimately the people of the country are the ones bearing the cost of TERF. At the time when funds were being allocated to create such a loan, SBP had little concern for inflation and printed the money to stimulate the economy.

Due to the act of printing money, the economy would have gone through inflationary pressures which have cost the people in the end. One of the contributing factors for the interest rates to be at 22% was the fact that large scale borrowing was carried out at low rates and there should have been some foresight by the SBP to make sure that the inflation that once inflation started to become a concern, there were measures in place to counteract it. The real cost of this program resulted in inflation in the economy and that cost has mainly been ignored in the debate that has been carried out around this issue.

The supporters of the scheme

The people who support the scheme state that the goal of the facility was to allow businesses to carry out their investment plans without any delays. Raza Baqir, the Governor of SBP during the pandemic, has stated that the SBP was under pressure from the business community to lower the interest rates and TERF was seen as a welcome relief to the worrying industrialists. “Ultimately, the institution won the hearts of many industrialists and businesses,” he said.

The loans were initially for green field and expansion related projects which were later tweaked for BMR projects as well. Proponents of the scheme state that the project was a success as the country was able to expand exports and create new job opportunities which might have seen unemployment and loss in economic output if the facility was not present.

Overall, the scheme is seen as being positive for the country and a much needed boost to the investment. It led to generation of tax revenue which would not have been possible without the program. The design of the scheme was to give the banks the authority to carry out the due diligence and assess the creditworthiness of the businesses which meant that SBP was not involved making the process fair and equitable to every business.

The SBP made sure the loans were to be provided to SMEs and businesses alike as the program was supposed to be sector agnostic. It was felt at that time that carrying out extensive imports of machinery would