12 minute read

CON TENTS

09

09 Why are fashion retailers all suddenly selling perfume?

Advertisement

14

14 The Return

Of The

King

22 In times of high inflation, everything goes in the grocery store business

26

26 Secure your financial future - Retail Investing Abdul Rehman

28 A beginner’s guide to Discounted Cash Flow (DCF) method for stock valuation

Publishing Editor: Babar Nizami - Joint Editor: Yousaf Nizami

Senior Editors: Abdullah Niazi I Sabina Qazi

Assistant Editor: Momina Ashraf

Editor Multimedia: Umar Aziz - Video Editors: Talha Farooqi I Fawad Shakeel

Reporters: Taimoor Hassan l Shahab Omer l Ghulam Abbass l Ahmad Ahmadani l Muhammad Raafay Khan

Shehzad Paracha l Aziz Buneri | Daniyal Ahmad | Asad Kamran l Shahnawaz Ali l Noor Bakht l Nisma Riaz

Regional Heads of Marketing: Mudassir Alam (Khi) | Zufiqar Butt (Lhe) | Malik Israr (Isb)

Business, Economic & Financial news by 'Pakistan Today'

Contact: profit@pakistantoday.com.pk

By Nisma Riaz

Chances are that if you walked into a shopping mall and decided to visit some of the most popular fashion retail stores, you would at some point be ambushed by an enthusiastic salesperson wielding the tester of a new perfume. Over the past few years, brands such as Khaadi, Sapphire, Beachtree, Sana Safinaz, and ETHNIC are only some of the large fashion retailers that have launched their own line of perfumes. So where has this sudden diversification come from, and how successful has it been? Profit interviewed a number of professionals within the industry and even more consumers to get to the bottom of this influx of new locally branded perfumes. To understand the phenomenon entirely, we must go back to the very beginning. And without any real doubt the pioneer that made this work was Junaid Jamshed’s brand J.

JJ’s swan song

In the early 2000s, Pakistan’s fashion retail landscape was changing fast. And one of the brands quickly establishing itself was J., which had recently been launched by former pop-sensation Junaid Jamshed. Mr Jamshed had opened his own line of clothing after quitting show business for religious reasons.

And this then became perhaps one of those rare moments where religious tradition and custom ended up informing a very smart business decision. You see at this point in time, there was a very limited market for perfume in Pakistan, and there were essentially three kinds of scents available on the market.

The first kind were imported perfumes worn by the urban intelligentsia of cities like Lahore and Karachi. The second kind were those created by local perfume makers. While many of these perfume makers could craft very ‘western’ scents as well, they operated on a hyper-local scale with very little branding and no marketing. Lahore’s Lohari gate and Shah Almi Gate, for example, continue to have famed perfume markets. However, the perfumes created here were made on demand and not sold outside of Lahore or under any brand names.

Other than these two options the vast majority of the population relied on wearing ‘attar’ as scents. Attar was and very much still continues to be associated with Islamic tradition because this was also the kind of scent used in Arabia at the time of the birth of Islam, and the techniques to extract it were later improved in different Islamic civilizations. The association between attar and religion was so strong, in fact, that religious figureheads such as Maulana Ilyas Attari (also known as Maulana Ilyas Qadri) of the Dawat e Islami set up businesses selling the fragrance in small vials which were then bought by devoted followers.

And this is where the idea came to Junaid Jamshed. At this point in time, fashion retailers had not yet ventured into a lot of side products such as perfumes. However, the story goes that a friend of Junaid Jamshed’s that he knew through his preaching complained that local attars were not that great as gifts, and it would be a good idea to introduce locally branded perfumes to the market that were packaged as high-end but more reasonably priced than their imported counterparts.

And that is exactly what J. did. They became the pioneer in this trend by starting to sell fragrances similar to attar from select outlets as early as 2005. However, it was not until 2009 that the category received significant attention. According to an inside source from J., “Until 2009, we were still in the experimental stage. But we recognized the potential and even then, the response from customers was quite encouraging.”

Over the past seven to eight years, the fragrance market has seen remarkable growth, with J. achieving significant success in 2013 after partnering with celebrities such as Adnan Siddiqui, Wasim Akram, Shahid Afridi, and Sania Mirza. But as J.’s success became apparent, it was also clear that other fashion retailers were not going to sit by and watch. They were ready to jump into the fray.

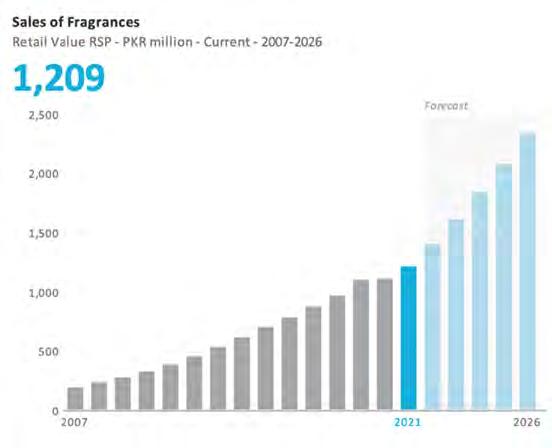

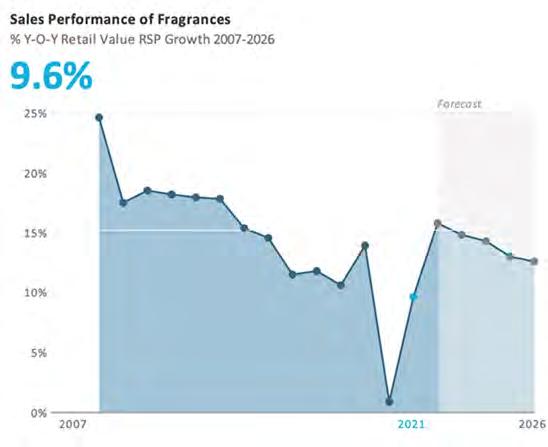

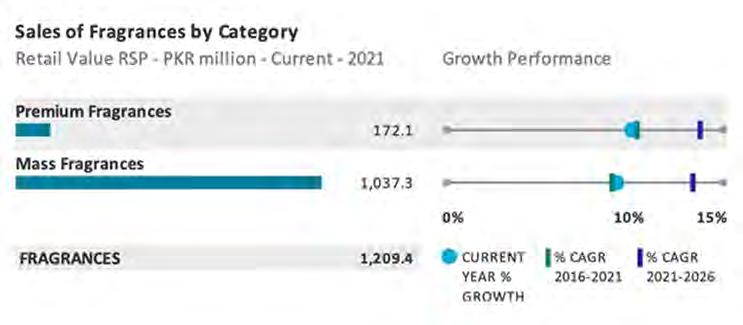

First whiff of competition

It wasn’t immediate, but it was bound to happen. Bonanza Satrangi followed J. in 2017, with Khaadi entering the market in 2021, Sana Safinaz in 2022, Zelbury in Q2 2022, and ETHNIC towards the end of 2022. The demand for fragrances in Pakistan remains concentrated among a small base of middle- and high-income urban consumers. However, according to Euromonitor, the industry is expected to see a steady year-on-year (YoY) growth rate of 9.6% from 2007 to 2026. The industry is also projected to grow from its 2021 size of Rs 1.2 billion to almost Rs 2.5 billion by 2026.

According to one industry source, some of these brands tried to cut into J.’s market by focusing on affordability instead of on packaging and longevity. Others tried to compete more directly with J. by producing high-end products that are better quality, both in terms of the formula itself and packaging, allowing them to justify higher prices. J. has over 100 outlets selling its perfumes and a range of over 100 fragrances to choose from. They also offer unique designer bottles, including ones shaped like a racket and a ball.

Of course, the journey hasn’t quite been so simple. And even J. took a lot of trial and error in getting where it is — which is undeniably the position of market leader. You see, very few brands in Pakistan have the technology and resources necessary to produce perfumes locally. “While we can make more volatile and lighter fragrances for body sprays and mists, we don’t have the proper factories or raw materials to create perfumes locally,” they explained.

In addition to these limitations, there are also certain restrictions that prevent manufacturers from producing high-quality perfumes in Pakistan. For example, a certain percentage of alcohol is required to make perfume, and there is no alternative ingredient that can be used to replace it. Moreover, storing large quantities of alcohol in Pakistan is not permitted, even at warehouses. This makes it difficult for local manufacturers to produce high volumes of quality perfumes. “The most popular areas to source fragrances are China and the UAE,” said the source. “Most retailers that sell fragrances in

Pakistan source their stock from China or other places, and then package and label the products locally.”

The source went on to explain that there are different types of wearable fragrances: Eau de Parfum (EDP) and Eau de Cologne (EDC). EDP contains a lower percentage of essential fragrance compounds, typically around 15 to 20 percent, but it’s a high-grade perfume that lasts a long time. EDC, on the other hand, contains a higher grade of fragrance with stronger notes, but a lower percentage of fragrance compounds (up to 8 percent). “It’s very difficult to produce EDCs locally,” the source added. “Most local production is focused on EDPs.”

Profit also spoke with the deputy general manager of the fragrance division at J., who explained that their production model is mixed. Some scents are produced locally, while others are imported. “However, even for the perfumes we produce locally, the raw materials are sourced from abroad,” they noted.

Same concept, different attitudes

The source at J. emphasised that packaging is an essential aspect of their product because many of the perfumes they sell are purchased as gifts. “No one wants to give a visibly cheap-looking present,” they explained. J. has been in the market longer and has more experience, using perfume houses’ technology that meets international standards.

Bonanza also has a broad range of fragrances, but it cannot match J.’s designer bottles and carefully crafted formula. However, it would be unfair to compare other brands’ quality with J. and Bonanza, as these two have established themselves earlier and are in a league of their own, while others are just starting.

But why have so many of these local perfumes popped up over the past few years? One explanation is that people simply can’t afford the imported kind anymore. The current economic situation in Pakistan, including inflation and economic unrest, has had a significant impact on people’s lifestyles. As imported products become increasingly unaffordable, many people have turned to local alternatives. Although the prices of most imported perfumes have remained relatively stable, the difference in exchange rates between the Pakistani rupee and the US dollar has caused a considerable price difference for Pakistani buyers.

According to Euromonitor, the fragrance market in Pakistan is dominated by mass-market fragrances, with premium fragrances having a Retail Value RSP of Rs 172.1 million in 2021, while mass-market fragrances had a Retail Value RSP of Rs 1.037.3 billion. The data from Euromonitor also indicates that premium fragrances not only had a lower compounded annualised growth rate (CAGR) from 2016-2021 but are also projected to fare similarly from 2021-2026. This provides opportunities for local brands that are offering competitive prices in comparison to their imported counterparts.

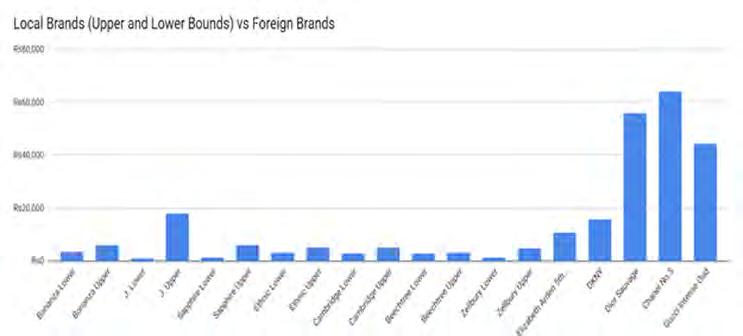

To understand the price differences between imported and local perfumes, Profit compared the cheapest and most expensive perfumes from some local brands with popular international brands. The results showed that imported perfumes are significantly more expensive than local ones, which explains the increasing popularity of local perfumes by clothing brands.

However, the shift towards local brands and products has been happening for some time now, and it’s not just due to the current economic climate. There has been a significant mindset shift among consumers who are now more willing to try and experiment with local products and are often pleasantly surprised by the quality.

So what has caused this change in consumer behaviour? According to an industry insider who has been in the business for over a decade, “It’s a matter of perception versus experience. The general perception across the country has been that imported products are of better quality. However, after trying local fragrances and experiencing their quality, this perception changes. People are now able to compare the quality of local perfumes to that of branded ones, and although there may be some differences, they still find good value for money in local alternatives, which is the main reason that has driven this mindset shift.”

Another factor contributing to the popularity of local perfumes is the increased exposure to global trends through social media and travel. People are now more aware of current trends and often see influencers on social media endorsing perfumes by local fashion brands, which motivates them to try them out.

Moreover, the progressive middle class in Pakistan, who are conscious of their lifestyle but cannot afford to spend a lot, are also more inclined towards local fragrances. These fragrances do not smell cheap and offer a great value proposition. Additionally, perfumes are intangible, and unlike carrying an outdated bag or clothes, there is no judgement or assumption made about the buyer’s spending habits or lifestyle.

In conclusion, the shift towards local fragrances in Pakistan is driven by a combination of factors, including affordability, quality, exposure to global trends, and changing mindsets. This trend is likely to continue in the coming years, providing an excellent opportunity for local brands to thrive and gain market share.

What are the consumers thinking?

Profit conducted a comprehensive survey to ascertain what motivates people to purchase fragrances from local fashion retailers. The results indicated three key reasons that were highlighted by almost every respondent.

The first and foremost reason was obviously the scent - the primary factor driving the purchase of perfumes! As one respondent shared, “I purchased Bonanza Musk because the scent was absolutely delightful! Although it’s not the most long-lasting fragrance, considering its price, I didn’t expect much in that aspect anyway. It’s not my go-to perfume yet, but I will most probably buy it again when I finish this bottle.”

Another significant factor highlighted by respondents was volatility, which was directly proportional to the frequency of repurchasing. Our source at J. echoed this sentiment, stating that “customers are highly conscious of how long a scent lasts! Good fragrances can uplift your mood, and people are well aware of that. If you smell nice, you feel good and make a positive impression on others, making long-lasting perfumes an attractive option for establishing a loyal customer base.”

Lastly, price was an important factor. Another respondent revealed that although no local perfume had replaced their imported ones, they preferred using local fragrances for daily wear. “Branded perfumes are long-lasting but also quite expensive. However, the ones available at Khaadi or Sapphire are perfect for daily use, despite needing to be reapplied. So, the perfume I choose to wear depends on where I am going and for how long I need it to last.

That being said, I have become very loyal to my Pour Femme by J. and people recognise me with that scent now!”

For some, discovering the world of local scents was an unexpected surprise. Quite a few respondents, mostly men who don’t frequent shopping malls as much as women, shared that they stumbled upon a whole new world of local scents after receiving a J. or a Cambridge perfume as a gift.

Gifting perfumes is an age-old tradition, and local retailers have made it more accessible and affordable for gift givers. One respondent explained, “Initially, I would only get a J. perfume for my father, but now I get it for my husband too. I particularly like J. for their men’s range. Both their Janan fragrances are fantastic.”

The same respondent continued, “Bloom by Bonanza used to be my favourite everyday perfume, but it’s been discontinued. It was a great scent for the price, and as a university student, I had limited pocket money, so it was affordable for me. I have only bought Maria B perfumes as gifts because the packaging is attractive and the scent is pleasant. However, since last year, I have been using Sana Safinaz. After starting work, I used to buy Paco Rabanne, but due to the dollar prices, I switched to Sana Safinaz and don’t plan on buying imported perfumes again.”

Others, who were more loyal to their imported fragrances, opined that “These are nice backups, but there’s no match for Valentino (duh). However, if the dollar continues to rise, I will stick to these.” and “I don’t have a favourite yet, and my go-to fragrance is still Paris Hilton, because c’mon, nothing smells like it. However, I think these local perfumes do smell quite nice and offer a good-quality affordable option.”

While Pakistan’s local fragrance market may not yet have the cachet of Victoria’s Secret or Paris Hilton perfumes, there’s an understated allure to the scents crafted here that make them a delightful option for daily wear or gift-giving. And in these uncertain times, clothing brands with an established reputation and a fiercely loyal customer base have thrived, rising above the fray and leaving their competitors in the dust. n

By Abdullah Niazi

Standing in the middle of his lush green mango orchards, Syed Ali Shah Darbelo can afford to smile. Weather advisories in his native home of Naushahro Feroze had been indicating soaring mercury levels in the month of March which would have been detrimental for his 50 acre mango farm. But even though he had been preparing for the worst, regular rain and an unseasonably cool month have left his trees blooming with all the signs of spring and a large harvest in the months to go.

But even as Darbelo and others like him take in the distinct scent of a mango orchard launching into full bloom, the happiness of these farmers is underlined with a sense of unease. Only last year the situation had been drastically different. The summer of 2022 was the hottest both Punjab and Sindh had seen in more than half a century. Average temperatures in mid-March (a vital time for mango trees) were soaring between 37-42 degrees, compared to the usual 34 degree temperature that this month sees in Punjab’s mango belt. This made the mangoes more susceptible to disease, premature ripening, and being of a lower quality. Overall, yields fell in both Punjab and Sindh although final data has still not been monitored by provincial crop monitoring departments.

This year, average temperatures in the same region in mid to late March have fluctuated from 27-32 degrees. Increased rain showers in the month have also helped the mango crops bloom faster and better. “After the first rains and storms of the season, spring has sprung on all the plants. And a good amount of rain during this time can make or break our entire harvest,” explains Darbelo.

Unable to contain a hint of excitement from his voice, Darbelo says that not only do rains in March result in better quality fruit, it can also have a direct effect on yield. “Before